Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Triton Emission Solutions Inc. | ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Triton Emission Solutions Inc. | ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Triton Emission Solutions Inc. | ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - Triton Emission Solutions Inc. | ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

[__] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

COMMISSION FILE NUMBER 000-33309

POLY SHIELD TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

|

DELAWARE

|

33-0953557

|

|

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

|

|

433 Plaza Real, Suite 175

|

||

|

Boca Raton, Florida

|

33432

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

1 (800) 648-4287

|

||

|

Registrant's telephone number, including area code

|

||

|

Securities registered pursuant to Section 12(b) of the Act:

|

NONE.

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.001 Par Value Per Share.

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

[__] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

[__] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [__] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). [__] Yes [__] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [__]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [__]

|

Accelerated filer [__]

|

|

Non-accelerated filer [__] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [__] Yes [X] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $18,876,072 as of June 30, 2011 ($0.45 X 41,946,826)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 29, 2012, the Registrant had 95,183,198 shares of common stock outstanding.

EXPLANATORY NOTE

We are filing this Amendment No. 1 to our Annual Report on Form 10-K for the year ended December 31, 2011, as originally filed with the Securities and Exchange Commission (“SEC”) on March 30, 2012 (the “Original Form 10-K”).

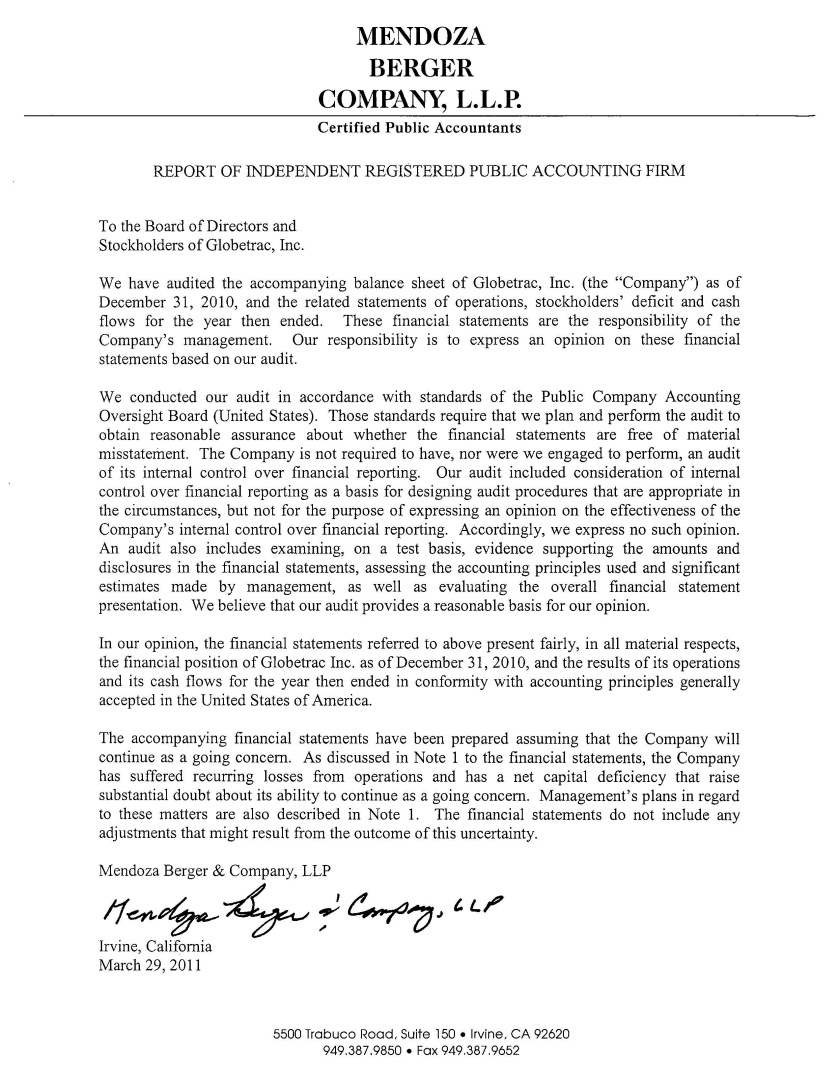

This Amendment No. 1 amends Item 8 of Part II of the Original Form 10-K to include the amended report of Dale Matheson Carr-Hilton Labonte LLP, our current principal accountants, for our financial statements for the fiscal year ended December 31, 2011, and to include the report of Mendoza Berger & Company, our former principal accountants, for our financial statements for the fiscal year ended December 31, 2010. Other than the inclusion of the amended report of Dale Matheson Carr-Hilton Labonte, and the report of Medoza Berger & Company, the financial statements included in Item 8 have not been modified, amended or updated.

Item 15 of Part III of this Amendment No. 1 has been amended solely to provide updated certifications from our principal executive officer and principal financial officer, as required by Section 302 and 906 of Sarbanes-Oxley Act of 2002 and Rule 12b-15 under the Securities Exchange Act of 1934, as amended.

Except as described above, this Amendment No. 1 does not modify, amend or update the disclosure made in the Original Form 10-K.

The filing of this Amendment No. 1 shall not be deemed an admission that the Original Form 10-K when made included any untrue statements of material fact or omitted to state a material fact necessary to make a statement not misleading.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

1.

|

Report of Independent Registered Public Accounting Firm (Dale Matheson Carr-Hilton Labonte LLP);

|

|

|

2.

|

Report of Independent Registered Public Accounting Firm (Mendoza Berger & Company);

|

|

|

3.

|

Audited Financial Statements for the Years Ended December 31, 2011 and 2010, including:

|

|

|

a.

|

Balance Sheets at December 31, 2011 and 2010;

|

|

|

b.

|

Statements of Operations for the years ended December 31, 2011 and 2010;

|

|

|

c.

|

Statement of Stockholders’ Deficit for the period from January 1, 2010 to December 31, 2011;

|

|

|

d.

|

Statements of Cash Flows for the years ended December 31, 2011 and 2010; and

|

|

|

e.

|

Notes to Financial Statements.

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders and Board of Directors of Globetrac Inc.

We have audited the accompanying balance sheet of Globetrac Inc. (the “Company”) as at December 31, 2011 and the related statements of operations, stockholders’ deficit and cash flows for the year then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit. The financial statements of Globetrac Inc. as of December 31, 2010 were audited by other auditors whose report thereon dated March 29, 2011, expressed an unqualified opinion on those financial statements.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, based on our audit and the report of other auditors, these financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2011 and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America. The financial statements of Globetrac Inc. as of December 31, 2010 were audited by other auditors whose report thereon dated March 29, 2011, expressed an unqualified opinion on those financial statements.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has incurred losses in developing its business, and further losses are anticipated. The Company requires additional funds to meet its obligations and the costs of its operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in this regard are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ DMCL

Dale Matheson Carr-Hilton Labonte LLP

CHARTERED ACCOUNTANTS

Vancouver, Canada

March 28, 2012

RDGXBRLParseBegin

RDGXBRLParseBeginGLOBETRAC INC.

BALANCE SHEETS

|

December 31, 2011

|

December 31, 2010

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 707 | $ | 5,400 | ||||

|

Accounts receivable

|

4,999 | 5,611 | ||||||

|

Prepaids

|

- | 999 | ||||||

|

Total current assets

|

$ | 5,706 | $ | 12,010 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$ | 7,120 | $ | 56,019 | ||||

|

Accrued liabilities

|

20,438 | 53,011 | ||||||

|

Note payable

|

20,264 | - | ||||||

|

Due to related parties

|

139,684 | 84,813 | ||||||

|

Total current liabilities

|

187,506 | 193,843 | ||||||

|

Stockholders' deficit

|

||||||||

|

Common stock $0.001 par value, 200,000,000 common shares authorized, 95,183,198 issued and outstanding at December 31, 2011 ( 2010 - 89,883,198)

|

95,183 | 89,883 | ||||||

|

Additional paid in capital

|

1,228,565 | 1,167,085 | ||||||

|

Accumulated deficit

|

(1,517,213 | ) | (1,452,213 | ) | ||||

|

Accumulated other comprehensive income

|

11,665 | 13,412 | ||||||

|

Total stockholders' deficit

|

(181,800 | ) | (181,833 | ) | ||||

|

Total liabilities and stockholders' deficit

|

$ | 5,706 | $ | 12,010 | ||||

The accompanying notes are an integral part of these financial statements

GLOBETRAC INC.

STATEMENTS OF OPERATIONS

|

Year ended December 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

Royalty income

|

$ | 41,699 | $ | 50,379 | ||||

|

General and administrative expenses

|

138,328 | 93,594 | ||||||

|

Loss before other items

|

(96,629 | ) | (43,215 | ) | ||||

|

Other items

|

||||||||

|

Interest expense

|

(4,054 | ) | (706 | ) | ||||

|

Gain on extinguishment of debt

|

35,683 | - | ||||||

|

|

||||||||

|

Net loss

|

$ | (65,000 | ) | $ | (43,921 | ) | ||

|

Net loss per share - basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | ||

|

Weighted average number of shares outstanding - basic and diluted

|

92,584,020 | 89,883,198 | ||||||

The accompanying notes are an integral part of these financial statements

GLOBETRAC INC.

STATEMENT OF STOCKHOLDERS' DEFICIT

FOR THE YEARS ENDED DECEMBER 31, 2011 AND 2010

|

Accumulated

|

||||||||||||||||||||||||

|

Common shares

|

Additional

|

Other

|

||||||||||||||||||||||

|

Number of

|

Paid-in

|

Accumulated

|

Comprehensive

|

|||||||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Deficit

|

Income

|

Total

|

|||||||||||||||||||

|

Balance at January 1, 2010

|

89,883,198 | $ | 89,883 | $ | 1,167,085 | $ | (1,408,292 | ) | $ | 13,412 | $ | (137,912 | ) | |||||||||||

|

Net loss

|

- | - | - | (43,921 | ) | - | (43,921 | ) | ||||||||||||||||

|

Balance at December 31, 2010

|

89,883,198 | 89,883 | 1,167,085 | (1,452,213 | ) | 13,412 | (181,833 | ) | ||||||||||||||||

|

Shares issued for debt

|

5,300,000 | 5,300 | 61,480 | - | - | 66,780 | ||||||||||||||||||

|

Net loss

|

- | - | - | (65,000 | ) | - | (65,000 | ) | ||||||||||||||||

|

Comprehensive loss

|

- | - | - | - | (1,747 | ) | (1,747 | ) | ||||||||||||||||

|

Balance at December 31, 2011

|

95,183,198 | $ | 95,183 | $ | 1,228,565 | $ | (1,517,213 | ) | $ | 11,665 | $ | (181,800 | ) | |||||||||||

The accompanying notes are an integral part of these financial statements

GLOBETRAC INC.

STATEMENTS OF CASH FLOWS

| Year ended December 31, | ||||||||

|

2011

|

2010

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$ | (65,000 | ) | $ | (43,921 | ) | ||

|

Non cash items:

|

||||||||

|

Gain on extinguishment of debt

|

(35,683 | ) | - | |||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Accounts receivable

|

612 | (725 | ) | |||||

|

Prepaids

|

999 | - | ||||||

|

Accounts payable

|

51,817 | (3,055 | ) | |||||

|

Accrued liabilities

|

(32,573 | ) | (2,902 | ) | ||||

|

Accrued interest

|

4,056 | - | ||||||

|

Due to related party

|

35,579 | (6,935 | ) | |||||

|

Net cash used in operating activities

|

(40,193 | ) | (57,538 | ) | ||||

|

Cash flows from financing activities

|

||||||||

|

Note payable

|

20,000 | - | ||||||

|

Due to related parties

|

15,500 | 49,500 | ||||||

|

Net cash from financing

|

35,500 | 49,500 | ||||||

|

Net decrease in cash

|

(4,693 | ) | (8,038 | ) | ||||

|

Cash, beginning

|

5,400 | 13,438 | ||||||

|

Cash, ending

|

$ | 707 | $ | 5,400 | ||||

|

Cash paid for:

|

||||||||

|

Income tax

|

$ | - | $ | - | ||||

|

Interest

|

$ | - | $ | - | ||||

|

Non-cash transactions:

|

||||||||

|

Shares issued for debt

|

$ | 53,000 | $ | - | ||||

The accompanying notes are an integral part of these financial statements

GLOBETRAC INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2011

NOTE 1 – ORGANIZATION AND NATURE OF OPERATIONS

GlobeTrac Inc. (the “Company”) was incorporated in the state of Delaware on March 2, 2000.

The Company was in the global wireless tracking business in Europe until November 1, 2004 when it exchanged this business for a royalty of 6% on future gross sales (Note 4). Royalties are to be paid until October 31, 2015.

Going Concern

The accompanying financial statements have been prepared assuming the Company will continue as a going concern. As of December 31, 2011, the Company has not achieved profitable operations and has accumulated a deficit of $1,517,213. Continuation as a going concern is dependent upon the ability of the Company to obtain the necessary financing to meet obligations and pay its liabilities arising from normal business operations when they come due and ultimately upon its ability to achieve profitable operations. The outcome of these matters cannot be predicted with any certainty at this time and raise substantial doubt that the Company will be able to continue as a going concern. These financial statements do not include any adjustments to the amounts and classification of assets and liabilities that may be necessary should the Company be unable to continue as a going concern. Management intends to obtain additional funding by borrowing funds from its directors and officers, issuing promissory notes and/or a private placement of common stock.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of presentation

The financial statements of the Company have been prepared in accordance with generally accepted accounting principles (“GAAP”) in the United States of America and are presented in US dollars.

Accounting estimates

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue recognition

Royalty revenue is recognized when pervasive evidence of an agreement exists, when it is received or when the royalty income is determinable and collectability is reasonably assured.

Accounts receivable consists of royalty income from one customer and is not collateralized. Management continually monitors the financial condition of its customer to reduce the risk of loss. The Company routinely assesses the financial strength of its source of revenue income and as a consequence, concentration of credit risk is limited.

Income taxes

Income tax expense is based on pre-tax financial accounting income. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets, including tax loss and credit carry forwards, and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. Deferred income tax expense represents the change during the period in the deferred tax assets and deferred tax liabilities. The components of the deferred tax assets and liabilities are individually classified as current and non-current based on their characteristics. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Loss per share

Basic loss per share is computed by dividing the net loss attributable to the common stockholders by the weighted average number of common shares outstanding during the reporting period. Diluted net income per common share includes the potential dilution that could occur upon exercise of the options and warrants to acquire common stock computed using the treasury stock method which assumes that the increase in the number of shares is reduced by the number of shares which could have been repurchased by the Company with the proceeds from the exercise of the options and warrants.

Foreign Currency Translations

Foreign denominated monetary assets and liabilities are translated into their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Revenue and expenses are translated at average rates of exchange during the period. Related translation adjustments are reported as a separate component of stockholders’ equity, whereas gains or losses resulting from foreign currency transactions are included in results of operations.

Financial Instruments

The Company’s financial instruments include cash, accounts receivable, accounts payable, notes payable, convertible notes, derivative liability and amounts due to related parties. The fair value of these financial instruments approximate their carrying values due to their short maturities.

Recent Accounting Pronouncements

Recent accounting pronouncements issued by the Financial Accounting Standards Board or other authoritative standards groups with future effective dates are either not applicable or are not expected to be significant to the financial statements of the Company.

NOTE 3 – DUE TO RELATED PARTIES

|

December 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

Due to a company controlled by a director – unsecured, 0% interest, due on demand

|

$ | 37,579 | $ | 1,500 | ||||

|

Due to a company controlled by a relative of a major shareholder – unsecured, 0% interest, due on demand

|

33,107 | 33,107 | ||||||

|

Due a major shareholder – unsecured, 8% interest, due on demand

|

15,165 | - | ||||||

|

Convertible notes due to a major shareholder and a company controlled by a relative of a major shareholder – unsecured, 7% interest, due on demand (a)

|

53,833 | 50,206 | ||||||

|

Due to related parties

|

$ | 139,684 | $ | 84,813 | ||||

(a) The convertible notes are convertible at the lower of $0.50 or the market price of the shares at the time of conversion.

During the years ended December 31, 2011 and 2010, the Company paid or accrued $67,200 and $66,300 in administrative fees to a company controlled by a director.

NOTE 4 – ROYALTY AGREEMENT

On November 1, 2004, the Company entered into an agreement to discontinue marketing, distributing and installing global wireless tracking and telematics equipment in Europe, which was carried on through its wholly-owned subsidiary, GlobeTrac Limited, in exchange for certain assets and liabilities and a 6% royalty to be paid on gross sales of all existing and qualified potential customers that the Company had. This royalty agreement expires on October 31, 2015.

The Company is subject to foreign exchange risk on our royalty revenue which is denominated in UK pounds and some purchases which are denominated in Canadian dollars. Foreign currency risk arises from the fluctuation of foreign exchange rates and the degree of volatility of these rates relative to the United States dollar. Foreign exchange rate fluctuations may adversely impact the Company’s results of operations as exchange rate fluctuations on transactions denominated in currencies other than our functional currency (the US dollar) result in gains and losses. To the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency-denominated transactions will result in increased net revenue. Conversely, the Company’s net revenue will decrease when the U.S. dollar strengthens against foreign currencies. The Company does not believe that it has any material risk due to foreign currency exchange.

NOTE 5 – COMMON STOCK

On June 29, 2011, the Company issued 5,300,000 shares of common stock with a fair value of $66,780 in settlement of $53,000 in debt and recognized a loss on settlement of debt of $13,780.

NOTE 6 – GAIN ON EXTINGUISHMENT OF DEBT

During the year, the Company wrote off $49,463 of old outstanding debt that have passed the statute of limitations and recognized a gain of the same amount.

NOTE 7 – INCOME TAXES

The reported income taxes differ from the amounts obtained by applying statutory rates to the loss before income taxes as follows:

|

December 31, 2011

|

December 31, 2010

|

|||||||

| $ | $ | |||||||

|

Net and comprehensive loss

|

(65,000 | ) | (43,921 | ) | ||||

|

Statutory tax rate

|

40.7 | % | 42.7 | % | ||||

|

Expected income tax recovery

|

(26,455 | ) | (18,754 | ) | ||||

|

Permanent differences

|

(14,523 | ) | - | |||||

|

Effect of changes in tax rates

|

15,807 | 7,774 | ||||||

|

Increase in valuation allowance

|

25,171 | 10,980 | ||||||

| - | - | |||||||

The Company’s tax-effected future income tax assets and liabilities are estimated as follows:

|

December 31, 2011

|

December 31, 2010

|

|||||||

| $ | $ | |||||||

|

Deferred income tax assets

|

||||||||

|

Non-capital losses carried forward

|

54,441 | 29,270 | ||||||

|

Less: Valuation allowance

|

(54,441 | ) | (29,270 | ) | ||||

|

Net deferred income tax assets

|

- | - | ||||||

At December 31, 2011 and 2010 the Company had a deferred tax asset that related to net operating losses. A 100% valuation allowance has been established; as management believes it is more likely than not that the deferred tax asset will not be realized.

As at December 31, 2011, the Company has net operating loss carry forwards of approximately $217,762 (2010 – $117,079) to reduce future federal and state taxable income. These losses expire by 2031.

Net operating losses incurred prior to May 6, 2002 are subject to an annual limitation due to the ownership change (as defined under Section 382 of the Internal Revenue Code of 1986) which resulted in a change in business direction. Unused annual limitations may be carried over to future years until the net operating losses expire. Utilization of net operating losses may also be limited in any one year by alternative minimum tax rules.

The Company is not currently subject to any income tax examinations by any tax authority. Should a tax examination be opened, management does not anticipate any tax adjustments, if accepted, that would result in a material change to its financial position.

NOTE 8 – SUBSEQUENT EVENT

On March 12, 2012, the Company entered into a license agreement with Teak Shield Corp. and its owners Robert and Marion Diefendorf (jointly the “Licensors”) whereby the Company has acquired a license to market and sell Teak Shield Corp.’s licensed products, and in exchange, the Company provides consideration to Licensors of a 5% royalty on all sales with a minimum $100,000 annual royalty payment, and agree to issue to the Licensors 5 million shares of the Company’s common stock.

In addition, for a onetime payment of $250,000, the Company will acquire the option to purchase, for a two year period, 100% of the Licensor’s ownership and interest in its proprietary rights and assets including all licensed products, manufacturing, patents, intellectual property, technology, contracts, trademarks, and goodwill. To complete the purchase the Company must pay to Licensors and additional $2,750,000.

RDGXBRLParseEnd

PART III

Item 15. Exhibits, Financial Statements Schedules.

|

1.

|

Financial Statements

|

Financial statements of GlobeTrac Inc. have been included in Item 8 above.

|

2.

|

Financial Statement Schedules

|

All schedules for which provision is made in Regulation S-X are either not required to be included herein under the related instructions or are inapplicable or the related information is included in the footnotes to the applicable financial statement and, therefore, have been omitted from this Item 15.

|

3.

|

Exhibits

|

All Exhibits required to be filed with the Form 10-K are included in this annual report or incorporated by reference to GlobeTrac’s previous filings with the SEC, which can be found in their entirety at the SEC website at www.sec.gov under SEC File Number 000-33309 and SEC File Number333-66590.

|

Exhibit

|

Description

|

Status

|

|

3.1

|

Articles of Incorporation filed as an exhibit to GlobeTrac’s registration statement on Form SB-2 filed on August 2, 2001, and incorporated herein by reference.

|

Filed

|

|

3.2

|

Bylaws filed as an exhibit to GlobeTrac’s registration statement on Form SB-2 filed on August 2, 2001, and incorporated herein by reference.

|

Filed

|

|

3.3

|

Certificate of Amendment to Articles of Incorporation changing the Issuer’s name to GlobeTrac Inc. filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 15, 2003, and incorporated herein by reference.

|

Filed

|

|

3.4

|

Notification of Dissolution for Globetrac Limited dated March 14, 2007 filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 16, 2007, and incorporated herein by reference.

|

Filed

|

|

10.1

|

Master Distributorship Agreement dated June 19, 2002 among WebTech Wireless International, WebTech Wireless Inc. and Global Axxess Corporation Limited filed as an attached exhibit to GlobeTrac’s Form 8-K (Current Report) filed on September 11, 2002, and incorporated herein by reference.

|

Filed

|

|

10.2

|

Loan Agreement dated November 27, 2002 between GlobeTrac Inc. and David Patriquin with attached promissory note dated November 27, 2002, filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 15, 2003, and incorporated herein by reference.

|

Filed

|

|

10.3

|

Amendment Letter Agreement dated June 4, 2003, between WebTech Wireless International Inc. and Globetrac Limited for the purpose of amending terms of the Master Distributorship Agreement filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 7, 2004, and incorporated herein by reference.

|

Filed

|

|

10.4

|

Amendment Letter Agreement dated March 8, 2004 between WebTech Wireless International Inc. and Globetrac Limited for the purpose of amending terms of the Master Distributorship Agreement filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 7, 2004, and incorporated herein by reference.

|

Filed

|

|

10.5

|

Letter Agreement dated November 26, 2004, among Global Axxess Corporation Limited, WebTech Wireless International and WebTech Wireless Inc. filed as an exhibit to GlobeTrac’s Form 8-K filed on December 22, 2004, and incorporated herein by reference.

|

Filed

|

|

10.6

|

Termination and Transfer Agreement dated for reference November 1, 2004, among Global Axxess Corporation Limited, WebTech Wireless International and WebTech Wireless Inc. filed as an exhibit to GlobeTrac’s Form 8-K filed on November 14, 2005, and incorporated herein by reference.

|

Filed

|

|

10.7

|

Letter Agreement dated June 9, 2011, among GlobeTrac Inc., Angelo Scola, and Thermoforte Green, LLC. filed as an exhibit to GlobeTrac’s Form 8-K filed on June 10, 2011, and incorporated herein by reference

|

Filed

|

|

10.8

|

Letter Agreement dated September 26, 2011, among GlobeTrac Inc., David Bernard, and Michael Avatar filed as an exhibit to GlobeTrac’s Form 8-K filed on September 30, 2011, and incorporated herein by reference

|

Filed

|

|

10.10

|

License agreement with an option to purchase with Teak Shield Corp. and its owners Robert and Marion Diefendorf, titled Technology License Agreement with Option to Purchase

|

Filed

|

|

14

|

Code of Ethics filed as an exhibit to GlobeTrac’s Form 10-KSB filed on April 15, 2003, and incorporated herein by reference.

|

Filed

|

|

31

|

Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

Included

|

|

32

|

Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

Included

|

|

101.INS**

|

XBRL Instance filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

|

101.SCH**

|

XBRL Taxonomy Extension Schema. Filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

|

101.CAL**

|

XBRL Taxonomy Extension Calculation Linkbase. Filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

|

101.DEF**

|

XBRL Taxonomy Extension Definition Linkbase. Filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

|

101.LAB**

|

XBRL Taxonomy Extension Label Linkbase. Filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

|

101.PRE**

|

XBRL Taxonomy Extension Presentation Linkbase. Filed as an exhibit to Globetrac’s Form 10-K filed on March 30, 2012 and incorporated herein by reference.

|

Filed

|

**XBRL Information is furnished and not filed or a part of a registration statement or prospectus for purposes of sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

POLY SHIELD TECHNOLOGIES INC.

|

|||

|

Date:

|

September 10, 2012 |

By:

|

/s/ Mitchell R. Miller |

|

MITCHELL R. MILLER

|

|||

|

Chief Executive Officer and President

|

|||

|

(Principal Executive Officer)

|

|||

|

Date:

|

September 10, 2012 |

By:

|

/s/ John da Costa |

|

JOHN DA COSTA

|

|||

|

Chief Financial Officer, Secretary and Treasurer

|

|||

|

(Principal Financial Officer)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Date:

|

September 10, 2012 |

By:

|

/s/ Mitchell R. Miller |

|

MITCHELL R. MILLER

|

|||

|

Chief Executive Officer and President

|

|||

|

Director

|

|||

|

Date:

|

September 10, 2012 |

By:

|

/s/ John da Costa |

|

JOHN DA COSTA

|

|||

|

Chief Financial Officer, Secretary and Treasurer

|

|||

|

Director

|