Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACCURIDE CORP | a12-23501_18k.htm |

| EX-99.2 - EX-99.2 - ACCURIDE CORP | a12-23501_1ex99d2.htm |

Exhibit 99.1

|

|

Deutsche Bank Leveraged Finance Conference October 10, 2012 |

|

|

Forward Looking Statements Statements contained in this news release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding Accuride’s expectations, hopes, beliefs and intentions with respect to future results. Such statements are subject to the impact on Accuride’s business and prospects generally of, among other factors, market demand in the commercial vehicle industry, general economic, business and financing conditions, labor relations, governmental action, competitor pricing activity, expense volatility and other risks detailed from time to time in Accuride’s Securities and Exchange Commission filings, including those described in Item 1A of Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011. Any forward-looking statement reflects only Accuride’s belief at the time the statement is made. Although Accuride believes that the expectations reflected in these forward-looking statements are reasonable, it cannot guarantee its future results, levels of activity, performance or achievements. Except as required by law, Accuride undertakes no obligation to update any forward-looking statements to reflect events or developments after the date of this news release. |

|

|

Industry Conditions |

|

|

Net Orders vs. Builds OEMs have continued to build in spite of weak orders – UNSUSTAINABLE! Current build levels are unsustainable Builds have exceeded orders by 53K since Feb 2012 Source: ACT Research |

|

|

Industry Backlog and Inventory OEMs have put off significant production cuts for as long as they can Steadily declining backlogs + rising inventory levels = pressure on builds Low cancellations point to a near-term soft patch rather than a protracted downturn Source: ACT Research |

|

|

OEM build schedules have deteriorated – risk of further deterioration remains high Risk to current build plans 22% Reduction Forecasted OEM Build Schedules |

|

|

Customer build schedules have deteriorated rapidly with little warning Customer Production Cuts June 18 OEM 3 June 19 OEM 5 July 13 OEM 4 July 13 OEM 1 Aug 1 OEM 5 Aug 1 OEM 2 Aug 15 OEM 1 Aug 16 OEM 3 Aug 30 OEM 4 Sept 7 OEM 3 Sept 10 OEM 1 Sept 20 OEM 4 June 19 OEM 2 Key: Reduced build rates Took out build days Sept 13 OEM 4 ??? |

|

|

Class 8 Build Forecast Accuracy Actual Class 8 builds are coming in below our conservative estimates 2012 Class 8 Builds ACT FTR Accuride Initial Forecast 296,493 284,481 265,000 Current Forecast 284,716 269,375 <245,000 Current H/(L) Initial (11,777) (15,106) (20,000) 2013 Class 8 Builds ACT FTR Accuride Initial Forecast 288,675 233,000 220 - 230K Accuride’s initial 2012 Class 8 Build forecast was 11% lower than ACT and 7% lower than FTR, which was viewed as conservative at the beginning of the year It now appears that actual Class 8 Builds for 2012 will be even lower 2012 A Tale of Two Halves 1H 2H Full Year Class 8 Builds 156,000 <90,000 <245,000 The run-rate for the second half of 2012 has dropped significantly Accuride’s preliminary 2013 Class 8 Build forecast is 22% lower than ACT and 3% lower than FTR |

|

|

Other Commercial Factors Other commercial factors are negatively impacting our business; however, we are adjusting our cost structure and market strategy to mitigate these impacts The unfavorable ruling by the ITC in the anti-dumping case is creating additional pressure on our steel wheel aftermarket business Navistar and Paccar will no longer offer Gunite hub and drum assemblies as standard equipment on their vehicles Near-term softness in the global construction, agriculture and oil & gas industries has reduced Brillion’s 2012 forecast Anti Dumping Suit (Wheels) OEM Decisions (Gunite) Other Industrial Softness (Brillion) Customer Steel Wheels Aluminum Wheels Drums Hubs OE AM Daimler Navistar Paccar Volvo |

|

|

Comments from Industry Peers Companies across the industry are reacting to the abrupt slowdown “Industry orders for new trucks in North America have slowed in recent months as customers evaluate the mixed signals of a sluggish economic recovery. PACCAR's third quarter truck production is expected to be 15-20 percent lower than the second quarter, reflecting build rate adjustments in North America and the normal two-week summer shutdown in Europe.” “As we announced on September 4, weakness in the global economy constrained revenue growth at FedEx Express during our first quarter and affected our earnings. . . We are taking further actions to reduce costs and adjust our networks to match current and anticipated shipment volumes.” “. . . third quarter 2012 earnings are expected to be in the range of $1.18 to $1.25 per diluted share, primarily due to volume declines in certain markets and lower revenues from fuel surcharges. Decreased coal and merchandise shipments, offset in part by growth in intermodal volumes, are together expected to reduce revenues by approximately $120 million compared with third quarter 2011.” “. . . along with uncertain industry conditions, the company is not providing fourth quarter earnings guidance until industry volumes solidify and these potential actions are defined.” “Revenue projections for the second half are lower than our previous forecast due to reduced expectations for the European commercial vehicle market, unfavorable volume adjustments from a large North American commercial vehicle customer which were below our forecast, and continued weakness in the Brazilian market. With the current market forecast , we are reducing cost to align with the realities of our end markets and customer schedules.” October 5, 2012 September 19, 2012 September 18, 2012 September 6, 2012 September 11, 2012 “There are a number of geopolitical and economic factors driving uncertainty in the world today, but our base case scenario calls for modest global economic growth over the next few years. We think this is a reasonable view and the most likely outcome, and based on that, we expect 2015 sales and revenues for Caterpillar to be in a range of $80 to $100 billion, and for profit in a range of $12 to $18 per share.” September 24, 2012 |

|

|

Industry Fundamentals September’s figure of 51.5 alleviates concerns about a rapid economic contraction Expect moderate economic growth in the near-term The age of the U.S. fleet is 6.7 years The median age of the U.S. fleet over the past 25 years is 5.8 years Maintenance costs typically rise sharply at the 5 years/500K miles Freight volumes ticked up at the end of 2011 through mid-2012 Recent freight volumes have been somewhat flat, but are expected to accelerate in 2013 ISM Manufacturing Index Fleet Age (Class 8) Freight Loadings Underpinnings for commercial vehicle recovery remain intact Source: ACT Research & FTR Associates |

|

|

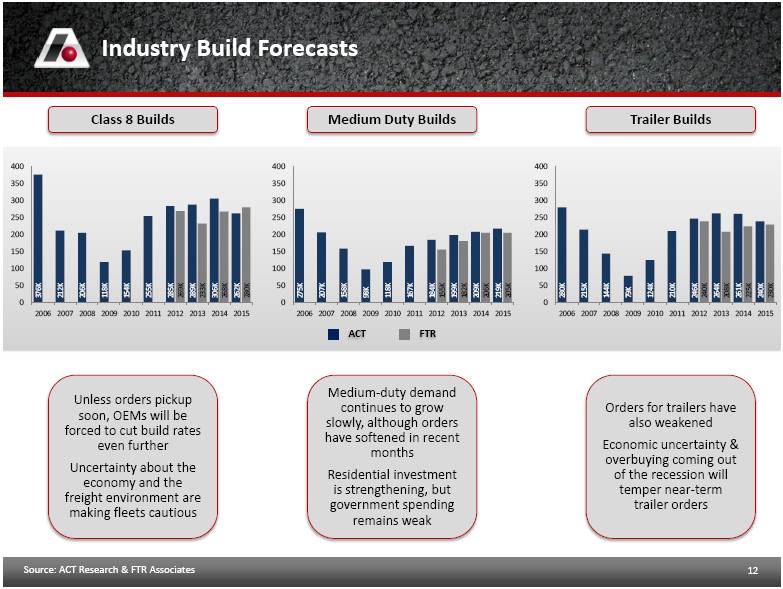

Industry Build Forecasts Class 8 Builds Medium Duty Builds Trailer Builds Source: ACT Research & FTR Associates Unless orders pickup soon, OEMs will be forced to cut build rates even further Uncertainty about the economy and the freight environment are making fleets cautious Medium-duty demand continues to grow slowly, although orders have softened in recent months Residential investment is strengthening, but government spending remains weak Orders for trailers have also weakened Economic uncertainty & overbuying coming out of the recession will temper near-term trailer orders ACT FTR |

|

|

Accuride Actions |

|

|

Cost Reductions We are taking the necessary steps to adjust our cost structure to the current industry conditions without jeopardizing our long-term “Fix & Grow” initiatives Corporate Staffing Cuts > $ 5 million annually Other Expense Cuts $ 4 million annually Hourly Staff Reductions > 350 People |

|

|

Structural Cost Reductions Reducing our structural costs will allow us to operate more efficiently, while profitably serving our customers’ needs more dependably Customer Price Increase + Union Concessions = Business model with positive EBIT Closure is ahead of schedule and should be complete by the end of Q4 2012 Incremental 240 staff reductions by year-end Complete closure by the end of Q1 2013 Investigating options to conclude lease obligation London (Wheels) Elkhart (Gunite) Portland (Imperial) |

|

|

Adequate Liquidity We have adequate liquidity even under significantly reduced 2013 build scenarios |

|

|

Critical “Fix & Grow” Activity Status Q1 ‘12 Q2 Q3 Q4 Q1 ‘13 Imperial Consolidation Brillion Improvements Aluminum Expansion Gunite Machining Ahead of schedule & on budget Consolidate Gunite Plants ERP Migration Q4 ‘13 ----> Our capital intensive restructuring of operations will be complete by 2012 CAPEX requirements will be between 3.5 – 4.0% of revenue beginning in 2013 On revised schedule & on budget |

|

|

Strategic Objectives Accuride Vision: Accuride will be the premier supplier of wheel-end system solutions to the global commercial vehicle industry #1-2 globally in wheel-end systems ROIC > 20% through a cycle >80% of revenue from CORE products Balanced geographical revenues: 40% North America 30% Asia 20% Europe 10% South America >25% of annual revenues from new & evolutionary products >95% retention of personnel Maximize ACW share price OUR FOCUS Share Price Grow Globally Create a competitive cost structure & LEAN operating culture Divest non-core assests fix core business & operations Customer Centric, Technology Leadership Ethical People, Selfless Leaders, Team Oriented |

|

|

Summary Industry conditions and key customer developments are creating a challenging near-term environment making it difficult to provide a reliable outlook for the remainder of the year. We are responding to the rapidly declining volumes by aggressively adjusting our cost structure without jeopardizing our long-term “Fix & Grow” plans. We have the liquidity available to continue to execute our plans to streamline and fix the operations within our core businesses. Our Aluminum Wheel and Gunite manufacturing equipment launches are progressing well and are on track to be completed by year-end. We are focused on the long-term success of Accuride and are confident that Accuride will be a much stronger and more dependable company for our customers and shareholders. |

|

|

Questions |