Attached files

| file | filename |

|---|---|

| EX-8.1 - FORM OF OPINION OF MCDERMOTT WILL & EMERY LLP - HYSTER-YALE MATERIALS HANDLING, INC. | d371112dex81.htm |

| EX-23.1 - EX-23.1 - HYSTER-YALE MATERIALS HANDLING, INC. | d371112dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 17, 2012

Registration No. 333-182388

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HYSTER-YALE MATERIALS HANDLING, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3537 | 31-1637659 | ||

| (State of Incorporation) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5875 Landerbrook Drive

Cleveland, Ohio 44124

(440) 449-9600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles A. Bittenbender

Vice President, General Counsel and Secretary

5875 Landerbrook Drive

Cleveland, Ohio 44124

(440) 449-9600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Randi C. Lesnick, Esq. Jones Day 222 E. 41st Street New York, NY 10017 |

Thomas C. Daniels, Esq. Jones Day 901 Lakeside Avenue Cleveland, Ohio 44114 |

Thomas Murphy, Esq. McDermott Will & Emery LLP 227 West Monroe Street, Suite 4400 Chicago, IL 60606 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer (Do not check if a smaller reporting company) x Smaller reporting company ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering Price(3) |

Amount of Registration Fee(3) | ||||

| Class A common stock, par value $0.01 per share | 8,394,475 shares | Not Applicable(2) | $161,974,630 | $18,562.29 | ||||

| Class B common stock, par value $0.01 per share | 8,394,475 shares | Not Applicable(2) | $161,974,630 | $18,562.29 | ||||

| Class A common stock, par value $0.01 per share | 8,394,475 shares(4) | (4) | (4) | (4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | This prospectus relates to shares of Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, of Hyster-Yale Materials Handling, Inc. (“Hyster-Yale”) which will be distributed pursuant to a spin-off transaction to the holders of Class A common stock, par value $1.00 per share, and Class B common stock, par value $1.00 per share, of NACCO Industries, Inc. (“NACCO”). The amount of Hyster-Yale Class A common stock (“Hyster-Yale Class A Common”) and Hyster-Yale Class B common stock (“Hyster-Yale Class B Common”) to be registered represents the maximum number of shares of Hyster-Yale Class A Common and Hyster-Yale Class B Common, respectively, that will be distributed to the holders of NACCO Class A common stock (“NACCO Class A Common”) and NACCO Class B common stock (“NACCO Class B Common”) upon consummation of the spin-off. One share of Hyster-Yale Class A Common and one share of Hyster-Yale Class B Common will be distributed for each share of NACCO Class A Common outstanding on the record date of the spin-off and one share of Hyster-Yale Class A Common and one share of Hyster-Yale Class B Common will be distributed for each share of NACCO Class B Common outstanding on the record date of the spin-off. Because it is not possible to accurately state the number of shares of NACCO Class A Common and NACCO Class B Common that will be outstanding as of the record date of the spin-off, this calculation is based on the shares of NACCO Class A Common and the shares of NACCO Class B Common outstanding as of August 8, 2012. |

| (2) | Not included pursuant to Rule 457(o) under the Securities Act. |

| (3) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f)(2) of the Securities Act. The book value of securities as of the latest practicable date prior to the filing of the registration statement is $323,949,260.00. Such fee has previously been paid. |

| (4) | Represents the maximum number of shares of Hyster-Yale Class A Common issuable upon conversion of shares of Hyster-Yale Class B Common issued upon the distribution of the Hyster-Yale Class B Common described in this Registration Statement. Such shares of Hyster-Yale Class A Common, if issued, will be issued for no additional consideration and, therefore, pursuant to Rule 457(i), no registration fee is required. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not distribute these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

PROSPECTUS

SUBJECT TO COMPLETION, DATED SEPTEMBER 17, 2012

[ ] Shares of Class A Common Stock

[ ] Shares of Class B Common Stock

Hyster-Yale Materials Handling, Inc.

PRELIMINARY COPY

To the Stockholders of NACCO Industries, Inc.:

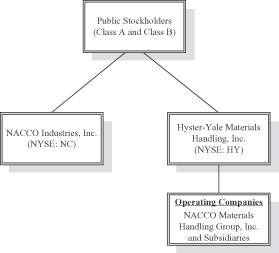

We are pleased to inform you that the board of directors of NACCO Industries, Inc. (“NACCO”) has approved the spin-off of Hyster-Yale Materials Handling, Inc. (“Hyster-Yale”) to NACCO stockholders. Hyster-Yale designs, engineers, manufactures, sells and services a comprehensive line of lift trucks and aftermarket parts marketed globally primarily under the Hyster® and Yale® brand names. Immediately following the spin-off, Hyster-Yale will be an independent public company.

To effect the spin-off, NACCO will make a distribution of all of the outstanding shares of Hyster-Yale common stock to holders of NACCO common stock as of 5:00 p.m., Eastern Time, on September 25, 2012, the record date for the spin-off. NACCO will distribute one share of Hyster-Yale Class A common stock, referred to as Hyster-Yale Class A Common or our Class A Common, and one share of Hyster-Yale Class B common stock, referred to as Hyster-Yale Class B Common or our Class B Common, for each share of NACCO common stock, whether NACCO Class A common stock, referred to as NACCO Class A Common or NACCO Class B common stock, referred to as NACCO Class B Common. The spin-off is expected to occur on [ ], 2012. Hyster-Yale has applied to list the Hyster-Yale Class A Common on the NYSE under the symbol “HY.” The Hyster-Yale Class B Common will not be listed on the NYSE or any other stock exchange and is subject to substantial restrictions on transfer. Each share of Hyster-Yale Class A Common is entitled to one vote per share on matters submitted to a vote of the Hyster-Yale common stockholders. Each share of Hyster-Yale Class B Common is entitled to ten votes per share on matters submitted to a vote of the Hyster-Yale common stockholders, is subject to transfer restrictions and is convertible into one share of Hyster-Yale Class A Common at any time without cost at the option of the holder.

After the spin-off, NACCO will continue to own and operate its three other principal businesses, which are mining (The North American Coal Corporation), small appliances (Hamilton Beach Brands, Inc.) and specialty retailing (The Kitchen Collection, LLC).

No vote of NACCO stockholders is required in connection with this spin-off. NACCO stockholders will not be required to pay any consideration for the shares of Hyster-Yale common stock they receive in the spin-off, and they will not be required to surrender or exchange shares of their NACCO common stock or take any other action in connection with the spin-off. We expect that, for U.S. federal income tax purposes, the spin-off will be tax-free to you, except with respect to cash received in lieu of fractional shares of Hyster-Yale common stock.

Because NACCO owns all of the outstanding shares of Hyster-Yale’s common stock, there currently is no public trading market for Hyster-Yale common stock. We anticipate that a limited market, commonly known as a “when-issued” trading market, for Hyster-Yale’s Class A Common will develop on or shortly before the record date for the spin-off and will continue up to and including the spin-off date. We expect the “regular-way” trading of Hyster-Yale’s Class A Common will begin on the first trading day following the spin-off date.

In reviewing this prospectus, you should carefully consider the matters described in “Risk Factors” beginning on page 14 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this prospectus is [ ], 2012.

Table of Contents

| Page | ||||

| 1 | ||||

| 6 | ||||

| 12 | ||||

| 14 | ||||

| 22 | ||||

| 23 | ||||

| 31 | ||||

| 34 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | |||

| 57 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

65 | |||

| 74 | ||||

| 140 | ||||

| 143 | ||||

| Description of Capital Stock of Hyster-Yale after the Spin-Off |

145 | |||

| 150 | ||||

| Annexes | ||||

| F-1 | ||||

| Form of Amended and Restated Certificate of Incorporation of Hyster-Yale |

A-1 | |||

| B-1 | ||||

This prospectus is being furnished solely to provide information to NACCO stockholders who will receive shares of Hyster-Yale common stock in the spin-off. It is not and is not to be construed as an inducement or encouragement to buy or sell any securities of NACCO or Hyster-Yale. This prospectus describes Hyster-Yale’s business, its relationship with NACCO and how the spin-off affects NACCO and its stockholders, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of the common stock that you will receive in the spin-off.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations.

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPIN-OFF

The following questions and answers briefly address some commonly asked questions about the spin-off. They may not include all the information that is important to you. We encourage you to read carefully this entire prospectus, including the annexes and the other documents to which we have referred you. We have included page references in certain parts of this section to direct you to a more detailed discussion of each topic presented in this section. Unless the context indicates otherwise, “Hyster-Yale,” “we,” “us” and “our” refer to Hyster-Yale Materials Handling, Inc. and its subsidiaries before the spin-off and after the spin-off, as applicable. “NACCO” refers to NACCO Industries, Inc., unless the context clearly indicates otherwise, not its subsidiaries.

What will NACCO stockholders receive in the spin-off?

To effect the spin-off, NACCO will make a distribution of all of the outstanding shares of Hyster-Yale common stock to NACCO common stockholders as of the record date, which will be September 25, 2012. For each share of NACCO Class A Common held on the record date, NACCO will distribute one share of Hyster-Yale Class A Common and one share of Hyster-Yale Class B Common. Similarly, for each share of NACCO Class B Common held on the record date, NACCO will distribute one share of Hyster-Yale Class A Common and one share of Hyster-Yale Class B Common.

No fractional shares of our Class A Common or our Class B Common will be distributed in the spin-off. Instead, as soon as practicable after the spin-off, the transfer agent will convert the fractional shares of our Class B Common into an equal number of fractional shares of our Class A Common, aggregate all fractional shares of our Class A Common into whole shares of our Class A Common, sell these shares of our Class A Common in the open market at prevailing market prices and distribute the applicable portion of the aggregate net cash proceeds of these sales to each holder who otherwise would have been entitled to receive a fractional share in the spin-off. You will not be entitled to any interest on the amount of the cash payment made in lieu of fractional shares.

NACCO stockholders will not be required to pay for shares of our common stock received in the spin-off, or to surrender or exchange shares of NACCO common stock or take any other action to be entitled to receive our common stock. The distribution of our common stock will not cancel or affect the number of outstanding shares of NACCO common stock. Accordingly, NACCO stockholders should retain any NACCO stock certificates they hold.

Immediately after the spin-off, holders of NACCO common stock as of the record date will hold all of the outstanding shares of our Class A Common and our Class B Common. Based on the number of shares of NACCO common stock outstanding on August 1, 2012, NACCO expects to distribute approximately 8.4 million shares of our Class A Common and approximately 8.4 million shares of our Class B Common to NACCO stockholders in the spin-off (page 24).

Why is NACCO spinning off Hyster-Yale?

NACCO is a holding company that owns businesses in four separate business segments: lift trucks (Hyster-Yale), mining (The North American Coal Corporation), small appliances (Hamilton Beach Brands, Inc.) and specialty retailing (The Kitchen Collection, LLC). NACCO’s board of directors, which is referred to as the NACCO board, determined that separating its lift trucks business from NACCO’s other businesses through the spin-off of Hyster-Yale is in the best interests of NACCO and its stockholders and has concluded that the separation will provide each company with a number of significant opportunities and benefits, including:

| • | Create Opportunities for Growth. Create greater flexibility for Hyster-Yale to pursue strategic growth opportunities, such as acquisitions and joint ventures, in the materials handling industry because it will have the ability to offer its stock as consideration in connection with potential future acquisitions or other growth opportunities. |

1

Table of Contents

| • | Management Focus. Reinforce management’s focus on serving each of Hyster-Yale’s market segments and customer application needs, and on responding flexibly to changing market conditions and growth markets. |

| • | Access to Capital and Capital Structure. Provide Hyster-Yale with direct access to equity capital markets and greater access to debt capital markets to fund its growth strategies and to establish a capital structure and dividend policy reflecting its business needs and financial position. |

| • | Recruiting and Retaining Employees. Strengthen the alignment of senior management incentives with the needs and performance of the Company through the use of equity compensation arrangements that will also improve our ability to attract, retain and motivate qualified personnel. |

| • | Investor Choice. Provide investors with a focused investment option in the materials handling business that offers different investment and business characteristics, including different opportunities for growth, capital structure, business models and financial returns. This will allow investors to evaluate the separate merits, performance and future prospects of Hyster-Yale and NACCO. |

The NACCO board also considered the following factors, among others, in connection with its decision to spin-off Hyster-Yale:

| • | Proportionate Interest. As a result of the equal distribution of dividends to both classes of NACCO common stock required by NACCO’s Restated Certificate of Incorporation, which is referred to as the NACCO Charter, following the spin-off, the interest of NACCO stockholders in Hyster-Yale will differ from the interest those stockholders currently have in NACCO. In particular, the collective voting power in Hyster-Yale of holders of NACCO Class A Common will increase by approximately 51% while the collective voting power in Hyster-Yale of holders of NACCO Class B Common will decrease by approximately 51%. |

| • | Certain Restrictions Relating to Tax-Free Distributions. The ability of Hyster-Yale to engage in significant equity transactions could be limited or restricted for a period of time after the spin-off in order to preserve the tax-free nature of the spin-off. See “Risk Factors – We might not be able to engage in desirable strategic transactions and equity issuances following the spin-off because of certain restrictions relating to requirements for tax-free distributions.” |

| • | No Existing Public Market. There is no existing public market for our common stock and the combined market values of NACCO common stock and our common stock following the spin-off may be less than the value of NACCO common stock prior to the spin-off; and |

| • | Risks Factors. Certain other risks associated with the spin-off and our business after the spin-off, as described in this prospectus under the heading “Risk Factors” beginning on Page 14. |

What businesses will NACCO engage in after the spin-off?

NACCO will continue to be a holding company that engages in three principal businesses after the spin-off: mining, small appliances and specialty retailing.

Why does Hyster-Yale have two classes of common stock?

NACCO has two classes of common stock. The spin-off of Hyster-Yale from NACCO is structured to provide the NACCO stockholders with substantially the same capital structure that currently exists for the NACCO stockholders. In addition, Hyster-Yale’s governance-related provisions of its certificate of incorporation and bylaws, as well as a stockholders’ agreement to which Hyster-Yale will be a party, are substantially the same

2

Table of Contents

as NACCO’s governance-related provisions and stockholders’ agreement, as described in more detail in “Ancillary Agreements — Stockholders’ Agreement” and “Description of Capital Stock of Hyster-Yale after the Spin-off.”

Why will I receive Hyster-Yale Class A Common and Hyster-Yale Class B Common if I currently own only NACCO Class A Common or NACCO Class B Common?

The NACCO Charter provides that each share of NACCO Class A Common and NACCO Class B Common is equal in respect of rights to dividends and any other distribution in cash, stock or property. Therefore, pursuant to the terms of the NACCO Charter, NACCO is required to distribute one share of Hyster-Yale Class A Common and one share of Hyster-Yale Class B Common for each share of NACCO common stock, whether NACCO Class A Common or NACCO Class B Common. As a result of this requirement for equal distribution, the proportionate interest that NACCO stockholders will have in Hyster-Yale following the spin-off will differ from the interest those stockholders currently have in NACCO. In particular, the collective voting power in Hyster-Yale of holders of NACCO Class A Common will increase by approximately 51% while the collective voting power in Hyster-Yale of holders of NACCO Class B Common will decrease by approximately 51%. See “Risk Factors – The relative voting power of holders of our Class B Common who convert their shares of our Class B Common into Class A Common will diminish” and “Risk Factors – The relative voting power of the remaining holders of Class B Common will increase as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common.”

Who is entitled to receive shares of our common stock in the spin-off?

Holders of NACCO common stock at the close of business on September 25, 2012, the record date for the spin-off, will be entitled to receive shares of our common stock in the spin-off.

When is the spin-off expected to be completed?

The spin-off is expected to be completed during the third quarter of 2012.

What do I need to do to receive my shares of Hyster-Yale common stock?

You do not need to take any action to receive your shares of our common stock. The shares of our common stock will be distributed on the date of the spin-off to holders of NACCO common stock as of the record date for the spin-off in book-entry form in accordance with Section 170 of the General Corporation Law of the State of Delaware (the “DGCL”).

What if I want to receive certificates representing my shares of Hyster-Yale common stock?

While the shares of our common stock will be distributed in book-entry form, you may request to receive certificates representing your shares of our common stock from our transfer agent.

What will govern my rights as a Hyster-Yale stockholder?

Your rights as a Hyster-Yale stockholder will be governed by Delaware law, as well as our amended and restated certificate of incorporation and our amended and restated bylaws. A description of these rights is included in this prospectus under the heading “Description of Capital Stock of Hyster-Yale after the Spin-Off” (page 145). Our amended and restated certificate of incorporation will be substantially in the form attached to this prospectus as Annex A, and our amended and restated bylaws will be substantially in the form attached to this prospectus as Annex B. These documents are substantially comparable to NACCO’s constituent documents.

3

Table of Contents

What if I want to convert or sell the shares of Hyster-Yale Class B Common I receive in the spin-off?

Like the NACCO Class B Common, our Class B Common will not be listed on the NYSE or any other stock exchange, and we do not expect any trading market for our Class B Common to exist. In addition, our Class B Common generally will not be transferable except to or among a limited number of permitted transferees pursuant to our amended and restated certificate of incorporation. The violation of these transfer restrictions will cause our Class B Common to convert automatically into Class A Common, as described in more detail in “Description of Capital Stock of Hyster-Yale after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common” beginning on page 145. However, our Class B Common will be convertible at any time, without cost to you, into our Class A Common on a share-for-share basis. If you want to sell the equity interest represented by your shares of our Class B Common, you may convert those shares into an equal number of shares of our Class A Common at any time, without cost, and then sell your shares of our Class A Common in the public market.

You will receive a conversion form when you receive the shares of our Class B Common that you are entitled to receive in the spin-off. The conversion form will include instructions for converting shares of our Class B Common into an equal number of shares of our Class A Common. If you elect to convert your shares of our Class B Common into shares of our Class A Common, you should follow the instructions included with the form, complete, sign and date the form, and return the form, along with your certificate, if any, representing shares of our Class B Common, to our transfer agent. If you deliver a certificate, our transfer agent, as promptly as practicable after receipt of your completed, signed and dated form and certificate, will issue to you a certificate representing shares of our Class A Common equal to the number of shares of our Class B Common that you elected to convert. Any Class A Common issued upon conversion of Class B Common will be issued in the name or names you specified in the form. The conversion will be deemed to have been made immediately prior to the close of business on the date you surrendered your completed, signed and dated form and certificate, if any. After you receive shares of our Class A Common you may sell those shares in the public market. After you convert our Class B Common into our Class A Common, such shares may not be converted back into shares of our Class B Common.

Do I have to convert my shares of Class B Common before I sell them?

No. If you do not wish to complete the conversion process before you sell, you may effect a sale of our Class A Common into which your shares of our Class B Common is convertible. If you hold certificated Class B Common simply deliver the certificate or certificates representing such shares of our Class B Common to a broker, properly endorsed, in contemplation of the sale. The broker will then instruct the transfer agent to convert such Class B Common and, if necessary, present a certificate or certificates representing shares of our Class B Common to our transfer agent, who will issue to the purchaser a certificate, if necessary, representing the number of shares of our Class A Common sold in settlement of the transaction.

Are there risks associated with the spin-off and our business after the spin-off?

Yes. You should carefully review the risks described in this prospectus under the heading “Risk Factors” beginning on page 14.

Who can answer my questions about the spin-off?

If you have any questions about the spin-off, please contact the following.

NACCO Industries, Inc.

5875 Landerbrook Drive

Cleveland, Ohio 44124-4017

Attn: Investor Relations

Telephone: 449-449-9669

4

Table of Contents

Is stockholder approval needed in connection with the spin-off?

No vote of NACCO stockholders is required or will be sought in connection with the spin-off.

Where will the shares of Hyster-Yale common stock be listed?

We have applied for listing of our shares of Class A Common on the New York Stock Exchange under the symbol “HY.” Our Class B Common will not be listed on the NYSE or any other stock exchange.

Where can I find more information about Hyster-Yale and NACCO?

You can find more information about NACCO and us from various sources described under “Where You Can Find More Information” beginning on page 150.

What are the U.S. federal income tax consequences of the spin-off to NACCO stockholders?

The spin-off is conditioned upon receipt by NACCO of an opinion of counsel to the effect that, for U.S. federal income tax purposes, the contribution of assets to Hyster-Yale by NACCO and the assumption of liabilities of NACCO by Hyster-Yale (the “Contribution”) together with the spin-off will qualify as a reorganization under Section 368(a)(1)(D) of the Internal Revenue Code (the “Code”), and the spin-off will qualify as tax-free under Sections 355 and 361 of the Code, except for cash received in lieu of fractional shares. The opinion will rely on certain facts and assumptions, and certain representations and undertakings, provided by NACCO and us regarding the past and future conduct of our respective businesses and other matters.

Because the Contribution and the spin-off will qualify under Sections 355 and 361 of the Code, for U.S. federal income tax purposes, no gain or loss will be recognized by us in connection with the Contribution and spin-off, no gain or loss will be recognized by a NACCO stockholder and no amount will be included in the income of a stockholder, upon the receipt of our common stock in the spin-off. A NACCO stockholder will recognize gain or loss with respect to any cash received in lieu of a fractional share. See “Material U.S. Federal Income Tax Consequences” beginning on page 31.

Each NACCO stockholder is urged to consult a tax advisor as to the specific tax consequences of the spin-off to that stockholder, including the effect of any state, local, or non-U.S. tax laws and any changes in applicable tax laws.

How will I determine the tax basis I will have in the shares of Hyster-Yale Class A and Class B common stock I receive in the spin-off?

Generally, for U.S. federal income tax purposes, your aggregate basis in the stock you hold in NACCO and the Hyster-Yale common stock received in the spin-off (including cash received in lieu of fractional shares) will equal the aggregate basis of NACCO common stock held by you immediately before the spin-off. This aggregate basis will be allocated among your NACCO common stock and the Hyster-Yale common stock you receive in the spin-off (including any fractional share interests in Hyster-Yale for which cash is received) in proportion to the relative fair market value of each immediately following the spin-off. See “Material U.S. Federal Income Tax Consequences” beginning on page 31.

You should consult your tax advisor about how this allocation will work in your situation (including a situation where you have purchased or received NACCO shares at different times or for different amounts) and regarding any particular consequences of the spin-off to you, including the application of state, local and non-U.S. tax laws.

5

Table of Contents

This summary of the information contained in this prospectus may not include all the information that is important to you. To understand fully and for a more complete description of the terms and conditions of the spin-off, you should read this prospectus, including the annexes, in its entirety and the documents to which you are referred. See “Where You Can Find More Information” (page 150). Page references have been included parenthetically to direct you to a more complete discussion of each topic presented in this summary.

Information About Hyster-Yale (page 57)

Hyster-Yale is a Delaware corporation and a wholly owned subsidiary of NACCO. We design, engineer, manufacture, sell and service a comprehensive line of lift trucks and aftermarket parts marketed globally. Our well-known brands include Hyster® and Yale®. For more information about our business, including our competitive strengths, see “Business of Hyster-Yale” beginning on page 57.

Hyster-Yale Materials Handling, Inc.

5875 Landerbrook Drive

Cleveland, Ohio 44124

(440) 449-9600

Information about NACCO

NACCO is a holding company that will continue to have three principal businesses after the spin-off: mining, small appliances and specialty retailing. The North American Coal Corporation (“NA Coal”) mines and markets coal primarily as fuel for power generation and provides selected value-added mining services for other natural resources companies. Hamilton Beach Brands, Inc. (“HBB”) is a leading designer, marketer and distributor of small electric household appliances, as well as commercial products for restaurants, bars and hotels. The Kitchen Collection, LLC (“KC”) is a national specialty retailer of kitchenware and gourmet foods operating under the Kitchen Collection® and Le Gourmet Chef® store names in outlet and traditional malls throughout the United States.

NACCO Industries, Inc.

5875 Landerbrook Drive

Cleveland, Ohio 44124

(440) 449-9600

The Spin-Off (page 140)

On [ ], 2012, the NACCO board of directors and the Hyster-Yale board of directors, which is referred to as our Board, each approved the spin-off of Hyster-Yale, upon the terms and subject to the conditions contained in the separation agreement between NACCO and us, which is referred to as the separation agreement. For a more detailed description of the terms of the separation agreement, see “The Separation Agreement” beginning on page 140.

We encourage you to read the separation agreement, which is filed as an exhibit to the registration statement that contains this prospectus, because it sets forth the terms of the spin-off.

Stock Ownership of Hyster-Yale Directors and Executive Officers (page 65)

The stock ownership of our directors and executive officers immediately after the spin-off is described under the heading “Security Ownership of Certain Beneficial Owners and Management” beginning on page 65.

6

Table of Contents

Ownership of Hyster-Yale after the Spin-Off (page 26)

Immediately after the spin-off, NACCO stockholders as of the record date will hold all of the outstanding shares of our Class A Common and our Class B Common. Based on the number of shares of NACCO common stock outstanding on August 1, 2012, NACCO expects to distribute approximately 8.4 million shares of our Class A Common and approximately 8.4 million shares of our Class B Common in the spin-off.

Operations of Hyster-Yale after the Spin-Off (page 26)

We will continue to conduct business after completion of the spin-off under multiple brands and trade names. Our headquarters will continue to be located in Cleveland, Ohio.

Management of Hyster-Yale after the Spin-Off (page 26)

After the spin-off, our executive officers will be substantially the same as our executive officers immediately before the spin-off and will remain in office until their respective successors are duly elected or appointed and qualified in accordance with our amended and restated certificate of incorporation and our amended and restated bylaws or as otherwise provided by law.

After the spin-off, we will be led by:

| • | Alfred M. Rankin, Jr. as Chairman, President and Chief Executive Officer; |

| • | Michael P. Brogan as President and Chief Executive Officer – NACCO Materials Handling Group; |

| • | Charles A. Bittenbender as Vice President, General Counsel and Secretary; |

| • | Kenneth C. Schilling as Vice President, Chief Financial Officer; |

| • | Suzanne S. Taylor as Deputy General Counsel and Assistant Secretary; |

| • | Mary D. Maloney as Associate General Counsel and Assistant Secretary; |

| • | Jennifer M. Langer as Controller; and |

| • | Brian K. Frentzko as Vice President, Treasurer. |

Hyster-Yale Board after the Spin-Off (page 26)

After the spin-off, our Board will consist of Alfred M. Rankin, Jr., J.C. Butler, Jr., Carolyn Corvi, John P. Jumper, Dennis W. LaBarre, Michael E. Shannon, Britton T. Taplin, Claiborne Rankin and Eugene Wong, who will remain in office until their respective successors are duly elected or appointed and qualified in accordance with our amended and restated certificate of incorporation and our amended and restated bylaws or as otherwise provided by law. Of these individuals, the following served as our directors prior to the spin-off: Alfred M. Rankin, Jr., John P. Jumper, Dennis W. LaBarre, Michael E. Shannon, Britton T. Taplin and Eugene Wong.

Committees of the Hyster-Yale Board after the Spin-Off (page 27)

After the spin-off, our Board will have an audit review committee, a compensation committee, a nominating and corporate governance committee and a finance committee. Our Board has determined that Carolyn Corvi, John P. Jumper, Dennis W. LaBarre, Michael E. Shannon, Britton T. Taplin and Eugene Wong satisfy the criteria for director independence as set forth in the NYSE rules.

7

Table of Contents

Immediately after the spin-off, the members of our audit review committee, compensation committee, nominating and corporate governance committee and finance committee will be as follows:

| Audit Review Committee |

Compensation Committee | |

| Carolyn Corvi |

Carolyn Corvi | |

| John P. Jumper |

John P. Jumper (Chairperson) | |

| Michael E. Shannon (Chairperson) |

Michael E. Shannon | |

| Eugene Wong |

Eugene Wong | |

| Nominating and Corporate Governance Committee |

Finance Committee | |

| John P. Jumper |

J.C. Butler, Jr. | |

| Dennis W. LaBarre |

Carolyn Corvi (Chairperson) | |

| Michael E. Shannon (Chairperson) |

Dennis W. LaBarre | |

| Alfred M. Rankin, Jr. | ||

| Claiborne Rankin | ||

| Britton T. Taplin | ||

Interests of NACCO and Hyster-Yale Directors and Executive Officers in the Spin-Off (page 27)

Some NACCO and Hyster-Yale directors and executive officers have interests in the spin-off that are different from, or in addition to, the interests of NACCO stockholders who will receive shares of our common stock in the spin-off. The NACCO board and our Board were aware of these interests and considered them in making their respective decisions to approve the separation agreement. These interests include:

| • | the designation of certain of our directors and officers before the spin-off as our directors or executive officers after the spin-off, including some who will serve as directors or executive officers of both Hyster-Yale and NACCO; |

| • | the rights of Mr. Rankin, our Chairman, President and Chief Executive Officer, as a party to the stockholders’ agreement among Hyster-Yale and certain members of the Rankin and Taplin families with respect to ownership of our common stock, as described in more detail in “Security Ownership of Certain Beneficial Owners and Management” beginning on page 65 and “Ancillary Agreements — Stockholders’ Agreement” beginning on page 144; |

| • | the participation of our executive officers in various incentive compensation plans for 2012 prior to the spin-off, as previously approved by the compensation committee of the NACCO Materials Handling Group, Inc. (“NMHG”) board of directors, which is referred to as the NMHG compensation committee or the compensation committee of the NACCO Industries, Inc. board of directors, which is referred to as the NACCO compensation committee; |

| • | the provision of NACCO equity compensation to our directors who were directors of NACCO prior to the spin-off under the NACCO Non-Employee Directors’ Equity Compensation Plan, referred to as the NACCO Non-Employee Directors’ Plan, as described in more detail in “Management — Compensation of Directors” beginning on page 83; |

| • | the provision of Hyster-Yale equity to our directors and the participation by our directors in an equity compensation plan following the spin-off, as described in more detail in “Management — Compensation of Directors” beginning on page 83; |

| • | the participation by certain of our executive officers in a NACCO equity incentive compensation plan before the spin-off, subject to the approval of grants of awards by the NACCO compensation committee, as described in more detail in “Management — Hyster-Yale Executive Compensation — Compensation Discussion and Analysis — Long-Term Incentive Compensation — Historically” beginning on page 103; and |

8

Table of Contents

| • | the participation by executive officers in a Hyster-Yale equity incentive compensation plan after the spin-off, subject to the approval of grants of awards by the Hyster-Yale compensation committee, which is referred to as our compensation committee or the Hyster-Yale compensation committee, as described in more detail in “Management — Hyster-Yale Executive Compensation — Compensation Discussion and Analysis — Long-Term Incentive Compensation — Going Forward” beginning on page 112. |

Listing of Hyster-Yale Common Stock (page 29)

We have applied to list our Class A Common on the NYSE under the symbol “HY.” Our Class B Common will not be listed on the NYSE or any other stock exchange.

Market for Hyster-Yale Common Stock (page 29)

Currently, there is no public market for our Class A Common. We have applied to list our Class A Common on the NYSE. If the NYSE approves the listing, we expect that a “when-issued” trading market for our Class A Common will develop before the record date for the spin-off. “When-issued” trading refers to a transaction made conditionally because the stock has been authorized but is not yet issued or available. Even though when-issued trading may develop, none of these trades will settle before the record date for the spin-off, and if the spin-off does not occur, all when-issued trading will be null and void. On the first trading day after the spin-off, when-issued trading will end and “regular-way” trading will begin. “Regular-way” trading refers to trading after a stock has been issued and typically involves a transaction that settles on the third full business day after the date of a transaction. Our Class B Common will not be listed on the NYSE or any other stock exchange or otherwise traded and will be subject to substantial restrictions on transfer, the violation of which will cause it to convert automatically into Class A Common, as described in more detail in “Description of Capital Stock of Hyster-Yale after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common” beginning on page 145.

Material U.S. Federal Income Tax Consequences (page 31)

The spin-off is conditioned upon the receipt by NACCO of an opinion of counsel to the effect that, for U.S. federal income tax purposes, the Contribution and the spin-off together will qualify as a reorganization under Section 368(a)(1)(D) of the Code, and the spin-off will qualify as tax-free under Sections 355 and 361 of the Code, except for cash received in lieu of fractional shares. The opinion of counsel to NACCO will be based on, among other things, current law and certain representations of factual matters made by, among others, NACCO and us, which, if incorrect, could jeopardize the conclusions reached in the opinion.

Because the spin-off will qualify under Sections 355 and 361 of the Code:

| • | no taxable gain or loss will be recognized by a NACCO stockholder as a result of the spin-off (except with respect to cash that a NACCO stockholder may receive instead of a fractional share in our Class A Common and our Class B Common); and |

| • | the distribution of our common stock to NACCO stockholders in connection with the spin-off will qualify as tax-free to NACCO. |

NACCO may waive, in its sole discretion, this tax opinion condition to its obligation to complete the spin-off. NACCO does not currently intend to waive this condition to its obligation to complete the spin-off. In the event this condition were to be waived by NACCO and any changes to the tax consequences relating to the contribution or distribution were material, Hyster-Yale would undertake to recirculate this prospectus prior to the commencement of the distribution. See “Material U.S. Federal Tax Consequences” beginning on page 31.

You are encouraged to consult with your own tax advisor for a full understanding of the tax consequences of the spin-off to you.

9

Table of Contents

Accounting Treatment (page 30)

The spin-off will be accounted for by NACCO as a spin-off of Hyster-Yale. After the spin-off, Hyster-Yale is expected to be accounted for as a discontinued operation by NACCO. If accounted for as a discontinued operation, the measurement date would be the effective date of the spin-off, which is referred to as the spin-off date. After the spin-off, our assets and liabilities will be accounted for at the historical book values carried by NACCO prior to the spin-off. Costs related to the spin-off will be recognized by NACCO as incurred before the spin-off.

Ancillary Agreements (page 143)

In connection with the spin-off, we will enter into a transition services agreement with NACCO, a tax allocation agreement with NACCO, an office services agreement with NACCO and a stockholders’ agreement with certain of our stockholders. This stockholders’ agreement is substantially similar to the stockholders’ agreement that was entered into among certain stockholders of NACCO.

Transition Services Agreement

Under the terms of the transition services agreement, NACCO will obtain services from us and provide services to us on a transitional basis, as needed, for varying periods after the spin-off date. These services will include:

| • | legal and consulting support relating to employee benefits, compensation and human resources matters; |

| • | general accounting support, including public company support; |

| • | general legal, public company, information technology and infrastructure, insurance and internal audit support (including responding to requests from regulatory and compliance agencies) as needed; and |

| • | tax compliance and consulting support (including completion of federal audits and appeals through the 2010 tax year; 2011 tax sharing computations; 2011 state income tax return filings for certain operating subsidiaries of NACCO after the spin-off and miscellaneous provision and tax return oversight). |

None of the transition services are expected to exceed one year. NACCO or Hyster-Yale may extend the initial transition period for a period of up to three months for any service upon 30 days written notice to the other party prior to the initial termination date. We expect NACCO to pay us net aggregate fees of no more than $625,000 over the initial term of the transition services agreement.

Tax Allocation Agreement

Hyster-Yale and NACCO will enter into a tax allocation agreement prior to the spin-off that will generally govern NACCO’s and Hyster-Yale’s respective rights, responsibilities and obligations after the spin-off with respect to taxes for any tax period ending on or before the date of the spin-off, as well as tax periods beginning before and ending after the date of the spin-off. Generally, Hyster-Yale will be liable for all pre-spin-off U.S. federal income taxes, foreign income taxes and certain non-income taxes attributable to Hyster-Yale’s business. In addition, the tax allocation agreement will address the allocation of liability for taxes that are incurred as a result of restructuring activities undertaken to effectuate the spin-off. The tax allocation agreement will also provide that Hyster-Yale is liable for taxes incurred by NACCO that arise as a result of Hyster-Yale’s taking or failing to take, as the case may be, certain actions that result in the spin-off failing to meet the requirements of a tax-free distribution under Sections 355 and 361 of the Code.

10

Table of Contents

Office Services Agreement

Prior to the spin-off, NACCO and Hyster-Yale will enter into an office services agreement pursuant to which Hyster-Yale will provide certain office services to NACCO, including shared reception and operator services, messenger services and mail room services, and will also provide NACCO with the right to use certain meeting rooms of Hyster-Yale under certain mutually agreed upon conditions. NACCO will pay fees to Hyster-Yale that will be determined on an arm’s-length basis. NACCO is expected to pay approximately $180,000 annually to Hyster-Yale for these services. NACCO will also indemnify Hyster-Yale for any damages arising from the use of Hyster-Yale’s services or meeting rooms. The office services agreement will have an initial term of one year and will automatically renew for additional one year periods until terminated by either NACCO or Hyster-Yale.

Stockholders’ Agreement

Our Class B Common is subject to substantial restrictions on transfer as set forth in our amended and restated certificate of incorporation. In addition, we intend to enter into a stockholders’ agreement with certain of our stockholders who are members of the Rankin and Taplin families. Immediately following the spin-off, 39.51% of our Class B Common will be subject to the stockholders’ agreement. See “Security Ownership of Certain Beneficial Owners and Management.” The terms of the stockholders’ agreement require signatories to the agreement, prior to any conversion of our Class B Common into our Class A Common by such signatories, to offer such Class B Common to all of the other signatories on a pro rata basis. A signatory may sell or transfer all shares not purchased under the right of first refusal as long as they are converted into our Class A Common prior to such sale or transfer. Under the stockholders’ agreement, we may, but are not obligated to, buy any of the shares of our Class B Common not purchased by signatories following the trigger of the right of first refusal. A substantially similar stockholders’ agreement is in effect among certain stockholders of NACCO. For a description of transfer restrictions on our Class B Common, see “Description of Capital Stock of Hyster-Yale after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common.”

11

Table of Contents

Market Price Data

There is no established trading market for shares of our Class A Common or our Class B Common. At August 1, 2012, there were 100 shares of our common stock outstanding, all of which immediately prior to the spin-off were owned by NACCO.

In connection with the spin-off, NACCO will distribute approximately 8.4 million shares of our Class A Common and approximately 8.4 million shares of our Class B Common to holders of NACCO Class A Common and NACCO Class B Common as of the record date for the spin-off. We have applied to list our Class A Common on the NYSE under the symbol “HY.” Our Class B Common will not be listed on the NYSE or any other stock exchange or otherwise traded and will be subject to substantial restrictions on transfer.

Dividends

We paid dividends to NACCO in 2009, 2010 and 2011 in the aggregate amount of $15.0 million. We paid dividends to NACCO in the amount of $5.0 million from January 1, 2012 to September 14, 2012.

Dividend Policy

We currently intend to pay regular quarterly dividends after the spin-off. The declaration of such future dividends and the establishment of the per share amount, record dates and payout dates for such future dividends will be at the discretion of our Board and will depend on various factors then existing, including earnings, financial condition, results of operations, capital requirements, level of indebtedness, contractual restrictions with respect to the payment of dividends, restrictions imposed by applicable law, general business conditions and other factors that our Board deems relevant. Our credit facility and term loan limit our ability to pay dividends or make distributions in respect of our capital stock in certain circumstances. For a discussion of these restrictions, see the discussion under “Management’s Discussion and Analysis of the Financial Condition and Results of Operations — Liquidity and Capital Resources of Hyster-Yale — Before the Spin-Off — Financing Activities” beginning on page 50 and “Management’s Discussion and Analysis of the Financial Condition and Results of Operations — Liquidity and Capital Resources of Hyster-Yale — After the Spin-Off” beginning on page 54.

12

Table of Contents

Summary Historical Financial Data of Hyster-Yale

The following table sets forth our summary historical financial data as of and for each of the periods indicated. We derived the summary historical financial data as of and for each of the five years ended December 31, 2011 from our audited consolidated financial statements. We derived the summary historical financial data as of and for the three and six months ended June 30, 2012 and 2011 from our unaudited condensed consolidated financial statements which, in the opinion of our management, include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results of the interim period. This information is only a summary and you should read it in conjunction with the historical consolidated financial statements and the related notes and “Management’s Discussion and Analysis of the Financial Condition and Results of Operations,” included in this prospectus.

| Three Months Ended June 30 | Six Months Ended June 30 | Year Ended December 31 | ||||||||||||||||||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | 2011 | 2010 | 2009 | 2008(1) | 2007 | ||||||||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||||||||||||

| Operating Statement Data: | ||||||||||||||||||||||||||||||||||||

| Revenues | $ | 602.0 | $ | 648.0 | $ | 1,231.5 | $ | 1,234.6 | $ | 2,540.8 | $ | 1,801.9 | $ | 1,475.2 | $ | 2,824.3 | $ | 2,719.7 | ||||||||||||||||||

| Operating profit (loss) | $ | 24.6 | $ | 27.5 | $ | 54.4 | $ | 57.9 | $ | 110.0 | $ | 46.1 | $ | (31.2 | ) | $ | (344.0 | ) | $ | 57.3 | ||||||||||||||||

| Net income (loss) | $ | 19.5 | $ | 19.1 | $ | 40.7 | $ | 41.4 | $ | 82.6 | $ | 32.3 | $ | (43.2 | ) | $ | (375.8 | ) | $ | 39.2 | ||||||||||||||||

| Net (income) loss attributable to noncontrolling interest | $ | - | $ | 0.1 | $ | - | $ | 0.1 | $ | - | $ | 0.1 | $ | 0.1 | $ | (0.2 | ) | $ | 0.1 | |||||||||||||||||

| Net income (loss) attributable to stockholder | $ | 19.5 | $ | 19.2 | $ | 40.7 | $ | 41.5 | $ | 82.6 | $ | 32.4 | $ | (43.1 | ) | $ | (376.0 | ) | $ | 39.3 | ||||||||||||||||

| June 30 | December 31 | |||||||||||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | 2009 | 2008(1) | 2007 | ||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||||||||||

| Total assets | $ | 1,032.0 | $ | 1,120.5 | $ | 1,117.0 | $ | 1,041.2 | $ | 914.1 | $ | 1,095.1 | $ | 1,603.6 | ||||||||||||||

| Long-term debt | $ | 112.5 | $ | 161.5 | $ | 54.6 | $ | 215.5 | $ | 229.2 | $ | 229.7 | $ | 233.6 | ||||||||||||||

| Stockholder’s equity | $ | 335.7 | $ | 283.8 | $ | 296.3 | $ | 230.7 | $ | 207.1 | $ | 154.2 | $ | 524.3 | ||||||||||||||

| Six Months Ended June 30 | Year Ended December 31 | |||||||||||||||||||||||||||

| 2012 | 2011 | 2011 | 2010 | 2009 | 2008(1) | 2007 | ||||||||||||||||||||||

| (In millions) | ||||||||||||||||||||||||||||

| Cash Flow Data: | ||||||||||||||||||||||||||||

| Provided by (used for) operating activities | $ | 53.1 | $ | (3.8 | ) | $ | 54.6 | $ | 47.5 | $ | 115.9 | $ | (27.3 | ) | $ | 34.6 | ||||||||||||

| Provided by (used for) investing activities | $ | (5.7 | ) | $ | (6.4 | ) | $ | (15.9 | ) | $ | (8.5 | ) | $ | 5.8 | $ | (37.5 | ) | $ | (33.9 | ) | ||||||||

| Provided by (used for) financing activities | $ | (89.0 | ) | $ | (12.9 | ) | $ | (19.5 | ) | $ | (24.4 | ) | $ | (18.3 | ) | $ | 48.0 | $ | (34.1 | ) | ||||||||

| Other Data: | ||||||||||||||||||||||||||||

| Cash dividends paid | $ | - | $ | 5.0 | $ | 10.0 | $ | 5.0 | $ | - | $ | - | $ | 17.3 | ||||||||||||||

(1) During the fourth quarter of 2008, NACCO’s stock price significantly declined compared with previous periods and the market value of NACCO equity was below its book value of tangible assets and its book value of equity. NACCO performed an interim impairment test, which indicated that goodwill and certain other intangibles were impaired at December 31, 2008. Therefore, we recorded a non-cash impairment charge of $351.1 million during the fourth quarter of 2008.

13

Table of Contents

In addition to the other information included in this prospectus, including the matters addressed in “Special Note Regarding Forward-Looking Statements” on page 22, you should carefully consider the matters described below. The risk factors described below include risk factors that will be applicable to our business if the spin-off is consummated, as well as risks related to the spin-off.

Risks Relating to the Spin-Off

The relative voting power of holders of our Class B Common who convert their shares of our Class B Common into shares of our Class A Common will diminish.

Holders of our Class B Common will have ten votes per share of our Class B Common, while holders of our Class A Common will have one vote per share of our Class A Common. Holders of our Class A Common and holders of our Class B Common generally will vote together as a single class on most matters submitted to a vote of our stockholders. Holders of our Class B Common who convert their shares of our Class B Common into shares of our Class A common will reduce their voting power.

The relative voting power of the remaining holders of Class B Common will increase as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common.

After the spin-off, holders of our Class A Common and holders of our Class B Common generally will vote together on most matters submitted to a vote of our stockholders. Consequently, as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common, the relative voting power of the remaining holders of our Class B Common will increase. Immediately after the spin-off, the holders of our Class B Common will collectively control approximately 90.9% of the voting power of the outstanding shares of our common stock and the holders of our Class A Common will collectively control approximately 9.1% of the voting power of the outstanding shares of our common stock.

If the spin-off by NACCO of our common stock to NACCO’s stockholders does not qualify as a tax-free transaction, tax could be imposed on NACCO stockholders.

NACCO intends to obtain, immediately before the spin-off, an opinion from counsel to the effect that, for U.S. federal income tax purposes, the Contribution and the spin-off together will qualify as a reorganization under Section 368(a)(1)(D) of the Code, and the spin-off will qualify as tax-free under Sections 355 and 361 of the Code, except for cash received in lieu of fractional shares. The receipt of the opinion is a condition to the spin-off. Although NACCO may waive, in its sole discretion, this tax opinion condition, if a satisfactory opinion from counsel regarding the tax-free qualification of the spin-off cannot be obtained, the NACCO board would consider not completing the spin-off. In the event this condition were to be waived by NACCO and any changes to the tax consequences relating to the contribution or distribution were material, Hyster-Yale would undertake to recirculate this prospectus prior to the commencement of the distribution. The opinion will rely on certain facts and assumptions, and certain representations and undertakings, provided by NACCO and us regarding the past and future conduct of our respective businesses and other matters. If any of these facts, assumptions or representations are incorrect, the conclusion reached in the opinion could be jeopardized.

Notwithstanding the opinion, the Internal Revenue Service could determine on audit that the spin-off should be treated as a taxable transaction if it determines that any of these facts, assumptions, representations or undertakings is not correct or has been violated, or that the spin-off should be taxable for other reasons, including as a result of a significant change in stock or asset ownership after the spin-off. If the spin-off ultimately is determined to be taxable, the spin-off could be treated as a taxable dividend or capital gain to you for U.S. federal income tax purposes, and you could incur significant U.S. federal income tax liabilities.

14

Table of Contents

If the spin-off does not qualify as a tax-free transaction, tax could be imposed on NACCO and, in certain circumstances, we may be required to indemnify NACCO after the spin-off for that tax.

For the reasons described in the preceding risk factor, the spin-off may not be tax-free to NACCO. In that event, NACCO would be required to recognize gain in an amount up to the fair market value of our common stock that NACCO distributes on the spin-off date.

Under the terms of the tax allocation agreement that we intend to enter into in connection with the spin-off, in the event that the spin-off were determined to be taxable solely as the result of actions taken after the spin-off by or in respect of Hyster-Yale, any of its affiliates or its stockholders, Hyster-Yale would be responsible for all taxes imposed on NACCO as a result thereof. Such tax amounts could be significant.

We might not be able to engage in desirable strategic transactions and equity issuances following the spin-off because of certain restrictions relating to requirements for tax-free distributions.

Our ability to engage in significant equity transactions could be limited or restricted after the spin-off in order to preserve, for U.S. federal income tax purposes, the tax-free nature of the spin-off. Even if the spin-off otherwise qualifies for tax-free treatment under the Code, it may result in corporate-level taxable gain to NACCO under the Code if there is a 50% or greater change in ownership, by vote or value, of shares of our stock or NACCO’s stock occurring as part of a plan or series of related transactions that includes the spin-off. Any acquisitions or issuances of our stock or NACCO’s stock within two years after the spin-off are generally presumed to be part of such a plan, although we or NACCO may be able to rebut that presumption.

Under the tax allocation agreement that we will enter into with NACCO, we will be prohibited from taking or failing to take any action that prevents the spin-off from being tax-free. Further, during the two-year period following the spin-off, without obtaining the consent of NACCO, a private letter ruling from the Internal Revenue Service or an unqualified opinion of a nationally recognized law firm, we may be prohibited from:

| • | approving or allowing any transaction that results in a change in ownership of 35% or more of the value or the voting power of our common stock; |

| • | redeeming equity securities; |

| • | selling or otherwise disposing of more than 35% of the value of our assets; |

| • | acquiring a business or assets with equity securities to the extent one or more persons would acquire 35% or more of the value or the voting power of our common stock; and |

| • | engaging in certain internal transactions. |

These restrictions may limit our ability to pursue strategic transactions or engage in new businesses or other transactions that could maximize the value of our business. See “Ancillary Agreements – Tax Allocation Agreement” beginning on page 143.

The combined market values of NACCO common stock and our common stock that NACCO stockholders will hold after the spin-off may be less than the market value of NACCO common stock prior to the spin-off.

After the spin-off, holders of NACCO common stock prior to the spin-off will own a combination of NACCO common stock and our common stock. Any number of matters, including the risks described in this prospectus, may adversely impact the value of NACCO common stock and our common stock after the spin-off. Some of these matters may not have been identified by NACCO prior to the consummation of the spin-off and, in any event, may not be within NACCO’s or our control. In the event of any adverse circumstances, facts, changes or effects, the combined market values of NACCO common stock and our common stock held by NACCO stockholders after the spin-off may be less than the market value of NACCO common stock before the spin-off.

15

Table of Contents

Risks Relating to Our Business after the Spin-Off

Our lift truck business is cyclical. Any downturn in the general economy could result in significant decreases in our revenue and profitability and an inability to sustain or grow the business.

Our lift truck business historically has been cyclical. Fluctuations in the rate of orders for lift trucks reflect the capital investment decisions of our customers, which depend to a certain extent on the general level of economic activity in the various industries our lift truck customers serve. During economic downturns, customers tend to delay new lift truck and parts purchases. Consequently, we have experienced, and in the future may continue to experience, significant fluctuations in our revenues and net income. If there is a downturn in the general economy, or in the industries served by our lift truck customers, our revenue and profitability could decrease significantly, and we may not be able to sustain or grow our business.

The pricing and costs of our products have been and may continue to be impacted by foreign currency fluctuations, which could materially increase costs, result in material exchange losses and materially reduce operating margins.

Because we conduct transactions in various foreign currencies, including the euro, British pound, Australian dollar, Brazilian real, Japanese yen, Chinese renminbi and Swedish kroner, our lift truck pricing is subject to the effects of fluctuations in the value of these foreign currencies and fluctuations in the related currency exchange rates. As a result, our sales have historically been affected by, and may continue to be affected by, these fluctuations. In addition, exchange rate movements between currencies in which we purchase materials and components and manufacture certain of our products and the currencies in which we sell those products have been affected by and may continue to result in exchange losses that could materially reduce operating margins. Furthermore, our hedging contracts may not fully offset risks from changes in currency exchange rates.

The cost of raw materials used by our products has and may continue to fluctuate, which could materially reduce our profitability.

At times, we have experienced significant increases in our materials costs, primarily as a result of global increases in industrial metals including steel, lead and copper and other commodity prices, including rubber, as a result of increased demand and limited supply. We manufacture products that include raw materials that consist of steel, rubber, copper, lead, castings and counterweights. We also purchase parts provided by suppliers that are manufactured from castings and steel or contain lead. The cost of these parts is impacted by the same economic conditions that impact the cost of the parts we manufacture. The cost to manufacture lift trucks and related service parts has been and will continue to be affected by fluctuations in prices for these raw materials. If costs of these raw materials increase, our profitability could be reduced.

We are subject to risks relating to our foreign operations.

Foreign operations represent a significant portion of our business. We expect revenue from foreign markets to continue to represent a significant portion of our total revenue. We own or lease manufacturing facilities in Brazil, Italy, Mexico, The Netherlands and Northern Ireland, and own interests in joint ventures with facilities in China, Japan, the Philippines and Vietnam. We also sell domestically produced products to foreign customers and sell foreign produced products to domestic customers. Our foreign operations are subject to additional risks, which include:

| • | potential political, economic and social instability in the foreign countries in which we operate; |

| • | currency risks, see the risk factor titled “The pricing and costs of our products have been and may continue to be impacted by foreign currency fluctuations, which could materially increase our costs, result in material exchange losses and materially reduce operating margins”; |

| • | imposition of or increases in currency exchange controls; |

16

Table of Contents

| • | potential inflation in the applicable foreign economies; |

| • | imposition of or increases in import duties and other tariffs on our products; |

| • | imposition of or increases in foreign taxation of earnings and withholding on payments we receive from our subsidiaries; |

| • | regulatory changes affecting international operations; and |

| • | stringent labor regulations. |

Part of our strategy to expand our worldwide market share is strengthening our international distribution network. A part of this strategy also includes decreasing costs by sourcing basic components in lower-cost countries. Implementation of this part of our strategy may increase the impact of the risks described above and there can be no assurance that such risks will not have an adverse effect on our revenues, profitability or market share.

We depend on a limited number of suppliers for specific critical components.

We depend on a limited number of suppliers for some of our critical components, including diesel, gasoline and alternative fuel engines and cast-iron counterweights used to counterbalance some lift trucks. Some of these critical components are imported and subject to regulation, primarily with respect to customary inspection of such products by the U.S. Customs and Border Protection under the U.S. Department of Homeland Security. The results of our operations could be adversely affected if we are unable to obtain these critical components, or if the costs of these critical components were to increase significantly, due to regulatory compliance or otherwise, and we were unable to pass the cost increases on to our customers.

Our failure to compete effectively within our industry could result in a significant decrease in our revenues and profitability.

We experience intense competition in the sale of lift trucks and aftermarket parts. Competition in the lift truck industry is based primarily on strength and quality of dealers, brand loyalty, customer service, new lift truck sales prices, availability of products and aftermarket parts, comprehensive product line offerings, product performance, product quality and features and the cost of ownership over the life of the lift truck. We compete with several global manufacturers that operate in all major markets. These manufacturers may have lower manufacturing costs, greater financial resources and less debt than us, which may enable them to commit larger amounts of capital in response to changing market conditions. If we fail to compete effectively, our revenues and profitability could be significantly reduced.

We rely primarily on our network of independent dealers to sell our lift trucks and aftermarket parts and we have no direct control over sales by those dealers to customers. Ineffective or poor performance by these independent dealers could result in a significant decrease in our revenues and profitability and our inability to sustain or grow our business.

We rely primarily on independent dealers for sales of our lift trucks and aftermarket parts. Sales of our products are therefore subject to the quality and effectiveness of the dealers, who are not subject to our direct control. As a result, ineffective or poorly performing dealers could result in a significant decrease in our revenues and profitability and we may not be able to sustain or grow our business.

If our current cost reduction and efficiency programs, including the introduction of new products, do not prove effective, our revenues, profitability and market share could be significantly reduced.

Changes in the timing of implementation of our current cost reduction, efficiency and new product programs may result in a delay in the expected recognition of future costs and realization of future benefits. In addition, if future industry demand levels are lower than expected, the actual annual cost savings could be lower than expected. If we are unable to successfully implement these programs, our revenues, profitability and market share could be significantly reduced.

17

Table of Contents

If the global capital goods market declines, the cost saving efforts we have implemented may not be sufficient to achieve the benefits we expect.

If the global economy or the capital goods market declines, our revenues could decline. If revenues are lower than expected, the programs we have implemented may not achieve the benefits we expect. Furthermore, we may be forced to take additional cost saving steps that could result in additional charges that materially adversely affect our ability to compete or implement our current business strategies.

Our actual liabilities relating to pending lawsuits may exceed our expectations.

We are a defendant in pending lawsuits involving, among other things, product liability claims. We cannot be sure that we will succeed in defending these claims, that judgments will not be rendered against us with respect to any or all of these proceedings or that reserves set aside or insurance policies will be adequate to cover any such judgments. We could incur a charge to earnings if reserves prove to be inadequate or the average cost per claim or the number of claims exceed estimates, which could have a material adverse effect on our results of operations and liquidity for the period in which the charge is taken and any judgment or settlement amount is paid.

We are subject to recourse or repurchase obligations with respect to the financing arrangements of some of our customers.

Through arrangements with General Electric Capital Corporation (“GECC”) and others, dealers and other customers are provided financing for new lift trucks in the United States and in major countries of the world outside of the United States. Through these arrangements, our dealers and certain customers are extended credit for the purchase of lift trucks to be placed in the dealer’s floor plan inventory or the financing of lift trucks that are sold or leased to customers. For some of these arrangements, we provide recourse or repurchase obligations such that we would become obligated in the event of default by the dealer or customer. Total amounts subject to these types of obligations at June 30, 2012 and December 31, 2011 were $154.3 million and $179.1 million, respectively. Generally, we maintain a perfected security interest in the assets financed such that, in the event that we become obligated under the terms of the recourse or repurchase obligations, we may take title to the assets financed. We cannot be certain, however, that the security interest will equal or exceed the amount of the recourse or repurchase obligations. In addition, we cannot be certain that losses under the terms of the recourse or repurchase obligations will not exceed the reserves that we have set aside in our consolidated financial statements. We could incur a charge to earnings if our reserves prove to be inadequate, which could have a material adverse effect on our results of operations and liquidity for the period in which the charge is taken.

Our actual liabilities relating to environmental matters may exceed our expectations.

Our manufacturing operations are subject to laws and regulations relating to the protection of the environment, including those governing the management and disposal of hazardous substances. If we fail to comply with these laws or our environmental permits, then we could incur substantial costs, including cleanup costs, fines and civil and criminal sanctions. In addition, future changes to environmental laws could require us to incur significant additional expenses or restrict operations.

In addition, our products may be subject to laws and regulations relating to the protection of the environment, including those governing vehicle exhausts. Regulatory agencies in the United States and Europe have issued or proposed various regulations and directives designed to reduce emissions from spark ignited engines and diesel engines used in off-road vehicles, such as industrial lift trucks. These regulations require us and other lift truck manufacturers to incur costs to modify designs and manufacturing processes and to perform additional testing and reporting.

We are investigating or remediating historical contamination at some current and former sites caused by our operations or those of businesses we acquired. We have also been named as a potentially responsible party for cleanup costs under the so-called Superfund law at several third-party sites where we (or our predecessors) disposed of wastes in the past. Under the Superfund law and often under similar state laws, the entire cost of

18

Table of Contents

cleanup can be imposed on any one of the statutorily liable parties, without regard to fault. While we are not currently aware that any material outstanding claims or obligations exist with regard to these sites, the discovery of additional contamination at these or other sites could result in significant cleanup costs that could have a material adverse effect on our financial condition and results of operations.