Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - Diamond Resorts Corp | a8-kamendmentxinvestorslid.htm |

Diamond Resorts International® 1 September 2012

David F. Palmer President & Chief Financial Officer Management Presenter Diamond Resorts International® 2

Company Overview Diamond Resorts is a branded resort management company that operates one of the largest vacation-ownership networks in the world Santa Barbara Golf and Ocean Club – Canaries, Spain Diamond Resorts International® 3

242 Branded and Affiliated Resorts Lake Tahoe Vacation Resort – South Lake Tahoe, California Diamond Resorts International® 4

Approximately 490,000 Owner-Families Diamond Resorts International® 5

29 Countries Diamond Resorts International® 6

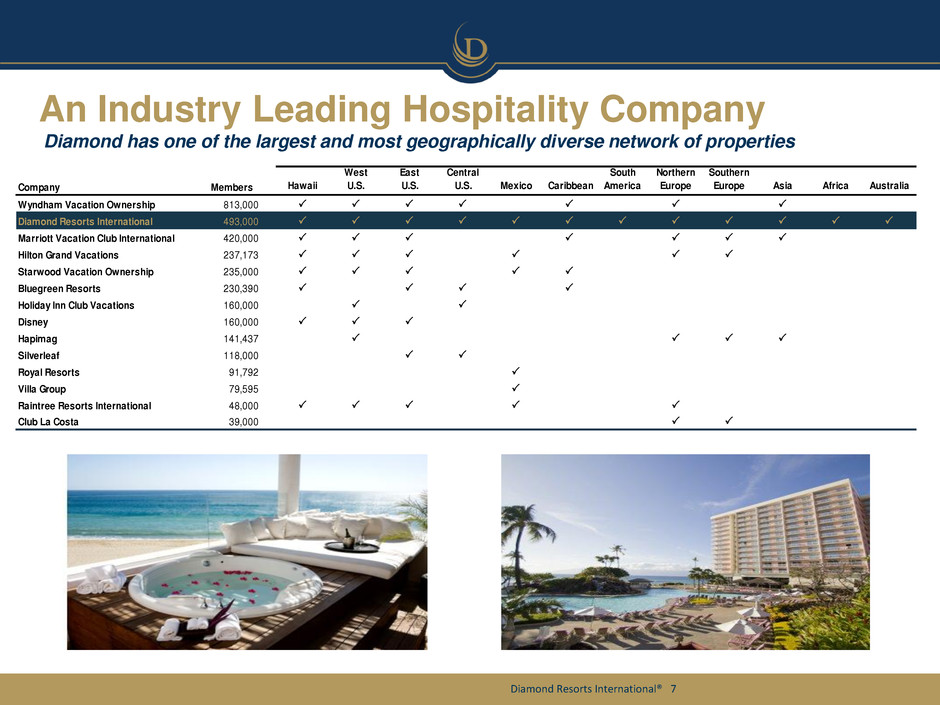

Company Members Hawaii West U.S. East U.S. Central U.S. Mexico Caribbean South America Northern Europe Southern Europe Asia Africa Australia Wyndham Vacation Ownership 813,000 P P P P P P P Diamond Resorts International 493,000 P P P P P P P P P P P P Marriott Vacation Club International 420,000 P P P P P P P Hilton Grand Vacations 237,173 P P P P P P Starwood Vacation Ownership 235,000 P P P P P Bluegreen Resorts 230,390 P P P P Holiday Inn Club Vacations 160,000 P P Disney 160,000 P P P Hapimag 141,437 P P P P Silverleaf 118,000 P P Royal Resorts 91,792 P Villa Group 79,595 P Raintree Resorts International 48,000 P P P P P Club La Costa 39,000 P P An Industry Leading Hospitality Company Diamond has one of the largest and most geographically diverse network of properties Diamond Resorts International® 7

Business Segments Hospitality and Resort Management Services Marketing and Sales of Vacation Interests Consumer Financial Services Diamond Resorts International® 8

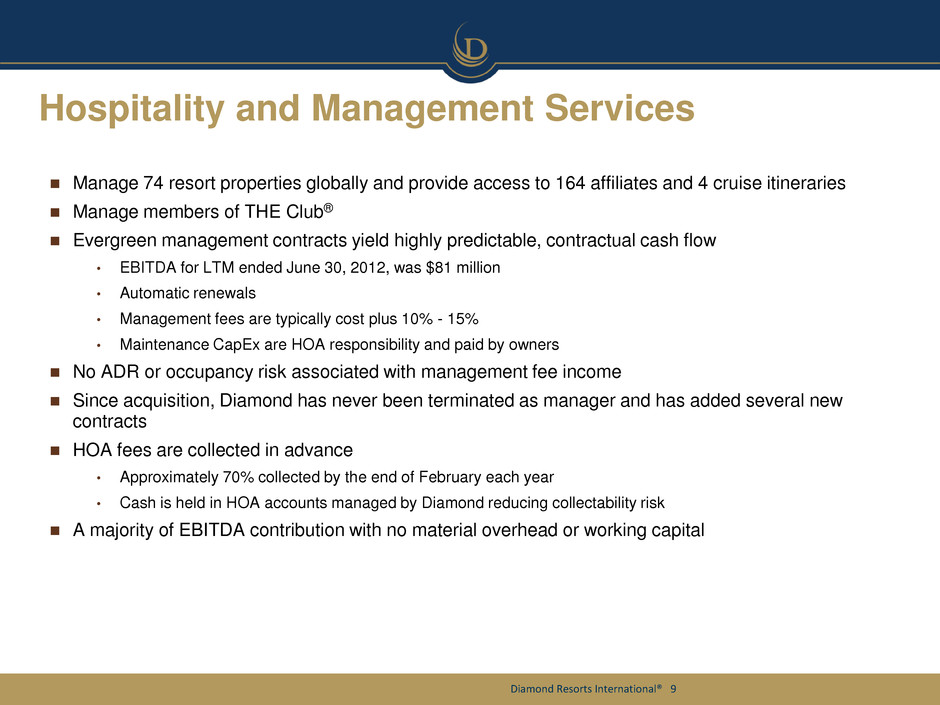

Hospitality and Management Services Manage 74 resort properties globally and provide access to 164 affiliates and 4 cruise itineraries Manage members of THE Club® Evergreen management contracts yield highly predictable, contractual cash flow • EBITDA for LTM ended June 30, 2012, was $81 million • Automatic renewals • Management fees are typically cost plus 10% - 15% • Maintenance CapEx are HOA responsibility and paid by owners No ADR or occupancy risk associated with management fee income Since acquisition, Diamond has never been terminated as manager and has added several new contracts HOA fees are collected in advance • Approximately 70% collected by the end of February each year • Cash is held in HOA accounts managed by Diamond reducing collectability risk A majority of EBITDA contribution with no material overhead or working capital Diamond Resorts International® 9

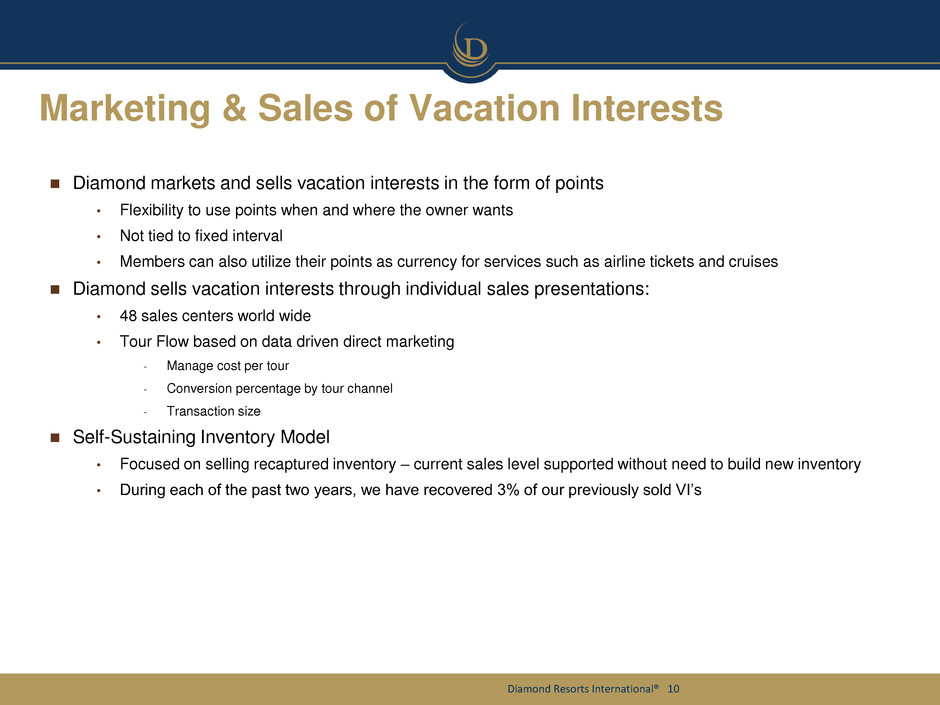

Marketing & Sales of Vacation Interests Diamond markets and sells vacation interests in the form of points • Flexibility to use points when and where the owner wants • Not tied to fixed interval • Members can also utilize their points as currency for services such as airline tickets and cruises Diamond sells vacation interests through individual sales presentations: • 48 sales centers world wide • Tour Flow based on data driven direct marketing - Manage cost per tour - Conversion percentage by tour channel - Transaction size Self-Sustaining Inventory Model • Focused on selling recaptured inventory – current sales level supported without need to build new inventory • During each of the past two years, we have recovered 3% of our previously sold VI’s Diamond Resorts International® 10

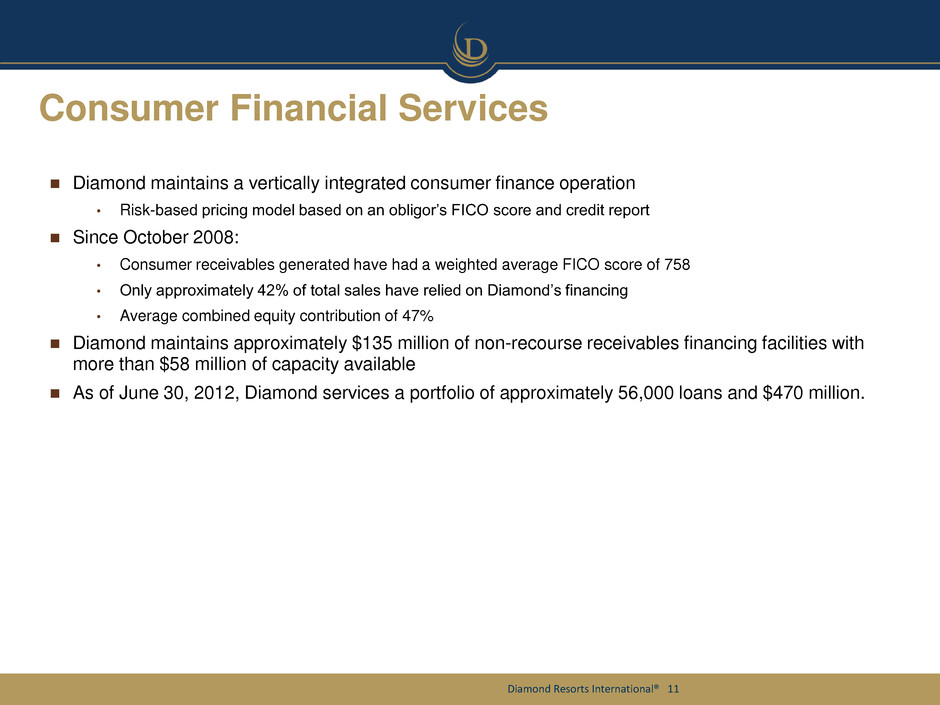

Consumer Financial Services Diamond maintains a vertically integrated consumer finance operation • Risk-based pricing model based on an obligor’s FICO score and credit report Since October 2008: • Consumer receivables generated have had a weighted average FICO score of 758 • Only approximately 42% of total sales have relied on Diamond’s financing • Average combined equity contribution of 47% Diamond maintains approximately $135 million of non-recourse receivables financing facilities with more than $58 million of capacity available As of June 30, 2012, Diamond services a portfolio of approximately 56,000 loans and $470 million. Diamond Resorts International® 11

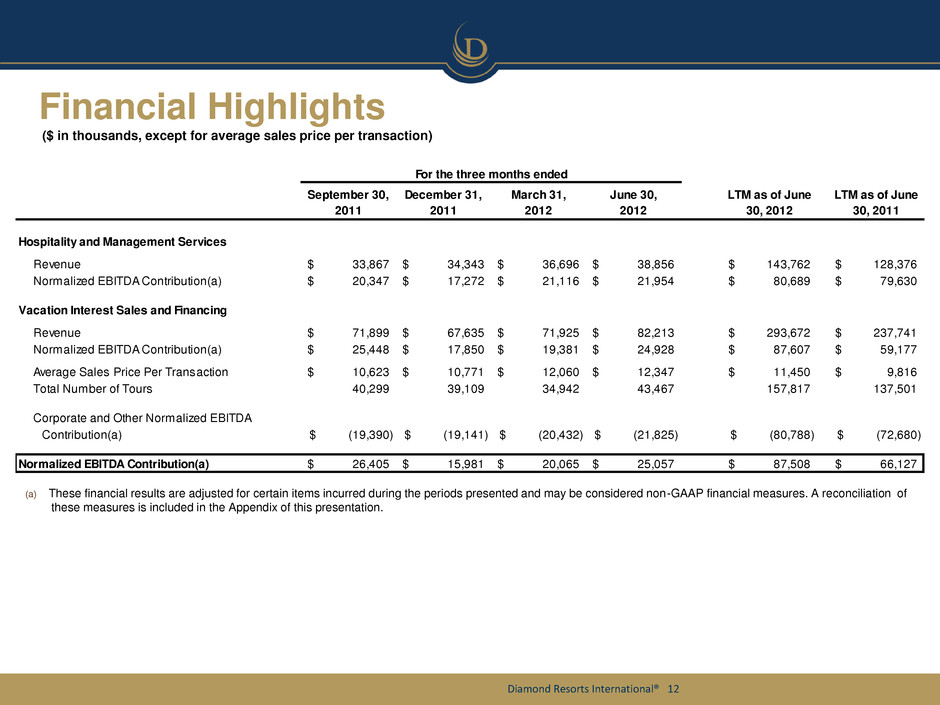

Financial Highlights ($ in thousands, except for average sales price per transaction) (a) These financial results are adjusted for certain items incurred during the periods presented and may be considered non-GAAP financial measures. A reconciliation of these measures is included in the Appendix of this presentation. Diamond Resorts International® 12 For the three months ended September 30, 2011 December 31, 2011 March 31, 2012 June 30, 2012 LTM as of June 30, 2012 LTM as of June 30, 2011 Hospitality and Management Services Revenue 33,867$ 34,343$ 36,696$ 38,856$ 143,762$ 128,376$ Normalized EBITDA Contribution(a) 20,347$ 17,272$ 21,116$ 21,954$ 80,689$ 79,630$ Vacation Interest Sales and Financing Revenue 71,899$ 67,635$ 71,925$ 82,213$ 293,672$ 237,741$ Normalized EBITDA Contribution(a) 25,448$ 17,850$ 19,381$ 24,928$ 87,607$ 59,177$ Average Sales Price Per Transaction 10,623$ 10,771$ 12,060$ 12,347$ 11,450$ 9,816$ Total Number of Tours 40,299 39,109 34,942 43,467 157,817 137,501 Corporate and Other Normalized EBITDA Contribution(a) (19,390)$ (19,141)$ (20,432)$ (21,825)$ (80,788)$ (72,680)$ Normalized EBITDA Contribution(a) 26,405$ 15,981$ 20,065$ 25,057$ 87,508$ 66,127$

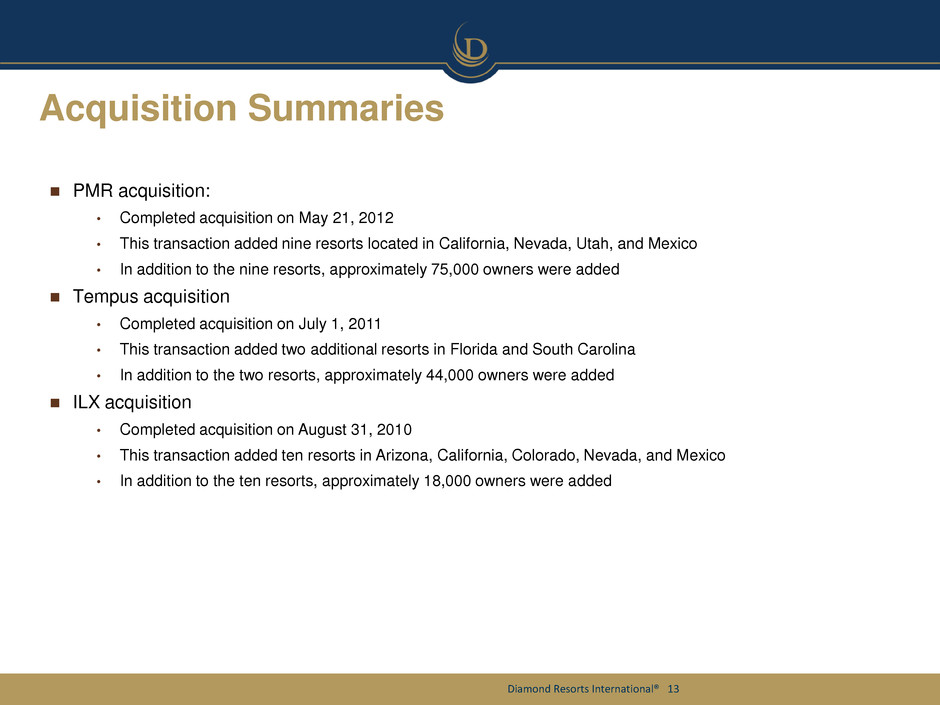

Acquisition Summaries PMR acquisition: • Completed acquisition on May 21, 2012 • This transaction added nine resorts located in California, Nevada, Utah, and Mexico • In addition to the nine resorts, approximately 75,000 owners were added Tempus acquisition • Completed acquisition on July 1, 2011 • This transaction added two additional resorts in Florida and South Carolina • In addition to the two resorts, approximately 44,000 owners were added ILX acquisition • Completed acquisition on August 31, 2010 • This transaction added ten resorts in Arizona, California, Colorado, Nevada, and Mexico • In addition to the ten resorts, approximately 18,000 owners were added Diamond Resorts International® 13

Important Note Regarding Forward-Looking Statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. These statements may be identified by the use of words such as “believe”, “expect”, “anticipate”, “plan”, “estimate”, “should”, “will”, “intend”, or similar expressions. Outcomes related to such statements are subject to numerous risk factors and uncertainties including those listed in the company’s most recent Form 10-K and subsequent SEC filings. Diamond Resorts International® 14

Diamond Resorts International® 15 Appendix

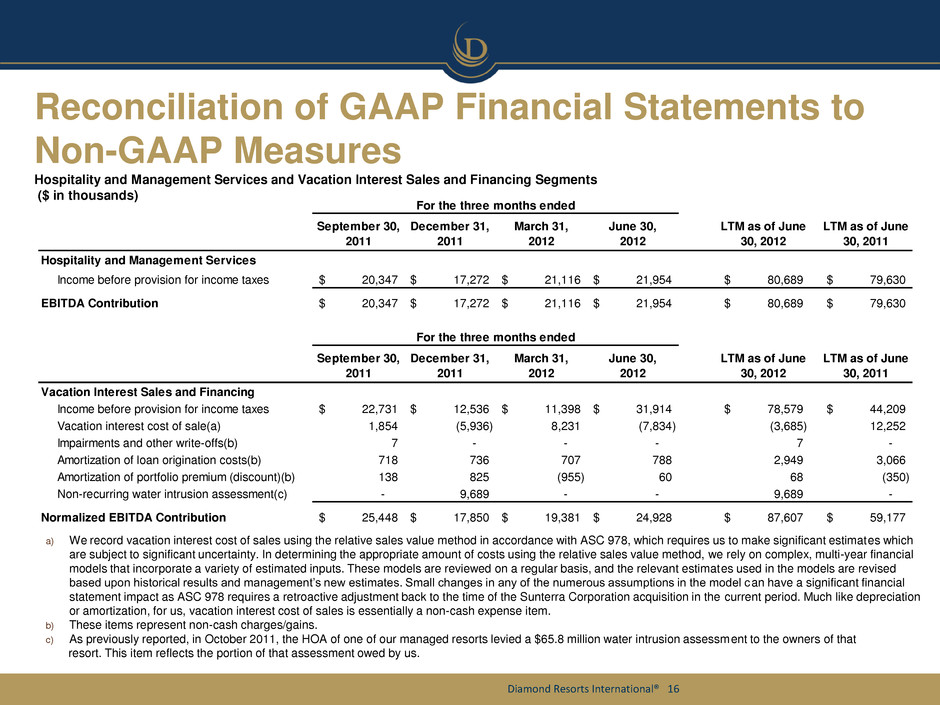

a) We record vacation interest cost of sales using the relative sales value method in accordance with ASC 978, which requires us to make significant estimates which are subject to significant uncertainty. In determining the appropriate amount of costs using the relative sales value method, we rely on complex, multi-year financial models that incorporate a variety of estimated inputs. These models are reviewed on a regular basis, and the relevant estimates used in the models are revised based upon historical results and management’s new estimates. Small changes in any of the numerous assumptions in the model can have a significant financial statement impact as ASC 978 requires a retroactive adjustment back to the time of the Sunterra Corporation acquisition in the current period. Much like depreciation or amortization, for us, vacation interest cost of sales is essentially a non-cash expense item. b) These items represent non-cash charges/gains. c) As previously reported, in October 2011, the HOA of one of our managed resorts levied a $65.8 million water intrusion assessment to the owners of that resort. This item reflects the portion of that assessment owed by us. Diamond Resorts International® 16 Reconciliation of GAAP Financial Statements to Non-GAAP Measures Hospitality and Management Services and Vacation Interest Sales and Financing Segments ($ in thousands) For the three months ended September 30, 2011 December 31, 2011 March 31, 2012 June 30, 2012 LTM as of June 30, 2012 LTM as of June 30, 2011 Hospitality and Management Services Income before provision for income taxes 20,347$ 17,272$ 21,116$ 21,954$ 80,689$ 79,630$ EBITDA Contribution 20,347$ 17,272$ 21,116$ 21,954$ 80,689$ 79,630$ For the three months ended September 30, 2011 December 31, 2011 March 31, 2012 June 30, 2012 LTM as of June 30, 2012 LTM as of June 30, 2011 Vacation Interest Sales and Financing Income before provision for income taxes 22,731$ 12,536$ 11,398$ 31,914$ 78,579$ 44,209$ Vacation interest cost of sale(a) 1,854 (5,936) 8,231 (7,834) (3,685) 12,252 Impairments and other write-offs(b) 7 - - - 7 - Amortization of loan origination costs(b) 718 736 707 788 2,949 3,066 Amortization of portfolio premium (discount)(b) 138 825 (955) 60 68 (350) Non-recurring water intrusion assessment(c) - 9,689 - - 9,689 - Normalized EBITDA Contribution 25,448$ 17,850$ 19,381$ 24,928$ 87,607$ 59,177$

Diamond Resorts International® 17 Reconciliation of GAAP Financial Statements to Non-GAAP Measures Corporate and Other Segment ($ in thousands) (a) Excludes interest expense related to non-recourse indebtedness incurred by our special purpose vehicles that is secured by our VOI consumer loans. (b) These items represent non-cash charges/gains. (c) Consists of one-time severance expense associated with the termination of certain personnel. For the three months ended September 30, 2011 December 31, 2011 March 31, 2012 June 30, 2012 LTM as of June 30, 2012 LTM as of June 30, 2011 Corporate and Other Loss before provision for income taxes (6,123)$ (62,378)$ (41,114)$ (21,925)$ (131,540)$ (144,631)$ Corporate interest expense(a) 16,453 17,086 17,011 18,453 69,003 56,931 Depreci tion and amortization(b) 3,853 3,801 3,805 4,369 15,828 12,802 Los on extinguishment of debt(b) - - - - - 1,081 Impairments and other write-offs(b) 686 555 (11) - 1,230 2,672 Gain on the disposal of assets(b) (76) (259) (72) (24) (431) (1,535) (Gain) adjustment on bargain purchase from business combinations(b) (34,183) 19,854 (51) (22,698) (37,078) - Non-recurring severance expense(c) - 2,200 - - 2,200 - Normalized EBITDA Contribution (19,390)$ (19,141)$ (20,432)$ (21,825)$ (80,788)$ (72,680)$

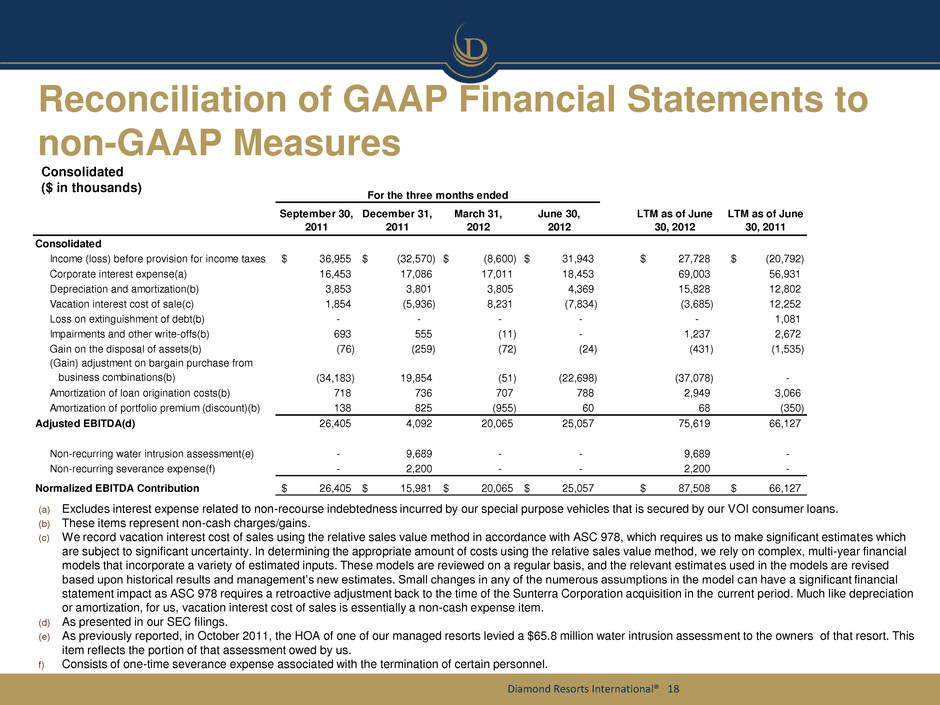

(a) Excludes interest expense related to non-recourse indebtedness incurred by our special purpose vehicles that is secured by our VOI consumer loans. (b) These items represent non-cash charges/gains. (c) We record vacation interest cost of sales using the relative sales value method in accordance with ASC 978, which requires us to make significant estimates which are subject to significant uncertainty. In determining the appropriate amount of costs using the relative sales value method, we rely on complex, multi-year financial models that incorporate a variety of estimated inputs. These models are reviewed on a regular basis, and the relevant estimates used in the models are revised based upon historical results and management’s new estimates. Small changes in any of the numerous assumptions in the model can have a significant financial statement impact as ASC 978 requires a retroactive adjustment back to the time of the Sunterra Corporation acquisition in the current period. Much like depreciation or amortization, for us, vacation interest cost of sales is essentially a non-cash expense item. (d) As presented in our SEC filings. (e) As previously reported, in October 2011, the HOA of one of our managed resorts levied a $65.8 million water intrusion assessment to the owners of that resort. This item reflects the portion of that assessment owed by us. f) Consists of one-time severance expense associated with the termination of certain personnel. Diamond Resorts International® 18 Reconciliation of GAAP Financial Statements to non-GAAP Measures Consolidated ($ in thousands) For the three months ended September 30, 2011 December 31, 2011 March 31, 2012 June 30, 2012 LTM as of June 30, 2012 LTM as of June 30, 2011 Consolidated Income (loss) before provision for income taxes 36,955$ (32,570)$ (8,600)$ 31,943$ 27,728$ (20,792)$ Corporate interest expense(a) 16,453 17,086 17,011 18,453 69,003 56,931 Depreciation and amortization(b) 3,853 3,801 3,805 4,369 15,828 12,802 Vacation interest cost of sale(c) 1,854 (5,936) 8,231 (7,834) (3,685) 12,252 Loss on extinguishment of debt(b) - - - - - 1,081 Impairments and other write-offs(b) 693 555 (11) - 1,237 2,672 Gain on the disposal of assets(b) (76) (259) (72) (24) (431) (1,535) (Gain) adjustment on bargain purchase from business combinations(b) (34,183) 19,854 (51) (22,698) (37,078) - Amortization of loan origination costs(b) 718 736 707 788 2,949 3,066 Amortization of portfolio premium (discount)(b) 138 825 (955) 60 68 (350) Adjusted EBITDA(d) 26,405 4,092 20,065 25,057 75,619 66,127 Non-recurring water intrusion assessment(e) - 9,689 - - 9,689 - Non-recurring severance expense(f) - 2,200 - - 2,200 - Normalized EBITDA Contribution 26,405$ 15,981$ 20,065$ 25,057$ 87,508$ 66,127$