Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mattersight Corp | d416696d8k.htm |

Mattersight

Discussion September 2012

1

Exhibit 99.1 |

Agenda

•

Mattersight Overview

•

Behavioral Analytics Overview

•

Predictive Routing

•

Current Outlook and Summary

2 |

3

Mattersight Overview |

Mattersight

Overview •

Sample Customers…

3 of the 4 largest P&Cs

4 of the largest Health Care Payers

top 3 Retail Bank

top 3 Mutual Fund

top 5 Cable Operator

4

•

Be the Leader in Enterprise Analytics Focused on

Customer Interactions and Behaviors

•

Invested $75m to Build Out a Robust

Analytics Platform

•

Build Deep Partnerships with Large

Enterprises with a SaaS+ Model

Mission…

Commitment…

Business Model… |

We Are About Big

Data •

Capture

70

Trillion

Call

and

Desktop

Usage

Data

Attributes

Daily

•

Apply

Over

2

Million

Algorithms

to

Every

Interaction

•

Execute

250

Billion

Algorithmic

Computations

Daily

•

Process

350

TB

of

Raw

and

Analyzed

Data

a

Day

•

Invested

500

Man

Years

Building

Algorithms

and

a

Robust

Data Model in the Cloud

5 |

6

Behavioral Analytics Overview |

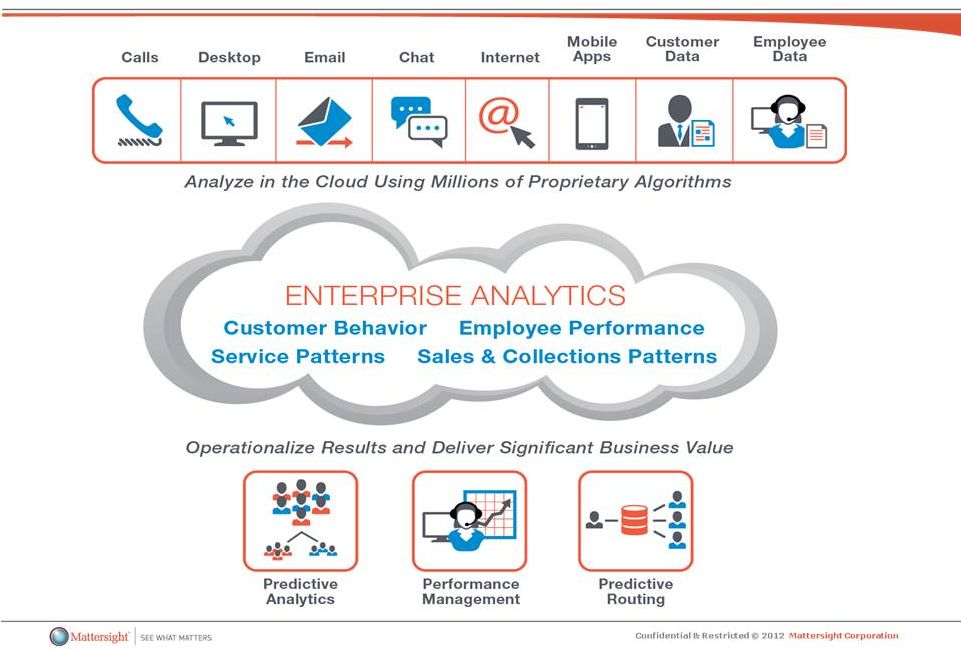

Behavioral

Analytics: Turning Unstructured Data Into Business Insight

7 |

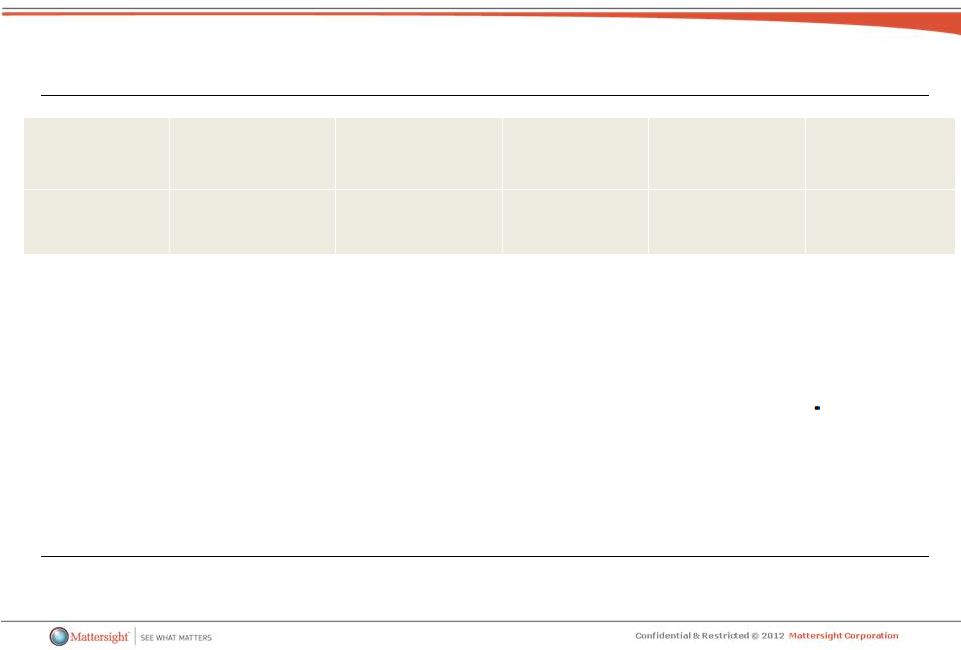

Service

Sales

Collections

Fraud

Back Office

Estimated

Market Size in

Users

3.0 million

.2 million

.4 million

.6 million

5.0 million

Estimated

Annual TAM

$4.0 b

$.2 b

$.4 b

$.6 b

$4.0 b

Delivering

Measurable

ROI

•

Reduce

headcount

•

Improve CSAT

•

Increase FCR

•

Reduce Attrition

•

3x –

5x returns

•

Increase pull-

through

•

Increase cross-

sell/up-sell

•

Improve CRM

analytics

•

5x –

10x

returns

•

Increase

collections

•

Improve

collection

predictions

•

5x –

10x

returns

•

Reduce fraud

losses

•

Identify fraud

strategies

•

5x returns

•

Reduce

headcount

•

Improve

compliance

Attacking an Emerging $5+ Billion Market

8

5x returns |

Case Study

– Large P&C Company

9

Company Overview

12.2 million policies in force

$15 billion in revenues

8%

Market

Share/4

th

largest

auto

insurer

Problem Description

26 million calls per year

Prior to BA, no way to extract

data/trends from those calls

CSR performance management had

not changed in 2 decades

Business Case for Mattersight

Analytics

~$135 million of benefits over 5 years

Most compelling project in their queue

Why Mattersight Vs. Nice

Managed Service vs. Software Tool

Robust product functionality

Strong references

Business Partnership

Outperformed expectations during the

pilot

Account Opportunity

Closed deal for 3,700 service seats

Closed deal for 1,000 sales seats

Currently engaged in a Pilot for

additional 500 seats

Pilots in progress for Attrition and

CSAT models

Pursuing Routing and Multi Channel

Pilots

$10m+/year total account opportunity |

10

Predictive Routing |

Predictive

Routing Using Big Data Analytics Is a Game Changer…

•

Leveraging Our Massive Data Set We Discovered a

Transformational Insight…

•

…Routing to Best Customer/Employee Match Can Drive an

Immediate 10% to 30% Improvement in Attrition, Sales,

Cost, or CSAT…

•

…and Requires No Change in People or Processes…

•

…

is Delivered in a SaaS Model Leveraging Existing

Technology…

•

…and Will Be Easy for Clients to Do Low Cost Trials

11 |

…And

Drives Significant Economic Value 12

Current Sales

Conversion Rate

Projected Conversion

Rate Based on

Routing to Best Rep

Annual Estimated

Revenue Impact

Sales Conversion Data

23.7

25.9

$140m

Assumptions:

950 Sales Reps

4.3m Calls Per Year

$1,500 Annual Policy Value

…Resulting in Huge Incremental Value

When a Call Arrives, Predictive Routing Instructs the Telephony

System to Route the Caller to the Best Available Agent

Best Match Conversion Rate: 45.9%

Average Match Conversion Rate: 23.7%

Worst Match Conversion Rate: 4.9% |

Why Predictive

Routing Changes the Game for Mattersight

•

Drives Significant Value

•

Shortens Pilot Cycles

•

Simplifies Value Proposition

•

Opens up SMB Market

•

More Scalable with Very High Gross Margins

•

Does Not Require Any Work by the Client to Achieve Value

•

Leverages a Highly Differentiated Proprietary Mattersight

Data Set and Patented Process

13 |

Current Status

of Predictive Routing Roll Out Launch Status

In “soft”

launch

Formal launch set for Q4

Customers/Pipeline

1 deployed

1 in deployment

1 Pilot in progress

8 active pursuits

Potential Risks and Issues

New integrations

Unknown, unknown technical and operational challenges

New buyer constituencies

Legacy routing paradigms

14 |

15

Current Outlook and Summary |

Current

Outlook 16

Positives

Strong Pipeline growth

Increase in new logos

Continue to be well positioned for $50m+ deal related to expansion of ACA

Potentially huge impact of Routing

Added strong players

No real competitive threat

Growth Levers

Close current pipeline

Win ACA mega deal

Continue to close Pilots focused on Performance Management

Accelerate Pilots with Routing application

License technology to create new applications

Challenges

Implementation delays

Pilots slow to deploy and convert

Lumpy nature of large deals

Uncertainty of roll out of ACA

12 Month Goals…Q4 2013

25% to 35%+ yr/yr subscription growth rate

Adjusted EBITDA positive

200 bps to 400 bps expansion in gross margin

If

ACA

mega

deal

hits,

subscription

growth

rate

could

increase

by

20%+ |

Summary

•

Emerging Multi Billion $ Market Opportunity

•

Highly Differentiated Solution

•

Increasing New Logo Capture

•

Exciting New Routing Application

•

Business Model Drives Significant Customer Value and Sticky

Revenues

•

Expanding Gross Margins

•

Fighting Through Deployment and Conversion Delays and

Numerous Positive Indicators Emerging

17 |