Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OPENTABLE INC | a12-21814_18k.htm |

Exhibit 99.1

OFFICE LEASE

POST MONTGOMERY CENTER

One Montgomery Tower

San Francisco, California

LANDLORD:

POST-MONTGOMERY ASSOCIATES

TENANT:

OPENTABLE, INC.,

a Delaware corporation

OFFICE LEASE

POST MONTGOMERY CENTER

ONE MONTGOMERY TOWER

San Francisco, California

BASIC LEASE INFORMATION

|

Lease Date: |

|

September 19, 2012. |

|

|

|

|

|

Landlord: |

|

Post-Montgomery Associates, |

|

|

|

a California general partnership. |

|

|

|

|

|

Tenant: |

|

OPENTABLE, INC., a Delaware corporation. |

|

|

|

|

|

Premises: |

|

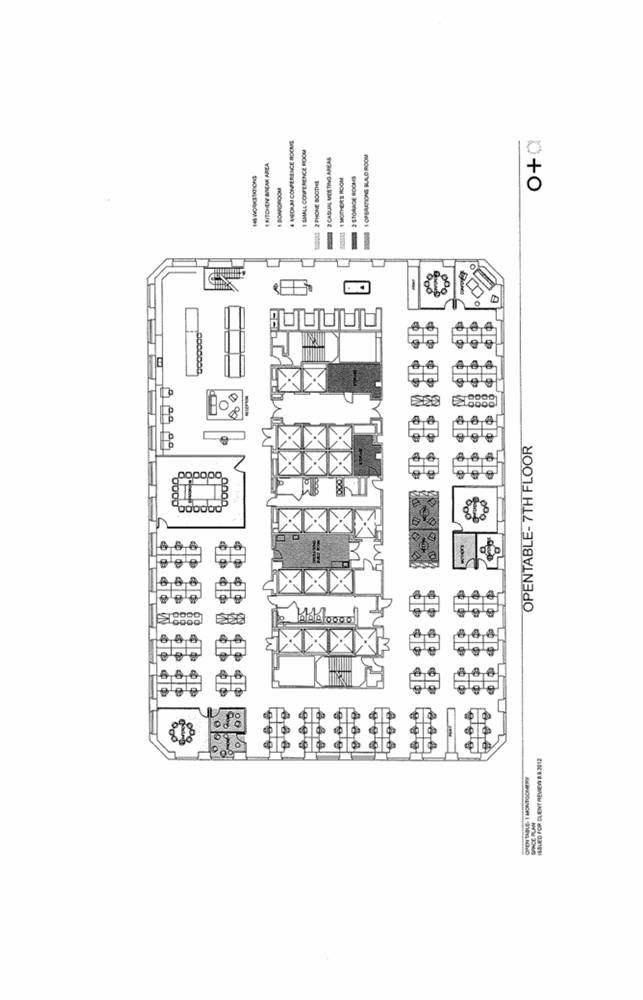

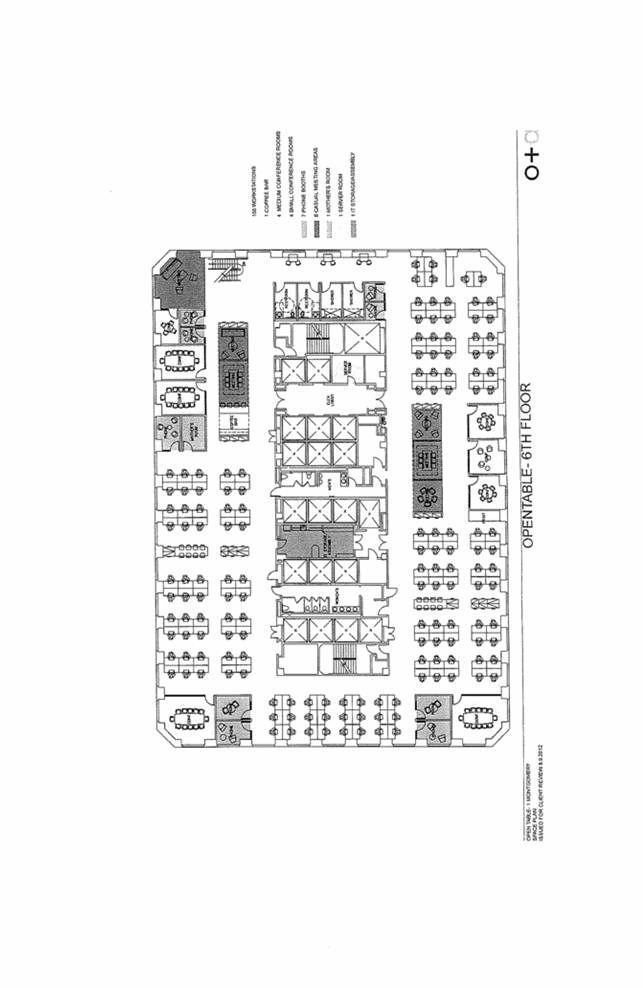

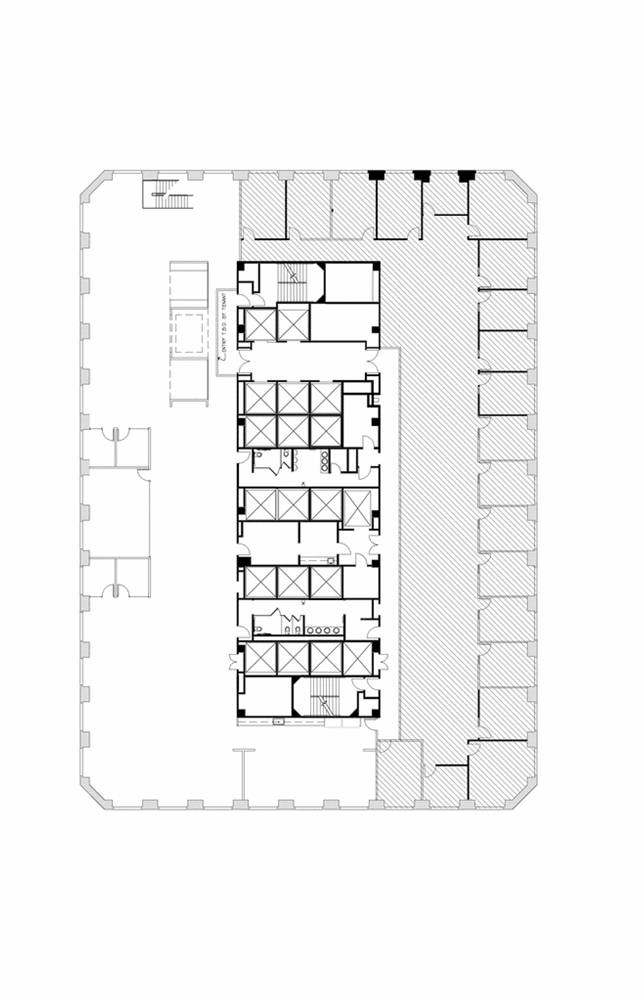

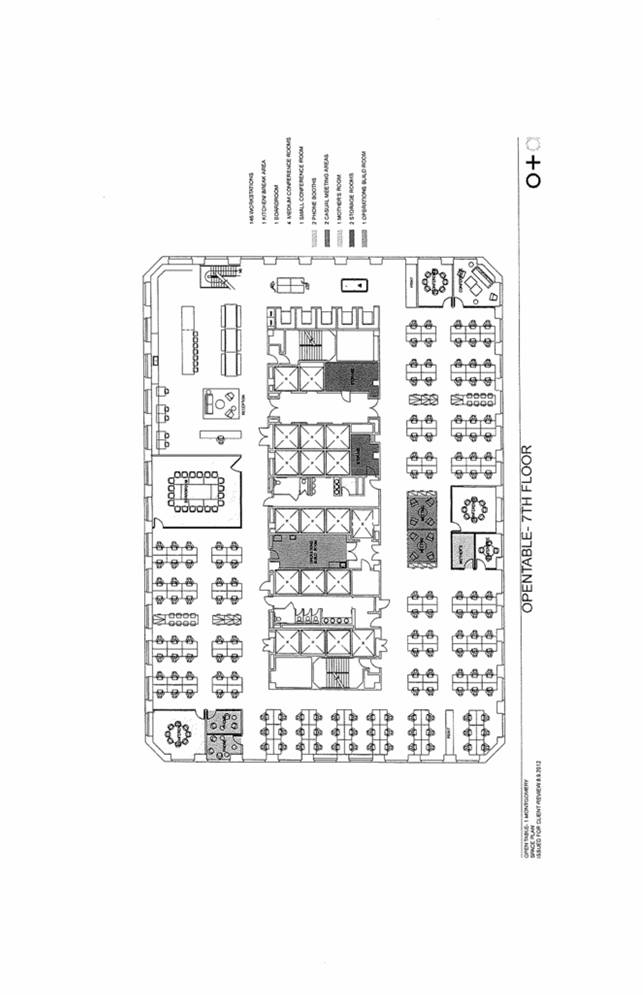

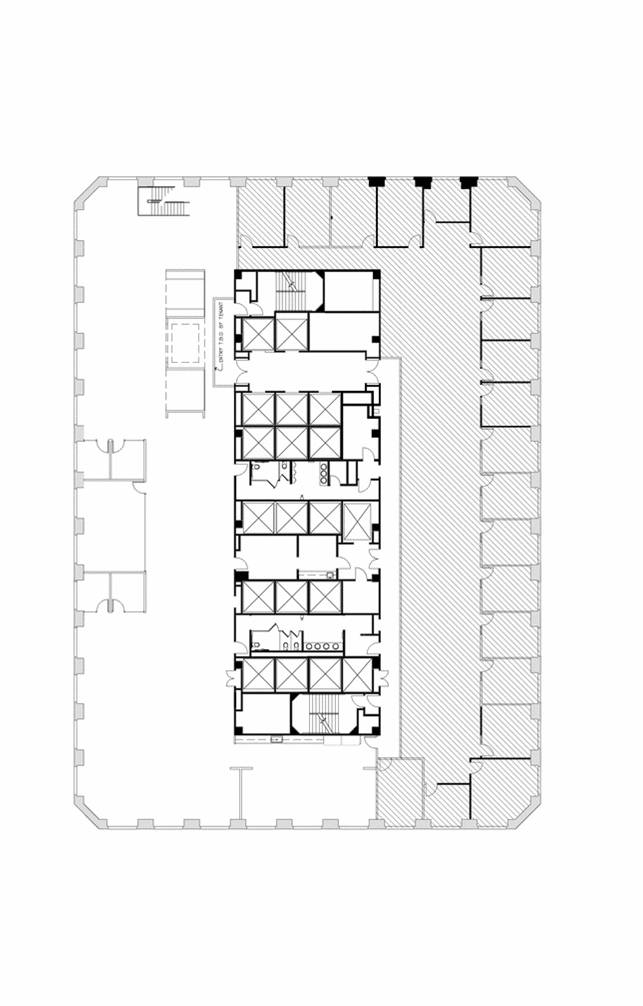

48,161 square feet of rentable area located on a portion of the 5th Floor and all of the 6th and 7th Floors, commonly referred to as Suite 500, Suite 600 and Suite 700, as shown on the Floor Plan(s) attached to this Lease as Exhibit A. |

|

|

|

|

|

Term: |

|

Eighty four (84) months, commencing on the Commencement Date. |

|

|

|

|

|

Commencement Date: |

|

May 1, 2013. |

|

|

|

|

|

Target Delivery Date: |

|

The date that is sixty (60) days after the full execution and delivery of this Lease and the Letter of Credit with respect to that portion of Landlord’s Work (as defined in the Work Letter) other than the 5th Floor Corridor Work (as defined in the Work Letter) and the Post Delivery Work (as defined in the Work Letter) and the date that is ninety (90) days after the full execution and delivery of this Lease and the Letter Credit with respect to the 5th Floor Corridor Work. Each Target Delivery date shall be subject to extension for delays arising from the acts or omissions of Tenant and delays described in Section 31.12. |

|

|

|

|

|

Expiration Date: |

|

The date which is eighty-four (84) months after the Commencement Date. |

|

|

|

|

|

Renewal Right: |

|

One option to extend for a period of five (5) years, pursuant to the terms and conditions set forth in Article 33. |

|

|

|

|

|

Expansion Right: |

|

As set forth in Article 36. |

|

Right of First Offer: |

|

As set forth in Article 35. |

Base Rent; Rent Abatement:

|

|

|

Rentable |

|

Annual Base |

|

Annual |

|

Monthly |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 1 |

|

48,161 |

|

$ |

42.50 |

|

$ |

2,046,842.50 |

|

$ |

170,570.21 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 2 |

|

48,161 |

|

$ |

43.50 |

|

$ |

2,095,003.50 |

|

$ |

174,583.63 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 3 |

|

48,161 |

|

$ |

44.50 |

|

$ |

2,143,164.50 |

|

$ |

178,597.04 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 4 |

|

48,161 |

|

$ |

45.50 |

|

$ |

2,191,325.50 |

|

$ |

182,610.46 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 5 |

|

48,161 |

|

$ |

46.50 |

|

$ |

2,239,486.50 |

|

$ |

186,623.88 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 6 |

|

48,161 |

|

$ |

47.50 |

|

$ |

2,287,647.50 |

|

$ |

190,637.29 |

|

|

|

|

|

|

|

|

|

|

|

| |||

|

Lease Year 7 |

|

48,161 |

|

$ |

48.50 |

|

$ |

2,335,808.50 |

|

$ |

194,650.71 |

|

* As an inducement to Tenant entering into this Lease, Base Rent in the amount of $170,570.21 per month shall be abated for the first three and one-half (3.5) months after the Commencement Date. During such abatement period, Tenant shall still be responsible for the payment of all of its other monetary obligations under the Lease.

|

Base Year: |

|

2013, subject to Section 33.2(d). |

|

|

|

|

|

Tenant’s Percentage Share: |

|

7.17% |

|

|

|

|

|

Construction Allowance: |

|

Fifty Dollars ($50.00) per rentable square foot of the Premises, pursuant to Section 5.1 of the Work Letter. |

|

|

|

|

|

Permitted Use: |

|

General corporate and administrative offices consistent with first-class office buildings in the San Francisco downtown financial district. |

|

|

|

|

|

Letter of Credit Required Amount: |

|

$1,023,421.25, subject to reduction as set forth in Section 34.1. |

|

|

|

|

|

Building Directory Spaces: |

|

one (1) directory strip, as set forth in Section 31.14. |

|

|

|

|

|

Parking Spaces: |

|

One space per 3,500 rentable square feet of the Premises. |

|

Tenant’s Address: |

|

Prior to Commencement Date: |

|

|

|

|

|

|

|

799 Market Street, 4th Floor |

|

|

|

San Francisco, CA 94103 |

|

|

|

|

|

|

|

On and after Commencement Date: |

|

|

|

|

|

|

|

One Montgomery Street, Suite 700 |

|

|

|

San Francisco, CA 94104 |

|

|

|

|

|

Landlord’s Address: |

|

Post Montgomery Center |

|

|

|

One Montgomery Street, Suite 450 |

|

|

|

San Francisco, CA 94104 |

|

|

|

|

|

Brokers: |

|

|

|

|

|

|

|

Landlord’s Broker: |

|

Cushman & Wakefield of California, Inc. |

|

|

|

|

|

Tenant’s Broker: |

|

Studley, Inc. |

Exhibits:

Exhibit A: Floor Plan(s) of Premises

Exhibit B: Rules and Regulations

Exhibit C: Work Letter

Exhibit C-1: Space Plan for the Premises

Exhibit D: Confirmation of Lease Term

Exhibit E: Letter of Credit Form

TABLE OF CONTENTS

|

|

|

|

Page |

|

|

|

|

|

|

1. |

Definitions |

1 | |

|

|

|

|

|

|

|

1.1 |

Terms Defined |

1 |

|

|

|

|

|

|

|

1.2 |

Basic Lease Information |

10 |

|

|

|

|

|

|

|

1.3 |

Certain Defined Terms |

10 |

|

|

|

|

|

|

2. |

Lease of Premises |

11 | |

|

|

|

|

|

|

|

2.1 |

Bicycle Storage Room |

11 |

|

|

|

|

|

|

3. |

Term; Condition and Acceptance of Premises |

11 | |

|

|

|

|

|

|

|

3.1 |

Delivery of Premises; Term Commencement |

11 |

|

|

|

|

|

|

|

3.2 |

Early Entry |

12 |

|

|

|

|

|

|

4. |

Rent |

12 | |

|

|

|

|

|

|

|

4.1 |

Obligation to Pay Base Rent |

12 |

|

|

|

|

|

|

|

4.2 |

Manner of Rent Payment |

13 |

|

|

|

|

|

|

|

4.3 |

Additional Rent |

13 |

|

|

|

|

|

|

|

4.4 |

Late Payment of Rent; Interest |

13 |

|

|

|

|

|

|

|

4.5 |

Additional Rent Upon Tenant’s Failure to Perform |

13 |

|

|

|

|

|

|

|

4.6 |

Rent Abatement |

14 |

|

|

|

|

|

|

5. |

Calculation and Payments of Escalation Rent |

14 | |

|

|

|

|

|

|

|

5.1 |

Payment of Estimated Escalation Rent |

14 |

|

|

|

|

|

|

|

5.2 |

Escalation Rent Statement and Adjustment |

14 |

|

|

|

|

|

|

|

5.3 |

Proration for Partial Year |

15 |

|

|

|

|

|

|

|

5.4 |

Audit Right |

15 |

|

|

|

|

|

|

6. |

Impositions Payable by Tenant |

16 | |

|

|

|

|

|

|

7. |

Use of Premises |

16 | |

|

|

7.1 |

Permitted Use |

16 |

|

|

|

|

|

|

|

7.2 |

No Violation of Requirements |

16 |

|

|

|

|

|

|

|

7.3 |

Compliance with Requirements |

17 |

|

|

|

|

|

|

|

7.4 |

No Nuisance |

18 |

|

|

|

|

|

|

|

7.5 |

Compliance With Environmental Laws; Use of Hazardous Materials |

18 |

|

|

|

|

|

|

|

7.6 |

Pre-Existing Hazardous Materials |

18 |

|

|

|

|

|

|

8. |

Building Services |

19 | |

|

|

|

|

|

|

|

8.1 |

Maintenance of Project |

19 |

|

|

|

|

|

|

|

8.2 |

Building-Standard Services |

19 |

|

|

|

|

|

|

|

8.3 |

Interruption or Unavailability of Services |

20 |

|

|

|

|

|

|

|

8.4 |

Tenant’s Use of Excess Electricity and Water; Premises Occupancy Load |

21 |

|

|

|

|

|

|

|

8.5 |

Provision of Additional Services |

22 |

|

|

|

|

|

|

|

8.6 |

Tenant’s Supplemental Air Conditioning |

22 |

|

|

|

|

|

|

9. |

Maintenance of Premises |

22 | |

|

|

|

|

|

|

10. |

Alterations to Premises |

22 | |

|

|

|

|

|

|

|

10.1 |

Landlord Consent; Procedure |

22 |

|

|

|

|

|

|

|

10.2 |

General Requirements |

22 |

|

|

|

|

|

|

|

10.3 |

Landlord’s Right to Inspect |

24 |

|

|

|

|

|

|

|

10.4 |

Tenant’s Obligations Upon Completion |

24 |

|

|

|

|

|

|

|

10.5 |

Repairs |

25 |

|

|

|

|

|

|

|

10.6 |

Ownership and Removal of Alterations |

25 |

|

|

|

|

|

|

|

10.7 |

Minor Alterations |

26 |

|

|

|

|

|

|

|

10.8 |

Landlord’s Fee |

26 |

|

|

|

|

|

|

11. |

Liens |

26 | |

|

12. |

Damage or Destruction |

26 | |

|

|

|

|

|

|

|

12.1 |

Obligation to Repair |

26 |

|

|

|

|

|

|

|

12.2 |

Landlord’s Election |

27 |

|

|

|

|

|

|

|

12.3 |

Tenant’s Election |

27 |

|

|

|

|

|

|

|

12.4 |

Cost of Repairs |

27 |

|

|

|

|

|

|

|

12.5 |

Damage at End of Term |

28 |

|

|

|

|

|

|

|

12.6 |

Waiver of Statutes |

28 |

|

|

|

|

|

|

13. |

Eminent Domain |

28 | |

|

|

|

|

|

|

|

13.1 |

Effect of Taking |

28 |

|

|

|

|

|

|

|

13.2 |

Condemnation Proceeds |

29 |

|

|

|

|

|

|

|

13.3 |

Restoration of Premises |

29 |

|

|

|

|

|

|

|

13.4 |

Taking at End of Term |

29 |

|

|

|

|

|

|

|

13.5 |

Tenant Waiver |

29 |

|

|

|

|

|

|

14. |

Insurance |

30 | |

|

|

|

|

|

|

|

14.1 |

Liability Insurance |

30 |

|

|

|

|

|

|

|

14.2 |

Form of Policies |

31 |

|

|

|

|

|

|

|

14.3 |

Vendors’ Insurance |

32 |

|

|

|

|

|

|

15. |

Waiver of Subrogation Rights |

32 | |

|

|

|

|

|

|

16. |

Tenant’s Waiver of Liability and Indemnification |

32 | |

|

|

|

|

|

|

|

16.1 |

Waiver and Release |

32 |

|

|

|

|

|

|

|

16.2 |

Indemnification of Landlord |

32 |

|

|

|

|

|

|

17. |

Assignment and Subletting |

33 | |

|

|

|

|

|

|

|

17.1 |

Compliance Required |

33 |

|

|

|

|

|

|

|

17.2 |

Request by Tenant; Landlord Response |

33 |

|

|

|

|

|

|

|

17.3 |

Standards and Conditions for Landlord Approval |

34 |

|

|

17.4 |

Costs and Expenses |

35 |

|

|

|

|

|

|

|

17.5 |

Payment of Excess Rent and Other Consideration |

35 |

|

|

|

|

|

|

|

17.6 |

Assumption of Obligations; Further Restrictions on Subletting |

36 |

|

|

|

|

|

|

|

17.7 |

No Release |

36 |

|

|

|

|

|

|

|

17.8 |

No Encumbrance; No Change in Permitted Use |

37 |

|

|

|

|

|

|

|

17.9 |

Right to Assign or Sublease Without Landlord’s Consent |

37 |

|

|

|

|

|

|

18. |

Rules and Regulations |

37 | |

|

|

|

|

|

|

19. |

Entry of Premises by Landlord; Modification to Common Areas |

38 | |

|

|

|

|

|

|

|

19.1 |

Entry of Premises |

38 |

|

|

|

|

|

|

|

19.2 |

Modifications to Common Areas |

38 |

|

|

|

|

|

|

|

19.3 |

Waiver of Claims |

39 |

|

|

|

|

|

|

20. |

Default and Remedies |

39 | |

|

|

|

|

|

|

|

20.1 |

Events of Default |

39 |

|

|

|

|

|

|

|

20.2 |

Tenant Cure Periods |

40 |

|

|

|

|

|

|

|

20.3 |

Landlord’s Remedies Upon Occurrence of Event of Default |

40 |

|

|

|

|

|

|

|

20.4 |

Damages Upon Termination |

41 |

|

|

|

|

|

|

|

20.5 |

Computation of Certain Rent for Purposes of Default |

41 |

|

|

|

|

|

|

|

20.6 |

Landlord’s Right to Cure Defaults |

41 |

|

|

|

|

|

|

|

20.7 |

Waiver of Forfeiture |

41 |

|

|

|

|

|

|

|

20.8 |

Remedies Cumulative |

41 |

|

|

|

|

|

|

|

20.9 |

Landlord’s Default |

42 |

|

|

|

|

|

|

21. |

Subordination, Attornment and Nondisturbance |

42 | |

|

|

|

|

|

|

|

21.1 |

Subordination and Attornment |

42 |

|

|

|

|

|

|

|

21.1 |

Notice to Encumbrancer |

43 |

|

|

|

|

|

|

|

21.2 |

Rent Payment Direction |

43 |

|

22. |

Sale or Transfer by Landlord; Lease Non-Recourse |

43 | |

|

|

|

|

|

|

|

22.1 |

Release of Landlord on Transfer |

43 |

|

|

|

|

|

|

|

22.2 |

Lease Nonrecourse to Landlord; Limitation of Liability |

44 |

|

|

|

|

|

|

23. |

Estoppel Certificate |

44 | |

|

|

|

|

|

|

|

23.1 |

Procedure and Content |

44 |

|

|

|

|

|

|

|

23.2 |

Effect of Certificate |

45 |

|

|

|

|

|

|

24. |

No Light, Air, or View Easement |

45 | |

|

|

|

|

|

|

25. |

Holding Over |

45 | |

|

|

|

|

|

|

26. |

Security Deposit |

46 | |

|

|

|

|

|

|

|

26.1 |

Application of Security Deposit |

46 |

|

|

|

|

|

|

27. |

Waiver |

47 | |

|

|

|

|

|

|

28. |

Notices; Tenant’s Agent for Service |

47 | |

|

|

|

|

|

|

29. |

Authority |

47 | |

|

|

|

|

|

|

30. |

Parking |

47 | |

|

|

|

|

|

|

|

30.1 |

Lease of Parking Spaces |

47 |

|

|

|

|

|

|

|

30.2 |

Management of Project Parking Garage |

48 |

|

|

|

|

|

|

|

30.3 |

Waiver of Liability |

48 |

|

|

|

|

|

|

31. |

Miscellaneous |

48 | |

|

|

|

|

|

|

|

31.1 |

No Joint Venture |

48 |

|

|

|

|

|

|

|

31.2 |

Successors and Assigns |

48 |

|

|

|

|

|

|

|

31.3 |

Construction and Interpretation |

49 |

|

|

|

|

|

|

|

31.4 |

Severability |

49 |

|

|

|

|

|

|

|

31.5 |

Entire Agreement |

49 |

|

|

|

|

|

|

|

31.6 |

Governing Law |

50 |

|

|

|

|

|

|

|

31.7 |

Costs and Expenses |

50 |

|

|

31.8 |

Standards of Performance and Approvals |

50 |

|

|

|

|

|

|

|

31.9 |

Brokers |

51 |

|

|

|

|

|

|

|

31.10 |

Memorandum of Lease |

51 |

|

|

|

|

|

|

|

31.11 |

Quiet Enjoyment |

51 |

|

|

|

|

|

|

|

31.12 |

Force Majeure |

51 |

|

|

|

|

|

|

|

31.13 |

Surrender of Premises |

52 |

|

|

|

|

|

|

|

31.14 |

Building Directory |

52 |

|

|

|

|

|

|

|

31.15 |

Name of Building; Address |

52 |

|

|

|

|

|

|

|

31.16 |

Exhibits |

52 |

|

|

|

|

|

|

|

31.17 |

Survival of Obligations |

53 |

|

|

|

|

|

|

|

31.18 |

Time of the Essence |

53 |

|

|

|

|

|

|

|

31.19 |

Waiver of Trial By Jury; Waiver of Counterclaim |

53 |

|

|

|

|

|

|

|

31.20 |

Consent to Venue |

53 |

|

|

|

|

|

|

|

31.21 |

Financial Statements |

53 |

|

|

|

|

|

|

|

31.22 |

Subdivision; Future Ownership |

53 |

|

|

|

|

|

|

|

31.23 |

Modification of Lease |

54 |

|

|

|

|

|

|

|

31.24 |

Confidential Information |

54 |

|

|

|

|

|

|

|

31.25 |

No Option |

54 |

|

|

|

|

|

|

|

31.26 |

Independent Covenants |

54 |

|

|

|

|

|

|

|

31.27 |

First Source Hiring Program |

55 |

|

|

|

|

|

|

|

31.28 |

Compliance with Anti-Terrorism Law |

55 |

|

|

|

|

|

|

|

31.29 |

Bankruptcy of Tenant |

55 |

|

|

|

|

|

|

|

31.30 |

Rent Not Based on Income |

56 |

|

|

|

|

|

|

|

31.31 |

Counterparts |

56 |

|

|

|

|

|

|

|

31.32 |

Signage |

56 |

|

|

31.33 |

Stairways |

56 |

|

|

|

|

|

|

32. |

Communications and Computer Lines and Equipment |

57 | |

|

|

|

|

|

|

|

32.1 |

Lines and Equipment |

57 |

|

|

|

|

|

|

|

32.2 |

Interference |

58 |

|

|

|

|

|

|

|

32.3 |

General Provisions |

58 |

|

|

|

|

|

|

33. |

Option To Extend |

60 | |

|

|

|

|

|

|

|

33.1 |

Grant of Extension Option |

60 |

|

|

|

|

|

|

|

33.2 |

Terms Applicable to Premises During Extension Term |

60 |

|

|

|

|

|

|

|

33.3 |

Prevailing Market Rate |

60 |

|

|

|

|

|

|

|

33.4 |

Procedure for Determining Prevailing Market Rate |

61 |

|

|

|

|

|

|

|

33.5 |

General Provisions |

62 |

|

|

|

|

|

|

34. |

Letter of Credit |

63 | |

|

|

|

|

|

|

|

34.1 |

Letter of Credit |

63 |

|

|

|

|

|

|

|

34.2 |

Delivery of Letter of Credit |

64 |

|

|

|

|

|

|

|

34.3 |

Draws on the Letter of Credit |

65 |

|

|

|

|

|

|

|

34.4 |

Applicable Definitions |

66 |

|

|

|

|

|

|

|

34.5 |

Transfer of Letter of Credit |

67 |

|

|

|

|

|

|

|

34.6 |

Letter of Credit is Not Security Deposit |

67 |

|

|

|

|

|

|

|

34.7 |

Substitute Letter of Credit |

68 |

|

|

|

|

|

|

35. |

Tenant’s Right Of First Offer |

68 | |

|

|

|

|

|

|

|

35.1 |

Availability Notice |

68 |

|

|

|

|

|

|

|

35.2 |

Specific Offer Space |

68 |

|

|

|

|

|

|

|

35.3 |

Exercise by Tenant |

68 |

|

|

|

|

|

|

|

35.4 |

Terms Applicable to the Specific Offer Space |

69 |

|

|

|

|

|

|

|

35.5 |

No Defaults |

70 |

|

|

35.6 |

Rights Personal |

70 |

|

|

|

|

|

|

36. |

Tenant’s Right Of Expansion |

70 | |

|

|

|

|

|

|

|

36.1 |

Expansion Option |

70 |

|

|

|

|

|

|

|

36.2 |

Availability Notice |

70 |

|

|

|

|

|

|

|

36.3 |

Exercise Notice |

70 |

|

|

|

|

|

|

|

36.4 |

Terms Applicable to the Expansion Space |

70 |

|

|

|

|

|

|

|

36.5 |

Effect of Default |

71 |

|

|

|

|

|

|

|

36.6 |

Right Personal |

71 |

|

|

|

|

|

|

|

36.7 |

Effect of Exercise of Other Rights |

72 |

OFFICE LEASE

THIS LEASE is made and entered into by and between Landlord and Tenant as of the Lease Date.

Landlord and Tenant hereby agree as follows:

1. Definitions.

1.1 Terms Defined. The following terms have the meanings set forth below. Certain other terms have the meanings set forth elsewhere in this Lease.

Alterations: Alterations, additions or other improvements to the Premises made by or on behalf of Tenant (other than the initial leasehold improvements, if any, made by or on behalf of Tenant pursuant to the Work Letter).

Appraisal Panel: Appraisal Panel shall have the meaning set forth in Article 33.

Anti-Terrorism Law: Any Requirements relating to terrorism, anti-terrorism, money-laundering or anti-money laundering activities, including without limitation the United States Bank Secrecy Act, the United States Money Laundering Control Act of 1986, Executive Order No. 13224, and Title 3 of the USA Patriot Act, and any regulations promulgated under any of them.

ASA Appraiser: ASA Appraiser shall have the meaning set forth in Article 33.

Bankruptcy Code: Bankruptcy Code shall mean the United States Bankruptcy Code.

Base Building Operating Expenses and Base Building Property Taxes: The Building Operating Expenses and the Building Property Taxes allocable to the Base Year, including, for purposes of the Base Building Property Taxes, any reduction in Base Building Property Taxes obtained by Landlord after the date hereof as a result of a commonly called Proposition 8 application.

Base Year: Base Year shall have the meaning set forth in the Basic Lease Information.

Building: The high-rise office portion of the Project, commonly known as One Montgomery Tower, including related Common Areas and the Project parking garage. The Building does not include the Galleria, other than the Project parking garage.

Building Holidays: New Year’s Day, Martin Luther King, Jr. Day, President’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, the day after Thanksgiving, and Christmas Day.

Building Operating Expenses: Operating Expenses allocable to the Building. Landlord, in its commercially reasonable discretion, shall determine the portion of Operating Expenses allocable to the Building in accordance with sound real estate accounting and management practices consistently applied; provided, however, that Landlord shall make such allocation in a consistent and nondiscriminatory manner. If less than ninety-five percent (95%) of the rentable area of the Building is occupied during the Base Year or any subsequent calendar year during the Term, then actual Building Operating Expenses for the Base Year and such subsequent calendar year shall be adjusted to reflect Landlord’s reasonable estimate of Building Operating Expenses as if ninety-five percent (95%) of the entire rentable area of the Building had been occupied. Landlord’s reasonable “gross up” of such Building Operating Expenses shall be final and binding on Tenant, in the absence of manifest error, subject to Section 5.4. Notwithstanding any provision in this Lease to the contrary, in no event shall the amount of Building Operating Expenses for any calendar year subsequent to the Base Year be deemed to be less than the amount of Base Building Operating Expenses.

Building Property Taxes: Eighty-eight and Four Tenths Percent (88.4%) of Real Estate Taxes, except that to the extent the Building, or a portion thereof, is separately assessed, then One Hundred Percent (100%) of such separately assessed Real Estate Taxes. Notwithstanding any provision in this Lease to the contrary, in no event shall the amount of Building Property Taxes for any calendar year subsequent to the Base Year be deemed to be less than the amount of Base Building Property Taxes.

Building Standard Hours: 6:00 a.m. to 6:00 p.m. on weekdays and 8:00 a.m. to 2:00 p.m. on Saturdays (except Building Holidays).

Building Systems: The life-safety, electrical, mechanical, heating, ventilation, air-conditioning, plumbing, fire-protection, telecommunications, or other utility systems serving the Premises, the Building, the Project or the Galleria, as applicable.

Casualty: Fire, earthquake, or any other event of a sudden, unexpected, or unusual nature.

Casualty Discovery Date: Casualty Discovery Date shall have the meaning set forth in Section 12.1.

Claims: Any and all obligations, losses, claims, actions (including remedial or enforcement actions of any kind and administrative or judicial proceedings, suits, orders or judgments), causes of action, liabilities, penalties, damages (including consequential and punitive damages), costs and expenses (including reasonable attorneys’ and consultants’ fees and expenses).

Common Areas: Those areas of the Project designated by Landlord, in its sole discretion, from time to time for the nonexclusive use of occupants of the Project, and their agents, employees, customers, invitees and licensees, and other members of the public, including the roof-top garden terrace located in the Project. Common Areas do not include the exterior windows and walls and the roof of the Project (other than the

roof-top garden terrace), or any space in the Project (including in the Premises) used for common shafts, stacks, pipes, conduits, ducts, electrical or other utilities, telecommunication systems, or other installations for Building Systems serving the Project.

Comparable Buildings: Comparable Buildings shall have the meaning set forth in Article 33.

Comparison Leases: Comparison Leases shall have the meaning set forth in Article 33.

Confidential Information: Confidential Information shall have the meaning set forth in Section 31.24.

Construction Guide: The Post Montgomery Center Construction & Remodeling Guide, as updated, revised and/or superseded from time to time.

Control: Ownership of more than fifty percent (50%) of all of the voting stock of a corporation or more than fifty percent (50%) of all of the legal and equitable interest in any other business entity.

Encumbrance: Any ground lease or underlying lease, or the lien of any mortgage, deed of trust, or any other security instrument now or hereafter affecting or encumbering the Project, or any part thereof or interest therein.

Encumbrancer: The holder of the beneficial interest under an Encumbrance.

Environmental Laws: All Requirements relating to the environment, health and safety, or the use, generation, handling, emission, release, discharge, storage or disposal of Hazardous Materials.

Equipment: Equipment shall have the meaning set forth in Section 32.1.

Escalation Rent: Tenant’s Percentage Share of the total dollar increase, if any, in Building Operating Expenses allocable to each calendar year, or part thereof, after the Base Year, over the amount of Base Building Operating Expenses, and Tenant’s Percentage Share of the total dollar increase, if any, in Building Property Taxes allocable to the tax year or years occurring in each such calendar year over the Base Building Property Taxes for the tax year or years occurring in the Base Year.

Event of Default: Event of Default shall have the meaning set forth in Section 20.1.

Excess Rent: Excess Rent shall have the meaning set forth in Section 17.5(a).

Executive Order No. 13224: Executive Order No. 13224 on Terrorist Financing effective September 24, 2001, and relating to “Blocking Property and Prohibiting

Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism,” as may be amended from time to time.

Extension Option: Extension Option shall have the meaning set forth in Article 33.

Extension Term: Extension Term shall have the meaning set forth in Article 33.

Floor: The entire rentable area of any floor in the Building.

FSHP: The First Source Hiring Program, as described in Section 31.27.

Galleria: The retail shopping center portion of the Project, commonly known as The Crocker Galleria, including related Common Areas and the Project parking garage.

Hazardous Materials: Petroleum, asbestos, polychlorinated biphenyls, radioactive materials, radon gas, mold, or any chemical, material or substance now or hereafter defined as or included in the definition of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “pollutants,” “contaminants,” “extremely hazardous waste,” “restricted hazardous waste” or “toxic substances,” or words of similar import, under any Environmental Laws.

Impositions: Taxes, assessments, charges, excises and levies, business taxes, license, permit, inspection and other authorization fees, transit development fees, assessments or charges for housing funds, service payments in lieu of taxes and any other fees or charges of any kind at any time levied, assessed, charged or imposed by any Federal, State or local entity, (i) upon, measured by or reasonably attributable to the cost or value of Tenant’s equipment, furniture, fixtures or other personal property located in the Premises, or the cost or value of any Alterations; (ii) upon, or measured by, any Rent payable hereunder, including any gross receipts tax; (iii) upon, with respect to or by reason of the development, possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof; or (iv) upon this Lease transaction, or any document to which Tenant is a party creating or transferring any interest or estate in the Premises. Impositions do not include penalties, interest (unless included as part of an assessment payable over time), profit taxes, business taxes, capital levy taxes, estate taxes, succession taxes, recordation taxes, gift taxes, corporation taxes, documentary stamp taxes, mortgage lien taxes, transfer gains taxes, franchise, transfer, inheritance or capital stock taxes, tax increment financing or recording fees, or income taxes measured by the net income of Landlord from all sources, unless any such taxes are levied or assessed against Landlord as a substitute for, in whole or in part, any Imposition.

Indemnitees: Indemnitees shall have the meaning set forth in Section 16.1.

Inducements: Inducements shall have the meaning set forth in Section 4.5.

Interest Rate: The greater of (i) ten percent (10%) per annum, or (ii) the Prime Rate plus five percent (5%); provided, however, that if such rate of interest shall exceed

the maximum rate allowed by law, the Interest Rate shall be automatically reduced to the maximum rate of interest permitted by applicable law.

Interference: Interference shall have the meaning set forth in Section 32.1.

Land: The parcel of land shown as Lots 4, 5, 6, 7, 8, 14, 15 and 16 on that certain Parcel Map, filed February 13, 1981, at Page 6, in Book 19, of Parcel Maps, of the Official Records of the City and County of San Francisco, California.

Landlord’s Determination: Landlord’s Determination shall have the meaning set forth in Article 33.

Lease Year: Each consecutive twelve (12) month period during the Term of this Lease, provided that the last Lease Year shall end on the Expiration Date.

Lines: Lines shall have the meaning set forth in Section 32.1.

MAI appraiser: MAI appraiser shall have the meaning set forth in Article 33.

Major Alterations: Alterations which (i) may affect the structural portions of the Project, (ii) may affect or interfere with the Project roof, walls, elevators, heating, ventilating, air conditioning, electrical, plumbing, telecommunications, security, life-safety or other Building Systems, (iii) may affect the use and enjoyment by other tenants or occupants of the Project of their premises, (iv) may be visible from outside the Premises, (v) utilize materials or equipment which are inconsistent with Landlord’s standard building materials and equipment for the Project, (vi) result in the imposition on Landlord of any requirement to make any alterations or improvements to any portion of the Project (including handicap access and life safety requirements) in order to comply with Requirements, or (vii) materially increase the cost to clean, maintain or repair, or increase the cost to relet, the Premises.

Minor Alterations: Alterations (i) that are not Major Alterations, (ii) that do not require the issuance of a building or other governmental permit, authorization or approval, (iii) that do not require work to be performed outside the Premises in order to comply with Requirements, and (iv) the cost of which does not exceed Fifty Thousand Dollars ($50,000.00) in any one instance.

Negotiation Period: Negotiation Period shall have the meaning set forth in Article 33.

Net Worth: The excess of total assets over total liabilities, determined in accordance with generally accepted accounting principles, excluding, however, from the determination of total assets, goodwill and other intangibles.

Non-Standard Improvements: Unusual or atypical office improvements, including without limitation, raised computer room or server room floors, trading floors, floor penetration (other than customary cabling and electrical), server rooms larger than 1,000 rentable square feet in the aggregate, stairways, vaults, restrooms (other than base

Building restrooms), showers (unless otherwise provided in this Lease), and other improvements or alterations which are of such specialized nature or application that they are not reasonably suited for use by a successor occupant of the Premises using the Premises for general office uses.

Operating Expenses: All costs of management, operation, ownership, maintenance and repair of the Project, including: (i) salaries, wages, bonuses, other compensation and all payroll burden of employees, payroll, social security, worker’s compensation, unemployment and similar taxes and impositions with respect to such employees, and the cost of providing disability or other benefits imposed by law or otherwise with respect to such employees; (ii) property management fees and expenses, including Landlord’s fees and expenses for any management performed by it; provided, however, that any such fees shall not exceed three percent (3%) of the annual gross revenue of the Project; (iii) rental and other costs and expenses for Landlord’s, property management, and marketing offices in the Project; (iv) electricity, natural gas, water, waste disposal and recycling, sewer, heating, lighting, air conditioning and ventilating and other utilities; (v) janitorial, maintenance, security, life safety and other services, such as alarm service, window cleaning, elevator maintenance, landscaping and uniforms (and the cleaning and/or replacement thereof) for personnel providing services; (vi) materials, supplies, tools and rental equipment; (vii) license, permit and inspection fees and costs; (viii) insurance premiums and costs (including earthquake and/or flood if so elected by Landlord in its sole discretion), and the deductible portion of any insured loss under Landlord’s insurance or the amount that would be the deductible portion of such loss but for self-insurance thereof by Landlord; (ix) sales, use and excise taxes; (x) legal, accounting and other professional services for the Project, including costs, fees and expenses of contesting the validity or applicability of any law, ordinance, rule, regulation or order relating to the Building; (xi) the cost of supplies and services such as telephone, courier services, postage and stationery supplies; (xii) normal repair and replacement of worn-out equipment, facilities and installations; (xiii) depreciation on personal property, including exterior window draperies provided by Landlord and Common Area floor coverings, and/or rental costs of leased furniture, fixtures, and equipment; and (xiv) expenditures for capital improvements made at any time to the Project (A) that are intended in Landlord’s judgment as labor saving devices, or to reduce or eliminate other Operating Expenses or to effect other economies in the operation, maintenance, or management of the Project, or (B) that are necessary or appropriate in Landlord’s judgment for the health and safety of occupants of the Project, or (C) that are necessary under any Requirements which were not applicable to the Project at the time it was constructed, or (D) that are replacements of items which Landlord is obligated to maintain, all amortized over such reasonable period as Landlord shall determine at an interest rate of ten percent (10%) per annum, or, if applicable, the rate paid by Landlord on funds borrowed for the purpose of constructing or installing such capital improvements, except that Landlord may treat as costs chargeable in the calendar year incurred, and not as capital expenditures, any item that is less than two percent (2%) of Operating Expenses estimated by Landlord for the calendar year in question. Operating Expenses do not include: (1) Real Estate Taxes; (2) legal fees, brokers’ commissions, advertising expenses, tenant improvements, attorneys fees’ and costs and lease concessions (including rental abatement and construction allowances) or other costs

incurred in the negotiation, termination, or extension of leases or in proceedings involving a specific tenant including without limitation marketing concessions, tenant improvement allowances, lease takeover payments, third-party consultant fees; (3) depreciation, except as set forth above; (4) except as set forth above, interest, principal, points and fees, amortization or other costs associated with any debt and rent payable under any lease to which this Lease is subject and all costs and expenses associated with any such debt or lease and any ground lease rent, irrespective of whether this Lease is subject or subordinate thereto; costs of alterations, repairs, capital improvements, equipment replacement and other items which under generally accepted accounting principles are properly classified as capital expenditures, except that the annual amortization of these costs shall be included to the extent otherwise expressly permitted in this Lease; (5) capital items, except as set forth above; (6) costs of decorating, redecorating or special cleaning or other services not provided on a regular basis to tenants of the Building; (7) costs related to the entity constituting Landlord from time to time; (8) financing costs, fees and interest, including without limitation payments under any ground lease; (9) the cost of any items for which Landlord is reimbursed by insurance or otherwise compensated by parties other than tenants of the Building pursuant to clauses similar to this paragraph; (10) any operating expense representing an amount paid to an affiliate of, or entity related to, Landlord which is in excess of the amount which would be paid in the absence of such relationship; (11) the cost of alterations of space or tenant improvements in the Building for space leased to other tenants; (12) the costs of any Hazardous Materials removal or remediation required to be performed by Landlord, except for the disposal, removal or remediation of Hazardous Materials brought on the Project in compliance with applicable Requirements performed by Landlord in connection with the ordinary maintenance and operation of the Project; (13) bad debt or rent loss; and (14) costs related to any project or building other than the Building; (15) expenses incurred by Landlord to lease space to new tenants or to retain existing tenants, including leasing commissions, advertising and promotional expenditures; (16) expenses incurred by Landlord to resolve disputes or to enforce or negotiate lease terms with prospective or existing tenants or in connection with any financing, sale or syndication of the Building; (17) expenses incurred for the repair, maintenance or operation of any parking garage, including but not limited to, salaries and benefits of any attendants, and taxes; (18) expenses for the replacement of any item covered under warranty, to the extent of the warranty; (19) costs to correct any penalty or fine incurred by Landlord due to Landlord’s violation of any federal, state or local law or regulation and any interest or penalties due for late payment by Landlord of any of the Operating Expenses; (20) expenses for any item or service not provided to Tenant but exclusively to certain other tenants in the Building; (21) salaries of, benefits and other compensation paid to (a) employees above the grade of building manager, and (b) employees to the extent their time is not spent directly in the operation of the Building; (22) Landlord’s general corporate overhead and administrative expenses; (23) the acquisition cost of sculptures, paintings and other objects of art; (24) costs of repair necessitated by Landlord’s gross negligence or willful misconduct; and (25) costs to remedy a condition existing prior to the Commencement Date which an applicable governmental authority, if it had knowledge of such condition prior to the Commencement Date and if such condition was not subject to a variance or a

grandfathered code waiver exception, would have then required to be remedied pursuant to the then current Applicable Laws in their form existing as of the Commencement Date unless and to the extent caused by the acts or omissions of Tenant or the Tenant Parties. In addition, Operating Expenses for the Base Year shall not include market-wide labor-rate increases due to extraordinary circumstances, such as boycotts and strikes, nor utility rate increases due to extraordinary circumstances, including, but not limited to, conservation surcharges, boycotts, embargoes or other shortages.

Option Notice: Option Notice shall have the meaning set forth in Article 33.

Pre-Default Inducements: Pre-Default Inducements shall have the meaning set forth in Section 4.5.

Pre-Existing Hazardous Materials: Hazardous Materials (classified as such on the Lease Date) existing in or on the Premises or the Project on the date possession of the Premises is delivered to Tenant.

Prevailing Market Rate: Prevailing Market Rate shall have the meaning set forth in Article 33.

Prime Rate: The prime rate (or base rate) reported in the Money Rates column or section of The Wall Street Journal as being the base rate on corporate loans at large U.S. money center commercial banks (whether or not such rate has actually been charged by any such bank) on the first day on which The Wall Street Journal is published in the month in which the subject sums are payable or incurred.

Prohibited Person: (i) A person or entity that is listed in the Annex to Executive Order No. 13224, or a person or entity owned or controlled by an entity that is listed in the Annex to Executive Order No. 13224; (ii) a person or entity with whom Landlord is prohibited from dealing or otherwise engaging in any transaction by any Anti-Terrorism Law; or (iii) a person or entity that is named as a “specially designated national and blocked person” on the most current list published by the U.S. Treasury Department Office of Foreign Assets Control at its official website, http://www.treas.gov/ofac/t11sdn.pdf, or at any replacement website or other official publication of such list.

Project: The Land, all buildings and other improvements at any time located on the Land (including the Building and the Galleria), and all appurtenances related thereto, including the roof-top garden terrace and loading dock area, collectively commonly known as Post Montgomery Center.

Real Estate Taxes: Taxes, assessments and charges now or hereafter levied or assessed upon, or with respect to, the Project, or any personal property of Landlord used in the operation thereof or located therein, or Landlord’s interest in the Project or such personal property, by any Federal, State or local entity, including: (i) all real property taxes and general, special, supplemental and escape assessments; (ii) charges, fees or assessments for transit, public improvements, employment, job training, housing, day care, open space, art, police, fire or other governmental services or benefits; (iii) service

payments in lieu of taxes; (iv) any tax, fee or excise on the use or occupancy of any part of the Project; (v) any tax, assessment, charge, levy or fee for environmental matters, or as a result of the imposition of mitigation measures, such as parking taxes, employer parking regulations or fees, charges or assessments due to the treatment of the Project, or any portion thereof or interest therein, as a source of pollution or stormwater runoff; (vi) any other tax, fee or excise, however described, that may be levied or assessed as a substitute for, or as an addition to, in whole or in part, any other Real Estate Taxes; and (vii) consultants’ and attorneys’ fees and expenses incurred in connection with proceedings to contest, determine or reduce Real Estate Taxes. Real Estate Taxes do not include: (A) franchise, transfer, inheritance or capital stock taxes, or income taxes measured by the net income of Landlord from all sources, unless any such taxes are levied or assessed against Landlord as a substitute for, in whole or in part, any Real Estate Tax; and (B) penalties, fines, interest or charges due for late payment of Real Estate Taxes by Landlord. If any Real Estate Taxes are payable, or may at the option of the taxpayer be paid, in installments, such Real Estate Taxes shall, together with any interest that would otherwise be payable with such installment, be deemed to have been paid in installments, amortized over the maximum time period allowed by applicable law.

Related Company: (i) An entity which controls, is controlled by, or is under common control with Tenant; (ii) an entity into or with which Tenant is merged or consolidated, by purchase, reorganization, or otherwise; (iii) an entity to which at least sixty percent (60%) of Tenant’s assets are transferred; (iv) an entity created by the sale of Tenant’s stock, pursuant to Section 17.9(a), or (v) Tenant, where Tenant admits additional members in connection with obtaining additional equity investment in Tenant, so long as the identity of the persons responsible for the operation and management of the business of Tenant does not change.

Rent: Base Rent, Escalation Rent and all other additional charges and amounts payable by Tenant in accordance with this Lease.

Rent Payment Direction: Rent Payment Direction shall have the meaning set forth in Section 21.3.

Requirements: All laws, including Environmental Laws, ordinances, rules, regulations, orders, decrees, permits, and requirements of courts and governmental authorities now or hereafter in effect, including the Americans With Disabilities Act (42 U.S.C. § 12101 et seq.) and Title 24 of the California Code of Regulations and all regulations and guidelines promulgated thereunder; the provisions of any insurance policy carried by Landlord or Tenant on any portion of the Project, or any property therein; the requirements of any independent board of fire underwriters; any directive or certificate of occupancy issued pursuant to any law by any public officer or officers applicable to the Project; the provisions of all recorded documents affecting any portion of the Project (including the Declaration of Crocker Properties, Inc., regarding building electric lighting, recorded August 26, 1981, as modified by Amended and Restated Declaration, dated December 5, 1984, recorded December 5, 1984), as any such document may be amended from time to time; and all life safety programs, procedures and rules from time to time or at any time implemented or promulgated by Landlord.

Target Delivery Date: The date set forth in the Basic Lease Information as the Target Delivery Date.

Tenant Parties: Tenant, all persons or entities claiming by, through or under Tenant, and their respective employees, agents, contractors, licensees, invitees, representatives, officers, directors, shareholders, partners, and members.

Tenant’s Determination: Tenant’s Determination shall have the meaning set forth in Article 33.

Tenant Improvements: Shall have the meaning set forth in the Work Letter.

Tenant’s Percentage Share: The percentage set forth in the Basic Lease Information as Tenant’s Percentage Share, as adjusted by Landlord from time to time to take into account a remeasurement of or changes in the physical size of the Premises, the Building or the Project, whether such changes in size are due to an addition to or a sale or conveyance of a portion of the Project or otherwise. Landlord reserves the right to remeasure the Premises and the Building effective upon the commencement of the Extension Term in accordance with the then current measurement standards promulgated by the Building Owners and Managers Association (BOMA) or other generally accepted measurement standards and thereafter to adjust Tenant’s Percentage Share accordingly.

USA Patriot Act: The “Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001” (Public Law 107-56), as may be amended from time to time.

Wattage Allowance: Six (6) watts per rentable square foot, with three 200 amp, 208 volt, 3-phase panel boards, with 42 circuits each for Tenant’s outlets and machinery.

Work Letter: The agreement attached hereto as Exhibit C, which sets forth the respective responsibilities of Landlord and Tenant regarding the design and construction of alterations, additions and improvements to prepare the Premises for occupancy by Tenant.

1.2 Basic Lease Information. The Basic Lease Information is incorporated into and made a part of this Lease. Each reference in this Lease to any Basic Lease Information shall mean the applicable information set forth in the Basic Lease Information, except that in the event of any conflict between an item in the Basic Lease Information and this Lease, this Lease shall control.

1.3 Certain Defined Terms. The parties acknowledge that (i) the rentable area of the Premises and the Building have been finally determined by the parties for all purposes under this Lease, including the calculation of Tenant’s Percentage Share, and will not, except as otherwise provided in this Lease, be changed, and (ii) the percentage for allocation of Building Property Taxes is conclusive and binding on the parties. The rentable areas of the Premises and the Building have been measured substantially in accordance with the Standard Method for Measuring Floor Area in Office Buildings, ANSI Z65.1 — 1996. If any space is added to or

deleted from the Premises, or any abatement of Rent is based on rentable area, the rentable area for the added or deleted space, or such abatement, shall be determined by Landlord.

2. Lease of Premises. Landlord leases to Tenant and Tenant leases from Landlord the Premises, together with the non-exclusive right to use, in common with others, the Common Areas, subject to the terms, covenants and conditions set forth in this Lease. Landlord reserves from the leasehold estate hereunder (i) all exterior walls and windows bounding the Premises, (ii) all space located within the Premises for common shafts, stacks, pipes, conduits, ducts, utilities, telecommunications systems, and other installations for Building Systems, the use thereof and access thereto, and (iii) the right to install, remove or relocate any of the foregoing for service to any part of the Project, including the premises of other tenants of the Building; provided that such installation, removal or relocation shall not (A) unreasonably interfere with the use of the Premises, (B) materially and adversely affect the Tenant’s improvements to the Premises, or (C) reduce the square footage of the Premises.

2.1 Bicycle Storage Room. The Premises shall include a room for bicycle storage located on the third floor of the Building containing approximately 320 rentable square feet in a location to be reasonably designated by Landlord (the “Bicycle Storage Room”). Tenant shall pay Base Rent for the Bicycle Storage Room in the amount of $533.33 per month during the first forty-two (42) months of the Term and in the amount of $586.67 per month during the balance of the initial Term. If Tenant exercises the Extension Option, the Base Rent per rentable square foot for the Bicycle Storage Room during the Extension Term shall be equal to 50% of the Prevailing Market Rate per rentable square foot determined for the balance of the Premises pursuant to Article 33 for the same period. The rentable area of the Bicycle Storage Room shall be taken into account as part of the Premises for purposes of determining Tenant’s Percentage Share. Tenant shall not be entitled to any Construction Allowance or other allowances with respect to the Bicycle Storage Room. Tenant shall have the right to transport bicycles into and out of the Bicycle Storage Room via the freight elevator for the Building.

3. Term; Condition and Acceptance of Premises.

3.1 Delivery of Premises; Term Commencement. This Lease shall be effective as of the Lease Date. The Term of this Lease shall commence on the Commencement Date and end on the Expiration Date, unless sooner terminated or extended pursuant to the provisions of this Lease. The design and construction of any alterations, additions or improvements that Tenant may deem necessary or appropriate to prepare the Premises for occupancy by Tenant shall be governed by the Work Letter. Except as provided in the Work Letter and this Lease, Tenant agrees to accept the Premises in their “as-is” condition, without any representations or warranties by Landlord, and with no obligation of Landlord to make any alterations or improvements to the Premises or to provide any tenant improvement allowance. If Landlord is responsible for constructing any alterations, additions or improvements pursuant to the Work Letter, then subject to any contrary provisions in the Work Letter, Landlord shall cause the work to be performed by Landlord to be “substantially complete” (as defined in the Work Letter) prior to delivery of possession of the Premises to Tenant, and Landlord and Tenant shall perform a walk-through of the Premises upon Landlord’s substantial completion of the Landlord Work (as defined in the Work Letter), and prior to Tenant’s commencement of the Tenant’s Work (as defined in the Work Letter), in order to identify any punchlist items and any defective

work or systems; provided, however, such walk-through shall not bar Tenant from making a later claim for any latent or patent defects in (i) Landlord’s Work, or (ii) the condition of the Premises. Landlord shall exercise commercially reasonable efforts (without any obligation to engage overtime labor or commence any litigation) to deliver possession of the Premises to Tenant in the condition specified in this Section 3.1 on or before the Target Delivery Date. If Landlord, for any reason whatsoever, cannot deliver possession of the Premises to Tenant in the condition specified in this Section 3.1 on or before the Target Delivery Date, this Lease shall not be void or voidable, and Landlord shall not be in default or liable to Tenant for any loss or damage resulting therefrom, subject to Tenant’s right to extend the Commencement Date, as set forth below. If Landlord does not deliver the Premises with Landlord’s Work other than the Post Delivery Work and the 5th Floor Corridor Work substantially completed by the Target Delivery Date applicable to it and/or if Landlord does not complete the 5th Floor Corridor Work by the Target Delivery Date applicable to it, then the Commencement Date shall be delayed by one day for each day that Tenant is delayed in completing the Tenant Improvements after May 1, 2013, due to Landlord’s failure to complete the applicable work by the applicable date. Within ten (10) days after request, Tenant shall execute and deliver to Landlord a Confirmation of Lease Term in the form of Exhibit D attached hereto.

3.2 Early Entry. Following the Delivery Date, Tenant shall have the right to enter the Premises prior to the Rent Commencement Date, without the obligation to pay Base Rent or any other Rent (other than specific charges made for additional services requested by Tenant), for the purposes of performing the Tenant Work (as described in the Work Letter), installing Tenant’s furniture, fixtures & equipment (“FF&E”), otherwise preparing the Premises for Tenant’s move-in, and for general early occupancy (collectively, the “Early Entry”). If Tenant exercises its Early Entry rights, or takes possession of or enters into the Premises prior to the Commencement Date for any other reason, such possession or entry shall be subject to all of the terms, covenants and conditions of this Lease, including Tenant’s insurance obligations contained in Article 14 and Tenant’s indemnity obligations contained in Article 16, but excluding Tenant’s obligation to pay Base Rent or any other Rent (other than specific charges made for additional services requested by Tenant). In no event will Tenant’s Early Entry constitute or trigger the Rent Commencement Date.

4. Rent.

4.1 Obligation to Pay Base Rent. Tenant shall pay Base Rent to Landlord during the Term, in advance, in equal monthly installments, commencing on the Commencement Date, and thereafter on or before the first day of each calendar month during the Term; provided, however, that upon signing this Lease, Tenant shall pay to Landlord an amount equal to the Base Rent for the fifth full month of the Term, which amount shall be applied to the Base Rent owing for the fifth month of the Term. If the Commencement Date is other than the first day of a calendar month, the installment of prepaid Base Rent for the first month of the Term shall be prorated on the basis of a thirty (30) day month, and the balance shall be credited to Base Rent owing for the second month of the Term. If the Expiration Date is other than the first day of a calendar month, or if this Lease shall be terminated as of a day other than the last day of a calendar month (except in the case of an Event of Default), the installment of Base Rent for the last fractional month of the Term shall be prorated on the basis of a thirty (30) day month.

4.2 Manner of Rent Payment. All Rent shall be paid by Tenant without notice, demand, abatement, deduction or offset, in lawful money of the United States of America, and if payable to Landlord, at Landlord’s Address, or to such other person or at such other place as Landlord may from time to time designate by notice to Tenant.

4.3 Additional Rent. All Rent not characterized as Base Rent or Escalation Rent shall constitute additional rent, and if payable to Landlord shall, unless otherwise specified in this Lease, be due and payable fifteen (15) days after Tenant’s receipt of Landlord’s invoice therefor.

4.4 Late Payment of Rent; Interest. Tenant acknowledges that late payment by Tenant of any Rent will cause Landlord to incur administrative costs not contemplated by this Lease, the exact amount of which is extremely difficult and impracticable to ascertain based on the facts and circumstances pertaining as of the Lease Date. Accordingly, if Tenant fails to pay Rent when due (and such failure continues for a period of five (5) business days after receipt by Tenant of a notice of such failure), then Tenant shall pay to Landlord a late charge equal to three percent (3%) of such Rent; provided, however, that the foregoing notice and grace period shall not apply during the remainder of any twelve (12) month period if Landlord has previously sent to Tenant a notice of failure to pay any Rent one (1) time in such twelve (12) month period and during such twelve (12) month period such late charge shall be due if Tenant fails to pay Rent within five (5) business days after such Rent is due. Any Rent, other than late charges, due Landlord under this Lease, if not paid when due, shall also bear interest at the Interest Rate from the date due until paid. The parties acknowledge that such late charge and interest represent a fair and reasonable estimate of the administrative costs and loss of use of funds Landlord will incur by reason of a late Rent payment by Tenant, but Landlord’s acceptance of such late charge and/or interest shall not constitute a waiver of an Event of Default with respect to such Rent or prevent Landlord from exercising any other rights and remedies provided under this Lease.

4.5 Additional Rent Upon Tenant’s Failure to Perform. Landlord and Tenant acknowledge that to induce Tenant to enter into this Lease, and in consideration of Tenant’s agreement to perform all of the terms, covenants and conditions to be performed by Tenant under this Lease, as and when performance is due during the Term, Landlord has incurred (or will incur) significant costs, including, without limitation, the following: (i) expenditures incurred to prepare the Premises for Tenant’s occupancy, (ii) commissions to Landlord’s Broker and/or Tenant’s Broker, (iii) attorneys’ fees and related costs incurred and/or paid by Landlord in connection with the negotiation and preparation of this Lease, and/or (iv) rent abatements or concessions (collectively, the “Inducements”). Landlord and Tenant further acknowledge that Landlord would not have granted the Inducements to Tenant but for Tenant’s agreement to perform all of the terms, covenants, and conditions to be performed by it under this Lease for the entire Term, and that Landlord’s agreement to incur such expenditures and grant such inducements is, and shall remain, conditioned upon Tenant’s faithful performance of all of the terms, covenants and conditions to be performed by Tenant under this Lease for the entire Term. Accordingly, if an Event of Default shall occur hereunder, Landlord shall be relieved of any unfulfilled obligation to grant Inducements hereunder, or to incur further expenses in connection therewith, and Tenant shall pay as liquidated damages for Landlord’s granting the Inducements and not as a penalty, within thirty (30) days after the occurrence of the Event of Default, as Additional Rent, the unamortized portion of those Inducements incurred or granted prior to the

date of the Event of Default (the “Pre-Default Inducements”). Landlord may or, at Tenant’s request, shall, after the occurrence of an Event of Default, forward a statement to Tenant setting forth the amount of the Pre-Default Inducements, but the failure to deliver such a statement shall not be or be deemed to be a waiver of the right to collect the Pre-Default Inducements or extend the date upon which such amount shall be due and payable.

4.6 Rent Abatement. As of the Commencement Date, the first three and one half (3½) months of Base Rent shall be abated. During such abatement period, Tenant shall be responsible for the payment of all of its other monetary obligations under this Lease.

5. Calculation and Payments of Escalation Rent. During each full or partial calendar year of the Term subsequent to the Base Year, Tenant shall pay to Landlord Escalation Rent in accordance with the following procedures:

5.1 Payment of Estimated Escalation Rent. During December of the Base Year and December of each subsequent calendar year, or as soon thereafter as practicable, Landlord shall give Tenant notice of its estimate of Escalation Rent due for the ensuing calendar year. On or before the first day of each month during each ensuing calendar year, Tenant shall pay to Landlord in advance, in addition to Base Rent, one-twelfth (1/12th) of such estimated Escalation Rent, unless such notice is not given in December, in which event Tenant shall continue to pay on the basis of the prior calendar year’s estimate until the month after such notice is given, and subsequent payments by Tenant shall be based on Landlord’s notice. With the first monthly payment based on Landlord’s notice, Tenant shall also pay the difference, if any, between the amount previously paid for such calendar year and the amount which Tenant would have paid through the month in which such notice is given, based on Landlord’s noticed estimate. If at any time Landlord reasonably determines that the Escalation Rent for the current calendar year will vary from Landlord’s estimate, Landlord may, by notice to Tenant, revise its estimate for such calendar year, and subsequent payments by Tenant for such calendar year shall be based upon such revised estimate.

5.2 Escalation Rent Statement and Adjustment. Within one hundred twenty (120) days after the close of each calendar year, or as soon thereafter as practicable, Landlord shall deliver to Tenant a statement of the actual Escalation Rent for such calendar year, showing in reasonable detail (i) the Building Operating Expenses and the Building Property Taxes comprising the actual Escalation Rent, and (ii) payments made by Tenant on account of Building Operating Expenses and Building Property Taxes for such calendar year. If Landlord’s statement shows that Tenant owes an amount that is more than the payments previously made by Tenant for such calendar year, Tenant shall pay the difference to Landlord within thirty (30) days after delivery of the statement. If Landlord’s statement shows that Tenant owes an amount that is less than the payments previously made by Tenant for such calendar year, Landlord shall credit the difference first against any sums then owed by Tenant to Landlord and then against the next payment or payments of Rent due Landlord, except that if a credit amount is due Tenant after the termination of this Lease, Landlord shall pay to Tenant any excess remaining after Landlord credits such amount against any sums owed by Tenant to Landlord. Notwithstanding any provision in this Lease to the contrary, however, in no event shall any decrease in Building Operating Expenses or Building Property Taxes below the Base Building Operating Expenses or Base Building Property Taxes, respectively, entitle Tenant to any refund, decrease in Base Rent,

or any credit against sums due under this Lease. Subject to Section 5.4, all annual statements shall be conclusive and binding upon Tenant; provided, however, that Landlord may revise the annual statement for any calendar year if Landlord first receives invoices from third parties, tax bills or other information relating to adjustments to Building Operating Expenses or Building Property Taxes allocable to such calendar year after the initial issuance of such annual statement, and/or the amount of Building Operating Expenses or Building Property Taxes allocable to the Base Year is subsequently adjusted.

5.3 Proration for Partial Year. If the Commencement Date is other than the first day of a calendar year or if this Lease terminates other than on the last day of a calendar year (other than due to an Event of Default), the amount of Escalation Rent for such fractional calendar year shall be prorated on the basis of twelve (12) thirty (30) day months in each calendar year. Upon such termination, Landlord may, at its option, calculate the adjustment in Escalation Rent prior to the time specified in Section 5.2 above.

5.4 Audit Right.

(a) Landlord shall respond to any informal inquiries by Tenant regarding the Escalation Rent within thirty (30) days after receipt of same. In addition, Tenant shall have one hundred twenty (120) days after receipt of Landlord’s Statement (including any revised Landlord’s Statement) to notify Landlord in writing that Tenant disputes the correctness of Landlord’s Statement (“Dispute Notice”). If Tenant timely delivers a Dispute Notice to Landlord, Tenant’s auditor (“Tenant’s Auditor”) shall have the right, upon reasonable prior notice, during normal business hours, to examine all relevant records of Landlord concerning the year that is covered by Landlord’s Statement at the Building management office or other location in San Francisco designated by Landlord. Tenant’s Auditor shall be subject to Landlord’s prior written approval, which shall not be unreasonably, withheld or delayed. Without limiting the generality of the preceding sentence, Tenant’s Auditor must have at least seven (7) years of experience reviewing financial operating records of comparable office buildings in the San Francisco downtown financial district and must not be retained on a contingency fee basis. The inspection of Landlord’s records must be completed within fifteen (15) business days after Tenant’s Auditor commences its inspection and within sixty (60) days after Landlord’s receipt of the Dispute Notice. Tenant agrees to keep, and to cause Tenant’s Auditor to keep, all information obtained by Tenant or Tenant’s Auditor confidential. If requested by Landlord, Tenant shall require Tenant’s Auditor to sign and deliver a confidentiality agreement to Landlord, reasonably acceptable in form and content to Landlord, prior to Landlord making its books and records available for inspection. If Tenant fails to deliver a Dispute Notice to Landlord within one hundred twenty (120) days after receipt of Landlord’s Statement, Tenant shall have no further right to dispute the correctness of Landlord’s Statement.

(b) If, following the examination of Landlord’s records by Tenant’s Auditor, Tenant continues to object to Landlord’s Statement, the parties shall meet and attempt in good faith to resolve the dispute. If it is finally determined (by agreement between the parties, voluntary mediation or arbitration, settlement or court order) that Landlord’s Statement was incorrect, the appropriate party shall pay to the other party the deficiency or overpayment, as applicable, within thirty (30) days after said determination, or at Landlord’s option, any overpayment by Tenant shall be credited against the next installment(s) of Rent payable by

Tenant, or refunded to Tenant within sixty (60) days if the Lease has expired or otherwise been terminated. All costs and expenses of Tenant’s Auditor shall be paid by Tenant unless it is finally determined that Landlord’s Statement overstated the actual Operating Expenses and Real Estate Taxes for the applicable calendar year by five percent (5%) or more, in which case Landlord shall pay the reasonable costs of Tenant’s Auditor for the audit of Landlord’s records, up to a maximum amount of Five Thousand Dollars ($5,000.00).