Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VIAD CORP | d414958d8k.htm |

Investor

Presentation September 2012

Exhibit 99.1 |

2

Forward Looking Statements

As provided by the safe harbor provision under the Private Securities Litigation Reform Act of

1995, Viad cautions readers that, in addition to historical information contained

herein, this presentation includes certain information, assumptions and discussions

that may constitute forward-looking statements. These forward-looking statements

are not historical facts, but reflect current estimates, projections, expectations, or trends

concerning future growth, operating cash flows, availability of short-term

borrowings, consumer demand, new or renewal business, investment policies, productivity

improvements, ongoing cost reduction efforts, efficiency, competitiveness, legal

expenses, tax rates and other tax matters, foreign exchange rates, and the realization of

restructuring cost savings. Actual results could differ materially from those discussed

in the forward-looking statements. Viad’s businesses can be affected by a host

of risks and uncertainties. Among other things, natural disasters, gains and losses of

customers, consumer demand patterns, labor relations, purchasing decisions related to customer

demand for exhibition and event services, existing and new competition, industry

alliances, consolidation and growth patterns within the industries in which Viad

competes, acquisitions, capital allocations, adverse developments in liabilities

associated with discontinued operations and any deterioration in the economy, may individually

or in combination impact future results. In addition to factors mentioned elsewhere,

economic, competitive, governmental, technological, capital marketplace and other

factors, including terrorist activities or war, a pandemic health crisis and

international conditions, could affect the forward-looking statements in this press release. Additional

information concerning business and other risk factors that could cause actual results to

materially differ from those in the forward-looking statements can be found in

Viad’s annual and quarterly reports filed with the Securities and Exchange

Commission. Information about Viad Corp obtained from sources other than the

company may be out-of-date or incorrect. Please rely only on company press

releases, SEC filings and other information provided by the company, keeping in mind

that forward-looking statements speak only as of the date made. Viad undertakes no obligation to update any

forward-looking statements, including prior forward-looking statements, to reflect

events or circumstances arising after the date as of which the forward-looking

statements were made. |

3

Viad Overview

Viad

Corp

(NYSE:

VVI)

operates

2

business

units:

Travel

&

Recreation

Group,

comprised

of

Brewster, Glacier Park, and Alaska Denali

Travel.

Marketing

&

Events

Group,

comprised

of

Global Experience Specialists (GES) and

affiliates. |

4

Company Highlights

Rapidly growing Travel & Recreation business

providing high-end leisure travel experiences in and

around North American national parks

Global leader in producing some of the largest and

most prestigious tradeshows and exhibitions

Balance sheet strength

$78.0 million in cash (6/30/12)

0.6% debt-to-capital (6/30/12)

$0.10 per share quarterly dividend (150% increase)

Recently increased from $0.04 per share quarterly

Recurring revenue streams

90+% show retention rate

Leading and defensible market positions |

Travel &

Recreation Group 5 |

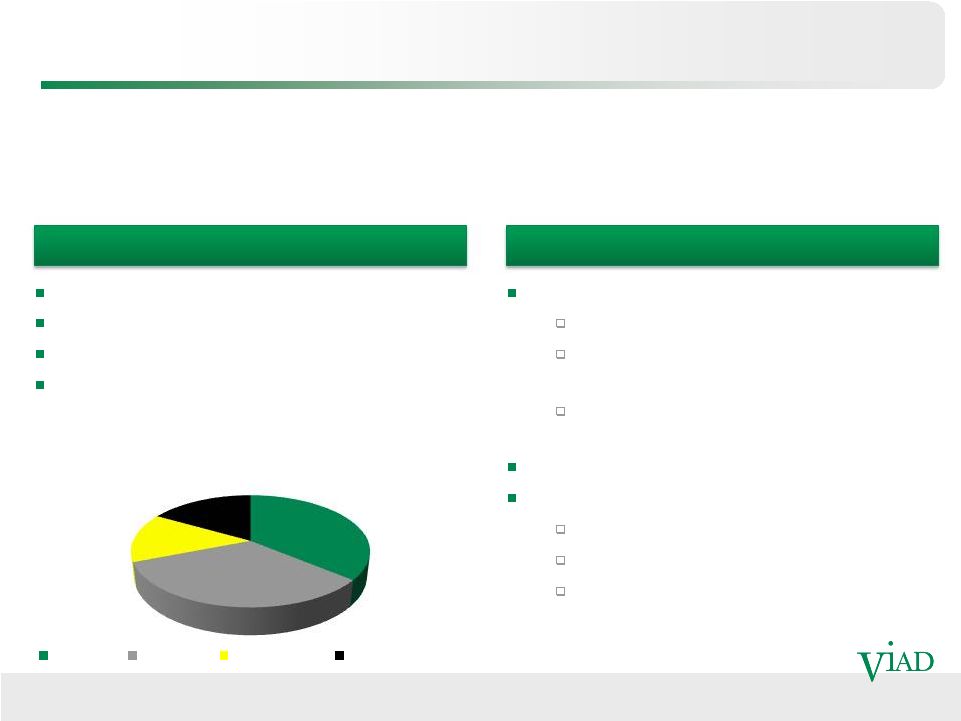

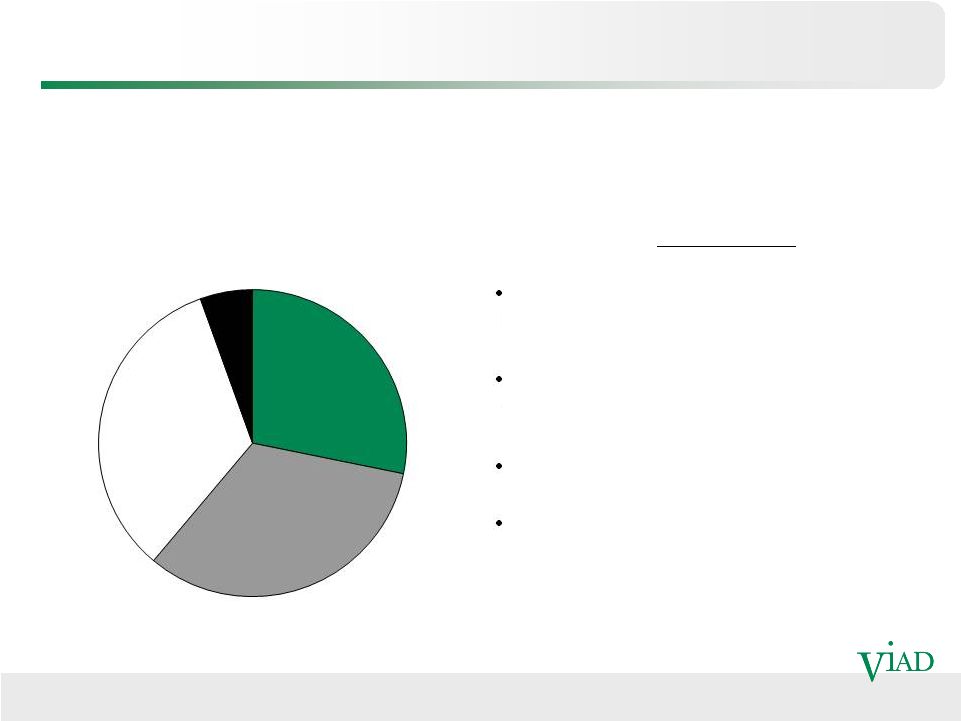

6

Viad’s Travel & Recreation Group, comprised of Brewster, Glacier Park, Inc. and

Alaska Denali Travel, offers experiential leisure travel services and rich front-

country experiences to national park visitors.

Travel & Recreation (T&R)

Hospitality

Recreational Attractions

Package Tours

Ground Transportation

Services

Services

Strengths

Strengths

Exclusive and unique services

One-of-a-kind attractions

Largest concessionaire in Montana’s

Glacier National Park (GNP)

One of three in-holdings in Denali

National Park and Preserve (Alaska)

Strong cash flows and ROIC

Strong operating margins

Attractions offer the highest margins

Hospitality margins are also strong

Package Tours and Transportation

margins are lower, but these businesses

help drive volume to Viad’s Attractions

and Hotels

2011 Revenue Mix

Hospitality

Attractions

Transportation

Packaged Tours

36%

33%

14%

17% |

7

Travel & Recreation: Hospitality

The Travel & Recreation Group provides lodging

accommodations in and around Glacier National Park, Denali

National Park and Preserve, Banff National Park and Jasper

National Park.

Owned Hotels

Banff International Hotel

Banff National Park, AB

Glacier Park Lodge

East Glacier, MT

Grouse Mountain Lodge

Whitefish, MT

Mount Royal Hotel

Banff National Park, AB

St.

Mary

Lodge

&

Resort

St.

Mary,

MT

Prince

of

Wales

Hotel

Denali

Cabins

Denali

National

Park,

AK

Denali Backcountry Lodge

Denali National Park, AK

Glacier View Inn

Jasper National Park, AB

Glacier Park Concession Contract

Many Glacier Hotel

Glacier National Park, MT

Lake McDonald Lodge

Glacier National Park, MT

Swift Current Motor Inn

Glacier National Park, MT

Rising Sun Motor Inn

Glacier National Park, MT

Village Inn Motel

Glacier National Park, MT

Total

Room

Count

Waterton

Lakes

Nat’l

Park,

AB

May

–

Sept

86

46

115

924

510

1,434

Location

Operating

Season

Rooms

Year-round

May

–

Sept

Year-round

May

–

Sept

Year-round

May

–

Sept

May

–

Sept

April –

Oct

May

–

Sept

May

–

Sept

May

–

Sept

May

–

Sept

May

–

Sept

214

100

88

72

36

32

42

135

145

161

162 |

Travel &

Recreation: GNP Concession Contract Glacier Park, Inc. (GPI) has been the chosen

concessionaire in Glacier National Park since 1980.

Concession contract covers all services provided by GPI within Glacier National Park

510 out of 1,017 total rooms in the Glacier National Park area are operated under the

concession contract

Concession contract was set to expire on 12/31/05 but has been extended on a year-

to-year basis through 12/31/12; likely to be extended again through

12/31/13 (bid

process is still pending)

Two-day site visit for prospective bidders took place Sept 19 –

20, 2012

Possible terms for a new contract would be for 10, 15, or 20 years

Viad is well-positioned for contract bid process

8 |

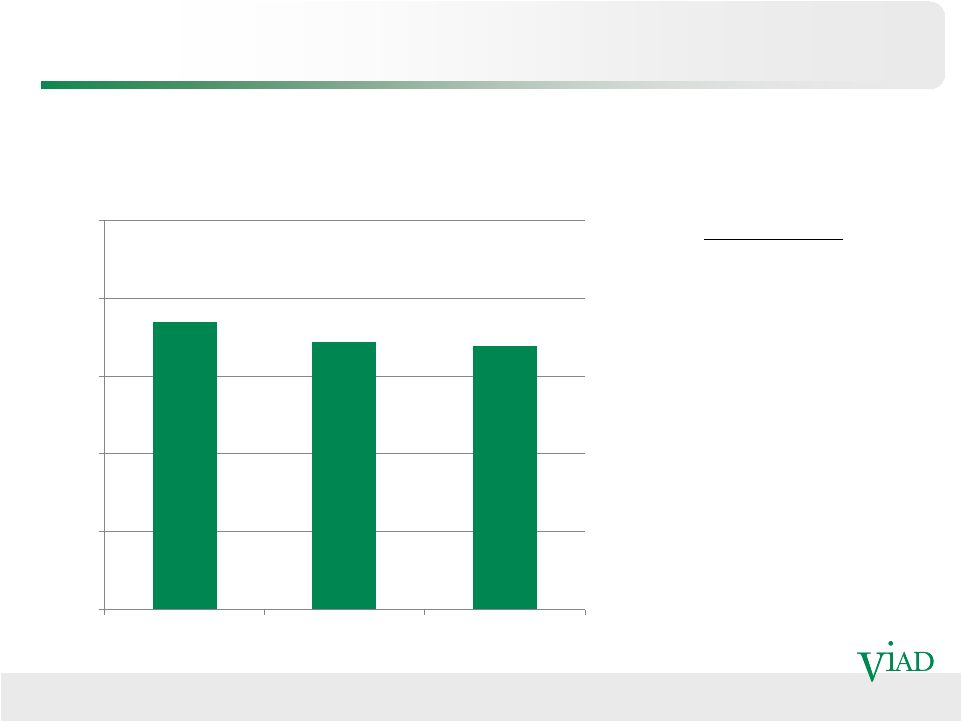

9

Travel & Recreation: Hospitality Metrics

**

**Excludes 2012 Banff Int’l acquisition (162 rooms) and rooms under renovation in 2011 at

Many Glacier Hotel (111 rooms). * RevPAR defined as revenues from room sales divided by

the number of rooms available. Amount shown represents simple average of all T&R

hospitality properties. Hospitality revenue growth is being fueled by acquisitions of new

properties and improved RevPAR

$28.2

$31.0

$37.4

$0

$5

$10

$15

$20

$25

$30

$35

$40

2009

2010

2011

Hospitality Revenues

$124

$131

$131

924

924

1,161

700

800

900

1000

1100

1200

$100

$110

$120

$130

$140

$150

$160

$170

$180

$190

$200

2009

2010

2011

RevPAR

Room Count

Room Count vs. RevPAR* |

10

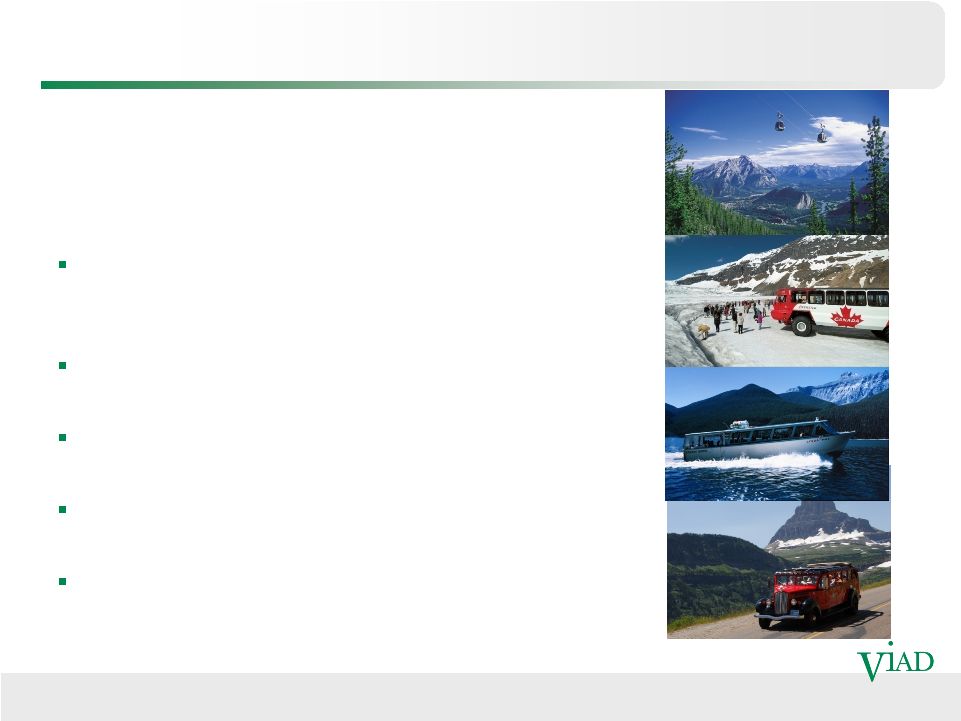

Travel & Recreation: Attractions

The Travel & Recreation Group offers unique

attractions that enhance the guest experience,

including:

The Banff Gondola, which offers visitors an unobstructed

view of the Canadian Rockies and overlooks the town of

Banff, Alberta (~475,000 passengers in 2011)

Tours of the Athabasca Glacier on the Columbia Icefield

aboard Ice Explorers (~315,000 passengers in 2011)

Boat cruises on Lake Minnewanka in Banff (~33,000

passengers in 2011)

Interpretive tours in Glacier National Park on authentic

1930s red touring buses (~48,000 passengers in 2011)

Coming soon: Glacier Discovery Walk |

11

Travel & Recreation: Attractions Metrics

Attractions Revenues

# of Passengers vs. Rev per Passenger*

* Rev

per

Passenger

defined

as

total

attractions

revenue

divided

by

number

of

passengers.

Amount

shown

represents

simple

average

of

all

T&R attractions.

Attractions revenue growth driven by price and volume increases |

12

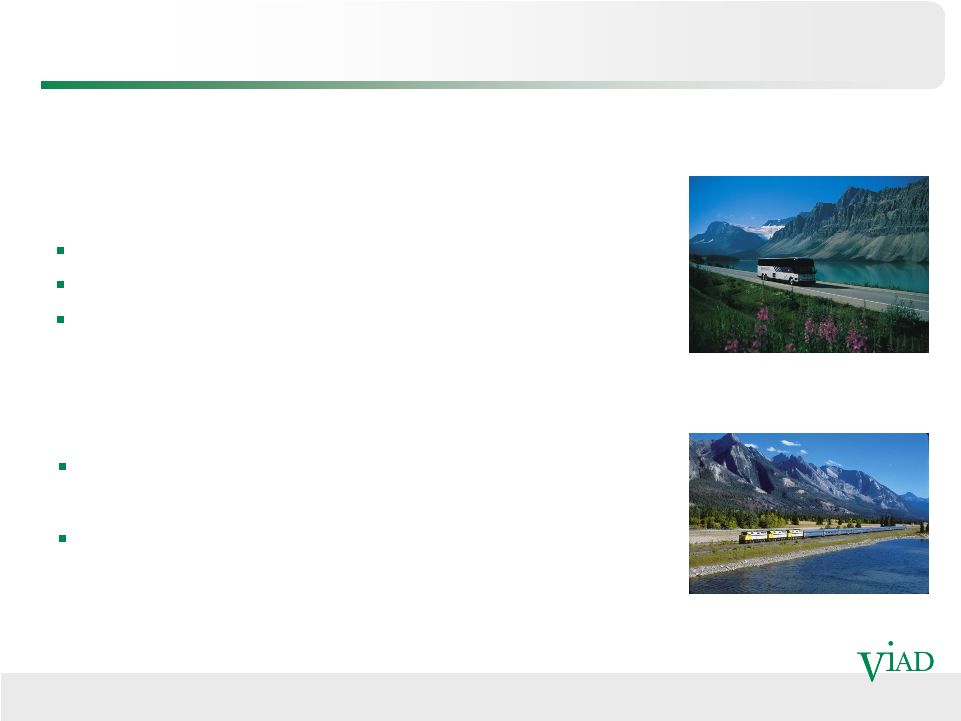

Travel & Recreation: Transportation and Package Tours

The Travel & Recreation Group provides ground

transportation services to group tours and individual

travelers, including:

Charter motorcoach services

Sightseeing

Airport shuttle and other scheduled services

The Travel & Recreation Group offers in-bound package

tours throughout Canada and in Alaska

Drives traffic to our hotels, attractions and transportation

services

Incorporates other tourism products/activities, including

rail, skiing, sightseeing |

13

Travel & Recreation: Transportation and Package Tours

Transportation and Package Tours revenues are also on the rise

$9.8

$12.7

$17.4

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

$20

2009

2010

2011

Package Tours Revenues

$15.8

$14.8

$0

$2

$4

$6

$8

$10

$12

$14

$16

$18

2009

2010

2011

$12.1

Transportation

Revenues

*

*

Includes higher revenues from transportation business related to the 2010 Winter Olympic and

Paralympic Games. |

14

Travel & Recreation: Acquisition Criteria

•

“Buy right”

–

location, asset, price, ROIC, and terms

•

Significant opportunity to add value to acquired assets

•

Leverage economies of scale –

e.g., leveraging our major suppliers, such as our

service supplier, to lower the cost of purchases, leveraging G&A

•

Leverage economies of scope –

e.g., cross-sell overnight guests into high margin

recreational attractions; cross-sell visitors at one attraction to add on another

attraction; utilize our extensive sales and marketing network to

drive higher

occupancy & RevPAR at acquired hotels

•

Improve lodging amenities leading to enhanced visitor experience

•

Apply Viad’s T&R professional facilities management to increase efficiency /

asset productivity |

Marketing &

Events Group |

16

Marketing & Events Group: Overview

The Marketing & Events Group is a leading global exhibition and tradeshow

producer offering best-in-class event production, cutting-edge creative and

design, and service delivery.

Exhibitions & Events

Official Services Contractor

Exhibitor Appointed Contractor

Other Marketing Services

Branded Entertainment (owned touring

exhibitions, works for hire)

Retail (holiday installations, kiosks, retail

merchandizing units)

Clients include:

Show organizers

Corporate brand marketers

Movie studios

Retail shopping centers

Services

Services

Strengths

Strengths

A leading market position

Global reach

Leading positions in US, Canada, UK and

UAE

Global relationships

Long-term contracts and strong backlog of

business

Typical contract length is 3 –

5 years

Revenue backlog of $1 Billion+

Good customer and industry diversity

Largest single show provides less than 5%

of M&E annual revenue

Shows span a broad range of industries,

reducing exposure to any one industry |

17

Marketing & Events: Business Mix

Revenues: U.S. vs. Int’l *

Operating Margins: U.S. vs. Int’l

* Excludes intercompany eliminations.

** EAC stands for Exhibitor Appointed Contractor.

$0

$200

$400

$600

$800

$1,000

2009

2010

2011

U.S.

Int'l.

-6%

-4%

-2%

0%

2%

4%

6%

2009

2010

2011

$568.4

$571.0

$631.4

$172.6

$197.8

$218.6

-3.9%

-2.7%

-1.0%

5.3%

5.1%

5.2%

U.S.

Int'l.

73%

24%

2%

1%

Exhibitions -

Official Services Contracting

Exhibitions -

EAC** and Other

Branded Entertainment

Retail

2011 US Revenues by Major LOB

32%

68%

2011 Int’l Revenues by Region

Canada

EMEA |

Marketing &

Events (U.S.): Exhibitions & Events Installing & Dismantling

Logistics/Transportation

Exhibit Rental

Furnishings & Carpet

Graphics

Lighting

Storage

Refurbishing

ROI Analysis

Show Planning &

Production

Look & Feel Design

Layout & Floor Plan

Designs

Furnishings & Carpet

Signage

Show Traffic Analysis

*Note: Exclusive services vary by show

Material Handling (Drayage)

Electrical Distribution

Cleaning

Plumbing

Overhead Rigging

Booth Rigging

Exhibit Construction

Exhibit Program

Development & Design

Brand Planning

Integrated Marketing

Campaigns

At-Event Activities

18

Show Organizer:

~20% of M&E U.S. revenue

Exhibitor Exclusive:*

~33% of M&E U.S. revenue

Exhibitor

Discretionary:

~20% of M&E U.S. revenue

Program

Exhibitors:

~25% of M&E U.S. revenue

GES competes with other

vendors to provide non-

exclusive services to Exhibitors

Official Services Contract with Show Organizer

gives GES the exclusive right to provide services

to Show Organizer and Exhibitors |

Marketing &

Events (U.S.): Industry Size/Growth Viad’s Marketing & Events Group derives the

majority of its revenues from the $11.9* Billion Exhibition and Events Industry.

Graph Data Source: Center for Exhibition Industry Research (CEIR), CEIR Index.

19

* Data Source: 2010 IBIS Report

Post-recession growth rates are stronger than in recent history

2.1%

1.5%

2.6%

1.9%

11.5%

1.2%

3.4%

2.4%

1.7%

1.6%

2.8%

10.4%

0.7%

2.5%

0.6%

1.5%

2.8%

3.8%

7.1%

3.2%

3.2%

14%

12%

10%

8%

6%

4%

2%

0%

2%

4%

6%

2005

2006

2007

2008

2009

2010

2011

Net Sq. Ft.

Exhibitors

Attendees

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Year-over-

Year Change in Industry Metrics |

20

Marketing & Events (U.S.): Show Revenues

8.3% growth in Base Same-

Show revenues 6/30/12 YTD

GES services ~5 to ~15 non-annual

shows >$250k in rev. each year

Major non-annual shows include:

Every 2 Years:

•

IMTS –

Q310, Q312

•

IWF –

Q310, Q312

•

PROMAT –

Q109, Q111, Q113

Every 3 Years:

•

CONEXPO-CON/AGG –

Q111,

Every 4 Years:

•

MINExpo –

Q312

Strong base of recurring revenues, with long-term contracts and high renewal rate

Q114

Shows That Occur in the Same Quarter, Same City Each

Year (Base Same-Shows)

Shows That DO NOT Occur in the Same Quarter, Same City

Each Year (all the other shows)

$107

$36

$44

$29

$94

$40

$43

$36

$100

$46

$49

$38

$112

$49

$160

$140

$120

$100

$80

$60

$40

$20

$0

$49

$54

$34

$48

$38

$54

$58

$41

$82

$57

$40

$50

$49

$66

$160

$140

$120

$100

$80

$60

$40

$20

$0

Same Qtr -

Dif City

Same Yr -

Dif Qtr

Non-Annual & Other |

21

Marketing & Events (U.S.): Revenue Growth

$22.5

$26.9

$20.9

$0

$10

$20

$30

$40

2009

2010

2011

Shows That Occur in the Same Year,

Different Quarter Each Year

$216.0

$212.1

$232.3

$0

$50

$100

$150

$200

$250

$300

2009

2010

2011

Shows That Occur in the Same

Quarter, Same City Each Year

(Base Same-

Shows)

$94.5

$90.3

$94.9

$0

$30

$60

$90

$120

2009

2010

2011

Shows That Occur in the Same

Quarter, Different City Each Year

$67.1

$74.8

$112.3

$0

$25

$50

$75

$100

$125

2009

2010

2011

Non-

Annual Shows & Other |

22

Marketing & Events (U.S.): Margin Improvement

Key Initiatives

Focus on labor management to improve

variable costs

Drive down fixed expenses through

consolidation of service delivery network

Tight control over discretionary SG&A

Increase show floor penetration

Expect incremental margins of 20%+ on revenues beyond current revenue run

rate.

Variable

Labor

Other

Variable

Costs

Semi

Variable

Costs

Fixed

Costs

Cost Structure (2011)

- |

23

Marketing & Events (U.S.): Labor Management

Key Initiatives

•

Labor productivity gains at

show site

•

Rigorous & strategic planning

•

Introduction of new tools to

support planning,

measurement and

benchmarking

•

Mutually favorable union

agreements

•

Wage / benefits rates

•

Work rules

37.4%

36.9%

36.8%

30.0%

32.0%

34.0%

36.0%

38.0%

40.0%

2009

2010

2011

Variable Labor as a % of Revenues

(Base Same-Shows) |

24

Marketing & Events (U.S.): Reduction in Overhead

Key Initiatives

Optimize U.S. Service Delivery

Network

•

Reduce invested capital and

operating expenses through

rationalization of facilities,

inventory and equipment

•

Achievements to date:

•

~30% reduction in facilities

square footage since 2008

•

~$6 million facility cost

reduction 2012 vs. 2008

•

Analysis is ongoing

Tight control over discretionary

SG&A

0.0

0.5

1.0

2.0

2.5

3.0

3.5

4.0

2008

2012

U.S. Service Delivery Network Sq. Ft.

1.5

3.6

2.5 |

25

Marketing & Events Group: Profit Improvement

Total M&E Revenues

Total M&E Operating Margins

Targeting 5% operating margins for Total M&E in 2014, driven by initiatives to improve

U.S. profitability

$730.5

$756.5

$840.6

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2009

2010

2011

-1.8%

-0.7%

0.6%

-2.0%

-1.5%

-1.0%

-0.5%

0.0%

0.5%

1.0%

2009

2010

2011 |

Financials

26 |

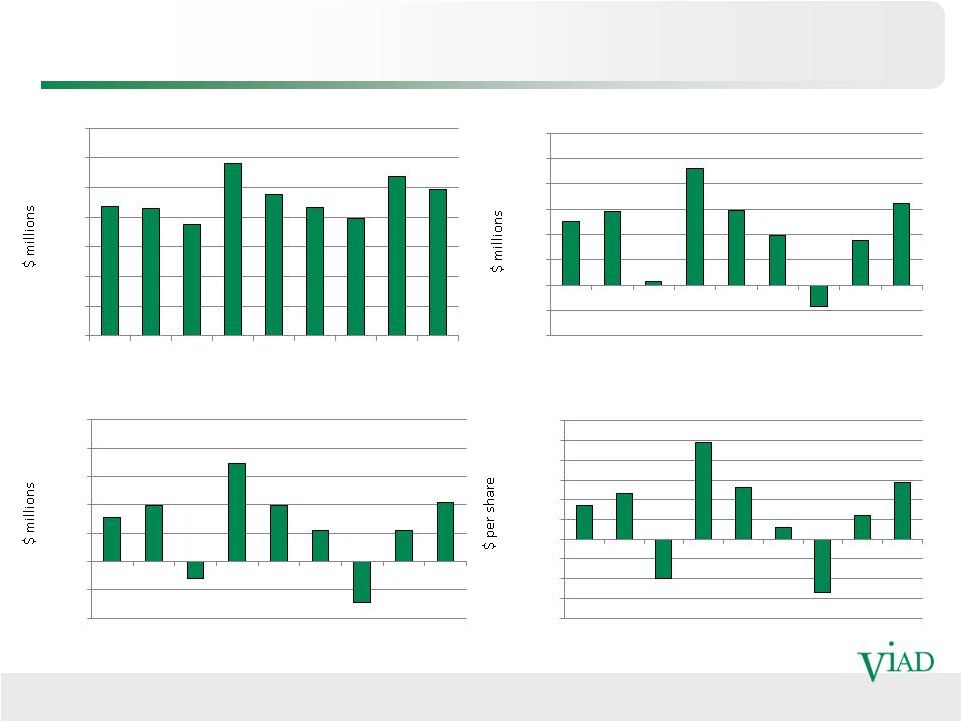

27

Selected Annual Financials

Revenues

Operating Income

Income Before Other Items Per Share*

Adjusted EBITDA*

*A reconciliation of this non-GAAP measure can be found in the Appendix.

$805.8

$844.8

$942.4

$0

$200

$400

$600

$800

$1,000

$1,200

2009

2010

2011

$4.2

$14.8

$25.4

$0

$5

$10

$15

$20

$25

$30

$35

2009

2010

2011

($0.11)

$0.19

$0.55

($0.30)

($0.20)

($0.10)

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

$0.70

2009

2010

2011

$12.8

$32.3

$43.3

$0

$10

$20

$30

$40

$50

$60

2009

2010

2011 |

28

Selected Quarterly Financials

Revenues

Operating Income

Income Before Other Items Per Share*

Adjusted EBITDA*

*A reconciliation of this non-GAAP measure can be found in the Appendix

$218.3

$215.1

$187.0

$290.1

$238.7

$216.2

$197.4

$268.8

$246.5

$0

$50

$100

$150

$200

$250

$300

$350

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

$12.5

$14.5

$0.8

$23.1

$14.8

$9.7

($4.3)

$8.9

$16.0

-$10

-$5

$0

$5

$10

$15

$20

$25

$30

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

$7.7

$9.9

($3.1)

$17.3

$9.9

$5.4

($7.2)

$5.5

$10.5

-

-

$0

$5

$10

$15

$20

$25

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

$0.17

$0.23

($0.20)

$0.49

$0.26

$0.06

($0.27)

$0.12

$0.29

($0.40)

($0.30)

($0.20)

($0.10)

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

$5

$10 |

29

Selected Balance Sheet Highlights

As of June 30, 2012:

Cash:

$78.0 million

Shares Outstanding:

20.3 million

Debt:

$2.6 million

Debt to Capital:

0.6%

Free Cash Flow*

CapEx

*A reconciliation of this non-GAAP measure can be found in the appendix

($30.9)

$23.0

$10.0

($40)

($30)

($20)

($10)

$0

$10

$20

$30

2009

2010

2011

$21.3

$17.0

$21.5

$0

$5

$10

$15

$20

$25

2009

2010

2011 |

30

Disciplined Capital Deployment

Selective investments to support organic growth

Strategic acquisitions after careful due diligence

Strategic fit in or adjacent to Viad’s core businesses

Good cultural fit

Economic return criteria met

Quarterly Dividend

$0.10 per share effective October 2012 (150%

increase over prior quarterly dividend of $0.04 per

share)

Share Repurchases

250,760 shares were repurchased in 2011

356,300 shares were repurchased in 2010

2.8 million shares were repurchased between 2006-

2008

53,621 shares remaining under announced

authorization as of June 30, 2012

Viad’s strong balance sheet enables the company to employ a disciplined

capital deployment strategy.

Debt-to-Capital

Net Cash:

$103.6M

$136.8M

$97.1M

3.2%

2.3%

0.8%

0.0%

1.0%

2.0%

3.0%

4.0%

2009

2010

2011 |

Appendix

31 |

32

Reconciliation of Income Before Other Items Per Share

(1)

(1)

This non-GAAP measure should be considered in addition to, but not as a substitute for, a

similar measure presented in accordance with GAAP.

2009

2010

2011

Income (Loss) Before Other Items per Share:

Income (loss) from continuing operations attributable

to Viad

$(5.28)

$0.01

$0.43

Impairment charges, net of tax

4.92

0.01

--

Restructuring charges, net of tax

0.43

0.13

0.12

Resolution of tax matters

(0.18)

0.04

--

Income (loss) before other items

$(0.11)

$0.19

$0.55

Weighted average outstanding and potentially

dilutive common shares (thousands)

19,960

20,277

20,055 |

33

Reconciliation of Income Before Other Items Per Share

(1)

(1)

This non-GAAP measure should be considered in addition to, but not as a substitute for, a

similar measure presented in accordance with GAAP.

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Income (Loss) Before Other Items

per Share:

Income (loss) from continuing operations

attributable to Viad

$0.15

$0.23

$(0.24)

$0.48

$0.22

$0.06

$(0.35)

$0.05

$0.27

Impairment charges, net of tax

--

--

0.01

--

--

--

--

--

--

Restructuring charges, net of tax

0.02

0.01

0.05

0.01

0.04

--

0.08

0.07

0.02

Resolution of tax matters

--

(0.01)

(0.02)

--

--

--

--

--

--

Income (loss) before other items

$0.17

$0.23

$(0.20)

$0.49

$0.26

$0.06

$(0.27)

$0.12

$0.29

Weighted average outstanding and

potentially dilutive common shares

(thousands)

20,375

20,309

19,709

20,080

20,121

20,033

19,569

19,917

19,961 |

34

Reconciliation of Adjusted EBITDA

(1)

(1)

This non-GAAP measure should be considered in addition to, but not as a substitute for, a

similar measure presented in accordance with GAAP.

Adjusted EBITDA ($ Millions)

2009

2010

2011

Net income (loss) attributable to Viad

$(104.7)

$0.4

$9.2

Income from discontinued operations

(0.7)

(0.3)

(0.5)

Impairment charges

116.9

0.3

--

Interest expense

1.7

1.8

1.5

Income taxes

(28.6)

1.7

3.9

Depreciation and amortization

28.3

28.3

29.1

Adjusted EBITDA

$12.8

$32.3

$43.3

Note: Calculated amounts presented above are calculated using dollars in thousands.

|

35

Reconciliation of Adjusted EBITDA

(1)

(1)

This non-GAAP measure should be considered in addition to, but not as a substitute for, a

similar measure presented in accordance with GAAP.

Adjusted EBITDA

($ Millions)

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Net income (loss)

attributable to Viad

$3.0

$4.8

$(4.4)

$9.8

$4.5

$1.2

$(6.3)

$1.0

$6.1

Income from

discontinued

operations

--

--

(0.3)

--

--

--

(0.5)

--

(0.6)

Impairment charges

--

--

0.3

--

--

--

--

--

--

Interest expense

0.5

0.5

0.4

0.4

0.4

0.4

0.3

0.4

0.3

Income taxes

1.8

1.9

(2.2)

5.9

2.6

0.5

(5.1)

0.5

2.3

Depreciation and

amortization

7.2

7.3

6.9

7.0

7.3

7.6

7.2

7.0

8.0

Adjusted EBITDA

$12.5

$14.5

$0.8

$23.1

$14.8

$9.7

$(4.3)

$8.9

$16.0

Note: Calculated amounts presented above are calculated using dollars in thousands.

|

36

Reconciliation of Free Cash Flow

(1)

(1)

This non-GAAP measure should be considered in addition to, but not as a substitute for, a

similar measure presented in accordance with GAAP.

Free Cash Flow ($ Millions)

2009

2010

2011

Net cash provided by (used in) operating activities

$(6.2)

$43.3

$34.7

Less:

Capital expenditures

(21.3)

(17.0)

(21.5)

Dividends paid

(3.3)

(3.3)

(3.2)

Free cash flow (outflow)

$(30.9)

$23.0

$10.0

Note: Calculated amounts presented above are calculated using dollars in thousands.

|