Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - iWallet Corp | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - iWallet Corp | ex32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - iWallet Corp | ex31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - iWallet Corp | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - iWallet Corp | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2012 | |

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT |

| For the transition period from _________ to ________ | |

| Commission file number: 333-168775 |

| Queensridge Mining Resources, Inc. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | 27-1830013 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

912 Sir James Bridge Way Las Vegas, Nevada |

89145 |

| (Address of principal executive offices) | (Zip Code) |

|

Registrant’s telephone number: (702) 596-5154 |

|

|

| |

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

|

Securities registered under Section 12(g) of the Exchange Act:

| |

| Title of class | |

| none | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| [ ] Large accelerated filer | [ ] Accelerated filer |

| [ ] Non-accelerated filer | [X] Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [X] No [ ]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. N/A

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 6,427,800 as of October 9, 2012.

| 2 |

PART I

In General

We were incorporated on January 29, 2010, under the laws of the state of Nevada. We hold a 100% interest in the Cutwell Harbour mineral claims, located in Newfoundland, Canada. Mr. Phillip Stromer is our President, CEO, Secretary, Treasurer, and sole director.

Our business plan is to explore the Cutwell Harbour mineral claims to determine whether there are commercially exploitable reserves of gold or other metals. Phase I of our program was performed in December of 2010 and consisted of on-site surface reconnaissance, sampling, and geochemical analyses. This phase of the program was performed at a cost of $10,521.33. The analysis of the samples taken during our Phase I program unfortunately did not confirm the presence of substantial gold mineralization. A large portion of the Cutwell Harbour property has not been sampled, however, and our consulting geologist has recommended that we undertake additional sampling work on the property.

Phase II would entail additional sampling on areas of the property not sampled during Phase I, followed by geochemical analyses of the various samples gathered. The Phase II program will cost approximately $16,767. We will require some additional financing in order complete Phase II of our planned exploration program. In the alternative, we may conduct a more limited Phase II sampling program than the one originally planned. We currently do not have any arrangements for financing and we may not be able to obtain financing when required.

Once we receive the analyses of Phase II of our exploration program, our board of directors, in consultation with our consulting geologist will assess whether to proceed with additional mineral exploration programs. In making this determination to proceed with a further exploration, we will make an assessment as to whether the results of the initial program are sufficiently positive to enable us to proceed. This assessment will include an evaluation of our cash reserves after the completion of the initial exploration, the price of minerals, and the market for the financing of mineral exploration projects at the time of our assessment.

In the event that additional exploration programs on the Cutwell Harbour mineral claims are undertaken, we anticipate that substantial additional funding will be required in the form of equity financing from the sale of our common stock and from loans from our director. We cannot provide investors with any assurance, however, that we will be able to raise sufficient funding from the sale of our common stock to fund all of our anticipated expenses. We do not have any arrangements in place for any future equity financing. We believe that outside debt financing will not be an alternative for funding exploration programs on the Cutwell Harbour property. The risky nature of this enterprise and lack of tangible assets other than our mineral claim places debt financing beyond the credit-worthiness required by most banks or typical investors of corporate debt until such time as an economically viable mine can be demonstrated.

We do not have plans to purchase any significant equipment or change the number of our employees during the next twelve months.

Acquisition of the Cutwell Harbour mineral claims.

We acquired a 100% interest in the Cutwell Harbour mineral claims located in northern Newfoundland, Canada. Our ownership in the Cutwell Harbor claims was electronically staked and recorded under the electronic mineral claim staking and recording procedures of the Online Mineral Claims Staking System administered by the Department of Natural Resources, Government of Newfoundland and Labrador, Canada. A party is able to stake and record an interest in a particular mineral claim if no other party has an interest in the said claim that is in good standing and on record. There is no formal agreement between us and/or our subsidiary and the Government of Newfoundland and Labrador.

| 3 |

The Cutwell Harbor claims are administered under the Mineral Act of Newfoundland and Labrador. Our interest in the Cutwell Harbor claims will continue for up to twenty years provided that the minimum required expenditures toward exploration work on the claim are made in compliance with the Act. The required amount of expenditures toward exploration work is set by the Province of Newfoundland and Labrador and can be altered in its sole discretion. Currently, the amount required to be expended annually for exploration work within the first year that the mineral claim is acquired is $200 per claim. The required expenditures per claim increase gradually each year up to a maximum of $1,200 per claim for the sixteenth year and beyond. Within 60 days following the anniversary date of the claim, an assessment report on the work performed must be submitted to the Mineral Claims Recorder. Every five years, renewal fee of between $25 and $100 per claim is also required.

We selected the Cutwell Harbour mineral property based upon an independent geological report which was commissioned from Richard A. Jeanne, a Consulting Geologist.

Description and Location of the Cutwell Harbour mineral claim

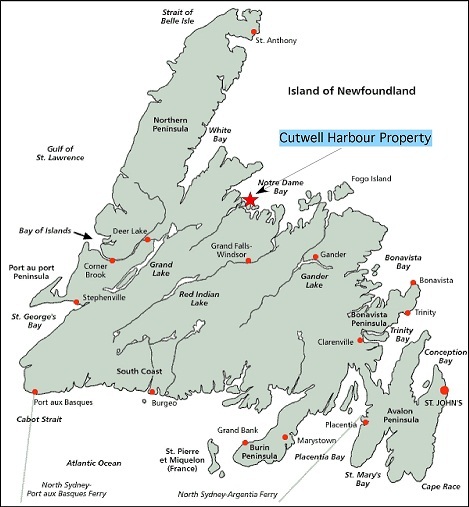

The Cutwell Harbour property is located on Long Island in Notre Dame Bay, on the north coast of Newfoundland, Canada (fig. 1). It comprises 150 hectares (≈ 371 acres), approximately centered at latitude 49° 36’ 55.8" North, longitude 55° 40’ 54.1" West (UTM Zone 21, 595230E – 5496497N). It lies within the area covered by NTS map sheet 02E/12.

The description of the property is as follows:

Beginning at the Northeast corner of the herein described parcel of land, and said corner having UTM coordinates of 5 497 000 N, 596 000 E; of Zone 21; thence South 1,000 metres, thence West 1,500 metres, thence North 1,000 metres, thence East 1,500 metres to the point of beginning. All bearings are referred to the UTM grid, Zone 21. NAD27.

The Government of Newfoundland and Labrador owns the land covered by the Cutwell Harbour mineral claims. Currently, we are not aware of any native land claims that might affect the title to the mineral claim or to Newfoundland and Labrador’s title of the property. Although we are unaware of any situation that would threaten this claim, it is possible that a native land claim could be made in the future. The federal and provincial government policy at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. If we should encounter a situation where a native person or group claims and interest in this claim, we may choose to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish any interest that we hold in this claim.

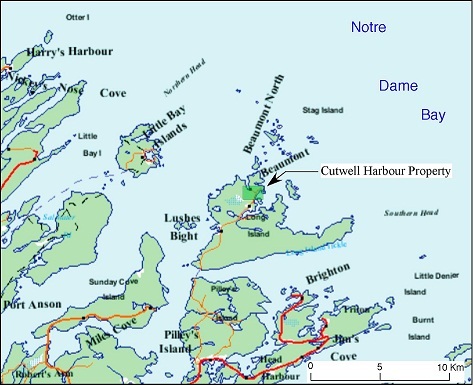

Exploration Potential of the Cutwell Harbor Mineral Claims

The property is located near the community of Beaumont on Long Island, in Notre Dame Bay, just off the north coast of Newfoundland on NTS map sheet 02E/12. Access to the property can be gained from the Trans-Canada Highway at South Brook via route 380 to Pilley’s island then north via secondary roads and ferry to Long Island and the community of Beaumont. The region receives abundant snowfall during the winter months, making geological exploration and other related activities impractical during this time. The climate during the remainder of the year is moderate. The topography is moderately rugged with elevations ranging from sea level to about 140 meters. Although some portions of the property are wooded, in general, vegetative and soil cover is sparse, providing good bedrock exposure.

| 4 |

In 1980, Brinco Mining, Ltd. and Getty Mines Limited formed a joint venture and conducted reconnaissance exploration that included geological, geochemical and geophysical surveys in the vicinity of the Cutwell Harbour Property. In response to the discovery of several base metal occurrences in felsic volcanic rocks during this program, Getty Canadian Minerals engaged Tillicum Resources Ltd in 1983 to conduct geologic mapping, sampling and geophysical surveys over other areas of Long Island that are underlain by these rock types. A number of additional base metal anomalies were identified during this program, and in 1990, northern Long Island was staked under license 3948, issued to Eastern Goldfields. Continued exploration on this claim by Tillicum Resources for Eastern Goldfields led to the discovery of anomalous gold (1072 ppb) at Cutwell Harbour. These claims were relinquished by Eastern Goldfields in 1993.

Most rock chip sampling conducted by Tillicum Resources was concentrated within an area less that 20 by 60 meters in dimension with the exception of one sample collected about 100 meters along strike on the mineralized unit. An anomalous gold value of 1072 ppb was returned for one of the clustered samples and a value of 225 ppb for the sample collected 100 meters distant. The 1072 ppb sample is notable as it was not collected from a single site, but over a 10 meter interval. The elevated values indicate potential for economic grades of gold mineralization over significant portions of this unit. Widespread silicification and pyritization coupled with the proximity of a possible source of mineralization in the form of the nearby felsic stock lend further support to this potential.

The clustering of samples taken to date has not delineated the aerial extent nor defined the nature of mineralization. It is known that the region has been subjected to extensive structural deformation so the possibility of vein or stockwork mineralization exists.

Armed with our present understanding of this gold occurrence, the potential for economic mineralization could be evaluated relatively easily through a mapping and sampling program.

Recommendations From Our Consulting Geologist

In order to evaluate the exploration potential of the Cutwell Harbour claims, our consulting geologist has recommended on site surface reconnaissance, mapping and sampling to be followed by geochemical analyses of the samples to be taken. The primary goal of the exploration program is to identify sites for additional gold exploration. We have completed Phase I of the recommended program. The budget for the recommended Phase II exploration is as follows:

Exploration Budget Phase II |

Exploration Expenditure | ||

| On site mapping and sampling | $ | 7,000 | |

| Geochemical Analyses (≈50 samples) | $ | 1,500 | |

| Data compilation and report preparation | $ | 2,800 | |

| Other expenses and contingency | $ | 5,467 | |

| Total | $ | 16,767 |

We will require additional financing in order complete Phase II of our planned exploration program. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Upon our review of the results, we will assess whether the results are sufficiently positive to warrant additional phases of the exploration program. We will make the decision to proceed with any further programs based upon our consulting geologist’s review of the results and recommendations. In order to complete significant additional exploration beyond the currently planned Phase II, we will need to raise additional capital.

Competition

The mineral exploration industry, in general, is intensely competitive and even if commercial quantities of reserves are discovered, a ready market may not exist for the sale of the reserves.

| 5 |

Most companies operating in this industry are more established and have greater resources to engage in the production of mineral claims. We were incorporated on January 29, 2010 and our operations are not well-established. Our resources at the present time are limited. We may exhaust all of our resources and be unable to complete full exploration of the Cutwell Harbour mineral claims. There is also significant competition to retain qualified personnel to assist in conducting mineral exploration activities. If a commercially viable deposit is found to exist and we are unable to retain additional qualified personnel, we may be unable to enter into production and achieve profitable operations. These factors set forth above could inhibit our ability to compete with other companies in the industry and entered into production of the mineral claim if a commercial viable deposit is found to exist.

Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result our not receiving an adequate return on invested capital.

Compliance with Government Regulation

The main agency that governs the exploration of minerals in the Province of Newfoundland and Labrador is the Department of Natural Resources.

The Department of Natural Resources manages the development of Newfoundland and Labrador’s mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Department regulates and inspects the exploration and mineral production industries in Newfoundland and Labrador to protect workers, the public and the environment.

The material legislation applicable to Queensridge Mining Resources, Inc. is the Mineral Act of Newfoundland and Labrador. Any person who intends to conduct an exploration program on a staked or licensed area must submit prior notice with a detailed description of the activity to the Department of Natural Resources. An exploration program that may result in major ground disturbance or disruption to wildlife or wildlife habitat must have an Exploration Approval from the department before the activity can commence.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy any environmental damage caused such as refilling trenches after sampling or cleaning up fuel spills. Our initial exploration program does not require any reclamation or remediation because of minimal disturbance to the ground. The amount of these costs is not known at this time because we do not know the extent of the exploration program we will undertake, beyond completion of the recommended exploration phase described above, or if we will enter into production on the property. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially-economic deposit is discovered.

Employees

We have no employees as of the date of this prospectus other than our president and CEO, Mr. Stromer. We conduct our business largely through agreements with consultants and other independent third party vendors.

Research and Development Expenditures

We have not incurred any research or development expenditures since our incorporation.

| 6 |

Subsidiaries

We do not currently have any subsidiaries.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

The Cutwell Harbour property is located on Long Island in Notre Dame Bay, on the north coast of Newfoundland, Canada (fig. 1). It comprises 150 hectares (≈ 371 acres), approximately centered at latitude 49° 36’ 55.8" North, longitude 55° 40’ 54.1" West (UTM Zone 21, 595230E – 5496497N). It lies within the area covered by NTS map sheet 02E/12. The boundaries of the property are described as follows: Beginning at the Northeast corner of the herein described parcel of land, and said corner having UTM coordinates of 5 497 000 N, 596 000 E; of Zone 21; thence South 1,000 metres, thence West 1,500 metres, thence North 1,000 metres, thence East 1,500 metres to the point of beginning. All bearings are referred to the UTM grid, Zone 21. NAD27.

Figure 1. Location map of the Cutwell Harbour property

| 7 |

Figure 2. Claim Layout. Cutwell Harbour property shown in green.

We are not currently a party to any legal proceedings. We are not aware of any pending legal proceeding to which any of our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material interest adverse to us.

Our agent for service of process in Nevada is Val-U-Corp Services, Inc., 1802 N. Carson St., #212, Carson City, NV 89701.

Item 4. Mine Safety Disclosures

Not applicable.

| 8 |

PART II

Item 5. Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. The OTCBB is a network of security dealers who buy and sell stock. The dealers are connected by a computer network that provides information on current "bids" and "asks", as well as volume information. Our shares are quoted on the OTCBB under the symbol “QUSR”.

The following table sets forth the range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending June 30, 2012 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| June 30, 2012 | $ | 0.1970 | $ | 0.1970 | ||||||

| March 31, 2012 | n/a | n/a | ||||||||

| December 31, 2011 | n/a | n/a | ||||||||

| September 30, 2011 | n/a | n/a | ||||||||

Fiscal Year Ending June 30, 2011 | ||||||||||

| Quarter Ended | High $ | Low $ | ||||||||

| June 30, 2011 | n/a | n/a | ||||||||

| March 31, 2011 | n/a | n/a | ||||||||

| December 31, 2010 | n/a | n/a | ||||||||

| September 30, 2010 | n/a | n/a | ||||||||

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

| 9 |

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Holders of Our Common Stock

As of October 9, 2012, we had 6,427,800 shares of our common stock issued and outstanding, held by thirty-one (31) shareholders of record.

Dividends

There are no restrictions in our articles of incorporation or bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

| 1. | we would not be able to pay our debts as they become due in the usual course of business, or; |

| 2. | our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. |

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

Recent Sales of Unregistered Securities

We closed an issue to 3,100,000 shares of common stock on February 8, 2010 to our sole officer and director, Phillip Stromer, at a price of $0.001 per share. The total proceeds received from this offering were $3,100. These shares were issued pursuant to Section 4(2) of the Securities Act of 1933 and are restricted shares as defined in the Securities Act. We did not engage in any general solicitation or advertising.

We completed an offering of 3,250,000 shares of our common stock at a price of $0.005 per share to a total of sixteen (16) purchasers on March 29, 2010. The total amount we received from this offering was $16,250. We completed an offering of 77,800 shares of our common stock at $0.25 per share to a total of thirteen (13) purchasers on May 29, 2010. The total amount we received from this offering was $19,450. The identity of the purchasers from both of these offerings is included in the selling shareholder table set forth above. We completed both of these offerings pursuant Rule 504 of Regulation D of the Securities Act of 1933.

Securities Authorized for Issuance under Equity Compensation Plans

None.

Item 6. Selected Financial Data

A smaller reporting company is not required to provide the information required by this Item.

| 10 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations for the Years Ended June 30, 2012 and 2011, and for the period from January 29, 2010 (date of inception) through June 30, 2012

We have not earned any revenues since the inception of our current business operations. We incurred expenses and a net loss in the amount of $37,802 for the year ended June 30, 2012. Our expenses consisted of professional fees in the amount of $32,098, rent in the amount of $3,720, general and administrative expenses in the amount of $1,109, and interest in the amount of $875. By comparison, we incurred expenses and a net loss of $88,364 during the fiscal year ended June 30, 2011. Our expenses during the fiscal year ended June 30, 2011 consisted of professional fees in the amount of $58,672, consulting fees of $11,500, mineral exploration costs of $10,521, rent in the amount of $3,720, general and administrative expenses of $3,826, and interest of $125. We have incurred total expenses and a net loss of $137,711 from inception on January 29, 2010 through June 30, 2012.

Liquidity and Capital Resources

As of June 30, 2012, we had current assets in the amount of $1,774 consisting entirely of cash. Our current liabilities as of June 30, 2012, were $90,685, consisting primarily of accrued expenses. Thus, we had a working capital deficit of $88,911 as of June 30, 2012.

We have incurred cumulative net losses of $137,711 since inception. We have not attained profitable operations and are dependent upon obtaining financing in order to continue pursuing significant exploration activities. As discussed above, we have completed Phase I of our exploration program and intend to go forward with Phase II at an approximate cost of $16,767. Our cash on hand will not be sufficient to fund the full recommended Phase II exploration program together with our ongoing administrative expenses. Additional financing will therefore be required in order for us to proceed with Phase II. At this time, we do not have any financing commitments or other arrangements in place. We therefore face a significant risk that we will be unable to complete the entirety of our planned exploration program. In the event that additional equity or debt financing cannot be obtained, we may consider performing a more limited Phase II exploration program in order to meet the constraints posed by our available capital resources.

Off Balance Sheet Arrangements

As of June 30, 2012, there were no off balance sheet arrangements.

| 11 |

Going Concern

Our financial statements have been prepared assuming that we will continue as a going concern which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. We have incurred cumulative losses of $137,711 since inception, expect to incur further losses in the development of our business and have been dependent on funding operations through the issuance of convertible debt and private sale of equity securities. These conditions raise substantial doubt about our ability to continue as a going concern. Management’s plans include continuing to finance operations through the private or public placement of debt and/or equity securities and the reduction of expenditures. However, no assurance can be given at this time as to whether we will be able to achieve these objectives. The financial statements do not include any adjustment relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Critical Accounting Policies

In December 2001, the SEC requested that all registrants list their most “critical accounting polices” in the Management Discussion and Analysis. The SEC indicated that a “critical accounting policy” is one which is both important to the portrayal of a company’s financial condition and results, and requires management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effect of matters that are inherently uncertain. Management does not believe that any of our accounting policies currently fit this definition.

Recently Issued Accounting Pronouncements

We do not expect the adoption of recently issued accounting pronouncements to have a significant impact on our results of operations, financials position or cash flow.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company is not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

Index to Financial Statements Required by Article 8 of Regulation S-X:

| 12 |

Silberstein Ungar, PLLC CPAs and Business Advisors

Phone (248) 203-0080

Fax (248) 281-0940

30600 Telegraph Road, Suite 2175

Bingham Farms, MI 48025-4586

www.sucpas.com

Report of Independent Registered Public Accounting Firm

To the Board of Directors of

Queensridge Mining Resources, Inc.

Las Vegas, Nevada

We have audited the accompanying balance sheets of Queensridge Mining Resources, Inc. as of June 30, 2012 and 2011, and the related statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and the period from January 29, 2010 (inception) through June 30, 2012. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Queensridge Mining Resources, Inc. as of June 30, 2012 and 2011, and the results of its operations and its cash flows for the years then ended and the period from January 29, 2010 (inception) through June 30, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 9 to the financial statements, the Company has limited working capital, has not yet received revenue from sales of products or services, and has incurred losses from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans with regard to these matters are described in Note 9. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Silberstein Ungar, PLLC

Bingham Farms, Michigan

October 9, 2012

| F-1 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

BALANCE SHEETS

AS OF JUNE 30, 2012 AND 2011

| 2012 | 2011 | ||||||

| ASSETS | |||||||

| Current Assets | |||||||

| Cash and cash equivalents | $ | 1,774 | $ | 6,133 | |||

| TOTAL ASSETS | $ | 1,774 | $ | 6,133 | |||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | |||||||

| LIABILITIES | |||||||

| Current Liabilities | |||||||

| Accrued expenses | $ | 67,095 | $ | 51,747 | |||

| Accrued interest – related party | 1,000 | 125 | |||||

| Notes payable – related party | 10,000 | 0 | |||||

| Shareholder loans | 12,590 | 5,370 | |||||

| Total Current Liabilities | 90,685 | 57,242 | |||||

| Long – Term Liabilities | |||||||

| Notes payable – related party | 10,000 | 10,000 | |||||

| Total Liabilities | 100,685 | 67,242 | |||||

| STOCKHOLDERS’ EQUITY (DEFICIT) | |||||||

| Common stock, $.001 par value, 75,000,000 shares authorized, 6,427,800 shares issued and outstanding |

6,428 | 6,428 | |||||

| Additional paid in capital | 32,372 | 32,372 | |||||

| Deficit accumulated during the exploration stage | (137,711 | ) | (99,909 | ) | |||

| Total Stockholders’ Equity (Deficit) | (98,911 | ) | (61,109 | ) | |||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | $ | 1,774 | $ | 6,133 | |||

See accompanying notes to financial statements.

| F-2 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

FOR THE YEARS ENDED JUNE 30, 2012 AND 2011 AND THE

PERIOD FROM JANUARY 29, 2010 (INCEPTION) TO JUNE 30, 2012

| Year ended June 30, 2012 | Year ended June 30, 2011 | Period from January 29, 2010 (Inception) to June 30, 2012 | |||||||||

| REVENUES | $ | 0 | $ | 0 | $ | 0 | |||||

| OPERATING EXPENSES | |||||||||||

| Professional fees | 32,098 | 58,672 | 96,930 | ||||||||

| Consulting fees | — | 11,500 | 11,500 | ||||||||

| Impairment expense – mineral properties | — | — | 3,000 | ||||||||

| Exploration costs | — | 10,521 | 10,521 | ||||||||

| Rent | 3,720 | 3,720 | 8,990 | ||||||||

| General and administrative | 1,109 | 3,826 | 5,770 | ||||||||

| TOTAL OPERATING EXPENSES | 36,927 | 88,239 | 136,711 | ||||||||

| LOSS FROM OPERATIONS | (36,927 | ) | (88,239 | ) | (136,711 | ) | |||||

| OTHER INCOME (EXPENSE) | |||||||||||

| Interest expense | (875 | ) | (125 | ) | (1,000 | ) | |||||

| LOSS BEFORE PROVISION FOR FEDERAL INCOME TAX | (37,802 | ) | (88,364 | ) | (137,711 | ) | |||||

| PROVISION FOR FEDERAL INCOME TAX | 0 | 0 | 0 | ||||||||

| NET LOSS | $ | (37,802 | ) | $ | (88,364 | ) | $ | (137,711 | ) | ||

| LOSS PER SHARE: BASIC AND DILUTED | $ | (0.01 | ) | $ | (0.01 | ) | |||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: BASIC AND DILUTED | 6,427,800 | 6,427,800 | |||||||||

See accompanying notes to financial statements.

| F-3 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

AS OF JUNE 30, 2012

| Common stock | Additional paid-in | Deficit accumulated during the exploration | Total Stockholders’ Equity | ||||||||||||||||

| Shares | Amount | capital | stage | (Deficit) | |||||||||||||||

| Inception, January 29, 2010 | 0 | $ | 0 | $ | 0 | $ | 0 | $ | 0 | ||||||||||

| Shares issued to founder for cash | 3,100,000 | 3,100 | — | — | 3,100 | ||||||||||||||

| Shares issued for cash | 3,250,000 | 3,250 | 13,000 | — | 16,250 | ||||||||||||||

| Shares issued for cash | 77,800 | 78 | 19,372 | — | 19,450 | ||||||||||||||

| Net loss for the period ended June 30, 2010 | — | — | — | (11,545 | ) | (11,545 | ) | ||||||||||||

| Balance, June 30, 2010 | 6,427,800 | 6,428 | 32,372 | (11,545 | ) | 27,255 | |||||||||||||

| Net loss for the year ended June 30, 2011 | — | — | — | (88,364 | ) | (88,364 | ) | ||||||||||||

| Balance, June 30, 2011 | 6,427,800 | 6,428 | 32,372 | (99,909 | ) | (61,109 | ) | ||||||||||||

| Net loss for the year ended June 30, 2012 | — | — | — | (37,802 | ) | (37,802 | ) | ||||||||||||

| Balance, June 30, 2012 | 6,427,800 | $ | 6,428 | $ | 32,372 | $ | (137,711 | ) | $ | (98,911 | ) | ||||||||

See accompanying notes to financial statements.

| F-4 |

QUEENSRIDGE MINING RESOURCES, INC.

(A EXPLORATION STAGE COMPANY)

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED JUNE 30, 2012 AND 2011 AND THE

PERIOD FROM JANUARY 29, 2010 (INCEPTION) TO JUNE 30, 2012

| Year ended June 30, 2012 | Year ended June 30, 2011 | Period from January 29, 2010 (Inception) to June 30, 2012 | |||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||

| Net loss for the period | $ | (37,802 | ) | $ | (88,364 | ) | $ | (137,711 | ) | ||

| Adjustments to Reconcile Net Loss to Net Cash Used in Operating Activities: |

|||||||||||

| Changes in Assets and Liabilities: | |||||||||||

| Increase in accrued expenses | 16,223 | 45,712 | 68,095 | ||||||||

| CASH FLOWS USED IN OPERATING ACTIVITIES | (21,579 | ) | (42,652 | ) | (69,616 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||

| Proceeds from shareholder loans | 7,220 | 3,720 | 12,590 | ||||||||

| Proceeds from notes payable - related party | 10,000 | 10,000 | 20,000 | ||||||||

| Proceeds from sale of common stock | 0 | 0 | 38,800 | ||||||||

| CASH FLOWS PROVIDED BY FINANCING ACTIVITIES | 17,220 | 13,720 | 71,390 | ||||||||

| NET INCREASE (DECREASE) IN CASH | (4,359 | ) | (28,932 | ) | 1,774 | ||||||

| Cash, beginning of period | 6,133 | 35,065 | 0 | ||||||||

| CASH, END OF PERIOD | $ | 1,774 | $ | 6,133 | $ | 1,774 | |||||

| SUPPLEMENTAL CASH FLOW INFORMATION: | |||||||||||

| Interest paid | $ | — | $ | — | $ | — | |||||

| Income taxes paid | $ | — | $ | — | $ | — | |||||

See accompanying notes to financial statements.

| F-5 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 – SUMMARY OF ACCOUNTING POLICIES

Nature of Business

Queensridge Mining Resources, Inc. (“Queensridge” or the “Company”) was incorporated in Nevada on January 29, 2010. Queensridge is an exploration stage company and has not yet realized any revenues from its planned operations. Queensridge is currently in the process of acquiring certain mining claims.

Exploration Stage Company

The accompanying financial statements have been prepared in accordance with generally accepted accounting principles related to exploration stage companies. An exploration stage company is one in which planned principal operations have not commenced, or, if its operations have commenced, there have been no significant revenues there from.

Basis of Presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States of America and are presented in US dollars.

Accounting Basis

The Company uses the accrual basis of accounting and accounting principles generally accepted in the United States of America (“GAAP” accounting). The Company has adopted a June 30 fiscal year end.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less to be cash equivalents. At June 30, 2012 and 2011 the Company had cash balances totaling $1,774 and $6,133, respectively.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash and cash equivalents, accrued expenses, accrued interest – related party, shareholder loans and notes payable to a related party. The carrying amount of these financial instruments approximates fair value due either to length of maturity or interest rates that approximate prevailing market rates unless otherwise disclosed in these financial statements.

Income Taxes

Income taxes are computed using the asset and liability method. Under the asset and liability method, deferred income tax assets and liabilities are determined based on the differences between the financial reporting and tax bases of assets and liabilities and are measured using the currently enacted tax rates and laws. A valuation allowance is provided for the amount of deferred tax assets that, based on available evidence, are not expected to be realized. It is the Company’s policy to classify interest and penalties on income taxes as interest expense or penalties expense. As of June 30, 2012, there have been no interest or penalties incurred on income taxes.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| F-6 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 – SUMMARY OF ACCOUNTING POLICIES (CONTINUED)

Dividends

The Company has not adopted any policy regarding payment of dividends. No dividends have been paid during the periods shown.

Basic Income (Loss) Per Share

Basic income (loss) per share is calculated by dividing the Company’s net loss applicable to common shareholders by the weighted average number of common shares during the period. Diluted earnings per share is calculated by dividing the Company’s net income available to common shareholders by the diluted weighted average number of shares outstanding during the year. The diluted weighted average number of shares outstanding is the basic weighted number of shares adjusted for any potentially dilutive debt or equity. There are no such common stock equivalents outstanding as of June 30, 2012 or 2011.

Revenue Recognition

The Company is in the development stage and has yet to realize revenues from operations. Once the Company has commenced operations, it will recognize revenues when delivery of goods or completion of services has occurred provided there is persuasive evidence of an agreement, acceptance has been approved by its customers, the fee is fixed or determinable based on the completion of stated terms and conditions, and collection of any related receivable is probable.

Stock-Based Compensation

The Company accounts for employee stock-based compensation in accordance with the guidance of FASB ASC Topic 718, Compensation – Stock Compensation which requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. The fair value of the equity instrument is charged directly to compensation expense and additional paid-in capital over the period during which services are rendered. There has been no stock-based compensation issued to employees.

The Company follows ASC Topic 505-50, formerly EITF 96-18, “Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in Conjunction with Selling Goods and Services,” for stock options and warrants issued to consultants and other non-employees. In accordance with ASC Topic 505-50, these stock options and warrants issued as compensation for services provided to the Company are accounted for based upon the fair value of the services provided or the estimated fair market value of the option or warrant, whichever can be more clearly determined. There has been no stock-based compensation issued to non-employees.

Mineral Properties

Costs of exploration and the costs of carrying and retaining unproven mineral lease properties are expensed as incurred. Mineral property acquisition costs are capitalized including licenses and lease payments. Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company's title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

Impairment losses are recorded on mineral properties used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets’ carrying amount.

| F-7 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 1 – SUMMARY OF ACCOUNTING POLICIES (CONTINUED)

Recent Accounting Pronouncements

The Company does not expect the adoption of recently issued accounting pronouncements to have a significant impact on the Company’s results of operations, financial position or cash flows.

NOTE 2 – MINERAL PROPERTIES

During the period ended June 30, 2010, the Company electronically staked and recorded a 100% interest in a block of mining claims located in northern Newfoundland, Canada known as the Cutwell Harbour property for $3,000. The mineral properties were found to be unproven and the entire balance of $3,000 was impaired as of June 30, 2010.

Exploration costs totaled $0 and $10,521 for the periods ended June 30, 2012 and 2011, respectively.

NOTE 3 – SHAREHOLDER LOANS

The Company has received advances from a shareholder to help fund operations. The balance of the shareholder loans was $12,590 and $5,370 as of June 30, 2012 and 2011, respectively. The loans are unsecured, non-interest bearing and have no specific terms of repayment.

NOTE 4 – NOTES PAYABLE – RELATED PARTY

The Company received two $10,000 loans from a related party during the years ended June 30, 2012 and 2011. The notes bear interest at 5% per annum and are due on April 24, 2013 and October 4, 2013. Interest expense of $875 and $125 was recorded for the years ended June 30, 2012 and 2011, respectively.

NOTE 5 – ACCRUED EXPENSES

Accrued expenses consisted of the following at June 30:

| 2012 | 2011 | ||||||

| Accrued accounting fees | $ | 6,750 | $ | 10,750 | |||

| Accrued legal fees | 60,345 | 40,997 | |||||

| Total accrued expenses | $ | 67,095 | $ | 51,747 | |||

NOTE 6 – COMMON STOCK

On February 8, 2010, the Company issued 3,100,000 founder shares at $0.001 (par value) for cash totaling $3,100.

On March 29, 2010, the Company issued 3,250,000 shares at $0.005 for cash totaling $16,250.

On May 29, 2010, the Company issued 77,800 shares at $0.25 for cash totaling $19,450.

The Company had 6,427,800 shares of common stock issued and outstanding as of June 30, 2012 and 2011.

The Company has not issued any stock options or warrants as of June 30, 2012.

| F-8 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 7 – INCOME TAXES

From inception through the year ended June 30, 2012, the Company has incurred net losses and, therefore, has no tax liability. The net deferred tax asset generated by the loss carry-forward has been fully reserved. The cumulative net operating loss carry-forward is approximately $137,700 at June 30, 2011, and will expire beginning in the year 2030.

The provision for Federal income tax consists of the following as of June 30:

| 2012 | 2011 | ||||||

| Federal income tax benefit attributable to: | |||||||

| Current operations | $ | 12,853 | $ | 30,044 | |||

| Less: valuation allowance | (12,853 | ) | (30,044 | ) | |||

| Net provision for Federal income tax | $ | 0 | $ | 0 | |||

The cumulative tax effect at the expected rate of 34% of significant items comprising our net deferred tax amount is as follows at June 30:

| 2012 | 2011 | ||||||

| Deferred tax asset attributable to: | |||||||

| Net operating loss carryover | $ | 46,822 | $ | 33,969 | |||

| Valuation allowance | (46,822 | ) | (33,969 | ) | |||

| Net deferred tax asset | $ | 0 | $ | 0 | |||

Due to the change in ownership provisions of the Tax Reform Act of 1986, net operating loss carry forwards for federal income tax reporting purposes are subject to annual limitations. Should a change in ownership occur net operating loss carry forwards may be limited as to use in future years.

NOTE 8 – COMMITMENTS

Operating Lease

The Company leases its office facilities on a month-to-month basis at a rate of $310 per month. Rent expense for the fiscal years ended June 30, 2012 and 2011 totaled $3,720 and $3,720, respectively.

| F-9 |

QUEENSRIDGE MINING RESOURCES, INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO THE FINANCIAL STATEMENTS

JUNE 30, 2012

NOTE 9 – LIQUIDITY AND GOING CONCERN

The Company has negative working capital, has incurred losses since inception, and has not yet received revenues from sales of products or services. These factors create substantial doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustment that might be necessary if the Company is unable to continue as a going concern.

The ability of Queensridge to continue as a going concern is dependent upon the Company generating cash from the sale of its common stock and/or obtaining debt financing and attaining future profitable operations. Management’s plans include selling its equity securities and obtaining debt financing to fund its capital requirement and ongoing operations; however, there can be no assurance the Company will be successful in these efforts.

NOTE 10 – SUBSEQUENT EVENTS

In accordance with ASC 855-10, the Company’s management has analyzed its operations through the date on which the financial statements were issued, and has determined it does not have any material subsequent events to disclose.

| F-10 |

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

No events occurred requiring disclosure under Item 304 of Regulation S-K during the fiscal year ending June 30, 2012.

Item 9A. Controls and Procedures

As required by Rule 13a-15 under the Securities Exchange Act of 1934, we have carried out an evaluation of the effectiveness of our disclosure controls and procedures as of the end of the period covered by this annual report, June 30, 2012. This evaluation was carried out under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Securities Exchange Act of 1934 is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosure.

Based upon that evaluation, including our Chief Executive Officer and Chief Financial Officer, we have concluded that our disclosure controls and procedures were ineffective as of the end of the period covered by this annual report.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rule 13a-15(f) under the Securities Exchange Act of 1934). Management has assessed the effectiveness of our internal control over financial reporting as of June 30, 2012 based on criteria established in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As a result of this assessment, management concluded that, as of June 30, 2012, our internal control over financial reporting was not effective. Our management identified the following material weaknesses in our internal control over financial reporting, which are indicative of many small companies with small staff: (i) inadequate segregation of duties and effective risk assessment; and (ii) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines.

We plan to take steps to enhance and improve the design of our internal control over financial reporting. During the period covered by this annual report on Form 10-K, we have not been able to remediate the material weaknesses identified above. To remediate such weaknesses, we hope to implement the following changes during our fiscal year ending June 30, 2012: (i) appoint additional qualified personnel to address inadequate segregation of duties and ineffective risk management; and (ii) adopt sufficient written policies and procedures for accounting and financial reporting. The remediation efforts set out in (i) and (ii) are largely dependent upon our securing additional financing to cover the costs of implementing the changes required. If we are unsuccessful in securing such funds, remediation efforts may be adversely affected in a material manner.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to an exemption for non-accelerated filers set forth in Section 989G of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

None

| 13 |

PART III

Item 10. Directors, Executive Officers and Corporate Governance

The following information sets forth the names, ages, and positions of our current directors and executive officers as of October 9, 2012.

| Name | Age | Position(s) and Office(s) Held |

| Phillip Stromer | 51 | President, Chief Executive Officer, Chief Financial Officer, and Director |

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Phillip Stromer. Mr. Stromer is our CEO, CFO, President, Secretary, Treasurer and sole director. Mr. Stromer has been a professional pilot since 1990. Mr. Stromer currently serves as a captain with U.S. Airways, a position he has held since 2002. Prior to his career as a pilot, Mr. Stromer worked as a civil engineer for Marin County, California where he focused on subdivision design, project management, and project cost analysis and estimating. Mr. Stromer holds a B.S. in civil engineering from California State University, Chico. Mr. Stromer is our founder and initial shareholder and has served as our sole officer and director since our inception on January 29, 2010. Mr. Stromer has no specific professional experience, qualifications, or skills that led to his appointment as our sole officer and director.

Directors

Our bylaws authorize no less than one (1) director. We currently have one Director.

Term of Office

Our Directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Significant Employees

Phillip Stromer is our only employee.

We conduct our business through agreements with consultants and arms-length third parties. Current arrangements in place include the following:

| 1. | A verbal agreement with our consulting geologist provides that he will review all of the results from the exploratory work performed upon the site and make recommendations based on those results in exchange for payments equal to the usual and customary rates received by geologist firms performing similar consulting services. |

| 2. | Verbal agreements with our accountants to perform requested financial accounting services. |

| 3. | Written agreements with auditors to perform audit functions at their respective normal and customary rates. |

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

| 14 |

Involvement in Certain Legal Proceedings

To the best of our knowledge, during the past ten years, none of the following occurred with respect to a present or former director, executive officer, or employee: (1) any bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; (2) any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); (3) being subject to any order, judgment or decree, not subsequently reversed, suspended vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his or her involvement in any type of business, securities or banking activities; and (4) being found by a court of competent jurisdiction (in a civil action), the SEC or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Committees of the Board

We do not currently have a compensation committee, executive committee, or stock plan committee.

Audit Committee

We do not have a separately-designated standing audit committee. The entire Board of Directors performs the functions of an audit committee, but no written charter governs the actions of the Board when performing the functions of what would generally be performed by an audit committee. The Board approves the selection of our independent accountants and meets and interacts with the independent accountants to discuss issues related to financial reporting. In addition, the Board reviews the scope and results of the audit with the independent accountants, reviews with management and the independent accountants our annual operating results, considers the adequacy of our internal accounting procedures and considers other auditing and accounting matters including fees to be paid to the independent auditor and the performance of the independent auditor. Our Board of Directors, which performs the functions of an audit committee, does not have a member who would qualify as an “audit committee financial expert” within the definition of Item 407(d)(5)(ii) of Regulation S-K. We believe that, at our current size and stage of development, the addition of a special audit committee financial expert to the Board is not necessary.

Nomination Committee

Our Board of Directors does not maintain a nominating committee. As a result, no written charter governs the director nomination process. Our size and the size of our Board, at this time, do not require a separate nominating committee.

When evaluating director nominees, our directors consider the following factors:

· The appropriate size of our Board of Directors;

· Our needs with respect to the particular talents and experience of our directors;

· The knowledge, skills and experience of nominees, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board;

· Experience in political affairs;

· Experience with accounting rules and practices; and

· The desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board members.

Our goal is to assemble a Board that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Board will also consider candidates with appropriate non-business backgrounds.

| 15 |

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Board may also consider such other factors as it may deem are in our best interests as well as our stockholders. In addition, the Board identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Board then identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Board are polled for suggestions as to individuals meeting the criteria described above. The Board may also engage in research to identify qualified individuals. To date, we have not engaged third parties to identify or evaluate or assist in identifying potential nominees, although we reserve the right in the future to retain a third party search firm, if necessary. The Board does not typically consider shareholder nominees because it believes that its current nomination process is sufficient to identify directors who serve our best interests.

Code of Ethics

As of October 9, 2012, we had not adopted a Code of Ethics for Financial Executives, which would include our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

Item 11. Executive Compensation

Compensation Discussion and Analysis

The Company presently not does have employment agreements with any of its named executive officers and it has not established a system of executive compensation or any fixed policies regarding compensation of executive officers. Due to financial constraints typical of those faced by a development stage mineral exploration business, the company has not paid any cash and/or stock compensation to its named executive officers

Our current named executive officer holds substantial ownership in the Company and is motivated by a strong entrepreneurial interest in developing our operations and potential revenue base to the best of his ability. As our business and operations expand and mature, we may develop a formal system of compensation designed to attract, retain and motivate talented executives.

Summary Compensation Table

The table below summarizes all compensation awarded to, earned by, or paid to each named executive officer for our last two completed fiscal years for all services rendered to us.

| SUMMARY COMPENSATION TABLE | |||||||||

|

Name and principal position |

Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|

Phillip Stromer, CEO, CFO, President, Secretary-Treasurer, & Director |

2012 2011

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0

|

0 0 |

Narrative Disclosure to the Summary Compensation Table

Our named executive officer does not currently receive any compensation from the Company for his service as an officer of the Company.

| 16 |

Outstanding Equity Awards At Fiscal Year-end Table

The table below summarizes all unexercised options, stock that has not vested, and equity incentive plan awards for each named executive officer outstanding as of the end of our last completed fiscal year.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |||||||||

| OPTION AWARDS | STOCK AWARDS | ||||||||

|

Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date

|

Number of Shares or Shares of Stock That Have Not Vested (#) |

Market Value of Shares or Shares of Stock That Have Not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Shares or Other Rights That Have Not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Shares or Other Rights That Have Not Vested (#) |

| Phillip Stromer | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Compensation of Directors Table

The table below summarizes all compensation paid to our directors for our last completed fiscal year.

| DIRECTOR COMPENSATION | |||||||

| Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Non-Qualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

| Phillip Stromer | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Narrative Disclosure to the Director Compensation Table

Our directors do not currently receive any compensation from the Company for their service as members of the Board of Directors of the Company.

| 17 |

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

The following table sets forth, as of October 9, 2012, the beneficial ownership of our common stock by each executive officer and director, by each person known by us to beneficially own more than 5% of the our common stock and by the executive officers and directors as a group. Except as otherwise indicated, all shares are owned directly and the percentage shown is based on 6,427,800 shares of common stock issued and outstanding on October 9, 2012.

|

Title of class |

Name and address of beneficial owner |

Amount of beneficial ownership |

Percent of class* |

| Common |

Phillip Stromer 912 Sir James Bridge Way Las Vegas, Nevada 89145 |

3,100,000 | 48.23% |

| Common | Total all executive officers and directors | 3,100,000 | 48.23% |

| Common | Other 5% Shareholders | ||

| None |

As used in this table, "beneficial ownership" means the sole or shared power to vote, or to direct the voting of, a security, or the sole or shared investment power with respect to a security (i.e., the power to dispose of, or to direct the disposition of, a security). In addition, for purposes of this table, a person is deemed, as of any date, to have "beneficial ownership" of any security that such person has the right to acquire within 60 days after such date.

The persons named above have full voting and investment power with respect to the shares indicated. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a "beneficial owner" of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

Item 13. Certain Relationships and Related Transactions, and Director Independence

Except as set forth below, none of the following parties has, since our date of incorporation, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

- Any of our directors or officers;

- Any person proposed as a nominee for election as a director;

- Any person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding shares of common stock;

- Any of our promoters;

- Any relative or spouse of any of the foregoing persons who has the same house address as such person.

1. We are party to a Commercial Lease Agreement with the PKS Trust, an entity for which our sole officer and director, Phillip Stromer, is a Trustee. Under the Commercial Lease Agreement, we rent certain square footage at 912 Sir James Bridge Way, Las Vegas, Nevada 89145 for use as our executive offices at a rate of $310.00 per month. We entered into the Commercial Lease Agreement on February 1, 2010. The lease runs for a term of two years and expires on February 1, 2012.

| 18 |

2. Our sole officer and largest shareholder, Phillip Stromer, has committed to fund our legal and accounting compliance expenses through additional infusions of equity or debt capital on an as-needed basis. Mr. Stromer’s commitment to fund legal and accounting expenses as needed through additional infusions of equity or debt capital is not the subject of a formal written agreement with us, but instead consists of his commitment to us as our founder and controlling shareholder to maintain our compliance obligations through the future contribution of additional capital if and when needed. In order to ensure our continuing regulatory compliance, Mr. Stromer made this commitment to the company concurrently with the initial filing of our registration statement on Form S-1, on August 12, 2010. There are no limits as to time or dollar amount on Mr. Stromer’s commitment in this regard.

3. Our balance sheet reflects a loan payable to related party in the amount of $12,590. This sum reflects funds advanced by Mr. Stromer on behalf of the company. There is no written agreement or any specific unwritten agreement regarding the terms of our repayment of these funds. Our obligation to repay these funds is unsecured, does not bear any interest, and has no specific due date for repayment.

4. On April 24, 2011, we borrowed the sum of $10,000 from our sole officer and director under a Promissory Note. The Note bears annual interest at the rate of five percent (5%), with all principal and interest due on or before April 24, 2013.

5. On October 4, 2011, we borrowed $10,000 from our sole officer and director, Phillip Stromer, under a Promissory Note. The note bears interest at a rate of five percent (5%) per year, with all principal and interest due on or before October 4, 2013.

Director Independence

We are not a “listed issuer” within the meaning of Item 407 of Regulation S-K and there are no applicable listing standards for determining the independence of our directors. Applying the definition of independence set forth in Rule 4200(a)(15) of The Nasdaq Stock Market, Inc., we do not have any independent directors.

Item 14. Principal Accounting Fees and Services

Below is the table of Audit Fees (amounts in US$) billed by our auditor in connection with the audit of the Company’s annual financial statements for the years ended:

| Financial Statements for the Year Ended | Audit Services | Audit Related Fees | Tax Fees | Other Fees | ||||||||||||

| June 30, 2012 | $ | 5,750 | $ | 4,600 | $ | 750 | — | |||||||||

| June 30, 2011 | $ | 5,500 | $ | 4,500 | $ | 750 | — | |||||||||

| 19 |

PART IV

Item 15. Exhibits, Financial Statements Schedules

| (a) | Financial Statements and Schedules |

The following financial statements and schedules listed below are included in this Form 10-K.

Financial Statements (See Item 8)

| (b) | Exhibits |

| Exhibit Number | Description |

| 3.1 | Articles of Incorporation (1) |

| 3.2 | Bylaws(1) |

| 10.1 | Promissory Note dated April 24, 2011(2) |

| 10.2 | Promissory Note dated October 4, 2011(3) |

| 23.1 | Consent Of Independent Registered Public Accounting Firm |

| 31.1 | Certification of Chief Executive Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2 | Certification of Chief Financial Officer pursuant to Securities Exchange Act Rule 13a-14(a)/15d-14(a), as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 32.1 | Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 101** | The following materials from the Company’s Annual Report on Form 10-K for the year ended June 30, 2012 formatted in Extensible Business Reporting Language (XBRL). |

| (1) | Incorporated by reference to Registration Statement on Form S-1 filed August 12, 2010. |

| (2) | Incorporated by reference to Annual Report on Form 10-K for the year ended June 30, 2011, filed on October 13, 2011 |

| (3) | Incorporated by reference to Quarterly Report on Form 10-Q for the quarter ended December 31, 2011, filed on February 21, 2012 |

**Filed herein

| 20 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Queensridge Mining Resources, Inc.

| By: | /s/ Philip Stromer |

| Philip Stromer | |

| Title: | President |