Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | barclays20128kbody.htm |

New York, NY Bill Rogers Chief Executive Officer, SunTrust Banks, Inc. September 11, 2012 Barclays Capital Global Financial Services Conference

2 Important Cautionary Statement About Forward-Looking Statements The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2011 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, net interest income and net interest margin are presented on a fully taxable-equivalent (“FTE”) basis, and ratios are presented on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward-looking statements. Statements about (a)expected efficiency expense savings, (b) normalization of cyclically high expenses, (c) expected increases in Tier 1 common capital as a result of the sale of the Coke shares; and (d) the expected level of future incurred losses on pre-2009 loans sold to GSEs, and the related provision expense, are forward looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potential” or “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Item 1A of Part II of our 10-K and in other periodic reports that we file with the SEC. Those factors include: we may not achieve targeted level of expense reductions and efficiency goals; if in the future we incur additional loan losses, then we will need to record additional mortgage repurchase provision expense; if in the future we receive greater levels of mortgage repurchase requests than expected, then we may will need to record additional mortgage repurchase provision expense; difficult market conditions have adversely affected our industry; concerns over market volatility continue; the Dodd-Frank Act makes fundamental changes in the regulation of the financial services industry, some of which may adversely affect our business; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; emergency measures designed to stabilize the U.S. banking system are beginning to wind down; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we will realize future losses if the proceeds we receive upon liquidation of nonperforming assets are less than the carrying value of such assets; weakness in the economy and in the real estate market, including specific weakness within our geographic footprint, has adversely affected us and may continue to adversely affect us; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages. We may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain borrower defaults, which could harm our liquidity, results of operations, and financial condition; we are subject to risks related to delays in the foreclosure process; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies; as a financial services company, adverse changes in general business or economic conditions could have a material adverse effect on our financial condition and results of operations; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital or liquidity; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; depressed market values for our stock may require us to write down goodwill; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other natural or man-made disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; the soundness of other financial institutions could adversely affect us; we rely on other companies to provide key components of our business infrastructure; we rely on our systems, employees, and certain counterparties, and certain failures could materially adversely affect our operations; we depend on the accuracy and completeness of information about clients and counterparties; regulation by federal and state agencies could adversely affect the business, revenue, and profit margins; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we may not pay dividends on your common stock; disruptions in our ability to access global capital markets may negatively affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, our operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations and require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries.

3 SunTrust’s Market Position Imparts Significant Opportunity

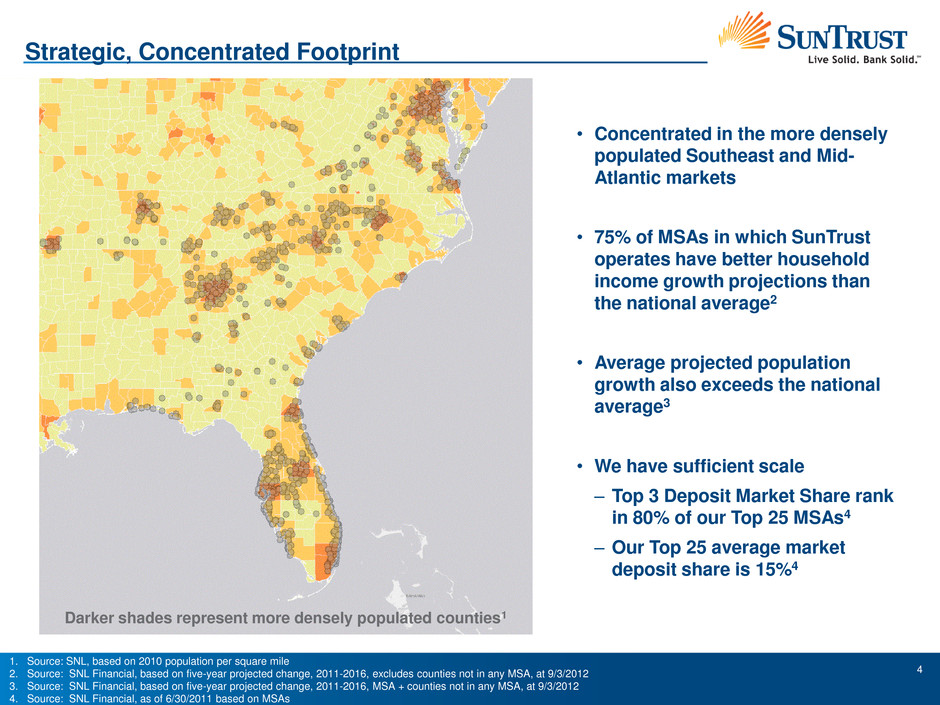

4 Strategic, Concentrated Footprint • Concentrated in the more densely populated Southeast and Mid- Atlantic markets • 75% of MSAs in which SunTrust operates have better household income growth projections than the national average2 • Average projected population growth also exceeds the national average3 • We have sufficient scale – Top 3 Deposit Market Share rank in 80% of our Top 25 MSAs4 – Our Top 25 average market deposit share is 15%4 Darker shades represent more densely populated counties1 1. Source: SNL, based on 2010 population per square mile 2. Source: SNL Financial, based on five-year projected change, 2011-2016, excludes counties not in any MSA, at 9/3/2012 3. Source: SNL Financial, based on five-year projected change, 2011-2016, MSA + counties not in any MSA, at 9/3/2012 4. Source: SNL Financial, as of 6/30/2011 based on MSAs

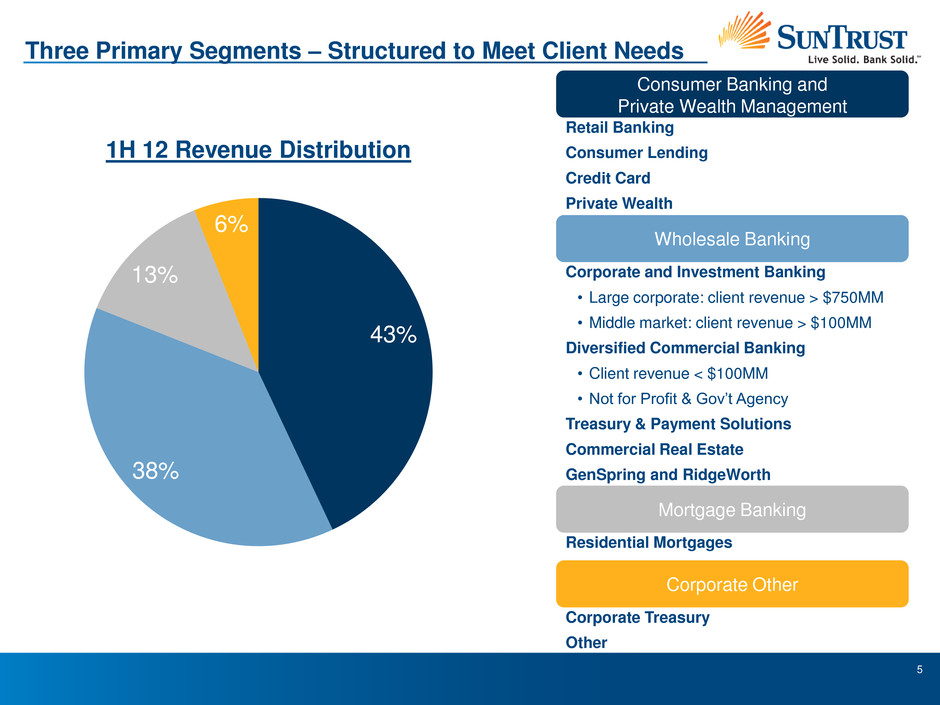

5 Three Primary Segments – Structured to Meet Client Needs Mortgage Banking Consumer Banking and Private Wealth Management Wholesale Banking Retail Banking Consumer Lending Credit Card Private Wealth Residential Mortgages Corporate and Investment Banking • Large corporate: client revenue > $750MM • Middle market: client revenue > $100MM Diversified Commercial Banking • Client revenue < $100MM • Not for Profit & Gov’t Agency Treasury & Payment Solutions Commercial Real Estate GenSpring and RidgeWorth 43% 38% 13% 6% Corporate Other 1H 12 Revenue Distribution Corporate Treasury Other

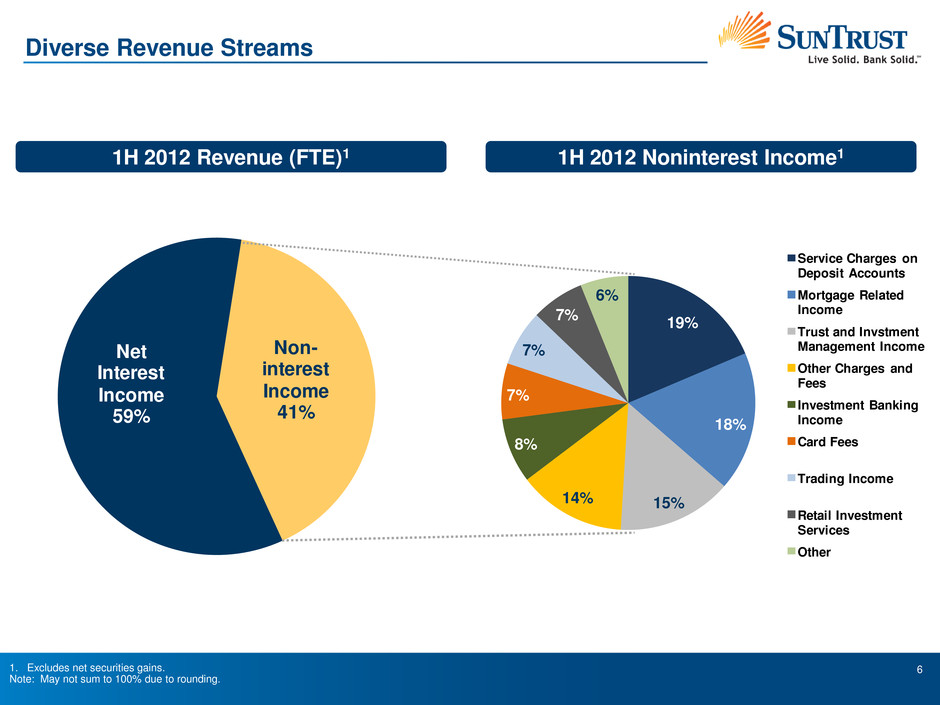

6 Diverse Revenue Streams 1H 2012 Revenue (FTE)1 1. Excludes net securities gains. Note: May not sum to 100% due to rounding. 1H 2012 Noninterest Income1 Non- interest Income 41% Net Interest Income 59% 19% 18% 15%14% 8% 7% 7% 7% 6% Service Charges on Deposit Accounts Mortgage Related Income Trust and Invstment Management Income Other Charges and Fees Investment Banking Income Card Fees Trading Income Retail Investment Services Other

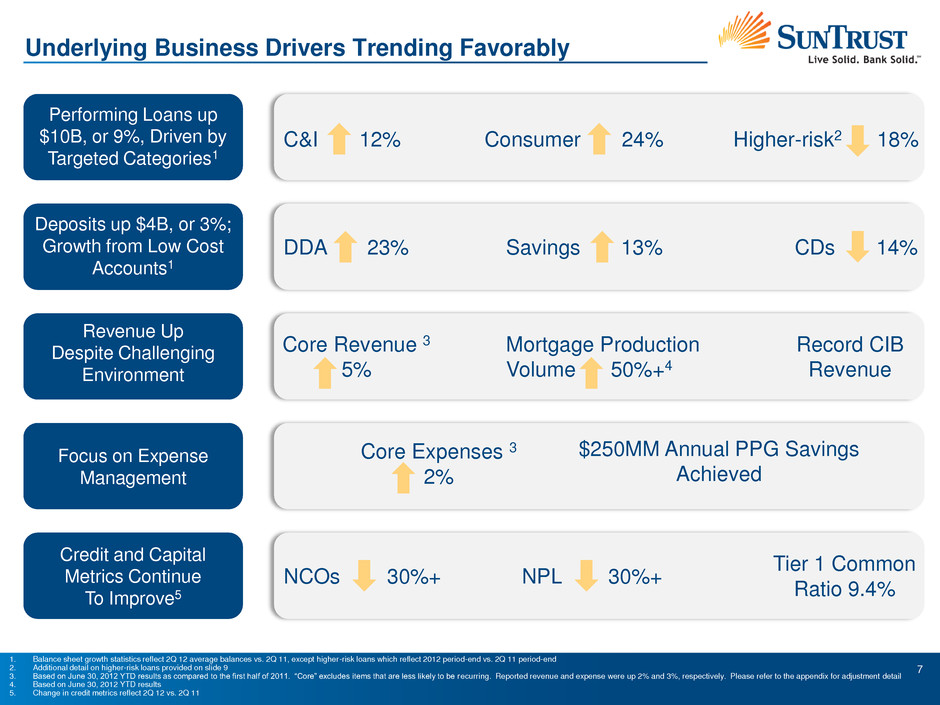

7 Underlying Business Drivers Trending Favorably Performing Loans up $10B, or 9%, Driven by Targeted Categories1 Deposits up $4B, or 3%; Growth from Low Cost Accounts1 Revenue Up Despite Challenging Environment Focus on Expense Management Credit and Capital Metrics Continue To Improve5 C&I 12% Consumer 24% Higher-risk2 18% DDA 23% Savings 13% Core Revenue 3 5% Mortgage Production Volume 50%+4 Record CIB Revenue Tier 1 Common Ratio 9.4% $250MM Annual PPG Savings Achieved CDs 14% NCOs 30%+ NPL 30%+ 1. Balance sheet growth statistics reflect 2Q 12 average balances vs. 2Q 11, except higher-risk loans which reflect 2012 period-end vs. 2Q 11 period-end 2. Additional detail on higher-risk loans provided on slide 9 3. Based on June 30, 2012 YTD results as compared to the first half of 2011. “Core” excludes items that are less likely to be recurring. Reported revenue and expense were up 2% and 3%, respectively. Please refer to the appendix for adjustment detail 4. Based on June 30, 2012 YTD results 5. Change in credit metrics reflect 2Q 12 vs. 2Q 11 Core Expenses 3 2%

8 Strengthened Balance Sheet and Reduced Risk

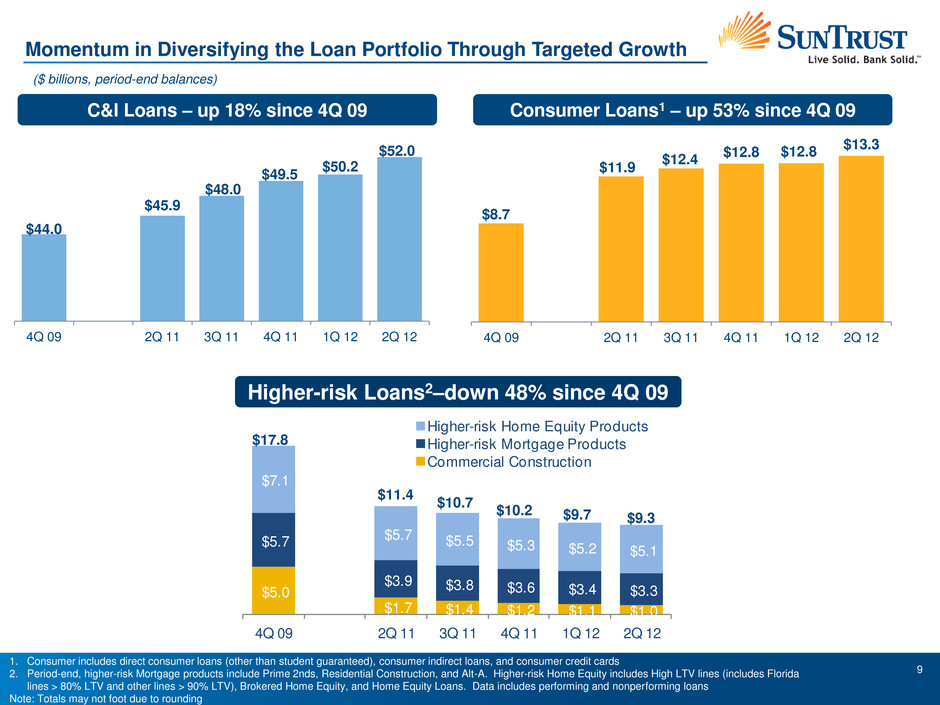

9 $8.7 $11.9 $12.4 $12.8 $12.8 $13.3 4Q 09 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 C&I Loans – up 18% since 4Q 09 Consumer Loans1 – up 53% since 4Q 09 Momentum in Diversifying the Loan Portfolio Through Targeted Growth ($ billions, period-end balances) 1. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans, and consumer credit cards 2. Period-end, higher-risk Mortgage products include Prime 2nds, Residential Construction, and Alt-A. Higher-risk Home Equity includes High LTV lines (includes Florida lines > 80% LTV and other lines > 90% LTV), Brokered Home Equity, and Home Equity Loans. Data includes performing and nonperforming loans Note: Totals may not foot due to rounding $44.0 $45.9 $48.0 $49.5 $50.2 $52.0 4Q 09 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 Higher-risk Loans2–down 48% since 4Q 09 $5.0 $1.7 $1.4 $1.2 $1.1 $1.0 $5.7 $3.9 $3.8 $3.6 $3.4 $3.3 $7.1 $5.7 $5.5 $5.3 $5.2 $5.1 4Q 09 2Q 11 3Q 11 4Q 11 1Q 12 2Q 12 Higher-risk Home Equity Products Higher-risk Mortgage Products Commercial Construction $17.8 $11.4 $10.7 $10.2 $9.7 $9.3

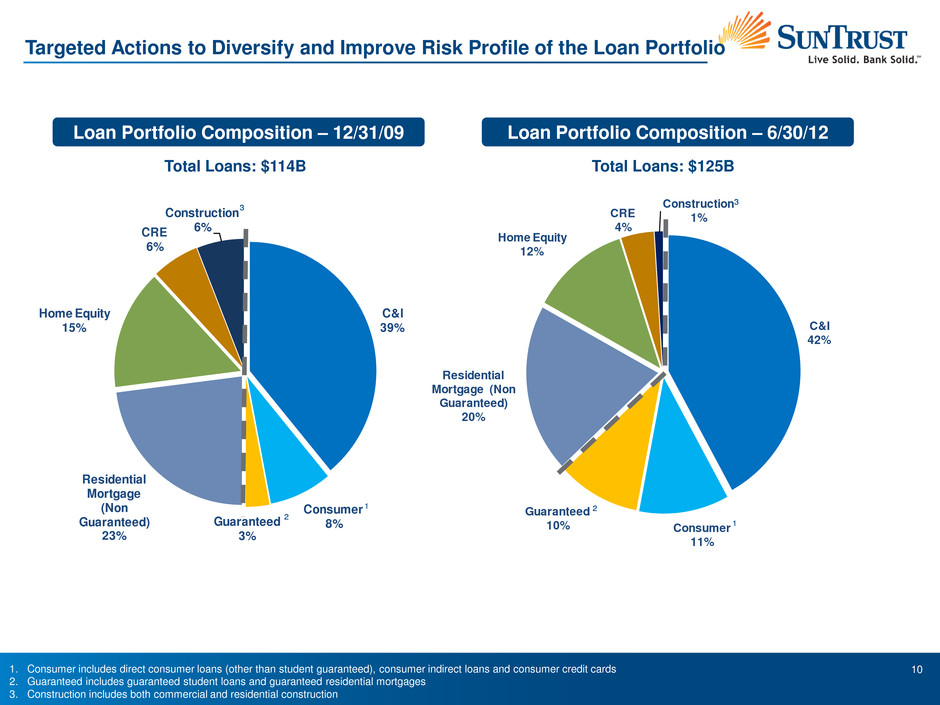

10 1. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans and consumer credit cards 2. Guaranteed includes guaranteed student loans and guaranteed residential mortgages 3. Construction includes both commercial and residential construction Targeted Actions to Diversify and Improve Risk Profile of the Loan Portfolio Loan Portfolio Composition – 6/30/12 Total Loans: $125B Loan Portfolio Composition – 12/31/09 Total Loans: $114B C&I 42% Consumer 11% Guaranteed 10% Residential Mortgage (Non Guaranteed) 20% Home Equity 12% CRE 4% Construction 1% ¹ ² C&I 39% Consumer 8%Guaranteed 3% Residential Mortgage (Non Guaranteed) 23% Home Equity 15% CRE 6% Construction 6% ¹ ² ³ ³

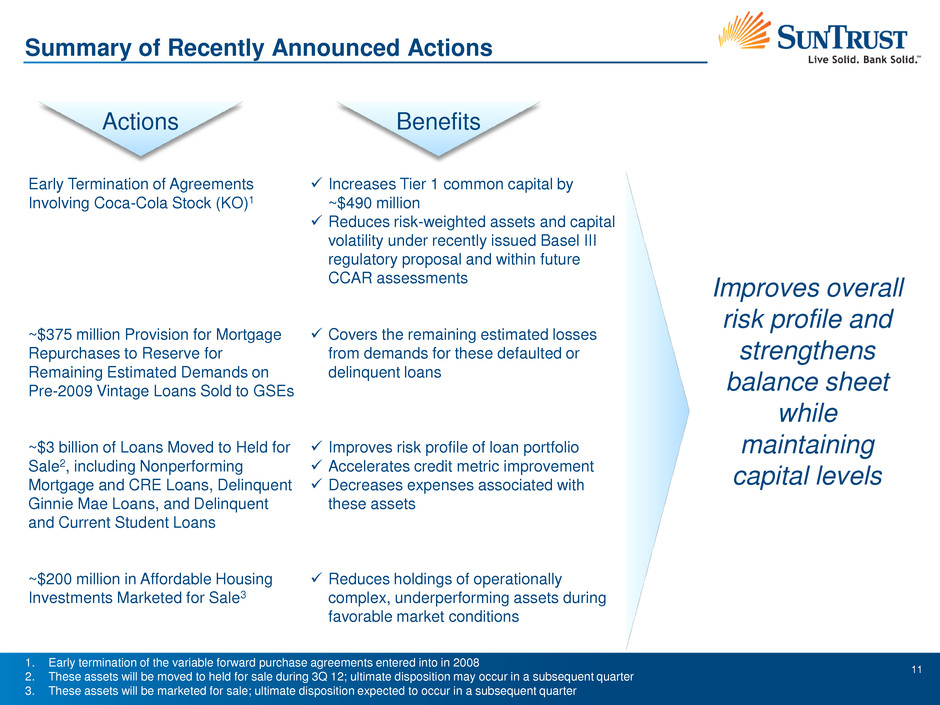

11 Summary of Recently Announced Actions 1. Early termination of the variable forward purchase agreements entered into in 2008 2. These assets will be moved to held for sale during 3Q 12; ultimate disposition may occur in a subsequent quarter 3. These assets will be marketed for sale; ultimate disposition expected to occur in a subsequent quarter Improves overall risk profile and strengthens balance sheet while maintaining capital levels Actions Benefits Early Termination of Agreements Involving Coca-Cola Stock (KO)1 ~$375 million Provision for Mortgage Repurchases to Reserve for Remaining Estimated Demands on Pre-2009 Vintage Loans Sold to GSEs ~$3 billion of Loans Moved to Held for Sale2, including Nonperforming Mortgage and CRE Loans, Delinquent Ginnie Mae Loans, and Delinquent and Current Student Loans ~$200 million in Affordable Housing Investments Marketed for Sale3 Increases Tier 1 common capital by ~$490 million Reduces risk-weighted assets and capital volatility under recently issued Basel III regulatory proposal and within future CCAR assessments Covers the remaining estimated losses from demands for these defaulted or delinquent loans Improves risk profile of loan portfolio Accelerates credit metric improvement Decreases expenses associated with these assets Reduces holdings of operationally complex, underperforming assets during favorable market conditions

12 Looking Ahead: Focused on Improved Efficiency and Profitable Growth

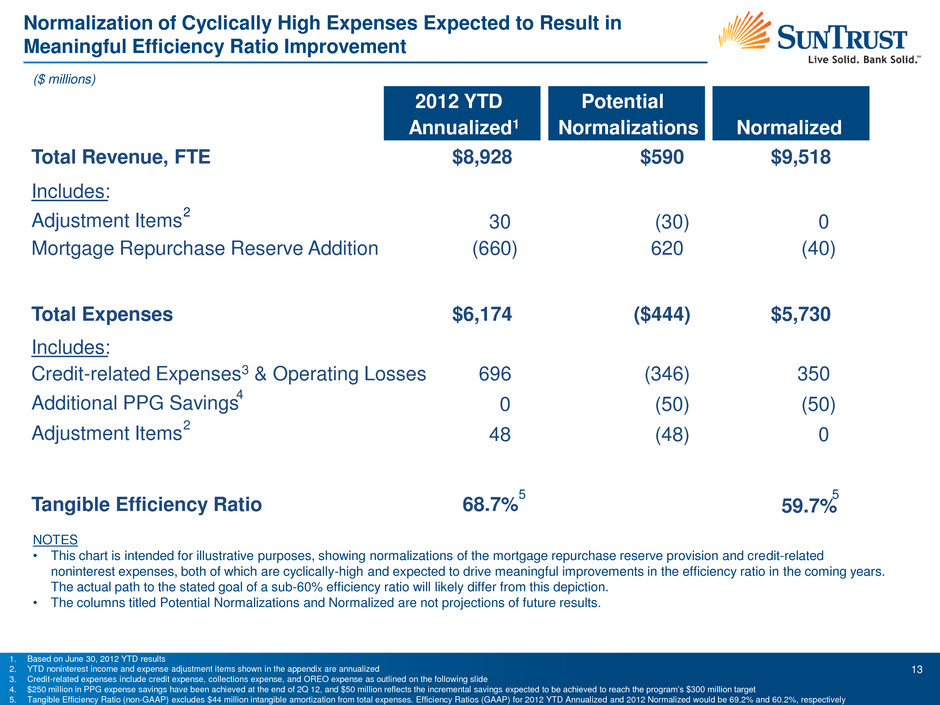

13 Normalization of Cyclically High Expenses Expected to Result in Meaningful Efficiency Ratio Improvement 1. Based on June 30, 2012 YTD results 2. YTD noninterest income and expense adjustment items shown in the appendix are annualized 3. Credit-related expenses include credit expense, collections expense, and OREO expense as outlined on the following slide 4. $250 million in PPG expense savings have been achieved at the end of 2Q 12, and $50 million reflects the incremental savings expected to be achieved to reach the program’s $300 million target 5. Tangible Efficiency Ratio (non-GAAP) excludes $44 million intangible amortization from total expenses. Efficiency Ratios (GAAP) for 2012 YTD Annualized and 2012 Normalized would be 69.2% and 60.2%, respectively NOTES • This chart is intended for illustrative purposes, showing normalizations of the mortgage repurchase reserve provision and credit-related noninterest expenses, both of which are cyclically-high and expected to drive meaningful improvements in the efficiency ratio in the coming years. The actual path to the stated goal of a sub-60% efficiency ratio will likely differ from this depiction. • The columns titled Potential Normalizations and Normalized are not projections of future results. ($ millions) 5 59.7% 2012 YTD Potential Annualized1 Normalizations Normalized Total Revenue, FTE $8,928 $590 $9,518 Includes: Adjustment Items 2 30 (30) 0 Mortgage Repurchase Reserve Addition (660) 620 (40) Total Expenses $6,174 ($444) $5,730 Includes: Credit-related Expenses3 & Operating Losses 696 (346) 350 Additional PPG Savings 4 0 (50) (50) Adjustment Items 2 48 (48) 0 Tangible Efficiency Ratio 68.7% 5

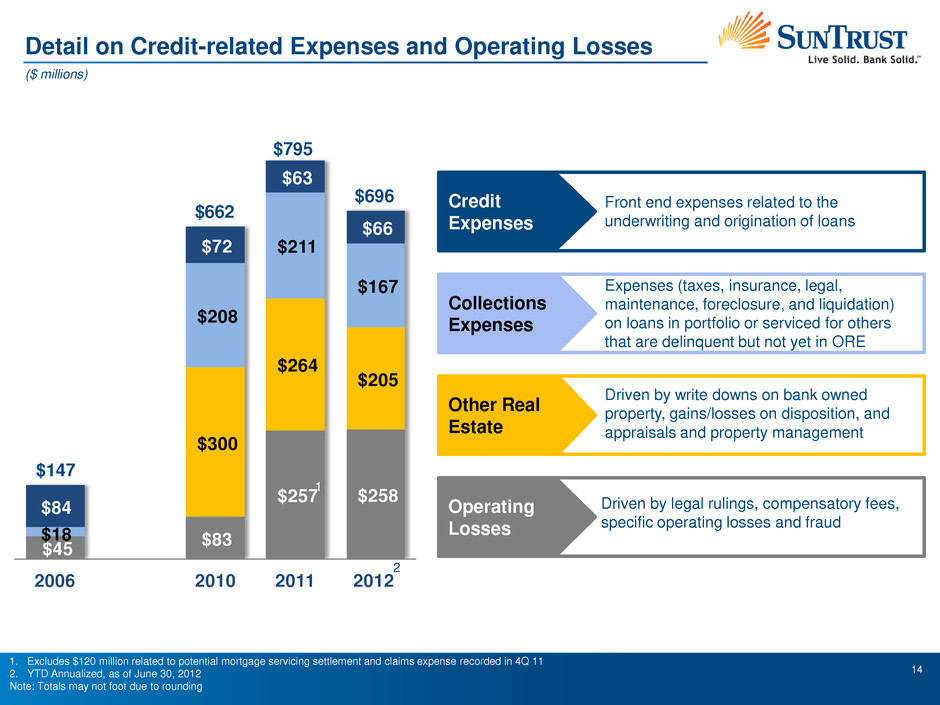

14 $83 $257 $258 $45 $300 $264 $205 $18 $208 $211 $167 $84 $72 $63 $66 2006 2010 2011 2012 Detail on Credit-related Expenses and Operating Losses Collections Expenses Credit Expenses Other Real Estate Operating Losses Driven by legal rulings, compensatory fees, specific operating losses and fraud Driven by write downs on bank owned property, gains/losses on disposition, and appraisals and property management Front end expenses related to the underwriting and origination of loans Expenses (taxes, insurance, legal, maintenance, foreclosure, and liquidation) on loans in portfolio or serviced for others that are delinquent but not yet in ORE $147 $662 $795 $696 ($ millions) 2 1. Excludes $120 million related to potential mortgage servicing settlement and claims expense recorded in 4Q 11 2. YTD Annualized, as of June 30, 2012 Note: Totals may not foot due to rounding 1

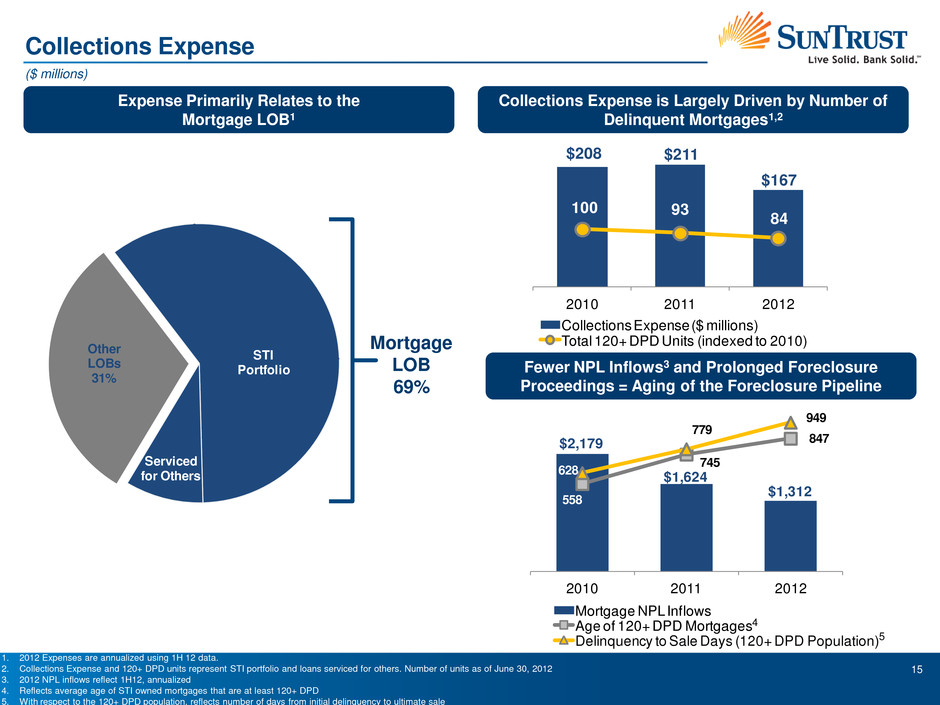

15 Other LOBs 31% STI Portfolio Serviced for Others $208 $211 $167 100 93 84 2010 2011 2012 Collections Expense ($ millions) Total 120+ DPD Units (indexed to 2010) $2,179 $1,624 $1,312 558 745 847 628 779 949 2010 2011 2012 Mortgage NPL Inflows Age of 120+ DPD Mortgages Delinquency to Sale Days (120+ DPD Population) Collections Expense 1. 2012 Expenses are annualized using 1H 12 data. 2. Collections Expense and 120+ DPD units represent STI portfolio and loans serviced for others. Number of units as of June 30, 2012 3. 2012 NPL inflows reflect 1H12, annualized 4. Reflects average age of STI owned mortgages that are at least 120+ DPD 5. With respect to the 120+ DPD population, reflects number of days from initial delinquency to ultimate sale ($ millions) Expense Primarily Relates to the Mortgage LOB1 Collections Expense is Largely Driven by Number of Delinquent Mortgages1,2 Fewer NPL Inflows3 and Prolonged Foreclosure Proceedings = Aging of the Foreclosure Pipeline Mortgage LOB 69% 4 5

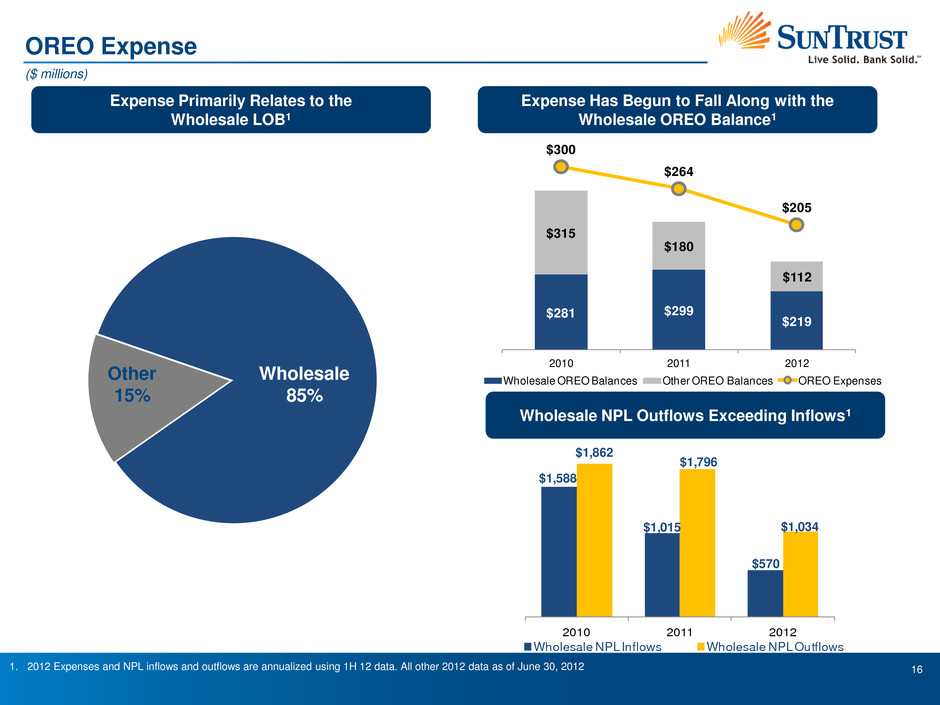

16 Wholesale 85% OREO Expense 1. 2012 Expenses and NPL inflows and outflows are annualized using 1H 12 data. All other 2012 data as of June 30, 2012 Expense Primarily Relates to the Wholesale LOB1 Wholesale NPL Outflows Exceeding Inflows1 Expense Has Begun to Fall Along with the Wholesale OREO Balance1 Other 15% $1,588 $1,015 $570 $1,862 $1,796 $1,034 2010 2011 2012 Wholesale NPL Inflows Wholesale NPL Outflows ($ millions) $281 $299 $219 $315 $180 $112 $300 $264 $205 2010 2011 2012 Wholesale OREO Balances Other OREO Balances OREO Expenses

17 Well Positioned for Organic Growth Market Position The Advantage The Opportunity • Strong share in attractive markets • High client loyalty • Proven relationship based coverage • Strong, full-service Diversified Commercial Banking platform in growth markets • Nationwide, middle-market Corporate and Investment Bank • Highly-targeted Commercial Real Estate business, with a full relationship focus • Multi-channel platform; emphasis on in-footprint originations • Second highest customer satisfaction in industry (J.D. Power, 2011) • Markets provide foundation for growth • High level of insight from clients • Peer-leading client loyalty delivered through a relationship approach • A differentiated client experience, driven by cohesive “Top Tier” client approach in target industries/segments • Agility across targeted segments; ability to react quickly to changing market conditions • Provides a meaningful entry point to win new clients/deepen the relationship • Meet more client needs / “monetize” the loyalty • Targeted segments • Improve efficiency and execute consistently • Deepen existing relationships; increase pace of high-quality acquisition • Best-in-class market position through targeted industry, product and client expansion • Re-enter select markets and asset classes leading to increased market share • Optimize channels in “new mortgage” to improve efficiency in loan originations • Continue to work through “legacy mortgage” issues Consumer Banking and Private Wealth Management Wholesale Banking Mortgage Banking

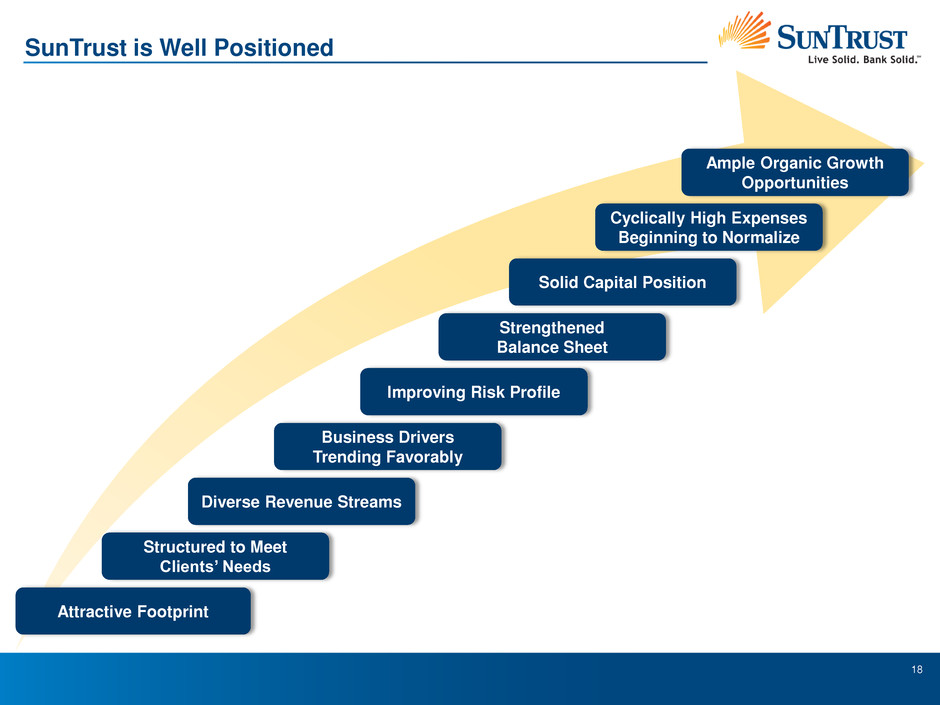

18 Attractive Footprint Structured to Meet Clients’ Needs Strengthened Balance Sheet Improving Risk Profile Diverse Revenue Streams Ample Organic Growth Opportunities Business Drivers Trending Favorably Solid Capital Position Cyclically High Expenses Beginning to Normalize SunTrust is Well Positioned

19 Appendix

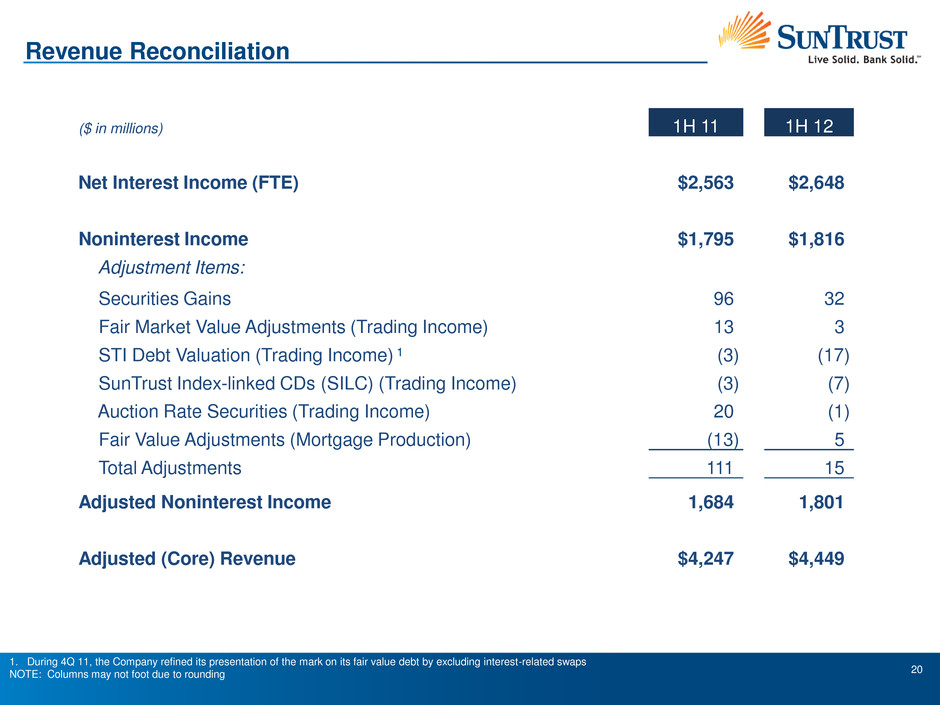

20 Revenue Reconciliation 1. During 4Q 11, the Company refined its presentation of the mark on its fair value debt by excluding interest-related swaps NOTE: Columns may not foot due to rounding ($ in millions) 1H 11 1H 12 Net Interest Income (FTE) $2,563 $2,648 Noninterest Income $1,795 $1,816 Adjustment Items: Securities Gains 96 32 Fair Market Value Adjustments (Trading Income) 13 3 STI Debt Valuation (Trading Income) 1 (3) (17) SunTrust Index-linked CDs (SILC) (Trading Income) (3) (7) Auction Rate Securities (Trading Income) 20 (1) Fair Value Adjustments (Mortgage Production) (13) 5 Total Adjustments 111 15 Adjusted Noninterest Income 1,684 1,801 Adjusted (Core) Revenue $4,247 $4,449

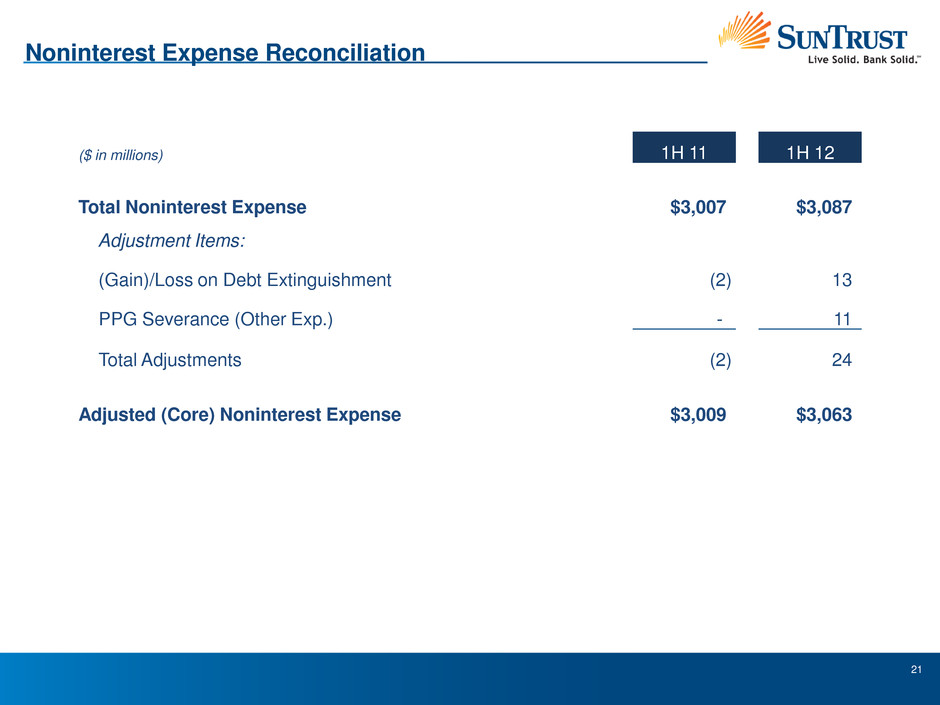

21 Noninterest Expense Reconciliation ($ in millions) 1H 11 1H 12 Total Noninterest Expense $3,007 $3,087 Adjustment Items: (Gain)/Loss on Debt Extinguishment (2) 13 PPG Severance (Other Exp.) - 11 Total Adjustments (2) 24 Adjusted (Core) Noninterest Expense $3,009 $3,063

New York, NY Bill Rogers Chief Executive Officer, SunTrust Banks, Inc. September 11, 2012 Barclays Capital Global Financial Services Conference