Attached files

| file | filename |

|---|---|

| 8-K - 8-K CURRENT REPORT - Chelsea Therapeutics International, Ltd. | v323335_8k.htm |

Exhibit 99.1

© 2004 - 2011 Chelsea Therapeutics, Inc. Rodman and Renshaw Investor Conference Joseph Oliveto Interim CEO September 10, 2012

Forward - Looking Statements This presentation is being provided for informational and discussion purposes . This presentation is not intended to provide and should not be relied upon as investment advice or an opinion regarding the appropriateness or suitability of any investment . Nothing herein should be construed to be an offer to sell, or a solicitation of an offer to buy, any securities . This presentation contains forward - looking statements regarding future events including our intention to pursue the development of Northera . These statements are subject to risks and uncertainties that could cause the actual events or results to differ materially . These include the risk that the FDA will not accept any proposal regarding any trial or other data to support Study 301 or any other study, including the primary endpoint ; the risk that we will not be able to resubmit the NDA for Northera and that the FDA will not approve a resubmitted NDA ; the risk that our resources will not be sufficient to develop any study of Northera that will be acceptable to the FDA ; the risk that we cannot complete any additional study for Northera without the need for additional capital ; the risk that we do not achieve anticipated cost savings as previously announced ; the risk of reliance on key personnel including specifically in this time of uncertainty following the resignation of our former CEO ; risks of distraction of the Board and management at this critical time ; the risks and costs of drug development and that such development may take longer or be more expensive than anticipated ; our need to raise additional operating capital in the future ; our reliance on our lead drug candidate droxidopa ; risk of regulatory approvals of droxidopa or our other drug candidates for additional indications ; risk of volatility in our stock price, related litigation, and analyst coverage of our stock ; reliance on collaborations and licenses ; intellectual property risks ; our history of losses ; the risks of competition ; and market acceptance for our products if any are approved for marketing . A complete list of these and additional risk factors can be found in our most recent Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q filed with the Securities and Exchange Commission . Chelsea Therapeutics assumes no obligation and does not intend to update these forward - looking statements . NASDAQ: CHTP

Norepinephrine Replacement Therapy Northera™ (droxidopa) Oral “ prodrug ” of norepinephrine : directly metabolized to form norepinephrine Targeting multiple , high potential markets Neurogenic Orthostatic Hypotension (NOH ) * Intradialytic hypotension * Freezing of gait * Fibromyalgia Adult ADHD Parkinson’s Disease Other norepinephrine related indications NASDAQ: CHTP

Northera™: Norepinephrine Replacement Therapy • Oral “ prodrug ” of norepinephrine : directly metabolized to form norepinephrine • Replenishes diminished level of natural neurotransmitter, norepinephrine, within autonomic nervous system • Unique mechanism of action limits side effects seen with other drugs • Only chronic oral therapy treating root cause of NOH • Well documented safety and efficacy • Marketed ex US (Japan) since 1989 • Orthostatic hypotension associated with Parkinson’s Disease • Freezing of gait in Parkinson's Disease • Hypotension associated with dialysis NASDAQ: CHTP

Neurogenic Orthostatic Hypotension Neurogenic Orthostatic Hypotension (Neurogenic OH or NOH): Sudden, potentially dangerous, fall in BP when standing from a sitting/lying position • Caused by diminished synthesis and/or release of the norepinephrine used by autonomic nerves to regulate vasoconstriction • 500 – 1000 mL of blood shifts to the lower body upon standing • Reduced ability to push blood back to the heart and brain from the lower body • Poor perfusion of the brain leads to dizziness, lightheadedness & syncope • Some patients cannot stand unaided for more than a few minutes a day NASDAQ: CHTP

The Neurogenic OH Patient Symptomatic Neurogenic OH affects patients with primary autonomic failure, a group of diseases that includes… Parkinson’s Disease • Prevalence of disease: 120 cases per 100,000 population • Prevalence of symptomatic Neurogenic OH: 18% Multiple Systems Atrophy • Prevalence of disease: 1 - 9 cases per 100,000 population • Prevalence of symptomatic Neurogenic OH: 81% Pure Autonomic Failure • Prevalence of disease: 1 - 9 per 100,000 population • Prevalence of symptomatic Neurogenic OH: 100% NASDAQ: CHTP

Neurogenic OH: Current Therapeutic Landscape • Midodrine (ProAmatine®)…alpha agonist • Never satisfied FDA’s requirement to demonstrate clinical benefit • Accelerated Approval using change in BP as surrogate for efficacy • Must successfully complete 2 Phase IV studies by 2014 or may be withdrawn from the market • Provides constant/undifferentiated pressor effect • Black box warning for supine hypertension…22% at 10 mg dose • Alpha agonist side effects • piloerection (goose bumps, hair standing on end) • paresthesia (tingling, prickling or numbness of skin (scalp) • Poor patient persistence and compliance • Poor penetration of Parkinson’s Disease Market • $55 - 60M peak sales (at $30/day would generate $315 million/year) Neurogenic OH remains a significant unmet medical need NASDAQ: CHTP

Neurogenic OH Study Design Difficulties • Study endpoints – symptomatic Neurogenic OH has sub - optimal endpoints and scales • Variability in symptoms among patients; not all patients have all types of symptoms • Elderly patient population with potential issues in recalling or defining symptoms • Lack of previous studies in the field to inform how the scales behave in actual trials • Study duration – longer term trials are difficult to conduct • Patients frequently drop out for reasons other than efficacy, confounding ability to detect treatment differences over time • Patients may have a ‘treadmill effect’ or begin to forget baseline severity, increasing variability in responses over time • Investigators are reluctant to enroll the most severe patients into long term trials that have placebo controls 8 NASDAQ: CHTP

Northera ™: Extensive Pivotal Phase 3 Program Study 302: Proof of Efficacy – Withdrawal Design Short - term , 5 - week study with 2 - week randomized placebo - controlled withdrawal phase Study 303: Study 306A/B: Proof of Efficacy – Induction Design Long - term, 2 - week randomized placebo - controlled; 12+ months open - label extension Study 301: Pivotal Proof of Efficacy – Induction Design Short - term, 4 - week study with 1 - week randomized placebo - controlled induction phase Total of over 500 patients treated with Northera ™ to date 9 Study 304: Long - term safety extension to Study 301/306, Ongoing; 24+ months Study 305: 24 - HR BP Monitoring Study – subgroup of 301 patients Study 306B: Long - term, up to 10 - week randomized placebo - controlled study with 8 weeks at optimized dose NASDAQ: CHTP

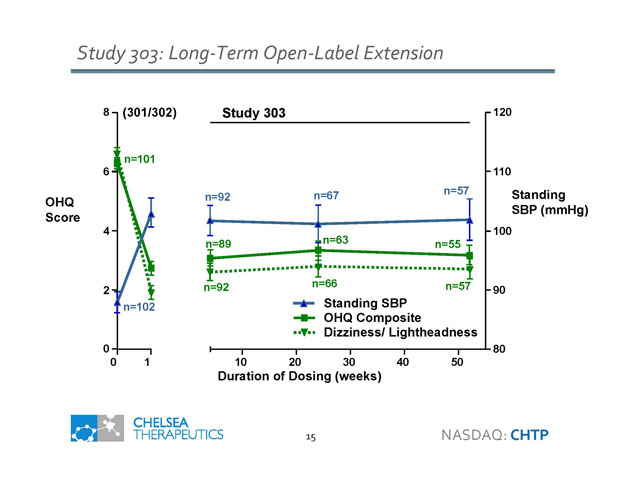

Efficacy and Safety Summary • Pivotal Study 301: Primary endpoints demonstrate benefit • Item 1 Dizziness: p<0.001 • OHQ composite: p=0.003 • Supportive Study 302 • OHQ composite (post - hoc): p=0.026 • Consistent effects across pivotal and supportive studies • Improvement in a broad range of individual symptoms • Reduction of symptom impact on activities of daily living • Supportive Study 303 • Durable benefits observed for up to 12 months of therapy • Droxidopa was safe and well tolerated across multiple studies • Small increase in supine hypertension versus placebo • Most common adverse events were headache and dizziness • Long term extension studies type and rate of adverse events including death were consistent with expectations for this patient population 10 NASDAQ: CHTP

Study 301: Symptoms of NOH in PD, MSA & PAF 11 0.00 0.20 0.40 0.60 0.80 1.00 1.20 1.40 Favors Northera Favors Placebo p=0.003 Difference between Northera and Placebo (in change from Randomization to End of Study) *** ** ** ** *** * * ** *p ≤ 0.05 ** p ≤ 0.01 *** p ≤ 0.001 ** ** NASDAQ: CHTP

- 0.93 - 1.83 - 3 - 2.5 - 2 - 1.5 - 1 - 0.5 0 OHQ Composite - 1.1 - 2.4 Dizziness/ Lightheadedness p<0.001 Study 301: OHQ composite and OHSA 1 Analysis Change in Score (Randomization to EOS) Improved No Effect p=0.003 Placebo Droxidopa n=79 n=81 n=80 n=82 12 NASDAQ: CHTP

Study 301: Responder Analysis OHQ Composite Score 40.5% 25.3% 11.4% 2.5% 61.7% 40.7% 27.2% 17.3% 0% 10% 20% 30% 40% 50% 60% 70% >1 unit >2 units >3 units >4 units Percent of Patients Improvement in OHQ Composite Score Placebo Droxidopa p=0.011 p=0.045 p=0.016 p=0.003 13 NASDAQ: CHTP

Study 301: Responder Analysis Dizziness/ Lightheadedness 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 1 Unit 2 Units 3 Units 4 Units 5 Units 6 Units 7 Units Percent of Patients Improvement in Dizziness/Lightheadedness Placebo Droxidopa p=0.034 p=0.004 p=0.023 p=0.006 p=0.003 p=0.01 p=0.018 14 NASDAQ: CHTP

Study 303: Long - Term Open - Label Extension OHQ Score (301/302) 8 6 4 2 0 0 1 n=101 n=102 Study 303 Standing SBP (mmHg) Duration of Dosing (weeks) 10 20 30 40 50 80 90 100 110 120 n =63 n=55 n=89 n=66 n=92 n=57 Standing SBP n=67 n=92 n=57 OHQ Composite Dizziness/ Lightheadness 15 NASDAQ: CHTP

Long - term Studies in NOH Associated with PD: 306A & 306B Visit 2 Droxidopa, TID Placebo, TID Visits 3a, 3b, 3c, etc. Visit 4 Visit 5 Visit 6 Visit 7 600 mg 500 mg 400 mg 300 mg 200 mg 100 mg 600 mg 500 mg 400 mg 300 mg 200 mg 100 mg Week 1 Week 2 Week 4 Week 8 Randomization / Baseline Double - Blind Titration to Optimal Dose Double - Blind Stable Dose Therapy ≤ 2 Weeks ≤ 2 Weeks Visit 1 Screening … of Stable Dose Double - Blind Therapy NASDAQ: CHTP

Study 306A: OHSA #1 17 Reported Data from 51 patients completed treatment in Jan 2011 NASDAQ: CHTP

Study 306A: Cumulative Falls NASDAQ: CHTP Northera (n=24) Placebo (n=27) Number of Days of Therapy Number of Falls Total falls = 79 Total falls = 197

• Falls per patient/week pre - specified as efficacy criteria in 306 statistical analysis plan • Allows for distribution of falls to be standardized and compared by arm Study 306A: Reducing Falls per patient/week NASDAQ: CHTP 2.3 Fold or 60% Reduction in Falls per Patient/Week 0.39 Mean Falls / Patient / Week 0.93

Regulatory Timeline • Dec 2010: Pre - NDA meeting minutes • FDA advised that it was reasonable to submit the currently available efficacy and safety data (Studies 301, 302, 303, and 304) for review and approval • Sept 2011: NDA filed • Nov 2011: NDA accepted with Priority Review • Feb 2012: Advisory Committee voted 7 - 4 in favor of approval • Mar 2012: FDA issued complete response letter • May 2012: End - of - review meeting held with the FDA 20 NASDAQ: CHTP

FDA Advisory Committee • FDA briefing materials revealed review team not recommending approval of the product • Concerns regarding duration of Study 301 • Did not fully accept that data from Study 302 was supportive • Size of the safety database could not rule out potential for rare events • OHSA Item #1 (dizziness/lightheadedness) was most appropriate endpoint • Cardiovascular Renal Division Advisory Committee Voted 7 to 4 in Favor of Approval • Lack of treatments /severe unmet medical need for NOH • Believed safety data was sufficient to support approval/post - approval studies could address any potential for an association with rare events • Agreed that dizziness was most important symptomatic endpoint • Did not fully accept Study 302 data as supportive 21 NASDAQ: CHTP

Complete Response Letter/End - of - Review Meeting Complete Response Letter • Requesting additional study to confirm efficacy and demonstrate durability of effect over 2 - 3 month period • No outstanding safety concerns related to market authorization End of Review Meeting • Discussed concern over single site driving Study 301 results • Discussed how to address request for an additional study • Dizziness/lightheadedness most relevant symptomatic endpoint • Longer duration studies (acknowledged difficulties in patient population) • Data supporting 306B blinding was requested before FDA would confirm it supports the proposed changes to the development program • Submitted revised proposal and 306B blinding documentation • Theoretical concern that company could have become unblinded • Effectively negating utility of 306B as potential pivotal efficacy study 22 NASDAQ: CHTP

Study 306 B Will Provide Important Clinical Insight • Enrollment phase stopped • 174 patients randomized • Single largest placebo controlled efficacy study conducted in NOH • Primary Analysis Population (n=152) • Modified Intent to Treat = all randomized patients who receive at least one dose of study drug and report OHQ data at Visit 4 • Missing date will be excluded • Visit 4 = 1 week of stable dose therapy; avg 2 wks of double blind therapy including titration 23 NASDAQ: CHTP

Study 306B Will Provide Important Clinical Insight Efficacy analysis plan • Primary endpoint: • Mean change in OHSA item #1 (dizziness/lightheadedness) from baseline to visit 4 • Represents 1 wk of stable dose ; avg. 2 wks of double blind therapy including titration • 92% power to show a statistically significant difference (assumptions from study 306A) • Secondary endpoints analyzed (top 3) • Change in standing blood pressure at visit 4; 99% power • OHSA item #1 at visit 5 (2 wks stable dose); 93% power • OHSA item #1 at visit 6 (4 wks stable dose); 81% power • Long term treatment data out to 8 weeks will be analyzed for multiple additional efficacy and safety endpoints including rate of falls Meta - Analysis of 306 A and B (n = 225 randomized) • Greater insights into sub - populations and secondary analyses • Potentially informative for the next clinical study design 24 NASDAQ: CHTP

Going Forward Next Clinical Study • Multiple study designs are currently drafted • Modeled utilizing existing data (301, 302, 303, Sumitomo sponsored studies) • Operational plans (CRO and clinical site evaluations, budgeting, etc.) being developed • The preferred study design is expected to be finalized following evaluation of study 306B data Planned FDA Communication • Preferred clinical study protocol synopsis will be submitted to FDA • Acceptance will be sought regarding acceptability as a confirmatory efficacy study for NDA approval • Formal acceptance, via a SPA, is not currently planned Second Quarter Financial Results (6/30/12) Cash and Cash Equivalents $40.8 million Guidance to end 2012 with cash and equivalents > $25 million Anticipated to cover operating expense into 4Q 2013 NASDAQ: CHTP

© 2004 - 2011 Chelsea Therapeutics, Inc. Rodman and Renshaw Investor Conference September 10, 2012