Attached files

| file | filename |

|---|---|

| EX-99.1 - KRAFT FOODS INC. PRESS RELEASE, DATED SEPTEMBER 7, 2012 - Kraft Foods Group, Inc. | d407519dex991.htm |

| 8-K - FORM 8-K - Kraft Foods Group, Inc. | d407519d8k.htm |

The

New Kraft Foods Group September 7, 2012

Investor Day

Exhibit 99.2 |

Chris Jakubik

Vice President, Investor Relations |

3

Forward-Looking Statements

This

presentation

contains

a

number

of

forward-looking

statements.

The

words

“plan,”

“drive,”

“build,”

“focus,”

“manage,”

“can,”

“will,”

“expect”

and similar expressions are intended to identify our forward-looking

statements. Examples of forward-looking statements include, but are not

limited to, statements regarding our strategic plans, financial

targets and long-term guidance, including revenue and operating income growth, margins, EPS and

market

share;

our

future

dividends;

our

restructuring

costs;

our

opportunities

to

improve

profitability

and

generate

cash; our plans to provide ongoing guidance; and our expectations and goals for

efficiency and productivity, resource allocation, reinvestment in our

business, input cost management, sales execution, cash management, free cash

flow, innovation and employee recruitment, compensation and investment. These forward-looking

statements involve risks and uncertainties, many of which are beyond our control,

and important factors that could cause actual results to differ materially

from those indicated in the forward-looking statements include, but are

not limited to, increased competition; continued consumer weakness and weakness in economic conditions;

our ability to differentiate our products from retailer and economy brands; our

ability to maintain our reputation and brand image; continued volatility of,

and sharp increases in, commodity and other input costs; pricing actions;

increased costs of sales; regulatory or legal changes, restrictions or actions;

unanticipated expenses and business disruptions; product recalls and product

liability claims; unexpected safety or manufacturing issues; our

indebtedness and our ability to pay our indebtedness; our inability to protect our

intellectual property rights; and tax law changes. For additional

information on these and other factors that could affect our forward-looking

statements, see our risk factors, as they may be amended from time to time, set

forth in our filings with the SEC, including

our

Registration

Statement

on

Form

10.

We

disclaim

and

do

not

undertake

any

obligation

to

update

or

revise any forward-looking statement in this presentation, except as required

by applicable law or regulation. |

4

The New Kraft Foods Group

Who we are

What we’ll do

What to expect

Meet our team |

John

Cahill Executive Chairman |

6

1966

1972

1975

1983

1988

1979

1965

1777

Our Heritage and Our Legacy Lie with Our Iconic Brands

Source: Kraft Foods Archives

1780

1862

1870

1880

1899

1903

1905

1906

1927

1928

1930

1933

1937

1954

1959

1957

1982

2004

2011

1889

1896

1883

1897

1892

1800

1900

1700

2000 |

7

We have Unparalleled Strength with Our Portfolio

Household penetration 98% in U.S., 99% in Canada

10 brands with more than $500MM in 2011 annual sales

Another 17 brands with 2011 annual sales over $100MM

Average of 2x the share of the nearest branded competitor

Source: Kraft Foods Group, Nielsen |

8

We are the 4th Largest Player in North American Food

and Beverages

Food & Beverage Net Revenue ($B)

North America, Latest Fiscal Year

(1) Per Kraft Foods Group Form 10 filing

(2) Estimates

(3) U.S. figures

Source: Public disclosures in press releases or SEC filings, Kraft Foods Group

analysis as of August 30, 2012 |

9

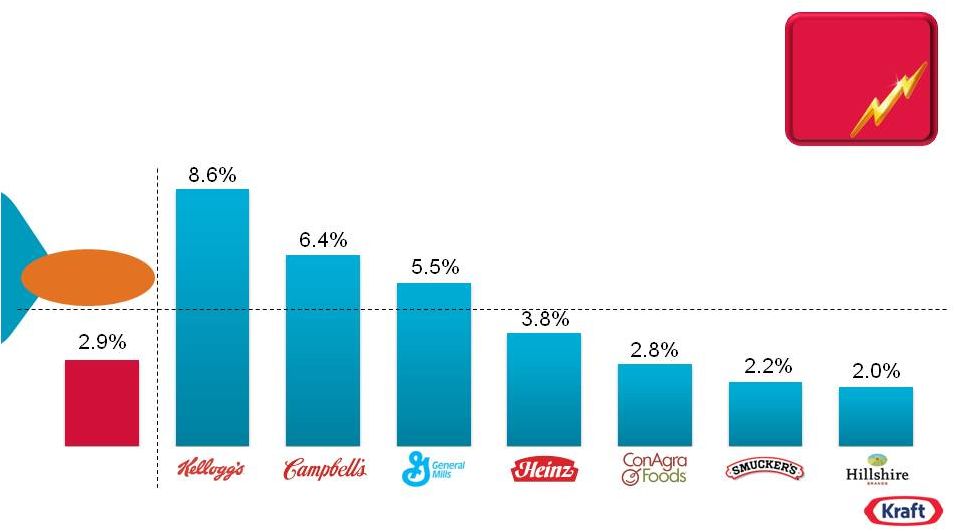

A Huge Opportunity to Improve Profitability

Average

16.6%

Adjusted Operating Income Margin

(1)

North America, Latest Fiscal Year

(3)

(4)

9

(2)

(1) Reported Operating Income Margin for the 12 months ended December 31, 2011 was 15.7%.

See GAAP to Non-GAAP reconciliation at the end of the presentation. (2)

Excludes PepsiCo Americas Beverages business (21.3% with PAB business); (3) includes Corporate Expenses; (4) ex-Post Cereal business

Note: Adjusted Operating Income Margins exclude Corp Allocations (unless otherwise noted) and are on

an “ex one-time items” basis Source: Public disclosures in press releases or SEC

filings, Kraft Foods Group analysis as of August 30, 2012 |

10

An Experienced and Diverse Team with the Right Skills

CEO: 23 years Johnson & Johnson, 3 years private equity

Leadership Team

–

Evenly split between proven Kraft personnel and external hires

–

195 years of combined Kraft experience

–

350 years of combined CPG/Industry experience

–

Drawing experience from other venerable CPG companies including Procter

& Gamble, Swift & Company, Fonterra Brands, PepsiCo, S.C. Johnson

Board expertise covering consumer products, retail, supply chain,

international, social media |

11

Our Mission

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Superior

Dividend

Payout |

Tony Vernon

Chief Executive Officer |

13

The New Kraft Foods Group

Who we are

What we’ll do

What to expect

Meet our team |

“Post Office”

culture

20-70-10 performance model

Limited investment in people

and training

Best recruiter and developer of

industry talent

“Peanut-butter spread”

resource

allocation

Strategic resource allocation based

on margin, materiality, momentum

Inconsistent innovation

Best-in-class innovation

High-cost producer

Lowest-cost producer leveraging

best brands and scale

High overheads

Leanest overheads

Cash as output

of business model

Cash as lifeblood

of business model

The Journey of a $19 Billion Startup

To

To

From

14 |

We’ve Made Good Progress…

(1)

Reported

net

revenue

growth

was

3.8%,

reported

operating

income

growth

was

1.2%,

reported

operating

income

margin

change

was

(0.4)pp,

all

on

a

trailing

four

quarter

basis

ending

June 30, 2012, see GAAP to Non-GAAP reconciliation at the end of the

presentation; (2) Estimated; (3) Total Company Source:

Public

disclosures

in

press

releases

or

SEC

filings,

Kraft

Foods

Group

analysis

as

of

August

30,

2012;

Peer Company financials based on North America operating segments only.

Peer Comparison –

Trailing 4 Quarters

Vol/Mix

Price

Organic

Revenue

Growth

Adjusted

Operating

Inc Growth

Margin

Change

Kraft Foods Group

(1)

(1.3)pp

6.2 pp

4.9 %

6.3 %

0.4 pp

Center-of-Store Peers

Campbell

(3.6)

2.3

(1.3)

(3.8)

(0.5)

Heinz

(1.5)

2.4

0.9

(2.4)

(0.3)

ConAgra

(2.8)

4.8

2.0

(1.6)

(0.8)

Kellogg

(1.0)

5.0

4.0

0.1

(0.7)

General Mills

(4.7)

8.7

4.0

(2.8)

(1.4)

Smuckers

(4.0)

13.3

9.4

(0.5)

(2.7)

Center-of-Store Average

(3.1)pp

6.3 pp

3.2 %

(1.9)%

(0.9)pp

Nestle

2.0

(2)

PepsiCo

(0.8)

4.3

3.5

3.4

(0.3)

Hormel

(3.2)

5.3

2.1

(4.1)

(0.7)

Hershey

(0.6)

(2)

6.6

(2)

6.0

(2)

12.5

(3)

1.0

(3)

Total Peer Average

(2.4)pp

5.4 pp

3.0 %

0.7 %

(0.7)pp

15 |

16

…

Despite an Operating Environment that Promises to

Remain the Most Difficult in a Generation

The North American food and beverage market is large, highly profitable

but mature and slow growing

A

weak

economy

with

relatively

high

commodity

volatility

is

the

“new normal”

Private label has achieved a sustained increase across the market since

the 2008 recession

Mutual dependence with our largest retail food customers

Several major demographic shifts and changing consumer preferences

are transforming the market |

17

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

Make Our

People Our

Competitive

Edge

Our Plan will Sustain Our Momentum and Take Our

Performance to the Next Level |

Make

Our People Our

Competitive

Edge

Our Plan

Aggressively compensate for performance

Invest in our people

Create a lean, horizontal organization

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Execute with

Excellence

18 |

19

Aggressively Compensate for Performance

Increasing variable component in compensation programs

Adopting 20/70/10 performance model

Driving broader, deeper stock compensation and ownership

We’ll put more of our pay “at risk”

Make Our

People Our

Competitive

Edge |

20

Invest in Our People

Building Talent Acquisition, University Relations

as a competitive advantage

Establishing integrated succession planning process to

develop next generation of general managers

Creating

“Kraft

University”

to

assemble

world-class

capabilities

Our next generation managers will lead the industry

Make Our

People Our

Competitive

Edge |

21

Invest in Our People

ISC

Academy

Marketing

Academy

Leadership Development/Management/Diversity & Inclusion

Leadership Development/Management/Diversity & Inclusion

Accreditation required for all managers

Accreditation required for all managers

Sales

Academy

RDQ&I

Academy

Functional

Academies

Business Skill Building:

Business Skill Building:

Cash

Cash

Management,

Management,

Organizational

Organizational

Agility,

Agility,

Compliance,

Compliance,

New

New

Hire,

Hire,

etc.

etc.

Make Our

People Our

Competitive

Edge

21

•

Intro to Marketing

& CIS

•

Marketing/CIS

Fundamentals

•

Advanced

Marketing & CIS

•

Innovation & New

Products

•

Intro to Sales

•

Sales

Fundamentals

•

Advanced Sales

•

Intro to RDQ&I

•

RDQ&I

Fundamentals

•

Advanced

RDQ&I

•

Finance/Business

Acumen

•

Information

Systems

•

Corporate Affairs

& Legal

•

Human Resources

•

Intro to Supply

Chain

•

Supply Chain

Fundamentals

•

Advanced Supply

Chain

•

Procurement

Excellence

Kraft University |

22

Create a Lean, Horizontal Organization

Revamping organizational structure to become nimble

and non-hierarchical

Pushing accountability down to the right levels

Transforming headquarters

We’re changing how we work and where we work

Make Our

People Our

Competitive

Edge |

Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Our Plan

Strategically allocate resources

Leverage our leading sales capability

Relentlessly focus on cash generation

Make Our

People Our

Competitive

Edge

Execute with

Excellence

23 |

24

Strategically Allocate Resources

Each of our brands can deliver outstanding returns…

but not all need the same resources to reach their potential

24

Execute with

Excellence |

Strategically Allocate Resources

We’ve already begun to make progress re-allocating

advertising spend within businesses

% of A&C spend on Power Brands

A&C as % of NR (2012E)

Power Brands currently include Lunchables, Planters, Velveeta Shells &

Cheese, Capri Sun, Jell-O, Philadelphia, Kraft Macaroni & Cheese, Kool-Aid, Miracle

Whip,

Snacking

Cheese,

MiO,

and

Gevalia

Execute with

Excellence

CAGR

12.7%

25 |

Vernon_BTS_MainStream Reel.wmv |

Strategically Allocate Resources

Leveraged non-traditional vehicles to create buzz

Focused on strategic partnerships

Tactically innovated to expand category, generate in-store excitement

We’ve

managed

and

marketed

our

“jewels”

more

entrepreneurially

2011 Net

Revenue

Growth

7%

10%

9%

Execute with

Excellence

27 |

Vernon_BTS_Entrepreneurial Reel v2.wmv |

Strategically Allocate Resources

Our leadership team now will evaluate the collective

needs of our brands and franchises

Margin, Materiality, Momentum

Power Brands

Jewels

Price Protect

Fix

Execute with

Excellence

29 |

Strategically Allocate Resources

We will strategically allocate a broad set of key

resources to brands and franchises

Margin, Materiality,

Momentum

Brand Building

Low Cost

Advertising

Growth R&D & Capex

Brand Management & Sales

Resources

Productivity R&D & Capex

Supply Chain & Procurement

Resources

Overhead Reductions

Higher

Lower

Lower

Higher

Execute with

Excellence

30 |

31

Leverage Our Leading Sales Capability

Kantar 2011 Power Rankings

Key Sales Force Attributes

Rank

Best Sales Force

#1

Best Shopper Marketing

#2

Best Supply Chain Management

#2

Most Helpful Shopper Insights

#2

2011 Overall Rankings

Partnering with Acosta will make us even stronger

Execute with

Excellence

8.1

8.1

10.5

12.8

13.2

22.6

28.4

32.7

Kelloggs

ConAgra

Coke

Unilever

Nestle

PepsiCo

General Mills

KFG |

Leverage Our Leading Sales Capability

Employing a relentless focus on ROI

Bringing world-class category leadership to Center Store

Building strong, sustainable relationships with our customers

Several initiatives will generate higher returns on our

investment in sales

Execute with

Excellence

32 |

33

Relentlessly Focus on Cash Generation

Building free-cash flow, return-on-capital metrics and

targets into business-unit plans

Appointed

a

“Cash

Czar,”

establish

monthly

cash

reviews

by

leadership team

Institutionalizing disciplined business-process execution

and education

We’re putting the tools and processes in place to make

cash “king”

at Kraft

Execute with

Excellence |

Our

Plan Delight the changing consumer

Drive “premium-ness”

through innovation platforms

Differentiate with world-class marketing

34

Make Our

People Our

Competitive

Edge

Execute with

Excellence

Turbocharge

Our Iconic

Brands

Redefine

Efficiency |

35

Delight the Changing Consumer

We can delight the consumers more ways, on more brands, in

more places than any competitor

Beverages

Cheese

Enhancers

Convenient

Meals

Desserts

& Snacks

35

Turbocharge

Our Iconic

Brands |

Delight the Changing Consumer

Good, Better, Best

Delivering the right product at the right price points

Ready-to-Drink Beverages

Cold Cuts

Sandwich Cheese

Convenient Meals

$1.79

$2.49

$2.99

$1.99

$2.99

$3.99

$1.99

$2.99

$3.99

$0.99

$1.99

$3.49

Turbocharge

Our Iconic

Brands

36 |

37

Delight the Changing Consumer

Economically challenged consumer segment

Dollar stores, drug stores, club

Targeted price points for alternate channels

Turbocharge

Our Iconic

Brands |

Drive

“Premium-ness”

Through

Innovation

Platforms

Liquid Concentrates

Lunchables “With”

Premium/One Cup

Convenient Meals

“Aging Up”

Capri Sun

Jell-O Reinvention

Fresh Take

Oscar Mayer Selects

Turbocharge

Our Iconic

Brands

38 |

Drive

“Premium-ness” Through Innovation

Platforms

Health & Wellness

% Revenue from Products

That Meet “Better Choices”

Criteria

Improved Nutritional Profiles

Beneficial Ingredients

Simplification

Sodium Reduction

Fruits & Vegetables

Vitamin Fortified

No Artificial Colors, Preservatives, “Road to Real”

39

Turbocharge

Our Iconic

Brands |

Differentiate with World-Class Marketing

Advertising as % of Net Revenue

Latest Fiscal Year

Average 4.5%

KFG

65% of

peer avg

Note: Advertising spend excludes Consumer Promotion spend

Source: Company SEC filings, Nielsen 2011 ad spend/US x AOC, Kraft Foods Group

analysis We must do a better job supporting our brands

Turbocharge

Our Iconic

Brands

40 |

Differentiate with World-Class Marketing

2011 Net Revenue Growth

Where we’ve spent, it’s had an impact

Turbocharge

Our Iconic

Brands

41

20%

11%

10%

9%

8%

7% |

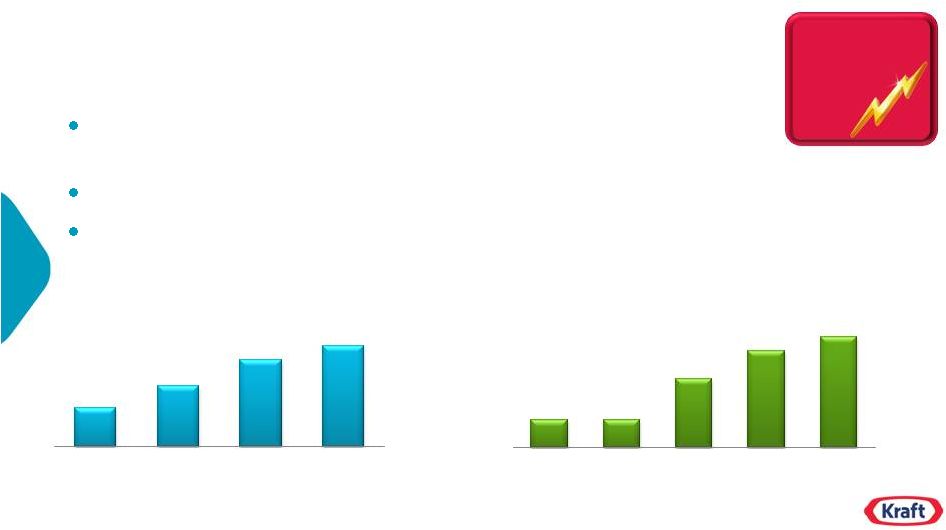

Differentiate with World-Class Marketing

U.S. Hispanic Population

(MM)

KFG Hispanic A&C Index

(2011=100)

Hispanic marketing is a huge opportunity

Our portfolio of family brands are advantaged

with Latina moms

We have underspent in media and at point of purchase

Will be major focus in new Kraft

Turbocharge

Our Iconic

Brands

22

35

51

59

1990

2000

2010

2015E

100

100

250

350

400

2011

2012E

2013E

2014E

2015E

42 |

Vernon_BTS_HispanicReel.wmv |

Our

Plan Drive industry-leading productivity

Realize lowest-cost overheads

44

Make Our

People Our

Competitive

Edge

Execute with

Excellence

Turbocharge

Our Iconic

Brands

Redefine

Efficiency |

Drive

Industry-Leading Productivity Lean Six Sigma

Strategic-sourcing initiatives

Maintenance optimization

Simplification across supply chain

Business-process excellence

Manage labor-cost inflation

Streamline and optimize manufacturing networks

Raise the return bar for business investments

We’re pulling all the levers of productivity to ensure

we drop more to the bottom line

Redefine

Efficiency

45 |

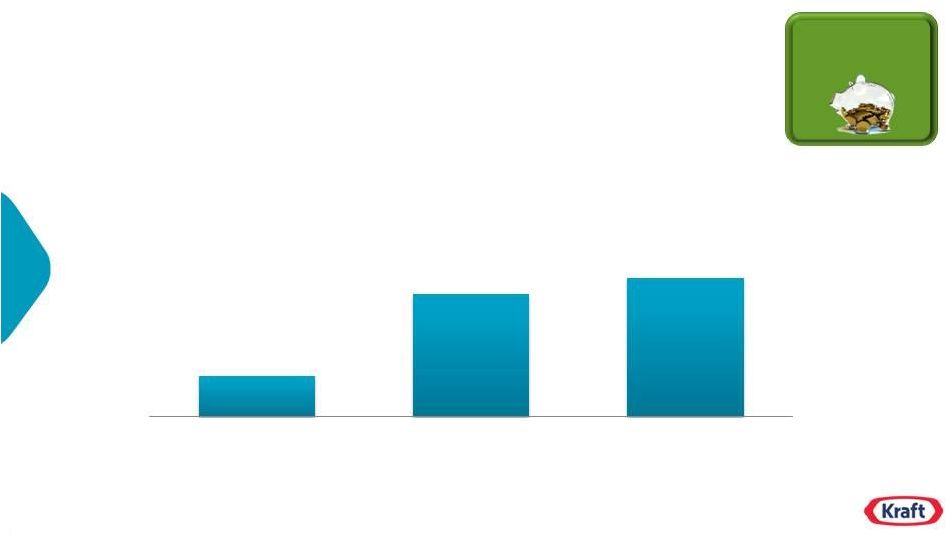

Drive

Industry-Leading Productivity We are targeting at least 2.5% net

productivity Productivity as a % of COGS

Redefine

Efficiency

1.5%

~2.5%

At least

2.5%

2011

2012E

2013+E

46 |

47

Realize Lowest-Cost Overheads

“Clean sheet”

approach to purge complex legacy

structures, practices

–

Business decisions driven by commercial units

–

Small HQ with efficient shared-service model

–

Corporate function cost structures to live up to best-in-class external

benchmarks Moving to standardize backroom business systems

Savings expected to more than offset dis-synergies from becoming an independent

public company

We’re targeting best-in-class overhead costs

47 |

Our

Mission Redefine

Efficiency

Turbocharge

Our Iconic

Brands

Make Our

People Our

Competitive

Edge

Make Kraft North American

Food & Beverage Company

48

Execute with

Excellence |

Tim

McLevish Chief Financial Officer |

The

New Kraft Foods Group Who we are

What we’ll do

What to expect

Meet our team

50 |

51

We have All the Ingredients for Success

A portfolio of the greatest brands in food & beverage

Scale to achieve lowest delivered product costs and lowest

overheads

Strong and diverse management team

Operational and financial momentum |

52

But Our Financial Targets Must Reflect Several Realities

A volatile commodity-price environment is here to stay

We must reinvest to deliver sustainable growth

We

put

dollars

in

shareholders’

pockets…

not

growth

rates,

not

margins |

53

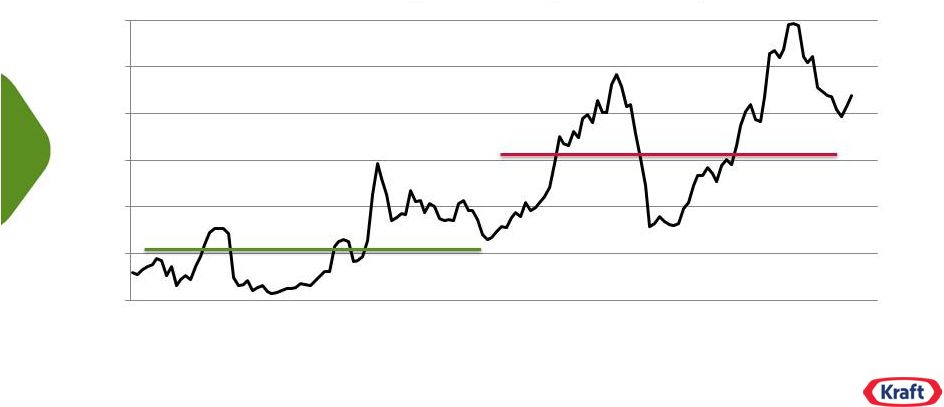

A Volatile Commodity-Price Environment is Here to Stay

KFG Commodity Price Index (2012E = 100%)

Year

Note: The index measures a basket of 23 commodities weighted to Kraft Foods Group

volumes. Price multiplied by quantity equals total cost. This index holds

quantity fixed at expected 2012 volumes and measures the theoretical effect on

total cost due to changes in only price. Price is spot price only and does not

include any effect from hedging.

50

60

70

80

90

100

110

00

01

02

03

04

05

06

07

08

09

10

11

12 |

54

We Must Reinvest to Deliver Sustainable Growth

Many levers to deliver at least 2.5% net productivity

Further opportunity from negative overhead growth (NOG) in the

near-term, zero overhead growth (ZOG) long-term

Need to be competitive and sustainable on several fronts

–

People

–

Brand building

–

Innovation |

55

We Put Dollars in Shareholders’

Pockets…

Not Growth

Rates, Not Margins

Inconsistent commitment

Key cultural priority

Revenue growth and OI margin

focus

Balanced emphasis on both P&L and

Balance Sheet

No capital charges

ROIC focus from strategic to

operating decisions

Functional silos, metrics

and incentives

End-to-end metrics

Information and reports

Decision tools that create bias for

action

To

To

From |

56

Our Long-Term Growth Algorithm is Built to Last

(1) Market defined as the North American Food & Beverage market

(2) Free Cash Flow = Cash Flow from Operations, less Capital Expenditures

Metric

Long-Term Target

Organic Revenue

Profitable

growth at or above market growth

(1)

Operating Income

Consistent

mid-single-digit growth

EPS

Consistent mid-to-high, single-digit growth

Free Cash Flow

(2)

At least

85% of Net Income

Dividends

Consistent

mid-single-digit growth |

How We

Think about Other Drivers Driver

Expectation

Advertising Spend

We expect to hit our Long-Term Targets for consistent growth in

Operating Income dollars and Earnings Per Share even as we increase

our share of voice

Market Share

We expect to deliver profitable growth at or above market growth*

Operating Income Margins

We

put

dollars

in

shareholders’

pockets,

not

margins

Delivering against the targets we’ve laid out should lead to margin

expansion

Restructuring Spend

No “ex items”

reporting

2013 spin-off and restructuring related costs of ~$240 million to fall to

~$125 million of annual spending on cost-savings initiatives

thereafter ROIC

We’re driving a return discipline down to lowest levels of our

organization

ROIC will expand moving forward…

more to come

*Market defined as the North American Food & Beverage market

57 |

58

Our Ongoing Guidance Policy Will Help Us Focus on

Sustainable Long-Term Shareholder Value

Our long-term growth algorithm is our ongoing expectation

–

No point estimates on annual or quarterly P&L line items

We will provide quantitative assessments

–

Material events (e.g., extraordinary pruning, acquisitions, etc.)

–

Financial

implications

of

significant

decisions

(e.g.,

change

in

pension

accounting)

We will provide qualitative assessments

–

Business trends

–

Competitive dynamics

–

Material actions taken or decisions made |

59

We Recognize that Using Our 2012 Reported Financials Will

Make Projecting Future Results Difficult

Expect solid top-line and underlying profit growth, consistent with previous

KFT guidance

Q1-Q3 presentation based on Form 10 requirements

–

Carve-out financials below revenue reflect ParentCo charges

–

Pro-forma interest based on assumed rate, excluding seasonal needs

Q4 presentation will reflect standalone results

–

Potential headwind from required, spin-related pension revaluation

Later-than-usual filing of Q4/FY 2012 results

Exceptional need for specific 2013 guidance |

60

2013 Guidance: Continued Momentum, Clean Base

Organic revenue growth in line with market growth

–

Including pruning impact of ~(1)pp

Productivity, overhead savings to drive ~$2.60 GAAP EPS

–

Interest expense ~$520MM

–

Tax rate ~35%

–

Includes restructuring costs of ~$240MM or $0.26 per share versus expected ongoing

costs of ~$125MM or $0.14 per share per annum

“Typical”

seasonality of quarterly sales and earnings

–

Normally generate ~48% of earnings in H1, ~52% in H2

Free Cash Flow ~70% of GAAP net income

–

Below long-term target of at least 85% due to fifth tax payment in 2013

We expect to recommend an annual dividend of $2.00 per share

|

Our

Debt Profile is Relatively Fixed at an Average Rate of 5% and No Maturities

Until June 2015 ($ Millions)

$1,400

$1,000

$900

$900

$2,000

$896

$900

$2,000

Debt Maturity Profile

Source: Kraft Foods Group Form 10 filing

61

2013

2014

2015

2017

2018

2020

2022

2039

2040

2042 |

62

Priorities for Free Cash Flow

Fund a highly competitive dividend

Reinvest in the

business

Acquisitions that quickly

achieve EPS accretion and an

IRR > risk-adjusted hurdle rate

Share

repurchase |

63

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Superior

Dividend

Payout

We are Well-Positioned to Deliver Predictable Returns

|

Tony Vernon

Chief Executive Officer |

Our

Mission THE

Innovator

THE

Strongest Portfolio

THE

Lowest Cost Producer

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry

65 |

The

New Kraft Foods Group Who we are

What we’ll do

What to expect

Meet our team

66 |

67

Our Team

Deanie Elsner

EVP and

President,

Beverages

George Zoghbi

EVP and

President,

Cheese & Dairy

Michael Osanloo

EVP and

President,

Grocery

Nick Meriggioli

EVP and

President,

Oscar Mayer

Dino Bianco

EVP and President,

National

Businesses and

Marketing Services

*Effective when the spin-off occurs |

68

Our Team

Chuck Davis

EVP, Research,

Development, Quality and

Innovation

Robert Gorski

EVP, Integrated

Supply Chain

Tom Corley

EVP and President

US Sales

Tom Sampson

EVP, Business

Transformation

*Effective when the spin-off occurs |

69

Our Team

Kim Rucker

EVP, Corporate &

Legal Affairs,

General Counsel and

Corporate Secretary

Diane Johnson May

EVP, Human Resources

Sam Rovit

EVP, Strategy

President, Planters

*Effective when the spin-off occurs

Tim McLevish

EVP and Chief

Financial Officer |

|

GAAP

to Non-GAAP Reconciliation Reported

(GAAP)

Unrealized

G/(L) on

Hedging

Activities

Headquarter

Pension

Expense

General

Corporate

Expenses

Adjusted

Operating

Income

(Non-GAAP)

Net Revenue

18,655

$

-

$

-

$

-

$

18,655

$

Operating Income

2,923

(63)

(155)

(55)

3,196

Operating Income Margin

15.7%

17.1%

Kraft Foods Group, Inc.

Operating Income to Adjusted Operating Income

For the Twelve Months Ended December 31, 2011

($ in millions, except percentages) (Unaudited)

71 |

GAAP

to Non-GAAP Reconciliation 72

Reported

(GAAP)

Impact of

Divestitures

Impact of

the 53rd

Week of

Shipments

Impact of

Currency

Organic

(Non-GAAP)

Reported

(GAAP)

Organic

(Non-GAAP)

Vol / Mix

Pricing

June 30, 2012

4,786

$

-

$

-

$

25

$

4,811

$

0.9%

1.5%

(1.4)pp

2.9pp

June 30, 2011

4,741

-

-

-

4,741

March 31, 2012

4,453

-

-

6

4,459

1.1%

3.4%

(2.6)pp

6.0pp

March 31, 2011

4,405

(91)

-

-

4,314

December 31, 2011

5,035

-

(225)

4

4,814

9.2%

8.1%

(0.2)pp

8.3pp

December 31, 2010

4,611

(159)

-

-

4,452

September 30, 2011

4,474

-

-

(33)

4,441

4.1%

6.6%

(0.8)pp

7.4pp

September 30, 2010

4,297

(130)

-

-

4,167

Trailing four quarter average

3.8%

4.9%

(1.3)pp

6.2pp

Organic Growth Drivers

Percent Change

Kraft Foods Group, Inc.

Net Revenue to Organic Net Revenue

For the Three Months Ended,

($ in millions, except percentages) (Unaudited)

Note: Reported net revenues include intercompany sales with Kraft ParentCo subsidiaries which

were $54 million for the six months ended June 30, 2012 and $100 million for the twelve

months ended December 31, 2011. |

GAAP

to Non-GAAP Reconciliation Reported

(GAAP)

Restructuring

Costs

Unrealized

G/(L) on

Hedging

Activities

Headquarter

Pension

Expense

General

Corporate

Expenses

Adjusted

Operating

Income

(Non-GAAP)

June 30, 2012

2,963

$

(116)

$

(26)

$

(194)

$

(40)

$

3,339

$

June 30, 2011

2,929

-

15

(146)

(81)

3,141

Trailing four quarter growth

1.2%

6.3%

Kraft Foods Group, Inc.

Operating Income to Adjusted Operating Income

For the Trailing Four Quarters Ended,

($ in millions, except percentages) (Unaudited)

73 |

GAAP

to Non-GAAP Reconciliation Reported

(GAAP)

Restructuring

Costs

Unrealized

G/(L) on

Hedging

Activities

Headquarter

Pension

Expense

General

Corporate

Expenses

Adjusted

Operating

Income

Margin

(Non-GAAP)

June 30, 2012

15.8%

(0.6)pp

(0.2)pp

(1.0)pp

(0.2)pp

17.8%

June 30, 2011

16.2%

0.0pp

0.1pp

(0.8)pp

(0.5)pp

17.4%

Trailing four quarter margin growth

(0.4)pp

0.4pp

Kraft Foods Group, Inc.

Operating Income Margin to Adjusted Operating Income Margin

For the Trailing Four Quarters Ended,

(Unaudited)

74 |