Attached files

| file | filename |

|---|---|

| 8-K - ROSETTA RESOURCES INC 8-K 10-15-2012 - NBL Texas, LLC | form8k.htm |

Exhibit 99.1

REDEFINED BUILDING VALUE IN UNCONVENTIONAL RESOURCES Rosetta Resources Inc. Eagle Ford Plan – Leaving No Stone Unturned John D. Clayton Senior Vice President, Asset Development October 15, 2012 3rd Annual Conference San Antonio, Texas Exhibit 99.1

This presentation includes forward-looking statements, which give the Company's current expectations or forecasts of future events based on currently available information. Forward-looking statements are statements that are not historical facts, such as expectations regarding drilling plans, including the acceleration thereof, production rates and guidance, resource potential, incremental transportation capacity, exit rate guidance, net present value, development plans, progress on infrastructure projects, exposures to weak natural gas prices, changes in the Company's liquidity, changes in acreage positions, expected expenses, expected capital expenditures, and projected debt balances. The assumptions of management and the future performance of the Company are subject to a wide range of business risks and uncertainties and there is no assurance that these statements and projections will be met. Factors that could affect the Company's business include, but are not limited to: the risks associated with drilling of oil and natural gas wells; the Company's ability to find, acquire, market, develop, and produce new reserves; the risk of drilling dry holes; oil and natural gas price volatility; derivative transactions (including the costs associated therewith and the abilities of counterparties to perform thereunder); uncertainties in the estimation of proved, probable, and possible reserves and in the projection of future rates of production and reserve growth; inaccuracies in the Company's assumptions regarding items of income and expense and the level of capital expenditures; uncertainties in the timing of exploitation expenditures; operating hazards attendant to the oil and natural gas business; drilling and completion losses that are generally not recoverable from third parties or insurance; potential mechanical failure or underperformance of significant wells; availability and limitations of capacity in midstream marketing facilities, including processing plant and pipeline construction difficulties and operational upsets; climatic conditions; availability and cost of material, supplies, equipment and services; the risks associated with operating in a limited number of geographic areas; actions or inactions of third-party operators of the Company's properties; the Company's ability to retain skilled personnel; diversion of management's attention from existing operations while pursuing acquisitions or dispositions; availability of capital; the strength and financial resources of the Company's competitors; regulatory developments; environmental risks; uncertainties in the capital markets; general economic and business conditions (including the effects of the worldwide economic recession); industry trends; and other factors detailed in the Company's most recent Form 10-K, Form 10-Q and other filings with the Securities and Exchange Commission. If one or more of these risks or uncertainties materialize (or the consequences of such a development changes), or should underlying assumptions prove incorrect, actual outcomes may vary materially from those forecasted or expected. The Company undertakes no obligation to publicly update or revise any forward-looking statements except as required by law. Forward-Looking Statements and Terminology Used *

For filings reporting year-end 2011 reserves, the SEC permits the optional disclosure of probable and possible reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the term “net risked resources” to describe the Company’s internal estimates of volumes of natural gas and oil that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of unproved resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates. We use the term “BFIT NPV10” to describe the Company’s estimate of before income tax net present value discounted at 10 percent resulting from project economic evaluation. The net present value of a project is calculated by summing future cash flows generated by a project, both inflows and outflows, and discounting those cash flows to arrive at a present value. Inflows primarily include revenues generated from estimated production and commodity prices at the time of the analysis. Outflows include drilling and completion capital and operating expenses. Net present value is used to analyze the profitability of a project. Estimates of net present value may change significantly as additional data becomes available, and with adjustments in prior estimates of actual quantities of production and recoverable reserves, commodity prices, capital expenditures, and/or operating expenses. Forward-Looking Statements and Terminology Used (cont.) *

INVEST IN SWEAT EQUITY Focus on understanding the rocks; appreciate your technical staffs! Faith, hope & luck are not substitutes for brains, initiative & work ethic! ENTER EARLY Focus on quality over quantity; know the difference! They are called sweet spots for a reason! START DELINEATION Focus on optimizing full scale development; not just the next well It does you absolutely no good to drill your best well last! NEVER STOP OPTIMIZING Focus on profitability Admire your activity but track your production and count your pennies! GET TO KNOW YOUR PORTFOLIO Focus on optionality There is not a better feeling in the world than knowing you have your future well in hand! X * During the last two conferences, I outlined some comments on Rosetta’s approach in the Eagle Ford …

INVEST IN SWEAT EQUITY Focus on understanding the rocks; appreciate your technical staffs! Faith, hope & luck are not substitutes for brains, initiative & work ethic! ENTER EARLY Focus on quality over quantity; know the difference! They are called sweet spots for a reason! START DELINEATION Focus on optimizing full scale development; not just the next well It does you absolutely no good to drill your best well last! NEVER STOP OPTIMIZING Focus on profitability Admire your activity but track your production and count your pennies! GET TO KNOW YOUR PORTFOLIO Focus on optionality There is not a better feeling in the world than knowing you have your future well in hand! LEAVE NO STONE UNTURNED Focus on ongoing refinement of well spacing and well recoveries You rarely go wrong when you grow what you know in your own backyard! * Today, let’s talk about another angle for you to consider …

Area Window Net Acreage Gates Ranch Liquids 26,500 Non-Gates Ranch Liquids 23,500 Encinal Area Dry Gas 15,000 TOTAL 65,000 * Current Drilling Activity Area Operating two rigs in Gates Ranch and three in Briscoe Ranch, Central Dimmit County and Karnes Trough area Participated in 10 successful wells in non-operated Chupadera Ranch in western Webb County to date Scheduled to drill Hanks area in LaSalle County in latter part of 2012 Rosetta is now a pure-play Eagle Ford producer with a “backyard” inventory of high-return, low-risk unconventional drilling opportunities …

Gross Daily Rate Completed Well Count 11.2 mboepd * At the time of the first DUG conference in 2010, our Eagle Ford wells were producing roughly 11 mboepd gross …

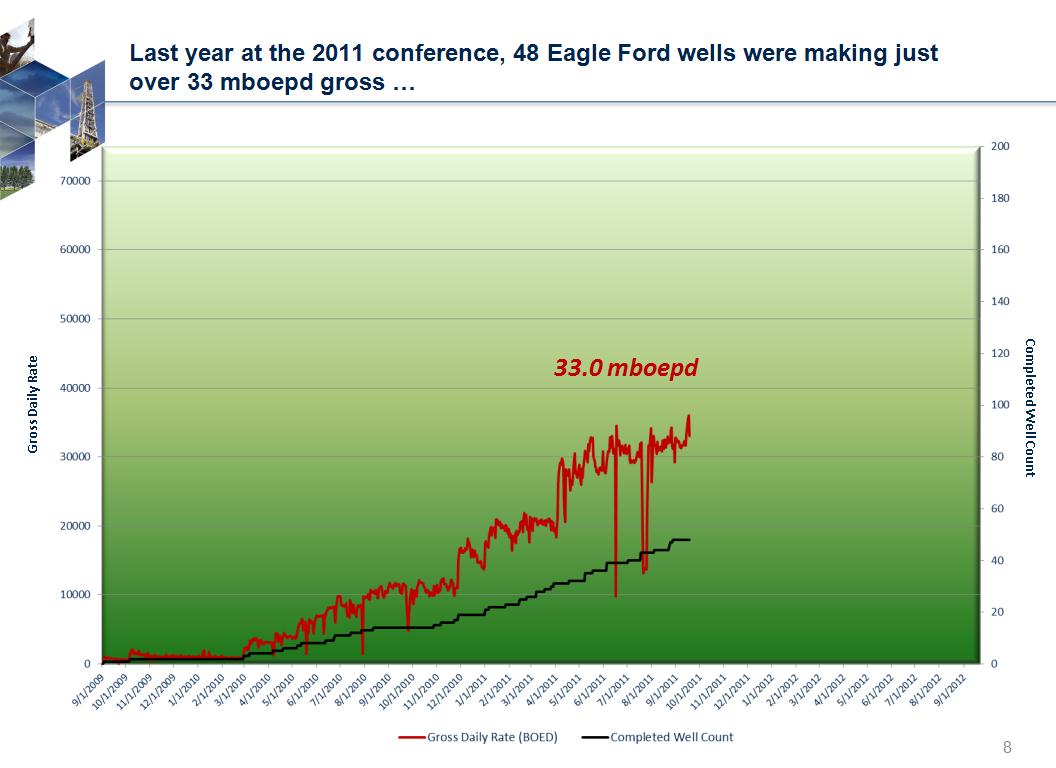

Gross Daily Rate Completed Well Count * 33.0 mboepd Last year at the 2011 conference, 48 Eagle Ford wells were making just over 33 mboepd gross …

Gross Daily Rate Completed Well Count * 56.6 mboepd* Today, we now have over 100 producing wells in the play that are making approximately 57 mboepd gross … *Gross daily rate will not tie to SEC volumes

* Summary 26,500 net acres in Webb County 72 completions as of 6/30/2012 1Q 2012: 10 completions 2Q 2012: 6 completions 356 well locations remaining under current spacing assumptions Average Well Characteristics Well Costs: $7.5 - $8.0 million Spacing: 475 feet apart or 55 acres Composite EUR: 1.67 MMBoe F&D Costs: $4.65/Boe Condensate Yield = 64 Bbls/MMcf NGL Yield = 100 Bbls/MMcf Shrinkage = 20% Mix: Oil 23%, NGLs 32% Gates Ranch has been the main contributor to that growth with only 17% of the ultimate development on production at the end of 2Q …

Composite Type Curve – 1.7 MMBoe (23% Oil / 32% NGLs) South Type Curve – 1.9 MMBoe North Type Curve – 1.4 MMBoe * And we expect to recover approximately 715 MMBoe or 1.67 MMBoe per well based on our 55-acre spacing development plan …

* Summary 3,545 net acres in southern Dimmit County 1 completion as of 6/30/2012 67 well locations remaining Average Well Characteristics Well Costs: $7.5 - $8.0 million Spacing: 425 feet apart or 50 acres Condensate Yield = 76 Bbls/MMcf NGL Yield = 121 Bbls/MMcf Shrinkage = 20% Future Activity Completion of first 3-well pad ongoing in 3Q 2012 Planned full development activity will last well into 2016 Discovery Well Initial Rate* – 10/2011 1,990 Boe/d, 68% Liquids (850 Bo/d, 490 B/d NGLs, 3,900 Mcf/d) *Seven-day stabilized rate This year we also began full development of Briscoe Ranch, located five miles north of Gates Ranch, with the first 3-well pad drilled on the lease …

* Production and pressure data from the Briscoe Ranch discovery well point to estimated recoveries per well in excess of 890 MBoe …

* SUMMARY 1,900 net acres; located in oil window 10 total completions as of 6/30/2012 1Q 2012: 2 completions 2Q 2012: 7 completions 12 well locations remaining Well Costs: $8.5 - $9.0 million Activity planned through 2013 Klotzman (Dewitt County) 8 total completions as of 6/30/2012 1Q 2012: 1 completion 2Q 2012: 6 completions Rosetta-owned oil truck terminal started operation in late July Reilly (Gonzales County) 2 completions as of 6/30/2012 1Q 2012: 1 completion 2Q 2012: 1 completion Klotzman 1H Discovery Well Initial Rate* – 11/2011 3,033 Boe/d, 81% Oil (2,450 Bo/d, 250 B/d NGLs, 2,000 Mcf/d) Adele Dubose 1H Delineation Well Initial Rate* – 2/2012 1,463 Boe/d, 76% Oil (1,109 Bo/d, 153 B/d NGLs, 1,200 Mcf/d) *Seven-day stabilized rate Going further northeast into the oil window, leases in our Karnes Trough area provide 22 locations; all will be drilled this year with half completed …

* And, Klotzman oil wells are expected to recover 665 MBoe with impressive economics paying out in approximately six to nine months …

* Summary 8,100 net acres in Dimmit County 4 completions as of 6/30/2012 2Q 2012: 2 completions 123 well locations remaining Well Costs: $7.5 - $8.0 million Light Ranch 1H Discovery Well Initial Rate* – 10/2010 987 Boe/d, 78% Liquids (510 Bo/d, 260 B/d NGLs, 1,300 Mcf/d) Vivion 1H Discovery Well Initial Rate* – 9/2011 680 Boe/d, 89% Liquids (506 Bo/d, 102 B/d NGLs, 436 Mcf/d) Light Ranch 3 total completions as of 6/30/2012 2Q 2012: 2 completions Vivion 1 completion as of 6/30/2012 Lasseter & Eppright 3Q 2012: 1 well in progress *Seven-day stabilized rate Finally, development activity is underway on all three of our Central Dimmit County leases with 123 well locations remaining …

* Denotes roughly 10,000 net acres in the liquids window of the play in Webb (~3,000), LaSalle (~3,500), and Gonzales (~3,000) counties. * At a pace of 60 wells per year, and well spacing from 50 to 80 acres, we have a drilling inventory of roughly 15 years ahead of us … just on our existing leasehold

Gross Daily Rate Completed Well Count Actual completion pace of 35 wells per year for first 3 years To put that into perspective, our first three years of activity completed roughly 35 wells per year and grew production to approximately 57 mboepd gross … *

Gross Daily Rate Completed Well Count Completion pace of 60 wells per year used as an example to show the true “running room” of the portfolio Using our pace of 60 wells per year, we will be active in this play, on this acreage position, drilling and completing wells for many more years to come … *

Gross Daily Rate Completed Well Count 50 to 55-acre well spacing (2Q12 Call) Completion pace of 60 wells per year used as an example to show the true “running room” of the portfolio 65-acre well spacing (3Q11 Call) 100-acre well spacing (2009) The current “backyard” inventory reflects our most recent analysis on reduced well spacing, adding 123 locations to the full development plan … *

LEAVE NO STONE UNTURNED Focus on ongoing refinement of well spacing and well recoveries You rarely go wrong when you grow what you know in your own backyard! So, building on last year’s message, Rosetta’s Eagle Ford development plan is leaving no stone unturned in our portfolio … *

LEAVE NO STONE UNTURNED Focus on ongoing refinement of well spacing and well recoveries You rarely go wrong when you grow what you know in your own backyard! So, building on last year’s message, Rosetta’s Eagle Ford development plan is leaving no stone unturned in our portfolio … *

REDEFINED BUILDING VALUE IN UNCONVENTIONAL RESOURCES