Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ANDEAVOR LOGISTICS LP | d406099d8k.htm |

| EX-99.1 - PRESS RELEASE - ANDEAVOR LOGISTICS LP | d406099dex991.htm |

Exhibit 99.2

SUMMARY

This summary highlights selected information contained elsewhere in this offering memorandum. You should carefully read the entire offering memorandum, including the “Risk Factors” and the combined consolidated financial statements and related notes included elsewhere in this offering memorandum, before making an investment decision. The following summary is qualified in its entirety by the more detailed information and financial statements and notes thereto included elsewhere in this offering memorandum. You should consider, among other things, the matters set forth in “Risk Factors” before deciding to invest in the notes.

The Company

We are a fee-based, growth-oriented Delaware limited partnership formed by Tesoro to own, operate, develop and acquire logistics assets. Our logistics assets are integral to the success of Tesoro’s refining and marketing operations and are used to gather crude oil and to distribute, transport and store crude oil and refined products. Our assets consist of a crude oil gathering system in the Bakken Shale/Williston Basin area of North Dakota and Montana, eight refined products terminals in the midwestern and western United States, one crude oil marine terminal in California, a crude oil and refined products storage facility and five related short-haul pipelines in Utah. Our common units trade on the New York Stock Exchange (the “NYSE”) under the symbol “TLLP.”

We generate revenue by charging fees for gathering, transporting and storing crude oil and for terminalling, transporting and storing crude oil and refined products. Since we do not own any of the crude oil or refined products that we handle nor engage in the trading of crude oil or refined products, we have minimal direct exposure to risks associated with commodity price fluctuations. However, these risks indirectly influence our activities and results of operations over the long term through their effects on our customers’ operations. Currently, substantially all of our revenue is derived from Tesoro under various long-term, fee-based commercial agreements that generally include minimum volume commitments.

For LTM June 30, 2012, giving pro forma effect to the Transactions (as defined in “— The Transactions”), we would have had revenues of approximately $136 million and Adjusted EBITDA of approximately $74 million. See “— Summary Historical and Pro Forma Combined Consolidated Financial and Operating Data” for reconciliations of our pro forma net income to pro forma Adjusted EBITDA.

Our Assets and Operations

Our operations are divided into two segments: our crude oil gathering segment and our terminalling, transportation and storage segment. For LTM June 30, 2012, we had pro forma revenue of $58.9 million from our crude oil gathering segment and revenue of $77.5 million from our terminalling, transportation and storage segment.

Crude Oil Gathering. Our crude oil gathering system in North Dakota and Montana, which we refer to as our High Plains system, includes approximately 700 miles of common carrier pipeline (the “High Plains Pipeline”), approximately 40,000 barrels per day (“bpd”) of truck-based crude oil gathering, and related storage assets. This system gathers and transports crude oil produced in the Williston Basin, including production from the Bakken Shale formation. We refer to this area, a significant portion of which is serviced by our High Plains system, as the Bakken Shale/Williston Basin area. The High Plains Pipeline has the capacity to deliver more than 85,000 bpd to Tesoro’s Mandan, North Dakota Refinery (which was recently expanded to 68,000 bpd capacity), 9,000 bpd to a third-party pipeline at Richey, Montana, and up to 40,000 bpd to third-party pipelines from our Ramberg, North Dakota station.

Terminalling, Transportation and Storage. We own and operate eight refined products terminals with aggregate truck and barge delivery capacity of approximately 239,300 bpd. We also own and operate a crude oil marine terminal with barge delivery capacity of approximately 145,000 bpd. The terminals

1

provide distribution at Tesoro’s refineries located in Wilmington and Martinez, California (the Wilmington and Martinez refineries, respectively); Salt Lake City, Utah (the Utah refinery); Kenai, Alaska (the Alaska refinery); Anacortes, Washington (the Washington refinery); and Mandan, North Dakota (the North Dakota refinery). The assets we received in the Martinez Contribution included a single-berth dock, which has an estimated throughput capacity of approximately 145,000 bpd, five associated crude oil storage tanks with a combined capacity of 425,000 barrels, five short-haul pipelines and two firewater tanks with 48,000 barrels of shell capacity. We also own and operate assets that exclusively support Tesoro’s Utah refinery, including a refined products and crude oil storage facility with total shell capacity of approximately 878,000 barrels and three short-haul crude oil supply pipelines and two short-haul refined product delivery pipelines connected to third-party interstate pipelines.

Our Commercial Agreements with Tesoro

All of our operations are strategically located within Tesoro’s refining and marketing supply chain and substantially all of our revenues are generated by providing services to Tesoro’s refining and marketing businesses under various long-term, fee-based commercial agreements with Tesoro. Under these agreements, most of which we entered into in connection with our initial public offering (“IPO”) and many of which have since been amended, we provide pipeline transportation, trucking, terminal distribution and storage services to Tesoro, and Tesoro commits to provide us with minimum monthly throughput volumes of crude oil and refined products. These commercial agreements with Tesoro include:

| • | a 10-year pipeline transportation services agreement under which Tesoro pays us fees for gathering and transporting crude oil on our High Plains system; |

| • | a 5-year amended crude oil trucking transportation services agreement under which Tesoro pays us fees for trucking related services and scheduling and dispatching services that we provide through our High Plains truck-based crude oil gathering operation; |

| • | a 10-year master terminalling services agreement under which Tesoro pays us fees for providing terminalling services at our eight refined products terminals; |

| • | a 10-year terminalling use and throughput agreement under which Tesoro pays us fees for providing terminalling services at the Martinez Terminal, which became effective April 1, 2012, the date of the Martinez Contribution; |

| • | a 10-year pipeline transportation services agreement under which Tesoro pays us fees for transporting crude oil and refined products on our five Salt Lake City (“SLC”) short-haul pipelines; and |

| • | a 10-year SLC storage and transportation services agreement under which Tesoro pays us fees for storing crude oil and refined products at our SLC storage facility and transporting crude oil and refined products between the storage facility and Tesoro’s Utah refinery through interconnecting pipelines on a dedicated basis. |

For additional information about these commercial agreements, as well as other revenue we receive from Tesoro and third parties, please read “Business — Overview — Commercial Agreements with Tesoro,” “Business — Overview — Other Agreements with Tesoro” and “Certain Relationships and Related Party Transactions — Commercial Agreements, Omnibus Agreement and Operational Services Agreement.”

In addition to our commercial agreements with Tesoro, we are also party to an omnibus agreement and an operational services agreement with Tesoro. Under the omnibus agreement, which was amended and restated effective April 1, 2012, Tesoro has agreed not to engage in the business of owning or operating crude oil or refined products pipelines, terminals or storage facilities in the United States that are not integral to a Tesoro refinery, subject to certain exceptions. In addition, under the omnibus agreement, Tesoro has granted us a right of first offer to acquire certain of its logistics assets, including terminals,

2

pipelines, docks, storage facilities and other related logistic assets located in Alaska, California and Washington, to the extent it decides to sell, transfer or otherwise dispose of any of those assets. As of June 30, 2012, giving pro forma effect to the Transactions, the aggregate gross book value of Tesoro’s logistics assets on which we have a right of first offer would have been approximately $108 million. The consideration to be paid by us for logistics assets, if any, offered to us in the future by Tesoro, as well as the consummation and timing of any acquisition by us of these assets, would depend upon, among other things, the timing of Tesoro’s decision to sell, transfer or otherwise dispose of these assets and our ability to successfully negotiate a price and other purchase terms for these assets. Management of our general partner will negotiate the terms of any acquisition with management of Tesoro, subject to approval of our general partner’s board of directors and, if our general partner’s board of directors so authorizes, the conflicts committee of our general partner’s board of directors. The omnibus agreement also addresses our payment of a fee to Tesoro for the provision of various centralized corporate services, Tesoro’s reimbursement of us for certain capital expenditures, and Tesoro’s indemnification of us for certain matters, including environmental, title and tax matters. Please read “Certain Relationships and Related Party Transactions — Commercial Agreements, Omnibus Agreement and Operational Services Agreement.”

Under our operational services agreement with Tesoro, which was amended and restated effective April 1, 2012, we periodically reimburse Tesoro for the provision of certain support services to us in support of our assets, and we also pay Tesoro an annual fee for support services performed by certain of Tesoro’s field-level employees in support of our pipelines, terminals and storage facilities. Please read “Business — Overview — Other Agreements with Tesoro — Amended and Restated Operational Services Agreement.”

Business Strategies

Our primary business objectives are to maintain stable cash flows and to increase our quarterly cash distribution per unit over time. We intend to accomplish these objectives by executing the following strategies:

| • | Focus on Stable, Fee-Based Business. We intend to focus on opportunities to provide committed, fee-based logistics services to Tesoro and third parties. We believe that our long-term fee-based contracts with Tesoro will enhance the stability of our cash flows and minimize our direct exposure to commodity price fluctuations. |

| • | Pursue Attractive Organic Expansion Opportunities. We intend to evaluate investment opportunities to make capital investments to expand our existing asset base that may arise from the growth of Tesoro’s refining and marketing business or from increased third-party activity in our areas of operations. We intend to focus on organic growth opportunities that complement our existing asset base or provide attractive returns in new areas within our geographic footprint. With expected production growth in the Bakken Shale/Williston Basin area, we continue to evaluate opportunities to expand our High Plains system to provide critical takeaway capacity for crude oil producers. For example, we expect to invest a total of approximately $63.0 million in projects that are expected to increase volumes on our High Plains system to over 100,000 bpd in 2013. |

We also evaluate opportunities to expand our terminal operations to meet rising demand in Tesoro’s core areas of operation. As a result of our strategic relationship with Tesoro, if Tesoro requires expanded logistics infrastructure and capabilities to support its refining and marketing operations, we expect to be favorably positioned to construct and operate the necessary logistics assets. For example, Tesoro recently completed an expansion of its North Dakota refinery from 58,000 to 68,000 bpd and is utilizing our High Plains system to deliver the incremental crude oil supply. We expect to spend approximately $36.0 million on projects to further grow terminalling volumes by over 40,000 bpd through optimization and expansion in 2013.

3

| • | Grow Through Strategic Acquisitions. We plan to pursue accretive acquisitions of complementary assets from Tesoro as well as from third parties. In order to provide us with initial acquisition opportunities, Tesoro has granted us a right of first offer to acquire certain logistics assets that it retained following our IPO. As Tesoro executes its growth strategy, which may include the acquisition of additional assets, we believe we are well-positioned to acquire any associated logistics assets as those opportunities arise. For example, TRMC contributed its Martinez Terminal to us effective April 1, 2012, and in connection with this offering of notes TRMC expects to contribute through TLGP to us its Long Beach Marine terminal and Los Angeles short-haul pipelines. See “The Transactions.” Our third-party acquisition strategy is focused on logistics assets in the western half of the United States where we believe our knowledge of the market will provide us with a competitive advantage. We intend to pursue these third-party acquisition opportunities independently as well as jointly with Tesoro. |

| • | Optimize Existing Asset Base and Pursue Third-Party Volumes. We seek to enhance the profitability of our existing assets by pursuing opportunities to add Tesoro and third-party volumes, improve operating efficiencies and increase utilization. Historically, Tesoro operated its logistics assets primarily in support of its refining and marketing business. As a result, we have available capacity on our High Plains system and in many of our refined product terminals where we believe we have the ability to increase utilization with minimal capital investment. On the High Plains system, we continue to evaluate several opportunities to increase utilization, including receipt and delivery interconnections with third-party pipeline systems. For example, we established tariffs to the Bridger pipeline at Richey, Montana starting in April 2012 and an interconnect to the Rangeland crude oil terminal at Dry Fork, North Dakota starting in May 2012. |

As a result of the strategic locations of many of our refined product terminals, we are also evaluating the potential demand for increased access to our terminals where we have available capacity. We also continue to explore various strategic initiatives to improve operating efficiencies at some of our terminals that would increase capacity for additional volumes from Tesoro and potential third parties.

Competitive Strengths

We believe we are well positioned to achieve our primary business objectives and execute our business strategies based on the following competitive strengths:

| • | Long-Term, Fee-Based Contracts. Currently, we generate a substantial majority of our revenue under long-term, fee-based contracts with Tesoro. We believe that these contracts promote cash flow stability and minimize our direct exposure to commodity price fluctuations, although these risks indirectly influence our activities and results of operations over the long term. Under these contracts, Tesoro has committed to ship a minimum volume of crude oil on our High Plains system, to deliver a minimum volume of refined products through our terminals, to transport a minimum volume of crude oil through our Martinez Terminal, to transport a minimum volume of crude oil and refined products on our five short-haul pipelines in Salt Lake City and to store crude oil and refined products at our SLC storage facility and transport crude oil and refined products between the storage facility and Tesoro’s Utah refinery on a dedicated basis. These contracts contain fees that are indexed for inflation. |

| • | Relationship with Tesoro. We have a strategic relationship with Tesoro, which we believe will provide us with a stable base of cash flows as well as opportunities for growth. All of our logistics assets are directly linked to Tesoro’s refining and marketing operations. Our High Plains system currently delivers all of the crude oil processed by Tesoro’s North Dakota refinery and our refined product terminals provide critical storage and distribution infrastructure for six of Tesoro’s seven refineries. Tesoro accounted for, giving pro forma effect to the Transactions, 92% of our revenues |

4

| during LTM June 30, 2012. Giving pro forma effect to the Transactions, as of June 30, 2012, we would have had a right of first offer to acquire certain logistics assets, with a gross book value of approximately $108 million, that were retained by Tesoro at the time of our IPO. We believe we are well-positioned to partner with Tesoro in the construction or acquisition of new logistics infrastructure associated with Tesoro’s refining and marketing growth initiatives. We also expect to benefit from Tesoro’s extensive operational, commercial and technical expertise, as well as its industry relationships throughout the midstream and downstream value chain, as we look to optimize and expand our existing asset base. |

| • | Assets Positioned in Areas of High Demand. Our High Plains system is located in the Williston Basin, one of the most prolific onshore oil producing basins in North America, and gathers and transports production from the Bakken Shale formation. The Bakken Shale, which is within the Williston Basin, has emerged as one of the most attractive resource plays in North America, with estimated technically recoverable reserves of approximately 3.65 billion barrels (according to United States Geological Survey estimates published in April 2008). We expect producers to invest substantial capital to develop the Bakken Shale and other emerging plays in the Williston Basin. A development of this scale will require substantial investment in pipeline and storage infrastructure, and we believe that our existing footprint will give us a strategic advantage to capitalize on this opportunity. |

In addition, most of our terminalling assets are located in the Mountain and Pacific regions of the United States, which the Energy Information Administration (the “EIA”) expects to see greater growth rate in refined products demand than the U.S. national average over the next 25 years, with the Mountain region expected to have the highest refined products demand growth rate of any U.S. region over the same period. We believe there is an opportunity to capitalize on this increased demand for refined products in our markets by optimizing our existing available capacity and pursuing acquisitions and other growth opportunities. For example, in 2011, we invested capital to expand the services offered by, and capacity of, our terminals including the addition of ethanol blending capabilities at our SLC and Burley terminals.

| • | Experienced Management Team. Our management team has significant experience in the management and operation of logistics assets and the execution of expansion and acquisition strategies. Our management team includes some of the most senior officers of Tesoro. |

| • | Financial Flexibility. We believe we will have the financial flexibility to execute our growth strategy through the available capacity under our revolving credit facility and our ability to access the debt and equity capital markets. At the close of this offering, giving pro forma effect to the Transactions, we expect to have approximately $299.7 million of borrowing capacity under the revolving credit facility. |

Our Relationship with Tesoro

One of our principal strengths is our relationship with Tesoro. Tesoro is the fourth largest independent refiner in the United States by crude capacity and, through its subsidiaries, owns and operates seven refineries that serve markets in Alaska, Arizona, California, Hawaii, Idaho, Minnesota, Nevada, North Dakota, Oregon, Utah, Washington and Wyoming. Tesoro also sells transportation fuels and convenience products through a network of approximately 1,375 retail stations, primarily under the Tesoro ®, Shell ®, and USA Gasoline TM brands. For LTM June 30, 2012, Tesoro had consolidated revenues of approximately $31.7 billion, operating income of $1.3 billion, net earnings of $689 million and, as of June 30, 2012, had consolidated total assets of approximately $10.4 billion. Tesoro Corporation’s common stock trades on the NYSE under the symbol “TSO.”

5

Tesoro owns and operates substantial crude oil and refined products logistics assets and maintains a significant interest in us through its ownership of 52% of our outstanding partnership units (including a 2% general partner interest) as well as all of our incentive distribution rights. Given Tesoro’s significant ownership in and its intent to continue to use us as the primary vehicle to grow its logistics operations, we believe Tesoro continues to be motivated to promote and support the successful execution of our business strategies. In particular, we believe it will be in Tesoro’s best interest for it to contribute additional logistics assets to us over time and to facilitate organic growth opportunities and accretive acquisitions from third parties, although Tesoro is under no obligation to contribute any assets to us or accept any offer for its assets that we may choose to make.

We believe the terms and conditions of all of our agreements with Tesoro are generally no less favorable to either party than those that could have been negotiated with unaffiliated parties with respect to similar services.

The Transactions

Substantially concurrently with the completion of this offering, TRMC is expected to contribute through TLGP to us its Long Beach Marine terminal and Los Angeles short-haul pipelines in exchange for total consideration of approximately $210 million, comprised of approximately $189 million in cash and the remaining $21 million in partnership units (the “Concurrent Contribution”). We estimate that this contribution would have resulted in approximately $5.9 million of incremental EBITDA for the quarter ended June 30, 2012 (consisting of net income of $2.1 million, plus $0.4 million of depreciation and amortization expenses and $3.4 million of interest and financing costs, net). Going forward, we expect these assets will result in an estimated $22.0 million of incremental annual EBITDA.

The Long Beach Marine terminal is comprised of a wharf with a two-vessel berth dock leased from the City of Long Beach and six storage tanks with a combined capacity of 235,000 barrels. These assets receive and load crude oil, intermediate feedstocks and refined products through marine vessel deliveries for transportation to and from the Wilmington refinery and other third-party facilities. The total throughput capacity for these assets is estimated to be approximately 200,000 bpd.

The Los Angeles short-haul pipelines to be contributed consist of six pipelines, totaling approximately 15 miles in length, that transport crude oil and refined products to and from the Wilmington refinery, Tesoro’s Long Beach Marine Terminal, and various third-party facilities. Historically, the pipelines have transported approximately 45% to 60% of the Wilmington refinery’s overall crude oil supply, 100% of its marine based intermediate feedstock shipments and receipts, and routine finished petroleum products shipments and receipts. The aggregate short-haul pipeline throughput is expected to be approximately 70,000 bpd.

We intend to use the proceeds from this offering to fund our cash payment of approximately $189 million for the Concurrent Contribution and to repay approximately $118 million of outstanding indebtedness under our revolving credit facility. See “Use of Proceeds.” We expect to pay the $7.4 million of estimated fees and expenses related to this offering and the Concurrent Contribution with the remaining proceeds and cash on hand.

The Concurrent Contribution, this offering of notes and the use of proceeds therefrom as set forth under “Use of Proceeds” and the payment of estimated fees and expenses in connection with this offering and the Concurrent Contribution are collectively referred to as the “Transactions.”

Recent Developments

Tesoro Acquisition of BP Assets in Southern California

On August 13, 2012, Tesoro announced that TRMC had entered into a purchase and sale agreement with BP West Coast Products, LLC, and certain other sellers to purchase BP’s integrated Southern

6

California refining and marketing business (the “BP Acquisition”). The assets to be acquired by TRMC include BP’s 266,000 bpd Carson refinery located adjacent to the Wilmington refinery, three marine terminals, four land storage terminals, over 100 miles of pipelines, four product marketing terminals and approximately 800 dealer-operated retail stations in Southern California, Nevada and Arizona. In addition, the assets include the ARCO® brand and associated registered trademarks, as well as a master franchisee license for the ampm® convenience store brand. In addition, TRMC will acquire the sellers’ 51% ownership in the 400 megawatt gas supplied Watson cogeneration facility and a 350,000 metric ton per year anode coke calcining operation, both located near the Carson refinery. The transaction, which is subject to regulatory approval, is expected to close before mid-2013.

Tesoro has indicated that it intends to offer us the integrated logistics system to be acquired in the BP Acquisition in multiple transactions over the first twelve months following the closing of its BP Acquisition. The integrated logistics system, which we estimate to have a master limited partnership value of approximately $1.0 billion and believe would provide us with extensive regional product distribution capabilities, includes the three marine terminals, four land storage terminals, over 100 miles of pipelines (including connected access to the Los Angeles International Airport) and four product marketing terminals. Although Tesoro has indicated it will offer us these assets, it is not obligated to do so.

Anacortes Unit Train Unloading Facility

On August 2, 2012, Tesoro reaffirmed its intention to offer us the Anacortes, Washington unit train unloading facility. Tesoro also announced that it expects the facility, which includes facilities for dedicated trains of rail cars (“unit trains”) and has a permitted capacity to deliver up to 50,000 bpd of Bakken crude oil to Tesoro’s Washington refinery, to be operational in the third quarter of 2012 and to close the sale of the facility to us in the fourth quarter of 2012.

Second Amendment to Revolving Credit Facility

On August 22, 2012, we announced the entering into of the second amendment to our revolving credit agreement, effective August 17, 2012, to revise the interest coverage and leverage ratios that the revolving credit agreement requires us to maintain. See “Description of Other Indebtedness — Revolving Credit Facility.”

7

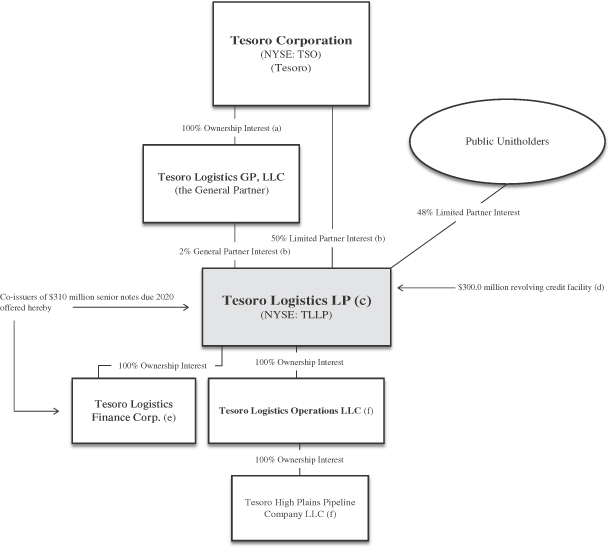

Organizational Structure

The following diagram summarizes our organizational structure, equity ownership and principal indebtedness, after giving pro forma effect to the completion of this offering. This diagram is provided for illustrative purposes only and does not show all legal entities or obligations of such entities:

| (a) | 100% ownership interest in Tesoro Logistics GP, LLC includes an indirect ownership interest through a wholly owned subsidiary. |

| (b) | In connection with the Concurrent Contribution, we expect to issue additional partnership units to Tesoro with a value of approximately $21 million. See “The Transactions.” |

| (c) | Issuer of the notes offered hereby and borrower under our revolving credit facility. |

| (d) | As of June 30, 2012, after giving pro forma effect to the Transactions, we would have had no borrowings and $0.3 million in letters of credit outstanding under our revolving credit facility, resulting in total unused credit availability of $299.7 million. |

8

| (e) | Finance Corp., the co-issuer of the notes, is a direct wholly owned subsidiary of TLLP and carries on no independent business other than acting as a co-issuer of the notes and is or will become a guarantor of our revolving credit facility. |

| (f) | Our operating subsidiaries currently consist of Tesoro Logistics Operations LLC and Tesoro High Plains Pipeline Company LLC, each of which is a guarantor of the notes offered hereby and a guarantor under our revolving credit facility. |

Management of Tesoro Logistics LP

We are managed and operated by the board of directors and executive officers of Tesoro Logistics GP, LLC, our general partner. Tesoro is the sole owner of our general partner and has the right to appoint the entire board of directors of our general partner. Unlike shareholders in a publicly traded corporation, our unitholders are not entitled to elect our general partner or the board of directors of our general partner. Some of the executive officers and directors of our general partner currently serve as executive officers and directors of Tesoro. For more information about the directors and executive officers of our general partner, please read “Management — Directors and Executive Officers of Tesoro Logistics GP, LLC.”

In order to maintain operational flexibility, our operations are conducted through, and our operating assets are owned by, various operating subsidiaries. However, neither we nor our subsidiaries have any employees. Our general partner has the sole responsibility for providing the personnel necessary to conduct our operations, whether through directly hiring employees or by obtaining the services of personnel employed by Tesoro or others. All of the personnel that will conduct our business are employed by our general partner and its affiliates, including Tesoro, but we sometimes refer to these individuals in this offering memorandum as our employees.

Principal Executive Offices and Internet Address

Our principal executive offices are located at 19100 Ridgewood Parkway, San Antonio, Texas 78259-1828, and our telephone number is (210) 626-6000. Our website is located at www.tesorologistics.com. The information on or accessible through our website is not part of this offering memorandum and should not be relied upon in connection with making any investment decision with respect to the notes offered by this offering memorandum.

9

Summary Historical and Pro Forma Combined Consolidated Financial and Operating Data

The following table shows summary historical combined consolidated financial and operating data for the Partnership and our Predecessors for the periods and as of the dates presented. The summary historical combined consolidated financial and operating data contain (i) the combined financial results of TLLP Predecessor, our predecessor for accounting purposes, as of and for the years ended December 31, 2009 and 2010 and for the period from January 1, 2011 through April 25, 2011 and (ii) the combined consolidated financial results of the Partnership for the period from April 26, 2011 (the date the Partnership commenced operations) through December 31, 2011, as of December 31, 2011 and as of and for the six months ended June 30, 2011 and 2012. The TLLP Predecessor information includes the financial results of the initial net assets contributed by Tesoro during the initial public offering through April 25, 2011.

In addition, effective April 1, 2012, we entered into the Martinez Contribution with TRMC and TLGP pursuant to which TRMC contributed through TLGP to TLLP the Martinez Terminal. This transaction was a transfer between entities under common control and was accounted for as if the transfer occurred at the beginning of the period presented, and prior periods were retrospectively adjusted to furnish comparative information. Accordingly, the financial information contained herein of the TLLP Predecessor and TLLP have been retrospectively adjusted to include the historical results of the Martinez Terminal for all periods presented. We refer to the historical results of the TLLP Predecessor and the Martinez Terminal (prior to the Martinez Contribution) collectively as our Predecessors. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview and Business Strategy” for further information.

The combined consolidated financial data as of December 31, 2010 and 2011 and for the years ended December 31, 2009, 2010 and 2011 were derived from our audited consolidated financial statements included elsewhere in this offering memorandum. The unaudited combined consolidated financial data as of December 31, 2009 is derived from unaudited combined financial statements not included or incorporated by reference in this offering memorandum. The unaudited combined consolidated financial data for the six months ended June 30, 2011 and 2012 were derived from our unaudited combined consolidated financial statements included elsewhere in this offering memorandum, which have been prepared on a basis consistent with our audited combined financial statements. In the opinion of management, such unaudited combined consolidated financial data for the six months ended June 30, 2011 and 2012 reflect all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the results for those periods. However, operating results for interim periods are not necessarily indicative of the results that may be expected for the entire fiscal year.

There are differences in the way our Predecessors recorded revenues and the way the Partnership records revenues since completion of our IPO and following the Martinez Contribution. Our assets have historically been a part of the integrated operations of Tesoro, and our Predecessors generally recognized only the costs and did not record revenue associated with the trucking, terminalling, storage and short-haul pipeline transportation services provided to Tesoro on an intercompany basis, including the Martinez Terminal. Accordingly, the revenues in our Predecessors’ historical combined financial statements relate only to amounts received from third parties for these services and amounts received from Tesoro with respect to transportation regulated by the Federal Energy Regulatory Commission (“FERC”) and the North Dakota Public Service Commission (“NDPSC”) on our High Plains system. For this reason, as well as the other factors described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Overview and Business Strategy — Factors Affecting the Comparability of Our Financial Results,” our results of operations may not be comparable to our Predecessors’ historical results.

The unaudited pro forma combined consolidated financial information reflects adjustments to the historical combined consolidated financial statements of TLLP to give effect to: (i) the Concurrent Contribution, including the expected impact of the long-term commercial terminalling and transportation agreements and amendments to our operational services agreement that we plan to enter into in connection with the Concurrent Contribution, (ii) this offering of notes and the application of proceeds therefrom and (iii) the payment of estimated fees and expenses in connection with this offering and the Concurrent

10

Contribution. The pro forma adjustments have been prepared as if the transactions to be effected at the closing of the notes offering and the Concurrent Contribution had taken place, in the case of the unaudited pro forma condensed combined consolidated balance sheet, as of June 30, 2012, and as of January 1, 2011, in the case of the unaudited pro forma condensed combined consolidated statements of operations of the Partnership for the six and twelve months ended June 30, 2012 and the year ended December 31, 2011. The pro forma financial information for the twelve months ended June 30, 2012 has been prepared by applying the above described pro forma adjustments to the twelve months ended June 30, 2012 historical financial information which was obtained by subtracting the statement of operations data for the six months ended June 30, 2011 included elsewhere in this offering memorandum from the statement of operations data for the year ended December 31, 2011 included elsewhere in this offering memorandum and then adding the statement of operations data for the six months ended June 30, 2012 included elsewhere in this offering memorandum. See “Unaudited Pro Forma Condensed Combined Consolidated Financial Information” and “The Transactions.”

The unaudited pro forma combined consolidated financial information has been prepared for illustrative purposes only and is not necessarily indicative of our financial position or results of operations had the Transactions actually occurred on the dates assumed, nor is such unaudited pro forma combined consolidated financial information necessarily indicative of the results to be expected for any future period. A number of factors may affect our results. See “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

11

The following table should be read together with, and is qualified in its entirety by reference to, the historical combined consolidated financial statements and the accompanying notes included elsewhere in this offering memorandum. The table should also be read together with “The Transactions,” “Use of Proceeds,” “Unaudited Pro Forma Condensed Combined Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| Years Ended December 31, | Six Months Ended June 30, |

Pro Forma

LTM Ended June 30, 2012 |

||||||||||||||||||||||

| 2009 | 2010 | 2011(a) | 2011(a) | 2012(a) | ||||||||||||||||||||

| (In thousands, except units, per unit amounts, bpd and per barrel data) | ||||||||||||||||||||||||

| (Predecessors) | (Predecessors) | |||||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||

| Crude oil gathering |

$ | 19,422 | $ | 19,592 | $ | 44,959 | $ | 16,258 | $ | 30,175 | $ | 58,876 | ||||||||||||

| Terminalling, transportation and storage |

3,237 | 3,708 | 35,987 | 9,778 | 30,090 | 77,451 | ||||||||||||||||||

| Total revenues(b) |

22,659 | 23,300 | 80,946 | 26,036 | 60,265 | 136,327 | ||||||||||||||||||

| Operating and maintenance expenses |

38,580 | 44,203 | 48,553 | 22,209 | 29,188 | 61,912 | ||||||||||||||||||

| Imbalance settlement gains |

(1,558 | ) | (3,250 | ) | (7,153 | ) | (2,367 | ) | (5,047 | ) | (9,833 | ) | ||||||||||||

| Depreciation and amortization expenses |

10,876 | 10,056 | 10,127 | 5,057 | 5,053 | 11,328 | ||||||||||||||||||

| General and administrative expenses(c) |

3,637 | 3,578 | 8,384 | 3,612 | 7,061 | 11,833 | ||||||||||||||||||

| Loss on asset disposals |

1,114 | 830 | 26 | 26 | 236 | 236 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Costs and Expenses |

52,649 | 55,417 | 59,937 | 28,537 | 36,491 | 75,476 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating Income (Loss) |

(29,990 | ) | (32,117 | ) | 21,009 | (2,501 | ) | 23,774 | 60,851 | |||||||||||||||

| Interest and financing costs, net |

— | — | (1,610 | ) | (461 | ) | (1,550 | ) | (24,168 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net Income (Loss) |

$ | (29,990 | ) | $ | (32,117 | ) | $ | 19,399 | $ | (2,962 | ) | $ | 22,224 | $ | 36,683 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||||||

| Net Property, Plant and Equipment |

$ | 172,105 | $ | 165,569 | $ | 174,089 | $ | 166,946 | $ | 180,946 | $ | 203,169 | ||||||||||||

| Total Assets |

175,265 | 169,656 | 207,978 | 188,086 | 215,489 | 240,288 | ||||||||||||||||||

| Total Liabilities, excluding debt |

11,462 | 12,228 | 15,979 | 11,448 | 14,617 | 14,617 | ||||||||||||||||||

| Total Debt |

— | — | 50,000 | 50,000 | 118,000 | 310,000 | ||||||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||

| Cash Flows From (Used In): |

||||||||||||||||||||||||

| Operating activities |

$ | (20,945 | ) | $ | (21,031 | ) | $ | 28,478 | $ | 291 | $ | 29,395 | ||||||||||||

| Investing activities |

(13,909 | ) | (4,711 | ) | (13,765 | ) | (1,856 | ) | (7,464 | ) | ||||||||||||||

| Financing activities |

34,854 | 25,742 | 3,613 | 11,531 | (18,849 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Increase in cash and cash equivalents |

$ | — | $ | — | $ | 18,326 | $ | 9,966 | $ | 3,082 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||

| EBITDA(d) |

$ | (19,114 | ) | $ | (22,061 | ) | $ | 31,136 | $ | 2,556 | $ | 28,827 | $ | 72,179 | ||||||||||

| Adjusted EBITDA(d) |

(18,000 | ) | (21,231 | ) | 32,061 | 2,816 | 30,159 | 74,080 | ||||||||||||||||

| Distributable cash flow(d) |

23,533 | 1,828 | 26,844 | 39,829 | ||||||||||||||||||||

| Distributions to unitholders |

351,797 | 333,280 | 90,627 | 109,144 | ||||||||||||||||||||

| Capital Expenditures: |

||||||||||||||||||||||||

| Maintenance(e) |

$ | 4,361 | $ | 4,100 | $ | 6,925 | $ | 717 | $ | 1,952 | $ | 10,219 | ||||||||||||

| Expansion(f) |

5,922 | 367 | 10,418 | 1,348 | 11,307 | 20,377 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Capital Expenditures |

$ | 10,283 | $ | 4,467 | $ | 17,343 | $ | 2,065 | $ | 13,259 | $ | 30,596 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

12

| Years Ended December 31, | Six Months Ended June 30, |

Pro Forma

LTM Ended June 30, 2012 |

||||||||||||||||||||||

| 2009 | 2010 | 2011(a) | 2011(a) | 2012(a) | ||||||||||||||||||||

| (In thousands, except units, per unit amounts, bpd and per barrel data) | ||||||||||||||||||||||||

| (Predecessors) | (Predecessors) | |||||||||||||||||||||||

| Operating Information: |

||||||||||||||||||||||||

| Crude oil gathering segment: |

||||||||||||||||||||||||

| Pipeline throughput (bpd)(g) |

52,806 | 50,695 | 57,900 | 55,972 | 59,852 | 57,895 | ||||||||||||||||||

| Average pipeline revenue per barrel(h) |

$ | 1.01 | $ | 1.06 | $ | 1.27 | $ | 1.17 | $ | 1.34 | $ | 1.40 | ||||||||||||

| Trucking volume (bpd) |

22,963 | 23,305 | 24,059 | 22,652 | 30,350 | 27,883 | ||||||||||||||||||

| Average trucking revenue per barrel(h) |

$ | 2.06 | $ | 1.07 | $ | 2.81 | $ | 2.87 | ||||||||||||||||

| Terminalling, transportation and storage segment: |

||||||||||||||||||||||||

| Terminalling throughput (bpd)(i) |

173,969 | 162,910 | 196,126 | 185,160 | 185,374 | 318,085 | ||||||||||||||||||

| Average terminalling revenue per barrel(h) |

$ | 0.39 | $ | 0.23 | $ | 0.72 | $ | 0.55 | ||||||||||||||||

| Short-haul pipeline transportation throughput (bpd)(j) |

62,822 | 60,666 | 65,636 | 64,185 | 69,153 | 92,727 | ||||||||||||||||||

| Average short-haul pipeline transportation revenue per barrel |

$ | 0.18 | $ | 0.10 | $ | 0.25 | $ | 0.24 | ||||||||||||||||

| Storage capacity reserved (shell capacity barrels) |

878,000 | 878,000 | 878,000 | 878,000 | 878,000 | 878,000 | ||||||||||||||||||

| Storage revenue per barrel on shell capacity (per month) |

$ | 0.50 | $ | 0.50 | $ | 0.51 | $ | 0.51 | ||||||||||||||||

| (a) | Results of operations include amounts related to the Predecessors during the six months ended June 30, 2012 and 2011 prior to April 1, 2012 for the Martinez Contribution and prior to April 26, 2011, for assets contributed in the IPO, respectively. |

| (b) | Our Predecessors did not record revenues for intercompany trucking, terminalling, storage and short-haul pipeline transportation services. |

| (c) | Our Predecessors’ general and administrative expenses included direct charges for the management and operation of our logistics assets and certain expenses allocated by Tesoro for general corporate services. Although Tesoro continues to charge the Partnership a similar combination of direct charges, the amounts allocated increased as a result of additional operational administrative resources utilized for management and growth of our assets. |

| (d) | For a discussion of the non-GAAP financial measures of EBITDA, Adjusted EBITDA and distributable cash flow, please read “— Non-GAAP Financial Measures” below. |

| (e) | Maintenance capital expenditures include expenditures required to maintain equipment, reliability, tankage and pipeline integrity and safety, and to address environmental regulations. |

| (f) | Expansion capital expenditures include expenditures to acquire or construct new assets and to expand existing facilities or services that may increase throughput capacity on our pipelines and in our terminals or increase storage capacity at our storage facilities. |

| (g) | Historical pipeline throughput for 2010 includes the effects of a scheduled turnaround at Tesoro’s North Dakota refinery in April and May of 2010. |

| (h) | Average pipeline revenue per barrel includes tariffs for committed and uncommitted volumes of crude oil under the pipeline transportation services agreement with Tesoro at the closing of this offering, as well as fees for the injection of crude oil into the pipeline system from trucking receipt points (“pumpover fees”). Average trucking service revenue per barrel includes tank usage fees and fees for providing trucking, dispatching, accounting and data services under our trucking transportation services agreement with Tesoro. Average terminalling revenue per |

13

| barrel includes terminal throughput fees as well as ancillary service fees for services such as ethanol blending and additive injection. |

| (i) | We experienced reduced terminalling throughput due to scheduled turnarounds at Tesoro’s Utah refinery during the year ended December 31, 2010 and Tesoro’s Wilmington refinery during the years ended December 31, 2009 and 2010 and each of the six month periods ended June 30, 2011 and 2012. |

| (j) | Historical short-haul pipeline transportation throughput for 2010 includes the effects of a scheduled turnaround at Tesoro’s Utah refinery during the year ended December 31, 2010. |

Non-GAAP Financial Measures

We define EBITDA as net income (loss) before net interest and financing costs and depreciation and amortization expenses. We define Adjusted EBITDA as EBITDA plus amortization of debt issuance costs, unit-based compensation expense and loss on asset disposals. We define distributable cash flow as EBITDA less net cash interest paid, maintenance capital expenditures and payment of financing costs, plus the change in deferred revenue related to shortfall payments, reimbursement by Tesoro for certain maintenance capital expenditures and non-cash unit-based compensation expense. EBITDA, Adjusted EBITDA and distributable cash flow are not measures prescribed by GAAP but are supplemental financial measures that are used by management and may be used by external users of our consolidated financial statements, such as industry analysts, investors, lenders and rating agencies, to assess:

| • | our operating performance as compared to other publicly traded partnerships in the midstream energy industry, without regard to historical cost basis or financing methods; |

| • | the ability of our assets to generate sufficient cash flow to make distributions to our unitholders; |

| • | our ability to incur and service debt and fund capital expenditures; and |

| • | the viability of acquisitions and other capital expenditure projects and the returns on investment of various investment opportunities. |

We believe that the presentation of EBITDA and Adjusted EBITDA in this offering memorandum provides information useful to investors in assessing our financial condition and results of operations. The GAAP measures most directly comparable to EBITDA and Adjusted EBITDA are net income (loss) and net cash from (used in) operating activities. EBITDA and Adjusted EBITDA should not be considered an alternative to GAAP net income (loss) or net cash from (used in) operating activities. EBITDA and Adjusted EBITDA have important limitations as analytical tools, because they exclude some, but not all, items that affect net income (loss) and net cash from (used in) operating activities. You should not consider EBITDA or Adjusted EBITDA in isolation or as a substitute for analysis of our results as reported under GAAP. Our definitions of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other companies, because they may be defined differently by other companies in our industry, thereby diminishing their utility.

We believe that the presentation of distributable cash flow provides useful information to investors as it is a widely accepted financial indicator used by investors to compare partnership performance, as it provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. The GAAP measure most directly comparable to distributable cash flow is net income (loss). The amounts included in the calculation of distributable cash flow are derived from amounts separately presented in our combined consolidated financial statements, with the exception of deferred revenue related to shortfall payments, maintenance capital expenditures, reimbursement by Tesoro for certain maintenance capital expenditures and payment of financing costs. Distributable cash flow should not be considered in isolation or as an alternative to net income (loss) or operating income as an indication of our operating performance or as a substitute for analysis of our results as reported under GAAP. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies, because it may be defined differently by other companies in our industry, thereby diminishing its utility.

14

The following table presents a reconciliation of EBITDA, Adjusted EBITDA, and distributable cash flow to their most directly comparable GAAP financial measures on a historical basis for each of the periods indicated.

| Years Ended December 31, | Six Months Ended June 30, |

Pro Forma

LTM Ended June 30, 2012 |

||||||||||||||||||||||

| 2009 | 2010 | 2011(a) | 2011(a) | 2012(a) | ||||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| (Predecessors) | (Predecessors) | |||||||||||||||||||||||

| Reconciliation of EBITDA and Adjusted EBITDA to net income (loss) |

||||||||||||||||||||||||

| Net Income (Loss) |

$ | (29,990 | ) | $ | (32,117 | ) | $ | 19,399 | $ | (2,962 | ) | $ | 22,224 | $ | 36,683 | |||||||||

| Add: Depreciation and amortization expenses |

10,876 | 10,056 | 10,127 | 5,057 | 5,053 | 11,328 | ||||||||||||||||||

| Add: Interest and financing costs, net |

— | — | 1,610 | 461 | 1,550 | 24,168 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA |

$ | (19,114 | ) | $ | (22,061 | ) | $ | 31,136 | $ | 2,556 | $ | 28,827 | $ | 72,179 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Add: Amortization of debt issuance costs |

— | — | 420 | 111 | 384 | 597 | ||||||||||||||||||

| Add: Unit-based compensation expense |

— | — | 479 | 123 | 712 | 1,068 | ||||||||||||||||||

| Add: Loss on asset disposals |

1,114 | 830 | 26 | 26 | 236 | 236 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | (18,000 | ) | $ | (21,231 | ) | $ | 32,061 | $ | 2,816 | $ | 30,159 | $ | 74,080 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Reconciliation of EBITDA to net cash from (used in) operating activities: |

||||||||||||||||||||||||

| Net cash from (used in) operating activities |

$ | (20,945 | ) | $ | (21,031 | ) | $ | 28,478 | $ | 291 | $ | 29,395 | ||||||||||||

| Less: Changes in assets and liabilities |

(2,945 | ) | 200 | (1,973 | ) | (2,064 | ) | 786 | ||||||||||||||||

| Less: Amortization of debt issuance costs |

— | — | 420 | 111 | 384 | |||||||||||||||||||

| Less: Unit-based compensation expense |

— | — | 479 | 123 | 712 | |||||||||||||||||||

| Less: Loss on asset disposals |

1,114 | 830 | 26 | 26 | 236 | |||||||||||||||||||

| Add: Interest and financing costs, net |

— | — | 1,610 | 461 | 1,550 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| EBITDA |

$ | (19,114 | ) | $ | (22,061 | ) | $ | 31,136 | $ | 2,556 | $ | 28,827 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Reconciliation of Distributable Cash Flow to Net Income: |

||||||||||||||||||||||||

| Net income |

$ | 19,399 | $ | (2,962 | ) | $ | 22,224 | $ | 36,683 | |||||||||||||||

| Add: Depreciation and amortization expenses |

10,127 | 5,057 | 5,053 | 11,328 | ||||||||||||||||||||

| Add: Interest and financing costs, net |

1,610 | 461 | 1,550 | 24,168 | ||||||||||||||||||||

| Add: Change in deferred revenue related to shortfall payments |

— | — | 267 | 267 | ||||||||||||||||||||

| Add: Reimbursement for maintenance capital expenditures(b) |

8 | — | 532 | 540 | ||||||||||||||||||||

| Add: Non-cash unit-based compensation expense |

479 | — | 712 | 1,068 | ||||||||||||||||||||

| Less: Cash interest paid, net |

1,165 | 11 | 949 | 23,413 | ||||||||||||||||||||

| Less: Maintenance capital expenditures(b) |

6,925 | 717 | 1,952 | 10,219 | ||||||||||||||||||||

| Less: Payment of financing costs |

— | — | 593 | 593 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Distributable Cash Flow |

$ | 23,533 | $ | 1,828 | $ | 26,844 | $ | 39,829 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (a) | Results of operations include amounts related to the Predecessors during the six months ended June 30, 2012 and 2011 prior to April 1, 2012 for the Martinez Contribution and prior to April 26, 2011, for assets contributed in the IPO, respectively. |

| (b) | Maintenance capital expenditures include expenditures required to maintain equipment, reliability, tankage and pipeline integrity and safety, and to address environmental regulations. |

15

CAPITALIZATION

The following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2012 on:

| • | an actual basis; and |

| • | an as adjusted basis to give pro forma effect to the Transactions. |

You should read the following information in conjunction with the information contained in “Notice Regarding Presentation of Financial Information,” “Unaudited Pro Forma Condensed Combined Consolidated Financial Information,” “The Transactions,” “Use of Proceeds,” “Description of Other Indebtedness,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included elsewhere in this offering memorandum.

| As of June 30, 2012 | ||||||||

| Actual | As Adjusted | |||||||

| (In millions, except units) | ||||||||

| Cash and cash equivalents |

$ | 21.4 | $ | 17.0 | ||||

|

|

|

|

|

|||||

| Total debt: |

||||||||

| Revolving credit facility(a) |

118.0 | — | ||||||

| Notes offered hereby |

— | 310.0 | ||||||

| Total debt |

118.0 | 310.0 | ||||||

|

|

|

|

|

|||||

| Equity/partners’ capital: |

||||||||

| Held by public: |

||||||||

| Common units (14,956,339 units issued and outstanding) |

311.1 | 311.1 | ||||||

| Held by Tesoro: |

||||||||

| Common units (511,252 units issued and outstanding)(b) |

(87.5 | ) | (251.2 | ) | ||||

| Subordinated units (15,254,890 units issued and outstanding) |

(141.8 | ) | (142.0 | ) | ||||

| General partner units (626,861 units issued and outstanding)(b) |

1.1 | (2.2 | ) | |||||

|

|

|

|

|

|||||

| Total equity/partners’ capital |

82.9 | (84.3 | ) | |||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 200.9 | $ | 225.7 | ||||

|

|

|

|

|

|||||

| (a) | As of June 30, 2012, our revolving credit facility provided for borrowings (including letters of credit) of up to $300.0 million. As of June 30, 2012, we had borrowings of $118.0 million and letters of credit of $0.3 million outstanding under our revolving credit facility, resulting in unused credit availability of approximately 61% of the eligible borrowing base, or $181.7 million. As of June 30, 2012, after giving pro forma effect to the Transactions, we would have had no borrowings and letters of credit of $0.3 million outstanding under our revolving credit facility, resulting in unused credit availability of approximately 99% of the eligible borrowing base, or $299.7 million. See “Description of Other Indebtedness” and “Unaudited Pro Forma Condensed Combined Consolidated Financial Information.” |

| (b) | Unit amounts do not give effect to partnership interests to be issued in connection with the Concurrent Contribution (the number of which will be based in part on trading price of our common units on the NYSE). |

16

UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED

FINANCIAL INFORMATION

The following unaudited pro forma condensed combined consolidated financial information of Tesoro Logistics reflects adjustments to the historical combined consolidated financial statements of Tesoro Logistics to give effect to: (i) the Concurrent Contribution, including the expected impact of the long-term commercial terminalling and transportation agreements and amendments to our operational services agreement that we plan to enter into in connection with the Concurrent Contribution, (ii) this offering of notes and the application of proceeds therefrom and (iii) the payment of estimated fees and expenses in connection with this offering and the Concurrent Contribution. See “The Transactions” and “Use of Proceeds.”

The pro forma adjustments have been prepared as if the transactions to be effected at the closing of the notes offering and the Concurrent Contribution had taken place, in the case of the unaudited pro forma condensed combined consolidated balance sheet, as of June 30, 2012, and as of January 1, 2011, in the case of the unaudited pro forma condensed combined consolidated statements of operations of the Partnership for the six and twelve months ended June 30, 2012 and the year ended December 31, 2011. The pro forma financial information for the twelve months ended June 30, 2012 has been prepared by applying the above described pro forma adjustments to the twelve months ended June 30, 2012 historical financial information which was obtained by subtracting the statement of operations data for the six months ended June 30, 2011 included elsewhere in this offering memorandum from the statement of operations data for the year ended December 31, 2011 included elsewhere in this offering memorandum and then adding the statement of operations data for the six months ended June 30, 2012 included elsewhere in this offering memorandum.

The Concurrent Contribution will be recorded at historical cost as it is considered to be a transfer of a business between entities under common control. Our valuation of the Southern California Terminal Assets is primarily based on the revenues that will be generated under the proposed commercial terminalling agreement with Tesoro and other third-party contracts, as well as on our own independent estimates of expected future operating and general and administrative expenses based on the industry experience of our management team.

The unaudited pro forma condensed combined consolidated financial information has been prepared for illustrative purposes only and is not necessarily indicative of our financial position or results of operations had the Transactions actually occurred on the dates assumed, nor is such unaudited pro forma condensed combined consolidated financial information necessarily indicative of the results to be expected for any future period. A number of factors may affect our results. See “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.”

The pro forma adjustments are based on preliminary estimates and currently available information and assumptions that management believes are reasonable. The notes to the unaudited pro forma condensed combined consolidated statements of operations provide a detailed discussion of how such adjustments were derived and presented in the unaudited pro forma financial information. The unaudited pro forma condensed combined consolidated financial information should be read in conjunction with “Capitalization,” “Use of Proceeds,” “Selected Historical Combined Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our combined consolidated financial statements and related notes thereto included elsewhere in this offering memorandum.

17

TESORO LOGISTICS LP

UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED BALANCE SHEET

June 30, 2012

| Tesoro Logistics LP |

Southern California Terminal Assets |

Pro Forma Adjustments |

Tesoro Logistics LP Pro Forma |

|||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| ASSETS |

| |||||||||||||||||||

| CURRENT ASSETS |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 21,408 | $ | — | $ | 310,000 | (a | ) | $ | 16,984 | ||||||||||

| (189,000 | ) | (b | ) | |||||||||||||||||

| (118,000 | ) | (c | ) | |||||||||||||||||

| (424 | ) | (d | ) | |||||||||||||||||

| (7,000 | ) | (e | ) | |||||||||||||||||

| Receivables |

||||||||||||||||||||

| Trade |

433 | 2,889 | (2,889 | ) | (f | ) | 433 | |||||||||||||

| Affiliate |

9,361 | — | — | 9,361 | ||||||||||||||||

| Prepayments and other current assets |

1,550 | 57 | (57 | ) | (f | ) | 1,550 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Current Assets |

32,752 | 2,946 | (7,370 | ) | 28,328 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET PROPERTY, PLANT AND EQUIPMENT |

180,946 | 24,056 | — | (b | ) | 203,169 | ||||||||||||||

| (1,833 | ) | (g | ) | |||||||||||||||||

| OTHER NONCURRENT ASSETS |

1,791 | — | 7,000 | (e | ) | 8,791 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Assets |

$ | 215,489 | $ | 27,002 | $ | (2,203 | ) | $ | 240,288 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| LIABILITIES AND EQUITY |

| |||||||||||||||||||

| CURRENT LIABILITIES |

||||||||||||||||||||

| Accounts payable |

||||||||||||||||||||

| Trade |

$ | 7,967 | $ | 277 | $ | (277 | ) | (f | ) | $ | 7,967 | |||||||||

| Affiliate |

3,490 | 44 | (44 | ) | (f | ) | 3,490 | |||||||||||||

| Deferred revenue — affiliate |

1,948 | — | — | 1,948 | ||||||||||||||||

| Accrued liabilities |

1,166 | 856 | (856 | ) | (f | ) | 1,166 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Current Liabilities |

14,571 | 1,177 | (1,177 | ) | 14,571 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| OTHER NONCURRENT LIABILITIES |

46 | — | — | 46 | ||||||||||||||||

| DEBT |

118,000 | — | 310,000 | (a | ) | 310,000 | ||||||||||||||

| (118,000 | ) | (c | ) | |||||||||||||||||

| COMMITMENTS AND CONTINGENCIES |

||||||||||||||||||||

| EQUITY |

||||||||||||||||||||

| Equity of Predecessors |

— | 25,825 | (25,825 | ) | (h | ) | — | |||||||||||||

| Common unitholders |

223,563 | — | (185,220 | ) | (b | ) | 59,910 | |||||||||||||

| (212 | ) | (d | ) | |||||||||||||||||

| (1,733 | ) | (f | ) | |||||||||||||||||

| (1,796 | ) | (g | ) | |||||||||||||||||

| 25,308 | (h | ) | ||||||||||||||||||

| Subordinated unitholders |

(141,835 | ) | — | (204 | ) | (d | ) | (142,039 | ) | |||||||||||

| General partner — TLGP |

1,144 | — | (3,780 | ) | (b | ) | (2,200 | ) | ||||||||||||

| (8 | ) | (d | ) | |||||||||||||||||

| (36 | ) | (f | ) | |||||||||||||||||

| (37 | ) | (g | ) | |||||||||||||||||

| 517 | (h | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Equity |

82,872 | 25,825 | (193,026 | ) | (84,329 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Liabilities and Equity |

$ | 215,489 | $ | 27,002 | $ | (2,203 | ) | $ | 240,288 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

18

TESORO LOGISTICS LP

UNAUDITED PRO FORMA CONDENSED STATEMENTS OF COMBINED CONSOLIDATED OPERATIONS

Twelve Months Ended June 30, 2012

| Tesoro Logistics LP |

Southern California Terminal Assets |

Pro Forma |

Tesoro Logistics LP Pro Forma |

|||||||||||||||||

| (Dollars in thousands, except unit and per unit amounts) | ||||||||||||||||||||

| REVENUES |

||||||||||||||||||||

| Affiliate |

$ | 111,814 | $ | — | $ | 13,100 | (i | ) | $ | 124,914 | ||||||||||

| Third-party |

3,361 | 8,052 | — | 11,413 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenues |

115,175 | 8,052 | 13,100 | 136,327 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| COSTS AND EXPENSES |

||||||||||||||||||||

| Operating and maintenance expenses |

45,699 | 6,134 | (153 | ) | (j | ) | 52,079 | |||||||||||||

| 399 | (k | ) | ||||||||||||||||||

| Depreciation and amortization expenses |

10,123 | 1,277 | (72 | ) | (g | ) | 11,328 | |||||||||||||

| General and administrative expenses |

11,833 | 443 | (443 | ) | (l | ) | 11,833 | |||||||||||||

| Loss on asset disposals |

236 | — | — | 236 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Costs and Expenses |

67,891 | 7,854 | (269 | ) | 75,476 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| OPERATING INCOME |

47,284 | 198 | 13,369 | 60,851 | ||||||||||||||||

| Interest and financing costs, net |

(2,699 | ) | — | (21,469 | ) | (m | ) | (24,168 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET INCOME (LOSS) |

$ | 44,585 | $ | 198 | $ | (8,100 | ) | $ | 36,683 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Loss attributable to Predecessors |

(6,729 | ) | — | — | (6,729 | ) | ||||||||||||||

| Net income (loss) attributable to partners |

51,314 | 198 | (8,100 | ) | 43,412 | |||||||||||||||

| Less: General partner’s interest in net income, including distribution rights |

1,129 | 4 | (162 | ) | 971 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Limited partners’ interest in net income (loss) |

$ | 50,185 | $ | 194 | $ | (7,938 | ) | $ | 42,441 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income per limited partner unit: |

||||||||||||||||||||

| Common — basic and diluted |

$ | 1.64 | $ | 1.37 | ||||||||||||||||

| Subordinated — basic and diluted |

$ | 1.64 | $ | 1.36 | ||||||||||||||||

| Weighted average limited partner units outstanding: |

||||||||||||||||||||

| Common units — basic |

15,307,052 | 507,860 | 15,814,912 | |||||||||||||||||

| Common units — diluted |

15,334,563 | 507,860 | 15,842,423 | |||||||||||||||||

| Subordinated units — basic and diluted |

15,254,890 | — | 15,254,890 | |||||||||||||||||

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

19

TESORO LOGISTICS LP

UNAUDITED PRO FORMA CONDENSED STATEMENTS OF COMBINED CONSOLIDATED OPERATIONS

Year Ended December 31, 2011

| Tesoro Logistics LP |

Southern California Terminal Assets |

Pro Forma Adjustments |

Tesoro Logistics LP Pro Forma |

|||||||||||||||||

| (Dollars in thousands, except unit and per unit amounts) |

||||||||||||||||||||

| REVENUES |

||||||||||||||||||||

| Affiliate |

$ | 77,443 | $ | — | $ | 12,600 | (i | ) | $ | 90,043 | ||||||||||

| Third-party |

3,503 | 6,391 | — | 9,894 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenues |

80,946 | 6,391 | 12,600 | 99,937 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| COSTS AND EXPENSES |

||||||||||||||||||||

| Operating and maintenance expenses |

41,400 | 5,749 | (146 | ) | (j | ) | 47,402 | |||||||||||||

| 399 | (k | ) | ||||||||||||||||||

| Depreciation and amortization expenses |

10,127 | 1,221 | (71 | ) | (g | ) | 11,277 | |||||||||||||

| General and administrative expenses |

8,384 | 392 | (392 | ) | (l | ) | 8,384 | |||||||||||||

| Loss on asset disposals |

26 | — | — | 26 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Costs and Expenses |

59,937 | 7,362 | (210 | ) | 67,089 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| OPERATING INCOME (LOSS) |

21,009 | (971 | ) | 12,810 | 32,848 | |||||||||||||||

| Interest and financing costs, net |

(1,610 | ) | — | (22,504 | ) | (m | ) | (24,114 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET INCOME (LOSS) |

$ | 19,399 | $ | (971 | ) | $ | (9,694 | ) | $ | 8,734 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Loss attributable to Predecessors |

(15,169 | ) | — | — | (15,169 | ) | ||||||||||||||

| Net income (loss) attributable to partners |

34,568 | (971 | ) | (9,694 | ) | 23,903 | ||||||||||||||

| Less: General partner’s interest in net income, including incentive distribution rights |

692 | (19 | ) | (195 | ) | 478 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Limited partners’ interest in net income (loss) |

$ | 33,876 | $ | (952 | ) | $ | (9,499 | ) | $ | 23,425 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income per limited partner unit: |

||||||||||||||||||||

| Common — basic |

$ | 1.11 | $ | 0.76 | ||||||||||||||||

| Common — diluted |

$ | 1.11 | $ | 0.75 | ||||||||||||||||

| Subordinated — basic and diluted |

$ | 1.11 | $ | 0.76 | ||||||||||||||||

| Weighted average limited partner units outstanding: |

||||||||||||||||||||

| Common units — basic |

15,254,890 | 507,860 | 15,762,750 | |||||||||||||||||

| Common units — diluted |

15,282,366 | 507,860 | 15,790,226 | |||||||||||||||||

| Subordinated units — basic and diluted |

15,254,890 | — | 15,254,890 | |||||||||||||||||

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

20

TESORO LOGISTICS LP

UNAUDITED PRO FORMA CONDENSED STATEMENTS OF COMBINED CONSOLIDATED OPERATIONS

Six Months Ended June 30, 2012

| Tesoro Logistics LP |

Southern California Terminal Assets |

Pro Forma Adjustments |

Tesoro Logistics LP Pro Forma |

|||||||||||||||||

| (Dollars in thousands, except unit and per unit amounts) |

||||||||||||||||||||

| REVENUES |

||||||||||||||||||||

| Affiliate |

$ | 58,811 | $ | — | $ | 6,700 | (i | ) | $ | 65,511 | ||||||||||

| Third-party |

1,454 | 4,883 | — | 6,337 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Revenues |

60,265 | 4,883 | 6,700 | 71,848 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| COSTS AND EXPENSES |

||||||||||||||||||||

| Operating and maintenance expenses |

24,141 | 2,954 | (81 | ) | (j | ) | 27,214 | |||||||||||||

| 200 | (k | ) | ||||||||||||||||||

| Depreciation and amortization expenses |

5,053 | 673 | (36 | ) | (g | ) | 5,690 | |||||||||||||

| General and administrative expenses |

7,061 | 246 | (246 | ) | (l | ) | 7,061 | |||||||||||||

| Loss on asset disposals |

236 | — | — | 236 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Costs and Expenses |

36,491 | 3,873 | (163 | ) | 40,201 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| OPERATING INCOME |

23,774 | 1,010 | 6,863 | 31,647 | ||||||||||||||||

| Interest and financing costs, net |

(1,550 | ) | — | (10,407 | ) | (m | ) | (11,957 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET INCOME (LOSS) |

$ | 22,224 | $ | 1,010 | $ | (3,544 | ) | $ | 19,690 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less: Loss attributable to Predecessors |

(2,417 | ) | — | — | (2,417 | ) | ||||||||||||||

| Net income (loss) attributable to partners |

24,641 | 1,010 | (3,544 | ) | 22,107 | |||||||||||||||

| Less: General partner’s interest in net income, including distribution rights |

594 | 21 | (70 | ) | 545 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Limited partners’ interest in net income (loss) |

$ | 24,047 | $ | 989 | $ | (3,474 | ) | $ | 21,562 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income per limited partner unit: |

||||||||||||||||||||

| Common — basic |

$ | 0.79 | $ | 0.70 | ||||||||||||||||

| Common — diluted |

$ | 0.79 | $ | 0.69 | ||||||||||||||||

| Subordinated—basic and diluted |

$ | 0.78 | $ | 0.69 | ||||||||||||||||

| Weighted average limited partner units outstanding: |

||||||||||||||||||||

| Common units — basic |

15,359,788 | 507,860 | 15,867,648 | |||||||||||||||||

| Common units — diluted |

15,393,016 | 507,860 | 15,900,876 | |||||||||||||||||

| Subordinated units — basic and diluted |

15,254,890 | — | 15,254,890 | |||||||||||||||||

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

21

Note 1. Basis of Presentation