Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DEX ONE Corp | d410684d8k.htm |

Lender

Discussion Material September 18, 2012

Exhibit 99.1 |

2

Important Information For Investors And Security Holders

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote or approval. The

proposed merger transaction between SuperMedia Inc. (“SuperMedia”) and Dex

One Corporation (“Dex One”) will be submitted to the respective

stockholders of SuperMedia and Dex One. In connection with the proposed

transaction, Newdex, Inc., a subsidiary of Dex One (“Newdex”), will file

with the Securities and Exchange Commission (“SEC”) a registration

statement on Form S-4 that will include a joint proxy statement/prospectus to be

used by SuperMedia and Dex One to solicit the required approval of their

stockholders and that also constitutes a prospectus of Newdex.

INVESTORS AND SECURITY HOLDERS OF SUPERMEDIA AND DEX ONE ARE ADVISED TO CAREFULLY

READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS

(INCLUDING ALL AMENDMENTS AND SUPPLEMENTS) AND OTHER RELEVANT

DOCUMENTS

FILED

WITH

THE

SEC

WHEN

THEY

BECOME

AVAILABLE

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE RISKS

ASSOCIATED WITH THE TRANSACTION.

A

definitive

joint

proxy

statement/prospectus

will

be

sent

to

security

holders

of

SuperMedia

and

Dex

One

seeking

their

approval

of

the proposed transaction. Investors and security holders may obtain a free copy of

the joint proxy statement/prospectus (when available) and other

relevant

documents

filed

by

SuperMedia

and

Dex

One

with

the

SEC

from

the

SEC’s

website

at

www.sec.gov.

Copies

of

the

documents

filed

by

SuperMedia

with

the

SEC

will

be

available

free

of

charge

on

SuperMedia’s

website

at

www.supermedia.com

under

the

tab

“Investors”

or

by

contacting SuperMedia’s Investor Relations Department at (877)

343-3272. Copies of the documents filed by Dex One with the SEC will be available

free

of

charge

on

Dex

One’s

website

at

www.dexone.com

under

the

tab

“Investors”

or

by

contacting

Dex

One’s

Investor

Relations

Department

at

(800) 497-6329.

SuperMedia

and

Dex

One

and

their

respective

directors,

executive

officers

and

certain

other

members

of

management

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

their

respective

security

holders

with

respect

to

the

transaction.

Information

about

these

persons

is

set

forth in SuperMedia’s proxy statement relating to its 2012 Annual Meeting of

Shareholders and Dex One’s proxy statement relating to its 2012 Annual

Meeting

of

Stockholders,

as

filed

with

the

SEC

on

April

11,

2012

and

March

22,

2012,

respectively,

and

subsequent

statements

of

changes

in

beneficial ownership on file with the SEC. These documents can be obtained

free of charge from the sources described above. Security holders and

investors may obtain additional information regarding the interests of such

persons, which may be different than those of the respective companies’

security holders generally, by reading the joint proxy statement/prospectus and

other relevant documents regarding the transaction (when available), which

will be filed with the SEC. |

3

Forward-Looking Statements

Certain statements contained in this document are "forward-looking

statements" subject to the safe harbor created by the Private Securities Litigation

Reform Act of 1995, including but not limited to, statements about the benefits of

the proposed transaction and combined company, including future financial and

operating results and synergies, plans, objectives, expectations and intentions and other statements relating to the proposed transaction

and the combined company that are not historical facts. Where possible, the

words "believe," "expect," "anticipate," "intend," "should," "will," "would,"

"planned," "estimated," "potential," "goal,"

"outlook," "may," "predicts," "could," or the negative of such terms, or other comparable expressions, as

they relate to Dex One, SuperMedia, the combined company or their respective

management, have been used to identify such forward-looking statements.

All forward-looking statements reflect only Dex One’s and SuperMedia’s current beliefs and assumptions with respect to future business

plans, prospects, decisions and results, and are based on information currently

available to Dex One and SuperMedia. Accordingly, the statements are subject

to significant risks, uncertainties and contingencies, which could cause Dex One’s, SuperMedia’s or the combined company’s actual

operating

results,

performance

or

business

plans

or

prospects

to

differ

materially

from

those

expressed

in,

or

implied

by,

these

statements.

Factors

that

could

cause

actual

results

to

differ

materially

from

current

expectations

include

risks

and

other

factors

described

in

Dex

One’s

and

SuperMedia’s publicly available reports filed with the SEC, which contain

discussions of various factors that may affect the business or financial

results of Dex One, SuperMedia or the combined company. Such risks and other

factors, which in some instances are beyond either company’s control,

include: the continuing decline in the use of print directories; increased competition, particularly from existing and emerging digital

technologies;

ongoing

weak

economic

conditions

and

continued

decline

in

advertising

sales;

the

companies’

ability

to

collect

trade

receivables

from

customers

to

whom

they

extend

credit;

the

companies’

ability

to

generate

sufficient

cash

to

service

their

debt;

the

companies’

ability

to

comply

with

the financial covenants contained in their debt agreements and the potential impact

to operations and liquidity as a result of restrictive covenants in

such

debt

agreements;

the

respective

companies’

ability

to

refinance

or

restructure

their

debt

on

reasonable

terms

and

conditions

as

might

be

necessary

from

time

to

time;

increasing

interest

rates;

changes

in

the

companies’

and

the

companies’

subsidiaries

credit

ratings;

changes

in

accounting

standards;

regulatory

changes

and

judicial

rulings

impacting

the

companies’

businesses;

adverse

results

from

litigation,

governmental

investigations or tax related proceedings or audits; the effect of labor strikes,

lock-outs and negotiations; successful realization of the expected

benefits

of

acquisitions,

divestitures

and

joint

ventures;

the

companies’

ability

to

maintain

agreements

with

major

Internet

search

and

local

media

companies;

the

companies’

reliance

on

third-party

vendors

for

various

services;

and

other

events

beyond

their

control

that

may

result

in

unexpected

adverse operating results.

With respect to the proposed merger, important factors could cause actual results

to differ materially from those indicated by forward-looking statements

included herein, including, but not limited to, the ability of Dex One and SuperMedia to consummate the transaction on the terms set forth

in

the

merger

agreement;

the

risk

that

anticipated

cost

savings,

growth

opportunities

and

other

financial

and

operating

benefits

as

a

result

of

the

transaction may not be realized or may take longer to realize than expected; the

risk that benefits from the transaction may be significantly offset by costs

incurred in integrating the companies; potential adverse impacts or delay in completing the transaction as a result of obtaining consents from

lenders to Dex One or SuperMedia; failure to receive the approval of the

stockholders of either Dex One or SuperMedia for the transaction; and

difficulties in connection with the process of integrating Dex One and SuperMedia,

including: coordinating geographically separate organizations; integrating

business cultures, which could prove to be incompatible; difficulties and costs of integrating information technology systems; and the

potential difficulty in retaining key officers and personnel. These risks, as

well as other risks associated with the merger, will be more fully discussed

in the joint proxy statement/prospectus included in the registration statement on

Form S-4 that Newdex intends to file with the SEC in connection with the

proposed transaction. None of Dex One, SuperMedia or the combined company is

responsible for updating the information contained in this presentation beyond the

presentation date. |

4

Transaction Overview |

5

Transaction Objective

•

Improve Positioning for Growth

–

National scale and scope

–

Greater market share

•

Improve Quality and Productivity

–

Achieve a complete suite of social, mobile and local solutions

–

Capture marketing consultant expertise and best practices

–

Apply best technology systems and platforms, operating processes, tools and client

care techniques

•

Strengthen the Balance Sheet

–

Expense synergies

–

Efficient use of tax assets

–

Enhance cash flow

–

Extend runway for payment of senior debt

Accelerate the Transformation of the Companies |

6

Summary Transaction Terms

Structure

Stock for stock merger in which SuperMedia stockholders exchange existing shares for shares in

the new combined company, Dex Media

Implement 1-5 reverse split

Exchange Ratio /

Ownership Split

40% SuperMedia / 60% Dex One

Name

Dex Media, Inc. (publicly-traded successor to Dex One)

Governance

11 member board

5 appointed by SuperMedia

5 appointed by Dex One

1 independent to be selected jointly

Chairman

Alan Schultz (Dex One)

Management

CEO: Peter McDonald (SuperMedia)

CFO: Dee Jones (SuperMedia)

Remaining management to be determined by representatives of each board and Peter McDonald

Estimated Synergies

$150–175MM of annual run-rate expense synergies

$175–225MM of cash flow due to preservation of Dex One tax attributes

Loan Modifications to be

Sought

SuperMedia lenders agree to extend maturity by one year from December 31, 2015 to December 31,

2016, as well as modify certain other provisions

Dex One lenders at all 3 silos agree to extend maturities by 26 months from October 24, 2014 to

December 31, 2016, as well as modify certain covenants, amortization requirements and certain

other provisions

Tax Sharing

The SuperMedia silo will have the ability to utilize savings resulting from Dex One’s tax

attributes, subject to a tax sharing agreement where the SuperMedia silo will retain 25% of

any tax savings and the Dex One silos will benefit from 75% of the tax savings

Shared Services

New shared services agreement to allocate corporate and other shared services among the

subsidiarie similar to existing Dex One agreement

Trading Restrictions

Trading restrictions for 5% shareholders to preserve tax assets

Restrictions can be removed at the Board’s option and in certain circumstances may be removed

after closing of the merger

|

7

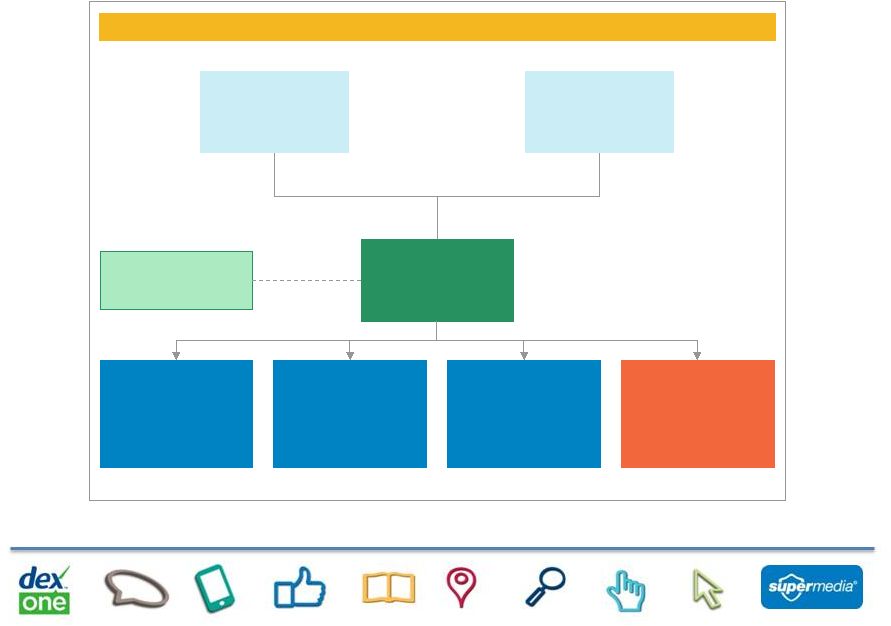

Condensed Pro Forma Corporate Structure

Dex East, Inc.

2012E Net Debt:

$489MM

2012E EBITDA:

$162MM

2012E PF EBITDA:

$188MM

Net Leverage

Stand-alone:

3.0x

PF East:

2.6x

Dex West, Inc.

2012E Net Debt:

$452MM

2012E EBITDA:

$184MM

2012E PF EBITDA:

$214MM

Net Leverage

Stand-alone:

2.4x

PF West:

2.1x

Dex One Shareholders

RHD, Inc.

2012E Net Debt:

$731MM

2012E EBITDA:

$215MM

2012E PF EBITDA:

$247MM

Net Leverage

Stand-alone:

3.4x

PF RHDI:

3.0x

Illustrative 2012E Pro Forma Corporate Structure Summary

(1)

Dex Media , Inc.

(HoldCo)

2012E Net Debt: $219MM

40% Ownership

60% Ownership

SuperMedia Shareholders

SuperMedia, Inc.

2012E Net Debt:

$1,366MM

2012E EBITDA:

$534MM

2012E PF EBITDA:

$622MM

Net Leverage

Stand-alone:

2.5x

PF SuperMedia:

2.2x

2012E PF Net Debt: $3.3Bn

2012E PF EBITDA: $1.3Bn

2012E PF Net Leverage: 2.6x

Note

1.

Pro forma analysis assumes gross, run-rate synergies as of 2012 and excludes

costs to achieve |

8

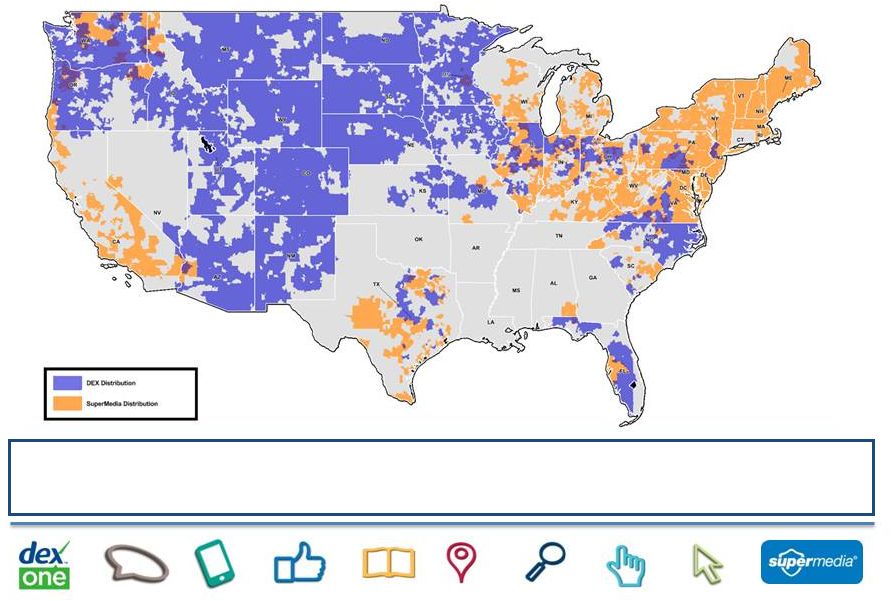

National Presence: Increased Scale & Scope

More Than 3,100 Marketing Consultants Building Trusted Relationships and

Delivering Results to Over 700,000 Local Businesses |

9

Peter McDonald Background

•

SuperMedia: Sept. 2010-Present, CEO

–

Implementing transformation from a product-focused yellow pages company to a

customer-focused marketing consultant across all local media, including

a complete suite of digital solutions –

Achieved

significant

cost

reductions

resulting

in

a

900bp

EBITDA

margin

improvement

(32%

FY2010

to

41%

in YTD2012).

•

RH Donnelley: 2002-Sept. 2008, President & COO

–

COO from 2004

–

Integrated acquisition of Dex Media ($1.6bn in revenues), generating synergies of

$75 million (~10% of Dex Media’s operating costs).

•

SBC Directory Operations: 2000-2001, $4.5bn in revenues, CEO

–

Replaced SBC CEO, when McDonald’s Ameritech operation was acquired.

–

Integrated SBC, Ameritech, Southern New England Telecom and PacTel

directories •

Ameritech Publishing and Advertising: 1994-2000, $1bn revenues, CEO

–

Launched one of industry’s first internet yellow pages operation in 1994:

Smartpages.com •

Previously, CEO of Dontech (RH Donnelley/Ameritech JV), GM of Donnelley Information

Publishing, AVP Planning & GM of Northeast region of RH Donnelley, GM of

National Telephone Directory Corporation.

More than 35 years of experience in the yellow pages industry and

managed three of the major U.S. directory operations |

10

Financial Overview |

11

Pro Forma Financial Summary

•

Declining print revenue and cash flow will continue to depress revenue and EBITDA

over the near-term

•

Synergies mitigate cash flow decline and provide company with time and resources to

grow digital business

•

Combined revenue from digital solutions will represent ~20% of total revenue in

2012 2011A

2012E

2011A

2012E

2011A

2012E

Revenue, net

1,642

1,371

1,481

1,304

3,123

2,675

Expenses

1,034

837

852

744

1,886

1,581

Run-Rate Synergies

(1)

-

-

-

-

(175)

(175)

Expenses

1,034

837

852

744

1,711

1,406

Adj. EBITDA

(2)

608

534

629

560

1,412

1,269

SuperMedia

(3,4)

Dex One

Pro Forma

Notes

Pro forma analysis assumes gross, run-rate synergies as of 2012 and excludes costs to achieve

Adjusted EBITDA is determined by adjusting EBITDA to exclude (i) gain on debt repurchases, (ii)

stock-based compensation expense and long-term incentive program, (iii) impairment

charges and (iv) gain on sale of assets, net and (v) other non-recurring items

SuperMedia EBITDA contains add-back for stock-based compensation expense/LTI expense of $6 and

$5 in 2011A and 2012E, respectively in order to make comparable to Dex One adjusted EBITDA

metric Historical and forecasted digital revenue for SuperMedia include approximately $17

million from a discontinued operation that was divested in August 2012. EBITDA forecasts also

include an offsetting $17 million in expenses

1.

2.

3.

4. |

12

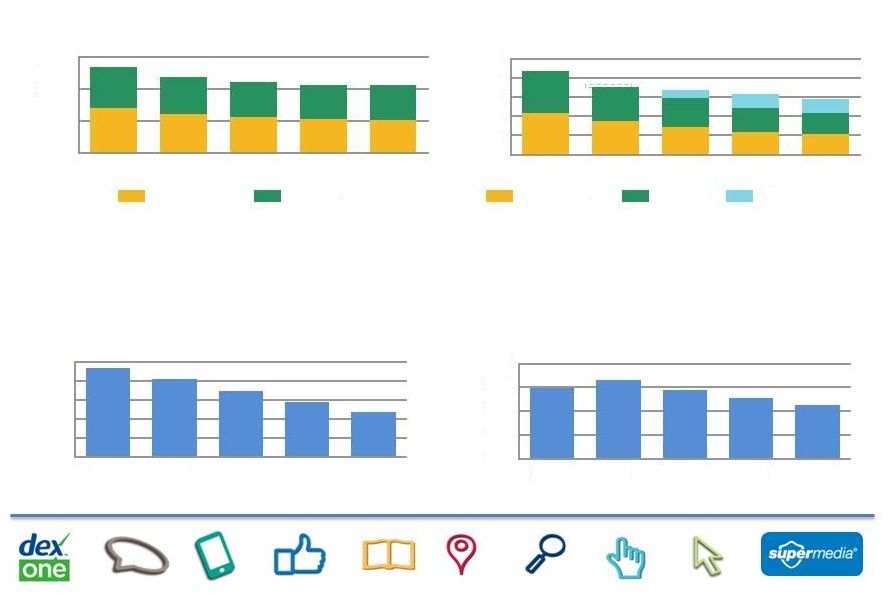

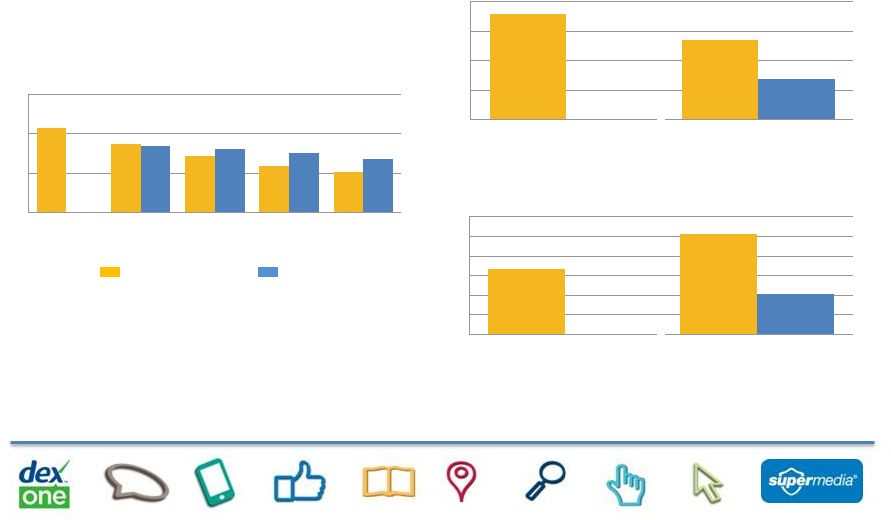

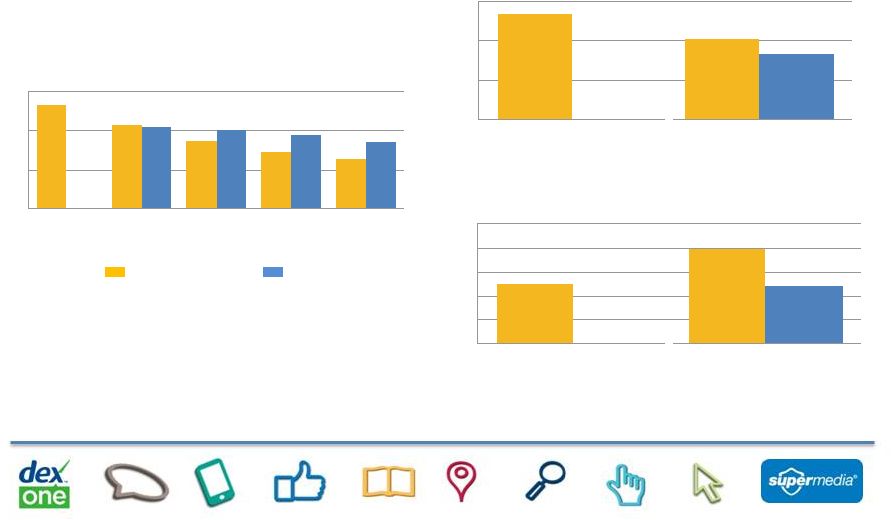

Pro Forma Projected Financial Performance

Growth (%):

Print:

(18.8)

(20.6)

(18.0)

(18.0)

(18.0)

Digital:

14.0

26.8

24.7

22.1

21.2

Total:

(14.3)

(12.1)

(6.8)

(3.9)

(0.3)

SuperMedia

Dex One

SuperMedia

Dex One

Synergies

1,371

1,186

1,095

1,040

1,023

1,304

1,167

1,098

1,066

1,077

2,675

2,353

2,193

2,107

2,100

0

1,000

2,000

3,000

2012E

2013E

2014E

2015E

2016E

Revenue

$MM

534

427

351

257

560

455

381

316

287

104

175

175

1,094

865

836

782

720

0

250

500

750

1,000

1,250

2012E

2013E

2014E

2015E

2016E

EBITDA

$MM

3,256

2,855

2,406

2,006

1,628

0

700

1,400

2,100

2,800

3,500

2012E

2013E

2014E

2015E

2016E

Debt

$MM

Net

3.0

3.3

2.9

2.6

2.3

0.00

1.00

2.00

3.00

4.00

2012E

2013E

2014E

2015E

2016E

Net Debt/Trailing EBITDA

x

(17)

291 |

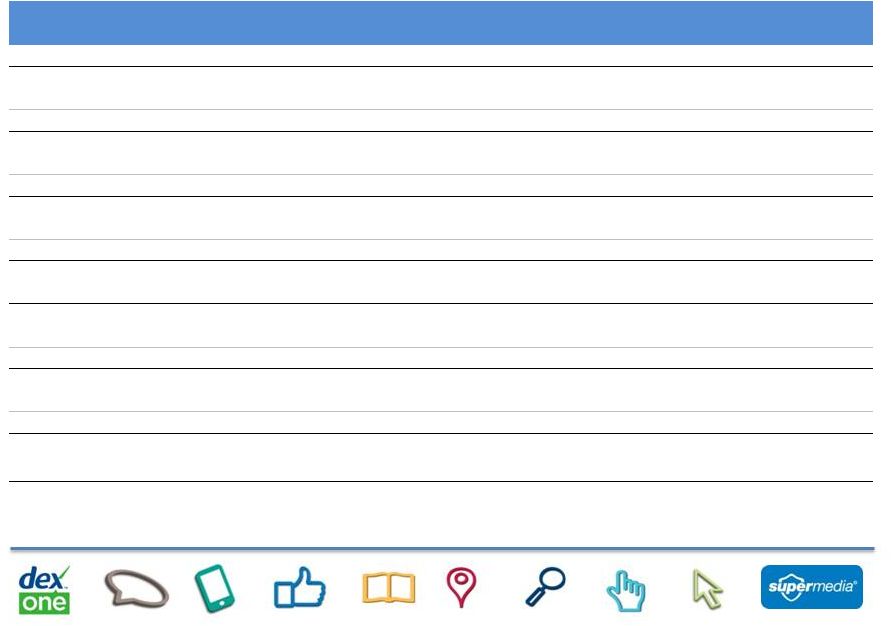

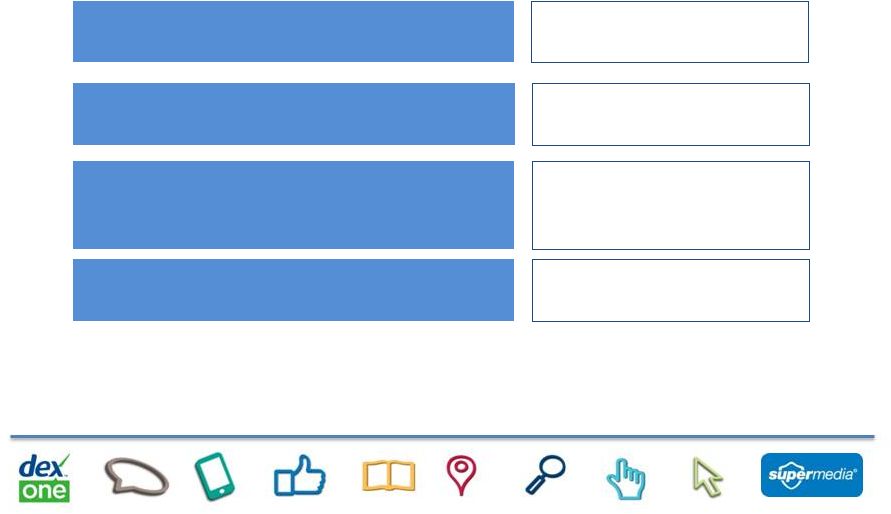

13

Comparison to Stand-Alone

Without Merger

Pro Forma

1,336

1,216

1,122

1,064

1,025

1,366

1,238

1,086

945

841

0

500

1,000

1,500

2012E

2013E

2014E

2015E

2016E

SuperMedia Net Debt

2.5

2.9

3.2

3.7

4.0

2.5

3.0

2.7

2.5

2.4

0.0

1.0

2.0

3.0

4.0

2012E

2013E

2014E

2015E

2016E

SuperMedia Net Debt / Trailing EBITDA Ratio

1,860

1,605

1,401

1,269

1,152

1,885

1,617

1,320

1,060

787

0

500

1,000

1,500

2,000

2012E

2013E

2014E

2015E

2016E

Dex One Net Debt

Without Merger

Pro Forma

3.3

3.5

3.7

4.0

4.0

3.4

3.6

3.0

2.6

2.1

0.0

1.0

2.0

3.0

4.0

2012E

2013E

2014E

2015E

2016E

Dex One Net Debt / Trailing EBITDA Ratio |

14

Long-Term Revenue Forecasts

•

The long term rate of decline in print revenues is based on an observed secular

trend in the industry over the past 4-5 years

–

The rate of revenue decline was exacerbated during 2008-2009 by the economic

downturn –

2011

reports

by

third

party

industry

observers

forecasted

annual

North

American

print

yellow

page

revenue

declines ranging from 12-16% during the projection period.

Year-to-date 2012 print revenue declines, however, have exceeded

these levels, which will also result in higher decline rates in 2013

–

Based on recent results and the observed longer term secular decline, management

projections contemplate an -18% annual decline in print revenue over

the forecast period •

The long term digital revenue growth forecast anticipates the company slightly

outpacing the overall

digital

media

industry

annual

growth

rate

of

18-21%

(1)

–

Enhancements

to

their

social,

local

and

mobile

digital

solutions

will

enable

the

companies

to

fully

participate

in the growing digital market

–

SuperMedia’s digital growth rate is projected to lag Dex One’s by

9-12 months as SuperMedia’s 2012 initiatives are realized in

revenue –

By 2014 the digital revenue growth rates are projected to converge

2011A

2012E

2013E

2014E

2015E

2016E

2011A

2012E

2013E

2014E

2015E

2016E

2011A

2012E

2013E

2014E

2015E

2016E

Print & Direct Mail

1,320

1,068

841

690

566

466

1,406

1,145

919

754

618

507

2,726

2,213

1,761

1,444

1,184

975

Digital

159

240

334

416

508

615

273

253

291

363

443

537

432

493

625

779

951

1,153

Other

17

11

7

7

7

10

0

0

0

0

0

0

17

11

7

7

7

7

Allowances & Credits

(16)

(14)

(15)

(14)

(14)

(14)

(37)

(27)

(24)

(22)

(21)

(20)

(53)

(41)

(39)

(36)

(35)

(35)

Net Revenue

1,481

1,304

1,167

1,098

1,066

1,077

1,642

1,371

1,186

1,095

1,040

1,023

3,123

2,675

2,353

2,193

2,107

2,100

Year-over-Year Growth Rates

Print & Direct Mail

-19%

-21%

-18%

-18%

-18%

-19%

-20%

-18%

-18%

-18%

-19%

-20%

-18%

-18%

-18%

Digital

51%

39%

25%

22%

21%

-7%

15%

25%

22%

21%

14%

27%

25%

22%

21%

Net Revenue

-12%

-11%

-6%

-3%

1%

-17%

-13%

-8%

-5%

-2%

-14%

-12%

-7%

-4%

0%

Dex One

SuperMedia

Pro Forma Combined

Note

1.

Source: Forrester, BIA/Kelsey, Barclays, Borrell, company estimates

|

15

•

Consolidate and rationalize G&A

functions

•

Reduce directory printing, paper,

production and distribution costs

•

Rationalize real estate, reduce

locations and adopt most

efficient real estate management

practices

•

Consolidate and rationalize IT

platforms, systems and

operations

•

Rationalize suppliers and

achieve scale discounts

Operations

•

Standardize on single platforms

and tools

•

Apply best IP and solutions to

reduce traffic acquisition costs,

rationalize digital products and

solutions and streamline and

automate digital fulfillment

•

Eliminate duplication in SEM

networks and standardize

agreements with distribution

partners

•

Rationalize suppliers and

partners

•

Rationalize development

resources

•

Eliminate duplicative business

development efforts

Digital Solutions

•

Apply best practices to

consulting approach, recruiting

and training

•

Adopt most effective

segmentation, channel

management and productivity

practices

•

Align compensation plans

•

Rationalize overlapping and

contiguous markets

Go To Market

Expected cumulative gross synergies of $535MM through 2016

Expense Synergies |

16

Cost to Achieve

Synergies

•

Expense synergies actions will be implemented in 2013 and ~70% of the run rate

synergies are expected to be realized in 2014

•

Total cost to achieve synergies of ~$100-120 million offset by realization of

synergy benefit over the same time period

•

The combined company will benefit from the increased scale and cost

efficiencies. The companies have conservatively not modeled any

revenue synergies Expense Synergies

Cumulative Net Synergies

-17

87

262

437

Cumulative Gross Synergies

60

185

360

535

60

125

175

175

77

21

0

50

100

150

200

2013E

2014E

2015E

2016E

2013E-2016E Expense Synergies Summary |

17

•

Vast majority of the synergies are associated with overhead and support

functions –

Management expects ~70-80% of the annual synergies will be captured in shared

service cost functions (see Appendix A for additional details on Amended

Shared Services Agreement) •

Alvarez & Marsal Transaction Advisory Group, LLC (“A&M”) was

retained by SuperMedia to evaluate management’s expense synergy

estimates and the one-time costs to achieve. –

After substantial investment of time and resources of both SuperMedia and Dex One,

A&M performed a detailed review of management’s estimates

–

The results of A&M’s review have been considered by management in the

synergy savings and one-time costs to achieve presented herein

Expense Synergies

Category

Low

High

Description

Print Product & Publishing

25

30

Paper, printing and distribution economies of scale & process/vendor

management redundancies

Digital Product Costs

20

25

Traffic acquisition efficiencies & fulfillment redundancies

Sales, Marketing & Advertising

40

45

Channel management redundancies, training efficiencies, expense and

headcount redundancies

IT

20

25

Platform consolidation, vendor consolidation & support efficiencies

Corporate & Operational Overhead

45

50

Headcount and occupancy redundancies, best practices efficiencies,

additional outsourcing opportunities, management redundancies

Total

150

175

|

18

Tax Asset Utilization

•

Dex One expects to have tax attributes of ~$1.8 billion at 2012 year-end

–

~$900 million net operating losses (NOLs)

–

~$900 million intangible basis

•

Provide $175-225 million of cash flow

–

Transaction preserves Dex One tax attributes and allows them to offset earnings of

the combined company

–

Provides Dex One lenders with incremental cash flow and SuperMedia lenders with a

portion of the overall tax savings

•

Existing Dex One Tax Sharing Agreement will be left in place, with certain

modifications

–

Dex One entities are reimbursed amongst themselves for tax attributes at 50%, no

reimbursement for tax attributes used to offset cancellation of

indebtedness income •

SuperMedia will enter into new Tax Sharing Agreement with Dex One such that:

–

The SuperMedia silo will reimburse the Dex One silos at 75% for tax

attributes –

The SuperMedia silo will retain 25% of the tax savings

•

Merger agreement contemplates trading restrictions for 5% shareholders to preserve

tax attributes |

19

Shared Digital Strategy

•

Each company expects to achieve approximately the same revenue from digital

products

and

solutions

in

2012

($240

-

$250

million

per

company)

•

Over the past 2½

years, both companies have improved their digital operations

–

Dex One has increased digital revenue by over 60%

–

SuperMedia

has

improved

digital

profit

contribution

(1)

margin

from

approximately

7%

to

32%

•

Over the past 18 months both companies have enhanced their digital

go-to-market strategy

–

Filled out their digital product offerings

–

Re-educated their go-to-market teams to be digital marketing

consultants –

Begun

offering

bundled

solutions

to

provide

digital

presence

and

performance

(leads)

–

Initial focus has been on penetrating existing print client base

Establishing digital relationships with existing and new local business

customers will be the driver for profitable market share growth

Note

1.

Profit contribution is a non-GAAP metric of revenue less direct and indirect

expenses. |

20

Foundation For Digital Growth

•

The companies will share and employ proven capabilities to improve combined digital

revenue growth and contribution margin to improve cash flow

–

Rationalize and enhance digital products

–

Apply most effective bundling and pricing practices

–

Achieve

quality

and

cost

improvements

in

fulfillment,

operations

and

service

–

Rationalize and enhance operating platforms, customer portals and consultant

analysis, presentation and administrative tools

–

Standardize on the most effective and efficient existing sales channels and

supplement with additional channels

•

Initiatives will focus on profitably increasing digital market share

–

Penetrating the rest of the existing customer base with digital products

–

Leading with digital products to increase new customer relationships

Merger provides ability to leverage digital strengths of each company

|

21

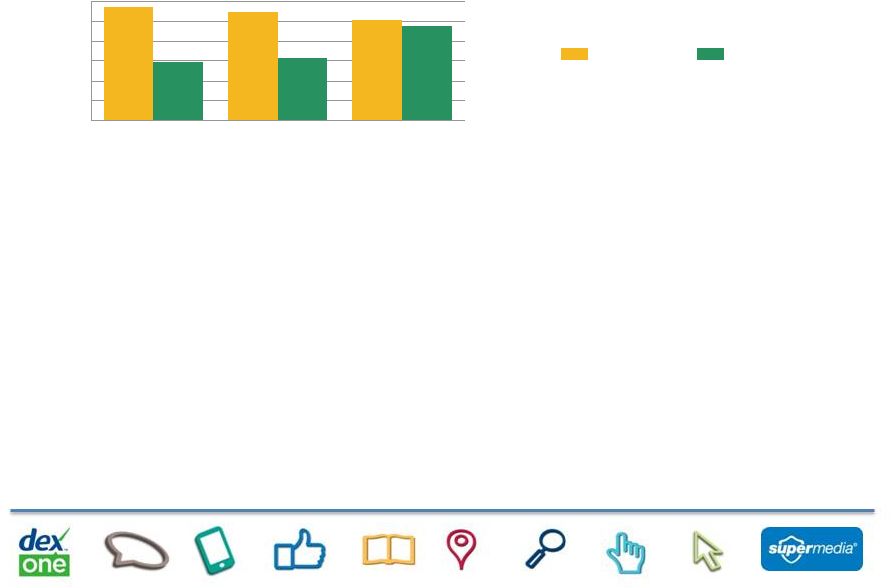

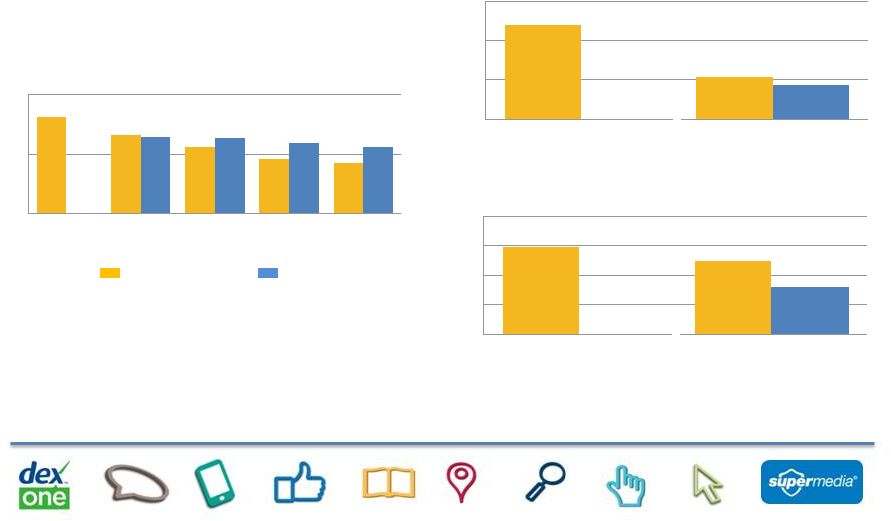

Historical Digital Trends

•

Dex

One

has

realized

significant

digital

revenue

growth

over

the

past

year

from

a

variety

of

initiatives

–

Enhancements to existing product offerings have led to better fulfillment and

quality scores –

Expanded digital packages have enabled Dex One to better tailor solutions to the

needs of its customers –

Improved

levels

of

digital

expertise

across

their

sales

channels

have

led

to

richer

customer

interactions

–

Reductions in the time to market for new products have been achieved through a

growing partnership network •

SuperMedia rationalized products and channels to focus on profitability

–

In 2009, SuperMedia had significant digital revenue stream but little profit

contribution after including all sales costs, overhead and technology

costs –

In 2010 and 2011, management undertook a comprehensive approach to address the

cost structure and develop a new strategy for digital solutions

•

Underperforming sales channels were closed or divested (Internet-only channel,

reseller channel) •

Low margin products were eliminated or re-designed

–

While revenue declined over the three year period, profit contribution margin was

greatly enhanced Note

1.

Dex

One

digital

revenue

in

2010

pro

forma

for

the

disposition

of

Business.com

285

273

253

147

159

240

0

50

100

150

200

250

300

2010A

2011A

2012E

Digital Revenue

(1)

SuperMedia

Dex One

$MM |

22

Amendment Overview |

23

Credit Agreement Amendments Approach

•

The proposed merger and the maturity extension allows both companies to improve

cash flow and reduce leverage relative to their stand-alone

prospects –

The lenders at EACH credit silo receive MORE cumulative cash from interest,

mandatory amortization

and

mandatory

sweep

under

the

proposed

loan

amendments

than

they

would

on a stand-alone basis

–

Despite

distressed

levels

of

both

companies’

debt,

NO

proposed

principal

or

interest

reduction as part of the merger

–

Significant operational and financial synergies which can be used to efficiently

de-leverage •

The combined companies requires the runway to transform and achieve synergies

without risk of triggering a default due to a covenant breach, mandatory

amortization or maturity

–

The merger will require significant management effort to reduce expenses and

headcount •

In order to achieve the merger benefits, the necessary components of the credit

agreement amendments include:

–

Modest extension of maturity

–

Reset financial covenants to provide operating flexibility

–

Reduction in Dex One’s mandatory amortization and shift to a quarterly cash

sweep –

Ability to use the borrower’s portion of cash flow in market-based tender

for debt |

24

Credit Agreement Amendments Approach

•

This approach is not new, as the proposed amendments mirror the approach taken in

the existing SuperMedia credit agreement

–

SuperMedia has used all of its free cash flow to return ~$1 billion to its lenders

since emergence from bankruptcy through June 2012

–

~$625 million of principal reduction through mandatory cash sweep and the balance

returned to lenders using the borrower’s portion of cash flow to

tender for debt •

Both the Dex One and SuperMedia management teams and the Boards of the

respective companies support the proposed merger and believe that all stakeholders

benefit relative to the stand-alone prospects of these

stakeholders |

25

Credit Agreement Amendments Overview

•

Extends maturity to December 31, 2016

–

All loans under the various credit agreements mature before the Senior

Subordinated Notes due 2017 •

Revised interest rate economics

–

Increased

LIBOR

spread

for

RHDI

and

Dex

West

lenders

through

the

extension

period

–

Implement LIBOR floor for Dex East lenders to equalize floor across all credit

silos at 3.0% –

Increased LIBOR spread for Dex East during the extension period

•

Adjusts

mandatory

amortization

and

cash

sweep

levels

at

RHDI

and

Dex

East

to

accommodate projected financial performance and volatility of cash flow during

transition period

–

Annual mandatory amortization of approximately $20 million for each Dex One credit

silo –

Compensating upward adjustment in cash flow sweep to re-capture any

incremental cash flow in 2013 and 2014

•

Provides the combined company with ability to make discounted tender offers through

maturity with borrower’s portion of excess cash flow

–

Market-based opportunity for borrowers to efficiently de-leverage

–

Liquidity for market participants

–

Improves debt trading dynamics |

26

RHDI Credit Agreement Amendment

Current

Proposed Amendment

Maturity

October 24, 2014

December 31, 2016

Interest Rate

2013 –

2014

L+600bps

(1)

(3.0% floor)

L+625 bps (3.0% Floor)

2015 –

2016

N/A

L+650 bps (3.0% Floor)

Mandatory Amortization

2013 –

2014

$10.8 million per quarter

$5.0 million per quarter

2015 –

2016

N/A

$5.0 million per quarter

Cash Flow Sweep

2013 –

2014

50% -

60% of ECF

(2)

, annually

90.0% of ECF for first $25.9 million,

50.0% thereafter, quarterly

2015 –

2016

N/A

50.0% of ECF, quarterly

Discount Tender Opportunity

Borrower’s portion of ECF through 12/31/13

Borrower’s portion of ECF through maturity

Leverage Covenant

2013 –

2014

4.25x in 2013 & 4.00x in 2014

6.0x

2015 –

2016

N/A

6.0x

Interest Coverage Covenant

2013 –

2014

1.90x in 2013 & 2.00x in 2014

1.0x

2015 –

2016

N/A

1.0x

Other

Maintain existing $5 million annual RP basket and allow pull-forward of future

basket amounts through maturity into current year, extend discounted

voluntary prepayments, permit borrower’s portion of excess cash flow

basket to roll-over and permit certain other affiliate transactions.

Notes

1.

Actual LIBOR spread based on grid pricing. Proposed amendment eliminated

grid-based pricing. 2.

Actual excess cash sweep percentage based on leverage ratio grid.

|

27

RHDI Pro Forma Metrics

Without Merger

Pro Forma

215

174

143

118

105

215

170

162

150

136

0

100

200

300

2012E

2013E

2014E

2015E

2016E

EBITDA

721

541

729

282

0

200

400

600

800

2012E

2016E

Net Debt

(1)

Note:

1.

3.4

5.2

3.4

2.1

0.0

1.0

2.0

3.0

4.0

5.0

6.0

2012E

2016E

Net Debt/Trailing EBITDA

(1)

For purposes of this analysis, borrower’s portion of excess cash flow is assumed to be used to

retire debt through a tender or voluntary repayment. The analysis above assumes a market

price of 100% for all bank debt tenders. |

28

RHDI Pro Forma Lender Economics

2013E

2014E

2015E

2016E

Total

2013E

2014E

2015E

2016E

Total

Leveraged Free Cash Flow

(1)

82

56

28

14

180

107

126

105

112

450

Amortization

43

43

-

-

86

20

20

20

20

80

Cash Sweep

26

11

28

14

79

58

67

45

48

218

Principal Payments

69

54

28

14

165

78

87

65

68

298

Cash Interest

64

58

57

55

234

65

54

45

34

198

Cash Returned to Lenders

133

112

85

69

399

143

141

110

102

496

Company Portion of Cash Flow

(2)

13

2

-

-

15

29

39

40

43

151

Cash Including Company Portion

146

114

85

69

414

172

180

150

145

647

Stand-Alone

(3)

Pro Forma

Notes

1.

Leveraged Free Cash represents EBITDA less working capital, capital expenditures,

cash interest, taxes and restricted payments. 2.

For purposes of this analysis, borrower’s portion of excess cash flow is

assumed to be used to retire debt through a tender (at 100%) or voluntary repayment.

3.

In the stand-alone projection, all cash flow after the original maturity is

presented as reducing debt as a cash flow sweep. •

Lenders will realize improved cash returns due to incremental cash flow

from synergies and tax sharing benefits

•

The proposed amendment adjusts the mandatory amortization to a level

that provides sufficient liquidity and operating flexibility during the integration

period

•

The cash sweep starts at 90% for the first $25.9 million to allow the lenders

to recapture all of the cash flow generated up to the current amortization

schedule through 2014 |

29

Dex East Credit Agreement Amendment

Current

Proposed Amendment

Maturity

October 24, 2014

December 31, 2016

Interest Rate

2013 –

2014

L+250bps

(no floor)

L+250 bps (3.0% floor)

2015 –

2016

N/A

L+300 bps (3.0% floor)

Mandatory Amortization

2013 –

2014

$29 million per quarter

$5.0 million per quarter

2015 –

2016

N/A

$5.0 million per quarter

Cash Flow Sweep

2013 –

2014

50% -

65% of ECF

, annually

90.0% of ECF, quarterly

2015 –

2016

N/A

50.0% of ECF, quarterly

Discount Tender Opportunity

Borrower’s portion of ECF through 12/31/13

Borrower’s portion of ECF through maturity

Leverage Covenant

2013 –

2014

5.00x

6.0x

2015 –

2016

N/A

6.0x

Interest Coverage Covenant

2013 –

2014

N/A

1.0x

2015 –

2016

N/A

1.0x

Other

Maintain existing $5 million annual RP basket and allow pull-forward of future

basket amounts through maturity into current year, extend discounted

voluntary prepayments, permit borrower’s portion of excess cash flow

basket to roll-over and permit certain other affiliate transactions.

Notes

1.

Actual LIBOR spread based on grid pricing. Proposed amendment eliminated

grid-based pricing. 2.

Actual excess cash sweep percentage based on leverage ratio grid.

2

1 |

30

Dex East Pro Forma Metrics

Without Merger

Pro Forma

162

131

112

93

86

162

128

127

119

112

0

100

200

2012E

2013E

2014E

2015E

2016E

EBITDA

478

214

487

174

0

200

400

600

2012E

2016E

Net Debt

(1)

3.0

2.5

3.0

1.6

0.0

1.0

2.0

3.0

4.0

2012E

2016E

Net Debt/Trailing EBITDA

(1)

Note

1.

For purposes of this analysis, borrower’s portion of excess cash flow is assumed to be used to

retire debt through a tender or voluntary repayment. The analysis above assumes a

market price of 100% for all bank debt tenders. |

31

Dex East Lender Economics

•

Based on the projected cash flow, it is not feasible for Dex East to service its

current amortization schedule on a stand-alone basis

•

The proposed amendment adjusts the mandatory amortization to a level that

provides sufficient liquidity and operating flexibility during the integration

period •

The lenders still capture the cash flow of Dex East through the 90% cash sweep

though 2014

•

Lenders improve their overall economics through the interest rate increase and

retain the vast majority of the cash flow generated through the revised

amortization schedule and the cash sweep

2013E

2014E

2015E

2016E

Total

2013E

2014E

2015E

2016E

Total

Leveraged Free Cash Flow

(1)

88

77

49

50

264

81

82

71

80

314

Amortization

88

77

-

-

165

20

20

20

20

80

Cash Sweep

-

-

49

50

99

59

61

28

33

181

Principal Payments

88

77

49

50

264

79

81

48

53

261

Cash Interest

20

17

26

23

86

32

28

25

21

106

Cash Returned to Lenders

108

94

75

73

350

111

109

73

74

367

Company Portion of Cash Flow

(2)

-

-

-

-

-

2

1

23

27

53

Cash Including Company Portion

108

94

75

73

350

113

110

96

101

420

Stand-Alone

(3)

Pro Forma

Notes

1.

Leveraged Free Cash represents EBITDA less working capital, capital expenditures,

cash interest, taxes and restricted payments. 2.

For purposes of this analysis, borrower’s portion of excess cash flow is

assumed to be used to retire debt through a tender (at 100%) or voluntary repayment.

3.

In the stand-alone projection, all cash flow after the original maturity is

presented as reducing debt as a cash flow sweep. |

32

Dex West Credit Agreement Amendment

Current

Proposed Amendment

Maturity

October 24, 2014

December 31, 2016

Interest Rate

2013 –

2014

L+400 bps

(1)

(3.0% floor)

L+425 bps (3.0% floor)

2015 –

2016

N/A

L+450 bps (3.0% floor)

Mandatory Amortization

2013 –

2014

$4.832 million per quarter

$4.832 million per quarter

2015 –

2016

N/A

$4.832 million per quarter

Cash Flow Sweep

2013 –

2014

50% of ECF

(2)

, annually

50.0% of ECF, quarterly

2015 –

2016

N/A

50.0% of ECF, quarterly

Discount Tender Opportunity

Borrower’s portion of ECF through 12/31/13

Borrower’s portion of ECF through maturity

Leverage Covenant

2013 –

2014

3.00x

6.0x

2015 –

2016

N/A

6.0x

Interest Coverage Covenant

2013 –

2014

1.35x

1.0x

2015 –

2016

N/A

1.0x

Other

Maintain existing $5 million annual RP basket and allow pull-forward of future

basket amounts through maturity into current year, extend discounted

voluntary prepayments, permit borrower’s portion of excess cash flow

basket to roll-over, permit certain other affiliate transactions and eliminate

ability to loan funds to Dex East and the senior secured leverage ratio

covenant. Notes

1.

Actual LIBOR spread based on grid pricing and leverage is expected to fall below

2.50x in 2012. Proposed amendment eliminates grid-based pricing.

2.

Actual cash sweep percentage based on leverage ratio grid and leverage is expected

to fall below 2.50x in 2012 resulting in a 50% ECF sweep this year. |

33

Dex West Pro Forma Financial Profile

Without Merger

Pro Forma

184

150

126

104

97

184

148

143

133

126

0

100

200

2012E

2013E

2014E

2015E

2016E

EBITDA

442

174

451

109

0

200

400

600

2012E

2016E

Net Debt

(1)

2.4

1.8

2.4

0.9

0.0

1.0

2.0

3.0

2012E

2016E

Net Debt/Trailing EBITDA

(1)

Note

1.

For purposes of this analysis, borrower’s portion of excess cash flow is assumed to be used to

retire debt through a tender or voluntary repayment. The analysis above assumes a market

price of 100% for all bank debt tenders. |

34

Dex West Lender Economics

•

The current amortization schedule for Dex West is the lowest among the Dex One

credit silos

•

Based on the projected cash flow, the proposed amendment does not require a

change to the mandatory amortization and extends it at the current levels through

December 31, 2016

•

Incremental

cash

flow

from

synergies

and

increased

interest

rate

starting

in

2013

provides the lenders with improved overall economics

2013E

2014E

2015E

2016E

Total

2013E

2014E

2015E

2016E

Total

Leveraged Free Cash Flow

(1)

86

71

57

55

269

87

89

84

83

343

Amortization

19

19

19

19

77

19

19

19

19

77

Cash Sweep

46

29

21

21

117

36

37

35

34

142

Principal Payments

65

48

40

40

194

55

56

54

53

219

Cash Interest

33

28

23

19

103

32

26

20

14

92

Cash Returned to Lenders

98

76

63

59

297

87

82

74

67

311

Company Portion of Cash Flow

(2)

20

24

16

16

76

32

33

30

30

124

Cash Including Company Portion

118

100

79

75

373

119

115

104

97

435

Stand-Alone

(3)

Pro Forma

Notes

1.

Leveraged Free Cash represents EBITDA less working capital, capital expenditures,

cash interest, taxes and restricted payments. 2.

For purposes of this analysis, borrower’s portion of excess cash flow is

assumed to be used to retire debt through a tender (at 100%) or voluntary repayment.

3.

In

the

stand-alone

projection,

analysis

assumes

existing

amortization

schedule

is

continued

in

2015

and

2016. |

35

SuperMedia Credit Agreement Amendment

Current

Proposed Amendment

Maturity

December 31, 2015

December 31, 2016

Interest Rate

2013 –

2015

L+800 bps (3% Floor)

L+800 bps (3% Floor)

2016

N/A

L+800 bps (3% Floor)

Mandatory Amortization

2013 –

2015

None

None

2016

N/A

None

Cash Flow Sweep

2013 –

2015

67.5% of FCF, quarterly

50.0% of FCF, quarterly

2016

N/A

50.0% of FCF, quarterly

Discount Tender Opportunity

Borrower’s portion of FCF through 12/31/13

Borrower’s portion of FCF through maturity

Leverage Covenant

2013 –

2015

7.5x

7.5x

2016

N/A

7.5x

Interest Coverage Covenant

2013 –

2015

1.10x

1.10x

2016

N/A

1.10x

Other

Refresh disposition and investment baskets, provide limited restricted payment,

allow borrower to enter into intercompany operating agreements, permit

below par loan repurchases out of borrower’s portion of cash flow and

permit certain other affiliate transactions. |

36

SuperMedia Pro Forma Financial Profile

Without Merger

Pro Forma

534

427

351

291

257

534

419

403

379

344

0

200

400

600

2012E

2013E

2014E

2015E

2016E

EBITDA

1,336

1,025

1,361

841

0

500

1,000

1,500

2012E

2016E

Net Debt

(1)

2.5

4.0

2.5

2.4

0.0

1.0

2.0

3.0

4.0

5.0

2012E

2016E

Net Debt/Trailing EBITDA

(1)

Note

1.

For purposes of this analysis, borrower’s portion of excess cash flow is assumed to be used to

retire debt through a tender or voluntary repayment. The analysis above assumes a market

price of 100% for all bank debt tenders. |

37

SuperMedia Lender Economics

•

Lenders will realize improved cash returns due to incremental cash flow

•

Pro forma cash sweep under proposed amendment will exceed the cash

sweep in the stand-alone projections

2013E

2014E

2015E

2016E

Total

2013E

2014E

2015E

2016E

Total

Leveraged Free Cash Flow

(1)

120

94

58

39

311

128

153

140

105

526

Amortization

-

-

-

-

-

-

-

-

-

-

Cash Sweep

81

64

39

26

210

64

76

70

52

262

Principal Payments

81

64

39

26

210

64

76

70

52

262

Cash Interest

154

142

134

129

559

154

138

122

109

523

Cash Returned to Lenders

235

206

173

155

769

218

214

192

161

785

Company Portion of Cash Flow

(2)

39

31

19

13

101

64

76

70

52

262

Cash Including Company Portion

274

237

192

167

870

282

291

262

213

1,048

Stand-Alone

(3)

Pro Forma

Notes

1.

Leveraged Free Cash represents EBITDA less working capital, capital expenditures,

cash interest, taxes and restricted payments. 2.

For purposes of this analysis, borrower’s portion of cash flow is assumed to

be used to retire debt through a tender (at 100%) or voluntary repayment.

3.

In the stand-alone projection, all cash flow after the original maturity is

presented as reducing debt as a cash flow sweep. |

38

Next Steps and Timeline |

39

Transaction Anticipated to be Completed by

End of 2012

Lender Steering Committee Formed/

FTI Due Diligence Process

August 2012

Finalize Amendments with Various

Lender Groups and Receive

Requisite Lender Consents

October 2012

Shareholder Approval and Closing

November 2012

Meeting With Lenders

September 2012 |

40

Appendix

A

Shared

Service

Agreement

Details |

41

•

Dex One currently uses a Shared Services Agreement to allocate overhead and

co- mingled back-office costs between the three operating

companies –

Shared expenses include:

•

General and Administration Services: Executive, Finance, Human Resources,

Legal, Information Technology, Corporate Facilities, Publishing and

Communications •

Operations Support Services: Marketing and Advertising, Print & Delivery,

Management, Customer Service, Billing, Credit and Operations Facilities

•

Sales Leadership and Effectiveness Services: Sales Leadership Team, Sales

Reporting, Training, Sales Office Support, Sales Compensation Analysis and

National Sales •

Digital Operations Services: Digital Information Technology: Digital Leadership

Team, Non-Print Product Development and Digital Reporting

–

Allocation of expense is based on prior year revenue and adjusted annually

•

The amended Shared Services Agreement will pool the combined shared services of

both SuperMedia and Dex One and then, similar to the existing Dex One

agreement, allocate the cost pool based on prior year revenue

–

The 2012 expense allocation will be 53%/47% for SuperMedia and Dex One,

respectively, based on 2011 revenue

–

The 2013 allocation will be based on 2012 revenue, currently forecast to be

51%/49% for SuperMedia and Dex One, respectively

–

Dex One Service will continue to allocate its portion of the shared service

expense to Dex East,

Dex

West,

RHDI

and

Dex

One

in

accordance

with

the

existing

allocation

methodology

(prior year’s revenue)

Shared Services Agreement |

42

Shared Services Agreement

SuperMedia

Dex One

Total

SuperMedia

Dex One

Total

SuperMedia

Dex One

2011A

288

247

535

283

252

535

(5)

5

YTD 6/30/12A

123

105

228

120

108

228

(3)

3

Actual Expense

Shared Service

Shared Service Agreement

Illustrative Result of

Difference from Actual

Allows senior management to be agnostic to where the synergy is realized (i.e. it does not

matter economically whether SuperMedia or Dex One eliminates the cost) as the overall

reduction is captured in the cost pool •

Agreement provides flexibility to implement common management platforms and

ultimately consolidate the cost structure

Costs will be tracked on detailed basis and billed / settled between SuperMedia

and Dex One every month

Vast majority of the synergies are derived from the shared service pool

(70-80% based on the year)

•

The proposed agreement was evaluated on a historical basis and management

determined that the methodology would have produced results within 2% of the

actual results |

43

Appendix

B

Dex

One

Silo

Comparison |

44

Dex West

Dex East

RHDI

Market Tier Split

2012 Ad Sales

Major Metro

Markets

Seattle, Portland, Phoenix, Salt Lake

City

Minneapolis, Denver

Las Vegas, Chicago, Orlando

(partial)

Revenue & EBITDA

LTM Q2 2012

Revenue (% of Total)

EBITDA (% of Total)

EBITDA Margin

32%

33%

45%

Revenue (% of Total)

EBITDA (% of Total)

EBITDA Margin

27%

29%

47%

Revenue (% of Total)

EBITDA (% of Total)

EBITDA Margin

41%

38%

41%

Silo Overview

•

Dex

One

management

primarily

operates

the

business

on

a

regional

and

consolidated

basis

-

rather

than

at

the

silo

level

–

while

recognizing

the

unique

credit

circumstances

facing

each

silo

•

Management believes its product offerings, training, and execution are similar

across all regions –

Differences

in

silo

performance

relate

to

the

markets

themselves

rather

than

factors

under

direct

management control

–

The proposed merger will preserve underlying silo operating characteristics and

the relative performance differences

Major

Metro

Market

42%

Large

Market

13%

Mid

Market

33%

Small

Market

12%

Major

Metro

Market

30%

Large

Market

25%

Mid

Market

29%

Small

Market

16%

Major

Metro

Market

40%

Large

Market

10%

Mid

Market

34%

Small

Market

16% |

45

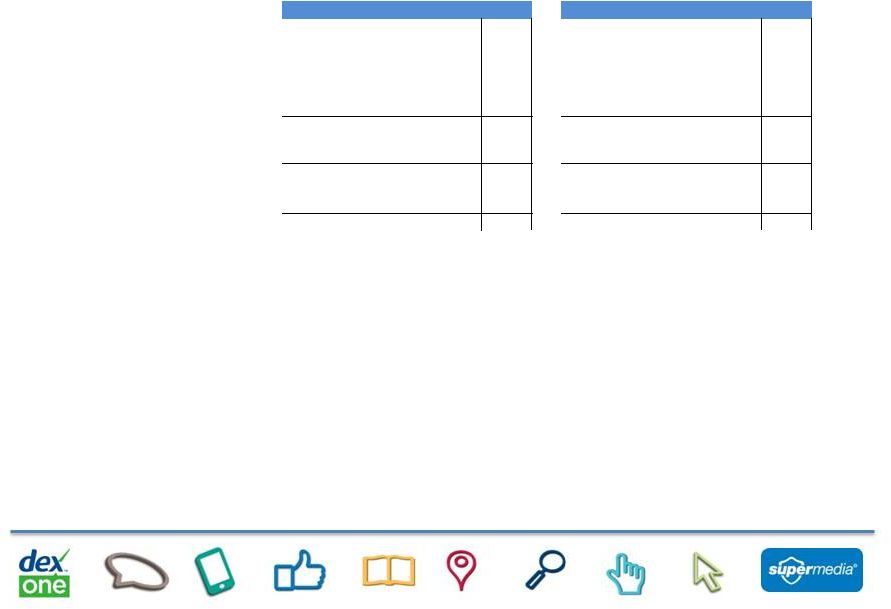

Silo Historical Revenue Performance

•

Each of the Dex One silos has experienced differing revenue and cost trends over

time •

Market size has been the biggest driver of print ad sales / revenue decline with

major metros declining at a faster rate than small/ rural markets

–

Dex West includes major metro markets that suffer from a set of challenges unique

to those areas –

Due

to

the

historical

declines

already

incurred,

each

silo

has

a

similar

revenue

exposure

to

major

metro and large markets

–

Digital penetration (digital revenue as % of total revenue) is similar across all

silos Revenue Index

(Indexed with its Q1 2010 value set at 100)

Digital Revenue (as % of Total)

(32%)

(26%)

(22%)

65%

70%

75%

80%

85%

90%

95%

100%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

17%

21%

18%

5%

7%

9%

11%

13%

15%

17%

19%

21%

23%

25%

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Dex West

Dex East

RHDI |

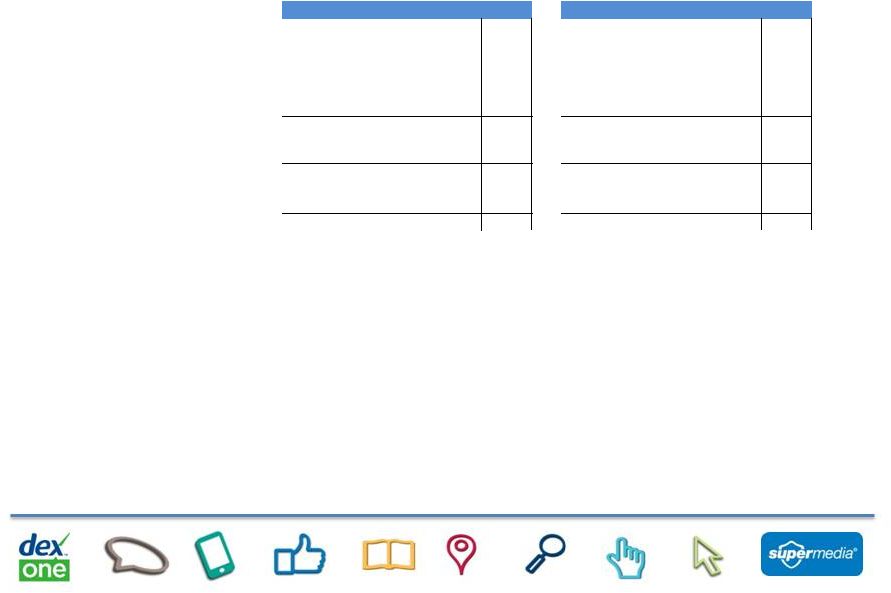

46

Silo Historical EBITDA Performance

•

Historically,

RHDI

margins

have

been

lower

than

Dex

West

and

Dex

East

–

However, from a trending perspective, relative EBITDA performance varies from

period to period –

Examples

of

differences

that

impact

margin

include

the

timing

of

initiatives

such

as

print/paper

optimization,

distribution

initiatives,

re-scoping markets and centralizing telesales

•

Key underlying operating differences at each silo level include:

–

Bad Debt:

RHDI markets have exhibited worse bad debt trends as a result of economic

factors. –

Sales & Sales Support Costs:

Vary by silo due to population density. For example, RHDI regions are spread over

greater distances, resulting in higher headcount and sales person/manager

costs –

Print Cost of Sales:

Smaller markets (RHDI has the greatest proportion) have a higher cost per

directory than large markets due to scale

–

Digital

Cost

of

Sales:

RHDI

markets

have

less

organic

traffic

on

Dexknows.com

than

Dex

One

markets

(likely

due

to

less

name

brand

recognition

in

non-Dex

One

markets),

driving

a

higher

level

of

purchased

traffic

to

support

the

IYP

product

–

G&A:

Dex West continues to have higher state and local taxes due to the Washington

Business and Occupancy tax EBITDA Margin

EBITDA Index

(Indexed with its Q1 2010 value set at 100) |

47

Appendix

C

Financial

Projection

Details

EBITDA and Adjusted EBITDA are not measurements of operating performance computed in

accordance with GAAP and should not be considered as a substitute for net income (loss)

prepared in conformity with GAAP. In addition, EBITDA and Adjusted EBITDA may not be

comparable to similarly titled measures of other companies. Management believes that these

non-GAAP financial measures are important indicators of our operations because they

exclude items that may not be indicative of, or related to, our core operating results, and

provide a better baseline for analyzing our underlying business. Adjusted EBITDA is

determined by adjusting EBITDA for (i) gain on debt repurchases, (ii) stock-based compensation

expense and long-term incentive program, (iii) impairment charges and (iv) gain on sale

of assets, net and (v) other non-recurring items. Leveraged free cash flow is not a measurement of operating performance computed in accordance

with GAAP and should not be considered as a substitute for cash flow from operations

prepared in conformity with GAAP. In addition, leveraged free cash flow may not be comparable to a similarly titled measure of other companies. Management believes

that this cash flow measure provides investors and stockholders with a relevant measure of

liquidity and a useful basis for assessing the Company's ability to fund its activities and

obligations.

|

48

Consolidated Pro Forma Detail

Notes

1.

Projections reflect proposed amendments and estimated synergies

2.

“Other”

primarily represents capital expenditures, changes in working capital and other

operating cash flow requirements $MM

2012E

2013E

2014E

2015E

2016E

Revenue

2,675

$

2,353

$

2,193

$

2,107

$

2,100

$

Adj EBITDA - Pre Synergies

1,094

882

732

607

544

Synergies, net

-

(17)

104

175

175

Adj EBITDA

(1)

1,094

865

836

782

719

Bank Interest

(316)

(283)

(246)

(212)

(178)

Bond Interest

(22)

(16)

(16)

(16)

(17)

Payments to Hold Co

-

-

-

-

-

Taxes/Tax Sharing

(111)

(66)

(46)

(65)

(60)

Other

(2)

(96)

(82)

(63)

(72)

(71)

Leveraged Free Cash Flow

550

418

465

416

394

Debt, ending

3,467

3,066

2,617

2,218

1,840

Cash, ending

211

211

212

212

212

Net Debt, ending

3,256

2,855

2,406

2,006

1,628

Net Debt/Adj EBITDA

3.0x

3.3x

2.9x

2.6x

2.3x

Dex Media (Combined Companies) |

49

Pro Forma SuperMedia and Dex One Detail

Notes

1.

Projections reflect proposed amendments and estimated synergies

2.

“Other”

primarily represents capital expenditures, changes in working capital and other

operating cash flow requirements 3.

Historical and forecasted digital revenue for SuperMedia include approximately $17

million from a discontinued operation that was divested in August, 2012. EBITDA

forecasts also include an offsetting $17 million in expenses

$MM

2012E

2013E

2014E

2015E

2016E

2012E

2013E

2014E

2015E

2016E

Revenue

1,371

$

1,186

$

1,095

$

1,040

$

1,023

$

1,304

$

1,167

$

1,098

$

1,066

$

1,077

$

Adj EBITDA - Pre Synergies

534

427

351

291

257

560

455

381

316

287

Synergies, net

(9)

52

88

87

-

(9)

52

88

88

Adj EBITDA

(1)

534

419

403

379

344

560

446

434

403

375

Bank Interest

(174)

(154)

(138)

(122)

(109)

(142)

(130)

(108)

(90)

(69)

Bond Interest

-

-

-

-

-

(22)

(16)

(16)

(16)

(17)

Payments to Hold Co

-

-

-

-

-

-

-

-

-

-

Taxes/Tax Sharing

(96)

(97)

(84)

(83)

(96)

(15)

31

38

18

36

Other

(2)

(23)

(41)

(28)

(33)

(35)

(73)

(42)

(34)

(38)

(36)

Leveraged Free Cash Flow

241

128

153

140

105

309

290

313

276

289

Debt, ending

1,461

1,334

1,181

1,041

936

2,006

1,732

1,436

1,177

904

Cash, ending

95

95

95

95

95

115

115

116

117

117

Net Debt, ending

1,366

1,238

1,086

945

841

1,890

1,617

1,320

1,060

787

Net Debt/Adj EBITDA

2.6x

3.0x

2.7x

2.5x

2.4x

3.4x

3.6x

3.0x

2.6x

2.1x

SuperMedia

(3)

Dex One |

50

Pro Forma Dex One Credit Silo Detail

Notes

1.

Projections reflect proposed amendments and estimated synergies

2.

“Other”

primarily represents capital expenditures, changes in working capital and other

operating cash flow requirements $MM

2012E

2013E

2014E

2015E

2016E

2012E

2013E

2014E

2015E

2016E

Revenue

541

$

479

$

449

$

437

$

441

$

348

$

308

$

292

$

285

$

288

$

Adj EBITDA - Pre Synergies

215

174

143

118

105

162

131

112

93

86

Synergies, net

-

(3)

20

33

32

-

(2)

15

26

26

Adj EBITDA

(1)

215

170

162

150

136

162

128

127

119

112

Bank Interest

(77)

(65)

(54)

(45)

(34)

(24)

(32)

(28)

(25)

(21)

RP for Bond Interest

(8)

(6)

(6)

(6)

(6)

(6)

(4)

(4)

(4)

(4)

RP Basket

(5)

(5)

(5)

(5)

(5)

(5)

(5)

(5)

(5)

(5)

Taxes/Tax Sharing

5

26

38

21

34

(6)

8

4

0

7

Other

(2)

(60)

(14)

(10)

(11)

(14)

14

(14)

(12)

(13)

(9)

Leveraged Free Cash Flow

69

107

126

105

112

137

81

82

71

80

Debt, ending

755

648

522

417

306

538

458

375

304

224

Cash, ending

24

24

24

24

24

50

50

50

50

50

Net Debt, ending

731

624

498

393

282

489

408

325

255

174

Net Debt/Adj EBITDA

3.4x

3.7x

3.1x

2.6x

2.1x

3.0x

3.2x

2.6x

2.1x

1.6x

RHDI

Dex Media East |

51

Pro Forma Dex One Credit Silo Detail

Notes

1.

Projections reflect proposed amendments and estimated synergies

2.

“Other”

primarily represents capital expenditures, changes in working capital and other

operating cash flow requirements 3.

Projections

assume

senior

subordinated

note

holders

continue

to

receive

interest

on

existing

terms

(50%

in

cash

and

50%

PIK)

4.

Projections

assume

senior

subordinated

notes

are

repurchased

in

a

market-based

tender

using

cash

at

Hold

Co.

For

purposes

of

the

projections

herein,

the

market-

$MM

2012E

2013E

2014E

2015E

2016E

2012E

2013E

2014E

2015E

2016E

Revenue

411

$

366

$

339

$

325

$

329

$

4

$

14

$

18

$

19

$

19

$

Adj EBITDA - Pre Synergies

184

150

126

104

97

(2)

-

1

1

(0)

Synergies, net

-

(3)

17

29

29

-

-

-

-

-

Adj EBITDA

(1)

184

148

143

133

126

(2)

-

1

1

(0)

Bank Interest

(42)

(32)

(26)

(20)

(14)

-

-

-

-

-

RP for Bond Interest

(8)

(6)

(6)

(6)

(6)

22

16

16

16

17

RP Basket

(5)

(5)

(5)

(5)

(5)

15

15

15

15

15

Taxes/Tax Sharing

(12)

(4)

(4)

(4)

(5)

(1)

-

-

-

-

Bond Interest

-

-

-

-

-

(22)

(16)

(16)

(16)

(17)

Other

(2)

(12)

(14)

(13)

(14)

(13)

(15)

-

-

-

-

Leveraged Free Cash Flow

106

87

89

84

83

(3)

15

16

16

15

Debt, ending

489

402

313

228

145

224

225

226

228

229

Cash, ending

37

37

37

37

37

5

5

6

7

7

Net Debt, ending

452

365

276

192

109

219

220

220

221

223

Net Debt/Adj EBITDA

2.5x

2.5x

1.9x

1.4x

0.9x

n/a

n/a

n/a

n/a

n/a

Dex Media West

Hold Co

(3,4)

based tender is assumed to occur at par, although current indicated prices are

significantly lower |