Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - National American University Holdings, Inc. | d408794d8k.htm |

Exhibit 99.1

| NASDAQ: NAUH September 2012 |

| 2 This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, about National American University Holdings, Inc. and its affiliated entities (the "Company"). Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of the Company's management, are subject to risks and uncertainties, which could cause actual results of the Company to differ from any future results expressed or implied by such forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: future operating or financial results; uncertainties regarding the strength of the future growth of the education industry; uncertainties regarding the availability of student loans and other financing sources primarily used for tuition; continued compliance with government regulations; changing legislative or regulatory environments; management of growth; intensity of competition; the availability of cash to pay dividends, the ability to meet debt obligations or obtain additional financing to fund operations and/or acquisitions; general market conditions; changing interpretations of generally accepted accounting principles; and general economic conditions, as well as other relevant risks detailed in the Company's filings with the Securities and Exchange Commission, including its report on Form 10-K for the period ended May 31, 2012. The information set forth herein should be read in light of such risks. The Company does not undertake any obligation to update anyone with regard to the forward-looking statements. Safe Harbor |

| Dr. Ronald Shape Chief Executive Officer Ms. Venessa Green Chief Financial Officer Presenters |

| NAUH OVERVIEW - Dr. Shape |

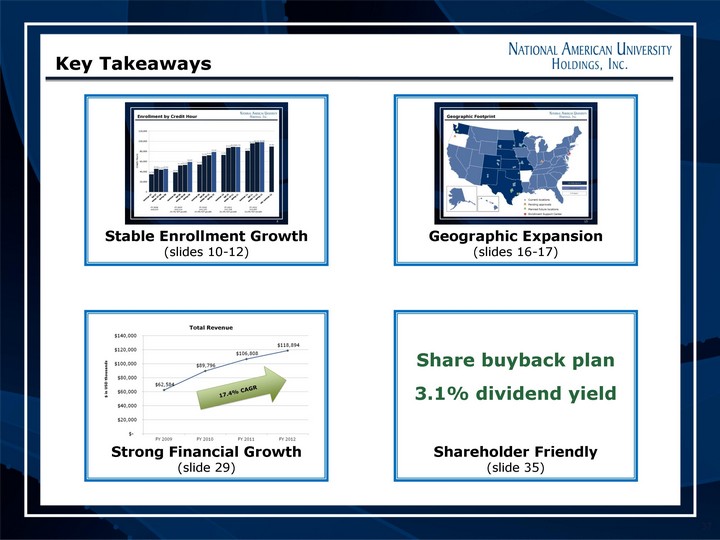

| 5 Key Takeaways Stable Enrollment Growth (slides 10-12) Geographic Expansion (slides 16-17) Share buyback plan 3.1% dividend yield Shareholder Friendly (slide 35) Strong Financial Growth (slide 29) |

| National American University Holdings, Inc., through its wholly owned subsidiary, operates National American University (NAU), a regionally accredited, proprietary, multi-campus institution of higher learning offering associate, bachelor's, and master's degree programs in health care and business-related disciplines Offers degree programs in on-ground and online formats, and combination of both, providing students increased flexibility to take courses at times and places convenient to their busy lifestyles Has a strong presence in the Midwest and is growing its geographic footprint Company Overview |

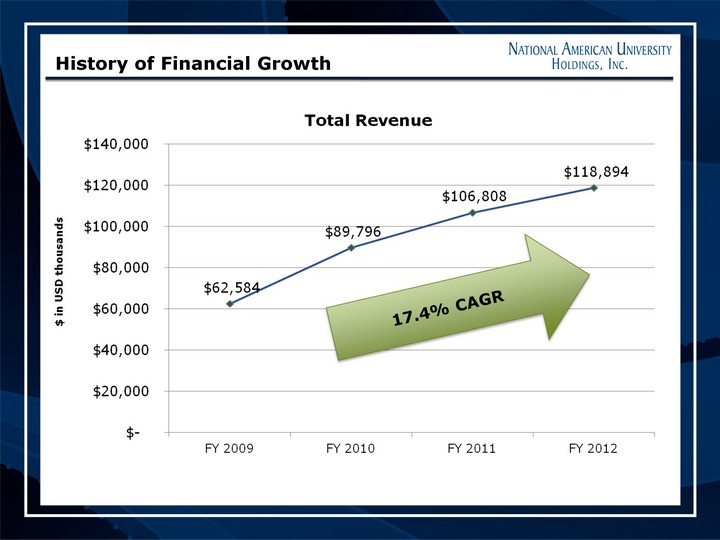

| Post-secondary education company catering to the non-traditional student, typically in his/her early 30s, seeking to complete a degree either for the first time or in a new field, while also juggling pressures of family obligations and work commitments Regionally accredited by the Higher Learning Commission; various programmatic accreditations Associate, bachelor's, and master's degree programs and select industry-focused diplomas Flexible course and program delivery: on-ground, online, or a combination of both 35 physical locations (two pending approvals) in the Midwest and growing, as of 8/2/2012 Growth primarily driven by: Continued investment in the expansion and development of physical locations and academic programs Improved enrollment management system and recruitment processes Quality academic programming Economic conditions FY 2012 annual revenues increased 11.3% to $118.9 million from $106.8 million in prior year FY 2012 income before non-controlling interest and taxes was $8.8 million $30.6 million in cash and short-term investments, no long-term debt at 5/31/2012 Dividend-paying company (MRQ: $0.0325 per share) Proven management team with extensive experience in the post-secondary education industry Substantial Scale with a History of Profitable, Organic Growth Solid Financials, Well Capitalized, Experienced Management Investment Highlights |

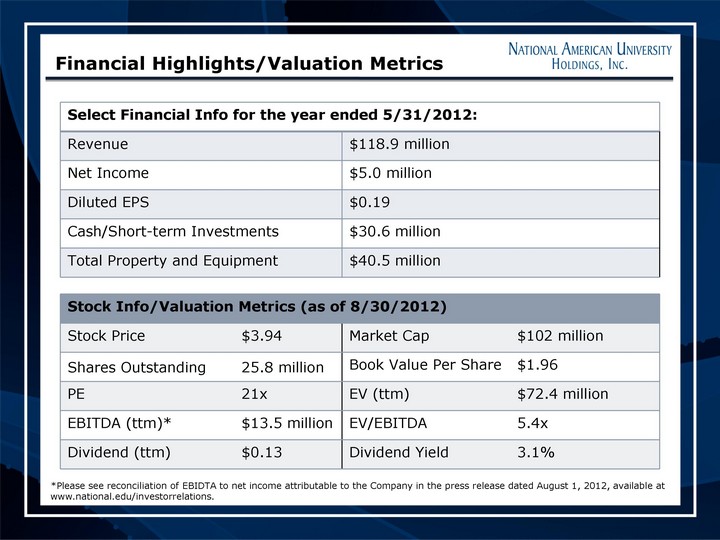

| Financial Highlights/Valuation Metrics Select Financial Info for the year ended 5/31/2012: Select Financial Info for the year ended 5/31/2012: Revenue $118.9 million Net Income $5.0 million Diluted EPS $0.19 Cash/Short-term Investments $30.6 million Total Property and Equipment $40.5 million Stock Info/Valuation Metrics (as of 8/30/2012) Stock Info/Valuation Metrics (as of 8/30/2012) Stock Info/Valuation Metrics (as of 8/30/2012) Stock Info/Valuation Metrics (as of 8/30/2012) Stock Price $3.94 Market Cap $102 million Shares Outstanding 25.8 million Book Value Per Share $1.96 PE 21x EV (ttm) $72.4 million EBITDA (ttm)* $13.5 million EV/EBITDA 5.4x Dividend (ttm) $0.13 Dividend Yield 3.1% *Please see reconciliation of EBIDTA to net income attributable to the Company in the press release dated August 1, 2012, available at www.national.edu/investorrelations. |

| Dr. Ronald Shape CEO Dr. Sam Kerr Provost & General Counsel Ms. Venessa Green CFO Dr. Bob Paxton President - Distance Learning Dr. Jerry L. Gallentine President Mr. Scott Toothman VP of Institutional Support & Military Services Ms. Michaelle Holland President of Campus Operations Experienced NAU Management Team |

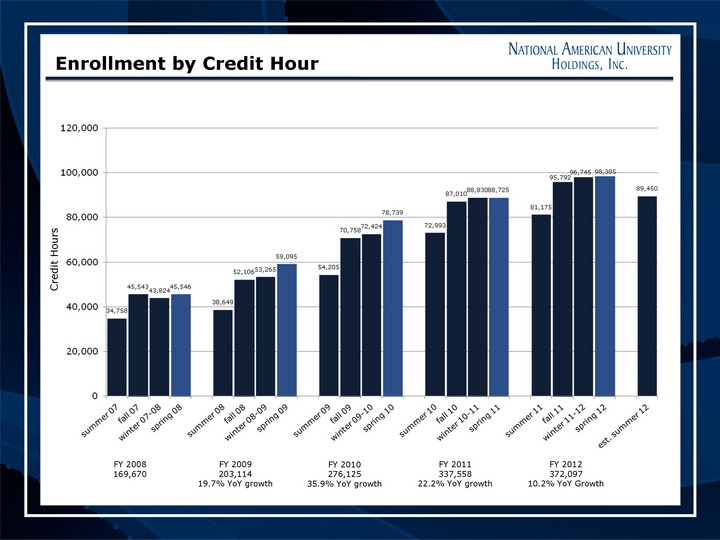

| FY 2008 169,670 FY 2009 203,114 19.7% YoY growth FY 2010 276,125 35.9% YoY growth Credit Hours FY 2011 337,558 22.2% YoY growth FY 2012 372,097 10.2% YoY Growth Enrollment by Credit Hour |

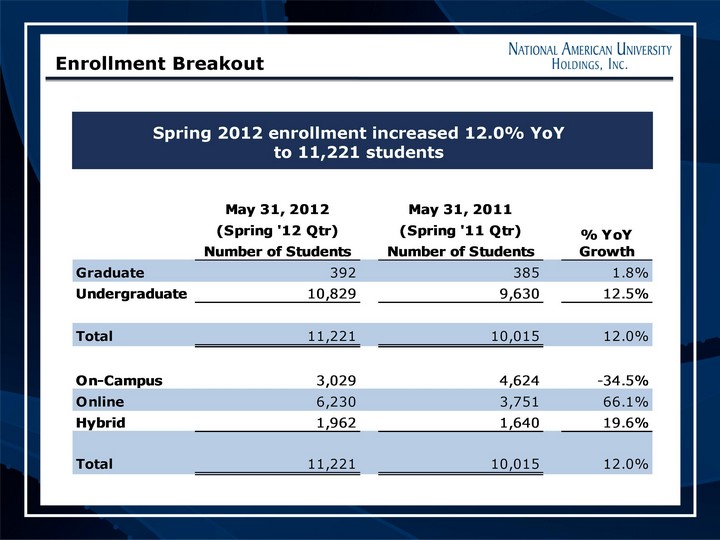

| Spring 2012 enrollment increased 12.0% YoY to 11,221 students Enrollment Breakout |

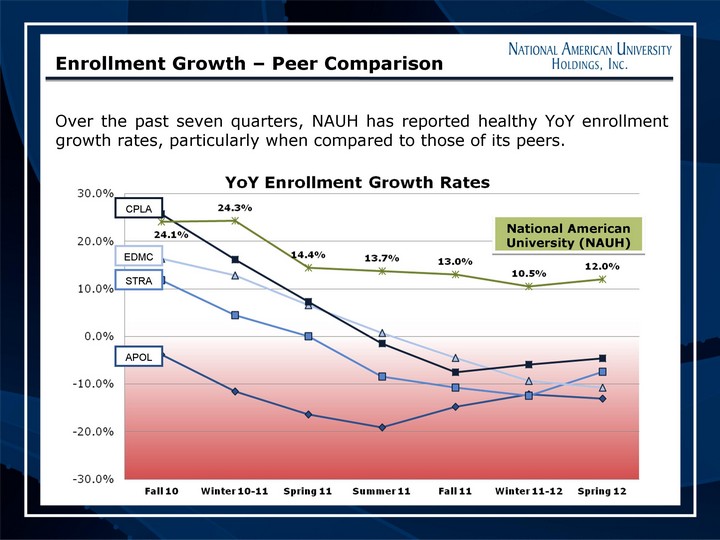

| APOL STRA EDMC National American University (NAUH) Over the past seven quarters, NAUH has reported healthy YoY enrollment growth rates, particularly when compared to those of its peers. Enrollment Growth - Peer Comparison CPLA |

| Continued investment in the expansion and development of physical locations Dedicated focus on utilizing existing capacity Continued investment in the expansion of current academic programs and development of new academic programs Improved enrollment management system and recruiting processes Quality academic programming Economic conditions Timing of regulatory approvals for new locations and new programs Factors Driving Enrollment Growth |

| EXPANSION - Dr. Shape |

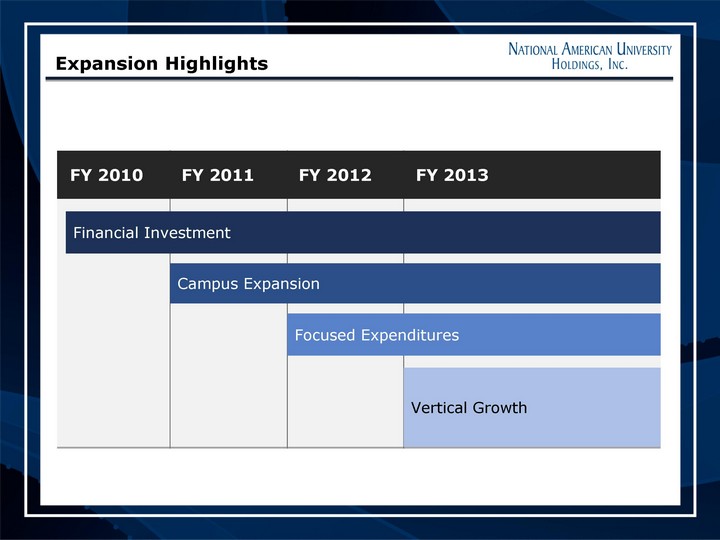

| Financial Investment Campus Expansion Focused Expenditures Vertical Growth FY 2010 FY 2011 FY 2012 FY 2013 Expansion Highlights |

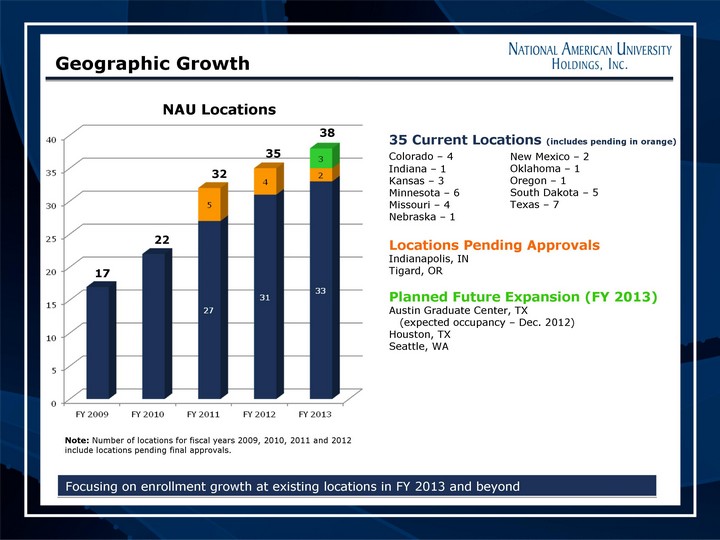

| 35 Current Locations (includes pending in orange) Colorado - 4 Indiana - 1 Kansas - 3 Minnesota - 6 Missouri - 4 Nebraska - 1 Locations Pending Approvals Indianapolis, IN Tigard, OR Planned Future Expansion (FY 2013) Austin Graduate Center, TX (expected occupancy - Dec. 2012) Houston, TX Seattle, WA NAU Locations Note: Number of locations for fiscal years 2009, 2010, 2011 and 2012 include locations pending final approvals. 17 22 32 35 Focusing on enrollment growth at existing locations in FY 2013 and beyond New Mexico - 2 Oklahoma - 1 Oregon - 1 South Dakota - 5 Texas - 7 38 Geographic Growth |

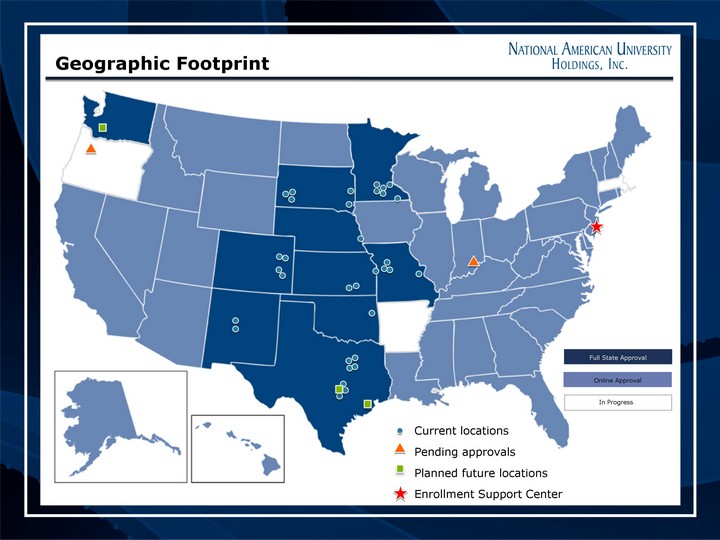

| Current locations Pending approvals Planned future locations Enrollment Support Center Full State Approval Online Approval In Progress Geographic Footprint |

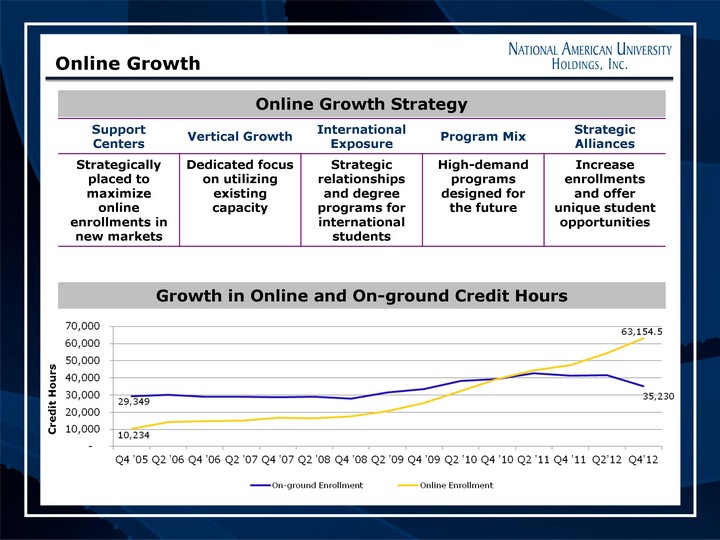

| Online Growth Strategy Support Centers Vertical Growth International Exposure Program Mix Strategic Alliances Strategically placed to maximize online enrollments in new markets Dedicated focus on utilizing existing capacity Strategic relationships and degree programs for international students High-demand programs designed for the future Increase enrollments and offer unique student opportunities Growth in Online and On-ground Credit Hours Credit Hours Online Growth |

| ACADEMICS - Dr. Shape |

| Academic Highlights Continued academic program expansion, including business, IT, and allied health at the undergraduate level with additional emphasis areas at the graduate level Established Roueche Graduate Center, which will be located in Austin, Texas, and house NAU's Harold D. Buckingham Graduate School Continued growth in allied health and associate degree programs Received written confirmation of CCNE accreditation for the Online RN to BSN, BSN, LPN to BSN Bridge, and MSN programs Developed the NAU Community College Advisory Board to promote relationships with community colleges Established university press to advance original research in the field of higher education through The Journal of Career & Professional Education Continued focus on course completion, persistence and placement of our graduates |

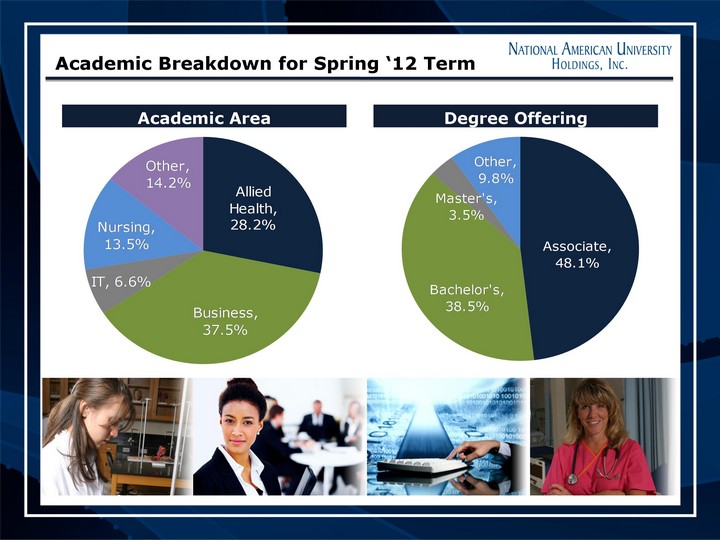

| Degree Offering Academic Area Academic Breakdown for Spring '12 Term |

| Dr. John E. Roueche President Community College Advisory Board Former Professor & Director, Community College Leadership Program and Sid W. Richardson Regents Chair, The University of Texas at Austin Located in Austin, Texas Led by Dr. John E. Roueche, a nationally recognized authority in community college education Will house NAU's Harold D. Buckingham Graduate School Represents NAU's commitment to quality graduate programming NAU is in the process of pursuing additional graduate programming, including potential doctoral programs Goal: to better serve the graduate student community and continue pursuing additional graduate opportunities Roueche Graduate Center |

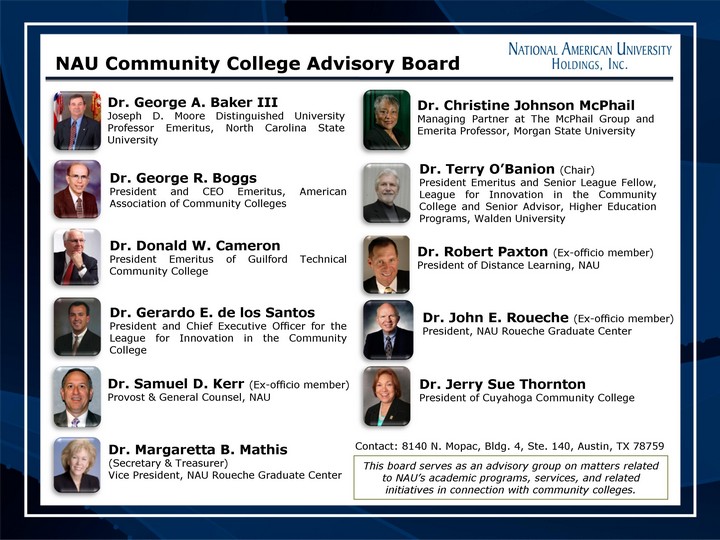

| NAU Community College Advisory Board Dr. George R. Boggs President and CEO Emeritus, American Association of Community Colleges Dr. Donald W. Cameron President Emeritus of Guilford Technical Community College Dr. Gerardo E. de los Santos President and Chief Executive Officer for the League for Innovation in the Community College Dr. Terry O'Banion (Chair) President Emeritus and Senior League Fellow, League for Innovation in the Community College and Senior Advisor, Higher Education Programs, Walden University Dr. Margaretta B. Mathis (Secretary & Treasurer) Vice President, NAU Roueche Graduate Center Dr. Robert Paxton (Ex-officio member) President of Distance Learning, NAU Dr. Samuel D. Kerr (Ex-officio member) Provost & General Counsel, NAU This board serves as an advisory group on matters related to NAU's academic programs, services, and related initiatives in connection with community colleges. Dr. John E. Roueche (Ex-officio member) President, NAU Roueche Graduate Center Dr. Jerry Sue Thornton President of Cuyahoga Community College Dr. George A. Baker III Joseph D. Moore Distinguished University Professor Emeritus, North Carolina State University Dr. Christine Johnson McPhail Managing Partner at The McPhail Group and Emerita Professor, Morgan State University Contact: 8140 N. Mopac, Bldg. 4, Ste. 140, Austin, TX 78759 |

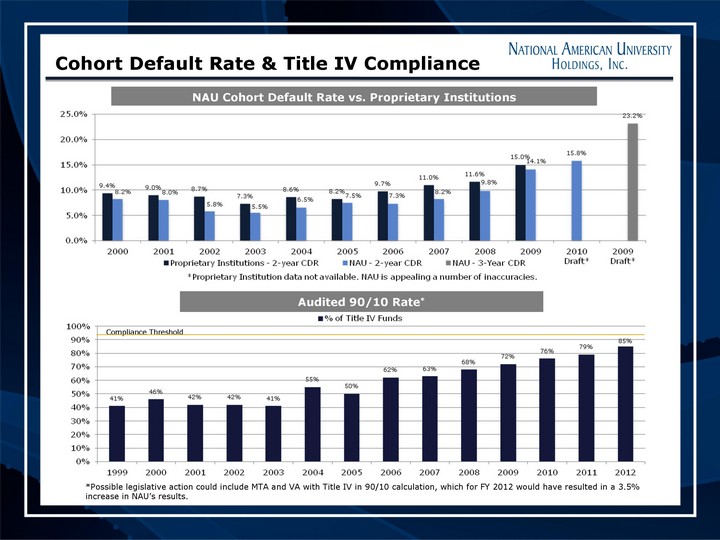

| Accreditation & Regulatory Excellence Regional accreditation by the Higher Learning Commission and member of the North Central Association of Colleges and Schools Programmatic accreditation and approvals by various national educational and professional associations Continual evaluation of regulatory compliance by NAU senior management Consistently low Title IV 90/10 ratio and Cohort Default Rates Academic Excellence and Student Value High student persistence Successful course completion Affordable tuition History of Profitable Organic Growth |

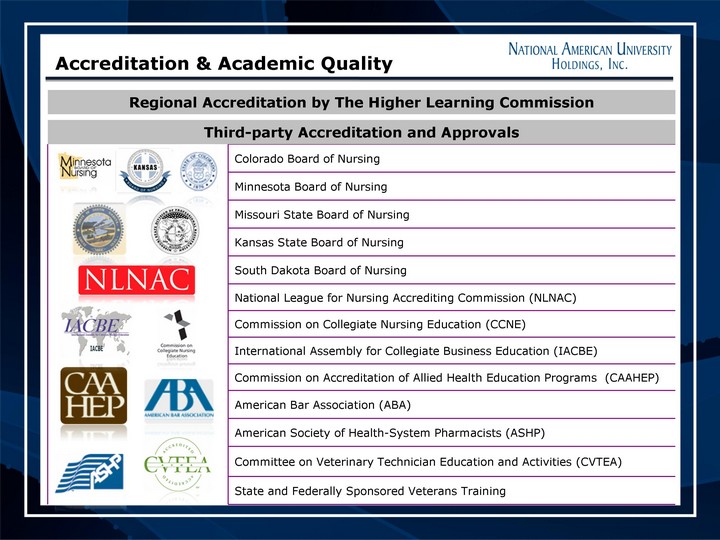

| Colorado Board of Nursing Minnesota Board of Nursing Missouri State Board of Nursing Kansas State Board of Nursing South Dakota Board of Nursing National League for Nursing Accrediting Commission (NLNAC) Commission on Collegiate Nursing Education (CCNE) International Assembly for Collegiate Business Education (IACBE) Commission on Accreditation of Allied Health Education Programs (CAAHEP) American Bar Association (ABA) American Society of Health-System Pharmacists (ASHP) Committee on Veterinary Technician Education and Activities (CVTEA) State and Federally Sponsored Veterans Training Third-party Accreditation and Approvals Regional Accreditation by The Higher Learning Commission Accreditation & Academic Quality |

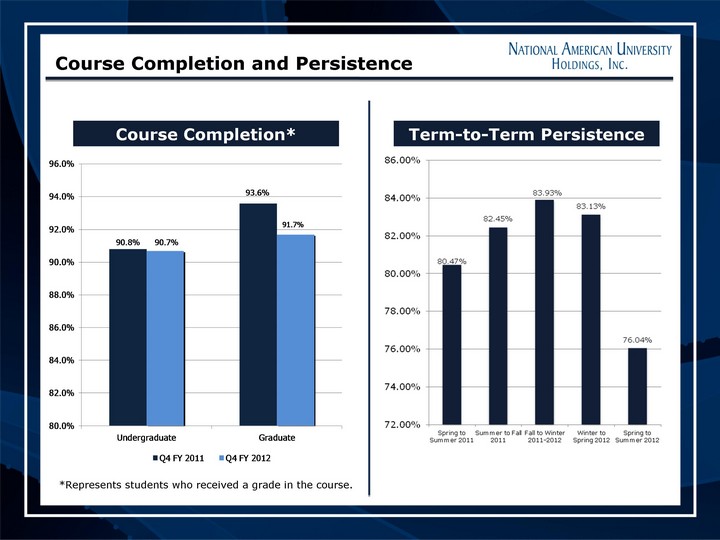

| Course Completion* Term-to-Term Persistence *Represents students who received a grade in the course. Course Completion and Persistence |

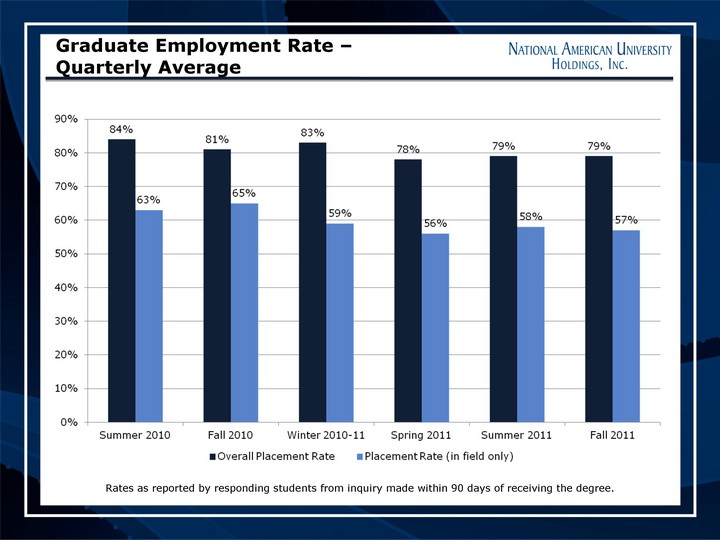

| Rates as reported by responding students from inquiry made within 90 days of receiving the degree. Graduate Employment Rate - Quarterly Average |

| FINANCIALS - Ms. Green |

| History of Financial Growth |

| Cohort Default Rate & Title IV Compliance NAU Cohort Default Rate vs. Proprietary Institutions Audited 90/10 Rate* Compliance Threshold *Possible legislative action could include MTA and VA with Title IV in 90/10 calculation, which for FY 2012 would have resulted in a 3.5% increase in NAU's results. |

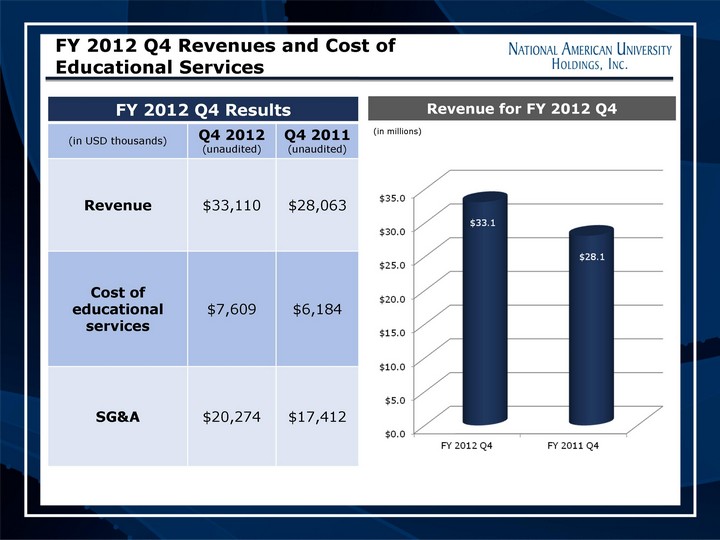

| FY 2012 Q4 Revenues and Cost of Educational Services FY 2012 Q4 Results FY 2012 Q4 Results FY 2012 Q4 Results (in USD thousands) Q4 2012 (unaudited) Q4 2011 (unaudited) Revenue $33,110 $28,063 Cost of educational services $7,609 $6,184 SG&A $20,274 $17,412 Revenue for FY 2012 Q4 (in millions) |

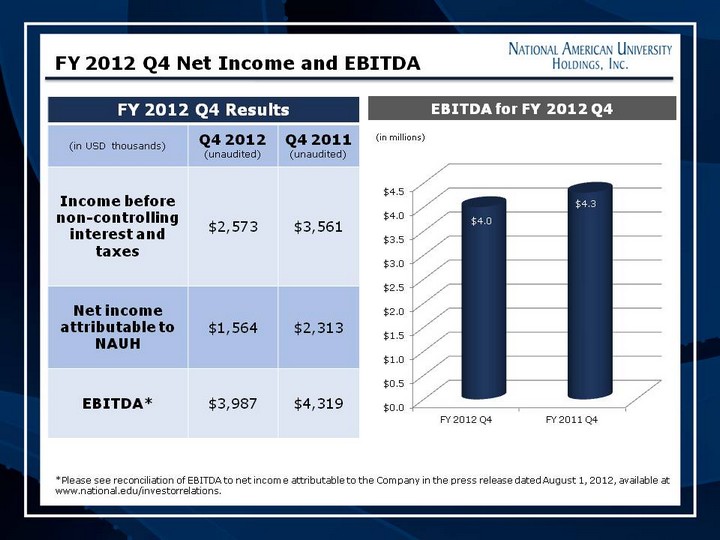

| FY 2012 Q4 Results FY 2012 Q4 Results FY 2012 Q4 Results (in USD thousands) Q4 2012 (unaudited) Q4 2011 (unaudited) Income before non-controlling interest and taxes $2,573 $3,561 Net income attributable to NAUH $1,564 $2,313 EBITDA* $3,987 $4,319 EBITDA for FY 2012 Q4 (in millions) *Please see reconciliation of EBITDA to net income attributable to the Company in the press release dated August 1, 2012, available at www.national.edu/investorrelations. FY 2012 Q4 Net Income and EBITDA |

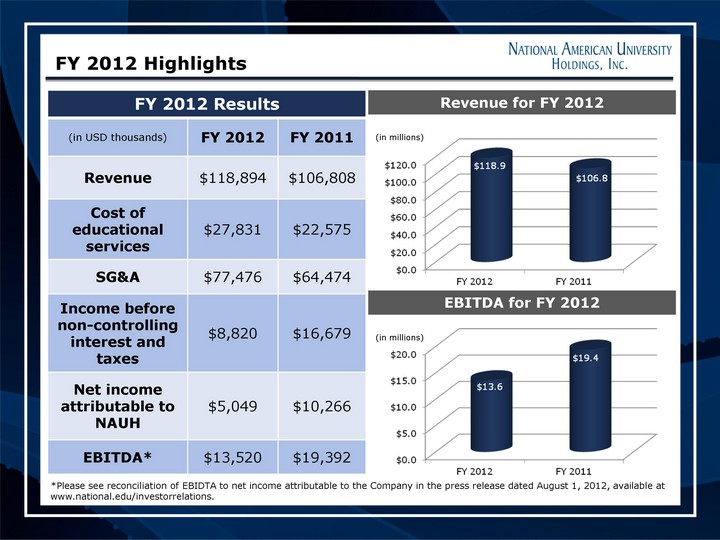

| FY 2012 Results FY 2012 Results FY 2012 Results (in USD thousands) FY 2012 FY 2011 Revenue $118,894 $106,808 Cost of educational services $27,831 $22,575 SG&A $77,476 $64,474 Income before non-controlling interest and taxes $8,820 $16,679 Net income attributable to NAUH $5,049 $10,266 EBITDA* $13,520 $19,392 Revenue for FY 2012 EBITDA for FY 2012 (in millions) (in millions) FY 2012 Highlights *Please see reconciliation of EBIDTA to net income attributable to the Company in the press release dated August 1, 2012, available at www.national.edu/investorrelations. |

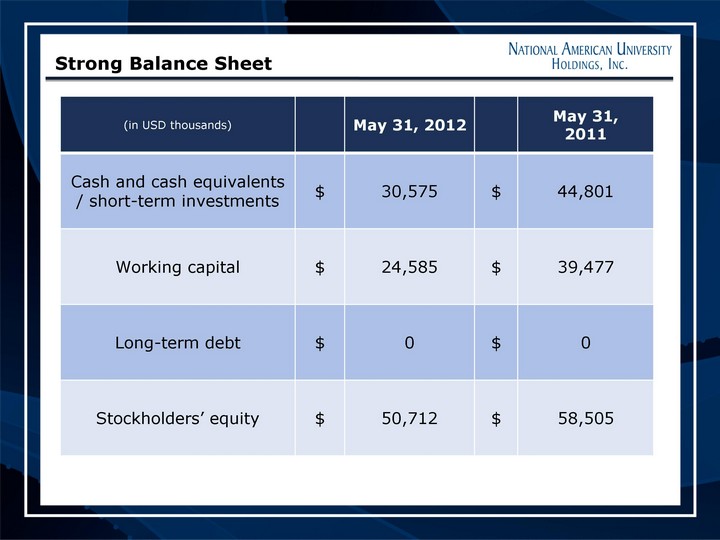

| Strong Balance Sheet (in USD thousands) May 31, 2012 May 31, 2011 Cash and cash equivalents / short-term investments $ 30,575 $ 44,801 Working capital $ 24,585 $ 39,477 Long-term debt $ 0 $ 0 Stockholders' equity $ 50,712 $ 58,505 |

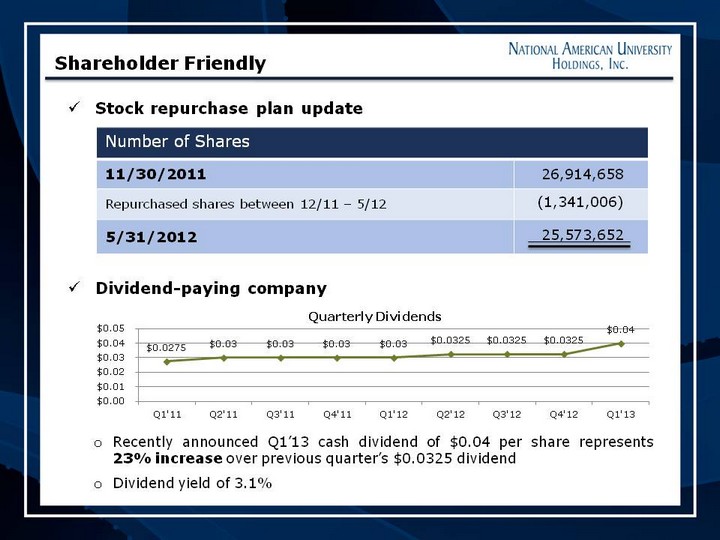

| Number of Shares Number of Shares 11/30/2011 26,914,658 Repurchased shares between 12/11 - 5/12 (1,341,006) 5/31/2012 25,573,652 Shareholder Friendly Stock repurchase plan update Dividend-paying company Recently announced Q1'13 cash dividend of $0.04 per share represents 23% increase over previous quarter's $0.0325 dividend Dividend yield of 3.1% |

| CONCLUSION - Dr. Shape |

| 37 Key Takeaways Stable Enrollment Growth (slides 10-12) Geographic Expansion (slides 16-17) Share buyback plan 3.1% dividend yield Shareholder Friendly (slide 35) Strong Financial Growth (slide 29) |

| Contact Information: National American University Holdings, Inc. Dr. Ronald Shape 605-721-5220 rshape@national.edu Investor Relations Counsel The Equity Group Inc. Carolyne Yu Adam Prior 212-836-9610 212-836-9606 cyu@equityny.com aprior@equitny.com Thank You |