Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALIDUS HOLDINGS LTD | a20120830-vrandfsrpressrel.htm |

| EX-99.1 - EXHIBIT - VALIDUS HOLDINGS LTD | exh991-vrandfsrpressrelease.htm |

AUGUST 30, 2012 Validus Agreed Acquisition of Flagstone FILED BY VALIDUS HOLDINGS, LTD. PURSUANT TO RULE 425 UNDER THE SECURITIES ACT OF 1933 AND DEEMED FILED PURSUANT TO RULE 14a-12 UNDER THE SECURITIES EXCHANGE ACT OF 1934 SUBJECT COMPANY: FLAGSTONE REINSURANCE HOLDINGS, S.A. COMMISSION FILE NO. 001-33364

Cautionary Note Regarding Forward-Looking Statements 2 This presentation may include forward-looking statements, both with respect to Validus and Flagstone and their industries, that reflect their current views with respect to future events and financial performance. Statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate,” “will,” “may,” “would” and similar statements of a future or forward-looking nature identify forward-looking statements. All forward- looking statements address matters that involve risks and uncertainties, many of which are beyond Validus’ and Flagstone’s control. Accordingly, there are or will be important factors that could cause actual results to differ materially from those indicated in such statements and, therefore, you should not place undue reliance on any such statements. Validus and Flagstone believe that these factors include, but are not limited to, the following: 1) unpredictability and severity of catastrophic events; 2) issues relating to claims and coverage that may emerge from changing industry practices or changing legal, judicial, social or other environmental conditions; 3) rating agency actions; 4) adequacy of Validus’ and Flagstone’s risk management and loss limitation methods; 5) competition in the insurance and reinsurance markets; 6) cyclicality of demand and pricing in the insurance and reinsurance markets; 7) adequacy of Validus’ and Flagstone’s respective loss reserves; 8) the estimates and judgments that Validus and Flagstone use in preparing their respective financial statements, which are more difficult to make than if Validus and Flagstone were mature companies; 9) retention of key personnel; 10) potential conflicts of interest with Validus’ and Flagstone’s respective officers and directors, 11) continued availability of capital and financing; 12) potential loss of business from one or more major insurance or reinsurance brokers; 13) the credit risk that each of Validus and Flagstone assume through their dealings with their respective insurance and reinsurance brokers; 14) Validus’ and Flagstone’s respective ability to implement, successfully and on a timely basis, complex infrastructure, distribution capabilities, systems, procedures and internal controls, and to develop accurate actuarial data to support the business and regulatory and reporting requirements; 15) the risk that Validus and Flagstone could be bound to policies that contravene their respective underwriting guidelines by managing general agents and other third parties who support certain of their businesses; 16) availability of reinsurance and retrocessional coverage; 17) the effect on Validus’ and Flagstone’s investment portfolios of changing financial market conditions including inflation, interest rates, liquidity and other factors; 18) the impact of currency fluctuations on Validus’ and Flagstone’s operating results; 19) the impact of heightened European sovereign debt risk on Validus’ and Flagstone’s fixed income portfolios; 20) the integration of Flagstone or other businesses Validus may acquire or new business ventures Validus may start; 21) the legal, regulatory and tax regimes under which Validus and Flagstone operate; and 22) acts of terrorism or outbreak of war, as well as Validus and Flagstone management’s response to any of the aforementioned factors. Additionally, the proposed transaction is subject to risks and uncertainties, including: (A) that Validus and Flagstone may be unable to complete the proposed transaction because, among other reasons, conditions to the closing of the proposed transaction may not be satisfied or waived; (B) uncertainty as to the timing of completion of the proposed transaction; (C ) uncertainty as to the actual premium (if any) that will be realized by Flagstone shareholders in connection with the proposed transaction; (D) uncertainty as to the long-term value of Validus common shares; (E) failure to realize the anticipated benefits of the proposed transaction, including as a result of failure or delay in integrating Flagstone’s businesses into Validus; and (F) the outcome of any legal proceedings to the extent initiated against Validus, Flagstone and others following the announcement of the proposed transaction, as well as management’s response to any of the aforementioned factors.

Cautionary Note Regarding Forward-Looking Statements (2) The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in Validus’ most recent reports on Form 10-K and Form 10-Q and the risk factors included in Flagstone’s most recent reports on Form 10-K and Form 10-Q and other documents of Validus and Flagstone on file with the Securities and Exchange Commission (“SEC”). In addition to the risks described above, risks and uncertainties relating to the proposed transaction will be more fully discussed in the preliminary proxy statement/prospectus included in the registration statement on Form S-4 that will be filed by Validus with the SEC. Any forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by Validus or Flagstone will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Validus or Flagstone or their respective businesses or operations. Each forward- looking statement speaks only as of the date of the particular statement and, except as may be required by applicable law, Validus and Flagstone undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise. The contents of any websites referenced in this presentation are not incorporated by reference herein. 3

Additional Information About The Proposed Transaction And Where To Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Certain matters relating to the proposed transaction will be submitted to shareholders of Flagstone for their consideration. Flagstone shareholders are urged to read the preliminary proxy statement/prospectus included in the registration statement on Form S-4 that will be filed by Validus with the SEC in connection with the proposed transaction when it is filed, any supplement or amendment thereto that may be filed, and any other relevant documents that may be filed, with the SEC because they will contain important information. This presentation is not a substitute for the proxy statement/prospectus included in the registration statement on Form S-4 or any other documents which Validus or Flagstone may file with the SEC and send to Flagstone shareholders in connection with the proposed transaction. All such documents, when filed, will be available free of charge at the SEC’s website (www.sec.gov) or by directing a request to Validus through Jon Levenson, Executive Vice President, at +1-441-278-9000, or Flagstone through Brenton Slade, Chief Marketing Officer , at +1-441-278-4303. 4

Participants In the Solicitation Validus and Flagstone and their respective directors and officers may be deemed to be participants in any solicitation of Flagstone shareholders in connection with the proposed transaction. Information about Validus’ directors and officers is available in Validus’ definitive proxy statement, dated March 21, 2012, for its 2012 annual general meeting of shareholders. Information about Flagstone’s directors and officers is available in Flagstone’s definitive proxy statement, dated March 28, 2012, for its 2012 annual general meeting of shareholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus included in the registration statement on Form S-4 and other relevant materials to be filed with the SEC when they become available. You can obtain such documents free of charge at the SEC’s website (www.sec.gov) or by using the contact information above. 5

An Attractive Transaction for Validus and Flagstone Shareholders • Builds on Validus leadership position in catastrophe risk and proven integration skill • Adds $291.61 million of property cat reinsurance premium • Business purchased with appropriate margin of safety for Validus shareholders ─ 73.2% of Flagstone June 30, 2012 diluted book value per share ─ $58.2 million bargain purchase gain after $135.2 million balance sheet adjustments • Provides a liquidity event for Flagstone shareholders ─ 19.4% premium to Flagstone August 29, 2012 share price • Combined entity with common shareholders’ equity of $4.0 billion2 and $5.2 billion of total capitalization 6 Strategic acquisition strengthens Validus and completes Flagstone’s repositioning 1) FSR last twelve months of Property Cat gross written premium as of June 30, 2012. 2) Consolidated Pro Forma shareholders’ equity at June 30, 2012 available to Validus.

Transaction Background • Validus was initially approached in March 2012, but declined to participate in the process • During 2012, Flagstone continued to make progress on repositioning its operations: – Completed the sales of Island Heritage and Flagstone at Lloyd’s – Continued reduction in workforce and streamlining of organization – Significant reduction of underwriting leverage – 40% NPW/Equity Ratio vs. 70% historically • In late July 2012, Flagstone approached Validus about a potential transaction • Parties able to agree a transaction which provided a market premium and enhanced liquidity to Flagstone shareholders 7 1) Further detail to be provided in the joint Flagstone/Validus Proxy Statement/Prospectus, to be filed with the U.S. S.E.C.

Validus, From Formation to Today: A Case Study in Value Creation • Validus has established leading global positions in Bermuda and at Lloyd’s – Market leading position in Bermuda reinsurance, the world’s most important property-catastrophe reinsurance market – Competitive position at Lloyd’s, where Talbot is the 11th largest of 89 syndicates – Size and scale to remain a strong, independent competitor • Business plan since formation has been to focus on short-tail lines, which have been the best- priced classes of risk – Underwriting acumen has been validated by ability to attract and manage third-party capital from sophisticated investors • Maintained a focus on underwriting profits in conjunction with a strong balance sheet – Minimal exposure to interest rate risk – History of favorable reserve development • Delivered superior financial results since 2007 IPO, outperforming short-tail Bermuda peers • Active capital management, returning $1.60 billion to investors through repurchases and dividends from IPO through Q2 20121 8 1) Excluding cash paid in IPC transaction, through July 24, 2012.

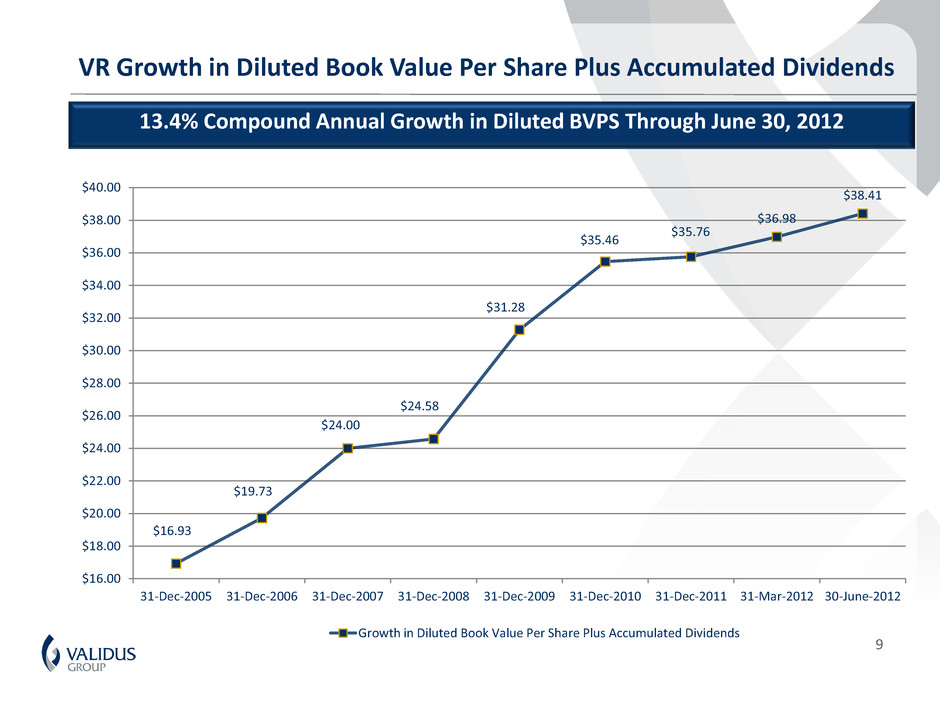

13.4% Compound Annual Growth in Diluted BVPS Through June 30, 2012 9 VR Growth in Diluted Book Value Per Share Plus Accumulated Dividends $16.93 $19.73 $24.00 $24.58 $31.28 $35.46 $35.76 $36.98 $38.41 $16.00 $18.00 $20.00 $22.00 $24.00 $26.00 $28.00 $30.00 $32.00 $34.00 $36.00 $38.00 $40.00 31-Dec-2005 31-Dec-2006 31-Dec-2007 31-Dec-2008 31-Dec-2009 31-Dec-2010 31-Dec-2011 31-Mar-2012 30-June-2012 Growth in Diluted Book Value Per Share Plus Accumulated Dividends

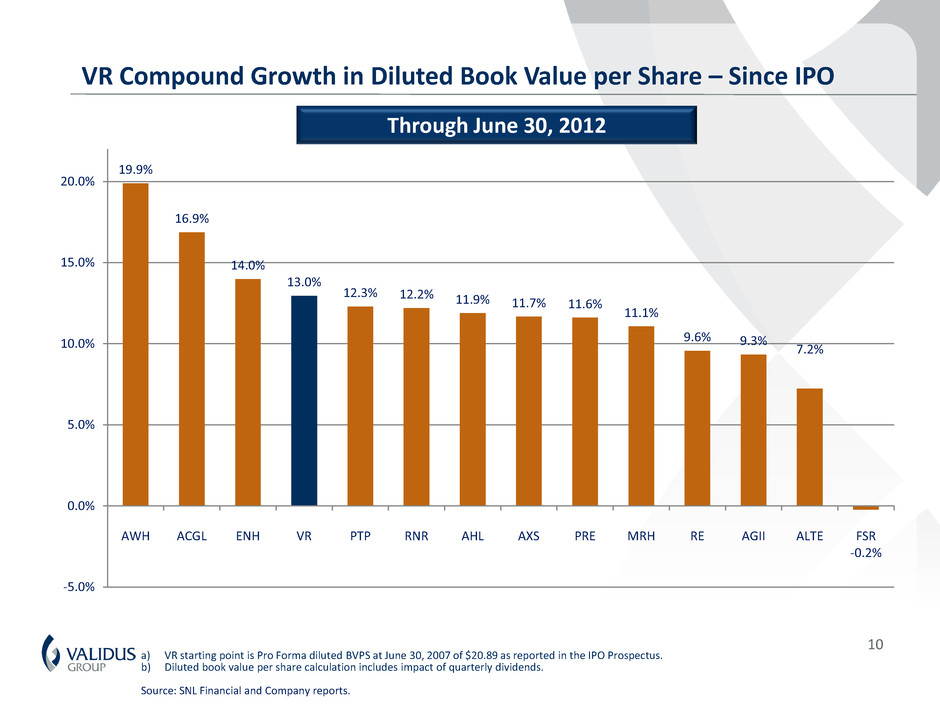

10 a) VR starting point is Pro Forma diluted BVPS at June 30, 2007 of $20.89 as reported in the IPO Prospectus. b) Diluted book value per share calculation includes impact of quarterly dividends. Source: SNL Financial and Company reports. Through June 30, 2012 VR Compound Growth in Diluted Book Value per Share – Since IPO 19.9% 16.9% 14.0% 13.0% 12.3% 12.2% 11.9% 11.7% 11.6% 11.1% 9.6% 9.3% 7.2% -0.2% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% AWH ACGL ENH VR PTP RNR AHL AXS PRE MRH RE AGII ALTE FSR

Transaction Overview

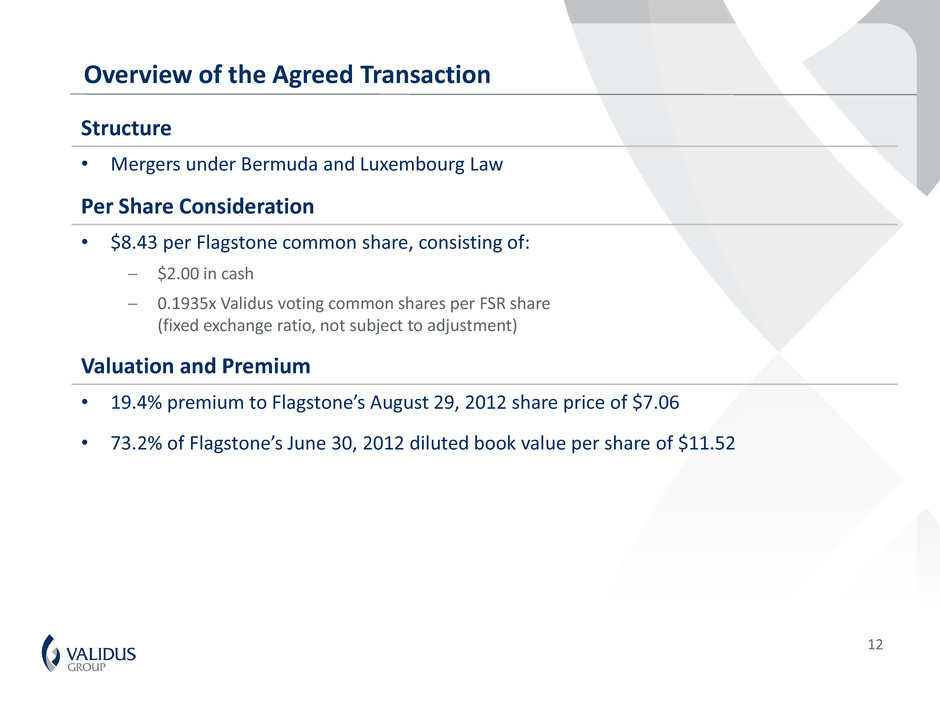

Structure • Mergers under Bermuda and Luxembourg Law Per Share Consideration • $8.43 per Flagstone common share, consisting of: ─ $2.00 in cash ─ 0.1935x Validus voting common shares per FSR share (fixed exchange ratio, not subject to adjustment) Valuation and Premium • 19.4% premium to Flagstone’s August 29, 2012 share price of $7.06 • 73.2% of Flagstone’s June 30, 2012 diluted book value per share of $11.52 Overview of the Agreed Transaction 12

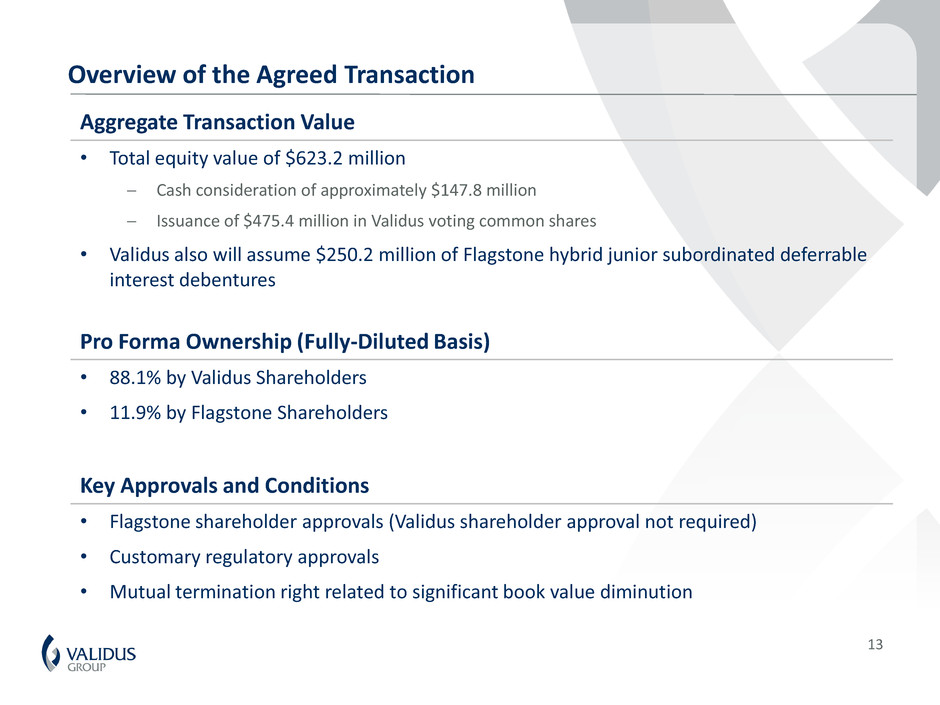

Aggregate Transaction Value • Total equity value of $623.2 million ─ Cash consideration of approximately $147.8 million ─ Issuance of $475.4 million in Validus voting common shares • Validus also will assume $250.2 million of Flagstone hybrid junior subordinated deferrable interest debentures Pro Forma Ownership (Fully-Diluted Basis) • 88.1% by Validus Shareholders • 11.9% by Flagstone Shareholders Key Approvals and Conditions • Flagstone shareholder approvals (Validus shareholder approval not required) • Customary regulatory approvals • Mutual termination right related to significant book value diminution Overview of the Agreed Transaction 13

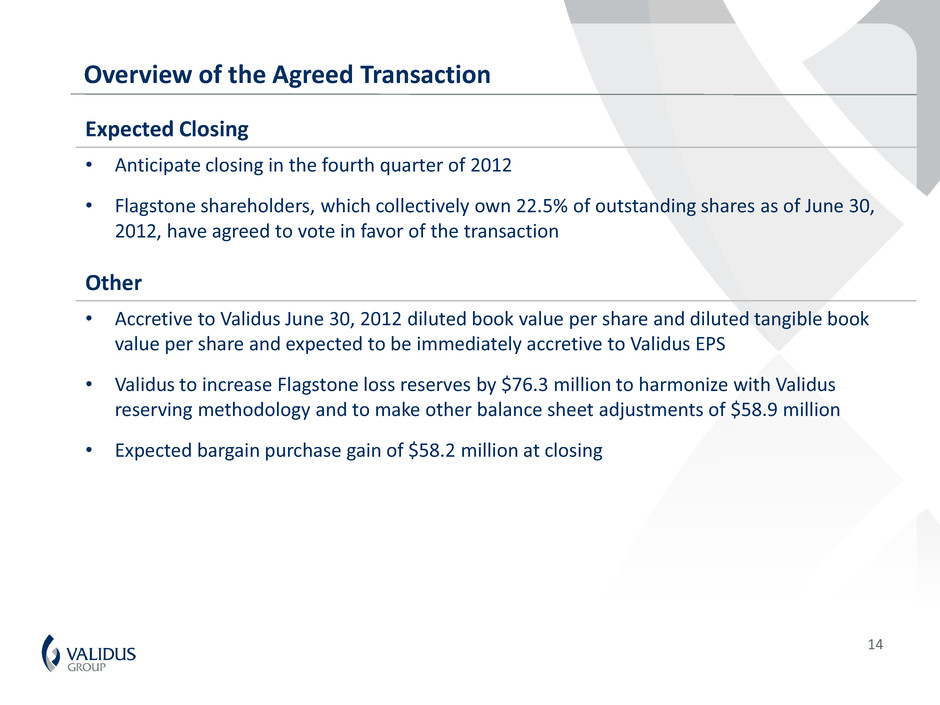

Overview of the Agreed Transaction Expected Closing • Anticipate closing in the fourth quarter of 2012 • Flagstone shareholders, which collectively own 22.5% of outstanding shares as of June 30, 2012, have agreed to vote in favor of the transaction Other • Accretive to Validus June 30, 2012 diluted book value per share and diluted tangible book value per share and expected to be immediately accretive to Validus EPS • Validus to increase Flagstone loss reserves by $76.3 million to harmonize with Validus reserving methodology and to make other balance sheet adjustments of $58.9 million • Expected bargain purchase gain of $58.2 million at closing 14

Validus Plus Flagstone Further Enhancing Validus Leadership in Property Catastrophe Reinsurance

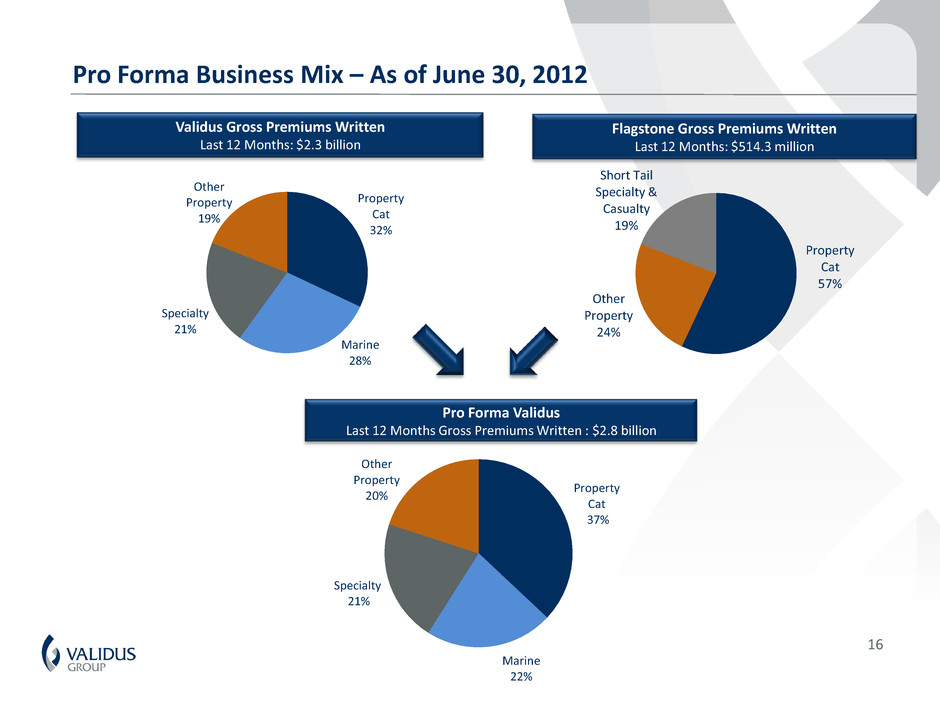

Pro Forma Business Mix – As of June 30, 2012 16 Pro Forma Validus Last 12 Months Gross Premiums Written : $2.8 billion Validus Gross Premiums Written Last 12 Months: $2.3 billion Flagstone Gross Premiums Written Last 12 Months: $514.3 million Property Cat 57% Other Property 24% Short Tail Specialty & Casualty 19% Property Cat 32% Marine 28% Specialty 21% Other Property 19% Property Cat 37% Marine 22% Specialty 21% Other Property 20%

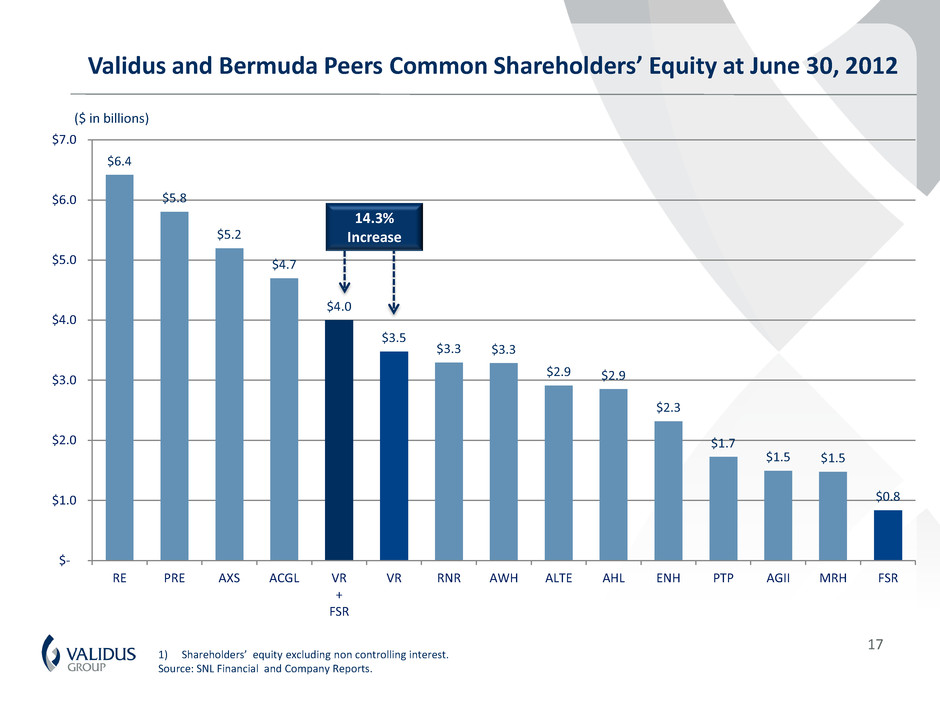

Validus and Bermuda Peers Common Shareholders’ Equity at June 30, 2012 17 1) Shareholders’ equity excluding non controlling interest. Source: SNL Financial and Company Reports. $6.4 $5.8 $5.2 $4.7 $4.0 $3.5 $3.3 $3.3 $2.9 $2.9 $2.3 $1.7 $1.5 $1.5 $0.8 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 RE PRE AXS ACGL VR + FSR VR RNR AWH ALTE AHL ENH PTP AGII MRH FSR 14.3% Increase ($ in billions)

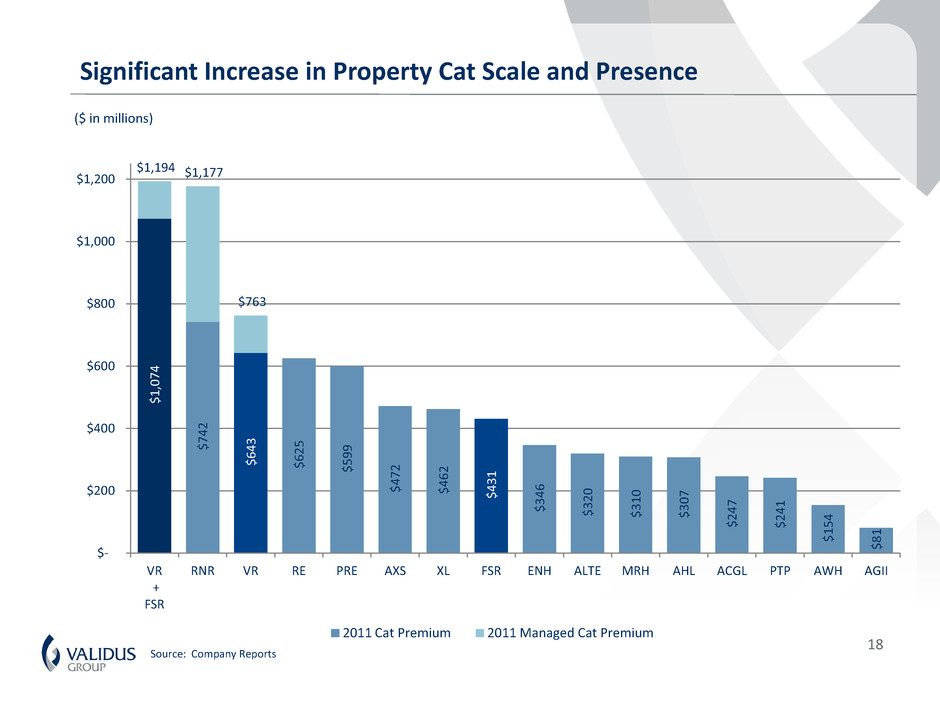

18 Significant Increase in Property Cat Scale and Presence Source: Company Reports ($ in millions) $ 1 ,0 7 4 $ 7 4 2 $ 6 4 3 $ 6 2 5 $ 5 9 9 $ 4 7 2 $ 4 6 2 $ 4 3 1 $ 3 4 6 $ 3 2 0 $ 3 1 0 $ 3 0 7 $ 2 4 7 $ 2 4 1 $ 1 5 4 $ 8 1 $1,194 $1,177 $763 $- $200 $400 $600 $800 $1,000 $1,200 VR + FSR RNR VR RE PRE AXS XL FSR ENH ALTE MRH AHL ACGL PTP AWH AGII 2011 Cat Premium 2011 Managed Cat Premium

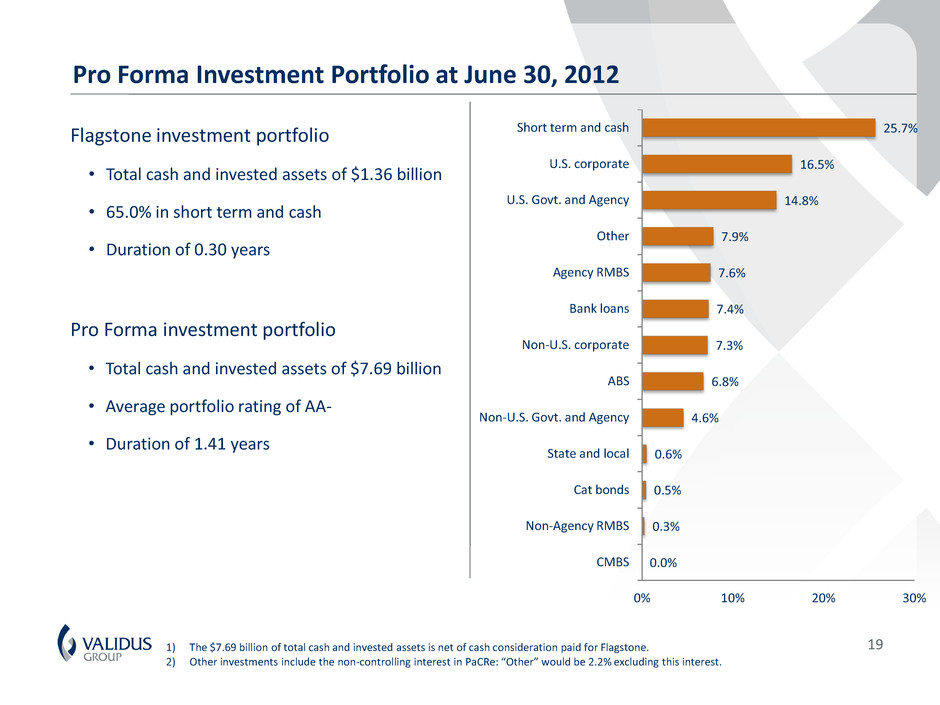

Pro Forma Investment Portfolio at June 30, 2012 19 Flagstone investment portfolio • Total cash and invested assets of $1.36 billion • 65.0% in short term and cash • Duration of 0.30 years Pro Forma investment portfolio • Total cash and invested assets of $7.69 billion • Average portfolio rating of AA- • Duration of 1.41 years 1) The $7.69 billion of total cash and invested assets is net of cash consideration paid for Flagstone. 2) Other investments include the non-controlling interest in PaCRe: “Other” would be 2.2% excluding this interest. 25.7% 16.5% 14.8% 7.9% 7.6% 7.4% 7.3% 6.8% 4.6% 0.6% 0.5% 0.3% 0.0% Short term and cash U.S. corporate U.S. Govt. and Agency Other Agency RMBS Bank loans Non-U.S. corporate ABS Non-U.S. Govt. and Agency State and local Cat bonds Non-Agency RMBS CMBS 0% 10% 20% 30%

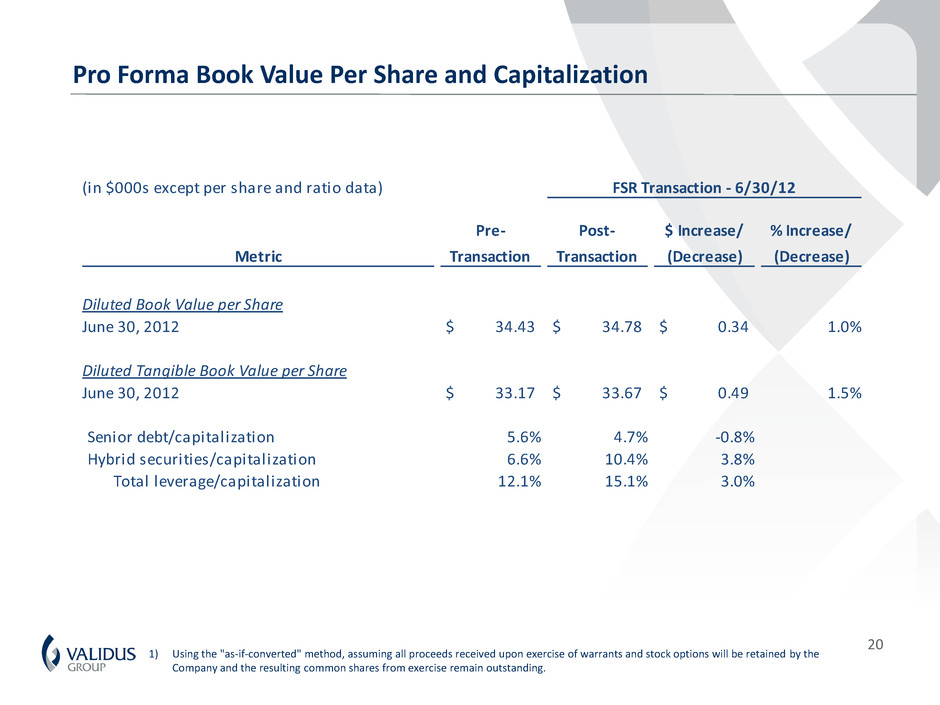

Pro Forma Book Value Per Share and Capitalization 20 1) Using the "as-if-converted" method, assuming all proceeds received upon exercise of warrants and stock options will be retained by the Company and the resulting common shares from exercise remain outstanding. (in $000s except per share and ratio data) FSR Transaction - 6/30/12 Metric Pre- Transaction Post- Transaction $ Increase/ (Decrease) % Increase/ (Decrease) Diluted Book Value per Share June 30, 2012 34.43$ 34.78$ 0.34$ 1.0% Diluted Tangible Book Value per Share June 30, 2012 33.17$ 33.67$ 0.49$ 1.5% Senior debt/capitalization 5.6% 4.7% -0.8% Hybrid securities/capitalization 6.6% 10.4% 3.8% Total leverage/capitalization 12.1% 15.1% 3.0%

Pro Forma Ratio of 1:100 US Windstorm Risk to Capital 21 2 3 .6 % Pro Forma PML/Capital Remains Within Stated Risk Appetite 1 9 .0 % 2 1 .4 % 2 0 .8 % 2 0 .7 % 2 1 .1 % 1 8 .0 % 1 7 .8 % 2 2 .3 % 2 1 .2 % 2 1 .6 % 2 2 .0 % 3/31/10 6/30/10 9/30/10 12/31/10 3/31/11 6/30/11 9/30/11 12/31/11 3/31/12 6/30/12 Proforma 6/30/2012

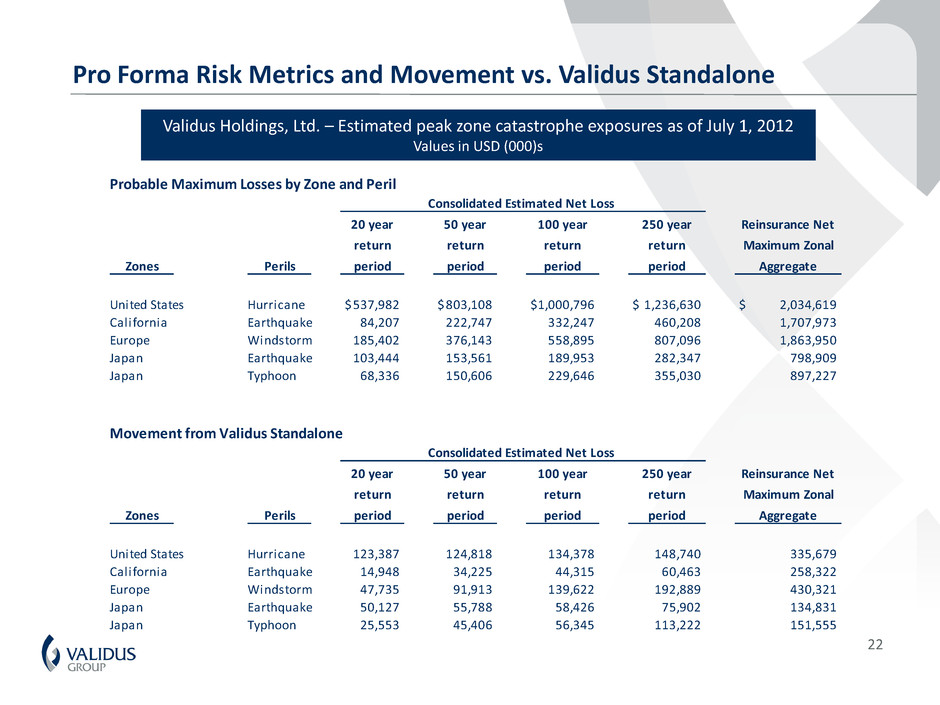

Pro Forma Risk Metrics and Movement vs. Validus Standalone 22 Probable Maximum Losses by Zone and Peril Zones Perils 20 year return period 50 year return period 100 year return period 250 year return period Reinsurance Net Maximum Zonal Aggregate United States Hurricane 537,982$ 803,108$ 1,000,796$ 1,236,630$ 2,034,619$ California Earthquake 84,207 222,747 332,247 460,208 1,707,973 Europe Windstorm 185,402 376,143 558,895 807,096 1,863,950 Japan Earthquake 103,444 153,561 189,953 282,347 798,909 Japan Typhoon 68,336 150,606 229,646 355,030 897,227 Movement from Validus Standalone Zones Perils 20 year return period 50 year return period 100 year return period 250 year return period Reinsurance Net Maximum Zonal Aggregate United States Hurricane 123,387 124,818 134,378 148,740 335,679 California Earthquake 14,948 34,225 44,315 60,463 258,322 Europe Windstorm 47,735 91,913 139,622 192,889 430,321 Japan Earthquake 50,127 55,788 58,426 75,902 134,831 Japan Typhoon 25,553 45,406 56,345 113,222 151,555 Consolidated Estimated Net Loss Consolidated Estimated Net Loss Validus Holdings, Ltd. – Estimated peak zone catastrophe exposures as of July 1, 2012 Values in USD (000)s

Validus Track Record of Successful Transaction Execution and Integration 23 • In July 2007, Validus acquired Talbot, a leading Lloyd’s Syndicate for $382 million – Talbot has contributed $277 million of net income since acquisition • By moving first, Validus acquired the syndicate with the best business fit • A large number of competitors followed Validus' entry into Lloyd’s – E.g., Allied World, Arch, Ariel, Argo, Aspen, Flagstone, Montpelier, Max and RenaissanceRe – None have reached the scale or profitability that Talbot brings to Validus • In September 2009, Validus closed the combination with IPC Holdings for $1.67 billion • Transaction consummated at below IPC book value – Resulted in significant accretion to Validus book value per share • Solidified Validus position as leader in global short- tail reinsurance markets – Strategically positioned Validus as a lead and quoting market – Size and market presence created opportunity for differentiated price/terms on many programs Acquisition of Talbot (July 2007) Amalgamation with IPC (Sept. 2009)

Post-Combination Business Plan • Flagstone will become a wholly owned subsidiary of Validus Reinsurance, Ltd. after the transaction closing • Validus has successfully integrated similar businesses in the past, notably the 2009 acquisition of IPC Holdings, Ltd. • Validus intends to merge the property catastrophe portfolios using Validus’ proprietary VCAPS system, supporting analytic research and Validus’ underwriting expertise • Flagstone’s outwards retrocessional protections will remain in place to manage risk limits • Validus intends to continue its share repurchase program following the transaction – Following re-underwriting of the combined cat portfolios, residual excess capital will be put to work in the business and/or returned to shareholders 24

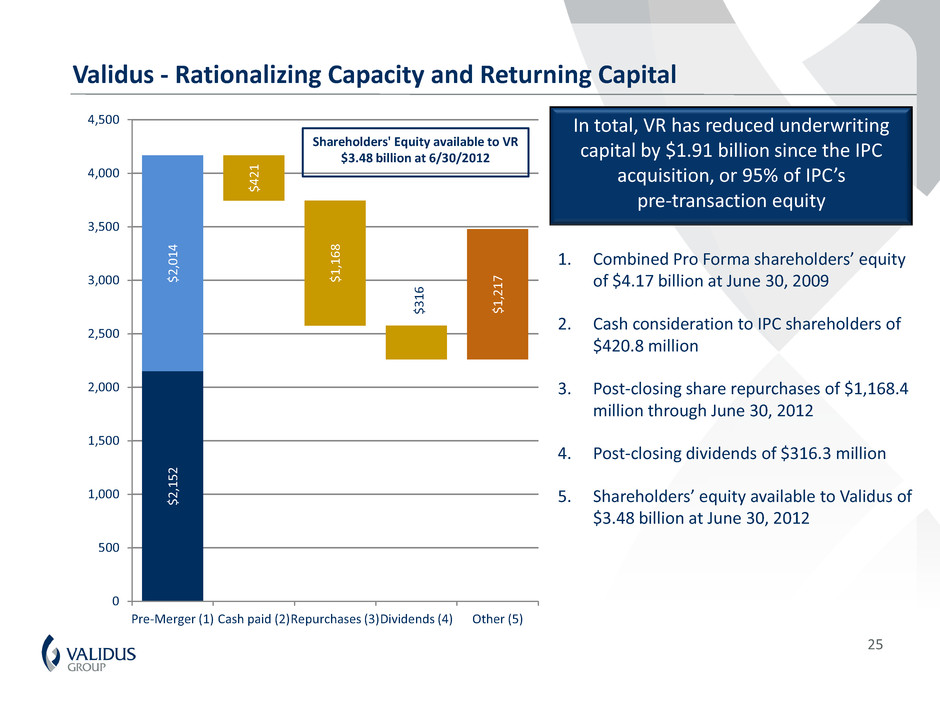

Validus - Rationalizing Capacity and Returning Capital 1. Combined Pro Forma shareholders’ equity of $4.17 billion at June 30, 2009 2. Cash consideration to IPC shareholders of $420.8 million 3. Post-closing share repurchases of $1,168.4 million through June 30, 2012 4. Post-closing dividends of $316.3 million 5. Shareholders’ equity available to Validus of $3.48 billion at June 30, 2012 In total, VR has reduced underwriting capital by $1.91 billion since the IPC acquisition, or 95% of IPC’s pre-transaction equity $ 2 ,1 5 2 $ 2 ,0 1 4 $ 4 2 1 $ 1 ,1 6 8 $ 3 1 6 $ 1 ,2 1 7 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 Pre-Merger (1) Cash paid (2) Repurchases (3) Dividends (4) Other (5) Shareholders' Equity available to VR $3.48 billion at 6/30/2012 25

Summary Transaction Rationale • Completes Flagstone’s strategic repositioning • Provides a liquidity event at a premium for Flagstone shareholders • Transaction economics provide an appropriate margin of safety for Validus shareholders • Further strengthens Validus’ market leading franchise in property catastrophe reinsurance 26