Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SCHLUMBERGER LIMITED/NV | d406443d8k.htm |

Exhibit 99

Thank you and good afternoon ladies and gentlemen. I would like to start by thanking Barclays Capital and James West in particular for the invitation to speak at this conference.

Today I will focus my comments on two technology directions that I believe will grow in importance for Schlumberger going forward, and where we continue to actively invest. The first one is drilling technology where I will update you on the progress we have made in terms of creating a step change in drilling performance since we closed the Smith transaction two years ago. The second is subsea technology where we see a strong need for total system integration to help drive production and recovery rates from the growing number of subsea field developments around the world.

I have chosen these two technology directions to illustrate how we continuously aim to create long-term value for both our customers and shareholders. And we do this by setting ambitious goals and pursuing them with the full power of our unique scientific platform technology portfolio and integration capabilities.

But first let me share with you our view of the medium-term industry fundamentals as well as the market outlook for oilfield services.

And as always some of the following statements are forward-looking. Actual results may differ. Please see our latest SEC filings.

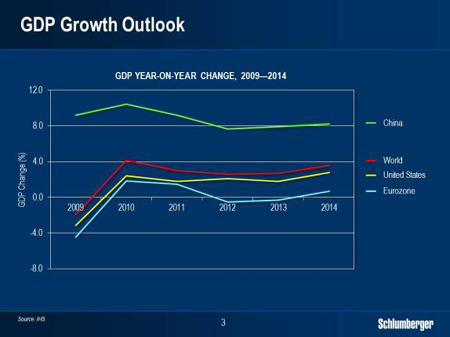

Turning to the global economy, the general situation remains unsettled. It seems clear that the present macro-economic uncertainties driven by the ongoing Eurozone crisis, sluggish recovery in the US, and slowing growth in China will remain with us for some time.

2

In the latest release from IHS, the global GDP growth estimates for 2012 and 2013 are 2.6% and 2.7% respectively, while the key financial market indicators continue to show mixed results from month to month.

While the markets look for introduction of further stimulus to the main economies, the only thing we have seen so far are verbal reassurances from the European Central Bank, which by itself appears to have dampened some of the immediate downside scenarios for the region.

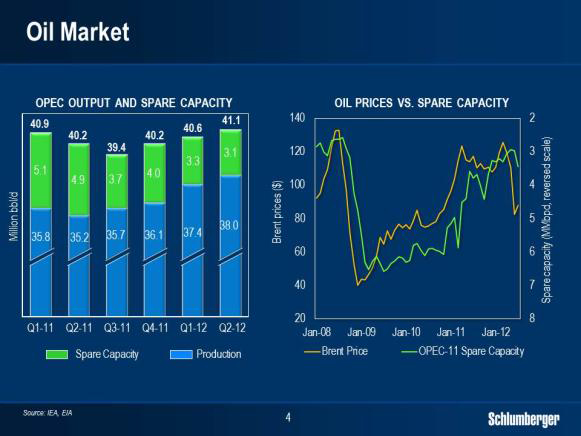

Although the recovery in the global economy remains slow, the supply and demand balance of the oil market continues to be tight.

The supply from OPEC has increased year-on-year, but the overall production capacity of the group has remained more or less flat as the higher production has come through a direct reduction in spare capacity, which reached a four-year low in the past months. On the non-OPEC side, the surge in US production from the liquid-rich unconventional plays continues to mask more disappointing figures from other countries, where production from new projects has not been sufficient to offset the decline in the mature fields.

In spite of the continuing worries about the global economy worldwide, oil demand is still expected to grow faster in 2012 than in 2011 and the latest growth outlook for 2013 is more or less in line with 2012 at around 1%. At the same time, the global

3

production decline from existing fields continues to average just over 4% per year based on numbers from IEA and IHS, hence requiring the replacement of over 3 million bbl/d of oil production every year. This alone will continue to require significant investments in particular, as future reserves and production will typically come from reservoirs with more challenging surface and reservoir conditions.

Oil prices in general have remained closely correlated to global spare capacity in recent years and, absent a significant drop in demand, we see prices being supported around current levels although they could be subject to periods of volatility as we saw in June of this year.

For natural gas, market trends are more regional in nature.

Overseas, demand for LNG is broadening across the globe with more and more countries importing or exporting liquefied gas, driving investments in new LNG projects in a number of regions.

In Asia, LNG prices have weakened in recent months driven by lower demand growth from China and stabilizing demand in Japan as some nuclear capacity is now back on line. Still, Asia is expected to remain a major driver of LNG demand going forward. In Europe, LNG prices remain largely flat as the impact of weaker demand and the concerns over the Eurozone outlook are offset by lower domestic supply. In the US, the gas market is in the process of rebalancing with storage levels that peaked close to 60% over the 5-year average in March now having narrowed to less than 15%.

4

US natural gas production seems to be stabilizing around 65 bcf/d with the impact of lower dry-gas drilling so far being offset by higher production of associated gas in the liquid-rich plays. At the same time, natural gas prices have improved from the 10-year low reached in the first few months of this year.

5

So how does this macro situation translate into spending within the oilfield services market?

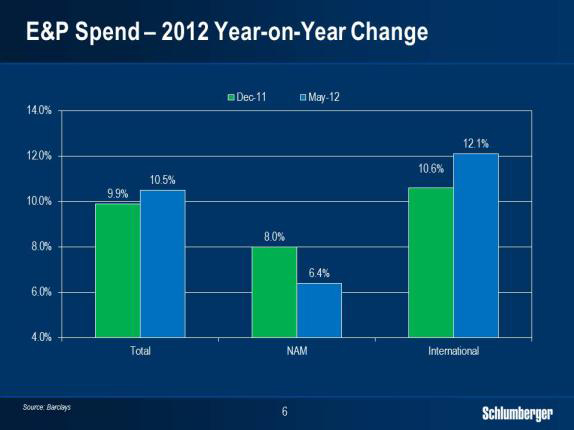

The Barclays E&P spending survey, which was recently updated, confirms the main trends we observe from talking to our customers. In this survey, the 2012 growth in International E&P spend is revised upward to 12.1%. At the same time, the 2012 growth in North America E&P spend is revised downward to 6.4%, mainly driven by flattening overall rig count and lower hydraulic fracturing pricing.

The survey also highlights that for the first time in several years outside of a downturn, the growth in international spend is expected to outgrow that of North America in percentage terms. By area, international growth continues to be driven by key offshore markets such as Sub-Sahara Africa, the North Sea and Brazil, as well as key land markets in North Africa, the Middle East, Russia and China.

This spend forecast also confirms that while we continue to face macro uncertainty and volatility in the global financial markets, the demand for oilfield products and services in the international market remains resilient, although growth rates will not always follow a straight line.

Shifting gears to technology, it is now two years since we closed the Smith and Geoservices transactions where we added significantly to our drilling technology offering. The background

6

for these transactions was the strong growth outlook for drilling services, and a clear ambition of creating a step change in drilling performance for our customers through a much wider application of science, technology and total system optimization.

I would now like to update you on the progress we have made versus this ambition, and show you that the results from our new Drilling Group have exceeded our expectations.

7

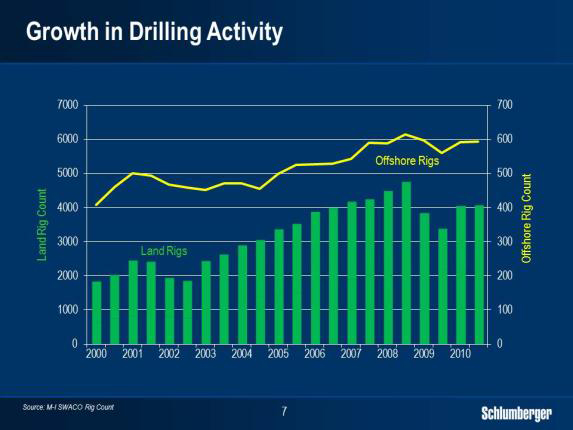

Over the past ten years, we have more or less seen a doubling in the number of land and offshore rigs operating worldwide. At the same time, new reservoirs are generally being found deeper with higher pressures and temperatures. Furthermore, the rapid growth in deepwater drilling activity has mandated new standards for operational integrity and the extensive use of horizontal wells in unconventional land drilling has created a strong drive towards operational efficiency and factory drilling.

All of these trends represent more complex and challenging drilling operations with increasing demand for quality and efficiency from the drilling service providers. These trends are set to continue and present a significant business opportunity for companies that can help operators take their drilling performance to the next level. With the formation of our Drilling Group, which includes Geoservices, M-I SWACO and the other relevant Smith product lines, we are actively pursuing this drilling prize.

We are doing this by taking a much more scientific approach to the drilling process, aiming to optimize the entire drilling system rather than just the individual components.

8

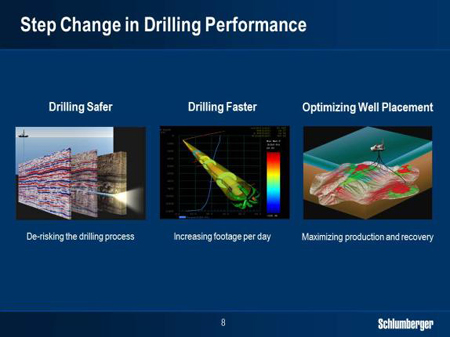

Creating a step change in drilling performance means pursuing three major aspects of the drilling process. First, drilling safer—by de-risking the overall drilling operation and preventing undesired events; second, drilling faster—so reducing the time and cost of each well; and third, placing the wells in the optimum location in the reservoir to maximize production and recovery. All three aspects represent significant value to our customers and I will discuss each of them separately.

9

Drilling safer is all about de-risking the drilling operation, preventing the occurrence of incidents such as stuck pipe and lost circulation which cost the industry hundreds of millions of dollars each year. And even more importantly, to help avoid kicks from over-pressured zones that can lead to uncontrolled situations. We do this by combining real-time drilling and formation evaluation data from our drilling tools with the reservoir model, and by using advanced interpretation techniques to analyse and act on the data in real time.

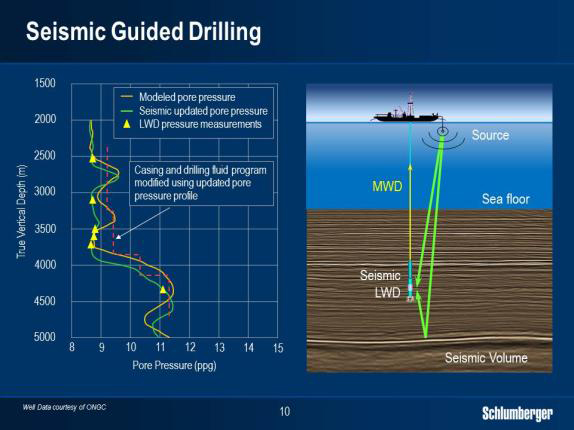

Seismic Guided Drilling is a good example of how we are building our de-risking capabilities. Here we combine logging-while-drilling data with the seismic model in real time to help narrow down the depth uncertainty and to identify over-pressured zones in front of the drill bit prior to drilling through them.

This example shows a well drilled in a challenging high-pressure, high-temperature deepwater environment where over-pressured zones had been seen in previous wells drilled in the area. To manage this risk, we built an extensive pre-drill model of the expected formation pressure using petrophysical and seismic data from offset wells. This model was updated in real time based on measurements from our sonic-while-drilling and seismic-while-drilling tools.

By leveraging the latest advances in computing power, we were also able to re-image the seismic model around the well while drilling. This allowed us to both narrow down the depth uncertainty of the

10

different zones as well as predict the formation pressure 500 m in front of the drill bit. The drilling program was then modified to reflect the real-time predictions, so allowing the well to be drilled safely to conclusion. Had the well been drilled using the original drilling program without real-time seismic re-imaging, we would likely have encountered major drilling problems and delays.

De-risking the drilling process in this way requires seismic, petrophysics and drilling experts working closely together as a single integrated team using real-time workflows. We are well supplied with these experts, and we have co-located them in our regional Operations Support Centers around the globe.

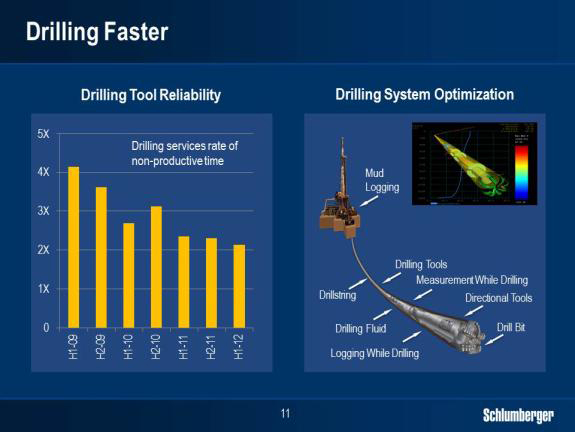

Drilling wells faster is achieved by reducing non-productive time as well as by increasing the drilling rate of penetration, and our Drilling Group is making progress in both areas.

We continue to reduce non-productive time by engineering and manufacturing more reliable drilling tools, and by taking a much more scientific approach to how we maintain our drilling tools in the field. Our ultimate goal is to drill each hole section in one run, thereby eliminating non-productive time linked to downhole tool failures.

We are not there yet but over the past four years we have halved the rate of non-productive time related to our drilling operations. This is already generating significant value for our customers and is clearly setting us apart from our competitors.

11

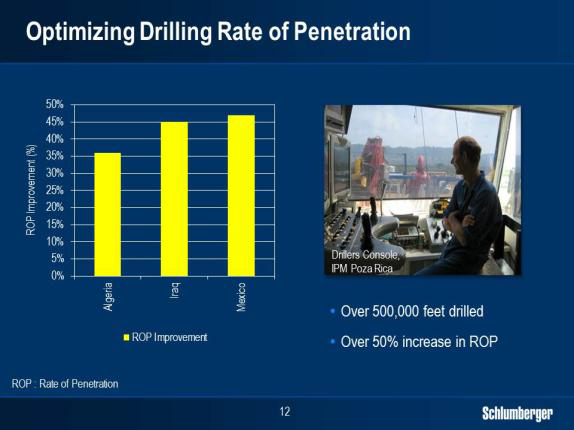

The second way of drilling faster is to increase the rate of penetration when the drill bit is on bottom drilling. This is driven by how fast rock is crushed and removed from the borehole.

Today, a significant part of the energy we pass from the top drive does not reach the drill bit but is instead lost through undesired shock and vibrations throughout the drill string. By optimizing the total drilling system much like balancing the tires on a car to ensure a smoother drive, we can better harness the surface energy applied to ensure it reaches the drill bit and increases the rate of penetration. We achieve this total system optimization by establishing computer models that can predict the behaviour of the entire drill string from top drive to drill bit as it rotates. And we use these models to optimize upfront design as well as on-going drilling operations in real time.

We continue to test these predictive models in our IPM operations to drive drilling performance on our well construction projects. Here, the models provide optimal set points for weight on bit, rotational speed, and flow rate in real time, allowing the driller to continuously optimize these surface parameters. IPM has already used this process on a number of projects around the world including Mexico Algeria and Iraq. To date more than 500,000 feet have been drilled using early versions of these optimization models yielding an average increase in drilling rate of penetration over 40%.

12

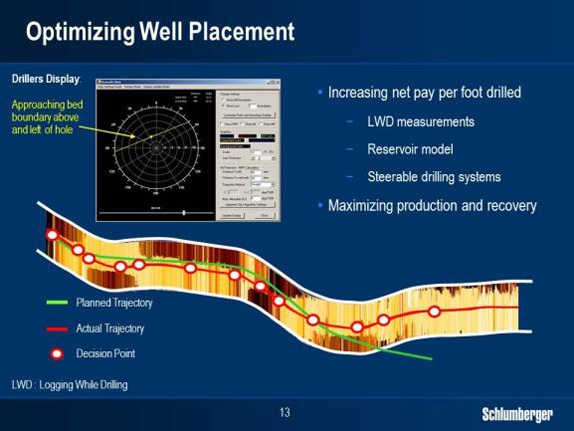

When it comes to well placement, the goal is to position the well in the optimum location in the reservoir with respect to net pay and reservoir quality in order to maximize production and recovery. This is achieved by tying formation evaluation measurements from our logging-while-drilling-tools to the reservoir model in real-time, and adjusting the well path as we learn more about what we are drilling through. Today, our logging-while-drilling measurements can see 360o around the well, and as deep as 100 ft into the formation. This is particularly useful when drilling horizontal wells in thin layers to very tight tolerances.

This example is from a deepwater well in an offshore field in Brazil. Our customer was looking to drill into a thin and complex reservoir target representing a significant well placement challenge. By using deep-reading formation evaluation data while drilling, we were able to steer the well path within the narrow boundaries in a manner similar to an aircraft pilot using GPS to steer around a mountain at night. The success and value of the well placement technology and workflow in this case were demonstrated by the production rate from the well, which was more than twice that of the best producing well in the field.

13

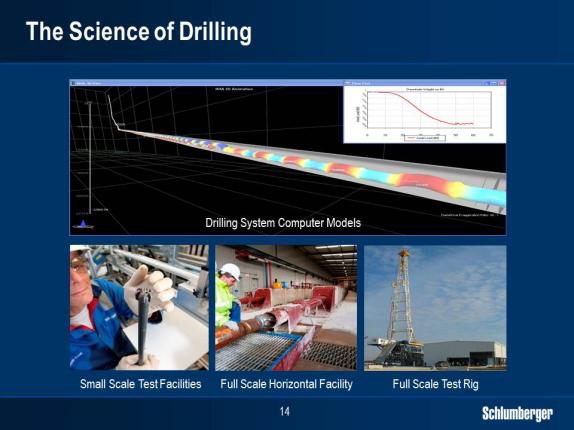

As I have shown you, we are looking to create a step change in drilling performance for our customers by drilling safer, faster, and with optimum well placement. Common to all of this is a more scientific approach to drilling where we use modelling and real-time predictions together with integrated teams of experts to help optimize the entire drilling system. So why hasn’t this been done before?

The main reason is that it represents an unprecedented technical challenge requiring a complete range of drilling expertise as well as additional capabilities in areas such as seismic, petrophysics, system modeling and data processing. We have these additional capabilities in abundance within our Reservoir Characterization Group, and we are now applying them to help address the drilling challenge.

As we continue to build and enhance our drilling computer models we are also investing in a range of test facilities where we can verify the model predictions under controlled and measurable conditions. These capabilities range in scale all the way from the lab to the drilling rig. They include a scaled test facility in our research center in Cambridge, UK, where we have reproduced the mechanical properties of a real drill string on a scale of 1 to 12. They also include a full scale horizontal drilling facility in Stonehouse, UK, where we can drill 150-ft intervals using a full size bottomhole assembly; and a dedicated full size test rig in Cameron, Texas, where we send technology prototypes and systems for intensive testing under full drilling conditions.

14

All these testing capabilities are critical for our scientists as they continue to work on developing our drilling computer models.

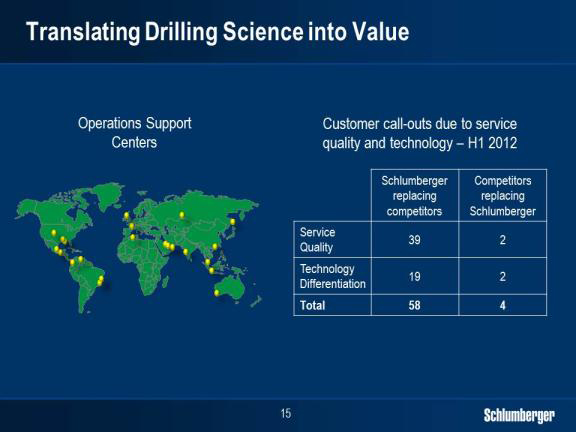

In our field operations we translate these scientific advances into tangible improvements in drilling performance through the 22 Operations Support Centers we have established around the world. In these centers, which house over 400 drilling and petroleum technical experts, we conduct all the upfront planning and design of the wells we drill for our customers. From these centers we also oversee our drilling operations in real time through direct links to the rigs to help optimize drilling performance and prevent operational problems.

We also link our technical sales and commercial people to the centers to ensure that we capture our share of the value associated with the drilling performance we are delivering. Today we do this in a number of ways. In some cases we are awarded work at premium pricing due to our unique capabilities and performance. In other cases we replace our competitors at premium pricing as they are unable to perform. And more and more we are moving towards performance-based contracts where the better we perform, the more we are rewarded.

15

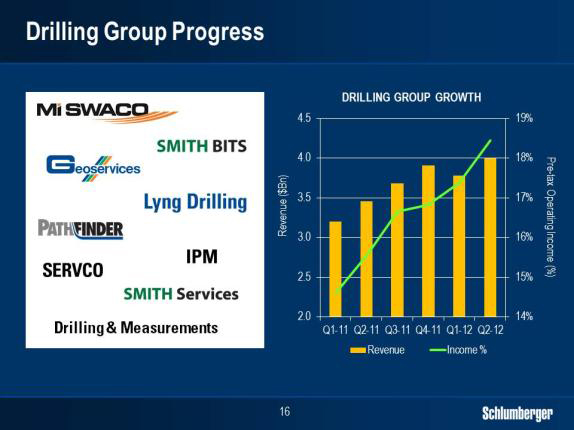

It is now 2 years since we completed the Geoservices and Smith transactions, which together represented a $13 billion investment. Ultimately the success of these types of investments can only be measured by the resulting financial performance so where do we stand in this respect?

First of all, the integration of 7 new product lines and 30,000 new employees from the transactions is now complete and we have managed to retain all key personnel in the process.

Second, the Smith transaction, which is the largest ever undertaken by Schlumberger, ended up being accretive to earnings per share by the third full quarter after the close—more than one year earlier than our initial target. And if you look at the quarterly financial performance of the total Drilling Group, we have seen steady growth in the top line as well as marked improvement in margins over the past six quarters. And this has been in an environment where pricing has, at best, been flat.

The new approach we are taking to drilling builds on our unique scientific capabilities and shows the potential Schlumberger has to move the boundaries of current industry performance. So far we are satisfied with the progress we are making in our pursuit of the drilling prize, knowing very well that most of the upside potential from our drilling investments still lies ahead.

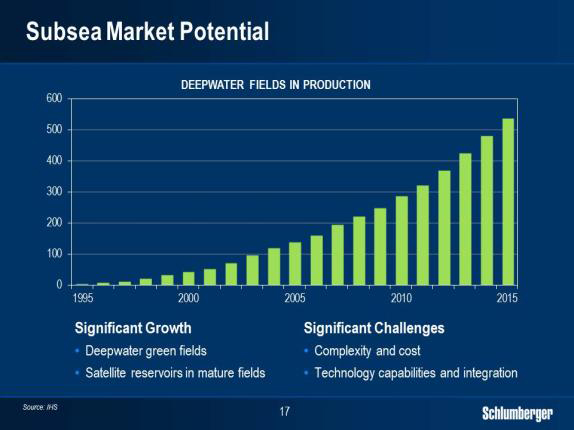

Another area that will also benefit from wider application of science, technology and total system optimization is the subsea market, which will play an important role in terms of future reserves and production for our industry. So let’s take a closer look at this market.

16

In recent years we have seen a rapid growth in the number of offshore developments using subsea technology. These span both green fields in deepwater environments, as well as the tie-back of satellite reservoirs to existing host facilities at conventional water depths. We estimate that over 200 new deepwater subsea fields will come online in the next 4 years, and that by 2020 there will be more than 11,000 subsea wells in operation worldwide.

Subsea developments will therefore become more and more important for many of our customers in terms of production and reserves. Hence the ability to help maximize production and reserves from these assets represents a key business opportunity going forward.

17

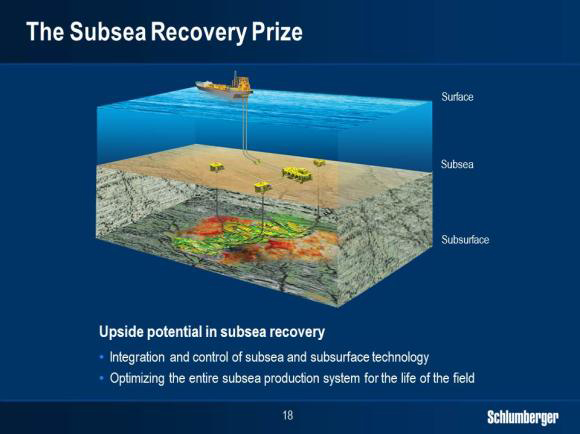

Subsea developments today are faced with significant challenges including high development costs and complex reservoir well and production dynamics. The current development approach and the available subsea technology have technical and commercial limitations that result in development solutions that often fall short of delivering the full production and recovery potential of the reservoirs.

In fact recovery rates from subsea developments can be less than half of what we see in conventional topside developments. To further illustrate the opportunity this presents it has been estimated that deepwater reserves currently represent around 10% of global oil reserves. Therefore a potential doubling of deepwater recovery rates to bring them in line with topside developments could add a further 10% to global oil reserves.

Today the industry is still not able to create subsea development and processing systems with the capability and flexibility to maximize production and reserves throughout the lifespan of the field. The result is that factors such as wax, scale, lack of gas-handling or water-handling capabilities and insufficient pressure support ultimately limit production and recovery rates from subsea developments. Overcoming these challenges in a cost effective way therefore represents a massive prize for the industry.

18

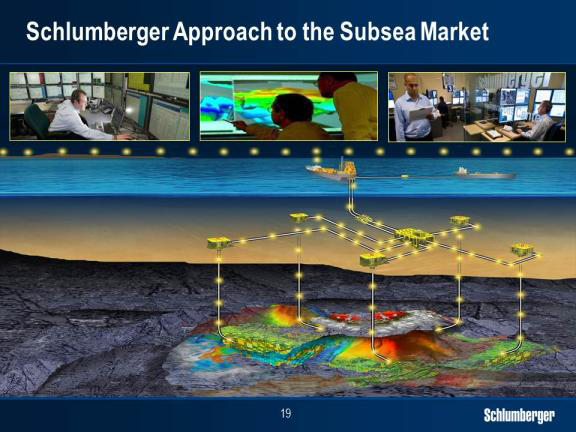

We believe the key to unlocking the recovery potential of subsea developments will be to design and optimize the entire subsea production system from the reservoir pore space through the well completion and the subsea processing system all the way to the export point. This represents a significant technical challenge that requires a broad scientific and technology platform and the ability to engage with customers way beyond the existing subsea hardware.

Total subsea system optimization can only start with a deep understanding of the reservoir and a clear ability to predict well and field production over the lifetime of the reservoir. The next step is to create an intelligent and flexible production system that includes both the well and a complete subsea processing plant. Here, intelligent well completions including in-well ESPs tied together with subsea boosting technology in a unified control system, as well as subsea separation and re-injection capabilities will be critical to drive production and recovery. So, of these elements, what can Schlumberger bring to the table?

19

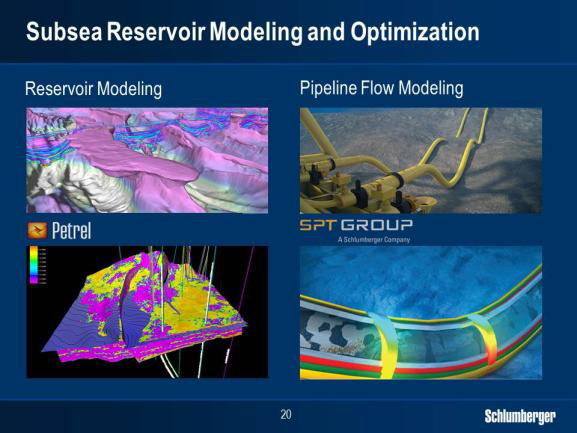

First, we are the clear leaders in reservoir characterization and modeling, starting with the best measurements in the industry. We also own the market-leading reservoir simulator Intersect, which is fully integrated into the industry standard modeling platform Petrel. And our reservoir characterization leadership is further cemented through the largest geoscience community in the industry counting over 5,000 technical experts spread around the globe.

And through our recent acquisition of the SPT Group which is the leader in pipeline flow modeling and subsea flow assurance, we are now extending our production prediction capabilities from the reservoir and the well all the way to the export point, factoring in all the constraints of the entire subsea production system.

20

Second, we are one of the market leaders within artificial lift through our REDA ESP technology. Going forward we see significant potential in combining high performance ESPs with subsea multiphase pumps to create a powerful dual boosting system driven by a common control system.

In addition, we are also the clear leaders in intelligent completion technology with over 3,500 gauges and 400 flow control valves installed worldwide over the past 5 years. We are currently working on our next generation system in collaboration with a key customer, and with this new system we will be able to measure pressure, temperature, flow rate and water cut in real-time across multiple zones in single or multilateral wells.

The system will also allow production from each zone to be adjusted through choke valves controlled remotely which will help contribute to higher recovery rates. This technology is designed for maximum reliability and flexibility, eliminating the need for hydraulics and with power and control provided by a single electrical line.

We expect the new system to become commercially available within the next two years and to be fully integrated into our subsea offering.

21

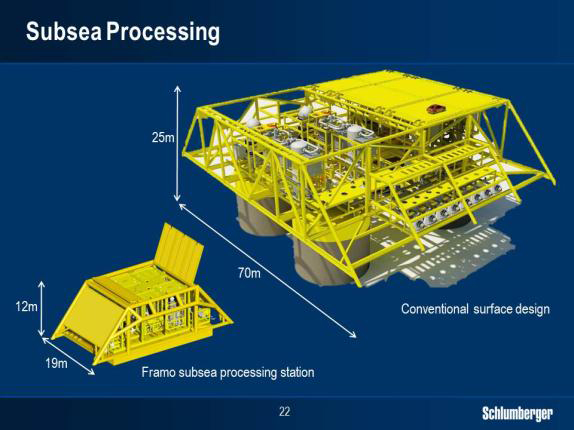

Third, and moving from the well to the subsea processing factory, we are now the leaders in subsea multiphase boosting and metering as well as in wet gas compression through Framo Engineering, which is one of our fastest growing product lines.

The unique multiphase boosting and compression solutions we offer today already hold significant recovery rate potential. In some cases, we have seen reserves per well increase by as much as 60% through subsea boosting, and up to 100% when combined with ESPs. Furthermore in our new subsea engineering and test center in Bergen, Norway, Framo Engineering continues to break new technology barriers in terms of functionality reliability and compact design.

As offshore developments go deeper and reservoir conditions become more complex, the industry can no longer practically or financially rely on topside facilities to provide the necessary processing capabilities. Some of our major customers are now considering how to move processes like separation of oil, gas and water, as well as re-injection of water back into the reservoir from the surface to subsea. This will require more sophisticated subsea processing equipment and control systems with additional focus on flow assurance and monitoring of asset integrity.

Building on our existing subsea position we will continue to develop our offering in close dialogue with key customers through a combination of organic growth partnerships and potential M&A activity. There is still a lot of work to be done, but we believe

22

we are in a prime position to drive development of complete subsea production systems and ultimately help our customers improve production and recovery from their subsea developments.

As we continue to develop our technology offering we are also maintaining a strong focus on the planning and execution of our current operations. As always, our world revolves around our customers and how we best can serve them and help them create value through application of our expertise and our technology.

However, in recent years we have also started to put significantly more focus on the remaining part of our value chain such as supplier management and internal support activities which, given our size, can be translated into additional competitive advantage.

Today our third-party spend between capex and opex is in the range of $20 billion per year and we have over 30,000 people employed in internal support functions such as shared services, transportation, distribution and maintenance. Even small improvements in quality and efficiency in these areas can represent meaningful contributions to our bottom line.

We have therefore embarked on several multiyear initiatives where we look to further streamline the company by applying science, technology and workflow integration to these areas.

23

Ladies and gentlemen, I set out to show you today that the market for oilfield services continues to be resilient and offers exciting opportunities for growth. The role of science, technology and integration capability continue to grow in importance as operating environments become more challenging and as realizing the future performance upside for the industry requires more and more total system optimization.

In this market, the Schlumberger technology portfolio remains unique and highly relevant and our scientific platform that has helped create our leadership position in Reservoir Characterization is proving to also have broad applications both within Drilling and Production.

Our scientific approach to drilling system optimization is one example of how we look to set ambitious and challenging goals to create long-term value for our customers and shareholders. The plan I have outlined for the subsea market is another.

Finally, our balanced business portfolio, our unmatched international presence and margin performance, the quality and efficiency of our execution, and the capabilities and motivation of the 115,000 people in our organization give me a lot of confidence in our ability to outperform in both topline growth and bottom line returns in the coming years.

And I am proud to lead our organization forward with that very clear goal in mind. Thank you.

24