Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Orexigen Therapeutics, Inc. | d406133d8k.htm |

Exhibit 99.1

September 2012 |

2

Forward-Looking Statements

Forward-Looking Statements

This presentation contains forward-looking statements about Orexigen Therapeutics, Inc.

Words such as "believes," "anticipates," "plans,"

"expects," "indicates," "will," "intends," "potential," "suggests," "assuming," "designed,“ “probability” and

similar expressions are intended to identify forward-looking statements. These statements

are based on the Company's current beliefs and expectations. These forward-looking

statements include statements regarding the timing of the enrollment of the

Contrave® Light Study, the timing of a resubmission of the Contrave NDA, the Special

Protocol Assessment, or SPA, the cost of conducting the Light Study, the timing expected

for the interim analysis of the Light Study, the timing of FDA input for Empatic™,

the potential for, and timing of, approval for Contrave or Empatic, and the potential for the therapeutic or

commercial value of Contrave or Empatic. The inclusion of forward-looking statements should

not be regarded as a representation by Orexigen that any of its plans will be achieved.

Actual results may differ from those set forth in this presentation due to the risk and

uncertainties inherent in Orexigen’s business, including, without limitation: the SPA is not

binding on the FDA if public health concerns unrecognized at the time the SPA agreement was

entered into become evident, other new scientific concerns regarding product safety or

efficacy arise, or if Orexigen fails to comply with the agreed upon trial protocol; the

progress and timing of the Light Study; Orexigen's ability to demonstrate in the Contrave outcomes trial that the

risk of major adverse cardiovascular events in overweight and obese subjects treated with

Contrave does not adversely affect the product candidate's benefit-risk profile; the

potential that earlier clinical trials may not be predictive of future results in the

Light Study or in a Phase 3 trial for Empatic; the potential for adverse safety findings

relating to Empatic or Contrave to delay or prevent regulatory approval or

commercialization, or result in product liability claims; the potential for early termination of the

collaboration agreement between Orexigen and Takeda; the costs and time required to complete

additional clinical, non-clinical or other requirements prior to any resubmission of

an NDA for Contrave and the Phase 3 trials for Empatic; the therapeutic and commercial

value of Contrave or Empatic; Orexigen's ability to attract and retain key personnel; Orexigen's ability to maintain

sufficient capital; and other risks described in the Company's filings with the Securities and

Exchange Commission (SEC). You are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date hereof, and Orexigen

undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof.

Further information regarding these and other risks is included under the heading "Risk

Factors" in Orexigen’s Quarterly Report on Form 10-Q, which was filed with

the SEC on August 9, 2012 and is available from the SEC's website (www.sec.gov) and on

Orexigen’s website (www.orexigen.com) under the heading "Investor Relations”. All

forward-looking statements are qualified in their entirety by this cautionary

statement. This caution is made under the safe harbor provisions of Section 21E of the Private

Securities Litigation Reform Act of 1995. |

Large, growing

market Unmet need, limited

competition

Differentiated product

profile

Skilled partner with heavy

resourcing

Path to Commercial Success

Path to Commercial Success

Orexigen: Contrave

®

Poised to Deliver

Orexigen: Contrave

®

Poised to Deliver

Regulatory clarity on

the Light Study design

and potential for

approvability at interim

analysis

High probability of

technical success

Path to approval

Path to approval

3 |

Path to

Approval Path to Approval

4 |

5

The Light Study was designed to satisfy the single

approval deficiency identified in the CRL

CRL identified a single approval deficiency of theoretical CV risk

Complete NDA already reviewed by FDA

–

Efficacy threshold has been met

–

General safety & tolerability profile established

–

Positive Ad-Com

World-class advisors assembled to steer the study |

6

The Light Study began enrolling patients June 2012

Protocol based on guidance from OND and conducted under a SPA

Contrave could be approved with a positive interim analysis at 87

MACE events

–

Must exclude a doubling of MACE at the interim analysis to be approved

–

Must exclude a 40% increase at the final analysis (371 events)

Enrollment update: Orexigen expects to complete enrollment of

patients

required

for

the

interim

analysis

in

the

fourth

quarter

of

2012 and to accrue 87 MACE in 2013 |

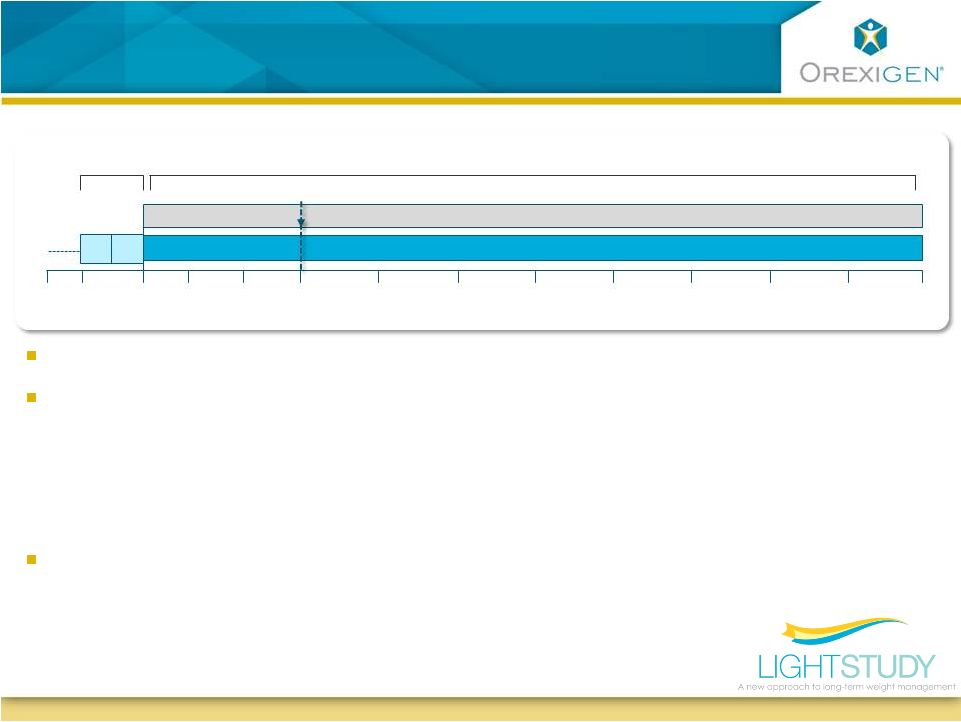

7

Light Study Design

Primary endpoint is ITT analysis of MACE (MI, stroke, CV death)

Targeting MACE event rate of 1.5% per year

Streamlined study -

large sample size, but limited information per subject

Contrave32 + WeightMate

Placebo + WeightMate

Wk 208

Wk 182

Wk 130

Wk 104

Wk 78

Wk 52

Wk 26

Wk 16

Wk 156

Wk 8

Wk 2

Day1

Wk -2

Evaluation of appropriateness of treatment

Lead-in

Treatment Period

–

Real-world

test

-

long term exposure to study drug only in patients demonstrating

early potential to benefit from therapy

–

Those with limited weight loss or increased blood pressure drop study drug at Week

16 but remain in ITT analysis

–

No ongoing labs, infrequent visits, minimal data collection

–

Total cost to interim analysis and approval is estimated at ~$100M

|

8

Probability of Technical Success of the

Light Study is High

Hurdle for approval requires excluding a doubling of CV risk in non-

inferiority design, not demonstrating CV benefit

Bupropion well characterized in >50M patients over >25 years

–

Large patient registries and AERS have not identified evidence of

increased CV events

Risk Engine modeling of 1-year Contrave Phase 3 data predicts

reduced

10-year CV risk compared to placebo

Trial focus on responders to drug therapy allows real-world test

–

Long term exposure to study drug is only in those demonstrating early

potential to benefit from therapy |

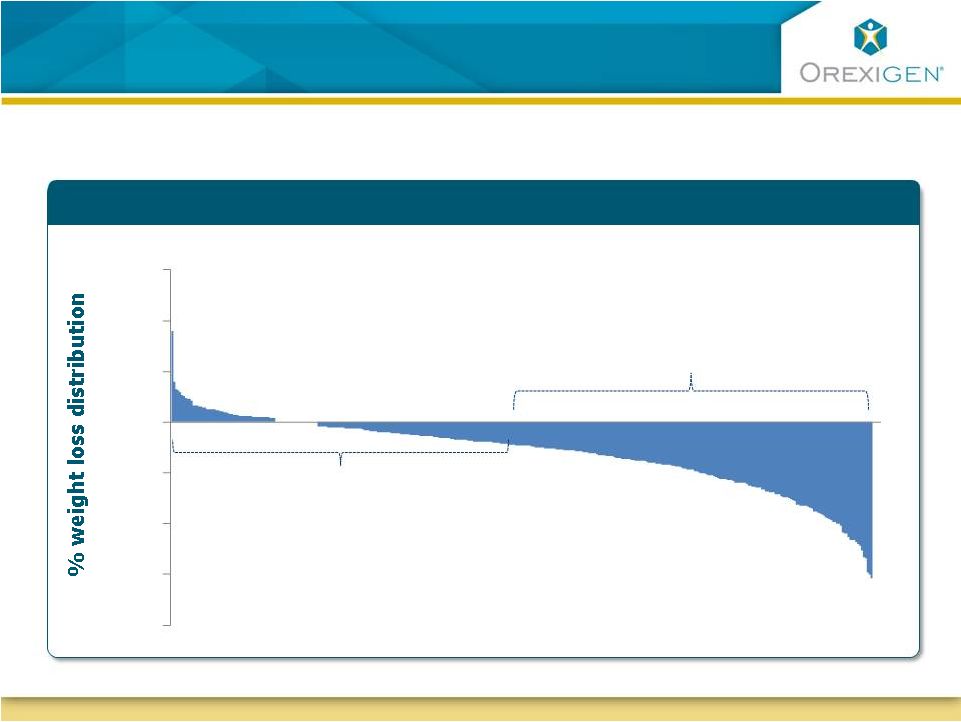

9

Our Focus is on Responders to Contrave Therapy

Our Focus:

Responders

Non-responders discontinue

drug therapy

0

10

20

30

Illustrative : Typical distribution of weight loss response to obesity therapy

-10

-20

-30

-40 |

10

Responders Maintained Meaningful Weight Loss

Contrave Responders Achieved Significant Weight

Loss

Represents

one

year

data

for

responders

(patients

with

5%

weight

loss

at

week

16

per

recommended

treatment

protocol)

In the Contrave

®

clinical development program the most frequent treatment-emergent

adverse

events

on

Contrave

®

were

nausea,

constipation,

headache,

vomiting

and

dizziness. These were mostly mild to moderate in severity, transient, and typically

occurred during the first weeks of treatment.

5%

-

1

0%

Weight

Loss

Avg.

Wt

.

Loss

=

17

.0

lbs

10

%

-

1

5%

Weight

Loss

Avg.

Wt

.

Loss

=

2

6.7

lbs

>

1

5

%

Weight

Loss

Avg.

Wt

.

Loss

=

43

.9

lbs

Weight

Gain

0%

-

5%

Weight

Loss |

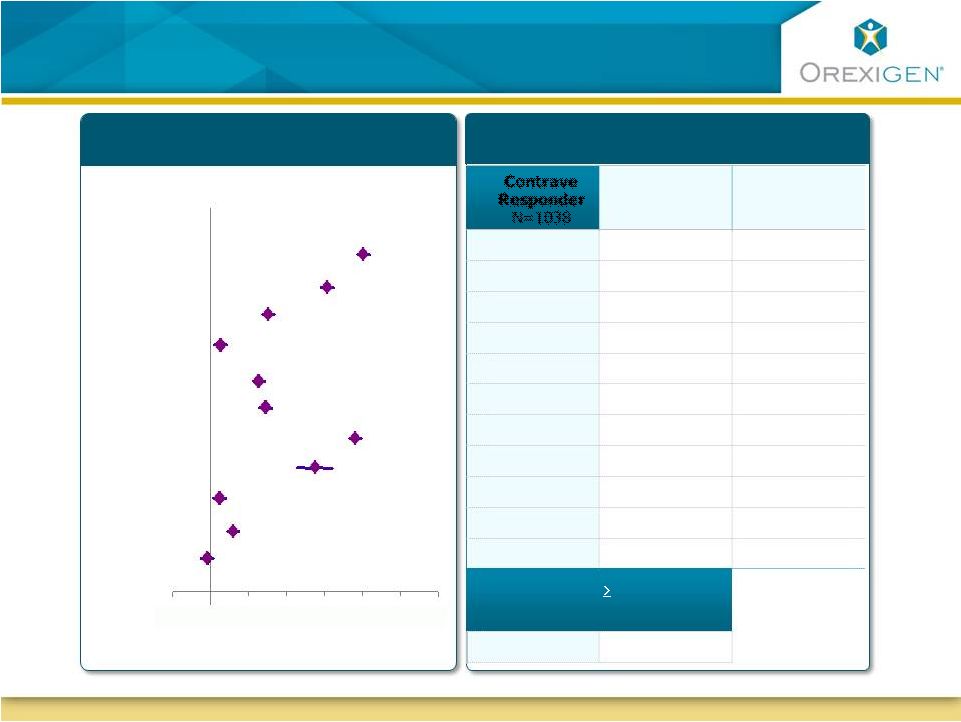

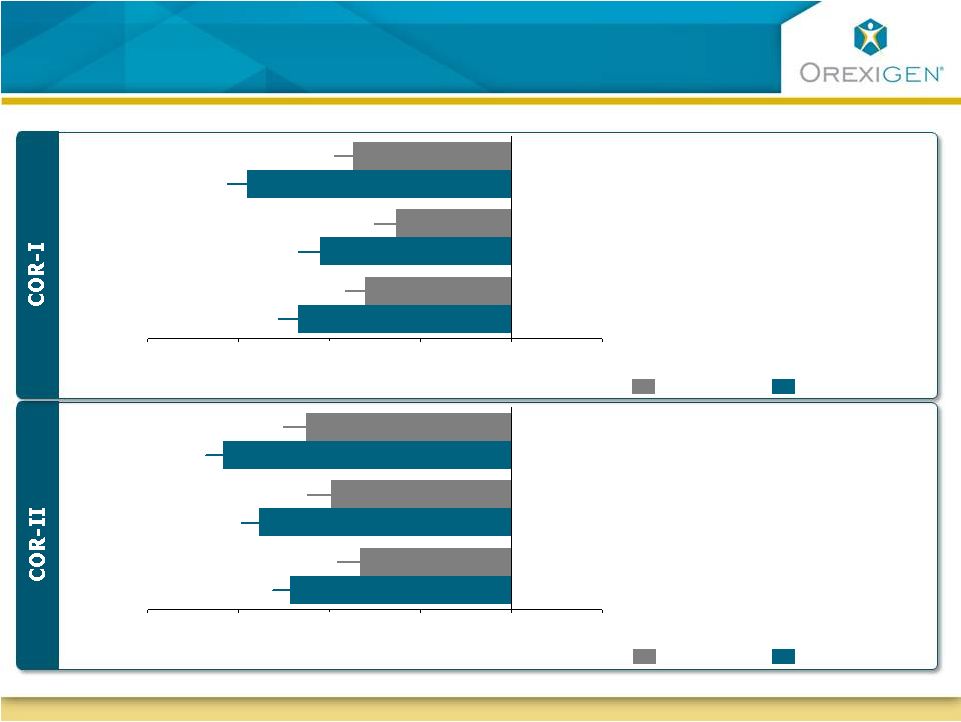

11

Contrave Responders Achieve Improvements Across

Multiple Cardiometabolic Parameters

Contrave Responders Achieve Improvements Across

Multiple Cardiometabolic Parameters

Responders Maintained Meaningful

Weight Loss

Contrave32 Standardized

Mean Change from Baseline at 1 Year

Change from Baseline at 1 Year

Body Weight

Waist Circ.

HDL

LDL

Triglycerides

hsCRP

IWQOL

HbA1c

SBP

DBP

Heart Rate

Improvement

(Standardized Mean Change from Baseline)

Contrave

Responder

N=1038

Placebo

Responder

N=254

All Placebo

N=1319

-11.3%

-8.6%

-2.4%

-9.5 cm

-7.2 cm

-3.5 cm

5.2 mg/dL

2.9 mg/dL

0.0 mg/dL

-2.5 mg/dL

1.7 mg/dL

0.0 mg/dL

-16.0%

-9.2%

-2.8%

-38.9%

-36.2%

-14.5%

14.7

12.3

8.3

-1.0%

-0.6%

-0.1%

-0.9 mm Hg

-2.8 mm Hg

-1.6 mm Hg

-1.6 mm Hg

-2.6 mm Hg

-1.3 mm Hg

0.2 bpm

-2.3 bpm

-0.2 bpm

Proportion w/

5% Wt Loss

Wk 16

51%

19%

-0.4

0

0.4

0.8

1.2

1.6

2

2.4 |

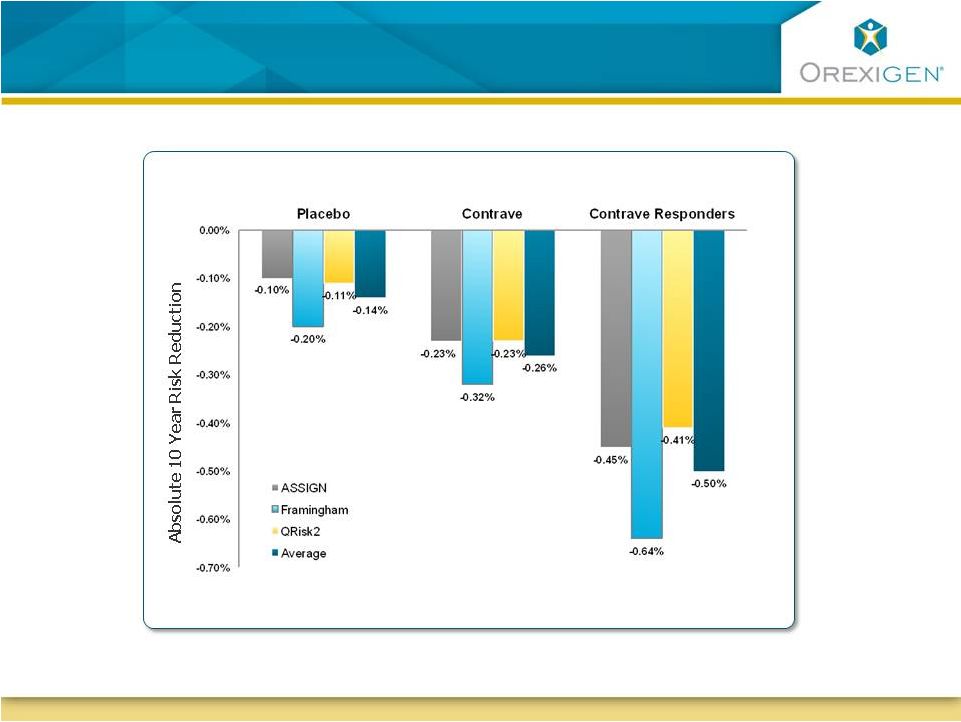

12

Risk Engine Modeling Suggests Long-term CVD Risk

Reduction on Contrave

Risk Engine Modeling Suggests Long-term CVD Risk

Reduction on Contrave |

13

Patient demographic targets are based on

epidemiologic modeling and clinical trial experience

Patient demographic targets are based on

epidemiologic modeling and clinical trial experience

Target

Current (August)

Age

64

61

Younger Age Group

<25%

14%

Gender

50:50 (M:F)

44:56

Minority

15%

>20%

CV disease

30%

35%

Diabetes

>70%

87%

Smoking status

>5%

X

Orexigen is targeting to enroll a patient population with a modeled

background

annual

MACE

rate

of

>2%

expecting

to

observe

a

MACE

rate of ~1.5% |

14

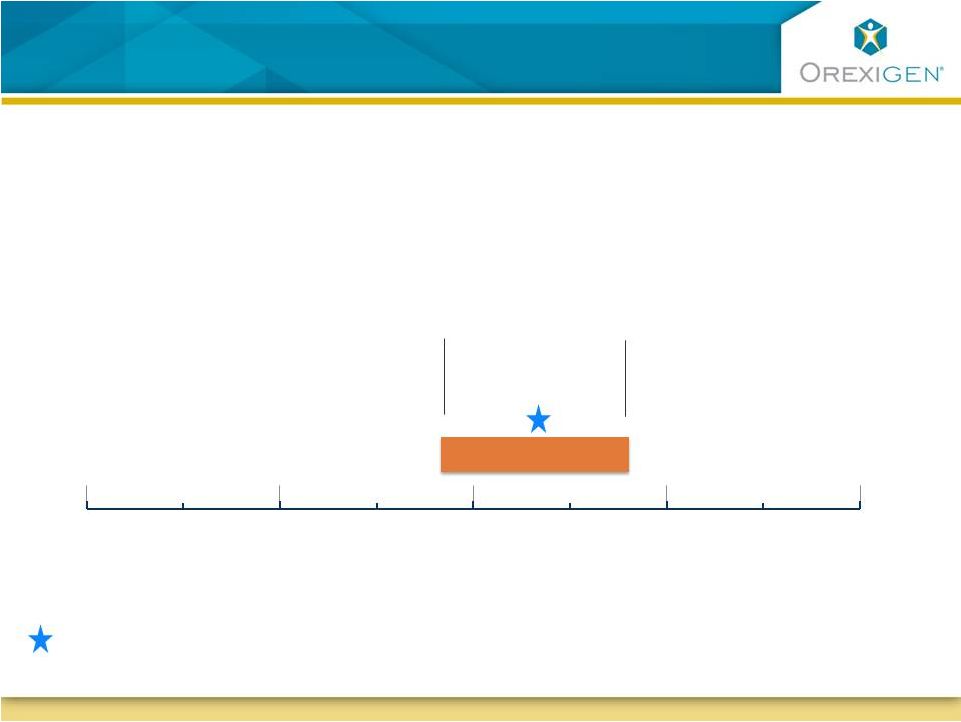

Precise timing of the 87

th

event dependent on

the actual observed event rate

Precise timing of the 87

th

event dependent on

the actual observed event rate

87

th

event

3Q 12 4Q 12 1Q 13

2Q 13

3Q 13

4Q 13

1Q 14

2Q 14

Timing of 87

th

event based on 1.5% event rate

2%

1.25%

Interim analysis triggered by official MACE adjudication

Assumed event rate (ER) |

15

Path to Commercial

Path to Commercial

Success

Success |

16

Contrave Poised for Commercial Success

Contrave Poised for Commercial Success

Blockbuster Building Blocks

Blockbuster Building Blocks

Market Size / Market Growth

Unmet Need / Limited Competition

Differentiated Product Profile

Heavy Resourcing |

17

Obesity: A Large Untapped Market in Need of Solutions

Obesity: A Large Untapped Market in Need of Solutions

US Population

Source: CDC (2009)

~

1

in

3

People

in the US are

Obese

US Obesity Rate Growth

Source: CDC (2010)

The obesity epidemic is also expected to grow globally

n= ~685M people

n= ~484M people

Blockbuster Market Size

Blockbuster Market Growth |

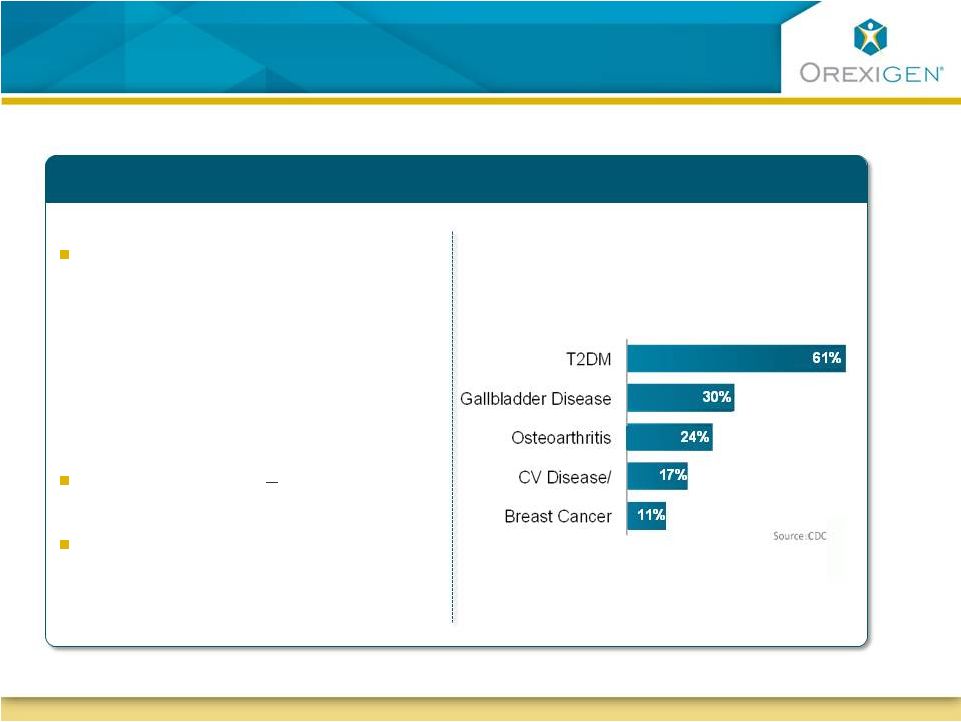

Significant

Unmet Need in the Market Significant Unmet Need in the Market

T2DM, 61% of which is

attributable to obesity, is an

epidemic

1 in 3 adults in the U.S. may

have diabetes by 2050 (CDC)

Associated with premature

death & physical/psychosocial

consequences

Weight loss of 5

10% confers

significant benefits

Large gaps in current treatment

paradigm

Serious Disease Attributable to Obesity

–

–

Treatment Options Needed

18 |

19

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

Contrave is Uniquely Positioned for Significant

Segments of the Obese Population

A Typical Obese Patient

Has diabetes

and/or

dyslipidemia

62

%

Has difficulty

controlling eating

in response to

food cravings

50

%

Is depressed or

has depressive

symptoms

63

%

Is female,

many of child

bearing age

72

% |

20

Patients With Diabetes On Contrave Achieve

Improvements In Glycemic Control with Weight Loss

Patients With Diabetes On Contrave Achieve

Improvements In Glycemic Control with Weight Loss

As little as 5 -

10% weight loss

has been shown to reduce

mortality risk by ~25%

Half the Contrave patients who

completed therapy lost

5%

body weight

Half the Contrave patients who

completed therapy achieved

ADA HbA1c guideline of <7%

Patients on Contrave

experienced a reduction in

rescue medications

Source: Williamson, Diabetes Care, Vol 23, No. 10 Oct (2000)

HbA1c, change from baseline

ITT-LOCF (Mean baseline A1C = 8.0%) |

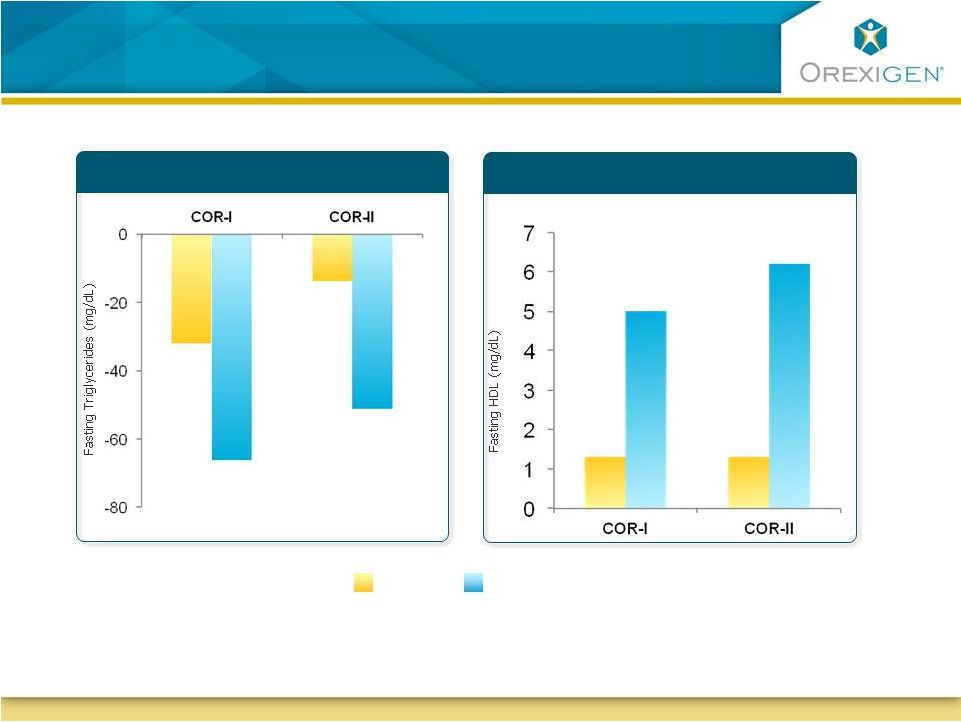

21

Patients with Dyslipidemia Experienced Clinically

Significant Improvement in Lipid Profiles

Patients with Dyslipidemia Experienced Clinically

Significant Improvement in Lipid Profiles

Placebo

P < 0.05

P < 0.05

P < 0.05

P < 0.05

Data is for completers in high-risk subgroups. High risk is defined by ATPIII Guidelines;

Baseline 200-222mg/dl for TGs, 40-41 mg/dl for HDL

N=82

N=87

N=69

N=135

N=122

N=121

N=117

N=184

HDL Cholesterol

Triglycerides

Contrave32 |

22

Patients Experienced Statistically Significant

Improvements in Eating Control

Patients Experienced Statistically Significant

Improvements in Eating Control

-20

-15

-10

-5

0

5

*

*

*

Change from baseline (mm)

-20

-15

-10

-5

0

5

*

*

*

Change from baseline (mm)

Less

More

Placebo (N=511)

Contrave32 (N=471)

How difficult has it been to control your eating?

How often have you eaten in response to food cravings?

How difficult has it been to resist any food cravings?

How difficult has it been to control your eating?

How often have you had food cravings?

How difficult has it been to resist any food cravings?

*P<0.05 vs. Placebo; ITT-LOCF; results were measured based on

measurements using 100mm VAS scale Less

More

Placebo (N=456)

Contrave32 (N=702) |

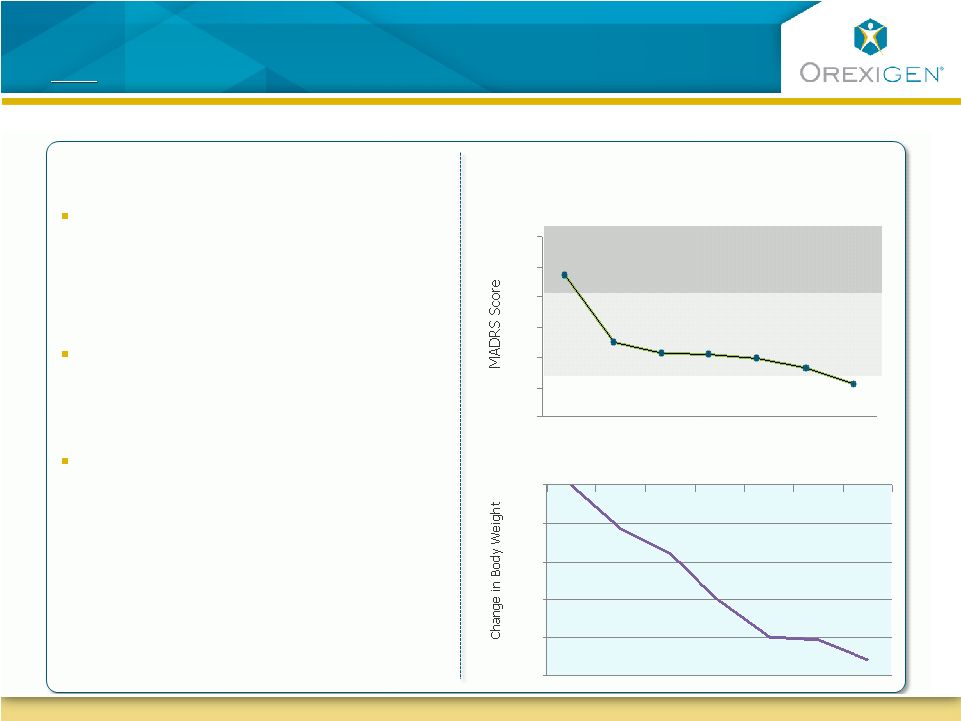

Depressed

Patients Experienced Significant Weight Loss and

Improvements in Depressive Symptoms

Depressed Patients Experienced Significant Weight Loss

and

Improvements in Depressive Symptoms

In a 24-week Phase 2 open-label trial

of obese depressed patients,

Contrave significantly improved

measures of depression

At the same time,

patients who

completed the trial lost over 9%

of their body weight

In addition, in a Control of Eating

Questionnaire, patients reported

decreases in hunger and cravings,

and less difficulty resisting cravings

Week 0

(N=23)

Week 12

(N=14)

Week 24

(N=13)

Not depressed

Mildly depressed

Moderately depressed

Montgomery Asberg Depression Rating Scale

(Observed Case)

Week 0

Week 12

Week 24

Change in Body Weight

(Observed Case)

Trial included 25 obese patients that met DSM-IV criteria for major depression.

0

5

10

15

20

25

30

-10%

-8%

-6%

-4%

-2%

0%

23 |

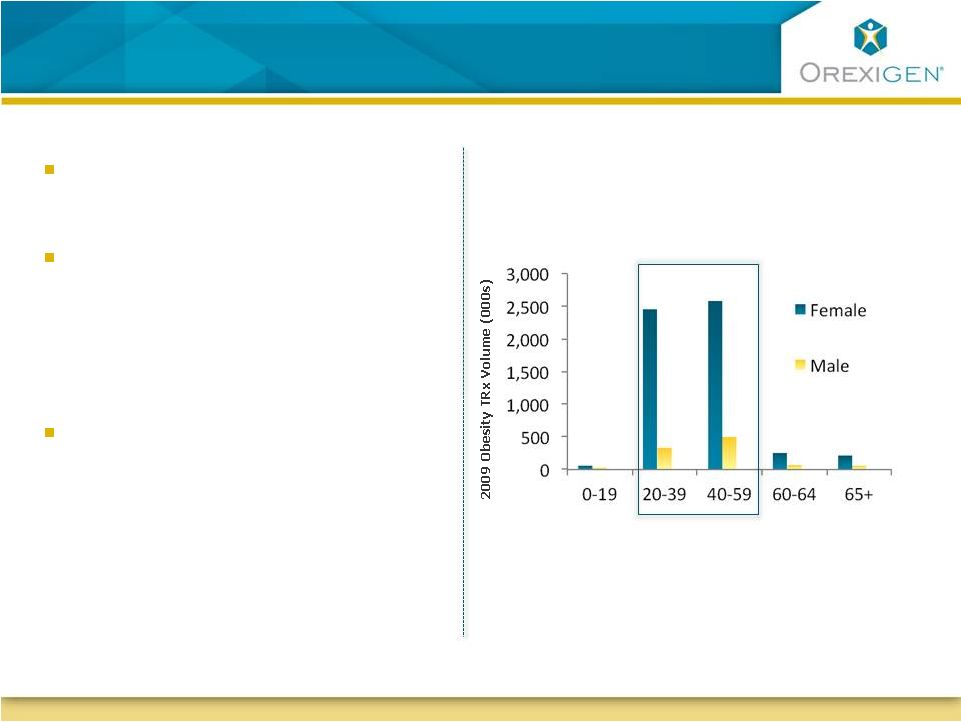

24

Contrave May Be The Logical Treatment Choice for

Women

Contrave May Be The Logical Treatment Choice for

Women

Source: Orexigen market research; IMS Health, National Disease and

Therapeutic Index, Obesity (2010) 18: 347-353 Women seek obesity therapy

more than men

Women tend to crave food more

than men, and younger women

tend to crave more than older

women

(Pelchat, 1997)

Female gender is one of the few

factors that has been consistently

associated with an increased risk

of depression among obese

individuals

(Ma, 2010)

Majority of the obesity Rxs today go to

women of child-bearing age

Age (years) |

25

Empatic™

is Following Behind Contrave Providing a

Different Tool for the Treatment of Obesity

Empatic™

is Following Behind Contrave Providing a

Different Tool for the Treatment of Obesity

Empatic™

(zonisamide SR / bupropion SR) works by stimulating POMC

and inhibiting AGRP/NPY

–

Enhances 5HT and DA release leading to synergistic effects on POMC

firing

Associated with robust effects on weight loss in Phase 2

Different profile of constituent drugs provides the potential for

alternative, complementary positioning vs. Contrave |

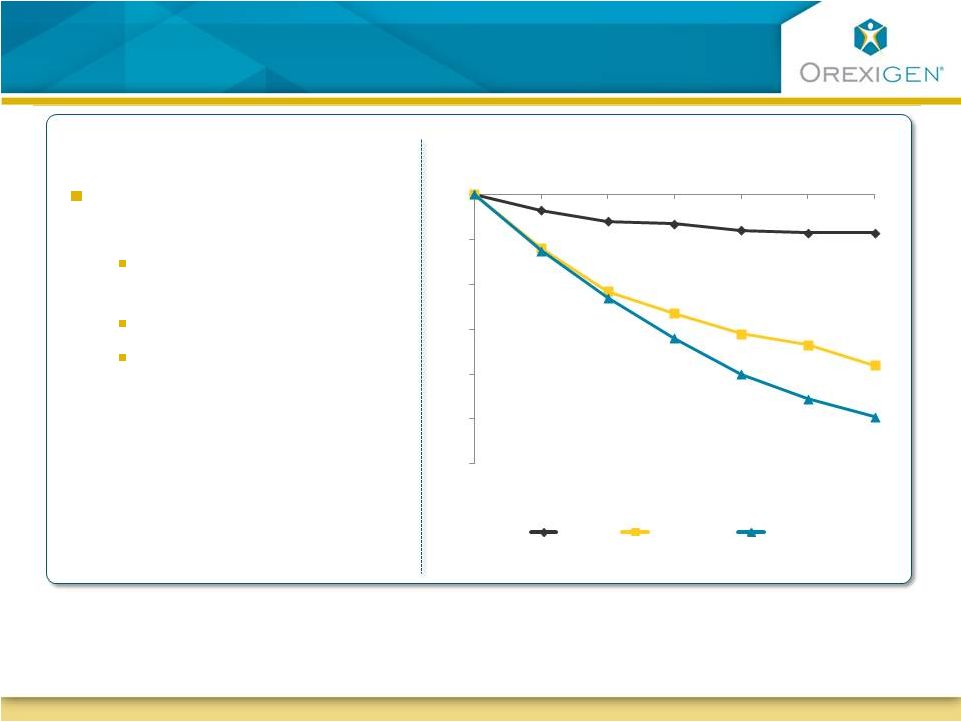

26

Empatic Demonstrates Early and Progressive

Weight Loss

Empatic Demonstrates Early and Progressive

Weight Loss

The most frequently reported adverse events in patients treated with Empatic were

headache, insomnia, nausea and constipation. The most common reasons for

discontinuation from treatment were insomnia, headache, irritability and nausea.

At 24 weeks, Empatic

demonstrates:

Clinically meaningful

weight loss

No evidence of plateau

Both Empatic doses

appear efficacious and

could provide dosing

flexibility

Observed Case Analysis

-12%

-10%

-8%

-6%

-4%

-2%

0%

4

8

12

16

20

24

Placebo

Empatic120

Empatic360

-9.9%

-7.6%

-1.7%

Study Week

Note :

All differences between Empatic and placebo statistically significant at all time points |

27

In a Phase IIa Empatic clinical trial, completers

demonstrated 15% weight loss at one year

In a Phase IIa Empatic clinical trial, completers

demonstrated 15% weight loss at one year

Completers

Modified

ITT-LOCF

Week

LS mean ±SE

ZB-201 through Week 48

Placebo (N=72 through Week 24)

ZB360 (N=66 through Week 24; N=39 from Week 28 through

48 )

18

15

12

9

6

3

0

0

4

8

12

16

20

24

28

32

36

40

44

48

52

-

-

-

-

-

- |

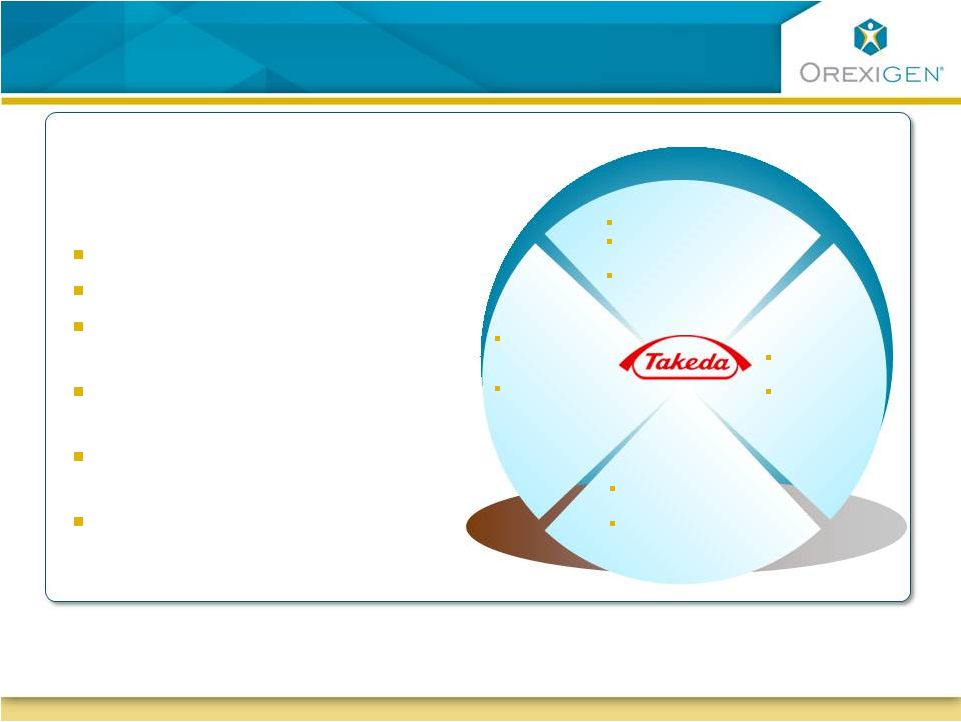

28

Commercialization plans

Commercialization plans

North American Contrave rights

$50mm upfront to Orexigen

$1 billion milestones including

$100mm before first sale

Tiered royalties on net sales

from 20 –

35%

Takeda has multi-year contractual

promotional requirements

Orexigen retains a right to co-

promote, paid for by Takeda

under certain circumstances

Heavy Resourcing for Contrave:

Takeda is an ideal partner

Licensing terms:

SCALE

Top 15 Pharma

Significant U.S.

Presence

Primary Care Focus

COMMITMENT TO

OBESITY

Partnership

with Amylin

Stated

Strategy

DOMAIN

EXPERIENCE

Leader in

Cardiometabolic

Care

Excellence in

Life Cycle

Management

SUCCESSFUL

BRAND BUILDER

Actos ~$3B in U.S.

Sales in 2009

Prevacid ~$3B in

U.S. Sales in 2009

•

ROW Strategy: Partner Contrave and Empatic

•

Orexigen plans to keep U.S. Empatic rights |

29

Attractive Value Proposition for Orexigen

Attractive Value Proposition for Orexigen

Significant revenue potential projected from lead product, Contrave

Retained ROW rights for future catalysts and upside

Sufficient cash (~$126.2m as of June 30, 2012) to fund operations

through Contrave NDA resubmission

World-class clinical advisory board to steer the Light Study

Large capable partner in Takeda responsible for North American

commercialization

Maintain global rights to second product candidate, Empatic, which

has completed Phase II

Focused, experienced and capable team |

30 |