Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HollyFrontier Corp | hfc-form8xkseptemberpresen.htm |

Investor Presentation Fall 2012

2 HollyFrontier Corporation Disclosure Statement Statements made during the course of this presentation that are not historical facts are “forward- looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing and acquisition strategies, the possibility of terrorist attacks and the consequences of any such attacks, general economic conditions, and our ability to successfully integrate the business of Holly Corporation and Frontier Oil Corporation and to realize partially or fully the anticipated benefits of our merger of equals with Frontier. Additional information on risks and uncertainties that could affect the business prospects and performance of Holly Frontier and Holly Energy Partners is provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. HollyFrontier and Holly Energy Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

3 HollyFrontier Corporation

4 HollyFrontier Investment Highlights Pure Play Competitive Refiner 5 refineries with combined processing capacity of over 440,000 barrels per day (bpd) High complexity facilities with access to multiple sources of crude supply—combined Nelson Complexity rating of over 12.0 High degree of crude source flexibility All crude oil ‘WTI’ price based Attractive markets Geographic: Rocky Mountains, Southwest and Mid-Continent Plains states Advantaged crude supply: High growth Canadian, Bakken, Permian, Niobrara Product mix: Balanced gasoline and diesel product slate plus high value / high margin specialty lubricants Growth & Capital Improvement Reinvested over $1 billion of cash flow generated in recent years into facilities CAPEX focused on both growth & feedstock flexibility to lower crude & raw material costs Purchased Woods Cross, El Dorado and Tulsa Refineries (285,000 bpd) at industry lows on a per barrel basis Cheyenne investments have improved margins by over $2/bbl Integrated Tulsa facilities in Fall 2011 for improved yields and lower operating costs Woods Cross has earned nearly $900mm in EBITDA since purchasing for $25mm in 2003 Strong Financial Performance Strong track record of capital return to shareholders over the last 12 months Historical industry leading return on invested capital among peers Historical industry leading earnings per barrel among peers Low debt among peers and history of conservative financial management HEP ownership Stable cash flow quarterly from HEP through regular and incentive distributions 12.1 million common units (NYSE:HEP) plus 100% of General Partner (w/ Incentive IDR’s)

5 Footprint of HollyFrontier and HEP Collaboration with HEP provides strategic growth opportunities in logistics and marketing operations

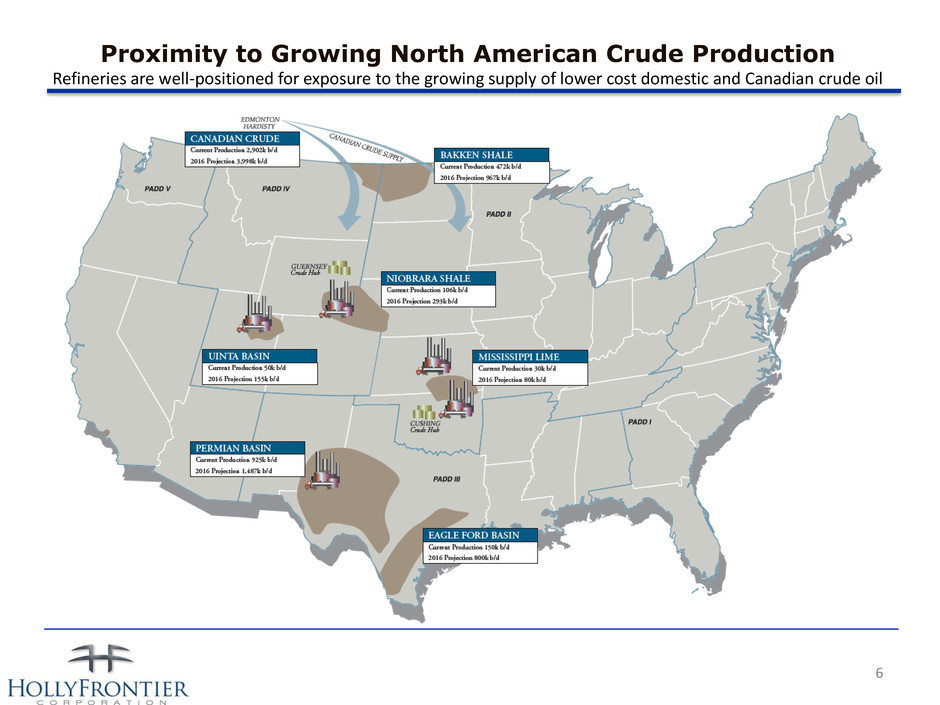

6 Proximity to Growing North American Crude Production Refineries are well-positioned for exposure to the growing supply of lower cost domestic and Canadian crude oil

7 UNEV Pipeline & Woods Cross Refinery Economics Overview: 400 mile, 12” refined products pipeline from Salt Lake City to Las Vegas with terminals in Cedar City, UT and Las Vegas, NV 62,000 bpd capacity (low cost expandability to 118,000 bpd) HollyFrontier sold its 75% interest to Holly Energy July 2012. (Sinclair owns 25%) Start up — January 2012 Benefits: Provides new outlet to address historic winter demand reduction in local markets allowing Woods Cross to run at full capacity year round Allows access to sizeable new market for Rocky Mountain refiners – which have significantly lower crude costs than West Coast competitors Enables potential product pricing upgrade given Las Vegas typically trades at seasonal premium to Salt Lake Woods Cross Expansion: Woods Cross refinery expansion from 31,000 BPD to 45,000 BPD at a cost of approximately $225 million with expected payback period of less than 2 years 24,000 barrels of which will be able to run Black Wax Expected completion —Late 2014 • Based on Aug 24th closing price of $66.91 • Payment in year 5 is based on year 4 UNEV EBITDA * Cap is expected to be $33.8 mm at the end of Year 4 (the earliest time at which profit sharing can begin), and it is subject to adjustment under certain circumstances. Newfield Crude Supply Agreement: 10 year attractive crude supply agreement with Newfield Exploration Company 20,000 barrels per day of Black and Yellow wax crude oil produced in the Uinta Basin HEP Purchase: HEP purchased 100% of HFC’s 75% interest for $315 million - $260 million in cash and $55 million in HEP LP units (current value $68.9 million*) HFC will provide $1.25 million per quarter GP giveback for years 1-3 and $1.25 million for up to four additional quarters if the Woods Cross expansion is not complete by end of year 3 Beginning year 5, HFC is entitled to receive 50% of HEP’s UNEV EBITDA* share over $30 million per year up to defined cap*

2500 3500 4500 5500 6500 7500 8500 9500 10500 2011 2012 2013 2014 2015 2016 Canada (conventional & oil sands) Bakken Permian Niobrara Uinta Mississippian 8 Crude Growth in our “Backyard” Canadian, Bakken, Permian, Niobrara, Uinta, Mississippi Lime Source: Deutsche Bank, Macquarie, Simmons & Co, Canadian Association of Petroleum Producers, North Dakota Pipeline Authority, and the EIA. 10MBPD

9 Strategic Investment & Acquisition Historical Investments • Approximately $600mm invested for enhanced feedstock flexibility & modest growth • Synergistic acquisitions of Tulsa refineries at less than $1,000 per daily bbl* • Tulsa interconnection improving profitability through better yields & lower costs (HEP constructed for HFC use) • Cheyenne LPG project completed to improve yields Woods Cross Phase 1 • Woods Cross refinery expansion from 31,000 BPD to 45,000 BPD at a cost of approximately $225 million with expected payback period of less than 2 years • 24,000 barrels of which will be able to run Black Wax • Expected completion —Late 2014 Future Investments • Evaluating future investments based principally upon stranded crude economies & additional liquid yield improvements • Focus on underwritten projects; with off-take and crude supply agreements in place • Potential further LPG projects *After accounting for sales of Tulsa logistics assets

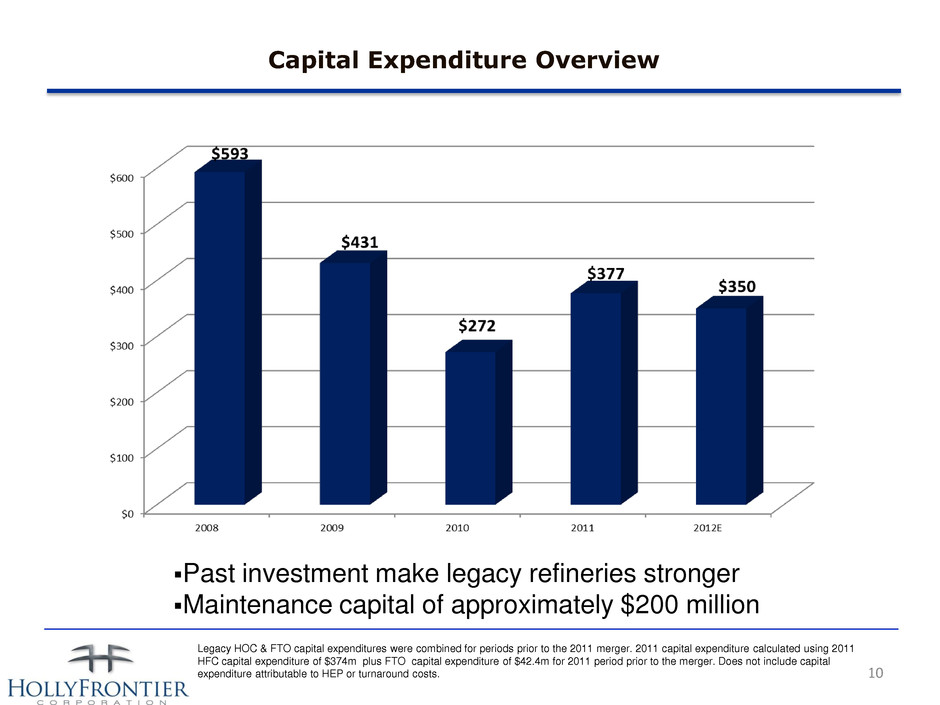

10 Capital Expenditure Overview Past investment make legacy refineries stronger Maintenance capital of approximately $200 million Legacy HOC & FTO capital expenditures were combined for periods prior to the 2011 merger. 2011 capital expenditure calculated using 2011 HFC capital expenditure of $374m plus FTO capital expenditure of $42.4m for 2011 period prior to the merger. Does not include capital expenditure attributable to HEP or turnaround costs.

11 Cash Returns to Shareholders Since the July 2011 merger we have declared $640m in dividends & authorized $700m of share repurchases: Increased our regular dividend three times – doubling it since the merger • Aug 25th: Raised regular quarterly cash dividend from $0.075 to $0.0875 per share, a 14% increase • Nov 16th: Raised regular quarterly cash dividend from $0.0875 to $0.10 per share, a 13% increase • May 16th: Raised regular quarterly cash dividend from $0.10 to $0.15 per share, a 50% increase Declared 5 special dividends • Aug 3rd: Declared special cash dividend of $0.50 per share* • Nov 16th: Declared special cash dividend of $0.50 per share • Feb 12th: Declared special cash dividend of $0.50 per share • May 16th: Declared special cash dividend of $0.50 per share • Aug 13th: Declared special cash dividend of $0.50 per share Announced two $350m share repurchase programs • Jan 3rd: Announced the authorization of a $350 million share repurchase program replacing the $100 million share repurchase program announced in September 2011 • June 28th: Announced the authorization of a $350 million share repurchase program in addition to the share repurchase program announced in January *Dividend is split adjusted. The dividend declared was $1.00, but has been split adjusted for HFC’s two-for-one stock split announced August 3rd,

12 Cash Return to Shareholders LTM Cash Yield to Shareholders Last Twelve Months includes YTD 2012 dividends declared and excludes cash dividends in the same period through 2011. Data from filings and press releases. As of 8/24/2012 stock prices. See page 25 for calculations.

13 Pro Forma HollyFrontier Returns on Capital (combined) Returns on Invested Capital (Average 2007-2011)* *5-year average ROIC calculated by taking the average of ROIC’s for the years 2007-2011. ROIC calculated by dividing net income by the sum of total debt and total equity. For HFC, legacy HOC/FTO earnings, debt & equity were combined for 5-year calculations. See page 25 for calculations.

14 Strong Financial Metrics vs Peers Net Income per Barrel of Crude Capacity HFC earnings per bbl strongest in peer sector (2007-2011) Q2 2012 earnings per bbl $12.24 HFC earnings calculated by adding legacy HOC plus FTO earnings for periods prior to the merger. See page 25 for calculations.

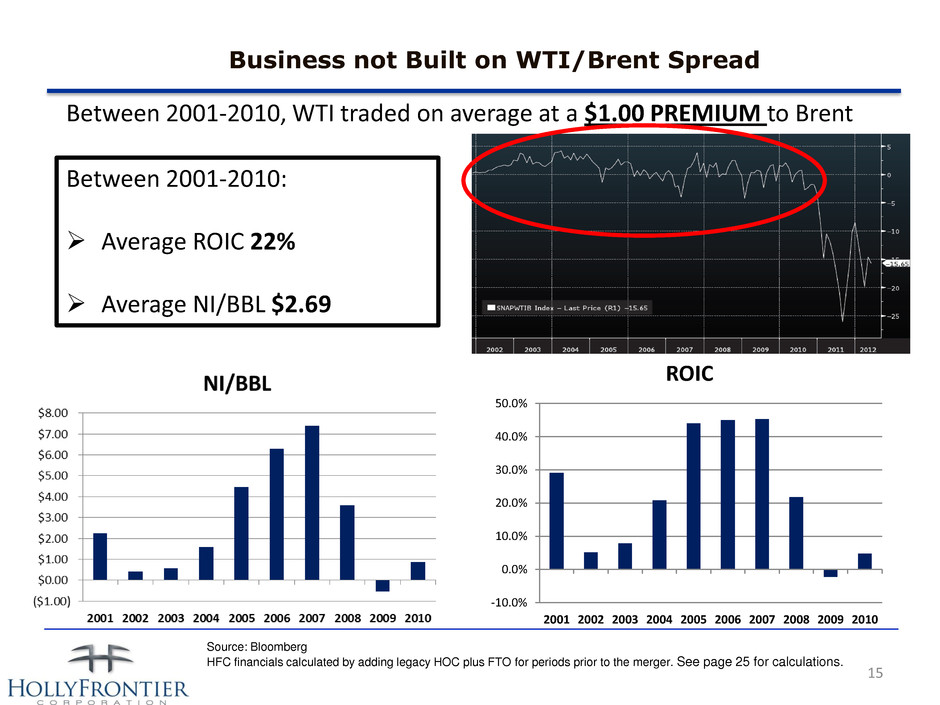

15 Business not Built on WTI/Brent Spread Between 2001-2010, WTI traded on average at a $1.00 PREMIUM to Brent Between 2001-2010: Average ROIC 22% Average NI/BBL $2.69 -10.0% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 ROIC Source: Bloomberg HFC financials calculated by adding legacy HOC plus FTO for periods prior to the merger. See page 25 for calculations.

16 HEP Growth: Distributable Cash Flow Since Inception HFC received $46m in cash distributions for FY 2011

17 Value of HFC’s LP & GP Interests in HEP HFC owns 12.1mm common units: $780 -- 830MM1 Multiple of GP cash flow: 15X 20X 25X Current GP Interest IDR Distributions:2 $250MM $350MM $430MM HEP value to HFC is in the approximate $1 billion to $1.2 billion range.3 LP Interest: GP Interest: 1 Based on range of $65 to $69 per unit for valuation purposes. NYSE closing price on 08/24/12 was $66.91 2 Values are equal to quarterly GP IDR cash flow (for Q2 2012) on an annualized basis minus the $5m GP giveback for the next 3 years (as part of the HEP UNEV purchase transaction) times the above range of commonly used market multiples. GP IDR cash flow is approximately $5.6MM per quarter. These values do not reflect actual after tax value to HFC. 3 Approximate limited partner unit value estimated using a range based on recent market price & general partner value estimated using a commonly used range of Wall Street market multiples applied to incentive distributable cash flow. These values do not reflect actual after tax value to HFC.

18 HollyFrontier Corporation (NYSE: HFC) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 871-3555 www.hollyfrontier.com Neale Hickerson, Vice President, Investor Relations Neale.hickerson@hollyfrontier.com 214-871-3572 Julia Heidenreich, Investor Relations Julia.Heidenreich@hollyfrontier.com 214-871-3422

19 Appendix

20 Mid-Continent: El Dorado & Tulsa Refineries The Mid-Continent Region comprises our Tulsa and El Dorado Refineries and has a combined crude oil processing capacity of 260,000 BPSD. Product Mix Gasolines, 46% Diesel fuels, 32% Jet fuels, 7% Asphalt, 4% Lubricants, 4% Other, 7% Crude and Feedstocks Sour crude oil, 6% Sweet crude oil, 76% Heavy sour crude oil, 10% Other feedstocks and blends, 8% Mid-Continent Sales of Refinery Produced Products 268,320 BPD • Located in El Dorado, Kansas • 135,000 BPSD capacity and Nelson Complexity rating of 11.8 • Processes sour and heavy (Canadian) crude oils into high value light products • Distributes to high margin markets in Colorado and Mid-Continent/Plains states • Tulsa West and Tulsa East facilities are located less than two miles apart in Tulsa, Oklahoma and are operated as an integrated facility through interconnecting pipelines • 125,000 BPSD capacity and Nelson Complexity rating of 14.0 • Processes predominantly sweet crude oil with up to 10,000 BPD of heavy Canadian crudes • Distributes to the Mid-Continent states and also sells its specialty lubricants, which are high value products that provide a higher margin, throughout the United States and Central and South America TULSA REFINERIES EL DORADO REFINERY

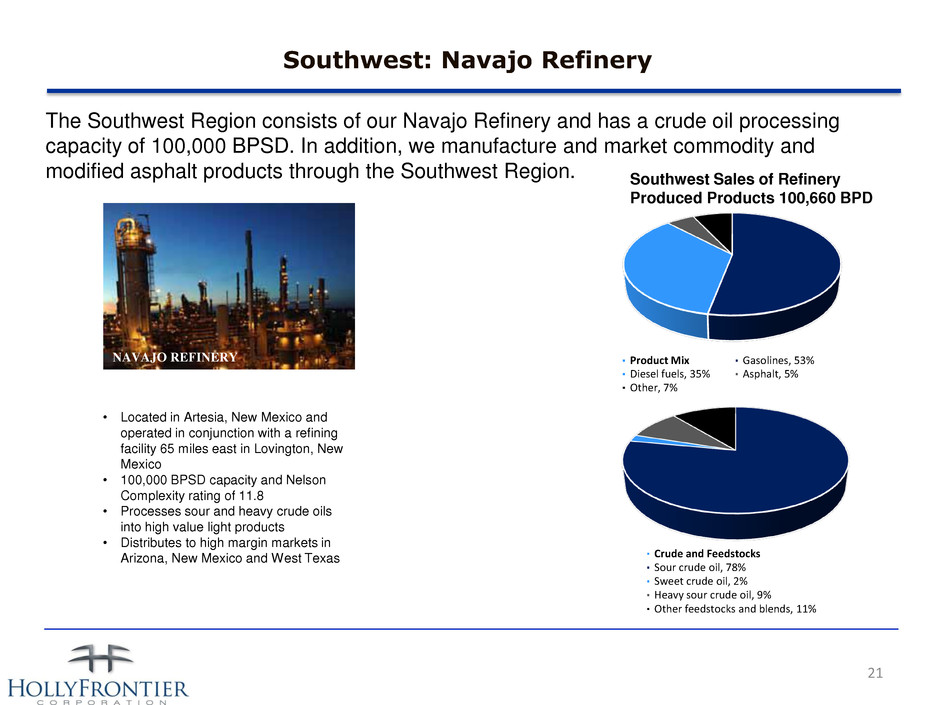

21 Southwest: Navajo Refinery The Southwest Region consists of our Navajo Refinery and has a crude oil processing capacity of 100,000 BPSD. In addition, we manufacture and market commodity and modified asphalt products through the Southwest Region. Southwest Sales of Refinery Produced Products 100,660 BPD • Located in Artesia, New Mexico and operated in conjunction with a refining facility 65 miles east in Lovington, New Mexico • 100,000 BPSD capacity and Nelson Complexity rating of 11.8 • Processes sour and heavy crude oils into high value light products • Distributes to high margin markets in Arizona, New Mexico and West Texas Product Mix Gasolines, 53% Diesel fuels, 35% Asphalt, 5% Other, 7% Crude and Feedstocks Sour crude oil, 78% Sweet crude oil, 2% Heavy sour crude oil, 9% Other feedstocks and blends, 11% NAVAJO REFINERY

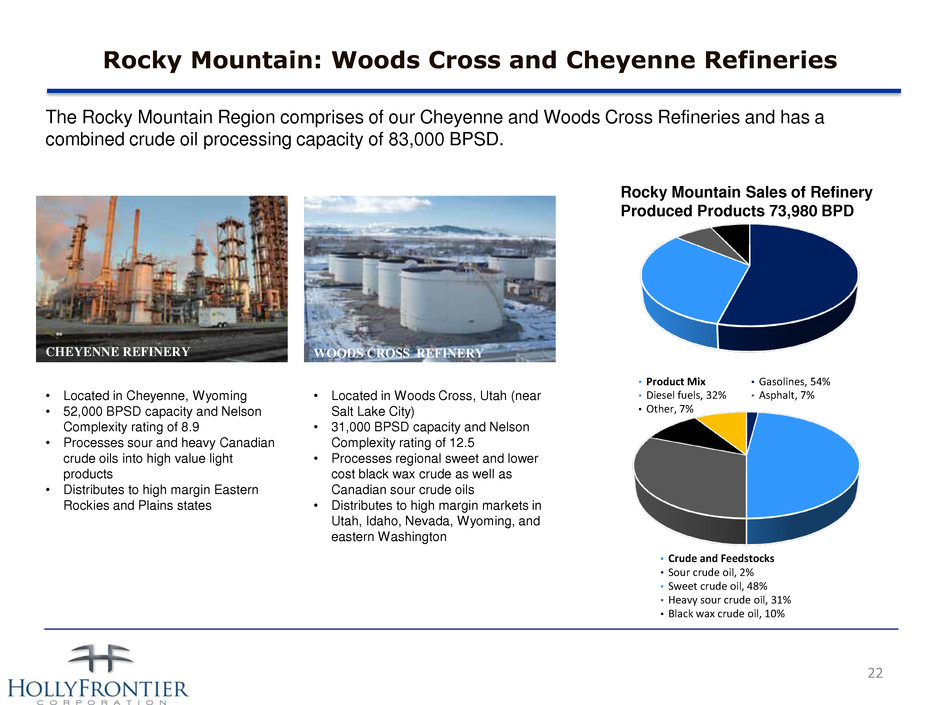

22 Rocky Mountain: Woods Cross and Cheyenne Refineries The Rocky Mountain Region comprises of our Cheyenne and Woods Cross Refineries and has a combined crude oil processing capacity of 83,000 BPSD. Rocky Mountain Sales of Refinery Produced Products 73,980 BPD • Located in Cheyenne, Wyoming • 52,000 BPSD capacity and Nelson Complexity rating of 8.9 • Processes sour and heavy Canadian crude oils into high value light products • Distributes to high margin Eastern Rockies and Plains states • Located in Woods Cross, Utah (near Salt Lake City) • 31,000 BPSD capacity and Nelson Complexity rating of 12.5 • Processes regional sweet and lower cost black wax crude as well as Canadian sour crude oils • Distributes to high margin markets in Utah, Idaho, Nevada, Wyoming, and eastern Washington Product Mix Gasolines, 54% Diesel fuels, 32% Asphalt, 7% Other, 7% Crude and Feedstocks Sour crude oil, 2% Sweet crude oil, 48% Heavy sour crude oil, 31% Black wax crude oil, 10% CHEYENNE REFINERY WOODS CROSS REFINERY

23 Holly Energy Partners Holly Energy Partners owns and operates substantially all of the refined product pipeline and terminalling assets that support our refining and marketing operations in the Mid- Continent, Southwest and Rocky Mountain regions of the United States. • 2,800 miles of crude oil and petroleum product pipelines • 12 million barrels of refined product and crude oil storage • 26 terminals and loading rack facilities in 9 Western and Mid-Continent states • 25% joint venture interest in SLC Pipeline, LLC — a 95-mile crude oil pipeline system that serves refineries in the Salt Lake City area • 75% joint venture interest in UNEV Pipeline, LLC – a 400-mile refined products pipeline system connecting Salt Lake area refiners to the Las Vegas product markets. HEP PRODUCTS

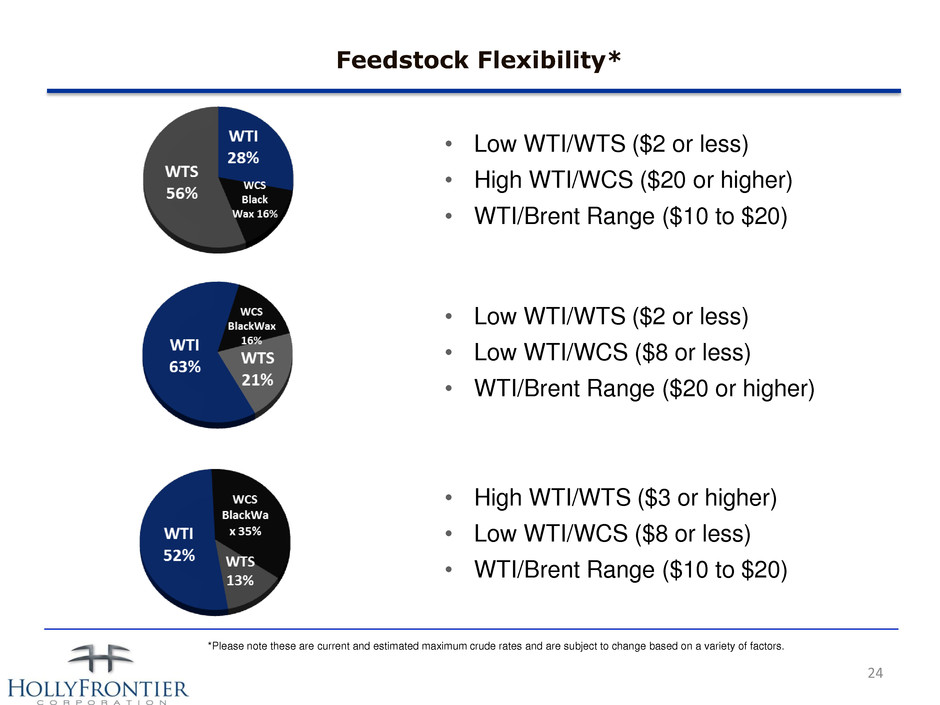

24 Feedstock Flexibility* • High WTI/WTS ($3 or higher) • Low WTI/WCS ($8 or less) • WTI/Brent Range ($10 to $20) • Low WTI/WTS ($2 or less) • High WTI/WCS ($20 or higher) • WTI/Brent Range ($10 to $20) • Low WTI/WTS ($2 or less) • Low WTI/WCS ($8 or less) • WTI/Brent Range ($20 or higher) *Please note these are current and estimated maximum crude rates and are subject to change based on a variety of factors.

25 Financial Metrics* Net Income/BBL crude capacity 2011 2010 2009 2008 2007 5 yr ave HFC 8.23 0.88 -0.55 3.61 7.39 3.91 CVI 5.12 0.34 1.67 3.94 -1.62 1.89 DK 3.09 -3.65 0.03 1.21 4.40 1.02 TSO 2.25 -0.12 -0.58 1.15 2.36 1.01 VLO 2.61 0.41 -2.17 -1.19 5.31 0.99 WNR 2.41 -0.31 -4.29 0.79 2.79 0.28 ALJ 0.46 -1.39 -1.36 1.46 1.67 0.17 Returns on Invested Capital Company 2011 ROIC 2010 ROIC 2009 ROIC 2008 ROIC 2007 ROIC 5 Yr. Ave CVI 18.7% 1.0% 6.0% 15.0% -7.0% 6.7% VLO 8.7% 1.0% -9.0% -5.0% 21.0% 3.3% DK 15.5% -11.0% 0.0% 3.0% 11.0% 3.7% ALJ 2.9% -10.0% -8.0% 5.0% 11.0% 0.2% WNR 8.2% -1.0% -19.0% 3.0% 10.0% 0.2% HFC 16.4% 4.8% -2.3% 21.8% 45.3% 17.2% TSO 10.0% -1.0% -3.0% 6.0% 12.0% 4.8% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Average WTI/Brent (SNAPWTIB) $ 1.11 $ 1.04 $ 2.40 $ 3.35 $ 1.57 $ 0.33 $ (0.28) $ 1.34 $ (0.47) $ (0.57) $ 1.00 ROIC 29.1% 5.2% 7.9% 20.8% 44.0% 45.0% 45.3% 21.8% -2.3% 4.8% 22% NI/BBL $ 2.23 $ 0.41 $ 0.57 $ 1.59 $ 4.45 $ 6.28 $ 7.39 $ 3.61 $ (0.55) $ 0.88 $ 2.69 * Holly debt excludes HEP debt; All amounts are based on publicly-available financial statements, which we have assumed to be accurate. LTM Cash Yield to Shareholders LTM Cash Dividend Aug 24th Close HFC 6.4% 2.50$ 38.99$ DK 2.1% 0.52$ 24.55$ MPC 2.3% 1.10$ 48.75$ VLO 2.2% 0.63$ 29.24$ ALJ 1.2% 0.16$ 13.67$ WNR 0.8% 0.20$ 26.20$ CVI 0.6% 0.16$ 28.29$ PSX 0.5% 0.20$ 41.36$ TSO 0.3% 0.12$ 39.45$

26 Definitions Non GAPP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. Refining gross margin or refinery gross margin: the difference between average net sales price and average costs of products per barrel of produced refined products. This does not include the associated depreciation, depletion and amortization costs. Refining gross margin or refinery gross margin is a non-GAAP performance measure that is used by our management and others to compare our refining performance to that of other companies in our industry. This margin does not include the effect of depreciation, depletion and amortization. Other companies in our industry may not calculate this performance measure in the same manner. Our historical refining gross margin or refinery gross margin is reconciled to net income under “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” of HollyFrontier Corporation’s 2011 10-K filed February 29, 2012. Net Operating Margin: Net operating margin is a non-GAAP performance measure that is used by our management and others to compare our refining performance to that of other companies in our industry. This margin does not include the effect of depreciation, depletion and amortization. Other companies in our industry may not calculate this performance measure in the same manner. Our historical net operating margin is reconciled to net income under “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” of HollyFrontier Corporation’s 2011 10-K filed February 29, 2012. EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer to as EBITDA, is calculated as net income plus (i) interest expense net of interest income, (ii) income tax provision, and (iii) depreciation, depletion and amortization. EBITDA is not a calculation provided for under accounting principles generally accepted in the United States; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” of HollyFrontier Corporation’s 2011 10-K filed February 29, 2012. Debt-To-Capital: A measurement of a company's financial leverage, calculated as the company's long term debt divided by its total capital. Debt includes all long-term obligations. Total capital includes the company's debt and shareholders' equity. 5 Year Return on Invested Capital: A measurement which for our purposes is calculated using the 5 year average Net Income divided by the sum of the 5 year average of Total Equity and Long Term Debt. We consider ROIC to be a meaningful indicator of our financial performance, and we evaluate this metric because it measures how effectively we use the money invested in our operations. IDR: Incentive Distribution Rights BPD: the number of barrels per calendar day of crude oil or petroleum products. BPSD: the number of barrels per stream day of crude oil or petroleum products. MMSCFD: million standard cubic feet per day. Gas Oil Hydrocracker: a refinery unit which uses catalyst at high pressure and temperature and in the presence of hydrogen to convert high boiling point hydrocarbons to light transportation fuels and low sulfur FCC feedstock. Solvent deasphalter / residuum oil supercritical extraction (“ROSE”): a refinery unit that uses a light hydrocarbon like propane or butane to extract non asphaltene heavy oils from asphalt or atmospheric reduced crude. These deasphalted oils are then further converted to gasoline and diesel in the FCC process. The remaining asphaltenes are either sold, blended to fuel oil or blended with other asphalt as a hardener..