Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ABM INDUSTRIES INC /DE/ | d406691d8k.htm |

| EX-99.1 - PRESS RELEASE - ABM INDUSTRIES INC /DE/ | d406691dex991.htm |

Exhibit 99.2

| Third Quarter 2012 Investor Call NYSE: ABM September 6, 2012 |

| Agenda 2 1 Introduction & Overview | Henrik Slipsager, Chief Executive Officer 2 Third Quarter 2012 Financial Review | Jim Lusk, Chief Financial Officer 3 Third Quarter 2012 Operational Review | Henrik Slipsager, CEO, Jim McClure, EVP & Tracy Price, EVP 4 Fiscal 2012 Outlook | Henrik Slipsager, Chief Executive Officer Forward-Looking Statements and Non-GAAP Financial Information: Our discussions during this conference call will include forward-looking statements. Actual results could differ materially from those projected in the forward-looking statements. The factors that could cause actual results to differ are discussed in the Company's 2011 Annual Report on Form 10-K and in our 2012 reports on Form 10-Q and Form 8-K. These reports are available on our website at http://investor.abm.com/ under "SEC Filings". A description of factors that could cause actual results to differ is also set forth at the end of this presentation. Also, the discussion during this conference call will include certain financial measures that were not prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). Reconciliations of those non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures can be found on the Investor Relations portion of our website at http://investor.abm.com and at the end of this presentation. 5 Questions and Answers |

| 2012 Third Quarter Financial Highlights 3 Revenues up sequentially by ~ 2% and essentially flat year-over-year primarily due to lower contribution from government business Security revenue grew by over 4% Cash flow from continuing operations for nine months ended July 31, 2012 of $82.2 million compared to $82.6 million in 2011. Reduced outstanding loans under Line of Credit by $14 million sequentially and for the fiscal year by $48 million Approved $50 million share repurchase program Announced our 186th consecutive dividend |

| Third Quarter Results Synthesis - Key Financial Metrics 4 Net Income Net Income of $12.6 million, down 54.9% or $15.3 million compared to fiscal 2011. The decrease is from an $7.8 million charge, primarily for a non-cash increase in the Company's self-insurance reserves relating to claims from prior years, a $2.2 million increase in payroll due to an additional working day in the third quarter fiscal 2012 (66 days compared to 65 days), and the third quarter of fiscal 2011 includes a discrete tax benefit of $4.7 million Adjusted EBITDA1 Adjusted EBITDA of $49.8 million was down $5.1 million for the quarter compared to the third quarter of fiscal 2011. The primary reason for the decline was $3.7 million higher labor costs in the Janitorial segment for the additional working day Cash Flow For the nine months ended July 31st, 2012 cash flow from continuing operations was $82.2 million compared to $82.6 million for the comparable period in 2011 1 Reconciliation of Adjusted Income from Continuing Operations and Adjusted EBITDA in the appendix of this presentation |

| Insurance Analysis & Cash Flow Information Insurance review (In thousands) (In thousands) Cash Flow from Operating Activities (in millions) Days sales outstanding (DSO) for the third quarter were 51 days DSO up 1 day year-over-year and sequentially 5 Adjustment to self-insurance reserve - prior fiscal years Cumulative amount by fiscal year Cash Flow (In millions) * * YTD - Nine months |

| Facility Solutions Q3 2012 Results Synthesis - Revenues Revenues of $602.5 million, up $3.8 million compared to 2011 Tag business of $38.9 million, essentially flat Revenues flat at $1.1 billion. Janitorial Services Parking & Shuttle Services Security Services Revenues down $6.3 million to $229.9 million Lower contribution of $13.6 million due to early termination of U.S. Government contracts and reduced government project work Revenue of $155.0 million, up $1.7 million compared to 2011 Increased revenue from management reimbursement contracts and new business Revenues of $91.6 million, up over 4% due to new business Majority of new business from integrated facility solutions jobs 6 |

| Q3 2012 Results Synthesis - Operating Profits1 Janitorial's operating profit of $34.9 million, decreased $5.3 million or 13.2%. The decrease resulted primarily from $3.7 million higher labor expense associated with the additional working day Operating profit for Facility Solutions, including income from unconsolidated affiliates, decreased $1.6 million or 14.2% to $9.5 million, resulting from early termination of government projects and cancelation of contracts Parking's operating profit of $7.8 million was up 8.3% from improved operating margins Operating profit for Security was up by $0.1 million to $2.9 million as margins remained flat 1Excludes Corporate 2Includes $0.7 million and $1.2 million of Income from Unconsolidated Affiliates for fiscal 2012 and 2011, respectively. 7 |

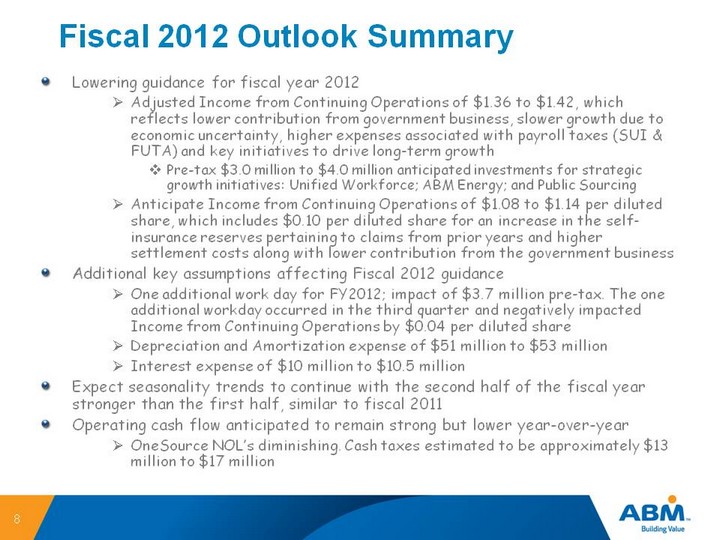

| Fiscal 2012 Outlook Summary Lowering guidance for fiscal year 2012 Adjusted Income from Continuing Operations of $1.36 to $1.42, which reflects lower contribution from government business, slower growth due to economic uncertainty, higher expenses associated with payroll taxes (SUI & FUTA) and key initiatives to drive long-term growth Pre-tax $3.0 million to $4.0 million anticipated investments for strategic growth initiatives: Unified Workforce; ABM Energy; and Public Sourcing Anticipate Income from Continuing Operations of $1.08 to $1.14 per diluted share, which includes $0.10 per diluted share for an increase in the self- insurance reserves pertaining to claims from prior years and higher settlement costs along with lower contribution from the government business Additional key assumptions affecting Fiscal 2012 guidance One additional work day for FY2012; impact of $3.7 million pre-tax. The one additional workday occurred in the third quarter and negatively impacted Income from Continuing Operations by $0.04 per diluted share Depreciation and Amortization expense of $51 million to $53 million Interest expense of $10 million to $10.5 million Expect seasonality trends to continue with the second half of the fiscal year stronger than the first half, similar to fiscal 2011 Operating cash flow anticipated to remain strong but lower year-over-year OneSource NOL's diminishing. Cash taxes estimated to be approximately $13 million to $17 million 8 |

| Forward-Looking Statement This presentation contains forward-looking statements that set forth management's anticipated results based on management's current plans and assumptions. Any number of factors could cause the Company's actual results to differ materially from those anticipated. These factors include but are not limited to the following: we may not be able to achieve anticipated global growth due to various factors, including, but not limited to, an inability to make strategic acquisitions or compete internationally; our acquisition strategy may adversely impact our results of operations as we may not be able to achieve anticipated results from any given acquisition; and activities relating to integrating an acquired business may divert management's focus on operational matters; we are subject to intense competition that can constrain our ability to gain business, as well as our profitability; any increases in costs that we cannot pass on to clients could affect our profitability; we have high deductibles for certain insurable risks, and, therefore are subject to volatility associated with those risks; we primarily provide our services pursuant to agreements which are cancelable by either party upon 30 to 90 days' notice; our success depends on our ability to preserve our long-term relationships with clients; our international business exposes us to additional risks, including risks related to compliance with both U.S. and foreign laws; we conduct some of our operations through joint ventures and our ability to do business may be affected by the failure of our joint venture partners to perform their obligations or the improper conduct of employees, joint venture partners or agents; significant delays or reductions in appropriations for our government contracts as well as changes in government and client priorities and requirements (including cost-cutting, the potential deferral of awards, reductions or terminations of expenditures in response to the priorities of Congress and the Executive Office, or budgetary cuts) may negatively affect our business, and could have a material adverse effect on our financial position, results of operations or cash flows; we incur significant accounting and other control costs that reduce profitability; a decline in commercial office building occupancy and rental rates could affect our revenues and profitability; deterioration in economic conditions in general could further reduce the demand for facility services and, as a result, could reduce our earnings and adversely affect our financial condition; financial difficulties or bankruptcy of one or more of our major clients could adversely affect our results; our ability to operate and pay our debt obligations depends upon our access to cash; future declines in the fair value of our investments in auction rate securities could negatively impact our earnings; uncertainty in the credit markets may negatively impact our costs of borrowing, our ability to collect receivables on a timely basis and our cash flow; any future increase in the level of debt or in interest rates can affect out results of operations; an impairment charge could have a material adverse effect on our financial condition and results of operations; we are defendants in a number of class and representative actions or other lawsuits alleging various claims that could cause us to incur substantial liabilities; federal health care reform legislation may adversely affect our business and results of operations; changes in immigration laws or enforcement actions or investigations under such laws could significantly adversely affect our labor force, operations and financial results; labor disputes could lead to loss of revenues or expense variations; we participate in multi-employer defined benefit plans which could result in substantial liabilities being incurred; and natural disasters or acts of terrorism could disrupt services. Additional information regarding these and other risks and uncertainties the Company faces is contained in the Company's Annual Report on Form 10-K for the year ended October 31, 2011 and in other reports the Company files from time to time with the Securities and Exchange Commission 9 |

| Appendix - Unaudited Reconciliation of non-GAAP Financial Measures |

| 11 ABM Industries Incorporated and Subsidiaries |

| 12 |

| Unaudited Reconciliation of non-GAAP Financial Measures 13 |