Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SunCoke Energy, Inc. | d423917d8k.htm |

Investor

Meetings October 2012

Exhibit 99.1 |

Safe Harbor

Statement Some of the information included in this presentation contains

“forward-looking statements” (as defined in Section 27A of the

Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as

amended). Such forward-looking statements are based on management’s beliefs

and assumptions and on information currently available. Forward-looking statements

include the information concerning SunCoke’s possible or assumed future results of operations, the planned Master

Limited Partnership, business strategies, financing plans, competitive position, potential

growth opportunities, potential operating performance improvements, the effects of

competition and the effects of future legislation or regulations. Forward-looking

statements include all statements that are not historical facts and may be identified by the

use of forward-looking terminology such as the words “believe,”

“expect,”

“plan,”

“intend,”

“anticipate,”

“estimate,”

“predict,”

“potential,”

“continue,”

“may,”

“will,”

“should”

or the negative of these terms or similar expressions. Forward-looking statements involve

risks, uncertainties and assumptions. Actual results may differ materially from those

expressed in these forward-looking statements. You should not put undue reliance on

any forward-looking statements. In accordance with the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings

with the Securities and Exchange Commission cautionary language identifying important factors (but not necessarily all the

important factors) that could cause actual results to differ materially from those expressed

in any forward-looking statement made by SunCoke. For more information concerning

these factors, see SunCoke's Securities and Exchange Commission filings. All

forward-looking statements included in this presentation are expressly qualified in their

entirety by such cautionary statements. SunCoke does not have any intention or

obligation to update publicly any forward-looking statement (or its associated cautionary

language) whether as a result of new information or future events or after the date of this

presentation, except as required by applicable law.

This presentation includes certain non-GAAP financial measures intended to supplement, not

substitute for, comparable GAAP measures. Reconciliations of non-GAAP financial

measures to GAAP financial measures are provided in the Appendix at the end of the

presentation. Investors are urged to consider carefully the comparable GAAP measures and the reconciliations to those

measures provided in the Appendix, or on our website at www.suncoke.com.

2

Investor Visits - October 2012 |

About

SunCoke Largest independent producer of

metallurgical coke in the Americas

Coke is an essential ingredient in blast

furnace production of steel

Cokemaking business generates

~85% of Adjusted EBITDA

(1)

5.9 million tons of capacity in six

facilities; 5 in U.S. and 1 in Brazil

2012 U.S. coke production is expected

to be in excess of 4.3 million tons

Coal mining operations represents

~15% of Adjusted EBITDA

(1)

High quality mid-vol. metallurgical coal

reserves in Virginia and West Virginia

2012 coal production expected to be

1.6 million tons

3

(1)

For a definition and reconciliation of Adjusted EBITDA, please see appendix.

Investor Visits - October 2012 |

Blast Furnaces

and Coke Most efficient blast

furnaces require

800-900 lbs/NTHM

of fuel to produce

a ton of hot metal

4

1 short ton

of hot metal (NTHM)

Coke is a vital material to

Coke is a vital material to

blast furnace steel making

blast furnace steel making

Blast furnaces are the most

Blast furnaces are the most

efficient and proven method

efficient and proven method

of reducing iron oxides

of reducing iron oxides

into liquid iron

into liquid iron

We believe stronger, larger

We believe stronger, larger

coke is becoming more

coke is becoming more

important as blast furnaces

important as blast furnaces

seek to optimize fuel needs

seek to optimize fuel needs

Top Gas

BEST IN CLASS in lbs/ST

Iron

burden

Iron ore/

pellets

Scrap

3100

198

Flux

Limestone

30

Fuel

Coke

600

BEST IN CLASS in lbs/ST

Fuel

Nat Gas

Coal

Up to

80-120

to

120-

180

Up

Investor Visits - October 2012 |

More than

doubled capacity since 2006 with four new plants

-

Only company to design, build and

operate new greenfield developments

in U.S. in more than a decade

-

Supply about 20% of U.S. and Canada

coke needs

(1)

Secure, long-term take-or-pay

contracts with leading steelmakers

-

Customers include ArcelorMittal, U.S.

Steel and AK Steel

Cokemaking operations are

strategically located in proximity to

customers’

facilities

The Leading Independent Cokemaker

SunCoke

Cokemaking Capacity

(In thousands of tons)

5

(1)

Source: Company estimates

2006

2007

2008

2009

2010

2011

Jewell Coke

(Virginia)

Indiana Harbor

(Indiana)

Haverhill I

(Ohio)

Vitória

(Brazil)

Haverhill II

(Ohio)

Granite City

(Illinois)

Middletown

(Ohio)

2,490

4,190

4,740

5,390

5,390

5,940

Investor Visits - October 2012 |

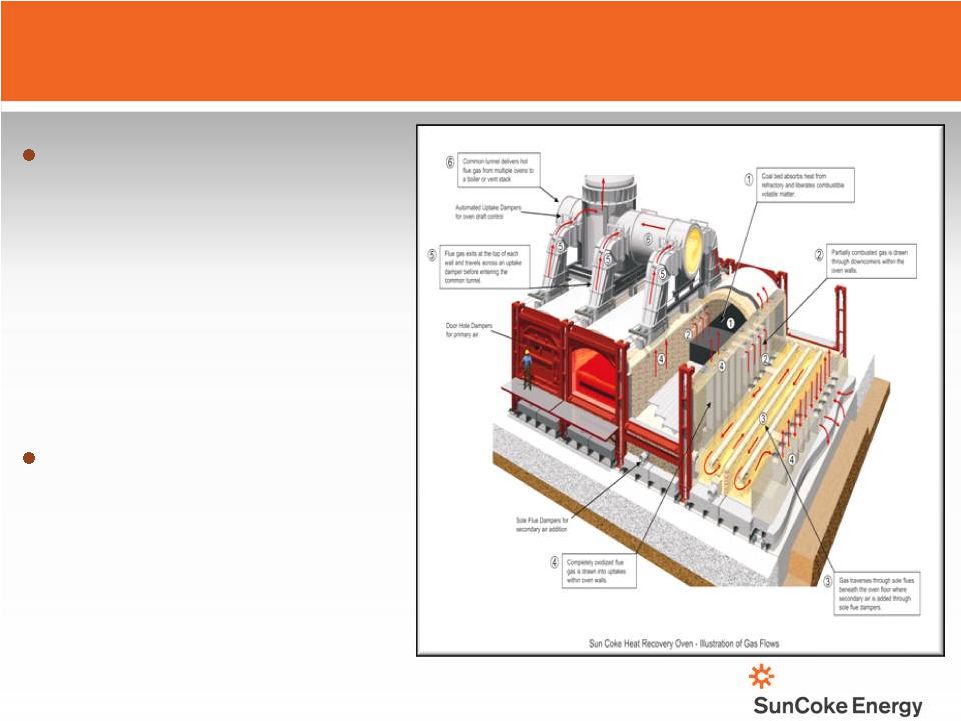

SunCoke’s

Heat Recovery Cokemaking Technology

6

Investor Visits - October 2012 Industry leading environmental

signature -

Leverage negative pressure technology

to substantially reduce hazardous emissions -

Convert waste heat into steam

and electrical power

-

Generate about 9 MW of

electric power per 110,000

tons of annual coke production

Meet stringent U.S. EPA

Maximum Achievable Control

Technology standard -

Traditional by-product cokemaking

methods have significant environmental impacts |

SunCoke’s

Value Proposition Provide an assured supply of coke to steelmakers

Larger, stronger coke for improved blast furnace performance

Demonstrated sustained 15% -

20% turndown capability

High quality coke with cheaper coal blends

-

Burn loss vs. by-product

Capital preservation and lower capacity cost per ton;

particularly relative to greenfield investment

Stringent U.S. regulatory environment

Power prices and reliability versus value of coke oven gas and

by-product "credits"

High Quality

& Reliable

Coke Supply

Turndown

Flexibility

Coal

Flexibility

Capital

Efficiency

& Flexibility

Environment

/Economic

Trade-offs

7

Investor Visits - October 2012 |

Key Contract

Provisions Customers must take all our production up to a maximum or

pay contract price for amount not taken

-We are obligated to deliver a

minimum quantity of coke annually

Cost of coal is passed-through subject to achieving a

contracted coal-to-coke yield standard

Operating costs are passed-through based on annually

negotiated budget or a fixed budget adjusted for inflation

These costs are passed-through

Take-or-Pay

Fixed Fee

Coal Cost

Operating

Costs

Transportation

& Taxes

8

Investor Visits - October 2012

Represents profit and return on capital

-Fixed fee is fixed for life of

contract |

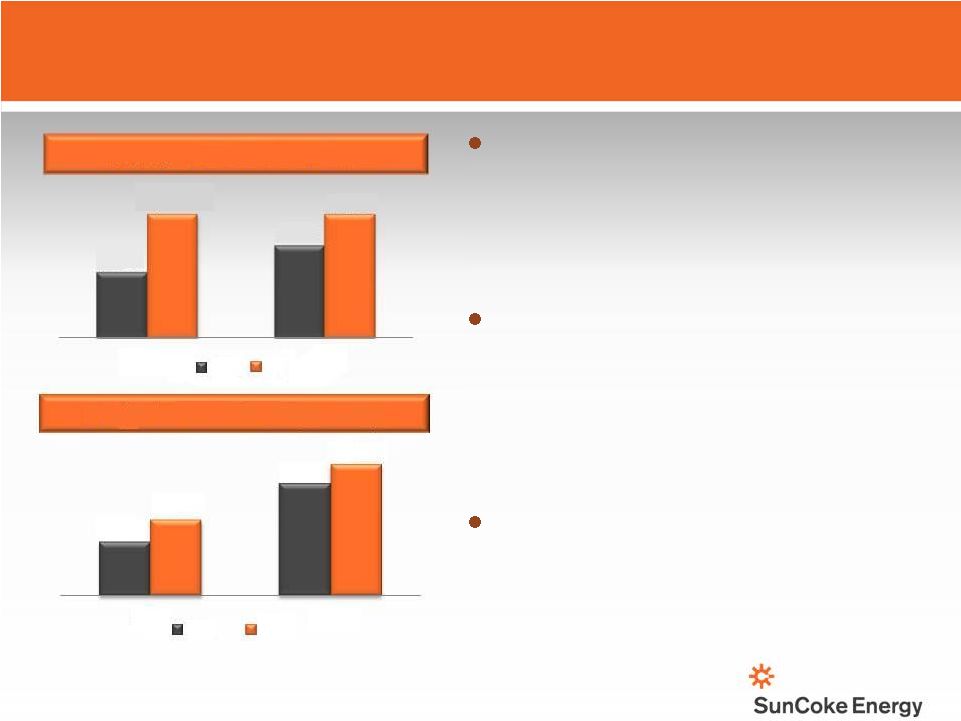

Q1 & Q2 2012

Earnings Overview Results driven by strong Coke business

performance

-

Middletown startup has been a success

-

Continued improvement at Indiana Harbor

-

Strong operations at other facilities

Coal action plan progressing

-

Difficult demand/price environment

-

Taking action to reduce high cash

production costs

-

Achieved improved sequential quarter

performance

Strong liquidity position

-

Generated $66 million of free cash flow

(2)

in

first half 2012

-

Cash balance of $190 million and virtually

undrawn revolver of $150 million

(1)

For a definition and reconciliation of Adjusted EBITDA, please see the appendix.

(2)

For a definition and reconciliation of free cash flow, please see the appendix.

9

$0.17

$0.24

$0.32

$0.32

2011

2012

Q1

Q2

Earnings Per Share

(diluted)

$26.6

$55.8

$37.7

$65.5

2011

2012

Q1

Q2

Adjusted EBITDA

(1)

(in millions)

Investor Visits - October 2012 |

Domestic Coke

Business Summary (Jewell Coke & Other Domestic Coke)

10

(Tons in thousands)

($ in millions, except per ton amounts)

Strong performance driven by Middletown, Indiana Harbor and other operations

Domestic Coke Adjusted EBITDA

(1)

Per Ton

Domestic Coke Production

Investor Visits - October 2012

(1)

For a definition of EBITDA and Adjusted EBITDA/Ton and reconciliations, please see the

appendix. (2) Includes Indiana Harbor contract billing adjustment of $6.0

million, net of NCI, and inventory adjustment of $6.2 million, net of NCI, of

which $3.1 million is attributable to Q3 2011.

(3)

Includes a $2.4 million, net of NCI, charge related to coke inventory reduction and a $1.3

million, net of NCI, lower cost or market adjustment on pad coal inventory

and lower coal-to-coke yields related to the startup at Middletown. |

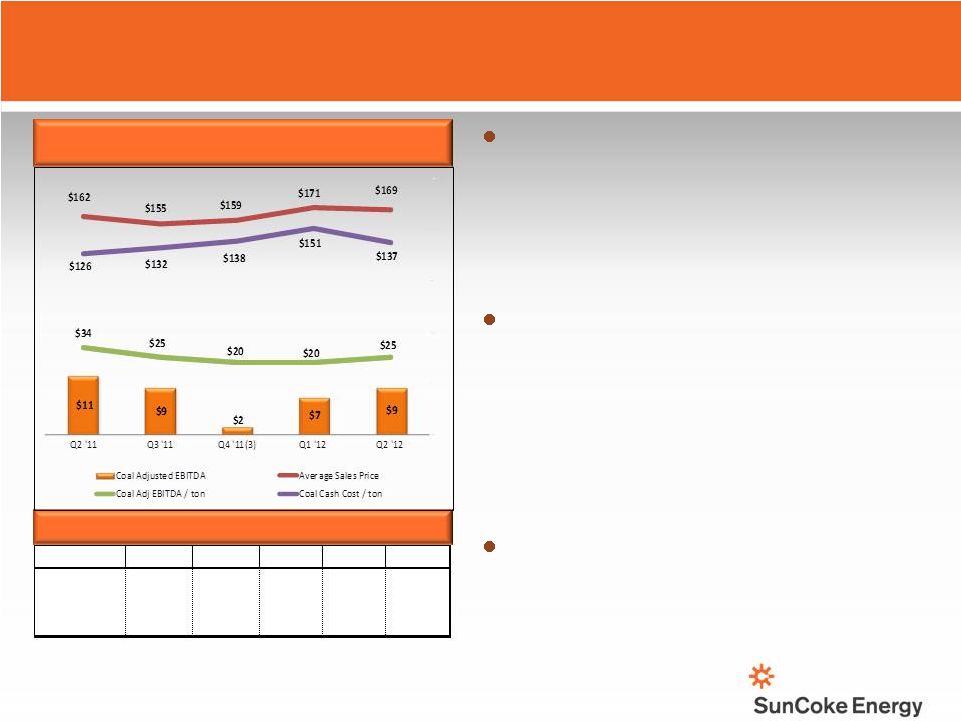

Coal Mining

Financial Summary 11

($ in millions, except per ton amounts)

Cash production costs increasing in face of

difficult demand/price environment

-

Pricing up modestly, reflecting strong mid-vol.

pricing/volumes, offset by weak hi-vol. and thermal

pricing/volumes

-

Cash costs up $11/ton, reflecting decreased mix and

higher costs of hi-vol. and thermal production

Coal action plan implemented in Q1 2012

gaining traction

-

Focus on most productive mines to reduce costs

delivered sequential quarter improvement

-

Cash cost per ton at Jewell decreased from

$161 in Q1 2012 to $143 in Q2 2012

-

Jewell reject rates improved from 68% in Q1

2012 to 66% in Q2 2012

-

Expect further cash cost reductions for 2013

Intend to maintain cash neutral position in

2012

-

Reduced capital spending in line with outlook

Coal Mining Adjusted EBITDA

(1)

and Avg. Sales

Price/Ton

(2)

Coal Sales, Production and Purchases

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Coal Sales

334

371

363

373

365

Coal Producton

340

340

349

375

401

Purchased Coal

24

22

20

19

4

(1)

For a definition and a reconciliation of Adjusted EBITDA, please see the appendix. (2)

Average Sales Price is the weighted average sales price for all coal sales

volumes, including sales to affiliates and sales to Jewell Coke.

(3)

Q4 2011 Adjusted EBITDA inclusive of Black Lung Liability charge of $3.4 million and

OPEB expense allocation of $1.8 million.

Investor Visits - October 2012 |

12

(1)

For a definition and reconciliation of free cash flow, please see appendix.

First Half 2012 Sources & Uses of Cash

Liquidity position and credit metrics improving;

free cash flow

(1)

was $66 million in first half 2012

($ in millions)

Q4 2011

Cash

Balance

1H 2012

Net Income

Depreciation,

Depletion &

Amortization

Deferred

Taxes

Changes in

Working

Capital

Other

Capital

Expenditures

Cash used in

financing

activities

Q2 2012

Cash

Balance

Investor Visits - October 2012 |

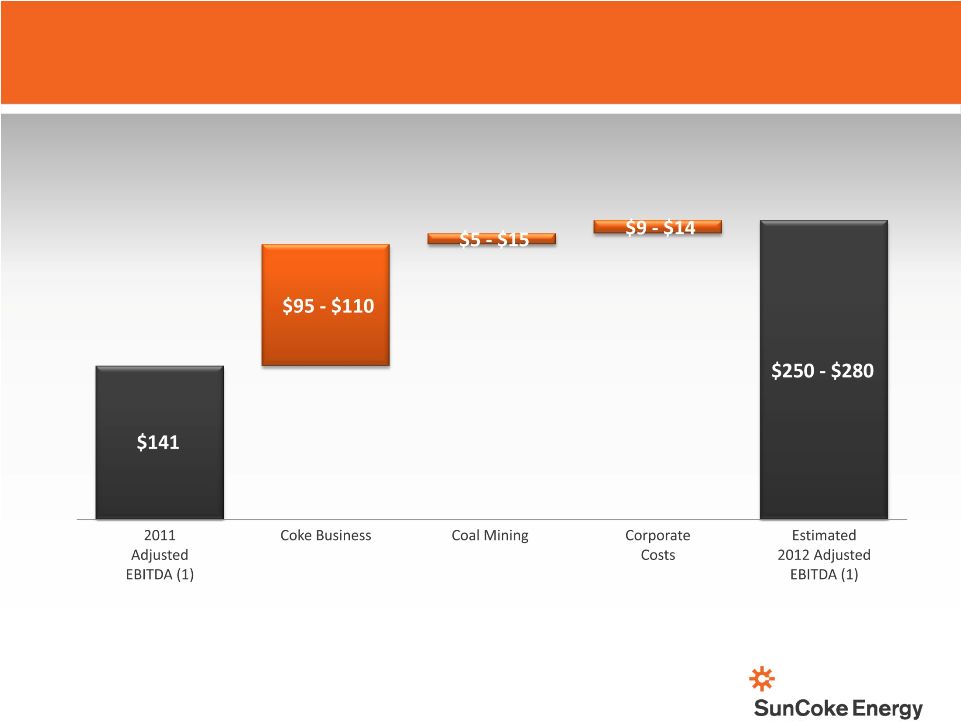

2012 Adjusted

EBITDA (1)

Outlook

($ in millions)

13

(1)

For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA, please see the

appendix. Strong U.S. cokemaking business expected to

drive increase in Adjusted EBITDA

(1)

in 2012

Investor Visits - October 2012 |

Strategies for

Enhancing Shareholder Value 14

Operational

Excellence

•

Maintain focus on details

and discipline of coke and

coal mining operations

•

Sustain and enhance top

quartile safety

performance and ability to

meet environment

standards

•

Leverage operating know-

how and technology to

continuously improve

yields and operating costs

Grow The Coke

Business

•

U.S. & Canada

•

Continue permitting

efforts for next potential

U.S. facility

•

Explore opportunities to

make strategic

investments in existing

capacity

•

International

•

Execute India entry and

pursue follow-on growth

Strategically Optimize

Assets

•

Coke MLP

•

Execute plan to place a

portion of our

cokemaking assets into

an MLP structure

•

Coal

•

Optimize operations and

investments to enhance

long-term strategic

flexibility

Investor

Visits

-

October

2012 |

Source:

CRU, The Annual Outlook for Metallurgical Coke 2012. Replace aging coke batteries

operated by integrated steel producers Source: CRU, The Annual Outlook for

Metallurgical Coke 2012 51% of coke capacity is at facilities >30 years old

Integrated

Integrated

Steel

Steel

Producers

Producers

63%

63%

SunCoke

18%

DTE

5%

Other Merchant

Other Merchant

& Foundry

& Foundry

6%

6%

Imports

Imports

8%

8%

U.S. and Canada Opportunity

15

Total 2011 Coke Demand: 19.5 million tons

Average Age

%

of U.S. & Canada

coke production

9

37

27%

24%

SunCoke

U.S. &

Canada

(excl SXC)

30

40 years

40+ years

-

Investor Visits - October 2012 |

Coke Price

Comparison 16

SunCoke’s coke is competitive on price, quality and reliability, providing us the

opportunity to displace imported coke

Based on July 2012 prices

U.S. and Canada Coke Imports

Representative Delivered Coke Prices -

$/ton

1

Includes approx. $50/ton freight and approx. $40/ton handling loss

for

shipping to Great Lakes region

2

Includes approx. $45/ton freight and approx. $30/ton handling loss

for shipping to Great Lakes region

Imports

SunCoke sales volumes

Chinese Coke Price

SunCoke Coke Price @ Spot Coal Price

Chinese 40% Export Tax Premium (Tariff)

SunCokePrice

-

Contracted

Coal

Price

Differential

Investor Visits - October 2012

Source: World Price (DTC), Coke Market Report, CRU and company estimates |

Natural Gas in

The Blast Furnace Impact of Low Natural Gas Prices

•

Natural gas cannot completely replace

coke in blast furnace

–

We estimate natural gas and other

injectants can replace up to about 30%

–

The less coke used the more important

the coke’s quality

•

Alternative technologies take time to

implement, require significant capital

commitments and are energy intensive

•

Coke oven gases produced by

integrated steelmakers’

own coke

ovens is less valuable in low cost

natural gas environment, potentially

impacting steelmakers’

future

reinvest/rebuild decisions

Blast Furnace Fuel Pricing

17

Source: CRU, SXC Analysis

US$/MMBtu

Investor Visits - October 2012 |

Sources: CRU, The Annual Outlook for

Metallurgical Coke 2011, CIA World Factbook.

India Opportunity

•

Committed to

India entry

strategy

–

Discussing

opportunities in

India

–

Targeting

potential entry by

early 2013

18

India

Steel/Coke

Market

Growing Steel

Market

Coke supply

Deficit

Active

Merchant

Market

Electric Power

Deficit

Projected to be 3rd largest

steel market by 2020

Blast furnace to play a critical

role in growth

Importing approximately

2 million tons annually

Coke capacity investment lags

steel investment

3.5 million tons merchant

production or 13% of total

17 active merchant

coke producers

10% -

20% short power

Average wholesale price >$80

mwh (2x U.S. rate)

Investor Visits - October 2012 |

Master Limited

Partnership Filed S-1 on August 8, 2012

–

Amended S-1 on September 14, 2012

and October 9, 2012

Expected Assets/Structure

–

At closing of offering, MLP expected

to own approximately a 65% interest

in Haverhill and Middletown

–

SXC to own General Partner, incentive

distribution rights and a portion of

the partnership units

Proceeds to SXC

–

Expected uses include paying down

debt, funding expansion and other

general corporate purposes

19

Middletown Operations

Haverhill Operations

Investor Visits - October 2012 |

Appendix

|

Definitions

•

Adjusted

EBITDA

represents

earnings

before

interest,

taxes,

depreciation,

depletion

and

amortization

(“EBITDA”)

adjusted

for

sales

discounts

and

the

deduction

of

income

attributable

to

non-controlling

interests

in

our

Indiana

Harbor

cokemaking

operations.

EBITDA

reflects

sales

discounts

included

as

a

reduction

in

sales

and

other

operating

revenue.

The

sales

discounts

represent

the

sharing

with

our

customers

of

a

portion

of

nonconventional

fuels

tax

credits,

which

reduce

our

income

tax

expense.

However,

we

believe

that

our

Adjusted

EBITDA

would

be

inappropriately penalized if these discounts were treated as a reduction of EBITDA since they

represent sharing of a tax benefit which is not included in EBITDA. Accordingly, in

computing Adjusted EBITDA, we have added back these sales discounts. Our Adjusted

EBITDA also reflects the deduction of income attributable to noncontrolling

interest

in

our

Indiana

Harbor

cokemaking

operations.

EBITDA

and

Adjusted

EBITDA

do

not

represent

and

should

not

be

considered

alternatives

to

net

income

or

operating

income

under

United

States

generally

accepted

accounting principles (GAAP) and may not be comparable to other similarly titled measures of

other businesses. Management believes Adjusted EBITDA is an important measure of the

operating performance of the Company’s assets.

•

Adjusted

EBITDA/Ton

represents

Adjusted

EBITDA

divided

by

tons

sold.

•

Free Cash Flow

equals cash from operations less cash used in investing activities less cash distributions to

non- controlling interests. Management believes Free Cash Flow information

enhances an investor’s understanding of a business’

ability to generate cash. Free Cash Flow does not represent and should not be

considered an alternative to net income or cash flows from operating activities as

determined under GAAP and may not be comparable to other similarly titled measures of

other businesses. 21

Investor Visits - October 2012 |

Reconciliations

22

$ in millions

Adjusted Operating Income

46.6

37.1

80.4

14.9

33.5

24.6

7.4

Net Income (Loss) attributable to Noncontrolling Interest

1.3

(0.3)

(1.7)

(0.5)

3.4

1.6

(6.2)

Subtract: Depreciation Expense

(20.2)

(18.4)

(58.4)

(16.0)

(14.7)

(14.7)

(13.0)

Adjusted EBITDA

65.5

55.8

140.5

31.4

44.8

37.7

26.6

Subtract: Depreciation, depletion and amortization

(20.2)

(18.4)

(58.4)

(16.0)

(14.7)

(14.7)

(13.0)

Subtract: Financing expense, net

(11.8)

(12.0)

(1.4)

(7.1)

(3.3)

4.5

4.5

Subtract: Income Tax

(7.0)

(5.3)

(7.2)

2.9

(5.1)

(1.9)

(3.1)

Subtract: Sales Discount

(3.8)

(3.2)

(12.9)

(3.2)

(3.5)

(3.1)

(3.1)

Add: Net Income attributable to NCI

1.3

(0.3)

(1.7)

(0.5)

3.4

1.6

(6.2)

Net Income

24.0

16.6

58.9

7.5

21.6

24.1

5.7

Reconciliations from Adjusted Operating Income and Adjusted EBITDA to Net Income

FY 2011

Investor Visits - October 2012

Q2 2012

Q1 2012

Q1 2011

Q2 2011

Q3 2011

Q4 2011 |

Reconciliations

23

$ in millions, except per ton data

Jewell Coke

Other

Domestic

Coke

International

Coke

Jewell Coal

Corporate

Combined

Domestic

Coke

Q2 2012

Adjusted EBITDA

12.5

48.6

0.7

9.3

(5.6)

65.5

61.1

Subtract: Depreciation, depletion and amortization

(1.3)

(13.7)

(0.1)

(4.3)

(0.8)

(20.2)

(15.0)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

1.3

1.3

1.3

Adjusted Pre-Tax Operating Income

11.2

36.2

0.6

5.0

(6.4)

46.6

47.4

Adjusted EBITDA

12.5

48.6

0.7

9.3

(5.6)

65.5

61.1

Sales Volume (thousands of tons)

170

892

358

373

1,062

Adjusted EBITDA per Ton

73.5

54.5

2.0

24.9

57.5

Q1 2012

Adjusted EBITDA

15.0

40.1

0.1

7.4

(6.8)

55.8

55.1

Subtract: Depreciation, depletion and amortization

(1.3)

(12.6)

(0.1)

(4.1)

(0.3)

(18.4)

(13.9)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

(0.3)

(0.3)

(0.3)

Adjusted Pre-Tax Operating Income

13.7

27.2

-

3.3

(7.1)

37.1

40.9

Adjusted EBITDA

15.0

40.1

0.1

7.4

(6.8)

55.8

55.1

Sales Volume (thousands of tons)

186

892

358

373

1,078

Adjusted EBITDA per Ton

80.6

45.0

0.3

19.8

51.1

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

Investor Visits - October 2012 |

Reconciliations

24

$ in millions, except per ton data

Jewell Coke

Other

Domestic

Coke

International

Coke

Jewell Coal

Corporate

Combined

Domestic

Coke

Q4 2011

Adjusted EBITDA

10.6

21.3

10.2

2.5

(13.2)

31.4

31.9

Subtract: Depreciation, depletion and amortization

(1.2)

(10.6)

(0.1)

(3.7)

(0.4)

(16.0)

(11.8)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

(0.5)

(0.5)

(0.5)

Adjusted Pre-Tax Operating Income

9.4

10.2

10.1

(1.2)

(13.6)

14.9

19.6

Adjusted EBITDA

10.6

21.3

10.2

2.5

(13.2)

31.4

31.9

Sales Volume (thousands of tons)

166

837

295

363

1,003

Adjusted EBITDA per Ton

63.9

25.4

34.6

6.9

31.8

Q3 2011

Adjusted EBITDA

13.9

34.3

1.7

9.2

(14.3)

44.8

48.2

Subtract: Depreciation, depletion and amortization

(1.2)

(9.9)

-

(3.3)

(0.3)

(14.7)

(11.1)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

3.4

3.4

3.4

Adjusted Pre-Tax Operating Income

12.7

27.8

1.7

5.9

(14.6)

33.5

40.5

Adjusted EBITDA

13.9

34.3

1.7

9.2

(14.3)

44.8

48.2

Sales Volume (thousands of tons)

191

777

373

371

968

Adjusted EBITDA per Ton

72.8

44.1

4.6

24.8

49.8

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

Investor Visits - October 2012 |

Reconciliations

25

$ in millions, except per ton data

Jewell Coke

Other

Domestic

Coke

International

Coke

Jewell Coal

Corporate

Combined

Domestic

Coke

Q2 2011

Adjusted EBITDA

10.6

25.3

0.8

11.5

(10.5)

37.7

35.9

Subtract: Depreciation, depletion and amortization

(1.4)

(9.6)

(0.1)

(3.2)

(0.4)

(14.7)

(11.0)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

1.6

1.6

1.6

Adjusted Pre-Tax Operating Income

9.2

17.3

0.7

8.3

(10.9)

24.6

26.5

Adjusted EBITDA

10.6

25.3

0.8

11.5

(10.5)

37.7

35.9

Sales Volume (thousands of tons)

170

757

412

334

927

Adjusted EBITDA per Ton

62.4

33.4

1.9

34.4

38.7

Q1 2011

Adjusted EBITDA

11.0

8.5

1.0

12.3

(6.2)

26.6

19.5

Subtract: Depreciation, depletion and amortization

(1.1)

(8.6)

-

(2.7)

(0.6)

(13.0)

(9.7)

Add (Subtract): Net (Income) loss attributable

to noncontrolling interests

(6.2)

(6.2)

(6.2)

Adjusted Pre-Tax Operating Income

9.9

(6.3)

1.0

9.6

(6.8)

7.4

3.6

Adjusted EBITDA

11.0

8.5

1.0

12.3

(6.2)

26.6

19.5

Sales Volume (thousands of tons)

175

697

362

386

872

Adjusted EBITDA per Ton

62.9

12.2

2.8

31.9

22.4

Reconciliations from Adjusted EBITDA to Adjusted Pre-Tax Operating Income

Investor Visits - October 2012 |

(in

millions) 2012E

Low

2012E

High

Net Income

$98

$122

Depreciation, Depletion and Amortization

74

72

Total financing costs, net

48

46

Income tax expense

25

37

EBITDA

$245

$277

Sales discounts

11

10

Noncontrolling interests

(6)

(7)

Adjusted EBITDA

$250

$280

Estimated EBITDA Reconciliation

2012E Net Income to Adjusted EBITDA Reconciliation

26

Investor Visits - October 2012 |

Free Cash Flow

Reconciliations 2012E Estimated Free Cash Flow Reconciliation

27

(in millions)

1 Half

2012

Cash from operations

$ 86.7

Less cash used for investing activities

(20.7)

Less payments to minority interest

( -

)

Free Cash Flow

$ 66.0

(in millions)

2012

Cash from operations

In excess of

$ 189

Less cash used for investing activities

Approx.

(85)

Less payments to minority interest

Approx.

(4)

Free Cash Flow

In excess of

$ 100

First Half 2012 Free Cash Flow Reconciliation

st

Investor Visits - October 2012 |