Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF MONTGOMERY COSCIA GREILICH LLP - Oryon Technologies, Inc. | d411600dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on September 13, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ORYON TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 3640 | 26-2626737 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

4251 Kellway Circle

Addison, Texas 75001

(214) 267-1321

(Address, including zip code, and telephone number, including area code, or registrant’s principal executive offices)

Thomas P. Schaeffer

President and Chief Executive Officer

Oryon Technologies, Inc.

4251 Kellway Circle

Addison, Texas 75001

(214) 267-1321

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David R. Earhart

Looper Reed & McGraw PC

1601 Elm Street

Suite 4600

Dallas, Texas 75201

(214) 237-6393

Approximate date of commencement of proposed sale to the public: As soon as practicable after the Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered (1) |

Proposed Maximum Offering Price Per Share (2) |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common Stock, $0.001 par value |

4,000,000 | $0.7525 | $3,010,000 | $344.95 | ||||

| Common Stock, $0.001 par value, issuable upon exercise of warrants |

4,000,000 | $0.7525 | $3,010,000 | $344.95 | ||||

| Total |

8,000,000 | $6,020,000 | $689.90 | |||||

|

| ||||||||

|

| ||||||||

| (1) | All 4,000,000 shares registered pursuant to this registration statement are to be offered by the selling shareholders. Pursuant to Rule 416 under the Securities Act, this registration statement also covers such number of additional shares of common stock to prevent dilution resulting from stock splits, stock dividends and similar transactions pursuant to the terms of the warrants referenced below. |

| (2) | Estimated solely for the purpose of calculating the registration fee, which has been computed in accordance with Rule 457(c) and Rule 457(g) under the Securities Act, based on the average of the high and low prices for the Common Stock on September 6, 2012, as reported on the OTCQB Tier of the U.S. OTC Market. |

The Registrant hereby amends this Registration Statement on such date or date as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

(Subject to completion, dated September 13, 2012)

Prospectus

Oryon Technologies, Inc.

8,000,000 Shares

Common Stock

This prospectus relates to the resale by the holders of 4,000,000 shares of our common stock and up to 4,000,000 shares of common stock issuable upon the exercise of warrants to purchase shares of our common stock.

We will not receive any of the proceeds from the resale of shares offered by the selling shareholders under this prospectus.

Our common stock is traded on the OTCQB Tier of the U.S. OTC Markets under the symbol “ORYN.” On September 12, 2012, the last reported sale price of our common stock was $0.80 per share.

This investment involves risks. See “Risk Factors” beginning on page 3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2012.

Table of Contents

i

Table of Contents

Unless otherwise indicated, in this Registration Statement on Form S-1 (this “Registration Statement”), references to “we,” “our,” “us,” “ORYN,” the “Company” or the “Registrant” refer to Oryon Technologies, Inc., a Nevada corporation and its wholly-owned subsidiary OryonTechnologies, LLC, a Texas limited liability company (“Oryon”). References to “our common stock,” “our shares of common stock,” “our shares of preferred stock” or “our capital stock” or similar terms shall refer to the common stock and preferred stock of the Registrant.

The Company

We are in the business of developing and commercializing a three dimensional electroluminescent technology. Our technology is patented and trademarked under the name Elastolite®.

Our principal executive offices are at 4251 Kellway Circle, Addison, Texas 75001 and our telephone number at that address is (214) 267-1321.

The Offering

We signed a financing agreement (the “Financing Agreement”) on November 2, 2011, with Maxum Overseas Fund (“Maxum”) under which Maxum agreed to: (1) invest $100,000 in the common equity of the Company and (ii) either invest an additional amount up to $1,900,000 in the common equity of the Company or assist the Company in securing all or a portion of such $1,900,000 investment from alternate sources. Prior to entering into this funding relationship, there were no relationships between Maxum and the directors, officers or other affiliates of Oryon. To the best of our knowledge, prior to entering into this funding relationship there were no existing relationships between Maxum and the Registrant’s then-existing directors, officers or other affiliates.

Under the terms of the Financing Agreement, for each dollar invested, the investor(s) making such investment were issued two (2) shares of common stock of the Company and a warrant to purchase two (2) shares of common stock of the Company with an exercise price of $0.75 per share and a term of five (5) years. Between November 2, 2011, and August 31, 2012, the Company received a total of $2,000,000 from subscriptions pursuant to the Financing Agreement resulting in the obligation to issue 4,000,000 shares (the “Subscription Shares”) and warrants having the right to purchase an additional 4,000,000 shares, each with an exercise price of $0.75. The Subscription Shares were issued in reliance upon Regulation S under the Securities Act of 1933, as amended and the rules and regulations promulgated thereunder (the “Securities Act”), to investors in offshore transactions (as defined in Rule 902 under Regulation S under the Securities Act), based upon representations made by such investors.

The selling shareholders will determine when and how they will sell the common stock offered by this prospectus. See “Plan of Distribution.” We will not receive any of the proceeds from the sale of the common stock offered by this prospectus.

1

Table of Contents

You should carefully consider the risks described below together with all of the other information included in this Registration Statement before making an investment decision with regard to our securities. The statements contained in this Registration Statement that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Company and Our Industry

Oryon has limited revenues and has incurred losses.

Oryon has limited revenues and we anticipate that our existing cash and cash equivalents will not be sufficient to fund our longer term business needs and we will need to generate additional revenue or receive additional investment to continue operations. In 2010 and 2011, Oryon had losses of approximately $1.5 million and $1.6 million, respectively. Based on our current internal forecast, we anticipate that we will continue to incur losses through the year ending December 2013.

We operate a business that is highly speculative and may not generate any profit.

There can be no assurance that our products will have commercial viability and/or that our plan to develop and exploit our technology is feasible. Because of the numerous risks and uncertainties associated with developing and marketing new technologies, we are unable to predict the extent of any future profits, if at all. We have financed operations and internal growth primarily through funding provided by investors and funds generated from operations. To date, we have devoted substantially all of our efforts to research and development, infrastructure building and initial marketing activities. There is no guarantee the cost estimates used by us or the sales volumes projected are accurate and will be attained. An inability to meet sales volumes as forecast or to achieve assumed cost figures could have a negative impact on our profitability, cash flow and survival. Some of the initial sales volumes that we are projecting are expected to be in the apparel and gear areas. These areas are highly volatile and sometimes affected by economic conditions beyond our control, which could impact planned sales volumes and could negatively impact our finances.

Our auditors have expressed uncertainty as to our ability to continue as a going concern.

Primarily as a result of our recurring losses and our lack of liquidity, we received a report from our independent auditors that includes an explanatory paragraph describing the substantial uncertainty as to our ability to continue as a going concern as of our fiscal year ended December 31, 2011.

If we fail to raise additional capital, our ability to implement our business model and strategy could be compromised.

We have limited capital resources and operations. To date, our operations have been funded entirely from the proceeds from limited revenues, equity and debt financings. We currently do not have adequate capital or revenue to meet current or projected operating expenses. We anticipate needing substantial additional capital in the near future to develop and market new products, services and technologies. We currently do not have commitments for financing to meet our expected needs and we may not be able to obtain additional financing on terms acceptable to us, or at all. Even if we obtain financing for our near term operations and product development, we expect that we will require additional capital beyond the near term. If we are unable to raise capital when needed, our business, financial condition and results of operations would be materially adversely affected, and we could be forced to reduce or discontinue our operations. Debt financing, if obtained, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt and could increase our expenses, and would be required to be repaid regardless of our operating results. Moreover, we may issue equity securities in connection with such debt financing. Equity financing, even if obtained, could result in ownership and economic dilution to our existing stockholders and/or require us to grant certain rights and preferences to new investors. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current operations.

We do not currently have credit facilities or arrangements in place as a source of funds and there can be no assurance that we will be able to raise sufficient additional capital or raise such capital on acceptable terms or raise such capital when we need it. If such capital is not available on satisfactory terms, or is not available at all, we may be required to delay, scale back or stop the development of our products and/or cease our operations.

2

Table of Contents

If our products or technology do not gain market acceptance, we may not be able to fund future operations.

There can be no assurance that our products or technology will have commercial viability and/or that our plan to develop and exploit our technology is feasible. A number of factors may affect the market acceptance of our products, including, among others, the perception by consumers of the effectiveness of our products, our ability to fund our sales and marketing efforts, and the effectiveness of our sales and marketing efforts. If our products do not gain acceptance by consumers, we may not be able to fund future operations, including the development of new products, and/or our sales and marketing efforts for our current products, which inability would have a material adverse effect on our business, financial condition and operating results.

If we underestimate our operating expenses, we may not be able to fund future operations.

To date, we have devoted substantially all of our efforts to research and development, infrastructure building and initial marketing activities. There is no guarantee that our cost estimates or projected sales volumes are accurate and will be attained. An inability to meet sales volumes as forecast or to achieve assumed cost figures could have a negative impact on our profitability, cash flow and survival.

We expect our operating expenses to increase in connection with the continued development of our products and technology and expansion of our marketing activities. We may also incur costs and expenses that are unexpected, in excess of amounts anticipated or are otherwise not contemplated or provided for in connection with our business plan. If these or other costs or expenses are incurred, it could have a material adverse effect on our financial performance.

Any failure to adequately establish outsourcing capabilities and an internal and distributor sales force will impede our growth.

We require adequate arrangements with third party outsourcing sources to manufacture our products. Any failure to enter into and maintain such arrangements would adversely affect our growth. In addition, we expect to be substantially dependent on an internal and distributor sales force to attract new consumers of our products and technology. We believe that there may be significant competition for qualified, productive sales personnel and distributors who have the skills and technical knowledge necessary to promote and sell our products and technology. Our ability to achieve significant growth in revenue in the future will depend, in large part, on our success in establishing our sales network. If we are unable to develop an efficient sales network, it will make our growth more difficult and our business could suffer.

Our failure to accurately estimate demand for our products and technology could adversely affect our business and financial results.

We may not accurately estimate demand for our products and technology. Our ability to estimate the overall demand for our products and technology is imprecise and may be less precise in certain markets. If we materially underestimate demand for our products and technology we might not be able to satisfy demand on a short-term basis. Moreover, industry-wide shortages of certain electronic and lighting components, parts or raw materials have been, and could, from time to time in the future, be experienced. Such shortages could interfere with and/or delay production of our products by our customers and could have a material adverse effect on our business and financial results.

Changes in consumer preferences may reduce demand for our products and technology.

Our future success will depend upon our ability to develop and introduce different and innovative lighting solutions and applications for Elastolite. In order to develop our market share, the impact of our products must address a consumer need and then meet that need in the areas of quality and derived benefits. There can be no assurance of our ability to meet that need and there is no assurance that consumers will purchase our products. Additionally, our products are considered premium products and to maintain market share during recessionary periods we may have to reduce profit margins which would adversely affect our results of operations. Product lifecycles for some consumer electronic products in which our products may be used may be limited to a few years before consumers’ preferences change. There can be no assurance that our products will become or remain profitable for us. Our industry is subject to changing consumer preferences and shifts in consumer preferences may adversely affect us if we misjudge such preferences. We may be unable to achieve volume growth through product initiatives. We also may be unable to penetrate new markets. If we are unable to address any or all of these issues, it may affect our ability to produce revenues and our business, financial condition and results of operations will be adversely affected.

3

Table of Contents

If we are unable to develop and establish brand image or product quality, or if we encounter product recalls, our business may suffer.

Our success depends on our ability to develop and establish brand image for our products, lighting solutions and applications for Elastolite®. We have no assurance that our advertising, marketing and promotional programs will have the desired impact on our products’ brand image or consumer preferences. Product quality issues, real or imagined, or allegations of product defects, even if false or unfounded, could tarnish the image of the affected brands and may cause consumers to choose other products. We may be required from time to time to recall products entirely. Product recalls could adversely affect our profitability and our brand image. We do not maintain recall insurance. While we do not expect to have any credible product liability litigation, there is no assurance that we will not experience such litigation in the future. In the event we do experience product liability claims or a product recall, our financial condition and business operations could be materially adversely effected.

We may acquire or make investments in companies or technologies that could cause loss of value to our stockholders and disruption of our business.

Subject to our capital constraints, we intend to continue to explore opportunities to acquire companies or technologies in the future. Entering into an acquisition entails many risks, any of which could adversely affect our business, including:

| • | Failure to integrate the acquired assets and/or companies with our current business; |

| • | The price we pay may exceed the value we eventually realize; |

| • | Loss of share value to our existing stockholders as a result of issuing equity securities as part or all of the purchase price; |

| • | Potential loss of key employees from either our current business or the acquired business; |

| • | Entering into markets in which we have little or no prior experience; |

| • | Diversion of management’s attention from other business concerns; |

| • | Assumption of unanticipated liabilities related to the acquired assets; and |

| • | The business or technologies we acquire or in which we invest may have limited operating histories, may require substantial working capital, and may be subject to many of the same risks we are subject to. |

If we do not respond effectively and on a timely basis to rapid technological change, our business could suffer.

Our industry is characterized by rapidly changing technologies, industry standards, customer needs and competition, as well as by frequent new product and service introductions. We must respond to technological changes affecting both our customers and suppliers. We may not be successful in developing and marketing, on a timely and cost-effective basis, new services that respond to technological changes, evolving industry standards or changing customer requirements. Our success will depend, in part, on our ability to accomplish all of the following in a timely and cost-effective manner:

| • | Effectively using and integrating new technologies; |

| • | Continuing to develop our technical expertise; |

| • | Enhancing our engineering and system design services; |

| • | Developing services that meet changing customer needs; |

| • | Advertising and marketing our services; and |

| • | Influencing and responding to emerging industry standards and other changes. |

An interruption in the supply of products and services that we obtain from third parties could cause a decline in sales of our products.

In designing, developing and supporting our products, lighting solutions and applications for Elastolite®, we rely on many third party providers. These suppliers may experience difficulty in supplying us products or services sufficient to meet our needs or they may terminate or fail to renew contracts for supplying us these products or services on terms we find acceptable. If our liquidity deteriorates, our vendors may tighten our credit, making it more difficult for us to obtain suppliers on terms satisfactory to us. Any significant interruption in the supply of any of these products or services could cause a decline in sales of our services, unless and until we are able to replace the functionality provided by these products and services. We also depend on third parties to deliver and support reliable products, enhance their current products, develop new products on a timely and cost-effective basis and respond to emerging industry standards and other technological changes.

4

Table of Contents

Growth of internal operations and business may strain our financial resources.

We intend to significantly expand the scope of our operating and financial systems in order to build and expand our business. Our growth rate may place a significant strain on our financial resources for a number of reasons, including, but not limited to, the following:

| • | The need for continued development of our financial and information management systems; |

| • | The need to manage strategic relationships and agreements with manufacturers, suppliers and distributors; and |

| • | Difficulties in hiring and retaining skilled management, technical and other personnel necessary to support and manage our business. |

We cannot give you any assurance that we will adequately address these risks and, if we do not, our ability to successfully expand our business could be adversely affected.

Current global economic conditions may adversely affect our industry, business and result of operations.

Historically, disruptions in the current global credit and financial markets have included diminished liquidity and credit availability, a decline in consumer confidence, a decline in economic growth, an increased unemployment rate, and uncertainty about economic stability. There can be no assurance that there will not be deterioration in credit and financial markets and confidence in economic conditions. These economic uncertainties affect businesses such as ours in a number of ways, making it difficult to accurately forecast and plan our future business activities. Adverse global economic conditions and tightening of credit in financial markets may lead consumers to postpone spending, which may cause our customers to cancel, decrease or delay their existing and future orders with us. In addition, financial difficulties experienced by our suppliers, manufacturers, distributors or customers could result in product delays, increased accounts receivable defaults and inventory challenges. We are unable to predict the likely duration and severity of the current disruptions in the credit and financial markets and adverse global economic conditions. If uncertain economic conditions continue or further deteriorate, our business and results of operations could be materially and adversely affected.

Significant changes in government regulation may hinder sales.

The production, distribution, sale and marketing of our products and technology are subject to the rules and regulations of various federal, state and local agencies, various environmental statutes, and various other federal, state and local statutes and regulations applicable to the production, transportation, sale, safety, and advertising of or pertaining to our products and technology. New statutes and regulations may also be instituted in the future. Compliance with applicable federal and state regulations is crucial to our success. Although we believe that we are in compliance with applicable regulations, should the federal government or any state in which we operate amend its guidelines or impose more stringent interpretations of current laws or regulations, we may not be able to comply with these new guidelines. Such regulations could require the reformulation of certain products to meet new standards, market withdrawal or discontinuation of certain products we are unable to redesign or reformulate, imposition of additional record keeping requirements and expanded documentation regarding the properties of certain products. Failure to comply with applicable requirements could result in sanctions being imposed on us or the manufacturers of any of our products, including but not limited to fines, injunctions, product recalls, seizures and criminal prosecution. Further, if a regulatory authority finds that a current or future product or production run is not in compliance with any of these regulations, we may be required to have the packaging of our products changed which may adversely affecting our financial condition and operations. We are also unable to predict whether or to what extent a warning under any of applicable statute would have an impact on costs or sales of our products.

If we are not able to adequately protect our intellectual property, we may not be able to compete effectively.

Our ability to compete depends in part upon the strength of our proprietary rights in our technologies, brands and content. Currently, and going forward, we expect to rely on a combination of U.S. and foreign patents, trademarks, trade secret laws and license agreements to establish and protect our intellectual property and proprietary rights. The efforts we have taken and expect to take to protect our intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of our intellectual property and proprietary rights. In addition, effective trademark, patent, copyright and trade secret protection may not be available or cost-effective in every country in which

5

Table of Contents

our services are made available. There may be instances where we are not able to fully protect or utilize our intellectual property in a manner that maximizes competitive advantage. If we are unable to protect our intellectual property and proprietary rights from unauthorized use, the value of our products may be reduced, which could negatively impact our business. Our inability to obtain appropriate protections for our intellectual property may also allow competitors to enter our markets and produce or sell the same or similar products. In addition, protecting our intellectual property and other proprietary rights is expensive and diverts critical managerial resources. We rely in part on our currently issued patents to support competitive position. There can be no assurance that some of our patents will not be challenged at a later date. There can be no guarantee that we will be successful in obtaining additional patents that we may need at a later date to support certain growth initiatives. Our ability to defend our patents, if they are challenged, or the inability to obtain certain patents in the future, could have a material adverse effect in future periods. If we are otherwise unable to protect our intellectual property and proprietary rights, our business and financial results could be adversely affected.

If we are forced to resort to legal proceedings to enforce our intellectual property rights, the proceedings could be burdensome and expensive. In addition, our proprietary rights could be at risk if we are unsuccessful in, or cannot afford to pursue, those proceedings. In addition, the possibility of extensive delays in the patent issuance process could effectively reduce the term during which a marketed product is protected by patents.

The intellectual property to support our intermediate and long-term growth plans continues to be developed and there can be no assurance that we will complete such process. The addition of intellectual property to support this growth is particularly dependent on the continued services of our technology team and its ability to develop additional technologies to support such growth plans. If we do not have the financial resources to develop the intellectual property to fully support these growth plans, our ability to develop future products and refinement of current products could be negatively impacted.

We may also need to obtain licenses to patents or other proprietary rights from third parties. We may not be able to obtain the licenses required under any patents or proprietary rights or they may not be available on acceptable terms. If we do not obtain required licenses, we may encounter delays in product development or find that the development, manufacture or sale of products requiring licenses could be foreclosed. We may, from time to time, support and collaborate in research conducted by universities and governmental research organizations. We may not be able to acquire exclusive rights to the inventions or technical information derived from these collaborations, and disputes may arise over rights in derivative or related research programs conducted by us or our collaborators.

Assertions against us by third parties for infringement of their intellectual property rights could result in significant costs and cause our operating results to suffer.

The electronic and alternative lighting industries are characterized by vigorous protection and pursuit of intellectual property rights and positions, which results in protracted and expensive litigation for many companies. Other companies with greater financial and other resources than us have gone out of business from costs related to patent litigation and from losing a patent litigation. We may be exposed to future litigation by third parties based on claims that our technologies or activities infringe the intellectual property rights of others. Although we try to avoid infringement, there is the risk that we will use a patented technology owned or licensed by another person or entity and be sued for patent infringement or infringement of another party’s intellectual property or proprietary rights. If we or our products are found to infringe the intellectual property or proprietary rights of others, we may have to pay significant damages or be prevented from making, using, selling, offering for sale or importing such products or services or from practicing methods that employ such intellectual property or proprietary rights.

Further, we may receive notices of infringement of third-party intellectual property rights. Specifically, we may receive claims from various industry participants alleging infringement of their patents, trade secrets or other intellectual property rights in the future. Any lawsuit resulting from such allegations could subject us to significant liability for damages and invalidate our proprietary rights. These lawsuits, regardless of their success, would likely be time-consuming and expensive to resolve and would divert management time and attention. Any potential intellectual property litigation also could force us to do one or more of the following:

| • | stop selling products or using technology or manufacturing processes that contain the allegedly infringing intellectual property; |

| • | pay damages to the party claiming infringement; |

| • | attempt to obtain a license for the relevant intellectual property, which may not be available on commercially reasonable terms or at all; and |

| • | attempt to redesign those products that contain the allegedly infringing intellectual property with non-infringing intellectual property, which may not be possible. |

6

Table of Contents

The outcome of a dispute may result in our need to develop non-infringing technology or enter into royalty or licensing agreements. We may agree to indemnify certain customers for certain claims of infringement arising out of the sale of our products. Any intellectual property litigation could have a material adverse effect on our business, operating results or financial condition.

Confidentiality agreements with employees and others may not adequately prevent disclosure of our trade secrets and other proprietary information.

Our success depends upon the skills, knowledge and experience of our technical personnel, our consultants and advisors as well as our licensors and contractors. Because we operate in a highly competitive field, we rely almost wholly on trade secrets to protect our proprietary technology and processes. However, trade secrets are difficult to protect. We enter into confidentiality and intellectual property assignment agreements with our corporate partners, employees, consultants, outside scientific collaborators, developers and other advisors. These agreements generally require that the receiving party keep confidential and not disclose to third parties confidential information developed by us during the course of the receiving party’s relationship with us. These agreements also generally provide that inventions conceived by the receiving party in the course of rendering services to us will be our exclusive property. However, these agreements may be breached and may not effectively assign intellectual property rights to us. Our trade secrets also could be independently discovered by competitors, in which case we would not be able to prevent use of such trade secrets by our competitors. The enforcement of a claim alleging that a party illegally obtained and was using our trade secrets could be difficult, expensive and time consuming and the outcome would be unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. The failure to obtain or maintain meaningful trade secret protection could adversely affect our competitive position.

We face intense competition and expect competition to increase in the future, which could prohibit us from developing a customer base and generating revenue.

There are many companies who do or will compete directly with our current and planned products, technology and services. These companies may already have an established market in our industry. Most of these companies have significantly greater financial and other resources than us and have been developing their products and services longer than we have been developing ours. Additionally, there are not significant barriers to entry in our industry and new companies may be created that will compete with us and other, more established companies who do not now directly compete with us, may choose to enter our markets and compete with us in the future. Our inability to compete effectively with larger companies could have a material adverse effect on our business activities, financial condition and results of operations.

If we are unable to attract, train and retain marketing, technical and financial personnel, our business may be materially and adversely affected.

Our future success depends, to a significant extent, on our ability to attract, train and retain marketing, technical and financial personnel. Recruiting and retaining capable personnel, particularly those with expertise in our chosen industries, are vital to our success. There is substantial competition for qualified marketing, technical and financial personnel, and there can be no assurance that we will be able to attract or retain our marketing, technical and financial personnel. If we are unable to attract and retain qualified employees, our business may be materially and adversely affected.

Our business depends substantially on the continuing efforts of our executive officers and our business may be severely disrupted if we lose their services.

Our future success depends substantially on the continued services of our executive officers. In particular, our performance depends, in large part, upon our officers and their existing relationships in the industry. We do not maintain key man life insurance on any of our executive officers and directors. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers. In addition, if any of our executives joins a competitor or forms a competing company, we may lose some of our customers.

7

Table of Contents

We are subject to manufacturing risks.

We intend to use contract manufacturers for a majority of our production volumes. There can be no assurance that contract arrangements will be finalized or maintained at cost levels that will insure that we achieve the necessary gross margin to attain profitability. Any interruption in the manufacturing capacity or production of contract manufacturers would impact their ability to complete orders under contract terms or accept new orders and could have a negative impact on our sales and financial viability.

We are subject to production risks.

Some of our products and technology have not undergone extensive field and consumer testing. If failure of our products or technology should occur, we could be subject to warranty claims and other liabilities which could have a negative effect on our financial stability and further negatively affect both current and future sales. Certain of our important raw materials are available or obtained from a limited number of suppliers at the current time. Should one of these suppliers discontinue its production or distribution of these materials, unless we have developed additional suppliers in the interim, the result would have a materially adverse impact on us and could result in our production being suspended until an acceptable substitute could be found.

We are subject to potential technological obsolescence.

Our success is based on our ability to capitalize on our core patents and intellectual property in the marketplace and continue, through research and development, to develop improved technology. Other companies may develop technology that leapfrogs our existing technology thereby making our technology obsolete. Advancements could materially adversely affect our growth and future business.

We are subject to marketing risks.

The markets that we targeted as immediately viable are subject to changing consumer trends and personal taste and could be impacted by factors outside our control. Any economic factors which impact our markets could have a negative impact on us and our financial performance. Certain of the markets that we have targeted are classified as “high tech” and as such are subject to rapid technological advancements as well as high barriers such as cost, vendor status, criteria and time constraints. If any of these markets are subject to adverse economic conditions or experience an economic downturn, we could be negatively impacted.

After we introduce some of our products to the market, it is expected that we will attract an increased level of competition from companies that make products that are similar to our product. Any increased level of competition from other companies in the areas that we have targeted could lead to lower margins than projected and have a negative impact on us. We have made assumptions on the timing and cycles to market that, if in error, could adversely impact future revenue and cash flow.

Our products are subject to government regulations and customer requirements regarding safety matters that may require significant expenditures by us to ensure compliance.

Our products (and certain uses of our products) may be subject to governmental regulations for compliance with applicable safety standards. Any failure to comply with such standards could subject us to both governmental fines as well as possible claims by consumers.

We are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with, existing and future requirements could adversely affect our business.

We may face new corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the Securities and Exchange Commission (“SEC”) and the Public Company Accounting Oversight Board. These laws, rules and regulations continue to evolve and may become increasingly stringent in the future. In particular, under SEC rules, we are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules and regulations is expected to be substantial. We cannot assure you that we will be able to fully comply with these laws, rules and regulations that address corporate governance, internal control reporting and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition and the value of our securities.

8

Table of Contents

Risks Relating to our Common Stock and our Status as a Public Company

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Prior to the Merger, the individuals who now constitute our senior management team had never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

Our board of directors does not intend to declare or pay any dividends to our stockholders in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of our board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors the board of directors considers relevant. There is no plan to pay dividends in the foreseeable future, and if dividends are paid, there can be no assurance with respect to the amount of any such dividend.

Nevada law and our articles of incorporation authorize us to issue shares of stock, which shares may cause substantial dilution to our existing stockholders and/or have rights and preferences greater than our common stock.

Pursuant to our Articles of Incorporation, we currently have 600,000,000 shares of common stock authorized and 50,000,000 shares of preferred stock authorized. As of August 31, 2012, we had 34,502,121 shares of common stock issued and outstanding, 1,000,000 shares to be issued in fulfillment of recent subscriptions, 27,111,248 shares to be issued in connection with the conversion of the Series C Notes that became effective August 31, 2012, and up to an additional 15,084,216 shares issuable upon exercise of outstanding options and warrants. As a result, our Board of Directors has the ability to issue a large number of additional shares of common stock without stockholder approval, which, if issued, could cause substantial dilution to our existing stockholders. In addition, we may elect to issue preferred stock or other securities in the future having rights and preferences greater to our common stock. Our Articles of Incorporation provide that the Board may designate the rights and preferences of preferred stock without a vote by the shareholders.

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Our common stock is not listed on any stock exchange, although it is quoted on the OTCQB Tier of the U.S. OTC Markets. No trades of our common stock took place on the OTCQB prior to the Merger. No assurance can be given that an active market will continue to develop or that a stockholder will ever be able to liquidate its shares of common stock without considerable delay, if at all. Many brokerage firms may not be willing to effect transactions in our securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political and market conditions, such as recessions, lack of available credit, interest rates or international currency fluctuations may adversely affect the market price and liquidity of our common stock.

Shares of our common stock that have not been registered under the Securities Act of 1933, as amended, regardless of whether such shares are restricted or unrestricted, are subject to resale restrictions imposed by Rule 144, including those set forth in Rule 144(i) which apply to a “shell company.” In addition, any shares of our common stock that are held by affiliates, including any received in a registered offering, will be subject to the resale restrictions of Rule 144(i).

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. As such, we may

9

Table of Contents

be deemed a “shell company” pursuant to Rule 144 prior to the Merger, and as such, sales of our securities pursuant to Rule 144 are not able to be made until a period of at least twelve months has elapsed from the date on which our Current Report on Form 8-K, as amended, dated May 4, 2012, was filed with the Commission reflecting our status as a non-“shell company.” Therefore, any restricted securities we sell in the future or issue to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after the date of the filing of our Current Report on Form 8-K, as amended, dated May 4, 2012, and we have otherwise complied with the other requirements of Rule 144. As a result, it may be harder for us to fund our operations and pay our employees and consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our previous status as a “shell company” could prevent us from raising additional funds, engaging employees and consultants, and using our securities to pay for any acquisitions (although none are currently planned), which could cause the value of our securities, if any, to decline in value or become worthless. Lastly, any shares held by affiliates, including shares received in any registered offering, will be subject to the resale restrictions of Rule 144(i).

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations which may limit a stockholder’s ability to buy and sell our stock.

Our stock is categorized as a “penny stock”. The SEC has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We may not qualify to meet listing standards to list our stock on an exchange.

The SEC approved listing standards for companies using reverse mergers to list on an exchange may limit our ability to become listed on an exchange. We would be considered a reverse merger company (i.e., an operating company that becomes an Exchange Act reporting company by combining with a shell Exchange Act reporting company) that cannot apply to list on NYSE, NYSE MKT (formerly NYSE-Amex) or Nasdaq until our stock has traded for at least one year on the U.S. OTC market, a regulated foreign exchange or another U.S. national securities market following the filing with the SEC or other regulatory authority of all required information about the merger, including audited financials. We would be required to maintain a minimum $4 share price ($2 or $3 for NYSE MKT) for at least thirty (30) of the sixty (60) trading days before our application and the exchange’s decision to list. We would be required to have timely

10

Table of Contents

filed all required reports with the SEC (or other regulatory authority), including at least one annual report with audited financials for a full fiscal year commencing after filing of the above information. Although there is an exception for a firm underwritten IPO with proceeds of at least $40 million, we do not anticipate being in a position to conduct an IPO in the foreseeable future. In order for the minimum stock price requirement to not apply, we must satisfy the one year trading requirement and file at least four (4) annual reports with the SEC after the Merger. To the extent that we cannot qualify for a listing on an exchange, our ability to raise capital will be diminished.

11

Table of Contents

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Registration Statement and other reports filed by the Registrant from time to time with the SEC (collectively the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this Registration Statement entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward-looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and pro forma financial statements and the related notes filed with this Registration Statement.

12

Table of Contents

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On May 4, 2012 (the “Closing Date”), Oryon Technologies, Inc., a Nevada corporation (the “Registrant,” “ORYN” or the “Company”), closed a merger transaction with Oryon Merger Sub, LLC, a Texas limited liability company and wholly-owned subsidiary of the Company (“Merger Sub”), and OryonTechnologies, LLC, a Texas limited liability company (“Oryon”) pursuant to an Agreement and Plan of Merger dated March 9, 2012 (the “Merger Agreement”).

We signed a financing agreement (the “Financing Agreement”) on November 2, 2011, with Maxum Overseas Fund (“Maxum”) under which Maxum agreed to: (1) invest $100,000 in the common equity of the Company and (ii) either invest an additional amount up to $1,900,000 in the common equity of the Company or assist the Company in securing all or a portion of such $1,900,000 investment from alternate sources. Prior to entering into this funding relationship, there were no relationships between Maxum and the directors, officers or other affiliates of Oryon. To the best of our knowledge, prior to entering into this funding relationship there were no existing relationships between Maxum and the Registrant’s then-existing directors, officers or other affiliates.

Under the terms of the Financing Agreement, for each dollar invested, the investor(s) making such investment will be issued two (2) shares of common stock of the Company and a warrant to purchase two (2) shares of common stock of the Company with an exercise price of $0.75 per share and a term of five (5) years. Between November 2, 2011, and August 31, 2012, the Company received a total of $2,000,000 from subscriptions pursuant to the Financing Agreement resulting in the obligation to issue 4,000,000 shares (the “Subscription Shares”) and warrants having the right to purchase an additional 4,000,000 shares, each with an exercise price of $0.75. The Subscription Shares were issued in reliance upon Regulation S under the Securities Act of 1933, as amended and the rules and regulations promulgated thereunder (the “Securities Act”), to investors in offshore transactions (as defined in Rule 902 under Regulation S under the Securities Act), based upon representations made by such investors.

In anticipation of the Merger (as defined below), on October 31, 2011, certain shareholders, including our two former executive officers and directors, Ms. Crystal Coranes and Ms. Rizalyn Cabrillas, surrendered in aggregate 30,000,000 shares of our common stock for cancellation, and on November 17, 2011, an additional 1,000,000 shares were surrendered for cancellation. Further, on April 19, 2012, an additional 12,000,000 shares were surrendered for cancellation by Ms. Coranes, and on April 30, 2012, an additional 2,000,000 shares were surrendered for cancellation. In total, of the 60,000,000 shares outstanding prior to October 31, 2011, an aggregate of 45,000,000 shares were surrendered for cancellation prior to the Merger. On March 12, 2012, the Company fulfilled some of the subscriptions pursuant to the Financing Agreement in the aggregate amount of $400,000 resulting in the issuance of 800,000 shares of common stock (along with warrants to purchase an additional 800,000 shares at $0.75 per share). As a result of the cancellations and the subscription fulfillment, our total number of issued and outstanding shares of common stock was 15,800,000 as of May 4, 2012. In addition, as of May 4, 2012, as a result of the fulfillment in March 2012 of $400,000 in subscriptions out of the aggregate of $725,000 in subscriptions received prior to the Closing Date, there remained unfulfilled subscriptions pursuant to the Financing Agreement for $325,000 resulting in an obligation to issue an additional 650,000 shares of Company common stock (subsequently issued on or about June 3, 2012) along with warrants for the purchase of an additional 650,000 shares of common stock at $0.75 per share.

Between November 2, 2011 and the Closing Date, the Company advanced the total of $725,000 that was derived from the sale of the Subscriptions Shares to Oryon in return for a series of promissory notes from Oryon in the cumulative amount of $725,000. The purpose of the advances was to provide Oryon with sufficient capital to sustain its operations until the Closing Date. The promissory notes did not have maturity dates and did not provide for interest if the Merger was completed. The promissory notes also provided that, at closing, as explained below, when Oryon became a wholly-owned subsidiary of the Company and, the amounts due under the promissory notes between the Company and Oryon became intercompany obligations within the corporate group, the promissory notes would be cancelled. In the event that the Merger was not completed, the promissory notes would accrue interest at 5% and become payable when the Company experienced one of several events as defined in the promissory notes. Subsequent to the Closing Date, the Company received $775,000 in aggregate from two additional subscriptions dated May 10, 2012, and May 15, 2012, pursuant to the Financing Agreement, resulting in the issuance upon fulfillment of the subscriptions, on or about June 3, 2012, of 1,550,000 shares and warrants having the right to purchase an additional 1,550,000 shares, each with an exercise price of $0.75. Subsequent to the end of the second quarter on June 30, 2012, the Company received $250,000 from each of two additional subscriptions ($500,000 in aggregate) dated July 24, 2012, and August 31, 2012, respectively, pursuant to the Financing Agreement, resulting in the issuance upon fulfillment of the subscriptions, during September 2012, of 1,000,000 shares and warrants having the right to purchase an additional 1,000,000 shares, each with an exercise price of $0.75.

13

Table of Contents

In accordance with the terms of Merger Agreement, on the Closing Date, Oryon merged into Merger Sub in exchange for the issuance to the members of Oryon (“Oryon Members”) of 16,502,121 shares of Company common stock (the “Merger”).

As a result of the Merger, the Oryon Members acquired 50.1% of our issued and outstanding common stock, Oryon became our wholly-owned subsidiary, and the Registrant acquired the business and operations of Oryon. Oryon is a technology company with certain valuable products and intellectual property rights related to a three-dimensional, elastomeric, membranous, flexible electroluminescent lamp.

Prior to the Merger, we were a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder (“Exchange Act”).

The following description of the terms and conditions of the Merger Agreement and the transactions contemplated thereunder that are material to the Registrant does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which was filed as Exhibit 2.1 to our Current Report on Form 8-K filed with the SEC on March 14, 2012.

Issuance of Common Stock. At the closing of the Merger (the “Closing”), each issued and outstanding membership unit of Oryon (each an “Oryon Unit”) immediately prior to the Closing was converted automatically into the right to receive eight (8) shares of Company common stock and a Contingent Share Right (as defined below) upon surrender of the Oryon Units (the “Merger Consideration”).

Convertible Debt of Oryon. Prior to Closing, Oryon solicited its Series C convertible promissory note holders (each a “Series C Holder”) to amend Oryon’s Series C convertible promissory notes (“Series C Notes”) such that each Series C Holder may elect to convert the amount of outstanding principal and accrued unpaid interest under its Series C Notes into shares of Company common stock on or after the Closing and that upon receipt by Oryon of the full $2 million of proceeds from a financing as contemplated in the Merger Agreement within nine (9) months of the Closing, all of the Series C Notes will automatically be converted into shares of Company common stock. The amendment provides that the number of shares of Company common stock issuable upon conversion of the Series C Notes shall be an amount equal to eight (8) shares of Company common stock multiplied by one dollar ($1.00) divided by the current conversion price for the applicable series of Series C Notes times the sum of face amounts of the Series C Notes and the accrued interest on the Series C Notes to the conversion date. The amendment further provides that certain events such as breach of covenants, failure to make payments when due or bankruptcy or similar proceedings would constitute an event of default under the Series C Notes entitling a majority in interest of the Series C Note holders to accelerate the Series C Notes. Such amendment was approved by the Series C Holders on March 26, 2012. On August 31, 2012, the Company received the last installment of the $2.0 million in proceeds required to cause the automatic conversion of the Series C Notes, resulting in the issuance of 27,111,248 shares.

Warrants and Options. In connection with the Merger, Oryon solicited the consent of the holders of outstanding warrants issued by Oryon to exchange such warrants effective as of the Closing, whereby each outstanding warrant to purchase an Oryon Unit shall be exchanged for a warrant to purchase eight (8) shares of Company common stock. Each warrant has a Contingent Share Right. Each outstanding option to purchase an Oryon Unit shall be exchanged for an option to purchase eight (8) shares of Company common stock under the Company’s 2012 Equity Incentive Plan. The options also have Contingent Share Rights in that each option, when exercised, will be exercisable for the number of Company shares for which it would have been exercisable had it been exercised prior to the Closing.

Change in Management. As a condition to closing the Merger, Ms. Crystal Coranes and Ms. Rizalyn Cabrillas resigned as members of the Registrant’s Board of Directors. In addition, at Closing, Ms. Coranes resigned as the Registrant’s President and Chief Executive Officer and Ms. Cabrillas resigned as the Registrant’s Chief Financial Officer and Secretary. At Closing, Messrs. Thomas Patrick Schaeffer, Mark E. Pape, Larry L. Sears, Jon S. Ross and Brendon W. Mills were appointed to the Registrant’s Board of Directors. Mr. Mills subsequently resigned and was replaced by Richard K. Hoesterey. In addition, effective at Closing, Mr. Schaeffer was appointed as the Registrant’s new President and Chief Executive Officer, and Mr. Pape was appointed as the Registrant’s new Chief Financial Officer, Treasurer and Secretary.

Additional information regarding the above-mentioned current directors and/or executive officers is set forth below under the section titled “Directors and Executive Officers.”

14

Table of Contents

From and after the Closing Date, our primary operations consist of the business and operations of Oryon. In the Merger, or reverse acquisition, the Registrant is the accounting acquiree and Oryon is the accounting acquirer. Accordingly, we are presenting herein the financial statements of Oryon and certain pro forma financial information. Further, we disclose information about the business, financial condition, and management of Oryon in this Registration Statement.

History of Oryon

In the late 1990’s, EL Specialists, Inc. (“ELS”), a company organized under the laws of Texas, the predecessor company of Oryon, engineered a technological breakthrough and developed a three dimensional, elastomeric, membranous lamp that eliminated the semi-rigid nature of conventional electroluminescent (“EL”). ELS patented and trademarked this process under the name Elastolite®.

Elastolite was created to replace conventional EL with a highly malleable, flexible, and economical elastomeric EL lamp technology that could be applied directly to fabrics for safety purposes. This concept required lamps that were ultra-thin, extremely flexible, washable, crushable, formable, elastic, and heat resistant. To accomplish this formidable goal, the ink formulas and manufacturing processes of conventional EL would need to be restructured.

In 2002, MRM Acquisitions, LLC, a company organized under the laws of Texas (“MRMA”), acquired the patents and intellectual property (“IP”) of ELS and began preparing Elastolite for commercialization.

In addition to the textile and related apparel applications for which it was invented, Elastolite opened multiple new and innovative opportunities for EL lighting in membrane switches, keypads, compression-molded plastics, athletic apparel, toys, occupational safety, point-of-sale displays, automotive and household utilitarian and decorative applications. In addition, the acquired IP also contained innovative patents in the biometric field that Oryon believes, when it is developed, will permit the launch of multiple, high volume, cost effective biometric applications.

In October 2002, OryonTechnologies, LP, a limited partnership formed under the laws of the State of Texas, was formed as the operating company charged with exploiting and commercializing the acquired technology. In October 2004, OryonTechnologies, LP was converted to a limited liability company, OryonTechnologies, LLC, a Texas limited liability company, and MRMA subsequently exchanged all the IP and patents held by MRMA for membership units of Oryon. Oryon spent its first years preparing Elastolite to be marketed.

In management’s opinion, Oryon created the framework to commercialize and successfully launch Elastolite through multiple innovations Oryon developed through market testing during the years 2003 through 2011. Oryon test marketed Elastolite in clothing with Marmot Mountain Ltd (2004) and with Lands’ End in over 100,000 lit textile products (2006). While the test marketing provided Oryon with technical information leading to the improvement of its technology, insufficient funding prevented Oryon from capitalizing on the resulting new product developments and Oryon was unable to sustain the relationship with the early customers. In addition, Oryon licensed the technology to Rogers Corporation to light cell phone keypads which ultimately resulted in the Motorola Razr cell phone which sold over 100,000,000 units (2006-2009) and produced over $8,000,000 in revenues to Oryon. Subsequent innovations in smart phone and touch screen technologies have eliminated the large market for more expensive keypad-type cellphones that utilized Oryon’s technology.

In 2008, Oryon granted a license to a Fortune 100 company in the field of occupational safety, spent over a year developing and qualifying Elastolite and the Elastolite electronic system for apparel with a leading global sports apparel company’s advanced innovation team for product launch in 2009-10, and received the first volume production order from them in 2009. Further, Oryon produced light for costumes used by Disney in the December 2010 3-D release of the movie Tron Legacy, established a relationship with Disney Consumer Products (“DCP”) and has worked with a leading U.S. department store as well as Adidas, Puma and Under Armour, among others, in the development of lit products. However, without sufficient funding to be able to deliver Elastolite to fulfill large orders, Oryon did not aggressively pursue major transactions with such customers. As a result of the completed Merger, the Company has the capital resources to re-engage with previous customers and prospects to develop additional product applications utilizing the Company’s most updated technology and techniques, although additional capital will be required to enable the Company to fulfill large orders that might result from such re-engagement.

15

Table of Contents

Based on the successful market testing and customer acceptance of the innovations developed by Oryon in the commercialization process of Elastolite in the apparel (including sports apparel and shoes), textile, safety and gear markets, Oryon felt it would be ready to commercially launch Elastolite in 2009. Consequently, in the summer of 2008, it hired an investment banker to raise the capital that would be required to support the launch of Elastolite and to provide the time for Oryon’s Fortune 100 and 500 potential customers to incorporate it in their product development process.

Financial offering materials were prepared and a fund raising process was initiated in September 2008. Unfortunately, at that same time the deepening US financial crisis and the difficult economic environment made the financing process untenable. Oryon subsequently did not have the funds required to support the development of new products in conjunction with its customers. Management did not want its customers to launch products at a time when Oryon could not provide effective and timely customer support. In addition, the Motorola Razr cell phone was approaching its end-of-life as a product and future revenue from this source could not be counted on. Management of Oryon therefore began to take steps to (a) reduce overhead, (b) continue application development for potentially high volume future products, (c) hold and maintain its major customers until adequate funding was available to launch product with them and (d) maintain barriers to entry (Oryon’s extensive patent portfolio) for potential competition until adequate financial resources could be raised.

To accomplish the above, Oryon raised capital through the issuance of convertible notes primarily to angel investors, raising investment capital of $888,000 in late 2008 and 2009, $1,000,000 in December 2009 and early 2010, and $560,000 in 2011. Oryon’s management anticipates that the merger with the Company, the potential financial resources it can provide, both private and public, and access to the public financing market will provide an opportunity for Oryon to successfully launch Elastolite, building upon the experience and customer relationships developed during the years 2008-2011.

Background of Transaction

The Registrant was organized under the laws of the State of Nevada on August 22, 2007 to explore mineral properties under the name “Eaglecrest Resources, Inc.” The Registrant was formed to engage in the exploration of mineral properties for gold. The Registrant had not generated any revenue from its business operations prior to the Closing Date, and the Registrant had been unable to raise sufficient funds to implement its operations.

As a result of the current difficult economic environment and the Registrant’s lack of funding to explore mineral properties, in 2011, the Registrant’s Board of Directors began to analyze strategic alternatives available to the Registrant to continue as a going concern. Such alternatives included raising additional debt or equity financing or consummating a merger or acquisition with a partner that may involve a change in the Registrant’s business plan. Through an introduction by an investment firm, Balanced Financial Securities, the Board of Directors identified Oryon as a potential strategic acquisition that the Board believed to be in the best interest of the Registrant and its shareholders. Oryon was attractive to the Registrant because it is a technology company with certain valuable products and intellectual property rights and has plans to grow its business. Oryon believed the Registrant to be an attractive business combination partner, due in part, to the perceived benefits of being a publicly registered company, allowing for increased access to capital. Accordingly, the parties entered into a letter of intent with respect to the Merger on October 24, 2011, executed the Merger Agreement on March 9, 2012, and closed the Merger on May 4, 2012.

16

Table of Contents

Corporate Structure

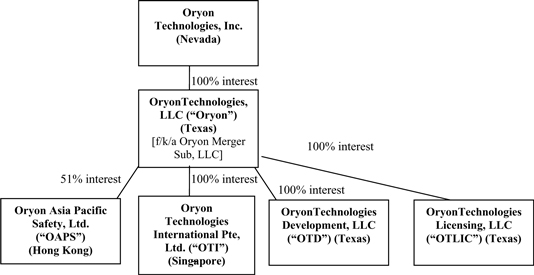

As a result of the Merger, the organizational structure of the Registrant is as follows:

Subsidiaries

As noted in the diagram above, Oryon currently owns:

| • | 51% interest in Oryon Asia Pacific Safety, Ltd. (“OAPS”), a Hong Kong corporation. The operations of OAPS are not material to Oryon and Oryon intends to liquidate OAPS before the end of 2012. |

| • | 100% of Oryon Technologies International Pte, Ltd. (“OTI”), a company organized under the laws of Singapore. The operations of OTI are not material to Oryon and Oryon intends to liquidate OTI before the end of 2012. |

| • | 100% of OryonTechnologiesDevelopment, LLC (“OTD”), a company organized under the laws of Texas. OTD currently conducts R&D and product development for Oryon. Oryon is evaluating whether to merge OTD into Oryon. |