Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - ARC Group Worldwide, Inc. | v324528_ex99-2.htm |

| EX-99.1 - EXHIBIT 99.1 - ARC Group Worldwide, Inc. | v324528_ex99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 8, 2012

ARC Group Worldwide, Inc.

(Exact Name of Registrant as Specified in its Charter)

Utah

(State or other jurisdiction of incorporation)

| 000-18122 | 87-0454148 | |

| (Commission File Number) | (IRS Employer Identification No.) | |

| 810 Flightline Blvd. | ||

| Deland, FL | 32724 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: 386-736-4890

Former Name or Former Address, if Changed Since Last Report:

7040 County Road 20 Longmont, Colorado 80504

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 0240.13e-4(c))

EXPLANATORY NOTE

As previously disclosed in its Current Report on Form 8-K filed on August 8, 2012 (the "Prior 8-K") with the Securities and Exchange Commission (the "SEC"), on August 8, 2012, ARC Group Worldwide, Inc. (referred to herein as the "Company" or "ARC") completed the acquisition of Quadrant Metals Technology, LLC ("QMT") and Advanced Forming Technology, Inc. ("AFT"). The QMT acquisition is being accounted for as a reverse acquisition whereby QMT is deemed to be the accounting acquirer in the acquisition. This Form 8-K/A amends the Prior 8-K for the purpose of furnishing certain historical financial statements and pro forma financials giving effect to the acquisitions.

Audited combined financial statements of AFT as of April 1, 2012 and April 3, 2011 and for the years ended April 1, 2012 and April 3, 2011 were previously reported in the Company’s Definitive Proxy Statement, which was filed with the SEC on July 16, 2012. The audited annual combined financial statements of Advanced Forming Technology are not included here but are incorporated herein by reference to the Company’s Definitive Proxy Statement.

Item 1.01 and Item 3.02 of the Prior 8-K are incorporated herein by reference thereto. Item 2.01 of the Prior 8-K is amended and restated as set forth herein, and Item 9.01 of this Form 8-K is set forth herein.

QMT AND AFT OVERVIEW

QMT was formed in April 2011, to function as a holding company for a group of diversified manufacturing and distribution companies. Upon formation, QMT acquired controlling interests in TeknaSeal LLC ("TeknaSeal") as of May 1, 2011 and in FloMet LLC ("Flomet") as of June 30, 2011. In addition, QMT acquired General Flange & Forge ("GF&F") as of April 14, 2011 and has held controlling interests in GF&F since that date. Furthermore, TubeFit LLC ("TubeFit") was formed on November 1, 2011 and QMT has held controlling interests in TubeFit since that date. While QMT was formed in 2011 as a holding company, affiliated companies have held controlling interests in FloMet and TeknaSeal for over 10 years.

AFT is comprised of two operating units, AFT-US and AFT Hungary. AFT-US was founded in 1987. From 1991 until its acquisition by ARC, AFT was operated as a division of Precision Castparts Corporation, a publicly traded company. In 1998, AFT-US moved its operations to a 113 acre campus in Longmont, Colorado with a 105,000 square foot facility. During 2001, AFT-Hungary was established on 10 acres in Rétság, Hungary as a supplier of MIM products to the European automotive industry. Following AFT’s successful U.S. model, a new state of the art facility was designed and built. The facility has since been expanded and upgraded.

| 2 |

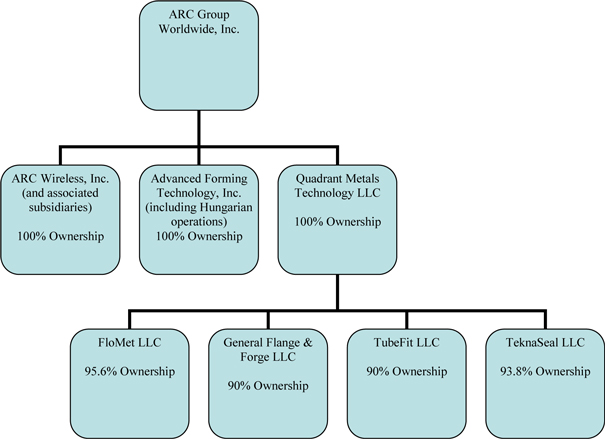

The following chart sets forth the entities comprising ARC Group Worldwide, Inc. and its ownership interests.

| 3 |

Item 2.01. Completion of Acquisition or Disposition of Assets

QMT Acquisition

Effective August 8, 2012, the Company acquired all of the shares of QMT pursuant to a Membership Interest Purchase Agreement, dated as of April 6, 2012 with Quadrant Management, Inc. (“QMI”), QMT, QMP Holding Corp., QTS Holding Corporation, John Schoemer, Arlan Clayton, Robert Marten, QMT and Carret P.T., LP (the “QMT Acquisition Agreement”). The QMT Acquisition Agreement is described in further detail in Item 1.01 of the Prior 8-K and in the Company’s Definitive Proxy Statement, as filed with the U.S. Securities & Exchange Commission on July 16, 2012, each of which is incorporated herein by reference thereto (such acquisition is referred to herein as the “QMT Acquisition”). QMT’s subsidiaries include FloMet LLC, TeknaSeal LLC, General Flange & Forge LLC and TubeFit LLC (the “QMT Group”).

The QMT Acquisition is accounted for as a "reverse acquisition" and QMT is deemed to be the accounting acquirer in the acquisition. The financial statements of QMT included in this document are presented as the continuing accounting entity.

AFT Acquisition

Effective August 8, 2012, the Company has acquired all of the shares of AFT pursuant to a Purchase Agreement dated as of April 6, 2012 (the “AFT Acquisition Agreement”) with Precision Castparts Corp. (“PCC”) and AFT Europa KFT (“AFTE”). The AFT Acquisition Agreement provided for the acquisition of AFT and special purpose acquisition company (the “AFTE SPV”) holding certain Hungarian assets associated with AFT. Pursuant to the terms of the AFT Acquisition Agreement, the Company received 100% of AFT and AFTE SPV, in exchange for the transfer of an aggregate of $43 million to PCC, of which $25,400,000 has been paid in cash and $17,600,000 has been paid in the form of a convertible note (the “AFT Convertible Note”) maturing in five years from the acquisition closing date (the “AFT Acquisition”). The AFT Acquisition is described in further detail in Item 1.01 of the Prior 8-K and in the Company’s Definitive Proxy Statement, as filed with the U.S. Securities & Exchange Commission on July 16, 2012, each of which is incorporated herein by reference thereto.

Corporate Information

ARC was organized under the laws of the State of Utah on September 30, 1987. The Company is and expects to remain a “reporting company”, and will therefore be required to continue to file annual, quarterly and other filings with the U.S. Securities and Exchange Commission (the "SEC"). Members of the public may read and copy any materials which we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Members of the public may obtain additional information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet site that contains reports, proxy and information statements, as well as other information regarding issuers that file electronically with the SEC. This site is located at http://www.sec.gov.

We make our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K (including exhibits and supplementary schedules) and amendments to those reports, filed or furnished under Section 13(a) or 15(d) of the Securities Exchange Act of 1934, available free of charge on our website at www.arcgroupworldwide.net, as soon as reasonably practicable after these reports are electronically filed with, or furnished to, the SEC. You may also request a copy of our SEC filings at no cost, by writing or telephoning us at: ARC Group Worldwide, Inc. 810 Flightline Blvd., Deland FL, 32724, phone: 386-736-4890.

| 4 |

Our principal offices were located at 6330 North Washington Street, Suite 13, Denver, Colorado 80216-1146 until the expiration of our lease on July 31, 2012. Our principal offices are now located at the QMT facility at 810 Flightline Blvd. Deland, FL 32724 as described more fully below.

Forward-Looking Statements.

This Report includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact included in this Report regarding our financial position, business strategy, plans and objectives of our management for future operations and capital expenditures, and other matters, other than historical facts, are forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements and the assumptions upon which the forward-looking statements are based are reasonable, we can give no assurance that such expectations will prove to have been correct.

Additional statements concerning important factors that could cause actual results to differ materially from our expectations are disclosed in this Report. In addition, the words “believe”, “may”, “will”, “when”, “estimate”, “continue”, “anticipate”, “intend”, “expect” and similar expressions, as they relate to us, our business or our management, are intended to identify forward-looking statements. All written and oral forward-looking statements attributable to us or persons acting on our behalf subsequent to the date of this Report are expressly qualified in their entirety by the Risk Factors regarding QMT set forth in the Company’s Definitive Proxy Statement, as filed with the U.S. Securities and Exchange Commission on July 16, 2012, which is incorporated herein by reference thereto.

ARC BUSINESS OVERVIEW

After completion of the mergers mentioned above, ARC operates three groups of companies: the Precision Components Group, consisting of FloMet, AFT-US, AFT-Hungary, and TeknaSeal LLC; the Flanges and Fittings Group, consisting of General Flange & Forge LLC and TubeFit LLC; and the Wireless Group, consisting of ARC Wireless LLC and ARC Wireless Ltd.

PRECISION COMPONENTS GROUP

The precision component industry is comprised of a number of significant industries commonly defined by the process and/or type of metal utilized to manufacture the component. Common processes include casting, forging, machining, stamping, powder metallurgy (conventional P/M metal injection molding ("MIM"), and powder forging) and extrusion. Materials range from basic iron and steel to aluminum, magnesium, zinc, precious metals, copper and brass, tin, tungsten, titanium and others. While there are no compiled figures for the total of these markets, it is believed to be in total of hundreds of billions of dollars annually.

The Precision Components Group companies participate in several significant metal component fabrication market segments providing high quality fabricated metal components and the hermetic sealing of those components to some of the fastest growing industries, among them medical devices, firearms and electronic devices.

| 5 |

FloMet

FloMet is a custom manufacturer of small precision metal components – a market estimated to be in excess of $100B annually. FloMet is recognized as a world-wide leader in the use of metal injection molding technology to manufacture precision miniature components utilizing its proprietary MIM process. FloMet is acknowledged as one of the pioneers and leading innovators in MIM and customized materials technology, backed by more than 25 years of experience in making high precision small metal components. FloMet’s ability to custom blend feedstocks allows it to manufacture components to either industry standards or customized metal alloy formulations. FloMet specializes in highly corrosion resistant stainless steels, but also manufactures components in carbon and alloy steels, nickel, cobalt-chrome, copper, bronze, and other alloys. Part sizes range from less than a gram to approximately one pound.

MIM technology is increasingly used to manufacture high volume miniature metal components that require specialized material properties or complex design. The worldwide MIM market is estimated to be in excess of $1.0B annually with recent annual growth rates of over 20% compounded as the technology receives increasing acceptance as a cost-effective and reliable solution to the challenges of high volume manufacture of tightly-toleranced small metal components. As one of the early movers in MIM technology, FloMet has extensive experience developing diverse customer applications, providing the company with a considerable competitive advantage in miniature component manufacturing. FloMet primarily serves the medical devices / surgical instruments, orthopedics, health / hearing, dental, industrial and firearms markets.

Customers

FloMet’s major market is medical devices, accounting for approximately 60% of total revenues. Orthodontics and Dental Equipment components represent approximately 20% of revenues. A relatively new and growing market for FloMet is the Health and Hearing market, representing approximately 10% of FloMet’s sales. FloMet developed a proprietary RF shielding alloy and thin-wall manufacturing process for this market. FloMet estimates that this business will double in the next few years as new applications are developed utilizing its proprietary capabilities by major hearing aid manufacturers. The remaining 10% of sales are to a variety of customers in Orthopedic, Firearms, Defense, and Industrial market segments.

FloMet is a custom manufacturer of customer-designed components. FloMet assists the customer with design recommendations to improve manufacturability and reduce costs but does not accept product design responsibility. FloMet’s manufacturing processes are carefully controlled utilizing a variety of sophisticated process controls and quality checks to ensure that each part shipped meets exacting customer specifications and quality requirements. Most of FloMet’s business relationships are longstanding, and include the sale of components that FloMet has produced for over 10 years. This is primarily a reflection of FloMet’s performance on an ongoing basis in meeting and exceeding customer expectations in quality, delivery, and total cost.

Growth Strategy

FloMet’s growth strategy is to deepen relationships with its existing customer base, and expand its offerings to new customers and new applications by continuing to provide superior value and position the company as their primary development source for new MIM applications.

| 6 |

Operations and Employees

FloMet is headquartered in DeLand, Florida with a 40,000 square foot facility housing its offices as well as engineering, tooling, mixing, molding, debinding, sintering, secondary operations and quality assurance all under one roof, offering a fully-integrated solution for complex small metal component needs. By controlling each step of the process, from the blending of powder to verifying statistical control of the finished parts, FloMet can assure that complex customer requirements are met for all parts. FloMet is ISO-9001:2000 certified. The ISO 9000 standards relate to quality management systems and are designed to assist organizations ensure they meet the needs of customers and other stakeholders. The standards are published by the International Organization for Standardization (ISO).

As of August 31, 2012, FloMet employed approximately 150 employees and contract workers in DeLand, FL. FloMet requires no special environmental permitting for its manufacturing processes. FloMet has an extremely low voluntary employee turnover rate due to the attractive package of benefits, training opportunities for advancement, excellent working conditions, and very competitive compensation levels.

Competition

FloMet’s competition includes both other MIM manufacturers and competing technologies such as precision machining and investment casting for certain applications. The domestic MIM industry is projected to be approximately $250M in size. There are about 40 identified MIM manufacturers involved in contract manufacturing and perhaps a dozen or so captive operations. The European market is projected to be approximately $350M in size and the Asian market is approximately $550M – primarily in China.

AFT

AFT is a leading provider of small precision metal components to a wide variety of industries. AFT specializes in using the MIM technology to produce complex miniature parts.

The business provides custom material solutions and has the capabilities to develop and test new materials based upon customer requirements. AFT’s current material capabilities include stainless steels, low alloys steels, alloy steels, soft magnetic materials, implant grade materials, high temperature alloys and titanium alloys. AFT has invested in the latest technology to provide cost-effective, efficient, and customized solutions to tooling and quality metal injection component manufacturing needs of clients in the automotive, medical, aerospace, firearms, electronics and consumer industries.

Operations and Employees

AFT’s US-MIM Division has approximately 176 employees and contract workers. The facility comprises a total of 105,000 square feet under roof and is equipped with state of the art machinery for the manufacture of MIM components. Highly sophisticated automation and controls are utilized, enabling high volume product flow with minimal interruption.

AFT-Hungary has approximately 184 employees and contract workers. The facility comprises a total of 70,000 square feet under roof and is similarly equipped to the US-MIM Division.

| 7 |

Competitors

AFT’s competition includes both other MIM manufacturers and competing technologies such as precision machining and investment casting for certain applications. There are about 40 identified MIM manufacturers involved in contract manufacturing and perhaps a dozen or so captive operations. While a lack of public information makes it difficult to provide a specific ranking of competitors, AFT is commonly recognized among the top three MIM competitors in North America and among the top four MIM competitors in Europe. AFT’s and FloMet’s main competitors include Indo-MIM, Parmatech, Kinetics, GKN, Schunk and Parmaco.

Customers

AFT sells to companies in the automotive, firearms, medical, aerospace, electronics and consumer industries.

TeknaSeal

TeknaSeal is a manufacturer of custom designed hermetic assemblies made using either a proprietary glass-to-metal sealing technology or an advanced ceramic-to-metal brazing technology, as appropriate to the customers’ requirements. Hermetic seal assemblies are used in customers’ devices to protect sensitive electronic components from the real world environment, or to protect the environment from the dangerous media in the customers’ devices, or both. Because the need for a hermetically sealed housing is so intertwined with the customers’ designs and production processes, many of the large manufacturers requiring hermetic seals have purchased or developed their own glass sealing operations. At the same time, many of the manufacturers of proprietary and/or generic hermetic housings and connectors have moved production off-shore to low cost countries. This means that high volume consumers of glass seals such as major manufacturers of industrial pressure sensors, automotive airbag initiators, and hermetic packages for discrete electronic components (transistors, crystal oscillators, etc.) are not an available market for TeknaSeal’s capabilities. For these reasons, TeknaSeal’s business plan is to concentrate on the higher technology, higher margin housings for aircraft and military sensors and the hermetic seals required for implantable medical devices.

TeknaSeal’s high technology target markets require the highest levels of performance and reliability that are provided by the company’s proprietary glass and ceramic seal technology, and the complexities of these customers’ designs make the responsive and deep engineering support provided by the TeknaSeal team mandatory.

It is estimated that the size of the market for independent glass seal manufacturers is between $250M and $500M annually. The major areas of growth in this market are in the industrial sensor segment and in the seals required for implantable medical devices and the batteries that power these devices. TeknaSeal anticipates that its growth in revenues for the near future will be driven by sales of seals for newly designed implantable medical devices. In the next two years the growth will come from implantable battery projects already in the development and approval stages, while growth for the out years will also include brazed ceramic feed-thru’s for implantable devices designed to provide new therapies to patients. In particular, the company feels there is an opportunity in manufacturing the high pin count feed-thrus that will be required for neuro-stimulators and has begun developing a novel method to economically manufacture these feed-thrus.

| 8 |

TeknaSeal’s position and experience at the highest performance end of the hermetic seal industry puts it in a good position to capture an increasing share of a potentially flattening market. In particular, the implantable medical device industry is developing ever smaller but more complicated devices that will require advanced seal and materials technology that TeknaSeal will endeavor to develop. TeknaSeal is active in and has deep experience in a wide variety of industries and uses the same personnel and equipment to serve the needs of these industries; this allows the company to be very quick to adapt to rapid changes in the market place and maintain profitability in uncertain times.

Customers

TeknaSeal makes certain components for air data (airspeed and altitude) instruments; virtually every commercial jet aircraft of any size contains components manufactured by TeknaSeal. In the last three years, this business has been growing at rate of about 30% per year as the airlines replace their fleets with more fuel efficient aircraft and put more miles on their existing aircraft. This higher level of production is expected to last for at least five more years and then begin to level off to a good sustained rate driven by the required maintenance schedule of this new fleet of aircraft. These components constitute approximately 40% of TeknaSeal’s revenues.

TeknaSeal is the sole-source provider of certain parts to a manufacturer of components for high technology medical devices. This business is high margin and has been growing nicely since FDA approval of the medical device was achieved in 2009, but there is a natural upper limit on this particular market. This currently makes up about 10% of TeknaSeal’s total annual revenue.

The balance of TeknaSeal’s revenue is made up of at least 25 more companies, none of whom make up more that 5% of the total annual revenues.

Competitors

TeknaSeal has a large number of competitors, most of which are considerably larger and/or are a part of a large diversified manufacturing company.

There are many other suppliers of glass-to-metal and ceramic-to-metal hermetic assemblies, but most of them seem to specialize in a rather narrow market niche and so do not usually directly compete with TeknaSeal.

Workforce and Production Equipment

TeknaSeal has 15 employees, working with three glass sealing furnaces and one vacuum brazing furnace in 8,000 square feet of space and is negotiating a lease for an additional 4,000 square feet to space to house production and offices.

FLANGE AND FITTINGS GROUP

General Flange & Forge

GF&F is one of approximately 10 domestic flange manufacturers in the United States, and the only one on the East Coast. GF&F has been in business since 1972. The majority of flange manufacturers are in the South West. GF&F is a very customer-driven and service-oriented company. GF&F estimates that the domestic market, combining carbon, stainless and alloy flanges, is more than a billion dollars.

| 9 |

GF&F’s business model is focused on converting foreign-purchased alloy steel and stainless steel forgings into domestic flanges via value-added processing to provide a finished component with sufficient domestic content to qualify as domestically produced. The company also sells foreign produced finished flanges for certain applications. Additionally, the company will purchase forgings produced in the US and Europe and machine them into finished flanges for high-integrity applications requiring.

Customers

GF&F’s customer base is diversified, serving the petroleum industry, instrumentation companies, valve manufacturers, fabricators, vessel and heat exchanger manufacturers, pump and compressor manufacturers and the domestic flange distributors. The company sells to US distributors in certain geographic regions and also acts as a distributor in the Northeast US market. Additionally, the company sells directly to customers in several fluid-handling market segments, including the highly demanding instrumentation segment where demanding quality requirements provide the opportunity for GF&F to achieve higher margins.

GF&F’s ability to provide both custom-machined flanges as well as standard (or commodity) flanges has positioned the company as a market leader in the Northeast United States in this Instrumentation market segment. These companies also require flanges machined to metric standards for their markets in Europe and Asia – a competitive advantage for GF&F because of its in-house machining capabilities. GF&F stocks a full range of most commonly purchased flange sizes up to 48” in diameter allowing it to capitalize on short lead-time situations which often provide significantly higher margin opportunities.

GF&F’s largest customer makes up 13% of its total sales for the year and the 5 largest customers total 41% of total sales.

Employees

GF&F has approximately 25 employees, many with significant tenure with the company. GF&F intends to pursue ISO 9000 registration in the next year.

TubeFit

TubeFit is a master distributor of import fittings and both import and domestic flanges. TubeFit estimates the overall PVF (Pipe Valve and Fitting) market domestically to be well over a billion dollars annually. The segment TubeFit serves is a segment of this market called the General Commodity Welds Fitting and Flange market – estimated to be over $400M annually.

Customers

TubeFit’s customers are primarily wholesalers who sell to contractors and end users and occasionally other distributors. More specifically, TubeFit targets the segment of the market that uses ½” through 24” weld fittings and flanges and requires immediate availability. TubeFit focuses on maintaining inventory of the more commonly used configurations of these fittings and flanges.

| 10 |

Employees

At the present time, TubeFit has only three employees, its President and two employees who are currently handling all company functions.

Growth Strategy

The business plan for growth is to focus on current wholesalers in the Southwest US – primarily Houston, TX and surrounding states.

Competitors

TubeFit has many larger competitors in the geographic area. Much of the selling is relationship-based, given the commodity nature of the product.

TubeFit’s suppliers are primarily well-established foreign manufacturers of these components that may also sell to competitors of TubeFit.

WIRELESS GROUP

The Wireless Group focuses on wireless broadband technology related to propagation and optimization. It designs and develops hardware, including antennas, radios, and related accessories, used in broadband and other wireless networks. Products are sold to public and private carriers, wireless infrastructure providers, wireless equipment distributors, value added resellers and other original equipment manufacturers.

Growth in product revenue is dependent on market acceptance of the new ARCFlexTM family of full solution radio products, on gaining further traction with current and new customers for the existing product portfolio, as well on developing new products to support our wireless initiatives. Revenue growth for the products is correlated to the overall global wireless market and to the ability to take market share from our competitors. The Group focuses on keeping our operational and general costs low in order to improve margins.

Specific growth areas are last mile wireless broadband Internet delivered over standards-based solutions such as Worldwide Interoperability for Microwave Access ("WiMAX"), WiFi or vendor specific proprietary solutions; GPS and Mobile SATCOM solutions for network timing, fleet and asset tracking and monitoring; Machine to machine ("M2M") communications for controlling or monitoring data from devices; and base stations to build out or optimize carrier networks.

The Wireless Group employs six people.

Risk Factors

In addition to the other information contained in this Report, those Risk Factors regarding QMT set forth in the Company’s Definitive Proxy Statement, as filed with the U.S. Securities and Exchange Commission on July 16, 2012, which is incorporated herein by reference thereto, should be considered when evaluating the forward-looking statements contained in this Report.

| 11 |

Unresolved Staff Comments

None

Properties

Our principal offices were located at 6330 North Washington Street, Suite 13, Denver, Colorado 80216-1146 until the expiration of our lease on July 31, 2012. Our principal offices are now located at the QMT facility at 810 Flightline Blvd. Deland, FL 32724, where we lease approximately 105,000 square feet under roof and is equipped with state of the art machinery for the manufacture of MIM components.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF QMT

The following discussion is intended to assist in understanding QMT’s business and the results of its operations. It should be read in conjunction with the Consolidated Financial Statements and the related notes that are incorporated by reference in this Report on Form 8-K/A (See Item 9.01). Certain statements made in this discussion may be forward looking. Forward-looking statements involve risks and uncertainties and a number of factors could cause actual results or outcomes to differ materially from QMT’s expectations.

The QMT Acquisition is being accounted for as a “reverse acquisition,” and QMT is deemed to be the accounting acquirer in the acquisition. The financial statements of QMT are presented as the continuing accounting entity.

Fiscal Year-End

The QMT Group companies’ fiscal year end is June 30th.

Business Overview

The worldwide metals component industry is comprised of a number of significant industries commonly defined by the process and/or type of metal utilized to manufacture the component. Common processes include casting, forging, machining, stamping, powder metallurgy (conventional P/M, metal injection molding (“MIM”), and powder forging) and extrusion. Materials range from basic iron and steel to aluminum, magnesium, zinc, precious metals, copper and brass, tin, tungsten, titanium and others. While there are no compiled figures for the total of these markets, it is believed to be in total of hundreds of billions of dollars annually.

The QMT companies participate in several significant metal component fabrication market segments providing high quality fabricated metal components to some of the fastest growing industries, among them medical devices, firearms, electronic devices, and the fluid handling industries – including energy (oil, gas, power plants, etc.).

QMT owns a majority interest in four companies: FloMet LLC, TeknaSeal LLC, General Flange & Forge LLC and TubeFit LLC (collectively referred to as the “QMT Group”), as described in further detail below. The QMT Group’s consolidated financial information is disclosed below, as well as the information for QMT itself.

| 12 |

QMT was formed in April 2011, to function as a holding company for a group of diversified manufacturing and distribution companies. Upon formation, QMT acquired controlling interests in TeknaSeal as of May 1, 2011 and in FloMet as of June 30, 2011. In addition, QMT acquired GF&F as of April 14, 2011 and has held controlling interests in GF&F since that date. Furthermore, TubeFit was formed on November 1, 2011 and QMT has held controlling interests in TubeFit since that date. While QMT was formed in 2011 as a holding company, Quadrant has held controlling interests in FloMet and TeknaSeal for over 20 years.

GF&F has been in business since 1972. GF&F is a domestic manufacturer of flanges in carbon steel, stainless steel and the alloys. GF&F also manufactures metric flanges, orifice unions, galvanized flanges, long weld necks, pad flanges/studding outlets, special facings and custom flanges. Since 1972, GF&F has been manufacturing domestic flanges in carbon steel, stainless steel and alloys. GF&F also maintains a large inventory of galvanized flanges and orifice unions. QMT believes that GF&F can handle any substantially custom machining requirements and special flange facings.

Consolidated Financial Condition of the QMT Group as of June 30, 2012 and 2011

As of June 30, 2012 the QMT Group had total assets of $21.3 million, consisting of total current assets of $9.7 million, plant and equipment, net of accumulated depreciation of $4.5 million, and total long-term assets of $7.1 million. In comparison, as of June 30, 2011 the QMT Group had total assets of $22.1 million, consisting of total current assets of $10.4 million, plant and equipment, net of accumulated depreciation of $4.6 million, and total long-term assets of $7.2 million. The decrease in total assets is mainly attributed to decreases in cash, inventory prepaid expenses and other long term assets, offset by an increase accounts receivable, goodwill and receivables from members and related parties.

At June 30, 2012 and 2011 QMT Group had working capital of $6 million and $6.1 million, respectively. QMT Group’s total current assets of $9.7 million as of June 30, 2012, current assets consisted of cash and cash equivalents of $1.4 million, accounts receivable, net of $3.7 million, a related party receivable of $0.2 million, inventory of $3.9 million and prepaid expenses and other assets of $0.4 million. Current liabilities consisted of current portion of long-term debt in the amount of $1.5 million, accounts payable and accrued expenses of $1.7 million, unearned mold income of $0.1 million and a related party payable of $0.4 million.

At June 30, 2011, QMT Group’s total current assets of $10.4 million consisted of cash and cash equivalents of $1.7 million, accounts receivable, net of allowance for doubtful accounts of $3.5 million, inventory of $4.4 million and prepaid expenses and other assets of $0.7 million. Current liabilities consisted of current portion of long-term debt in the amount of $1.5 million, line of credit of $0.7 million, accounts payable and accrued liabilities $1.7 million, a related party payable of $0.1 million and unearned mold income of $0.2 million.

During the year, the QMT Group companies’ made concerted efforts to better manage and rationalize inventory levels in order to free up cash from working capital. Such lean initiatives helped generate cash and reduced the consolidated inventory balances by $0.5 million from fiscal year 2011 to 2012. In addition, FloMet’s amortization of certain prepaids was accelerated due to an orthodontic component replacement resulting in a decrease in prepaid expenses of $0.3 million.

| 13 |

As of June 30, 2012 QMT Group’s long-term assets consisted of goodwill in the amount of $7.0 million, increased by $0.2 million over $6.8 million at June 30, 2011 attributable to the acquisition of TubeFit in November 2011 and other long term asset of $0.2 million at June 30, 2012. At June 30, 2011 other long terms assets were $0.3 million.

QMT Group’s total liabilities and members’ equity were $9 million and $12.3 million, respectively, as of June 30, 2012. In comparison, as of June 30, 2011 QMT Group’s total liabilities and members’ equity were $10.1 million and $12.0 million, respectively. The decrease in total liabilities is mainly attributed to the debt repayment of $1.2 million during fiscal year 2012. The increase in members’ equity was due to an increase in retained earnings offset by shareholder distributions during the fiscal 2012.

Consolidated Results of Operations for the Year Ended June 30, 2012 compared to June 30, 2011

For the fiscal year ended June 30, 2012, QMT Group’s total revenues were $31.3 million, including sales of $31.1 million, interest income of $0.03 million and other income of $0.16 million. In comparison, QMT Group’s total revenues were $20.4 million for the fiscal year ended June 30, 2011, consisting of sales of $20.4 million, interest income of $0.01 million and other income of $0.01 million.

The increase in sales from $20.4 million in 2011 to $31.1 million in 2012 is mainly attributed to increase in sales at FloMet and GF&F. FloMet witnessed a growth in sales due to an increase in demand from its medical device customers and the successful launch and initial production shipments for several new components. In addition, the QMT Group acquired GF&F in April 2011, which witnessed an increase in sales due to increased demand from its existing customers as well as from securing several new customers during the period. The increase in sales at FloMet and GF&F was partially offset by a slight slowdown in sales at TeknaSeal. This was primarily due to slower demand compared to historical levels from one of its key aircraft sensor housing customers. The leveling off of demand was caused by a small dip in demand for aircrafts combined by an intentional draw down of inventory at the customer.

For the year ended June 30, 2012, QMT Group’s total costs and expenses were $26.5 million, including cost of sales of $19.3 million, selling, general and administrative expenses of $6.6 million, other expense of $ .03 million and interest expense of $0.5 million. For the year ended June 30, 2011, QMT Group’s total costs and expenses were $17.7 million, including cost of sales of $12.8 million, selling, general and administrative expenses of $4.6 million, and interest expense of $0.3 million.

The cost of sales increased over the prior year in line with increase in sales over the same period. In addition, the cost of material of forged flange blanks from suppliers were higher than prior year costs due to more short-lead time or “spot buying” of these forgings at GF&F to respond to the stronger than anticipated demand from customers. The selling, general and administrative expenses increased over prior year due to increase in selling, general and administrative expenses as a result of addition of sales engineers, increase in management incentive pay due to significantly improved financial results in the period, and an increase in expenses associated with our China MIM pilot plant initiative. In addition, the higher selling, general and administrative expenses also included start-up costs associated with setting up new operations at TubeFit, including material costs for new inventory, warehousing costs, and sales & marketing costs for prospective new customers.

| 14 |

QMT Group’s earnings before non-controlling interest for the year ended June 30, 2012 were $4.8 million compared to earnings before non-controlling interest for the year ended June 30, 2011 of $2.7 million. The earnings before non-controlling interest increased significantly over the prior year both due to increase in overall sales as well as productivity improvements. The increase in sales allowed us to leverage the fixed costs structure at the various QMT Group companies. In addition, the companies’ focus on ongoing automation and other continuous improvement activities helped reduce labor costs contributing significantly to improved earnings for the year.

Income allocated to the QMT Group’s non-controlling interest was $0.3 million for the year ended June 30, 2012 compared to $.4 million for the year ended June 30, 2011.

For the year ended June 30, 2012, QMT Group’s net income was $4.5 million compared to $2.3 million in net income for the year ended June 30, 2011. As mentioned above, the significant improvement in net earnings in 2012 over the prior year was due to increased sales volume, continuous productivity improvement initiatives, and acquisition of new subsidiaries.

Results of Operations by Segment: Comparison between Twelve Months Ended June 30, 2012 and 2011

As detailed above, QMT operates as a diversified manufacturing holding company active in metal injection molding, specialty hermetic seals, and flanges & fittings. As of June 30, 2012 the QMT Group operated under two reportable business segments: Precision Components and Flanges & Fittings. The Precision Components segment includes results of its precision miniature components manufacturing subsidiary, FloMet LLC, as well as its hermetic sealing manufacturing subsidiary, TeknaSeal LLC. Whereas, the Flanges & Fittings business segment includes the results of the remaining two subsidiaries specializing in the manufacture and distribution of carbon, stainless and alloy flanges and fittings, namely General Flange & Forge LLC and TubeFit LLC. Subsequent to the acquisition of AFT as of August 8, 2012, the Precision Components segment will include results of AFT going forward.

| 15 |

The following table provides the dollar amount and percentage of net sales and operating profit for each reportable segment for fiscal years ending June 30, 2011 and 2012.

Results of Operations by Segment – Comparison Between Twelve Months Ended June 30, 2012 and 2011 (In Thousands)

| Year over Year Change | ||||||||||||||||||||||||

| 6/30/2012 | % of Sales | 6/30/2011 | % of Sales | $ | % | |||||||||||||||||||

| Net sales: | ||||||||||||||||||||||||

| Precision Components | $ | 22,413 | 72.1 | % | $ | 19,001 | 93.2 | % | 3,412 | 18.0 | % | |||||||||||||

| Flanges and Fittings | 8,682 | 27.9 | % | 1,390 | 6.8 | % | 7,292 | 524.6 | % | |||||||||||||||

| Consolidated net sales | 31,095 | 100 | % | 20,391 | 100 | % | 10,704 | 52.5 | % | |||||||||||||||

| Operating Costs: | ||||||||||||||||||||||||

| Precision Components | 17,453 | 56.1 | % | 16,058 | 78.8 | % | 1,395 | 8.6 | % | |||||||||||||||

| Flanges and Fittings | 7,873 | 25.3 | % | 1,373 | 6.7 | % | 6,500 | 473.4 | % | |||||||||||||||

| Consolidated Operating Costs | 25,326 | 81.4 | % | 17,431 | 85.5 | % | 7,895 | 45.3 | % | |||||||||||||||

| Segment operating income (loss): | ||||||||||||||||||||||||

| Precision Components | 4,960 | 15.9 | % | 2,943 | 14.4 | % | 2,017 | 68.5 | % | |||||||||||||||

| Flanges and Fittings | 809 | 2.6 | % | $ | 17 | 0.1 | % | 792 | 4658.8 | % | ||||||||||||||

| Corporate Expense | (630 | ) | (2.0 | )% | (1 | ) | 0.0 | % | 629 | |||||||||||||||

| Total segment operating income | 5,139 | 16.5 | % | 2,959 | 14.5 | % | 2,180 | 73.6 | % | |||||||||||||||

| Interest expense, net | 453 | 1.4 | % | 261 | 1.3 | % | 192 | 73.6 | % | |||||||||||||||

| Other non-operating(income)expense | (131 | ) | -0.4 | % | (13 | ) | 0.1 | % | (118 | ) | -907.7 | % | ||||||||||||

| Non- Operating Expenses | 322 | 1.0 | % | 248 | 1.3 | % | 74 | 29.8 | % | |||||||||||||||

| Consolidated income before income tax expense and non-controlling interest | $ | 4,817 | 15.5 | % | $ | 2,711 | 13.3 | % | 2,106 | 77.7 | % | |||||||||||||

Precision Components

Precision Components' sales were $22.4 million for the fiscal year ending June 30, 2012, compared to sales of $19.0 million for the fiscal year ending June 30, 2011, an increase of $3.4 million. Operating income was $5.0 million for the fiscal year ending June 30, 2012 compared to $2.9 million for the fiscal year ending June 30, 2011, an increase of $2.0 million. Segment operating income as a percent of segment sales for the fiscal year 2012 increased to 22.1 percent from 15.5 percent of segment sales for the same period last year.

Sales for the segment increased significantly, by $3.4 million or 18.0 percent, over the prior year primarily due to the growth witnessed in the precision components manufacturing business. FloMet’s sales increased due to an increase in demand from our medical device customers and the successful launch and initial production shipments for several new components. The increase in sales at FloMet was partially offset by a slight slowdown in sales at TeknaSeal, the hermetic sealing company. This was primarily due to slower demand compared to historical levels from one of its key aircraft sensor housing customers. The leveling off of demand was caused by a small dip in demand for aircrafts combined by an intentional draw down of inventory at the customer.

| 16 |

The operating costs for the segment increased over prior year due to increase in selling, general and administrative expenses as a result of addition of sales engineers, increase in management incentive pay due to significantly improved financial results in the period, and an increase in expenses associated with our China MIM pilot plant initiative.

Overall, the operating income for the segment increased significantly over the prior year both due to increase in overall sales as well as productivity improvements put in place by management. The segment's operating income as a percent of sales increased 6.7 percentage points over the prior year due to the company’s focus on achieving reductions in its labor costs as a result of ongoing automation and other continuous improvement activities. Such improvement initiatives were significant contributors to the segment’s improved performance in fiscal year 2012.

As we enter fiscal year 2013, the Precision Components segment is experiencing a slight slowdown in demand as is currently reflected in the overall manufacturing statistics for the economy. That said, our customers remain optimistic and we expect sales and operating income to grow during the course of the year. FloMet is off to a good start for the year with several large tooling orders. Furthermore, worldwide demand for commercial aircraft continues to grow and, with our customer dominating the air data market, we expect demand for our sensor housings to resume growing in fiscal year 2013 and beyond.

Flanges & Fittings

The Flanges & Fittings segment is comprised of two QMT subsidiaries, namely GF&F and TubeFit. QMT acquired GF&F as of April 14, 2011 and has held controlling interests in GF&F since that date. TubeFit was formed on November 1, 2011 and QMT has held controlling interests in TubeFit since that date. The financial results for this reporting segment for the fiscal year ending June 30, 2011 represented the period from the date of completion of acquisition of GF&F (i.e. April 14, 2011 through June 30, 2011).

Flanges and Fittings’ sales were $8.7 million for the year ending June 30, 2012, compared to sales of $1.4 million for the year ending June 30, 2011. Segment operating income was $0.81 million for the year ending June 30, 2012, compared to segment operating income of $0.02 million for the prior year. Segment operating income, as a percent of segment sales, for the year ended June 30, 2012 increased to 9.3 percent from 1.2 percent of segment sales for the year ended June 30, 2011.

Sales for the Flanges & Fittings segment increased significantly over the prior year primarily due to increased demand from customers as a result of the overall improvement in general economic conditions and securing several new customers during the period.

Total operating costs, which include cost of material of forged flange blanks from suppliers, were higher than prior year costs due to more short-lead time or “spot buying” of these forgings to respond to the stronger than anticipated demand from customers. In addition, the higher operating costs included start-up costs associated with setting up our new operations at TubeFit, including material costs for new inventory, warehousing costs, and sales & marketing costs for prospective new customers.

| 17 |

Overall, the operating income improved over prior year as increased volume allowed us to leverage fixed costs and offset much of the increase in material costs. The segment's operating income increased $0.8 million over the prior year due to its strong performance for the year.

As with our Precision Components segment, the Flanges & Fittings segment is witnessing a slight slowdown in overall demand from its customers. However, we remain optimistic about the overall prospects of the Flanges & Fittings industry. The increasing attention on energy, chemical manufacturing, food processing, and other industries requiring flow management all appear to position the companies within this industry, including GF&F and TubeFit, for continued growth. Both GF&F and TubeFit are focused on continuing to expand its customer base in 2013, particularly with the instrumentation market segment

Financial Condition

At June 30, 2012 we have a cash balance of $1.4 million, current assets of $9.7 million and current liabilities of $3.66 million. We believe that we have the ability to provide for our fiscal 2013 operational needs through projected operating cash flow and cash on hand.

Operating activities provided a positive cash flow of approximately $6.2 million and a decrease in cash of $0.5 million for the year ended June 30, 2012 and 2011, respectively.

During fiscal year ending June 30, 2012 and 2011 $0.7 million and $1.4 million was invested in manufacturing equipment to drive an increase in production efficiencies through automation and improvements. An investment in the acquisition of TubeFit during the fiscal year ending June 30, 2012 resulted in the addition of $0.1 million of goodwill and during the fiscal year ending June 30, 2011, goodwill increased $3.5 million mainly resulting from the acquisition of General Flange & Forge.

Financing activities for fiscal year end June 30, 2012 amounting to $1.1 million consisted mostly of consolidation and repayment of long term debt and $4.7 million was returned to the shareholders in the form of a distribution. During fiscal year ending June 30, 2011, approximately $5.5 million was financed for the acquisition of General Flange & Forge and $2.0 million was returned to the shareholders in the form of a distribution.

In a noncash transaction member units of TeknaSeal and Flomet amounting to $4.5 million and $5.7 million, respectively, were contributed to QMT during fiscal year ending June 30 2011.

Critical Accounting Policies and Estimates

Our significant accounting policies are summarized in Note A of our consolidated financial statements set forth in this report on Form 8-K/A. The preparation of financial statements requires management to make estimates and assumptions that affect amounts reported therein, including estimates about the effects of matters or future events that are inherently uncertain. Policies determined to be critical are those that have the most significant impact on our financial statements and require management to use a greater degree of judgment and/or estimates. Actual results may differ from these estimates under different assumptions or conditions.

| 18 |

Principles of Consolidation

The consolidated financial statements include the accounts of QMT and its majority owned subsidiaries for the years ending June 30, 2012 and 2011. All intercompany balances and transactions have been eliminated upon consolidation.

Cash and Cash Equivalents

For purposes of reporting cash flows, QMT considers all highly liquid debt instruments with an initial maturity of less than three months to be cash equivalents. QMT places its cash with high credit quality financial institutions and does not believe it is exposed to any significant credit risk on cash and cash equivalents. At times, cash in bank may exceed FDIC insurable limits.

Accounts Receivable

QMT uses the allowance method to account for uncollectible accounts receivable. The allowance is sufficient to cover both current and anticipated future losses. Uncollectible amounts are charged against the allowance account. Management estimates this amount based upon prior experience with customers and an analysis of individual trade accounts. An allowance for doubtful accounts of $124,733 and $69,092 has been reserved as of June 30, 2012 and 2011, respectively.

QMT offers most customers net 30-day terms. In special situations, QMT may offer extended terms or discounts to selected customers. Accounts are considered past due when invoices become thirty days past terms. No interest is charged on past due accounts.

Inventories

QMT values inventories at the lower cost or market using the first-in, first-out (FIFO) method. It is QMT’s practice to provide a valuation allowance for inventories to account for potential market pricing deflation and inventory shrinkage. Management actively reviews this inventory to determine that all materials are for products still in production to determine any potential obsolescence issues. An allowance for inventory obsolescence of $44,860 and $197,280 has been reserved as of June 30, 2012 and 2011, respectively.

Plant and Equipment

Plant and equipment are stated at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the assets as follows:

| Useful Life | ||||

| Building and Improvements | 7 to 40 years | |||

| Machinery and Equipment | 3 to 12 years |

Major additions and improvements are capitalized, while replacements, maintenance and repairs, which do not improve or extend the life of the respective assets, are expensed as incurred.

Depreciation expense totaled $728,903 in 2012 and $629,401 in 2011.

| 19 |

Long-lived Assets

The carrying value of long-lived assets are reviewed annually; if at any time the facts or circumstances at any of our individual subsidiaries indicate impairment of long-lived asset values, as a result of a continual decline in performance or as a result of fundamental changes in a subsidiary's market, a determination is made as to whether the carrying value of the property's long-lived assets exceeds estimated realizable value. Long-lived assets consist primarily of Property and Equipment and Goodwill. No impairment was determined as of June 30, 2012.

Goodwill and Intangibles

Goodwill is recognized as a result of a business combination when the price paid for the acquired business exceeds the fair value of its identified net assets. Identifiable intangible assets are recognized at their fair value when acquired. Goodwill and intangible assets with indefinite useful lives are not amortized, but instead tested for impairment at least annually. Intangible assets with definite useful lives are amortized over their respective estimated useful lives to their estimated residual values, and reviewed for impairment.

QMT identified no material separately identifiable intangible assets in 2011 as a result of its acquisitions.

QMT has evaluated its existing intangible assets and goodwill that was acquired in prior periods for impairment and has determined that goodwill and other intangibles are not impaired.

Acquisitions during fiscal 2012 and 2011 resulted in an increase in goodwill of $0.1 million and $3.5 million, respectively. The carrying amounts were as follows (in thousands):

| June 30, | June 30, | June 30, | ||||||||||||||||||

| 2010 | Additions | 2011 | Additions | 2012 | ||||||||||||||||

| Precision Components | $ | 3,373 | $ | 1,750 | $ | 5,123 | $ | 0 | $ | 5,123 | ||||||||||

| Flanges and Fitting | - | 1,711 | 1,711 | 129 | 1,840 | |||||||||||||||

| Total | $ | 3,373 | $ | 3,461 | 6,834 | $ | 129 | $ | 6,963 | |||||||||||

Unearned Income

Unearned income consists of customer deposits for the development of molds used in the manufacturing process. As of June 30, 2012 and 2011, QMT had $131,786 and $197,114, respectively, of unearned income related to mold development. QMT recognizes revenue and the related expenses when the customer approves the mold for production. Accordingly, as of June 30, 2012 and 2011, QMT has incurred costs of $101,372 and $105,600, respectively, related to molds in the process of being developed which have been deferred and are included in prepaid expenses and other assets on the accompanying balance sheet.

| 20 |

Revenue Recognition

Revenue is measured at the fair value of the consideration received or receivable net of sales tax, trade discounts and customer returns.

Revenue from the sale of goods is recognized when the following conditions are satisfied: (1) QMT has transferred to the buyer the significant risks and rewards of ownership of the goods; (2) QMT retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold; (3) the amount of revenue can be measured reliably; (4) it is probable that the economic benefits associated with the transaction will flow to the entity; and (5) the costs incurred or to be incurred in respect of the transaction can be measured reliably.

Research and Development Costs

Research and development costs are expensed as incurred. The majority of these expenditures consist of salaries for engineering and manufacturing personnel and fees paid to consultants for services rendered. For the years ended June 30, 2012 and 2011, QMT incurred $829,843 and $1,102,000, respectively, for research and development, which is included in selling, general and administrative expenses on the accompanying statement of income.

Financial Instruments

QMT's financial instruments consist of cash and cash equivalents, notes and accounts receivable, accrued liabilities, and notes and accounts payable. It is management's opinion that QMT is not exposed to significant interest rate or credit risks arising from these instruments. The fair values of these financial instruments approximate their carrying values.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income Taxes

As a limited liability company, QMT’s taxable income or loss is allocated to the members in accordance with their respective percentage ownership. Therefore, no provision or liability for income taxes has been included in the financial statements.

Management evaluated QMT’s tax position and concluded that QMT has taken no uncertain tax positions that require adjustment to the financial statements to comply with provisions of this guidance. With few exceptions, QMT is no longer subject to income tax examinations by the U.S. Federal, State or local tax authorities for years before 2009.

The tax returns for the years ending June 30, 2010 through 2012 are open to examination by federal and state authorities.

| 21 |

Presentation of Certain Taxes

QMT collects various taxes from customers and remits these amounts to applicable taxing authorities. QMT's accounting policy is to exclude these taxes from revenues and cost of sales.

Advertising

Advertising costs are charged to operations when incurred. Total advertising costs for the years ended June 30, 2012 and 2011 was approximately $99,037 and $131,567, respectively.

Recent Accounting Pronouncements

Changes to accounting principles generally accepted in the United States of America (U.S. GAAP) are established by the Financial Accounting Standards Board (FASB) in the form of accounting standards updates (ASU’s) to the FASB’s Accounting Standards Codification.

The Company considers the applicability and impact of all ASU’s. ASU’s not listed below were assessed and determined to be either not applicable or are expected to have minimal impact on our consolidated financial position or results of operations.

In May 2011, the Financial Accounting Standard Board ("FASB") issued an accounting update that amends ASC No. 820, "Fair Value Measurement" regarding fair value measurements and disclosure requirements. The amendments are effective during interim and annual periods beginning after December 15, 2011 and are to be applied prospectively. The accounting update will be applicable to the Company beginning in the third quarter of fiscal year 2012. As applicable to the Company, the adoption of the new guidance did not have a material impact on the consolidated financial statements.

In June 2011, the FASB issued an update to ASC No. 220, “Presentation of Comprehensive Income,” which eliminates the option to present other comprehensive income and its components in the statement of shareholders’ equity. The Company can elect to present the items of net income and other comprehensive income in a single continuous statement of comprehensive income or in two separate, but consecutive, statements. Under either method the statement would need to be presented with equal prominence as the other primary financial statements. The amended guidance, which must be applied retroactively, is effective for fiscal years, and interim periods within those years, beginning after December 15, 2011, with earlier adoption permitted. In December 2011, the FASB issued another update on the topic, which deferred the effective date pertaining only to the presentation of reclassification adjustments on the face of the financial statements. The adoption of the new guidance did not have a material impact on the consolidated financial statements.

In September 2011, the FASB issued amendments to the goodwill impairment guidance which provides an option for companies to use a qualitative approach to test goodwill for impairment if certain conditions are met. The amendments are effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011 (early adoption is permitted). The implementation of the amended accounting guidance has not had a material impact on our consolidated financial position or results of operations.

| 22 |

In December 2011, the FASB issued an amendment to the accounting guidance for disclosure of offsetting assets and liabilities and related arrangements. The amendment expands the disclosure requirements in that entities will be required to disclose both gross information and net information about both instruments and transactions eligible for offset in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting arrangement. The amendment is effective for fiscal years, and interim periods within those years, beginning on or after January 1, 2013, and shall be applied retrospectively. We do not expect the adoption of this accounting pronouncement to have a material impact on our financial statements when implemented.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Controls and Procedures

| a) | Disclosure Controls and Procedures. |

We have established disclosure controls and procedures to ensure that material information relating to the company is made known to the officers who certify our financial reports and to other members of senior management and the Board of Directors. Based on their evaluation, our principal executive officer and principal financial officer have concluded that disclosure controls and procedures (as defined in Rule 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934) were effective as of June 30, 2012 to ensure that information required to be disclosed in the reports that it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms.

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate control over financial reporting, as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

Our internal control over financial reporting includes those policies and procedures that:

| · | Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; |

| · | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and |

| · | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements. |

| 23 |

We conducted an evaluation of the effectiveness of our internal control over financial reporting based on the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the “COSO Framework”). Based on this evaluation under the COSO Framework, our management concluded that our internal control over financial reporting was effective as of June 30, 2012.

This report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the company to provide only management’s report in this report.

(b) Changes in Internal Control over Financial Reporting.

There have been no significant changes in our internal control over financial reporting that occurred during the quarter ended June 30, 2012 that have materially affected, or are reasonably likely to materially affect, our control over financial reporting.

The evaluation of our disclosure controls included a review of whether there were any significant deficiencies in the design or operation of such controls and procedures, material weaknesses in such controls and procedures, any corrective actions taken with regard to such deficiencies and weaknesses and any fraud involving management or other employees with a significant role in such controls and procedures.

Our management does not expect that our disclosure controls and procedures and our internal control over financial reporting will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the controls system are met. The design of any system of controls is based in part upon assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

Security Ownership of Certain beneficial Owners and Management

The number of shares beneficially owned includes shares of Common Stock with respect to which the persons named below have either investment or voting power. A person is also deemed to be the beneficial owner of a security if that person has the right to acquire beneficial ownership of that security within 60 days through the exercise of an option or through the conversion of another security. Except as noted, each beneficial owner has sole investment and voting power with respect to the Common Stock.

Common Stock not outstanding that is subject to options or other convertible securities or rights is deemed to be outstanding for the purpose of computing the percentage of Common Stock beneficially owned by the person holding such options or other convertible securities or rights, but is not deemed to be outstanding for the purpose of computing the percentage of Common Stock beneficially owned by any other person.

| 24 |

The following table summarizes certain information as of August 31, 2012, except as noted below, with respect to the beneficial ownership of our common stock by each director, director-nominee, by all executive officers, directors and director-nominees as a group, and by each other person known by us to be the beneficial owner of more than five percent of our common stock after giving effect to the 1:1.95 Reverse Stock Split effective August 7, 2012. As of August 31, 2012, approximately 5,672,700 shares of our Common Stock were issued and outstanding.

| Number of Shares | |||||||

| Beneficially Owned | Percent of | ||||||

| Name and Address of Beneficial Owner | (1) | Class | |||||

|

Theodore Deinard, Interim Chief Executive Officer, Acting Chief Financial Officer and Director ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

3,613,948 | (2)(4) | 63.7 | % | |||

|

Jason Young, Former Chief Executive Officer and Chairman of the Board ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

3,613,948 | (2)(4) | 63.7 | % | |||

|

Brean Murray Carret Group, Inc. 40 West 57th Street, 20th Floor New York, NY 10019 |

3,613,948 | (2)(4) | 63.7 | % | |||

|

Paul J. Rini 7376 Johnnycake Rd Mentor, Ohio 44060 |

289,742 | (3) | 5.11 | % | |||

|

Harold R. Bledsoe, Former Chief Technology Officer and Former President ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

0 | (5) | * | ||||

|

Robert Marten, President ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

83,941 | (5)(6) | 1.48 | % | |||

|

Arlan Clayton ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

806,046 | (7) | 14.21 | % | |||

|

Jerrold H. Abrahams, Director ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

256 | (8) | * | ||||

|

Lynn Wunderman, Director ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

0 | ||||||

|

Jonathan Bernstein, Director ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

0 | ||||||

|

Viktor Nemeth, Director ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

0 | ||||||

|

Keerat Kaur, Corporate Secretary ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

3,613,948 | (2)(4) | 63.7 | % | |||

|

Luke McGee, Assistant Secretary ARC Group Worldwide, Inc. 810 Flightline Blvd. Deland, FL 32724 |

3,613,948 | (2)(4) | 63.7 | % | |||

| All officers and directors as a group (9 persons) | 3,698,146 |

(2)(4)(6)(8) |

65.2 | % | |||

| 25 |

* Less than one percent.

| (1) | “Beneficial ownership” is defined in the regulations promulgated by the U.S. Securities and Exchange Commission as having or sharing, directly or indirectly (1) voting power, which includes the power to vote or to direct the voting, or (2) investment power, which includes the power to dispose or to direct the disposition, of shares of the common stock of an issuer. The definition of beneficial ownership includes shares underlying options or warrants to purchase common stock, or other securities convertible into common stock, that currently are exercisable or convertible or that will become exercisable or convertible within 60 days. Unless otherwise indicated, the beneficial owner has sole voting and investment power. |

| (2) | Consists of 3,613,948 shares beneficially owned by Brean Murray Carret Group, Inc. Mr. Young, the Company's Chairman of the Board, Mr. Theodore Deinard, Interim Chief Executive Officer and Acting Chief Financial Officer and Director, Ms. Keerat Kaur, Corporate Secretary and Mr. Luke McGee, Assistant Secretary, serve as representatives of Brean Murray Carret Group, Inc. and hold voting and investment power over these shares on behalf of the Brean Murray Carret Group, Inc. |

| (3) | Consists of shares owned by Mr. Paul J. Rini as of July 6, 2012 as reported on Form 4 |

| (4) | The shares owned by Brean Murray Carret Group, Inc. and its affiliates are included five times in the table in accordance with the rules governing disclosure of beneficial ownership. In addition to being shown as owned by Brean Murray Carret Group, Inc. and its affiliates, these same shares are included as being within the scope of the definition of beneficial ownership of Mr. Jason Young, Mr. Theodore Deinard, Ms. Keerat Kaur, Mr. Luke McGee and by all officers and directors as a group. |

| (5) | Effective as of September 16, 2012, Mr. Harold Bledsoe has resigned as the President and Chief Technology Officer of ARC Group Worldwide, Inc. (the “Company”). Mr. Bledsoe will remain as the President and Chief Technology Officer of the Company’s subsidiary, ARC Wireless, Inc. and effective as of September 16, 2012, Mr. Robert Marten has been appointed as the President of the Company |

| (6) | Consists of shares owned by Mr. Marten as of August 31, 2012 (see "Recent Sales of Unregistered Securities" below). |

| (7) | Consists of shares owned by Mr. Clayton as of August 31, 2012 (see "Recent Sales of Unregistered Securities" below). |

| (8) | Consists of shares owned by Mr. Abrahams as reported on Form 3 on February 27, 2012 |

| 26 |

Directors and Executive Officers

Our directors and executive officers are as follows:

| Name | Age | PositionwiththeCompany | InitialDateasDirector | |||

| Theodore Deinard | 39 | Interim Chief Executive Officer, Acting Chief Financial Officer and Director | Appointed to the Board August 2011 | |||

| Jason T. Young | 33 | Chairman of the Board | Appointed to the Board October 2008 | |||

| Viktor Nemeth | 36 | DirectorFormer Chairman of the Audit Committee, Chairman of the Compensation Committee | Appointed to the Board: November 2008 | |||

| Lynn Wunderman | 57 | DirectorAudit Committee Member, Compensation Committee Member | Appointed to the Board: April 2010 | |||

| Jonathan Bernstein | 32 | DirectorAudit Committee Member, Compensation Committee Member | Appointed to the Board: June 2010 | |||

| Jerrold H. Abrahams | 46 | DirectorChairman of the Audit Committee | Appointed to the Board: February 2012 | |||

| Harold R. Bledsoe | 30 | Former President and Former Chief Technology Officer | Resigned Effective September 2012 | |||

| Robert Marten | 60 | President | Appointed September 2012 | |||

| Keerat Kaur | 30 | Corporate Secretary | Appointed March 2012 | |||

| Luke McGee | 29 | Assistant Corporate Secretary | Appointed July 2012 |

| 27 |

Theodore Deinard. Mr. Deinard has served as the Company’s Interim Chief Executive Officer, Acting Chief Financial Officer and as a member of the Company’s Board of Directors since August 16, 2011. Mr. Deinard is a Principal of Quadrant Management Inc. where he is responsible for the evaluation and management of private investment transactions. Mr. Deinard was previously a Director with Citigroup Global Markets (“Citi”) working with issuers of tax-exempt bonds in the U.S. At that position he was responsible for the design, marketing, structuring, execution and maintenance of a broad portfolio of risk management, investment, and credit products including interest rate swaps, options, caps, floors, repurchase agreements, guaranteed investment contracts, rolling securities agreements, letters of credit, bridge loans, and structured notes. During his twelve-year tenure at Citi, Mr. Deinard was involved in the execution of over $26 billion in derivative, reinvestment, and lending transactions, serving both clients of Citi's Public Finance Department as well as issuers, advisors, and banks nationwide. Mr. Deinard was a co-chair of the SIFMA (formerly known as BMA) Municipal Financial Products Committee and was also a leading consultant to tax-exempt entities regarding the application of mark-to-market accounting standards for derivative instruments. Mr. Deinard received his Bachelor of Arts from Yale University.

Director Qualifications of Theodore Deinard:

Mr. Deinard’s experience in the investment industry has provided him with extensive knowledge regarding financial matters.

Jason Young. Mr. Young became a Director in October 2008, and he became Chairman of the Board and Chief Executive Officer of the Company in November 2008. On August 16, 2011, Mr. Young resigned as the Company’s Chief Executive Officer. Since 2005, Mr. Young has been a Managing Director at Quadrant Management, Inc., where he is responsible for making investments in US and emerging market companies, where he frequently serves in active Management or Director level roles. He has been an Investment Committee Member of the Carret Global India Fund of Hedge Funds since 2005. In 2008 Mr. Young became a member of the Investment Committee of the Vanterra Advantage Fund. From 2000 to 2005, Mr. Young worked for Merrill Lynch in the Investment Banking Group and later in the Global Principal Investment Group. In 1999, he was an Analyst at Helicon Capital Management, a hedge fund and private equity investment firm. He holds a BA in International Economics from UCLA. Because of his employment with Quadrant Management, Inc., which is under common control with the Brean Murray Carret Group, Inc., Mr. Young is deemed to be under control of the Brean Murray Carret Group, Inc.