Attached files

Exhibit 10.16

Lease between

SI 34, LLC and Palo Alto Networks, Inc.

(4301 Great America Parkway, Santa Clara, CA)

| 1. | PARTIES: |

THIS LEASE, is entered into on this 17th day of September, 2012, (“Effective Date”) between SI 34, LLC, a California limited liability company, whose address is 10600 North De Anza Boulevard, Suite 200, Cupertino, CA 95014, and Palo Alto Networks, Inc., a Delaware corporation, whose address is 3300 Olcott Street, Santa Clara, CA 95054, hereinafter called respectively Landlord and Tenant. Landlord and Tenant are collectively referred to in this Lease as the “Parties”.

| 2. | PREMISES: |

| A. | Definitions: |

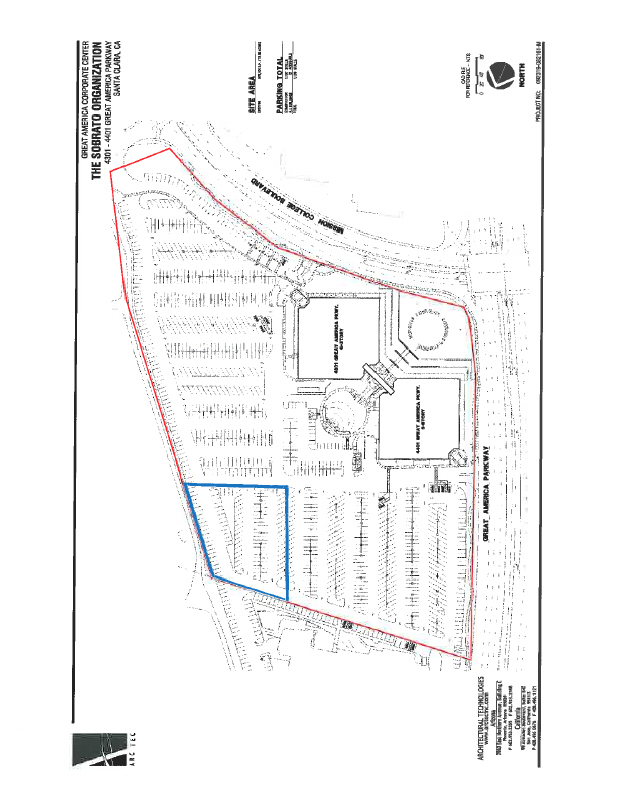

i. Building A. The term “Building A” shall mean that building containing approximately one hundred fifty one thousand thirty five (151,035) rentable square feet and all improvements owned by Landlord and installed therein, shown as Building A on Exhibit “A” attached hereto and commonly known as 4401 Great America Parkway, Santa Clara, California. Building A is comprised of two (2) parts: a 6-story portion containing approximately one hundred fifty thousand one hundred twenty eight (150,128) rentable square feet, and a corridor at the third (3rd) floor containing approximately nine hundred seven (907) rentable square feet that connects Building A and Building B (defined below).

ii. Building B. The term “Building B” or “Building” shall mean that 6-story building containing approximately one hundred fifty thousand one hundred twenty eight (150,128) rentable square feet and all improvements owned by Landlord and installed therein, shown as Building B on Exhibit “A” attached hereto and commonly known as 4301 Great America Parkway, Santa Clara, California.

iii. Premises. The term “Premises” shall initially mean the approximately forty five thousand (45,000) rentable square feet located on the 5th

and 6th floors of the Building and a server room in the Building containing approximately two hundred (200) rentable square feet of space (the “Initial Space”). Commencing on the Expansion Space Commencement Date (defined in Section 4 below), the term “Premises” shall mean the Building. The Building, less the Initial Space, is referred to in this Lease as the “Expansion Space”. Unless expressly provided otherwise, the term Premises as used herein shall include the Tenant Improvements (defined in Section 6.B below).

iv. Common Area. As used in this Lease, “Common Area” means the driveways, parking areas, sidewalks, and other facilities within the Project outside of the Project buildings, to the extent they are designated by Landlord for the common use and convenience of the tenants, occupants and other authorized users of the Project or Building. Until the Expansion Space Commencement Date, the term “Common Area” shall also include the first (1st) floor lobby and all stairs, elevators, hallways and other areas located in the Building (such lobby, stairs, elevators, hallways and other Building interior areas being the “Building Common Area”). From and after the Expansion Space Commencement Date the Building Common Area shall no longer be considered Common Area, but shall be part of the Premises leased to Tenant hereunder. Tenant acknowledges that a parking easement affecting the Project for the benefit of the adjacent property currently owned by Landlord and located at 4551 Great America Parkway, Santa Clara, California (“4551 GAP”), allows 4551 GAP the unrestricted use of ninety seven (97) parking spaces in the area designated as the 4551 GAP parking area on Exhibit “A”.

v. Project. The term “Project” shall mean the real property consisting of approximately thirteen and one-half (13.5) acres at the corner of Great America Parkway and Mission College Boulevard in Santa Clara, California upon which the Building and Building A are located, together with all improvements constructed thereon from

1

time to time, currently consisting of the Building, Building A and the Common Area, as indicated on Exhibit “A” attached hereto.

B. Grant: Landlord hereby leases the Premises to Tenant, and Tenant hires the Premises from Landlord. Concurrently with this Lease, Landlord and Tenant are entering into that certain Lease for Building A (the “Building A Lease”). Notwithstanding the Effective Date inserted in the introductory paragraph of this Lease above, this Lease shall not become effective unless and until the Building A Lease is also fully executed by Landlord and Tenant.

Subject to the provisions of this Lease and such rules and regulations as Landlord may from time to time prescribe, Tenant shall have the nonexclusive right, in common with other tenants of the Project and other users permitted by Landlord, to initially use not more than one hundred forty four (144) parking spaces within the Common Area designated, on “Exhibit A”, and the non-exclusive right, in common with other tenants of the Project and other users permitted by Landlord, to use the other Common Area within the Project and Building. Upon the commencement of the Lease Term as it relates to the Expansion Space, the number of non-exclusive parking spaces available to Tenant shall be increased by three hundred thirty nine (339), for a total of four hundred eighty three (483) parking spaces in the Common Area.

Landlord shall have the right, in its sole and absolute discretion, subject to the provisions of this Section 2.B, from time to time, to: (a) make changes to the Common Area and/or the Project (but not the Building), including, without limitation, changes in the location, size, shape and number of entrances, corridors, elevators, foyers, lobbies, restrooms, stairways and other similar facilities in other buildings in the Project (but not the Building), if applicable, and driveways, entrances, circulation drives, parking spaces, parking areas, direction of driveways, landscaped areas and walkways; (b) upon not less than three (3) business days prior written notice (except in the event of emergency or need to perform immediate repairs, in which events no prior notice shall be required) close temporarily any of the Common Area for maintenance and repair

purposes so long as reasonable access to the Premises remains available; (c) add minor improvements (e.g., fencing) to the Common Area (provided that, during the course of construction of such minor improvements, Tenant’s use of the parking area shall not be affected); and (d) use the Common Area while engaged in making minor additional improvements to the Common Area and repairs to the Building and/or the Project, all of which are hereby consented to by Tenant. Notwithstanding this paragraph above, Landlord shall not cause or permit the Project parking areas to be used as parking for events at the planned nearby football stadium (other than by Tenant’s and other Project tenants’ employees). Subject to Tenant’s rights under this Lease and the Building A Lease, Landlord reserves the absolute right to effect such other tenancies in the other Project buildings, if applicable, as Landlord in the exercise of its sole business judgment shall determine to best promote the interests of Landlord. Tenant has not relied on the fact, nor has Landlord represented, that any specific tenant or type or number of tenants shall occupy any space in the Building (or other Project buildings, if applicable), or that any specific tenant or type of tenant shall be excluded from occupying any space in the Building (or other Project buildings, if applicable). In exercising the foregoing rights, Landlord shall not unreasonably interfere with or disturb Tenant’s use of the Premises or Tenant’s access thereto or materially adversely affect Tenant’s rights under this Lease or materially increase Tenant’s obligations under this Lease.

The parties acknowledge that there is potential to construct additional buildings at the Project; however, Landlord agrees that no additional buildings will be constructed at the Project during the initial Lease Term without the express consent and approval by Tenant, which may be withheld in Tenant’s sole discretion.

Landlord and Tenant have agreed to use the square footage numbers set forth in this Lease as the basis of calculating the rent due under this Lease and Tenant’s Allocable Share (defined in Section 9.E below), and the rent due under this Lease and Tenant’s Allocable Share shall not be subject to revision if the actual square footages are more or less than as stated in this Lease,

2

except as expressly provided elsewhere in this Lease (for example, in the event of a partial taking of the Project as described in Section 17 below). No representation or warranty of any kind, express or implied, is given to Tenant with respect to the square footage of the Premises, Building or any other portion of the Project. Tenant shall have the sole responsibility for confirming the actual square footage of the Premises prior to entering into this Lease. Landlord shall have no liability to Tenant if the square footages described in this Lease differs from the actual square footages.

The parties acknowledge that the Building is currently leased to Yahoo! Inc. (“Yahoo”) pursuant to an existing lease with Landlord (the “Yahoo Lease”). Landlord represents that it has entered into a written agreement with Yahoo pursuant to which the Yahoo Lease is to terminate and Yahoo is required to vacate the Building prior to the Commencement Date (the “Yahoo Termination Agreement”). If Yahoo fails to vacate the Initial Space prior to the Commencement Date, or the Expansion Space prior to the Expansion Space Delivery Date, Landlord agrees to enforce Yahoo’s agreement to vacate the Initial Space or the Expansion Space, as applicable, as aforesaid using all available lawful methods, including, without limitation, commencing and prosecuting and unlawful detainer action and lawful eviction.

| 3. | USE: |

| A. | Permitted Uses: |

Tenant shall use the Premises as permitted under applicable zoning laws only for the following purposes: General office and administration, sales, marketing, research and development, engineering, electronic lab other uses incidental thereto (the “Permitted Uses”). Tenant shall not use the Premises for any use other than the Permitted Use without the prior written consent of Landlord. Tenant have the right to use only the number of parking spaces allocated to Tenant under this Lease. All commercial trucks and delivery vehicles shall be (i) parked at the rear of the Building, (ii) loaded and unloaded in a manner which does not interfere with the businesses of other occupants of

the Project, and (iii) permitted to remain within the Project only so long as is reasonably necessary to complete the loading and unloading. Landlord reserves the right to impose such additional reasonable rules and regulations with respect to the Common Area as Landlord deems reasonably necessary to operate the Project in a manner which protects the quiet enjoyment of all tenants in the Project. Landlord makes no representation or warranty that any specific use of the Premises desired by Tenant is permitted pursuant to any Laws (as defined in Section 8.C below).

| B. | Uses Prohibited: |

Neither Tenant nor Tenant’s Agents shall commit on the Premises or any portion of the Project any waste, nuisance, or other act or thing which may disturb the quiet enjoyment of any other tenant or user of the Project, nor allow any sale by auction or any other use of the Premises for an unlawful purpose. Tenant shall not (i) damage or overload the electrical, mechanical or plumbing systems of the Premises, (ii) attach, hang or suspend anything from the ceiling, walls or columns of the Building in excess of the load limits for which such ceiling, walls or columns are designed, or set any load on the floor in excess of the load limits for which such floors are designed, or (iii) generate dust, fumes or waste products which create a fire or health hazard or damage the Premises or any portion of the Project, including without limitation the soils or ground water in or around the Project. No materials, supplies, equipment, finished products or semi-finished products, raw materials or articles of any nature, or any waste materials, refuse, scrap or debris, shall be stored upon or permitted to remain on any portion of the Project outside of the Building without Landlord’s prior approval, which approval may be withheld in its sole and absolute discretion.

| C. | Advertisements and Signs: |

Tenant shall not place or permit to be placed, in, upon or about the exterior of the Building any signs not approved by the City of Santa Clara (“City”) and other governing authority having jurisdiction. Tenant shall not place or permit to be placed upon the Premises any signs,

3

advertisements or notices without the written consent of Landlord as to type, size, design, lettering, coloring and location, which consent will not be unreasonably withheld, conditioned or delayed. Any sign placed on the Premises shall be removed by Tenant, at its sole cost, prior to the expiration or sooner termination of the Lease, and Tenant shall repair, at its sole cost, any damage or injury to the Premises caused thereby, and if not so removed, then Landlord may have same so removed at Tenant’s expense. Subject to the requirements of this Section 3.C above, Landlord consents to Tenant’s placement of two (2) Building-mounted exterior signs and Tenant’s Allocable Share of monument signage on the monument signs within the Project, at Tenant’s sole cost and expense. Tenant shall have the exclusive right to all exterior Building-mounted signage and to the existing monument sign at the driveway to the Building.

| D. | Covenants, Conditions and Restrictions: |

This Lease is subject to the effect of (i) any covenants, conditions, restrictions, easements, mortgages or deeds of trust, ground leases, rights of way of record and any other matters or documents of record; and (ii) any zoning laws of the city, county and state where the Building is situated (collectively referred to herein as “Restrictions”) and Tenant shall conform to and shall not violate the terms of any such Restrictions.

| E. | Sustainability Requirements: |

As used in this Lease, “Sustainability Requirements” means any and all Laws relating to any “green building” or other environmental sustainability practices and requirements now or hereafter in effect or imposed by any governmental authority or applicable Laws from time to time (“Sustainability Requirements”). Without limiting the scope of any Sustainability Requirements that may be in effect from time to time, Tenant acknowledges that Sustainability Requirements may address whole-building or premises operations, construction issues, maintenance issues and other issues, including without limitation requirements relating to: chemical use; indoor air quality; energy and water

efficiency; recycling programs; interior and exterior maintenance programs; systems upgrades to meet green or sustainable building energy, water, air quality, and lighting performance standards; construction methods and procedures; material purchases; disposal of garbage, trash, rubbish and other refuse and waste; and the use of proven energy and carbon reduction measures. Neither Tenant nor Tenant’s Agents shall use or operate the Premises in a manner that will cause any part of the Project to be in non-compliance with any Sustainability Requirements in effect from time to time.

| 4. | TERM AND RENTAL: |

| A. | Term; Base Monthly Rent: |

The Lease term (“Lease Term”) as it relates to the Initial Space shall be for one hundred twenty-nine (129) months, commencing on the later of (i) November 1, 2012, or (ii) the date that Landlord delivers the Initial Space to Tenant in the condition required by Section 6.A (the “Initial Space Delivery Date”) (such later date being the “Commencement Date”), and ending one hundred twenty-nine (129) months thereafter (“Expiration Date”), subject to extension or sooner termination as described in this Lease.

The Lease Term as it relates to the Expansion Space shall commence on the later of (i) August 1, 2013, or (ii) the date that Landlord delivers the Expansion Space to Tenant in the condition required by Section 6.A (the “Expansion Space Delivery Date”) (such later date being the “Expansion Space Commencement Date”), and ending on the Expiration Date, subject to extension or sooner termination as described in this Lease.

During the period between the date of this Lease and the Expansion Space Commencement Date (the “Interim Period”), Landlord shall have possession and control of the Expansion Space, including, without limitation, the right to lease the Expansion Space to third parties (including Yahoo!); provided, however, that Landlord and Tenant may process, review and approve the Tenant Improvement Plans and Specifications during the Interim Period and Tenant shall be permitted access to the Expansion Space during

4

that period solely for the purposes of taking measurements and otherwise accommodating the design process.

In addition to all other sums payable by Tenant under this Lease, Tenant shall pay as base monthly rent (“Base Monthly Rent”) for the Premises the following amount:

| Month (starting on the Commencement Date)

|

Base Monthly Rent Per Agreed Upon Rentable Square Footage

| |

| 1-4 |

Zero dollars ($0.00)

| |

| 5-24 |

Two Dollars and Twenty Five Cents ($2.25) per rentable square foot

| |

| 25-36 |

Two Dollars and Thirty Three Cents ($2.33) per rentable square foot

| |

| 37-48 |

Two Dollars and Forty Two Cents ($2.42) per rentable square foot

| |

| 49-60 |

Two Dollars and Fifty One Cents ($2.51) per rentable square foot

| |

| 61-72 |

Two Dollars and Sixty Cents ($2.60) per rentable square foot

| |

| 73-84 |

Two Dollars and Seventy Cents ($2.70) per rentable square foot

| |

| 85-96 |

Two Dollars and Eighty Cents ($2.80) per rentable square foot

| |

| 97-108 |

Two Dollars and Ninety One Cents ($2.91) per rentable square foot

|

| 109-120 |

Three Dollars and Two Cents ($3.02) per rentable square foot

| |

| 121-129 |

Three Dollars and Thirteen Cents ($3.13) per rentable square foot

|

Base Monthly Rent shall be due and payable only as to that portion of the Premises as to which the Lease Term has commenced. The starting Base Monthly Rent for the Expansion Space shall be calculated based on the amount per agreed upon rentable square feet described in the schedule above in effect as of the Expansion Space Commencement Date. For illustration purposes only, if the Commencement Date occurs November 1, 2012 and the Expansion Space Commencement Date occurs on August 1, 2013, the Base Monthly Rent schedule would be as follows:

|

Month (starting on the Commencement Date) |

Agreed

|

Base Monthly Rent Per Agreed Upon Rentable Square Footage | ||||

|

1-4 (November 1, 2012 through February 28, 2013)

|

45,000 | $0.00 | ||||

|

5-9 (March 1, 2013 through July 31, 2013)

|

45,000 | $101,250 | ||||

|

10-24 (August 1, 2013 through September 30, 2014)

|

150,128 | $337,788 | ||||

|

25-36 (October 1, 2014 through September 30, 2015)

|

150,128 | $350,455 |

5

|

37-48 (October 1, 2015 through September 30, 2016)

|

150,128 | $363,597 | ||||

|

49-60 (October 1, 2016 through September 30, 2017)

|

150,128 | $377,232 | ||||

|

61-72 (October 1, 2017 through September 30, 2018)

|

150,128 | $390,378 | ||||

|

73-84 (October 1, 2018 through September 30, 2019)

|

150,128 | $406,054 | ||||

|

85-96 (October 1, 2019 through September 30, 2020)

|

150,128 | $421,281 | ||||

|

97-108 (October 1, 2020 through September 30, 2021)

|

150,128 | $437,079 | ||||

|

109-120 (October 1, 2021 through September 30, 2022)

|

150,128 | $453,469 | ||||

|

121-129 (October 1, 2022 through July 31, 2023)

|

150,128 | $470,474 | ||||

Base Monthly Rent shall be due in advance on or before the first day of each calendar month during the Lease Term. All sums payable by Tenant under this Lease shall be paid to Landlord in lawful money of the United States of America, without offset or deduction and except as otherwise expressly provided in this Lease without prior notice or demand, at the address specified in Section 1 of this Lease or at such place or places as may be designated in writing by Landlord during the Lease Term. Base

Monthly Rent for any period less than a calendar month shall be a pro rata portion of the monthly installment based on the number of days in the partial calendar month; provided that if this Lease terminates due to Tenant’s default, Tenant shall not be relieved of the obligation to pay future accruing rent, and the provisions of Section 14 shall control. Concurrently with Tenant’s execution of this Lease, Tenant shall pay to Landlord the sum of One Hundred One Thousand Two Hundred Fifty Dollars ($101,250) as a deposit to be applied on the Commencement Date against the Base Monthly Rent due for the fifth (5th) month of the Lease Term plus the amount of Ten Thousand Three Hundred Fifty Dollars ($10,350) as the estimated amount of Reimbursable Operating Costs due for the first (1st) month of the Lease Term.

| B. | [Intentionally Deleted] |

| C. | Late Charge: |

Tenant hereby acknowledges that late payment by Tenant to Landlord of Base Monthly Rent and other sums due hereunder will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which is extremely difficult to ascertain. Such costs include but are not limited to: administrative, processing, accounting, and late charges which may be imposed on Landlord by the terms of any contract, revolving credit, mortgage, or trust deed covering the Premises. Accordingly, if any installment of Base Monthly Rent or other sum due from Tenant shall not be received by Landlord or its designee within five (5) days after it is due, Tenant shall pay to Landlord a late charge equal to three (3%) percent of such overdue amount, which late charge shall be due and payable on the same date that the overdue amount was due. Notwithstanding the foregoing, Tenant shall be entitled to one (1) notice and five (5)-day cure period each calendar year before the first late charge for such calendar year shall accrue. No notice or additional cure period shall be required or apply for the second or any subsequent late charge during a calendar year. The parties agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant, excluding interest and attorneys fees and

6

costs. If any Base Monthly Rent or other sum due from Tenant remains delinquent for a period in excess of thirty (30) days then, in addition to such late charge, Tenant shall pay to Landlord interest on any rent that is not paid when due at the Agreed Interest Rate (defined in Section 14.B) from the date such amount became due until paid. Acceptance by Landlord of such late charge or interest shall not constitute a waiver of Tenant’s default with respect to such overdue amount nor prevent Landlord from exercising any of the other rights and remedies granted hereunder. In the event that a late charge is payable hereunder, whether or not collected, for three (3) consecutive installments of Base Monthly Rent, then the Base Monthly Rent shall automatically become due and payable quarterly in advance, rather than monthly, notwithstanding any provision of this Lease to the contrary. In no event shall this provision for a late charge be deemed to grant to Tenant a grace period or extension of time within which to pay any amount due under this Lease.

| 5. | SECURITY DEPOSIT: |

| A. | Amount and Purpose: |

Within seven (7) days after Tenant’s execution of this Lease, Tenant shall provide Landlord, as security for Tenant’s obligations under this Lease, an irrevocable standby letter of credit (as replaced or amended pursuant to this Section 5, the “Letter of Credit”) in the amount of Three Hundred Thousand Dollars ($300,000) in a form, containing terms, issued by a lending institution, and drawable in a location all reasonably acceptable to Landlord (the Letter of Credit and all proceeds thereof, and all other sums paid to Landlord in substitution of the foregoing, being referred to as the “Security Deposit”). Landlord hereby approves either JPMorgan Chase Bank N.A. or Silicon Valley Bank as an acceptable issuer of the Letter of Credit, so long as there is no material negative change in such issuer’s credit rating or ability to meet its obligations. If the issuing bank does not provide for local draws on the Letter of Credit, the Letter of Credit shall permit draws presented by telefacsimile (“fax”), with such fax presentation being considered the sole operative instrument of drawing, not contingent upon presentation of the original Letter of Credit or

original documents with respect thereto. If Tenant defaults beyond applicable notice and cure periods with respect to any provisions of this Lease, including but not limited to (i) the provisions relating to payment of Base Monthly Rent or other charges in default, or any other amount which Landlord may spend or become obligated to spend by reason of Tenant’s default, or (ii) breach of any of Tenant’s obligations under this Section 5, Landlord shall be entitled to draw the full amount of the Letter of Credit at any time by certifying the occurrence of such default to the issuer; thereafter, the Security Deposit shall be in the form of cash held by Landlord. Tenant’s failure to timely comply with its obligations under this Section 5 shall constitute a material default of Tenant, for which no notice or opportunity to cure shall apply or be required before Landlord is entitled to draw the full amount of the Letter of Credit. The Security Deposit shall be held by Landlord as security for the faithful performance by Tenant of every term, covenant and condition of this Lease applicable to Tenant, and not as prepayment of rent. Landlord may, but shall not be obligated to, and without waiving or releasing Tenant from any obligation under this Lease, use, apply or retain the whole or any part of the Security Deposit reasonably necessary for the payment of any amount which Landlord may spend by reason of Tenant’s default or as necessary to compensate Landlord for any loss or damage which Landlord may suffer by reason of Tenant’s default, including without limitation loss of future rents due under this Lease upon termination of this Lease due to a default by Tenant and other damages recoverable under California Civil Code Section 1951.2 under this Lease. Landlord shall not be deemed a trustee of the Security Deposit or any other funds held by Landlord, and Landlord shall not be required to keep the Security Deposit or any such other funds separate from its general funds. The Security Deposit and such other funds shall not bear interest for the benefit of Tenant. If Tenant shall default beyond applicable notice and cure periods in the payment of Base Monthly Rent or any scheduled payment of Reimbursable Operating Costs more than three (3) times in any twelve (12) month period, irrespective of whether or not such default is cured, then the Letter of Credit or cash Security Deposit held by Landlord shall, within ten (10) days after demand by Landlord,

7

be increased by Tenant to an amount equal to three (3) times the Base Monthly Rent then payable under this Lease.

| B. | Requirements of Letter of Credit: |

Tenant shall keep the Letter of Credit in effect during the entire Lease Term under this Lease, as the same may be extended, plus a period of four (4) weeks following the Expiration Date. At least thirty (30) days prior to expiration of any Letter of Credit, the term thereof shall be renewed or extended for a period of at least one (1) year. If the issuer of the Letter of Credit becomes insolvent, is closed or is placed in receivership, or if Landlord is notified that the Letter of Credit will not be honored, or if there is a material negative change in the issuer’s credit rating or ability to meet its obligations, then within five (5) business days after written demand from Landlord, Tenant shall deliver to Landlord a new Letter of Credit issued by a lending institution acceptable to Landlord in Landlord’s reasonable discretion, and otherwise meeting the requirements of this Section 5. In the event Landlord draws against the Letter of Credit and the Security Deposit reverts to a cash Security Deposit held by Landlord, Tenant shall replenish the remaining Security Deposit (by cash or additional letter of credit meeting the requirements of this Article 5) such that the aggregate amount of Security Deposit available to Landlord at all times during the Lease Term is the amount of the Security Deposit originally required, as the same may be required to be increased as provided below. If at any time while a Letter of Credit is held as a Security Deposit, Tenant is a Debtor (as defined in Section 101(13) of the Bankruptcy Code) under any case or filing, then, anything in this Section 5 to the contrary notwithstanding, Landlord shall not be required to give Tenant written notice of and/or opportunity to cure or grace period to cure any default under this Lease prior to Landlord drawing upon the Letter of Credit following Tenant’s failure to perform any of its obligations under this Lease. The Security Deposit shall be returned to Tenant within thirty (30) days after the Expiration Date and surrender of the Premises to Landlord in the condition required by this Lease, less any amount deducted in accordance with this Section 5, together with Landlord’s written notice itemizing

the amounts and purposes for such deduction; provided however that if at the end of such thirty (30) day period there are any uncured breaches by Tenant of its obligations under this Lease and the cost of cure or extent of damage as a result has not yet been ascertained by Landlord, then such thirty (30) day period shall be extended as reasonably necessary for Landlord to ascertain the cost of cure and extent to which Landlord has been damaged as a result thereof. Tenant hereby waives California Civil Code Section 1950.7, or any similar law now or hereafter in effect (including, without limitation, any federal law) to the extent the same may have the effect of limiting the circumstances under which Landlord would be allowed to use or apply the Security Deposit or amount that could be so used or applied, or imposing a deadline for the return of the Security Deposit. In the event of termination of Landlord’s interest in this Lease, Landlord shall deliver the Letter of Credit or cash Security Deposit to Landlord’s successor in interest in the Premises and thereupon be relieved of further responsibility with respect to the Letter of Credit or cash Security Deposit; provided however that if Tenant fails to timely perform its obligations under the next sentence, Landlord shall have the right, upon request of Landlord’s successor, to draw on the Letter of Credit on behalf of Landlord’s successor. Upon termination or transfer of Landlord’s interest in the Lease, within ten (10) business days after written request by Landlord or Landlord’s successor, Tenant shall either cause the Letter of Credit to be amended to name Landlord’s successor as the party entitled to draw down on the Letter of Credit and deliver such amendment to the requesting party, or shall obtain and deliver to the requesting party a new Letter of Credit naming Landlord’s successor as the party entitled to draw on the Letter of Credit and otherwise meeting the requirement of this Section 5. Landlord shall have the right to pledge the Letter of Credit or otherwise grant a security interest therein to Landlord’s lenders, and shall have the right to deliver the Letter of Credit or all or any portion of any cash Security Deposit to Landlord’s lenders in connection therewith, provided the Letter of Credit or cash Security Deposit shall only be used in accordance with, and shall continue to be governed by, the terms and provisions of this Section 5. At Landlord’s election, within ten (10) days after request by

8

Landlord, Tenant shall either cause the Letter of Credit to be amended to name Landlord’s lenders as the beneficiary or as a co-beneficiary with Landlord, and/or as a co-signer of any certification presented for a draw down of the Letter of Credit, and to incorporate other changes to the Letter of Credit reasonably requested by Landlord or Landlord’s lenders, or shall obtain a new Letter of Credit to effectuate such changes and otherwise meeting the requirements of this Section 5. If a new Letter of Credit is delivered to Landlord as required by this Section 5.B, the old Letter of Credit shall be promptly returned to Tenant. If Landlord or a designated lender rightfully attempts to draw on the Letter of Credit but does not receive the full amount requested in cash, Tenant shall within five (5) days after demand from Landlord, deposit with Landlord cash in the amount of the deficiency. Landlord shall only draw on the Letter of Credit following an Event of Default or in the event Tenant fails to renew the Letter of Credit at least thirty (30) days before its expiration.

| 6. | CONSTRUCTION: |

| A. | Landlord Work: |

Subject to this Section 6.A below, Landlord shall deliver the Initial Space to Tenant on the Initial Space Delivery Date and the Expansion Space to Tenant on the Expansion Space Delivery Date, in each case, in good condition and in compliance with applicable laws, codes and regulations (including, without limitation, the Americans with Disabilities Act (“ADA”)) and with all electrical, plumbing, ceiling tiles, roof, windows (including glazing and gaskets and caulking), structural elements, Building foundation, fire sprinkler, lighting, water, gas and heating, ventilating and air conditioning (“HVAC”), sewer, elevator and other Building operating systems, and parking lots and driveways and restrooms, in good working condition and repair and ADA compliant (except for deficiencies or non-compliance caused by Tenant, Tenant’s Agents or Tenant’s Alterations). Landlord shall have no responsibility for the generator, the UPS System and batteries, the phone system, the security system or the key card access system. Notwithstanding anything to the contrary in this Lease, Landlord shall cause any

defects or deficiencies in the foregoing delivery condition of the Initial Space and the Expansion Space to be corrected at Landlord’s sole cost and expense (and not as an Operating Cost), provided, that (i) Tenant gives written notice of such defect or deficiency to Landlord prior to (a) the date which is sixty (60) days following the Initial Space Delivery Date, with respect to defects or deficiencies in the Initial Space and any other element of the Building or the Project described in the first sentence of this paragraph, and (b) the date which is thirty (30) days following the Expansion Space Delivery Date with respect to defects or deficiencies in the Expansion Space (excluding the HVAC), the roof, the caulking and any other building operating systems, and (ii) the existence of any such defect or deficiency shall not cause an extension of or delay in the Commencement Date or the Expansion Space Commencement Date. The preceding time limitations notwithstanding, if during the course of construction of the Tenant Improvements, Tenant discovers that any element of the Building or the Project described in the first sentence of this paragraph is not in compliance with applicable laws, codes and regulations (including, without limitation, the ADA), Tenant shall give written notice of such non-compliance to Landlord promptly upon discovery, and Landlord shall use its best efforts to cause such non-compliance to be corrected at Landlord’s sole cost with the least possible interference with, or delay in, Tenant’s construction of the Tenant Improvements.

Except as expressly provided in this Section 6.A above, the Initial Space and Expansion Space shall be delivered to Tenant, and Tenant shall accept such delivery, in its then “AS IS, WITH ALL FAULTS” condition, without representation or warranty of any kind, express or implied, other than any which may be expressly contained in this Lease, and with no obligation on the part of Landlord to perform any other work (other than such work as this Lease expressly states must be performed by Landlord during the Lease Term). Landlord shall not be liable for any damage or loss incurred by Tenant for Landlord’s failure for whatever cause to deliver possession of the Premises by a particular date (including the Commencement Date or Expansion Space Commencement Date), nor shall

9

this Lease be void or voidable on account of such failure to deliver or delay in delivering possession of the Premises; provided that if Landlord does not deliver possession of the Initial Space to Tenant by December 1, 2012, (i) Tenant shall have the right to terminate this Lease by written notice delivered to Landlord within five (5) business days thereafter, and Landlord and Tenant shall be relieved of their respective obligations hereunder (other than those that this Lease states expressly survives expiration or sooner termination of this Lease) and the prepaid Base Monthly Rent, Reimbursable Operating Costs and the Security Deposit previously paid by Tenant to Landlord shall be reimbursed to Tenant, or (ii) at Tenant’s election, the date Tenant is otherwise obliged to commence payment of Base Monthly Rent with respect to the Initial Space shall be delayed by one additional day for each day that delivery of the Initial Space is delayed beyond December 1, 2012. If Landlord does not deliver possession of the Expansion Space to Tenant by August 1, 2013, Tenant shall have the right to terminate this Lease as to both the Initial Space and the Expansion Space, by written notice delivered to Landlord within five (5) business days thereafter, and Landlord and Tenant shall be relieved of their respective obligations hereunder thereafter accruing (other than those that this Lease states expressly survives expiration or sooner termination of this Lease) and the prepaid Base Monthly Rent, Reimbursable Operating Costs and the Security Deposit previously paid by Tenant to Landlord shall be reimbursed to Tenant or (ii) at Tenant’s election, the date Tenant is otherwise obliged to commence payment of Base Monthly Rent with respect to the Expansion Space shall be delayed by one additional day for each day that delivery of the Expansion Space is delayed beyond such date.

| B. | Tenant Improvement Construction: |

Landlord shall have no obligation to perform tenant improvement work with respect to the Initial Space or the Expansion Space.

All initial tenant improvements which Tenant desires to install in the Building (the “Tenant Improvements”) shall be constructed by Tenant in accordance with plans and specification approved by Landlord and the requirements of this Section

6.B and Article 8 below, at Tenant’s sole cost. The process for approval and disapproval of Tenant’s plans and specifications for the Tenant Improvements is described in Section 8.A below.

Prior to substantial completion, Tenant shall be obligated to (i) provide active phone lines to all elevators, and (ii) contract with a firm to monitor the fire system.

The point at which the high speed fiber optic communication lines enters the Project is a room in Building A (the “Fiber Room”). During the construction of the Tenant Improvements. Landlord shall provide Tenant with access to the Fiber Room upon twenty-four (24) hours written notice from Tenant, to permit Tenant to connect its fiber optic communication lines to the Building.

The Tenant Improvements shall not be removed or altered by Tenant except as provided in Article 8 below. Tenant shall have the right to depreciate and claim and collect any investment tax credits for the Tenant Improvements during the Lease Term. Upon expiration of the Lease Term or any earlier termination of the Lease, the Tenant Improvements shall become the property of Landlord and shall remain upon and be surrendered with the Premises, and title thereto shall automatically vest in Landlord without any payment therefore, subject to Article 7 and Article 8 below.

| 7. | ACCEPTANCE OF POSSESSION AND COVENANTS TO SURRENDER: |

| A. | Landlord’s Work |

Prior to the Expansion Space Commencement Date, Landlord shall cause the parking areas of the Project to be repaired, resealed and restriped in accordance with the Scope of Work which was delivered by Landlord to Tenant prior to the execution of this Lease, at Landlord sole cost and expense (the work described in this Section 7.A being “Landlord’s Work”).

| B. | Delivery and Acceptance: |

On the Commencement Date, Landlord shall deliver and Tenant shall accept possession of the

10

Initial Space. On the Expansion Space Commencement Date, Landlord shall deliver and Tenant shall accept possession of the Expansion Space. Except as otherwise specifically provided in this Lease, Tenant agrees to accept possession of the Initial Space and Expansion Space in their then existing condition, subject to all Restrictions and without representation or warranty by Landlord, express or implied.

| C. | Condition Upon Surrender: |

Tenant further agrees on the expiration or sooner termination of this Lease, to surrender the Premises to Landlord in good condition and repair, normal wear and tear, casualty damage, repairs and replacements which are the Landlord’s responsibility under this Lease, and Alterations and which it is permitted to surrender at termination of the Lease excepted. In no event shall Tenant be required to remove all or any portion of the Tenant Improvements. In this regard, “normal wear and tear” shall be construed to mean wear and tear caused to the Premises by the natural aging process which occurs in spite of prudent application of industry standards for maintenance, repair, replacement, and janitorial practices, and does not include items of neglected or deferred maintenance. In any event, and notwithstanding the foregoing, Tenant shall cause the following to be done prior to the Expiration Date or sooner termination of this Lease: (i) all interior walls shall be painted or cleaned, (ii) all tiled floors shall be cleaned and waxed, (iii) all carpets shall be cleaned and shampooed, (iv) all broken, marred, stained or nonconforming acoustical ceiling tiles shall be replaced, (v) all cabling placed above the ceiling by Tenant or Tenant’s contractors shall be removed (unless Landlord waives such requirement in writing), (vi) all windows shall be washed, (vii) the HVAC system shall be serviced by a reputable and licensed service firm and left in “good operating condition and repair”, which condition shall be so certified by such firm, and (viii) the plumbing and electrical systems and lighting shall be placed in good order and repair (including replacement of any burned out, discolored or broken light bulbs, ballasts, or lenses). On or before the Expiration Date or sooner termination of this Lease, Tenant shall remove all its personal property and trade fixtures from the Premises. As to all Alterations

for which Landlord consent was not obtained, Tenant shall ascertain from Landlord not more than one (1) year and not less than ninety (90) days before the Expiration Date or sooner termination of this Lease whether Landlord desires to have any such Alterations made by Tenant removed and the Premises or any parts thereof restored to the condition existing before such Alterations, or to cause Tenant to surrender any or all Alterations in place to Landlord. If Landlord shall so desire, Tenant shall, at Tenant’s sole cost and expense, remove such Alterations as Landlord requires and shall repair and restore said Premises or such parts thereof before the Expiration Date or sooner termination of this Lease. Such repair and restoration shall include causing the Premises to be brought into compliance with all applicable building codes and laws in effect at the time of the removal, repair and restoration to the extent such compliance is necessitated by the removal, repair and restoration work.

| D. | Failure to Surrender: |

Subject to this Section 7.D below, if Tenant fails to surrender the Premises at the Expiration Date or sooner termination of this Lease in the condition required by Section 7.C and other provisions of this Lease, Tenant shall be deemed to be holding over without Landlord’s consent, and Tenant shall indemnify, defend with counsel reasonably acceptable to Landlord, and hold Landlord and Landlord’s trustees, beneficiaries, shareholders, directors, officers, members, employees, partners, affiliates, agents, successors and assigns (collectively “Landlord Related Parties”) harmless from and against all claims, liabilities, obligations, penalties, fines, actions, losses, damages, costs or expenses (including without limitation reasonable attorneys fees) resulting from delay by Tenant in so surrendering the Premises including, without limitation, any claims made by any succeeding tenant founded on such delay and costs incurred by Landlord in returning the Premises to the required condition, plus interest thereon at the Agreed Interest Rate. If Tenant remains in possession of, or fails to remove all its personal property and trade fixtures from, the Premises after the Expiration Date or sooner termination of this Lease without Landlord’s consent, such hold over shall not

11

constitute a renewal or extension of the Lease Term, Tenant’s continued possession shall be on the basis of a tenancy at sufferance, and Tenant shall be liable to Landlord for one hundred fifty percent (150%) of the Base Monthly Rent due in the month preceding the earlier termination or Expiration Date, as applicable, prorated for partial months based on the number of days in such month, plus all other amounts payable by Tenant under this Lease. If Tenant holds over after the Expiration Date or sooner termination of this Lease with Landlord’s consent, such holding over shall be construed as a month to month tenancy, at one hundred fifty percent (150%) of the Base Monthly Rent for the month preceding expiration or sooner termination of this Lease in addition to all other rent due under this Lease, and shall otherwise be on the terms and conditions of this Lease, except for the following: those provisions relating to the Lease Term, any provisions requiring Landlord to perform any Landlord’s Work or install any Tenant Improvements, or grant any free rent or other concessions, any options to extend or renew and any right to lease any space at 4551 GAP pursuant to Section 19.E below, which provisions shall be of no further force and effect. This provision shall survive the termination or expiration of the Lease.

| 8. | ALTERATIONS & ADDITIONS: |

| A. | General Provisions: |

Tenant shall not make, or suffer to be made, any alteration or addition to the Premises (“Alterations”), or any part thereof, without obtaining Landlord’s prior written consent and delivering to Landlord the proposed architectural and structural plans for all such Alterations at least fifteen (15) days prior to the start of construction. All Tenant Improvements shall also constitute “Alterations” under this Lease. If such Alterations affect the structure of the Building, Tenant additionally agrees to reimburse Landlord its reasonable out-of-pocket costs incurred in reviewing Tenant’s plans. After obtaining Landlord’s consent (were such consent is required), Tenant shall not proceed to make such Alterations until Tenant has obtained all required governmental approvals and permits, and provides Landlord reasonable security, in form reasonably approved by Landlord, to protect

Landlord against mechanics’ lien claims; provided, however, that no such security shall be required in connection with Alterations that cost less than $600,000 per project. Tenant agrees to provide Landlord (i) not less than twenty (20) days prior written notice of the anticipated and actual start-date of the work, (ii) a complete set of half-size (15” X 21”) vellum as-built drawings, and (iii) a certificate of occupancy, or other final government approval if the City does not issue certificates of occupancy, for the work upon completion of the Alterations.

Where Landlord’s consent is required for Alterations, Tenant shall cause to be prepared and shall submit to Landlord: (i) all interior architectural design and engineering drawings, layouts and material specifications and schedules for the Premises; (ii) all working, finished, detailed architectural and engineering construction drawings (including “as-built” drawings) and specifications for the Alterations and any revisions thereto (collectively, “Tenant’s Plans”), all to be in compliance with all applicable building codes and all other applicable Laws. Except for “as-built” drawings, a copy of the foregoing shall be submitted to Landlord (prior to submission for application for construction permits) for Landlord’s review and consent (which consent will not be unreasonably withheld, delayed or conditioned). Tenant shall not be required to construct all or any particular portion of the Tenant Improvements and may enlarge or reduce the scope of the Tenant Improvements in its sole discretion (subject to Landlord’s review and approval of Tenant’s plans and specification as provided herein); provided that Tenant shall not leave any partially constructed or unfinished areas.

With respect to the Tenant Improvements, Landlord hereby approves the elements and description of the Tenant Improvements described on Exhibit “B-1” attached hereto (the “Preliminary Tenant Improvement Plans”. When the Tenant’s Plans for the Tenant Improvements have been approved by the parties in accordance to this Section 8.A, the same shall be attached to this Lease as Exhibit “B-2” and shall be referred to as the “Tenant Improvement Plans and Specifications”. Any changes requested by Tenant to the approved Tenant Improvement

12

Plans and Specifications shall be subject to the plan review and approval process described in this Section 8.A.

Not later than ten (10) days after Landlord’s receipt of Tenant’s Plans, Landlord shall advise Tenant if it approves them or if not shall advise Tenant what revisions are required to obtain Landlord’s approval; provided however that failure to notify Tenant of its decision within this ten (10) day period shall not be deemed approval by Landlord. If Landlord notifies Tenant that revisions are needed, then the parties shall confer and negotiate promptly and in good faith to reach agreement on modifications to the Tenant’s Plans. Not later than five (5) days after Landlord’s receipt of any the proposed modifications to the Tenant’s Plans, Landlord shall advise Tenant if it approves them or if not shall advise Tenant what further revisions are required to obtain Landlord’s approval; provided however that failure to notify Tenant of its decision within this five (5) day period shall not be deemed approval by Landlord. With respect to the Tenant Improvements, Landlord shall not withhold its consent to any element of the Tenant’s Plans or any change thereto that are consistent with or represent logical evolutions of the items described in the Preliminary Tenant Improvement Plans, except to the extent any elements of the Tenant’s Plans adversely affect the structural components or integrity of the Building. In addition, the materials and finishes utilized in construction of the Tenant Improvements shall be consistent in quality with those of the Building shell in the reasonable opinion of Landlord.

All Alterations shall be constructed by a licensed general contractor in compliance with all applicable Laws including, without limitation, all building codes, Sustainability Requirements and the Americans with Disabilities Act of 1990 as amended from time to time. Landlord hereby approves Permian Builders, Devcon Construction, South Bay Construction and Sobrato Construction as acceptable general contractors. Upon the Expiration Date or sooner termination of this Lease, all Alterations, except movable furniture and trade fixtures, shall become a part of the realty and belong to Landlord but shall nevertheless be subject to removal by Tenant as provided in Section 7.C. Notwithstanding the

foregoing, if at the time Landlord gives its consent to any Alteration (excluding the Tenant Improvements), Landlord advises Tenant in writing that such Alteration must be removed at expiration or sooner termination of this Lease, then Tenant shall be required to remove such Alteration and restore the Premises to the condition existing before such Alteration was performed not later than expiration or sooner termination of this Lease. If Landlord fails to so advise Tenant at the time of its consent, then such Alterations shall not be required to be removed. Alterations which are not deemed as trade fixtures include without limitation heating, lighting, electrical systems, air conditioning (other than supplemental HVAC units, which are addressed in the immediately following sentence), walls, carpeting, or any installation which has become an integral part of the Premises and cannot be removed without material damage to the Premises. Any supplemental HVAC system installed by Tenant may be removed by Tenant provided that (i) Tenant also removes all supplemental equipment and systems and other items installed to serve or operate the supplemental HVAC system, and (ii) Tenant repairs and restores the Premises or such parts thereof to the condition existing before the installation of the supplemental HVAC system, which repair and restoration shall include causing the Premises to be brought into compliance with all applicable building codes and laws in effect at the time of the removal, repair and restoration to the extent such compliance is necessitated by the removal, repair and restoration work. All Alterations shall be maintained, replaced or repaired by Tenant at its sole cost and expense. In no event shall Landlord’s approval of, or consent to, any architect, contractor, engineer or other consultant or professional, any Alterations, or any plans, specifications and drawings for any Alterations constitute a representation or warranty by Landlord of (i) the accuracy or completeness of the plans, specifications, drawings and Alterations or the absence of design defects or construction flaws therein, or the qualification of any person or entity, or (ii) compliance with applicable Laws, and Tenant agrees that Landlord shall incur no liability by reason of such approval or consent. Once any Alterations begin, Tenant shall diligently and continuously pursue their completion. Notwithstanding anything to the

13

contrary in this Section 8.A above, Tenant may make Alterations in the Premises which do not affect the structure or structural integrity of the Premises and do not adversely affect any Building systems, to the extent the cost of such work (i) does not exceed One hundred Thousand Dollars ($100,000) and (ii) does not, together with all other Alterations performed during the same calendar year, exceed Two Hundred Thousand Dollars ($200,000) in the aggregate.

| B. | Free From Liens: |

Tenant shall keep the Premises free from all liens arising out of work performed, materials furnished, or obligations incurred by Tenant or claimed to have been performed for or furnished to Tenant (other than the Tenant Improvements, to the extent paid for by Tenant). In the event Tenant fails to discharge any such lien within fifteen (15) days after receiving notice of the filing, Landlord shall immediately be entitled to discharge the lien at Tenant’s expense and all resulting costs incurred by Landlord, including attorney’s fees shall be due immediately from Tenant as additional rent.

| C. | Compliance With Governmental Regulations: |

The term Laws or Governmental Regulations shall mean all federal, state, county, city or governmental agency laws, statutes, ordinances, codes, standards, rules, requirements, regulations, Sustainability Requirements or orders now in force or hereafter enacted, promulgated, or issued. The term also includes government measures regulating or enforcing public access, traffic mitigation, occupational, health, or safety standards for employers, employees, landlords, or tenants. Tenant, at Tenant’s sole expense shall comply with all such Governmental Regulations applicable to the Premises or the Tenant’s use of the Premises and shall make all repairs, replacements, alterations, or improvements necessary to comply with said Governmental Regulations, other than work required of Landlord pursuant to Section 6.A above. The judgment of any court of competent jurisdiction or the admission of Tenant in any action or proceeding against Tenant (whether Landlord be a party thereto or not) that Tenant has violated

any such law, regulation or other requirement in its use of the Premises shall be conclusive of that fact as between Landlord and Tenant. Tenant’s obligations pursuant to this Section 8.C shall include, without limitation, maintaining and restoring the Premises and making structural and nonstructural alterations and additions to the Premises, Building and Common Area in compliance and conformity with all Laws and recorded documents to the extent required because of Tenant’s particular use of the Premises or any work or Alteration made by or on behalf of Tenant during the Lease Term. The foregoing shall include, without limitation, compliance with and improvements required by the Americans With Disabilities Act or any similar Laws, as they may be amended from time to time, subject to Landlord’s obligations under Section 6.A above. Landlord’s approval of any Alteration or other act by Tenant shall not be deemed to be a representation by Landlord that said Alteration or act complies with applicable Laws, and Tenant shall remain solely responsible for said compliance. Notwithstanding anything to the contrary in this Lease, Tenant shall not be required to make structural or non-structural alterations or improvements to the Premises to comply with Laws unless required, in whole or in part, by Tenant’s particular use of the Premises or any work or Alteration made by or on behalf of Tenant during the Lease Term.

| D. | Insurance Requirements: |

During the course of construction of its Alterations, Tenant shall cause the General Contractor to procure (as a cost of the Tenant Improvements) a “Broad Form” liability insurance policy in the amount of Three Million Dollars ($3,000,000.00). Tenant shall also procure or cause to be procured (as a cost of the Tenant Improvements) builder’s risk insurance for the full replacement cost of the Tenant Improvements while the Tenant Improvements are under construction, up until the date that the casualty insurance policy described in Section 10 below is in full force and effect.

Tenant shall maintain during the course of construction of its Alterations (other than the Tenant Improvements), at its sole cost and expense, builders’ risk insurance for the amount

14

of the completed value of the Alterations on an all-risk non-reporting form covering all improvements under construction, including building materials, and other insurance in amounts and against such risks as Landlord shall reasonably require in connection with the Alterations. In addition to and without limitation on the generality of the foregoing, Tenant shall ensure that its contractors procure and maintain in full force and effect during the course of construction a “broad form” commercial general liability and property damage policy of insurance naming Landlord, any property manager or Landlord affiliates designated by Landlord and Landlord’s lenders as additional insureds. The minimum limit of coverage of the aforesaid policy shall be in the amount of not less than One Million Dollars ($1,000,000.00) per occurrence and One Million Dollars ($1,000,000.00) annual aggregate, and shall contain a severability of interest clause or a cross liability endorsement. If Commercial General Liability Insurance or other form with a general aggregate limit is used, either the general aggregate limit shall apply separately to this project/location or the general aggregate limit shall be twice the required occurrence limit.

| 9. | MAINTENANCE OF PREMISES: |

| A. | Landlord’s Obligations: |

Landlord at its sole cost and expense, shall maintain in good condition, order, and repair, and replace as and when necessary, the structural components of the Building including the foundation, exterior load bearing walls and roof structure, except that the cost to repair any damage caused by Tenant or Tenant’s Agents shall be paid for by Tenant to the extent the cost of repair is not fully paid to Landlord from available insurance proceeds.

In addition, Landlord shall maintain in good condition, order, and repair, and replace as and when necessary, all underground utility facilities, the cost of which shall be a Reimbursable Operating Cost (as defined in Section 9.D below).

| B. | Tenant’s Obligations: |

Except for Landlord’s maintenance and repair obligations under Section 6.A, Section 9.A,

Section 15.E and Section 16 of this Lease, Tenant shall clean, maintain, repair and replace when necessary the Building and every part thereof through regular inspections and servicing, including but not limited to the following, to the extent Landlord does not elect to maintain the same as Reimbursable Operating Costs: (i) all plumbing and sewage facilities, (ii) all heating ventilating and air conditioning facilities and equipment, (iii) all fixtures, interior walls, floors, carpets and ceilings, (iv) all windows, door entrances, plate glass and glazing systems including caulking, and skylights, (v) all electrical facilities and equipment, (vi) all automatic fire extinguisher equipment, (vii) the parking lot, (viii) all elevator equipment, (ix) the roof membrane system, and (x) all waterscape, landscaping and shrubbery. All wall surfaces and floor tile are to be maintained in an as good a condition as when Tenant took possession free of holes, gouges, or defacements. With respect to items (ii), (viii) and (ix) above, Tenant shall provide Landlord a copy of a service contract between Tenant and a licensed service contractor providing for periodic maintenance of all such systems or equipment in conformance with the manufacturer’s recommendations. Tenant shall provide Landlord a copy of such preventive maintenance contracts and paid invoices for the recommended work if requested by Landlord. To the extent that any item in (i) through (x) above is determined by Landlord to be for the benefit of more than one (1) tenant or occupant of the Building or Project, Landlord shall assume the obligation to clean, maintain, repair and replace the same as Reimbursable Operating Costs (as defined in Section 9.D below) and Tenant shall have no obligation to clean, maintain, repair or replace such item.

Notwithstanding this Section 9.B above, if Tenant determines that any of the following located in or servicing the Premises (other than Tenant Improvements or Alterations) or the Project are in need of material repair or replacement, and (i) the cost of such repair replacement is in excess of Seventy-five Thousand Dollars ($75,000), and (ii) the material repair or replacement constitutes a capital cost under generally accepted accounting principles, then Tenant shall notify Landlord of same in writing: (i) fire and life safety systems, (ii) fire

15

pumps, (iii) elevators, (iv) roof membrane and (v) HVAC units. Tenant notifies Landlord of the foregoing, then Landlord shall cause such repair or replacement (whether an item is repaired or replaced shall be determined by Landlord in its reasonable discretion) to be made, subject to reimbursement by Tenant as follows: (1) the first Seventy-Five Thousand Dollars ($75,000) of such cost shall be paid by Tenant not later than thirty (30) days after demand for payment is delivered to Tenant, and Landlord shall not be required to contract for or begin such work until such amount has been paid to Landlord, and (2) the balance of such cost together with interest thereon at the Agreed Interest Rate shall be amortized over the useful life of the capital repair or replacement, as reasonably determined by Landlord in accordance with generally accepted accounting principles, and the monthly amortized cost shall be paid by Tenant to Landlord as additional rent on the first day of each calendar month during the remaining Lease Term.

If a capital repair (including resurfacing and restriping) to the parking lot of the Project is required in the last five (5) years of the Lease Term, and the cost of such repair replacement is in excess of Seventy-five Thousand Dollars ($75,000), then Landlord shall cause such replacement to be made, subject to reimbursement by Tenant in the same manner as provided in the immediately preceding paragraph.

If the cost of any material repair or replacement is Seventy-five Thousand Dollars ($75,000) or less, then such cost shall be a Reimbursable Operating Cost, to the extent properly included therein.

| C. | Obligations Regarding Reimbursable Operating Costs: |

In addition to the direct payment by Tenant of expenses as provided in Section 9.B, 10, 11 and 12 of this Lease, Tenant agrees to reimburse Landlord for Tenant’s Allocable Share (as defined in Section 9.E below) of Reimbursable Operating Costs (as defined in Section 9.D below) resulting from Landlord payment of expenses related to the Building or Project which are not otherwise paid by Tenant directly. Landlord shall have the right to periodically

provide Tenant with a written estimate of Reimbursable Operating Costs for the next twelve (12) months and Tenant shall thereafter, until Landlord revises such estimate, pay to Landlord as additional rental, along with its Base Monthly Rent, one twelfth of Tenant’s Allocable Share of the Reimbursable Operating Costs as estimated by Landlord. Within one hundred twenty (120) days after the end of each calendar year during the Lease Term Landlord shall deliver to Tenant a statement (“Annual Statement”) in which Landlord shall set forth the actual expenditures for Reimbursable Operating Costs for such calendar year and Tenant’s Allocable Share thereof. The Annual Statement shall be certified by an authorized officer of Landlord to be correct. If the Annual Statement shows that Tenant’s payments of estimated Reimbursable Operating Costs exceeded Tenant’s actual obligation in respect of such calendar year, Landlord shall accompany said Annual Statement with a payment to Tenant of the amount of such excess. If the Annual Statement shows that Tenant’s payments of estimated Reimbursable Operating Costs were less than its actual obligation in respect of such calendar year, Tenant shall pay said difference to Landlord within thirty (30) days after Tenant’s receipt of the Annual Statement.

If Tenant disputes the amount or characterization of any item contained in the Annual Statement then Tenant shall give written notice thereof to Landlord not later than one hundred twenty (120) days after the Annual Statement is delivered to Tenant. Tenant shall then have the right to cause Landlord’s records upon which the Annual Statement is based to be audited by an independent nationally recognized certified public accounting firm. Except as provided below, the fee for any audit conducted on Tenant’s behalf shall be borne solely by Tenant. In no event shall the fee for any audit be computed on a contingency fee basis or be otherwise dependent upon the findings of such audit, and Tenant shall confirm to Landlord in writing the non-contingent nature of the contract between Tenant and such auditor. Tenant shall not have any right to withhold any payment pending resolution of such dispute or audit, and payment by Tenant of any sum or sums in dispute shall not be deemed to be a waiver of Tenant’s right to audit or contest the Annual Statement in

16

accordance with the terms and conditions of this Lease. Landlord shall cooperate with such audit and shall provide Landlord’s books and records reasonably requested and relative to the audit which shall be conducted during regular business hours at the office where Landlord maintains its books and records, at no cost to Landlord except as expressly provided below. If after such audit the parties do not agree on the audit findings then the dispute shall be settled by arbitration pursuant to Section 20.E below. If, as a result of Tenant’s inspection of Landlord’s books or the findings of the third party independent audit of Landlord’s records and review, an error is discovered in the Annual Statement, Landlord shall revise the Annual Statement accordingly and any overpayment by Tenant shall be refunded by Landlord to Tenant not later than thirty (30) days after receipt by Landlord of written demand for payment, and any underpayment shall be paid by Tenant not later than thirty (30) days after receipt by Tenant of written demand for payment. If Tenant does not notify Landlord of a dispute within one hundred twenty (120) days after receipt of any Annual Statement, Tenant shall be deemed to have accepted such Annual Statement and waived its right to dispute the Annual Statement or conduct an audit with respect to the Annual Statement. Landlord’s records and any information provided by Landlord to auditors pursuant to this Section, and the results of any such audit, shall be kept confidential by Tenant and its auditors, and shall not be made available by the auditors or Tenant to any other person or entity except to Tenant’s parent or affiliates and outside legal and financial representatives and except in any dispute resolution proceeding between the parties relating to such audit. If requested by Landlord, Tenant and its auditor shall, prior to any such audit, execute and deliver to Landlord a confidentiality agreement prepared by Landlord, reasonably acceptable to Tenant. If the final audit discloses an error in Landlord’s determination of the Reimbursable Operating Costs in excess of five percent (5%) in Landlord’s favor (i.e. the Annual Statement overstated Reimbursable Operating Costs by more than five percent (5%)), then all reasonable out-of-pocket costs of the audits shall be borne by Landlord.

| D. | Reimbursable Operating Costs: |

For purposes of calculating Tenant’s Allocable Share of Building and Project costs, the term “Reimbursable Operating Costs” is defined as all costs and expenses which are incurred by Landlord in connection with ownership and operation of the Building or the Project in which the Premises are located, together with such additional facilities installed in the Project as may be determined by Landlord to be reasonably desirable or necessary to the ownership and operation of the Building and/or Project, except to the extent expressly excluded from Reimbursable Operating Costs pursuant to this Section 9.D below. All costs and expenses shall be determined in accordance with generally accepted accounting principles which shall be consistently applied (with accruals appropriate to Landlord’s business, but not in excess of eighteen (18) months). Reimbursable Operating Costs shall include, but not be limited to, the following to the extent the obligation therefor is not that of Tenant under the provisions of Section 9.B above: (i) common area utilities, including water, power, telephone, heating, lighting, air conditioning, ventilating, and Building utilities to the extent not separately metered; (ii) common area maintenance and service agreements for the Building and/or Project and the equipment therein, including without limitation, common area janitorial services, alarm and security services, exterior window cleaning, and maintenance of the sidewalks, landscaping, waterscape, roof membrane, parking areas, driveways, service areas, mechanical rooms, elevators, and the building exterior; (iii) insurance premiums and costs, including without limitation, the premiums and cost of fire, casualty and liability coverage and rental abatement and, if elected by Landlord, earthquake insurance applicable to the Building or Project (subject to the cost limitations set forth in Section 10 below); (iv) repairs, replacements and general maintenance (excluding repairs and general maintenance paid by proceeds of insurance or by Tenant or other third parties other than as Reimbursable Operating Costs, and repairs or alterations attributable solely to tenants of the Building or Project other than Tenant); (v) all real estate taxes and assessment installments or other impositions or charges which may be levied on

17

the Building or Project, upon the occupancy of the Building or Project and including any substitute or additional charges which may be imposed during, or applicable to the Lease Term including real estate tax increases due to a sale, transfer or other change of ownership of the Building or Project, as such taxes are levied or appear on the City and County tax bills and assessment rolls; (vi) costs of complying with Sustainability Requirements; (vii) deductibles under insurance policies; (viii) capital expenditures, which shall be amortized over their useful lives as reasonably determined by Landlord, together with interest on the unpaid portion of such expenditure at the Agreed Interest Rate; and (ix) any of items (i) through (vi) in Section 9.B above to the extent Landlord has elected to assume with respect thereto the obligations for cleaning, maintenance, repair and/or replacement. Landlord shall have no obligation to provide guard services or other security measures for the benefit of the Project. Tenant assumes all responsibility for the protection of Tenant and Tenant’s Agents from acts of third parties; provided, however, that nothing contained herein shall prevent Landlord, at its sole option, from providing security measures for the Project. This is a “Net” Lease, meaning that Base Monthly Rent is paid to Landlord absolutely net of all costs and expenses, except only those costs which this Lease expressly states shall be paid by Landlord at Landlord’s sole cost or which are expressly excluded from Reimbursable Operating Costs pursuant to this Section 9.B. The provision for payment of Reimbursable Operating Costs by means of monthly payment of Tenant’s Allocable Share of Building and/or Project Costs is intended to pass on to Tenant and reimburse Landlord for all costs of operating and managing the Building and/or Project, other than those costs which this Lease expressly states shall be paid by Landlord at Landlord’s sole cost or which are expressly excluded from Reimbursable Operating Costs pursuant to this Section 9.B . If less than one hundred percent (100%) of the Building and other Project buildings is leased at any time during the Lease Term, Landlord shall adjust Reimbursable Operating Costs to equal Landlord’s reasonable estimate of what Reimbursable Operating Costs would be had one

hundred percent (100%) of the Building and the other Project buildings been leased.

Reimbursable Operating Costs shall exclude the following: (a) Costs occasioned by the act, omission or violation of any law by Landlord, any other occupant of the Project, or their respective agents, employees or contractors; (b) Costs to correct any construction defect in the Premises, Building or the Project, (provided that Tenant shall be solely responsible for correcting defects in Alterations or any other correction of defects that becomes necessary due to any Alterations); (c) Costs incurred in connection with negotiations or disputes with any other occupant of the Project (other than Tenant’s Agents as to which Tenant shall be solely responsible) and costs arising from the violation by Landlord or any occupant of the Project (other than Tenant or Tenant’s Agents, as to which Tenant shall be solely responsible) of the terms and conditions of any lease or other agreement; (d) premiums for earthquake insurance in excess of the cost limitations set forth in Section 10 below; (e) Costs incurred in connection with the presence of any Hazardous Material; (f) interest, charges and fees incurred on debt; (g) costs of repair and maintenance to be performed at Landlord’s sole cost and expense as set forth in Section 9.A above; (h) Landlord’s net income, inheritance, gift, transfer, or estate taxes; (i) costs to correct any violation of any covenant, condition, restriction, underwriter’s requirement or law applicable to the Premises or the Project on the Commencement Date; (j) deductible amounts applicable to any earthquakes insurance carried by Landlord; (k) any co-insurance payments; and (l) real estate taxes or assessments: (1) in excess of the amount which would be payable if such assessment expense were paid in installments over the longest possible term, and (2) imposed on land or improvements other than the Project. Exclusion of costs from Reimbursable Operating Costs shall not be construed to release Tenant from the obligation to pay for such costs other than as Reimbursable Operating Costs as expressly provided elsewhere in this Agreement (including but not limited to the amortized cost of capital costs pursuant to Section 9.B above and Tenant’s obligations relating to Hazardous Materials pursuant to Article 13 below).

18

| E. | Tenant’s Allocable Share: |