UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 22, 2012

STRATEGIC INTERNET INVESTMENTS,

INCORPORATED

(Exact name of registrant as specified in

its charter)

| Delaware | 33-28188 | 84-1116458 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

24 First Avenue, P.O. Box 918, Kalispell, MT 59903

(Address of principal executive offices)

Registrant's telephone number, including area code: 760 536 8383

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

[ ] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e -4(c))

Item 1.01 Entry into a Material Definitive Agreement.

Effective August 20, 2012, the Company retained Regal Barrington

("Contractor") and Fred Schultz (“Schultz”), to provide management services for

the purpose of providing corporate development services to the Company;

assisting with the general administration of the Company’s affairs; coordinating

and arranging presentations for the Company at conventions, tradeshows and “road

shows; assisting the Company in developing its corporate profile, materials,

news releases, brochures, mail outs, etc.; assist the Company in formulating and

achieving its objectives including participating in planning meetings, and

implementation of such plans and objectives; liaising with, advising and

reporting to the Board upon all aspects of the business and affairs of the

Company; and such other duties as may be reasonably directed from time to time

by the Board.

The term of the Contractor’s appointment shall commence on Sept 1st, 2012 and continue for a term of 12 months expiring on September 1st, 2013. Thereafter this Agreement shall be automatically renewed for successive 6 month terms, subject only to termination by either party as specified within the agreement..

The Company shall issue to the Contractor and Schultz as to 60% and 40% respectively, 800,000 shares of restricted Rule 144 common stock as full compensation under the agreement.

As additional incentive, the Company shall grant the Contractor and Schultz restricted Rule 144 stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 480,000 Rule 144 restricted common shares and Schultz to purchase up to 320,000 Rule 144 restricted common shares in the capital of the Company at the exercise price of $0.10 per share or such other lower price as the Company, in its sole discretion may deem appropriate. All options granted will be exercisable over a five year period and will contain a vesting schedule as specified in the Company’s most current Stock Option Plan.

Copy of this agreement is contained in Schedule A

Item 1.01 Entry into a Material Definitive Agreement

Effective August 22, the Company retained the services of Paul D.

Sullivan, to provide consulting services for the purposes of evaluating

agreements and real estate opportunities, reviewing real estate purchase and

sale agreements and contracts, assignment of beneficial real estate and land

agreements, property management agreements, lease agreements, memorandums of

cooperation, joint venture agreements, real estate appraisals and valuation

reports, and other services. Mr. Sullivan is a partner at the law firm Measure,

Sampsel, Sullivan & O'Brien, P.C. where he practices real estate law. He is

a graduate of the University of Pennsylvania School of Law and currently resides

in Bigfork, Montana.

The Company shall, as of the date of the agreement, issue 300,000 shares of restricted Rule 144 common stock as full compensation under the consulting agreement.

The term of the Contractor’s appointment shall commence on Sept 1, 2012 and continue for a term of one year expiring on Sept1, 2012. Thereafter the Agreement shall be automatically renewed on a six month basis, subject only to termination in accordance with the agreement.

As additional incentive, the Company shall grant the Consultant stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 300,000 Rule 144 restricted common shares in the capital of the Company at the exercise price of $0.10 per share or such other lower price as the Company, in its sole discretion may deem appropriate. All options granted will be exercisable over a five year period and will contain a vesting schedule as specified in the Company’s most current Stock Option Plan.

Copy of this agreement is contained in Schedule B

Item 1.01 Entry into a Material Definitive Agreement.

Effective August 20th, 2012, Strategic Internet Investments, Incorporated. (“OTC:BB SIII”) signed a Letter of Intent (the "LOI") with G7 Entertainment Limited (“G7”), a non-arms length private British Columbia Corporation, 60% majority controlled by Mr. Abbas Salih, president and CEO of SIII. The LOI, attached hereto as Schedule C, sets out the terms and conditions that will allow SIII to acquire all of the assets as summarized below. The Assets are held under contractual rights by G7 as outlined within various Joint Venture Agreements (the "JV Agreements") between G7 and four UK corporations, as identified below. The JV Agreements, attached hereto as Schedule D, outline the terms and conditions of the formation of a joint venture between G7 and the respective real estate owners whereby G7 intends to facilitate the refinancing of existing mortgages in exchange for a 60% interest in the Joint Venture, which Joint Venture will hold title to the real estate assets.

The LOI outlines the terms and conditions whereby SIII can purchase a 100% interest in the Assets at a discounted price (the “SIII Purchase Price”) to the Fair Market Price. The Fair Market Price is to be determined by a mutually acceptable, independent professional real estate evaluator experienced in evaluating the type of assets to be purchased by SIII. The LOI states that the SIII Purchase Price will be equal to the fair market price, as outlined above, minus a discount that will be calculated to be 25% of the total equity contained within the assets ( equity = Fair Market Price – [outstanding mortgage(s) and/or other existing debt of the of the Assets])

The LOI allows for ongoing due diligence which is in process and the completion of a formal purchase agreement between the respective parties.

SIII intends to fund the acquisition of the assets by securing funding by way of equity and or debt financing and cannot predict with any certainty that such funding efforts will be successful and therefore provides a cautionary statement that the success of the contemplated acquisition cannot be assured.

Summary of the Assets and JV Agreement Partners (Copies provided in Schedule D)

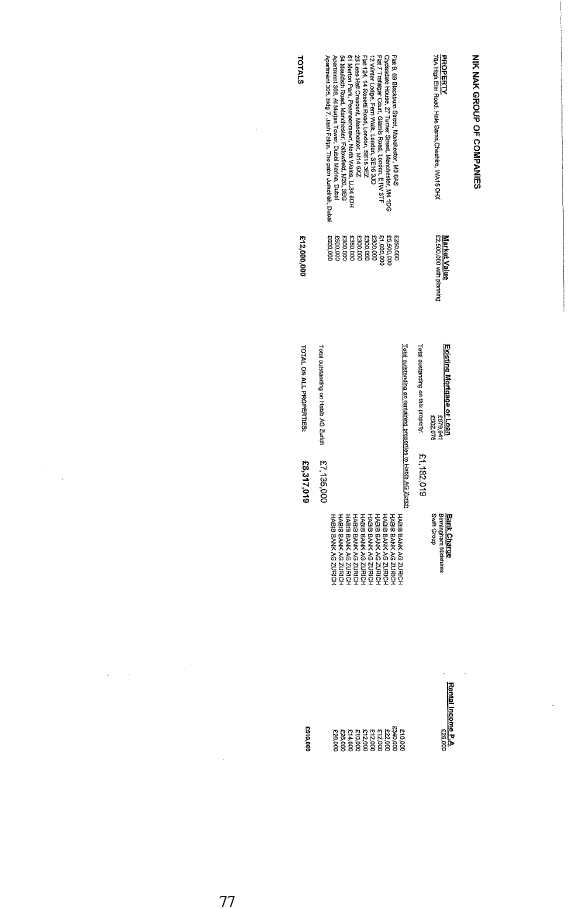

• Joint Venture 1; formed with Anujum Ahmed & Nik Nak International + Utocroft Ltd and G7 consists of the following properties:

Address

78A

High Elm Road, Hale Barns, UTOCROFT, WA15 0HX

Flat 9, 69 Blackburn Street,

Manchester, M3 6AS

Clydesdale House, 27 Turner Street, Manchester, M4

1DG

Flat 7, Trafalgar Court, Glamis Road, London, E1W 3TF

12 Winter

Lodge, Fern Walk, London, SE16 3JD

Flat 124, 14 Rosetti Road, London, SE16

3JD

23 Lees Hall Crescent, Manchester, M14 6XZ

61 Merton Park,

Penmaenmawr, North Wales, LL34 6DH

54 Mauldeth Road, Manchester,

Fallowfield, M20 3EG

Apartment 308, Al Murjan Tower, Dubai Marina, Dubai

Apartment 305, Bldg 7, Jash Falqa, The Palm Jumeirah, Dubai

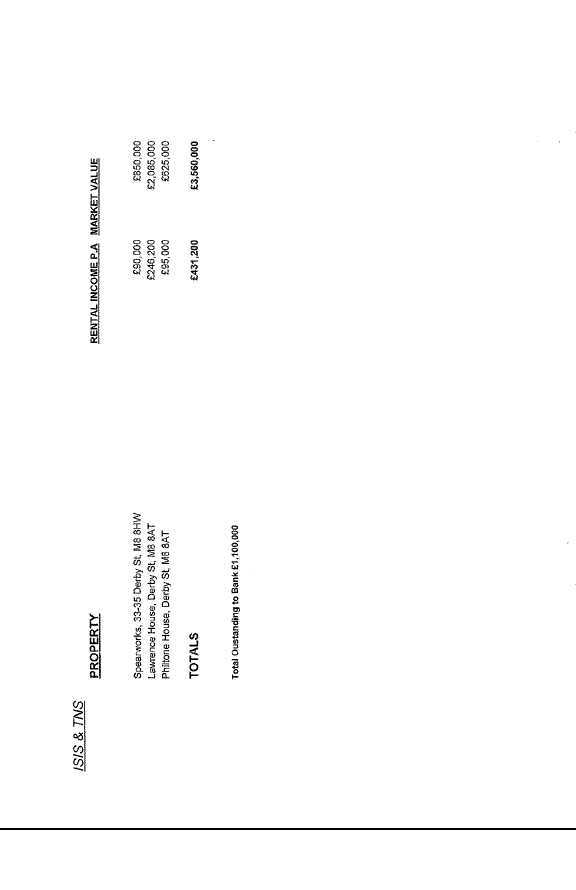

• Joint Venture 2; formed with ISIS Properties UK Ltd and G7 consists of the following properties:

Address

Spearworks, 33-35 Derby St, M8 8HW

Lawrence House, Derby St, M8 8AT

Philtone House, Derby St, M8 8AT

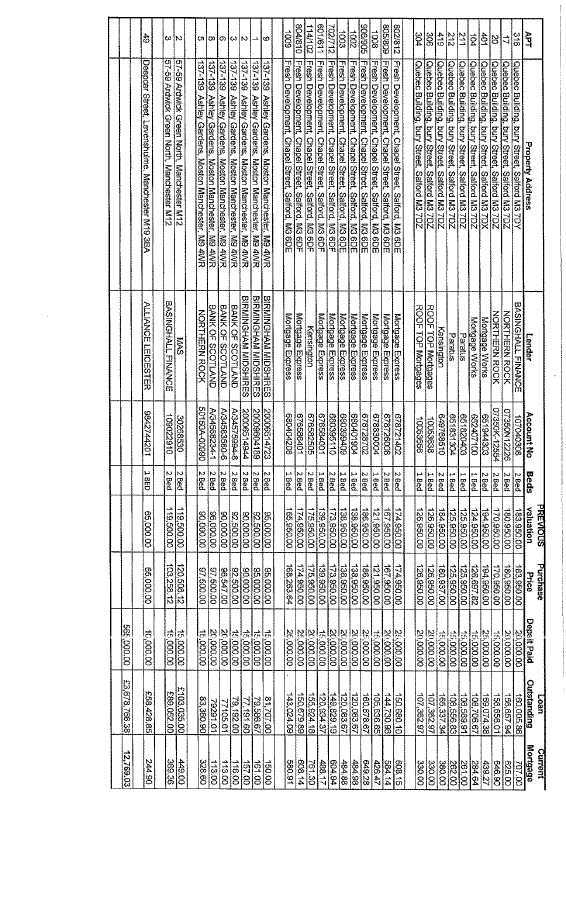

• Joint Venture 3; formed with Zahid Sarwar and G7 consists of the following properties:

Quebec Building, Bury Street, Salford

M3 7DY – Apartments 316,17,20

401,104,211,212,419, 306, 304

Fresh

Development, Chapel St., Salford, M3 6DE – Apartments 802/812, 505/809,

1008,

906/905, 1002, 1003, 702/712, 601/611, 114/102, 804/810, 1009

137-139 Ashley

Gardens, Moston Manchester, M9 4WR – Apartments 9,1,2,3,6,8,5

57-59 Ardwick

Green North, Manchester M12 – Apartments 2,3

Deepcar Street, Levenshulme, Manchester M19 3BA – Apartment 49

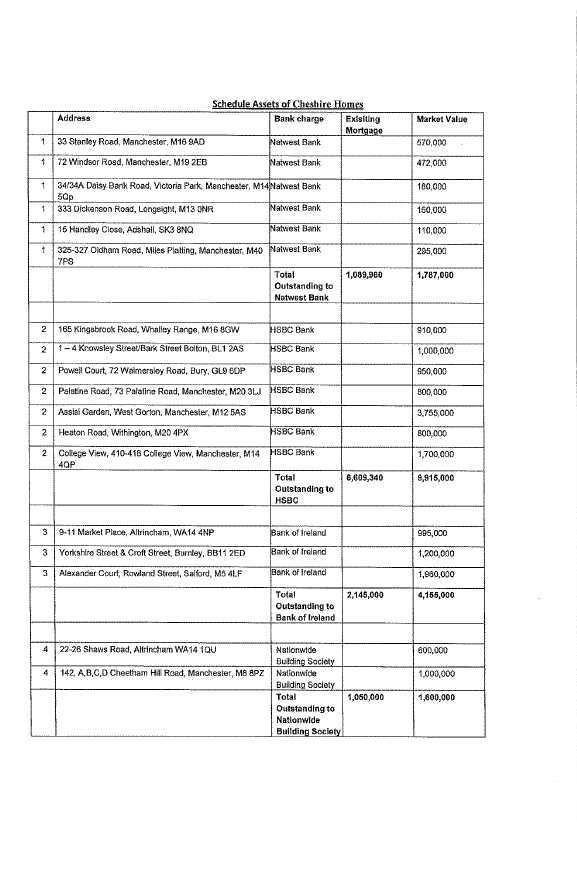

• Joint Venture 4; formed with Cheshire Homes UK Ltd and G7 consist of the following properties:

Address

33 Stanley Road,

Manchester, M16 9AD

72 Windsor Road, Manchester, M19 2EB

34/34A Daisy

Bank Road, Victoria Park, Manchester, M14 5Qp

333 Dickenson Road, Longsight,

M13 0NR

15 Handley Close, Adshall, SK3 8NQ

325-327 Oldham Road, Miles

Platting, Manchester, M40 7PS

165 Kingsbrook Road, Whalley Range, M16 8GW

1 – 4 Knowsley Street/Bark Street Bolton, BL1 2AS

Powell Court, 72

Walmersley Road, Bury, GL9 6DP

Palatine Road, 73 Palatine Road, Manchester,

M20 3LJ

Assisi Garden, West Gorton, Manchester, M12 5AS

Heaton Road,

Withington, M20 4PX

College View, 410-418 College View, Manchester, M14 4QP

9-11 Market Place, Altrincham, WA14 4NP

Yorkshire Street & Croft

Street, Burnley, BB11 2ED

Alexander Court, Rowland Street, Salford, M5 4LF

22-26 Shaws Road, Altrincham WA14 1QU

142, A,B,C,D Cheetham Hill Road, Manchester, M8 8PZ

• Joint Venture 5; formed with Cheshire Homes UK Ltd and G7 consists of the following properties:

Address

Adam Court 89-91

Wellington Road North, Stockport SK4 2LP

Wilbraham Court 16-18 Wilbraham

Court, Manchester, M14 6JY

Mariam Court 23 Laindon Road, Manchester M14 5YJ

Item 3.02 Unregistered Sales of Equity Securities

Pursuant to Items 1.01 listed above, The Company shall issue to the Contractor (or the contractor’s nominee) and Schultz as to 60% and 40% respectively, 800,000 shares of restricted Rule 144 common stock. As additional incentive, the Company shall grant the Contractor and Schultz stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 480,000 Common shares of Rule 144 restricted stock and Schultz to purchase up to 320,000 shares of Rule 144 restricted stock in the capital of the Company at the exercise price of $0.10 per share or such other lower price as the Company, in its sole discretion may deem appropriate. All options granted will be exercisable over a five year period and will contain a vesting schedule as specified in the Company’s most current Stock Option Plan.

Also in pursuant to Item 1.01 listed above, The Company shall issue to Paul D. Sullivan 300,000 shares of restricted Rule 144 common stock as full compensation under the agreement. As additional incentive, the Company shall grant the Consultant stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 300,000 Common shares of Rule 144 restricted stock in the capital of the Company at the exercise price of $0.10 per share or such other lower price as the Company, in its sole discretion may deem appropriate. All options granted will be exercisable over a five year period and will contain a vesting schedule as specified in the Company’s most current Stock Option Plan..

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective August 20, 2012, the Company appointed Fred Schultz of 1706 Serrano Street, Oceanside, CA. 92054 as a director of our company in connection with Section 2.2 of the Management Services agreement references in Item 1.01 above.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Address

Effective August 20, we changed our address from Nisar Square, Benyas Centre Office No 207, Dubai, United Arab Emirates to 24 First Avenue, P.O. Box 918, Kalispell, MT 59903 to 24 First Avenue, P.O. Box 918, Kalispell, MT 59903 Telephone # 760 536 8383

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

“Abbas Salih”

_________________________________________

By: /s/ Abbas Salih

Title: President

Date: August 22, 2012

SCHEDULE A

MANAGEMENT SERVICES AGREEMENT

BETWEEN

STRATEGIC INTERNET INVESTMENTS, INC

AND

REGAL BARRINGTON and FRED SCHULTZ

MANAGEMENT SERVICES AGREEMENT

THIS AGREEMENT made as of the 21st day of August, 2012.

BETWEEN:

STRATEGIC INTERNET INVESTMENTS, INC., having an office at 24 First Avenue East, P.O. Box 918, Kalispell, Montana 59903

(the “Company”)

OF THE FIRST PART

AND:

REGAL BARRINGTON having an office at 5835 West Hidden Springs Drive, Boise, Idaho 83714

(the “Contractor”)

OF THE SECOND PART

AND:

Fred Schultz of Regal Barrington, 1706 Serrano Street, Oceanside, CA 92054

(“Schultz”)

OF THE THIRD PART

IN CONSIDERATION of the premises and the mutual covenants herein contained the parties hereto agree as follows:

Article 1

Definitions

| 1.1 |

In this Agreement: | |

|

“Associated Company” means a company which directly or indirectly: | ||

| (a) |

controls, or is controlled by, the Company, or | |

| (b) |

is controlled by the same company that directly or indirectly controls the Company. | |

|

“Board” means the Board of Directors from time to time of the Company. | ||

“Notice Period” means a period of thirty days commencing on the day after notice of termination of the Contractor’s retainer is given by the Company in accordance with the terms of this Agreement.

Article 2

Appointment

| 2.1 |

The Company agrees to retain the Contractor to provide management services (the “Services”) from time to time as required by the Board and the Contractor agrees to provide such Services, reporting directly to the Board, subject to the terms and conditions of this Agreement. The Services to be provided by the Contractor shall include the following: | |

| (a) |

providing corporate development services to the Company; | |

| (b) |

assisting with the general administration of the Company’s affairs; | |

| (c) |

to coordinate and arrange presentations for the Company at conventions, tradeshows and “road shows; | |

| (d) |

to assist the Company in developing its corporate profile, materials, news releases, brochures, mail outs, etc. | |

| (e) |

to assist the Company in formulating and achieving its objectives including participating in planning meetings, and implementation of such plans and objectives; | |

| (f) |

liaising with, advising and reporting to the Board upon all aspects of the business and affairs of the Company; and | |

| (g) |

such other duties as may be reasonably directed from time to time by the Board | |

|

| ||

| 2.2 |

The Contractor agrees to provide the Services to the Company through the employment of personnel acceptable to the Company, acting reasonably. Such personnel shall include Schultz, if requested by the Company. Schultz agrees to accept an appointment as an officer or director of the Company if so requested by the Company. The Contractor shall provide its own office facilities and equipment to its employees for the purpose of providing the Services; provided that the personnel of the Contractor may also use the Company’s offices and facilities from time to time as mutually agreed upon. | |

| 2.3 |

The term of the Contractor’s appointment shall commence on August 15th, 2012 and continue for a term of 12 months expiring on August 15st, 2013. Thereafter this Agreement shall be automatically renewed for successive 6 month terms, subject only to termination in accordance with the provisions of Article 6. | |

| 2.4 |

The parties agree this agreement supersedes and replaces any previous consulting services agreement between any of the parties as it relates to Strategic Internet Investments, Inc. | |

Article 3

Relationship Between the Parties

| 3.1 |

The parties agree and intend that the relationship of the Contractor to the Company pursuant to this Agreement is that of independent contractor. Neither Schultz nor any other staff of the Contractor are employees of the Company, and are not entitled to the benefits provided by the Company to its employees except as otherwise mutually agreed upon from time to time. | |

| 3.2 |

The Contractor shall provide the Services in Oceanside, California and or Boise Idaho, except for travel from time to time as reasonably required for the Company’s business. | |

| 3.3 |

During the continuance of its retainer under this Agreement, the Contractor shall: | |

| (a) |

devote sufficient time to the business of the Company and its subsidiaries for the performance of the Services described herein; | |

| (b) |

provide the Services in a proper, loyal and efficient manner and shall use its best efforts to maintain and promote the interests and reputation of the Company and its subsidiaries and not do anything which is harmful to them; and | |

| (c) |

at all times promptly give to the Board (in writing if so requested) all such information and explanations as the Board may reasonably require in connection with matters relating to its retainer hereunder or with the business of the Company or its subsidiaries. | |

| 3.4 |

The Company is aware that the Contractor has now and will continue to provide services to other companies and the Company recognizes that these companies will require a certain portion of the time of the Contractor and its principal and other employees. The Company agrees that the Contractor may continue to provide services to such outside interests, provided that such interests do not conflict with the provision of the Contractor’s Services under this Agreement. Notwithstanding the above, it is understood that the Contractor will devote services primarily through the services of Schultz to the business affairs of the Company on a regular daily basis | |

| 3.5 |

During the term of this Agreement, the Contractor and/or its employees and associates may have access to confidential information consisting of the following categories of information (collectively, the “Trade Secrets”): | |

| (a) |

financial information, such as the Company’s earnings, assets, debts, or other financial data, whether relating to the Company generally, or to particular services, geographic areas or time periods; | |

| (b) |

supply and service information, such as goods and services, supplier’s names or addresses, terms of supply or service contracts, or of particular transactions, or related information about potential suppliers, to the extent that such information is not generally known to the public, and to the extent that the combination of suppliers or use of a particular supplier, though generally known or available, yields advantages to the Company, the details of which are not generally known; | |

| (c) |

in regards to real estate companies, properties information, such as details about ongoing or proposed investment or acquisition plans or agreements by or on behalf of the Company pertaining to any existing or proposed plans, the forecasts and results of any programs or information about impending transactions; | |

| (d) |

personnel information, compensation or other terms of employment, actual or proposed promotions, hiring, resignations, disciplinary actions, termination or reasons thereof, training methods, performance, or other Consultant information not including Consultants’ personal or medical histories; and/or | |

| (e) |

current shareholders lists, investors, contracts such as registered representatives/stockbrokers or potential investors, and officers and directors of the Company or any affiliated companies. | |

|

The Company and the Contactor shall consider their relationship as one of mutual trust and confidence with respect to the Trade Secrets. Therefore, during and after the term of this Agreement, the Contractor agrees to: | ||

| (f) |

except as subject to clause 3.06 of this Agreement, hold all such information in confidence and not to divulge, communicate or transmit it to others, or make any unauthorized copy or use of such information in any capacity either personal or business unrelated to that of the Company; | |

| (g) |

use the Trade Secrets only in the furtherance of proper Company related reasons for which such information is disclosed or discovered; | |

| (h) |

take all necessary reasonable action that the Company deems necessary or appropriate to not allow unauthorized use or disclosure of the Company’s Trade Secrets, and to protect the Company’s interest in the Trade Secrets. | |

| 3.6 |

The provisions set forth in Article 3.5 do not apply to: | |

| (a) |

information that has become public through disclosure of and by the Company; | |

| (b) |

information that by means other than the Contractor’s deliberate or inadvertent disclosure becomes well known or easily ascertainable to the public or to companies that compete directly with the Company; and | |

| (c) |

disclosure compelled by judicial or administrative proceedings. | |

| 3.7 |

All inventions, improvements, products, designs, programs, processes, formulae and methods of manufacture whether practicable or not (all of which are hereunder collectively included in the term “inventions”) which the Contractor may make or discover while retained pursuant to this Agreement and which relate to or are connected with any product, article or service of a kind produced, handled, provided or sold by or which relate to or are connected with any business carried on by the Company or any Associated Company, subject to any contrary provisions of the Patent Act (Canada) where applicable, be the sole, absolute and exclusive property of the Company and shall be held by the Contractor both during the continuance of its retainer hereunder and thereafter in trust for the Company. The Contractor shall at the request and cost of the Company apply for and execute any such documents, and do such acts and things as may in the opinion of the Board be necessary to give full effect to the terms of this Article. Further, the Contractor shall not do anything to imperil the validity of any such patent or protection or any application there for but on the contrary shall at the cost of the Company render all possible assistance to the Company both in obtaining and in maintaining such patents or other protection. | |

Article 4

Responsibility of the Contractor

| 4.1 |

The Contractor is aware and acknowledges that all of its activities shall be conducted in compliance with applicable securities legislation and the rules and by-laws of the applicable securities exchanges under whose jurisdictions their activities fall. |

Article 5

Remuneration and Expenses

| 5.01 |

(a) The Company shall issue to the Contractor (or the contractor’s nominee) and Schultz as to 60% and 40% respectively, 800,000 shares of restricted Rule 144 common stock under the following schedule, additionally upon each and every effective date said shares to be fully vested, and considered fully paid and earned. |

|

Should Schultz cease to be an officer or director of the company as contemplated in section 2.2 the pro rata portion of the un-issued share payments reserved for Schultz, referred to in this section 5.01, will be canceled and no longer be considered remuneration under this agreement. | |

|

(b) As described in Section 5.01, the “Contractor” and “Schultz” are willing to accept and the Company wishes to issue Rule 144 Restricted shares in the capital of the Company as full compensation for the services rendered under this agreement, subject to the terms and conditions hereinafter set forth and acknowledge their suitability to receive the shares under certain exemptions by completing Schedule 1 and Schedule 2 to this agreement, which by reference forms part of this agreement; |

| 5.02 |

As additional incentive and compensation, the Company shall grant the Contractor and Schultz stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 480,000 Common shares and Schultz to purchase up to 320,000 in the capital of the Company at the exercise price of $0.10 per share or such other lower price as the Company, in its sole discretion may deem appropriate. All options granted will be exercisable over a five year period and will contain a vesting schedule as specified in the Company’s most current Stock Option Plan. |

| 5.03 |

All vested options shall have full piggy back registration rights with any current or subsequent registration |

| 5.04 |

The parties agree that the Company will review the said remuneration on an annual basis and will make any adjustments it determines are reasonable in the sole opinion of the Directors, who may take into account (but are not limited to) the Contractor’s performance and the financial and operating success of the Company in the preceding period. Such review shall take place within six months following the fiscal year end of the Company. In no case will the annual salary be reduced unless by mutual agreement, such agreement to be in writing. For greater certainty, annual remuneration as referred to herein shall not include any other payments such as bonuses, share options, benefits, etc. |

| 5.05 |

The company and the contractor both acknowledge and understand that this agreement is temporary in nature and at the time the company secures private placement funding in an amount of $300,000 or more, this agreement will be replaced with a similar consulting agreement that contemplates a cash remuneration to the contractor for his services. Any incentive stock and stock options granted pursuant to section 5.1 and 5.2 above will survive this agreement and automatically become part of any future agreement. |

| 5.06 |

Prior to the Securing of a private placement, general book keeping and accounting work done by Fred Schultz shall receive $20.00 per hour to be paid monthly upon submission of a book keeping invoice. |

| 5.07 |

(a) The Contractor shall be entitled to participate in any incentive programs, including, without limiting the generality of the foregoing, share option plans, share purchase plans, share bonus plans or financial assistance plans, in accordance with and on terms and conditions determined by the Directors in their sole discretion. The Contractor acknowledges that its participation in these plans or programs will be to such extent and in such amounts as the Directors in their sole discretion may decide from time to time. |

| (b) Any amounts which the Contractor may be entitled to under any such plan or program shall not, for the purposes of this Agreement, be treated as salary. | |

| (c) The Contractor agrees that the Company may pursuant hereto, substitute, reduce, modify, or if necessary, eliminate such plans or programs at any time. All such plans or programs shall be governed by the policies of the various regulatory bodies which have jurisdiction over the affairs of the Company. | |

| 5.08 |

The Company shall promptly reimburse the Contractor for all reasonable business, travel, hotel, entertainment and other out-of-pocket expenses which are incurred by the Contractor in the provision of the Services hereunder. The Contractor shall provide the Company with copies of all vouchers, bills, invoices and statements relating to any expenses for which the Contractor claims reimbursement and any single expense over $300.00 shall require the Company’s approval in writing. |

| 5.09 |

The Company shall make payment of all salary, fees, and bonuses to Contractor by direct wire transfer to a designated bank account. Payment shall be made within ten (10) calendar days of the date of invoice. The Contractor shall be solely responsible for any additional fees or expenses that result from any dual taxation that may arise, as a result of the Contractor residing in the USA. Contractor shall be responsible for all USA withholdings, taxes and fees. |

| 5.10 |

The contractor acknowledges there are potential tax consequences for receiving shares as compensation and takes full responsibility for the reporting of any taxes due for this transaction. |

Article 6

Termination of Retainer

| 6.1 |

The Contractor or the Company may terminate the retainer pursuant to this Agreement at any time by providing written notice to the Contractor or the Company as the case may be of not less than the Notice Period. | |

| 6.2 |

The Company may terminate the Contractor’s retainer pursuant to this Agreement if the Contractor: | |

| (a) |

commits a material breach of a provision of this Agreement; | |

| (b) |

is unwilling or unable to perform the Services under this Agreement; | |

| (c) |

commits an act of fraud or of wilful misconduct in the discharge of the Services under this Agreement; | |

|

provided that the Company shall first deliver notice to the Contractor setting out the alleged facts or circumstances giving rise to its right of termination of this Agreement, and the Contractor shall have 30 days within which to cure such alleged breach or default hereunder. | ||

| 6.3 |

The Company shall make all payments hereunder arising from the termination of this Agreement in accordance with Article 6.3 by way of certified cheque or bank draft made payable to the Contractor. | |

| 6.4 |

Concurrently with the delivery of payments and resignations, if applicable, the parties hereto shall deliver mutual releases and discharges in favour of one another with respect to any matters arising up to the date of termination of this Agreement, in terms and substance satisfactory to the parties, acting reasonably. | |

| 6.5 |

Upon termination of the retainer under this Agreement, the Contractor shall promptly return to the Company all correspondence, documents, papers, records, software, keys and other property of the Company, which the Contractor has prepared or obtained in the course of providing the Services to the Company (and the Contractor shall not retain any copies thereof) and the Company shall return to the Contractor and Schultz any of their property which is in the possession or control of the Company. | |

Article 7

Notices

| 7.1 |

Notices to be given under this Agreement shall be in writing and shall be given to the parties at the addresses specified below. Any notice given shall be deemed to be given on the date delivered if delivered personally or by facsimile and shall be deemed to be given 4 days after being mailed to the address of the party described below when sent by prepaid registered mail. |

| 7.2 |

The address for service of the parties shall be: |

|

The Company: | |

|

Strategic Internet Investments, Incorporated | |

|

The Contractor and Schultz: | |

| 7.3 |

Any party may change its address for service of notice by written notice to the other party. |

Article 8

8.1 This paragraph intentionally deleted.

Article 9

General Provisions

| 9.1 |

This Agreement evidences the entire agreement between the parties and cannot be changed, modified, or supplemented except by a written supplementary agreement executed by both parties. |

| 9.2 |

This Agreement shall enure to and be binding upon the Company and its successors and the Contractor and his successors but otherwise shall not be assignable without the written consent of the other party. |

| 9.3 |

This Agreement shall be governed by and construed in accordance with the laws of the State of Montana, UNITED STATES, and the parties irrevocably attorn to the exclusive jurisdiction of the courts of United States with respect to any legal proceedings arising here from. |

| 9.4 |

If any provision of this Agreement is judicially determined to be void, illegal or unenforceable, such provision shall be ineffective to the extent of such voidness, illegality or unenforceability, but without invalidating or affecting the validity or enforceability of any remaining provisions of this Agreement. |

| 9.5 |

In this Agreement, the singular includes the plural and the plural includes the singular, and any reference to a gender includes the other gender. |

| 9.6 |

No waiver by either party to this Agreement of any default in performance on the part of the other party and no waiver by either party of any breach or of a series of breaches of any of the terms, covenants or conditions of this Agreement shall constitute a waiver of any subsequent or continuing breach of such terms, covenants or conditions. |

| Strategic Internet Investments, Inc. | ) | |

| ) | ||

| “Abbas Salih” | ) | |

| Title: President | ) | |

| ) | ||

| Abbas Salih | ) | |

| (Authorized Signatory) | ) | |

| ) | ||

| ) | ||

| Title: | ) | |

| ) | ||

| (Authorized Signatory) | ) | |

| REGAL BARRINGTON, LLC. | ) | |

| ) | ||

| ) | C/S | |

| Title: | ) | |

| /s/ Barry Clark | ) | |

| (Authorized Signatory) | ) | |

| ) | ||

| Vice President | ) | |

| Title: | ) | |

| ) | ||

| /s/ Fred Schultz | ) | |

| (Authorized Signatory) | ) | |

| ) | ||

| ) | ||

| SIGNED, SEALED AND DELIVERED by | ) | |

| FRED SCHULTZ in the presence of: | ) | |

| ) | ||

| /s/ Fred Schultz | ) | |

| (Fred Schultz) | ) | |

| ) | ||

| /s/ Rebecca Johnson | ) | |

| (Witness Signatory) | ) | |

| ) | ||

| Rebecca Johnson | ) | |

| Name | ) | |

| ) | ||

| ) | ||

| Address | ) | |

| ) | ||

| ) |

SCHEDULE 1

Regal

Barrington, LLC

I, Barry Clark, am accepting the shares issued under this agreement as full payment to me and upon acceptance by the Company, agree to become a shareholder of the Company. In order to inform the Company, I advise you as follows:

(1) Receipt of copies of the Business Plan and such other documents as I have requested. I hereby acknowledge that I have received the Business Plan documents (as may be supplemented from time to time) relating to the Company including financial statements of the company dated 12/31/12 and 6/30/12 and Forms 10KSB for 12/31/12 and 10QSB for 3/31/12 and 6/30/12 for Strategic Internet Investments, Inc. as filed with the Securities & Exchange Commission.

(2) Availability of Information. I hereby acknowledge that the Company has made available to me the opportunity to ask questions of, and receive answers from the Company and any other person or entity acting on its behalf, concerning the contents of the Plan and the information contained in the corporate documents and to obtain any additional information, to the extent the Company possesses such information or can acquire it without unreasonable effort or expense, necessary to verify the accuracy of the information provided by the Company and any other person or entity acting on its behalf.

(3) Representations and Warranties. I represent and warrant to the Company (and understand that it is relying upon the accuracy and completeness of such representations and warranties in connection with the availability of an exemption for the offer and sale of the shares from the registration requirements of applicable federal and state securities laws) that:

(A) RESTRICTED SECURITIES.

(1) I understand that the Shares have not been registered under the Securities Act of 1933, as amended (The Act), or any state securities laws.

(2) I understand that I cannot sell or otherwise dispose of the shares unless the shares are registered under the Act or the state securities laws or exemptions therefrom are available (and consequently, that I must bear the economic risk of the investment for an indefinite period of time):

(3) I understand that the Company has no obligation now or at any time to register the shares under the Act or the State securities laws or obtain exemptions therefrom.

(4) I understand that the Company will restrict the transfer of the shares in accordance with the foregoing representations.

(B) LEGEND.

I agree that any certificate representing the shares will contain and be endorsed with the following, or a substantially equivalent, LEGEND:

"This share certificate has been acquired pursuant to an investment representation by the holder and shall not be sold, pledged, hypothecated or donated, or otherwise transferred except upon the issuance to Company of a favorable opinion by its counsel and the submission to the Company of other evidence satisfactory to and as required by counsel to the Company; that any such transfer will not violate the Securities Act of 1933, as amended, and applicable state securities laws.

(C) AGE: CITIZENSHIP.

I am at least twenty-one years old and a citizen the United States.

(D) ACCURACY OF INFORMATION.

All information which I have provided to the Company concerning my financial position and knowledge of financial and business matters is correct and complete as of the date set forth at the end hereof, and if there should be any material change in such information prior to acceptance of this debt settlement subscription offer by the Company, I will immediately provide the Company with such information.

(6) SUITABILITY. I hereby warrant and represent:

(A) That I can afford a complete loss of the investment and can afford to hold the securities being purchased hereunder for an indefinite period of time;

(B) That I consider this investment a suitable investment and;

(C) That I have had prior experience in financial matters and investments.

(7) CONDITIONS.

This debt settlement subscription shall become binding upon the Company and me only when accepted, in writing, by the issuer.

(8) REPRESENTATIONS.

(A) I have been furnished and have carefully read the Company SEC filings and any documents attached as exhibits thereto. I am aware that:

(1) There are substantial risks incident to the ownership of shares in the Company, and such investment is speculative and involves a high degree of risk of loss by me of my entire investment in the Company;

(2) No federal or state agency has passed upon the Shares or made any finding or determination concerning the fairness of this investment;

(a) I acknowledge that I have been advised to consult my own attorney concerning the investment.

(b) I acknowledge that the investment in the Company is an illiquid investment. In particular, I recognize that:

(3) Due to restrictions described below, the lack of any market existing or to exist for these shares, in the event I should attempt to sell my shares in the Company, my investment will be highly illiquid and, probably must be held indefinitely.

(4) I must bear the economic risk of investment in the shares for an indefinite period of time, since the shares have not been registered under the Securities Act of 1933, as amended. Therefore, the shares cannot be offered, sold, transferred, pledged, or hypothecated to any person unless either they are subsequently registered under said Act or an exemption from such registration is available and the favorable opinion of counsel for the Company to that effect is obtain, which is not anticipated.

(5) My right to transfer my shares will also be restricted as provided in this Agreement.

(6) I represent and warrant to the Company that:

(a) I have carefully reviewed and understand the risks of, and other considerations relating to, a purchase of shares, including the risks set forth in this Agreement.

(b) I and my investment advisors, if any, have been furnished all materials relating to the Company and its proposed activities, the offering of shares, or anything set forth in the Plan which they have requested and have been afforded the opportunity to obtain any additional information necessary to verify the accuracy of any representations or information set forth in the Plan;

(c) The Company has answered all inquiries that I and my investment advisors, if any, have put to it concerning the Company and its proposed activities and the offering and sale of the Shares;

(d) Neither I nor my investment advisors, if any, have been furnished any offering literature other than the Business Plan and the documents that may be attached as exhibits thereto and I and my investment advisors, if any, have relied only on the information contained in the Business Plan and such exhibits and the information, as described in subparagraphs (b) and (c) above, furnished or made available to them by the Company;

(e) I am acquiring the shares for which I hereby subscribe for my own account, as principal, for investment purposes only and with a view to the resale of distribution of all or any part of such shares, and that I have no present intention, agreement or arrangement to divide my participation with others or to resell, transfer or otherwise dispose of all or any part of the shares subscribed for unless and until I determine, at some future date, that changed circumstances, not in contemplation at the time of this purchase, makes such disposition advisable;

(f) I, the undersigned, if on behalf of a corporation, partnership, trust, or other form of business entity, affirm that: it is authorized and otherwise duly qualified to purchase and hold shares in the Company; recognize that the information under the caption as set forth in (a) above related to investments by an individual and does not address the federal income tax consequences of an investment by any of the aforementioned entities and have obtained such additional tax advice that I have deemed necessary; such entity has its principal place of business as set forth below; and such entity has not been formed for the specific purpose of acquiring shares in the Company.

(g) I have adequate means of providing for my current needs and personal contingencies and have no need for liquidity in this investment; and

(7) I hereby adopt, accept, and agree to be bound by all the terms and conditions of this Agreement, and by all of the terms and conditions of the Articles of Incorporation, and amendments thereto, and By-Laws.

(8) I hereby represent and warrant that:

(a) I have either a net worth (exclusive of home, home furnishings, and automobiles) of at least five times the amount of the investment. If a corporation, it is on a consolidated basis according to its most recent financial statement, within the above standards, and if a partnership, each partner is within the above standards.

(9) I further hereby represent that either:

(a) I have such knowledge and experience in business and financial matters that I am capable of evaluating the Company and proposed activities thereof, the risks and merits of investment in the Shares and of making an informed investment decision thereon, and am not utilizing a purchaser representative in connection with evaluating such risks and merits; or

(10) I have/have not previously invested in private placement securities

(11) I further represent and warrant:

(1) That I hereby agree to indemnify the Company and hold the Company harmless from and against any and all liability, damage, cost, or expense incurred on account of or arising out of:

(a) Any inaccuracy in my declarations, representations, and warranties hereinabove set forth;

(b) The disposition of any of the shares which I will receive, contrary to my foregoing declarations, representations, and warranties; and

(c) Any action, suit or proceeding based upon (1) the claim that said declarations, representations, or warranties were inaccurate or misleading or otherwise cause for obtaining damages or redress from the Company; or (2) the disposition of any of the shares or any part thereof.

10. Accredited Investor. I represent that I am an “Accredited Investor” or an Officer of an “Accredited Investor” as defined below:

Accredited investor shall mean any person who comes within any of the following categories, or who the issuer reasonably believes come within any of the following categories, at the time of the sale of the securities to that person.

(A) Any bank as defined in section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in section 3(a)(5)(A) of the Act whether acting in its individual or fiduciary capacity; any broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934; any insurance company as defined in section 2(13) of the Act; any investment company registered under the Investment Company Act of 1940 or a business development company as defined in section 2(a)(48) of that Act; any Small Business Investment Company licensed by the U.S. Small Business Administration under section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 if the investment decision is made by a plan fiduciary, as defined in section 3(21) of such act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors;

(B) Any private business development company as defined in section 202(a)(22) of the Investment Advisers Act of 1940;

(C) Any organization described in section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000;

(D) Any director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive officer, or general partner of a general partner of that issuer;

(E) Any natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of his purchase exceeds $1,000,000;

(F) Any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year;

(G) Any trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in §230.506(b)(2)(ii); and

(H) Any entity in which all of the equity owners are accredited investors.

(I) An entity or person defined under SEC CFR §2330.001 and California Corporations Code §25102(n) (by inclusion).

An affiliate of, or person affiliated with, a specific person shall mean a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified.

I will hold title to my interest as follows:

| { } | Community Property | |

| {X} | Joint Tenants with Right Survivorship | |

| { } | Tenants in Common | |

| { } | Individually | |

| { } | Other: (Corporation, Trust, Etc., please indicate) |

(Note: Subscribers should seek the advice of their attorneys in deciding in which of the above forms they should take ownership of the Shares, since different forms of ownership can have varying gift tax and other consequences, depending on the state of the investor's domicile and their particular personal circumstances. For example, in community property states, if community property assets are used to purchase shares held in individual ownership, this might have adverse gift tax consequences.

If OWNERSHIP IS BEING TAKEN IN JOINT NAME WITH A SPOUSE OR ANY OTHER PERSON, THEN ALL SUBSCRIPTION DOCUMENTS MUST BE EXECUTED BY ALL SUCH PERSONS.)

| ”Barry Clark” | |

| Signed by Barry Clark as of Aug 21, 2012 |

SCHEDULE 2

Fred Schultz

I, Fred Schultz, am accepting the shares issued under this agreement as full payment to me and upon acceptance by the Company, agree to become a shareholder of the Company. In order to inform the Company, I advise you as follows:

(1) Receipt of copies of the Business Plan and such other documents as I have requested. I hereby acknowledge that I have received the Business Plan documents (as may be supplemented from time to time) relating to the Company including financial statements of the company dated 12/31/12 and 6/30/12 and Forms 10KSB for 12/31/12 and 10QSB for 3/31/12 and 6/30/12 for Strategic Internet Investments, Inc. as filed with the Securities & Exchange Commission.

(2) Availability of Information. I hereby acknowledge that the Company has made available to me the opportunity to ask questions of, and receive answers from the Company and any other person or entity acting on its behalf, concerning the contents of the Plan and the information contained in the corporate documents and to obtain any additional information, to the extent the Company possesses such information or can acquire it without unreasonable effort or expense, necessary to verify the accuracy of the information provided by the Company and any other person or entity acting on its behalf.

(3) Representations and Warranties. I represent and warrant to the Company (and understand that it is relying upon the accuracy and completeness of such representations and warranties in connection with the availability of an exemption for the offer and sale of the shares from the registration requirements of applicable federal and state securities laws) that:

(A) RESTRICTED SECURITIES.

(1) I understand that the Shares have not been registered under the Securities Act of 1933, as amended (The Act), or any state securities laws.

(2) I understand that I cannot sell or otherwise dispose of the shares unless the shares are registered under the Act or the state securities laws or exemptions therefrom are available (and consequently, that I must bear the economic risk of the investment for an indefinite period of time):

(3) I understand that the Company has no obligation now or at any time to register the shares under the Act or the State securities laws or obtain exemptions therefrom.

(4) I understand that the Company will restrict the transfer of the shares in accordance with the foregoing representations.

(B) LEGEND.

I agree that any certificate representing the shares will contain and be endorsed with the following, or a substantially equivalent, LEGEND:

"This share certificate has been acquired pursuant to an investment representation by the holder and shall not be sold, pledged, hypothecated or donated, or otherwise transferred except upon the issuance to Company of a favorable opinion by its counsel and the submission to the Company of other evidence satisfactory to and as required by counsel to the Company; that any such transfer will not violate the Securities Act of 1933, as amended, and applicable state securities laws.

(C) AGE: CITIZENSHIP.

I am at least twenty-one years old and a citizen the United States.

(D) ACCURACY OF INFORMATION.

All information which I have provided to the Company concerning my financial position and knowledge of financial and business matters is correct and complete as of the date set forth at the end hereof, and if there should be any material change in such information prior to acceptance of this debt settlement subscription offer by the Company, I will immediately provide the Company with such information.

(6) SUITABILITY. I hereby warrant and represent:

(A) That I can afford a complete loss of the investment and can afford to hold the securities being purchased hereunder for an indefinite period of time;

(B) That I consider this investment a suitable investment and;

(C) That I have had prior experience in financial matters and investments.

(7) CONDITIONS.

This debt settlement subscription shall become binding upon the Company and me only when accepted, in writing, by the issuer.

(8) REPRESENTATIONS.

(A) I have been furnished and have carefully read the Company SEC filings and any documents attached as exhibits thereto. I am aware that:

(1) There are substantial risks incident to the ownership of shares in the Company, and such investment is speculative and involves a high degree of risk of loss by me of my entire investment in the Company;

(2) No federal or state agency has passed upon the Shares or made any finding or determination concerning the fairness of this investment;

(a) I acknowledge that I have been advised to consult my own attorney concerning the investment.

(b) I acknowledge that the investment in the Company is an illiquid investment. In particular, I recognize that:

(3) Due to restrictions described below, the lack of any market existing or to exist for these shares, in the event I should attempt to sell my shares in the Company, my investment will be highly illiquid and, probably must be held indefinitely.

(4) I must bear the economic risk of investment in the shares for an indefinite period of time, since the shares have not been registered under the Securities Act of 1933, as amended. Therefore, the shares cannot be offered, sold, transferred, pledged, or hypothecated to any person unless either they are subsequently registered under said Act or an exemption from such registration is available and the favorable opinion of counsel for the Company to that effect is obtain, which is not anticipated.

(5) My right to transfer my shares will also be restricted as provided in this Agreement.

(6) I represent and warrant to the Company that:

(a) I have carefully reviewed and understand the risks of, and other considerations relating to, a purchase of shares, including the risks set forth in this Agreement.

(b) I and my investment advisors, if any, have been furnished all materials relating to the Company and its proposed activities, the offering of shares, or anything set forth in the Plan which they have requested and have been afforded the opportunity to obtain any additional information necessary to verify the accuracy of any representations or information set forth in the Plan;

(c) The Company has answered all inquiries that I and my investment advisors, if any, have put to it concerning the Company and its proposed activities and the offering and sale of the Shares;

(d) Neither I nor my investment advisors, if any, have been furnished any offering literature other than the Business Plan and the documents that may be attached as exhibits thereto and I and my investment advisors, if any, have relied only on the information contained in the Business Plan and such exhibits and the information, as described in subparagraphs (b) and (c) above, furnished or made available to them by the Company;

(e) I am acquiring the shares for which I hereby subscribe for my own account, as principal, for investment purposes only and with a view to the resale of distribution of all or any part of such shares, and that I have no present intention, agreement or arrangement to divide my participation with others or to resell, transfer or otherwise dispose of all or any part of the shares subscribed for unless and until I determine, at some future date, that changed circumstances, not in contemplation at the time of this purchase, makes such disposition advisable;

(f) I, the undersigned, if on behalf of a corporation, partnership, trust, or other form of business entity, affirm that: it is authorized and otherwise duly qualified to purchase and hold shares in the Company; recognize that the information under the caption as set forth in (a) above related to investments by an individual and does not address the federal income tax consequences of an investment by any of the aforementioned entities and have obtained such additional tax advice that I have deemed necessary; such entity has its principal place of business as set forth below; and such entity has not been formed for the specific purpose of acquiring shares in the Company.

(g) I have adequate means of providing for my current needs and personal contingencies and have no need for liquidity in this investment; and

(7) I hereby adopt, accept, and agree to be bound by all the terms and conditions of this Agreement, and by all of the terms and conditions of the Articles of Incorporation, and amendments thereto, and By-Laws.

(8) I hereby represent and warrant that:

(a) I have either a net worth (exclusive of home, home furnishings, and automobiles) of at least five times the amount of the investment. If a corporation, it is on a consolidated basis according to its most recent financial statement, within the above standards, and if a partnership, each partner is within the above standards.

(9) I further hereby represent that either:

(a) I have such knowledge and experience in business and financial matters that I am capable of evaluating the Company and proposed activities thereof, the risks and merits of investment in the Shares and of making an informed investment decision thereon, and am not utilizing a purchaser representative in connection with evaluating such risks and merits; or

(10) I have/have not previously invested in private placement securities

(11) I further represent and warrant:

(1) That I hereby agree to indemnify the Company and hold the Company harmless from and against any and all liability, damage, cost, or expense incurred on account of or arising out of: (a) Any inaccuracy in my declarations, representations, and warranties hereinabove set forth;

(b) The disposition of any of the shares which I will receive, contrary to my foregoing declarations, representations, and warranties; and

(c) Any action, suit or proceeding based upon (1) the claim that said declarations, representations, or warranties were inaccurate or misleading or otherwise cause for obtaining damages or redress from the Company; or (2) the disposition of any of the shares or any part thereof.

10. Accredited Investor. I represent that I am an “Accredited Investor” or an Officer of an “Accredited Investor” as defined below:

Accredited investor shall mean any person who comes within any of the following categories, or who the issuer reasonably believes come within any of the following categories, at the time of the sale of the securities to that person.

(A) Any bank as defined in section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in section 3(a)(5)(A) of the Act whether acting in its individual or fiduciary capacity; any broker or dealer registered pursuant to section 15 of the Securities Exchange Act of 1934; any insurance company as defined in section 2(13) of the Act; any investment company registered under the Investment Company Act of 1940 or a business development company as defined in section 2(a)(48) of that Act; any Small Business Investment Company licensed by the U.S. Small Business Administration under section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000; any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974 if the investment decision is made by a plan fiduciary, as defined in section 3(21) of such act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors;

(B) Any private business development company as defined in section 202(a)(22) of the Investment Advisers Act of 1940;

(C) Any organization described in section 501(c)(3) of the Internal Revenue Code, corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5,000,000;

(D) Any director, executive officer, or general partner of the issuer of the securities being offered or sold, or any director, executive officer, or general partner of a general partner of that issuer;

(E) Any natural person whose individual net worth, or joint net worth with that person’s spouse, at the time of his purchase exceeds $1,000,000;

(F) Any natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years and has a reasonable expectation of reaching the same income level in the current year;

(G) Any trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in §230.506(b)(2)(ii); and

(H) Any entity in which all of the equity owners are accredited investors.

(I) An entity or person defined under SEC CFR §2330.001 and California Corporations Code §25102(n) (by inclusion).

An affiliate of, or person affiliated with, a specific person shall mean a person that directly, or indirectly through one or more intermediaries, controls or is controlled by, or is under common control with, the person specified.

I will hold title to my interest as follows:

| { } | Community Property | |

| {X} | Joint Tenants with Right Survivorship | |

| { } | Tenants in Common | |

| { } | Individually | |

| { } | Other: (Corporation, Trust, Etc., please indicate) |

(Note: Subscribers should seek the advice of their attorneys in deciding in which of the above forms they should take ownership of the Shares, since different forms of ownership can have varying gift tax and other consequences, depending on the state of the investor's domicile and their particular personal circumstances. For example, in community property states, if community property assets are used to purchase shares held in individual ownership, this might have adverse gift tax consequences. If OWNERSHIP IS BEING TAKEN IN JOINT NAME WITH A SPOUSE OR ANY OTHER PERSON, THEN ALL SUBSCRIPTION DOCUMENTS MUST BE EXECUTED BY ALL SUCH PERSONS.)

| ”Fred Schultz” | |

| Signed by Fred Schultz as of Aug 21, 2012 |

SCHEDULE B

CONSULTING SERVICES AGREEMENT

BETWEEN

STRATEGIC INTERNET INVESTMENTS, INC

AND

PAUL SULLIVAN

CONSULTING SERVICES AGREEMENT

THIS AGREEMENT made as of the 21st day of August, 2012.

BETWEEN:

Strategic Internet Investments,

Inc., having an office at

Strategic Internet Investments,

Incorporated

C/O Measure, Sampsel, Sullivan and O’Brien

24 First Avenue

East, STE C

P.O. Box 918

Kalispell, Montana 59903

Fax #406-752-7168

Phone 406-752-6373

(the “Company”)

OF THE FIRST PART

AND:

Paul D. Sullivan, Jr.

24 First Avenue East, STE

C

Kalispell, Montana 59903

(the “Contractor”)

OF THE SECOND PART

IN CONSIDERATION of the premises and the mutual covenants herein contained the parties hereto agree as follows:

Article 1

Definitions

| 1.1 |

In this Agreement: | |

|

“Associated Company” means a company which directly or indirectly: | ||

| (a) |

controls, or is controlled by, the Company, or | |

| (b) |

is controlled by the same company that directly or indirectly controls the Company. | |

|

“Board” means the Board of Directors from time to time of the Company. | ||

“Notice Period” means a period of thirty days commencing on the day after notice of termination of the Contractor is given by the Company in accordance with the terms of this Agreement.

Article 2

Appointment

| 2.1 |

The Company agrees to retain the Contractor to provide consulting services (the “Services”) from time to time as required by the Board and the Contractor agrees to provide such Services, reporting directly to the Board, subject to the terms and conditions of this Agreement. The Services to be provided by the Contractor shall include the following: | |

| (a) |

providing consulting services to the Company for the purpose of evaluating agreements and real estate opportunities, | |

| (b) |

providing services may include, reviewing real estate purchase and sale agreements and contracts, assignment of beneficial real estate and land agreements, property management agreements, lease agreements, memorandums of cooperation, joint venture agreements, real estate appraisals and valuation reports, | |

| 2.2 |

The Contractor agrees to provide the Services to the Company, acting reasonably. The Contractor shall provide its own office facilities and equipment for the purpose of providing the Services. | |

| 2.3.1 |

The term of the Contractor’s appointment shall commence on August 21st, 2012 and continue for a term of one year expiring on August 21st, 2013. Thereafter this Agreement shall be automatically renewed on a six month basis, subject only to termination in accordance with the provisions of Article 6. | |

| 2.3.2 |

This agreement is subject to the approval of the Company’s Board of Directors and if such approval is not obtained this agreement will expire without obligation of either party. | |

Article 3

Relationship Between the Parties

| 3.1 |

The parties agree and intend that the relationship of the Contractor to the Company pursuant to this Agreement is that of independent contractor. Neither Contractor nor any other staff of the Contractor are employees of the Company, and are not entitled to the benefits provided by the Company to its employees except as otherwise mutually agreed upon from time to time. | |

| 3.2 |

The Contractor shall provide the Services in Kalispell, Montana except for travel from time to time as reasonably required for the Company’s business. | |

| 3.3 |

During the continuance of its retainer under this Agreement, the Contractor shall: | |

| (a) |

devote sufficient time to the business of the Company and its subsidiaries for the performance of the Services described herein; | |

| (b) |

provide the Services in a proper, loyal and efficient manner and shall use its best efforts to maintain and promote the interests and reputation of the Company and its subsidiaries and not do anything which is harmful to them; and | |

| (c) |

at all times promptly give to the Board (in writing if so requested) all such information and explanations as the Board may reasonably require in connection with matters relating to its retainer hereunder or with the business of the Company or its subsidiaries. | |

| 3.4 |

The Company is aware that the Contractor has now and will continue to provide services to other clients and companies and the Company recognizes that these individuals and companies will require a majority of the time of the Contractor and its principal and other employees. The Company agrees that the Contractor will continue to provide services to such outside interests, provided that such interests do not conflict with the provision of the Contractor’s Services under this Agreement. Notwithstanding the above, it is understood that the Contractor will devote services to the business affairs of the Company on a part time basis. | |

| 3.5 |

During the term of this Agreement, the Contractor and/or its employees and associates may have access to confidential information consisting of the following categories of information (collectively, the “Trade Secrets”): | |

| (a) |

financial information, such as the Company’s earnings, assets, debts, or other financial data, whether relating to the Company generally, or to particular services, geographic areas or time periods; | |

| (b) |

supply and service information, such as goods and services, supplier’s names or addresses, terms of supply or service contracts, or of particular transactions, or related information about potential service providers, to the extent that such information is not generally known to the public, and to the extent that the combination of suppliers or use of a particular contractor, though generally known or available, yields advantages to the Company, the details of which are not generally known; | |

| (c) |

in regards to real estate companies, appraisal and valuation information, such as details about ongoing or proposed real estate investments or agreements by or on behalf of the Company pertaining to any existing or proposed real estate purchase or lease agreements, the forecasts and the results of any valuation reports or information about impending transactions; | |

| (d) |

personnel information, compensation or other terms of employment, actual or proposed promotions, hiring, resignations, disciplinary actions, termination or reasons thereof, training methods, performance, or other Consultant information not including Consultants’ personal or medical histories; and/or | |

| (e) |

current shareholders lists, investors, contracts such as registered representatives/stockbrokers or potential investors, and officers and directors of the Company or any affiliated companies. | |

|

The Company and the Contactor shall consider their relationship as one of mutual trust and confidence with respect to the Trade Secrets. Therefore, during and after the term of this Agreement, the Contractor agrees to: | ||

| (f) |

except as subject to clause 3.6 of this Agreement, hold all such information in confidence and not to divulge, communicate or transmit it to others, or make any unauthorized copy or use of such information in any capacity either personal or business unrelated to that of the Company; | |

| (g) |

use the Trade Secrets only in the furtherance of proper Company related reasons for which such information is disclosed or discovered; | |

| (h) |

take all necessary reasonable action that the Company deems necessary or appropriate to not allow unauthorized use or disclosure of the Company’s Trade Secrets, and to protect the Company’s interest in the Trade Secrets. | |

| 3.6 |

The provisions set forth in Article 3.5 do not apply to: | |

| (a) |

information that has become public through disclosure of and by the Company; | |

| (b) |

information that by means other than the Contractor’s deliberate or inadvertent disclosure becomes well known or easily ascertainable to the public or to companies that compete directly with the Company; and | |

| (c) |

disclosure compelled by judicial or administrative proceedings. | |

| 3.7 |

The parties acknowledge that Contractor is an attorney admitted to practice law in the State of Montana in the United States, and is unable to give legal advice pertaining to issues outside of that jurisdiction. Any advice, statements, or comments pertaining to matters outside of that jurisdiction constitute solely general advice or beliefs and shall not be relied upon as legal advice. | |

Article 4

Responsibility of the Contractor

| 4.1 |

The Contractor is aware and acknowledges that all of its activities shall be conducted in compliance with applicable securities legislation and the rules and by-laws of the applicable securities exchanges under whose jurisdictions their activities fall. |

Article 5

Remuneration and Expenses

| 5.1 |

The Company shall pay the Contractor 300,000 (Three Hundred Thousand) shares of SIII Rule 144 restricted common stock as full compensation under this agreement, shares to be considered fully earned and paid upon the execution of this contract. |

As described within this Section 5.1, the Consultant is willing to accept and the Company wishes to issue Rule 144 Restricted shares in the capital of the Company as full compensation for the services rendered under this agreement, subject to the terms and conditions hereinafter set forth and the Consultant acknowledges his suitability to receive the shares under certain exemptions by completing Schedule 1 to this agreement which by reference forms part of this agreement;

| 5.2 |

The Company shall promptly reimburse the Contractor for all reasonable business, travel, hotel, entertainment and other out-of-pocket expenses which are incurred by the Contractor in the provision of the Services hereunder. The Contractor shall provide the Company with copies of all vouchers, bills, invoices and statements relating to any expenses for which the Contractor claims reimbursement and any single expense over $300.00 shall require the Company’s advance approval. |

|

| |

| 5.3 |

As incentive and compensation, the Company shall grant the Contractor stock options pursuant to the Company’s Stock Option Plan that will allow the Contractor to purchase up to 300,000 Rule 144 restricted common shares in the capital of the Company at the exercise price of $0.10 per share, or such other lower price as the Company, in its sole discretion may deem appropriate.. All options granted will be exercisable over a minimum of a five year period and will reflect provisions as specified in the Company’s most current Stock Option Plan. |

| 5.4 |

The company and the contractor both acknowledge and understand that this agreement is temporary in nature and at the time the company secures private placement funding in an amount of $300,000 or more, this agreement will be replaced with a similar consulting agreement that contemplates a cash remuneration to the contractor for his services, initially on a minimum three month term which term can be extended with mutual consent. Any incentive stock options granted pursuant to section 5.3 above will survive this agreement and automatically become part of any future agreement. |

Article 6

Termination of Retainer

| 6.1 |

The Contractor or the Company may terminate this Agreement at any time by providing written notice to the Contractor or the Company as the case may be of not less than the Notice Period. | |

| 6.2 |

The Company may terminate the Contractor’s retainer pursuant to this Agreement if the Contractor: | |

| (a) |

commits a material breach of a provision of this Agreement; | |

| (b) |

is unwilling or unable to perform the Services under this Agreement; | |

| (c) |

commits an act of fraud or of wilful misconduct in the discharge of the Services under this Agreement; | |

|

provided that the Company shall first deliver notice to the Contractor setting out the alleged facts or circumstances giving rise to its right of termination of this Agreement, and the Contractor shall have 30 days within which to cure such alleged breach or default hereunder. | ||

| 6.3 |

The Company shall make all payments hereunder arising from the termination of this Agreement in accordance with Article 6.2 by way of stock issuance, certified cheque or bank draft made payable to the Contractor. |

| 6.4 |

Concurrently with the delivery of payments and resignations, if applicable, the parties hereto shall deliver mutual releases and discharges in favour of one another with respect to any matters arising up to the date of termination of this Agreement, in terms and substance satisfactory to the parties, acting reasonably. |

| 6.5 |

Upon termination of the retainer under this Agreement, the Contractor shall promptly return to the Company all correspondence, documents, papers, records, software, keys and other property of the Company, which the Contractor has prepared or obtained in the course of providing the Services to the Company (and the Contractor shall not retain any copies thereof) and the Company shall return to the Contractor and Strickland any of their property which is in the possession or control of the Company. |

Article 7

Notices

| 7.1 |

Notices to be given under this Agreement shall be in writing and shall be given to the parties at the addresses specified below. Any notice given shall be deemed to be given on the date delivered if delivered personally or by facsimile and shall be deemed to be given 4 days after being mailed to the address of the party described below when sent by prepaid registered mail. |

| 7.2 |

The address for service of the parties shall be: |

|

The Company: | |

|

Strategic Internet Investments, Incorporated | |