Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MoneyOnMobile, Inc. | d405681d8k.htm |

Harold Montgomery, CEO

214-758-8603

hmontgomery@calpian.com

Exhibit 99.1 |

Required Statement About Forecasts

THIS DOCUMENT DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION

OF AN OFFER TO BUY ANY SECURITIES. ANY OFFER OF SECURITIES OF THE

COMPANY SHALL BE MADE ONLY TO QUALIFIED INVESTORS IN ACCORDANCE WITH

APPLICABLE SECURITIES LAWS. THE

SECURITIES LAWS PROHIBIT ANY PERSON WHO HAS

MATERIAL NON-PUBLIC INFORMATION ABOUT A COMPANY FROM PURCHASING OR

SELLING, DIRECTLY OR INDIRECTLY, SECURITIES OF SUCH COMPANY.

Calpian’s models and projections are based on certain key assumptions, including but not limited to

the following:

Availability of adequate and appropriately priced financing to continue in

business

Availability of acquisitions which can be completed Continued performance

of key staff

Continued favorable business conditions and economic climate. Money on Mobile

Forecasts are the representation of MOM Management.

Certain of the statements contained herein may be statements of future expectations and other

forward-looking statements that are based on management's current views and assumptions

and involve known and unknown risks and uncertainties that could cause actual results,

performance or events to differ materially from those expressed or implied in such statements.

In addition to statements which are forward-looking by reason of context, the words

“may,” “will,” “should,” “expects,” “plans,”

“intends,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or

“continue” and similar expressions identify forward-looking statements. Actual results,

performance or events may differ materially from those in such statements due to, without

limitation, (i) our ability to acquire retail credit card processing residual streams

(“residuals”), (ii) our ability to raise capital to fund our acquisitions, (iii) our ability to

successfully integrate multiple residuals acquisitions, (iv) changing levels of competition, (v)

changes in laws and regulations, including government regulation of the credit card processing

industry and other related financial institutions, and (vi) general competitive factors. This

business plan is for confidential information purposes only and is not a solicitation for

investment. |

Investment Thesis:

Steady Cash Flow + Explosive Growth

Best of Both Worlds

•Steady cash flows

•Explosive growth in India

Calpian

Acquires merchant payment processing contracts for 2-3x CF Use Cash + Stock Leading Buyer in $1 billion niche business Base of steady recurring cash flow

Money On Mobile

•

Mobile phone based funds transfer

•

Simple SMS text messages

•

The “Paypal of India”

•

HUGE market, Greenfield opportunity

•

Growing FAST – 10% Compounded PER MONTH for Last 14

months. |

Management Team

Stanford MBA 1985

Started in payments in 1987

Maharastra Institute of Technology

10 years in payments

SMU MBA 1984

Started in payments in 1990

University of Houston MBA 1986, CPA

With Calpian since 2010

Stanford

University MBA 1985

Invested/built 30 companies, $1B of equity in companies, 10 public companies

•

70+ years in payments

•

Core team leaders together for 10+ years

•

Highly qualified

•

Very Experienced

Harold Montgomery – CEO

Shashank Joshi – President MoM

Craig Jessen – President

David Pilotte – CFO

Laird Cagan – Board of Directors |

ISO Role in the Payments Industry

Transaction Processors

First Data, JP Morgan/Chase, US Bank, Global, Alliance Data

Independent Sales

Organizations

(ISOs)

10,000 in the US

Processors Pay Monthly

Residuals

~$40/store/month

Calpian’s Target

Market

Small Merchants

6.3 million

Sales and service

Processor contract allows ISO

to sell payment processing |

•

10 Years Acquiring Residuals

•

500 Portfolios Underwritten, 200+ Acquired

•

Team Acquired 35,000+ Merchant Contracts

•

Structure: Seller guarantees minimum payout

Calpian History

•

We Did This Once Before

•

Capital Markets shut down in 2008-2009

•

Re-Launched as Public Co in 2011

Total Cash

Invested

Purchases

$10.4

Gross Cash

Returned

$21.8

Profit After Principal

Payback AND Financing

Cost @ 12%

$10.5

IRR

49% |

Steady Cash Flow

+

Explosive Growth |

Challenges and Opportunities In India

Challenges:

•

•

•

All cash economy

•

Opportunities:

•

650M+ cell phones

•

500M+ people have to walk to pay for everything or send money home

The window for a fast, easy, reliable

payment system is wide open

Lack of Bank Accounts – only 200m out of 1.2 billion people

No payment mechanisms – credit, debit or check No transportation – Daily

errands take time |

What Does MoM Do?

Allows consumers to use their mobile phone to transact:

•

Pre-paid cell phone

•

Pre-paid television

•

Utility payment

•

Ticketing: Movie, airline, bus, train

•

Domestic remittances (documented at $13+bn market)

•

Wide variety of uses

•

HUGE value proposition vs. current methods

•

Especially appealing to unbanked and rural

•

Rural to Urban migration feeds Domestic Remittance

ADDRESSABLE MARKET: 650+ MILLION UNIQUE CELL PHONES

MoM is the Checkbook/Debit Card of India |

How Does MoM Work?

Consumers

(Currently 5,500,000)

Retailers

(Currently 95,000)

Money on Mobile

Money on Mobile

CASH

CASH

CASH

Free to Consumer

Cell Time

Cell Time

Cell Time

SMS

TEXT

INSTRUCTIONS

6 Satellite TV 15 Cell

Providers Utilities |

Not

Much

Competition

–

Huge

Market

MoM is 2x Largest Competitor

•

MoM= +$335K/day

•

Beam= $150K/day

The Market is $31 billion and Growing

•

Cell Top up = $18 billion/yr

•

Domestic remittance = $13 billion/yr

•

It’s very early

•

The Market is HUGE

•

Low Success Threshold

MoM is positioned to maintain its huge lead and rapid growth Calpian

currently owns 32% of MOM and can buy up to 74% |

MoM

–

Retailers

•

100,000 retailers expected in 2012

•

Each retailer adds 80 users quickly, then more

•

Act as commission sales people

Calpian’s first

investment

94,971

Money on Mobile

Retailers

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000 |

Money on Mobile

Unique Users

-

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

6,000,000

MoM

–

Unique

Users

5.5 million unique users and growing

(this number reduced by 500K to avoid duplication with Cellbiz)

Calpian’s first

investment

5,521,595 |

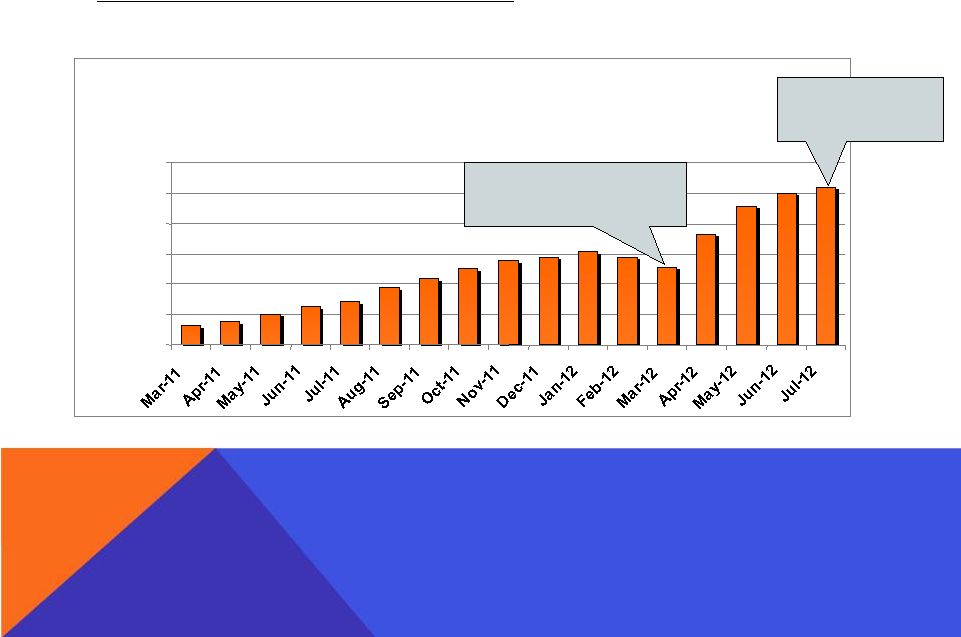

Money on Mobile

US

$ Volume Processed

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

MoM –

Volume Processed

•

Over USD$10 million processed in July 2012

•

Domestic Remittance will drive volumes higher

Calpian’s first

investment

$10,386,102 |

Money on Mobile

Gross Profit

$(100,000)

$(50,000)

$-

$50,000

$100,000

$150,000

$200,000

Apr-

11

May-

11

Jun-

11

Jul-

11

Aug-

11

Sep-

11

Oct-

11

Nov-

11

Dec-

11

Jan-

12

Feb-

12

Mar-

12

Apr-

12

12

Jun-

12

Jul-

12

MoM

-

Gross

Profit

(USD$)

•Adjusted for

non-recurring items

•Margin settling at .5% of gross processed

volume •Gross Profit = Net Operating

Revenue Calpian’s first

investment

May- |

Compare to MPESA in Kenya

MPESA

•

First Mobile Money System

•

5 years old

•

Domestic Remittance is majority of volume

•

Ubiquitous presence in Kenya

•Huge Market

•Once in a Lifetime Greenfield

Opportunity MPESA Metrics

70% Adults

25% of GDP

Net Operating

Revenue (.5%)

Kenya

15 Million

$18 billion

India

550 Million

$1.1 TRILLION

$5.5 Billion

$90 million/year |

Comparison to MPESA Customer Growth

MoM Growing Faster than MPESA

1

5

9

13

17

21

25

29

33

37

41

45

49

0

2,000,000

4,000,000

6,000,000

8,000,000

10,000,000

12,000,000

14,000,000

16,000,000

Months Since Launch

MPESA Customers

Money on Mobile Customers

Money on Mobile vs. MPESA Customer Growth |

US

Market

Comparables

The US Market Likes India’s Growth Potential

Name

Ticker

EBITDA

Multiple

P/E

Multiple

Calpian

Heartland

Payment

Systems

HPY

7.8x

22.2x

MoM

Make My

Trip

MMYT

65.5x

101x

If MoM Achieves Less than HALF its Plan: $20M/year EBITDA $1.3 Billion Market Cap $40+/share |

Financial

Projections

(US$)

2012

2013

2014

2015

2016

Calpian

EBITDA

$1.5M

$5.0M

$ 10.1M

$ 13.9M

$ 16.4M

MOM

EBITDA

$(3.8)M

$5.1M

$ 31.7M

$ 70.3M

$ 125.7M

Combined

EBITDA

$(2.3)M

$10.1M

$ 41.8M

$ 84.2M

$ 142.1M

MOM

Volume

Processed

$173M

$811M

$ 2,580M

$ 5,520M

$ 9,739M

•Calpian growth subject to available financing

•MOM Fiscal year ends 3.31 |

Harold Montgomery

214-758-8603

hmontgomery@calpian.com |