Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT OF MATERIAL EVENTS OR CORPORATE CHANGES - Forestar Group Inc. | a12-20995_18k.htm |

Exhibit 99.1

|

|

JMP Securities Financial Services & Real Estate Conference September 13, 2012 Accelerating Value Realization, Growing Through Strategic Investments and Delivering the Greatest Value from Every Acre |

|

|

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including the timing to consummate the proposed merger, the risk that a condition to closing of the proposed merger may not be satisfied; our ability to achieve the synergies and value creation contemplated by the proposed merger; our ability to promptly and effectively integrate Credo’s businesses, and the diversion of management time on merger-related matters. Other factors and uncertainties that might cause such differences include, but are not limited to: general economic, market, or business conditions; changes in commodity prices; the opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this news release to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found on our website at www.forestargroup.com. 2 |

|

|

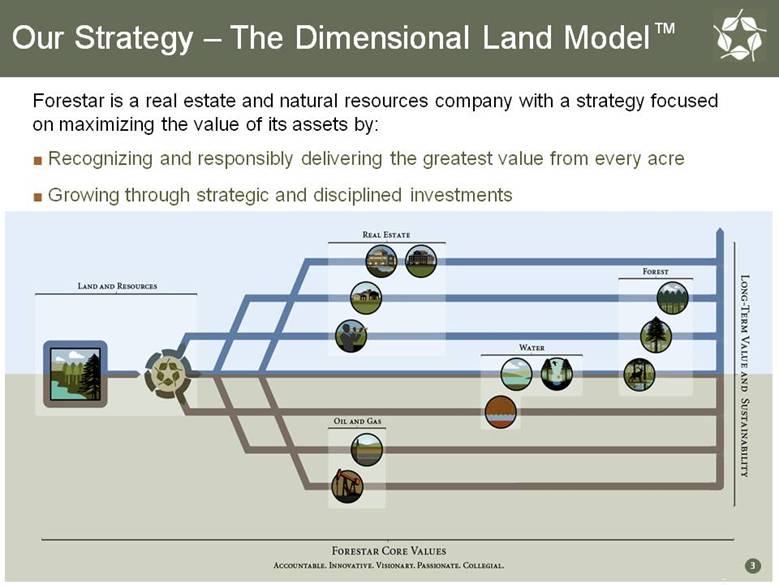

Forestar is a real estate and natural resources company with a strategy focused on maximizing the value of its assets by: Recognizing and responsibly delivering the greatest value from every acre Growing through strategic and disciplined investments 5 7 3 Our Strategy – The Dimensional Land Model TM |

|

|

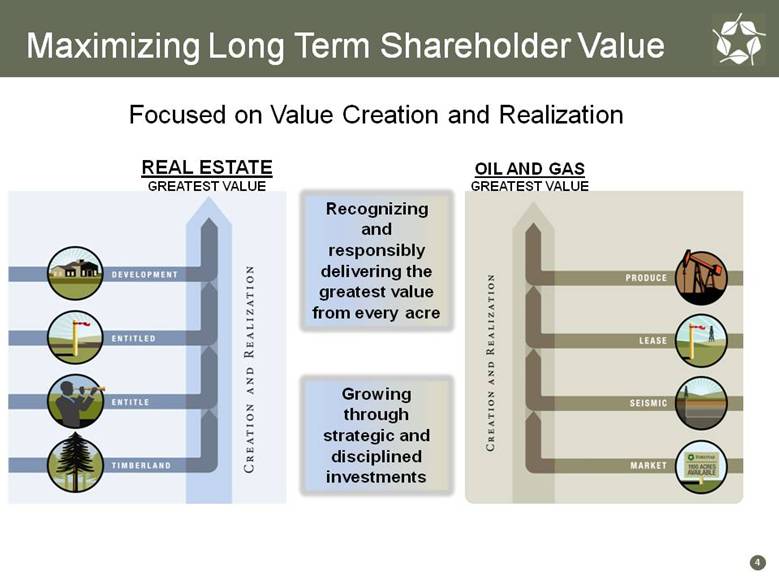

Focused on Value Creation and Realization 4 Recognizing and responsibly delivering the greatest value from every acre Growing through strategic and disciplined investments REAL ESTATE GREATEST VALUE OIL AND GAS GREATEST VALUE Maximizing Long Term Shareholder Value |

|

|

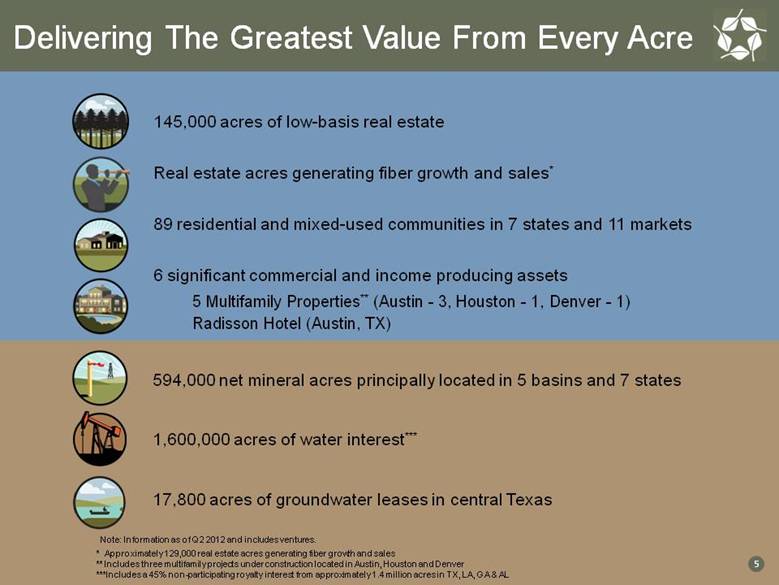

594,000 net mineral acres principally located in 5 basins and 7 states 1,600,000 acres of water interest*** 17,800 acres of groundwater leases in central Texas 145,000 acres of low-basis real estate Real estate acres generating fiber growth and sales* 89 residential and mixed-used communities in 7 states and 11 markets 6 significant commercial and income producing assets 5 Multifamily Properties** (Austin - 3, Houston - 1, Denver - 1) Radisson Hotel (Austin, TX) Note: Information as of Q2 2012 and includes ventures. 5 Delivering The Greatest Value From Every Acre * Approximately 129,000 real estate acres generating fiber growth and sales ** Includes three multifamily projects under construction located in Austin, Houston and Denver ***Includes a 45% non-participating royalty interest from approximately 1.4 million acres in TX, LA, GA & AL |

|

|

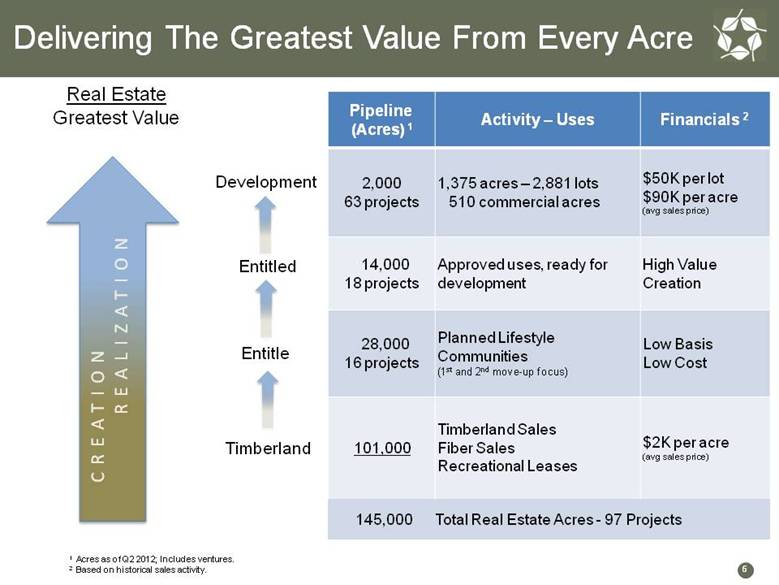

Real Estate Greatest Value Development Entitled Entitle Timberland Pipeline (Acres) 1 Activity – Uses Financials 2 2,000 63 projects 1,375 acres – 2,881 lots 510 commercial acres $50K per lot $90K per acre (avg sales price) 14,000 18 projects Approved uses, ready for development High Value Creation 28,000 16 projects Planned Lifestyle Communities (1st and 2nd move-up focus) Low Basis Low Cost 101,000 Timberland Sales Fiber Sales Recreational Leases $2K per acre (avg sales price) 145,000 Total Real Estate Acres - 97 Projects 1 Acres as of Q2 2012; Includes ventures. 2 Based on historical sales activity. Delivering The Greatest Value From Every Acre 6 |

|

|

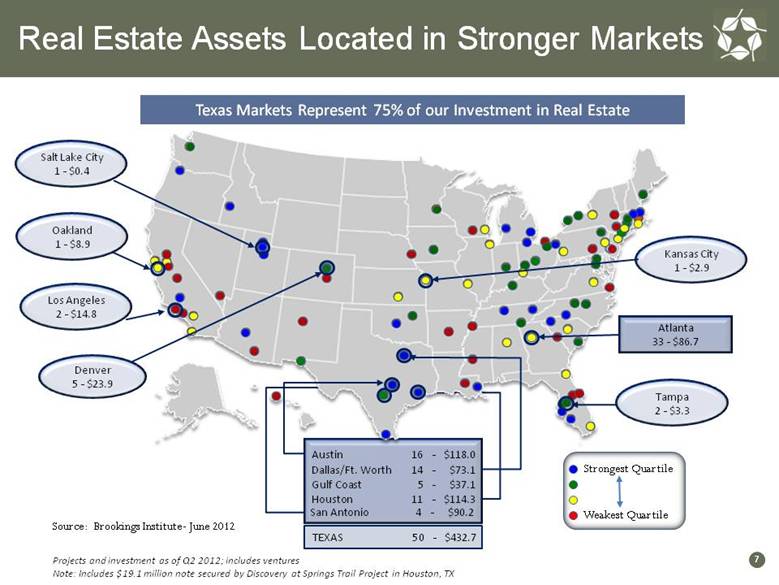

Note: MSA performance based on Employment, Gross Metropolitan Product (GMP) and House Price Index Source: Brookings Institute- June 2012 Salt Lake City 1 - $0.4 Oakland 1 - $8.9 Strongest Quartile Weakest Quartile Los Angeles 2 - $14.8 Kansas City 1 - $2.9 Tampa 2 - $3.3 Atlanta 33 - $86.7 San Antonio 4 - $90.2 Projects and investment as of Q2 2012; includes ventures Note: Includes $19.1 million note secured by Discovery at Springs Trail Project in Houston, TX TEXAS 50 - $432.7 Texas Markets Represent 75% of our Investment in Real Estate Real Estate Assets Located in Stronger Markets Denver 5 - $23.9 Austin 16 - $118.0 Dallas/Ft. Worth 14 - $73.1 Gulf Coast 5 - $37.1 Houston 11 - $114.3 7 |

|

|

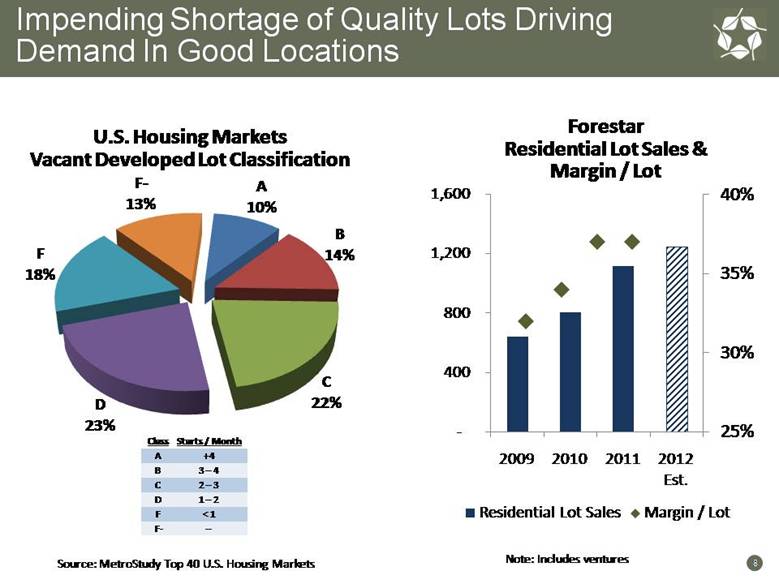

Impending Shortage of Quality Lots Driving Demand In Good Locations 8 Note: Includes ventures Forestar Residential Lot Sales & Margin / Lot U.S. Housing Markets Vacant Developed Lot Classification Source: MetroStudy Top 40 U.S. Housing Markets Class Starts / Month A +4 B 3 – 4 C 2 – 3 D 1 – 2 F < 1 F- – |

|

|

9 9 Community Development - Creating a Sense of Place Video: http://forestargroup.com/watch/8002 |

|

|

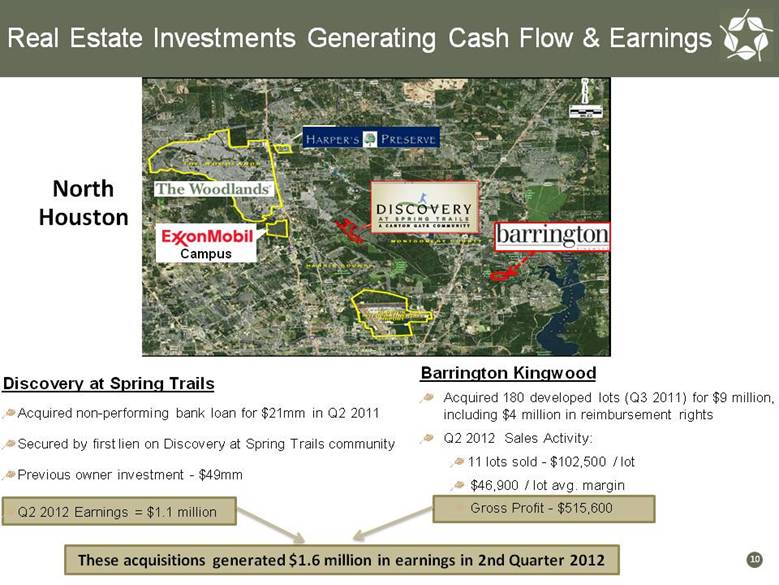

Discovery at Spring Trails Acquired non-performing bank loan for $21mm in Q2 2011 Secured by first lien on Discovery at Spring Trails community Previous owner investment - $49mm Q2 2012 Earnings = $1.1 million Barrington Kingwood Acquired 180 developed lots (Q3 2011) for $9 million, including $4 million in reimbursement rights Q2 2012 Sales Activity: 11 lots sold - $102,500 / lot $46,900 / lot avg. margin Gross Profit - $515,600 North Houston Campus 10 These acquisitions generated $1.6 million in earnings in 2nd Quarter 2012 Real Estate Investments Generating Cash Flow & Earnings |

|

|

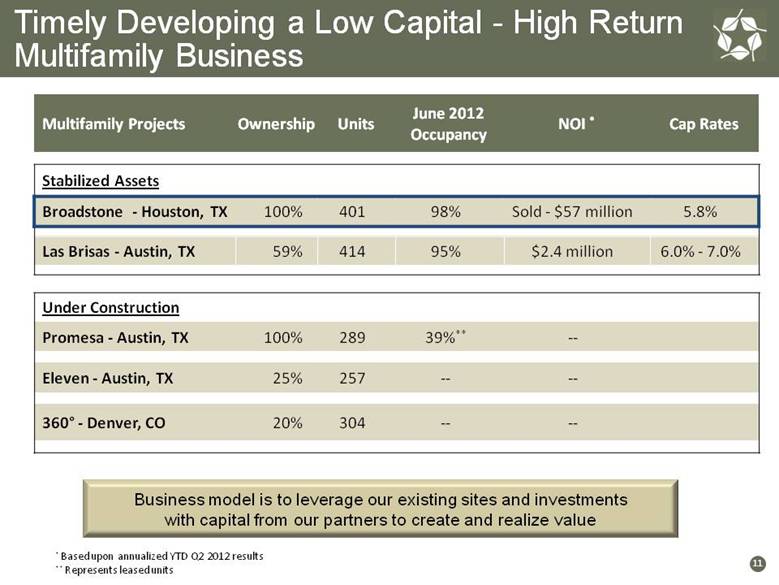

Timely Developing a Low Capital - High Return Multifamily Business 11 Multifamily Projects Ownership Units June 2012 Occupancy NOI * Cap Rates Stabilized Assets Broadstone - Houston, TX 100% 401 98% Sold - $57 million 5.8% Las Brisas - Austin, TX 59% 414 95% $2.4 million 6.0% - 7.0% Under Construction Promesa - Austin, TX 100% 289 39%** -- Eleven - Austin, TX 25% 257 -- -- 360° - Denver, CO 20% 304 -- -- * Based upon annualized YTD Q2 2012 results ** Represents leased units Business model is to leverage our existing sites and investments with capital from our partners to create and realize value |

|

|

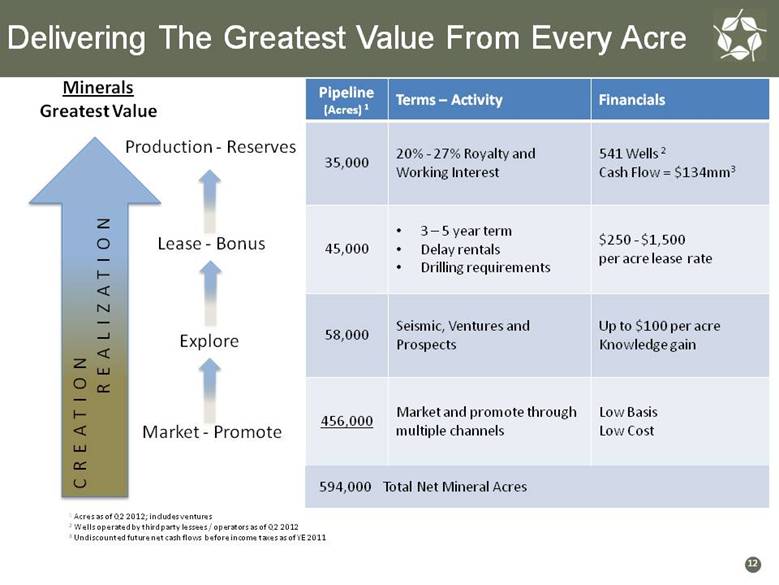

Minerals Greatest Value Pipeline (Acres) 1 Terms – Activity Financials 35,000 20% - 27% Royalty and Working Interest 541 Wells 2 Cash Flow = $134mm3 45,000 3 – 5 year term Delay rentals Drilling requirements $250 - $1,500 per acre lease rate 58,000 Seismic, Ventures and Prospects Up to $100 per acre Knowledge gain 456,000 Market and promote through multiple channels Low Basis Low Cost 594,000 Total Net Mineral Acres Production - Reserves Lease - Bonus Explore Market - Promote 1 Acres as of Q2 2012; includes ventures 2 Wells operated by third party lessees / operators as of Q2 2012 3 Undiscounted future net cash flows before income taxes as of YE 2011 Delivering The Greatest Value From Every Acre 12 |

|

|

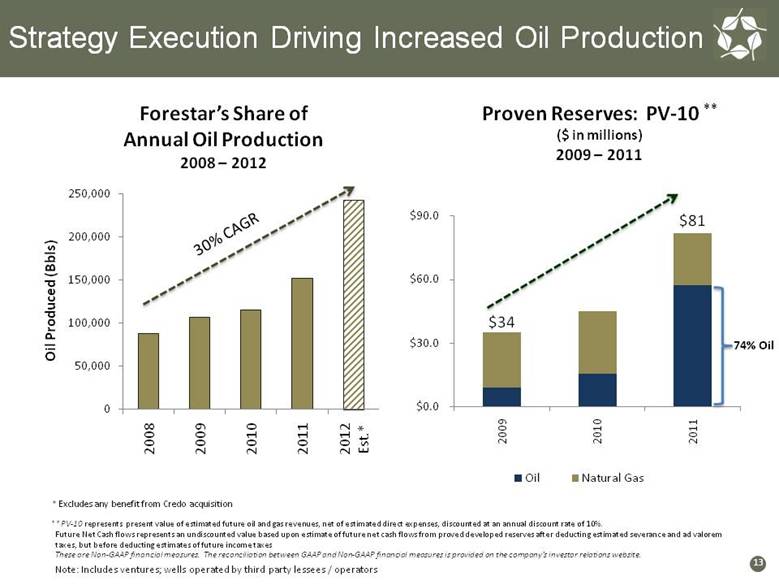

Note: Includes ventures; wells operated by third party lessees / operators 13 Forestar’s Share of Annual Oil Production 2008 – 2012 Strategy Execution Driving Increased Oil Production * Excludes any benefit from Credo acquisition 30% CAGR **PV-10 represents present value of estimated future oil and gas revenues, net of estimated direct expenses, discounted at an annual discount rate of 10%. Future Net Cash flows represents an undiscounted value based upon estimate of future net cash flows from proved developed reserves after deducting estimated severance and ad valorem taxes, but before deducting estimates of future income taxes These are Non-GAAP financial measures. The reconciliation between GAAP and Non-GAAP financial measures is provided on the company’s investor relations website. 74% Oil Proven Reserves: PV-10 ** ($ in millions) 2009 – 2011 |

|

|

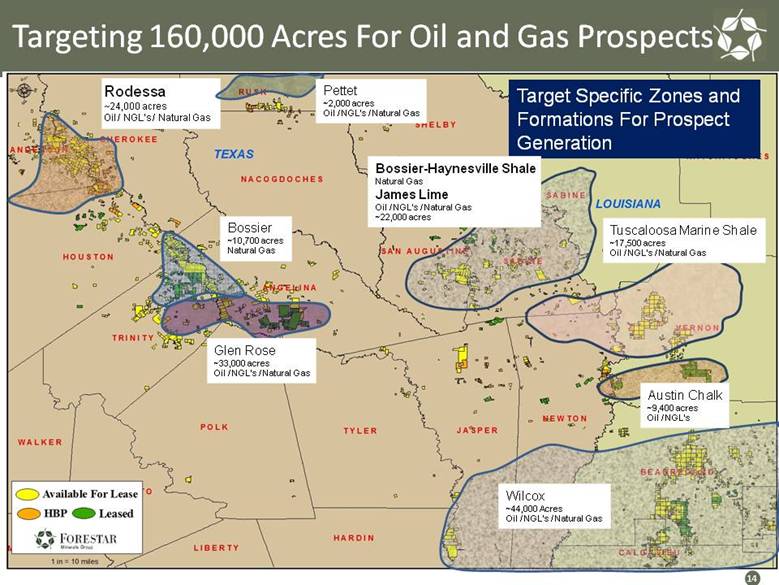

Rodessa ~24,000 acres Oil / NGL’s / Natural Gas Target Specific Zones and Formations For Prospect Generation Pettet ~2,000 acres Oil / NGL’s / Natural Gas Glen Rose ~33,000 acres Oil / NGL’s / Natural Gas Bossier ~10,700 acres Natural Gas Tuscaloosa Marine Shale ~17,500 acres Oil / NGL’s / Natural Gas Bossier-Haynesville Shale and James Lime ~22,000 acres Natural Gas Wilcox ~44,000 Acres Oil / NGL’s / Natural Gas Austin Chalk ~9,400 acres Oil / NGL’s Targeting 160,000 Acres For Oil and Gas Prospects 14 Bossier-Haynesville Shale Natural Gas James Lime Oil / NGL’s / Natural Gas ~22,000 acres |

|

|

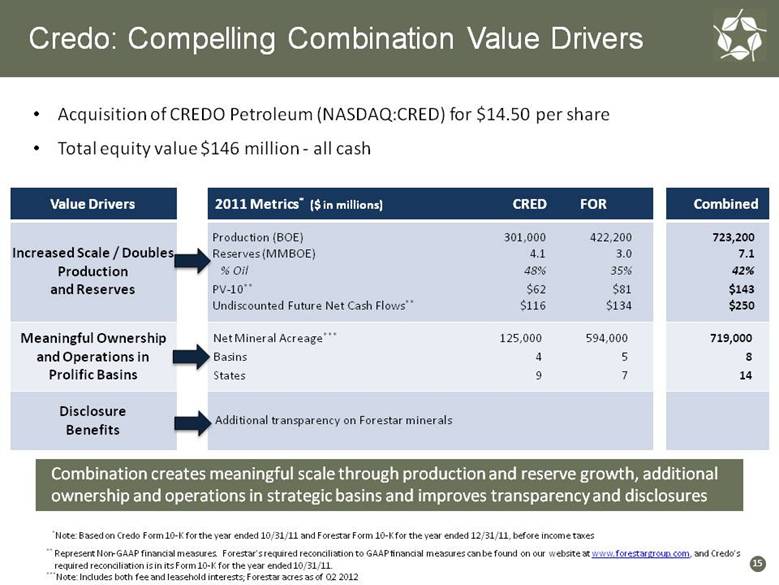

Credo: Compelling Combination Value Drivers Combination creates meaningful scale through production and reserve growth, additional ownership and operations in strategic basins and improves transparency and disclosures Value Drivers 2011 Metrics* ($ in millions) CRED FOR Combined Increased Scale / Doubles Production and Reserves Meaningful Ownership and Operations in Prolific Basins Disclosure Benefits Additional transparency on Forestar minerals Production (BOE) 301,000 422,200 723,200 Reserves (MMBOE) 4.1 3.0 7.1 % Oil 48% 35% 42% PV-10** $62 $81 $143 Undiscounted Future Net Cash Flows** $116 $134 $250 Net Mineral Acreage*** 125,000 594,000 719,000 Basins 4 5 8 States 9 7 14 ** Represent Non-GAAP financial measures. Forestar’s required reconciliation to GAAP financial measures can be found on our website at www.forestargroup.com, and Credo’s required reconciliation is in its Form 10-K for the year ended 10/31/11. ***Note: Includes both fee and leasehold interests; Forestar acres as of Q2 2012 *Note: Based on Credo Form 10-K for the year ended 10/31/11 and Forestar Form 10-K for the year ended 12/31/11, before income taxes 15 15 Acquisition of CREDO Petroleum (NASDAQ:CRED) for $14.50 per share Total equity value $146 million - all cash |

|

|

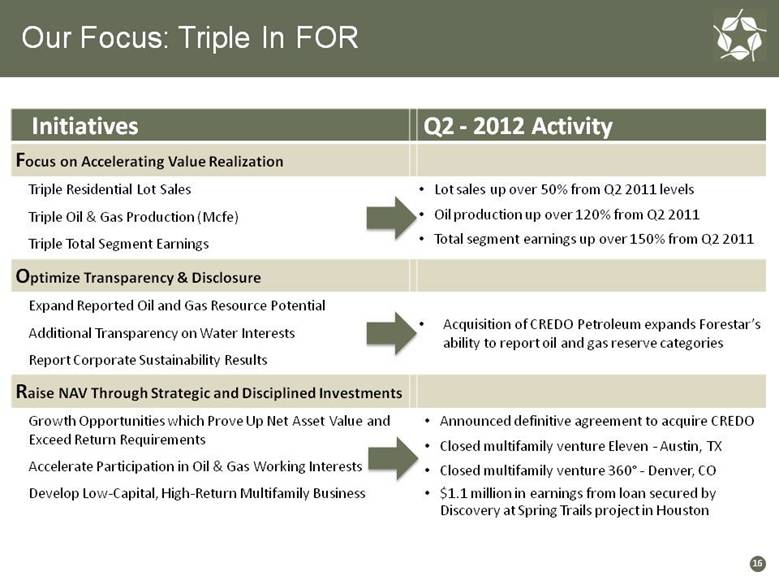

Our Focus: Triple In FOR Initiatives Q2 - 2012 Activity Focus on Accelerating Value Realization Triple Residential Lot Sales Lot sales up over 50% from Q2 2011 levels Oil production up over 120% from Q2 2011 Total segment earnings up over 150% from Q2 2011 Triple Oil & Gas Production (Mcfe) Triple Total Segment Earnings Optimize Transparency & Disclosure Expand Reported Oil and Gas Resource Potential Acquisition of CREDO Petroleum expands Forestar’s ability to report oil and gas reserve categories Additional Transparency on Water Interests Report Corporate Sustainability Results Raise NAV Through Strategic and Disciplined Investments Growth Opportunities which Prove Up Net Asset Value and Exceed Return Requirements Announced definitive agreement to acquire CREDO Closed multifamily venture Eleven - Austin, TX Closed multifamily venture 360° - Denver, CO $1.1 million in earnings from loan secured by Discovery at Spring Trails project in Houston Accelerate Participation in Oil & Gas Working Interests Develop Low-Capital, High-Return Multifamily Business 16 |

|

|

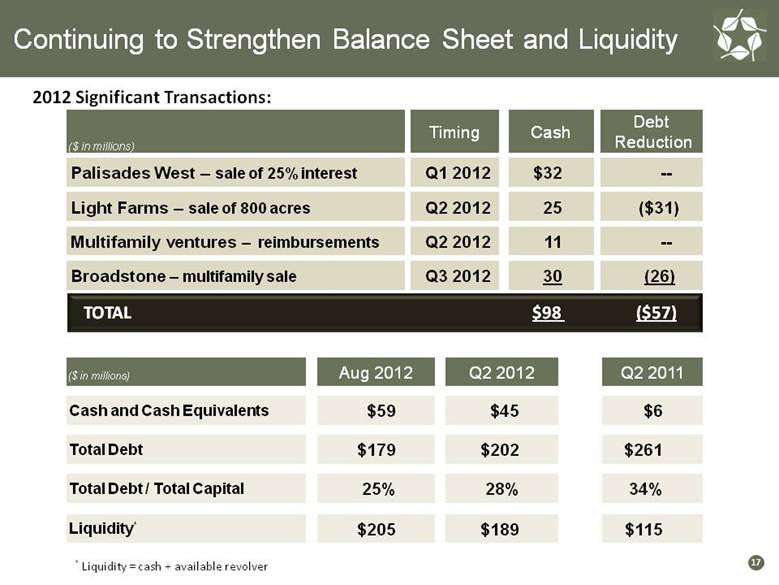

Continuing to Strengthen Balance Sheet and Liquidity 17 ($ in millions) Aug 2012 Q2 2012 Q2 2011 Cash and Cash Equivalents $59 $45 $6 Total Debt $179 $202 $261 Total Debt / Total Capital 25% 28% 34% Liquidity* $205 $189 $115 2012 Significant Transactions: ($ in millions) Timing Cash Debt Reduction Palisades West – sale of 25% interest Q1 2012 $32 -- Light Farms – sale of 800 acres Q2 2012 25 ($31) Multifamily ventures – reimbursements Q2 2012 11 -- Broadstone – multifamily sale Q3 2012 30 (26) * Liquidity = cash + available revolver TOTAL $98 ($57) |

|

|

Accelerating Value Realization Building momentum by increasing oil production and proven reserves Growing lot sales and increasing market share Realizing value from stabilized commercial assets Capitalizing on growth opportunities and investments to generate near-term cash flow and earnings Building Momentum By Accelerating Value Realization, Optimizing Transparency and Growing NAV 18 |

|

|

Anna Torma SVP Corporate Affairs Forestar Group Inc. 6300 Bee Cave Road Building Two, Suite 500 Austin, TX 78746 512-433-5312 annatorma@forestargroup.com 19 |