Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PNC FINANCIAL SERVICES GROUP, INC. | d413098d8k.htm |

| EX-5.1 - OPINION OF GEORGE P. LONG, III - PNC FINANCIAL SERVICES GROUP, INC. | d413098dex51.htm |

| EX-4.2 - DEPOSIT AGREEMENT - PNC FINANCIAL SERVICES GROUP, INC. | d413098dex42.htm |

| EX-3.1 - STATEMENT FOR SHARES--5.375% NON-CUMULATIVE PERPETUAL PREFERRED STOCK, SERIES Q - PNC FINANCIAL SERVICES GROUP, INC. | d413098dex31.htm |

| EX-1.1 - UNDERWRITING AGREEMENT - PNC FINANCIAL SERVICES GROUP, INC. | d413098dex11.htm |

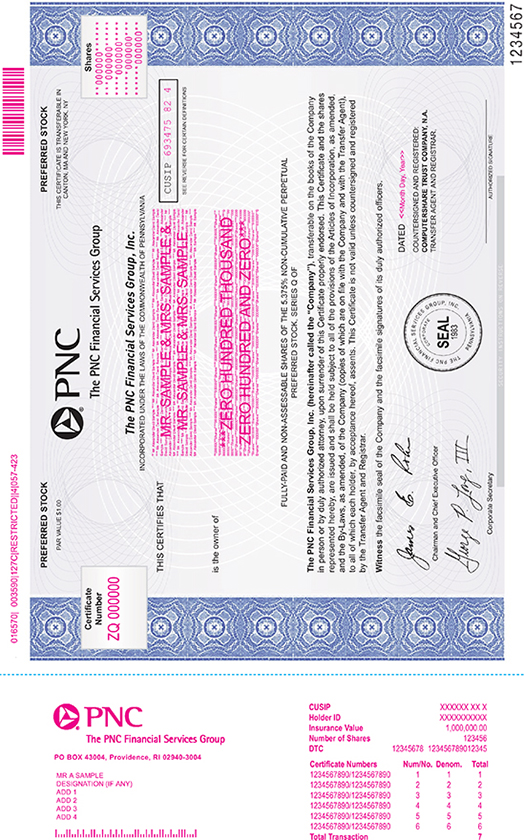

Exhibit 4.1

THE PNC FINANCIAL SERVICES GROUP, INC.

THE COMPANY WILL FURNISH WITHOUT CHARGE TO EACH SHAREHOLDER WHO SO REQUESTS, A SUMMARY OF THE POWERS, DESIGNATIONS, PREFERENCES AND RELATIVE, PARTICIPATING, OPTIONAL OR OTHER SPECIAL RIGHTS OF EACH CLASS OF STOCK OF THE COMPANY AND THE QUALIFICATIONS, LIMITATIONS OR RESTRICTIONS OF SUCH PREFERENCES AND RIGHTS, AND THE VARIATIONS IN RIGHTS, PREFERENCES AND LIMITATIONS DETERMINED FOR EACH SERIES, WHICH ARE FIXED BY THE ARTICLES OF INCORPORATION OF THE COMPANY, AS AMENDED, AND THE RESOLUTIONS OF THE BOARD OF DIRECTORS OF THE COMPANY, AND THE AUTHORITY OF THE BOARD OF DIRECTORS TO DETERMINE VARIATIONS FOR FUTURE SERIES. SUCH REQUEST MAY BE MADE TO THE OFFICE OF THE SECRETARY OF THE COMPANY OR TO THE TRANSFER AGENT. THE BOARD OF DIRECTORS MAY REQUIRE THE OWNER OF A LOST OR DESTROYED STOCK CERTIFICATE, OR HIS LEGAL REPRESENTATIVES, TO GIVE THE COMPANY A BOND TO INDEMNIFY IT AND ITS TRANSFER AGENTS AND REGISTRARS AGAINST ANY CLAIM THAT MAY BE MADE AGAINST THEM ON ACCOUNT OF THE ALLEGED LOSS OR DESTRUCTION OF ANY SUCH CERTIFICATE.

THE SECURITIES REPRESENTED BY THIS INSTRUMENT ARE NOT SAVINGS ACCOUNTS, DEPOSITS OR OTHER OBLIGATIONS OF A BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENTAL AGENCY.

The following abbreviations, when used in the inscription on the face of this certificate, shall be construed as though they were written out in full according to applicable laws or regulations:

| TEN COM |

- as tenants in common | UNIF GIFT MIN ACT- ........................ Custodian............................... | ||||||||||

| (Cust) | (Minor) | |||||||||||

| TEN ENT |

- as tenants by the entireties | under Uniform Gifts to Minors Act ................... | ||||||||||

| (State) | ||||||||||||

| JT TEN |

- as joint tenants with right of survivorship | UNIF TRF MIN ACT ............................... Custodian (until age.....)....................... | ||||||||||

| and not as tenants in common |

(Cust) | (Minor) | ||||||||||

| under Uniform Transfers to Minors Act. ................................ | ||||||||||||

| (State) | ||||||||||||

| Additional abbreviations may also be used though not in the above list. | ||||||||||||

| PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE | ||||

|

For value received, _______________ hereby sell, assign and transfer unto |

||||

|

|

| (PLEASE PRINT OR TYPEWRITE NAME AND ADDRESS, INCLUDING POSTAL ZIP CODE, OF ASSIGNEE) |

|

|

|

|

|

|

Shares | |||

| of the capital stock represented by the within Certificate, and do hereby irrevocably constitute and appoint |

||||

|

|

Attorney | |||

| to transfer the said stock on the books of the within-named Corporation with full power of substitution in the premises. |

| Dated: ___________________________________20__________ | Signature(s) Guaranteed: Medallion Guarantee Stamp THE SIGNATURE(S) SHOULD BE GUARANTEED BY AN ELIGIBLE GUARANTOR INSTITUTION (Banks, Stockbrokers, Savings and Loan Associations and Credit Unions) WITH MEMBERSHIP IN AN APPROVED SIGNATURE GUARANTEE MEDALLION PROGRAM, PURSUANT TO S.E.C. RULE 17Ad-15. | |

|

Signature: ___________________________________________

|

||

| Signature: ___________________________________________ |

||

| Notice: The signature to this assignment must correspond with the name as written upon the face of the certificate, in every particular, without alteration or enlargement, or any change whatever. |

||

|

|

The IRS requires that we report the cost basis of certain shares acquired after January 1, 2011. If your shares were covered by the legislation and you have sold or transferred the shares and requested a specific cost basis calculation method, we have processed as requested. If you did not specify a cost basis calculation method, we have defaulted to the first in, first out (FIFO) method. Please visit our website or consult your tax advisor if you need additional information about cost basis.

If you do not keep in contact with us or do not have any activity in your account for the time periods specified by state law, your property could become subject to state unclaimed property laws and transferred to the appropriate state. |

| ||