Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VANTAGESOUTH BANCSHARES, INC. | v324300_8-k.htm |

| EX-2.1 - EXHIBIT 2.1 - VANTAGESOUTH BANCSHARES, INC. | v324300_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - VANTAGESOUTH BANCSHARES, INC. | v324300_ex99-1.htm |

Crescent Financial Bancshares, Inc. Agreement to Acquire ECB Bancorp, Inc. September 2012

Cautionary Statement Regarding Forward-Looking Statements• This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements involve a number of risks and uncertainties. • Crescent Financial Bancshares, Inc. (“CRFN”) and ECB Bancorp, Inc. (“ECBE”) caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving CRFN and ECBE, CRFN’s and ECBE’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in CRFN’s and ECBE’s filings with the SEC. These include risks and uncertainties relating to: the ability to obtain the requisite CRFN and ECBE shareholder approvals; the risk that CRFN or ECBE may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger; the risk that a condition to closing of the merger may not be satisfied; the timing to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer than expected; disruption from the transaction making it more difficult to maintain relationships with customers and employees; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of each of CRFN’s and ECBE’s most recent Annual Report on Form 10-K filed with the SEC. Each forward-looking statement speaks only as of the date of the particular statement and except as may be required by law, neither CRFN nor ECBE undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

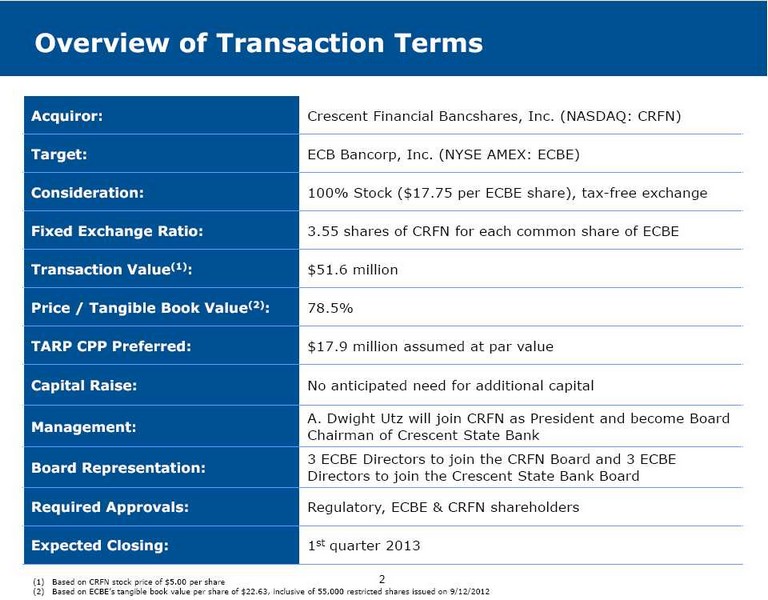

Overview of Transaction Terms Acquiror: Crescent Financial Bancshares, Inc. (NASDAQ: CRFN) Target: ECB Bancorp, Inc. (NYSE AMEX: ECBE) Consideration: 100% Stock ($17.75 per ECBE share), tax-free exchange Fixed Exchange Ratio: 3.55 shares of CRFN for each common share of ECBE Transaction Value(1): $51.6 million Price / Tangible Book Value(2): 78.5% TARP CPP Preferred: $17.9 million assumed at par value Capital Raise: No anticipated need for additional capital Management: A. Dwight Utz will join CRFN as President and become Board Chairman of Crescent State Bank Board Representation: 3 ECBE Directors to join the CRFN Board and 3 ECBE Directors to join the Crescent State Bank Board Required Approvals: Regulatory, ECBE & CRFN shareholders Expected Closing: 1st quarter 2013 (1) Based on CRFN stock price of $5.00 per share (2) Based on ECBE’s tangible book value per share of $22.63, inclusive of 55,000 restricted shares issued on 9/12/2012

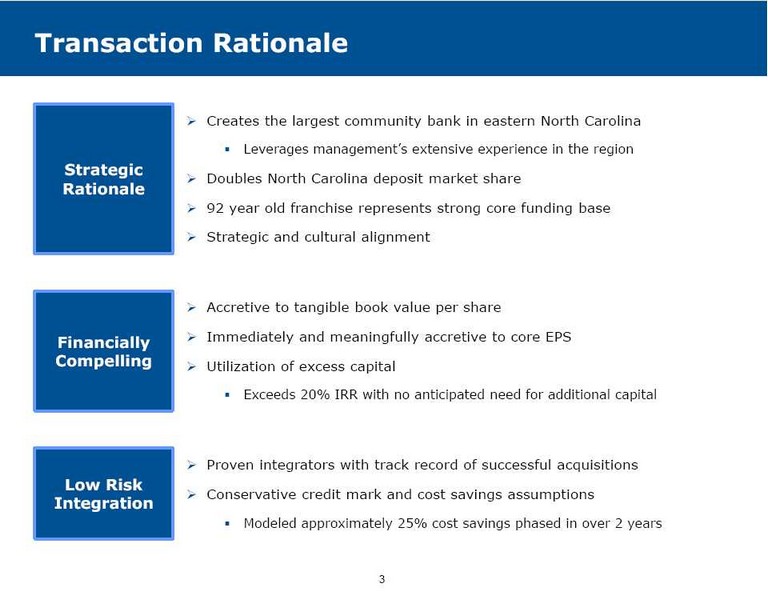

Transaction Rationale Strategic Rationale Financially Compelling Low Risk Integration Creates the largest community bank in eastern North Carolina Leverages management’s extensive experience in the region Doubles North Carolina deposit market share 92 year old franchise represents strong core funding base Strategic and cultural alignment Accretive to tangible book value per share Immediately and meaningfully accretive to core EPS Utilization of excess capital Exceeds 20% IRR with no anticipated need for additional capital Proven integrators with track record of successful acquisitions Conservative credit mark and cost savings assumptions Modeled approximately 25% cost savings phased in over 2 years

Strategic Market Expansion SCALE MANAGEMENT GROWTH PERFORMANCE CAPITAL Raleigh Greensboro Fayetteville Charlotte Wilmington Durham Elizabeth City Winston-Salem Greenville Virginia Beach North Carolina Deposit Market Share Rank Institution Number of Branches Deposits in Market ($mm) 1 Bank of America Corp. 193 134,648 2 Wells Fargo & Co. 337 38,769 3 BB&T Corp. 366 35,064 4 First Citizens BancShares Inc. 264 12,252 5 PNC Financial Services Group 175 10,262 6 SunTrust Banks Inc. 188 7,309 7 Capital Bank Finl Corp 54 2,468 8 First Bancorp 82 2,446 9 BNC Bancorp 30 2,389 10 FNB United Corp. 61 2,365 11 Fifth Third Bancorp 61 2,103 Pro Forma 45 1,727 12 Yadkin Valley Financial 31 1,715 13 NewBridge Bancorp 31 1,431 14 HomeTrust Bancshares Inc. 20 1,272 15 Fidelity BancShares (N.C.) Inc 64 1,147 16 Southern BancShares (NC) 56 1,143 17 Park Sterling Corporation 19 1,004 18 United Community Banks Inc. 21 947 19 Crescent & VantageSouth 20 914 20 Peoples Bancorp of NC Inc. 24 847 21 ECB Bancorp Inc. 25 813 22 Paragon Commercial Corp. 2 789 23 Macon Bancorp 12 781 24 Four Oaks Fincorp Inc. 16 767 25 First Community Bancshares Inc 24 738 Totals (1-25) 2,176 264,384 Totals (1-112) 2,721 282,894 Crescent & VantageSouth (20) ECBE (25) Jacksonville - Major Market Source: SNL Financial and MapInfo Note: Community banks not italicized Deposit data as of 6/30/2011; Pro forma for recently completed and announced transactions

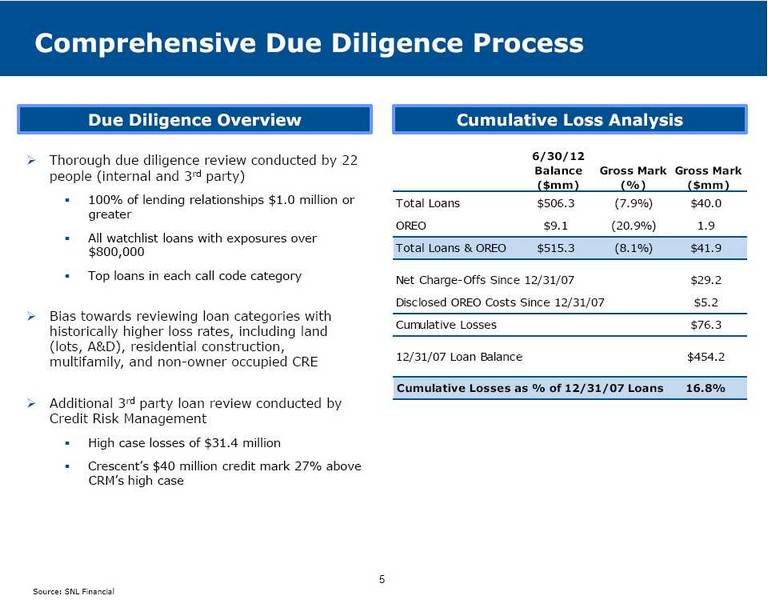

Comprehensive Due Diligence Process Due Diligence Overview Cumulative Loss Analysis Thorough due diligence review conducted by 22people (internal and 3rd party 100% of lending relationships $1.0 million or greater All watch list loans with exposures over $800,000 Top loans in each call code category Bias towards reviewing loan categories with historically higher loss rates, including land (lots, A&D), residential construction, multifamily, and non-owner occupied CRE Additional 3rd party loan review conducted by Credit Risk Management High case losses of $31.4 million Crescent’s $40 million credit mark 27% above CRM’s high case 6/30/12 Balance($($mm) Gross Mark(%)Gross Mark($($mm) Total Loans $506.3 (7.9%) $40.0 OREO $9.1 (20.9%) 1.9 Total Loans & OREO $515.3 (8.1%) $41.9 Net Charge-Offs Since 12/31/07 $29.2 Disclosed OREO Costs Since 12/31/07 $5.2 Cumulative Losses $76.3 12/31/07 Loan Balance $454.2 Cumulative Losses as % of 12/31/07 Loans 16.8%

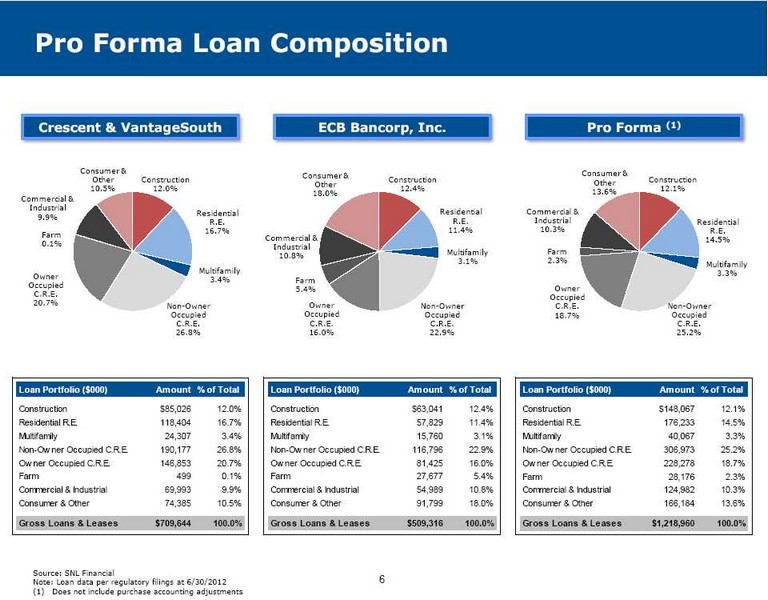

Pro Forma Loan Composition Crescent & VantageSouth ECB Bancorp, Inc. Pro Forma (1) Loan Portfolio ($000) Amount % of Total Construction $85,026 12.0% Residential R.E. 118,404 16.7% Multifamily 24,307 3.4% Non-Owner Occupied C.R.E. 190,177 26.8% Owner Occupied C.R.E. 146,853 20.7% Farm 499 0.1% Commercial & Industrial 69,993 9.9% Consumer & Other 74,385 10.5% Gross Loans & Leases $709,644 100.0% Loan Portfolio ($000) Amount % of Total Construction $148,067 12.1% Residential R.E. 176,233 14.5% Multifamily 40,067 3.3% Non-Owner Occupied C.R.E. 306,973 25.2% Owner Occupied C.R.E. 228,278 18.7% Farm 28,176 2.3% Commercial & Industrial 124,982 10.3% Consumer & Other 166,184 13.6% Gross Loans & Leases $1,218,960 100.0% Construction 12.4% Residential R.E. 11.4% Multifamily 3.1% Non-Owner Occupied C.R.E. 22.9% Owner Occupied C.R.E. 16.0% Farm 5.4% Commercial & Industrial 10.8% Consumer & Other 18.0% Loan Portfolio ($000) Amount % of Total Construction $63,041 12.4% Residential R.E. 57,829 11.4% Multifamily 15,760 3.1% Non-Owner Occupied C.R.E. 116,796 22.9% Owner Occupied C.R.E. 81,425 16.0% Farm 27,677 5.4% Commercial & Industrial 54,989 10.8% Consumer & Other 91,799 18.0% Gross Loans & Leases $509,316 100.0% Construction 12.0% Residential R.E. 16.7% Multifamily 3.4% Non-Owner Occupied C.R.E. 26.8% Owner Occupied C.R.E. 20.7% Farm 0.1% Commercial & Industrial 9.9% Consumer & Other 10.5% Construction 12.1% Residential R.E. 14.5% Multifamily 3.3% Non-Owner Occupied C.R.E. 25.2% Owner Occupied C.R.E. 18.7% Farm 2.3% Commercial & Industrial 10.3% Consumer & Other 13.6% Source: SNL Financial Note: Loan data per regulatory filings at 6/30/2012 (1) Does not include purchase accounting adjustments

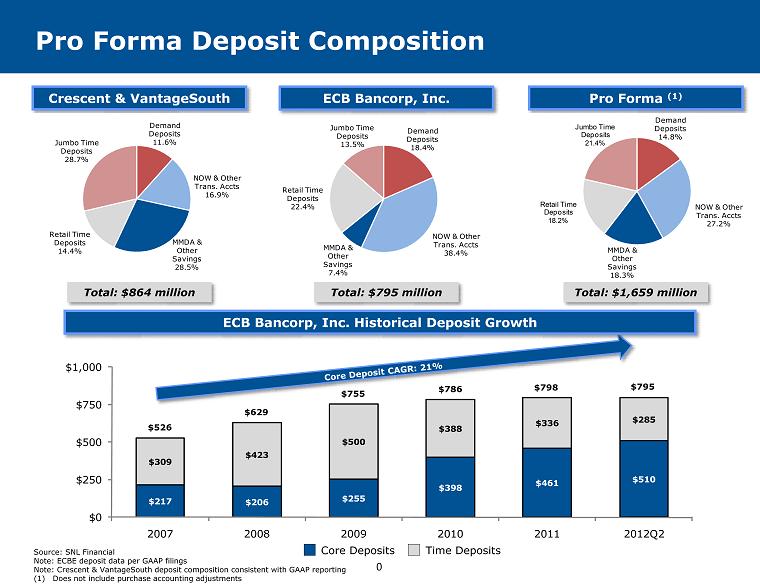

Pro Forma Deposit Composition Total: $864 million Total: $795 million Total: $1,659 million Crescent & VantageSouth ECB Bancorp, Inc. Pro Forma (1) Core Deposits Time Deposits ECB Bancorp, Inc. Historical Deposit Growth $786 $798 $755 $629 $526 $795 Demand Deposits 11.6% NOW & Other Trans. Accts 16.9% MMDA & Other Savings 28.5% Retail Time Deposits 14.4% Jumbo Time Deposits 28.7% Demand Deposits 18.4% NOW & Other Trans. Accts MMDA & 38.4% Other Savings 7.4% Retail Time Deposits 22.4% Jumbo Time Deposits 13.5% Demand Deposits 14.8% NOW & Other Trans. Accts 27.2% MMDA & Other Savings 18.3% Retail Time Deposits 18.2% Jumbo Time Deposits 21.4% $217 $206 $255 $398 $461 $510 $309 $423 $500 $388 $336 $285 $0 $250 $500 $750 Source: SNL Financial Note: ECBE deposit data per GAAP filings Note: Crescent & VantageSouth deposit composition consistent with GAAP reporting Does not include purchase accounting adjustments Core Deposits Time Deposits Core Deposit CAGR: 21%

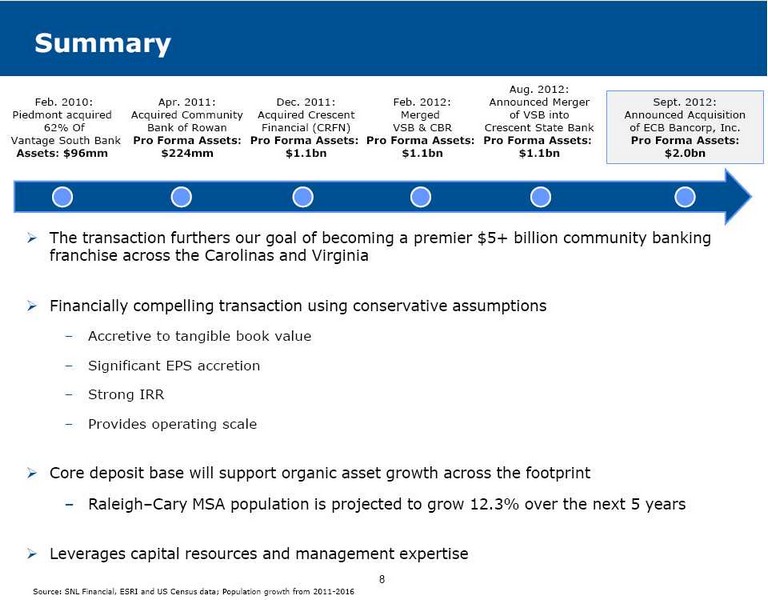

Summary The transaction furthers our goal of becoming a premier $5+ billion community banking franchise across the Carolinas and Virginia Financially compelling transaction using conservative assumptions Accretive to tangible book value Significant EPS accretion Strong IRR Provides operating scale Core deposit base will support organic asset growth across the footprint Raleigh–Cary MSA population is projected to grow 12.3% over the next 5 years Leverages capital resources and management expertise Feb. 2010: Piedmont acquired 62% Of Vantage South Bank Assets: $96mm Apr. 2011: Acquired Community Bank of Rowan Pro Forma Assets: $224mm Dec. 2011: Acquired Crescent Financial (CRFN) Pro Forma Assets: $1.1bn Feb. 2012: Merged VSB & CBR Pro Forma Assets: $1.1bn Aug. 2012: Announced Merger of VSB into Crescent State Bank Pro Forma Assets: $1.1bn Source: SNL Financial, ESRI and US Census data; Population growth from 2011-2016

Additional Information About the Merger and Where to Find It In connection with the proposed merger, CRFN will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will contain a joint proxy statement/prospectus of CRFN and ECBE. The companies will file with the SEC other relevant materials in connection with the proposed merger, and will mail the joint proxy statement/prospectus to their respective shareholders. SHAREHOLDERS OF BOTH CRFN AND ECBE ARE STRONGLY URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN THEY BECOME AVAILABLE AND OTHER RELEVANT DOCUMENTS FILED WITH THESEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING CRFN, ECBE AND THE PROPOSED MERGER. You will be able to obtain a free copy of the Registration Statement, as well as other filings containing information about Crescent Financial Bancshares, Inc., at the SEC’s Internet site (http://www.sec.gov). The documents can also be obtained, without charge, by directing a written request to either Crescent Financial Bancshares, Inc., 3600 Glenwood Avenue, Suite 300, Raleigh, NC 27612, Attention: Terry Earley, Executive Vice President and Chief Financial Officer, or ECB Bancorp, Inc., Post Office Box 337, Engelhard, NC 27824, Attention: Tom Crowder, Chief Financial Officer. CRFN, ECBE and their respective directors and executive officers may be deemed “participants” in the solicitation of proxies from shareholders of CRFN and ECBE in favor of the merger. Information about the directors and executive officers of ECB Bancorp, Inc. and their ownership of ECBE common stock is set forth in ECBE’s definitive proxy statement filed with the SEC on April 27, 2012 and available at the SEC’s Internet site (http://www.sec.gov) and from ECB Bancorp, Inc. at the address set forth in the preceding paragraph. Information about the directors and executive officers of Crescent Financial Bancshares, Inc. and their ownership of CRFN common stock is set forth in CRFN’s definitive proxy statement filed with the SEC on April 5, 2012 and available at the SEC’s Internet site (http://www.sec.gov) and from CRFN at the address set forth in the preceding paragraph. Additional information regarding the interests of these participants may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available.