Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Encompass Health Corp | bairdform8-k.htm |

September Healthcare Conferences

The information contained in this presentation includes certain estimates, projections and other forward- looking information that reflect our current outlook, views and plans with respect to future events, including legislative and regulatory developments, strategy, capital expenditures, development activities, dividend strategies, effective tax rates, financial performance, and business model. These estimates, projections and other forward-looking information are based on assumptions that HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between such estimates and actual events or results, and those differences may be material. There can be no assurance that any estimates, projections or forward-looking information will be realized. All such estimates, projections and forward-looking information speak only as of the date hereof. HealthSouth undertakes no duty to publicly update or revise the information contained herein. You are cautioned not to place undue reliance on the estimates, projections and other forward-looking information in this presentation as they are based on current expectations and general assumptions and are subject to various risks, uncertainties and other factors, including those set forth in the Form 10-K for the year ended December 31, 2011, the Form 10-Q for quarters ended March 31, 2012 and June 30, 2012, and in other documents we previously filed with the SEC, many of which are beyond our control, that may cause actual results to differ materially from the views, beliefs and estimates expressed herein. Note Regarding Presentation of Non-GAAP Financial Measures The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934. Schedules are attached that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with Generally Accepted Accounting Principles in the United States. Our Form 8-K, dated September 5, 2012, provides further explanation and disclosure regarding our use of non-GAAP financial measures and should be read in conjunction with these supplemental slides. Forward-Looking Statements 2

Portfolio – As of June 30, 2012 99 Inpatient Rehabilitation Hospitals (“IRF”) • 29 operate as JV’s with Acute Care Hospitals 26 Outpatient Rehabilitation Satellite Clinics 25 Hospital-Based Home Health Agencies 27 + Puerto Rico Number of States ~ 22,500 Employees Key Statistics – Trailing 4 Quarters ~ $2.1 Billion Revenue 121,006 Inpatient Discharges 922,426 Outpatient Visits Patients Served Most Common Conditions (Q2 2012): 1. Neurological 20.4% 2. Stroke 16.8% 3. Other orthopedic conditions 9.7% 4. Fracture of the lower extremity 9.5% 5. Debility 9.0% 3 Largest Owner and Operator of Inpatient Rehabilitation Hospitals in the U.S. New Hospitals Under construction, Ocala, FL; expect to be operational Q4 2012 Under construction, Stuart, FL; expect to be operational Q2 2013 Under construction, Littleton, CO; expect to be operational Q2 2013 Purchased land for southwest Phoenix, AZ; expect to be operational Q3 2013 CON approved for 50-bed hospital in Orlando, FL CON approved for Middletown, DE; being contested CON approved for Williamson Co, TN; being contested Marketshare ~ 8% of IRFs (Total in U.S. = 1,152) ~ 18% of Licensed Beds ~ 23% of Patients Served Our Company

6 Months 2012 Highlights 4 $252.1 $232.8 $0 $75 $150 $225 $300 +8.3% 6M 2012 6M 2011 Adjusted EBITDA (1) $1,072.0 $1,011.1 $300 $600 $900 $1,200 +6.0% 6M 2012 6M 2011 Net Operating Revenues 61,590 0 20,000 40,000 60,000 80,000 6M 2012 6M 2011 +4.5% Discharge Volume $0.79 $0.00 $0.40 $0.80 6M 2012 6M 2011 Earnings Per Share (2) (1) Reconciliation to GAAP provided on slides 14 – 17. (2) Income from continuing operations attributable to HealthSouth per diluted share for the first six months of 2012 was $0.79 per share compared to $0.74 per share for the same period of 2011. Earnings per share for the first six months of 2012 reflected strong operating results and an effective income tax rate of approximately 39%. Earnings per share in the first six months of 2011 reflected an effective income tax rate benefit of approximately (4.4%) due primarily to a $0.27 per diluted share income tax benefit that resulted from a settlement of federal income tax claims with the Internal Revenue Service for tax years 2007 and 2008 and a reduction in unrecognized tax benefits due to the lapse of the statute of limitations for certain federal and state claims. (millions) (millions) 58,938 $0.74

Volume: • Q3 2012 discharge growth is in line with the higher end of the previously disclosed expectations for July through December 2012 of 2.5% to 3.5%. ― Q3 2011 discharge growth was 5.1% Balance Sheet: • HealthSouth amended its credit agreement ― Increased the size of the revolver from $500 million to $600 million ― Eliminated the former $100 million term loan ― Extended the maturity to 2017 ― Lowered the interest rate spread by 50 bps Growth: • Acquired 34-bed inpatient rehabilitation unit from CHRISTUS; relocated to 108-bed HealthSouth Rehabilitation Institute of San Antonio. Q3 2012 Observations & Considerations (as of Sept 5, 2012) 5

Q3 2012 Observations & Considerations (as of Sept 5, 2012)(cont.) Growth: • Completing construction on 40-bed inpatient rehabilitation hospital in the Ocala, FL market ―Operational in Q4 2012 • Continued construction on 40-bed inpatient rehabilitation hospital in Littleton, CO (South Denver) ―Operational in Q2 2013 • Continued construction on 34-bed inpatient rehabilitation hospital in Stuart, FL (a joint venture with Martin Health Systems) ―Operational in Q2 2013 • Began permitting on 40-bed inpatient rehabilitation hospital in Southwest Phoenix, AZ ―Operational in Q3 2013 6

De Novo (40 bed) Assumptions and Timing 7 (1) Future cash payback periods may increase when the Company exhausts its significant NOLs. (2) Does not include Middletown, DE or Williamson Co., TN where CON awards are under appeal All projects have minimum IRR target of 15% (pre-tax). Investment Considerations • Target 4 openings/Year • Cash Payback (1) = 5 to 7 years • Assumes sequestration in 2013 • Inclusive of CON costs (where applicable) • Includes cost of CIS installation • All private rooms • First 30 patients treated for “zero” revenue (Medicare pre-certification) • Core infrastructure of building anticipates future expansion; potential to enhance returns with future bed expansion Capital Cost (millions) Low High Operational Date Location (2) Beds Construction, design, permitting, etc. $11.5 $15.5 Q1 2014 Orlando, FL 50 Land 2.0 2.5 Q3 2013 Q2 2013 Q2 2013 Southwest Phoenix, AZ Littleton, CO Stuart, FL 40 40 34 Equipment (including CIS) 3.5 4.0 $17.0 $22.0 Pre-Opening Expense (thousands) Low High Q4 2012 Ocala, FL 40 Operating $200 $300 Q4 2011 Cypress, TX 40 Salaries, wages, benefits 150 200 Q3 2010 Q2 2010 Bristol,VA Loudoun County, VA 25 40 $350 $500 Q3 2009 Mesa, AZ 40

2012 Guidance – (as of September 5, 2012) (1) Reconciliation to GAAP provided on slides 14 - 17. (2) Estimated effective income tax rate using pre-tax income from continuing operations attributable to HealthSouth 8 2012 Adjusted EBITDA (1) $487 million to $495 million (Represents 4.5% to 6.2% over 2011) Earnings per Share from Continuing Operations Attributable to HealthSouth $1.45 to $1.50 Considerations: Revenue growth of 3.7% to 5.3% (July through December 2012) ― Discharge growth between 2.5% and 3.5% (July through December 2012) ― Revenue per discharge growth between 2.0% and 2.5% (July through December 2012) ― Home health revenues subject to approx. $1.0 million reduction related to the 2012 Medicare Home Health rule Higher bad debt expense of approx. 1.3% of revenues (approx. $3 million more in second half of 2012) Installation of new clinical information system in twelve existing hospitals expected to increase operating expenses by approx. $3 million in second half 2012 Higher workers’ compensation expense of approx. $2 million in second half of 2012 Q4 2011 Adjusted EBITDA benefited by $2.4 million from a nonrecurring franchise tax recovery Considerations: Assumes provision for income tax of approx. 39% in 2012 vs. approx. 19% in 2011 (2) Cash taxes expected to be $8 to $12 million Basic share count of 94.6 million shares

Strong and Sustainable Business Fundamentals • Located in Medicare growth markets • Flexible, accelerated de novo strategy • Hospital acquisitions and unit consolidations Growth Opportunities • Strong balance sheet; ample liquidity, no near-term maturities • Minimal cash income tax expense ($8 - $12 million / year) attributable to NOLs • Substantial free cash flow generation Financial Strength • #1 market share: above industry same-store growth and margins • Consistent achievement of high-quality, cost-effective care • Roll-out of state-of-the-art clinical information system Industry Leading Position • Favorable demographic trends • Non-discretionary nature of many conditions treated in IRFs • Highly fragmented industry Attractive Healthcare Sector 9 • Focused labor management • Continued improvements in supply chain • Significant operating leverage of G&A expense Cost-Effectiveness • Portfolio of strategically located, well-designed physical assets • 99 IRFs (1); 65 owned and 34 long-term, real estate leases • Relatively low maintenance capex requirements Real Estate Portfolio (1) Inclusive of non-consolidated entities

Appendix

HealthSouth’s volume growth has outpaced competitors’ (1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry, including HealthSouth sites. (2) Includes consolidated HealthSouth inpatient rehabilitation hospitals classified as same store during that time period. Historic Discharge Growth vs. Industry - 30,000 60,000 90,000 120,000 2008 2009 2010 2011 2012 Q4 Q3 Q2 Q1 3.0% 6.0% 4.7% 5.9% 5.9% 5.8% 5.9% 2.7% 2.5% 1.3% 11 4.2% 5.0% 1.2% 3.5% 1.4% 4.0% -0.5% 1.7% 2.0% 5.0% -0.5% 1.9% Quarterly • TeamWorks = standardized and enhanced sales & marketing • Bed additions will help facilitate continued organic growth 2.1% 5.1% 6.1% 7.8% Yearly Discharge 6.9% 5.6% 3.1% 5.2% 4.5% Growth (6 Months) Q111 vs. Q211 vs. Q311vs. Q411 vs. Q112 vs. Q212 vs. Q110 Q210 Q310 Q410 Q111 Q211 Quarterly Discharge Growth Same Store HealthSouth vs. Industry UDS Industry Sites (1) HLS Same Store (2) 1.8% 6.5% 1.0% 5.0% 1.4% 1.9% 3.3% 0.9% 3.4% Yearly 2011 2012 2008 │ 2009 │ 2010 │ 2011 │ -1.4% 6 Months 2012

Priorities for Reinvesting Free Cash Flows 12 •Growth in core business Bed expansions (80-100 beds) De novo hospitals (complete Ocala; start 4 others) Acquisitions (target 2/year) (1) − Free standing IRFs − Hospital unit Growth Prioritie s A lt e rn a te O p p o rt u n it ie s Debt Reduction • Debt prepayment • Purchase leased properties (2) Shareholder Distribution • Convertible preferred stock repurchase ($125 million authorization) • Common share repurchase ($125 million authorization) • Cash dividends (one time or regular) 6 Months 2012 - $9.0 $46.5 - - $55.5 2012 Assumptions 6 Months 2012 $20 to $25 $10.7 $50 to $70 $17.0 TBD $2.1 $70 to $95, excluding acquisit ions $29.8 (millions) (1) Acquired 12 inpatient rehabilitation beds from a hospital in Andalusia, AL in order to add beds at our Dothan, AL hospital. (2) Includes the purchase of the real estate (previously subject to an operating lease) associated with our joint venture hospital in Fayetteville, AR for approx. $15 million, half of which was reimbursed to us by our joint venture partner through a capital contribution; also includes an initial investment for a replacement hospital for our currently leased hospital in Ludlow, MA.

$0 $10 $20 $30 $40 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Total Medicare Spending on Post-Acute Services $63.5 billion in 2011 Note: These numbers are program spending only and do not include beneficiary copayments. Sources: Center for Medicare & Medicaid Services, Medicare Trustees Report May 2012 – Page 6, MedPAC Data Book, June 2012 – page 118, MedPAC Report to Congress, Medicare Payment Policy, March 2012 – pages 184,193, 225, 227, 248, 251, 271, and 272. Medicare Spending on Post-Acute Services Skilled nursing facilities 18.5% Home health agencies 19.4% Inpatient rehabilitation hospitals 8.8% Long-term acute care hospitals 6.4% 13 2010 Medicare Margin Post-Acute Settings Inpatient rehabilitation spending (% of total Medicare spending) 1.8% 2.1% 2.2% 2.1% 1.9% 1.5% 1.4% 1.3% 1.2% 1.2% 1.2% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Projected 2012 Medicare Margins >14% 13.7% 8.0% 4.8%

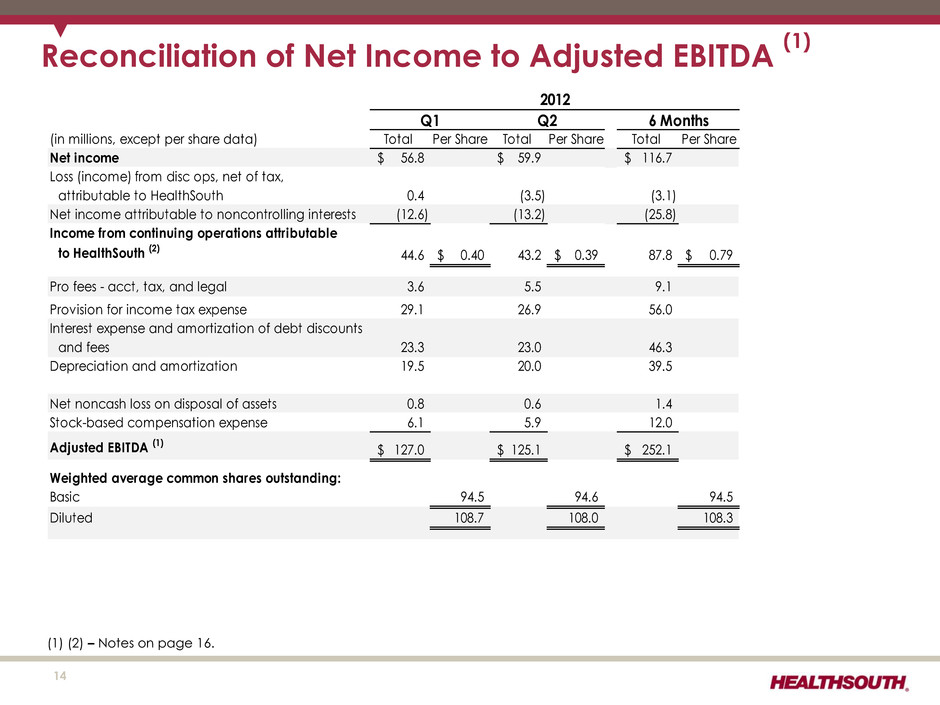

Reconciliation of Net Income to Adjusted EBITDA (1) (1) (2) – Notes on page 16. (in millions, except per share data) Total Per Share Total Per Share Total Per Share Net income 56.8$ 59.9$ 116.7$ Loss (income) from disc ops, net of tax, attributable to HealthSouth 0.4 (3.5) (3.1) Net income attributable to noncontrolling interests (12.6) (13.2) (25.8) Income from continuing operations attributable to HealthSouth (2) 44.6 0.40$ 43.2 0.39$ 87.8 0.79$ Pro fees - acct, tax, and legal 3.6 5.5 9.1 Provision for income tax expense 29.1 26.9 56.0 Interest expense and amortization of debt discounts and fees 23.3 23.0 46.3 Depreciation and amortization 19.5 20.0 39.5 Net noncash loss on disposal of assets 0.8 0.6 1.4 Stock-based compensation expense 6.1 5.9 12.0 Adjusted EBITDA (1) 127.0$ 125.1$ 252.1$ Weighted average common shares outstanding: Basic 94.5 94.6 94.5 Diluted 108.7 108.0 108.3 2012 Q1 Q2 6 Months 14

Reconciliation of Net Income to Adjusted EBITDA (1) (1) (2) – Notes on page 16. (in millions, except per share data) Total Per Share Total Per Share Total Per Share Total Per Share Total Per Share Net income 91.5$ 32.3$ 68.3$ 62.5$ 254.6$ (Income) loss from disc ops, net of tax, attributable to HealthSouth (17.6) (2.5) (34.8) 5.0 (49.9) Net income attributable to noncontrolling interests (11.7) (10.4) (11.3) (12.5) (45.9) Income from continuing operations attributable to HealthSouth (2) 62.2 0.57$ 19.4 0.14$ 22.2 0.17$ 55.0 0.50$ 158.8 1.42$ Gov't, class action, and related settlements - (10.6) - (1.7) (12.3) Pro fees - acct, tax, and legal 3.8 8.4 4.0 4.8 21.0 Provision for income tax (benefit) expense (7.4) 11.2 18.1 15.2 37.1 Interest expense and amortization of debt discounts and fees 35.1 34.9 26.3 23.1 119.4 Depreciation and amortization 19.5 19.6 19.5 20.2 78.8 Loss on early extinguishment of debt - 26.1 12.7 - 38.8 Net noncash loss on disposal of assets 0.1 1.0 2.8 0.4 4.3 Stock-based compensation expense 4.2 5.3 4.9 5.9 20.3 Adjusted EBITDA (1) 117.5$ 115.3$ 110.5$ 122.9$ 466.2$ Weighted average common shares outstanding: Basic 93.1 93.3 93.3 93.3 93.3 Diluted 109.0 109.5 109.2 109.1 109.2 2011 Q1 Q2 Full YearQ3 Q4 15

Reconciliation Notes for Slides 14-15 1. Adjusted EBITDA is a non-GAAP financial measure. The Company’s leverage ratio (total consolidated debt to Adjusted EBITDA for the trailing four quarters) is, likewise, a non- GAAP financial measure. Management and some members of the investment community utilize Adjusted EBITDA as a financial measure and the leverage ratio as a liquidity measure on an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance or liquidity. In evaluating Adjusted EBITDA, the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments set forth. 2. Per share amounts for each period presented are based on diluted weighted average shares outstanding unless the amounts are antidilutive, in which case the per share amount is calculated using the basic share count after subtracting the quarterly dividend on the convertible perpetual preferred stock. The difference in shares between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred stock. 16

(Millions) 2012 2011 2012 2011 2011 2010 2009 2008 2007 Net cash provided by operating activities 114.0$ 68.6$ 195.0$ 158.1$ 342.7$ 331.0$ 406.1$ 227.2$ 230.6$ Provision for doubtful accounts (6.5) (5.0) (12.8) (9.8) (21.0) (16.4) (30.7) (23.0) (28.5) Professional fees—accounting, tax, and legal 5.5 8.4 9.1 12.2 21.0 17.2 8.8 44.4 51.6 Interest expense and amortization of debt discounts and fees 23.0 34.9 46.3 70.0 119.4 125.6 125.7 159.3 229.2 UBS Settlement proceeds, gross - - - - - - (100.0) - - Equity in net income of nonconsolidated affiliates 3.1 3.2 6.4 5.7 12.0 10.1 4.6 10.6 10.3 Net income attributable to noncontrolling interests in continuing operations (13.2) (11.3) (25.8) (23.1) (47.0) (40.9) (33.3) (29.8) (31.1) Amortization of debt discounts and fees (0.9) (1.2) (1.8) (2.4) (4.2) (6.3) (6.6) (6.5) (7.8) Distributions from nonconsolidated affiliates (2.2) (2.8) (5.5) (5.5) (13.0) (8.1) (8.6) (10.9) (5.3) Current portion of income tax expense (benefit) 2.2 0.7 4.3 (1.4) 0.6 2.9 (7.0) (72.8) (330.4) Change in assets and liabilit ies 1.5 17.4 38.4 28.3 49.9 2.8 (2.1) 50.6 5.5 Net premium paid on bond issuance/redemption - 18.0 - 13.9 22.8 - - - - Change in government, class action and related settlements liability - (10.8) - (6.5) (8.5) 2.9 11.2 7.4 171.4 Cash provided by operating activ ities of discontinued operations (1.3) (5.1) (1.7) (7.2) (9.1) (13.2) (5.7) (32.5) (3.3) Other (0.1) 0.3 0.2 0.5 0.6 2.0 1.3 (1.4) 14.5 Adjusted EBITDA 125.1$ 115.3$ 252.1$ 232.8$ 466.2$ 409.6$ 363.7$ 322.6$ 306.7$ Q2 Full Year6 Months Net Cash Provided by Operating Activities Reconciled to Adjusted EBITDA 17