Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Yellow Corp | d407081d8k.htm |

1

YRC Worldwide Inc.

Deutsche Bank Transportation Conference

September 6, 2012

Exhibit 99.1 |

2

Forward-looking Statements

This presentation contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended. Words such as “

will,

” “

expect,

” “

intend,

” “

anticipate,

” “

believe,

”

“

project,

” “

forecast,

” “

propose,

” “

plan,

” “

designed,

” “

enable

”

and similar expressions are intended to identify forward-looking

statements. Forward-looking statements are inherently uncertain and are

subject to significant business, economic, competitive, regulatory and other

risks, uncertainties and contingencies, known and unknown, many of which are beyond our

control. Our future financial condition and results could differ materially from

those predicted in such forward-looking statements because of a number of factors, including (without

limitation) our ability to generate sufficient cash flows and liquidity to fund

operations and satisfy our obligations related to our substantial indebtedness

and lease and pension funding requirements; our ability to finance the maintenance, acquisition and replacement of revenue

equipment and finance other necessary capital expenditures; changes in equity and debt

markets; general or regional economic activity, including (without limitation)

customer demand in the retail and manufacturing sectors; the success of our management team in

implementing its strategic plan and operational and productivity improvements,

including (without limitation) our continued ability to meet high on-time

and quality delivery performance standards, and the impact of those improvements on our future liquidity and profitability;

inclement weather; price and availability of fuel; sudden changes in the cost of fuel

or the index upon which we base our fuel surcharge and the effectiveness of our

fuel surcharge program in protecting us against fuel price increases; competition and competitive pressure on

service and pricing; expense volatility, including (without limitation) expense

volatility due to changes in rail service or pricing for rail service our ability

to comply and the cost of compliance with federal, state, local and foreign laws and regulations, including (without limitation) laws

and regulations for the protection of employee safety and health and the environment;

terrorist attack; labor relations, including (without limitation) the continued

support of our union employees with respect to our strategic plan, the impact of work rules, work stoppages,

strikes or other disruptions, our obligations to multi-employer health, welfare and

pension plans, wage requirements and employee satisfaction; the impact of claims

and litigation to which we are or may become exposed; and other risks and contingencies, including

(without limitation) the risk factors that are included in our reports filed with the

Securities and Exchange Commission, including those described under “Risk Factors” in our annual report on Form 10-K and quarterly reports on

Form 10-Q. |

3

I.

Introduction

i.

Company Overview and History

ii.

Operating Company Descriptions

II.

July 2011 Transaction

i.

Transaction Details

ii.

Board of Directors / Management Team

iii.

Organizational and Operational Changes

iv.

YRC Freight “Flywheel”

III.

2Q12 Financial Update

i.

Financial Performance

ii.

Liquidity

IV.

Conclusion

V.

Appendix

Table of Contents |

4

I. Introduction |

5

YRC Worldwide is one of the largest less-than-truckload (LTL) carriers in

North America and generates approximately $5B of revenue by

providing services under a portfolio of four subsidiaries

Introduction

Approximately 23% of the public carrier market share,

providing the broadest coverage and more service capability

throughout North America than any competitor |

6

Revenue

$5.0B

Locations

431 U.S. and Canada

Trucks

15,000

Trailers

51,000

Annual tons

14.1M

Annual shipments

21.9M

Annual miles

1.1B

YRC Worldwide Tearsheet |

7

1919

Reddaway founded

1924

Yellow Cab and Transit Company founded

1929

Holland Motor Express founded

1930

Roadway Express launched

1931

New Penn begins operations

1952

Reimer Express begins service in Winnipeg

1959

Yellow Transit becomes a public company

1986

Glen Moore begins operations

1997

Roadway acquires Reimer Express in Canada

2001

Roadway acquires New Penn

2002

Meridian IQ launched

2003

Yellow acquires Roadway, Reimer and New Penn

2005

Yellow Roadway Corp. acquires USF which includes Holland and Reddaway

2005

Joint venture with Jin Jiang for JHJ International

2006

Corporation’s name changed to YRC Worldwide to reflect scope of services

2007

Meridian IQ renamed YRC Logistics

2008

Company acquires Jiayu China ground network

2010

Disposition of YRC Logistics

2011

July 2011 Transaction –

new board and management team

2011

Disposition of Glen Moore assets

2011

Headquarter consolidation –

one company, one culture, one vision with one mission

2012

Disposition of Jiayu (pending Chinese regulatory approvals)

2012

Excess real estate auction

Company History |

8

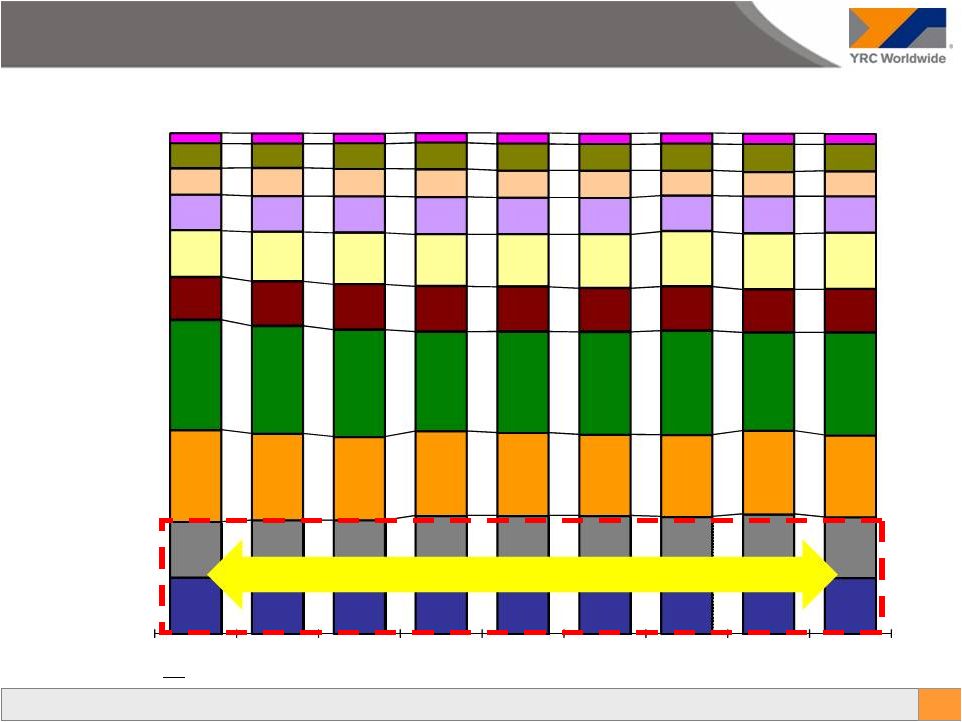

Source: Public filings (Form 10-K, Form 10-Q and earnings releases)

11.2%

11.3%

11.1%

11.6%

11.7%

11.7%

11.6%

11.6%

11.1%

11.2%

11.4%

11.6%

12.0%

11.9%

11.9%

11.8%

12.3%

12.2%

18.3%

17.3%

16.6%

16.9%

16.5%

16.2%

16.3%

16.7%

16.4%

22.0%

21.5%

21.4%

19.9%

20.2%

20.5%

20.8%

19.6%

20.5%

8.6%

9.0%

9.1%

9.1%

9.0%

8.8%

8.9%

8.7%

8.7%

9.3%

9.8%

10.3%

10.3%

10.4%

10.7%

11.0%

11.1%

11.2%

7.1%

7.1%

7.3%

7.4%

7.3%

7.2%

7.1%

7.4%

7.3%

5.3%

5.7%

5.6%

5.6%

5.5%

5.5%

5.0%

4.9%

5.0%

4.9%

4.8%

5.0%

5.3%

5.4%

5.2%

5.3%

5.5%

5.4%

2.1%

2.1%

2.0%

2.0%

2.1%

2.2%

2.1%

2.1%

2.1%

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Market Share Among Public Carriers

(Total Tonnage per Day)

Vitran

ABF

SAIA

ODFL

UPS Freight

Fed Ex Freight

Con-way

YRC Regional

YRC Freight

Roadrunner

23-24% Market Share

Market Share –

Stabilized and Holding Steady

Note: YRC Regional amounts exclude Glen Moore for all periods. FedEx

Freight amounts include Watkins for all periods and Vitran includes PJAX for all periods |

9

Segment Descriptions

YRC

Freight

is

comprised

of

the

merged

Yellow

Transportation

and

Roadway.

YRC

Freight

(YRCF)

offers

a

range

of

services

for

the

transportation

of

industrial,

commercial and retail goods in regional, national and international markets, primarily

through the operation of owned or leased equipment. YRC Freight also includes

YRC Reimer, a subsidiary located in Canada that specializes in shipments into,

across and out of Canada. In addition to the United States and Canada, YRC

Freight also serves parts of Mexico, Puerto Rico and Guam

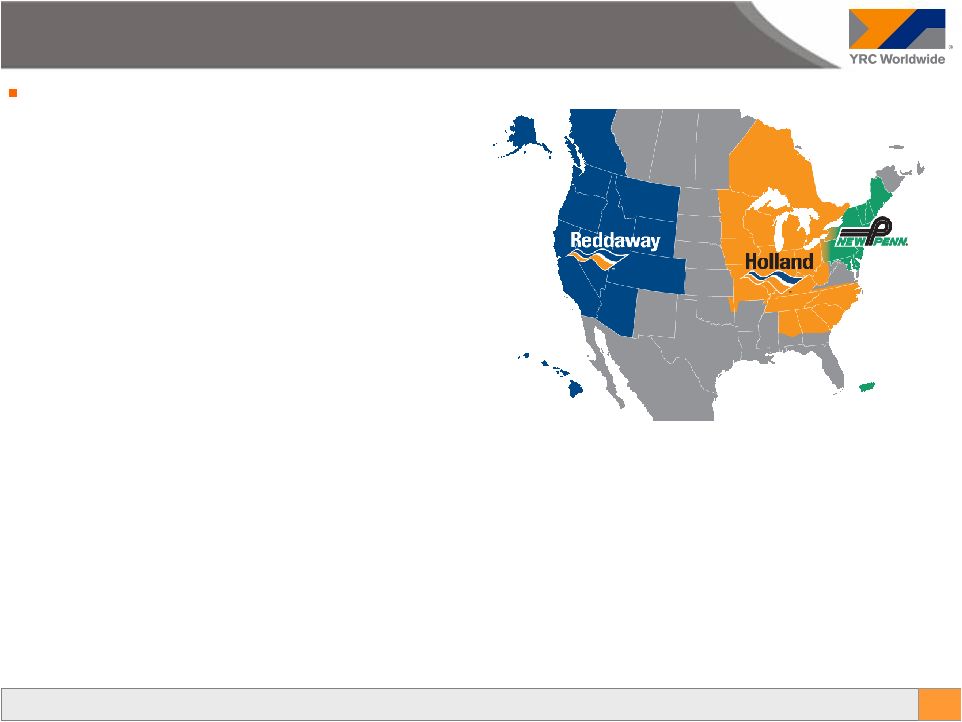

YRC

Regional

is

comprised

of

Holland,

Reddaway

and

New

Penn.

These

companies

each provide regional, next-day ground services in their respective regions

through a network of facilities located across the United States; Quebec,

Canada; Mexico; and Puerto Rico. Approximately 98% of Regional

Transportation shipments are completed in two days or less

YRCW has two

major segments

serving domestic as

well as international

customers |

10

YRC

Freight

was

created

through

the

March

2009

•

Customers:

~ 200,000*

•

Service Centers:

282**

•

Dock doors:

~ 15,600

•

Average Length of Haul:

~ 1,300 miles

•

Average LTL Weight/Shipment:

~ 950 pounds

•

Total Active Employees:

~ 22,000

•

Average days in transit

3.7

•

Business by days in transit:

Next day

4%

Two days

25%

Three days

29%

Four or more days

42%

** Includes Canada and Mexico

* Represents the number of unique payer locations

YRC Freight

integration of the Yellow Transportation and

Roadway networks, combining two companies with

more than 80 years experience each |

11

•

Customers:

~ 200,000*

•

Service Centers:

114

•

Dock Doors:

~ 3,900

•

Average Length of Haul:

~ 500 miles

•

Average LTL Weight/Shipment:

~ 1,300 pounds

•

Total Active Employees:

~ 11,000

•

Average Days in Transit

98% in less than 2

days

* Represents the number of unique payer locations

Regional Transportation

Regional Transportation provides transportation service

to customers in the regional and next-day markets and

is comprised of Holland, Reddaway and New Penn

–

Holland provides local next-day, regional and

expedited services through a network located in the

Central, Southeastern, and portions of the

Northeastern, United States. Holland also provides

service to the provinces of Ontario and Quebec,

Canada

–

Reddaway provides local next-day, regional and

expedited services through a network located in

California, the Pacific Northwest, the Rocky Mountain

States and the Southwest. Additionally, Reddaway

provides services to Alaska and to the provinces of

Alberta and British Columbia, Canada

–

New Penn provides local next-day, day-definite, and

time-definite services through a network located in

the Northeastern United States; Quebec, Canada;

and Puerto Rico |

12

II. July 2011 Transaction |

13

In July 2011, the restructuring was completed

–

New Board seated

–

New CEO placed

•

New Management structure / team followed

–

Additional liquidity provided

–

Extended maturities on all major credit facilities to late 2014 / early 2015

New Management team changed strategic focus and implemented new business plan

–

Singularly focusing on North American LTL operations

–

Closed the former legacy Roadway headquarters to create one company with

•

one vision

•

one culture and

•

one mission

–

Divesting non-core, non-strategic assets (e.g. Glen Moore, Jiayu, excess real

estate) –

Investing

via

the

P&L

to

improve

customer

experience

/

service

at

YRC

Freight

the

“Flywheel”

–

Streamlining the holding company, driving responsibility and autonomy to the

OpCos Since taking over and preparing a forecast based on the simplified and

focused strategic direction, the new management has exceeded its internally

prepared forecast July 2011 Transaction |

14

NAME

POSITION

DIRECTOR

SINCE

COMMITTEE(S)

COMPANY

James E. Hoffman

Retired President

2011

Compensation +

Alliant Energy Resources

James L. Welch

Chief Executive Officer

2011

YRC Worldwide Inc.

Raymond J. Bromark

Retired Partner

2011

Audit/Ethics *

PricewaterhouseCoopers LLP

Matthew A. Doheny

President

2011

Compensation

North Country Capital LLC

Finance *

Robert L. Friedman

Sr. Managing Director

2011

Audit/Ethics

The Blackstone Group, LP

Finance

Michael J. Kneeland

President and CEO

2011

Compensation *

United Rentals Inc.

Governance

Harry Wilson

Chairman and CEO

2011

Finance

MAEVA Advisors, LLC

James Winestock, Jr.

Retired Sr. Vice President for U.S. Operations

2011

Governance *

United Parcel Services, Inc.

Douglas A. Carty

Chairman

2011

Audit/Ethics

Switzer-Carty Transportation Inc.

Governance

North Country

Capital LLC

MAEVA Advisors,

LLC

+ =Chairman of the Board

* = Committee Chairman

Board of Directors |

15

James L. Welch Chief Executive Officer

–

As chief executive officer, James Welch leads YRC Worldwide and its operating

companies. During his 33-year tenure in the transportation and logistics

industry, Welch has established a proven track record of leading organizations

through difficult challenges and moving them to positions of improved operational

efficiency and profitability. –

Welch is the former president and chief executive officer of Dynamex Inc., a position

he took following a 29-year career at Yellow Transportation, a YRC

Worldwide subsidiary. Welch began his career with Yellow when he was 23; he rose

through the ranks and served from 2000-2007 as president and CEO.

–

He has a bachelor of science degree in psychology with a minor in business from West

Texas A&M University. In addition, he attended the Executive Development

Program at Yale University and is a regular attendee at the Center for Service

Leadership at Arizona State University. Jamie G. Pierson Executive Vice

President and Chief Financial Officer –

As the leader of the company’s financial organization, Jamie Pierson is

responsible for the areas of corporate finance, treasury, cash management,

accounting, tax, risk management and employee benefits. In addition to supporting the

holding company, Pierson’s team also assists the individual operating companies

when and where needed. Pierson joined YRC Worldwide in 2011, after

serving as interim CFO. –

Previously, Pierson was a managing director with Alvarez & Marsal North America

where he focused on out-of-court restructurings and company-side

senior management advisory. It was in this role that Pierson first worked with YRC

Worldwide,

and

subsequently

was

involved

with

all

aspects

of

the

company’s

financial

operations

and

ensuing

restructuring. Prior to A&M, Pierson was vice president, Corporate Development and

Integration with Greatwide Logistics Services. He also was a managing

director with FTI Capital Advisors, and in the finance advisory group of

Houlihan Lokey Howard & Zukin.

–

Pierson

graduated

from

the

University

of

Texas

where

he

earned

a

bachelor’s

degree

in

business

administration,

with

concentrations in finance and accounting and later a master’s degree in business

administration with concentrations in finance and entrepreneurship.

33 years

5+ years

Management Team |

16

Jeffrey A. Rogers President, YRC Freight

–

Jeff Rogers is president of YRC Freight, a leading transporter of industrial,

commercial and retail goods that specializes in

less-than-truckload

solutions

for

businesses

across

North

America.

A

28-year

veteran

of

the

freight

transportation

industry, Rogers has brought to YRC Freight a simple and direct approach to leadership

that is results-oriented. –

Prior

to

assuming

that

role

in

September

2011,

Rogers

served

for

three

years

as

president

of

another

YRC

Worldwide

company,

Holland,

which

provides

regional

transportation

service

in

12

states

and

two

Canadian

provinces.

His

previous assignments include serving as chief financial officer for YRC Worldwide

regional companies, and various operations

and

finance

roles

at

Yellow

Transportation

and

United

Parcel

Service.

–

A native of Wichita, Kansas, Rogers is a decorated military veteran. He holds a

bachelor's degree in accounting from Newman University in Wichita and a

master’s degree in business administration from Baker University. Scott D.

Ware President, Holland –

Scott Ware leads Holland, a YRC Worldwide subsidiary, that has long been recognized

for delivering the most next-day service lanes in its territory. Holland

provides industry leading, on-time reliability for less-than-truckload (LTL)

shipments

in

the

central

and

southeastern

US.

Before

being

named

president

in

May

2012,

Scott

served

as

vice

president

of Operations at Holland where he was responsible for the management and execution of

major operational initiatives focused on specific performance improvements.

Ware has more than 27 years of industry experience. –

Prior to joining Holland in 2007, Ware was director of LineHaul Operations at Saia,

Inc. He was previously director of Line

Haul

at

Jevic

Transportation

and

prior

to

that

a

manager

of

Freight

Flow

Operations

at

Con-way,

Inc.

28 years

Management Team

27 years |

17

Thomas J. “TJ”

O’Connor President, Reddaway

–

T.J.

O’Connor

leads

Reddaway,

a

YRC

Worldwide

subsidiary

that

has

built

a

long-standing

tradition

of

reliable,

next-

day and two-day delivery services for less-than-truckload shipments in the

western United States and Canada, including Alaska and Hawaii. He was named

president in 2007 after serving as president and CEO of USF Bestway.

–

A tenured member of the YRC Worldwide team, O’Connor joined Roadway in 1982.

While at Roadway, he served in various management positions including Western

Division vice president, district manager for Texas and Louisiana, and district

manager of Mountain Time Zone states. Steven D. Gast President, New

Penn –

Steve Gast leads New Penn, a YRC Worldwide subsidiary that is highly regarded as one

of the most efficiently operated less-than-truckload transportation

providers and has one of the lowest claim ratios in the industry. New Penn

provides reliable, next-day service through a network of 25 service centers in the

northeastern U.S., Quebec, Canada and

Puerto

Rico.

Gast

was

named

president

in

2006.

He

joined

the

company

in

1997

and

held

positions

of

increasing

responsibility in the areas of pricing, finance, administration and strategic

planning. –

Gast has more than 35 years of experience in the transportation industry. Starting as

a management trainee with McLean

Trucking

Company,

Gast

later

worked

for

Sun

Carriers,

Red

Star

and

Plymouth

Rock

before

joining

New

Penn

.

30 years

35 years

Management Team |

18

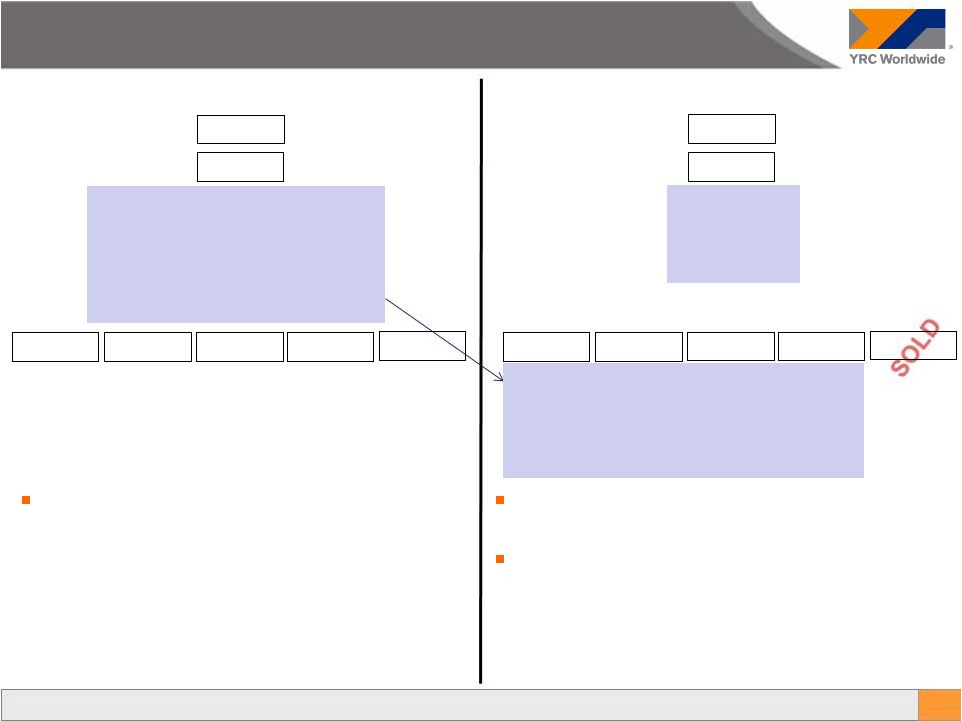

Eliminated:

–

Chief Operations Officer

–

Chief Marketing Officer

–

Chief Administrative Officer

–

President of Customer Care

YRCW

Holland

Reddaway

New Penn

YRC Freight

Glen Moore

Corporate

Former Structure

•

CEO / CFO team

•

Legal team

•

Quality team

•

Security team

•

Sales

•

Customer Care

•

HR

•

IT

•

Equipment Services

YRCW

Holland

Reddaway

New Penn

YRC Freight

Glen Moore

Corporate

New Structure

•

CEO / CFO team

•

Sales

•

Customer Care

•

HR

•

IT

•

Equipment Services

•

Legal team

•

Security team

Moved Sales, Customer Care, HR, IT and Equipment

Services

functions

from

“corporate”

down

to

the

OpCos

Decreased the number of corporate / shared service

employees from approximately 2,000 to < 400. The

1,600 employees were reallocated to the OpCos and

the individual OpCos are responsible for justifying their

value / existence within their respective companies

Streamlined Holding Company |

19

The last several years of activities have largely been focused on

–

The integration of Yellow and Roadway into YRCF in March 2009

–

Dramatic capacity and cost reductions to right-size the company (facilities,

equipment and employees) –

Financial restructuring efforts, including communication challenges with our

customers One result of these activities was that our service quality had been

damaged and was in need of improvement

Re-branded YRC to YRC Freight to give the company a sense of direction and

identity The Path Forward:

Under new leadership, focus shifted dramatically toward improving the customer

experience, resulting in increased shipment levels, improved business mix and

operational efficiency This will happen in stages (detail on the following

page) –

Improve service quality and win the hearts and minds of our employees

•

Introduce a new employee mantra and service promise, while maintaining steady

costs –

Productivity

improves

as

we

are

“in

cycle”

operationally

(fluid

and

efficient)

–

Costs associated with service failures decline

–

Volume picks up, customer churn slows down

–

Yield and business mix improve

The new employee mantra is simple

Pick it up on time.

Deliver it on time.

Don’t bust it.

Consistently!

YRCF –

Strategic Direction |

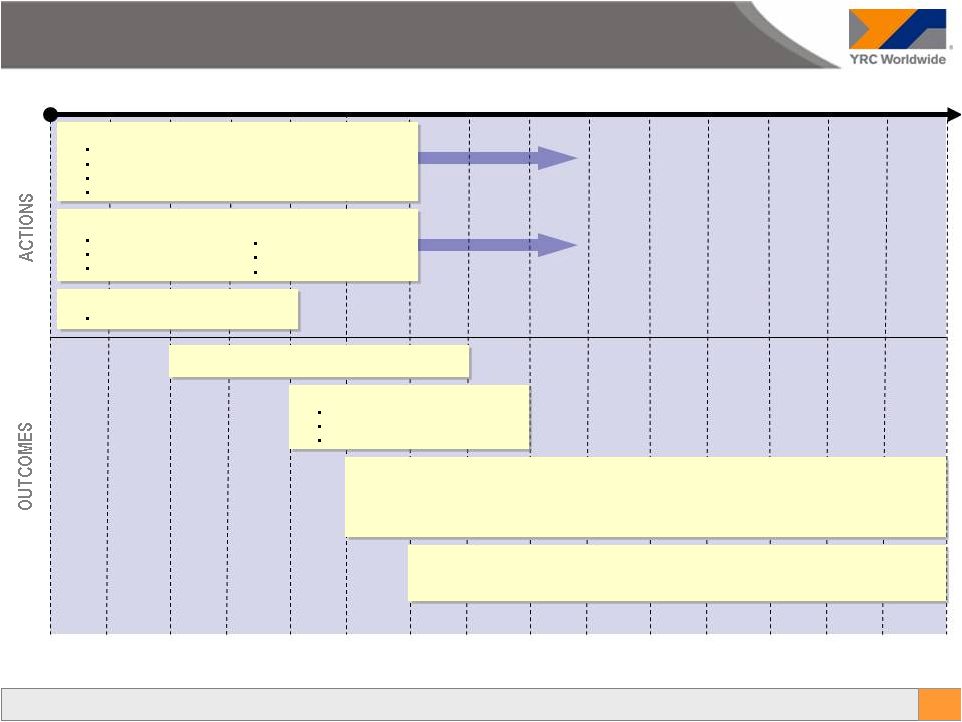

20

Month

Improve service quality

Consistent performance (on-time P&D, undamaged, recover quickly)

Get “in cycle”

Perform on Time-Critical shipments

TQM

Maintain productivity and cost

(No increase or decrease)

Volume picks up, churn goes down

•

Service

improvement

drives

sales/customer

confidence,

leading

to

increased

shipping

levels

•

Local channel churn slows down

•

Time-Critical shipments increase

Yield improves

•

Customer mix improves as local channel grows through improved service and better

pricing decisions •

Customers willing to pay more for better service; increase in high-yielding

Time-Critical shipments Productivity improves as we remain “in

cycle” Failure-related costs decline

Cargo claims

Service recoveries

Other

“Win hearts and minds”

Service quality tools

Introduce mantra, brand promise

Employee survey

Sep 11

Oct 11

Nov 11

Dec 11

Jan 12

Feb 12

Mar 12

Apr 12

May 12

Jun 12

Jul 12

Aug 12

Sep 12

Oct 12

Nov 12

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

Line of sight objectives

Training & education

Rewards & recognition, respect

YRCF –

Path Forward “The Flywheel” |

21

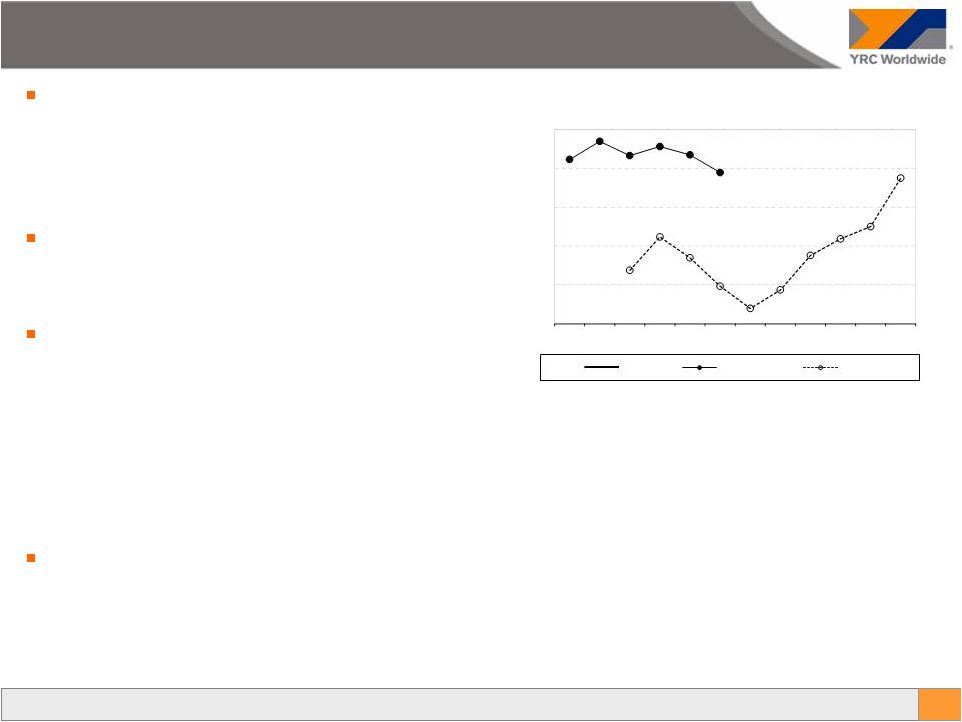

On-Standard Service Percent

YRCF –

On-Standard Service

60.0%

65.0%

70.0%

75.0%

80.0%

85.0%

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Focus is on maintaining momentum created in

the first quarter of 2012

-

Mantra: “Pick it up on time, deliver it on time

and don’t bust it. Consistently.”

On-Standard Service Percent appears to have

stabilized at or above 80.0% which is well

above the levels seen in 2011

Improving the customer experience is

anticipated to lead to

-

Higher shipment volume

-

Lower customer churn

-

Increased pricing power

-

Reduced service failure cost

In June 2012, the company raised service

standards (i.e. decreased the time to delivery) in

20K lanes causing a slight decrease in service

percent compared to earlier months in 2012

Goal

2012 Actual

2011 Actual |

22

III.

2Q12 Financial Update |

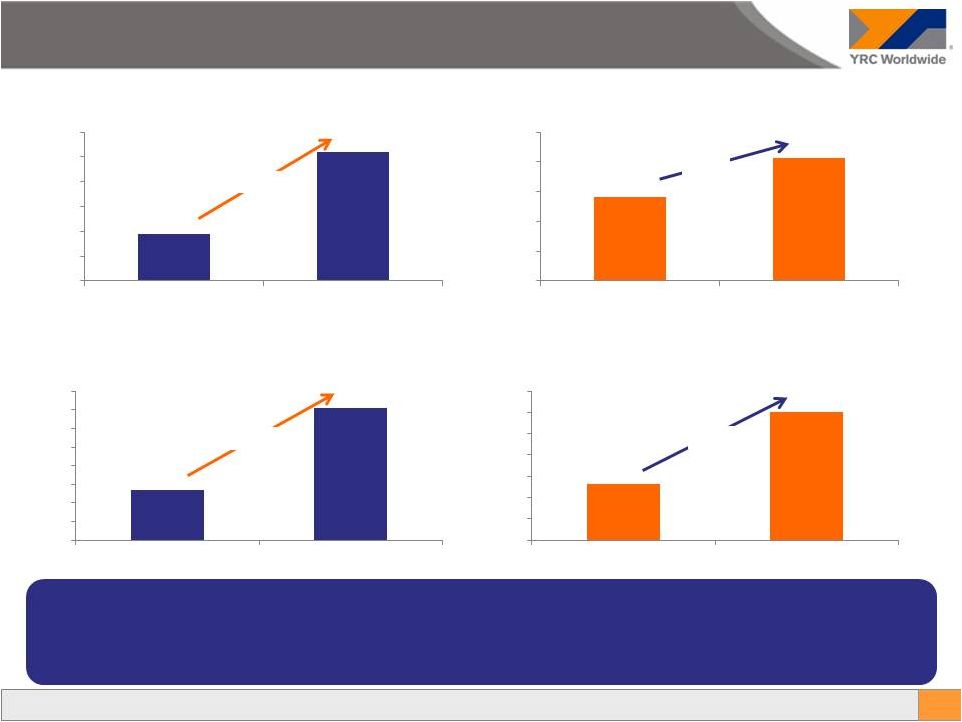

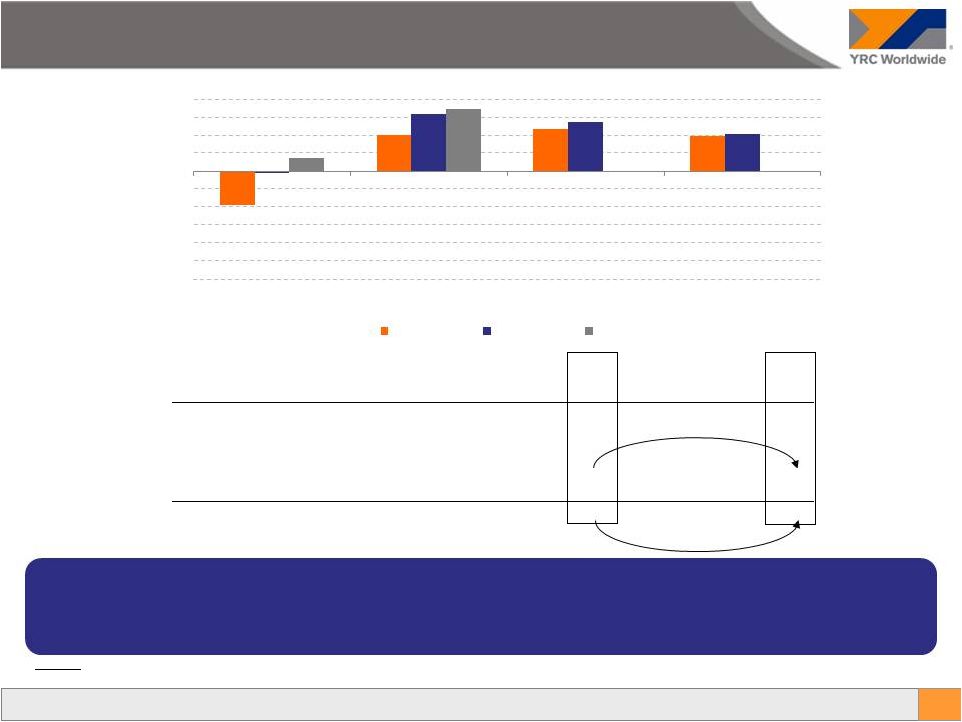

49.44K

48.41K

30.00

35.00

40.00

45.00

50.00

55.00

2Q11

2Q12

YRC Freight Shipments per Day

-2.1%

40.25K

41.25K

30.00

35.00

40.00

45.00

50.00

55.00

2Q11

2Q12

Regional Shipments per Day

+2.5%

29.14K

30.42K

20.00

22.00

24.00

26.00

28.00

30.00

32.00

2Q11

2Q12

Regional Tonnage per Day

+4.4%

28.66K

27.72K

20.00

22.00

24.00

26.00

28.00

30.00

32.00

2Q11

2Q12

YRC Freight Tonnage per Day

YOY Volume –

Down at YRC Freight, Up at Regional

23

Decline in volume at YRCF largely attributable to more active customer mix management

(increasing price on low margin accounts) and softening economy as the quarter

progressed

Increase in volume at Regional due to continued high-quality service and increasing

market share

-3.3% |

24

Improved

revenue

per

cwt

and

revenue

per

shipment

at

YRCF

attributable

to

“flywheel”

investment

in

service, more active customer mix management and industry-wide pricing discipline

Regional

increases

due

to

continued

superior

service

/

value

and

industry

pricing

discipline

$22.57

$23.24

$22.20

$22.40

$22.60

$22.80

$23.00

$23.20

$23.40

2Q11

2Q12

YRC Freight Revenue per cwt

+2.9%

$10.86

$11.12

$10.30

$10.50

$10.70

$10.90

$11.10

$11.30

2Q11

2Q12

Regional Revenue per cwt

+2.4%

$157

$164

$152

$154

$156

$158

$160

$162

$164

$166

2Q11

2Q12

Regional Revenue per Shipment

+4.3%

$262

$266

$259

$260

$261

$262

$263

$264

$265

$266

$267

2Q11

2Q12

YRC Freight Revenue per Shipment

+1.7%

YOY Yield –

Improved across the board |

25

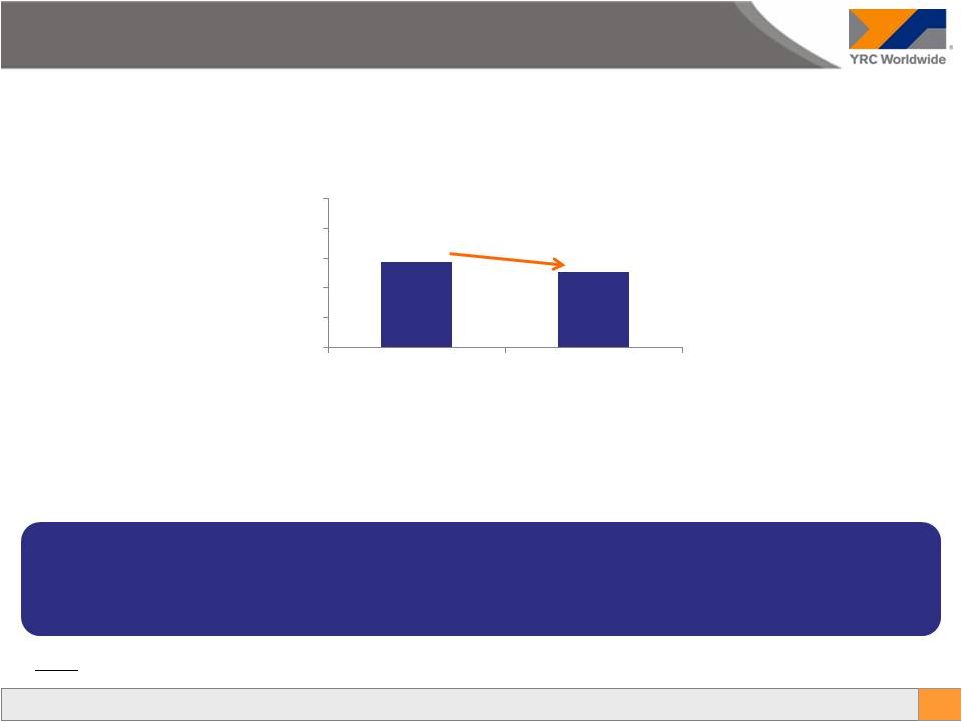

(0.5%)

($ in millions)

Footnotes:

(1)

$1,257.2

$1,250.8

$1,200.0

$1,220.0

$1,240.0

$1,260.0

$1,280.0

$1,300.0

2Q11

2Q12

2Q Comparison

Lower volume at YRCF, lower FSC and the inclusion of disposed truckload operations in

2Q11 offset by modestly higher yield led to a slight decline in YOY revenue

YRCW Revenue

1) 2Q11 includes revenue from the operations of Glen Moore. Excluding the $25.6M from

those disposed operations in 2Q11, revenue would have been $1,231.6M and would have resulted in a 1.6% YOY increase in 2Q12. |

26

($ in millions)

Reconciliation of Operating Income to Adjusted EBITDA

2Q11

2Q12

Operating revenue

1,257.2

$

1,250.8

$

Adjusted operating ratio

99.0%

98.3%

Reconciliation of operating income to adjusted EBITDA:

Operating income (loss)

(5.6)

$

15.5

$

(Gains) losses on property disposals, net

(7.3)

(6.5)

Union Equity Awards

Letter of credit expense

8.2

9.6

Restructuring professional fees

16.9

2.5

Gain (loss) on permitted dispositions and other

1.0

(0.2)

Adjusted operating income (loss)

13.2

20.9

Depreciation and amortization

48.1

45.7

Equity based compensation (benefit) expense

0.4

1.0

Restructuring professional fees, included in nonoperating

loss 1.2

-

Other nonoperating, net

0.3

2.5

Add: Truckload EBITDA income

1.3

-

Adjusted EBITDA

64.5

$

70.1

$

Consolidated Adjusted EBITDA increased $5.6M in 2Q12

Margin continues to expand as the quality of revenue at YRCF improves and cost management

inclusive of safety and workers comp / BIPD continue to pay dividends even

as pension contributions increased YOY

Regional segment pricing improvement leading to increased profitability and margin

expansion $64.5

$70.1

$.0

$20.0

$40.0

$60.0

$80.0

2Q11

2Q12

2Q Adjusted EBITDA

+8.7%

YRCW Adjusted EBITDA |

27

($ in thousands)

+21%

+2.5x

Footnotes:

1) See Appendix for reconciliation of Operating Income to Adjusted EBITDA.

(37,239)

40,400

47,287

39,878

(1,305)

64,528

54,648

41,286

15,318

70,098

($120)

($100)

($80)

($60)

($40)

($20)

$

$20

$40

$60

$80

1Q

2Q

3Q

4Q

2010

2011

2012

Highest quarterly EBITDA in 3 years and positive comping trend continuing

Reported 21% LTM increase

Proforma for pension = 2.5x LTM increase

YRCW Adjusted EBITDA (pro forma for Pension)

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Adj. EBITDA Reported

1

(37,239)

40,400

47,287

39,878

(1,305)

64,528

54,648

41,286

15,318

70,098

Union Pension Cessation Benefit

(21,000)

(21,000)

(21,000)

(21,000)

(21,000)

(14,000)

-

-

-

-

Pro forma Adj. EBITDA*

(58,239)

19,400

26,287

18,878

(22,305)

50,528

54,648

41,286

15,318

70,098

Pension Months Included above

3

3

3

3

3

2

Last Twelve Months:

Adj. EBITDA Reported

90,326

126,260

150,388

157,749

159,157

175,780

181,350

Union Pension Cessation Benefit

(84,000)

(84,000)

(77,000)

(56,000)

(35,000)

(14,000)

-

Pro forma Adj. EBITDA*

6,326

42,260

73,388

101,749

124,157

161,780

181,350

* Pro forma assumes $7M of union pension per month for all periods prior to June

2011 |

28

Three months

2012

2011

Change

Adjusted EBITDA

70.1

$

64.5

$

5.6

$

Total restructuring professional fees

(2.5)

(18.1)

15.6

Cash paid for interest

(28.8)

(10.3)

(18.5)

Cash paid for letter of credit fees

(9.5)

-

(9.5)

Working capital cash flows excluding income tax, net

(29.7)

(40.9)

11.2

Net cash used in operating activities before income taxes

(0.4)

(4.8)

4.4

Cash received from income taxes, net

0.9

(10.2)

11.1

Net cash used in operating activities

0.5

(15.0)

15.5

Acquisition of property and equipment

(15.6)

(12.7)

(2.9)

Free cash flow (deficit)

(15.1)

(27.7)

12.6

Total restructuring professional fees

2.5

18.1

(15.6)

Adjusted free cash flow (deficit)

(12.6)

$

(9.6)

$

(3.0)

$

Pro Forma Adjusted Free Cash Flow

Adjusted free cash flow (deficit)

(12.6)

(9.6)

(3.0)

Union Pension Cessation

-

(21.5)

21.5

Cash Interest

-

(18.4)

18.4

Lender Cash LC fees

-

(9.5)

9.5

Pro Forma adjusted free cash flow (deficit)

(12.6)

$

(59.0)

$

46.4

$

Quarterly Adjusted FCF declined by $3.0M to ($12.6M) in 2Q12 from ($9.6M) in 2Q11

largely due to resuming cash payment of interest and LC fees that exceeded the

increase in Adjusted EBITDA and decline in changes in Working Capital

However, on a pro forma basis after taking into account the Union Pension Cessation and

Cash Interest / LC Fees benefit in 2011, Adjusted FCF improved by $46.4M

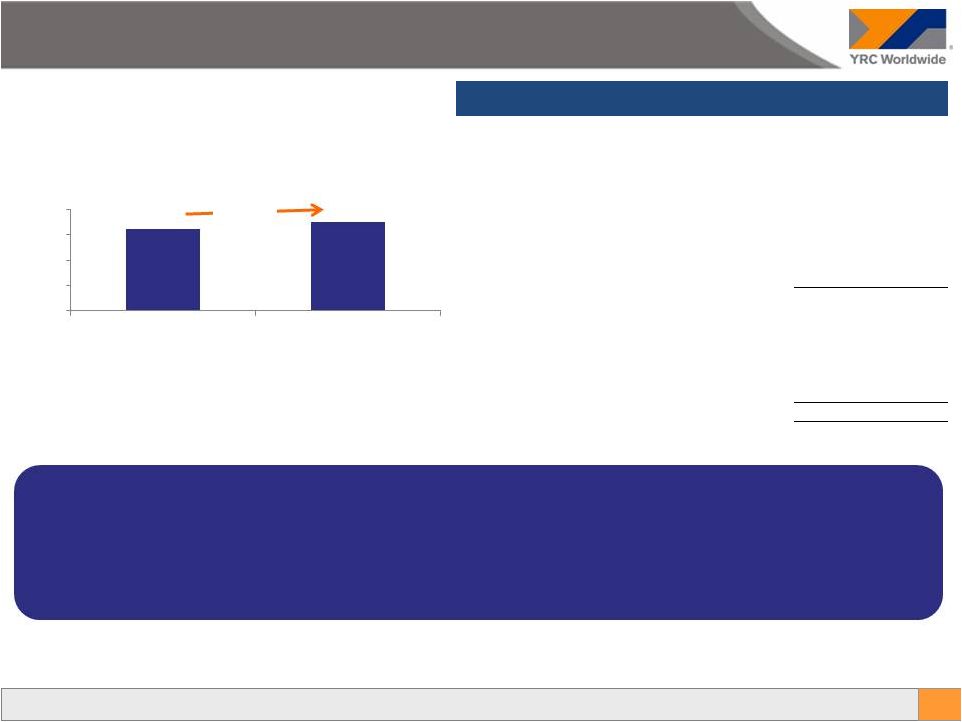

Total Liquidity improved $76M to $249M at the end of 2Q12 from $173M in 2Q11 as the

July 2011 restructuring brought incremental cash and liquidity from new credit

facilities and debt issuances Footnotes:

($ in millions)

$173

$249

2Q11

2Q12

Total Liquidity

+44.0%

Free Cash Flow and Liquidity

1

1) Represents balance sheet liquidity, which includes amounts such as restricted and

foreign cash that are disallowed under our credit agreements in determining compliance with our “minimum cash “ covenant

|

29

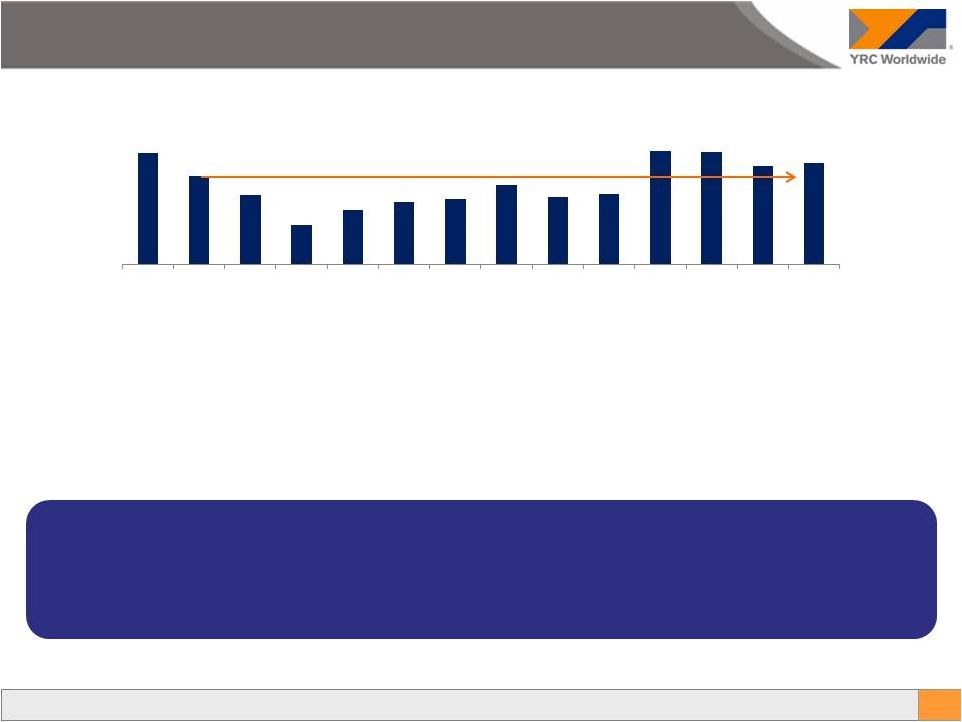

July 2011 transaction significantly enhanced liquidity via

Series B Notes proceeds and increased ABL availability

Best second quarter liquidity since 2008

($ in millions)

$275

$218

$171

$96

$134

$154

$161

$194

$165

$173

$279

$277

$241

$249

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Liquidity |

30

IV. Conclusion |

31

Subsequent to the July 2011 transaction

–

A new Board was seated

–

A new Management team was placed

–

Laser-like focus on North American LTL operations

–

One corporate headquarters with one culture, one vision and one mission

–

Reorganizing “corporate”

to support overall strategy and increase accountability across the organization

–

The new Management team made some strategic yet difficult decisions to refocus the

business and shed some non-core assets and has successfully executed against

those decisions / objectives •

Sold substantially all of the assets of truckload operations (Glen Moore)

•

Sold one of the company’s remaining two Chinese JVs (Jiayu); waiting on

regulatory approval to close •

Conducted auction of excess real estate; now moving to close sold properties

–

–

The recent credit agreement amendment to modify financial covenants provided the

company with increased financial flexibility for the foreseeable future

Conclusion

Management’s concept of the “Flywheel” is gaining traction as

On-Standard Service has increased approximately 20% points at YRC Freight

and the Regionals continue to deliver industry standard -- if not

better -- service

|

32

On a year-over-year basis

Revenue

increased 1.6%

reported highest quarterly EBITDA in four years

New management team executing on non-quantitative commitments AND exceeding

forecast Overall, much progress has been achieved year-over-year; have been

able to absorb resumption of both multi-employer pension expense and cash

interest and LC expense but still more to do Liquidity ended 2Q12 at $249M which

is the highest second quarter since 2008 Conclusion –

2Q12 Financial Results

Footnote

1) On a pro forma basis excluding Glen Moore revenue from 2011

1

Adjusted

EBITDA

positively

comping

for

the

3

rd

consecutive

year

and |

33

V. Appendix |

34

Operating Income to Adjusted EBITDA

Reconciliation of Operating Income to Adjusted EBITDA

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

Operating income (loss)

(232.2)

$

49.5

$

(17.3)

$

(27.9)

$

(68.4)

$

(5.6)

$

(26.1)

$

(38.1)

$

(48.8)

$

15.5

$

(Gains) losses on property disposals, net

8.5

(2.8)

(4.0)

2.6

(3.0)

(7.3)

(10.8)

12.9

8.4

(6.5)

Union Equity Awards

108.0

(83.0)

-

14.9

Letter of credit expense

8.4

8.3

8.3

8.3

8.1

8.2

9.3

9.6

8.1

9.6

Restructuring professional fees

12.1

9.3

6.6

6.0

8.5

16.9

12.4

4.3

0.5

2.5

Gain (loss) on permitted dispositions and other

5.3

-

-

-

2.2

1.0

-

(0.3)

(1.9)

(0.2)

Adjusted operating income (loss)

(89.9)

(18.7)

(6.4)

(10.9)

(52.7)

13.2

(0.3)

(11.6)

(33.8)

20.9

Depreciation and amortization

51.2

50.7

50.4

48.6

49.8

48.1

46.7

51.1

49.0

45.7

Equity based compensation (benefit) expense

1.9

1.4

2.2

0.7

(1.1)

0.4

0.6

0.7

1.1

1.0

Restructuring professional fees, included in nonoperating

loss 0.2

0.2

0.2

0.9

0.5

1.2

0.2

-

-

-

Other nonoperating, net

(0.8)

6.8

0.9

(0.2)

0.5

0.3

6.9

(0.7)

(0.9)

2.5

Add: Truckload EBITDA income

0.1

(0.0)

(0.0)

0.9

1.5

1.3

0.5

1.8

-

-

Adjusted EBITDA

(37.2)

$

40.4

$

47.3

$

39.9

$

(1.3)

$

64.5

$

54.6

$

41.3

$

15.3

$

70.1

$

|