Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - METLIFE INC | d405189d8k.htm |

ASIA

INVESTOR DAY 2012

John McCallion

Vice President

Investor Relations

Exhibit 99.1 |

Safe

Harbor Statement 2

These materials may contain or incorporate by reference information that includes or is based upon

forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements give expectations or forecasts of future events. These statements can be identified by the

fact that they do not relate strictly to historical or current facts. They use words such as

“anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” and

other words and terms of similar meaning in connection with a discussion of future operating or

financial performance. In particular, these include statements relating to future actions,

prospective services or products, future performance or results of current and anticipated services or products, sales efforts, expenses,

the outcome of contingencies such as legal proceedings, trends in operations and financial

results. Any or all forward-looking statements may turn out to be wrong. They can be affected by inaccurate

assumptions or by known or unknown risks and uncertainties. Many such factors will be important

in determining the actual future results of MetLife, Inc., its subsidiaries and affiliates. These statements are based on current

expectations and the current economic environment. They involve a number of risks and uncertainties

that are difficult to predict. These statements are not guarantees of future performance.

Actual results could differ materially from those expressed or implied in the forward-looking statements. Risks, uncertainties,

and other factors that might cause such differences include the risks, uncertainties and other factors

identified in MetLife, Inc.’s filings with the U.S. Securities and Exchange Commission

(the “SEC”). These factors include: (1) difficult conditions in the global capital markets; (2) concerns over U.S. fiscal policy and the “fiscal

cliff” in the U.S., as well as rating agency downgrades of U.S. Treasury securities; (3)

uncertainty about the effectiveness of governmental and regulatory actions to stabilize the

financial system, the imposition of fees relating thereto, or the promulgation of additional regulations; (4) increased volatility and disruption of the

capital and credit markets, which may affect our ability to seek financing or access our credit

facilities; (5) impact of comprehensive financial services regulation reform on us; (6)

economic, political, legal, currency and other risks relating to our international operations, including with respect to fluctuations of exchange rates;

(7) exposure to financial and capital market risk, including as a result of the disruption in Europe

and possible withdrawal of one or more countries from the Euro zone; (8) changes in general

economic conditions, including the performance of financial markets and interest rates, which may affect our ability to raise capital,

generate fee income and market-related revenue and finance statutory reserve requirements and may

require us to pledge collateral or make payments related to declines in value of specified

assets; (9) potential liquidity and other risks resulting from our participation in a securities lending program and other transactions;

(10) investment losses and defaults, and changes to investment valuations; (11) impairments of

goodwill and realized losses or market value impairments to illiquid assets; (12) defaults on

our mortgage loans; (13) the defaults or deteriorating credit of other financial institutions that could adversely affect us; (14) our ability to

address unforeseen liabilities, asset impairments, or rating actions arising from acquisitions or

dispositions, including our acquisition of American Life Insurance Company and Delaware

American Life Insurance Company (collectively, “ALICO”) and to successfully integrate and manage the growth of acquired businesses

with minimal disruption; (15) uncertainty with respect to the outcome of the closing agreement entered

into with the United States Internal Revenue Service in connection with the acquisition of

ALICO; (16) the dilutive impact on our stockholders resulting from the settlement of common equity units issued in connection

with the acquisition of ALICO or otherwise; (17) MetLife, Inc.’s primary reliance, as a holding

company, on dividends from its subsidiaries to meet debt payment obligations and the applicable

regulatory restrictions on the ability of the subsidiaries to pay such dividends; (18) downgrades in our claims paying ability, financial

strength or credit ratings; (19) ineffectiveness of risk management policies and procedures; (20)

availability and effectiveness of reinsurance or indemnification arrangements, as well as

default or failure of counterparties to perform; (21) discrepancies between actual claims experience and assumptions used in setting

prices for our products and establishing the liabilities for our obligations for future policy

benefits and claims; (22) catastrophe losses; (23) heightened competition, including with

respect to pricing, entry of new competitors, consolidation of distributors, the development of new products by new and existing competitors,

distribution of amounts available under U.S. government programs, and for personnel; (24)

unanticipated changes in industry trends; (25) changes in assumptions related to investment

valuations, deferred policy acquisition costs, deferred sales inducements, value of business acquired or goodwill; (26) changes in accounting

standards, practices and/or policies; (27) increased expenses relating to pension and postretirement

benefit plans, as well as health care and other employee benefits; (28) exposure to

losses related to variable annuity guarantee benefits, |

Safe

Harbor Statement (Continued) 3

including from significant and sustained downturns or extreme volatility in equity markets, reduced

interest rates, unanticipated policyholder behavior, mortality or longevity, and the adjustment

for nonperformance risk; (29) deterioration in the experience of the “closed block” established in connection with the reorganization

of Metropolitan Life Insurance Company; (30) adverse results or other consequences from litigation,

arbitration or regulatory investigations; (31) inability to protect our intellectual property

rights or claims of infringement of the intellectual property rights of others; (32) discrepancies between actual experience and assumptions

used in establishing liabilities related to other contingencies or obligations; (33) regulatory,

legislative or tax changes relating to our insurance, banking, international, or other

operations that may affect the cost of, or demand for, our products or services, or increase the cost or administrative burdens of providing

benefits to employees; (34) the effects of business disruption or economic contraction due to

disasters such as terrorist attacks, cyberattacks, other hostilities, or natural catastrophes,

including any related impact on our disaster recovery systems, cyber- or other information security systems and management continuity

planning; (35) the effectiveness of our programs and practices in avoiding giving our associates

incentives to take excessive risks; and (36) other risks and uncertainties described from time

to time in MetLife, Inc.’s filings with the SEC. MetLife, Inc. does not undertake any obligation to publicly correct or update any

forward-looking statement if MetLife, Inc. later becomes aware that such statement is not

likely to be achieved. Please consult any further disclosures MetLife, Inc. makes on related subjects in reports to the SEC.

|

Explanatory Note on Non-GAAP Financial Information

All references in these presentations (except in this Explanatory Note on

Non-GAAP Financial Information slide) to operating earnings, premiums,

fees and other revenues and operating return on equity, should be read as operating earnings available to common shareholders,

premiums, fees and other revenues (operating) and operating return on MetLife,

Inc.’s common equity, excluding AOCI, respectively. Operating

earnings

is

the

measure

of

segment

profit

or

loss

that

MetLife

uses

to

evaluate

segment

performance

and

allocate

resources.

Consistent with accounting principles generally accepted in the United States of

America ("GAAP") accounting guidance for segment reporting,

operating earnings is MetLife's measure of segment performance. Operating earnings

is also a measure by which MetLife senior management's and many other

employees' performance is evaluated for the purposes of determining their compensation under applicable compensation plans.

Operating earnings is defined as operating revenues less operating expenses, both

net of income tax. Operating earnings available to common shareholders is

defined as operating earnings less preferred stock dividends.

Operating

revenues

and

operating

expenses

exclude

results

of

discontinued

operations

and

other

businesses

that

have

been

or

will

be

sold

or

exited by MetLife, Inc. (“Divested Businesses”). Operating revenues also

excludes net investment gains (losses) (“NIGL”) and net derivative

gains (losses) (“NDGL”).

The following additional adjustments are made to GAAP revenues, in the line items

indicated, in calculating operating revenues: •

Universal life and investment-type product policy fees excludes the

amortization of unearned revenue related to NIGL and NDGL and certain

variable annuity guaranteed minimum income benefits ("GMIB") fees

("GMIB Fees"); •

Net investment income: (i) includes amounts for scheduled periodic settlement

payments and amortization of premium on derivatives that are hedges of

investments but do not qualify for hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance

joint ventures accounted for under the equity method, (iv) excludes certain

amounts related to contractholder-directed unit-linked investments, and (v) excludes certain amounts related to

securitization entities that are variable interest entities ("VIEs")

consolidated under GAAP; and •

Other revenues are adjusted for settlements of foreign currency earnings hedges.

4 |

Explanatory Note on Non-GAAP Financial Information

(Continued)

The following additional adjustments are made to GAAP expenses, in the line items

indicated, in calculating operating expenses: •

Policyholder benefits and claims and policyholder dividends excludes: (i) changes

in the policyholder dividend obligation related to NIGL and NDGL, (ii)

inflation-indexed benefit adjustments associated with contracts backed by inflation-indexed investments and amounts associated

with periodic crediting rate adjustments based on the total return of a

contractually referenced pool of assets, (iii) benefits and hedging costs

related to GMIBs ("GMIB Costs"), and (iv) market value adjustments

associated with surrenders or terminations of contracts ("Market Value

Adjustments");

•

Interest credited to policyholder account balances includes adjustments for

scheduled periodic settlement payments and amortization of premium on

derivatives that are hedges of policyholder account balances but do not qualify for hedge accounting treatment and excludes

amounts related to net investment income earned on contractholder-directed

unit-linked investments; •

Amortization of deferred policy acquisition costs (“DAC”) and value of

business acquired ("VOBA") excludes amounts related to: (i) NIGL and

NDGL, (ii) GMIB Fees and GMIB Costs, and (iii) Market Value Adjustments;

•

Amortization

of

negative

VOBA

excludes

amounts

related

to

Market

Value

Adjustments;

•

Interest expense on debt excludes certain amounts related to securitization

entities that are VIEs consolidated under GAAP; and •

Other expenses excludes costs related to: (i) noncontrolling interests, (ii)

implementation of new insurance regulatory requirements, and (iii)

acquisition and integration costs.

Operating return on MetLife, Inc.’s common equity is defined as operating

earnings available to common shareholders divided by average GAAP common

equity. Operating expense ratio is calculated by dividing operating expenses

(other expenses net of capitalization of DAC) by premiums, fees and other

revenues (operating).

MetLife believes the presentation of operating earnings and operating earnings

available to common shareholders as MetLife measures it for management

purposes enhances the understanding of the company's performance by highlighting the results of operations and the underlying

profitability

drivers

of

the

business.

Operating

revenues,

operating

expenses,

operating

earnings,

operating

earnings

available

to

common

shareholders, operating return on MetLife, Inc.’s common equity, operating

return on MetLife, Inc.’s common equity, excluding AOCI, investment

portfolio gains (losses) and derivative gains (losses) should not be viewed as

substitutes for the following financial measures calculated in

accordance

with

GAAP:

GAAP

revenues,

GAAP

expenses,

GAAP

income

(loss)

from

continuing

operations,

net

of

income

tax,

GAAP

net

income

(loss) available to MetLife, Inc.'s common shareholders, return on MetLife,

Inc.’s common equity, return on MetLife, Inc.’s common equity,

excluding AOCI, net investment gains (losses) and net derivative

gains (losses), respectively.

5 |

Explanatory Note on Non-GAAP Financial Information

(Continued)

6

Managed Assets is a financial measure based on methodologies other than GAAP. MetLife utilizes

“Managed Assets” to describe assets in its investment portfolio which are actively

managed and reflected at estimated fair value. MetLife believes the use of Managed Assets enhances the

understanding and comparability of its investment portfolio by excluding assets such as policy loans,

other invested assets, mortgage loans held- for-sale, and mortgage loans held by

consolidated securitization entities, as substantially all of those assets are not actively managed in MetLife’s

investment portfolio. Trading and other securities are also excluded as this amount is primarily

comprised of contractholder-directed unit-linked investments, where the contractholder,

and not the company, directs the investment of these funds. Mortgage loans and certain real estate

investments have also been adjusted from carrying value to estimated fair value. For the historical

periods presented, reconciliations of non-GAAP measures used in this presentation to the most directly comparable GAAP

measures are included in the Appendix to the presentation materials and are on the Investor Relations

portion of our Internet website. Additional information about our historical results is

also available on our Internet website in our Quarterly Financial Supplements for the corresponding

periods.

The non-GAAP measures used in this presentation should not be viewed as substitutes for the most

directly comparable GAAP measures.

In these presentations, we sometimes refer to sales activity for various products. These sales

statistics do not correspond to revenues under GAAP, but are used as relevant measures of

business activity.

In these presentations, we provide guidance on our future earnings, premiums, fees and other revenues,

and return on common equity on an operating or non-GAAP basis. A reconciliation of

the non-GAAP measures to the most directly comparable GAAP measures is not accessible on a

forward-looking basis because we believe it is not possible to provide other than a range of net investment gains and losses and net derivative

gains and losses, which can fluctuate significantly within or without the range and from period to

period and may have a significant impact on GAAP net income. |

Agenda

Asia Overview

Christopher Townsend

President, Asia

Japan

William Hogan

Chairman & CEO, MetLife Alico Japan

Sachin Shah

EVP & COO, MetLife Alico Japan

Hiroyoshi Kitamura

EVP, Profit Center & Products, MetLife Alico Japan

Atsushi Yagai

EVP, Strategy & Marketing, MetLife Alico Japan

Break

Korea and China

Jong Kim

CEO, MetLife Korea

Bob Pei

CEO, Sino-US United MetLife

Asia Financial Overview

Toby Brown

CFO, Asia

Break

Q&A

7 |

ASIA

INVESTOR DAY 2012

Christopher Townsend

President

Asia |

Strategy to Become a World-Class Company

Drive Toward

Customer Centricity

and a Global Brand

Grow

Emerging Markets

Build Global

Employee Benefits

Business

Refocus the U.S.

Business

9

GLOBAL *

WORLD-CLASS * SCALE

|

Meeting Growing Customer Demand

Grow and Leverage

Accident & Health

Solutions

Leverage

Multi-Channel

Distribution

Shifting costs from governments to

individuals

Aging populations needing health

solutions

Growing middle class needing protection

10 |

Asia Financial Results and Overview

#2 foreign life insurer in

Japan¹ #2 in

Accident & Health products in Japan² #1 foreign life

insurer in Korea³

Growing presence in China

$8.7B

Premiums, Fees and

Other Revenues

$867M

Operating Earnings

11

Overview

2011

Financial

Results

1

2

3

Based on Annualized New Premiums (ANP) in Statutory filings (MetLife Alico Japan statutory

fiscal year 2011, April 1, 2011 - March 31, 2012). Based on new

business policies and inforce policies (MetLife Alico Japan statutory fiscal year 2011, April 1, 2011 - March 31, 2012).

Based on ANP in Statutory filings (MetLife Korea statutory fiscal year 2011, January 1, 2011 -

December 31, 2011). Source: The Life Insurance Association of Japan; Korea Life Insurance

Association. See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

Target Key Segments in Mature Markets

MetLife’s 2

largest market

Strong growth in high-margin

products, despite challenging

environment

Leverage expertise across

MetLife, especially in Asia

Japan: A Cornerstone Market

MetLife’s 4

largest market

Diversified distribution

channels centered around a

strong career agency force

Favorable demographics drive

growth in Accident & Health

products

Korea: Growth Through Innovation

12

th

nd |

Asia: Seeking Growth in Emerging Markets

Top 5 life insurer in both the Direct Marketing and

Bancassurance channels in China

Expanding our agency model into more Chinese

provinces and cities

Several other attractive, fast-growing insurance

markets

13

Source: China Insurance Regulatory Commission, based on Gross Written Premiums

(GWP) for full year 2011; National Insurance Industry Communication Club. |

Asia Key Takeaways

Asia is a key segment and contributor to 2016 goals

Growing market share in mature markets

Opportunistically pursue organic and inorganic growth

in emerging markets

14 |

ASIA

INVESTOR DAY 2012

William

Hogan

Chairman & Chief Executive Officer

MetLife Alico Japan |

Why

MetLife Alico Macro trends creating attractive opportunities to take

share and capture growing segments

Competitive products and multi-distribution platform

Current positioning allows room for additional market

share gains

Growing significantly faster than market and building scale

Strong culture focused on profitable growth

16 |

Growing distribution productivity

Enhanced investment capability

Improving operating efficiency

Improving persistency

Growing brand preference

Acquiring new customers

Cross-selling

Broad product portfolio

We are Addressing Key Performance Drivers

Growth

Value

Multiplier

17 |

Japan Performance on the Right Trajectory

Operating Earnings

Operating Expense Ratio

Premiums, Fees and Other Revenues

Annualized New Premiums (ANP)

Persistency³

Operating Earnings,

31%

9%

50%

28%

124

192

18

as adjusted

²

1

2

3

(1H 2012 vs. 1H 2011)¹

Key Metrics

MetLife ALICO Japan has a fiscal year-end Nov. 30. Therefore, the results presented for the

first half of 2012 and 2011 reflect its operating results for the six months ended May 31, 2012

and 2011, respectively. Reflects $44 million in claims and expenses related to Japan earthquake and tsunami, $24 million of

higher than planned variable investment income, partially offset by a net $5 million in DAC and

other actuarial items. Excludes non-core $ Endowment and Retirement Assurance products.

bps

bps

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. |

ASIA

INVESTOR DAY 2012

Sachin N. Shah

Executive Vice President & Chief Operating Officer

MetLife Alico Japan |

Japan Offers

Attractive Growth Opportunities World’s 2 largest insurance market¹ Changing consumer needs

Consumers becoming more selective

Multi-channel access and service

Needs based advisory model

Opportunity to grow market share

Strain in social healthcare & pension

systems

Increased need for private

insurance

20

Swiss Re Research (2011).

1

nd |

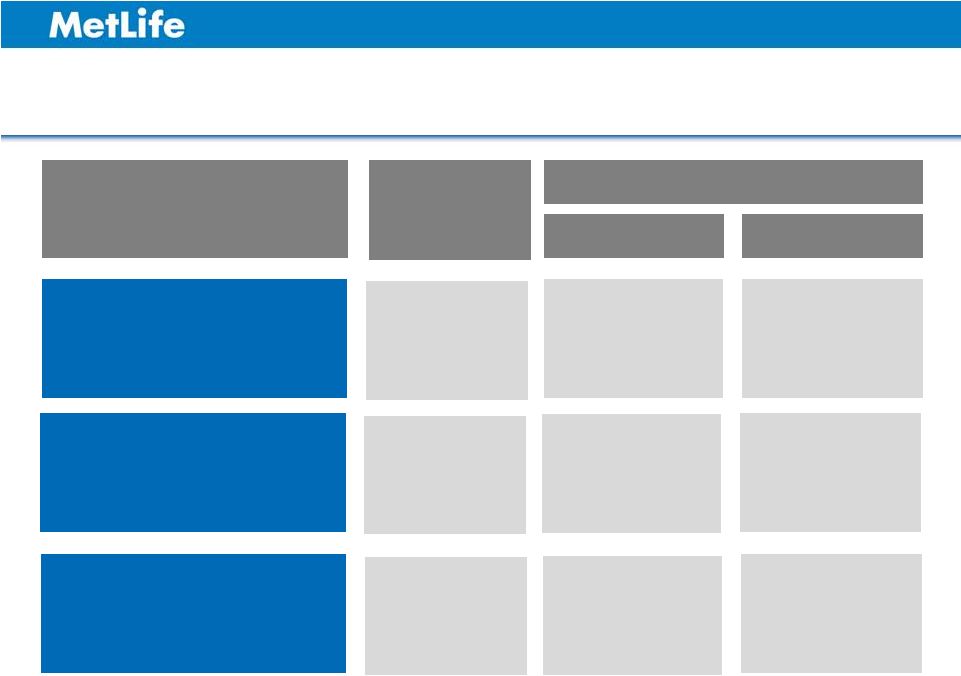

Married

Small / Medium Enterprises

Pre-Retirees

Retirees

Retirees

Singles

Married

A Comprehensive Life Insurance Solutions Provider

Face-to-Face

Bancassurance

Direct Marketing

Large & Growing Customer

Segments

Diverse

Distribution

Channels

Broad Product Portfolio

Primary Solutions

Ancillary Solutions

Protection Life

Accident & Health

Savings Whole Life

Annuities

Accident & Health

Group Insurance

Annuities

Protection Life

Accident & Health

Protection Life

21 |

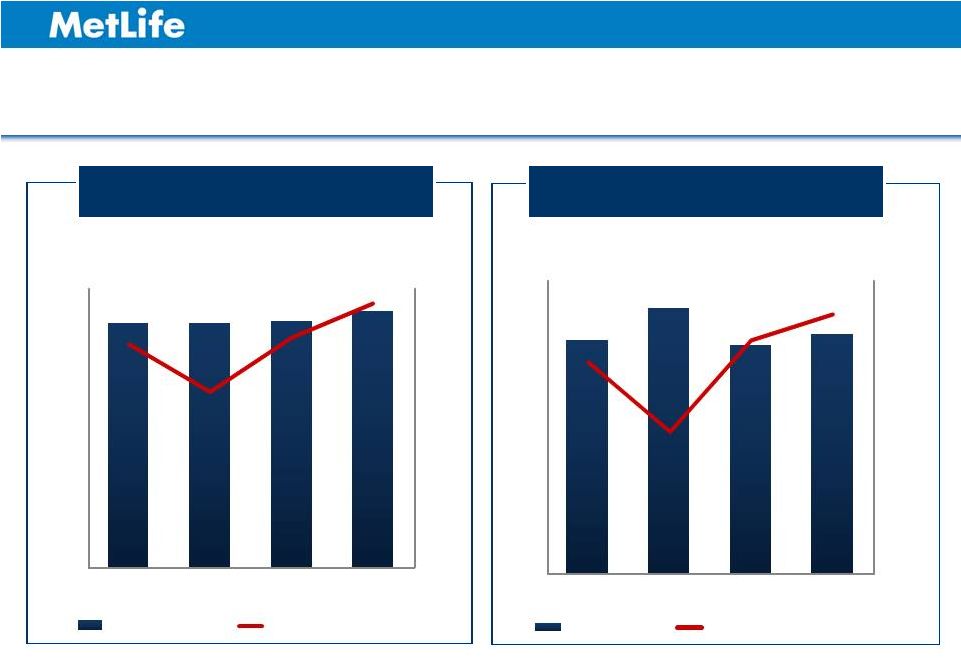

We

are Gaining Market Share MetLife

Alico

Premiums

¹

Market Share Trend

($ in Billions)

($ in Billions)

22

MetLife Alico ANP

Market Share Trend

0

0

0.0%

1.0%

2.0%

3.0%

4.0%

50

100

150

200

250

300

350

400

450

500

2008

2009

2010

2011

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

5

10

15

20

25

30

35

40

45

2008

2009

2010

2011

Industry ANP

MetLife Alico Market Share

Industry Premiums

MetLife Alico Market Share

Note : MetLife Plan FX rate of $1 = JPY 78.20.

Statutory premiums.

Source: Statistics of Life Insurance Business in Japan (for 2008-2010 data), Life Insurance

Association of Japan (for 2011 data). See Appendix for non-GAAP financial information,

definitions and/or reconciliations. 1 |

Strong Foundation Focused on Profitable Growth Segments

Multiple advice-based distribution channels

Broad, innovative protection and savings solutions

Strong execution culture, focused on growth and

profitability

Powerful brand assets of “U.S. No.1”

, Snoopy and Blimp

Solid balance-sheet, strong compliance and risk

management culture

1

Statistical study report of AM Best (Oct 2011).

23

1 |

Strategy Designed to Enhance Performance

24

Brand Enhancement

Value Growth

Customer Centricity

Distribution Growth |

Strategy Designed to Enhance Performance

25

Brand Enhancement

Value Growth

Customer Centricity

Atsushi Yagai

Hiroyoshi Kitamura

Atsushi Yagai

Distribution Growth

Sachin N. Shah |

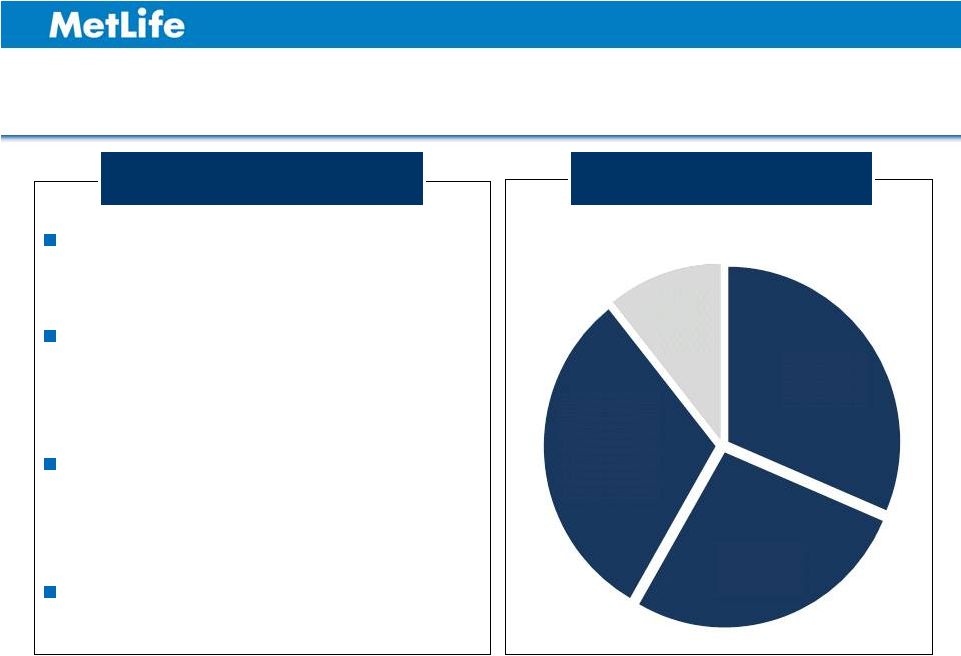

Multiple Distribution Channels, Greater Customer Access

Prominent professional career

agency channel

Strong independent agent

channel

Access to nearly 90%

of bank

deposit assets and customers

Leading Direct Marketing

player

Distribution Mix

1H 2012

1

Statutory Premiums, Deposits and Other Considerations.

Highlights

26

Career

22%

Direct

Marketing,

13%

Independent

Agents, 25%

Bancassurance,

40%

Agents,

1 |

Face-to-Face Distribution: A Leader in Productivity

Metrics

June 1, 2011 –

May 31, 2012

Career

Agency

Independent

Agency

Sales

Productivity

per

Active

Agent

per

month

$11,200

$12,100

Policy Productivity per Active Agent per month

6.2

6.4

Accident

&

Health

Cross-Sell

Ratio

¹

71%

60%

27

1

Note : MetLife Plan FX rate of $1 = JPY 78.20.

Percentage of new policies (among six core whole life products) sold with stand-alone Accident

& Health products and riders. |

Continued Growth from Face-to-Face Channels

Note : MetLife Plan FX rate of $1 = JPY 78.20.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Increase penetration in Brokerage

General Agency segment

Expand unique Independent

Agency Federation

Improve productivity & cross-sell

Re-align sales support resources

and reduce expenses

Growth Priorities

Face-to-Face ANP Trend

($ in Millions)

28

0

200

400

600

800

1,000

1,200

1,400

2008

2009

2010

2011

Others

Pure Protection |

Larger Banks Offer Higher-End Customer Base

101 partner financial institutions

Multi-layer wholesaling model /

needs based sales approach

Full-service training and unique

e-learning capabilities

Competitive multi-currency

products

Highlights

Individual Bank Deposits

in Japan

(Total = $7.1 Trillion)

29

1

Note : MetLife Plan FX rate of $1 = JPY 78.20.

Individual bank deposits exclude small credit unions and foreign banks.

1

Source: Kinzai, Nikkin Report and bank disclosure (as of March 31, 2012).

Japan

Post, 31%

Mega

Banks,

27%

Regional

& Other

Banks,

31%

Non

Partners,

11%

-

- |

Bancassurance: Focused on Profitable Segments

MetLife Alico

Industry

Single premium whole life driving

recent growth

Mostly JPY denominated

products

Low interest rates and aggressive

competition pressuring margins

30

A leader in more profitable foreign

currency segment

A leader in Accident & Health,

growing double-digits annually

since 2008

Growing protection opportunity |

Direct Marketing: Large, Highly Profitable Business

Industry pioneer in direct

marketing

Large sponsor base

Best-in-class call center

capabilities

Source of leads for face-to-face

channel

Highlights

Direct Marketing Product Mix

1H 2012

31

Statutory Premiums, Deposits and Other Considerations.

1

1

Accident

& Health,

76%

Life,

24% |

Direct Marketing Business Repositioning

Direct Marketing ANP &

Marketing Efficiency Trend

($ in Millions)

Note : MetLife Plan FX rate of $1 = JPY 78.20.

1

Campaign Sales / Marketing Spend in MetLife Alico. 1H 2009 Marketing Spend

Efficiency rebased to $100M. See Appendix for non-GAAP financial

information, definitions and/or reconciliations. Leverage and grow sponsor

business

Shift media mix to improve

efficiency

Expand existing online sales

capabilities

32

Direct Marketing Priorities

0

20

40

60

80

100

120

140

160

1H-2009

2H-2009

1H-2010

2H-2010

1H-2011

2H-2011

1H-2012

Sales

Marketing Spend Efficiency

100

155

1 |

Key

Takeaways: Japan Distribution Market offers attractive growth

opportunities Well positioned to capture profitable growth

Face-to-Face increasing productivity and profitable product

mix

Leveraging bank relationships for emerging protection

opportunity

Direct Marketing repositioning improving efficiency and growth

33 |

ASIA

INVESTOR DAY 2012

Hiroyoshi Kitamura

Executive Vice President,

Profit Center & Products

MetLife Alico Japan |

Broad Suite of Products

Accident & Health

Life

Annuity

Bancassurance

U.S.$ Whole Life

Yen Whole Life

Level Term

Sub-Standard

Whole Life

U.S.$ and Yen

Single Premium

Whole Life

Foreign Currency

Fixed Annuity

Foreign Currency

Fixed Annuity

35

Independent

Agents

Direct

Marketing

Career

Agents

Single Premium

Medical |

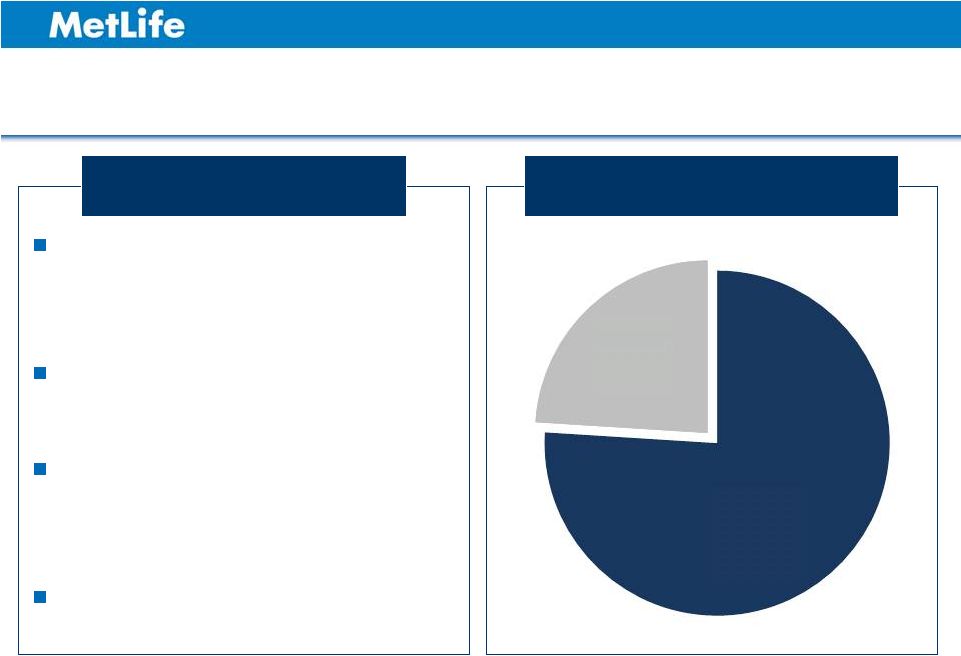

Diversified Product Mix Weighted toward Protection

Statutory Premiums, Deposits and

Other Considerations

1H 2012

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. 36

Operating Earnings

1H 2012

Accident

& Health,

26%

Group &

Credit,

1%

Annuities,

28%

Life Insurance,

45%

Life

Insurance,

10%

Accident &

Health,

70%

Group &

Credit, 1%

Annuities,

19% |

Proactively Growing Value

Relatively low in-force penetration

Volatile investment markets

Low interest rates

Asset diversification

Re-price, manage product mix and

enhance investment yields

Emphasize cross-selling / packaging

Increased competition and medical

technology advances

Continued product innovation

Leveraging global scale

Driving expense efficiency

37 |

Minimal Impact of Lower Interest Rates

Product

ANP Share

Sales Impact

Profitability

Impact

Level Premium Life

36%

Low

Medium

Accident & Health

29%

Low

Low

Fixed Annuity

25%

High

Low

Single Premium Life

9%

Medium

High

38

1

1

Percentages reflect share of annualized new premiums for fiscal year 2011. Excludes group insurance

products, which accounts for approximately 1% of total ANP share.

See Appendix for non-GAAP financial information, definitions and/or reconciliations. |

Leveraging MetLife’s Global Investment Capabilities

Total Investment Portfolio

As of June 30, 2012

Improving Asset Diversity and

Enhancing Investment Yields

Invest in USD corporate bonds,

swapped in AUD

Source USD commercial

mortgage loans

Utilize private placement bonds

in USD and AUD

Lengthen duration in Japanese

Government Bonds

39 |

Cross-Sell for

Both New and Existing Customers Maintain high cross-sell rates

through advice-based model

Mine existing customer

database

Direct marketing business

generates leads to agents

Cross-sell Opportunities

Policies per Customer

1

From January 1, 2011 through June 30, 2012.

40

1.54

1.56

1.58

1.60

1.62

Q1-2011

Q2-2011

Q3-2011

Q4-2011

Q1-2012

Q2-2012

~130,000 net policies cross-sold

1 |

Culture of Product Innovation

Dual-Currency

Fixed Annuity

$ Interest Sensitive

Whole Life

Single Premium

Whole Life FIH

Guaranteed Issue

Full-in-Hospital (FIH)

MetLife Alico has developed over 20 Industry First products

Product Innovation Examples:

Cancer Diagnosis

Rider for SIFIHWL

Simplified

Issue FIH

41

Interest Sensitive

Low Cash Value WL

2003

1999

2007

2000

2010

2006

2012 |

Product Innovation Continues

Advancing health care technology

and government policy relaxing

guidelines for mixed treatment

Nov. 2011

Outpatient Treatment Rider for

Sub-standard Medical

Nov. 2011

Advanced Medical Treatment Rider for

Sub-standard Medical

Sep. 2012

Cancer Rider for Sub-standard Medical

Government policy creating

incentives for

outpatient and

in-home treatment

42 |

Key

Takeaways: Japan Products Broad product portfolio meeting customer lifetime

needs Well-diversified and balanced

Emphasis on lower capital intensive and high ROE

products

Leveraging global investment capability

Continuing to innovate

43 |

ASIA

INVESTOR DAY 2012

Atsushi Yagai

Executive Vice President,

Strategy, Customer Marketing & Direct Marketing

MetLife Alico Japan |

Consumers Want a New Kind of Insurance Company

Source: MetLife internal research.

70% of policyholders considering

changing their current policy

68% of consumers consider two

brands or less

85% of consumers think life

insurance is too difficult and

complicated

Become easier to do business with

Enhance brand recognition and

preference

Focus on post-sale follow-up

45

MetLife Alico Response

Industry |

Persistency Ratio

Post-sale Follow-up Leads to Greater Retention

Key Initiatives

Agent notification system for

unpaid and lapsed policies

Increase credit card usage

“Orphan”

customer management

Align incentives to persistency

improvement

46

81%

82%

83%

84%

85%

86%

87%

88%

2008

2009

2010

2011 |

Become Easier To Do Business With

New Business

Benefit Payment

Relationship Management

Enhance self-service capabilities

Streamline and simplify claims

process

Redesign new business process and

simplify forms

47 |

Enhance Brand Recognition and Preference

48 |

Key

Takeaways: Japan Customer Centricity & Brand Enhancement

Customers want a new kind of

insurance company

Post-sale follow-up driving

persistency improvements

Becoming easier to do business

with will drive growth and value

creation

Leveraging unique brand assets

to enhance our brand

Efficiency

Persistency /

Brand Preference

Sales

49 |

ASIA

INVESTOR DAY 2012

William

Hogan

Chairman & Chief Executive Officer

MetLife Alico Japan Summary |

Growth

Value

Multiplier

51

Key Takeaways: MetLife Alico Japan |

ASIA

INVESTOR DAY 2012

Jong Kim

Chief Executive Officer

MetLife Korea |

MetLife Korea –

Building Value Through Discipline

Focused on productivity and profitability

Top-tier Career Agency

Fast growing General Agency

Successful launch of Accident & Health initiative

53 |

Increasing demand for Accident &

Health products

General Agency is

the fastest

growing channel

Rapidly aging society driving need

for retirement solutions

One of the first to launch individual

retirement products

Leverage Career Agency expertise to

drive General Agency success

Market growth is slowing

Enhance sales skills and productivity

in the Agency Channel; focus on

margin improvement

54

Korea -

Strategic Direction

Continue

successful

A&H

rollout |

Korea –

Demographic Trends

Age Distribution in Korea

Source: Statistics Korea; data as of Dec. 2011.

Korea will become a “super-

aged society”

by 2026

Dependent population

increasing, driving need for

retirement and protection

products

MetLife one of the first to

provide individual retirement

products following regulation

change

55

16%

13%

13%

73%

71%

63%

11%

16%

24%

0%

20%

40%

60%

80%

100%

2010

2020

2030

0-14

15-64

65+ |

Focused on Margin Improvement

Leveraging technology to drive persistency gains and

improve productivity

Revamped distributor compensation to better align

incentives with persistency

Maintain pricing discipline while offering competitive

products

56 |

Top-Tier Career Agency Drives Sales Growth

Source : Korea Life Insurance Association and MetLife internal

research. Note : MetLife Plan FX rate of $1 = 1,095 won.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Strong growth in

professional career agents

Focus on agent

productivity

#1 in % of Million Dollar

Round Table (MDRT)

qualifiers

Career Agency Channel

New Sales ANP

57 |

Career Agency –

High-Quality Agents

Highest agent

productivity in the

market

25% of agents qualified

for MDRT

Based on monthly new premiums per agent.

Source : Korea Life Insurance Association and MetLife internal research.

Note : MetLife Plan FX rate of $1 = 1,095 won.

Agent

Productivity

1

(2011)

% MDRT Qualifiers (2011)

58

1 |

“A Day in the Life of Two Agents”

Launched a mobile sales system to over 4,500 agents

Generated 8% of sales leads through mobile sales

system

Plan to roll out mobile service system to customers in

January 2013

59 |

General Agency –

Fastest Growing Channel in the

Market

Source : Korea Life Insurance Association and MetLife internal research.

Note : MetLife Plan FX rate of $1 = 1,095 won.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. General Agency Channel

New Sales ANP

MetLife’s General

Agency business grew

four times faster than the

market

Increasing number of

General Agency partners

Profitable mix of products

60

2009

2010

2011 |

Successful Launch of Accident & Health Initiative

Note : MetLife Plan FX rate of $1 = 1,095 won.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Strong sales growth driven by:

–

“A&H Everything”

initiative

–

Whole Life Cancer

product launch, Sept.

2011

Innovative products leveraging

MetLife Japan expertise

Accident & Health products

drive higher returns for the

business

61

Monthly Average New Sales of A&H in 2011

(ANP, stand-alone only)

2010

2011

Jan-Aug

Sep-Dec

A&H New Sales ANP |

Korea -

Key Takeaways

Focused on maximizing productivity and profitability

Continued success in Career Agency

Career Agency expertise leveraged in General Agency

channel

Positioned to capture retirement and Accident & Health

opportunities

62 |

ASIA

INVESTOR DAY 2012

Bob Pei

Chief Executive Officer

Sino-US United MetLife |

MetLife in China –

Building a Strong Franchise for

the Future

Maintaining strong sales growth into 2012

Strategically expanding footprint in China

Continuing to build on strong multi-channel distribution

capabilities

Disciplined marketing strategy

Strong joint venture partner relationship

64 |

Employee benefits market emerging

Insurance penetration increasing in

Tier 2 and Tier 3 cities

Continue to expand into new

provinces and cities

Expand employee benefits offering

Market growth is slowing;

increasing regulation

Continue leading position in Direct

Marketing and expand agency

penetration in existing cities

Deepen relationship with banks

65

China -

Strategic Direction

Foreign insurers share remains low

overall; higher in Tier 1 cities

Continue disciplined marketing

strategy and focus on target market

segments |

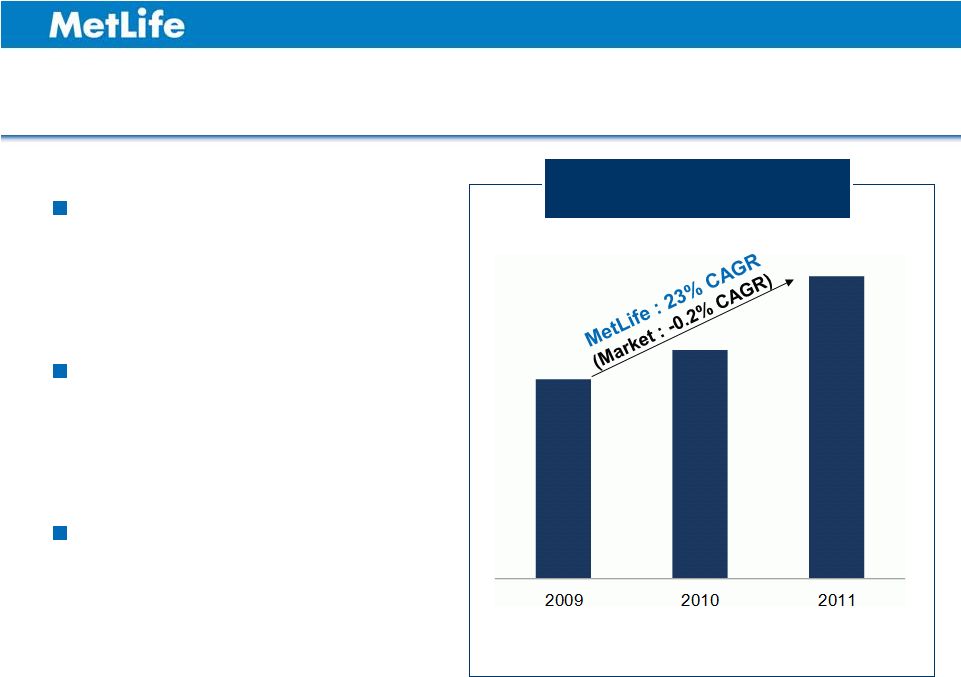

Strong Growth in China

Source : MetLife Plan FX rate of $1 = 6.225 yuan.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Geographic expansion

Improving productivity of

all channels

Successful merger of joint

ventures in 2011

Premiums, Fees and Other Revenues

66

2009

2010

2011 |

MetLife

in

China

–

Expanding

Footprint

11 cities at 2009 end

Chongqing

Branch

Chongqing

Jiangsu Branch

Nanjing

Wuxi

Guangdong Branch

Guangzhou

Shenzhen

Beijing HO

Beijing

Liaoning Branch

Dalian

Shenyang

Zhejiang Branch

Hangzhou

Ningbo

Shanghai HO

Shanghai

19 cities at 2010 end

Sichuan Branch

Chengdu

Suzhou

Nantong

Foshan

Dongguan

Shaoxing

Wenzhou

Fujian Branch

Fuzhou

Changzhou

Zhuhai

Jinhua

Hubei Branch

Wuhan

Shantou

MetLife had access to 37% of the insurance market at YE 2011

Source: MetLife internal research.

67

24 cities at 2011 end |

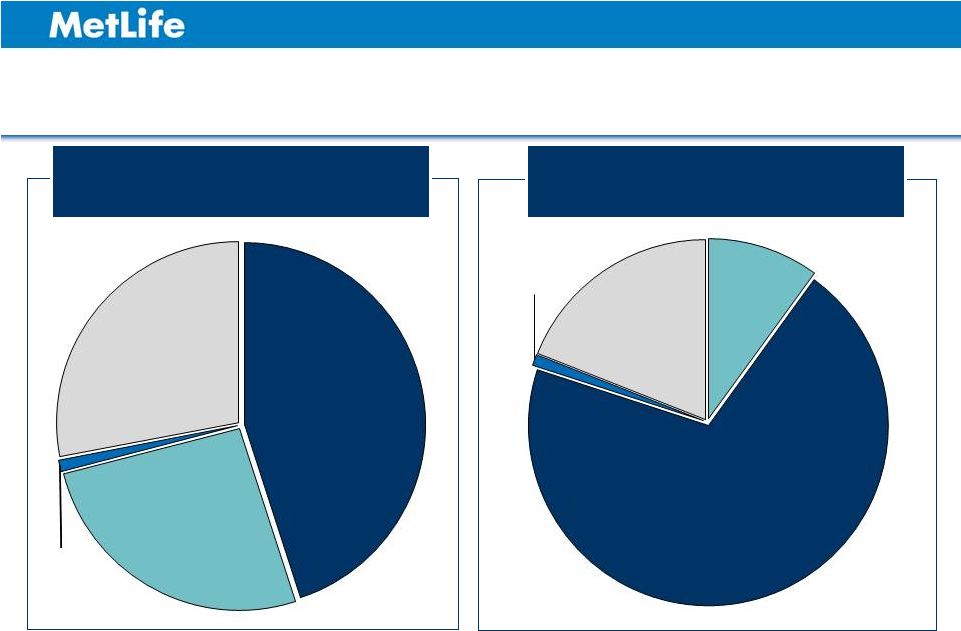

Diversified Channels and Balanced Business

Direct Marketing and

Bancassurance resulting in

faster payback on new city

entry

Building Agency and Group

as markets and operations

mature

Expanding beyond Tier 1 to

capture higher growth in

Tier 2 and Tier 3 cities

Distribution Mix

& Geographic Split

ANP 1H 2012

68

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. DMTM

Group

Bancassurance

Agency

Tier 1

Tier 2

Tier 3 |

Market Leader in Direct Marketing

Over 3,000 Telemarketing

Sales Representatives (TSRs),

focused on Accident & Health

Highest productivity among

competitors

Strong capability in generating

leads

Operate through sponsors and

proprietary channels

Rapidly Growing TSR Base

69

500

1,000

1,500

2,000

2,500

3,000

3,500

2009

2010

2011

0

1

1

National Life Insurers’ Direct Marketing / Telemarketing Data Exchange; data as of July

2012. |

Leading insurer with foreign banks

1

Strong account / wholesaler management and best-in-class

training

Expertise in targeting mass affluent segment

Balanced product portfolio with A&H, Life and Retirement

Track record for product innovation in variable products

Differentiated Bancassurance Model

1

Data as of June 2012 as provided by distribution partners.

70 |

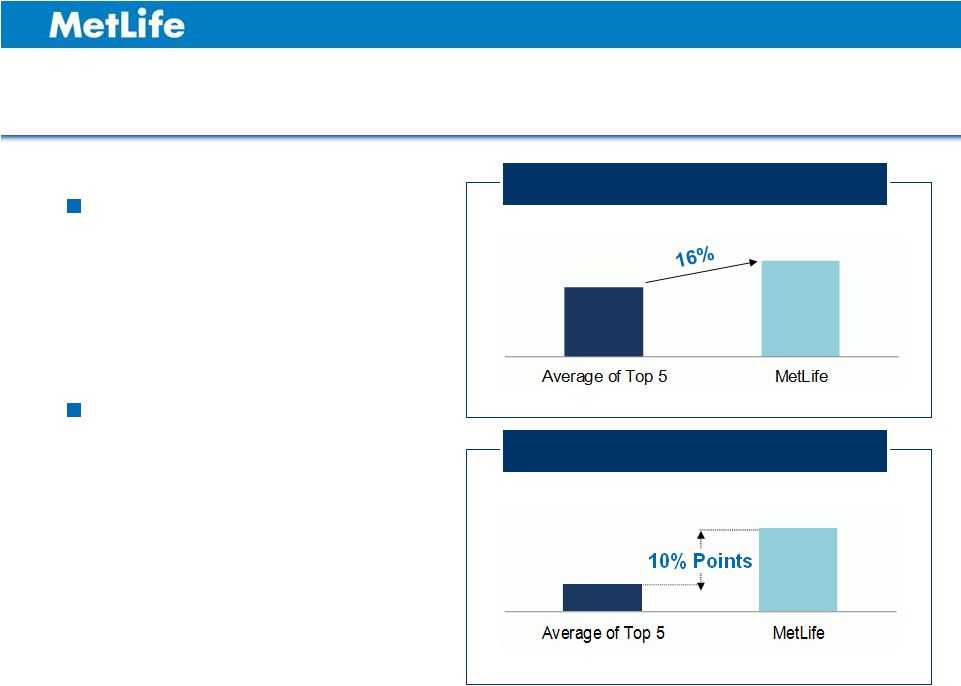

Highly Productive Agency Force

Market leader in productivity

Success based on selective

recruiting process and

compensation system

Need based selling model and

e-solution to differentiate from

competitors

Focused on protection products

1

National Insurance Industry Communication Club; data as of July 2012.

2

Includes only joint ventures operating in China.

Agency Productivity

71

Peer Average

MetLife

2

1 |

China -

Key Takeaways

Growing faster than the market

True multi-channel expertise

Disciplined approach to expansion

Optimize channel approach to city maturity & customer needs

A diversified, balanced and disciplined business

72 |

ASIA

INVESTOR DAY 2012

Toby Brown

Chief Financial Officer

MetLife Asia |

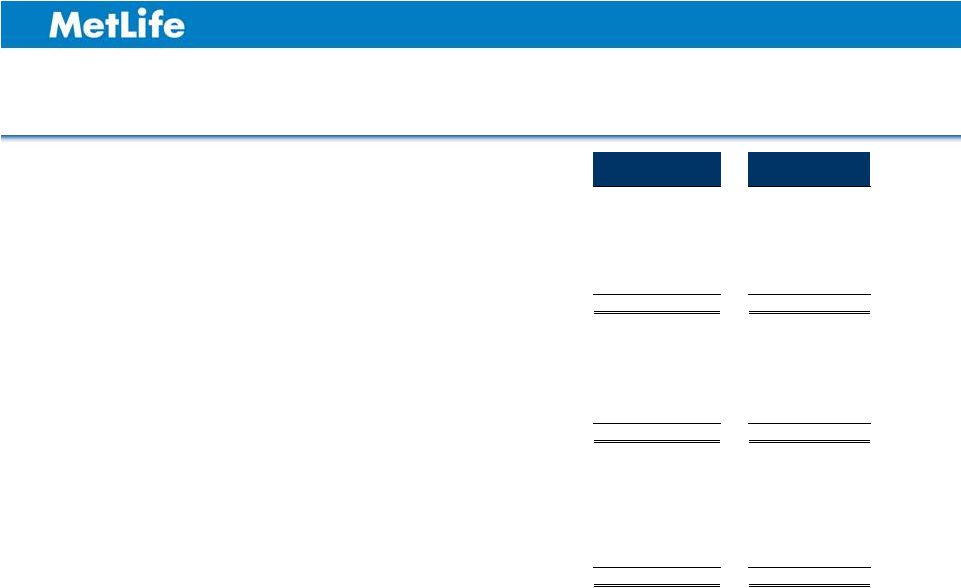

A

Growing Financial Position in Asia 74

($ in millions)

1H 2011

1H 2012

Change

Operating Earnings

$395

$572

45%

Annualized New Premiums (ANP)

$1,569

$1,780

13%

Premiums, Fees and Other Revenues

$4,300

$4,609

7%

Operating Expense Ratio

26.4%

24.3%

-210 bps

Japan SMR

896%

896%

-

Capital Repatriation

-

$1,575

-

1

1

2

2

3

3

1

May 31, 2012 and 2011, respectively.

2

China operating earnings and ANP included at 50% for non-consolidated joint

venture. 3

Excludes the China joint venture, which is recorded as net investment income in

MetLife Asia’s consolidated financial statements. See Appendix for

non-GAAP financial information, definitions and/or reconciliations. MetLife ALICO Japan has

a fiscal year-end Nov. 30. Therefore, the results presented for the first half of 2012 and 2011 reflect its operating results for the six months ended |

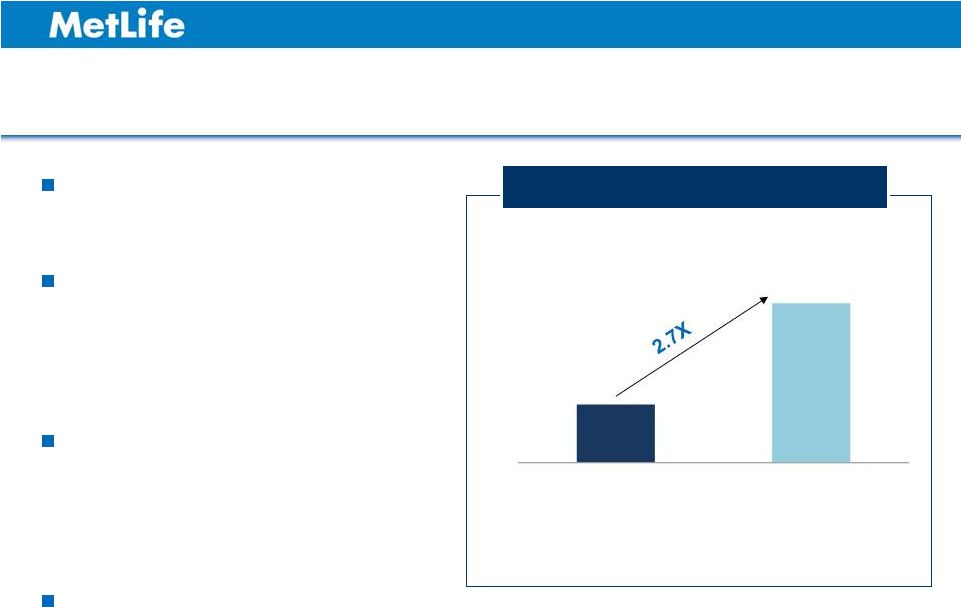

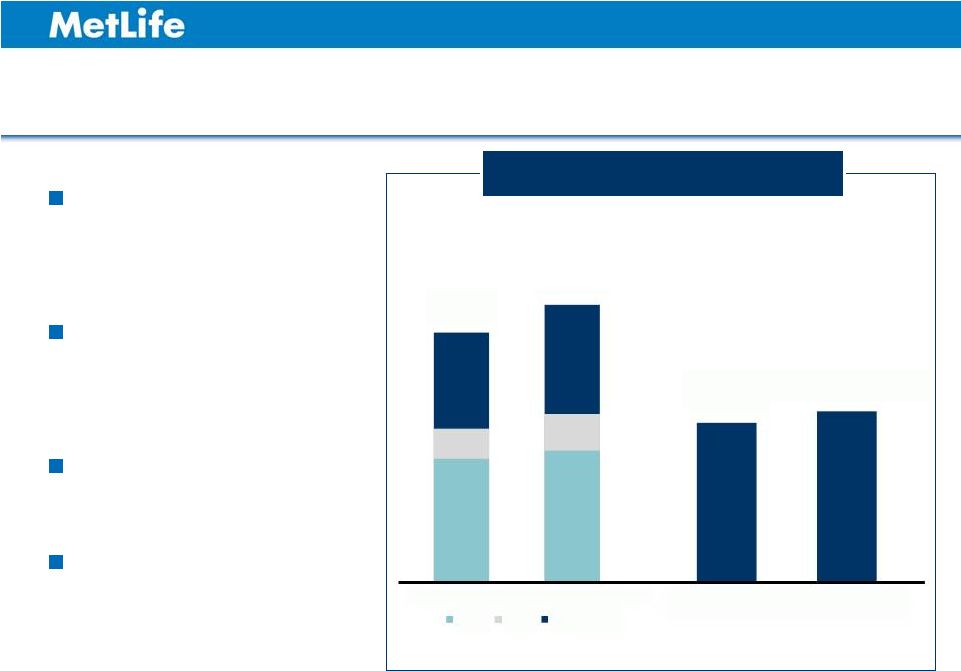

Operating Earnings Growth

75

Asia Operating Earnings up 45%;

Up 26% on an Adjusted Basis

1

Reflects $44 million in claims and expenses related to Japan earthquake and

tsunami. 2

Reflects $24 million of higher than planned variable investment income, partially

offset by a net $5 million in DAC and other actuarial items. See Appendix for

non-GAAP financial information, definitions and/or reconciliations.

Strong core performance,

improved operating margin

Repositioning of Japan

DM business

1H 2011 includes Japan

earthquake & tsunami

1H 2012 includes variable

investment income

$ in Millions

1

2

1H 2011

Adjusting Items

1H 2012

Adjusting Items

$395

$44

$572

($19) |

Strong New Business Growth

76

ANP up 13%

$1,569

$1,780

($ in Millions)

MetLife has a strong

and growing position

in Japan

Well positioned in

Korea and emerging

markets

Our focus is on

disciplined growth

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. 1H 2011

1H 2012

Other Asia

Korea

China

Japan |

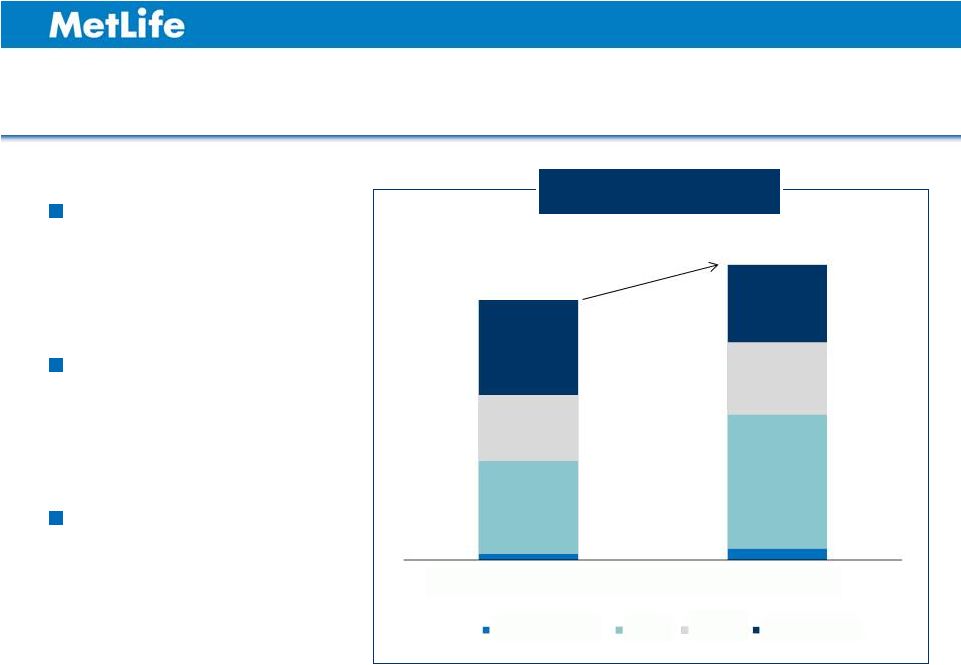

77

$1,569

$1,780

ANP up 13%

($ in Millions)

Growth weighted

towards protection

Clear, disciplined

pricing process

Proactive portfolio

management

Broad Based Growth Across Product Segments

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. 1H 2011

1H 2012

Group & Credit

Life

A&H

Retirement |

78

PDOC up 11%, PFOs up 7%

$9,963

$11,070

($ in Millions)

Double digit statutory

renewal premiums

growth

Increasing brand

activities in key

markets

Strong focus on

customer centricity

Increasing

distribution efficiency

Increased Multiplier from Persistency Initiatives

$4,300

$4,609

Statutory Premiums, Deposits

and Other Considerations

Premiums, Fees and

Other Revenues

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. 1H 2011

1H 2012

RNP

FYP

Single P

1H 2011

1H 2012 |

1H

2011 1H 2012

Net investment

income

$1,109

$1,383

Investment portfolio

gains/(losses)

($68)

($127)

Derivative

gains/(losses)

$41

$31

Managed Assets: $92.3 Billion

1

Asset Type

Income

1

Estimated fair value as of June 30, 2012.

See Appendix for non-GAAP financial information, definitions and/or

reconciliations. Foreign Government

Investment Grade Corps.

Structured Finance

U.S. Treasury & Agency

Real Estate

Below Investment Grade Corps.

Corp. Equity

Cash & Short-Term Investments

79

Asia Portfolio Credit Quality

91% A-rated or higher

99% investment grade

41%

10%

4%

2%

<1%

39%

3%

1% |

Macro and Strategic Overview

Challenging Economic

Environment

Managing business / earnings impacts

Maintaining credit quality

Leveraging MetLife’s investment capabilities

Investment Margin Expansion

Strategies

Leverage global credit skills

Competitive advantage in private assets

Cross-currency asset strategies

Maintain Disciplined ALM Philosophy

/ Risk Management

Highly diversified portfolio

Liability-driven asset strategies

Risk management focus

80 |

81

Operating Expense Ratio Improvement of

~210 bps; Expenses Nearly Flat YoY

1

Disciplined Expense Management

Absolute spend

levels nearly flat

Increased sales and

operating efficiency

Impact of improved

persistency on

revenues

0%

4%

8%

12%

16%

20%

24%

28%

1H 2011

1H 2012

26.4%

25.7%

1

24.3%

Excludes $28 million of expenses related to Japan earthquake and tsunami. See Appendix for non-GAAP

financial information, definitions and/or reconciliations. |

82

Strong Capital Position in Mature Markets

Japan and Korea

maintaining strong

SMRs

Subsidiary

conversion in Japan

completed,

repatriated $1.57

billion

Solvency Margin Ratio vs.

Industry Average

and Regulatory Minimum

1

0%

200%

400%

600%

800%

1000%

Japan

Korea

Latest reported

Industry Average

Regulatory minimum

Industry average is calculated using a simple average. Data from public filings as of June 30,

2012. 1

|

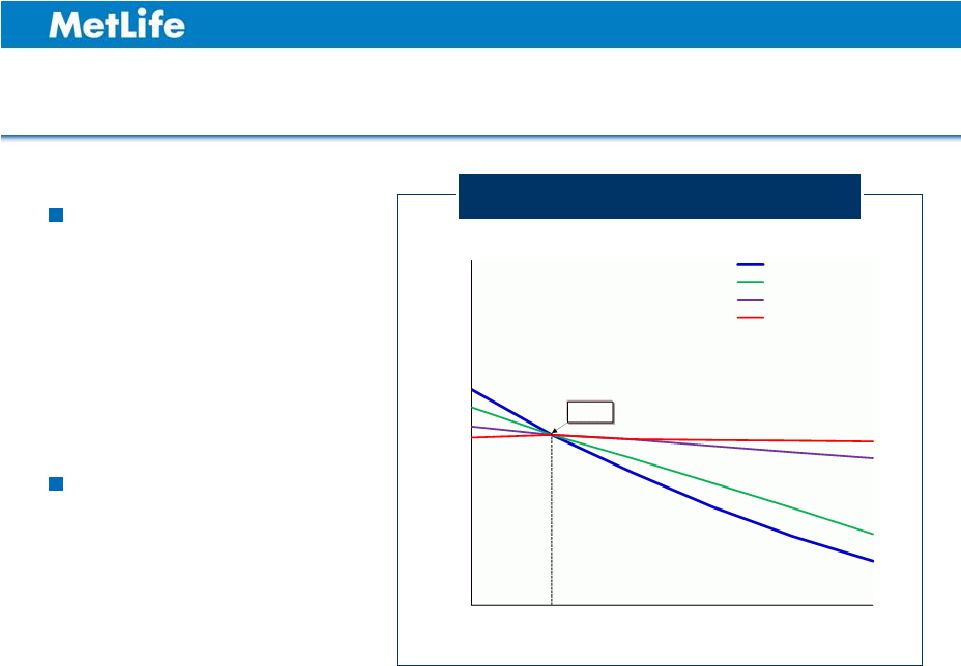

Sensitivity of Japan’s Solvency Margin Ratio to Interest

Rate Movements

83

SMR expected to

range between 600 -

700% for a 200 bps

increase in Japanese

interest rates

Rising interest rates

has a favorable

economic impact on

the business

SMR Sensitivity to Interest Rates

1

As of June 30, 2012.

600%

700%

800%

900%

1000%

1100%

1200%

-0.5%

0.0%

0.5%

1.0%

1.5%

2.0%

Interest Rate Change

Japan Rates Only

US Rates Only

Australian Rates Only

Others

896%

1 |

Sensitivity of Japan’s Solvency Margin Ratio to FX Rate

Movements

84

FX has a modest

impact on SMR ratio

A strengthening Yen

has a favorable

economic impact on

the business

SMR Sensitivity to Exchange Rates

1

As of June 30, 2012.

600%

700%

800%

900%

1000%

1100%

1200%

100

90

79.31

70

60

$ / Yen

Yen:USD

Yen:AUD

Yen:Others

896%

1 |

Further Opportunities to Drive Value

85

Global scale and simplicity efficiency

Increasing share of protection sales through our unique

multi-channel touch points

Increased investment margins

Operational & sales efficiency

Increased capital efficiency / deployment |

Key

Takeaways Asia is a core and growing contributor to MetLife

Balance of mature, developing and emerging markets all

with growth opportunities

Maintaining profitability discipline despite macro headwinds

Key initiatives capitalize on trends and opportunities

Future opportunities to further increase value

86 |

|

ASIA

INVESTOR DAY 2012

Appendix |

Explanatory Note on Non-GAAP Financial Information

89

All references in these presentations (except in this Explanatory Note on Non-GAAP Financial

Information slide) to operating earnings, premiums, fees and other revenues and operating

return on equity, should be read as operating earnings available to common shareholders,

premiums, fees and other revenues (operating) and operating return on MetLife, Inc.’s common equity, excluding AOCI,

respectively.

Operating earnings is the measure of segment profit or loss that MetLife uses to evaluate segment

performance and allocate resources. Consistent with accounting principles generally

accepted in the United States of America ("GAAP") accounting guidance for segment

reporting, operating earnings is MetLife's measure of segment performance. Operating earnings is also

a measure by which MetLife senior management's and many other employees' performance is

evaluated for the purposes of determining their compensation under applicable compensation

plans. Operating earnings is defined as operating revenues less operating expenses, both net of income tax.

Operating earnings available to common shareholders is defined as operating earnings less

preferred stock dividends.

Operating revenues and operating expenses exclude results of discontinued operations and other

businesses that have been or will be sold or exited by MetLife, Inc. (“Divested

Businesses”). Operating revenues also excludes net investment gains (losses) (“NIGL”) and net

derivative gains (losses) (“NDGL”). The following

additional adjustments are made to GAAP revenues, in the line items indicated, in calculating operating revenues:

•

Universal life and investment-type product policy fees excludes the amortization of unearned

revenue related to NIGL and NDGL and certain variable annuity guaranteed minimum income

benefits ("GMIB") fees ("GMIB Fees");

•

Net investment income: (i) includes amounts for scheduled periodic settlement payments and

amortization of premium on derivatives that are hedges of investments but do not qualify for

hedge accounting treatment, (ii) includes income from discontinued real estate operations,

(iii) excludes post-tax operating earnings adjustments relating to insurance joint ventures accounted for under the equity

method, (iv) excludes certain amounts related to contractholder-directed unit-linked

investments, and (v) excludes certain amounts related to securitization entities that are

variable interest entities ("VIEs") consolidated under GAAP; and

•

Other revenues are adjusted for settlements of foreign currency earnings hedges. |

Explanatory Note on Non-GAAP Financial Information

(Continued)

90

The following additional adjustments are made to GAAP expenses, in the line items indicated, in

calculating operating expenses: •

Policyholder benefits and claims and policyholder dividends excludes: (i) changes in the policyholder

dividend obligation related to NIGL and NDGL, (ii) inflation-indexed benefit adjustments

associated with contracts backed by inflation-indexed investments and amounts associated

with periodic crediting rate adjustments based on the total return of a contractually referenced pool

of assets, (iii) benefits and hedging costs related to GMIBs ("GMIB Costs"), and (iv)

market value adjustments associated with surrenders or terminations of contracts ("Market Value

Adjustments");

•

Interest credited to policyholder account balances includes adjustments for scheduled periodic

settlement payments and amortization of premium on derivatives that are hedges of policyholder

account balances but do not qualify for hedge accounting treatment and excludes amounts related

to net investment income earned on contractholder-directed unit-linked investments;

•

Amortization of deferred policy acquisition costs (“DAC”) and value of business acquired

("VOBA") excludes amounts related to: (i) NIGL and NDGL, (ii) GMIB Fees and GMIB Costs,

and (iii) Market Value Adjustments;

•

Amortization of negative VOBA excludes amounts related to Market Value Adjustments;

•

Interest expense on debt excludes certain amounts related to securitization entities that are VIEs

consolidated under GAAP; and

•

Other expenses excludes costs related to: (i) noncontrolling interests, (ii) implementation of new

insurance regulatory requirements, and (iii) acquisition and integration costs.

Operating return on MetLife, Inc.’s common equity is defined as operating earnings available to

common shareholders divided by average GAAP common equity.

Operating expense ratio is calculated by dividing operating expenses (other expenses net of

capitalization of DAC) by premiums, fees and other revenues (operating).

MetLife believes the presentation of operating earnings and operating earnings available to common

shareholders as MetLife measures it for management purposes enhances the understanding of the

company's performance by highlighting the results of operations and the underlying

profitability drivers of the business. Operating revenues, operating expenses, operating earnings,

operating earnings available to common shareholders, operating return on MetLife, Inc.’s

common equity, operating return on MetLife, Inc.’s common equity, excluding AOCI, investment

portfolio gains (losses) and derivative gains (losses) should not be viewed as substitutes for the

following financial measures calculated in accordance with GAAP: GAAP revenues, GAAP

expenses, GAAP income (loss) from continuing operations, net of income tax, GAAP net income

(loss) available to MetLife, Inc.'s common shareholders, return on MetLife, Inc.’s common equity,

return on MetLife, Inc.’s common equity, excluding AOCI, net investment gains (losses) and

net derivative gains (losses), respectively.

|

Explanatory Note on Non-GAAP Financial Information

(Continued)

Managed

Assets

is

a

financial

measure

based

on

methodologies

other

than

GAAP.

MetLife

utilizes

“Managed

Assets”

to

describe

assets

in

its

investment

portfolio

which

are

actively

managed

and

reflected

at

estimated

fair

value.

MetLife

believes

the

use

of

Managed

Assets

enhances

the

understanding

and

comparability

of

its

investment

portfolio

by

excluding

assets

such

as

policy

loans,

other

invested

assets,

mortgage

loans

held-for-sale, and mortgage loans held by consolidated securitization

entities, as substantially all of those assets are not actively managed in

MetLife’s investment portfolio. Trading and other securities are also

excluded as this amount is primarily comprised of contractholder-directed

unit-linked investments, where the contractholder, and not the company, directs

the investment of these funds. Mortgage loans and certain real estate

investments have also been adjusted from carrying value to estimated fair value.

For the historical periods presented, reconciliations of non-GAAP measures used

in this presentation to the most directly comparable GAAP measures are

included in this Appendix to the presentation materials and are on the Investor Relations portion of our Internet website.

Additional information about our historical results is also available on our

Internet website in our Quarterly Financial Supplements for the

corresponding periods.

The non-GAAP measures used in this presentation should not be viewed as

substitutes for the most directly comparable GAAP measures. In

these

presentations,

we

sometimes

refer

to

sales

activity

for

various

products.

These

sales

statistics

do

not

correspond

to

revenues

under

GAAP, but are used as relevant measures of business activity.

In these presentations, we provide guidance on our future earnings, premiums, fees

and other revenues, and return on common equity on an operating or

non-GAAP basis. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is not accessible

on a forward-looking basis because we believe it is not possible to provide

other than a range of net investment gains and losses and net derivative

gains and losses, which can fluctuate significantly within or without the range and from period to period and may have a significant

impact on GAAP net income.

91 |

Definitions |

Definitions

Sales / Annualized New Premiums:

•

10% of single-premium deposits (mainly from retirement products such as

variable annuity, fixed annuity and pensions) count towards

Annualized New Premiums. 20% of single-premium deposits from credit

insurance count towards Annualized New Premiums. •

100% of annualized full year premiums and fees from recurring-premium policy

sales of all products (mainly from risk and protection products such as

individual life, accident & health and group) count towards Annualized New Premiums.

93 |

Reconciliations |

95

MetLife ALICO Japan has a fiscal year-end Nov. 30. The results presented for the six months ended

June 30, 2012 and 2011 reflect its operating results for the six months ended May 31,

2012 and 2011, respectively. Reconciliation

of Operating Earnings Available to Common Shareholders to Net Income (Loss) Available to

MetLife, Inc.’s Common Shareholders – Asia

($ in Millions)

Six Months Ended

June 30, 2011

2011

Operating earnings available to common shareholders

$

572

$

395

$

867 Adjustments from operating earnings available to common

shareholders to net income (loss) available to MetLife, Inc.'s common

shareholders: Add: Net investment gains (losses)

(139)

(158)

(291)

Add: Net derivative gains (losses)

20

61

202

Add: Other adjustments to continuing operations

(1)

29

19

Add: Provision for income tax (expense) benefit

33

38

41

Add: Income (loss) from discontinued operations, net of income tax

-

(60)

(44)

Less: Net income (loss) attributable to noncontrolling interest

11

1

6

Net income (loss) available to MetLife, Inc.'s common shareholders

$

474

$

304

$

788 Six Months Ended

June 30, 2012 |

96

1

Other expenses (operating) net of capitalization of DAC.

Reconciliation of Premiums, Fees & Other Revenues (Operating) to Premiums, Fees &

Other Revenues (GAAP) and Reconciliation of Operating Expense Ratio – Asia

MetLife ALICO Japan has a fiscal year-end Nov. 30. The results presented for the six months ended

June 30, 2012 and 2011 reflect its operating results for the six months ended May 31, 2012 and

2011, respectively. ($ in Millions)

Six Months Ended

June 30, 2012

Six Months Ended

June 30, 2011

2011

Premiums, fees & other revenues (operating)

4,609

$

4,300

$

8,697

$

Adjustments from premiums, fees & other revenues (operating) to

premiums, fees & other revenues (GAAP):

Add: Universal life and investment-type product policy fees

(2)

-

-

Add: Other revenues

11

3

13

Premiums, fees & other revenues (GAAP)

4,618

$

4,303

$

8,710

$

Operating expenses

1

$

1,120

$

1,135 Operating expense ratio

24.3%

26.4% |

($ in

Billions) At June 30, 2012

Total investments

91.9

$

Add: Cash and cash equivalents

2.8

Add: Fair value adjustments

0.1

Less: Policy loans

1.7

Less: Other invested assets

(4.6)

Less: Trading and other securities

5.4

Managed assets

92.3

$

97

MetLife ALICO Japan has a fiscal year-end Nov. 30. The results presented for the six months ended

June 30, 2012 and 2011 reflect its operating results for the six months ended May 31, 2012 and

2011, respectively. Reconciliation of Total

Investments to Managed Assets - Asia |

98

($ in Millions)

Six Months Ended

June 30, 2012

Six Months Ended

June 30, 2011

Net investment income (operating)

$

Adjustments from net investment income (operating) to net

investment income (GAAP):

Add: Joint venture adjustments

Add: Net investment income on contractholder-directed unit-linked

investments Net investment income (GAAP)

$

$

Investment portfolio gains (losses)

$

$

Adjustments from investment portofilio gains (losses) to net

investment gains (losses):

Add: Other gains (losses) reported in net investment gains (losses) on GAAP

basis Net investment gains (losses)

$

$

Derivatives gains (losses)

$

$

Adjustments from derivative

gains (losses) to net derivative gains (losses):

Add: Joint venture adjustments

Add: Settlement of foreign currency earnings hedges

Net derivative gains (losses)

$

$

MetLife ALICO Japan has a fiscal year-end

Nov. 30. The results presented for the six months ended June 30, 2012 and 2011 reflect its operating results for the six months

ended May 31, 2012 and 2011, respectively.

1,383

-

149

1,532

(127)

(12)

(139)

31

-

(11)

20

$

1,109

(23)

91

1,177

(68)

(90)

(158)

41

23

(3)

61

Reconciliation of Net Investment Income (Operating) to Net Investment Income (GAAP),

Reconciliation of Investment Portfolio Gains (Losses) to Net Investment Gains (Losses)

and Reconciliation of Derivative Gains (Losses) to Net Derivative Gains (Losses) – Asia |

|

Christopher G. Townsend

President, Asia

MetLife, Inc.

Christopher Townsend is president of MetLife’s Asia region and a member of the company’s executive group. Appointed to this position in August 2012, Townsend oversees all of MetLife’s businesses in Japan, Korea, Australia, Hong Kong and China.

Prior to joining MetLife, Townsend was, since 2010, chief executive officer of the Asia Pacific region at Chartis, a leading insurance organization serving more than 70 million clients around the world. In addition to leading all aspects of the business across the region, which included 4,700 employees in 15 countries, he oversaw the company’s risk, audit, compliance and investment divisions. As CEO, Townsend drove capital optimization, cost efficiency and a focus on client needs as he implemented a strategy to take advantage of opportunities to drive an above average return on equity.

From 2007 to 2010, Townsend was chief executive officer of Chartis Australasia, with responsibility for the company’s businesses across Australia and New Zealand. Working with many of the company’s internal and external stakeholders, he developed and executed on a three-year plan to deliver a superior compound annual growth rate and solid combined operating ratios. In addition to reorganizing the business around its customers, he drove innovation through product development and the implementation of an ebusiness initiative that helped differentiate Chartis from many of its key competitors.

Earlier in his career, Townsend was the CEO of Chartis Hong Kong, served as senior vice president of mergers and acquisitions and also held a number of senior leadership roles in Hong Kong, London and Sydney. He joined Chartis in the United Kingdom in 1991 and spent more than half of his 21-year career in the company’s Asia Pacific region.

Townsend has previously served as a board member of the Hong Kong Federation of Insurers, governor of the American Chamber of Commerce and board member of the Insurance Council of Australia. He is a Chartered Insurer.

# # #

William R. Hogan

Director, Representative Statutory Executive Officer,

Chairman and Chief Executive Officer

MetLife Alico Life Insurance K. K.

William R. Hogan is Director, Representative Statutory Executive Officer, Chairman and Chief Executive Officer of MetLife Alico Life Insurance in Japan. He has been in this role since January 2011 and is responsible for overseeing the Japan operations.

Prior to his current role, Hogan was appointed senior vice president, International Product Management for MetLife. In this role, he was responsible for leading MetLife’s International Business’s product management efforts with a clear accountability for the development, management and measurements of all products, institutional, individual or inbound reinsurance, outside of the United States. He also had responsibility for international strategy and risk management.

Hogan joined MetLife in July 2005, following MetLife’s acquisition of The Travelers Insurance Company, excluding certain assets, and substantially all of Citigroup’s international insurance operations. Upon joining MetLife, he was responsible for all individually underwritten products sold through retail distribution including bancassurance, third-party distribution, direct and telemarketing, as well as through the company’s agency forces outside the United States.

Prior to joining MetLife, Hogan was regional head of Latin America for CitiInsurance, Citigroup’s international insurance division. As regional head, he was in charge of all insurance operations for CitiInsurance in Latin America, including managing four insurance companies and supporting Citibank insurance distribution in 12 countries.

Before taking responsibility for the Latin America region, Hogan was senior vice president, Travelers Life & Annuity, responsible for the P&L and operations of the life insurance and the retail annuities businesses. From 1997 to 2000, Hogan served as vice president and chief actuary for Travelers Life & Annuity, responsible for corporate risk oversight and all budgeting and financial reporting. In addition, he was chief actuary for the group annuity business. He started his career as an actuarial student with Travelers and held a variety of positions including that of actuary, individual annuities product development and asset liability.

Hogan received a B. A. degree in mathematics from Williams College. He is also a fellow in the Society of Actuaries.

# # #

Sachin N. Shah

Statutory Executive Officer and Executive Vice President, Chief Operating Officer

MetLife Alico Life Insurance K. K.

Sachin N. Shah is Statutory Executive Officer and Executive Vice President, COO of MetLife Alico Life Insurance in Japan. In this role, Shah is responsible for overall strategy, marketing, branding, all distribution channels and distribution support functions in Japan. He was the global leader for the integration of Alico into MetLife until closing of the transaction.

He was named to this position in 2011 and has held several leadership roles at MetLife since joining the company almost 14 years ago.

Prior to his current position, Shah was responsible for developing and executing business strategy for MetLife’s international business. In this role, Shah identified and managed key growth initiatives as well as mergers & acquisitions in the international markets where MetLife operates. Examples include entry into group dental business in Brazil, expansion of pensions business in Mexico, launching bancassurance and career agency in India, re-positioning the career agency channel in China, and expansion of general agency channel in Mexico.

Shah received a B.S. degree in electrical engineering and a master’s degree in technology and business management from Stevens Institute of Technology in New Jersey. He has been recognized by Who’s Who in Management Professionals and most recently in Who’s Who of National Business Leaders.

# # #

Hiroyoshi Kitamura

Statutory Executive Officer and Executive Vice President, Profit Center & Products

MetLife Alico Life Insurance K. K.

Hiroyoshi Kitamura is Statutory Executive Officer and Executive Vice President in charge of Profit Center & Products of MetLife Alico Life Insurance in Japan. In this role, he is responsible for top line and bottom line of all products sold in Japan, as well as product development and product management.

Prior to this role, Kitamura was Vice President in charge of the Insurance Profit Center, where he was responsible for Life, A&H and Group products.

From 2004 to 2007, he held positions of Regional Assistant Vice President in charge of Medical Profit Center at AIG Japan and its Korea Regional Office. In this role, he supervised A&H product development and product management at three life insurance companies in Japan and one in Korea.

Kitamura has worked in product development related positions since he became manager of the Medical Product Profit Center in 2002. In this role, not only did he develop various new products including Life-style Related Disease Insurance, but he also succeeded in packaging value added services with A&H products so to enhance product competitiveness.

Prior to his role at Medical Product Profit Center, in 1997 Kitamura started up data based marketing in Alico Japan to accelerate up-selling and cross-selling activities in face-to-face distributions. In this role, he worked closely with distribution, as well as information technology and operations.

Kitamura started his career at Alico Japan in direct marketing where he worked as an account manager for some of Alico Japan’s sponsors, including credit card companies.

Kitamura received a B.A. degree from Meiji Gakuin University and an MBA from New York University.

# # #

Atsushi Yagai

Executive Officer and Executive Vice President

Strategy, Customer Marketing & Direct Marketing

MetLife Alico Life Insurance K. K.

Atsushi Yagai is Executive Officer and Executive Vice President in charge of Strategy & Marketing and Direct Marketing for MetLife Alico Life Insurance in Japan. He has been in this role since January 2011, when he joined the company.