Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALTERRA CAPITAL HOLDINGS Ltd | d403763d8k.htm |

Investor Presentation

Quarter Ended June 30, 2012

Exhibit 99.1 |

2

Cautionary Note Regarding Forward-Looking Statements

This presentation may include forward-looking statements that reflect Alterra’s current views

with respect to future events and financial performance. Statements that include the words

“expect,” “intend,” “plan,” “believe,” “project,”

“anticipate,” “will,” “may” and similar statements of a future or

forward-looking nature identify forward-looking statements. All forward-looking

statements address matters that involve risks and uncertainties. Accordingly, there are

important factors that could cause actual results to differ materially from those indicated in such

statements and you should not place undue reliance on any such statements.

These factors include, but are not limited to, the following: (1) the adequacy of loss and benefit

reserves and the need to adjust such reserves as claims develop over time; (2) the failure of

any of the loss limitation methods employed; (3) the effect of cyclical trends, including with

respect to demand and pricing in the insurance and reinsurance markets; (4) changes in general

economic conditions, including changes in capital and credit markets; (5) any lowering or loss

of financial ratings; (6) the occurrence of natural or man-made catastrophic events with a

frequency or severity exceeding expectations; (7) actions by competitors, including

consolidation; (8) the effects of emerging claims and coverage issues; (9) the loss of business

provided to Alterra by its major brokers; (10) the effect on Alterra’s investment

portfolio of changing financial market conditions, including inflation, interest rates, liquidity and other

factors; (11) tax and regulatory changes and conditions; (12) retention of key personnel; (13) the

integration of new business ventures Alterra may enter into; and (14) management’s

response to any of the aforementioned factors. The foregoing review of important factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included herein and elsewhere,

including the Risk Factors included in Alterra’s most recent reports on Form 10-K and

Form 10-Q and other documents on file with the Securities and Exchange Commission. Any

forward-looking statements made in this presentation are qualified by these cautionary

statements, and there can be no assurance that the actual results or developments anticipated by

Alterra will be realized or, even if substantially realized, that they will have the expected

consequences to, or effects on, Alterra or it business or operations. Alterra undertakes no

obligation to update publicly or revise any forward-looking statement, whether as a result

of new information, future developments or otherwise.

|

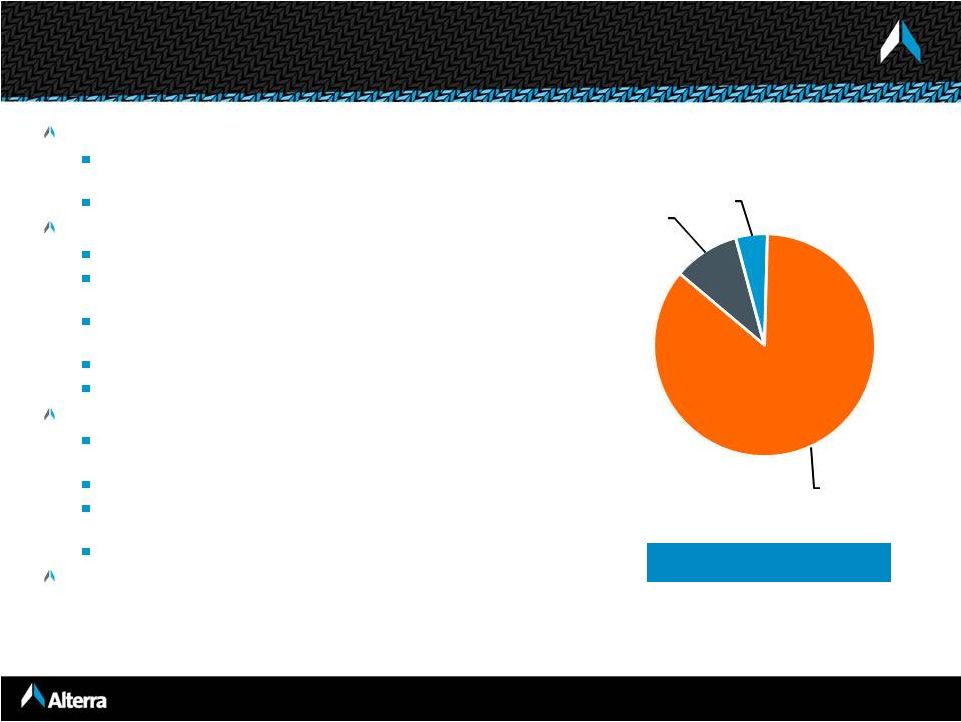

3

Alterra’s Franchise Is Well Positioned for Success

Global underwriter of specialty insurance and reinsurance

Multiple

operating

platforms

-

Bermuda,

Ireland,

United

States, Lloyd's and Latin America

Strong franchise positions across multiple specialty

classes of business

Opportunistic and disciplined underwriting strategy

Strong culture of risk management

Analytical and quantitative underwriting orientation

Business mix shift towards shorter-tail lines

5 year average combined ratio (including cats) of 90.8%

Liquid balance sheet with conservative reserving track record

Shareholders’

equity ~ $2.9 billion at 6/30/12

Low operating and financial leverage

S&P and AM Best ratings of “A”

Proven track record of active capital management

H1 2012 repurchases of $136.9 million and dividends of

$27.8

million,

or

5.9%

of

1/1/12

shareholders’

equity

2011 repurchases of $223.3 million and dividends of $54.5

million,

or

9.5%

of

1/1/11

shareholders’

equity

Increased quarterly dividend in August 2012 to $0.16 per

share

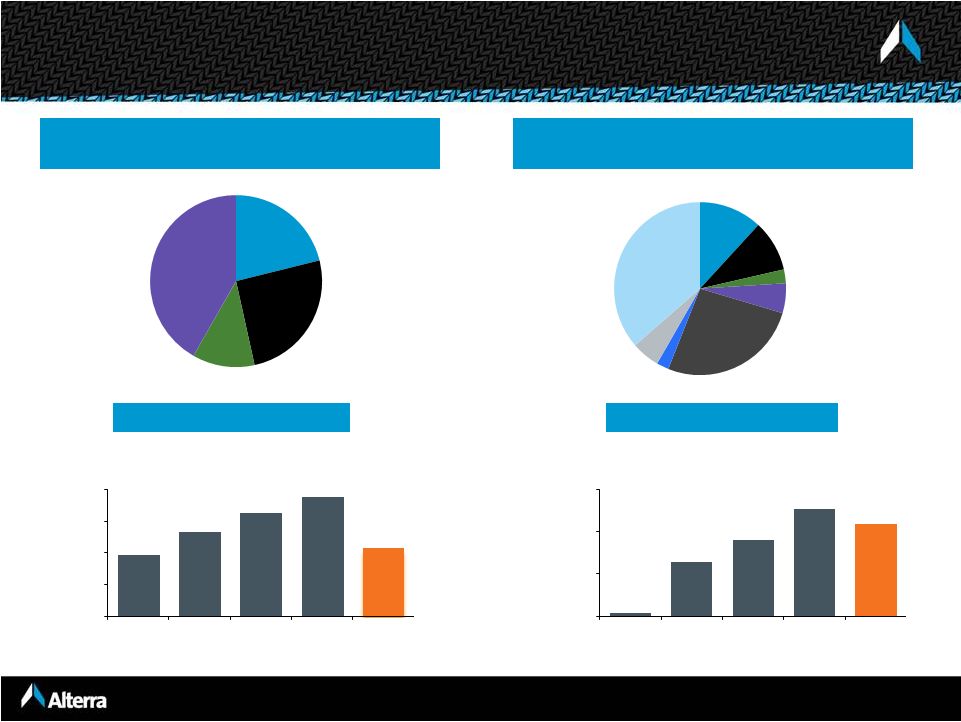

H1 2012 GPW

Short-

Tail

60%

Long-Tail

40%

Insurance

38%

Reinsurance

62% |

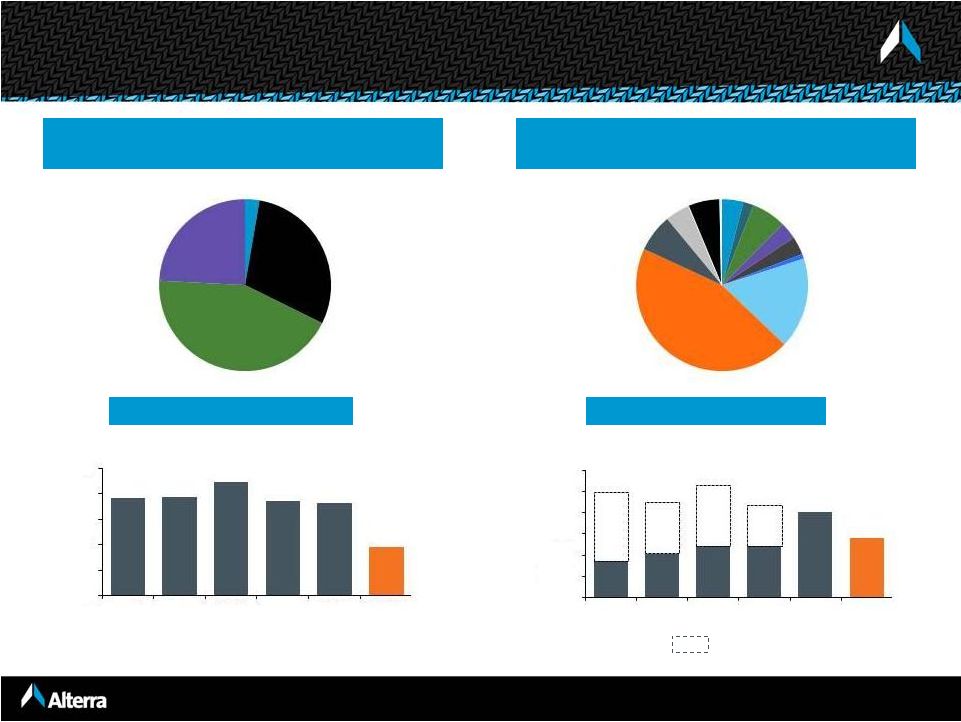

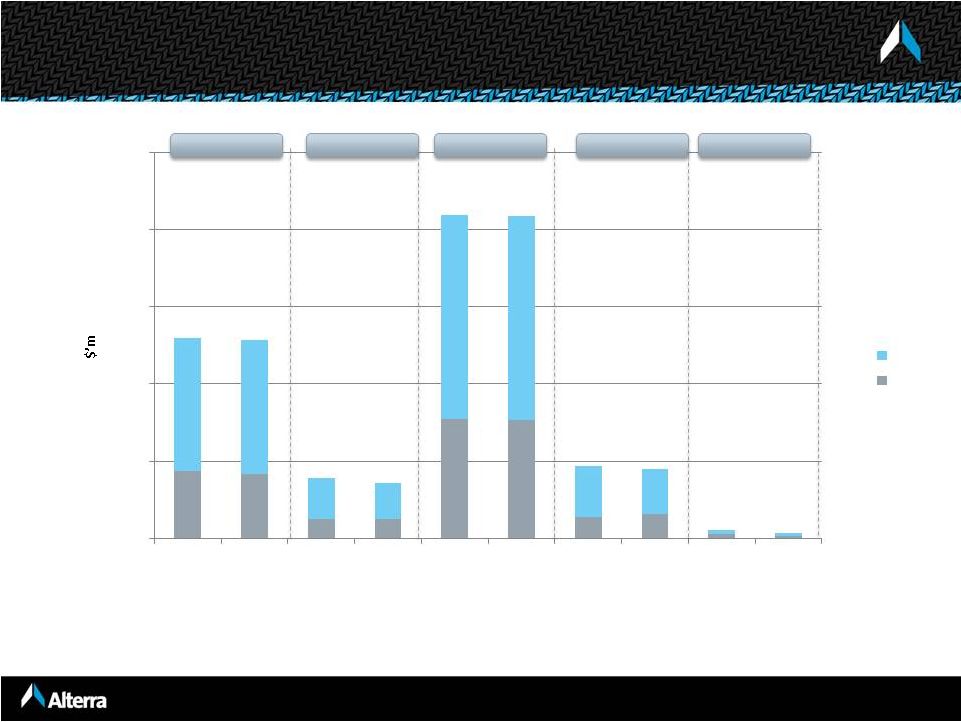

4

Second Quarter 2012 Results

Q2 2012 net operating diluted EPS of $0.68 per

share

Overall P&C gross premiums written grew 0.5%

to $565.8 million

Premium growth in US Insurance and

shorter-tail lines offset by declines in longer-

tail reinsurance lines

P&C net premiums written decreased 11.8% to

$376.1 million

Driven by increased reinsurance purchases

to manage aggregate exposures

Net investment income of $54.7 million compared

to $59.7 million in Q2 2011

Combined ratio of 86.6% compared to 93.7% in

Q2 2011

Diluted book value per share of $28.68 at 6/30/12

up from $26.91 at 12/31/11. Additional $1.58 per

diluted share of unrecorded unrealized

gains

in

the

held

to

maturity

investment

portfolio

.

Q2 2012 impacted by $7.4 million of equity

earnings and fee income from New Point Re IV.

P&C GPW

(0.5% increase)

Growth in Book Value

93.7%

86.6%

Combined Ratio

$563.0

$565.8

Diluted Book Value per Share

(7.6% increase

1

)

$26.91

$28.68

Expansion into new lines and regions

2

Unrealized gains on the held to maturity fixed maturity investments are not

included in equity as the investments are carried on the balance sheet at

amortized cost. Jun 30, 2011

Jun 30, 2012

Dec 31, 2011

Jun 30, 2012

2

1

Including adding back $0.28 per share of dividends. |

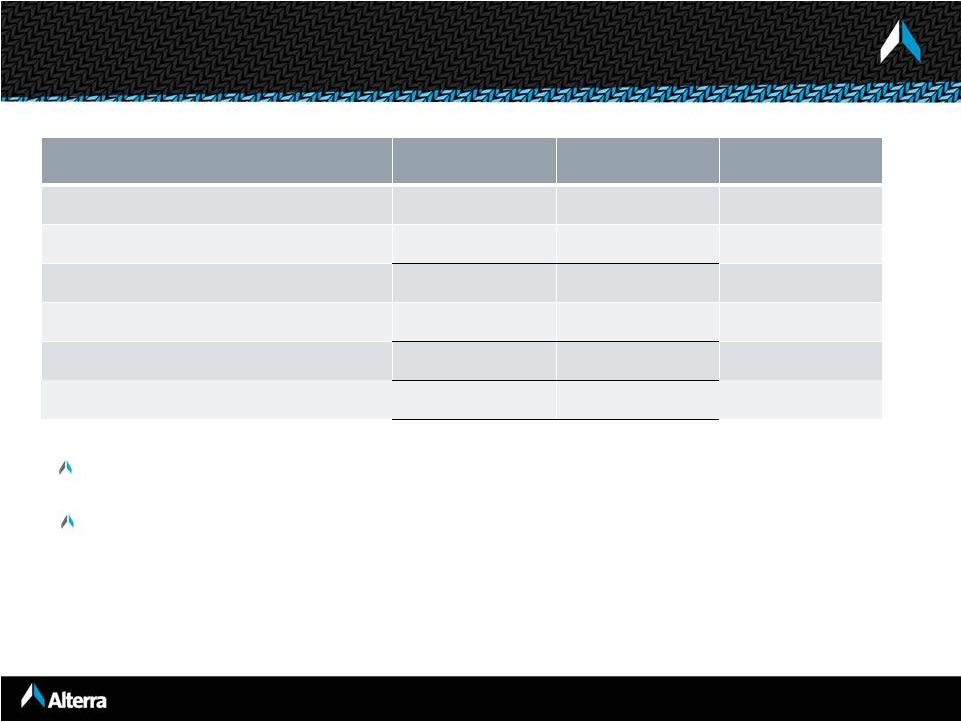

5

GPW $’millions

H1 2012

H1 2011

Period over Period

Growth %

Bermuda/ Dublin

221.9

182.2

US Reinsurance

39.1

42.4

GPW

on

contracts

bound

by

Alterra

in

the

period

1

261.0

224.6

20.8%

Alterra’s

share

of

New

Point

Re

IV

premiums

2

29.3

-

Total property reinsurance gross premiums

290.3

224.6

29.3%

Total

property

reinsurance

net

premiums

4

189.2

152.3

24.2%

Growth in Reinsurance Segment Property Premiums

1

Excluding premium adjustments and reinstatement premiums.

2

34.8% share of New Point Re IV gross premiums written. These premiums are not

included in Alterra’s reported gross premiums written as the investment in New

Point Re IV is accounted for under the equity method.

3

H1 2011 includes $13.4 million of New Point Re III gross premiums written. These

premiums are included in Alterra’s reported gross premiums written as Alterra owns

100% of New Point Re III.

4

Includes Alterra’s 34.8% share of New Point Re IV net premiums written.

20.8% growth in Alterra’s reinsurance segment property premiums reflects

improved market conditions

Participation

in

New

Point

Re

IV

increased

year

over

year

growth

to

29.3%

3 |

6

New Point IV and V

Sidecar vehicles formed to create additional capacity for the

property catastrophe collateralized marketplace

“Just in time”

capital as it is called down and utilized when needed

New

Point

IV

-

$200

million

of

capital

fully

deployed

in

2012

Alterra has a 34.8% equity interest

GPW was $84.3 million for the six months ended June 30, 2012

Income

of

$16.6

million

recognized

for

the

six

months

ended

June

30,

2012

New

Point

V

-

$210

million

of

available

capacity

New Point vehicles allow us to leverage our underwriting skills to earn fees

while providing additional capacity to brokers and clients

|

7

2011 global industry cat losses were over $105 billion

Market stressed by historic low returns on invested assets

Cash flow levels deteriorating

Industry reserve redundancies diminishing

Property cat rate increases have slowed

Casualty lines continue to show modest improvement

Pricing poised to positively move further with the next catalyst

Market Transitioning. . .

Alterra is positioned to be a beneficiary of improving market conditions

|

8

Pricing Is Improving for the First Time Since 1999. . .

More Rate Improvement Is Needed To Meaningfully Increase Exposure

------------------------------------------------------------------------------------------

Source: RBC Capital Markets and CIAB Commercial Property and Casualty

Market Index Survey Large Accounts:

Rates Remain Below 1999

Medium Accounts:

Rates ~3% Above 1999

Small Accounts:

Rates ~13% Above 1999 |

9

2004

Insurance

Property

2003

Insurance

Excess Liability

Professional Liability

2005

Reinsurance

Property / Property Cat

Harbor Point formed

2006

Insurance

Aviation

2008

Lloyd's Insurance

Financial Institutions

Prof. Indemnity

Lloyd's Reinsurance

Accident / Health

Property

2007

U.S. E&S Insurance

Property

Inland Marine

U.S. Casualty

Reinsurance

Multi Peril Crop

Experienced &

highly quantitative

underwriting teams

Lead underwriters average over 20 years in the

business

High percentage of employees hold

professional designations

2009

Lloyd's

Casualty (non U.S.)

A&H Insurance

U.S. Specialty

Professional Liability

Latin

America

Reinsurance

2002

Traditional Re

Workers' Comp

Medical Malpractice

GL / PL

Aviation

Identifying & Recruiting "Franchise Players" Has Been

Instrumental in Our Success

2010

Alterra formed

by the merger of Max

Capital and Harbor Point

2011

Lloyd’s

Property Direct &

Facultative

U.S. Specialty

Excess Casualty |

10

Local Knowledge

Global Reach |

11

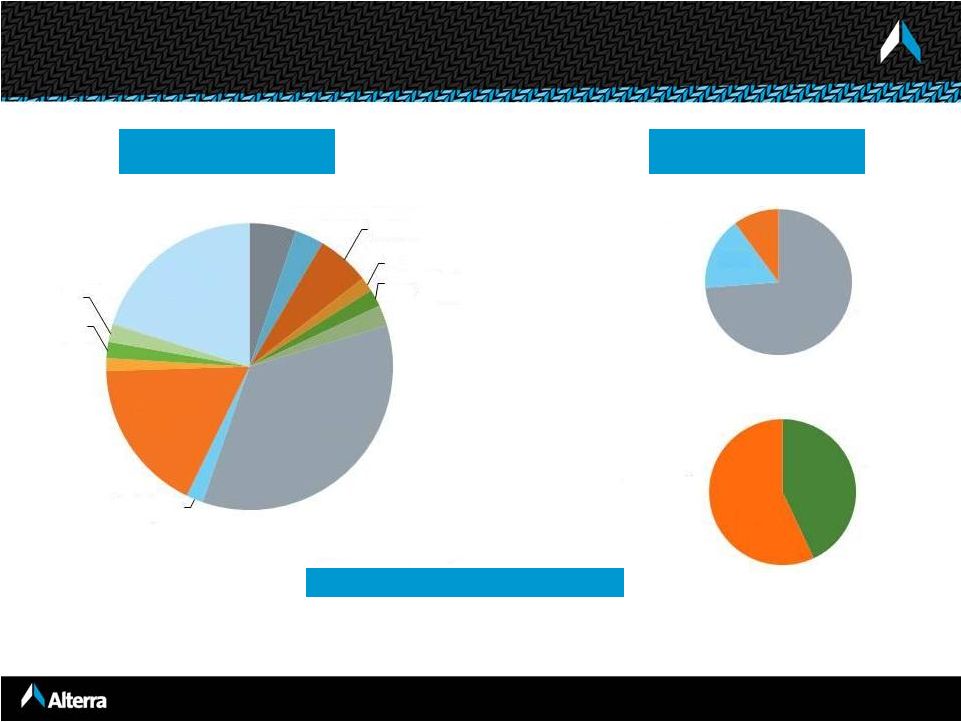

____________________

Note:

Pro forma gross premium written (“GPW”) represents the combined GPW of Max Capital

and Harbor Point net of intercompany eliminations of GPW. Global

Insurance (15.7% of H1 2012 P&C GPW)

Reinsurance

(46.1% of H1 2012 P&C GPW)

Professional

Liability

Property

Excess

Liability

Aviation

General Casualty

Property

Aviation

Workers Comp.

Professional Liability

Other

Med. Mal.

Marine & Energy

Agriculture

H1 2012 GPW: $192.0 million

= pro forma

$1,060.4

$815.4

Alterra Has a Strong Market Position in Specialty Classes …

Credit/ Surety

H1 2012 GPW: $565.2 million

$870.4

Auto

$382.9

$389.4

$447.3

$370.1

$365.8

$192.0

$0.0

$100.0

2007

2008

2009

2010

2011

H1 2012

$200.0

$300.0

$400.0

$500.0

$423.6

$345.2

$419.5

$487.1

$0.0

$200.0

$400.0

$600.0

$1,000.0

2007

2008

2009

2010

2011

H1 2012

$998.3

$900.4

$565.2

$800.0

$1,200.0

4%

2%

7%

3%

3%

1%

17%

45%

7%

5%

6%

3%

30%

43%

24% |

12

…With an Attractive Position in the U.S. Market and Lloyd’s

Professional

Liability

Property

Marine

Excess/

General

Liability

Property

Agriculture

Aviation

Financial Institutions

Accident & Health

Int’l Casualty

Marine

Professional Liability

U.S. Insurance

(17.6% of H1 2012 P&C GPW)

Alterra at Lloyd’s

(17.8% of H1 2012 P&C GPW)

H1 2012 GPW: $216.5 million

H1 2012 GPW: $218.2 million

21%

25%

12%

42%

12%

10%

3%

6%

26%

2%

5%

36%

$194.3

$265.9

$324.0

$374.7

$216.5

$0.0

$100.0

$200.0

$300.0

$400.0

2008

2009

2010

2011

H1 2012

$8.8

$129.0

$179.8

$253.1

$218.2

$0.0

$100.0

$200.0

$300.0

2008

2009

2010

2011

H1 2012 |

13

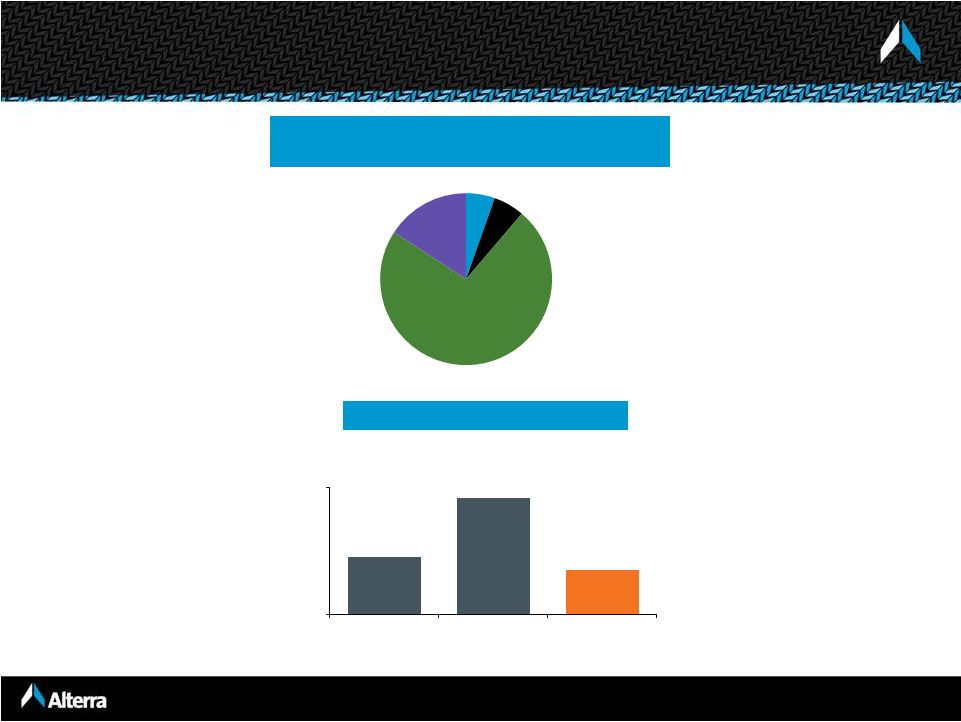

…and Latin America

Latin America

(2.8% of H1 2012 P&C GPW)

5%

6%

73%

16%

Property

Surety

Marine

General Liability

H1 2012 GPW: $34.8 million

$44.8

$91.8

$34.8

$0.0

$100.0

2010

2011

H1 2012 |

14

North America

Europe

Other

Reinsurance

Insurance

(1)

2011 GPW = $1,904.1 million

____________________

(1)

Includes

Reinsurance

segment,

Life

&

Annuity

reinsurance

and

reinsurance

written

through

Lloyd’s

platform.

Diversified and Balanced Business Mix

Global Platform

2011

Line of Business

2011

Auto

5%

Aviation

3%

Marine & Energy

6%

Agriculture

2%

Accident & Health

2%

Other Short

-Tail

2%

Property

35%

Whole Account

2%

General Casualty

17%

Financial

Institutions

2%

Workers' Comp

2%

Medical

Malpractice

2%

Professional

Liability

20%

74%

16%

10%

57%

43% |

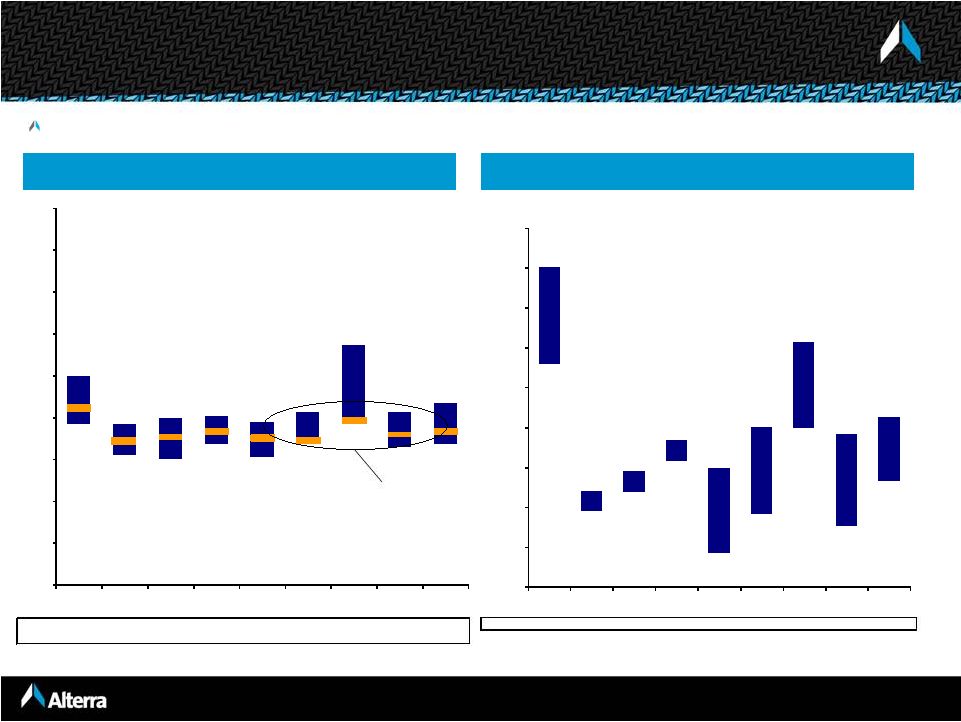

15

____________________

Source: Company filings, SNL Financial.

Diversified reinsurers include RE, AXS, ACGL, TRH, PRE, AWH, ENH, AHL, PTP, AGII and ALTE.

Property focused reinsurers include RNR, VR, MRH and FSR. Diversified

Reinsurers Property Focused Reinsurers

Diversified Platforms Generate More Consistent Margins

Alterra has performed well within its diversified peer group with less volatility

than property focused reinsurers Alterra has had one of

the lowest combined

ratios of its peer group

Median

115%

84%

83%

94%

84%

93%

115%

89%

95%

Alterra

106%

86%

88%

92%

88%

86%

98%

90%

92%

96%

77%

75%

84%

76%

85%

96%

82%

84%

124%

96%

99%

101%

97%

103%

143%

103%

108%

0%

25%

50%

75%

100%

125%

150%

175%

200%

225%

2005

2006

2007

2008

2009

2010

2011

H1 2012

Average

Median

170%

56%

62%

90%

66%

84%

125%

71%

90%

140%

48%

59%

79%

21%

45%

99%

38%

66%

201%

60%

73%

92%

75%

100%

154%

96%

106%

0%

25%

50%

75%

100%

125%

150%

175%

200%

225%

2005

2006

2007

2008

2009

2010

2011

H1 2012

Average |

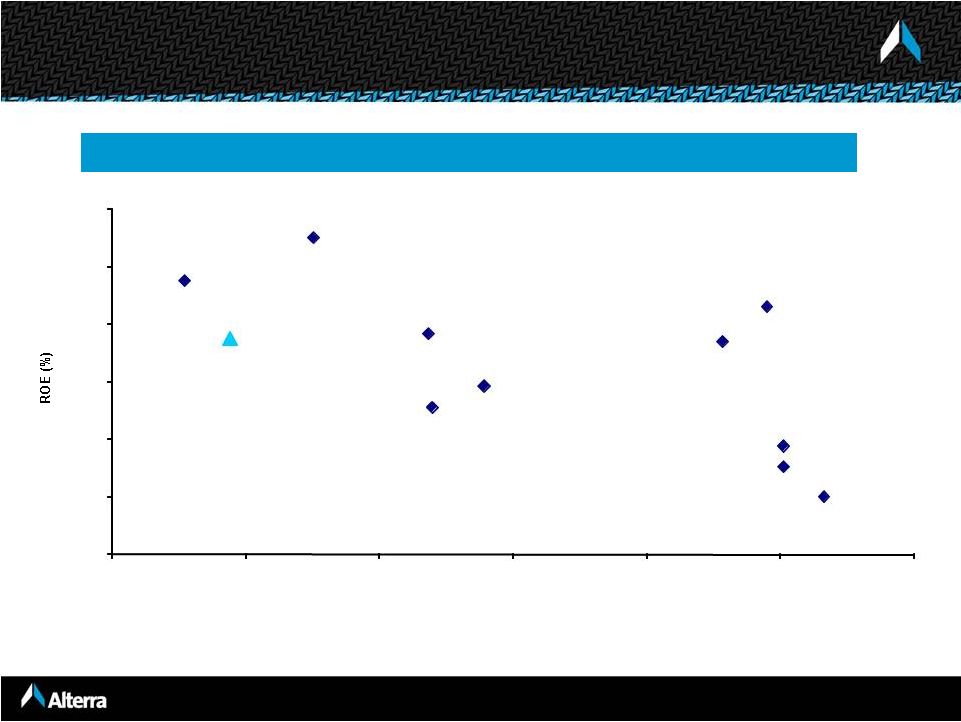

16

3 Year Return on Equity

Alterra’s

ROEs

Have

Been

More

Consistent

Than

Most

Peers

____________________

Source: JMP

Research,

SNL

Financial.

Three

years

ended

December

31,

2011.

Alterra ROE reflects Pro-Forma data for Max and Harbor Point prior to the merger in May

2010. ACGL

AHL

AXS

AWH

MRH

PRE

PTP

RNR

VR

ALTE

ENH

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

4%

6%

8%

10%

12%

14%

16%

Std. Dev. |

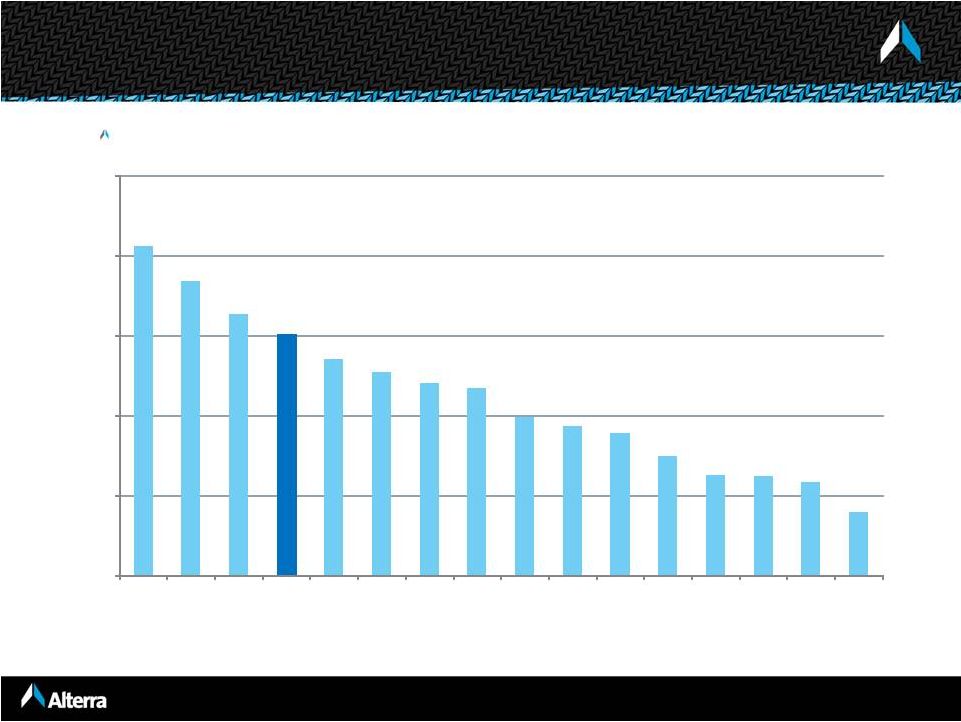

17

Active Capital Management

____________________

Source: SNL Financial and FactSet

Note: Capital returned to shareholders includes dividends and share

repurchases. For the three years ended December 31, 2011

Average Annual Capital Returned to Shareholders as a % of Opening

Shareholders’ Equity

20.6%

18.4%

16.3%

15.1%

13.6%

12.7%

12.0%

11.7%

9.9%

9.3%

8.9%

7.5%

6.3%

6.3%

5.8%

4.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

ACGL

AWH

AHL

ALTE

PTP

ENH

VR

MRH

PRE

RNR

AXS

AGII

FSR

XL

RE

ACE |

18

Our strategy is to diversify our book of business so that property cat

is one of many components of our business

Results demonstrate our successful risk management

Our reserving process has been tested by large, recent loss events

including:

2011 Australia floods, New Zealand earthquake, Japan

earthquake and tsunami, U.S. spring storms, Hurricane Irene,

Thai floods

2010 Chile earthquake, New Zealand earthquake

2008 Hurricanes Ike/Gustav

Superior Risk Management

Alterra’s losses from catastrophe events as a % of equity are

below our peer group average |

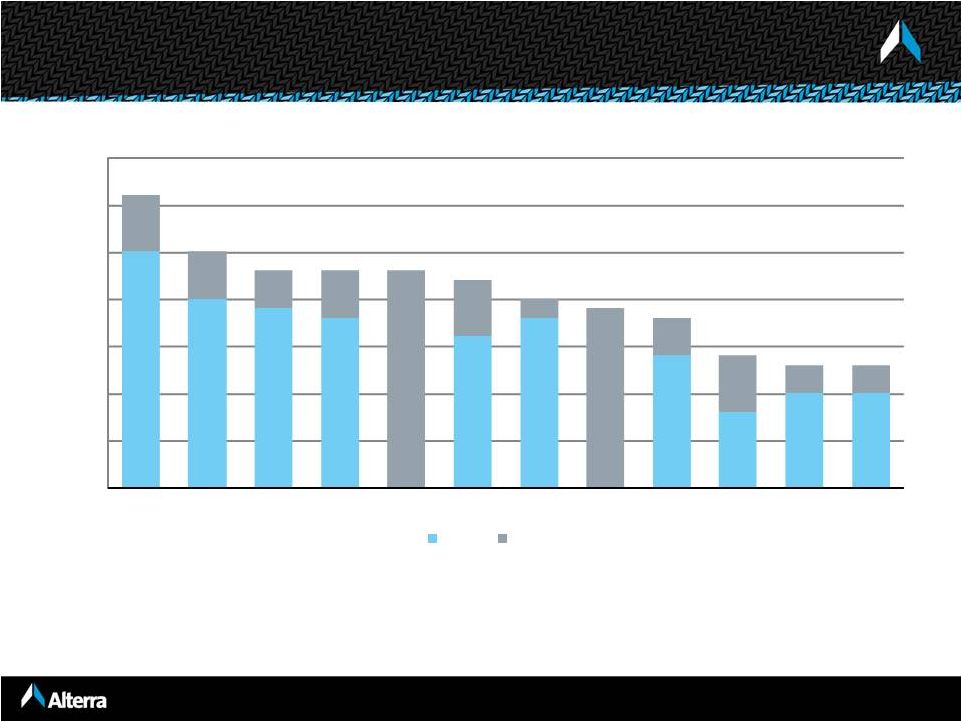

19

Peer PML’s as a Percentage of Shareholder’s Equity

____________________

Source: Dowling & Partners Research

Note: ALTE includes proportionate share of New Point Re IV. RNR and PRE do not disclose their

PMLs for either 1-in-100 year events or 1-in-250 year events. All data

is based on RMS 11 except RE which is based on AIR.

0%

5%

10%

15%

20%

25%

30%

35%

VR

ENH

MRH

ALTE

AWH

AHL

FSR

ACGL

AXS

Y

RE

PTP

As of July 1, 2012

1 in 100

1 in 250 |

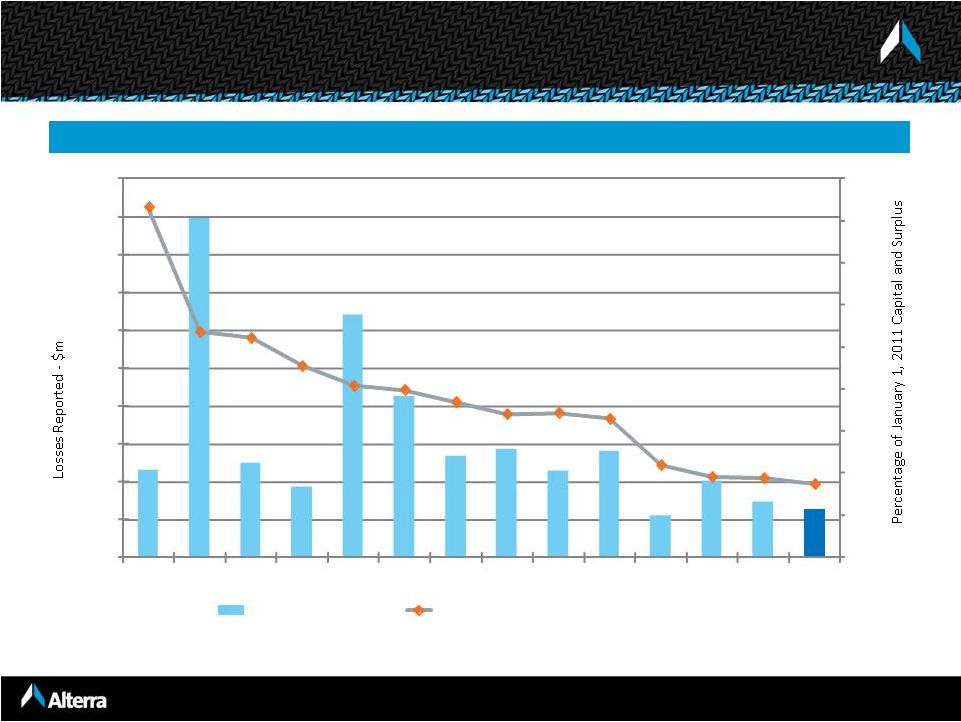

20

2011 –

“The Year of the Cat”

Alterra’s Ratio Of Losses to Equity Are Below Peer Group

__________________

Source: Company reports and SNL Financial

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

FSR

PRE

PTP

MRH

RE

TRH

AHL

VR

ENH

RNR

AGII

ACGL

AWH

ALTE

Losses

Percentage of January 1, 2011 Capital and Surplus |

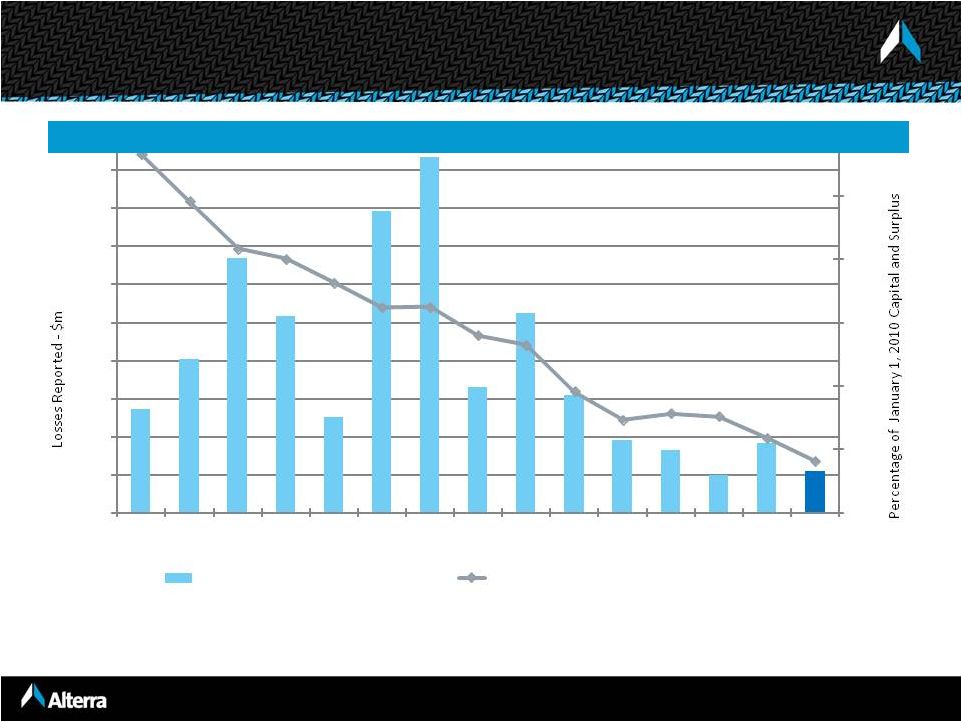

21

2010 –

Chile Earthquake / Windstorm Xynthia/

September New Zealand Earthquake

____________________

(2)

Q2 net losses reflect only losses from the Chile earthquake. Initial losses

include the Chile earthquake and Windstorm Xynthia. (3)

Initial loss estimate reflects 50% to 90% of Reuters consensus net operating earnings

prior to the earthquake, based on disclosure that net income would remain positive for the quarter.

(4)

Initial estimates based on Chile and Xynthia, ultimate losses include the Chile, Haiti,

and Baja earthquakes, Xynthia and the Australia hailstorms. Based on international catastrophe losses being two-thirds of total catastrophe losses as

disclosed in the earnings conference call.

(5)

Initial estimate is as of the first quarter conference call. Both initial and

revised estimates reflect only the Chile earthquake. (6)

Pro forma; includes losses from Harbor Point and Max Capital prior to the merger.

Expressed as a percentage of combined 12/31/09 equity prior to the special dividend.

0%

2%

4%

6%

8%

10%

0

50

100

150

200

250

300

350

400

450

FSR

PTP (1)

VR (2)

RNR (3)

MRH

RE

PRE

AHL

AXS (2)

TRH (2)

AWH

(2)(4)

ENH

AGII

(1)(5)

ACGL(1)

ALTE (6)

Ultimate Net Losses Reported

Percentage of January 1, 2010 Capital and Surplus

Alterra’s 2010 Losses Are Below Peer Group

Source: Company filings and press releases; losses are generally disclosed net of tax

and net of reinstatement premiums.

(1) Q2 net losses reflect Q1 estimates

plus reported development, if any. |

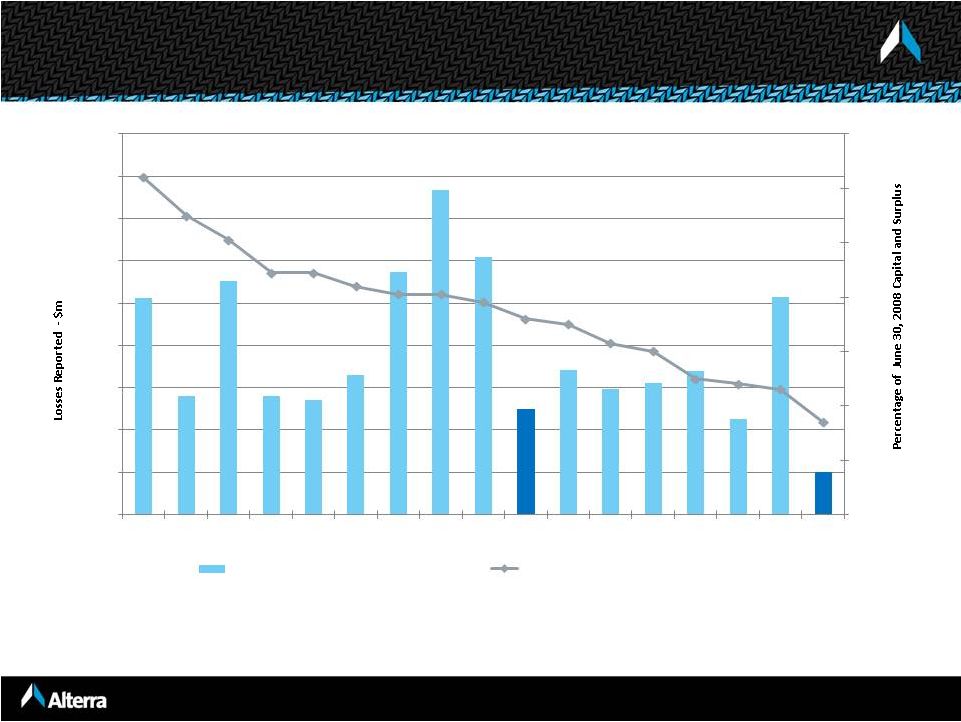

22

2008 –

Hurricanes Ike / Gustav

____________________

Source: Company filings, as of 12/31/08. Losses are generally disclosed net of reinstatement

premiums. (1)

Equity includes preferred shares, which subsequently converted to common shares.

(2)

Results reflect Ike only.

(3)

Equity includes preferred shares, which subsequently converted to common shares.

(4)

TRH does not disclose specific losses but did lose "$169.7 million principally relating to

Hurricane Ike." 0%

2%

4%

6%

8%

10%

12%

14%

0

50

100

150

200

250

300

350

400

450

VR

FSR

RNR

MRH

IPCR(1)

PTP(1)

ACGL

AXS

PRE(2)

HP(3)

AHL

ENH

ORH

TRH(4)

AWH

RE

MXGL

Ultimate Net Losses Reported

Percentage of June 30, 2008 Capital and Surplus |

23

PML goal of no more than 25% of starting capital in 1 in 250 year event

Adjust position as market pricing makes risk/reward attractive

Use RMS with “all switches on”

and gross-up factors on standard model

Incorporate AIR, market share, industry and client historical loss data

Capture detailed location data and put a premium on data quality

Historically, our losses for events have been close to expected ranges

PML and aggregate usage is incorporated into our pricing models

Key In-force PMLs as of July 1, 2012

U.S. wind

1 in 100 year event -

$498 million net loss (17.7% of 1/1/12 shareholders’

equity)

California earthquake

1 in 250 year event -

$360 million net loss (12.8% of 1/1/12 shareholders’

equity)

Europe wind

1 in 100 year event -

$145 million net loss (5.2% of 1/1/12 shareholders’

equity)

Cat Aggregate & PML Management |

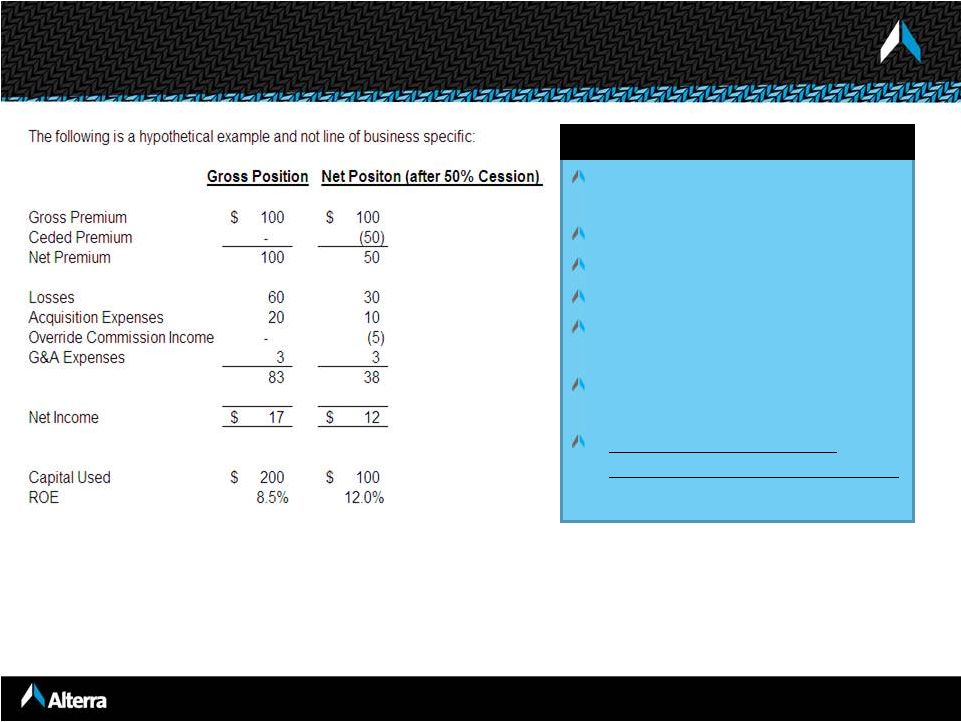

24

Disciplined Underwriting Management

Expands our market clout and

footprint

Reduces underwriting risk

Increases fee income

Earlier profit recognition

Assists in the risk

management process

Can dial down as market

pricing improves

Benefits of Ceding Premium Include:

Reduces Volatility and

Improves the Near term ROE |

Reserve for Losses and Loss Expenses

25

As of June 30, 2012 and December 31, 2011

Global Insurance

Reinsurance

U.S. Insurance

Alterra at Lloyd’s

Latin America

IBNR

Case

0

500

1,000

1,500

2,000

2,500

$1,297

$1,286

$467

$451

$56

$34

$2,094

$2,088

66%

67%

67%

64%

63%

63%

70%

65%

$ 394

$357

34%

33%

33%

36%

37%

37%

30%

35%

Q2 2012

Q4 2011

Q2 2012

Q4 2011

Q2 2012

Q4 2011

Q2 2012

Q4 2011

Q2 2012

Q4 2011 |

26

Favorable Reserve

Development

$5.9

$45.1

$90.8

$77.2

$105.5

$153.3

Development as a

% of Net Reserves

prior to

development

0.3%

2.5%

4.1%

3.4%

3.4%

4.6%

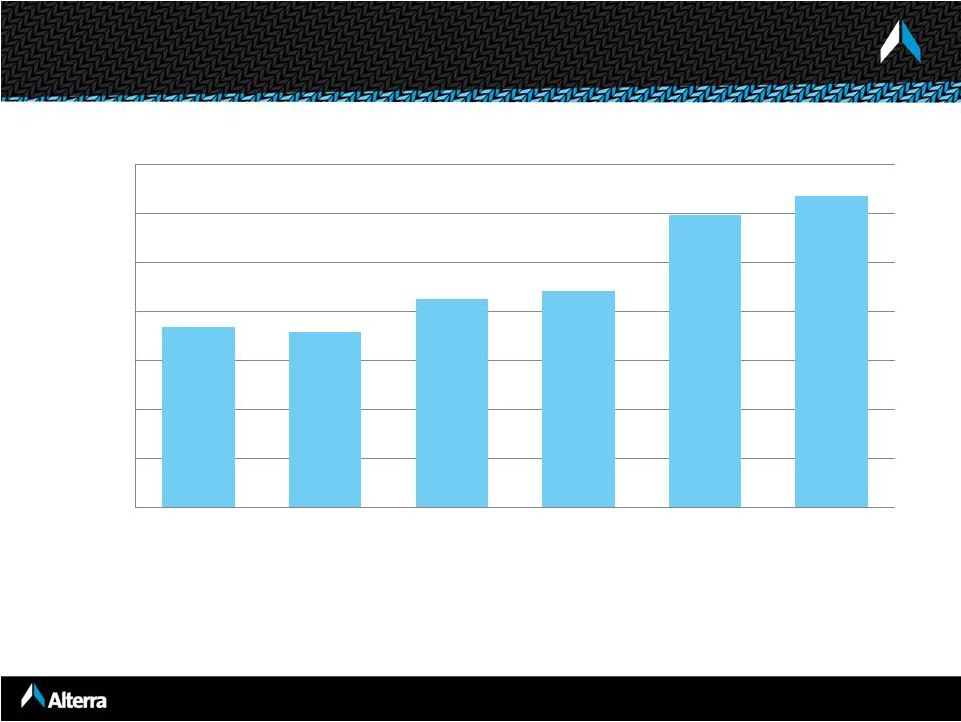

Reserve Development History

($ in millions)

____________________

$1,840

$1,796

$2,128

$2,213

$2,985

$3,182

500

1,000

1,500

2,000

2,500

3,000

3,500

2006

2007

2008

2009

2010

2011

-

Net Loss Reserves

Note: Reserve development and net reserves prior to May 12, 2010 are for Max Capital

only. Reserve development excludes changes in reserves resulting from changes in

premium estimates on prior years’ contracts. |

27

High Quality, Liquid Investment Portfolio

Alterra maintains a high quality, liquid portfolio

95.4% of portfolio in fixed income/cash, which consists of highly

rated securities

Assets are generally matched to liabilities

Cycle management extends to investments

Cash balance $764.0 million or 9.7% of portfolio

Average fixed income duration of approximately 4.1 years, including

cash

60.7% of the cash and fixed maturities portfolio is held in cash,

government

/

agency-backed

securities

and

“AAA”

securities

71.8%

of

fixed

income

portfolio

rated

“AA”

or

better

Hedge fund investments are marked-to-market

Minimal exposure to selected asset classes

CMBS

of

$399.0

million

(5.9%

of

portfolio)

–

average

rating

of

AA+/Aa1

ABS of $350.6 million (5.2% of portfolio)

RMBS

of

$1,322.8

million

(19.6%

of

portfolio)

–

93.9%

agency-

backed

No CDO’s, CLO’s, SIV’s or other highly structured securities

Less than $13 million of OTTI losses over the last eight

quarters

Carrying Value $7.9 billion

As of June 30, 2012

Cash

Other

Investments

4%

Fixed Income

10%

86% |

European government holdings

Total European government holdings

represent $750.4 million, or 9.5%, of the

$7.9 billion investment portfolio.

No direct exposure in Greece, Portugal,

Italy, Ireland or Spain.

European banking institutions

Total European banking institution

holdings represent $437.6 million, or

5.5%, of the $7.9 billion investment

portfolio.

Two largest holdings, which total $126.7

million, are with government-backed

banking institutions.

European Exposure

As of June 30, 2012

France

36%

Germany

34%

Netherlands

19%

Belgium

3%

United

Kingdom

6%

Denmark

1%

Other

Norway

1%

1%

European

Investment

Bank

16%

KFW

14%

Credit Suisse

8%

Lloyds

6%

UBS

6%

BNP Paribas

4%

HSBC

4%

Barclays

7%

Other

35%

28 |

29

____________________

Note:

Price / diluted book value multiple as of August 27, 2012.

Well Positioned to Build Shareholder Value

Franchise positions in attractive specialty markets

Established operating platforms provide global access to business

Diversified business portfolio across casualty and property lines

Opportunistic

approach

–

nimble

and

responsive

to

market

trends

High-quality, liquid investment portfolio

Invested asset leverage intended to drive more consistent returns

Balance sheet strength with low leverage / financial flexibility

Attractive entry point –

price / diluted book value of 0.81x |

30

Appendices |

31

June 30,

December 31,

2012

2011

Cash & Fixed Maturities

7,520

$

7,528

$

Other Investments

366

287

Premium Receivables

992

715

Losses Recoverable

1,084

1,068

Other Assets

735

588

Total Assets

10,697

$

10,186

$

Property & Casualty Losses

4,308

$

4,217

$

Life & Annuity Benefits

1,148

1,191

Deposit Liabilities

158

151

Funds Withheld

94

112

Unearned Premium

1,281

1,021

Senior Notes

441

441

Other Liabilities

415

244

Total

Liabilites 7,845

$

7,377

$

Shareholders' Equity

2,852

2,809

10,697

$

10,186

$

Strong Balance Sheet

($ in millions) |

32

YTD Results Comparison

($ in millions)

Six months ended

June 30,

June 30,

2012

2011

Gross Premiums Written

1,228

$

1,192

$

Net Premiums Earned

689

729

Net Investment Income

113

117

Net Realized and Unrealized Gains (Losses) on Investments

39

(25)

Other Than Temporary Impairment Charges

(6)

(1)

Other Income

7

2

Total Revenues

842

822

Total Losses, Expenses & Taxes

684

836

Net Income (Loss)

158

$

(14)

$

Net Operating Income

137

$

15

$

Property & Casualty Underwriting

Loss Ratio

58.6%

70.9%

Expense Ratio

31.0%

32.7%

Combined Ratio

89.5%

103.5% |

33

Six months ended June 30, 2012

($ in millions)

Totals in table may not add due to rounding. (1) Property and Casualty

only. Diversified Operating Platform

Property & Casualty

Global

Insurance

U.S.

Insurance

Reinsurance

Alterra at

Lloyd's

Latin

America

Total

Life & Annuity

Reinsurance

Corporate

Consolidated

Gross premiums written

$192.0

$216.5

$565.2

$218.2

$34.8

$1,226.7

$1.5

-

$

1,228.2

$

Reinsurance premiums ceded

(96.5)

(122.0)

(112.7)

(65.7)

(17.3)

(414.2)

(0.2)

-

(414.4)

Net premiums written

$95.6

$94.5

$452.5

$152.5

$17.5

$812.5

$1.3

-

$

813.8

$

Earned premiums

$186.9

$196.5

$405.1

$142.2

$42.5

$973.2

$1.5

-

$

974.7

$

Earned premiums ceded

(92.5)

(84.9)

(55.9)

(43.2)

(9.1)

(285.6)

(0.2)

-

(285.8)

Net premiums earned

94.4

111.6

349.2

99.1

33.3

687.6

1.3

-

689.0

Net losses and loss expenses

(40.8)

(74.9)

(190.8)

(71.7)

(24.6)

(402.8)

-

-

(402.8)

Claims and policy benefits

-

-

-

-

-

-

(26.7)

-

(26.7)

Acquisition costs

(0.3)

(13.9)

(81.4)

(16.9)

(9.2)

(121.6)

(0.3)

-

(121.9)

General and administrative expenses

(13.4)

(24.5)

(31.4)

(17.0)

(5.0)

(91.2)

(0.2)

-

(91.4)

Other income

0.8

0.1

6.3

-

-

7.2

-

-

7.2

Underwriting income (loss)

40.7

(1.6)

52.0

(6.5)

(5.4)

79.3

n/a

-

n/a

Net investment income

28.2

85.2

113.4

39.0

39.0

(5.9)

(5.9)

Corporate other income

0.1

0.1

Interest expense

(18.3)

(18.3)

Net foreign exchange gains

-

-

Corporate general and administrative expenses

(27.5)

(27.5)

Income before taxes

$2.4

$72.5

$154.1

Loss ratio

43.2%

67.1%

54.6%

72.4%

73.7%

58.6%

Acquisition cost ratio

0.3%

12.4%

23.3%

17.0%

27.6%

17.7%

14.2%

21.9%

9.0%

17.1%

14.9%

13.3%

Combined ratio

(1)

57.7%

101.5%

86.9%

106.5%

116.3%

89.5%

Net realized and unrealized gains on

investments

Net impairment losses recognized in

earnings

General and administrative expense

ratio |