Attached files

| file | filename |

|---|---|

| EX-99.1 - THE PRESS RELEASE, DEEMED "FILED" UNDER THE SECURITIES EXCHANGE ACT OF 1934 - WELLS FARGO & COMPANY/MN | d423805dex991.htm |

| 8-K - CURRENT REPORT ON FORM 8-K - WELLS FARGO & COMPANY/MN | d423805d8k.htm |

3Q12 Quarterly Supplement

October 12, 2012

Exhibit 99.2 |

Wells Fargo

3Q12 Supplement 1

Appendix

Pages 22-37

-

Non-strategic/liquidating loan portfolio risk reduction

23

-

Purchased credit-impaired (PCI) portfolios

24

-

PCI nonaccretable difference

25

-

PCI accretable yield

26

-

PCI accretable yield (Commercial & Pick-a-Pay)

27

-

Pick-a-Pay mortgage portfolio

28

-

Pick-a-Pay credit highlights

29

-

Real estate 1-4 family first mortgage portfolio

30

-

Home equity portfolio

31

-

Credit card portfolio

32

-

Auto portfolios

33

-

Student lending portfolio

34

Tier 1 common equity under Basel I

35

Tier 1 common equity under Basel III

(Estimated)

36

Forward-looking statements and

additional information

37

Table of contents

3Q12 Results

-

3Q12 Results

Page 2

-

Continued strong diversification

3

-

Balance Sheet and credit overview

4

-

Income Statement overview

5

-

Loans

6

-

Deposits

7

-

Net interest income

8

-

Noninterest income

9

-

Noninterest expense and efficiency ratio

10

-

Community Banking

11

-

Wholesale Banking

12

-

Wealth, Brokerage and Retirement

13

-

3Q12 Credit quality highlights

14

-

Credit quality

15-16

-

Mortgage servicing

17-18

-

Capital

19

-

Demonstrated momentum across the franchise

20

-

Summary

21 |

Wells Fargo

3Q12 Supplement 2

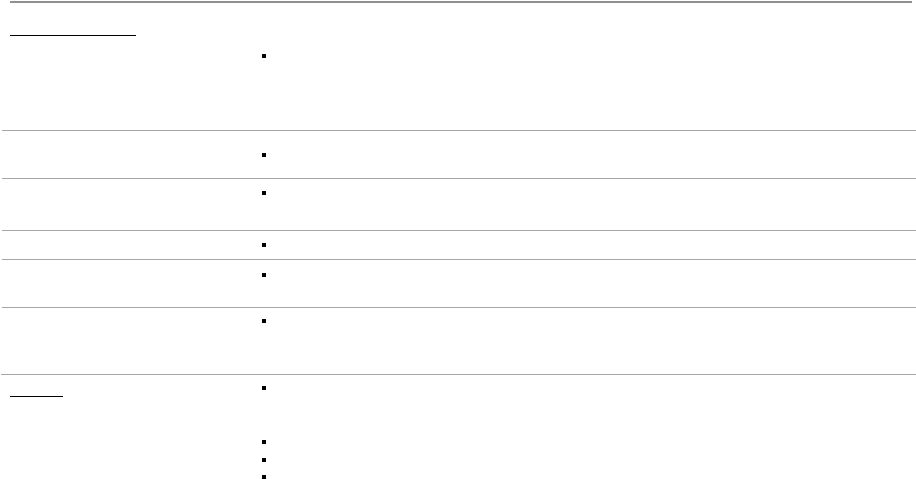

Record earnings of $4.9 billion, up 7% linked

quarter (LQ) and 22% year-over-year (YoY)

Record diluted earnings per common share of

$0.88, up 7% LQ and 22% YoY

Total revenue of $21.2 billion relatively stable as

lower net interest income was largely offset by

stronger noninterest income

Positive operating leverage; efficiency ratio

improvement to 57.1%

(1)

Pre-tax pre-provision profit

(2)

of $9.1 billion, up

$209 million LQ

Strong underlying credit performance

ROA = 1.45%, up 4 bps LQ and up 19 bps YoY

ROE = 13.38%, up 52 bps LQ and up 152 bps YoY

Capital levels remained strong

-

10.06% Tier 1 common equity ratio under Basel I

and estimated Tier 1 common equity ratio under

Basel III of 8.02%

(3)

3Q12 Results

Wells Fargo Net Income

($ in millions)

4,055

4,107

4,248

4,622

4,937

3Q11

4Q11

1Q12

2Q12

3Q12

(2) Pre-tax pre-provision profit (PTPP) is total revenue less noninterest

expense. Management believes PTPP is a useful financial measure because it enables

investors and others to assess the Company’s ability to generate capital to cover credit

losses through a credit cycle.

(3) Estimated Basel III calculation based on management’s current interpretation of

the Basel III capital rules proposed by federal banking agencies in notices of proposed

rulemaking announced in June 2012. The proposed rules and interpretations and assumptions used in estimating Basel III calculations are

subject to change depending on final promulgation of Basel III capital rules. See pages

35-36 for additional information regarding Tier 1 common equity ratios. (1) Efficiency ratio defined as

noninterest expense divided by total revenue (net interest income plus noninterest income). |

Wells Fargo

3Q12 Supplement 3

Balanced Spread and

Fee Income

Diversified Fee

Generation

Deposit Service Charges

11%

Card Fees

7%

Other Banking Fees

10%

Mortgage Servicing, net

2%

Insurance

4%

Net Gains from Trading

5%

Noninterest Income

50%

Net Interest Income

50%

Diversified Loan

Portfolio

Commercial Loans

40%

Consumer Loans

55%

Continued strong diversification

Foreign Loans

5%

Mortgage Orig./Sales, net

25%

Trust, Investment & IRA fees

10%

Commissions & All Other

Investment Fees

18%

Other Noninterest Income

(1)

8%

50%

50%

11%

10%

18%

7%

10%

2%

25%

4%

5%

8%

55%

40%

5%

All data is for 3Q12.

(1) Other noninterest income includes net gains on debt securities available

for sale, equity investments, operating leases and all other noninterest income.

|

Wells Fargo

3Q12 Supplement 4

Balance Sheet and credit overview

Balance Sheet

Loans

Total

period-end

loans

up

$7.4

billion

-

Core loans increased $11.9 billion primarily driven by the decision to retain

$9.8 billion of 1-4 family conforming first mortgage production

-

Non-strategic/liquidating

portfolio

decreased

$4.5

billion

(1)

Short-term investments/

Fed funds sold

Balances up $25.8 billion driven by strong deposit growth

Securities available for

sale (AFS)

Balances up $2.5 billion driven by an increase in fair value as new investments were

largely offset by the continued run-off of higher-yielding securities

Deposits

Balances up $23.3 billion

Long-term debt

Balances up $5.8 billion as $7.4 billion in issuances were partially offset by $2.2

billion in maturities

Common stock

repurchases

Purchased 16.5 million common shares in the quarter and an additional estimated

9 million shares through a forward repurchase transaction that is expected to

settle in 4Q12

Credit

Strong

core

credit

performance;

$200

million

reserve

release

(3)

on

strong

underlying credit

Effect of regulatory

guidance

(2)

implementation on credit

$1.4 billion reclassification of performing consumer loans to nonaccrual status

$567 million in net charge-offs fully covered by loan loss reserves

See page 14 for additional information

Period-end balances. All result comparisons are 3Q12 compared with 2Q12.

(1) See pages 6 and 23 for additional information regarding core loans and the

non-strategic/liquidating portfolio, which comprises the Pick-a-Pay, liquidating

home equity, legacy WFF indirect auto, legacy WFF debt consolidation, Education

Finance-government guaranteed, and legacy Wachovia Commercial & Industrial,

Commercial Real Estate, foreign and other PCI loan portfolios. (2) Office of the Comptroller of the Currency update to the Bank Accounting

Advisory Series issued third quarter 2012 (OCC guidance). The OCC guidance requires

write-down of performing consumer loans restructured in bankruptcy to collateral value.

(3) Provision expense minus net charge-offs excluding the effects of OCC guidance

implementation. |

Wells Fargo

3Q12 Supplement 5

Income Statement overview

Net interest income

NII down $375 million on lower variable income from elevated 2Q12 levels;

increased paydowns and cautious reinvestment also reduced AFS portfolio

income

Net interest margin (NIM) down 25 bps to 3.66% reflecting lower variable

income, continued balance sheet repricing and strong deposit growth

Noninterest income

Mortgage banking down $86 million

-

Net servicing income down $482 million on increased servicing and

foreclosure costs incorporated into our MSR valuation

-

Gain on sale revenue up $396 million despite ~$200 million in forgone

revenue resulting from the retention of new conforming production

Market sensitive revenues

(1)

up $252 million

-

Trading up $266 million reflecting $153 million higher deferred

compensation plan investment income (P&L neutral) as well as stronger

customer accommodation trading results

Service charges on deposit accounts up $71 million reflecting product and pricing

initiatives

Trust & investment fees up $56 million on higher asset based fees in retail

brokerage and asset management as well as higher retail brokerage transaction

revenue

Noninterest expense

Personnel expense down $29 million despite $152 million higher deferred

compensation expense and 2,600 additional FTEs primarily in mortgage and the

retail bank Eastern franchise

Operating losses down $243 million on lower litigation accruals

Insurance commissions expense down $112 million reflecting seasonality

All result comparisons are 3Q12 compared with 2Q12.

(1) Includes net gains from trading activities, net gains on debt securities available

for sale and net gains from equity investments. |

Wells Fargo

3Q12 Supplement 6

643.6

657.3

658.3

672.1

684.0

116.5

112.3

108.2

103.1

98.6

760.1

769.6

766.5

775.2

782.6

3Q11

4Q11

1Q12

2Q12

3Q12

Core loans

Non-strategic/liquidating loans

Loans

Strong core loan growth

Period-end loans up $7.4 billion from 2Q12

-

Commercial loans down $1.5 billion as growth in

C&I was more than offset by declines in CRE and

foreign

-

Consumer loans up $8.9 billion as growth in first

mortgage, auto, credit card and private student

lending was partially offset by a $2.8 billion

decline in junior lien mortgage

•

Includes

retention

of

$9.8

billion

of

1-4

family

conforming first mortgages

Non-strategic/liquidating loans

(1)

down $4.5

billion from 2Q12

Core loans grew $11.9 billion from 2Q12

Total average loan yield of 4.63% down 20 bps LQ

-

2Q12 loan yields reflected benefit from higher

than average PCI loan resolutions

-

Core loan yield excluding the

non-strategic/liquidating portfolio was down

7 bps

Period-end balances.

(1) See page 23 for additional information regarding the non-strategic/liquidating

portfolio, which comprises the Pick-a-Pay, liquidating home equity, legacy WFF

indirect auto, legacy WFF debt consolidation, Education Finance-government guaranteed, and

legacy Wachovia commercial & industrial, commercial real estate, foreign and other

PCI loan portfolios. Period–end

Loans

Outstanding

($ in billions)

(1)

Total average loan yield

4.87%

4.81%

4.81%

4.83%

4.63% |

Wells Fargo

3Q12 Supplement 7

Deposits

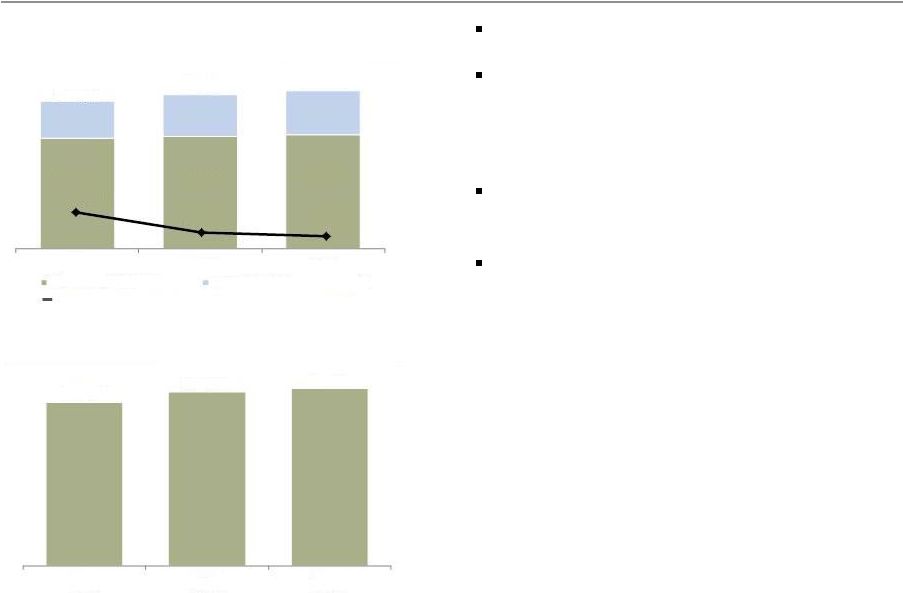

Strong growth and reduced average cost

Average deposits up $22.5 billion LQ to $946.5

billion driven by growth across the franchise

Average core deposits of $895.4 billion up $14.7

billion from 2Q12

-

115% of average loans

-

Average retail core deposits up 4%

annualized LQ

Average core checking and savings up $16.9

billion, or 2% from 2Q12

-

94% of average core deposits

Average deposit cost of 18 bps down 1 bp from

2Q12

Average Deposits and Rates

($ in billions)

Average deposit cost

Average Core Checking and Savings

($ in billions)

0.25%

0.19%

0.18%

661.4

669.5

679.3

221.2

254.5

267.2

882.6

924.0

946.5

3Q11

2Q12

3Q12

Interest-bearing deposits

Noninterest-bearing deposits

769.2

820.3

837.2

3Q11

2Q12

3Q12 |

Wells Fargo

3Q12 Supplement 8

(4)

1

1

7

(10)

3Q11

4Q11

1Q12

2Q12

3Q12

LQ Change in Variable Income

Contribution

(in basis points)

Net interest income

Net Interest Income (TE)

(1)

($ in millions)

Tax-equivalent net interest income

(1)

down $393

million from 2Q12; NIM declined to 3.66%

Average earning assets up $26.3 billion or 2% LQ

-

Short-term investments/fed funds sold up

$20.3 billion

-

$2.6 billion increase in mortgages held for sale

-

Trading assets down $3.1 billion

-

AFS securities down $1.9 billion

NIM down 25 bps from 2Q12 on:

-

Lower variable income ~ 10 bps of the decline

-

Continued balance sheet repricing as higher

yielding earning assets ran off and our cautious

reinvestment stance included shorter-maturity

securities ~8 bps

•

Securities ~ 6 bps and loans ~ 2bps

-

Strong deposit inflows with proceeds invested in

short-term investments/fed funds sold ~7 bps

Net Interest Margin (NIM)

(1) Tax equivalent net interest income is based on the federal statutory rate of 35% for

the periods presented. Net interest income was $10,542 million, $10,892 million,

$10,888

million,

$11,037

million

and

$10,662

million

for

3Q11,

4Q11,

1Q12,

2Q12

and

3Q12

respectively.

3.84%

3.89%

3.91%

3.91%

3.66%

10,714

11,083

11,058

11,213

10,820

3Q11

4Q11

1Q12

2Q12

3Q12 |

Wells Fargo

3Q12 Supplement 9

Noninterest income

Deposit service charges up 6% LQ reflecting product

and pricing changes

Trust and investment fees up 2% LQ on stronger

asset based fees in retail brokerage and asset

management as well as higher retail brokerage

transaction revenue

Card fees up 6% LQ reflecting higher interchange

revenue on higher volumes and new account growth

Mortgage banking down $86 million, or 3%, LQ as

strong originations were offset by lower servicing

income

•

Included a $207 million LQ decrease in the

mortgage repurchase build

Insurance down 21% LQ reflecting seasonality

Trading gains up $266 million LQ on $153 million

higher deferred compensation plan investment income

and stronger customer accommodation trading results

Operating leases up $98 million LQ on early lease

termination fees

9,086

9,713

10,748

10,252

10,551

3Q11

4Q11

1Q12

2Q12

3Q12

vs

vs

($ in millions)

3Q12

2Q12

3Q11

Noninterest income

Service charges on deposit accounts

$

1,210

6

%

10

Trust and investment fees

2,954

2

6

Card fees

744

6

(27)

Other fees

1,097

(3)

1

Mortgage banking

2,807

(3)

53

Insurance

414

(21)

(2)

Net gains from trading activities

529

101

n.m.

3

105

(99)

Net gains from equity investments

164

(32)

(52)

Operating leases

218

82

(23)

Other

411

3

15

Total nonterest income

$

10,551

3

%

16

Net gains on debt securities available

for sale

-

Net servicing income down $482 million on

increased servicing and foreclosure costs

incorporated into our MSR valuation

-

Gain on sale revenue up $396 million despite

~$200 million in forgone revenue resulting

from the retention of conforming production |

Wells Fargo

3Q12 Supplement 10

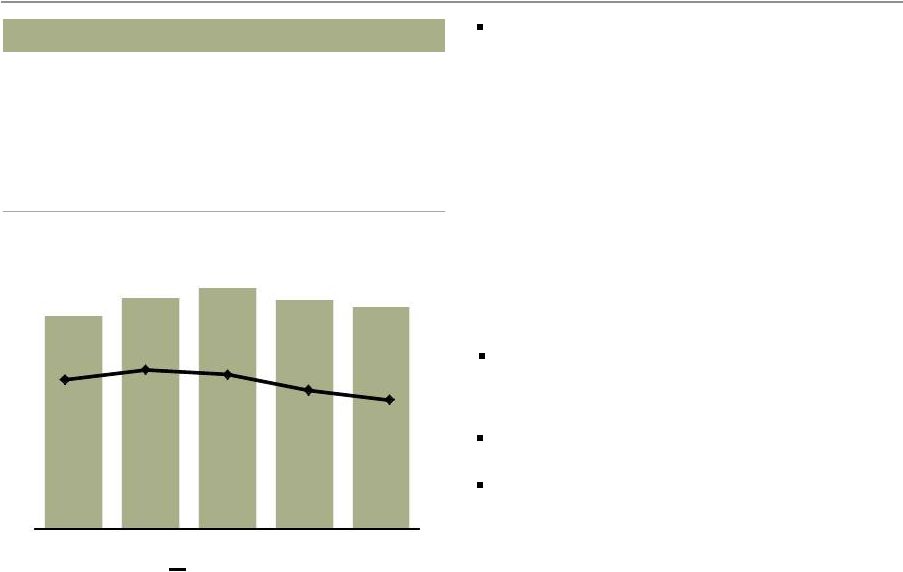

Noninterest expense and efficiency ratio

(1)

Noninterest expense down $285 million from

2Q12 driven by lower operating losses and

seasonally lower insurance commissions expense

-

Salaries expense down $57 million, or 2%, as

lower severance expense was partially offset by

2,600 additional FTEs primarily in mortgage and

the retail bank Eastern franchise

-

Employee benefits expense up $14 million, or

1%, as $152 million in higher deferred

compensation expense was partially offset by

other lower employee benefits

-

Other expense down $363 million LQ and

included:

•

Operating losses down $243 million on lower

litigation accruals

•

Insurance commissions expense down $132

million driven by seasonality

Efficiency ratio of 57.1% in 3Q12 was the lowest

in ten quarters

Continue to target an efficiency ratio of 55%-

59%

Efficiency Ratio

59.5%

60.7%

60.1%

58.2%

57.1%

11,677

12,508

12,993

12,397

12,112

3Q11

4Q11

1Q12

2Q12

3Q12

-

~$100 million in outside professional services

expense associated with mortgage servicing

regulatory consent orders, stable LQ

3Q12 expenses included:

vs

vs

($ in millions)

3Q12

2Q12

3Q11

Noninterest expense

Salaries

$

3,648

(2)

%

(2)

Commission and incentive compensation

2,368

1

13

Employee benefits

1,063

1

36

Equipment

510

11

(1)

Net occupancy

727

4

(3)

Core deposit and other intangibles

419

-

(10)

FDIC and other deposit assessments

359

8

8

Other

3,018

(11)

-

Total noninterest expense

$

12,112

(2)

%

4

(1)

Efficiency ratio defined as noninterest expense divided by total revenue (net interest income

plus noninterest income). |

Wells Fargo

3Q12 Supplement 11

Community Banking

Average loans were flat LQ as growth in first

mortgage, credit card, core auto and private

student lending was partially offset by non-

strategic/liquidating portfolio run-off and lower

home equity outstandings

Regional Banking

Continued

franchise

and

cross-sell

growth

(1)

-

Consumer checking

(2)

essentially flat to prior year

-

Business checking

(2)

up a net 3.9%

-

Retail bank cross-sell of 6.04 products per

household up from 5.90 in 3Q11

•

West cross-sell = 6.40

•

East cross-sell = 5.56

Consumer Lending

Credit card penetration

(1) (3)

rose to 32.1%, up

from 31.0% in 2Q12 and 28.1% in 3Q11

Consumer auto originations of $6.3 billion, down

3% LQ and up 20% YoY

Mortgage originations of $139 billion up 6% LQ

-

14% of originations were from HARP

(4)

Quarter-end pipeline of $97 billion down 5% LQ

Managed residential mortgage servicing of $1.9

trillion up 1% LQ

(1) Metrics reported on a one-month lag from reported quarter-end; for example

3Q12 cross-sell is as of August 2012.

(2) Checking account growth is 12-months ending for each respective period.

(3) Household penetration as of August 2012 and defined as the percentage of retail

banking deposit households that have a credit card with Wells Fargo. Household

penetration has been redefined to include legacy Wells Fargo Financial accounts.

(4) Home Affordable Refinance Program.

vs

vs

($ in millions)

3Q12

2Q12

3Q11

Net interest income

$

7,247

(1)

%

-

Noninterest income

5,863

1

12

Provision for credit losses

1,627

3

(18)

Noninterest expense

7,402

(2)

7

Income tax expense

1,250

(5)

2

Segment earnings

$

2,740

8

%

18

($ in billions)

Avg loans, net

$

485.3

-

(1)

Avg core deposits

594.5

1

7

3Q12

2Q12

3Q11

Regional Banking

Consumer

checking

account

growth

(1)(2)

0.1

%

1.0

6.3

Business

checking

account

growth

(1)(2)

3.9

3.8

4.0

Retail

Bank

household

cross-sell

(1)

6.04

6.00

5.90

vs

vs

($ in billions)

3Q12

2Q12

3Q11

Consumer Lending

Credit card payment volumes (POS)

$

12.1

4

%

15

Credit card penetration

(1)(3)

32.1

110

bps

400

Home Mortgage

Applications

$

188

(10)

%

11

Application pipeline

97

(5)

15

Originations

139

6

56

Managed residential

mortgage servicing ($ in trillions)

$

1.9

1

4 |

Wells Fargo

3Q12 Supplement 12

Wholesale Banking

Record net income of $2.0 billion

Net interest income down 10% driven by lower

PCI loan resolution income

-

Average loans up $6.9 billion driven by 2Q12

acquisitions and growth in commercial banking

and capital finance

Noninterest income up 5% LQ driven by higher

trading, operating lease income and commercial

mortgage banking

Provision expense down $245 million LQ on lower

losses, higher recoveries and a reserve release in

the quarter

Expenses down 7% LQ driven by seasonally lower

insurance expense as well as lower foreclosed

asset expense and personnel expense

Treasury Management

Commercial card spend volume of $4.1 billion up

3% LQ and 24% YoY

Investment Banking

Investment Banking fees from Commercial and

Corporate Banking customers up 13% YTD from

2011 YTD

2012 YTD U.S. investment banking market

share

(3)

of 5.1%

Asset Management

Total AUM up 3% LQ on higher market valuation

and positive net flows across all asset classes

(1) Approved and initiated.

(2) Source: Dealogic U.S. investment banking fee market share.

vs

vs

($ in millions)

3Q12

2Q12

3Q11

Net interest income

$

3,028

(10)

%

5

Noninterest income

2,921

5

31

Reversal of provision for

credit losses

(57)

n.m.

(68)

Noninterest expense

2,908

(7)

8

Income tax expense

1,103

18

34

Segment earnings

$

1,993

6

%

11

($ in billions)

Avg loans, net

$

277.1

3

9

Avg core deposits

225.4

2

8

vs

vs

($ in billions)

3Q12

2Q12

3Q11

Key Metrics:

Commercial card spend

volume

$

4.1

3

%

24

CEO Mobile Wire volume

(1)

3.4

(19)

36

YTD U.S. investment banking

market share %

(2)

5.1

%

-

bps

30

Total AUM

$

450.4

3

%

-

Advantage Funds AUM

209.4

3

(1)

|

Wells Fargo

3Q12 Supplement 13

Wealth, Brokerage and Retirement

Net interest income down 3% LQ driven by lower

yields on allocated investments and loan

portfolios

Noninterest income up 4% LQ due to the impact

of the higher equity market on hedged deferred

compensation plan investment results (offset in

expense)

Total revenue rose 2%; excluding $76 million

higher deferred compensation plan investment

results, revenues were flat as lower securities

gains and net interest income were partially

offset by higher asset-based fees and brokerage

transaction revenue

Expenses up 3% LQ primarily due to $77 million

higher deferred compensation expense;

excluding deferred compensation, expenses were

flat

Retail Brokerage

Managed account assets up 7% LQ and 25% YoY

driven by strong net flows and market

performance

Wealth Management

Wealth

Management

client

assets

up

1%

LQ

and

4% YoY

Retirement

IRA assets up 5% LQ and 13% YoY

Institutional Retirement plan assets up 4% LQ

and 14% YoY

(1) Includes deposits.

(2) Data as of August 2012.

vs

vs

($ in millions)

3Q12

2Q12

3Q11

Net interest income

$

680

(3)

%

(5)

Noninterest income

2,353

4

8

Provision for credit losses

30

(19)

(38)

Noninterest expense

2,457

3

4

Income tax expense

208

(1)

17

Segment earnings

$

338

(1)

%

17

($ in billions)

Avg loans, net

$

42.5

-

(1)

Avg core deposits

136.7

2

3

vs

($ in billions, except where noted)

3Q12

2Q12

Key Metrics:

WBR Clients Assets

(1)

($ in trillions)

$

1.4

4

%

10

Cross-sell

(2)

10.27

-

2

Retail Brokerage

Financial Advisors

15,167

-

-

Managed account assets

$

297

7

25

Client assets

(1)

($ in trillions)

1.2

4

11

Wealth Management

Client assets

(1)

199

1

4

Retirement

IRA Assets

295

5

13

Institutional Retirement

Plan Assets

260

4

14

vs

3Q11 |

Wells Fargo 3Q12

Supplement 14

3Q12 Credit quality highlights

($ in millions)

2Q12

Adjusted

(1)

Commercial nonaccruals

6,924

6,371

-

6,371

Consumer nonaccruals

13,654

14,673

1,441

13,232

Total nonaccrual loans

20,578

21,044

1,441

19,603

Total foreclosed assets

4,307

4,209

-

4,209

Total NPAs

24,885

25,253

1,441

23,812

as % of loans

3.21

%

3.23

3.04

Provision for credit losses

1,800

1,591

-

1,591

Commercial net charge-offs

358

217

-

217

Consumer net charge-offs

1,842

2,141

567

1,574

Total net charge-offs

2,200

2,358

567

1,791

as % of avg loans

1.15

%

1.21

0.92

Commercial

0.42

0.24

0.24

Consumer

1.76

2.01

1.48

Allowance for credit losses

$

18,646

17,803

(567)

18,370

as % of loans

2.41

%

2.27

2.35

as % of nonaccrual loans

91

85

94

Effect from OCC

Guidance

Implementation

Reported

3Q12

(1) The OCC guidance requires write-down of performing consumer loans restructured

in bankruptcy to collateral value. Management believes that the presentation in this

Quarterly Supplement of information excluding the impact of the OCC guidance provides useful disclosure regarding the underlying

credit quality of the Company’s loan portfolios. |

Wells Fargo

3Q12 Supplement 15

1.8

2.0

2.0

1.8

1.6

3Q11

4Q11

1Q12

2Q12

3Q12

Credit quality

Underlying trends showed continued improvement

Excluding the effect of the implementation of OCC

guidance as detailed on page 14:

-

Net charge-offs of $1.8 billion were down $409

million LQ

•

Commercial net charge-offs down $141

million on fewer losses and higher recoveries

•

Consumer net charge-offs down $268 million

driven by lower consumer real estate losses

-

0.92% net charge-off rate, down 23 bps LQ

-

NPAs declined $1.1 billion LQ on a $975 million

decline in nonaccrual loans and a $98 million

decline in foreclosed assets

Provision expense of $1.6 billion, down $209

million from 2Q12

Early stage consumer delinquency balances

increased 4% and rates increased 3 bps LQ

Allowance for credit losses = $17.8 billion

Currently expect future reserve releases absent

significant deterioration in the economy

Remaining PCI nonaccretable = 23.2% of

remaining UPB

(2)

Accretable yield balance included a $4.3 billion

increase reflecting an improved housing market

forecast and credit outlook

-

$3.6 billion increase in expected cash

flows

-

$687 million in nonaccretable difference

reclassified to accretable yield

(1) OCC guidance impact.

(2) Unpaid principal balance for PCI loans that have not had a UPB charge-off.

Net Charge-offs

($ in billions)

Provision Expense

($ in billions)

2.6

2.6

2.4

2.2

2.4

3Q11

4Q11

1Q12

2Q12

3Q12

1.37%

1.36%

1.25%

1.15%

1.21%

Net charge-off rate (as reported)

1.8

0.6

(1)

Net charge-off rate (as adjusted)

0.92% |

Wells Fargo

3Q12 Supplement 16

21.9

21.3

22.0

20.6

19.7

4.9

4.7

4.6

4.3

4.2

26.8

26.0

26.6

24.9

25.3

3Q11

4Q11

1Q12

2Q12

3Q12

Nonaccrual loans

Foreclosed assets

1.5

1.5

1.2

1.1

1.2

0.4

0.5

0.4

0.3

0.3

1.9

2.0

1.6

1.4

1.5

3Q11

4Q11

1Q12

2Q12

3Q12

Consumer

Commercial

Credit quality

Nonperforming Assets

($ in billions)

Consumer Loans 30-89 DPD &

Still

Accruing

(3)(4)

(Balances and rates)

Loans

90+

DPD

and

Still

Accruing

(3)(4)

($ in billions)

(1)

(2)

1.4

(2)

(1)

Includes $1.7 billion at March 31, 2012, resulting from implementation of Interagency

Supervisory Guidance on Allowance for Loan and Lease Losses Estimation Practices for

Loans and Lines of Credit Secured by Junior Liens on 1-4 Family Residential Properties issued January 31, 2012.

(2)

OCC guidance impact.

(3)

Consumer includes mortgage loans held for sale 30-89 days and 90 days or more past due and

still accruing.

(4)

Excludes mortgage loans insured/guaranteed by the FHA or VA, reverse mortgages, margin loans

and student loans whose repayments are predominantly guaranteed by guarantee agencies

on behalf of the U.S. Department of Education under the Federal Family Education Loan

Program. Also excludes the carrying value of PCI loans contractually delinquent. 2.37%

2.40%

2.00%

1.94%

1.97%

8.2

8.3

6.8

6.6

6.9

$0

$5

$10

3Q11

4Q11

1Q12

2Q12

3Q12 |

Wells Fargo

3Q12 Supplement 17

Mortgage servicing

Wells Fargo has a high quality servicing portfolio

Residential Mortgage Servicing Portfolio

$1.9 Trillion

(as of September 30, 2012)

Agency

Retained and acquired portfolio

Non-agency securitizations of

WFC originated loans

Non-agency acquired servicing

and private whole loan sales

71% of the portfolio is with the Agencies (FNMA,

FHLMC and GNMA)

20% are loans that we retained or acquired

-

Loss exposure handled through loan loss

reserves and PCI nonaccretable

4% are private securitizations where Wells Fargo

originated the loan and therefore has some

repurchase risk

-

78% prime at origination

-

58% from pre-2006 vintages

-

Insignificant amount of home equity and no

option ARMs

-

~50% do not have traditional reps and

warranties

5% are non-agency acquired servicing and

private whole loan sales

-

4% is acquired servicing where Wells Fargo

did not underwrite and securitize and has

repurchase recourse with the originator

-

1% are private whole loan sales

•

Less than 2% subprime at origination

•

Loans sold to others and subsequently

securitized are included in private

securitizations above

71%

20%

4%

5% |

Wells Fargo

3Q12 Supplement 18

4.86

6.10

5.57

9.39

6.52

7.24

2.28

2.64

4.85

4.10

3.58

4.13

7.14%

8.74%

10.42%

13.49%

10.10%

11.37%

Wells Fargo

Citi

JPM Chase

Bank of

America

Industry

Industry ex

WFC

Deliquency Rate

Foreclosure Rate

Mortgage servicing

Delinquency and outstanding repurchase demands

2Q12 Wells Fargo delinquency and foreclosure

ratio continued to be significantly lower than

peers

Wells Fargo’s total delinquency and foreclosure

ratio for 3Q12 was 7.32%, up LQ due to

seasonality, but down from 7.63% in 3Q11

Balance of total outstanding repurchase demands

were up 20% LQ but down 1% YoY

Agency

demands

outstanding

-

Agency repurchase demands outstanding up from

2Q12 on lower resolutions

-

New agency demands in total and in the 2006-

2008 vintages down LQ

-

Demands on newer vintage originations continued

to emerge consistent with our estimates

Non-Agency

demands

outstanding

-

Balance of non-agency repurchase demands

outstanding up LQ primarily due to new demands

that had been previously reserved for

Repurchase reserves of $2.0 billion increased

$269 million LQ on lower losses/reserve usage

and included a $462 million reserve addition vs.

$669 million in 2Q12

-

Incorporates current demand levels

-

Anticipates future expected demands

(2)

Total

Outstanding

Repurchase

Demands

(3)

and

Agency New Demands for 2006-2008 Vintages

2Q12 Servicing Portfolio Delinquency

Performance

(1)

$3.84

$2.95

$2.49

$2.24

$2.02

$2.01

$1.86

$1.67

$2.00

(1,000)

1,000

3,000

5,000

7,000

9,000

11,000

13,000

15,000

17,000

19,000

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Number of Outstanding Demands

Agency New Demands for 2006-2008 Vintages

Original Loan Balance of Outstanding Demands ($ in B)

(2) Industry is all large servicers ($6.1 trillion) including WFC, C, JPM and

BAC.

(3) Includes mortgage insurance rescissions. (1)

Inside Mortgage Finance, data as of June 30, 2012. Industry excluding WFC performance

calculated based on IMF data.

|

Wells Fargo

3Q12 Supplement 19

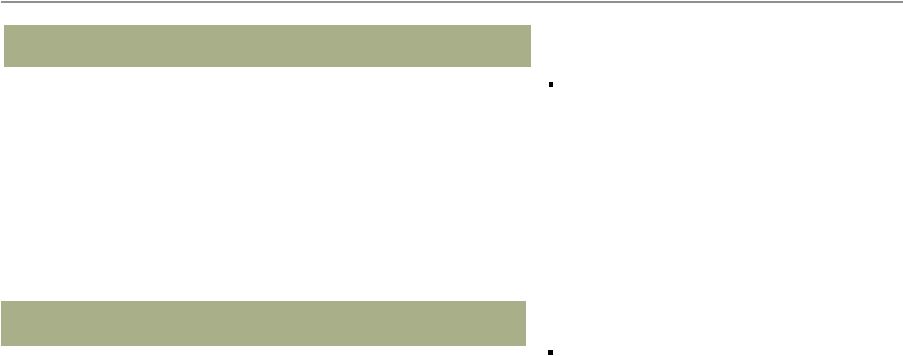

Capital

9.34%

9.46%

9.98%

10.08%

10.06%

3Q11

4Q11

1Q12

2Q12

3Q12

Capital remained strong

Tier 1 common equity ratio under Basel I

of 10.06%

-

Ratio reduced by 32 bps resulting from

refinements to the risk weighting of certain

unused lending commitments that provide for

the ability to issue standby letters of credit

Tier 1 common equity ratio under Basel III is

estimated to be 8.02% at 9/30/12

(1)

Tier 1 Common Equity Ratio

Under Basel I

See Appendix page 35 for additional information on Tier 1 common equity. 3Q12 capital

ratios are preliminary estimates.

(1) Estimated Basel III calculation based on management’s current interpretation of

the Basel III capital rules proposed by federal banking agencies in notices of proposed

rulemaking announced in June 2012. The proposed rules and interpretations and assumptions used in estimating Basel III calculations are

subject to change depending on final promulgation of Basel III capital rules. See pages

35-36 for additional information regarding Tier 1 common equity ratios. Purchased 16.5 million common shares in

3Q12 and entered into a $300 million 3Q12

forward repurchase transaction, estimated

to be 9 million shares, that is expected to

settle in 4Q12 |

Wells Fargo

3Q12 Supplement 20

Demonstrated momentum across the franchise

(1)

Metrics

reported

on

a

one-month

lag

from

reported

quarter-end;

for

example

3Q12

cross-sell

is

as

of

August

2012

(2)

Checking account growth is 12-months ending August 2012.

(3) Household penetration as of August 2012 and defined as the percentage of retail

banking deposit households that have a credit card with Wells Fargo. (4)

As of June 2012.

$11.4 billion in net new loan commitments to small business customers (primarily with annual

revenues less than $20 million) in the first three quarters of 2012, up approximately

30% from prior year Consumer credit card new accounts in 3Q12 increased 6% LQ and 46%

YoY with household penetration increasing 110 bps LQ to 32.1%

(3)

Focus on helping clients meet their financial needs contributed to a 7% LQ and 25% YoY

increase in managed account assets to $297 billion at quarter end

Cross-sell

of

6.7

products

per

relationship

(4)

up

from

6.5

at

year-end

2011

driven

by

increased

penetration with eastern commercial banking customers across multiple products

CMBS volumes tripled LQ

Record cross-sell of 10.27 products per household up from 10.04 in 3Q11

(1)

Dealer Services added 960 GM dealers in 3Q12 bringing total new dealers for 2012 to

1,683 Business

checking

accounts

up

a

net

3.9%

YoY

(2)

Rolled

out

Wells

Fargo

Mobile

®

Deposit

to

13

states;

on

track

to

complete

roll

out

by

year-end

Retail

bank

cross-sell

of

6.04

products

per

household

up

from

5.90

in

3Q11

(1)

Regional Banking

Consumer Lending Group

Wholesale Banking

Wealth, Brokerage and Retirement |

Wells Fargo

3Q12 Supplement 21

Summary

Record earnings of $4.9 billion and record diluted earnings per share of $0.88

Stable revenue and lower expenses resulted in positive operating

leverage

Expenses down $285 million from 2Q12

-

3Q12

efficiency

ratio

of

57.1%

within

our

target

range

of

55%

to

59%

(1)

Higher PTPP of $9.1 billion

Strong core credit performance

Solid returns

-

ROA = 1.45%, up 4 bps LQ and up 19 bps YoY

-

ROE = 13.38%, up 52 bps LQ and up 152 bps YoY

Capital levels remained strong

(1)

Noninterest expense and our efficiency ratio may be affected by a variety of factors,

including business and economic cyclicality, seasonality, changes in our business

composition and operating environment, growth in our business and/or acquisitions, and unexpected expenses relating to, among

other things, litigation and regulatory matters. |

Wells Fargo

3Q12 Supplement 22

Appendix |

Wells Fargo

3Q12 Supplement 23

(1) Net of purchase accounting adjustments.

Non-strategic/liquidating loan portfolio risk reduction

-$74.3

-$4.2

-$92.2

-$4.1

-$5.1

-$4.5

($ in billions)

3Q12

2Q12

1Q12

4Q11

3Q11

4Q08

Pick-a-Pay mortgage

(1)

$

60.1

62.0

64.0

65.7

67.4

95.3

Liquidating home equity

5.0

5.2

5.5

5.7

6.0

10.3

Legacy WFF indirect auto

1.1

1.5

1.9

2.5

3.1

18.2

Legacy WFF debt consolidation

15.0

15.5

16.0

16.5

17.2

25.3

Education Finance - gov't guaranteed

13.0

13.8

14.8

15.4

15.6

20.5

Legacy WB C&I, CRE and foreign PCI loans

(1)

3.8

4.3

5.2

5.7

6.3

18.7

Legacy WB other PCI loans

(1)

0.6

0.8

0.8

0.8

0.9

2.5

Total

$

98.6

103.1

108.2

112.3

116.5

190.8

|

Wells Fargo

3Q12 Supplement 24

Purchased credit-impaired (PCI) portfolios

Legacy Wachovia PCI loans continued to perform better than originally expected

(2) Reflects releases of $1.8 billion for loan resolutions and $5.2 billion from

the reclassification of nonaccretable difference to the accretable yield, which will

result in increasing income over the remaining life of the loan or pool of loans. ($ in billions)

(1)

December 31, 2008

$

29.2

62.5

6.5

98.2

June 30, 2012

6.6

34.6

1.7

42.9

September 30, 2012

5.9

33.1

1.5

40.5

12/31/08 Nonaccretable difference

$

10.4

26.5

4.0

40.9

Addition of nonaccretable difference due to acquisitions

0.2

-

-

0.2

Losses from loan resolutions and write-downs

(6.9)

(16.8)

(2.8)

(26.5)

Release of nonaccretable difference since merger

(3.1)

(3.0)

(0.9)

(7.0)

(2)

9/30/12 Remaining nonaccretable difference

0.6

6.7

0.3

7.6

Additional provision since 2008 merger

$

(1.7)

-

(0.1)

(1.8)

Release of nonaccretable difference since 2008 merger

3.1

3.0

0.9

7.0

(2)

Net performance

1.4

3.0

0.8

5.2

Commercial

Pick-a-Pay

Other

consumer

Total

Life-to-date

net

performance

Nonaccretable

difference

rollforward

Adjusted

unpaid

principal

balance

(1)

Includes write-downs taken on loans where severe delinquency (normally 180 days) or other

indications of severe borrower financial stress exist that indicate there will be a

loss of contractually due amounts upon final resolution of the loan. |

Wells Fargo

3Q12 Supplement 25

$687 million in nonaccretable difference reclassified to accretable yield in the quarter

-

$603 million reclass from Pick-a-Pay portfolio reflects improved housing market

forecast and credit outlook $376

million

of

the

$905

million

in

losses

from

loan

resolutions

and

write-downs

in

the

quarter

resulted

from

implementation of OCC guidance

$7.6 billion in nonaccretable difference remains to absorb losses on PCI loans

-

Remaining

nonaccretable

=

23.2%

of

unpaid

principal

balance

(UPB)

(5)

•

Remaining

Pick-a-Pay

nonaccretable

=

24.9%

of

Pick-a-Pay

UPB

(5)

PCI nonaccretable difference

Analysis of nonaccretable difference for PCI loans

($ in millions)

Pick-a-Pay

Total

Balance at June 30, 2012

$

658

8,128

Release of nonaccretable difference due to:

Loans

resolved

by

settlement

with

borrower

(1)

(24)

-

-

Loans

resolved

by

sales

to

third

parties

(2)

(4)

-

-

Reclassification

to

accretable

yield

for

loans

with

improving

credit-related

cash

flows

(3)

(41)

(603)

Use of nonaccretable difference due to:

Losses

from

loan

resolutions

and

write-downs

(4)

(32)

(846)

Balance at September 30, 2012

$

557

6,679

(27)

(905)

370

7,606

(24)

(4)

(43)

(687)

Other

consumer

Commercial

440

9,226

(1) Release of the nonaccretable difference for settlement with borrower, on

individually accounted PCI loans, increases interest income in the period of

settlement. Pick-a-Pay and Other consumer PCI loans do not reflect nonaccretable

difference releases for settlements with borrowers due to pool accounting for those

loans, which assumes that the amount received approximates the pool performance expectations.

(2) Release of the nonaccretable difference as a result of sales to third parties

increases noninterest income in the period of the sale. (3) Reclassification of nonaccretable difference to accretable yield for loans with

increased cash flow estimates will result in increased interest income as a prospective

yield adjustment over the remaining life of the loan or pool of loans. (4)

Write-downs to net realizable value of PCI loans are absorbed by the nonaccretable

difference when severe delinquency (normally 180 days) or other indications of severe

borrower financial stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(5) Unpaid principal balance of loans without write-downs. |

Wells Fargo

3Q12 Supplement 26

Accretable yield balance increased $3.8 billion LQ and included:

-

Accretion into interest income of $495 million, down LQ reflecting lower settlements with

borrowers -

$687 million reclass from nonaccretable difference

-

$3.6 billion increase in expected cash flows reflecting an improved housing market forecast

and credit outlook

Balance of $18.9 billion expected to accrete to income over the remaining life of the

underlying loans PCI accretable yield

(1) Includes accretable yield released as a result of settlements with borrowers, which

is included in interest income. (2) Includes accretable yield released as a

result of sales to third parties, which is included in noninterest income. (3)

Represents changes in cash flows expected to be collected due to changes in interest rates on variable rate PCI loans, changes in prepayment assumptions

and the impact of modifications.

Cumulative

Accretable yield rollforward

since

($ in millions)

3Q12

2Q12

merger

Total, beginning of period

$

15,153

15,763

10,447

Addition of accretable yield due to acquisitions

-

-

128

Accretion

into

interest

income

(1)

(495)

(630)

(8,838)

Accretion

into

noninterest

income

due

to

sales

(2)

-

(5)

(242)

Reclassification from nonaccretable difference for loans with improving credit-related

cash flows 687

84

5,219

Changes

in

expected

cash

flows

that

do

not

affect

nonaccretable

difference

(3)

3,567

(59)

12,198

Total, end of period

$

18,912

15,153

18,912 |

Wells Fargo

3Q12 Supplement 27

PCI accretable yield (Commercial

(1)

and Pick-a-Pay)

Commercial accretion

(2)

decreased

$119 million and accretable yield

percentage declined to 16.62%

reflecting lower settlements with

borrowers

Pick-a-Pay accretable yield balance

increased $3.7 billion reflecting an

improved housing market forecast and

credit outlook

-

Weighted average life increased

to 12.7 years

Pick-a-Pay PCI Accretable Yield

($ in millions)

3Q12

2Q12

1Q12

PCI interest income

Accretion

$

287

303

311

Average carrying value

27,260

28,041

28,734

Accretable yield percentage

4.21

%

4.32

4.32

Accretable yield balance

$

17,189

13,466

13,709

Weighted average life (years)

12.7

11.4

11.0

Commercial

(1)

PCI Accretable Yield

($ in millions)

3Q12

2Q12

1Q12

PCI interest income

Accretion

and resolution income

$

204

323

210

Average carrying value

4,914

5,629

6,638

Accretable

yield

percentage

(2)

16.62

%

22.95

12.61

Accretable yield balance

$

978

1,008

1,347

Weighted average life (years)

2.8

2.2

2.8

(1) Includes both legacy Wachovia PCI loans as well as recently purchased PCI

loans.

(2) Includes resolution income.

|

Wells Fargo

3Q12 Supplement 28

Pick-a-Pay mortgage portfolio

Carrying

value

of

$60.1

billion

in

first

lien

loans

outstanding,

down

$2.0

billion

from

2Q12

and

down

$35.2

billion from 4Q08 on paid-in-full loans and loss mitigation efforts

Adjusted unpaid principal balance of $66.1 billion, down $2.8 billion from 2Q12 and down $49.6

billion from 4Q08

$4.6 billion in modification principal forgiveness since acquisition reflects over 109,000

completed full-term modifications; additional $401 million of conditional

forgiveness that can be earned by borrowers through performance over the next 3 years

Modification redefault rate has been consistently better than the industry average (as

measured by 60+ DPD after six months)

($ in millions)

Product type

Adjusted

unpaid

principal

balance

% of total

Adjusted

unpaid

principal

balance

% of total

Adjusted

unpaid

principal

balance

% of total

Option payment loans

(1)

$

33,364

50

%

$

35,353

51

%

$

99,937

86

%

Non-option payment adjustable-rate and

fixed-rate loans

(1)(2)

8,974

14

9,315

14

15,763

14

Full-term loan modifications

(1)

23,736

36

24,184

35

-

-

Total

adjusted

unpaid

principal

balance

(1)(2)

$

66,074

100

%

$

68,852

100

%

$

115,700

100

%

Total carrying value

60,080

62,045

95,315

At 6/30/2012

At 9/30/2012

(3)

At 12/31/2008

(1)

Adjusted unpaid principal includes write-downs taken on loans where severe delinquency

(normally 180 days) or other indications of severe borrower financial stress exist that

indicate there will be a loss of contractually due amounts upon final resolution of the loan.

(2)

Includes loans refinanced under the Consumer Relief Refinance Program. (3) Reflects OCC

guidance. |

Wells Fargo

3Q12 Supplement 29

Pick-a-Pay credit highlights

Non-PCI

portfolio

Loans down 4% LQ driven by loans paid-in-full

85% of portfolio current

Nonaccrual loans increased $210 million, or 6%,

LQ

$394 million of nonaccruals associated with

implementation of OCC guidance

$152 million of nonaccrual TDRs reclassified to

accruing TDR status based on borrower payment

performance

$4.0 billion in nonaccruals includes $1.7 billion

of nonaccruing TDRs

Net charge-offs of $177 million down $26 million

LQ and included $42 million in losses from the

implementation of OCC guidance

43% of portfolio with LTV

(2)

80%

PCI

portfolio

Carrying value down 3%

67% of portfolio current

Life-of-loan losses continued to be lower than

originally projected at time of merger

($ in millions)

3Q12

2Q12

Non-PCI loans

Carrying

value

(1)

$

33,096

34,342

Nonaccrual loans

4,018

3,808

as a % of loans

12.14

%

11.09

Net charge-offs

$

177

203

as % of avg loans

2.09

%

2.35

90+ days past due

as % of loans

10.09

10.16

Current

average

LTV

(2)

84

%

85

Current average FICO

683

682

Contractual average loan size

$

204,000

206,000

Contractual average age of loans

8.54

years

8.29

% of loans in California

49

%

49

($ in millions)

3Q12

2Q12

PCI loans

Adjusted unpaid principal balance

(3)

$

33,107

34,644

Carrying

value

(1)

26,984

27,703

Current

average

LTV

(2)

90

%

89

Current average FICO

617

615

Contractual average loan size

$

304,000

307,000

Contractual average age of loans

6.50

years

6.25

% of loans in California

68

%

68

(1)

The carrying value, which does not reflect the allowance for loan losses, includes purchase

accounting adjustments, which, for PCI loans, are the nonaccretable difference and the

accretable yield, and for all other loans, an adjustment to mark the loans to a market yield at date of merger less any subsequent charge-offs.

(2) The current loan-to-value (LTV) ratio is calculated as the net carrying

value (defined in (1) above) divided by the collateral value. (3)

The adjusted unpaid principal balance includes write-downs taken on loans where severe

delinquency (normally 180 days) or other indications of severe borrower financial

stress exist that indicate there will be a loss of contractually due amounts upon final resolution of the loan.

|

Wells Fargo

3Q12 Supplement 30

Real estate 1-4 family first mortgage portfolio

First lien mortgage loans up 4% as growth in core

first lien mortgage was partially offset by

continued run-off in the liquidating portfolio

Pick-a-Pay non-PCI portfolio down 4%

PCI portfolio down 3%

Debt consolidation first lien down 3%

Core first lien up $12.8 billion, or 8%, reflecting

strong origination volumes and the decision to

retain $9.8 billion of conforming production

Core first lien mortgage nonaccruals up $496

million reflecting the implementation of

OCC guidance

Core net charge-offs down $67 million

-

-

-

-

(1) Ratios on Legacy WFF debt consolidation first mortgage loan portfolio only. (2)

Ratios on non run-off first lien mortgage loan portfolio only.

($ in millions)

3Q12

2Q12

Total real estate 1-4 family first mortgage

$

240,554

230,263

Less consumer non-strategic/liquidating portfolios:

Pick-a-Pay non-PCI first lien mortgage

33,096

34,342

PCI first lien mortgage

27,535

28,331

Debt consolidation first mortgage portfolio

14,640

15,129

Core first lien mortgage

165,283

152,461

Nonaccrual loans

$

2,279

2,158

as % of loans

15.57 %

14.26

Net charge-offs

$

214

191

as % of average loans

5.77 %

4.97

Nonaccrual loans

$

4,898

4,402

as % of loans

2.96 %

2.89

Net charge-offs

$

282

349

as % of loans

0.69 %

0.92

Legacy

WFF

debt

consolidation

first

mortgage

loan

performance

(1)

Core

first

lien

mortgage

loan

performance

(2) |

Wells Fargo

3Q12 Supplement 31

Home equity portfolio

Core Portfolio

(1)

Outstandings

down 3%

-

High quality new originations with weighted

average CLTV of 62%, 777 FICO, and 32% total

debt service ratio

3Q12 losses increased $308 million and included

$384 million from the implementation of OCC

guidance

2+ delinquencies stable

Continued decline in delinquency rate for loans with

a CLTV >100%, 3 bps improvement

Liquidating

Portfolio

Outstandings down 5%

3Q12 losses increased $40 million and included $52

million from the implementation of OCC

guidance

2+ delinquencies declined $19 million

Continued decline in delinquency rate for loans with

a CLTV >100%, 39 bps improvement

Total

home

equity

portfolio

=

$98

billion

21% in 1

lien position

40% in junior lien position behind WFC owned or

serviced 1

lien

-

Current 1

lien, Current junior lien = 95.9%

-

Current 1

lien, Delinquent junior lien = 0.9%

-

Delinquent 1

lien, Current junior lien = 1.4%

-

Delinquent 1

lien, Delinquent junior lien = 1.8%

39%

in

junior

lien

position

behind

third

party

1

lien

Excludes purchased credit-impaired loans. (1)

Includes equity lines of credit and closed-end junior liens associated with the

Pick-a-Pay portfolio totaling $1.4 billion at September 30, 2012 and $1.4

billion at June 30, 2012. (2)

CLTV is calculated based on outstanding balance plus unused lines of credit divided by

estimated home value. Estimated home values are determined predominantly based on

automated valuation models updated through September 2012. (3)

Unsecured balances, representing the percentage of outstanding balances above the most

recent home value.

($ in millions)

3Q12

2Q12

Core

Portfolio

(1)

Outstandings

$

92,979

95,753

Net charge-offs

935

627

as % of avg loans

3.93

%

2.60

2+ payments past due

$

2,685

2,686

as % loans

2.90

%

2.81

% CLTV > 100%

(2)

35

36

2+ payments past due

3.90

3.93

% Unsecured balances

(3)

16

16

% 1st lien position

21

21

Liquidating Portfolio

Outstandings

$

4,951

5,199

Net charge-offs

148

108

as % of avg loans

11.60

%

8.14

2+ payments past due

$

199

218

as % loans

4.03

%

4.19

% CLTV > 100%

(2)

72

73

2+ payments past due

4.07

4.46

% 1st lien position

4

4

st

st

st

st

st

st

st |

Wells Fargo

3Q12 Supplement 32

Credit card portfolio

$23.7 billion credit card outstandings up 4% from

2Q12 and 9% YoY on strong account growth

-

Consumer credit card new accounts in 3Q12

increased 6% LQ and 46% YoY with household

penetration increasing to 32.1%

(1)

-

Purchase dollar volume increased 4% and

transactions rose 5% from 2Q12

-

Purchase dollar volume increased 15% and

transactions rose 18% from 3Q11

Net charge-offs down $28 million, or 70 bps, LQ

and down $54 million, or 123 bps, YoY reflecting

continued steady improvement

(1) Household penetration as of August 2012 and defined as the percentage of retail

banking deposit households that have a credit card with Wells Fargo. ($ in millions)

3Q12

2Q12

Credit card outstandings

$

23,692

22,706

Net charge-offs

212

240

as % of avg loans

3.67

%

4.37 |

Wells Fargo

3Q12 Supplement 33

Auto portfolios

(1)

Core Consumer Portfolio

Core auto outstandings of $46.0 billion up 3% LQ

and 10% YoY

Continued strong originations; 3Q12 originations

down 3% LQ on increased competition and lower

risk-adjusted returns but up 20% YoY on growth

across the credit spectrum

Nonaccrual loans increased $150 million LQ and

included $155 million from the implementation of

OCC guidance

Net charge-offs were up $33 million LQ reflecting

seasonality and higher delinquencies

September Manheim index of 120.7, down 2% LQ

and down 2% from September 2011

30+ days past due increased $96 million LQ

reflecting seasonality

Commercial Portfolio

Loans of $6.6 billion were stable linked quarter

Continued strong credit performance

(1)

Legacy Wells Fargo Financial indirect portfolio balance as of September 30, 2012, was $1,104

million. ($ in millions)

3Q12

2Q12

Direct

Auto outstandings

$

2,357

2,387

Nonaccrual loans

46

46

as % of loans

1.95

%

1.92

Net charge-offs

$

6

0

as % of avg loans

1.02

%

n.m.

30+ days past due

$

30

26

as % of loans

1.27

%

1.09

Indirect

Auto outstandings

$

43,613

42,411

Nonaccrual loans

218

68

as % of loans

0.50

%

0.16

Net charge-offs

$

57

30

as % of avg loans

0.52

%

0.29

30+ days past due

$

609

517

as % of loans

1.40

%

1.22

Auto outstandings

$

6,599

6,652

Nonaccrual loans

-

-

as % of loans

-

%

-

Net charge-offs (recoveries)

$

-

-

as % of avg loans

n.m.

%

n.m.

Commercial Portfolio

Core Consumer Portfolios |

Wells Fargo

3Q12 Supplement 34

Student lending portfolio

$23.5 billion student lending outstandings down

3% LQ

Private Portfolio

$10.6 billion private loans outstandings up 2% LQ

and up 8% YoY

Applications increased 67% LQ due to peak

season

Dollar originations increased 205% LQ due to

seasonality

Continued to originate high quality loans with an

average FICO of 759 and 79% of new loans co-

signed

Net charge-offs up $1 million LQ due to

seasonality of repayments on loans

Government Portfolio

$13.0 billion liquidating government guaranteed

outstandings declined 6% LQ and 17% YoY

($ in millions)

3Q12

2Q12

Education Finance

Total outstandings

$

23,504

24,131

Private Portfolio

Private outstandings

$

10,553

10,308

Net charge-offs

27

26

as % of avg loans

1.02

%

1.01

30 days past due

$

231

181

as % of loans

2.19

%

1.76

Government Guaranteed Portfolio

Government outstandings

$

12,951

13,823

-

-

- |

Wells Fargo

3Q12 Supplement 35

Tier 1 common equity under Basel I

(1)

Quarter ended

Sept. 30,

June 30,

Mar. 31,

Dec. 31,

Sept. 30,

2012

2012

2012

2011

2011

$

156.1

149.4

146.8

141.7

139.2

(1.4)

(1.3)

(1.3)

(1.5)

(1.5)

154.7

148.1

145.5

140.2

137.7

(11.3)

(10.6)

(10.6)

(10.6)

(10.6)

(33.4)

(33.5)

(33.7)

(34.0)

(34.4)

3.3

3.5

3.7

3.8

4.0

(0.7)

(0.7)

(0.9)

(0.8)

(0.7)

(6.4)

(4.6)

(4.1)

(3.1)

(3.7)

(0.4)

(0.5)

(0.4)

(0.4)

(0.4)

(A)

$

105.8

101.7

99.5

95.1

91.9

(B)

$

1,052.4

1,008.6

996.8

1,005.6

983.2

(A)/(B)

10.06

%

10.08

9.98

9.46

9.34

(1)

(2)

Total risk-weighted assets

(2)

Tier 1 common equity to total risk-weighted assets

Cumulative other comprehensive income

Under the regulatory guidelines for risk-based capital,

on-balance sheet assets and credit equivalent amounts of derivatives and off-balance sheet items are assigned to one of several broad risk

categories according to the obligor or, if relevant, the guarantor or

the nature of any collateral. The aggregate dollar amount in each risk category is then multiplied by the risk weight associated with

that category. The resulting weighted values from each of the risk

categories are aggregated for determining total risk-weighted assets. The Company’s September 30, 2012, risk-weighted assets are

preliminary and reflect the Company’s refinement to its

determination of risk weighting of certain unused lending commitments that provide for the ability to issue standby letters of credit. Total

estimated on-balance sheet, and total estimated derivative and

off-balance sheet risk-weighted assets were $846.5 billion and $205.9 billion at September 30, 2012, respectively.

Tier 1 common equity is a non-generally accepted accounting

principle (GAAP) financial measure that is used by investors, analysts and bank regulatory agencies to assess the capital position of

financial services companies. Management reviews Tier 1 common equity

along with other measures of capital as part of its financial analyses and has included this non-GAAP financial information, and

the corresponding reconciliation to total equity, because of current

interest in such information on the part of market participants.

Other

Tier 1 common equity

MSRs over specified limitations

Wells Fargo & Company and Subsidiaries

($ in billions)

Total equity

Noncontrolling interests

Total Wells Fargo stockholders' equity

Adjustments:

FIVE QUARTER TIER 1 COMMON EQUITY UNDER BASEL I

(1)

Preferred equity

Goodwill and intangible assets (other than MSRs)

Applicable deferred taxes |

Wells Fargo

3Q12 Supplement 36

Tier 1 common equity under Basel III (Estimated)

(1)

Quarter ended

Sept. 30,

2012

$

105.8

6.0

Other

0.3

Total

Adjustments

from

Basel

I

to

Basel

III

6.3

Threshold

deductions,

as

defined

under

Basel

III

(4) (5)

(0.7)

Tier

1

common

equity

anticipated

under

Basel

III

(C)

$

111.4

(D)

$

1,390.1

(C)/(D)

8.02

%

(1)

(2)

(3)

(4)

(5)

(6)

Under

current

Basel

proposals,

risk-weighted

assets

incorporate

different

classifications

of

assets,

with

certain

risk

weights

based

on

a

borrower's

credit

rating

or

Wells

Fargo's

own

risk

models,

along

with

adjustments

to

address

a

combination

of

credit/counterparty,

operational

and

market

risks,

and

other

Basel

III

elements.

The

amount

of

risk-weighted

assets

anticipated

under

Basel

III

is

preliminary

and

subject

to

change

depending

on

final

promulgation

of

Basel

III

capital

rulemaking

and

interpretations

thereof

by

regulatory

authorities.

Volatility

in

interest

rates

can

have

a

significant

impact

on

the

valuation

of

cumulative

other

comprehensive

income

and

MSRs

and

therefore,

may

impact

adjustments

from

Basel

I

to

Basel

III,

and

MSRs

subject

to

threshold

deductions,

as

defined

under

Basel

III,

in

future

reporting

periods.

Tier

1

common

equity

is

a

non-generally

accepted

accounting

principle

(GAAP)

financial

measure

that

is

used

by

investors,

analysts

and

bank

regulatory

agencies

to

assess

the

capital

position

of

financial

services

companies.

Management

reviews

Tier

1

common

equity

along

with

other

measures

of

capital

as

part

of

its

financial

analyses

and

has

included

this

non-GAAP

financial

information,

and

the

corresponding

reconciliation

to

total

equity,

because

of

current

interest

in

such

information

on

the

part

of

market

participants.

Wells Fargo & Company and Subsidiaries

TIER

1

COMMON

EQUITY

UNDER

BASEL

III

(ESTIMATED)

(1)(2)

Tier

1

common

equity

to

total

risk-weighted

assets

anticipated

under

Basel

III

Threshold

deductions,

as

defined

under

Basel

III,

include

individual

and

aggregate

limitations,

as

a

percentage

of

Tier

1

common

equity,

with

respect

to

MSRs,

deferred

tax

assets

and

investments

in

unconsolidated

financial

companies.

($ in billions)

Tier 1 common equity under Basel I

Adjustments

from

Basel

I

to

Basel

III

(3)(5)

:

Cumulative

other

comprehensive

income

related

to

AFS

securities

and

defined

benefit

pension

plans

Total

risk-weighted

assets

anticipated

under

Basel

III

(6)

The

Basel

III

Tier

1

common

equity

and

risk-weighted

assets

are

calculated

based

on

management’s

current

interpretation

of

the

Basel

III

capital

rules

proposed

by

federal

banking

agencies

in

notices

of

proposed

rulemaking

announced

in

June

2012.

The

proposed

rules

and

interpretations

and

assumptions

used

in

estimating

Basel

III

calculations

are

subject

to

change

depending

on

final

promulgations

of

Basel

III

capital

rules.

Adjustments

from

Basel

I

to

Basel

III

represent

reconciling

adjustments,

primarily

certain

components

of

cumulative

other

comprehensive

income

deducted

for

Basel

I

purposes,

to

derive

Tier

1

common

equity

under

Basel

III. |

| Wells Fargo

3Q12 Supplement 37

Forward-looking statements and additional information

Forward-looking

statements:

This Quarterly Supplement and management’s related presentation contain

forward-looking statements about our future financial performance. These

forward-looking statements include statements using words such as “believe,” “expect,”

“anticipate,” “estimate,” “target”, “should,”

“may,” “can,” “will,” “outlook,” “appears” or similar expressions. These forward-

looking statements may include, among others, statements about: future credit quality and

performance, including our current expectation of future loan loss reserve releases;

mortgage repurchase exposure; exposure related to mortgage practices, including

foreclosures and servicing; our noninterest expense and efficiency ratio, including our targeted efficiency ratio range

as part of our expense management initiatives; the future economic environment; loan growth;

our net interest margin, including our expectations regarding continued pressure on our

net interest margin given the low interest rate environment; reduction or mitigation of

risk in our loan portfolios; future effects of loan modification programs; life-of-loan loss estimates;

the estimated impact of regulatory reform on our financial results and business and

expectations regarding our efforts to mitigate such impact; and our estimated Tier 1

common equity ratio as of September 30, 2012, under proposed Basel III capital rules.

Investors are urged to not unduly rely on forward-looking statements as actual results could differ materially from

expectations. Forward-looking statements speak only as of the date made, and we do not

undertake to update them to reflect changes or events that occur after that date. For

more information about factors that could cause actual results to differ materially

from expectations, refer to page 13 of Wells Fargo’s press release announcing our third quarter 2012 results, as well

as Wells Fargo’s reports filed with the Securities and Exchange Commission, including the

discussion under “Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2011.

Purchased credit-impaired loan portfolio: Loans that were acquired

from Wachovia that were considered credit impaired were written down at acquisition date in

purchase accounting to an amount estimated to be collectible and the related allowance for

loan losses was not carried over to Wells Fargo’s allowance. In addition, such

purchased credit-impaired loans are not classified as nonaccrual or nonperforming,

and are not included in loans that were contractually 90+ days past due and still accruing.