Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ACL I Corp | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - ACL I Corp | d401824dex311.htm |

| EX-32.1 - EXHIBIT 32.1 - ACL I Corp | d401824dex321.htm |

| EX-32.2 - EXHIBIT 32.2 - ACL I Corp | d401824dex322.htm |

| EX-31.2 - EXHIBIT 31.2 - ACL I Corp | d401824dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q/A

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-178345

ACL I CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 27-4241534 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1701 E. Market Street, Jeffersonville, Indiana |

47130 | |

| (Address of principal executive offices) | (Zip Code) | |

(812) 288-0100

(Registrant’s telephone number, including area code)

Former name, former address and former fiscal year, if changed since last report:

N/A

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. Not applicable.

Table of Contents

ACL I CORPORATION

QUARTERLY REPORT ON FORM 10-Q/A

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2012

| Page | ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | |||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| Certification by CEO |

||||

| Certification by CFO |

||||

| Certification by CEO |

||||

| Certification by CFO |

||||

| EX-31.1 |

||||

| EX-31.2 |

||||

| EX-32.1 |

||||

| EX-32.2 |

||||

2

Table of Contents

EXPLANATORY NOTE

On June 25, 2012, ACL I Corporation (the “Company”) filed with the Securities and Exchange Commission (the “SEC”) its Quarterly Report on Form 10-Q for the quarter ended March 31, 2012 (the “10-Q”). The purpose of this amendment is to revise the disclosure in “Part I – Item 1. Financial Information” restating the condensed consolidated statements of cash flow and associated reference to the restatement in Note 1, “Part I – Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Part I – Item 4. Controls and Procedures.”

As previously disclosed in the Company’s Current Report on Form 8-K, filed with the SEC on August 14, 2012, in connection with the preparation of the Company’s interim report for the three and six month period ended June 30, 2012, the Company’s management concluded that there were errors in the condensed consolidated statement of cash flows (the “Cash Flow Statement”) for the three months ended March 31, 2012. As a result of these errors, the Company’s management determined that adjustments were necessary to correct the presentation of the Cash Flow Statement contained in the Form 10-Q. The effect of the adjustments was to increase cash flows from investing activities by $20.5 million and decrease cash flows from operating activities by the same amount.

The errors were corrected in the preparation of the Cash Flow Statement for the six months ended June 30, 2012, and therefore, there is no impact on the condensed consolidated financial statements filed with the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012 filed with the SEC on August 14, 2012.

The following items have been amended:

Part I – Item 1. Financial Statements.

Part I – Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Part I – Item 4. Controls and Procedures.

With the exception of amended “Part I – Item 4. Controls and Procedures”, this Form 10-Q/A does not reflect events occurring after the filing of the original Form 10-Q, nor modify or update those disclosures in any way other than as required to reflect the effects of the change described above.

Table of Contents

PART I — FINANCIAL INFORMATION

ACL I CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited — In thousands)

| Three Months Ended March 31, 2012 |

Three Months Ended March 31, 2011 |

|||||||

| Revenues |

||||||||

| Transportation and Services |

$ | 182,273 | $ | 161,126 | ||||

| Manufacturing |

35,864 | 16,007 | ||||||

|

|

|

|

|

|||||

| Revenues |

218,137 | 177,133 | ||||||

|

|

|

|

|

|||||

| Cost of Sales |

||||||||

| Transportation and Services |

161,544 | 158,459 | ||||||

| Manufacturing |

30,909 | 16,242 | ||||||

|

|

|

|

|

|||||

| Cost of Sales |

192,453 | 174,701 | ||||||

|

|

|

|

|

|||||

| Gross Profit |

25,684 | 2,432 | ||||||

| Selling, General and Administrative Expenses |

10,221 | 18,076 | ||||||

|

|

|

|

|

|||||

| Operating Income (Loss) |

15,463 | (15,644 | ) | |||||

|

|

|

|

|

|||||

| Other Expense (Income) |

||||||||

| Interest Expense |

16,280 | 11,359 | ||||||

| Other, Net |

(38 | ) | (131 | ) | ||||

|

|

|

|

|

|||||

| Other Expense |

16,242 | 11,228 | ||||||

|

|

|

|

|

|||||

| Loss from Continuing Operations Before Income Taxes |

(779 | ) | (26,872 | ) | ||||

| Income Taxes (Benefit) |

(159 | ) | (10,459 | ) | ||||

|

|

|

|

|

|||||

| Loss from Continuing Operations |

(620 | ) | (16,413 | ) | ||||

| Discontinued Operations, Net of Tax |

26 | (97 | ) | |||||

|

|

|

|

|

|||||

| Net Loss |

$ | (594 | ) | $ | (16,510 | ) | ||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

4

Table of Contents

ACL I CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited — In thousands)

| Three Months Ended March 31, 2012 |

Three Months Ended March 31, 2011 |

|||||||

| Net Loss |

$ | (594 | ) | $ | (16,510 | ) | ||

| Other Comprehensive Income |

||||||||

| Change in fair value of cash flow hedges, net of tax provisions of $1,390 and $4,169 |

2,274 | 6,513 | ||||||

| Other |

(77 | ) | — | |||||

|

|

|

|

|

|||||

| Other Comprehensive Income |

2,197 | 6,513 | ||||||

|

|

|

|

|

|||||

| Total Comprehensive Income (Loss) |

$ | 1,603 | $ | (9,997 | ) | |||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

5

Table of Contents

ACL I CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| March 31, 2012 |

December 31, 2011 |

|||||||

| (unaudited) | ||||||||

| ASSETS |

||||||||

| Current Assets |

||||||||

| Cash |

$ | 837 | $ | 1,388 | ||||

| Accounts Receivable, Net |

85,532 | 87,368 | ||||||

| Inventory |

64,000 | 62,483 | ||||||

| Deferred Tax Assets |

2,489 | 6,390 | ||||||

| Assets Held for Sale |

1,612 | 1,612 | ||||||

| Prepaid and Other Current Assets |

27,773 | 19,328 | ||||||

|

|

|

|

|

|||||

| Total Current Assets |

182,243 | 178,569 | ||||||

| Properties, Net |

912,930 | 935,576 | ||||||

| Investment in Equity Investees |

6,575 | 6,470 | ||||||

| Accounts Receivable, Related Parties, Net |

11,669 | 11,725 | ||||||

| Goodwill |

17,692 | 17,692 | ||||||

| Other Assets |

50,811 | 54,759 | ||||||

|

|

|

|

|

|||||

| Total Assets |

$ | 1,181,920 | $ | 1,204,791 | ||||

|

|

|

|

|

|||||

| LIABILITIES |

||||||||

| Current Liabilities |

||||||||

| Accounts Payable |

$ | 44,429 | $ | 48,653 | ||||

| Accrued Payroll and Fringe Benefits |

10,249 | 20,035 | ||||||

| Deferred Revenue |

15,173 | 15,251 | ||||||

| Accrued Claims and Insurance Premiums |

13,476 | 13,823 | ||||||

| Accrued Interest |

9,848 | 22,978 | ||||||

| Customer Deposits |

— | 1,165 | ||||||

| Other Current Liabilities |

25,209 | 29,104 | ||||||

|

|

|

|

|

|||||

| Total Current Liabilities |

118,384 | 151,009 | ||||||

| Long Term Debt |

660,193 | 644,829 | ||||||

| Pension and Post Retirement Liabilities |

66,919 | 67,531 | ||||||

| Deferred Tax Liabilities |

165,771 | 168,365 | ||||||

| Other Long Term Liabilities |

42,806 | 46,335 | ||||||

|

|

|

|

|

|||||

| Total Liabilities |

1,054,073 | 1,078,069 | ||||||

|

|

|

|

|

|||||

| SHAREHOLDER’S EQUITY |

||||||||

| Other Capital |

190,173 | 190,651 | ||||||

| Retained Deficit |

(39,364 | ) | (38,770 | ) | ||||

| Accumulated Other Comprehensive Loss |

(22,962 | ) | (25,159 | ) | ||||

|

|

|

|

|

|||||

| Total Shareholder’s Equity |

127,847 | 126,722 | ||||||

|

|

|

|

|

|||||

| Total Liabilities and Shareholder’s Equity |

$ | 1,181,920 | $ | 1,204,791 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

6

Table of Contents

ACL I CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Restated, Unaudited — In thousands)

| Three Months | Three Months | |||||||

| Ended March 31, | Ended March 31, | |||||||

| 2012 | 2011 | |||||||

| OPERATING ACTIVITIES |

||||||||

| Net Loss |

$ | (594 | ) | $ | (16,510 | ) | ||

| Adjustments to Reconcile Net Loss to Net Cash Provided by (Used in) Operating Activities: |

||||||||

| Depreciation and Amortization |

27,010 | 27,525 | ||||||

| Debt Issuance Cost and Debt Discount Amortization |

158 | (337 | ) | |||||

| Deferred Taxes |

(4,140 | ) | (14,780 | ) | ||||

| Gain on Property Dispositions |

(6,384 | ) | (25 | ) | ||||

| Contribution to Pension |

(1,373 | ) | — | |||||

| Share-Based Compensation |

49 | 1,493 | ||||||

| Other Operating Activities |

(711 | ) | 1,394 | |||||

| Changes in Operating Assets and Liabilities: |

||||||||

| Accounts Receivable |

1,836 | 7,496 | ||||||

| Inventory |

(1,517 | ) | (20,443 | ) | ||||

| Other Current Assets |

(1,810 | ) | (1,001 | ) | ||||

| Accounts Payable |

(5,500 | ) | (5,227 | ) | ||||

| Accrued Interest |

1,897 | (2,528 | ) | |||||

| Other Current Liabilities |

(14,260 | ) | (5,257 | ) | ||||

|

|

|

|

|

|||||

| Net Cash Provided by (Used In) Operating Activities |

(5,339 | ) | (28,200 | ) | ||||

| INVESTING ACTIVITIES |

||||||||

| Property Additions |

(32,321 | ) | (10,006 | ) | ||||

| Proceeds from Property Dispositions |

15,345 | 155 | ||||||

| Impact of Barge Scrapping Operations |

20,512 | 1,369 | ||||||

| Other Investing Activities |

(1,001 | ) | (4,313 | ) | ||||

|

|

|

|

|

|||||

| Net Cash Used in Investing Activities |

2,535 | (12,795 | ) | |||||

| FINANCING ACTIVITIES |

||||||||

| 2016 PIK Toggle Notes Issued |

— | 250,000 | ||||||

| Discount on 2016 PIK Toggle Notes |

— | (4,375 | ) | |||||

| Revolving Credit Facility Borrowings |

1,521 | 44,630 | ||||||

| Bank Overdrafts on Operating Accounts |

1,276 | 1,288 | ||||||

| Debt Issuance/Refinancing Costs |

(66 | ) | (10,930 | ) | ||||

| Dividends Paid |

(478 | ) | (237,899 | ) | ||||

| Tax Benefit of Share-Based Compensation |

— | 1,090 | ||||||

|

|

|

|

|

|||||

| Net Cash Provided by Financing Activities |

2,253 | 43,804 | ||||||

| Net (Decrease) Increase in Cash and Cash Equivalents |

(551 | ) | 2,809 | |||||

| Cash and Cash Equivalents at Beginning of Period |

1,388 | 3,707 | ||||||

|

|

|

|

|

|||||

| Cash and Cash Equivalents at End of Period |

$ | 837 | $ | 6,516 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

7

Table of Contents

ACL I CORPORATION

CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDER’S EQUITY

(Unaudited — In thousands)

| Other Capital |

Retained Deficit |

Accumulated Other Comprehensive Loss |

Total | |||||||||||||

| Balance at December 31, 2011 |

$ | 190,651 | $ | (38,770 | ) | $ | (25,159 | ) | $ | 126,722 | ||||||

| Cash Distributions |

(478 | ) | — | — | (478 | ) | ||||||||||

| Comprehensive Earnings: |

||||||||||||||||

| Net Loss |

— | (594 | ) | — | (594 | ) | ||||||||||

| Net Gain on Fuel Swaps Designated as Cash Flow Hedging Instrument, Net of Tax |

— | — | 2,274 | 2,274 | ||||||||||||

| Other |

— | — | (77 | ) | (77 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Comprehensive Earnings |

1,603 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at March 31, 2012 |

$ | 190,173 | $ | (39,364 | ) | $ | (22,962 | ) | $ | 127,847 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of the condensed consolidated financial statements.

8

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(Dollars in thousands, except per share data)

Note 1. Reporting Entity and Accounting Policies

ACL I Corporation (“ACL I”) is a Delaware corporation. ACL I is a wholly owned subsidiary of Finn Holding Corporation (“Finn”). ACL I was incorporated in October 2010 but had no activity prior to December 21, 2010. Finn is primarily owned by certain affiliates of Platinum Equity, LLC (certain affiliates of Platinum Equity, LLC are referred to as “Platinum”). On December 21, 2010, the acquisition of American Commercial Lines Inc. (“ACL”) by Platinum (the “Acquisition”) was consummated. The assets of ACL I consist principally of its ownership of all of the stock of ACL which owns all of the stock of Commercial Barge Line Company (“CBL”). CBL does not conduct any operations independent of its ownership of all of the equity interests in American Commercial Lines LLC (“ACL LLC”), ACL Transportation Services LLC (“ACLTS”), and Jeffboat LLC (“Jeffboat”), Delaware limited liability companies, and ACL Professional Services, Inc., a Delaware corporation, and their subsidiaries.

In connection with the Acquisition the purchase price has been allocated in these statements as of the Acquisition date. The Acquisition was accomplished through the merger of Finn Merger Corporation (“Finn Merger”), a Delaware corporation and a wholly owned subsidiary of ACL I with and into ACL. Following the Acquisition, ACL I files as part of the consolidated federal tax return of its direct parent, Finn. In these condensed consolidated financial statements, unless the context indicates otherwise, the “Company” refers to ACL I and its subsidiaries, on a consolidated basis.

The operations of the Company include barge transportation together with related port services along the United States Inland Waterways consisting of the Mississippi River System, the Ohio River and the Illinois River and their tributaries and the Gulf Intracoastal Waterway (collectively the “Inland Waterways”) and marine equipment manufacturing. Barge transportation accounts for the majority of the Company’s revenues and includes the movement of bulk products, grain, coal, steel and liquids in the United States. The Company has long term contracts with many of its customers. Manufacturing of marine equipment is provided to customers in marine transportation and other related industries in the United States. Until its sale in December 2011, the Company also owned Elliot Bay Design Group (“EBDG”), an operation engaged in naval architecture and engineering which was significantly smaller than either the transportation or manufacturing segments. Discontinued operations consist of the results of operations related to Summit Contracting Inc. (“Summit”) which was sold by ACL in 2009 and all former international operations which were sold by ACL in 2006. The results of operations of EBDG and any residual earnings or losses related to Summit and the former international operations are recorded in discontinued operations for all periods presented.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. As such, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. The condensed consolidated balance sheet as of December 31, 2011 has been derived from the audited consolidated balance sheet at that date. The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Some of the significant estimates underlying these financial statements include reserves for doubtful accounts, reserves for obsolete and slow moving inventories, pension and post-retirement liabilities, incurred but not reported medical claims, insurance claims and related receivable amounts, deferred tax liabilities, assets held for sale, environmental liabilities, revenues and expenses on special vessels using the percentage-of-completion method, environmental liabilities, valuation allowances related to deferred tax assets, expected forfeitures of share-based compensation, estimates of future cash flows used in impairment evaluations, liabilities for unbilled barge and boat maintenance, liabilities for unbilled harbor and towing services, estimated sub-lease recoveries and depreciable lives of long-lived assets.

In the opinion of management, for all periods presented, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the interim periods presented herein are not necessarily indicative of the results that may be expected for the year ending December 31, 2012. Our quarterly revenues and profits historically have been lower during the first six months of the year and higher in the last six months of the year due primarily to the timing of the North American grain harvest and seasonal weather patterns.

9

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Periodically the Financial Accounting Standards Board (“FASB”) issues additional Accounting Standards Updates (“ASUs”). ASUs considered to have a potential impact on the Company where the impact is not yet determined are discussed as follows.

ASU Number 2011-8 was issued in September 2011, amending Topic 350 Intangibles — Goodwill and Other. The ASU allows entities to first assess qualitative factors to determine whether the existence of events or circumstances lead to a determination that it is more likely than not that the fair value of a reporting unit is less than its carrying value, whereas previous guidance required as the first step in an at least annual evaluation a computation of the fair value of a reporting entity. The Company has not yet determined if it will use the qualitative assessment in 2012. The ASU is effective for fiscal periods beginning after December 15, 2011.

Certain prior year amounts have been reclassified in these condensed consolidated financial statements to conform to the current year presentation. These reclassifications had no impact on previously reported net income.

Restatement of the Condensed Consolidated Statements of Cash Flows

The Company has determined that the condensed consolidated statement of cash flows for the three months ended March 31, 2012 (“Q1 2012”) included in its Quarterly Report on Form 10-Q for Q1 2012 should no longer be relied upon as a result of an error in the classification of cash flows associated with the scrapping of retired barges. These activities resulted in cash flows of $20.5 million during the first quarter of 2012. The change in classification of these activities during the first quarter of 2012 results in:

| • | a change from reported net cash provided by operating activities of $15.2 million to net cash used in operating activities of $(5.3) million; and |

| • | a change from reported net cash used in investing activities of $(18.0) million to net cash provided by investing activities of $2.5 million. |

This correction of this error in this Form 10Q/A had no effect on the Company’s reported cash and cash equivalents or the net increase in cash and cash equivalents in the condensed consolidated statement of cash flows or on any item in any of the related condensed consolidated statement of operations, condensed consolidated statement of comprehensive income, condensed consolidated balance sheet, or Adjusted EBITDAR (as defined in the Form 10-Q for Q1 2012). The change in classification also had no effect on the Company’s compliance with regulatory requirements, loan covenants or other contractual obligations.

Comparative amounts for the quarter ended March 31, 2011, were also corrected to reflect an increase in cash used in operating activities and a corresponding decrease in cash proceeds used in investing activities of $1.4.

Note 2. Debt

| March 31, 2012 |

December 31, 2011 |

|||||||

| Credit Facility |

$ | 156,599 | $ | 155,078 | ||||

| 2017 Notes |

200,000 | 200,000 | ||||||

| Plus Purchase Premium |

27,745 | 29,147 | ||||||

| PIK Notes |

279,246 | 264,219 | ||||||

| Less Discount |

(3,397 | ) | (3,615 | ) | ||||

|

|

|

|

|

|||||

| Long Term Debt |

$ | 660,193 | $ | 644,829 | ||||

|

|

|

|

|

|||||

Concurrent with the Acquisition, on December 21, 2010, ACL, CBL, ACL LLC, ACLTS and Jeffboat (the “Borrowers”) entered into a senior secured asset-based revolving credit facility (“Credit Facility”) which provides for borrowing capacity of up to an aggregate principal amount of $475,000 with a final maturity date of December 21, 2015. Proceeds of the Credit Facility are available for use by the Borrowers and, subject to certain limitations, their subsidiaries for working capital and general corporate purposes. At the Acquisition, proceeds of the Credit Facility were used, in part, to fund the liquidation of ACL’s previous facility and certain expenses associated with the Acquisition.

The Borrowers may also use the Credit Facility to issue letters of credit up to a total of $50,000. Availability under the Credit Facility is capped at a borrowing base, calculated based on certain percentages of the value of the Company’s vessels, inventory and receivables and subject to certain blocks and reserves, all as further set forth in the Credit Facility agreement. The Borrowers are currently prohibited from incurring more than $390,000 of indebtedness under the Credit Facility regardless of the size of the borrowing base until (a) all of the obligations (other than unasserted contingent obligations) under the indenture governing the 2017 Notes (defined below) are repaid, defeased, discharged or otherwise satisfied or (b) the indenture governing the 2017 Notes is replaced or amended or otherwise modified in a manner such that additional borrowings would be permitted. At the Borrowers’ option, the Credit Facility may be increased by $75,000, subject to certain requirements set forth in the Credit Facility agreement (“Credit Agreement”).

In accordance with the Credit Agreement, the Borrowers’ obligations under the Credit Facility are secured by, among other things, a lien on substantially all of their tangible and intangible personal property (including but not limited to vessels, accounts receivable, inventory, equipment, general intangibles, investment property, deposit and securities accounts, certain owned real property and intellectual property) and a pledge of the capital stock of each of ACL’s wholly owned restricted domestic subsidiaries, subject to certain exceptions and thresholds.

On February 15, 2011, ACL I completed a private placement of $250,000 in aggregate principal amount of 10.625%/11.375% Senior Payment in Kind (“PIK”) Toggle Notes due 2016 (the “PIK Notes”). Interest on the PIK Notes will accrue at a rate of 10.625% with respect to interest paid in cash and a rate of 11.375% with respect to interest paid by issuing additional PIK Notes. Selection of the interest payment method is solely a decision of ACL I. At the first interest payment date ACL I elected PIK interest, increasing the amount of PIK Notes outstanding by $14,219 to $264,219. On the second payment date ACL I also elected PIK interest which increased the PIK Notes by $15,027 to $279,246. The net of original issue discount proceeds of the PIK Notes offering were used primarily to pay a special dividend to ACL I’s stockholder to redeem equity advanced in connection with the acquisition of the Company by an affiliate of Platinum Equity, LLC and to pay certain costs and expenses related to the PIK Notes offering. These PIK Notes are unsecured and are not guaranteed by ACL I’s subsidiaries.

10

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

On July 7, 2009, CBL issued $200,000 aggregate principal amount of senior secured second lien 12.5 % notes due July 15, 2017 (the “2017 Notes”). The issue price was 95.181% of the principal amount of the 2017 Notes. The 2017 Notes are guaranteed by ACL and by all material existing and future domestic subsidiaries of CBL. At the Acquisition date the fair value of the 2017 Notes was $35,000 higher than the face amount. This amount is being amortized to interest expense using the effective interest method over the remaining life of the 2017 Notes.

The Credit Facility has no financial covenants unless borrowing availability is generally less than a certain defined level set forth in the Credit Agreement. The $232,156 in borrowing availability at March 31, 2012, exceeds the specified level by approximately $183,406. Should the springing covenants be triggered, the leverage calculation would include only first lien senior debt, excluding debt under the 2017 Notes. The 2017 Notes and Credit Facility also provide flexibility to execute sale leasebacks, sell assets and issue additional debt to raise additional funds. In addition, the Credit Facility places no direct restrictions on capital spending, but, subject to certain exceptions for redeemable capital interests, management benefit plans and stock dividends, as well as a $20,000 allowance for such payments, does limit the payment of cash dividends to a level equal to half of cumulative consolidated net income since July 1, 2009 plus the aggregate amount of any new capital contributions or equity offering proceeds. Outstanding redeemable capital interests and management benefit plans totaled less than $800 at March 31, 2012, and, since July 1, 2009, there has been no available cumulative consolidated net income through March 31, 2012. No new capital contributions or equity offerings were made since the Acquisition.

Borrowings under the Credit Agreement bear interest, at the Borrowers’ option, at either (i) an alternate base rate or an adjusted LIBOR rate plus, in each case, an applicable margin. Such applicable margin will, depending on average availability under the Credit Facility, range from 2.00% to 2.50% in the case of base rate loans and 2.75% to 3.25% in the case of LIBOR rate loans. Interest is payable (a) in the case of base rate loans, monthly in arrears, and (b) in the case of LIBOR rate loans, at the end of each interest period, but in no event less often than every three months. A commitment fee is payable monthly in arrears at a rate per annum equal to 0.50% of the daily unused amount of the commitments in respect of the Credit Facility. The Borrowers, at their option, may prepay borrowings under the Credit Facility and re-borrow such amounts, at any time (subject to applicable borrowing conditions) without penalty, in whole or in part, in minimum amounts and subject to other conditions set forth in the Credit Facility. For any period that availability is less than a certain defined level set forth in the Credit Agreement and until no longer less than such level for a 30-day period, the Credit Agreement imposes several financial covenants on CBL and its subsidiaries, including (a) a minimum fixed charge coverage ratio (as defined in the Credit Agreement) of at least 1.1 to 1; and (b) a maximum first lien leverage ratio of 4.25 to 1.0. The Credit Agreement requires that CBL and its subsidiaries comply with covenants relating to customary matters (in addition to those financial covenants described above), including with respect to incurring indebtedness and liens, using the proceeds received under the Credit Agreement, transactions with affiliates, making investments and acquisitions, effecting mergers and asset sales, prepaying indebtedness, and paying dividends.

During all periods presented the Company has been in compliance with the respective covenants contained in the Credit Facility.

Note 3. Inventory

Inventory is carried at the lower of cost (based on a weighted average method) or market and consists of the following.

| March 31, 2012 |

December 31, 2011 |

|||||||

| Raw Materials |

$ | 30,158 | $ | 26,865 | ||||

| Work in Process |

7,701 | 8,232 | ||||||

| Parts and Supplies |

26,141 | 27,386 | ||||||

|

|

|

|

|

|||||

| $ | 64,000 | $ | 62,483 | |||||

|

|

|

|

|

|||||

Note 4. Income Taxes

ACL I’s operating entities are primarily single member limited liability companies that are owned by a corporate parent and are subject to U.S. federal and state income taxes on a combined basis. The effective tax rates in the first quarters of 2012 and 2011 were 20.4% and 38.9%, respectively. The effective income tax rates are impacted by the significance of consistent levels of permanent book and tax differences on expected full year income in the respective periods. There is no tax-sharing agreement with the other companies included in the Finn consolidated return filing and therefore the tax attributes of the Company are stated on a stand-alone basis.

11

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 5. Employee Benefit Plans

A summary of the components of the Company’s pension and post-retirement plans follows.

| Three Months Ended March 31, |

||||||||

| 2012 | 2011 | |||||||

| Pension Components: |

||||||||

| Service cost |

$ | 1,140 | $ | 1,175 | ||||

| Interest cost |

2,645 | 2,650 | ||||||

| Expected return on plan assets |

(3,460 | ) | (3,225 | ) | ||||

| Amortization of unrecognized losses |

443 | — | ||||||

|

|

|

|

|

|||||

| Net periodic benefit cost |

$ | 768 | $ | 600 | ||||

|

|

|

|

|

|||||

| Post-retirement Components: |

||||||||

| Service cost |

$ | 3 | $ | 2 | ||||

| Interest cost |

45 | 55 | ||||||

| Amortization of net gain |

— | (12 | ) | |||||

|

|

|

|

|

|||||

| Net periodic benefit cost |

$ | 48 | $ | 45 | ||||

|

|

|

|

|

|||||

Note 6. Related Party Transactions

There were no related party freight revenues in the periods ended March 31, 2012 and 2011 and there were no related party receivables included in accounts receivable on the condensed consolidated balance sheets at March 31, 2012 and December 31, 2011 except contained in the caption Accounts Receivable Related Party, related to the receivable from Finn in connection with the Acquisition and certain subsequent payments associated with the wind-down of the pre-Acquisition share-based compensation plan. $14,284 of the receivable amount arose as a portion of the funding of the Acquisition purchase price representing the intrinsic value of the share-based compensation for certain non-executive level employees. Per the share-based compensation plan, which was assumed by Finn, on a change of control, as defined in the American Commercial Lines 2008 Omnibus Incentive Plan (“Omnibus Plan”), outstanding awards either vested and paid or had to be rolled over to equity of the acquirer. The payout of the non-executive level employees was paid with proceeds of an advance on the Company’s Credit Facility. The amount of the advance was shown as a receivable from Finn. Since the Acquisition, additional vesting of certain pre-Acquisition share-based awards has occurred and, per the terms of the Omnibus Plan, all awards previously granted to executives separating without cause from the Company within one year after the Acquisition date became fully vested. Finn redeemed certain of these shares. Dividends from the Company were declared and paid to Finn in amounts sufficient to fund these redemptions. These dividends reduced the Accounts Receivable Related Party Affiliate balance.

During the first quarter of 2012 and in the second quarter of 2011 the Company paid an annual management fee of $5,000 to Platinum. The management fee is amortized to selling, general and administrative expense over the course of the respective fiscal year.

Note 7. Business Segments

The Company has two reportable business segments: transportation and manufacturing. The Company’s transportation segment includes barge transportation operations and fleeting facilities that provide fleeting, shifting, cleaning and repair services at various locations along the Inland Waterways. The manufacturing segment constructs marine equipment for external customers as well as for the Company’s transportation segment.

Management evaluates performance based on a variety of measures including segment earnings, which is defined as operating income. The accounting policies of the reportable segments are consistent with those described in the summary of significant accounting policies described in ACL I’s filing on Form S-4/A filed May 8, 2012.

Intercompany sales are transferred at the lower of cost or fair market value and intersegment profit is eliminated upon consolidation.

Reportable segments are business units that offer different products or services. The reportable segments are managed separately because they provide distinct products and services to internal and external customers.

12

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

| Reportable Segments | Intersegment | |||||||||||||||

| Transportation | Manufacturing | Eliminations | Total | |||||||||||||

| Three Months ended March 31, 2012 |

||||||||||||||||

| Total revenue |

$ | 182,375 | $ | 51,424 | $ | (15,662 | ) | $ | 218,137 | |||||||

| Intersegment revenues |

102 | 15,560 | (15,662 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenue from external customers |

182,273 | 35,864 | — | 218,137 | ||||||||||||

| Operating expense |

||||||||||||||||

| Materials, supplies and other |

61,035 | — | — | 61,035 | ||||||||||||

| Rent |

6,728 | — | — | 6,728 | ||||||||||||

| Labor and fringe benefits |

28,699 | — | — | 28,699 | ||||||||||||

| Fuel |

43,281 | — | — | 43,281 | ||||||||||||

| Depreciation and amortization |

25,065 | — | — | 25,065 | ||||||||||||

| Taxes, other than income taxes |

3,018 | — | — | 3,018 | ||||||||||||

| Gain on disposition of equipment |

(6,384 | ) | — | — | (6,384 | ) | ||||||||||

| Cost of goods sold |

— | 31,011 | — | 31,011 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of sales |

161,442 | 31,011 | — | 192,453 | ||||||||||||

| Selling, general & administrative |

9,202 | 1,019 | — | 10,221 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

170,644 | 32,030 | — | 202,674 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

$ | 11,629 | $ | 3,834 | $ | — | $ | 15,463 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Reportable Segments | Intersegment | |||||||||||||||

| Transportation | Manufacturing | Eliminations | Total | |||||||||||||

| Three Months ended March 31, 2011 |

||||||||||||||||

| Total revenue |

$ | 161,328 | $ | 27,981 | $ | (12,176 | ) | $ | 177,133 | |||||||

| Intersegment revenues |

202 | 11,974 | (12,176 | ) | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenue from external customers |

161,126 | 16,007 | — | 177,133 | ||||||||||||

| Operating expense |

||||||||||||||||

| Materials, supplies and other |

56,843 | — | — | 56,843 | ||||||||||||

| Rent |

6,987 | — | — | 6,987 | ||||||||||||

| Labor and fringe benefits |

30,243 | — | — | 30,243 | ||||||||||||

| Fuel |

35,823 | — | — | 35,823 | ||||||||||||

| Depreciation and amortization |

25,519 | — | — | 25,519 | ||||||||||||

| Taxes, other than income taxes |

2,867 | — | — | 2,867 | ||||||||||||

| Gain on disposition of equipment |

(25 | ) | — | — | (25 | ) | ||||||||||

| Cost of goods sold |

— | 16,444 | — | 16,444 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total cost of sales |

158,257 | 16,444 | — | 174,701 | ||||||||||||

| Selling, general & administrative |

17,468 | 608 | — | 18,076 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

175,725 | 17,052 | — | 192,777 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

$ | (14,599 | ) | $ | (1,045 | ) | $ | — | $ | (15,644 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

13

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 8. Financial Instruments and Risk Management

The Company has price risk for fuel not covered by contract escalation clauses and in time periods from the date of price changes until the next monthly or quarterly contract price adjustment. From time to time the Company has utilized derivative instruments to manage volatility in addition to contracted rate adjustment clauses. For several years the Company has been entering into fuel price swaps with commercial banks. The number of gallons settled and related net gains, as well as additional gallons hedged and unrealized changes in market value are contained in the table below. As hedged fuel is used, any gains or losses incurred are recorded as a decrease or increase to fuel expense, a component of cost of sales.

The fair value of unsettled fuel price swaps is listed in the following table. These derivative instruments have been designated and accounted for as cash flow hedges. To the extent of their effectiveness, changes in fair value of the hedged instrument will be accounted for through other comprehensive income until the hedged fuel is used, at which time the gain or loss on the hedge instruments will be recorded as fuel expense (cost of sales). Accumulated other comprehensive loss at March 31, 2012 and December 31, 2011 of $22,962 and $25,159, respectively, consisted of gains (losses) on fuel hedging and pension and post-retirement losses, net of the related tax benefits of $13,950 and $15,417, respectively. Hedge ineffectiveness is recorded in income as a component of fuel expense as incurred.

The carrying amount and fair values of the Company’s financial instruments, which are recorded in Other Current Assets, are as follows.

| Description |

3/31/2012 | Fair Value of Measurements at Reporting Date Using Markets for Identical Assets (Level 1) |

||||||

| Fuel Price Swaps |

$ | 2,697 | $ | 2,697 | ||||

At March 31, 2012, the increase in the fair value of the financial instruments is recorded as a net receivable of $2,697 in the consolidated balance sheet and as a net of tax deferred gain in other comprehensive income in the consolidated balance sheet. Hedge ineffectiveness resulted in a decrease to fuel expense of $45 and $444 in the quarters ended March 31, 2012 and 2011, respectively. The fair value of the fuel price swaps is based on quoted market prices for identical instruments, or Level 1 inputs as to fair value. The Company may increase the quantity hedged or add additional months based upon active monitoring of fuel pricing outlooks by the management team.

| Gallons | Dollars | |||||||

| Fuel Price Swaps at January 1, 2012 |

19,400 | $ | (1,012 | ) | ||||

| 1st Quarter 2012 Fuel Hedge (Income) Expense |

(5,900 | ) | (1,679 | ) | ||||

| 1st Quarter 2012 Changes |

— | 5,388 | ||||||

|

|

|

|

|

|||||

| Fuel Price Swaps at March 31, 2012 |

13,500 | $ | 2,697 | |||||

|

|

|

|

|

|||||

Note 9. Contingencies

The nature of our business exposes us to the potential for legal proceedings, including those relating to labor and employment, personal injury, property damage and environmental matters. Although the ultimate outcome of any legal matter cannot be predicted with certainty, based on present information, including our assessment of the merits of each particular claim, as well as our current reserves and insurance coverage, we do not expect that any known legal proceeding will in the foreseeable future have a material adverse impact on our financial condition or the results of our operations.

Shareholder Appraisal Action

On April 12, 2011, IQ Holdings, Inc. (“IQ”) filed a Verified Petition for Appraisal of Stock against ACL in the Court of Chancery in the State of Delaware (the “Delaware Court”). Among other things, the appraisal petition seeks a judicial determination of the fair value of its 250,000 shares of common stock pursuant to 8 Del. C. § 262, and an order by the Delaware Court directing ACL to pay IQ the fair value of its shares as of the effective date of the Acquisition, taxes, attorney’s fees, and costs. Fact discovery is complete, expert reports (including rebuttal expert reports) have been exchanged and expert depositions are complete. While it is not possible at this time to determine the potential outcome of this action, we do not believe the action will result in a payment by ACL that would materially affect our financial condition, operations or cash flows.

14

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Environmental Litigation

We have been involved in the following environmental matters relating to the investigation or remediation of locations where hazardous materials have or might have been released or where we or our vendors have arranged for the disposal of wastes. These matters include situations in which we have been named or are believed to be a potentially responsible party (“PRP”) under applicable federal and state laws.

Collision Incident, Mile Marker 97 of the Mississippi River

ACL and ACL LLC, an indirect wholly owned subsidiary of ACL, have been named as defendants in the following putative class action lawsuits, filed in the United States District Court for the Eastern District of Louisiana (collectively the “Class Action Lawsuits”): Austin Sicard et al on behalf of themselves and others similarly situated vs. Laurin Maritime (America) Inc., Whitefin Shipping Co. Limited, D.R.D. Towing Company, LLC, American Commercial Lines, Inc. and the New Orleans-Baton Rouge Steamship Pilots Association, Case No. 08-4012, filed on July 24, 2008; Stephen Marshall Gabarick and Bernard Attridge, on behalf of themselves and others similarly situated vs. Laurin Maritime (America) Inc., Whitefin Shipping Co. Limited, D.R.D. Towing Company, LLC, American Commercial Lines, Inc. and the New Orleans-Baton Rouge Steamship Pilots Association, Case No. 08-4007, filed on July 24, 2008; and Alvin McBride, on behalf of himself and all others similarly situated v. Laurin Maritime (America) Inc.; Whitefin Shipping Co. Ltd.; D.R.D. Towing Co. LLC; American Commercial Lines Inc.; The New Orleans-Baton Rouge Steamship Pilots Association, Case No. 09-cv-04494 B, filed on July 24, 2009. The McBride v. Laurin Maritime, et al. action has been dismissed with prejudice because it was not filed prior to the deadline set by the United States District Court for the Eastern District of Louisiana (the “Court”). The claims in the Class Action Lawsuits stem from the incident on July 23, 2008, involving one of ACL LLC’s tank barges that was being towed by DRD Towing Company L.L.C. (“DRD”), an independent towing contractor. The tank barge was involved in a collision with the motor vessel Tintomara, operated by Laurin Maritime, at Mile Marker 97 of the Mississippi River in the New Orleans area. The tank barge was carrying approximately 9,900 barrels of #6 oil, of which approximately two-thirds was released. The tank barge was damaged in the collision and partially sunk. There was no damage to the towboat. The Tintomara incurred minor damage. The Class Action Lawsuits include various allegations of adverse health and psychological damages, disruption of business operations, destruction and loss of use of natural resources, and seek unspecified economic, compensatory and punitive damages for claims of negligence, trespass and nuisance. The Class Action Lawsuits were stayed pending the outcome of the two actions filed in the United States District Court for the Eastern District of Louisiana seeking exoneration from, or limitation of, liability related to the incident as discussed in more detail below. All claims in the class actions have been settled with payment to be made from funds on deposit with the Court in the IINA and IINA and Houston Casualty Company interpleader, mentioned below. IINA is DRD’s primary insurer and IINA and Houston Casualty Company are DRD’s excess insurers. The settlement has final approval from the court. Settlement funds were provided to claimants’ counsel and we expect final dismissal of all lawsuits against all parties will be entered with prejudice once all the releases are signed. Claims under the Oil Pollution Act of 1990 (“OPA 90”) were dismissed without prejudice. There is a separate administrative process for making a claim under OPA 90 that must be followed prior to litigation. We are processing OPA 90 claims properly presented, documented and recoverable. We have also received numerous claims for personal injury, property damage and various economic damages loss related to the oil spill, including notification by the National Pollution Funds Center of claims it has received. Additional lawsuits may be filed and claims submitted, however OPA 90 has a three year prescriptive period and any new claim filed after three years would be subject to dismissal. We are in early discussions with the Natural Resource Damage Assessment Group, consisting of various State and Federal agencies, regarding the scope of environmental damage that may have been caused by the incident. A suit was filed on July 22, 2009 in the Eastern District of Louisiana entitled Lloyd Balliviero, d/b/a Buras Marina v. American Commercial Lines LLC, Summit Environmental Services LLC, and Clean Harbors Environmental Services, Inc, in Case No. 09-4464 seeking payment for “rental cost” of its marina for cleanup operations. ACL and ACL LLC have also been named as defendants in the following interpleader action brought by DRD’s primary insurer IINA seeking court approval as to the disbursement of the funds: Indemnity Insurance Company of North America v. DRD Towing Company, LLC; DRD Towing Group, LLC; American Commercial Lines, LLC; American Commercial Lines, Inc.; Waits Emmet & Popp, LLC, Daigle, Fisse & Kessenich; Stephen Marshall Gabarick; Bernard Attridge; Austin Sicard; Lamont L. Murphy, individually and on behalf of Murphy Dredging; Deep Delta Distributors, Inc.; David Cvitanovich; Kelly Clark; Timothy Clark, individually and on behalf of Taylor Clark, Bradley Barrosse; Tricia Barrosse; Lynn M. Alfonso, Sr.; George C. McGee; Sherral Irvin; Jefferson Magee; and Acy J. Cooper, Jr., United States District Court, Eastern District of Louisiana, Civil Action 08-4156, Section “I-5,” filed on August 11, 2008. DRD’s excess insurers, IINA and Houston Casualty Company intervened into this action and deposited $9,000 into the Court’s registry. ACL LLC has filed two actions in the United States District Court for the Eastern District of Louisiana seeking exoneration from or limitation of liability relating to the foregoing incident as provided for in Rule F of the

15

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Supplemental Rules for Certain Admiralty and Maritime Claims and in 46 U.S.C. sections 30501, 30505 and 30511. Tintomara interests and DRD also filed limitation actions. ACL made a claim for its damages against Tintomara interests and DRD in their respective limitation actions. We have also filed a declaratory judgment action against DRD seeking to have the contracts between them declared “void ab initio”. This action has been consolidated with the limitation actions and stayed pending the outcome of the limitation actions. A trial on the ACL, Tintomara interests and DRD limitation actions has been concluded and we are awaiting the judge’s decision on liability of the parties and apportionment of ACL and Tintomara’s damages. On August 22, 2011 an action was filed in the U.S. District Court for the Eastern District of Louisiana captioned United States of America v. American Commercial Lines LLC and D.R.D. Towing, LLC, Civil Action No. 2:11-cv-2076. The action seeks damages of approximately $25 million, including certain repayment to the Oil Spill Liability Trust Fund for sums it paid related to the cleanup of the oil spill and to certain claimants for damages cognizable under OPA 90, a civil penalty under the Clean Water Act in an amount to be determined at trial as well as a claim for natural resources damages. On July 25, 2011 an action was filed in the 25th Judicial District for the Parish of Plaquemines State of Louisiana captioned Chuc Nguyen, et al. v. American Commercial Lines, Inc. and its Insurers, ABC Insurance Company and Indemnity Insurance Company of North America, No. 58936. The action filed by numerous commercial fishermen seeks damages for real or personal property, loss of subsistence use of natural resources associated with loss of profits or impairment of earning capacity. We participated in the U.S. Coast Guard investigation of the matter and participated in the hearings which have concluded. A finding has not yet been announced. Although we have made demand on DRD (including its insurers) and Tintomara interests for reimbursement of cleanup costs, indemnification and other damages sustained by the Company there is no assurance that any other party that may be found responsible for the accident will have the insurance or financial resources available to provide such defense and indemnification. We have various insurance policies covering pollution, property, marine and general liability. While the cost of cleanup operations and other potential liabilities are significant, we believe the Company has satisfactory insurance coverage and other legal remedies to cover substantially all of the cost.

At March 31, 2012, approximately 725 employees of our manufacturing segment were represented by a labor union under a contract that expires on April 1, 2013. These employees are represented by General Drivers, Warehousemen and Helpers, Local Union No. 89, affiliated with the International Brotherhood of Teamsters, Chauffeurs, Warehousemen and Helpers of America, at our shipyard facility.

Our remaining unionized employees at March 31, 2012 (approximately 20 positions) are represented by the International Union of United Mine Workers of America, District 12 — Local 2452 at ACLTS in St. Louis, Missouri under a collective bargaining agreement that expires December 31, 2013.

Although we believe that our relations with our employees and with the recognized labor unions are generally good, we cannot assure that we will be able to reach agreement on renewal terms of these contracts or that we will not be subject to work stoppages, other labor disruption or that we will be able to pass on increased costs to our customers in the future.

Note 10. Share-Based Compensation

On April 12, 2011, Finn adopted the Finn Holding Corporation 2011 Participation Plan (the “Participation Plan”) to provide incentive to key employees of Finn and its subsidiaries by granting performance units to key stakeholders, including ACL I’s named executive officers, to maximize Finn’s performance and to provide maximum returns to Finn’s stockholders. The Participation Plan may be altered, amended or terminated by Finn at any time.

Under the Participation Plan, the value of the performance units is related to the appreciation in the value of Finn from and after the date of grant. The performance units vest over a period specified in the applicable award agreements. Participants in the Participation Plan may be entitled to receive compensation for their vested units if certain performance-based “qualifying events” occur during the participant’s employment with the Company. These qualifying events are described below. The Compensation Committee for the Participation Plan (the “Plan Committee”) determines who is eligible to receive an award, the size and timing of the award and the value of the award at the time of grant. The performance units generally mature according to the terms approved by the Plan Committee and as set forth in a grant agreement. Payment on the performance units is contingent upon the occurrence of either (i) a sale of some or all of Finn common stock by its stockholders, or (ii) Finn’s payment of a cash dividend. The Participation Plan will expire April 1, 2016 and all performance units will terminate upon the expiration of the Participation Plan, unless sooner terminated pursuant to the terms of the Participation Plan.

16

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The maximum number of performance units that may be awarded under the Participation Plan is 36,800,000. During the year ended December 31, 2011, a total of 31,165,000 performance units were granted and 19,780,000 performance units were forfeited by executives that left employment in 2011. At no time during the year did the outstanding grants exceed the maximum authorized units. At December 31, 2011, the Company had committed to issue 17,595,000 performance units to executives that joined the Company during 2011. These units were granted during the quarter ended March 31, 2012. The fair value of the performance units on their grant date was zero.

Upon the occurrence of a qualifying event, participants with vested units may receive an amount equal to the difference between: (i) the value (as defined by the Participation Plan) of the units on the date of the qualifying event, and (ii) the value of the units assigned on the date of grant. No amounts are due to participants until the total cash dividends and net proceeds from the sale of common stock exceed values pre-determined by the Participation Plan. The Company accounts for grants made pursuant to this Participation Plan in accordance with FASB ASC 718, “Compensation — Stock Compensation” (“ASC 718”). It is anticipated that since the occurrence of future “qualifying events” is not determinable or estimable, no liability or expense will be recognized until the qualifying event(s) becomes probable and can be estimated.

Prior to the Acquisition, ACL had reserved the equivalent of approximately 54,000 shares of Finn for grants to employees and directors under the Omnibus Plan. According to the terms of the Omnibus Plan, forfeited share awards and expired stock options become available for future grants. No share-based awards were granted under this Omnibus Plan during the three months ended March 31, 2012 or 2011.

For all share-based compensation under the Omnibus Plan, as participants render service over the vesting periods, expense has been recorded to the same line items used for cash compensation. Generally, this expense is for the straight-line amortization of the grant date fair market value adjusted for expected forfeitures. Other capital is correspondingly increased as the compensation is recorded. Grant date fair market value for all non-option share-based compensation was the closing market value on the date of grant. Adjustments to estimated forfeiture rates have been made when actual results were known, generally when awards are fully earned. Adjustments to estimated forfeitures for awards not fully vested occur when significant changes in turnover rates became evident.

Effective as of the date of the Acquisition on December 21, 2010, all awards that had been granted to non-executive employees and to the former ACL board members vested and were paid out consistent with certain provisions in the Omnibus Plan. The payment of the intrinsic value of these awards totaling $14,284 was a part of the consideration paid for the Acquisition and included certain previously vested executive shares. This payment by the Company is recorded as an element of the intercompany receivable balance on the condensed consolidated balance sheet. Unvested awards previously granted to Company executives under the Omnibus Plan were assumed by Finn. There were no changes in the terms and conditions of the awards, except for adjustment to denomination in Finn shares for all award types and conversion to time-based vesting as to the performance units. At March 31, 2012, 8,799 shares were available under the Omnibus Plan for future awards, but there is no intention that any further awards will be granted under the Omnibus Plan.

During the three months ended March 31, 2012, 1,468 restricted stock units and 1,114 stock options, held by Company executives vested. This vesting event resulted in an increase in additional paid in capital and a tax benefit for the excess of the intrinsic value of the restricted units at the vesting date over the fair value at the date of grant of $206. These tax benefits will be recognized through paid in capital as it becomes more likely than not that the tax benefit will be realized. As of March 31, 2012, there were 2,857 options outstanding with a weighted average exercise price of $55.62 and 54 vested and 808 unvested restricted stock units outstanding.

During the three months ended March 31, 2011, 3,823 restricted stock units and 8,277 stock options, held by Company executives vested. This vesting event resulted in an increase in additional paid in capital and a tax benefit for the excess of the intrinsic value of the restricted units at the vesting date over the fair value at the date of grant of $1,090.

In the quarter ended March 31, 2012, the Company recorded total stock-based compensation of $49 and a related income tax benefit of $18. In the quarter ended March 31, 2011, the Company recorded total stock-based employee compensation of $1,493 and a related income tax benefit of $559. The 2010 total included $619 for expense related to certain executive outstanding awards which accelerated in accordance with the terms of the Omnibus Plan at the date of their separation from service during the quarter. The intrinsic value of awards held by separating executives was paid by the Company to the participants upon their separation from the Company, increasing the Company’s intercompany receivable from Finn.

17

Table of Contents

ACL I CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Also during the quarter ended March 31, 2011, subsequent to the issuance of $250,000 of the PIK Notes, Finn declared a dividend of $258.50 per share for each outstanding share which was paid to Finn shareholders during the quarter. This reduced Finn’s initial capital of $460,000 to $201,500. Per the terms of the Omnibus Plan, holders of outstanding share-based equity awards were entitled to receive either dividend rights, participation in the dividend or adjustment of awards to maintain the then-current intrinsic value of the existing awards. Finn elected to pay the dividend per share to holders of unvested restricted stock units and performance units and to adjust the strike prices of options issued or pay out a cash dividend, or some combination of such actions, to the extent necessary to maintain the intrinsic value of the units and options at date of dividend. The dividend resulted in payments of $3,659 to Company executives at the date of the dividend, with all remaining share-based awards’ new intrinsic value based on shares of Finn valued at $201.50 per share. The $3,659 payment was made by the Company and increased the Company’s related receivable from Finn. After the payouts to the executives, during the first quarter of 2011, the Company declared and paid dividends to Finn in an amount equal to the gross payments. Finn, in turn, used the proceeds to reimburse the Company for payments made on its behalf to separating executives and to holders of vested restricted units under the Omnibus Plan.

Note 11. Dispositions

Dispositions and Impairments —

In December 2011 the Company disposed of its interest in EBDG. In November 2009 the Company disposed of its interest in Summit. Due to the sale all results of operations are reflected in discontinued operations. EBDG provided naval architecture and design services and Summit provided environmental and civil construction services.

During the first quarter of 2011 one of the three boats held for sale was returned to service, one boat was sold in the third quarter of 2011 and two additional boats were placed into held for sale status in the fourth quarter. These three boats are being actively marketed. During the first quarter of 2012 eight surplus boats were sold at a small loss. Additionally, during the first quarter of 2012 262 retired barges were sold for scrap generating proceeds of $20,512 and gains on disposition of $7,167 in the quarter.

18

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) includes certain “forward-looking statements” that involve many risks and uncertainties. When used, words such as “anticipate,” “expect,” “believe,” “intend,” “may be,” “will be” and similar words or phrases, or the negative thereof, unless the context requires otherwise, are intended to identify forward-looking statements. These forward-looking statements are based on management’s present expectations and beliefs about future events. As with any projection or forecast, these statements are inherently susceptible to uncertainty and changes in circumstances. ACL I Corporation is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. The potential for actual results to differ materially from such forward-looking statements should be considered in evaluating our outlook.

The readers of this document are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. See the risk factors enumerated in “Item 1A. Risk Factors” of this Quarterly Report on Form 10-Q/A (this “Report”) for a detailed discussion of important factors that could cause actual results to differ materially from those reflected in such forward-looking statements.

INTRODUCTION

This MD&A is provided as a supplement to the accompanying condensed consolidated financial statements and footnotes to help provide an understanding of the financial condition, changes in financial condition and results of operations of ACL I Corporation (“ACL I”) and its subsidiaries. Unless the context indicates otherwise, the “Company” refers to ACL I and its subsidiaries, on a consolidated basis. This MD&A should be read in conjunction with, and is qualified in its entirety by reference to, the accompanying condensed consolidated financial statements and footnotes. This MD&A is organized as follows.

Overview. This section provides a general description of the Company and its business, as well as developments the Company believes are important in understanding the results of operations and financial condition or in understanding anticipated future trends.

Results of Operations. This section provides an analysis of the Company’s results of operations for the three months ended March 31, 2012 compared to the results of operations for the three months ended March 31, 2011.

Liquidity and Capital Resources. This section provides an overview of the Company’s sources of liquidity, a discussion of the Company’s debt that existed as of March 31, 2012, and an analysis of the Company’s cash flows for the three months ended March 31, 2012, and March 31, 2011.

Changes in Accounting Standards. This section describes certain changes in accounting and reporting standards applicable to the Company.

Critical Accounting Policies. This section describes any significant changes in accounting policies that are considered important to the Company’s financial condition and results of operations, require significant judgment and require estimates on the part of management in application from those previously described in our filing on Form S-4/A, filed May 8, 2012. The Company’s significant accounting policies include those considered to be critical accounting policies.

Quantitative and Qualitative Disclosures about Market Risk. This section discusses our analysis of exposure to potential losses arising from adverse changes in fuel prices and interest rates at March 31, 2012.

OVERVIEW

Our Business

The Company

The Company is one of the largest and most diversified inland marine transportation and service companies in the United States. The Company provides barge transportation and related services under the provisions of the Jones Act (the “Jones Act”) and manufactures barges, primarily for use in the inland rivers, commonly referred to as brown-water use. The Jones Act is a federal cabotage law that restricts domestic non-proprietary cargo marine transportation in the United States to vessels built and registered in the United States, manned by U.S. citizens and 75% owned by U.S. citizens.

We currently operate in two business segments, transportation and manufacturing. We are the third largest provider of dry cargo barge transportation and second largest provider of liquid tank barge transportation on the United States Inland Waterways, which consists of the Mississippi River, the Ohio River, the Illinois River and their tributaries and the Gulf Intracoastal Waterway (the “Inland Waterways”), accounting for 10.9% of the total inland dry cargo barge fleet and 10.2% of the total inland liquid cargo barge fleet as of December 31, 2011, according to InformaEconomics, Inc., a private forecasting service (“Informa”).

Our operations are tailored to service a wide variety of shippers and freight types. We provide additional value-added services to our customers, including warehousing and third-party logistics through our BargeLink LLC joint venture. Our operations incorporate advanced fleet management practices and information technology systems which allows us to effectively manage our fleet.

19

Table of Contents

Our manufacturing segment was the second largest manufacturer of brown-water barges in the United States in 2011 according to Criton Corporation (“Criton”), publisher of River Transport News.

The Industry

Transportation Industry. Barge market behavior is driven by the fundamental forces of supply and demand, influenced by a variety of factors including the size of the Inland Waterways barge fleet, local weather patterns, navigation circumstances, domestic and international consumption of agricultural and industrial products, crop production, trade policies and the price of steel. According to Informa, the Inland Waterways fleet peaked at 23,092 barges at the end of 1998. By the end of 2009, the industry fleet had, decreased to 17,498 dry and 3,009 liquid barges, for a total fleet size of 20,507, 11.2% below the 1998 level, with 113 more liquid tank barges and 2,698 fewer dry cargo barges than were in service at the end of 1998. Retirements of dry and liquid barges of 1,131 and 144 respectively during the two-year period including 2010 and 2011, were more than offset by new construction with additions in excess of retirements of 498 dry cargo barges and 75 liquid tank barges, resulting in an industry fleet of 21,080 at the end of 2011. This was 8.7% below the 1998 peak levels in the industry, with the number of dry cargo barges down 10.9% and liquid tank barges up almost 6.5%. Competition is intense for barge freight transportation. The top five carriers (by fleet size) of dry and liquid barges comprise over 55% of the industry fleet in each sector as of December 31, 2011. The average economic useful life of a dry cargo barge is generally estimated to be between 25 and 30 years and between 30 and 35 years for liquid tank barges.

TOP 5 CARRIERS BY FLEET SIZE

(as of December 31, 2011)

| Operator | Number of Barges |

Total Share |

Average Age (Yrs.) |

|||||||||

| Dry Cargo Barges |

||||||||||||

| Ingram Barge Company |

3,792 | 21.1 | % | 15.4 | ||||||||

| AEP River Operations |

3,199 | 17.8 | % | 11.6 | ||||||||

| Commercial Barge Line Company |

1,961 | 10.9 | % | 20.5 | ||||||||

| American River Transportation Co. |

1,786 | 9.9 | % | 18.5 | ||||||||

| Cargo Carriers, A business of Cargill, Inc. |

1,278 | 7.1 | % | 12.3 | ||||||||

|

|

|

|

|

|||||||||

| Top Five Total |

12,016 | 66.8 | % | 15.4 | ||||||||

| Other |

5,980 | 33.2 | % | 14.0 | ||||||||

|

|

|

|||||||||||

| Industry Total |

17,996 | |||||||||||

|

|

|

|||||||||||

| Liquid Cargo Barges |

||||||||||||

| Kirby Inland Marine, LP |

819 | 26.6 | % | 19.1 | ||||||||

| Commercial Barge Line Company |

316 | 10.2 | % | 21.3 | ||||||||

| Canal Barge Co., Inc. |

218 | 7.1 | % | 11.8 | ||||||||

| Marathon Petroleum Company LP |

181 | 5.9 | % | 12.1 | ||||||||

| Ingram Barge Company |

175 | 5.7 | % | 31.5 | ||||||||

|

|

|

|

|

|||||||||

| Top Five Total |

1,709 | 55.4 | % | 19.1 | ||||||||

| Other |

1,375 | 44.6 | % | 17.8 | ||||||||

|

|

|

|||||||||||

| Industry Total |

3,084 | 18.5 | ||||||||||

|

|

|

|||||||||||

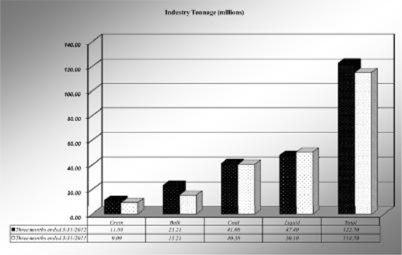

For purposes of industry analysis, the commodities transported on the Inland Waterways can be broadly divided into four categories: grain, bulk, coal and liquids. Using these broad cargo categories, the following graph depicts the total millions of tons shipped through the United States Inland Waterways for the three months ended March 31, 2012 and March 31, 2011 by all carriers according to data from the US Army Corps of Engineers Waterborne Commerce Statistics Center (the “Corps”). The Corps does not estimate ton-miles, which we believe is a more accurate volume metric. Note that the most recent periods are typically estimated for the Corps’ purposes by lockmasters and retroactively adjusted as shipper data is received.

20

Table of Contents

Source: U.S. Army Corps of Engineers Waterborne Commerce Statistics Center

Manufacturing Industry. The inland barge manufacturing industry competes primarily on quality of manufacture, delivery schedule, design capabilities and price. We consider Trinity Industries, Inc. to be our manufacturing segment’s most significant competitor for the large-scale manufacture of inland barges, although other firms have barge building capability on a smaller scale. We believe there are a number of shipyards located on the Gulf Coast that compete with our manufacturing segment for the manufacturing of liquid tank barges. In addition, certain other shipyards may be able to reconfigure to manufacture inland barges and related equipment. We believe, based on data reported by River Transport News (published by Criton), that Jeffboat and one other competitor together comprise the significant majority of barge manufacturing capacity in the U.S. We also believe that the new dry barge builds required to replace retiring barges may strain the capacity of barge manufacturing during the next five years. According to industry data provided by Informa, from 2005 through 2011, Jeffboat’s brown water liquid and dry cargo barge production accounted for between 24% and 43% of the overall market.

Consolidated Financial Overview

For the quarter ended March 31, 2012, the Company had net loss of $0.6 million compared to a net loss of $16.5 million in the quarter ended March 31, 2011.

The following table displays certain individually significant drivers of after-tax non-comparability in the respective first quarters of 2012 and 2011. Though both first quarters contain the impact of purchase accounting due to the significant difference in the level of asset sales and barge scrapping, we have separated the former basis and the impact of the purchase accounting revaluation of the assets disposed.

21

Table of Contents

| Three Months Ended March 31, | ||||||||

| 2012 | 2011 | |||||||

| Share-based compensation and restructuring costs |

($ | 93 | ) | ($ | 2,070 | ) | ||

| Merger related and consulting expenses before impact of boat/barge gains |

(308 | ) | (4,109 | ) | ||||

| Total historical cost gains on boat/barge sales |

18,027 | 729 | ||||||