Attached files

| file | filename |

|---|---|

| 8-K - MIDSOUTH BANCORP, INC 8-K 9-26-2012 - MIDSOUTH BANCORP INC | form8k.htm |

| EX-3.1 - EXHIBIT 3.1 - MIDSOUTH BANCORP INC | ex3_1.htm |

| EX-2.1 - EXHIBIT 2.1 - MIDSOUTH BANCORP INC | ex2_1.htm |

| EX-99.2 - EXHIBIT 99.2 - MIDSOUTH BANCORP INC | ex99_2.htm |

Exhibit 99.1

Merger Agreement with PSB Financial Corporation

September 26, 2012

September 26, 2012

Forward Looking Statement

Certain statements contained herein are forward-looking statements within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934 and subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which involve risks and uncertainties. These statements include, among others, statements

regarding future results, improvements in classified and criticized assets, changes in the local and national economy, the work-out

of nonaccrual loans, the competition for other potential acquisitions, the impacts from the integration of operations from

completed acquisitions and the impact of regulatory changes regarding electronic transactions.

1933 and Section 21E of the Securities Exchange Act of 1934 and subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, which involve risks and uncertainties. These statements include, among others, statements

regarding future results, improvements in classified and criticized assets, changes in the local and national economy, the work-out

of nonaccrual loans, the competition for other potential acquisitions, the impacts from the integration of operations from

completed acquisitions and the impact of regulatory changes regarding electronic transactions.

Actual results may differ materially from the results anticipated in these forward-looking statements. Factors that might cause

such a difference include, among other matters, the failure to obtain necessary regulatory approvals and the approval of PSB

shareholders; the ability of the parties to satisfy the other closing conditions; the effect of the announcement of the proposed

acquisition on relations with customers and employees; the effects of MidSouth’s expenditure of monies for legal and other

professional fees, which will be capitalized on its balance sheet and written off if the transaction is not completed; changes in

interest rates and market prices that could affect the net interest margin, asset valuation, and expense levels; changes in local

economic and business conditions, including, without limitation, changes related to the oil and gas industries, that could

adversely affect customers and their ability to repay borrowings under agreed upon terms, adversely affect the value of the

underlying collateral related to their borrowings, and reduce demand for loans; the timing and ability to reach any agreement to

restructure nonaccrual loans; increased competition for deposits and loans which could affect compositions, rates and terms; the

timing and impact of future acquisitions, the success or failure of integrating operations, and the ability to capitalize on growth

opportunities upon entering new markets; loss of critical personnel and the challenge of hiring qualified personnel at reasonable

compensation levels; legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and

their application by our regulators, changes in the scope and cost of FDIC insurance and other coverage; and other factors

discussed under the heading “Risk Factors” in MidSouth’s Annual Report on Form 10-K for the year ended December 31, 2011

filed with the SEC on March 15, 2012 and in its other filings with the SEC.

such a difference include, among other matters, the failure to obtain necessary regulatory approvals and the approval of PSB

shareholders; the ability of the parties to satisfy the other closing conditions; the effect of the announcement of the proposed

acquisition on relations with customers and employees; the effects of MidSouth’s expenditure of monies for legal and other

professional fees, which will be capitalized on its balance sheet and written off if the transaction is not completed; changes in

interest rates and market prices that could affect the net interest margin, asset valuation, and expense levels; changes in local

economic and business conditions, including, without limitation, changes related to the oil and gas industries, that could

adversely affect customers and their ability to repay borrowings under agreed upon terms, adversely affect the value of the

underlying collateral related to their borrowings, and reduce demand for loans; the timing and ability to reach any agreement to

restructure nonaccrual loans; increased competition for deposits and loans which could affect compositions, rates and terms; the

timing and impact of future acquisitions, the success or failure of integrating operations, and the ability to capitalize on growth

opportunities upon entering new markets; loss of critical personnel and the challenge of hiring qualified personnel at reasonable

compensation levels; legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and

their application by our regulators, changes in the scope and cost of FDIC insurance and other coverage; and other factors

discussed under the heading “Risk Factors” in MidSouth’s Annual Report on Form 10-K for the year ended December 31, 2011

filed with the SEC on March 15, 2012 and in its other filings with the SEC.

MidSouth does not undertake any obligation to publicly update or revise any of these forward-looking statements, whether to

reflect new information, future events or otherwise, except as required by law.

reflect new information, future events or otherwise, except as required by law.

Additional Information About This Transaction

In connection with the proposed transaction, PSB Financial Corporation (“PSB”) will distribute to its shareholders a proxy

statement that will also include information regarding MidSouth Bancorp, Inc. (“MidSouth”) and the MidSouth securities that are

expected to be privately issued in connection with the proposed transaction. SHAREHOLDERS OF PSB ARE URGED TO READ

THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS DISTRIBUTED BY PSB WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders of PSB will be able to obtain a

free copy of the proxy statement (when available) by directing a request by telephone or mail to PSB Financial Corporation, 880

San Antonio Avenue, Many, LA 71449, Attention: Clay Abington, 318.238.4489

statement that will also include information regarding MidSouth Bancorp, Inc. (“MidSouth”) and the MidSouth securities that are

expected to be privately issued in connection with the proposed transaction. SHAREHOLDERS OF PSB ARE URGED TO READ

THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS DISTRIBUTED BY PSB WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders of PSB will be able to obtain a

free copy of the proxy statement (when available) by directing a request by telephone or mail to PSB Financial Corporation, 880

San Antonio Avenue, Many, LA 71449, Attention: Clay Abington, 318.238.4489

THIS DOCUMENT DOES NOT CONSTITUTE AN OFFER TO SELL, OR THE SOLICITATION OF AN OFFER TO BUY,

ANY SECURITIES, NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY STATE OR JURISDICTION IN WHICH

SUCH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR

QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH STATE OR JURISIDICTION.

ANY SECURITIES, NOR SHALL THERE BE ANY SALE OF SECURITIES IN ANY STATE OR JURISDICTION IN WHICH

SUCH AN OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL PRIOR TO REGISTRATION OR

QUALIFICATION UNDER THE SECURITIES LAWS OF ANY SUCH STATE OR JURISIDICTION.

Participants in the Solicitation

PSB and its directors, executive officers, certain members of management and employees may have interests in the proposed

transaction or be deemed to be participants in the solicitation of proxies of PSB’s shareholders to approve matters necessary to be

approved to facilitate the proposed transaction. Certain information regarding the participants and their interests in the solicitation

will be set forth in the PSB proxy statement distributed in connection with the proposed transaction. Shareholders may obtain

additional information regarding the interests of such participants by reading the proxy statement for the proposed transaction when

it becomes available.

transaction or be deemed to be participants in the solicitation of proxies of PSB’s shareholders to approve matters necessary to be

approved to facilitate the proposed transaction. Certain information regarding the participants and their interests in the solicitation

will be set forth in the PSB proxy statement distributed in connection with the proposed transaction. Shareholders may obtain

additional information regarding the interests of such participants by reading the proxy statement for the proposed transaction when

it becomes available.

Summary of Acquisition Terms

Transaction Value $39 million (1)

Form of Consideration $18 million cash, including $2 million contingent payment

$11 million common equity

$10 million liquidation value of 4% non-cumulative

convertible preferred equity, conversion price of

convertible preferred equity, conversion price of

$18.00 MSL

Board Seat Pete Abington, 7% MSL ownership

Required Approvals Customary regulatory and PSB shareholders

Termination Fee $2.5 million

Expected Closing Fourth Quarter 2012

(1) Based on MSL 20-day average stock price as of September 26 of $14.54 and a fixed exchange ratio of 10.3441

Transaction Rationale

Strategic Rationale

– Complimentary geographic markets - expands MSL into Central and North Louisiana along

I-49 Corridor

I-49 Corridor

– Continues to build scale as MSL closes in on $2.0 billion in assets with opportunities to

increase efficiencies

increase efficiencies

– Strong management talent with similar cultures and strong community relationships

Strong Financial Fundamentals

– Greater than 30% earnings accretion in 2013 based on 25% cost savings fully realized by the

end of 2013 and no revenue enhancements

end of 2013 and no revenue enhancements

– Greater than 15% IRR (well above MSL’s cost of capital)

– Manageable tangible book value payback of approximately 3.3 years

Low Risk

– Low execution risk given expansion into contiguous market

– Comprehensive due diligence process undertaken

– Conservative credit mark of 2.3%

|

Pro Forma - as of June 30, 2012

|

|||

|

($ in millions)

|

|||

|

|

MSL

|

PSB

|

Pro Forma

|

|

Loans

|

751

|

271

|

1,022

|

|

Deposits

|

1,154

|

417

|

1,571

|

|

Assets

|

1,395

|

501

|

1,896

|

|

|

|

|

|

|

Branches

|

40

|

16

|

56

|

|

FTEs

|

449

|

146

|

595

|

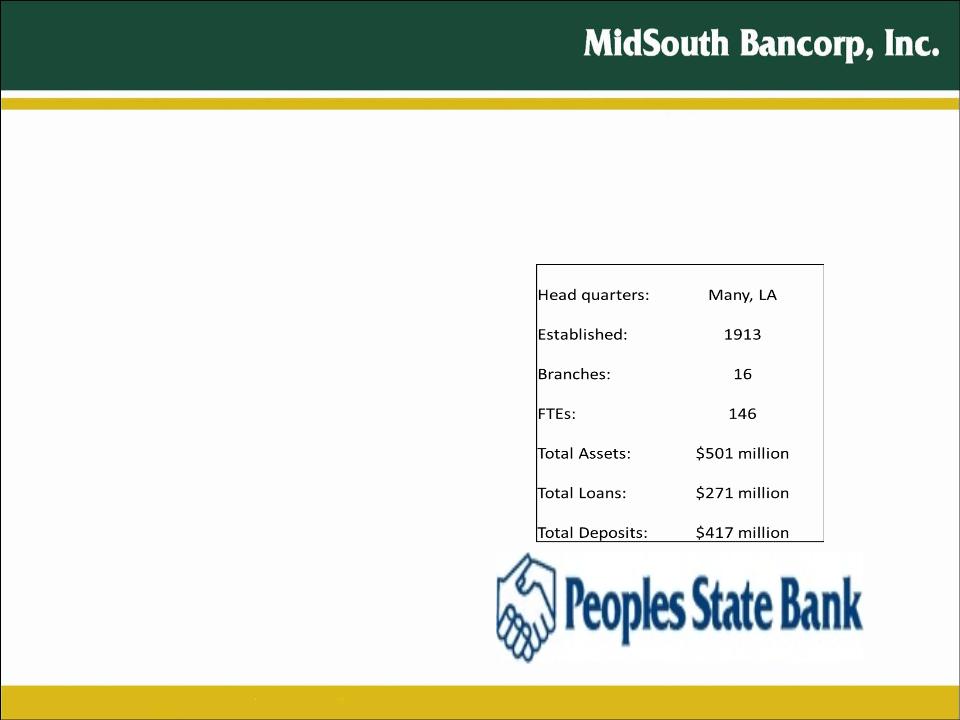

Peoples State Bank History

1913- Peoples State Bank founded, E.C. Dillon

President

President

1934 - John J. Blake named President following

death of E.C. Dillon

death of E.C. Dillon

1967 - John J. Blake Jr. named President

1984 - PSB Financial Corporation, a one bank

holding company controlled by Pete

Abington, purchased Peoples State Bank.

Total assets $28 million.

holding company controlled by Pete

Abington, purchased Peoples State Bank.

Total assets $28 million.

1985 - Acquired Bank of Pleasant Hill

1987 - FDIC assisted acquisitions of Pelican State

Bank in Mansfield and Liberty Bank &

Trust in Shreveport

Bank in Mansfield and Liberty Bank &

Trust in Shreveport

1996 - Acquired a branch in Alexandria of First

NBC, New Orleans

NBC, New Orleans

1986 - John J. Blake, III named President -

currently with the bank

currently with the bank

1997 - Acquired First Bank and Trust in

Natchitoches

Natchitoches

2005 - Purchased shell charter of First State Bank

and relocated branch to Texarkana, TX

and relocated branch to Texarkana, TX

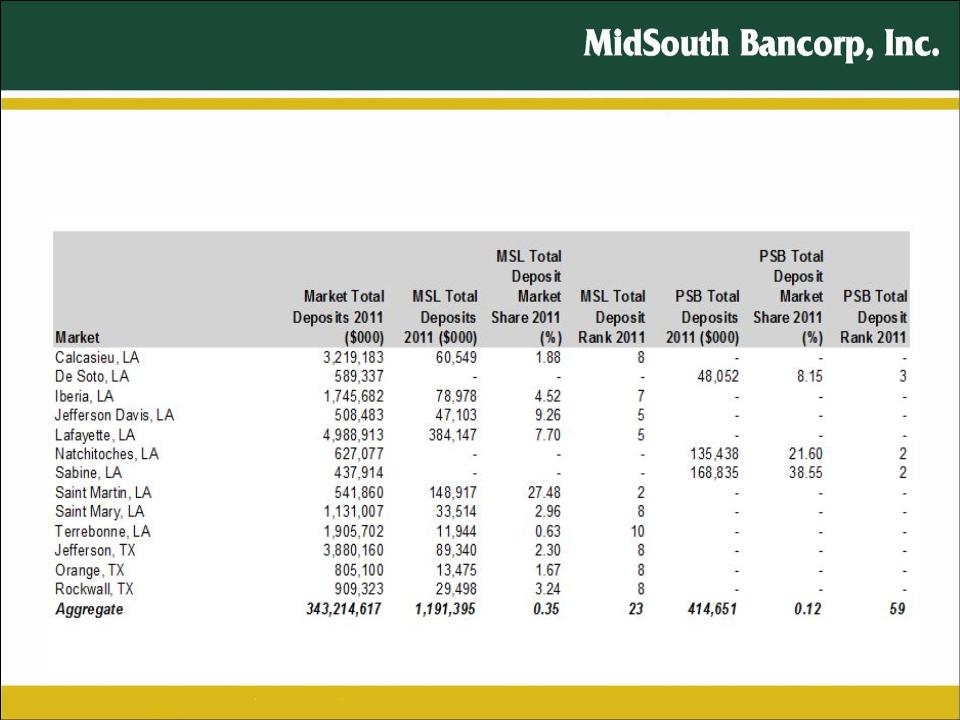

Franchise Overview

Pro forma Deposit Market Share

Financial Impact of Transaction

• Comprehensive onsite credit due diligence process by MSL

– Reviewed 74% of loan portfolio

– Conservative aggregate credit mark of 2.3% or $6 million

• Review of operations and business lines

– Realistic cost savings of 25% of 2012 pretax noninterest expenses fully realized by

end of 2013

end of 2013

– No revenue synergies assumed

– One time merger related expenses of $0.5 million after tax

– EPS immediately accretive

• Resulting Pro Forma Capital Ratios

– Tier 1 Leverage 8.61%

– Tier 1 Capital to RWA 13.58%

– Total RBC Ratio 14.22%

– TE/TA 7.5%

|

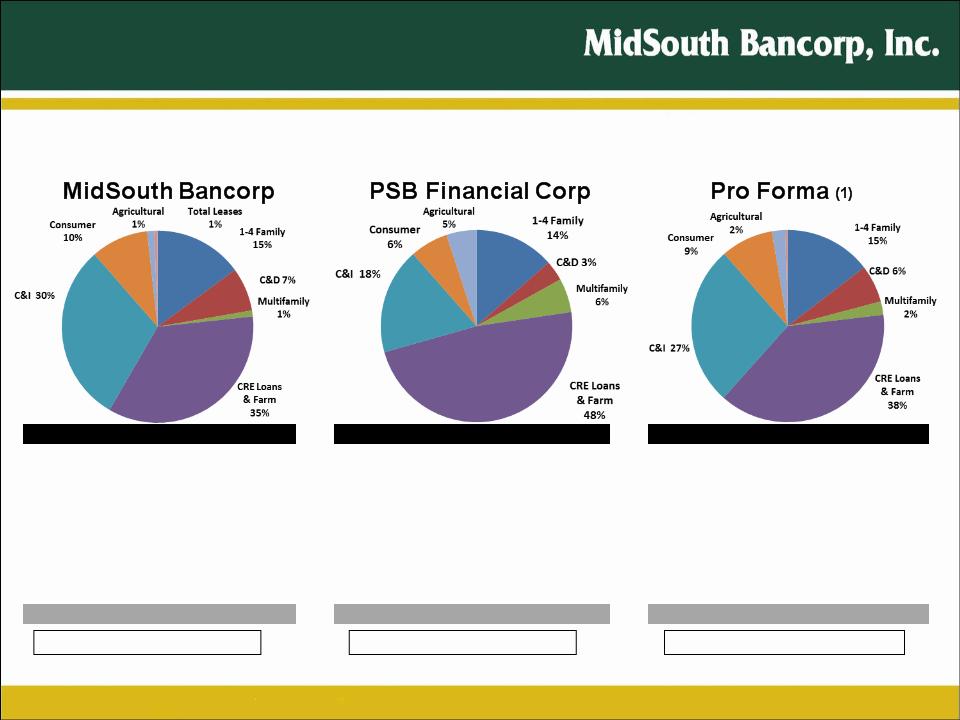

Loan Portfolio

|

Amount

|

% of Total

|

|

|

1-4 Family

|

112,343

|

14.95

|

%

|

|

C&D

|

55,111

|

7.33

|

|

|

Multifamily

|

7,566

|

1.01

|

|

|

CRE Loans & Farm

|

263,575

|

35.07

|

|

|

C&I

|

226,993

|

30.20

|

|

|

Consumer

|

72,873

|

9.70

|

|

|

Agricultural

|

9,168

|

1.22

|

|

|

Total Leases

|

3,974

|

0.53

|

|

|

Total Loans

|

751,603

|

100.00

|

%

|

|

Loan Portfolio

|

Amount

|

% of Total

|

|

|

1-4 Family

|

36,652

|

13.51

|

%

|

|

C&D

|

9,296

|

3.43

|

|

|

Multifamily

|

15,526

|

5.72

|

|

|

CRE Loans & Farm

|

130,175

|

47.97

|

|

|

C&I

|

48,465

|

17.86

|

|

|

Consumer

|

17,424

|

6.42

|

|

|

Agricultural

|

13,830

|

5.10

|

|

|

Total Leases

|

-

|

-

|

|

|

Total Loans

|

271,368

|

100.00

|

%

|

|

Loan Portfolio

|

Amount

|

% of Total

|

|

|

1-4 Family

|

148,995

|

14.56

|

%

|

|

C&D

|

64,407

|

6.30

|

|

|

Multifamily

|

23,092

|

2.26

|

|

|

CRE Loans & Farm

|

393,750

|

38.49

|

|

|

C&I

|

275,458

|

26.93

|

|

|

Consumer

|

90,297

|

8.83

|

|

|

Agricultural

|

22,998

|

2.25

|

|

|

Total Leases

|

3,974

|

0.39

|

|

|

Total Loans

|

1,022,971

|

100.00

|

%

|

PSB Yield on Total Loans: 5.45%

MidSouth Yield on Total Loans: 6.60%

Pro Forma Yield on Total Loans: 6.29%

Source: SNL Financial and Company Documents

(1) Excludes purchase accounting data

PRO FORMA LOAN COMPOSITION

MidSouth Bancorp

PSB Financial Corp

|

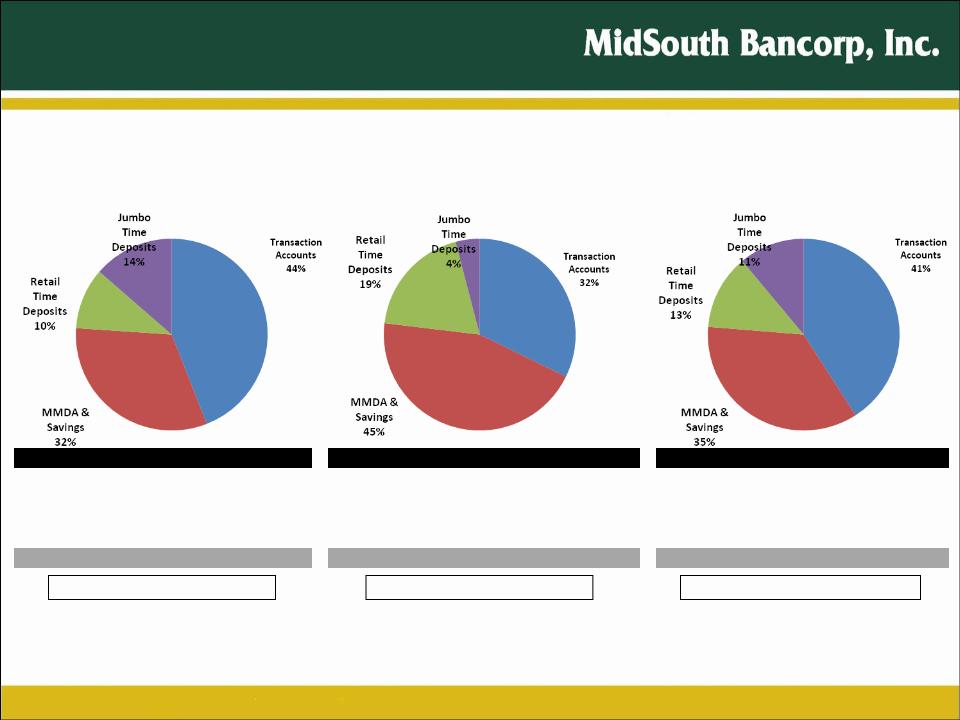

Deposit Composition

|

Amount

|

% of Total

|

|

|

Transaction Accounts

|

134,246

|

32.23

|

%

|

|

MMDA & Savings

|

186,063

|

44.67

|

|

|

Retail Time Deposits

|

79,330

|

19.04

|

|

|

Jumbo Time Deposits

|

16,907

|

4.06

|

|

|

Total Deposits

|

416,546

|

100.00

|

%

|

|

Deposit Composition

|

Amount

|

% of Total

|

|

|

Transaction Accounts

|

508,169

|

44.04

|

%

|

|

MMDA & Savings

|

369,524

|

32.03

|

|

|

Retail Time Deposits

|

119,098

|

10.32

|

|

|

Jumbo Time Deposits

|

156,970

|

13.61

|

|

|

Total Deposits

|

1,153,761

|

100.00

|

%

|

|

Deposit Composition

|

Amount

|

% of Total

|

|

|

Transaction Accounts

|

642,415

|

40.91

|

%

|

|

MMDA & Savings

|

555,587

|

35.38

|

|

|

Retail Time Deposits

|

198,428

|

12.64

|

|

|

Jumbo Time Deposits

|

173,877

|

11.07

|

|

|

Total Deposits

|

1,570,307

|

100.00

|

%

|

PSB Cost of Deposits: 0.67%

MidSouth Cost of Deposits: 0.48%

Pro Forma Cost of Deposits: 0.53%

Source: SNL Financial and Company Documents

(1) Excludes purchase accounting data

Pro Forma (1)

PRO FORMA DEPOSIT COMPOSITION