Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Leidos, Inc. | d404769d8k.htm |

| EX-99.1 - PRESS RELEASE - Leidos, Inc. | d404769dex991.htm |

©

SAIC. All rights reserved.

Unleashing Our Full Potential

August

30,

2012

Investor Presentation

National

Security

Engineering

Health

Government

Services

Enterprise IT

Exhibit 99.2 |

SAIC.com

©

SAIC. All rights reserved.

Forward-Looking Statements

2

Certain statements in this presentation contain or are based on

"forward-looking" information within the meaning of the Private Securities Litigation

Reform Act of 1995. In some cases, you can identify forward-looking

statements by words such as "expects," "intends," "plans," "anticipates,"

"believes," "estimates,“ and similar words or phrases.

Forward-looking statements in this presentation include, among others: our intent to separate

into two independent publicly traded companies as a result of the proposed

spin-off; revenue, growth and cost-efficiency expectations for the two

independent companies following the spin-off; the expectation that the

spin-off will be tax-free; statements regarding the resources, potential, priorities,

competitive positioning and opportunities for the independent companies

following the spin-off; expectations about future dividends and the timing of

the proposed transaction. These statements reflect our belief and

assumptions as to future events that may not prove to be accurate. Actual

performance and results may differ materially from the forward-looking

statements made in this presentation depending on a variety of factors,

including, but are not limited to: failure to obtain necessary regulatory

approvals or to satisfy any of the other conditions to the proposed spin-off;

adverse effects on the market price of our common stock and on our operating

results because of a failure to complete the proposed spin-off; failure to

realize the expected benefits of the proposed spin-off; negative effects

of announcement or consummation of the proposed spin-off on the market price

of the company’s common stock; significant transaction costs and/or

unknown liabilities; general economic and business conditions that affect the

companies in connection with the proposed spin-off; unanticipated

expenses such as litigation or legal settlement expenses; failure to obtain tax ruling

and/or opinion of counsel as to the tax-free nature of the transaction or

tax law changes; changes in capital market conditions that may affect

proposed debt financing; the impact of the proposed spin-off on the

Company’s or the newly formed company’s employees, customers and suppliers;

disruption to business operations as a result of the proposed transaction;

the inability to retain key personnel; and the inability of the companies to

operate independently following the spin-off. The proposed spin-off

will not require a shareholder vote. The proposed spin-off will be subject to

customary regulatory approvals, the receipt of an IRS tax ruling and a tax

opinion from counsel, the execution of intercompany agreements, finalization

of the capital structure of the two corporations, final approval of the SAIC

board and other customary matters.

These are only some of the factors that may affect the forward-looking

statements contained in this presentation. For further information concerning

risks and uncertainties associated with our business, please refer to the

filings we make from time to time with the U.S. Securities and Exchange

Commission, including the "Risk Factors," "Management's

Discussion and Analysis of Financial Condition and Results of Operations" and "Legal

Proceedings" sections of our latest annual report on Form 10-K and

quarterly reports on Form 10-Q, all of which may be viewed or obtained through the

Investor Relations section of our web site

at

All information in this presentation is as of August 30, 2012. The Company

expressly disclaims any duty to update the forward-looking statement

provided in this presentation to reflect subsequent events, actual results or

changes in the Company's expectations. The Company also disclaims any

duty to comment upon or correct information that may be contained in reports

published by investment analysts or others.

http://www.saic.com/.

|

SAIC.com

©

SAIC. All rights reserved.

Shaping Our Future

•

Actions taken to evolve in changing markets

–

Matured infrastructure (shared services, IT modernization )

–

Streamlined operations (organization level, clarified market assignments)

–

Focused on core competencies (divestitures, real estate monetization)

–

Developed

adjacent

markets

/more

access

(M&A

-

Health,

Engineering)

•

Strategic Review Imperatives

–

Sharpen focus on customer, cost structure and talent

–

Address growth inhibiting Organizational Conflict of Interest (OCI)

restrictions –

Maximize financial performance

3

Decision to separate SAIC into two different companies

•

National Security, Engineering, and Health

•

Government Technical Services and Enterprise IT

|

SAIC.com

©

SAIC. All rights reserved.

Transaction Overview

•

SAIC Inc. to distribute 100% of shares of Government Technical Services and

Enterprise IT business to shareholders via a tax-free

spin-off* •

Two publicly traded companies on the NYSE

•

Each company will be able to enhance shareholder value through

–

Elimination

of

organizational

conflicts

of

interest

(OCI)

that

limit

growth

by

blocking

access to

markets

–

Greater

market

alignment

and

focus

–

More

competitive

cost

structure

–

Focus

on

distinct

business

models

•

No shareholder approval required

•

Separation is expected to be completed next year

4

* Subject to IRS and other customary approvals |

SAIC.com

©

SAIC. All rights reserved.

Investment Benefits

Both companies optimized to create value:

•

Large

and

diversified

long-standing

client

base

•

Deep

capabilities

with

the

most

‘in

demand’

tech

skills

for

their

markets

•

Stable

and

healthy

cash

flows

•

Strong

and

experienced

management

team

•

Differentiated

and

competitive

business

in

their

own

space

5

National Security, Engineering,

and Health Solutions

Government Technical Services

and Enterprise IT

Technical

Services

Enterprise IT

National

Security

Engineering

Health

* Pro-forma current FY13 revenues

Government

Commercial

Government

Commercial

Revenues ~$7B *

Revenues ~$4B* |

SAIC.com

©

SAIC. All rights reserved.

National Security, Engineering, and Health

6

Strategy

overview

National defense systems, engineering and health technology provider

leveraging systems engineering integration, sensors, analytics

and large scale data management capabilities in high growth markets

with mission, complexity and large scale information characteristics

Target

markets

•

Mission Capability Integrator

•

ISR platform development (airborne, maritime, space and ground)

•

ISR processing, exploitation and dissemination

•

Cybersecurity

•

Engineering

•

Energy, environment and infrastructure

•

Water and natural resources

•

Electronic health records analytics and support

•

Government equipment modernization & sustainment

•

Security screening products

Points of

Differentiation

•

Ability to leverage big data and data analytics to raise the level of health

and engineering IT •

Expand

M&A

opportunities/revenue

growth

initiatives

Thesis of value

creation

•

Unlock growth by removing restrictions

•

Leverage focused synergy areas (Cyber/Data security, data analytics and

actionable exploitation) •

Open new revenue and M&A opportunities

•

Increase prominence to investors of fast growing Health and Engineering

businesses |

SAIC.com

©

SAIC. All rights reserved.

Future

Growth

Focus

-

National

Security,

Engineering, and Health

7

National

Security

•

Electronic warfare (EW)

•

Maritime domain awareness

•

Maritime ISR platforms

•

Missile warning/missile detection

•

Logistics readiness and sustainment of airborne and maritime platforms

Engineering

•

Transmission and distribution engineer and smart grid in Asia

•

International geothermal projects

•

Oil and gas services engineering

•

Natural resources program management and advanced automation

technology

Health

•

Electronic health records systems integration

•

Clinical information systems

•

Advanced clinical analytics

–

Quality and effectiveness

–

Cost |

SAIC.com

©

SAIC. All rights reserved.

Government Technical Services and Enterprise IT

8

Strategy

overview

Government technical services provider leveraging significant value from

long-standing customers relationships and mission expertise

with a focus on differentiated and repeatable solutions and

processes delivery at competitive price

Target

markets

•

Government enterprise IT services

•

Testing and service life extension

•

Logistics and supply chain management

•

Systems Engineering and Technical Assistance (SETA)

Points of

Differentiation

•

Engineering breadth, supply chain, technical expertise

•

Customer affinity and mission expertise

•

Low cost leadership

Thesis of value

creation

•

Improve management focus on Government services market

•

Drive a lower cost base tied directly to business needs

•

Expand addressable market and revenue growth through removal of restrictions

|

SAIC.com

©

SAIC. All rights reserved.

Future Growth Focus-

Government Technical Services

and Enterprise IT

9

Government

Technical

Services

Enterprise IT

•

Cost and financial analysis

•

Program office support

•

Technical services for new customers

•

C4 support services

•

Federal advisory and assistance

•

Transaction-based logistics and supply chain for new customers

•

Systems Engineering and Technical Assistance (SETA)

•

Enterprise-Wide

•

Cloud services

•

Network management

•

IT consolidation

•

Mobility

•

“X”

as a service

•

Big data management, analytics and visualization

|

SAIC.com

©

SAIC. All rights reserved.

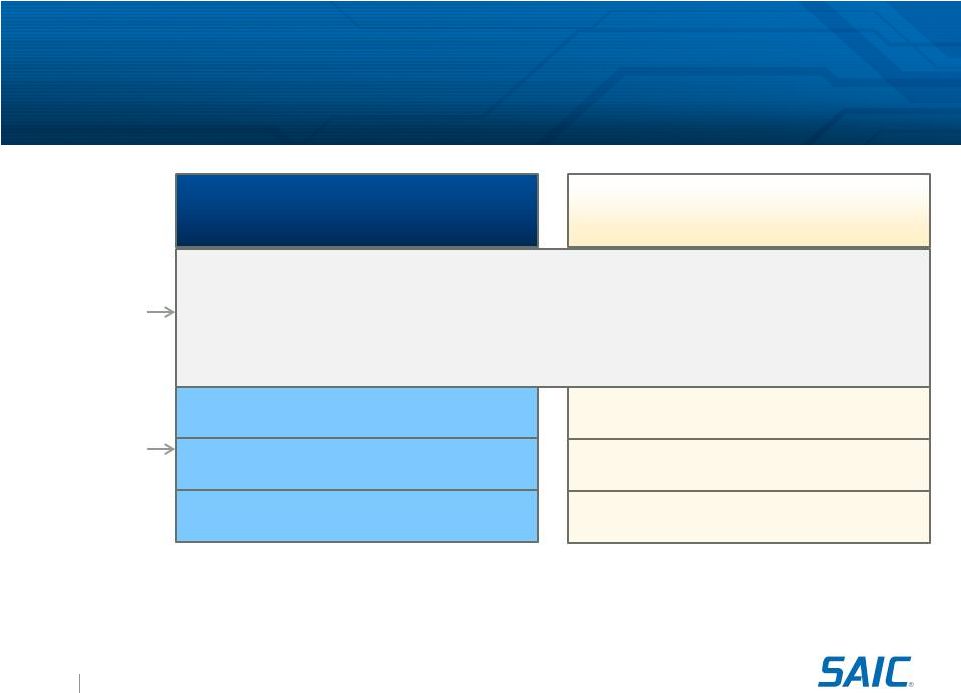

Capital Structure Attributes

10

National Security, Engineering,

and Health Solutions

•

Strong credit profile with access to

credit capital markets

Government Technical Services

and Enterprise IT

•

Government

•

Organic growth emphasized with

limited focus on M&A

•

Primarily

self-funding,

little

credit

access required

Common

Differentiated

•

Stable, predictable, and strong cash flow

•

Low capital intensity

•

Dividends

•

Government & Commercial

•

Organic growth with sufficient

firepower for M&A expansion |

SAIC.com

©

SAIC. All rights reserved.

Transaction Overview and Summary

•

Actions identified and taken to help shape our future

•

Completed the strategic review

•

Separation into aligned businesses

–

Opening of revenue channels

–

Enhanced focus on target markets

–

Employee continuity and opportunity

–

Client continuity

•

Completion next year

•

Shareholder vote not required *

11

Unleashing Our Full Potential

* The proposed spin-off will not require a shareholder vote. The proposed

spin-off will be subject to customary regulatory approvals, the receipt of an IRS tax

ruling and a tax opinion from counsel, the execution of intercompany

agreements, finalization of the capital structure of the two corporations, final approval of

the SAIC board and other customary matters. |

NATIONAL SECURITY •

ENERGY & ENVIRONMENT •

HEALTH •

CYBERSECURITY

©

SAIC. All rights reserved.

Thank You For Your Interest!

National

Security

Engineering

Health

Government

Services

Enterprise IT |