Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Xylem Inc. | d409589d8k.htm |

Wedbush 2012 Clear Technology &

Industrial Growth Conference

September 12, 2012

Exhibit 99.1 |

Forward

Looking Statements 2

This

document

contains

information

that

may

constitute

“forward-looking

statements.”

Forward-looking

statements

by

their

nature

address

matters

that

are,

to

different

degrees,

uncertain.

Generally,

the

words

“anticipate,”

“estimate,”

“expect,”

“project,”

“intend,”

“plan,”

“believe,”

“target”

and similar expressions identify forward-looking statements, which

generally are not historical in nature. However, the absence of these words or

similar expressions does not mean that a statement is not

forward-looking. These forward-looking statements include, but are

not limited to, statements about the separation of Xylem Inc. (the

“Company”) from ITT Corporation, the terms and the effect of the

separation, the nature and impact of the separation, capitalization of the

Company, future strategic plans and other statements that describe the Company’s business

strategy, outlook, objectives, plans, intentions or goals, and any discussion of

future operating or financial performance. All statements that address

operating performance, events or developments that we expect or anticipate will occur in

the

future

—

including

statements

relating

to

orders,

revenues,

operating

margins

and

earnings

per

share

growth,

and

statements

expressing

general

views

about

future

operating

results

—

are

forward-looking

statements.

Caution should be taken not to place undue reliance on any such forward-looking

statements because they involve risks, uncertainties and other factors that

could cause actual results to differ materially from those expressed or implied

in,

or

reasonably

inferred

from,

such

statements.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any forward-looking statements, whether as a result of new information, future

events or otherwise, except as required by law. In addition,

forward-looking statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from the Company’s historical experience and our

present expectations or projections. These risks and uncertainties include,

but are not limited to, those set forth in Item 1A of our Annual Report on Form 10-K, and

those described from time to time in subsequent reports filed with the Securities

and Exchange Commission. |

•

Design, Manufacture, & Service Highly Engineered Technologies

•

A True Water Pure Play

•

Diverse End Market & Geographic Mix

•

Leading Brands & Application Expertise

•

Resilient Portfolio & Large Installed Base

•

Unrivaled Global Reach …

Serving 150+ Countries

Global Leader in Water

Application Solutions

3

$3.8B Company Uniquely Positioned in the Attractive Water Industry

$3.8B Company Uniquely Positioned in the Attractive Water Industry

|

Water

Infrastructure

Equipment

& Services

End

Users

Uniquely Positioned …

4

…

…

Global Leader in Attractive Water Industry

Global Leader in Attractive Water Industry

$500B

Global Water

Industry

Growth Drivers

•

Depleting Water Supply

•

Tightening Regulation

•

Aging Infrastructure

•

Population Growth

•

Urbanization

•

Sustainability

•

Energy Efficiency

Technology Intensive $30B

•

Highly Engineered

•

Premium Value

•

High Performance

•

Knowledge-Based Services

•

Differentiated Solutions

•

Higher Profitability |

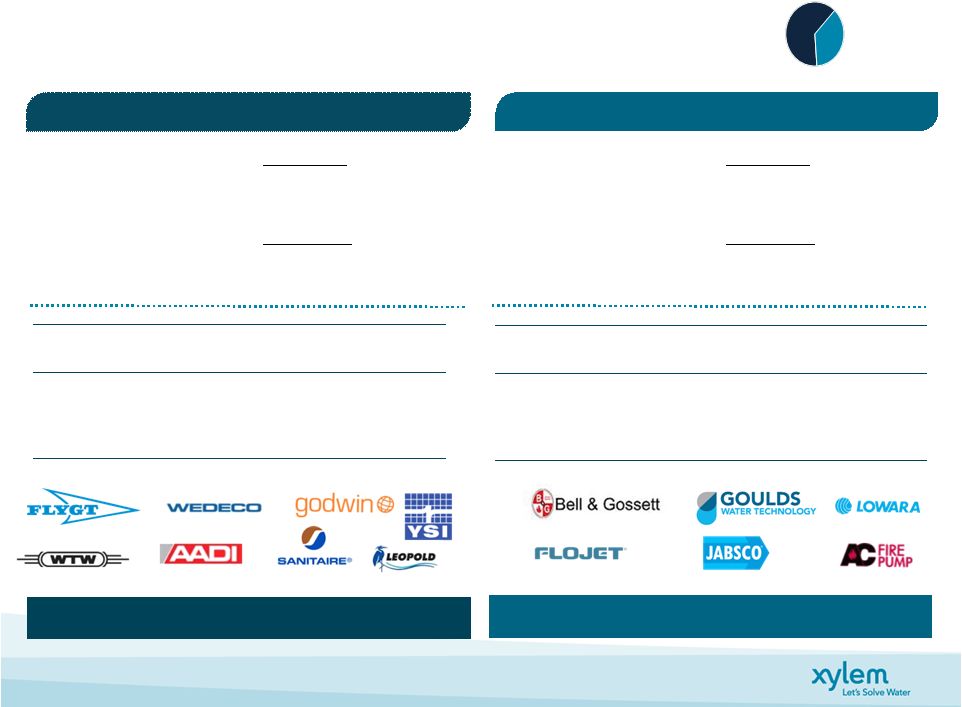

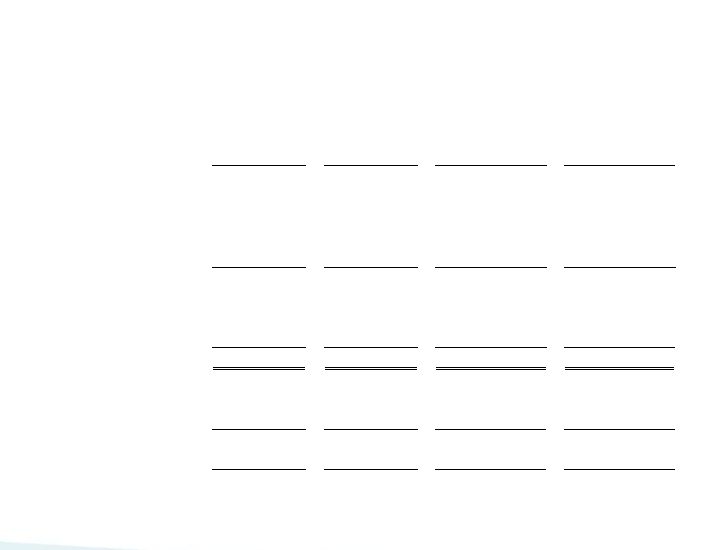

Segment Overview

Market Size: $16B

2011 Revenues: $2.4B

2011 Op Margin*: 14.9%

Water

Infrastructure

63%

Unique Position -

Only Provider of All Three “T’s”

Water Infrastructure Overview

Water Infrastructure Overview

Applied Water

37%

Market Size: $14B

2011 Revenues: $1.4B

2011 Op Margin*: 12.0%

Customers

Residential & Commercial,

Industrial Facilities, Agriculture

Large Installed Base

Growth Despite Slow New Construction

Applied Water Overview

Applied Water Overview

Customers

Public Utilities

Industrial Facilities

Distribution

World-Class Global Direct

(~70%) & Indirect Channels

Note: (1) Global market share based on company estimates.

Distribution

Primarily through World-Class

Indirect (+70%) Channels

5

*Excluding separation costs of $16M

*Excluding separation costs of $13M

Revenue by Application

Market

Share

(1)

Transport

73%

#1

Treatment

18%

#1

Test

9%

#2

Revenue by Application

Market

Share

(1)

Bldg. Services

53%

#2

Industrial Water

18%

#2

Irrigation

9%

#3 |

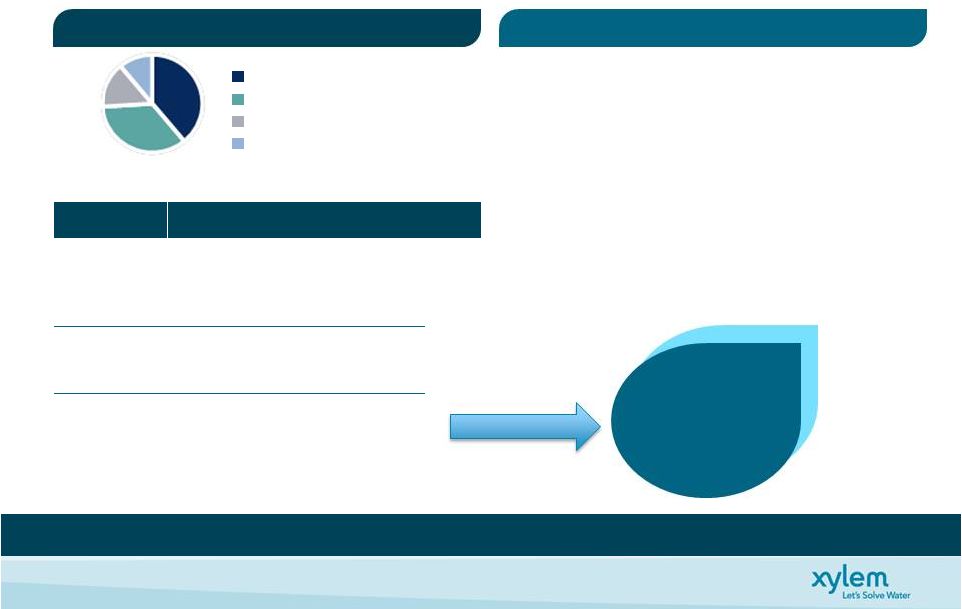

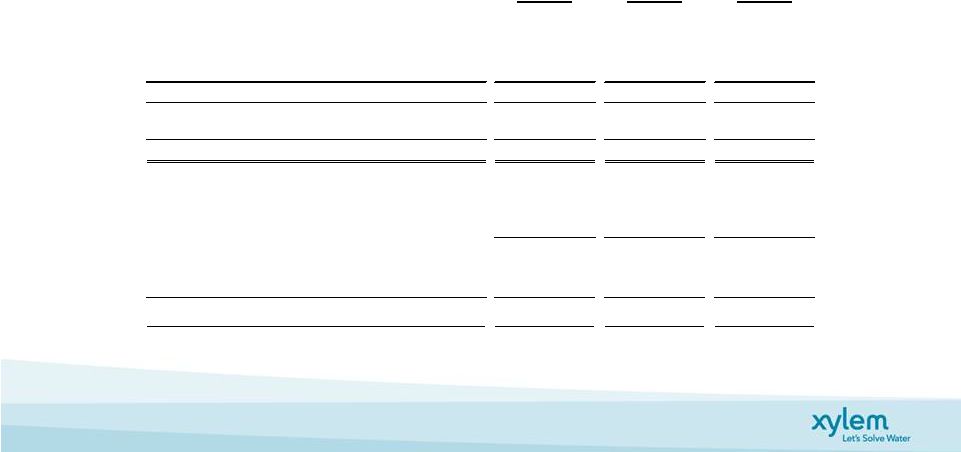

Diversified Geographic Market Mix

6

Europe

37%

U.S.

36%

Asia Pac

11%

Other

16%

Geographical Mix*

Geographical Mix*

*2011 Revenues

…

…

With Large Installed Base & Growing Emerging Market Exposure

With Large Installed Base & Growing Emerging Market Exposure

Region

Highlights

Europe

•

Large Installed Base

•

2011 Flat Organically

•

1H’12 Down 1%

•

So. Europe ~8% Tot Revenue

U.S.

•

Large Installed Base

•

2011 Up Low Single Digits

•

1H’12 Up Low Single Digits

Emerging

Markets

•

Evenly Spread Across Latin

America, Middle East & Africa,

Eastern Europe, Asia Pac

Emerging Markets

Emerging Markets

•

BRIC & ROW Focused Growth Strategy

•

40+ Sales Units Spread Globally

•

2 Localized R&D Centers

•

14 Production Facilities

•

’09 -’11 Revenue CAGR +20%

•

Proj.Long-Term Revenue Growth 8-10+%

Xylem

Xylem

Emerging

Emerging

Market Revenue

Market Revenue

~19% in 2011

~19% in 2011 |

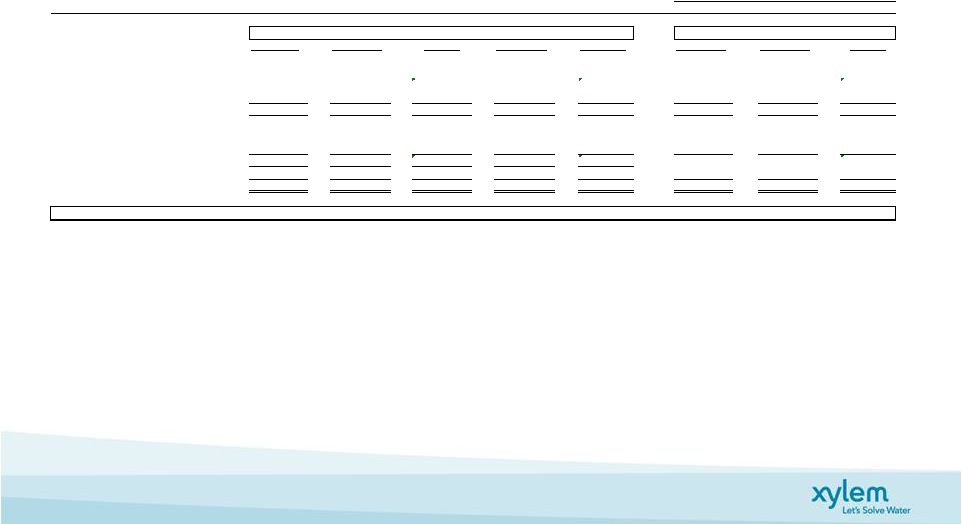

Agriculture

Agriculture

Residential

Residential

Commercial

Commercial

Public Utility

Public Utility

Diversified End Market Mix

7

…

…

With Strong Long Term Fundamentals & Growth Drivers

With Strong Long Term Fundamentals & Growth Drivers

Industrial

Industrial

% of XYL Revenue

40%

36%

13%

9%

3%

Cycle

•

Late/Less

Cyclical

•

Non-Cyclical

•

Late Cycle

•

Early Cycle

•

Mid Cycle

Fundamentals

•

Operation Critical

•

Growing Tariffs

•

Green Regulation

•

Energy Efficiency

•

Growing Demand

•

Aftermarket &

Replacement

•

Aftermarket &

Replacement

•

Strong

Replacement

•

Strong

Replacement

XYL ‘12

Organic Growth

•

Up Low to Mid

Single Digit

•

Flat to Up Low

Single Digit

•

Up Low Single

Digit

•

Up Low Single

Digit

•

Down Low Single

Digit to Flat

Depleting Water

Supply

Tightening

Regulation

Aging

Infrastructure

Population

Growth

Urbanization

Sustainability

Energy

Efficiency

LT Growth Drivers |

Public

Utility & Industrial Transport & Treatment

8

Application

Technologies

•

Waste Water Transport

•

Filtration

•

Biological Treatment

•

UV & Ozone Disinfection

Application

Application

Technologies

Technologies

•

•

Waste Water Transport

Waste Water Transport

•

•

Filtration

Filtration

•

•

Biological Treatment

Biological Treatment

•

•

UV & Ozone Disinfection

UV & Ozone Disinfection |

9

•

36% of Xylem Revenues related

to

Public

Utility

spending

–

in

2011:

•

~$1B for Maintenance Activities

•

Public Utility spending grows

long term

•

U.S.: ~6% CAGR 1965 –

2011

•

Europe similar to U.S.

•

Asia Pacific growing faster

•

Funding of expenditures secure

•

~80% funded by tariffs

•

Tariffs growing 8%/yr in U.S.

•

European Tariffs typically higher

than U.S.

•

Funds typically can not be used for

other purposes

Strong Long-term Fundamentals…Xylem Provides Mission Critical

Solutions Source: U.S. Census Bureau

The Public Utility End Market

•

~6% CAGR 1965 –

2011

•

Only 3 years (‘69, ’83 and ‘11) saw >10% drop

•

10% drop reduces Total XYL Revs. by ~(1-2) ppts

U.S. Water and Sewer Construction Spending - $M

|

Test

Applications 10

Analytical Instrumentation

Analytical Instrumentation

Diverse Applications

Diverse Applications

Environmental

Environmental

Water & Waste Water

Water & Waste Water

Food & Beverage

Food & Beverage

Chemical

Chemical

Pharmaceutical

Pharmaceutical

Ocean/Coastal

Ocean/Coastal |

Dewatering Applications

Dewatering Applications

Industrial Water Applications

Industrial Water Applications

Dewatering and Industrial

Water Applications

•

Mining

•

Oil, Gas & Chemical

•

Water & Waste Water

•

Marine

•

Mining

•

Oil, Gas & Chemical

•

Water & Waste Water

•

Marine

Diverse Applications

•

Construction

•

Disaster Recovery

•

Environmental

•

Heavy Industry |

Commercial & Residential

12

Customers

•

Developers

•

Building Operators

•

Building Designers

•

HVAC Specialists

•

Contractors

•

Plumbers

HVAC -

Heating

Pressure boosters

Fire protection

HVAC -

Cooling

Wastewater

Zone Control |

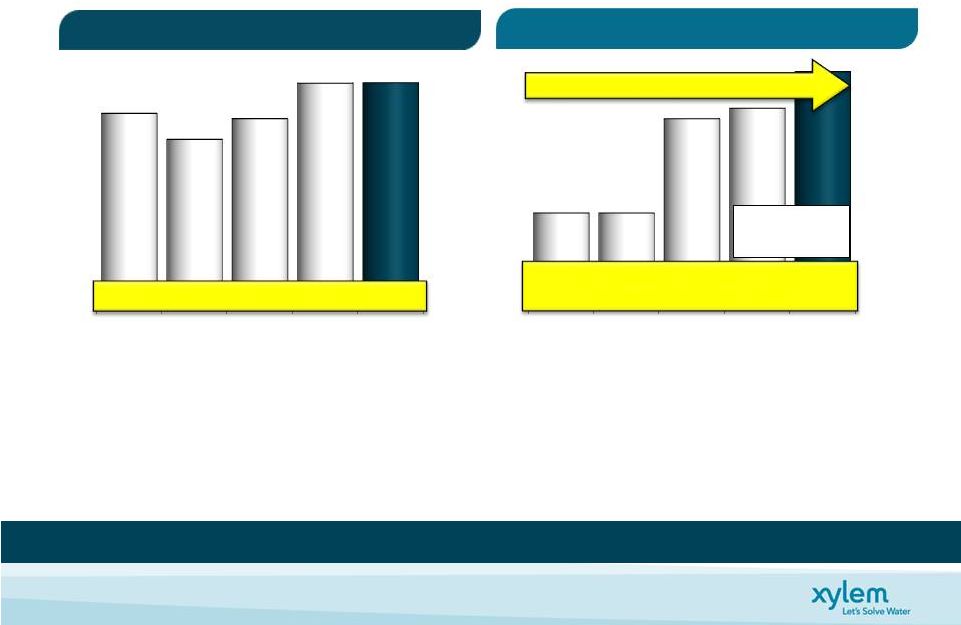

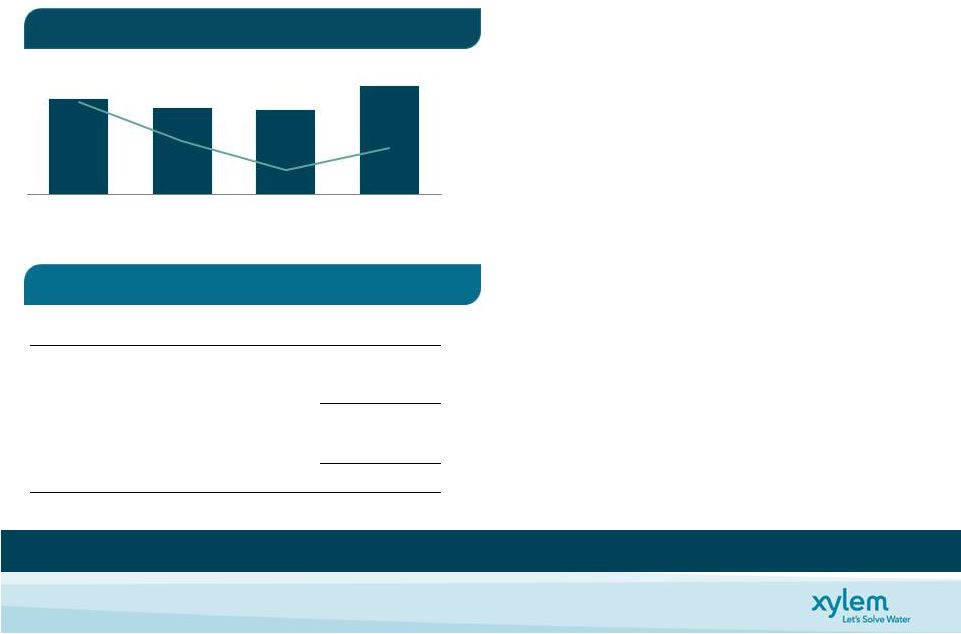

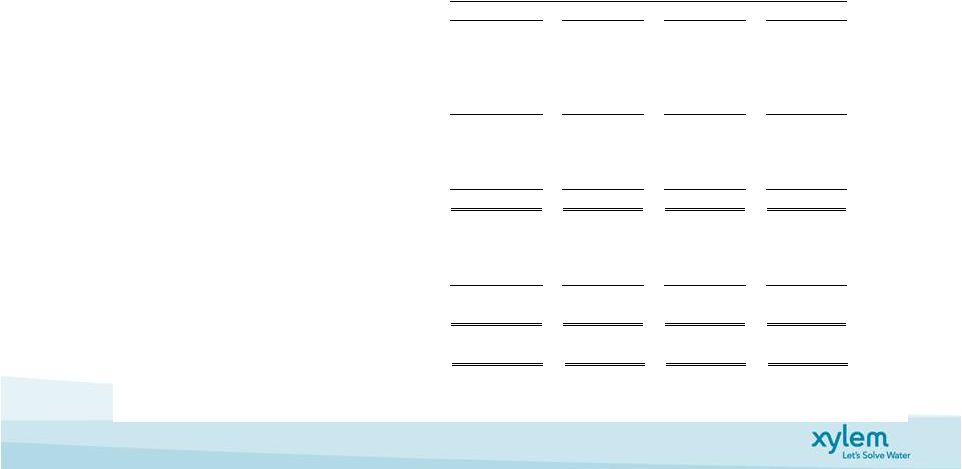

Resilient Portfolio & Increasing Profitability

…

…

Proven Track Record, Continued Focus

Proven Track Record, Continued Focus

13

•

Resilient Portfolio …

Despite Challenging End Market Conditions

•

Management Discipline …Proactive Actions (~$100M of Restructuring &

Realignment ‘08-’12) •

Operational Excellence …

Driving Productivity Initiatives

•

Continued Investment Driving Growth in Core Business

•

Key Acquisitions …

Transitioning Portfolio to Higher Profitability Levels

Revenue Up ~$510M …

+15%

Op Income Up ~$165M …

~46%

Incremental Margin ~32%

(2012E At Mid-Point Guidance)

Incl. Stand-

Alone Costs

12.7% 13.0%

$M, unless otherwise indicated

Expansion +290 Bps On Comp Basis

Revenue

Operating Margin *

2008

2009

2010

2011

2012E

10.8%

10.8%

12.6%

12.8%

13.7%

2008

2009

2010

2011

2012E

3,291

2,849

3,202

3,803

~3.8B

* Excludes the impact of restructuring and stand alone costs for all periods. See Appendix for

Non-GAAP Reconciliations |

Gross

Margin Improvement Funds Future Growth Xylem Continues to Invest While

Increasing Profitability Xylem Continues to Invest While Increasing

Profitability 14

•

Operational and Commercial Excellence

•

Growth in Higher Margin Analytics and Dewatering applications

•

Xylem’s Water Infrastructure Direct Sales Force a Key Competitive Advantage

2008

2009

2010

2011

34.7%

36.4%

37.9%

38.4%

Gross Margin

2008

2009

2010

2011

1.9%

2.2%

2.3%

2.6%

R&D

2008

2009

2010

2011

21.9%

23.4%

23.0%

23.1%

SG&A |

15

Highly Attractive Recurring Revenue Profile

•

15%

of Xylem revenue

•

Strong global presence

•

120+ owned service centers

•

600+ service employees

•

Extensive channel partner network

•

9% Revenue CAGR ‘06-’11 despite

economic

downturn

•

Approximately 22% of Xylem revenue

•

Installed base drives replacement sales

•

Brand loyalty drives like-for-like

replacement

•

Installed base provides opportunity for

upgrades, next generation and services

$M

Aftermarket Parts & Services Revenues

Note:

(1) Based on company estimates.

Aftermarket

Provides

Stability

and

Drives

Strong

Profitable

Growth

Replacement Equipment (1)

2006

2007

2008

2009

2010

2011

$370

$382

$396

$433

$512

$570

•

~11% revenue growth 2010-2011 |

Focused on Free Cash Flow

16

1

Free

Cash

Flow

=

Net

cash

from

operating

activities

-

Capital

expenditures

Strong

Strong

Free

Free

Cash

Cash

Flow

Flow

&

&

Solid

Solid

Balance

Balance

Sheet

Sheet

to

to

Fund

Fund

Growth

Growth

Initiatives

Initiatives

Capital Structure & Liquidity Position

Capital Structure & Liquidity Position

June 30, 2012

Cash

358

Debt

1,206

Net Debt

848

Shareholders’

Equity

1,948

Net Capital

2,796

Net Debt to Net Capital

30%

•

Strong Cash Flow Conversion

•

Balance Sheet Flexibility

•

No Significant Debt Maturities Until 2016

•

30% Net Debt to Net Capital

•

1.3x Net Debt/Adj. TTM EBITDA

•

$600M

Revolving

Credit

Facility

-

Unutilized

•

Access

to

Commercial

Paper

-

Unutilized

* See non-GAAP reconciliations.

$341

$308

$301

$388

152%

117%

91%

111%

2008

2009

2010

2011

Free Cash Flow

Free Cash Flow

1*

1*

and Conversion ($M)

and Conversion ($M) |

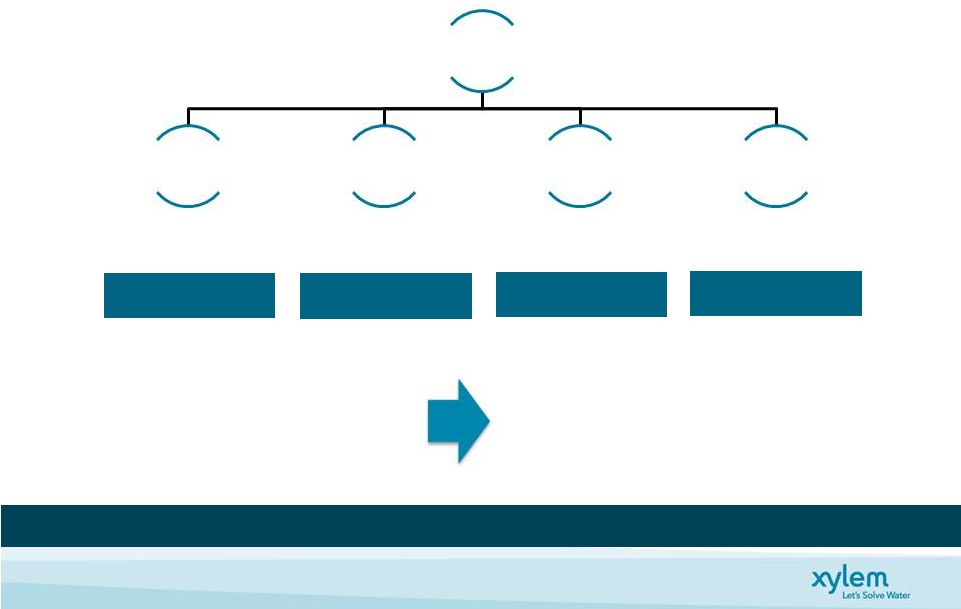

Disciplined Capital Deployment

17

•

2.5% –

3.5% of sales

•

~$0.10/share

•

In-line with peers

•

Up to $300M / year

Capital Deployment Strategy

•

Balance of organic & inorganic investment

•

Return value to shareholders

•

Maintain solid investment grade metrics

•

Debt & pension

Organic Growth

World Class Facilities

Cash Return to

Shareholders

Cash to Meet Key

Obligations

Inorganic Investment

to Fuel Growth

Capital Deployment Evaluation

•

Fold targeted performance into Operating plans

•

Quarterly / Annual investment review

•

Ensure targeted returns achieved

Focused on Long Term Shareholder Return

Focused on Long Term Shareholder Return

Capex

Return to

Shareholders

Financial

Obligations

Acquisition

Strategy

Cash from

Operations |

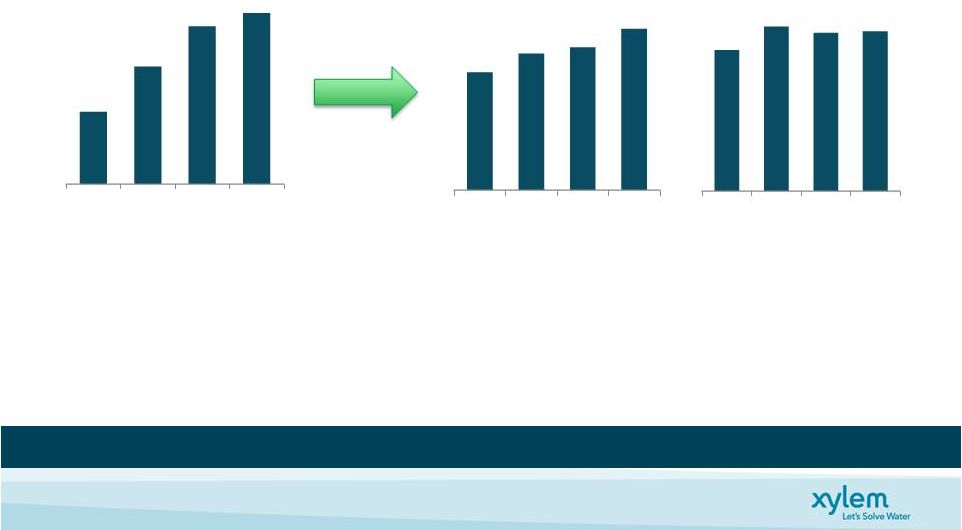

Xylem

Has a Focused Growth Strategy •

Replicate leadership positions

•

Strong aftermarket opportunities

•

Innovative application solutions

Organic & Inorganic Growth Expertise

Organic & Inorganic Growth Expertise

•

Established footprint

•

Localized innovation centers

•

Focused BRIC & ROW Strategy

•

Disciplined approach

•

History of successful integration

•

Bolt-on, niche go-forward strategy

18

$4.5B -

$5.0B

(1)

Revenue growth rates based on 2011

revenue of $3,803

$M, unless otherwise indicated

Organic Growth

Emerging Markets

Acquisition Strategy

~8% CAGR

2010

2011

2012E

2015E

3,202

3,803

~3.8B

Long Term Growth Rates

(1)

•

Organic

4 -

6%

•

M&A

1 -

2%

Market Growth Rates

•

Developed

1 -

3%

•

Emerging

8 -

10+%

•

Global

3 -

5% |

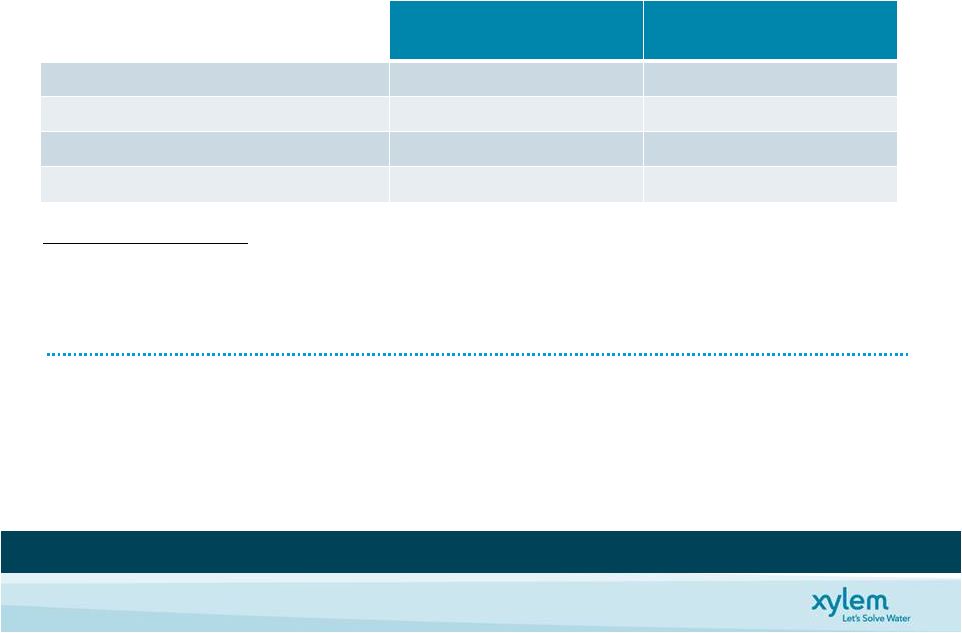

Financial Projections

19

•

Market growth of 3-5%...4-6% Xylem targeted growth

•

Acquisition strategy adds 1-2 % points of growth

•

Emerging markets > 20% of revenues

Xylem is Poised to Achieve its Long-Term Financial Objectives

Xylem is Poised to Achieve its Long-Term Financial Objectives

•

Operational & Commercial excellence expand segment margins 50-75 bps per

year –

Gross margin > 40%

•

Continued cash management discipline to achieve cash conversion of ~100%

•

Capital deployment strategy to drive ROIC

2012 FY Guidance

As of August 2, 2012

2015

Target

Revenues

~$3.8B

$4.5B to $5.0B

Operating Margin*

12.7% to 13.3%

14.5% to 15.5%

Free Cash Flow Conversion

95%

100%

Normalized EPS Growth*

+4% to +10%

* See non-GAAP reconciliations.

Long-Term Targets |

Investment

Highlights

20

•

$3.8B Company Uniquely Positioned in the Attractive Water Industry

•

Resilient Portfolio & Proven Track Record of Increasing Profitability

•

Leading Brands &

World-Class Distribution Channels

•

Diversified End & Geographic Markets Mix

•

Attractive Growth Opportunities & Large Installed Base

•

Solid Cash Flow Generation & Disciplined Capital Deployment Strategy

Ability to Deliver Strong & Consistent Financial Performance

Ability to Deliver Strong & Consistent Financial Performance

|

21

NYSE: XYL

Phil De Sousa, Investor Relations Officer (914)

323-5930

Janice Tedesco, Investor Relations Coordinator (914)

323-5931

http://investors.xyleminc.com

Thank you for your interest !

Thank you for your interest ! |

Appendix |

Non-GAAP

Measures 23

Xylem Inc. Non-GAAP Measures

Management views key performance indicators including revenue, gross margins, segment

operating income and margins, orders growth, free cash flow, working capital, and

backlog, among others. In addition, we consider certain measures to be useful to management and investors evaluating our operating performance

for the periods presented, and provide a tool for evaluating our ongoing operations,

liquidity and management of assets. This information can assist investors

in assessing our financial performance and measures our ability to generate capital for

deployment among competing strategic alternatives and initiatives. These

metrics, however, are not measures of financial performance under GAAP and should not be

considered a substitute for revenue, operating income, net income, earnings per

share (basic and diluted) or net cash from operations as determined in accordance with GAAP. We consider the following non-GAAP measures,

which may not be comparable to similarly titled measures reported by other companies, to be

key performance indicators: “Organic revenue" and "Organic

orders” transactions, and contributions from acquisitions and

divestitures. Divestitures include sales of portions of our business that did not meet the criteria for

classification as a discontinued operation or insignificant portions of our business that we

did not classify as a discontinued operation. The period-over-period

change resulting from foreign currency fluctuations assumes no change in exchange rates from

the prior period. “Constant currency”

rate. This approach is used for countries whose functional currency is not the U.S.

dollar. “EBITDA”

adjustment to EBITDA to exclude for one-time separation costs associated with the Xylem

spin-off from ITT Corporation. “Operating Income * ”, "Adjusted

Operating Income" and “Adjusted EPS”

restructuring and realignment and one-time separation costs associated with the Xylem

spin-off from ITT Corporation and tax-related special items. “Normalized

EPS”

stand alone costs in the prior comparable period.

“Free Cash Flow”

other significant items that impact current results which management believes are not

related to our ongoing operations and performance. Our definition of free

cash flows does not consider non-discretionary cash payments, such as debt. defined

as

revenue

and

orders,

respectively,

excluding

the

impact

of

foreign

currency

fluctuations,

intercompany

defined

as

financial

results

adjusted

for

currency

by

translating

current

period

and

prior

period

activity

using

the

same

currency

conversion

defined

as

earnings

before

interest,

taxes,

depreciation,

amortization

expense,

and

share-based

compensation.

“Adjusted

EBITDA”

reflects

the

defined

as

operating

income

and

earnings

per

share,

adjusted

to

exclude

defined

as

adjusted

earnings

per

share,

as

well

as

adjustments

to

reflect

the

incremental

current

period

amount

of

interest

expense

and

defined

as

net

cash

from

operating

activities,

as

reported

in

the

Statement

of

Cash

Flow,

less

capital

expenditures

as

well

as

adjustments

for |

Non-GAAP Reconciliation: Organic Revenue

24

(A)

(B)

(C)

(D)

(E)

(F) = B+C+D+E

(G) = F/A

Change

% Change

Change

% Change

Revenue

Revenue

2011 v. 2010

2011 v. 2010

FX Contribution

Eliminations

Adj. 2011 v. 2010

Adj. 2011 v. 2010

2011

2010

Year Ended December 31, 2011

Xylem Inc.

3,803

3,202

601

18.8%

(264)

(111)

-

226

7.1%

Water infrastructure

2,416

1,930

486

25.2%

(264)

(87)

2

137

7.1%

Applied Water

1,444

1,327

117

8.8%

-

(28)

(1)

88

6.6%

Change

% Change

Change

% Change

Revenue

Revenue

2010 v. 2009

2010 v. 2009

FX Contribution

Eliminations

Adj. 2010 v. 2009

Adj. 2010 v. 2009

2010

2009

Year Ended December 31, 2010

Xylem Inc.

3,202

2,849

353

12.4%

(263)

6

-

96

3.4%

Water Infrastructure

1,930

1,651

279

16.9%

(247)

(8)

-

24

1.5%

Applied Water

1,327

1,254

73

5.8%

(16)

16

-

73

5.8%

Change

% Change

Change

% Change

Revenue

Revenue

2009 v. 2008

2009 v. 2008

FX Contribution

Eliminations

Adj. 2009 v. 2008

Adj. 2009 v. 2008

2009

2008

Year Ended December 31, 2009

Xylem Inc.

2,849

3,291

(442)

-13.4%

(7)

158

-

(291)

-8.8%

Water infrastructure

1,651

1,824

(173)

-9.5%

-

108

-

(65)

-3.6%

Applied Water

1,254

1,527

(273)

-17.9%

(7)

53

-

(227)

-14.9%

Acquisitions /

Divestitures

Acquisitions /

Divestitures

Xylem Inc. Non-GAAP Reconciliation

Reported vs. Organic Revenue

($ Millions)

(As Reported -

GAAP)

(As Adjusted -

Organic)

Acquisitions /

Divestitures |

Non-GAAP Reconciliation: EBITDA

25

2011

2010

2009

2008

Pre-Tax Net Income

383

388

277

312

Interest, net

17

-

-

-

Depreciation and

Amortization (1)

150

101

79

72

EBITDA

550

489

356

384

Separation Costs

87

-

-

-

Adjusted EBITDA

637

489

356

384

Revenues

3,803

3,202

2,849

3,291

Adjusted EBITDA Margin

16.7%

15.3%

12.5%

11.7%

Note: (1) Includes share-based compensation.

Xylem Inc. Non-GAAP Reconciliation

EBITDA and Adjusted EBITDA

Years ended 2011, 2010, 2009, & 2008

($ Millions) |

Non-GAAP Reconciliation: Earnings Per Share

26

FY 2009

FY 2010

FY 2011

Net Income

263

329

279

Separation costs, net of tax

-

-

72

Adjusted Net Income before Special

Tax Items 263

329

351

Special Tax Items

(61)

(43)

7

Adjusted Net

Income 202

286

358

Diluted Earnings per Share

$1.42

$1.78

$1.50

Separation costs per Share

-

-

$0.39

Adjusted diluted EPS before Special Tax Items

$1.42

$1.78

$1.89

Special Tax Items per Share

($0.32)

($0.23)

$0.04

Adjusted diluted EPS

$1.10

$1.55

$1.93

Xylem Inc. Non-GAAP Reconciliation

Adjusted Diluted EPS

2009, 2010, & 2011

($ Millions, except per share amounts) |

Non-GAAP Reconciliation: Guidance

27

Illustration of Mid Point Guidance

2012 Guidance

FY '11

FY '12

As Reported

Adjustments

Adjusted

Adjustments

Normalized

As Projected

Adjustments

Adjusted

Total Revenue

3,803

3,803

3,803

3,800

3,800

Segment Operating Income

503

29

a

532

(10)

d

522

524

25

h,i

549

Segment Operating Margin

13.2%

14.0%

13.7%

13.8%

14.4%

Corporate Expense

108

(58)

b

50

18

e

68

66

(11)

h

55

Operating Income

395

87

482

(28)

454

458

36

494

Operating Margin

10.4%

12.7%

11.9%

12.1%

13.0%

Interest Expense

(17)

(17)

(39)

f

(56)

(54)

(54)

Other Non-Operating Income (Expense)

5

5

5

(2)

(2)

Income before Taxes

383

87

470

(67)

403

402

36

438

Provision for Income Taxes

(104)

(8)

c

(112)

16

g

(96)

(99)

(10)

j

(109)

Net Income

279

79

358

(51)

307

303

26

329

Diluted Shares

185.3

185.3

186.3

186.3

Diluted EPS

1.50

$

0.43

$

1.93

$

(0.27)

$

1.66

1.63

0.14

1.77

a

One time separation costs incurred at the segment level

b

One time separation costs incurred at the corporate level

c

Net

tax

impact

of

above

items,

plus

the

addition

of

2011

special

tax

items

d

Incremental stand alone costs to be incurred in 2012 at the segment level ($10M)

e

Incremental stand alone costs to be incurred in 2012 at the corporate level ($18M)

f

Incremental interest expense on long-term debt to be incurred in 2012

g

Tax

impact

of

incremental

interest

expense

and

stand

alone

costs

to

be

incurred

in

2012

h

Expected one time separation costs of $7M and $11M to be incurred at the segments and

headquarters, respectively. i

Restructuring & realignment costs of $18M to be incurred at the segments.

j

Tax impact of one time separation, restructuring & realignment costs expected to be

incurred in 2012 and tax special items realized through Q2 2012. Xylem Inc. Non-GAAP

Reconciliation Guidance

($ Millions, except per share amounts) |

Non-GAAP Reconciliation: Free Cash Flow

28

Xylem Inc. Non-GAAP Reconciliation

Net Cash -

Operating Activities vs. Free Cash Flow

Years ended 2011, 2010, 2009, & 2008

($ Millions)

Year Ended

2011

2010

2009

2008

Net Cash -

Operating Activities

449

395

370

408

Capital Expenditures

(126)

(94)

(62)

(67)

Free Cash Flow, including separation costs

323

301

308

341

Separation Costs (Cash Paid incl. Capex)

65

-

-

-

Free Cash Flow, excluding separation costs

388

301

308

341

Net Income

279

329

263

224

Separation Costs, net of tax

72

-

-

-

Adjusted Net Income

351

329

263

224

Free Cash Flow Conversion

111%

91%

117%

152% |

Non-GAAP Reconciliation: Adj. Operating Income & Margin

29

Mid Point Guidance

2008

2009

2010

2011

2012E

Revenue

3,291

2,849

3,202

3,803

3,800

Operating Income

315

276

388

395

458

Operating Margin

9.6%

9.7%

12.1%

10.4%

12.1%

Restructuring & Realignment

41

31

15

-

18

Separation Costs

-

-

-

87

18

Adjusted Operating

Income 356

307

403

482

494

Adjusted Operating Margin

10.8%

10.8%

12.6%

12.7%

13.0%

Standalone Costs

-

-

-

5

28

Adj. Operating Income, excl.

Standalone Costs 356

307

403

487

522

Adjusted Operating Margin, excl.

Standalone Costs 10.8%

10.8%

12.6%

12.8%

13.7%

Xylem Inc. Non-GAAP Reconciliation

Adjusted Operating Income

($ Millions) |