Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NCR CORP | d408018d8k.htm |

Exhibit 99.1

This summary highlights the information contained elsewhere in this offering memorandum. Because this is only a summary, it does not contain all of the information that may be important to you. For a more complete understanding of this offering, we encourage you to read this entire offering memorandum and the documents to which we refer you, including the information set forth under “Risk factors” and the more detailed information and our historical consolidated financial statements and the related notes included elsewhere in this offering memorandum.

In this offering memorandum, except as otherwise indicated or the context otherwise requires, the “Company,” “NCR,” “we,” “our” and “us” refer to NCR Corporation and its consolidated subsidiaries.

Overview

NCR Corporation is a leading global technology company that provides innovative products and services that enable businesses to connect, interact and transact with their customers and enhance their customer relationships by addressing consumer demand for convenience, value and individual service. Our portfolio of self-service and assisted-service solutions serve customers in the financial services, retail, hospitality, travel, telecommunications and technology industries and include automated teller machines (“ATMs”), self-service kiosks and point of sale devices, as well as software applications that can be used by consumers to enable them to interact with businesses from their computer or mobile device. We also complement these product solutions by offering a complete portfolio of services to help customers design, deploy and support our technology tools. We also resell third-party networking products and provide related service offerings in the telecommunications and technology sectors.

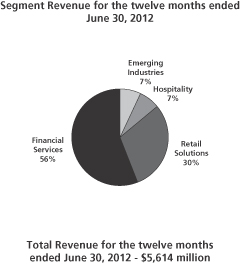

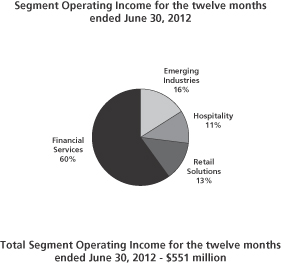

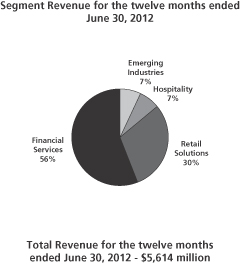

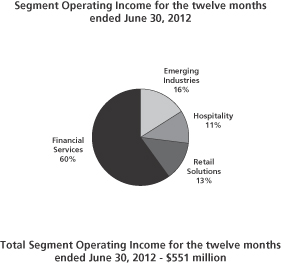

NCR has a 128-year operating history and as of June 30, 2012 had approximately 24,600 employees and contractors around the world. Our total revenue for the twelve months ended June 30, 2012 was $5,614 million, an increase of 15% over the prior twelve-month period. We have a balanced revenue base, having earned 50% of our revenue from services and 50% of our revenue from products in the twelve months ended June 30, 2012. Our segment operating income for the twelve months ended June 30, 2012 was $551 million, an increase of 32% over the prior twelve-month period. We had Adjusted EBITDA (as defined in note 1 to “Summary historical consolidated financial information” and as described in “Non-GAAP financial measures”) of $657 million in the twelve months ended June 30, 2012.

1

Operating segments

We categorize our operations into four reportable segments: Financial Services, Retail Solutions, Hospitality, and Emerging Industries.

|

|

Financial services—We offer solutions to enable customers in the financial services industry to reduce costs, generate new revenue streams and enhance customer loyalty. These solutions include a comprehensive line of ATM, branch and payment processing hardware and software, and related installation, maintenance, and managed and professional services. We also offer a complete line of printer consumables. In the twelve months ended June 30, 2012, the Financial Services segment generated revenues of $3,155 million and segment operating income of $330 million.

Retail solutions—We offer solutions to customers in the retail industry designed to improve selling productivity and checkout processes as well as increase service levels. These solutions primarily include retail-oriented technologies, such as point of sale terminals and bar-code scanners, as well as innovative self-service kiosks, such as self-checkout. We also offer installation, maintenance, and managed and professional services and a complete line of printer consumables. In the twelve months ended June 30, 2012, the Retail Solutions segment generated revenues of $1,703 million and segment operating income of $74 million.

Hospitality—We offer technology solutions to customers in the hospitality industry, serving businesses that range from a single restaurant to global chains and some of the world’s largest sports stadiums. Our solutions include point of sale hardware and software solutions, installation, maintenance, and managed and professional services and a complete line of printer consumables. In the first six months of 2012, the Hospitality segment generated revenue of $243 million and segment operating income of $40 million. The operations acquired from Radiant Systems, Inc. (“Radiant”) in the third quarter of 2011 comprise a substantial portion of this segment.

Emerging industries—We offer maintenance as well as managed and professional services for third-party computer hardware provided to select manufacturers, primarily in the telecommunications industry, who value and leverage our global service capability. Also included

2

in our Emerging Industries segment are solutions designed to enhance the customer experience for the travel and gaming industries, including self-service kiosks, as well as related installation, maintenance, and managed and professional services. In the twelve months ended June 30, 2012, the Emerging Industries segment generated revenues of $372 million and segment operating income of $85 million.

Products

We sell products that help businesses connect, interact and transact with their customers. Our product offerings fall into the following five categories:

ATMs and other financial products—We provide financial institutions, retailers and independent deployers with financial-oriented self-service technologies, such as ATMs, cash dispensers, and software solutions, including the APTRA™ self-service ATM software application suite (providing ATM management systems) as well as consulting services related to ATM security, software and bank branch optimization. ATM and other financial product solutions are designed to quickly and reliably process consumer transactions and incorporate advanced features such as automated check cashing/deposit, automated cash deposit, web-enablement and bill payment (including mobile bill payment). These solutions help enable businesses to reduce costs and generate new revenue streams while enhancing customer loyalty.

Point of sale solutions—We provide retail and hospitality oriented technologies such as point of sale terminals, bar-code scanners, software and services to companies and venues worldwide. Combining our retail and hospitality industry expertise, software and hardware technologies, and consulting services, our solutions are designed to enable cost reductions and improve operational efficiency while increasing customer satisfaction.

Self-service kiosks—We provide self-service kiosks to the retail, hospitality, and travel and gaming industries. Our versatile kiosk solutions can support numerous retail self-service functions, including self-checkout, wayfinding (our self-service retail software application that helps customers easily locate products or navigate through large, complex buildings and campuses), bill payment and gift registries. We provide self-check in/out kiosk solutions to airlines, hotels and casinos that allow guests to check-in/out without assistance. These solutions create pleasant and convenient experiences for consumers and enable our customers to reduce costs. The kiosks for the hospitality industry provide consumers the ability to order and pay at restaurants while enabling our customers to streamline order processing and reduce operating costs.

Check and document imaging—Our check and document imaging offerings provide end-to-end solutions for both traditional paper-based and image-based check and item processing. These solutions utilize advanced image recognition and workflow technologies to automate item processing, helping financial institutions increase efficiency and reduce operating costs. Consisting of hardware, software, consulting and support services, our comprehensive check and document imaging solutions enable check and item-based transactions to be digitally captured, processed and retained within a flexible, scalable environment.

Consumables—We develop, produce and market a complete line of printer consumables for various print technologies. These products include two-sided thermal paper (2ST®), paper rolls for receipts in ATMs and point of sale solutions, inkjet and laser printer supplies, thermal transfer and ink ribbons, labels, laser documents, business forms, and specialty media items such as photo

3

and presentation papers. Consumables are designed to optimize operations and improve transaction accuracy, while reducing overall costs.

Services

Services are an essential and integrated component of NCR’s complete solution offerings. We provide maintenance and support services for our product offerings and also provide other services including site assessment and preparation, staging, installation and implementation, systems management and complete managed services. We provide Predictive Services, a managed services offering, which is designed to predict and address information technology issues quickly before they happen.

We also offer a range of software and services such as Software as a Service, hosted services, and online, mobile and transactional services and applications such as bill pay and digital signage. In addition, we are also focused on expanding the resale of third party networking products and related service offerings to a broader base of customers in the telecommunications and technology sectors and servicing third-party computer hardware from select manufacturers, such as Cisco Systems, who value and leverage our global service capability.

Business strengths

We provide innovative products and services that enable businesses to connect, interact and transact with their customers and enhance their customer relationships by addressing consumer demand for convenience, value and individual service, while at the same time reducing costs and streamlining processes for our customers. Our key competitive strengths include:

Global market leader across multiple business segments. We are a leading provider of hardware and software solutions for the industries we serve. We have a leading market position across many of our solutions, including ATMs, automated deposit in the U.S., and ATM multi-vendor software. Similarly, we are the leading provider of self-service checkout globally, the No. 2 global provider of point of sale technology, and the leading provider of software and other solutions to the retail and hospitality industries in the U.S. Further, we are a leading provider of travel check-in solutions in the U.S.

Broad portfolio of innovative hardware and software solution offerings. Across our operating segments we provide a broad portfolio of hardware and software solution offerings. We offer our financial services customers ATMs, consulting services, kiosks, APTRA™ self-service ATM software solutions, mobile and internet banking and e-commerce integration. We offer our retail customers self-service solutions, point of sale, software, consulting services, e-mail marketing, mobile alerts and cloud-based retail solutions. We offer our hospitality customers point of sale, inventory management, loyalty and stored value, marketing services and loss prevention. We offer our travel customers airline check-in travel self-service, and we offer total premises services to our technology and telecommunication customers. We also offer a broad range of services to all of our customer segments. We continue to build on our heritage of innovation, as evidenced by our recent introduction of the NCR Silver™ product offering, a mobile iPad® Point of Sale system for retail customers, which we launched in the third quarter of 2012.

We work to be trusted partners to the customers we serve. We work to be trusted partners to all the customers we serve by leveraging our deep consumer and industry expertise. We also

4

maintain a diverse customer base, with no one customer accounting for more than 10% of our revenue in the twelve months ended June 30, 2012. We provide financial services solutions to all of the top 20 global financial institutions. Within the Emerging Industries segment, our travel business serves 4 of the 5 largest global airlines and our telecommunication and technology business is a service provider for 8 of the top 10 telecommunication and networking companies.

Attractive business model.

| • | We benefit from diversified revenue streams, both by industry and by geography. We have three core industry operating segments and a growing Emerging Industry segment. NCR has a strong regional balance, with revenues split across the globe (For the year ended December 31, 2011, percentage of revenues by geography were: U.S.: 36%; Europe: 27%; Brazil, India, China and Middle East Africa: 16%; Japan, Korea and South Asia Pacific: 13%; Americas (excluding U.S. and Brazil): 8%). |

| • | We have strong recurring revenue and visibility. For the year ended December 31, 2011, 51% of our revenue was from services, and many of our service contracts are multi-year. |

| • | We are also focused on growing our software portfolio with contracts that provide for recurring software maintenance revenue. Further, we have increased our gross margin and operating margin for each of the past three years through an increased focus on services and software sales. From the six months ended June 30, 2011 to the six months ended June 30, of 2012, our gross margin increased 330 basis points. Our NPOI as a percentage of revenue increased 160 basis points in the same period. |

| • | As of June 30, 2012, we have paid down $375 million of the debt used to acquire Radiant. |

Seasoned management team. We have an experienced and established management team with a strong reputation throughout our industry. Our management team has been integral to building and maintaining our market-leading position, developing enduring relationships with our customers, generating strong free cash flow and selectively investing in profitable growth areas. Led by Chief Executive Officer and President William Nuti, who joined NCR in 2005, our senior management team possesses a significant amount of industry and market knowledge, including several members who have over 20 years of industry experience.

Business strategy

We have a focused and consistent business strategy targeted at revenue growth, gross margin expansion and improved customer loyalty. To execute this strategy, we have identified three key imperatives that align with our financial objectives for 2012 and beyond. These imperatives are to deliver disruptive innovation; focus on migrating our revenue to higher margin software and services revenue; and more fully enable our sales force with a consultative selling model that better leverages the innovation we are bringing to the market. Our strategy is summarized in more detail below:

Gain profitable share. We seek to optimize our investments in demand creation to increase NCR’s market share in areas with the greatest potential for profitable growth, which include opportunities in self-service technologies with our core financial services, retail and hospitality customers as well as the shift of the business model to focus on growth of higher margin

5

software and services. We focus on expanding our presence in our core industries, while seeking additional growth by:

| • | penetrating market adjacencies in single and multi-channel self-service segments; |

| • | expanding and strengthening our geographic presence and sales coverage across customer tiers through use of the indirect channel; and |

| • | leveraging NCR Services and Consumable solutions to grow our share of customer revenue, improve customer retention, and deliver increased value to our customers. |

Expand into emerging growth industry segments. We are focused on broadening the scope of our self-service solutions from our existing customers to expand these solution offerings to customers in newer industry-vertical markets including telecommunications and technology as well as travel and gaming. We expect to grow our business in these industries through integrated service offerings in addition to targeted acquisitions and strategic partnerships.

Pursue strategic acquisitions that promote growth and improve gross margin. We are continually and currently exploring potential acquisition opportunities in the ordinary course of business to identify acquisitions that can accelerate the growth of our business and improve our gross margin mix, with a particular focus on software-oriented transactions. We may fund acquisitions through either equity or debt, including drawings under our senior secured credit facility.

Build the lowest cost structure in our industry. We strive to increase the efficiency and effectiveness of our core functions and the productivity of our employees through our continuous improvement initiatives.

Enhance our global service capability. We continue to identify and execute various initiatives to enhance our global service capability. We also focus on improving our service positioning, increasing customer service attach rates for our products and improving profitability in our services business. Our service capability can provide us a competitive advantage in winning customers and it provides NCR with an attractive and stable revenue source.

Innovation of our people. We are committed to solution innovation across all customer industries. Our focus on innovation has been enabled by closer collaboration between NCR Services and our Industry Solutions Group, as well as a model to apply best practices across all industries through one centralized research and development organization and one business decision support function. Innovation is also driven through investments in training and developing our employees by taking advantage of our new world-class training centers. We expect that these steps and investments will accelerate the delivery of new innovative solutions focused on the needs of our customers and changes in consumer behavior.

Enhancing the customer experience. We are committed to providing a customer experience to drive loyalty focusing on product and software solutions based on the needs of our customers, a sales force enabled with the consultative selling model to better leverage the innovative solutions we are bringing to market and sales and support service teams focused on delivery and customer interactions. We continue to rely on the Customer Loyalty Survey to measure our current state and set a course for our future state where we aim to continuously improve with solution innovations as well as through the execution of our service delivery programs.

6

Recent events

Second Amendment to our senior secured credit facility and Incremental Facility Agreement

On August 22, 2012, we entered into a Second Amendment with and among the lenders party thereto and JPMorgan Chase Bank, N.A., as the administrative agent (the “Second Amendment”) to that certain Credit Agreement dated as of August 22, 2011 (as amended as of December 21, 2011 and as amended and restated pursuant to the Second Amendment, the “senior secured credit facility”). Pursuant to the Second Amendment, the senior secured credit facility was amended and restated in its entirety. Amendments to the senior secured credit facility that were effected by the Second Amendment include the following:

| • | modification of the definition of “Consolidated EBITDA” to exclude one-time gains or losses associated with lump sums payments made to address pension and retirement obligations and to address a possible change by NCR to mark-to-market accounting for its pension and retirement plans; |

| • | elimination of the requirement that we prepay outstanding loans with the proceeds of excess cash flow; |

| • | modification of the leverage ratio to reflect our incurrence from time to time of new debt used to reduce our unfunded pension liabilities; and |

| • | modification of the limitation on investments covenant to remove restrictions on investments other than requirements relating to pro forma financial covenant compliance and an absence of default for material acquisitions. |

On August 22, 2012, we also entered into an Incremental Facility Agreement with and among the lenders party thereto and JPMorgan Chase Bank, N.A., as the administrative agent (the “Incremental Facility Agreement”). The Incremental Facility Agreement relates to, and was entered into pursuant to the senior secured credit facility. The Incremental Facility Agreement supplements the amounts available to us under the senior secured credit facility by $300 million by establishing a $150 million new tranche of term loan commitments and a $150 million new tranche of revolving loan commitments, bringing the total sum available to us under the senior secured credit facility and the Incremental Facility Agreement to $1.7 billion. The $150 million new tranche of term loan commitments was funded on August 22, 2012, and we are using the proceeds of this loan for general corporate purposes.

Divestiture of our Entertainment business.

On February 3, 2012, we entered into an Asset Purchase Agreement with Redbox Automated Retail, LLC (“Redbox”) a Delaware limited liability company, pursuant to which we agreed to sell certain assets of our entertainment business to Redbox. Pursuant to the terms of the agreement, as amended on June 22, 2012, and upon the terms and conditions thereof, on June 22, 2012, we completed the disposition of our entertainment line of business to Redbox for cash consideration of $100 million.

7

Second Phase of Pension Strategy.

On July 31, 2012, we announced that we expect to make a contribution to our U.S. pension plan and offer a voluntary lump sum payment option to certain former employees who are deferred vested participants of the U.S. pension plan who have not yet started monthly payments of their pension benefit. The planned contributions will be financed in part through this offering.

The actions announced constitute the second phase of our pension strategy. In April 2010, we announced the first phase of our strategy to substantially reduce future volatility in our U.S. pension plan through a rebalancing of our asset allocation to a portfolio of entirely fixed income assets by the end of 2012. The total liability associated with the U.S. deferred vested participants is approximately 33 percent of the U.S. pension liability. We believe that these actions will help reduce the size of the U.S. pension plan, improve plan funded status, free up cash flow and reduce pension-related expenses. We expect to complete lump sum payouts under the voluntary lump sum offer by year end 2012.

August 14, 2012 8-K.

On August 14, 2012 we disclosed in a Current Report on Form 8-K that we had received anonymous allegations from a purported whistleblower regarding certain aspects of the Company’s business practices in China, the Middle East and Africa, including allegations which, if true, might constitute violations of the Foreign Corrupt Practices Act. We have certain concerns about the motivation of the purported whistleblower and the accuracy of the allegations we received, some of which appear to be untrue. We take all allegations of this sort seriously and promptly retained experienced outside counsel and began an internal investigation that is ongoing. We do not comment on ongoing internal investigations.

Certain of the allegations relate to our business in Syria. We have ceased operations in Syria, which were commercially insignificant, notified the U.S. Treasury Department, Office of Foreign Assets Control (“OFAC”) of potential apparent violations and are taking other measures consistent with OFAC guidelines.

8

Summary historical consolidated financial information

The following tables present the summary historical consolidated financial data of NCR and its subsidiaries at the dates and for the periods indicated. We derived the following summary historical consolidated financial data for the years ended December 31, 2009, 2010 and 2011 and as of December 31, 2010 and 2011 from the audited consolidated financial statements of NCR and its subsidiaries included elsewhere in this offering memorandum.

We derived our summary consolidated historical financial data as of June 30, 2012 and other data for the six months ended June 30, 2012 and June 30, 2011 from our unaudited consolidated financial statements for the periods, which are included elsewhere in this offering memorandum. The unaudited statement of operations data for the twelve months ended June 30, 2012 was calculated by subtracting the data for the six months ended June 30, 2011 from the audited consolidated data for the year ended December 31, 2011, and then adding the corresponding data for the six months ended June 30, 2012. The unaudited balance sheet data as of June 30, 2011 has been derived from our unaudited condensed consolidated financial statements not included herein. The unaudited condensed consolidated financial statements were prepared on a basis consistent with our annual audited consolidated financial statements. In the opinion of management, the unaudited consolidated financial statements include all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of the results for those periods. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full year or any future period.

You should read this data in conjunction with, and it is qualified by reference to, the sections entitled “Selected historical consolidated financial information” and “Management’s discussion and analysis of financial condition and results of operations” and NCR’s consolidated financial statements and related notes appearing elsewhere in this offering memorandum.

| Consolidated statements of operations data: | Year ended December 31 | Six months ended June 30 |

Twelve months ended June 30 |

|||||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Product revenue |

$ | 2,208 | $ | 2,301 | $ | 2,592 | $ | 1,070 | $ | 1,276 | $ | 2,798 | ||||||||||||

| Service revenue |

2,371 | 2,410 | 2,699 | 1,260 | 1,377 | 2,816 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

4,579 | 4,711 | 5,291 | 2,330 | 2,653 | 5,614 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cost of products |

1,771 | 1,799 | 2,011 | 838 | 979 | 2,152 | ||||||||||||||||||

| Cost of services |

1,911 | 1,922 | 2,098 | 994 | 1,019 | 2,123 | ||||||||||||||||||

| Selling, general and administrative expenses |

629 | 685 | 794 | 335 | 402 | 861 | ||||||||||||||||||

| Research and development expenses |

134 | 156 | 176 | 81 | 103 | 198 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

4,445 | 4,562 | 5,079 | 2,248 | 2,503 | 5,334 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income from operations |

134 | 149 | 212 | 82 | 150 | 280 | ||||||||||||||||||

| Net income (loss) attributable to NCR |

(33 | ) | 134 | 53 | 46 | 109 | 116 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

9

| Consolidated balance sheet data: | As of December 31 | As of June 30 | ||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Cash and cash equivalents |

$ | 451 | $ | 496 | $ | 398 | $ | 457 | $ | 377 | ||||||||||

| Total assets |

4,094 | 4,361 | 5,591 | 4,504 | 5,623 | |||||||||||||||

| Underfunded pension liabilities |

1,048 | 997 | 1,346 | 979 | 1,291 | |||||||||||||||

| Total debt |

15 | 11 | 853 | 11 | 740 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Consolidated statements of cash flows data: | Year ended December 31 | Six months ended June 30 |

Twelve months ended June 30 |

|||||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Net cash provided by operating activities |

$ | 289 | $ | 279 | $ | 388 | $ | 120 | $ | 120 | $ | 388 | ||||||||||||

| Net cash used in investing activities |

(134 | ) | (111 | ) | (1,206 | ) | (59 | ) | (77 | ) | (1,224 | ) | ||||||||||||

| Net cash provided by (used in) financing activities |

(288 | ) | (14 | ) | 802 | (56 | ) | (109 | ) | 749 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Other financial data: | Year ended December 31 | Six months ended June 30 |

||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Adjusted EBITDA(1) |

$ | 418 | $ | 480 | $ | 590 | $ | 242 | $ | 309 | ||||||||||

| (1) | “Adjusted EBITDA” is a non-GAAP financial measure that we define as income from continuing operations plus interest expense (net), income tax expense (benefit), depreciation and amortization, and other adjustments identified in the reconciliation table below. Additionally, we believe Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We also believe that investors, analysts and ratings agencies consider Adjusted EBITDA useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance, and management uses this measurement for one or more of these purposes. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported in accordance with GAAP. For additional information on Adjusted EBITDA, see “Non-GAAP financial measures” elsewhere in this offering memorandum. |

10

| Reconciliation of adjusted EBITDA to Income from continuing operations |

Year ended December 31 | Six months ended June 30 |

Twelve months ended June 30 |

|||||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Income from continuing operations |

$ | 82 | $ | 144 | $ | 146 | $ | 64 | $ | 105 | $ | 187 | ||||||||||||

| Plus: Interest expense (net) |

4 | (3 | ) | 8 | (1 | ) | 15 | 24 | ||||||||||||||||

| Plus: Income tax expense (benefit) |

8 | (11 | ) | 51 | 19 | 20 | 52 | |||||||||||||||||

| Plus: Depreciation and amortization |

122 | 114 | 128 | 58 | 81 | 151 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

216 | 244 | 333 | 140 | 221 | 414 | ||||||||||||||||||

| Adjustments: |

||||||||||||||||||||||||

| Plus: Amortization of Actuarial Loss—Pension(a) |

141 | 181 | 192 | 90 | 56 | 158 | ||||||||||||||||||

| Plus: Amortization of Actuarial Loss—Postretirement(b) |

3 | 4 | 3 | 2 | 2 | 3 | ||||||||||||||||||

| Plus: Impairment Charges(c) |

46 | 14 | — | — | 7 | 7 | ||||||||||||||||||

| Plus: Acquisition Related Transaction Costs(d) |

— | — | 30 | 1 | — | 29 | ||||||||||||||||||

| Plus: Acquisition Related Severance Costs(e) |

— | — | 7 | — | — | 7 | ||||||||||||||||||

| Plus: Acquisition Related Integration Costs(f) |

— | — | — | — | 8 | 8 | ||||||||||||||||||

| Plus: Stock-Based Compensation |

12 | 21 | 33 | 15 | 22 | 40 | ||||||||||||||||||

| Plus: Corporate Headquarters Relocation(g) |

6 | 18 | — | — | — | — | ||||||||||||||||||

| Plus (Less): Litigation Charge (Settlement)(h) |

6 | 8 | (3 | ) | (3 | ) | — | — | ||||||||||||||||

| Less: Gain on Sale of PP&E |

(12 | ) | (10 | ) | (5 | ) | (3 | ) | (7 | ) | (9 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 418 | $ | 480 | $ | 590 | $ | 242 | $ | 309 | $ | 657 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| (a) | For all periods presented, amounts related to the amortization of actuarial losses generated in previous periods, which is a non-cash portion of pension expense. |

| (b) | For all periods presented, amounts related to the amortization of actuarial losses generated in previous periods, which is a non-cash portion of postretirement income. |

| (c) | For the year ended December 31, 2009, amount related to impairment of an equity investment as well as a charge for the write-off of inventory and the accrual of purchase commitments related to the equity investment. For the year ended December 31, 2010 and for the six months ended June 30, 2012, amounts related to impairment of equity investments. |

| (d) | For the year ended December 31, 2011 and for the six months ended June 30, 2011, amounts related to the transaction costs incurred in connection with the acquisition of Radiant, which include accounting, legal and advisor fees, but not financing fees. |

| (e) | For the year ended December 31, 2011, amount related to the accrual of severance costs related to the acquisition of Radiant. These costs will continue to be paid out through at least 2013. |

| (f) | For the six months ended June 30, 2012, amount related to integration costs related to the acquisition of Radiant, which include information technology, legal and tax fees. |

| (g) | For the years ended December 31, 2010 and 2009, amounts related to incremental costs directly related to the relocation of the Company’s worldwide headquarters from Dayton, OH, to Duluth, GA. |

| (h) | For the years ended December 31, 2011, 2010 and 2009, amounts related to either litigation charges or benefit from a final legal settlement recorded in selling, general and administrative expenses and other (expense) income, net. |

NCR utilizes additional non-GAAP measures, including free cash flow, NPOI, non-GAAP gross margin and net debt.

“Free cash flow” is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities and cash provided by (used in) discontinued operations, less capital

11

expenditures for property, plant and equipment, net of grant reimbursements and additions to capitalized software as identified in the reconciliation table below. NCR’s management uses free cash flow to assess the financial performance of the company and believes it is useful for investors because it relates the operating cash flow of the Company to the capital that is spent to continue and improve business operations. In particular, free cash flow indicates the amount of cash generated after capital expenditures which can be used for, among other things, investments in the Company’s existing businesses, strategic acquisitions and investments, repurchase of NCR stock and repayment of the Company’s debt obligations. Free cash flow does not represent the residual cash flow available for discretionary expenditures, since there may be other non-discretionary expenditures that are not deducted from the measure. This non-GAAP measure should not be considered as a substitute for, or superior to, cash flows from operating activities determined in accordance with GAAP. For additional information on free cash flow, see “Non-GAAP financial measures” elsewhere in this offering memorandum.

| Reconciliation of free cash flow to net cash provided by operating activities: |

Year ended December 31 | Six months ended June 30 |

Twelve months ended June 30 |

|||||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | ||||||||||||||||||

|

|

|

|

||||||||||||||||||||||

| Net Cash Provided by Operating Activities |

$ | 289 | $ | 279 | $ | 388 | $ | 120 | $ | 120 | $ | 388 | ||||||||||||

| Less: Expenditures for Property, Plant and Equipment, net of grant reimbursements |

(43 | ) | (69 | ) | (61 | ) | (32 | ) | (31 | ) | (60 | ) | ||||||||||||

| Less: Additions to Capitalized Software |

(61 | ) | (57 | ) | (62 | ) | (29 | ) | (37 | ) | (70 | ) | ||||||||||||

| Net Cash Used in Discontinued Operations |

(135 | ) | (116 | ) | (77 | ) | (55 | ) | (44 | ) | (66 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Free cash flow (non-GAAP) |

$ | 50 | $ | 37 | $ | 188 | $ | 4 | $ | 8 | $ | 192 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

“NPOI” is a non-GAAP financial measure of income from operations that excludes the impact of pension expense and certain special items, including amortization of acquisition-related intangibles, as identified in the reconciliation table below. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, NCR’s management uses NPOI to evaluate year-over-year operating performance. NCR defines non-pension operating income based on its GAAP income (loss) from operations excluding pension expense and special items. NCR also uses non-pension operating income to manage and determine the effectiveness of its business managers and as a basis for incentive compensation. This non-GAAP measure should not be considered as a substitute for or superior to results determined in accordance with GAAP. NPOI refers to segment operating income on a consolidated basis. For additional information on NPOI, see “Non-GAAP financial measures” elsewhere in this offering memorandum.

12

| Reconciliation of NPOI to income from operations: | Year ended December 31 | Six months ended June 30 |

Twelve months ended June 30 |

|||||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| Income from Operations (GAAP) |

$ | 134 | $ | 149 | $ | 212 | $ | 82 | $ | 150 | $ | 280 | ||||||||||||

| Adjustments: |

||||||||||||||||||||||||

| Plus: Pension Expense |

159 | 208 | 222 | 104 | 78 | 196 | ||||||||||||||||||

| Plus: Impairment Charges(a) |

22 | — | — | — | — | — | ||||||||||||||||||

| Plus: Acquisition Related Transaction Costs(b) |

— | — | 30 | 1 | — | 29 | ||||||||||||||||||

| Plus: Acquisition Related Severance Costs(c) |

— | — | 7 | — | — | 7 | ||||||||||||||||||

| Plus: Acquisition Related Amortization of Intangibles(d) |

— | — | 12 | — | 19 | 31 | ||||||||||||||||||

| Plus: Acquisition Related Integration Costs(e) |

— | — | — | — | 8 | 8 | ||||||||||||||||||

| Plus: Corporate Headquarters Relocation(f) |

6 | 18 | — | — | — | — | ||||||||||||||||||

| Plus (Less): Litigation Charge (Settlement)(g) |

— | 8 | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-Pension Operating Income (non-GAAP) |

$ | 321 | $ | 383 | $ | 483 | $ | 187 | $ | 255 | $ | 551 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

| (a) | For the year ended December 31, 2009, amount related to a charge for the write-off of inventory and the accrual of purchase commitments related to the impairment of an equity investment. |

| (b) | For the year ended December 31, 2011 and for the six months ended June 30, 2011, amounts related to the transaction costs incurred in connection with the acquisition of Radiant, which include accounting, legal and advisor fees, but not financing fees. |

| (c) | For the year ended December 31, 2011, amount related to the accrual of severance costs related to the acquisition of Radiant. These costs will continue to be paid out through at least 2013. |

| (d) | For the year ended December 31, 2011 and for the six months ended June 30, 2012, amounts related to the amortization of intangibles acquired in connection with the acquisition of Radiant. |

| (e) | For the six months ended June 30, 2012, amount related to integration costs related to the acquisition of Radiant, which include information technology, legal and tax fees. |

| (f) | For the years ended December 31, 2010 and 2009, amounts related to incremental costs directly related to the relocation of the Company’s worldwide headquarters from Dayton, OH, to Duluth, GA. |

| (g) | For the year ended December 31, 2010, the amount related to a litigation charge recorded in selling, general and administrative expenses. |

“Non-GAAP gross margin” is a non-GAAP financial measure of gross margin that excludes the impact of pension expense and certain special items identified in the reconciliation table below. Due to the significant change in its pension expense from year to year and the non-operational nature of pension expense and these special items, NCR’s management uses non-GAAP gross margin to evaluate year-over-year operating performance. NCR determines non-GAAP gross margin based on its GAAP gross margin excluding pension expense and special items. This non-GAAP measure should not be considered as a substitute for or superior to results determined in accordance with GAAP. For additional information on non-GAAP gross margin, see “Non-GAAP financial measures” elsewhere in this offering memorandum.

13

| Reconciliation of non-GAAP gross margin to gross margin: | Year ended December 31 | |||||||||||

| (in millions) | 2009 | 2010 | 2011 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Total gross margin as a percentage of revenue |

19.6% | 21.0% | 22.3% | |||||||||

| Pension expense |

1.9% | 2.5% | 2.5% | |||||||||

| Impairment of assets related to an equity investment (a) |

0.5% | — | — | |||||||||

| Acquisition related amortization of intangibles (b) |

— | — | 0.1% | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin as a percentage of revenue (non-GAAP) |

22.0% | 23.5% | 24.9% | |||||||||

|

|

|

|

|

|

|

|||||||

| Reconciliation of non-GAAP gross margin to gross margin: | Year ended December 31 | |||||||||||

| (in millions) | 2009 | 2010 | 2011 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Product gross margin as a percentage of revenue |

19.8% | 21.8% | 22.4% | |||||||||

| Pension expense |

0.4% | 0.5% | 0.4% | |||||||||

| Impairment of assets related to an equity investment (a) |

1.0% | — | — | |||||||||

| Acquisition related amortization of intangibles (b) |

— | — | 0.2% | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin as a percentage of revenue (non-GAAP) |

21.2% | 22.3% | 23.0% | |||||||||

|

|

|

|

|

|

|

|||||||

| Reconciliation of non-GAAP gross margin to gross margin: | Year ended December 31 | |||||||||||

| (in millions) | 2009 | 2010 | 2011 | |||||||||

|

|

|

|

|

|

|

|

||||||

| Services gross margin as a percentage of revenue |

19.4% | 20.2% | 22.3% | |||||||||

| Pension expense |

3.4% | 4.4% | 4.5% | |||||||||

|

|

|

|

|

|

|

|||||||

| Non-GAAP gross margin as a percentage of revenue (non-GAAP) |

22.8% | 24.6% | 26.8% | |||||||||

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||||

| (a) | For the year ended December 31, 2009, amount related to a charge for the write-off of inventory and the accrual of purchase commitments related to the impairment of an equity investment. |

| (b) | For the year ended December 31, 2011, amounts related to the amortization of intangibles acquired in connection with the acquisition of Radiant. |

(2) “Net debt” is a non-GAAP financial measure that we define as total debt minus cash and cash equivalents, as identified in the reconciliation table below. NCR’s management considers net debt to be an important measure of liquidity and an indicator of our ability to meet ongoing obligations. This non-GAAP measure should not be considered a substitute for, or superior to, total debt under GAAP or any other GAAP measure of indebtedness or financial condition. For additional information on Net Debt, see “Non-GAAP financial measures” elsewhere in this offering memorandum.

| Reconciliation of net debt to total debt | As of December 31 | As of June 30 | ||||||||||||||||||

| (in millions) | 2009 | 2010 | 2011 | 2011 | 2012 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Total debt (GAAP) |

$ | 15 | $ | 11 | $ | 853 | $ | 11 | $ | 740 | ||||||||||

| Less: Cash and cash equivalents |

451 | 496 | 398 | 457 | 377 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Net Debt (non-GAAP) |

(436 | ) | (485 | ) | 455 | (446 | ) | 363 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

14

You should review and consider carefully the following risk factors as well as all the other information presented in this offering memorandum before purchasing the notes. The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties that we are not aware of, that we currently believe are immaterial or that, in our judgment, do not reach the level of materiality that merits disclosure may also impair our business operations. Any of the following risks, if they were to occur, could materially and adversely affect our business, results of operations, prospects or financial condition. In that event, the market price and liquidity of the notes could decline and you could lose all or part of your investment. This offering memorandum also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including the risks described below and the risks described elsewhere in this offering memorandum. See “Forward-looking statements.”

Risks related to our business and industry

Our business may be negatively affected by global economic and credit conditions.

Our business has been, and will continue to be, sensitive to domestic and global economic and credit conditions. For example, recovery from the credit crisis and global economic downturn of 2008 has been uneven and tentative and has created a challenging and unpredictable environment in which to market the products and services of our various businesses across different geographic segments, with European markets posing particular concern. The strength of global economic and credit conditions depends on a number of factors, including the effects of government actions to address sovereign debt issues, improve global credit markets and generally stimulate economic conditions. It is difficult to predict the success of these actions, or the development of new economic conditions that could impact our business.

A negative economic climate could impact the ability of our customers to make capital expenditures, thereby affecting their ability to purchase our products or services. Additionally, if as in the recent past, customers in the financial services sector respond to a negative economic climate by further consolidation, it could further reduce our base of potential customers in the financial industry. Our retail customers also could face continuing fluctuations in consumer confidence and, as a result, could be impacted by weak consumer spending. This could, in turn, result in increased financial pressures that could impact the capital expenditures of our retail customers and, potentially, the ability of certain retail customers to pay accounts receivable owed to NCR. Negative global economic conditions also may have a material effect on our customers’ ability to obtain financing for the purchase of our products and services from third party financing companies, which could adversely affect our operating results.

If we do not compete effectively within the technology industry, we will not be successful.

We operate in the intensely competitive information technology industry. This industry is characterized by rapidly changing technology, evolving industry standards, frequent new product introductions, price and cost reductions, and increasingly greater commoditization of products, making differentiation difficult. Our competitors include other large companies in the technology industry, such as: IBM, Hewlett-Packard Company, Diebold, Inc., Wincor, Hyosung, Fujitsu and Unisys Corporation, some of which have more widespread distribution and market

15

penetration for their platforms and service offerings. In addition, we compete with companies in specific market segments, such as entry-level ATMs, imaging solutions, and business consumables and media products. Our future competitive performance and market position depend on a number of factors, including our ability to:

| • | react to competitive product and pricing pressures (particularly in the ATM marketplace); |

| • | penetrate and meet the changing competitive requirements and deliverables in developing and emerging markets, such as India and China; |

| • | exploit opportunities in new vertical markets, such as travel and telecom and technology; |

| • | rapidly and continually design, develop and market, or otherwise maintain and introduce innovative solutions and related products and services for our customers that are competitive in the marketplace; |

| • | react on a timely basis to shifts in market demands; |

| • | compete in reverse auctions for new and continuing business; |

| • | reduce costs without creating operating inefficiencies; |

| • | maintain competitive operating margins; |

| • | improve product and service delivery quality; and |

| • | effectively market and sell all of our diverse solutions. |

Our business and operating performance could be impacted by external competitive pressures, such as increasing price erosion and the entry of new competitors into our existing product and geographic markets. Our customers sometimes finance our product sales through third-party financing companies. In the case of customer default, these financing companies may be forced to resell this equipment at discounted prices, thus impacting our ability to sell incremental units. The impact of these product and pricing pressures could include lower customer satisfaction, decreased demand for our solutions, loss of market share and reduction of operating profits.

Our revenue, operating results, and margins could fluctuate for a number of reasons, including:

Manufacturing. We manufacture advanced ATMs at our facilities in Columbus, Georgia, USA; Manaus, Brazil; Budapest, Hungary; Puducherry, India; and Beijing, China; self checkout solutions in Columbus, Georgia, USA and Budapest, Hungary; and certain point of sale terminals in Alpharetta, Georgia, USA; Salzburg, Austria; Beijing, China; Geelong, Australia; and Adelaide, Australia. If we develop problems with product quality or on-time delivery to customers, we could experience business interruption that could negatively impact our business and operating results.

Seasonality. Our sales are historically seasonal, with lower revenue in the first quarter and higher revenue in the fourth quarter of each year. Such seasonality also causes our working capital cash flow requirements to vary from quarter to quarter depending on the variability in the volume, timing and mix of product sales. In addition, revenue in the third month of each quarter is typically higher than in the first and second months. These factors, among other things, make forecasting more difficult and may adversely affect our ability to manage working capital and to predict financial results accurately.

16

Foreign currency. Our revenue and operating income are subject to variability due to the effects of foreign currency fluctuations against the U.S. Dollar. We have exposure to approximately 50 functional currencies. We endeavor to mitigate the effects of currency fluctuations by our hedging strategy; however, certain significant currency fluctuations could adversely affect our results of operations, including sales and gross margins.

Cost/Expense reductions. While we continue to search for opportunities to reduce our costs and expenses to improve operating profitability without jeopardizing the quality of our products or the effectiveness of our operations, our success in achieving targeted cost and expense reductions depends on a number of factors. These include our ability to achieve infrastructure rationalizations, drive lower component costs, improve supply chain efficiencies, and among other things, optimize the efficiency of our customer services and professional services consulting resources. If we do not successfully execute on our cost reduction initiatives or if we experience delays in completing the implementation of these initiatives, our results of operations or financial condition could be adversely affected.

Contractual obligations of consulting services. We maintain a professional services consulting workforce to fulfill contracts that we enter into with our customers which may contemplate that services will be performed over multiple periods. Our profitability under those contracts is largely a function of performing our contractual obligations within the estimated costs to perform these obligations. If we exceed these estimated costs, our profitability related to these contracts may be negatively impacted. In addition, if we are unable to maintain appropriate utilization rates for our consultants, we may not be able to sustain profitability on these contracts.

Acquisitions, divestitures and alliances. As part of our strategy, we intend to selectively acquire and divest technologies, products and businesses, either through acquisitions, investments, joint ventures, or strategic alliances. As these acquisitions, divestitures and alliances take place and we begin to include or exclude, as the case may be, the financial results related to these transactions, it could cause our operating results to fluctuate materially, depending on the size and nature of any future transactions. In addition, our operating results may be adversely affected if we are unable to properly integrate future acquisitions or if investments or alliances do not perform up to, or meet, our original expectations.

Pension funds. Consistent with local competitive practice and regulations, we sponsor pension plans in many of the countries where we do business. A number of these pension plans are supported by pension fund investments that are subject to financial market risk. Additionally, we are required to make a number of actuarial assumptions for each plan, including the expected long-term return on plan assets and the discount rate on a country-by-country basis after consultation with independent actuarial consultants. We examine interest rate levels and trends within each country, particularly yields on high-quality long-term corporate bonds, relative to our expected future benefit payments to determine our discount rate assumptions. Our long-term expected rate of return on asset assumptions are developed by considering the asset allocation and implementation strategies employed by each pension fund relative to capital market expectations.

Beginning in 2008, financial markets experienced significant volatility, with declining government bond yields and widening credit spreads on fixed income investments and poor performance in equity markets. The equity markets improved somewhat in subsequent years, but this volatility created a significant, underfunded pension obligation. In 2010, in an effort to alleviate future volatility, we began implementation of a three-year pension strategy to

17

rebalance our pension asset portfolio. However, our remaining underfunded pension obligation continues to require significant cash contributions, and may require material increases in those cash contributions in future years. Our financial position and liquidity could be materially impacted by these contributions. See “Effects of pension, postemployment and postretirement benefit plans” and “Financial condition, liquidity and capital resources” sections of the “Management’s discussion and analysis of financial condition and results of operations” included in this offering memorandum for further information regarding the funded status of our pension plans and potential future cash contributions.

Our future financial results could be materially impacted by further volatility in the performance of financial markets, changes in regulations regarding funding requirements, an inability to successfully complete implementation of our pension strategy and changes in the actuarial assumptions, including those described in our “Critical accounting policies” section of the “Management’s discussion and analysis of financial condition and results of operations” included in this offering memorandum.

Stock-based compensation. Similar to other companies, we use stock awards as a form of compensation for certain employees and non-employee directors. All stock-based awards, including grants of employee stock options, are required to be recognized in our financial statements based on their fair values. The amount recognized for stock compensation expense could vary depending on a number of assumptions or changes that may occur. For example, assumptions such as the risk-free rate, expected holding period and expected volatility that drive our valuation model could change. Other examples that could have an impact include changes in the mix and type of awards, changes in our compensation plans or tax rate, changes in our forfeiture rate, differences in actual results compared to management’s estimates for performance-based awards or an unusually high amount of expirations of stock options.

Income taxes. We are subject to income taxes in the United States and a number of foreign jurisdictions. We recognize deferred tax assets and liabilities based on the differences between the financial statement carrying amounts and the tax basis of assets and liabilities. Significant judgment is required in determining our provision for income taxes. We regularly review our deferred tax assets for recoverability and establish a valuation allowance if it is more likely than not that some portion or all of a deferred tax asset will not be realized. As a result of the significant declines in the value of pension plan assets and increases in the actuarially valued pension benefit obligations, our deferred tax assets increased significantly beginning in 2008 and totaled approximately $942 million and approximately $768 million at December 31, 2011 and 2010, respectively. If we are unable to generate sufficient future taxable income, if there is a material change in the actual effective tax rates, if there is a change to the time period within which the underlying temporary differences become taxable or deductible, or if the tax laws change unfavorably, then we could be required to increase our valuation allowance against our deferred tax assets, which could result in a material increase in our effective tax rate. Additionally, we are subject to ongoing tax audits in various jurisdictions both in the U.S. and internationally, the outcomes of which could result in the assessment of additional taxes. Our effective tax rate in the future could be adversely affected by changes in the mix of earnings in countries with differing statutory tax rates, the changes in the valuation of deferred tax assets and liabilities, changes in tax laws and regulations, and management’s assessment in regards to repatriation of earnings.

Software and services. In recent years, we have begun to shift our business model to focus increasingly on sales of higher-margin software and services in addition to our ATM, point-of-sale

18

and other hardware. Our ability to successfully grow our software and services businesses depends on a number of different factors, including market acceptance of our software solutions, enabling our sales force to use a consultative selling model that better incorporates our comprehensive solutions, and the expansion of our services capabilities and geographic coverage, among others. If we are not successful in growing our software and services businesses at the rate that we anticipate, we may not meet expected growth and gross margin projections or expectations, and operating results could be negatively impacted.

Real estate. Our strategy over the past several years with respect to owned and leased real estate has been to reduce our holdings of excess real estate. In line with this strategy, the exit of facilities may affect net income, and current and future real estate market conditions could impede our ability to reduce the size of our real estate portfolio or affect the amount of consideration received in any transactions.

Our multinational operations, including our expansion into new and emerging markets, expose us to business and legal risk in the various countries where we do business.

For the six months ended June 30, 2012 and the years ended December 31, 2011 and 2010, the percentage of our revenues from outside of the United States was 60%, 64% and 67%, respectively, and we expect our percentage of revenues generated outside the United States to continue to be significant. In addition, we continue to seek to further penetrate existing international markets, and to identify opportunities to enter into or expand our presence in developing and emerging markets, including Brazil, Russia, China, India, Africa, and the Middle East. While we believe that our geographic diversity may help to mitigate some risks associated with geographic concentrations of operations (e.g., adverse changes in foreign currency exchange rates, deteriorating economic environments or business disruptions due to economic or political uncertainties), our ability to manufacture and sell our solutions internationally, including in new and emerging markets, is subject to risks, which include, among others:

| • | the impact of ongoing global economic and credit crises on the stability of national and regional economies; |

| • | political conditions that could adversely affect demand for our solutions, or our ability to access funds and resources, in these markets; |

| • | the impact of a downturn in the global economy on demand for our products; |

| • | currency exchange rate fluctuations that could result in lower demand for our products as well as generate currency translation losses; |

| • | changes to and compliance with a variety of laws and regulations that may increase our cost of doing business or otherwise prevent us from effectively competing internationally; |

| • | the institution of, or changes to, trade protection measures and import or export licensing requirements; |

| • | the successful implementation and use of systems, procedures and controls to monitor our operations in foreign markets; |

| • | changing competitive requirements and deliverables in developing and emerging markets; |

| • | work stoppages and other labor conditions or issues; |

19

| • | disruptions in transportation and shipping infrastructure; and |

| • | the impact of civil unrest relating to war and terrorist activity on the economy or markets in general, or on our ability, or that of our suppliers, to meet commitments. |

If we do not swiftly and successfully develop and introduce new solutions in the competitive, rapidly changing environment in which we do business, our business results will be impacted.

The development process for our solutions requires high levels of innovation from both our product development team and suppliers of the components embedded in our solutions. In addition, the development process can be lengthy and costly, and requires us to commit a significant amount of resources to bring our business solutions to market. If we are unable to anticipate our customers’ needs and technological trends accurately, or are otherwise unable to complete development efficiently, we would be unable to introduce new solutions into the market on a timely basis, if at all, and our business and operating results could be impacted. Likewise, we sometimes make assurances to customers regarding the operability and specifications of new technologies, and our results could be impacted if we are unable to deliver such technologies, or if such technologies do not perform as planned. Once we have developed new solutions, if we cannot successfully market and sell those solutions, our business and operating results could be impacted. Also, our hardware and software-based solutions, particularly those that are new, may contain known, as well as undetected errors, which may be found after the product introductions and shipments. While we attempt to remedy errors that we believe would be considered critical by our customers prior to shipment, we may not be able to detect or remedy all such errors, and this could result in lost revenues, delays in customer acceptance and incremental costs, each of which would impact our business and operating results.

If third-party suppliers upon which we rely are not available, our ability to bring our products to market in a timely fashion could be affected.

In most cases, there are a number of vendors providing the services and producing the parts and components that we utilize in our products. However, there are some services and components that are purchased from single sources due to price, quality, technology or other reasons. For example, we depend on transaction processing services from Accenture, computer chips and microprocessors from Intel Corporation and operating systems from Microsoft Corporation. Certain parts and components used in the manufacturing of our ATMs and the delivery of many of our retail solutions are also supplied by single sources. In addition, there are a number of key suppliers for our businesses who provide us with critical products for our solutions. If we were unable to purchase the necessary services, including contract manufacturing, parts, components or products from a particular vendor, and we had to find an alternative supplier, our new and existing product shipments and solution deliveries could be delayed, impacting our business and operating results.

We have, from time to time, formed alliances with third parties that have complementary products, software, services and skills. These alliances represent many different types of relationships, such as outsourcing arrangements to manufacture hardware and subcontract agreements with third parties to perform services and provide products and software to our customers in connection with our solutions. For example, we rely on third parties for cash replenishment services for our ATM products. Also, some of these third parties have access to

20

confidential NCR and customer data, the integrity and security of which we need to ensure. These alliances introduce risks that we cannot control, such as nonperformance by third parties and difficulties with or delays in integrating elements provided by third parties into our solutions. Lack of information technology infrastructure, shortages in business capitalization, and manual processes and data integrity issues of smaller suppliers can also create product time delays, inventory and invoicing problems, staging delays, as well as other operating issues. The failure of third parties to provide high-quality products or services that conform to required specifications or contractual arrangements could impair the delivery of our solutions on a timely basis, create exposure for non-compliance with our contractual commitments to our customers and impact our business and operating results.

Our continuing ability to be a leading technology and services solutions provider could be negatively affected if we do not develop and protect intellectual property that drives innovation.

It is critical to our continued development of leading technologies that we are able to protect and enhance our proprietary rights in our intellectual property through patent, copyright, trademark and trade secret laws. These efforts include protection of the products and the application, diagnostic and other software we develop. To the extent we are not successful in protecting our proprietary rights, our business could be adversely impacted. Also, many of our offerings rely on technologies developed by others, and if we are unable to continue to obtain licenses for such technologies, our business would be impacted. Over the last several years, there has been an increase in the issuance of software and business method patents, and more companies are aggressively enforcing their intellectual property rights. These trends could impact NCR. From time to time, we receive notices from third parties regarding patent and other intellectual property claims. Whether such claims are with or without merit, they may require significant resources to defend. If an infringement claim is successful, or in the event we are unable to license the infringed technology or to substitute similar non-infringing technology, our business could be adversely affected.

Breaches to our systems or products that compromise the security and integrity of personally identifiable information could have a negative impact on our results of operations.

Certain of our products and services are used by our customers to store and transmit personally identifiable information of their customers. Also, we have regularly collected, transferred and retained certain customer data as part of our entertainment business, and maintain personal information about our employees. This information is subject to a variety of laws, regulations and industry standards governing its collection, use, disclosure and disposal. Vulnerabilities in the security of our products and services, whether relating to hardware, software or otherwise, could compromise the confidentiality of, or result in unauthorized access to or the loss of information transmitted or stored using our products or solutions. Additionally, vulnerabilities in the security of our own internal systems could compromise the confidentiality of, or result in unauthorized access to personal information of our employees. If we do not maintain the security and integrity of personally identifiable information in accordance with applicable regulatory requirements, we could lose customers and be exposed to claims, costs and reputational harm that could materially and adversely affect our operating results. In addition, if we are required to implement new or different data protection measures, the associated costs could be significant.

21

Our restructuring and re-engineering initiatives could negatively impact productivity and business results.

As part of our ongoing efforts to optimize our cost structure, from time to time, we shift and realign our employee resources, which could temporarily result in reduced productivity levels. In addition to our initiatives to reduce costs and expenses, we have initiatives to grow revenue, such as improving sales training, addressing sales territory requirements, maintaining and monitoring customer satisfaction with our solutions, and focusing on our strong value propositions. We typically have many such initiatives underway. If we are not successful in managing our various restructuring and re-engineering initiatives, and minimizing any resulting loss in productivity, our business and operating results could be negatively impacted.

If we do not attract and retain quality employees, we may not be able to meet our business objectives.

Our employees are vital to our success. Our ability to attract and retain highly skilled technical, sales, consulting and other key personnel is critical, as these key employees are difficult to replace. If we are unable to attract or retain highly qualified employees by offering competitive compensation, secure work environments and leadership opportunities now and in the future, our business and operating results could be negatively impacted.

If we do not maintain effective internal controls, accounting policies, practices, and information systems necessary to ensure reliable reporting of our results, our ability to comply with our legal obligations could be negatively affected.

Our internal controls, accounting policies and practices, and internal information systems enable us to capture and process transactions in a timely and accurate manner in compliance with applicable accounting standards, laws and regulations, taxation requirements and federal securities laws and regulations. Our internal controls and policies are being closely monitored by management as we continue to implement a worldwide Enterprise Resource Planning (“ERP”) system. While we believe these controls, policies, practices and systems are adequate to ensure data integrity, unanticipated and unauthorized actions of employees or contractors (both domestic and international), temporary lapses in internal controls due to shortfalls in transition planning and oversight, or resource constraints, could lead to improprieties and undetected errors that could impact our financial condition, results of operations, or compliance with legal obligations. Moreover, while management has concluded that the Company’s internal control over financial reporting was effective as of December 31, 2011, due to their inherent limitations, such controls may not prevent or detect misstatements in our reported financial statements. Such limitations include, among other things, the potential for human error or circumvention of controls. Further, the Company’s internal control over financial reporting is subject to the risk that controls may become inadequate because of a failure to remediate control deficiencies, changes in conditions or a deterioration of the degree of compliance with established policies and procedures.

Our ability to effectively manage our business could be negatively impacted if we do not invest in and maintain reliable information systems.

It is periodically necessary to replace, upgrade or modify our internal information systems. If we are unable to replace, upgrade or modify such systems in a timely and cost-effective manner, especially in light of demands on our information technology resources, our ability to capture

22

and process financial transactions and therefore, our financial condition, results of operations, or ability to comply with legal and regulatory reporting obligations, may be impacted.

If we do not successfully integrate acquisitions or effectively manage alliance activities, we may not drive future growth.

As part of our overall solutions strategy, we intend to make investments in companies, products, services and technologies, either through acquisitions, investments, joint ventures or strategic alliances. Acquisitions and alliance activities inherently involve risks. The risks we may encounter include those associated with:

| • | assimilating and integrating different business operations, corporate cultures, personnel, infrastructures and technologies or products acquired or licensed; |

| • | the potential for unknown liabilities within the acquired or combined business; and |

| • | the possibility of conflict with joint venture or alliance partners regarding strategic direction, prioritization of objectives and goals, governance matters or operations. |