Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PRUDENTIAL FINANCIAL INC | d405277d8k.htm |

September 12, 2012

September 12, 2012

Prudential Financial, Inc.

2012 Tokyo Investor Day

Exhibit 99.1 |

Eric

Durant Eric Durant

Senior Vice President

Senior Vice President

Investor Relations

Investor Relations

Prudential Financial, Inc.

Prudential Financial, Inc.

2012 Tokyo Investor Day |

Forward-Looking Statements

3

Tokyo Investor Day 9.12.2012

Certain of the statements included in this presentation constitute forward-looking statements

within the meaning of the U. S. Private Securities Litigation Reform Act of 1995. Words such as

“expects,” “believes,” “anticipates,” “includes,” “plans,” “assumes,” “estimates,” “projects,” “intends,”

“should,” “will,” “shall,” or variations of such words are generally

part of forward-looking statements. Forward-looking statements are made based on

management’s current expectations and beliefs concerning future developments and their potential

effects upon Prudential Financial, Inc. and its subsidiaries. There can be no assurance

that future developments affecting Prudential Financial, Inc. and its subsidiaries will be those anticipated

by management. These forward-looking statements are not a guarantee of future performance and

involve risks and uncertainties, and there are certain important factors that could cause

actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking

statements, including, among others: (1) general economic, market and political conditions,

including the performance and fluctuations of fixed income, equity, real estate and other

financial markets; (2) the availability and cost of additional debt or equity capital or external financing for our

operations; (3) interest rate fluctuations or prolonged periods of low interest rates; (4) the degree

to which we choose not to hedge risks, or the potential ineffectiveness or insufficiency of

hedging or risk management strategies we do implement, with regard to variable annuity or other product

guarantees; (5) any inability to access our credit facilities; (6) reestimates of our reserves for

future policy benefits and claims; (7) differences between actual experience regarding

mortality, morbidity, persistency, surrender experience, interest rates or market returns and the assumptions

we use in pricing our products, establishing liabilities and reserves or for other purposes; (8)

changes in our assumptions related to deferred policy acquisition costs, value of business

acquired or goodwill; (9) changes in assumptions for retirement expense; (10) changes in our financial strength

or credit ratings; (11) statutory reserve requirements associated with term and universal life

insurance policies under Regulation XXX and Guideline AXXX; (12) investment losses, defaults

and counterparty non-performance; (13) competition in our product lines and for personnel; (14) difficulties in

marketing and distributing products through current or future distribution channels; (15) changes in

tax law; (16) economic, political, currency and other risks relating to our international

operations; (17) fluctuations in foreign currency exchange rates and foreign securities markets; (18) regulatory

or legislative changes, including the Dodd-Frank Wall Street Reform and Consumer Protection Act;

(19) inability to protect our intellectual property rights or claims of infringement of the

intellectual property rights of others; (20) adverse determinations in litigation or regulatory matters and our

exposure to contingent liabilities, including in connection with our divestiture or winding down of

businesses; (21) domestic or international military actions, natural or man-made disasters

including terrorist activities or pandemic disease, or other events resulting in catastrophic loss of life;

(22) ineffectiveness of risk management policies and procedures in identifying, monitoring and

managing risks; (23) effects of acquisitions, divestitures and restructurings, including

possible difficulties in integrating and realizing the projected results of acquisitions, including risks

associated with the acquisition of certain insurance operations in Japan; (24) interruption in

telecommunication, information technology or other operational systems or failure to maintain

the security, confidentiality or privacy of sensitive data on such systems; (25) changes in statutory or U.S.

GAAP accounting principles, practices or policies; (26) Prudential Financial, Inc.’s primary

reliance, as a holding company, on dividends or distributions from its subsidiaries to meet

debt payment obligations and the ability of the subsidiaries to pay such dividends or distributions in light of

our ratings objectives and/or applicable regulatory restrictions; and (27) risks due to the lack of

legal separation between our Financial Services Businesses and our Closed Block Business.

Prudential Financial, Inc. does not intend, and is under no obligation, to update any particular forward-

looking statement included in this presentation.

Prudential Financial, Inc. of the United States is not affiliated with Prudential

PLC which is headquartered in the United Kingdom. |

Non–GAAP Measures

4

Tokyo Investor Day 9.12.2012

The information referred to above and on the prior page, as well as the risks of our businesses

described in our Forms 10-K and 10-Q, should be considered by readers when reviewing

forward-looking statements contained in this presentation.

This presentation includes references to “adjusted operating income.” Adjusted operating

income is a non-GAAP measure of performance of our Financial Services Businesses.

Adjusted operating income excludes “Realized investment gains (losses), net,” as adjusted, and related charges and adjustments. A

significant element of realized investment gains and losses are impairments and credit-related and

interest rate-related gains and losses. Impairments and losses from sales of

credit-impaired securities, the timing of which depends largely on market credit cycles, can vary considerably across periods. The timing

of other sales that would result in gains or losses, such as interest rate-related gains or

losses, is largely subject to our discretion and influenced by market opportunities as well as

our tax and capital profile.

Realized investment gains (losses) within certain of our businesses for which such gains (losses) are

a principal source of earnings, and those associated with terminating hedges of foreign

currency earnings and current period yield adjustments are included in adjusted operating income. Adjusted operating

income excludes realized investment gains and losses from products that contain embedded derivatives,

and from associated derivative portfolios that are part of a hedging program related to the

risk of those products. Adjusted operating income also excludes gains and losses from changes in value of certain

assets and liabilities relating to foreign currency exchange movements that have been economically

hedged or considered part of our capital funding strategies for our international subsidiaries,

as well as gains and losses on certain investments that are classified as other trading account assets.

Adjusted operating income also excludes investment gains and losses on trading account assets

supporting insurance liabilities and changes in experience- rated contractholder liabilities

due to asset value changes, because these recorded changes in asset and liability values are expected to ultimately accrue to

contractholders. Trends in the underlying profitability of our businesses can be more clearly

identified without the fluctuating effects of these transactions. In addition, adjusted

operating income excludes the results of divested businesses, which are not relevant to our ongoing operations. Discontinued operations,

which is presented as a separate component of net income under GAAP, is also excluded from adjusted

operating income.

We believe that the presentation of adjusted operating income as we measure it for management purposes

enhances understanding of the results of operations of the Financial Services Businesses by

highlighting the results from ongoing operations and the underlying profitability of our businesses.

However, adjusted operating income is not a substitute for income determined in accordance with GAAP,

and the adjustments made to derive adjusted operating income are important to an understanding

of our overall results of operations.

For additional information about adjusted operating income and the comparable GAAP measure, including

reconciliation between the two, please refer to our Form 8-K filed on April 26, 2012, which

provides supplementary financial information for historical periods reflecting the retrospective adoption of revised U.S.

GAAP accounting standards related to deferred policy acquisition costs, as well as our Forms 10-K

and 10-Q, located on the Investor Relations website at

www.investor.prudential.com. Additional historical

information relating to the Company’s financial performance is also located on the Investor Relations

website. |

Edward P. Baird

Edward P. Baird

Executive Vice President

Executive Vice President

Chief Operating Officer, International Businesses

Chief Operating Officer, International Businesses

Prudential Financial, Inc.

Prudential Financial, Inc.

2012 Tokyo Investor Day |

Our

Historical Strategy and Business Model…

…Is the Foundation for Our

Evolving Strategy

•

Concentrate on a limited number of

attractive countries

•

Target the affluent and mass-

affluent consumer

•

Needs-based selling

•

Proprietary distribution based on

selective recruiting, professional

training, performance-based

variable compensation

•

Historical focus on death

protection insurance

•

Concentrate on a limited number of

attractive countries

•

Expand the breadth and depth of our

capabilities in those countries

-

Target middle to mass-affluent

consumer and small/medium

business market

-

Diversify distribution and products to

meet additional customer needs

•

Maintain our proven discipline,

quality, and execution in all markets,

channels, products, and customer

relationships

Prudential’s International Strategy

6

Tokyo Investor Day 9.12.2012 |

Multiple Distribution Channels

Life

Planners

•

Full time college educated professionals

•

Highly selective recruiting

•

Needs-based selling

•

Emphasis on death protection and retirement products

•

Access to business/professional market

Life

Consultants

(1)

•

Life Planner concepts adapted to broad middle market

•

Key association relationship offers unique access to education market

Bank

Channel

•

Growth driven by distribution expertise

•

Emphasis on death protection products

•

Benefits of strong brand and reputation

Independent

Agencies

•

Broadens geographical coverage

•

Enhances access to attractive markets including small businesses

7

Tokyo Investor Day 9.12.2012

1)

Formal name is “Life Plan Consultants”.

|

Solid

Business Model Building on a Sustained Track Record of Success

•

High ROE, strong AOI growth, low volatility

•

Returns and earnings primarily driven by stable mortality and

expense margins

•

Competitive advantages in distribution, coupled with financial strength

and reputation, driving growth across multiple channels

•

Strong growth prospects enhanced by product portfolio serving lifetime

financial security needs

•

Superior return prospects maintained as growth strategy has broadened

•

Leading position in attractive Japanese market

8

Tokyo Investor Day 9.12.2012 |

Mitsuo Kurashige

Mitsuo Kurashige

Chief Executive Officer

Chief Executive Officer

Japan Life Insurance Operations

Japan Life Insurance Operations

Japanese Insurance Operations |

Investable

Asset Pool

Market Size

Household

Wealth

Retirement

Market

Product

Trend

Distribution

Trend

Japan: Substantial Growth Opportunities

in an Attractive Market

1)

Source: Swiss Re -

World Insurance in 2011, based on 2011 life insurance premiums.

2)

Based on December 31, 2011 data; Sources: Federal Reserve, Bank of Japan, U.S.

Census Bureau, Oanda. •

World’s second largest life insurance market:

Life premiums $525 billion

(1)

•

Household sector wealth $19.3 trillion, similar to

U.S. on per-capita basis

(2)

•

$10.9 trillion household pool of currency and deposits

is world’s largest, ~50% higher than U.S.

(2)

•

Expanding retirement market driven by aging population, increased

emphasis on individual responsibility for financial security

•

Customers prefer insurance products to equities, for savings

and investments

•

Growing distribution opportunities include banks and

independent distributors

10

Tokyo Investor Day 9.12.2012 |

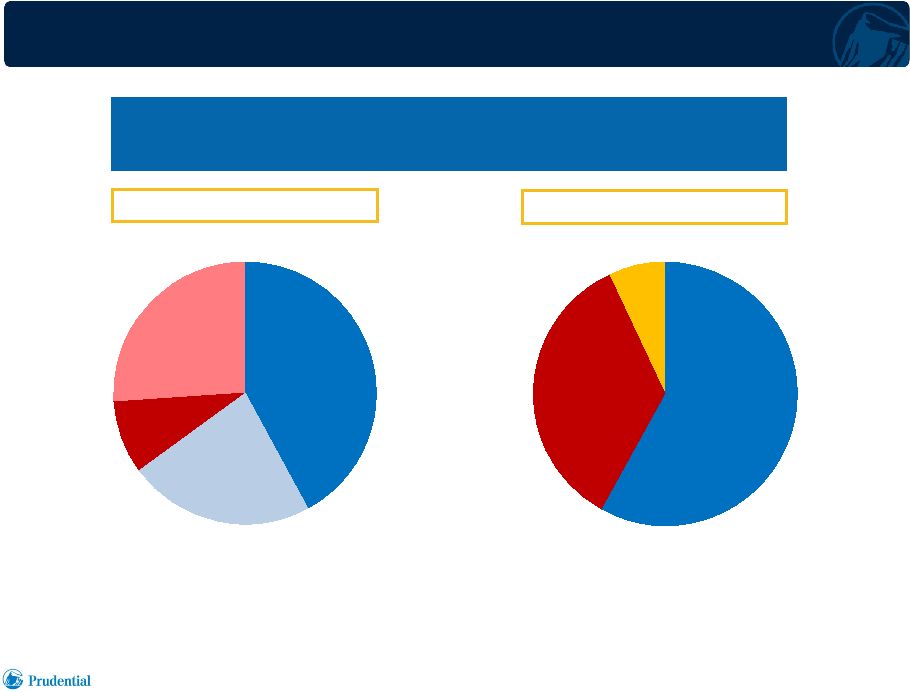

Household Sector Financial Assets –

Japan and the United States

Financial Assets of the Household Sector

Financial Assets of the Household Sector

Japan

$19.3 Trillion

United States

$49.1 Trillion

Source: Bank of Japan (data as of December 31, 2011).

Japan data translated to U.S. dollars at Japanese yen 77 per U.S. dollar (FX rate

as of December 31, 2011). 11

Tokyo Investor Day 9.12.2012

Currency and

Deposits

57%

Bonds

2%

Investments

Trusts

3%

Equities

6%

Insurance

and Pension

Reserves

28%

Other

4%

Currency and

Deposits

14%

Bonds

10%

Investment

Trusts

12%

Equities

31%

Insurance

and Pension

Reserves

29%

Other

4% |

Prudential’s Japanese Insurance Operations

•

Key driver of sustained growth and solid returns for Prudential

International Insurance

•

Market leadership position strengthened by Star / Edison acquisition

and integration

•

Expanding, complementary distribution channels

•

Broad product portfolio meets lifetime financial security needs

•

Consistently strong business drivers

•

Well capitalized companies recognized as financially strong insurers

•

Conservatively managed investment portfolio based on sound asset-

liability management

•

Maintaining our proven discipline, quality and execution in all markets,

channels, products and customer relationships

12

Tokyo Investor Day 9.12.2012 |

Diversified Distribution

Serving the Japanese Market

•

Mid-affluent to

affluent consumers

•

Business and

professional market

Tokyo Investor Day 9.12.2012

13

•

Mass middle market

•

Association relationships

•

Bank clients with investable

wealth, under-served

protection needs

•

Business and

professional market

Life

Consultants

(1)

Bank

Channel

1)

Formal name is “Life Plan Consultants”.

Life Planners

Independent

Agencies |

Star

/ Edison Acquisition Impact on Prudential’s Presence in Japan

Tokyo Investor Day 9.12.2012

14

New Business Face Amount

New Business Face Amount

(1)

(1)

:

:

Share Improvement of 3.1 Percentage Points

Share Improvement of 3.1 Percentage Points

4 Years Ago

FY2007

Market

Share

FY2011

Market

Share

1. Dai-ichi

13.3%

1. Nippon

12.6%

2. Sumitomo

11.1%

2. Dai-ichi

11.1%

3. Nippon

9.7%

3. Prudential

10.4%

4. T&D Financial

9.3%

4. T&D Financial

9.5%

5. AIG Group

7.8%

5. Meiji-Yasuda

8.3%

6. Prudential

7.3%

6. Sony

6.3%

7. Meiji-Yasuda

6.7%

7. Sumitomo

6.1%

8. Sony

5.7%

8. MetLife Alico

5.6%

9. Millea

3.9%

9. MS & AD Group

5.3%

10. Fukoku

3.5%

10. NKSJ

4.5%

1)

Industry data from Life Insurance Association of Japan. Data shown are based on companies’

Japanese statutory results for the fiscal years ended March 31, 2012 and March 31, 2008. New

business amounts are individual life and annuity contracts including net increase by conversion. Excludes Kampo Life (Japanese

post office). Prudential’s share for the fiscal year ended March 31, 2012 includes Star / Edison,

which contributed 2.3% of share when last reported separately, for the nine months ended

December 31, 2011. |

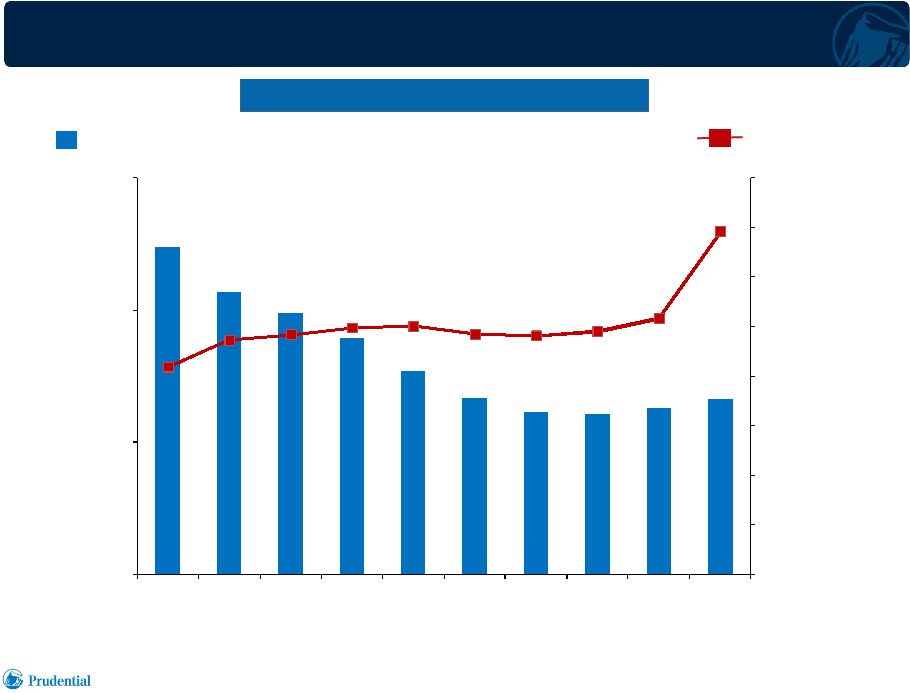

124,009

106,581

98,723

89,375

76,983

66,670

61,303

60,822

63,155

66,576

4,197

4,732

4,848

4,984

5,018

4,861

4,826

4,917

5,170

6,935

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

0

50,000

100,000

150,000

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

Prudential New Business in Japan

Steady Growth while Industry Total has been Decreasing

New Business Face Amount

New Business Face Amount

(In Billion Yen)

Tokyo Investor Day 9.12.2012

15

Industry

Prudential Japanese

Insurance operations

Industry data from “Statistics of Life Insurance Business” and data posted in each

insurer’s homepage, for fiscal year ended March 31. Excluding Kampo Life (Japanese

post office). |

Ranking in the Life Insurance Industry in Japan

Metric

(1)

# Rank

Market Share

New business face amount

3

10.4%

New business annualized premiums

3

9.2%

In-force face amount

5

6.8%

Premium income

5

7.1%

Total assets

6

4.9%

16

1)

Data from financial statements posted in each insurer’s homepage. For fiscal

year ended March 31, 2012. Excluding Kampo Life (Japanese post office).

Tokyo Investor Day 9.12.2012 |

Japan

Insurance Market Overview •

Industry Trends

–

Insurer quality drives market positioning

•

Greater consumer focus on insurer’s financial strength following

market meltdown

•

Regulators strengthening solvency standards for insurance companies

•

Retrenchment of weakened competitors

–

Growing demand for retirement and savings products; continuing

demand for A&H products

–

Strengthening yen increasing appeal of foreign currency

denominated products

Tokyo Investor Day 9.12.2012

17 |

Japan

Insurance Market Overview •

Recent Developments

–

Earthquake / Tsunami disaster reinforced perceived need for

death protection

–

Pending reduction in assumed interest rate for standard valuation reserves

on new business (1.5% to 1.0%)

–

Opportunity to shift from saving-type products to protection-based

products –

Cancer products tax changes

•

Prudential’s Response

–

Pioneer in protection product distribution: focus on needs-based selling

provides sustained competitive advantage

–

Expansion of markets for retirement, inheritance and business succession

–

Distribution adapting to evolving customer demographics and lifestyles

Tokyo Investor Day 9.12.2012

18 |

Prudential’s Positioning in Japan:

Life Planners

•

Life Planner Distribution

–

Life Planner –

a selective, high quality sales force

•

Hire about 3 out of 100 candidates

•

Well trained and professional

•

Customer focused

•

Disciplined, and demonstrate “missionary zeal”

–

Emphasize protection products requiring analysis of client needs

–

Significant sales to small business/executive/professional market

–

Exceptional sales productivity and persistency

Tokyo Investor Day 9.12.2012

19 |

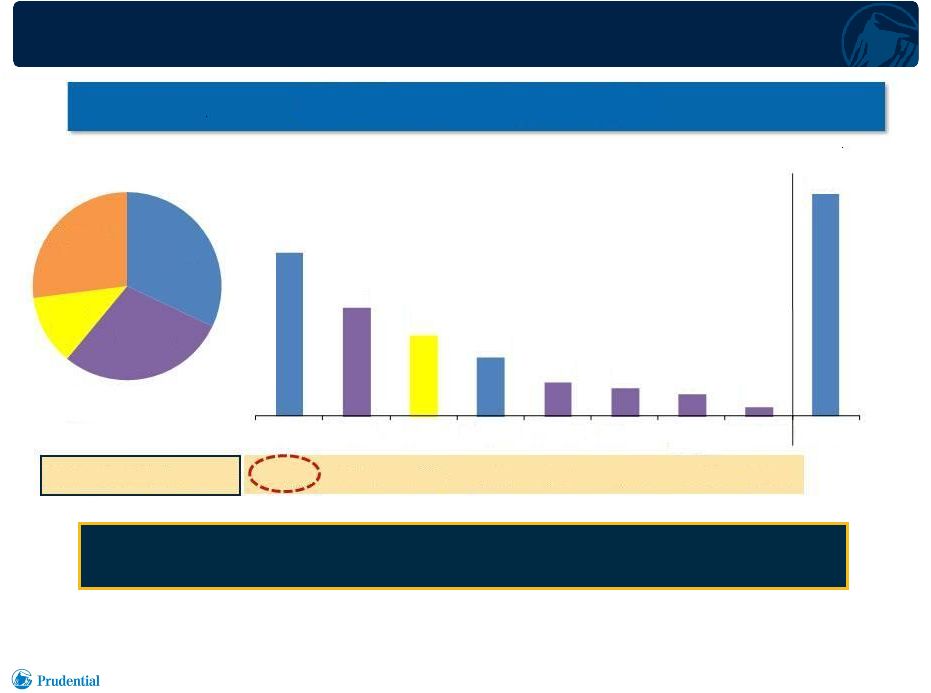

Prudential’s Positioning in Japan:

Life Planners

POJ holds the #1 position for 15 consecutive years

POJ holds the #1 position for 15 consecutive years

of highest number of MDRT members

of highest number of MDRT members

(3)

Tokyo Investor Day 9.12.2012

20

811

537

400

291

165

139

107

41

1,102

POJ

Sony

Alico

Gibraltar

Dai

-

ichi

Nippon

Meiji

Yasuda

Sumitomo

Pru Japan

PRU

32%

Sony +

Big 4

29%

Alico

12%

All Other

27%

Japan’s Total MDRT

Members: 3,409

(2)

MDRT % within Company

25.6%

11.7%

8.0%

2.4%

0.4%

0.3%

0.4%

0.2%

MDRT

MDRT

Japan

Japan

Membership

Membership

(1)

(1)

1)

Source: Million Dollar Round Table Association, Japan - membership data for all 43 individual

companies as of March 31, 2012.

2)

(Domestic) Big 4: Dai-ichi, Nippon, Meiji Yasuda and Sumitomo.

3)

Pru Japan: POJ and Gibraltar. |

Prudential’s Positioning in Japan:

Life Consultants

•

Broad market coverage reaching

substantially all prefectures, with access

to nearly all of Japanese population

•

Prudential training supports emphasis on death

protection products and needs-based selling

•

Teachers Association and other affinity group

relationships provide recurring sources of

new business, relatively unaffected by

economic trends

•

Serving expanding need for retirement

income security products

•

Popularity of U.S. dollar and other non-yen

denominated products bolstered by yen

strengthening, low local interest rates

Tokyo Investor Day 9.12.2012

21

86 branch offices

supporting Life Consultants

Tokyo area

Osaka area |

Prudential’s Positioning in Japan:

Bancassurance

Tokyo Investor Day 9.12.2012

22

•

Increased our presence in the Japan Bancassurance market by expanding our

successful model to mega and regional banks; reaching 100+ distributors,

including banks and bank-affiliated insurance agencies

•

Competitive protection product portfolio meets life insurance needs of bank

customer base

•

Diversified product suite supports bank partners’

objectives to serve customers

•

Prudential-trained

former

Life

Planners

“seconded”

to

selected

distributors

bring

expertise in protection product sales by education and training support

•

Prudential/Gibraltar brands appeal to security-focused customers; especially

attractive to “large ticket”

customers |

Prudential’s Positioning in Japan:

Independent Agency

Tokyo Investor Day 9.12.2012

23

•

Commenced distribution of selected products in 2010; contributed

$435 million

(1)

to annualized new business premiums for 2011 including

$298 million from Star / Edison distribution

•

Star / Edison acquisition substantially expanded independent

agency channel; 3,434 independent agency relationships as of

June 30, 2012

•

Broadens geographical coverage, enhances access to attractive markets

including small businesses

1)

Foreign denominated actively translated to U.S. dollars at uniform exchange rates;

Japanese yen 85 per U.S. dollar. |

Japan

– Track Record of Success

Tokyo Investor Day 9.12.2012

24

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates

for all periods presented; Japanese yen 85 per U.S. dollar. Annualized New

Business Premiums Annualized New Business Premiums

(1)

(1)

($ millions)

+31%

+70%

+39%

$1,224

$1,600

$2,724

$1,276

$1,775

2009

2010

2011

2Q11

YTD

2Q12

YTD |

Japan

– Track Record of Success

Tokyo Investor Day 9.12.2012

25

Pre-Tax

Pre-Tax

Adjusted

Adjusted

Operating

Operating

Income

Income

(1)

(1)

($ millions)

$1,497

$1,724

$2,321

$1,117

$1,262

2009

2010

2011

2Q11

YTD

2Q12

YTD

+13%

+35%

+15%

1)

Excludes corporate management and development expenses incurred in the U.S. related to Japanese

Insurance operations other than Gibraltar Life. Excludes International Investments businesses

previously included in the International Investments segment and currently included within “Gibraltar

Life and Other Operations” for financial reporting purposes, with pre-tax adjusted operating

income of $25 million, $28 million and $120 million in 2009 , 2010 and 2011, respectively, and

$19 million and $12 million for the six months ended June 30, 2011 and 2012, respectively. Excludes

transaction and integration costs relating to the Star / Edison acquisition of $213 million in 2011,

and $76 million and $95 million for the six months ended June 30, 2011 and 2012, respectively. |

John

Hanrahan John Hanrahan

President and Chief Executive Officer

President and Chief Executive Officer

Prudential of Japan

Prudential of Japan

Prudential of Japan |

Life

Planner Business Model: Sustainable Competitive Advantage

“Beneficial cycle”

Recruiting, developing and

retaining high quality people

Strong sales and high

persistency drive steady growth

Strong profitability

Sustained superior returns

Growing market for Prudential’s

value proposition

27

Tokyo Investor Day 9.12.2012

Hire about 3 out of 100

Hire about 3 out of 100

candidates

candidates

Well trained career professionals

Well trained career professionals

Customer focused

Customer focused

“Missionary zeal”

“Missionary zeal”

Death protection

Death protection

Retirement security

Retirement security

Business market benefits

Business market benefits

Life Planners: A selective,

Life Planners: A selective,

high quality sales force

high quality sales force

Expanding

Expanding

market

market

opportunities

opportunities

serving financial security needs

serving financial security needs

over a lifetime

over a lifetime |

Life

Planner Model – Beneficial Cycle

Tokyo Investor Day 9.12.2012

28

High Life Planner Productivity

6.9 policies/LP/Month

(1)

High Policy Persistency

High Policy Persistency

(2)

(2)

13 month 95.0%

25 month 89.2%

Prudential of Japan

Prudential of Japan

Strategy

Strategy

•

Needs-based selling

•

Primarily death

protection products

•

Upscale/small

business/professional market

1)

For the year ended December 31, 2011; includes medical and cancer policies.

2)

As of June 30, 2012.

Quality

Referrals

High Life Planner Retention

High Life Planner Retention

(2)

(2)

12 month 82.4%

24 month 62.4%

High

Customer

Satisfaction

High

Life

Planner

Income |

Quality Focused Distribution

Tokyo Investor Day 9.12.2012

29

1)

As of June 30, 2012.

2)

Source: Million Dollar Roundtable Association, Japan, as of March 31, 2012.

3)

As of or for the year ended December 31, 2011. Agent productivity is the average

number of new policies sold per agent, per month; includes medical and cancer

policies. Average premium based on average annualized premium per new policy;

includes medical and cancer policies. Agent retention based on 12-month

period. Policy persistency based on face amount and 13-month period. 3,116

POJ Life Planners 3,116 POJ Life Planners

(1)

(1)

Industry-Leading MDRT

Qualifications

811 POJ MDRT members –

#1 position in Japanese industry

for 15 consecutive years

(2)

25.6% of POJ Life Planners

are MDRT members –

Highest percentage in industry

(2)

Exceptionally Strong

Exceptionally Strong

Key Drivers

Key Drivers

(3)

(3)

POJ

POJ

Life Planners

Life Planners

Agent Productivity

6.9

Average Premium

$3,600

Agent Retention

81%

Policy Persistency

95% |

Business Model Built with Discipline

Tokyo Investor Day 9.12.2012

30

1)

As of fiscal year-end for indicated years (March 31 of subsequent year); direct

business only; includes annuities. Policies In-Force

Policies In-Force

(1)

(1)

2011

0

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010 |

Strong Sales Growth

Tokyo Investor Day 9.12.2012

31

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates;

Japanese yen 85 per U.S. dollar. ($ millions)

POJ Annualized New Business Premiums

POJ Annualized New Business Premiums

(1)

(1)

2009

2010

2011

2Q11

YTD

2Q12

YTD

$612

$703

$781

$389

$601

$-

$100

$200

$300

$400

$500

$600

$700

$800

$900 |

0

50

100

150

200

250

300

350

400

0

100

200

300

400

500

600

Increasing Protection Opportunity

(1)

Tokyo Investor Day 9.12.2012

32

Population

126 million

1998

2011

Life Insurance

Agents (000)

354,000

241,000

530

357

Population per Agent

Number of Life Insurance Agents in Japan

Population

128 million

Population

per Agent

1)

Population data as of October 1 of each year, according to Japanese Ministry of Internal Affairs and

Communications (Somusho), Bureau of Statistics. Life Insurance agent data as of March 31 of

each year, according to Life Insurance Association of Japan. |

Tokyo Investor Day 9.12.2012

33

Future Retirement Sales Opportunity

Insured

Clients

(1)

Lifetime Client Relationships Provide

Significant Opportunity for Retirement Oriented Sales

Age Group

1)

As of August 2012.

0

150,000

300,000

450,000

Under 20

20-29

30-39

40-49

50-59

60+

Primary

Client Focus

Death Protection

Retirement Income Security |

41

43

44

48

55

3

4

4

4

5

57

58

68

69

84

1

3

7

6

2007

2008

2009

2010

2011

Annuity

Retirement

Accident & Health

Death Protection

Lifetime Relationships and Innovative Products

Drive Second Sale Opportunities

Tokyo Investor Day 9.12.2012

34

Prudential of Japan

Prudential of Japan

Second Sales to Existing Customers

Second Sales to Existing Customers

(1)

(1)

Annualized New Business Premiums

($ millions)

1)

Data based on Prudential of Japan; individual market only; foreign denominated

activity translated to U.S. dollars at uniform exchange rates; Japanese yen 85 per

U.S. dollar. |

Life

Planner Model Serving an Expanding Market Tokyo Investor Day 9.12.2012

35

Age

Age

High Net Worth Market

Business Insurance Market

Individual Insurance Market

Sophisticated

Sophisticated

Estate Planning

Estate Planning

Business

Business

Succession

Succession

Family

Family

Distribution

Distribution

of Inheritances

of Inheritances

Nursing,

Nursing,

Medical Care

Medical Care

Employee Benefit

Employee Benefit

Program Funding

Program Funding

Owner

Owner

Death Protection

Death Protection

20s –

40s

50s –

60s

Planning for

post-Retirement |

Product Portfolio Meets Client Needs Over a Lifetime

Tokyo Investor Day 9.12.2012

36

Client Need

Client Need

Product Class

Product Class

Key Features

Key Features

Lower premium

premature death

protection

Term Insurance

•

Death protection for stated period

with level premiums

•

May add third-sector

protection riders

Death protection with

savings feature

Whole Life

•

Death protection

•

Embedded savings fund

•

Guaranteed crediting rate

•

May add third-sector

protection riders

Retirement

accumulation

and income

Retirement

•

Death protection in working years

•

Retirement accumulation fund

•

Policy paid-up at retirement age

•

Annuitization options

•

May add third-sector

protection riders |

Protection-Focused Product Portfolio

Drives Sustainable Returns

Tokyo Investor Day 9.12.2012

37

•

Expense margins

driven by scale,

back-office

efficiencies

•

Margins earned

over in-force

period extended

by superior

persistency

•

Third-sector

riders enhance

overall margins

Product

Product

Drivers of Returns

Drivers of Returns

Term Insurance

•

Serves basic death

protection needs

•

Robust mortality margins on

high average face amounts

•

Potential for add-on and

replacement sales through

client life cycle

Whole Life Insurance

•

Death protection with

savings elements

•

Robust mortality margins on

protection element

•

Potential for investment spread

earnings over policy term

Retirement Products

•

Savings and

protection for

financial security in

mature phase of

life cycle

•

Robust mortality margins on

protection element during

working years

•

Potential for investment spread

earnings over policy term

•

Potential for extended margins

over annuitization period |

Kei

Sato Kei Sato

President and Chief Executive Officer

President and Chief Executive Officer

Gibraltar Life

Gibraltar Life

Gibraltar Life |

Gibraltar Life

Key Business Philosophies

•

Stay focused on death protection products for customers with

needs-based approach

•

Differentiate based on “Three Qualities”

–

Quality People

–

Quality Service

–

Quality Products

•

Maintain “C = C”

principle

–

“Contribution = Compensation”

Tokyo Investor Day 9.12.2012

39

“BIG”

LIFE

Gibraltar

AIG Star

AIG Edison

Life

Legal entity merger, January 2012

Life

Life

GIBRALTAR |

Star

/ Edison Integration on Track “Prudentializing”

sales force

Business integration proceeding on schedule; systems integration

well underway

Integrated product portfolio

Migrated acquired investment portfolio to Prudential standards

Enhanced risk management and internal controls

Tokyo Investor Day 9.12.2012

40

Now expect approximately $450 million total pre-tax integration costs –

down $50 million from original estimate

Incurred about $270 million integration costs through 2Q:12; expect about

$70 million additional in second half of year

Targeting annual cost savings of $250 million, with about 65% realized by

2012, 80% by 2013

Now expect approximately $450 million total pre-tax integration costs –

Now expect approximately $450 million total pre-tax integration costs –

down $50 million from original estimate

down $50 million from original estimate

Incurred about $270 million integration costs through 2Q:12; expect about

Incurred about $270 million integration costs through 2Q:12; expect about

$70 million additional in second half of year

$70 million additional in second half of year

Targeting annual cost savings of $250 million, with about 65% realized by

Targeting annual cost savings of $250 million, with about 65% realized by

2012, 80% by 2013

2012, 80% by 2013 |

Star

/ Edison Integration Distribution

•

Field office consolidation (660 to 461)

•

Transition to Prudential’s

compensation systems

•

New recruiting criteria and training

methods based on Prudential way

•

Allocation of well-trained Star / Edison

agents to increase penetration of key

Teachers market

•

Enhancement of field support functions

•

Reorganization of agency network

focused on productivity:

–

terminated ~700 agencies

in the first half of 2012, bringing

total to 3,434

(2)

•

Field office deployment:

–

office network covering the entire

country (59 offices), but focused on

major cities

•

Implementing selective criteria for

appointment and continuation of agencies

and high standards for wholesalers

Life

Life

Consultant

Consultant

(1)

(1)

Channel

Channel

Independent Agency Channe

Independent Agency Channel

1)

Formal name is “Life Plan Consultant”.

2)

As of June 30, 2012.

Tokyo Investor Day 9.12.2012

41 |

Star

/ Edison Integration Operations

•

Migrated to Prudential risk

management and asset-liability

management standards

•

Integrated product portfolios including

successor to Star’s popular “Shindan

Kakumei”

medical product

•

Enhanced internal control

system to meet Prudential standards

IT & Operations

Others

•

Exit from AIG’s service

•

Completed system integration in key

areas, such as new business, call-

center and accounting, etc.

•

System development to support sales

and insurance administration is

well underway

•

Centralized insurance operations in

two sites -

Tokyo and Nagasaki

Tokyo Investor Day 9.12.2012

42 |

12/31/10

12/31/11

6/30/12

12/31/10

12/31/11

06/30/12

12/31/10

12/31/11

06/30/12

Star / Edison Integration

Impact on Prudential’s Presence in Japan

Number of

Life Consultants

Number of

Policies In-force

(1)

Number of

Independent Agencies

1)

In thousands; direct business only; includes annuities.

12,791

12,031

7,477

3,903

7,417

6,281

4,150

3,434

238

•

Acquisition added 3.5 million in-force policies

•

Enhanced distribution through captive agents and independent agencies

•

Developing selective, high-performing independent agency network

Tokyo Investor Day 9.12.2012

43

Gibraltar

Star/Edison |

“Big”

Gibraltar –

Post Merger

Enhanced Capabilities and Growth Prospects Driven by Business Integration

•

Market reach with continued focus on death protection and retirement

products, bolstered by enhanced Life Consultant force driven by

‘Prudentialized’

compensation and training

•

Expanded resources for further development of Teachers Association

market and other attractive markets such as Self Defense Force

•

Geographically expanded but selective high-performing independent

agency channel

•

Cost effective distribution and operations through business integration

Tokyo Investor Day 9.12.2012

44 |

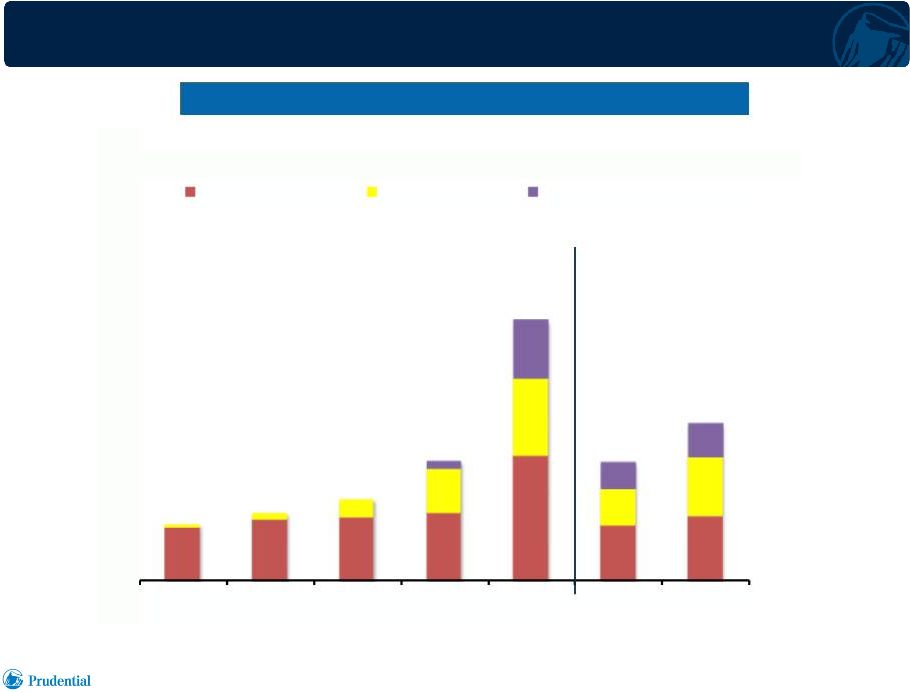

New

Business Acquired by Gibraltar Building Prudential’s Presence in

Japan (in millions)

1)

Foreign

denominated

activity

translated

to

U.S.

dollars

at

uniform

exchange

rates

for

all

periods

presented;

Japanese

yen

85

per

U.S.

dollar.

Star

/

Edison

results included from date of acquisition (February 1, 2011).

Tokyo Investor Day 9.12.2012

45

2007

2008

2009

2010

2011

2Q11 YTD

2Q12 YTD

Life Consultants

Bank Channel

Independent Agency

422

509

612

897

1,943

1,174

887

Annualized New Business Premiums

Annualized New Business Premiums

(1)

(1) |

Life

Consultant Channel Proven Approach in Attractive Teachers Association

Market •

Association relationship provides Gibraltar Life Consultants with

access

to

school

sites

and

teachers’

offices

•

One-on-one sales on site by Life Consultants

•

Specialized training program for Life Consultants working in

education market

•

Co-promotion by Association employees and Life Consultants

•

Marketing approaches adapted to characteristics of 47 local

prefecture Association membership bases

•

Specialized products tailored to Association membership status;

favorable underwriting and persistency support competitive pricing

Tokyo Investor Day 9.12.2012

46 |

•

Teachers market remains a primary stable source of business for

“Big” Gibraltar

•

Approximately one-quarter of Life Consultant channel new business is

derived from this market

New Policy Count

New Policy Count

Acquired in 2Q12 YTD

Acquired in 2Q12 YTD

Life Consultant Channel

Key

Driver

-

Teachers

Market

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates;

Japanese yen 85 per U.S. dollar. Tokyo Investor Day 9.12.2012

47

Annualized New Business Premiums

Annualized New Business Premiums

(1)

(1)

2Q12 YTD

2Q12 YTD

24%

76%

Teachers

Market

Other clients

22%

78% |

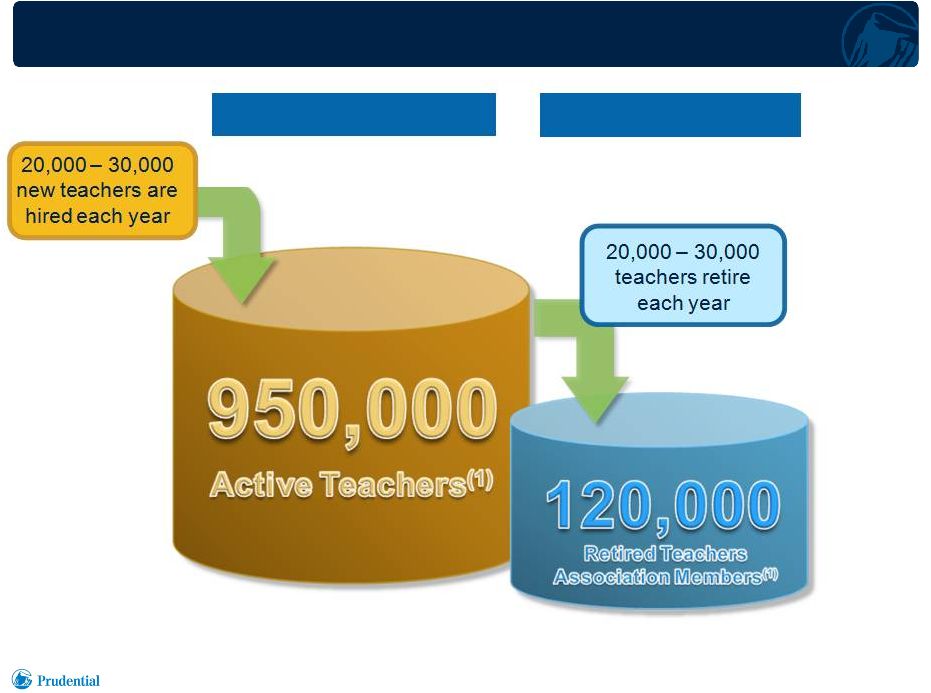

•

Relationship since 1952

•

Approximately 600,000 members

(1)

•

Access to approximately 950,000

teachers and school personnel

through 47 prefectural (local)

associations and 36,000 schools

(1)

Member eligibility:

School teachers and personnel

Approved by:

The Prime Minister of Japan

1)

As of June 30, 2012.

Life Consultant Channel -

Teachers Market

Tokyo Investor Day 9.12.2012

48 |

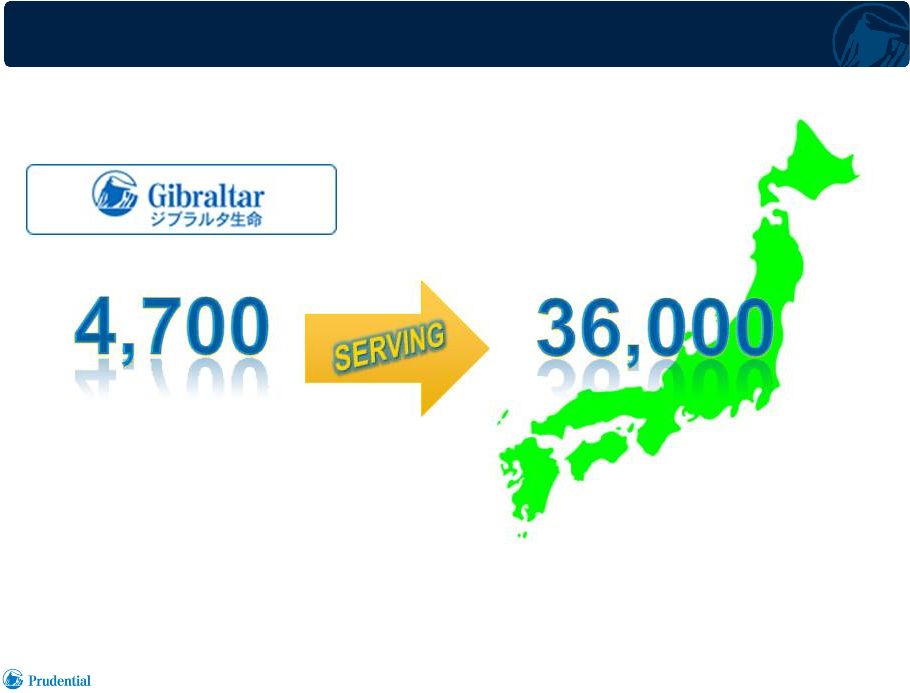

Approximately

Life Consultants

Approximately

Public schools nationwide

1)

Data as of June 30, 2012.

Life Consultant Channel -

Teachers Market

Tokyo Investor Day 9.12.2012

49 |

Teachers

Association:

Perennial

Sales

Opportunities

(1)

1)

Numbers approximate as of June 30, 2012.

Active Market

Active Market

Retiree Market

Retiree Market

Tokyo Investor Day 9.12.2012

50 |

Retirement Sales

– Second Sale Opportunity

1)

Annualized new business premiums; foreign denominated activity translated to U.S. dollars at uniform

exchange rates; Japanese yen 85 per U.S. dollar. Life Consultant Channel -

Teachers Market

Number of Public School Teachers

Tokyo Investor Day 9.12.2012

51

Gibraltar

policyholders among

teachers retiring in

March, 2012

11,541

Retiring teachers who

purchased Gibraltar

policies in 2Q:12

2,717

Total

Premiums: $24 million

(1) |

Independent Agency Channel

A Differentiated Strategy

Key strategies

•

Focus

on

“Quality”

not

just

top-line

growth

•

Price competition is not our key to winning sales

•

Strong partnership with high performing agencies

Key success factors

•

Develop highly-motivated agencies and producers who subscribe to

our business approach

•

Develop and train qualified marketing representatives to work

with agencies

Tokyo Investor Day 9.12.2012

52 |

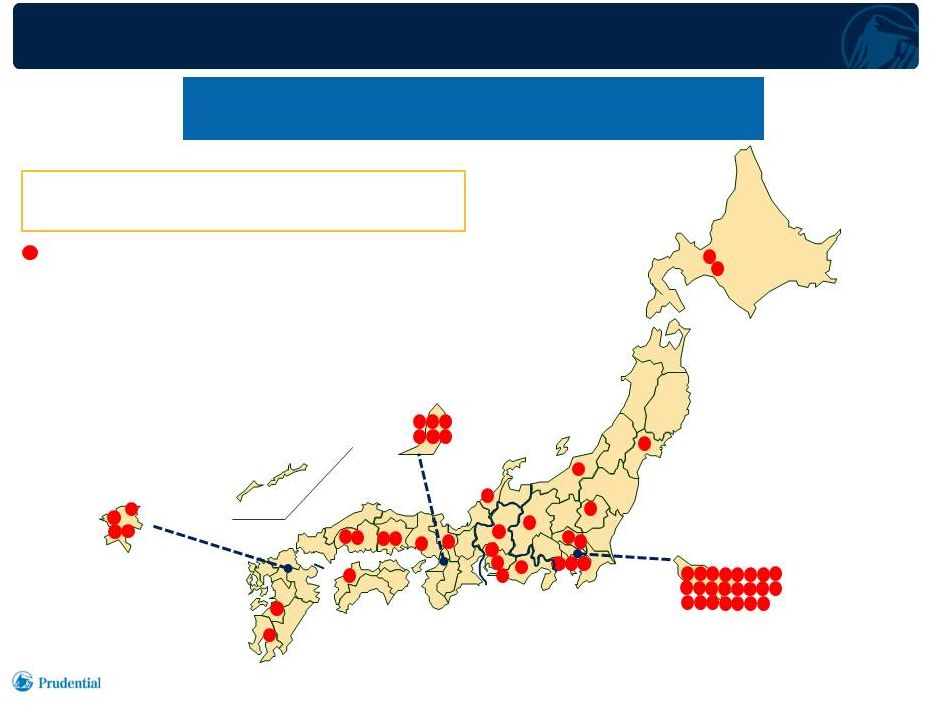

59

field offices Tokyo Investor Day 9.12.2012

53

Tokyo area

Osaka area

Fukuoka area

Over 8,300 independent agency locations

supervised by field offices

Sales offices/marketing representatives

Sales offices/marketing representatives

strategically located near targeted metropolitan area markets

strategically located near targeted metropolitan area markets

Independent Agency Channel

Targeted Market Coverage |

74%

26%

Independent Agency Channel

Market Opportunity

•

The channel focuses on individual market in addition to the business market

–

Complements individual market coverage of Life Consultant channel

–

Serves

customers

who

seek

independent

advice

for

their

purchase

of

insurance

–

Access to solid customer bases through strong clients relationships with

independent agencies

Annualized New Business Premium

Annualized New Business Premium

$255 million

$255 million

(1)

(1)

Tokyo Investor Day 9.12.2012

54

1)

For the six months ended June 30, 2012. Foreign denominated activity translated to

U.S. dollars at uniform exchange rates, Japanese yen 85 per U.S. dollar.

Business Market

Individual Market |

Gibraltar Life

Drivers of Continued Strong Growth and Returns

•

Life Consultant and Independent Agency channels substantially

enhanced by Star / Edison acquisition

•

Business integration synergies being realized as planned

•

Stable and diversified business model; main focus on death

protection products

•

Broad market coverage including powerful, long-standing Teachers

Association relationship

•

Differentiation based on quality people, quality service,

quality products

Tokyo Investor Day 9.12.2012

55 |

Takeshi

Tanigawa

President and Chief Executive Officer

Prudential Gibraltar Financial Life

Bank Channel Distribution |

Typical Bank Channel Approach

in the Japanese Market

Prudential’s Distinctive

Bank Channel Strategy

Bancassurance Powered by Prudential

57

Tokyo Investor Day 9.12.2012

•

Foreign carriers drove high bank

channel sales through aggressive

variable annuity strategies

•

Sales efforts concentrated on

specific products

•

Value propositions dependent on

market performance; sales tied to

market trends

•

Profitability challenges require

significant product feature changes,

sales suspensions

•

Built bancassurance model focused

on protection products following late

2007 deregulation opportunity

•

Leveraged Prudential’s strengths to

establish position as protection

product pioneer

•

Diverse product portfolio and timely

product introductions meet bank

customers’

needs

•

Effective sales support including

expertise of “seconded”

former

Life Planners

•

Established mega-bank distribution

relationships; expanding partnership

with influential regional banks

driven by insurance sales success |

Competitive Advantages Drive

Bank Channel Success

•

Prudential distribution strengths leveraged to bank channel, providing

effective access to world’s largest pool of household wealth held in

currency and deposits

•

Competitive portfolio focused on protection products meets life

insurance needs of bank customer base

•

Life insurance based retirement income products and fixed annuities

attractive to bank customers seeking retirement/investment solutions

•

Prudential / Gibraltar brands appeal to security focused customers;

especially

attractive

to

“large

ticket”

clients

•

Sales support resources and training help drive bank partners’

distribution success

•

Strong growth potential through additional development of

distribution relationships

Tokyo Investor Day 9.12.2012

58 |

Solid

Product Portfolio Backed by Proven Prudential Resources and Support

Tokyo Investor Day 9.12.2012

59

Product Portfolio

Resources and Support

1)

At certain banks.

•

Products tailored to bank client

needs, with main focus on

death protection

•

Product lineup supports sales

by bank partners to individuals,

families, and business market:

–

death protection

–

life insurance based

retirement solutions

–

fixed annuities

•

Sales supported by “seconded”

former Prudential of Japan Life

Planners with strong background

as life insurance professionals

(1)

•

Wholesalers with Prudential

sales skills, product expertise,

and bancassurance experience

serve partner banks

•

Sales training for bank personnel

provides structured knowledge

and skills oriented toward

protection product sales |

Bancassurance Enhances Access to

Substantial Japanese Household Investable Wealth

Japanese household wealth

Japanese household wealth

held

held

in

in

currency

currency

and

and

deposits

deposits

(1)

(1)

$10.9 Trillion

$10.9 Trillion

Prudential policies typically attractive to bank channel

customers with significant investable wealth

•

Whole life

•

U.S. dollar and other non-yen

fixed annuities

•

Retirement income

Average

premium

per

policy

from

bank

channel

sales

(2)

$8,800

1)

Based on December 31, 2011 data; source: Bank of Japan.

2)

For the six months ended June 30, 2012; based on annualized new business premiums;

foreign denominated activity translated to U.S. dollars at uniform exchange

rates; Japanese yen 85 per U.S. dollar. 60

Tokyo Investor Day 9.12.2012 |

Tokyo Investor Day 9.12.2012

61

Offering one of the largest product line-ups in Bancassurance

with emphasis on protection products

Product Lineup

1)

As of June 30, 2012.

2)

Products available in portfolio; sales not significant.

(1)

Currency-

designated-

type

fixed

individual

annuities

Primarily

USD, AUD

Variable

individual

annuities

USD

(2)

Single pay

insurance

SD, EUR,

AUD, Yen

arly restricted

single pay WL

Yen, USD

Whole life

Insurance

Yen, USD

Retirement

insurance

USD

whole life

U

E

death benefit

income

Family

insurance

Yen

Level term

insurance

Yen

Increasing

term

insurance

Yen

Whole Life

cancer

insurance

Yen

Annuity

Whole

Life

Retirement

Term

income

Cancer

Bank Channel Product Suite

Well-diversified Product Lineup Focused on Protection Products |

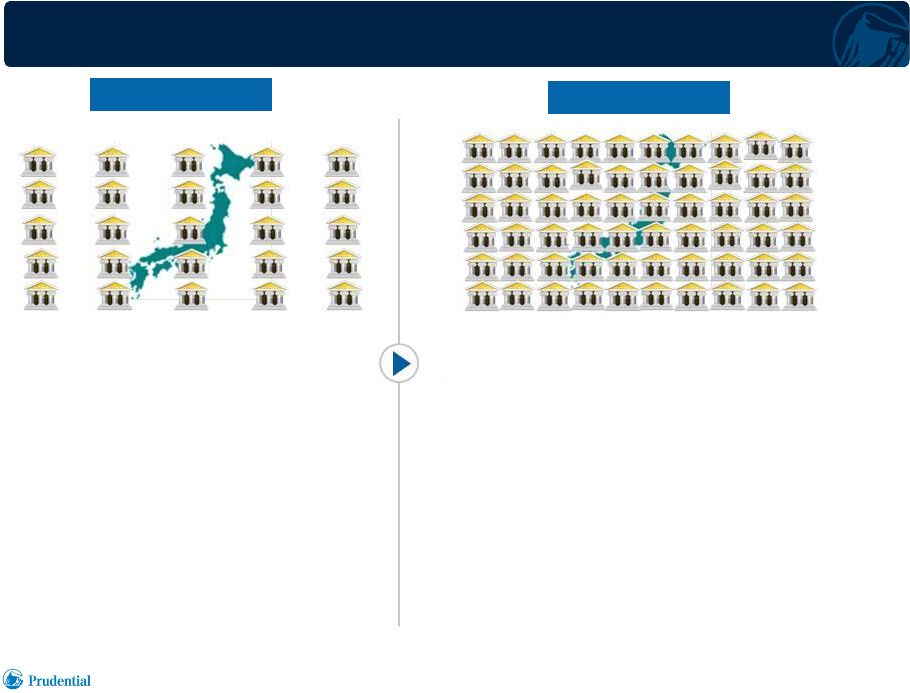

Bank

Channel Building Relationships for Continued Growth

•

Sales through 25 banks

•

Over 60 bank sales relationships established,

including three of Japan’s four largest banks

•

Expanding relationships with large regional

banks

(3)

; 23 of these banks selling Prudential products

•

Over 100 distributors, including bank-affiliated

insurance agencies

•

Active relationships offer approximately 6,000+

potential points of sale

(4)

covering the majority of the

Japanese prefectures

2009

2009

(1)

(1)

2012

2012

(2)

(2)

62

Tokyo Investor Day 9.12.2012

1)

As of December 31, 2009.

2)

As of June 30, 2012.

3)

Banks with deposits of 3 trillion yen or more. 4)

Potential points of sale represent an aggregated total number of branches of the bank partners as of

March 2011. |

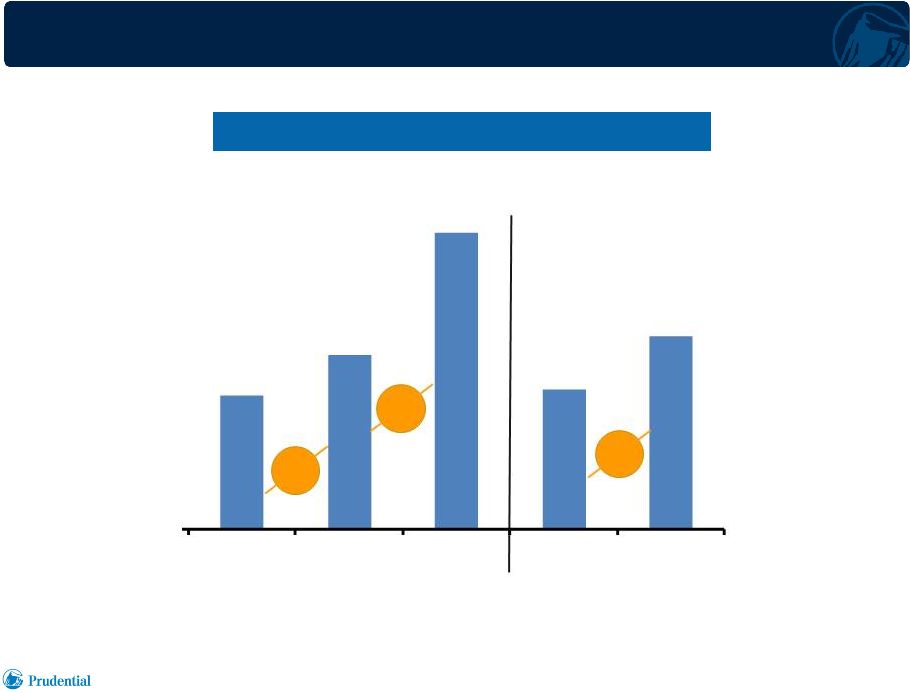

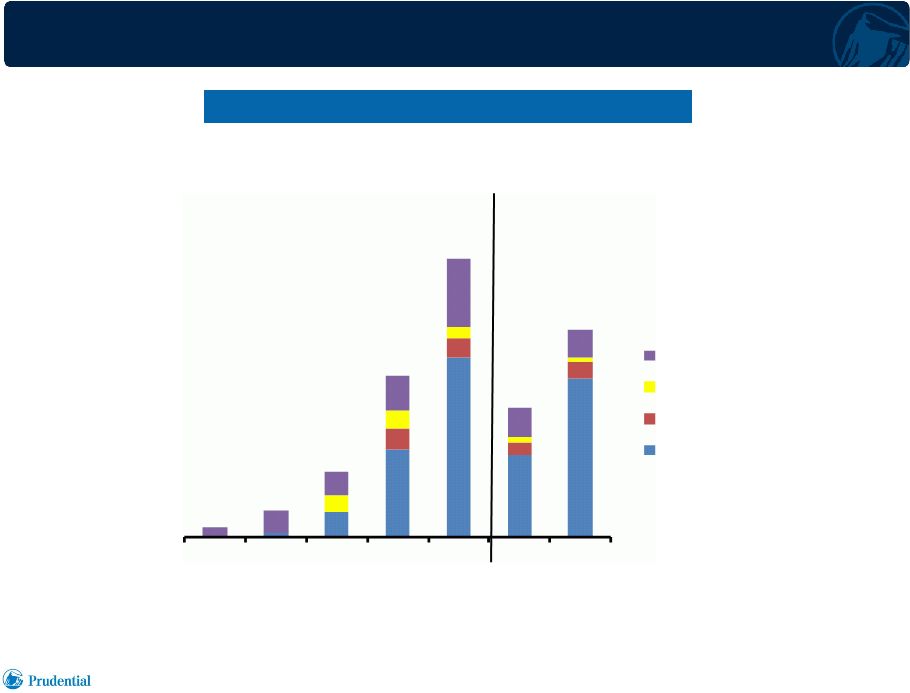

Bank

Channel Sales Growth Driven By Protection Products

Annualized New Business Premiums

Annualized New Business Premiums

(1)

(1)

($ millions)

$271

$433

$56

$22

$137

$336

$580

63

Tokyo Investor Day 9.12.2012

2007

2008

2009

2010

2011

2Q11

YTD

2Q12

YTD

Annuity

Retirement

Accident & Health

Death Protection

1)

Foreign denominated activity translated to U.S. dollars at uniform exchange rates for all periods

presented; Japanese yen 85 per U.S. dollar. |

19%

81%

Bank Channel Sales Growth

Driven by Focus on Banks with Strongest Sales Potential

Tokyo Investor Day 9.12.2012

64

Annualized New Business Premiums

Annualized New Business Premiums

$433 million

$433 million

(1)

(1)

1)

For the six months ended June 30, 2012. Foreign denominated activity translated to

U.S. dollars at uniform exchange rates; Japanese yen 85 per U.S. dollar.

Sales through

mega-banks and large

regional banks with

deposits of

3 trillion yen or more

Other Bank sales |

Bank

Channel Prospects for Continued Growth

Tokyo Investor Day 9.12.2012

65

•

Continue to grow sales with main focus on death protection products,

complemented by diverse product line meeting lifetime financial security

needs •

Expand bank channel support by “seconded”

former Life Planners; increase

number of bank associates trained in needs-based selling of protection

products, especially at mega-banks

•

Acquire new distribution relationships and develop existing relationships,

especially with leading regional banks

•

Build

on

opportunities

arising

from

growing

bank

retail

business

serving

retirement and estate planning needs |

Ken

Tanji Chief Financial Officer, International Businesses

Prudential Financial, Inc.

Prudential International Insurance

Financial Overview |

Drivers of Sustainable Financial Performance

Quality Focused

Quality Focused

Multi Channel

Multi Channel

Distribution

Distribution

Servicing Client’s

Servicing Client’s

Protection and

Protection and

Retirement Needs

Retirement Needs

Well Managed

Well Managed

Investment Portfolio

Investment Portfolio

Risks

Risks

Capital

Capital

Management

Management

Tokyo Investor Day 9.12.2012

67 |

$1,109

$1,275

Stable Earnings Growth

($ millions)

Tokyo Investor Day 9.12.2012

68

$1,581

$1,651

$1,887

$2,263

2008

2009

2010

2011

2Q11

YTD

2Q12

YTD

Gibraltar Life and

Other operations

Life Planner

(1)

(1)

1)

Pre-tax adjusted operating income for International Insurance operations as presented above

excludes the results of our International Investments businesses previously included in the

International Investments segment and currently included within “Gibraltar Life and Other Operations” for financial reporting purposes,

with pre-tax adjusted operating income (loss) of $(412) million, $25 million, $28 million and $120

million in 2008, 2009, 2010, and 2011, respectively, and $19 million and $12 million for the

six months ended June 30, 2011 and 2012, respectively.

Pre-Tax

Pre-Tax

Adjusted

Adjusted

Operating

Operating

Income

Income |

Quality Focused Distribution

1)

Number of agents at the end of respective periods. Agent productivity is the

average number of new policies sold per agent, per month; includes medical and

cancer policies. Average premium based on average annualized premium per new

policy; includes medical and cancer policies. Policy persistency based on face

amount and 13-month period. Agent retention based on 12-month period.

2)

Excluding Star / Edison agents.

Tokyo Investor Day 9.12.2012

69

Gibraltar Life Consultants

Gibraltar Life Consultants

6,330

3.7

$1,700

91%

58%

6,241

3.8

$1,900

93%

67%

2008

2011

(2)

POJ Life Planners

POJ Life Planners

3,071

6.8

$3,000

95%

83%

3,137

6.9

$3,600

95%

81%

2008

2011 |

2007

2008

2009

2010

2011

2Q12

Life Planner, excluding POJ

Gibraltar Life

Prudential of Japan (POJ)

Scale Enhanced by Star / Edison Acquisition

(millions)

7.3

7.5

7.8

8.0

11.7

1)

At period end; direct business only; policy count includes annuities.

11.8

Tokyo Investor Day 9.12.2012

70

Number of In-force Policies

(1) |

42%

23%

9%

26%

58%

35%

7%

Balanced Product and Currency Mix

Japan

Japan

Annualized

Annualized

New

New

Business

Business

Premium

Premium

$1.8 billion

$1.8 billion

By Product Type

By Currency Denomination

Accident

& Health

Retirement

Annuity

Death Protection

1)

For the six months ended June 30, 2012. Foreign denominated activity translated to

U.S. dollars at uniform exchange rates; Japanese yen 85 per U.S. dollar.

2)

Primarily Australian dollars.

USD

Other

(2)

JPY

Tokyo Investor Day 9.12.2012

71

(1) |

Accident &

Health

1)

Conceptual illustration based on typical products.

Tokyo Investor Day 9.12.2012

72

Retirement / Savings Oriented

Investment

Margin

Mortality,

Expense &

Other Margin

Term Life

Recurring Pay

Whole Life

Retirement

Income

Single Pay

Whole Life

Fixed Annuity

Source of Earnings

(1)

Product Profitability Characteristics

Protection Oriented |

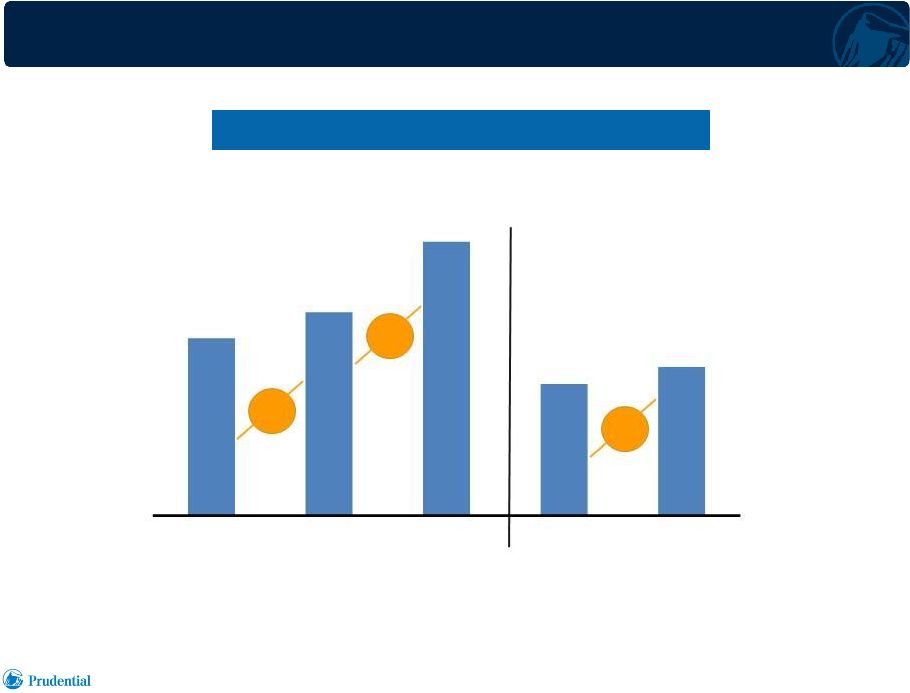

Stable Sources of Earnings

($ millions)

Tokyo Investor Day 9.12.2012

73

$1,581

$1,651

$1,887

$2,263

Investment

Margin

Mortality,

Expense &

Other Margin

2008

2009

2010

2011

2Q11

YTD

2Q12

YTD

$1,109

$1,275

Pre-Tax

Adjusted

Operating

Income

1)

Pre-tax adjusted operating income for International Insurance operations as presented above

excludes the results of our International Investments businesses previously included in the

International Investments segment and currently included within “Gibraltar Life and Other Operations” for financial reporting purposes,

with pre-tax adjusted operating income (loss) of $(412) million, $25 million, $28 million and $120

million in 2008, 2009 , 2010 and 2011, respectively, and $19 million and $12 million for the

six months ended June 30, 2011 and 2012, respectively.

(1) |

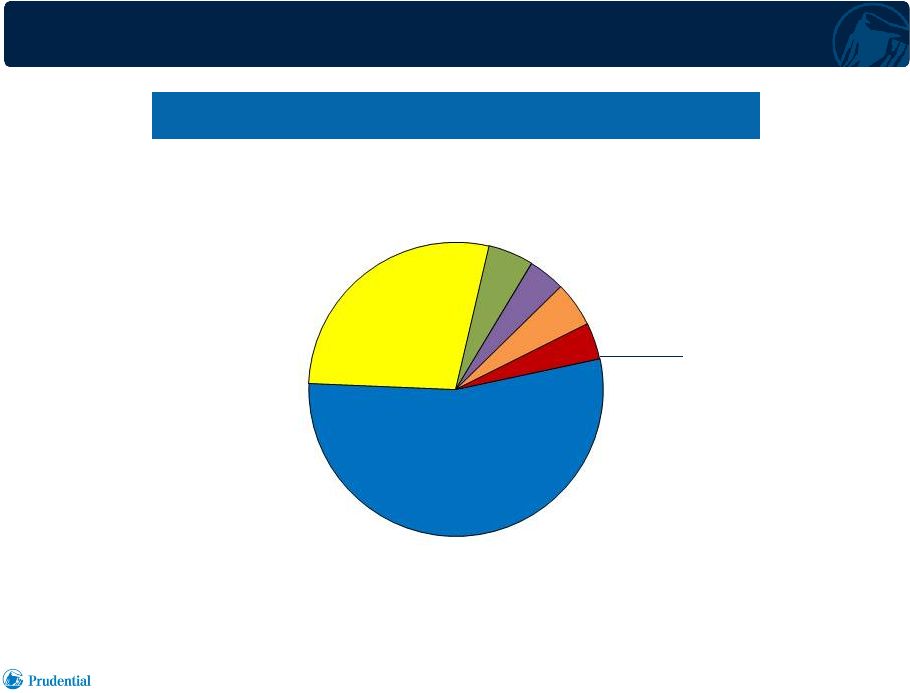

High

Quality Investment Portfolio Tokyo Investor Day 9.12.2012

74

Japan

Investment

Portfolio

(1)

1)

As of June 30, 2012.

2)

Includes commercial/residential mortgage backed securities and asset backed

securities. 3)

Includes commercial/residential mortgage loans.

Corporate

Bonds

(Investment

Grade)

2% Corporate Bonds (Below Investment Grade)

1% Equities

1% Real Estate

Structured

Securities

(2)

Commercial

Loans

(3)

Risk Assets

Other

(4)

Government

(JGB & UST)

54%

28%

5%

4%

5%

4%

Includes trading account assets supporting insurance liabilities and policy loans. 4)

|

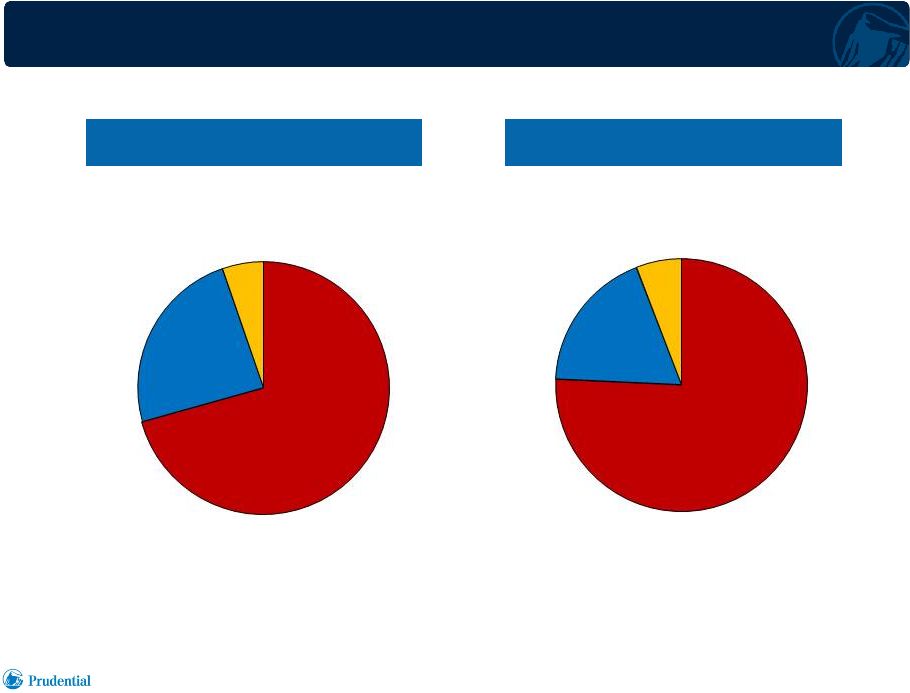

Well

Managed Investment Portfolio Tokyo Investor Day 9.12.2012

75

Prudential Japanese

Insurance Operations

(1)

1)

As of June 30, 2012. Includes Prudential of Japan and Gibraltar.

2)

As of March 31, 2012. Domestic Big 4: Nippon, Dai-ichi, Meiji-Yasuda

and Sumitomo. 3)

Domestic Big 4

(2)

Risk Assets

(3)

Risk Assets

(3)

82%

18%

96%

4%

Prudential Japanese Insurance operations’ risk assets represent real estate, equities and below

investment grade securities. Risk assets of the Big 4 represent principally real estate and

equities, and do not include below investment grade securities. |

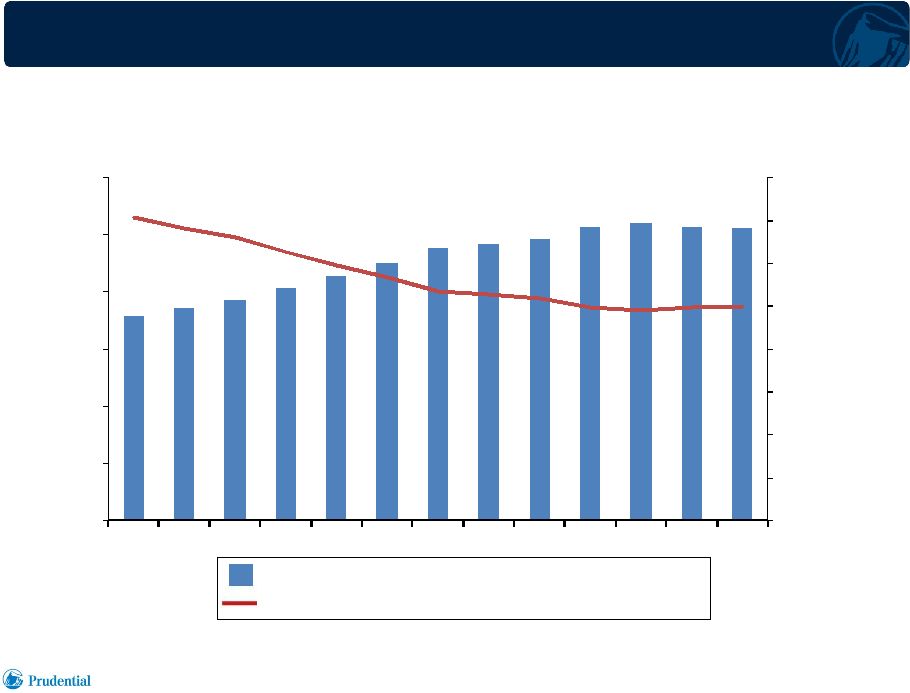

Interest Rate Environment

Tokyo Investor Day 9.12.2012

76

10 Year Government Bond Yield

10 Year Government Bond Yield

•

Interest rates have been low in Japan for more than fifteen years

–

Majority of POJ’s in-force business was written in a low rate

environment –

Rehabilitation measures lowered crediting rates of legacy business of

Gibraltar •

High quality long duration investment portfolio

•

Recently

lowered

guaranteed

crediting

rates

of

U.S.

dollar

products

(1)

•

Protection product profitability relatively less

sensitive to interest rates

–

Provides stable source of M&E earnings

–

Lower lapse risk than savings products if

interest rates rise

•

Fixed annuity designed to mitigate interest

rate risk

–

Pricing updates bi-weekly

–

Early surrenders subject to market value

adjustments (MVA)

0%

1%

2%

3%

4%

5%

6%

7%

8%

1997

2000

2003

2006

2009

2012

JGB

UST

2%

1)

For new business, commencing second quarter 2012. |

Foreign Currency Matching -

Japan

Tokyo Investor Day 9.12.2012

77

Investment

Portfolio

(1)(2)

1)

As of June 30, 2012.

2)

Investment portfolio is presented on a U.S. GAAP carrying value basis. Includes

cash and cash equivalents of approximately $6 billion, and excludes securities

lending activity of approximately $2 billion.

3)

Insurance liability balances represent future policy benefits and policyholder

account balances on a U.S. GAAP basis. 4)

Primarily Australian dollar.

USD

Other

(4)

JPY

USD

Other

(4)

$150 billion

$136 billion

JPY

Reserves

(1)(3)

$106

$36

$8

$103

$25

$8 |

Foreign Currency Risk Management

Potential Exposure

Risk Management

Asset-Liability

Management

Accounting

Remeasurement

Well Matched FX

Non-Economic Noise

Shareholder Value in $USD

Comprehensive

Hedging Program

Income

Book Value

Cash Flow

78

Tokyo Investor Day 9.12.2012 |

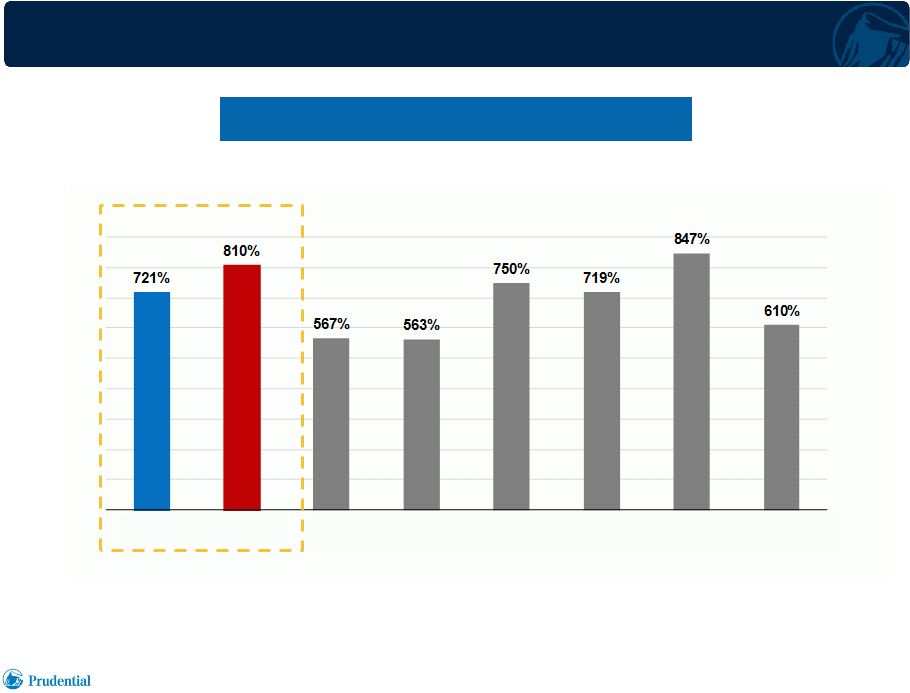

Solvency Capital

Solvency

Margin

Ratios

(1)

Tokyo Investor Day 9.12.2012

79

1)

As of March 31, 2012.

2)

Consolidated basis.

400%

800%

(2)

(2)

(2)

POJ

Gibraltar

Nippon

Dai-ichi

Meiji-Yasuda

Sumitomo

MetLife Alico

Aflac |

Solvency Margin Ratio

Tokyo Investor Day 9.12.2012

80

March 31, 2012

721%

Prudential of Japan

Stressed Scenario

Gibraltar

(1)

~675%

810%

~690%

•

Japan Equity

•

Real Estate

•

Yen FX

•

Interest Rates

-38%

-36%

-20%

+100 bps

Stressed Scenario

1)

Gibraltar consolidated basis.

2)

Represents indicated change applied to asset valuation as of March 31, 2012.

(2) |

Capital Management Opportunities

Tokyo Investor Day 9.12.2012

81

•

Dividends –

In accordance with regulatory and solvency standards

•

Affiliated

Debt

Repayment

–

approximately

$4

billion

outstanding

on

books

of

Prudential’s

Japanese

Insurance

companies

(1)

•

Affiliated Lending –

In accordance with regulatory and credit standards

•

International Insurance operations redeployed approximately 60% of

after-tax

adjusted

operating

income

since

2002

(2)

1)

As of June 30, 2012; includes amounts relating to preferred stock issues. 2)

Through December 31, 2011. Years 2007 – 2011 have been restated for U.S. GAAP accounting

standards applicable to deferred policy acquisition costs (DAC) effective January 1, 2012.

Years 2002 – 2006 are based on former U.S. GAAP accounting standards applicable to DAC. After-tax AOI is based on

Financial Services Businesses effective tax rates. AOI excludes results of our International

Investments businesses previously included in the International Investments segment and

currently included within “Gibraltar Life and Other operations” for financial reporting purposes. |

Superior Return Prospects Maintained

as Growth Strategy has Broadened

82

2013 ROE

2013 ROE

Potential

Potential

~ 18% -

19%

22.2%

17.5%

2010

2011

Tokyo Investor Day 9.12.2012

Prudential International Insurance

Return on Equity

(1)

Reflects

Star /

Edison

before

expense

synergies

1)

Business unit Return on Equity (ROE) is unlevered and is based on overall Financial Services

Businesses effective tax rate applicable to adjusted operating income. Excludes results of

International Investments businesses previously included in International Investments segment and currently included within

“Gibraltar Life and other operations” for financial reporting purposes of $28 million in

2010 and $120 million in 2011. Excludes transaction and integration costs relating to the Star

/ Edison acquisition in 2011 of $213 million. |

Key

Takeaways •

Focus on quality distribution drives margins and ROE

•

Third party distribution leverages scale and enhances growth

•

Emphasis on protection products combined with scale provides

stable source of mortality and expense earnings

•

High quality investment portfolio is well matched with our

insurance liabilities

•

Insurance operations are well capitalized

•

Significant capital redeployment opportunities

Tokyo Investor Day 9.12.2012

83 |