Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZIOPHARM ONCOLOGY INC | v323275_8k.htm |

Exhibit 99.1

Better Cancer Medicine 19 th Annual NewsMakers in the Biotech Industry Conference

Forward - Looking Statements This presentation contains certain forward - looking information about ZIOPHARM Oncology that is intended to be covered by the safe harbor for “forward - looking statements” provided by the Private Securities Litigation Reform Act of 1995 , as amended . Forward - looking statements are statements that are not historical facts . Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s)” and similar expressions are intended to identify forward - looking statements . These statements include, but are not limited to, statements regarding our ability to successfully develop and commercialize our therapeutic products ; our ability to expand our long - term business opportunities ; financial projections and estimates and their underlying assumptions ; and future performance . All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the control of the Company, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward - looking information and statements . These risks and uncertainties include, but are not limited to : whether any of our therapeutic candidates will advance further in the clinical trials process and whether and when, if at all, they will receive final approval from the U . S . Food and Drug Administration or equivalent foreign regulatory agencies and for which indications ; whether any of our therapeutic candidates will be successfully marketed if approved ; whether our DNA - based biotherapeutics discovery and development efforts will be successful ; our ability to achieve the results contemplated by our collaboration agreements ; the strength and enforceability of our intellectual property rights ; competition from pharmaceutical and biotechnology companies ; the development of and our ability to take advantage of the market for DNA - based biotherapeutics ; our ability to raise additional capital to fund our operations on terms acceptable to us ; general economic conditions ; and the other risk factors contained in our periodic and interim reports filed with the SEC including, but not limited to, our Annual Report on Form 10 - K for the fiscal year ended December 31 , 2011 , and our Quarterly Report on Form 10 - Q for the fiscal quarter ended June 30 , 2012 . Our audience is cautioned not to place undue reliance on these forward - looking statements that speak only as of the date hereof, and we do not undertake any obligation to revise and disseminate forward - looking statements to reflect events or circumstances after the date hereof, or to reflect the occurrence of or non - occurrence of any events .

Early to Late - Stage Small Molecules DNA - Based Therapeutics Revolutionary Discovery Technology Poised to Cure Cancers Our Approach Better Cancer Medicine Diverse Portfolio of Therapeutics Addressing Unmet Medical Needs in Cancer

2012 Anticipated Key Clinical Milestones Indibulin: Oral Phase 1/2 Data Darinaparsin: Ongoing Studies with Solasia Early Stage Small Molecule Pipeline IL - 12 DNA Program Phase 1 Data 2012 Phase 2 Melanoma 2H 2012 New DNA Candidates • Preclinical Data 2012 Palifosfamide DNA Therapeutics PICASSO 3 STS Pivotal PFS Data 4Q 2012 MATISSE SCLC Phase 3 Initiation 2Q 2012

Compound Preclinical Phase 1 Phase 2 Phase 3 Palifosfamide Soft Tissue Sarcoma Small Cell Lung Cancer Other Phase 2 Study Oral DNA Therapeutics Ad IL - 12 DC IL - 12 Other Candidates Indibulin Breast Cancer Darinaparsin Oral Data - Driven Oncology Portfolio

• Palifosfamide – Wholly - owned asset – Two Phase 3 programs • Metastatic soft tissue sarcoma • S mall cell lung cancer – Potential in multiple solid tumor types • DNA therapeutics – Targeting established pathways – Approaching Phase 2 for melanoma – Exploring multiple avenues for revolutionary treatment modality Near - Term Value Drivers

Palifosfamide

Broad Application Effect in solid tumors and hematological malignancies Safety, Efficacy and Accessibility Active in ALDH hi cells, rapid on - off kinetics, less toxic and ease of administration Addressing Unmet Needs Orphan Drug status for STS in U.S. and Europe Long Commercial and Development Runway U.S. pharmaceutical composition patent rights extending to 2029; other pending applications WW A Novel DNA - Targeted Drug

Soft Tissue Sarcoma $ in Millions • High unmet medical need; no first - line drug approved in ~30 years • First - line metastatic, non - GIST STS: 1 – Approximately 9,000 in U.S. 2 – Approximately 14,000 in Europe • Market in transformation – April 2012 FDA full approval of Votrient ® for second - line therapy validate PFS endpoint; May 2012 positive opinion from CHMP • Objective of palifosfamide in combination with doxorubicin as standard of care for first - line metastatic STS 1 Source : U.S.: IntrinsiQ Data, © Copyright 2012, IntrinsiQ, LLC an AmerisourceBergen Specialty Group company. All rights reserved; re mainder of world Company estimated from epidemiology (SEER, NCCN ). 2 IntrinsiQ : # new patient prescriptions written for first - line, non - GIST STS over 12 months.

Phase 3 Structure ( PICASSO 3) N : Fully Enrolled - Approximately 424 patients; first - line metastatic STS Regimen: Palifosfamide + doxorubicin vs. doxorubicin + placebo Primary Endpoint: PFS for accelerated approval; OS for full approval Powered for PFS & OS PFS Power: 85% power to detect 0.60 HR, 3 month median Δ (p=0.0005, one - tailed) PFS Analysis: Evaluation of PFS by IDMC following a pre - determined number of PFS events Study sites: > 150 centers worldwide Results: Pivotal PFS data expected 4Q 2012 Design Based on Successful Randomized Phase 2 Study with Similar Design

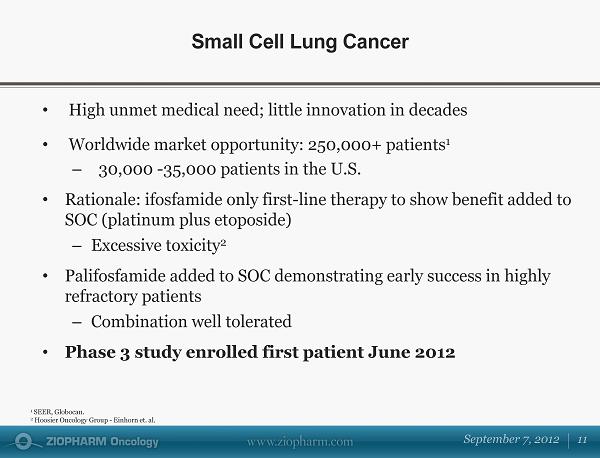

Small Cell Lung Cancer • High unmet medical need; little innovation in decades • Worldwide market opportunity: 250,000+ patients 1 – 30,000 - 35,000 patients in the U.S. • Rationale: ifosfamide only first - line therapy to show benefit added to SOC (platinum plus etoposide) – Excessive toxicity 2 • Palifosfamide added to SOC demonstrating early success in highly refractory patients – Combination well tolerated • Phase 3 study enrolled first patient June 2012 1 SEER, Globocan. 2 Hoosier Oncology Group - Einhorn et. al .

Design Multinational, multi - center, randomized controlled, open - label, adaptive trial N Up to 548 subjects Population Males and females, age ≥18 years, with extensive - stage small cell lung cancer Primary Endpoint Overall survival (OS) Secondary Endpoints Progression free survival (PFS) Objective response rate (ORR) Quality of Life (QOL) Disease related symptoms Phase 3 in SCLC (“MATISSE”) The MATISSE Study: M ulticenter A daptive T rial I nvestigating S mall Cell Lung Cancer S urvival E ndpoints

MATISSE Adaptive Trial Design Single pre - planned evaluation by the IDMC • Optimize chances of success • Stop trial for efficacy/futility • Complete trial as planned or resize study 125 Events Continue trial with decreased sample size Complete trial as planned Continue trial with increased event size

Palifosfamide Market Opportunity

• No uniform standard of care for first - line in U.S. market 1 – Opportunity to consolidate the market within 24 months after launch 2 • EU market primarily ifosfamide and/or doxorubicin 3 • Palifosfamide could become new standard of care in first - line metastatic, non - GIST STS 2 – Better efficacy profile – Better safety profile – Outpatient administration – Better health economic profile STS Market Position 1 Source : U.S.: IntrinsiQ Data, © Copyright 2012, IntrinsiQ, LLC an AmerisourceBergen Specialty Group company . All rights reserved. 2 High prescribing STS market research; Hammond Hill, LLC 2012. 3 Data on file.

• Etoposide plus carboplatin represents ~70% of current SOC 1 • Goal to establish palifosfamide in combination with etoposide and carboplatin as first - line standard of care in metastatic SCLC SCLC Market Position 1 Source : U.S.: IntrinsiQ Data, © Copyright 2012, IntrinsiQ, LLC an AmerisourceBergen Specialty Group company . All rights reserved.

• Recent, U.S. orphan drug launches in oncology priced at $9K - $23K per cycle range – Examples of products: Adcetris ™ , Caprelsa ® , Istodax ® , Zelboraf ® • >$ 1 Bn total global market potential for palifosfamide in STS and SCLC Market Potential Scenarios of U.S. Only Peak Gross Revenues in $Million Palifosfamide Price Per Patient Per Year Patients Treated $ 54,000 $ 72,000 $ 90,000 Soft Tissue Sarcoma 4,000 $ 216 $ 288 $ 360 4,500 $ 243 $ 324 $ 405 5,000 $ 270 $ 360 $ 450 Small Cell Lung Cancer 5,500 $ 297 $396 $ 495 6,500 $ 351 $ 468 $ 585 7,500 $ 405 $ 540 $ 675 Note: Assumes 6 cycles per patient per year.

IL - 12 DNA

• R evolutionary technology for precise, controlled delivery of therapeutic proteins in vivo • Focused, disciplined approach to development – Minimize expense – Drive value through near - term proof - of - concept studies • Lead therapeutic in melanoma for early validation of target and platform • “Next - wave” of therapeutic approaches in research pipeline (antibody technology, protein - protein decoys, immunotoxins, etc .) DNA Therapeutics

Using Natural Cell Biology to Produce Proteins Controlled Oral ligand activates DNA, protein production begins Target Cell mRNA Translation Precision Therapeutic proteins Adaptable

Two Clinical Stage Product Candidates • DC IL - 12 Phase 1b in metastatic melanoma – Safety profile predictable – 2 PRs, 2 SDs, biomarker effects • Ad IL - 12 Phase 1b in metastatic melanoma – S afe to date – Preliminary activity – Significant data expected 2H 2012 P ost - treatment Pre - treatment CT PET Baseline Necrosis prior to cycle 2

Next Phase of Development: • Remains a significant unmet need in metastatic melanoma despite evolving landscape • Phase 2 to begin at confirmation of biologically effective dose • Phase 2 modifications to include additional patient - selection criteria to maximize signal detection • Planned to be completed 1H 2013 Will inform additional studies and development plans: • Breast Cancer • Head and neck cancer Phase 1/2 of Ad - IL12 + AL in Melanoma

Early - Stage Development

DNA Therapeutics • Preclinical and discovery continuing to advance multiple antibody, immunotoxin, and protein decoy candidates • INDs next 12 to 24 months from preclinical work in progress Indibulin • Novel oral tubulin binding agent; expected low toxicity and neurotoxicity not seen • Ongoing Phase 1/2 study in metastatic breast cancer Darinaparsin • Novel mitochondrial - and hedgehog - targeted agent (organic arsenic); oral and IV • Ongoing studies in partnership with Solasia Early - Stage Clinical Development

• Primary shares outstanding: approximately 79.6M • Cash: approximately $ 110.4M @6/30/12 • Current cash resources expected to support operations into 2H 2013 Financial Highlights

2012 Anticipated Key Clinical Milestones Indibulin: Oral Phase 1/2 Data Darinaparsin: Ongoing Studies with Solasia Early Stage Small Molecule Pipeline IL - 12 DNA Program Phase 1 Data 2012 Phase 2 Melanoma 2H 2012 New DNA Candidates • Preclinical Data 2012 Palifosfamide DNA Therapeutics PICASSO 3 STS Pivotal PFS Data 4Q 2012 MATISSE SCLC Phase 3 Initiation 2Q 2012

Better Cancer Medicine 19 th Annual NewsMakers in the Biotech Industry Conference