Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lincolnway Energy, LLC | a8-kseptember2012newsletter.htm |

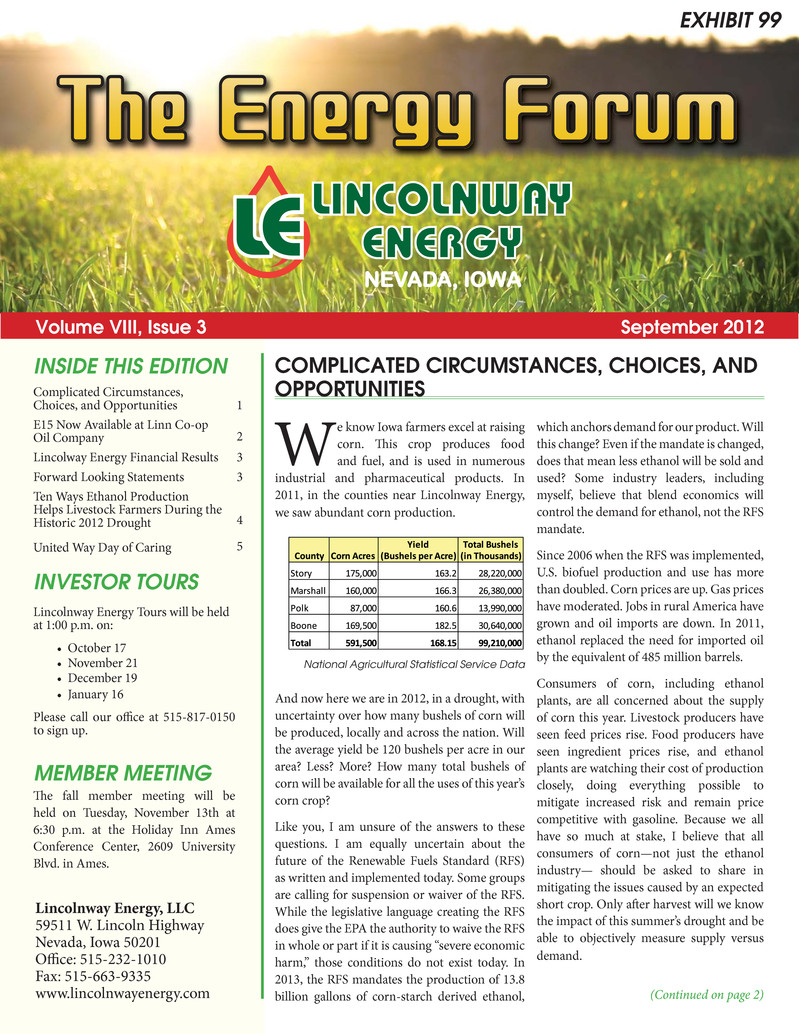

Volume VI, Issue 3 Spring 2010 NEVADA, IOWA Volume VIII, Issue 3 September 2012 INSIDE THIS EDITION Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201 Offi ce: 515-232-1010 Fax: 515-663-9335 www.lincolnwayenergy.com INVESTOR TOURS COMPLICATED CIRCUMSTANCES, CHOICES, AND OPPORTUNITIES We know Iowa farmers excel at raising corn. Th is crop produces food and fuel, and is used in numerous industrial and pharmaceutical products. In 2011, in the counties near Lincolnway Energy, we saw abundant corn production. National Agricultural Statistical Service Data And now here we are in 2012, in a drought, with uncertainty over how many bushels of corn will be produced, locally and across the nation. Will the average yield be 120 bushels per acre in our area? Less? More? How many total bushels of corn will be available for all the uses of this year’s corn crop? Like you, I am unsure of the answers to these questions. I am equally uncertain about the future of the Renewable Fuels Standard (RFS) as written and implemented today. Some groups are calling for suspension or waiver of the RFS. While the legislative language creating the RFS does give the EPA the authority to waive the RFS in whole or part if it is causing “severe economic harm,” those conditions do not exist today. In 2013, the RFS mandates the production of 13.8 billion gallons of corn-starch derived ethanol, which anchors demand for our product. Will this change? Even if the mandate is changed, does that mean less ethanol will be sold and used? Some industry leaders, including myself, believe that blend economics will control the demand for ethanol, not the RFS mandate. Since 2006 when the RFS was implemented, U.S. biofuel production and use has more than doubled. Corn prices are up. Gas prices have moderated. Jobs in rural America have grown and oil imports are down. In 2011, ethanol replaced the need for imported oil by the equivalent of 485 million barrels. Consumers of corn, including ethanol plants, are all concerned about the supply of corn this year. Livestock producers have seen feed prices rise. Food producers have seen ingredient prices rise, and ethanol plants are watching their cost of production closely, doing everything possible to mitigate increased risk and remain price competitive with gasoline. Because we all have so much at stake, I believe that all consumers of corn—not just the ethanol industry— should be asked to share in mitigating the issues caused by an expected short crop. Only aft er harvest will we know the impact of this summer’s drought and be able to objectively measure supply versus demand. (Continued on page 2) Complicated Circumstances, Choices, and Opportunities E15 Now Available at Linn Co-op Oil Company Lincolway Energy Financial Results Forward Looking Statements Ten Ways Ethanol Production Helps Livestock Farmers During the Historic 2012 Drought United Way Day of Caring 1 2 3 3 4 5 Lincolnway Energy Tours will be held at 1:00 p.m. on: • October 17 • November 21 • December 19 • January 16 Please call our offi ce at 515-817-0150 to sign up. MEMBER MEETING Th e fall member meeting will be held on Tuesday, November 13th at 6:30 p.m. at the Holiday Inn Ames Conference Center, 2609 University Blvd. in Ames. EXHIBIT 99

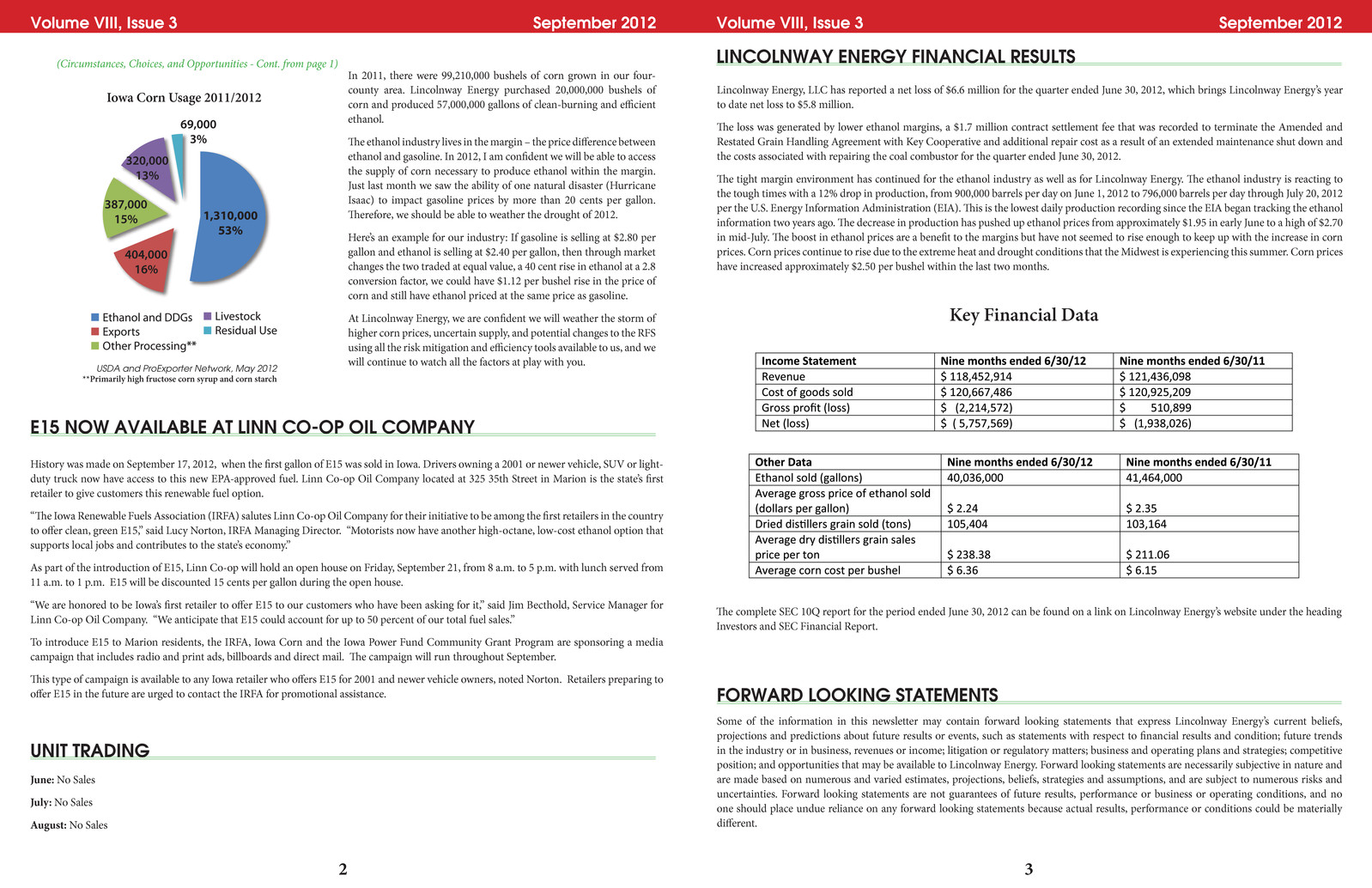

Volume VIII, Issue 3 September 2012 Volume VIII, Issue 3 September 2012 2 3 Iowa Corn Usage 2011/2012 USDA and ProExporter Network, May 2012 **Primarily high fructose corn syrup and corn starch FORWARD LOOKING STATEMENTS Some of the information in this newsletter may contain forward looking statements that express Lincolnway Energy’s current beliefs, projections and predictions about future results or events, such as statements with respect to fi nancial results and condition; future trends in the industry or in business, revenues or income; litigation or regulatory matters; business and operating plans and strategies; competitive position; and opportunities that may be available to Lincolnway Energy. Forward looking statements are necessarily subjective in nature and are made based on numerous and varied estimates, projections, beliefs, strategies and assumptions, and are subject to numerous risks and uncertainties. Forward looking statements are not guarantees of future results, performance or business or operating conditions, and no one should place undue reliance on any forward looking statements because actual results, performance or conditions could be materially diff erent. Lincolnway Energy, LLC has reported a net loss of $6.6 million for the quarter ended June 30, 2012, which brings Lincolnway Energy’s year to date net loss to $5.8 million. Th e loss was generated by lower ethanol margins, a $1.7 million contract settlement fee that was recorded to terminate the Amended and Restated Grain Handling Agreement with Key Cooperative and additional repair cost as a result of an extended maintenance shut down and the costs associated with repairing the coal combustor for the quarter ended June 30, 2012. Th e tight margin environment has continued for the ethanol industry as well as for Lincolnway Energy. Th e ethanol industry is reacting to the tough times with a 12% drop in production, from 900,000 barrels per day on June 1, 2012 to 796,000 barrels per day through July 20, 2012 per the U.S. Energy Information Administration (EIA). Th is is the lowest daily production recording since the EIA began tracking the ethanol information two years ago. Th e decrease in production has pushed up ethanol prices from approximately $1.95 in early June to a high of $2.70 in mid-July. Th e boost in ethanol prices are a benefi t to the margins but have not seemed to rise enough to keep up with the increase in corn prices. Corn prices continue to rise due to the extreme heat and drought conditions that the Midwest is experiencing this summer. Corn prices have increased approximately $2.50 per bushel within the last two months. LINCOLNWAY ENERGY FINANCIAL RESULTS Key Financial Data Th e complete SEC 10Q report for the period ended June 30, 2012 can be found on a link on Lincolnway Energy’s website under the heading Investors and SEC Financial Report. UNIT TRADING In 2011, there were 99,210,000 bushels of corn grown in our four- county area. Lincolnway Energy purchased 20,000,000 bushels of corn and produced 57,000,000 gallons of clean-burning and effi cient ethanol. Th e ethanol industry lives in the margin – the price diff erence between ethanol and gasoline. In 2012, I am confi dent we will be able to access the supply of corn necessary to produce ethanol within the margin. Just last month we saw the ability of one natural disaster (Hurricane Isaac) to impact gasoline prices by more than 20 cents per gallon. Th erefore, we should be able to weather the drought of 2012. Here’s an example for our industry: If gasoline is selling at $2.80 per gallon and ethanol is selling at $2.40 per gallon, then through market changes the two traded at equal value, a 40 cent rise in ethanol at a 2.8 conversion factor, we could have $1.12 per bushel rise in the price of corn and still have ethanol priced at the same price as gasoline. At Lincolnway Energy, we are confi dent we will weather the storm of higher corn prices, uncertain supply, and potential changes to the RFS using all the risk mitigation and effi ciency tools available to us, and we will continue to watch all the factors at play with you. (Circumstances, Choices, and Opportunities - Cont. from page 1) History was made on September 17, 2012, when the fi rst gallon of E15 was sold in Iowa. Drivers owning a 2001 or newer vehicle, SUV or light- duty truck now have access to this new EPA-approved fuel. Linn Co-op Oil Company located at 325 35th Street in Marion is the state’s fi rst retailer to give customers this renewable fuel option. “Th e Iowa Renewable Fuels Association (IRFA) salutes Linn Co-op Oil Company for their initiative to be among the fi rst retailers in the country to off er clean, green E15,” said Lucy Norton, IRFA Managing Director. “Motorists now have another high-octane, low-cost ethanol option that supports local jobs and contributes to the state’s economy.” As part of the introduction of E15, Linn Co-op will hold an open house on Friday, September 21, from 8 a.m. to 5 p.m. with lunch served from 11 a.m. to 1 p.m. E15 will be discounted 15 cents per gallon during the open house. “We are honored to be Iowa’s fi rst retailer to off er E15 to our customers who have been asking for it,” said Jim Becthold, Service Manager for Linn Co-op Oil Company. “We anticipate that E15 could account for up to 50 percent of our total fuel sales.” To introduce E15 to Marion residents, the IRFA, Iowa Corn and the Iowa Power Fund Community Grant Program are sponsoring a media campaign that includes radio and print ads, billboards and direct mail. Th e campaign will run throughout September. Th is type of campaign is available to any Iowa retailer who off ers E15 for 2001 and newer vehicle owners, noted Norton. Retailers preparing to off er E15 in the future are urged to contact the IRFA for promotional assistance. E15 NOW AVAILABLE AT LINN CO-OP OIL COMPANY June: No Sales July: No Sales August: No Sales

Volume VIII, Issue 3 September 2012 Volume VIII, Issue 3 September 2012 4 5 TEN WAYS ETHANOL PRODUCTION HELPS LIVESTOCK FARMERS DURING THE HISTORIC 2012 DROUGHT On the heels of USDA’s monthly crop report, the Iowa Renewable Fuels Association (IRFA) today unveiled a list of ten ways ethanol production is helping livestock farmers during the historic 2012 drought. While the drought is having a profound impact on crop production, thanks to ethanol production there is a larger and more fl exible corn supply than was available during previous droughts of this magnitude. * For 22 out of the 25 years prior to enactment of the RFS, large livestock producers were able to purchase corn for a price below the cost of production. Th is was “sustainable” only because of multi-billion dollar crop support programs in the Farm Bill. Th is situation gave a competitive advantage to livestock producers (like those in Texas, North Carolina, and Arkansas that control the national livestock groups) who purchase all their corn. Since 2006, the market economics have reversed, thereby benefi ting the farmer-feeder over the large livestock producers. When you also factor in the cost advantages of ethanol’s feed co-product (distillers grains) it is clear that ethanol production is not “bad” for livestock producers, although ethanol production has played a role in returning corn prices to levels sustainable by market forces, not price support programs. “Today’s USDA report confi rms what we already knew – that the drought’s impact on supply and price will be felt by corn consumers around the world. Yet, the ag sector has seen droughts before, and it will survive again. Th is is a time when all of agriculture should pull together. Unfortunately, national livestock trade associations have chosen to politicize the on- going drought as part of their multi-year eff ort to return corn prices to $2 per bushel.* At a time like this, it is important to look past the rhetoric to the facts. And the fact is that ethanol production provides a benefi t to Midwestern livestock producers in many ways.” Th e ethanol industry has driven the production of a larger corn crop. Simply put, there is more corn to go around. American farmers responded to the demand for more corn for ethanol processing by planting millions more acres. With no ethanol industry, farmers would have likely planted around 75 million acres of corn this year (just like they did in 2001), instead of 95 million acres. So, factoring in drought reduced yields, without ethanol production the 2012 corn crop would likely be more than two billion bushels smaller and there would be NO distillers grains to use as a cost-eff ective substitute for high-priced corn and soybean meal. Th e ethanol industry will bear the brunt of any rationing stemming from the drought. Without ethanol, the smaller corn harvest (yield and acres) would have to be rationed solely by livestock producers (domestic or export customers). Ethanol producers have already cut back production by over 10% (several plants have shut down, putting people out of work), and that’s likely just the beginning. Due to ethanol demand, seed companies spent much more than they would have otherwise on research and development over the last decade. As a result, farmers have access to seed varieties with greater yields that can withstand the drought much better than in prior years, like 1988. Maintaining the RFS sends a market signal to world farmers (including those in South America who will be planting soon) and U.S. farmers not to reduce corn acres. Conversely, lowering the threshold for waiving the RFS would send a market signal that renewable fuels are not a reliable market and corn acres planted would be reduced – ultimately hurting the livestock groups asking for such a waiver. One-third of every bushel of corn processed into ethanol returns to the livestock feed supply in the form of distillers grains – including all of the protein, fat, fi ber and other nutrients. Only the starch portion of the kernel is used to produce ethanol. Last year the amount of distillers grains produced was more than the total amount of grain consumed by all the beef cattle in American feedlots. As the nutritious feed portions of the corn kernel are concentrated, distillers grains are a more effi cient source of energy and protein than the ingredients they are replacing in livestock diets. Distillers grains provide approximately 130-150% of the energy of an equivalent amount of corn when fed to beef cattle. Th is allows for the use of cheap roughage (corn stalks, soybean straw) to be used in livestock diets. Without distillers grains, the cost of cattle and hog rations in the Midwest would go up as distillers grains and roughage are replaced with expensive corn and soybean meal. Bill Couser, of the Couser Cattle Company near Nevada, Iowa, stated: “It’s amazing to see what ethanol has done for the cattle industry in the state. It used to take 75 bushels of corn to fi nish a 1300 pound steer. Today, with distillers grains, we use only 16 to 30 bushels of corn and that number keeps dropping.” Th e drought has negatively impacted much pasture land. Without ample grass, cows may be unable to nurse their calves for the traditional 200-day period. According to Purdue University research, by incorporating distillers grains at 30 or 60 percent of the ration and weaning calves aft er 100 days, cattle feeders can save money on feed costs with no negative impacts on average daily gain, feed intake and marbling score. Distillers grains improve weight gains despite external factors, such as hot, dry weather. Andy Jenson of Jenson Farms in Nebraska stated that since cattle like the taste of distillers, they eat on a steady basis and gain weight more uniformly, despite changes in weather. Distillers grains provide an economic source of energy, amino acids and phosphorus for hog diets. According to University of Minnesota research, distillers grains improves the digestive health of grower-fi nisher pigs and may increase the size of litters when sows are fed high levels of distillers grains (30-50% inclusion rate). Roger Zylstra, of Zylstra Hillside Pork near Kellogg, Iowa, adds 30% distillers grains to his hog rations and notes that animal performance is the same while costs are reduced. IRFA Executive Director Monte Shaw A group of Lincolnway Energy employees participated in the United Way Day of Caring. Th ey spent the morning working at the Nevada Public Library. Th ey did weeding and hedge trimming on the library grounds and also worked on moving books inside the library. Lincolnway Energy has been a proud contributor to the Story County United Way since 2006. UNITED WAY DAY OF CARING

Volume VIII, Issue 3 September 2012 COME JOIN US ON THE WEB! If you haven’t already, please give us your e-mail address. This way you can receive the full color newsletter via e-mail and we can save on postage. E-mail your request to us at info@lincolnwayenergy.com. Lincolnway Energy, LLC 59511 W. Lincoln Highway Nevada, Iowa 50201-7992