Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TRANS ENERGY INC | d400685d8k.htm |

| EX-99.2 - EX-99.2 - TRANS ENERGY INC | d400685dex992.htm |

THE

THE

OIL

OIL

&

&

GAS

GAS

CONFERENCE

CONFERENCE

August 2012

Exhibit 99.1 |

This

presentation

contains

“forward-looking

statements”

within

the

meaning

of

section

21E

of

the

United

States

Securities

Exchange

Act

of

1934, as amended (the “Exchange Act”) which represent our expectations or

beliefs about future events. These statements can be identified

generally

by

forward-looking

words

such

as

“expect”,

“believe”,

“anticipate”,

“plan”,

“intend”,

“estimate”,

“may”,

“will”

or

similar

words.

Forward-looking statements are statements about the future and are inherently

uncertain, and our actual achievements or other future events or conditions

may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and

other

factors,

including,

without

limitation,

those

described

in

Item

1A

of

the

company’s

annual

report

on

form

10-K

for

the

year

ended

December 31, 2011 under the heading, “Risk Factors”, and elsewhere in the

annual report and our filings with the Securities and Exchange Commission.

These risks and uncertainties include, but are not limited to: 1. The risks

of the oil and gas industry, such as operational risks in exploring for, developing and producing crude oil and natural gas; 2.

market demand; 3. risks and uncertainties involving geology of oil and gas

deposits; 4. the uncertainty of reserves estimates and reserves life;

5.

the

uncertainty

of

estimates

and

projections

relating

to

production,

costs

and

expenses;

potential

delays

or

changes

in

plans

with

respect to exploration or development projects or capital expenditures; 6.

fluctuations in oil and gas prices, foreign currency exchange rates

and

interest

rates;

7.

health,

safety

and

environmental

risks;

8.

uncertainties

as

to

the

availability

and

cost

of

financing;

9.

the

possibility

that

government

policies

or

laws

may

change

or

governmental

approvals

may

be

delayed

or

withheld;

10.

other

sections

of

this

presentation

may

include additional factors that could adversely affect our business and financial

performance. Moreover, we operate in a very competitive and

rapidly

changing

environment.

New

risk

factors

emerge

from

time

to

time

and

it

is

not

possible

for

our

management

to

predict

all

risk

factors, nor can we assess the impact of all factors on our business or the extent

to which any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking statements.

Our

forward-looking

statements

contained

in

this

presentation

are

made

as

of

the

respective

dates

set

forth

in

this

presentation.

Such

forward-looking statements are based on the beliefs, expectations and opinions

of management as of the date the statements are made. We do not intend to

update these forward-looking statements. For the reasons set forth above, investors should not place undue reliance on

forward-looking statements.

Readers are encouraged to read our December 31, 2011 Annual Report on Form 10-K

and any and all of our other documents filed with the SEC regarding

information about Trans Energy, Inc. for meaningful cautionary language in respect of the forward-looking statements

herein.

Interested

persons

are

able

to

obtain

copies

of

filings

containing

information

about

Trans

Energy,

Inc.,

without

charge,

at

the

SEC’s

internet site (http://www.sec.gov).

2

Disclaimer |

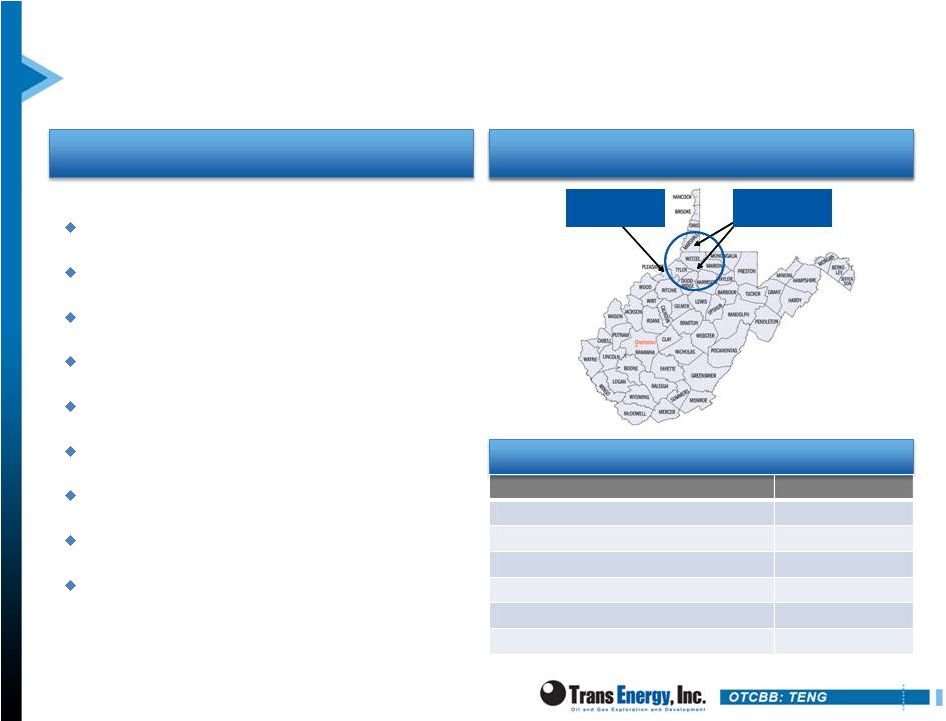

COMPANY OVERVIEW

COMPANY OVERVIEW |

About Trans Energy

6/30/2012

LTM Revenue

$ 14.6 million

Net Debt (as of 6/30/2012)

$34.5 million

Recent Stock Price (TENG)

$ 1.60

Shares Outstanding (8/10/2012)

13.2 million

Market Capitalization

$21.1 million

Enterprise Value

$55.6 million

Trans Energy: (OTCBB: TENG)

Pure Play Marcellus Shale

Proved Reserves: 35.5 Bcfe

Recent Daily Production: 4,565 Mcfe

52-Week Range: $1.26 -

$3.20

3-Month

Average

Daily

Volume

–

841

Shares

Shares Outstanding: 13.2 Million

Market Capitalization: $21.1 million

Experienced Management Team

Selected Financial Information

4

Trans Energy’

Areas of Operation

Trans Energy’

Corporate Office

s

s

Company Overview

Area of Operation |

Why

Invest in Trans Energy? 5

Marcellus Shale Pure Play

62,000 gross acres in core of the Marcellus Shale

Upper Utica Shale potential

Upper Devonian upside potential

High-BTU, liquid-rich focus

$1.50 per MMBtu breakeven gas price

Extensive Organic Drilling Inventory

400 + potential drilling locations (111 ready to drill today)

3+ Tcfe upside potential

Significant portion of acreage HBP

Off-take agreements totaling up to 45,000 MMBtu per day

Improved Financials

$50 million credit facility funding near term drilling program

Experienced Management w/ Technical Expertise

More than 200 years combined management experience

Well-funded joint development partner has geologic /

engineering team

Marcellus Shale pure play

Predictable and repeatable inventory

Prominent land position with strong

upside potential

Trades at a significant discount to

NAV

Experienced Management Team |

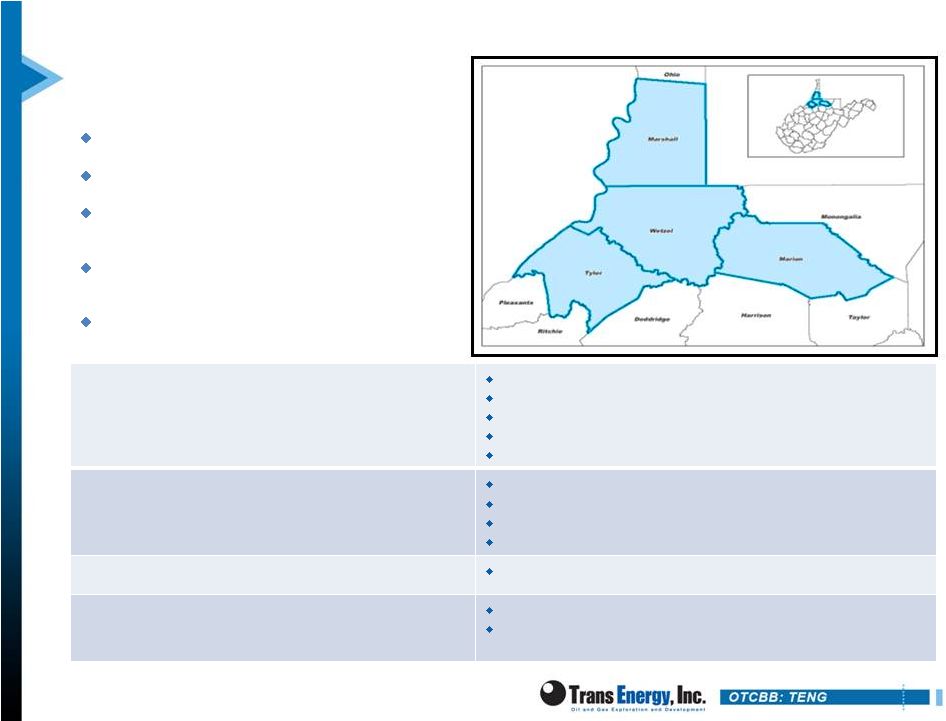

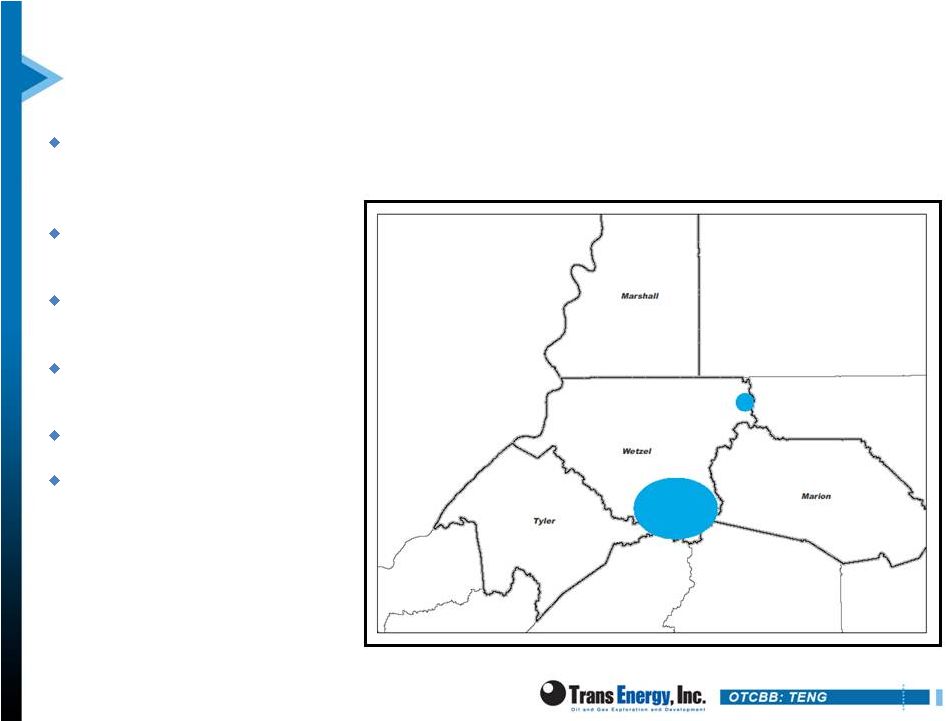

Corporate Strategy

Consolidate acreage surrounding legacy positions in the core

of the Marcellus

Marshall, Wetzel, Marion and Tyler counties

Building

upon

local

presence

–

West

Virginia

company

Drill to turn highly prospective acreage into 3P reserves

Secure and maintain land position via production rights

Grow production and reserves / monetize assets

6 |

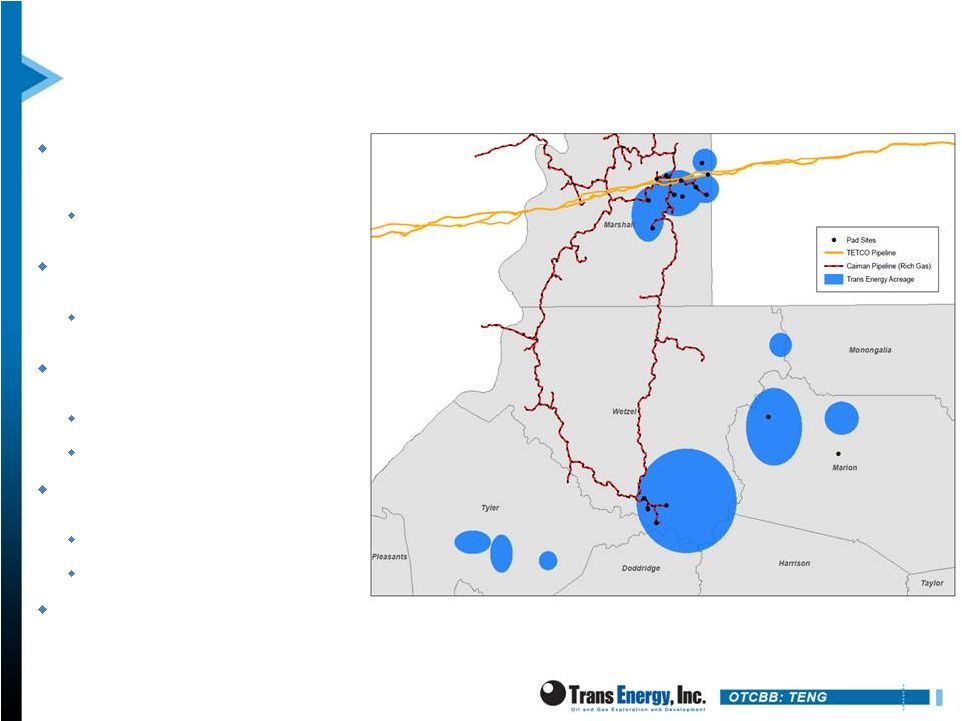

Current Marcellus Acreage

Significant Marcellus acreage that

is held by shallow well production

Approximately [350] horizontal well

locations from HBP acreage alone

Primary term leased acreage can

generally be held by production

from shallow vertical or Marcellus

horizontal wells

Current drilling program

supplemented with selective

shallow drilling will HBP all strategic

acreage with near term lease

expirations over the next two years

Significant amount of acreage is

also prospective for the Utica shale

7

Acreage Breakdown –

23,226 Net acres

7,621 acres

14,800 acres

805 acres

Held by Production

Leased -

Term

Mineral Right -

Purchased |

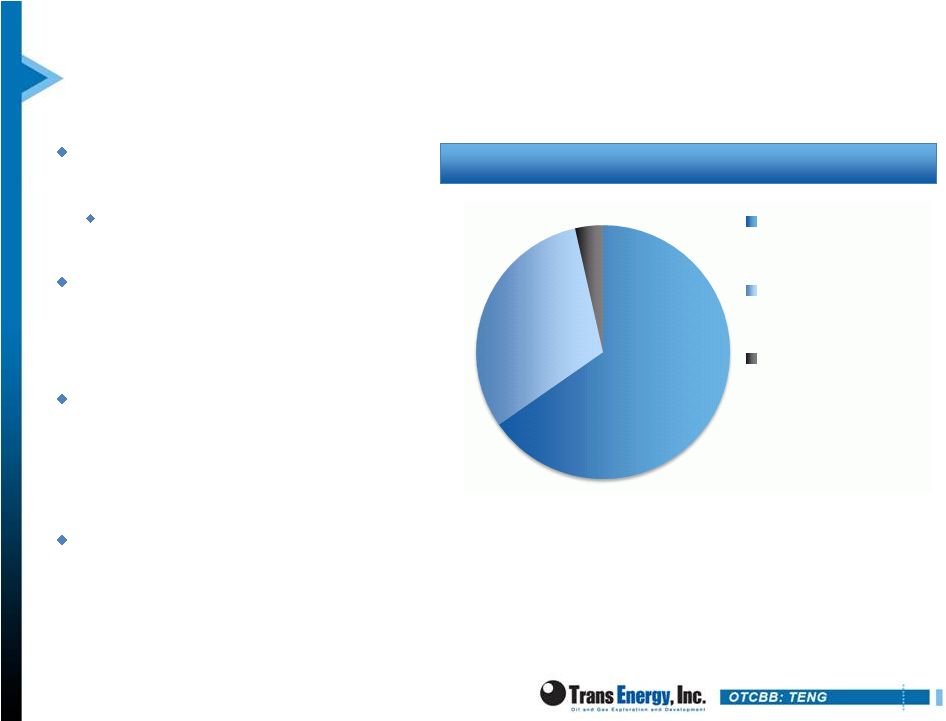

Resource and Reserves

Trans Energy has exposure to more than 3 Tcfe of Marcellus resource potential

More than 400 potential drilling locations (111 ready to drill today)

EUR per well of 1.2 –

2.0 Bcfe /1000’

of lateral

To date, less than 5% of resource has been booked as proved reserves

8

6/30/12 SEC Reserve Summary

(1)

(1)

Based on Proved Reserve Bcfe values for ASD from the 6/30/2012 SEC reserve report

prepared by independent reserve engineer Wright & Company, Inc.

Trans Energy has 3.25 Bcfe of PDP reserves associated with shallow assets that are

not included in the above figures.

Proved Reserve Mix

(1)

Proved Reserve Category Mix

(1)

($ in millions)

Oil

(MMbbl)

Gas

(Bcf)

NGL

(MMbbl)

Total

(Bcfe)

% of total

Total

PV10%

PDP

0.0084

14.330

0.533

17.5784

49.5%

$65.1

$26.3

PDNP

0.0000

6.479

0.287

8.201

23.1%

$29.9

$14.2

PUD

0.0044

7.690

0.342

9.7684

27.5%

$ 28.0

$8.9

Total Proved

0.0128

28.499

1.162

35.5478

$123.0

$49.4

Oil

-

0.2%

Gas

-

80.0%

NGL

-

18.8%

PUD

-

27.5%

PDP/PDNP

-

72.5% |

Experienced Management Team

9

Steve Lucado

Chairman of the Board

Director since 2011

More than 18 years professional financial experience, including E&P CFO experience

Bachelor of Arts Degree Harvard University, MBA, University of Chicago

John Corp

President & Director

Served as a Director since 2005 and is currently acting President

More than 25 years drilling, production and operations experience

Received a Bachelor of Science Degree in Petroleum Engineering from Marietta

College

John Tumis

Chief Financial Officer

Chief Financial Officer of Trans Energy since April 2011

More than 25 years experience in financial and strategic business planning in the oil

and natural gas industry

Received a Bachelor of Science Degree from Ohio Northern University and is a

certified public accountant

Leslie Gearhart

Vice President of Operations

& General Secretary

Acting Vice President of Operations and General Secretary

Has more than 25 years of experience in the oil and gas industry

in the Appalachian

Basin

Graduated with a Bachelor of Science Degree in Petroleum Engineering from

Marietta College |

Joint Development Partner: Republic Energy

Republic is a privately held Dallas-based E&P company

Technical team has 200+ years combined industry

experience

Former VP Geology and Head of Completion Operations for North Texas

from Mitchell Energy Corporation

Mitchell

was

the

cutting

edge

Barnett

player

–

wrote

the

book

on

shale

fracing

Focused on assets in the JV with Trans Energy

Equity financing from Energy Trust Partners (an affiliate of

Energy Spectrum) and Wells Fargo

10 |

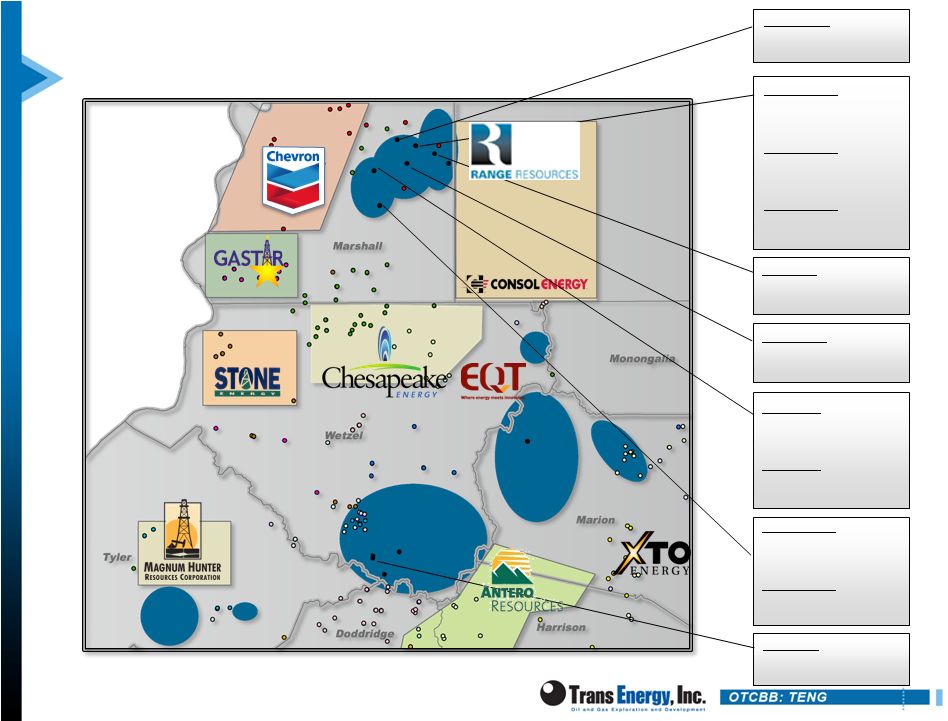

Competitive Market Position

11

TENG

TENG

TENG

TENG

Groves #1H

Lateral:

5,300 ft.

EUR:

1.37

Bcfe/1000

ft.

Whipkey #1H

Lateral:

2,100 ft.

EUR:

1.68

Bcfe/1000

ft.

Whipkey #2H

Lateral:

3,600 ft.

EUR:

1.83

Bcfe/1000

ft.

Whipkey #3H

Lateral:

3,600 ft.

EUR:

1.87

Bcfe/1000

ft.

Stout #2H

Lateral:

4,000 ft.

EUR:

1.99

Bcfe/1000

ft.

Keaton #1H

Lateral:

4,700 ft.

EUR:

2.03

Bcfe/1000

ft.

Lucey #1H

Lateral:

3,000 ft.

EUR:

1.22

Bcfe/1000

ft.

Lucey #2H

Lateral:

2,700 ft.

EUR:

1.37

Bcfe/1000

ft.

Goshorn #1H

Lateral:

4,300 ft.

EUR:

1.22

Bcfe/1000

ft.

Goshorn #2H

Lateral: 4763 ft.

EUR:

1.30

Bcfe/1000

ft.

Hart #28H

Lateral:

2,200 ft

EUR: 1.52 Bcfe/1000’

ft. |

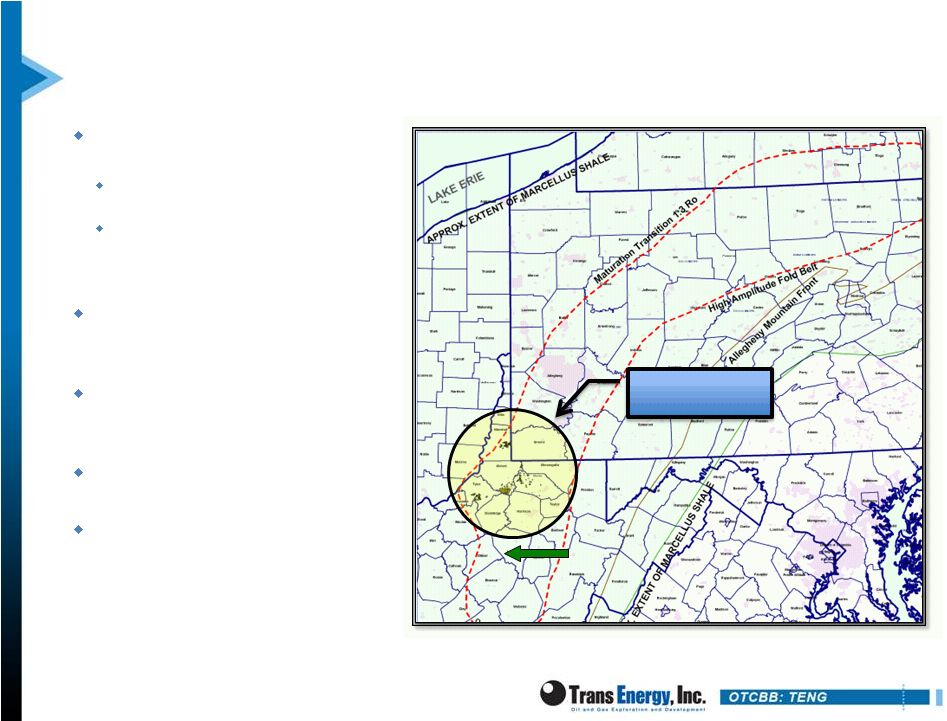

Marcellus Overview

Majority of Company acreage

located in wet gas window

NGL yields in the 1.4 –

1.9 gallons per mcf

range

Ft. Beeler processing plants provide 320

MMcf/day throughput capacity

Condensate and NGLs provide

$1.50 -

$2.00 pricing uplift

vs. dry gas

$1.50 per MMBtu breakeven

natural gas price (at current NGL

price and yield)

Low-cost, highly predictable and

repeatable play

In Trans Energy’s area of

operation, the Marcellus shale is

approximately 50 –

100 feet thick

12

Dry Gas

Wet Gas

Trans Energy Area of

Operation |

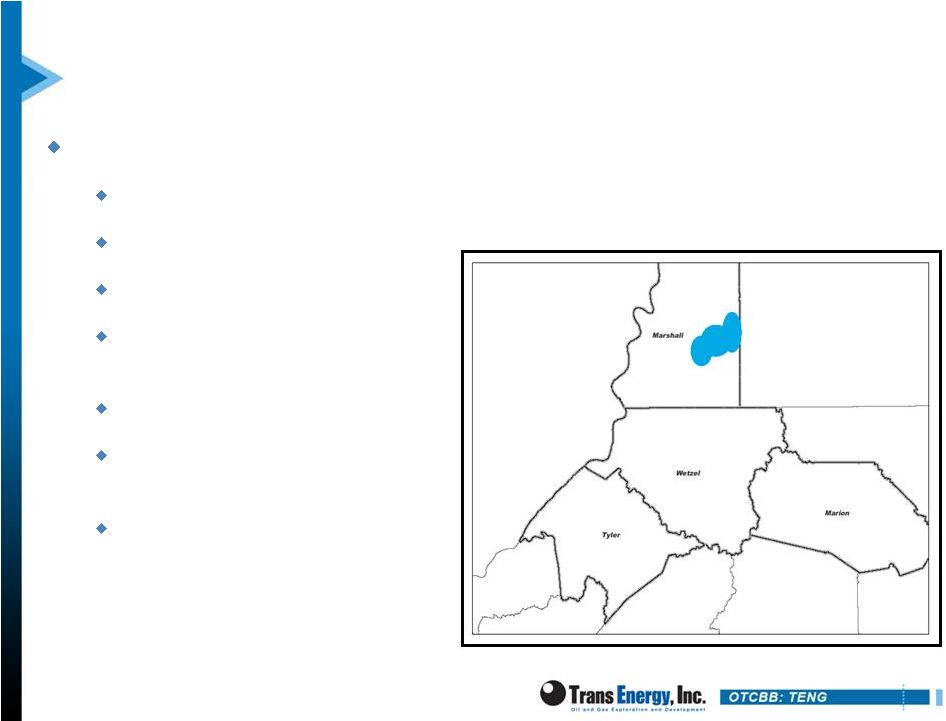

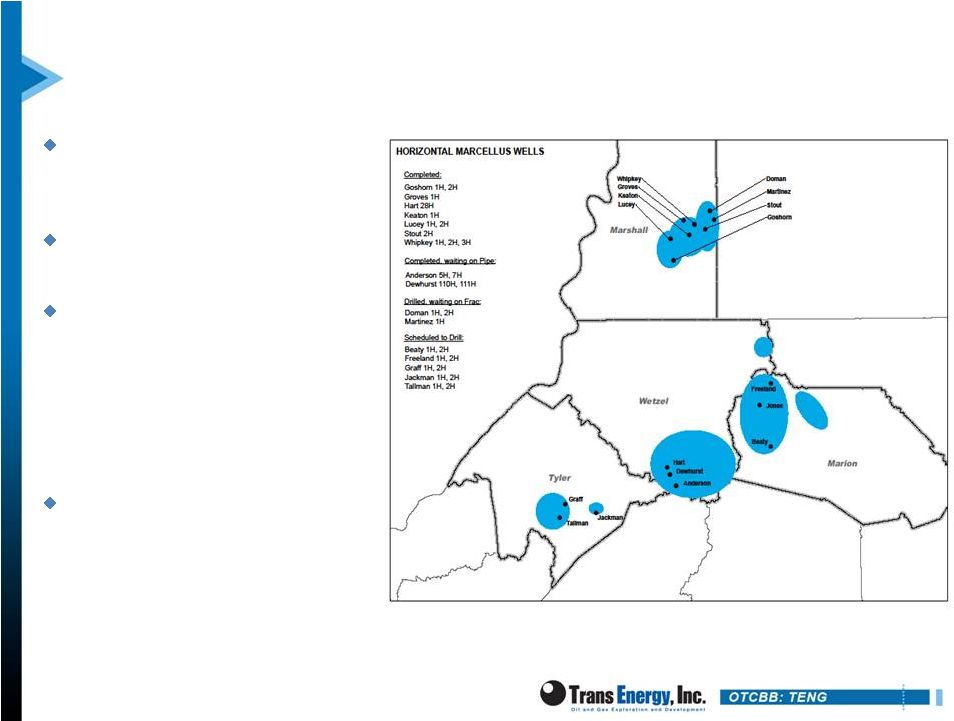

Marshall County: Drilled & Completed

10 Marcellus wells drilled and fraced

Average 30-day IP of 4.2 MMcfe/d

20% Oil/NGLs

4,000’

Average lateral length

Average EUR / 1000’

lateral

of 1.68 Bcfe

4.5 Frac Stages/1000' lateral

Drill/time of 35 days spud

to rig release

47 remaining liquid-rich

locations in these units

13 |

14

Wetzel County: Drilled and Completed

JV has 28,659 gross acres

of leased and owned

minerals.

Number of horizontal wells

drilled: 5

4.5 Frac Stages/1000'

lateral

Drill/time of 35 days spud to

rig release

35 ready to drill locations

61 additional potential

locations |

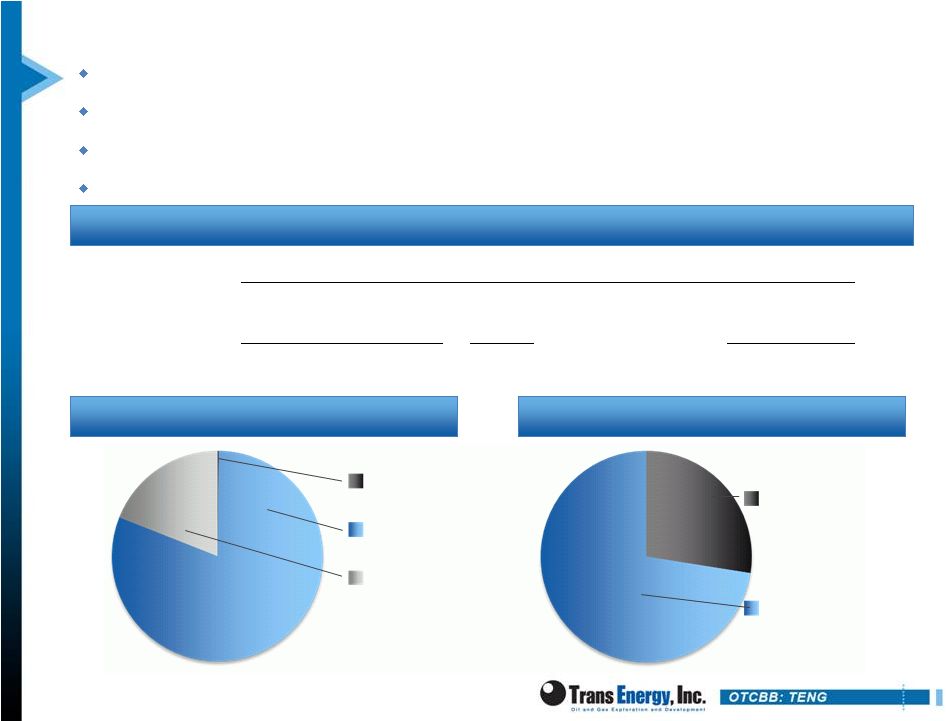

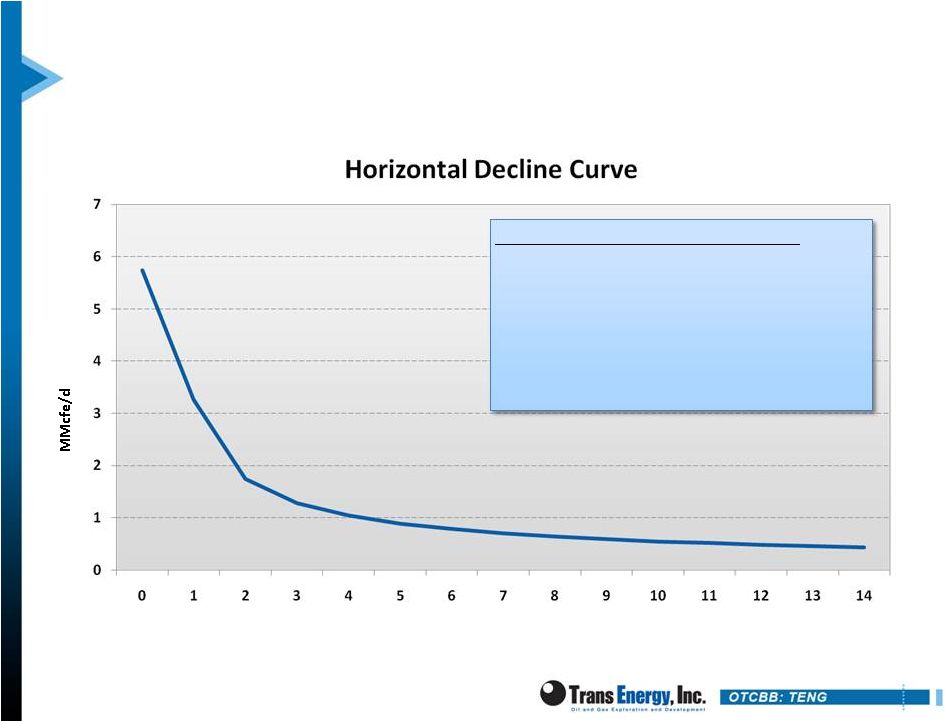

Marshall and Wetzel County Well Performance

(1)

Based on realized prices of $90 per barrel Oil, realized NGL prices of $45 per

barrel and $3.00 natural gas price.

(2)

Realized $90 per barrel oil and realized NGL prices of $45 per barrel held

constant. Years

Projected Horizontal Well Results

Reserves per well: 7.6 Bcfe

30 Day IP Rates: 5.7 MMcfe/d

Percent Liquids: 20%

Gross cost per well: $7.0MM

Average Lateral Length: 4000'

IRR

(1)

: 25%

Breakeven Gas Price

(2)

: $1.50 per MMBtu |

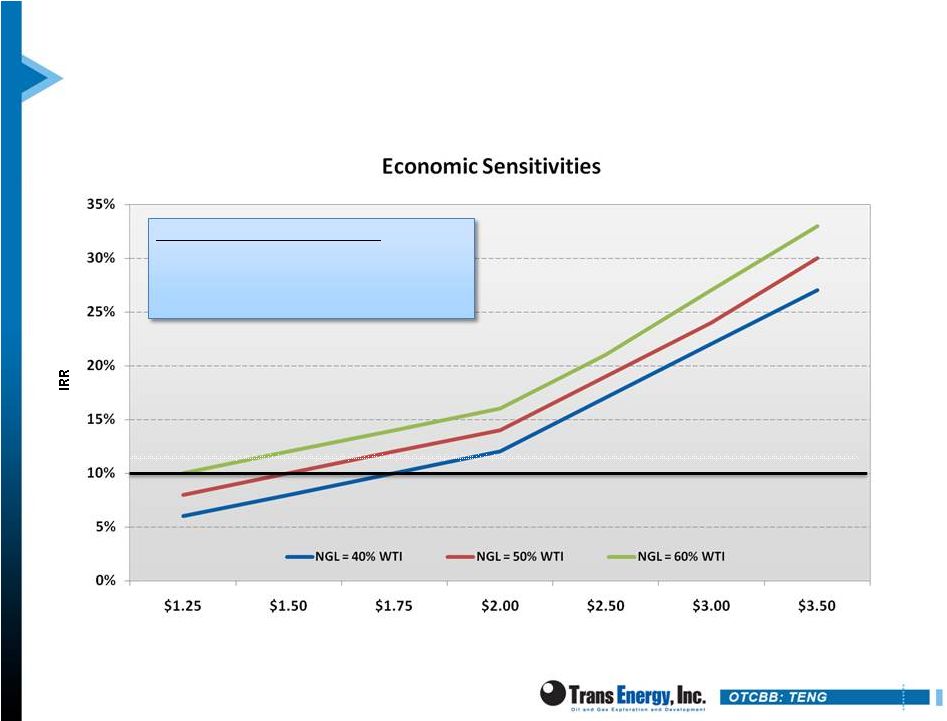

Marshall and Wetzel County Well Performance

Natural Gas Price ($ per MMBtu)

Projected

Horizontal

Well

Reserves per well: 7.6 Bcfe

30 Day IP Rates: 5.7 MMcfe/d

Percent Liquids: 20% |

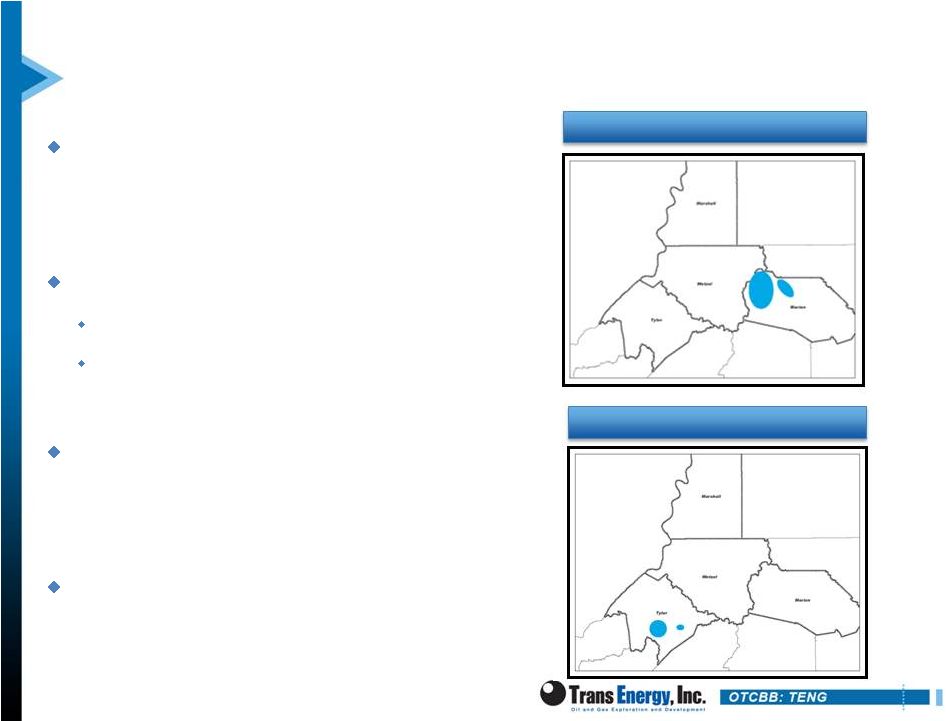

The

Next Step: Tyler & Marion Counties JV has 20,302 gross acres of

leased and owned minerals

8 Well drilling program

4 wells Marion county

4 wells Tyler county

Total number of wells capable

of being drilled today: 39

Total number of potential

wells: 132

17

Marion County

Tyler County |

Wet

Gas Provides Positive Economics $2.50 NYMEX Equals $3.73/mcf Wellhead

Price •

$2.50 / MMBTU NYMEX Henry Hub

•

$85 NYMEX WTI

18

Natural Gas

Natural Gas Liquids

Condensate

Production Breakdown

.9 mcf

1.6 gallons/mcf

.00212 bbls/mcf

Gross Realized Price by Product

$2.51 net

(1)(2)

$1.09 net

(3)(4)(5)

$0.13 net

(6)

Total Realized Price per 1 mcf

$3.73/mcf

Gathering, Transportation and

Processing

($0.75/mcf)

Net Realized Price per 1 mcf

$2.98/mcf

1.

$0.02 premium to NYMEX Henry Hub

2.

1.116 MMBTU/mcf residue BTU factor

3.

40% NYMEX WTI per NGLs

4.

42 gal/bbl conversion factor

5.

90% NGLs

6.

$26.00 less WTI for Appalachian Light Sweet

One mcf Natural Gas via Wellhead Production |

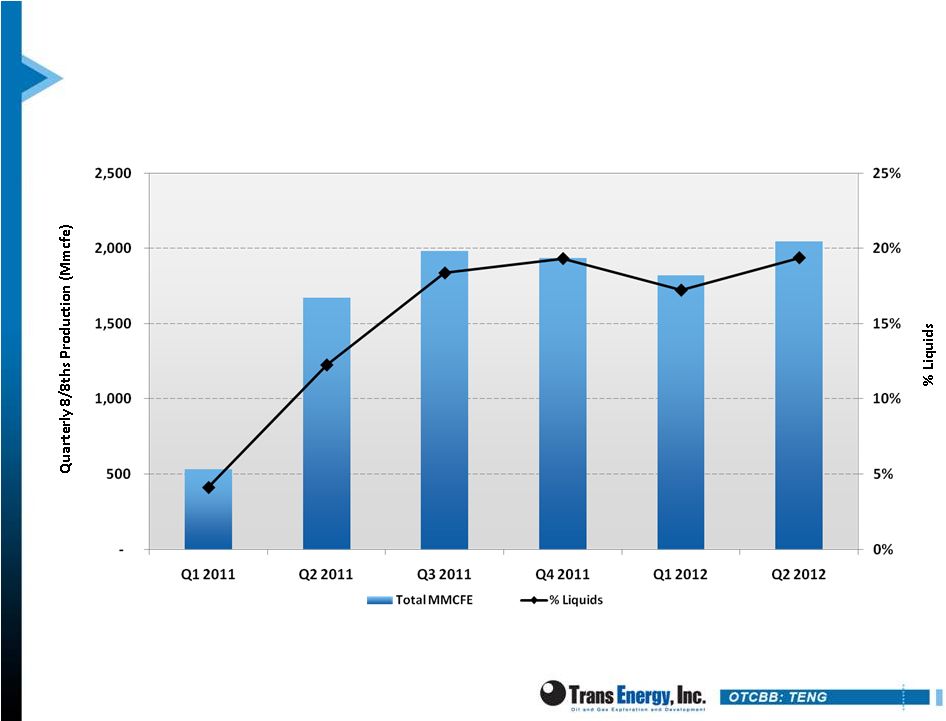

Horizontal Marcellus Production History

19 |

Williams Partners Off-Take Agreement

20-year gas gathering agreement

with Williams for up to 45,000

MMBTU / day

90,000 MMBTU / day including

Republic capacity

Williams committed to provide off-

take for all wells to be drilled

Access to the TETCO, Columbia and

Dominion lines

Williams providing off-take for all

existing horizontal wells

Marshall County wells feed into TETCO

Hart well feeds into the Dominion line

Ft. Beeler cryogenic processing

facility started up in Q2 2011

NGL

yields

up

to

1.4

–

1.9

gal/mcf

Second facility just started

Recently purchased from Caiman

Energy for $2.5 billion

20 |

Near Term Drilling Program

Four (4) wells in Wetzel

county drilled and

awaiting tie-in

Three (3) wells drilled in

Marshall waiting on Frac

With capital provided by

the new credit facility and

cash flow from

operations, the Company

plans to bring seven (7)

horizontal wells on line

before year end

Wells to be drilled in 2013

primarily in Marion, Tyler

and Marshall Counties to

define acreage potential

and prevent lease

expirations

21 |

Net

Asset Value 22

Trading at significant discount to net asset value (NAV)

Trans Energy

(1)

Sum-of-Parts NAV

6/30/2012 Proved Reserves (PDP and PDNP)

25.78

Bcfe

1.00

$4.00

$25,779,400

$103,117,600

$1.96

$7.84

54 Current drilling location from existing pads

(2,

3)

170

Bcfe

$1.00

$4.00

$170,017,639

$680,070,556

$12.92

$51.68

70 Current drilling location from new pads

(2,

3)

178

Bcfe

$0.25

$0.75

$44,500,000

$133,500,000

$3.38

$10.15

Undeveloped Acreage:

Marcellus

14,000

Net acres

$1,000

$5,000

$14,000,000

$70,000,000

$1.06

$5.32

Utica

20,000

Net acres

$0

$0

$0

$0

$0.00

$0.00

Upper Devonian

20,000

Net acres

$0

$0

$0

$0

$0.00

$0.00

Less:

Net debt

($34,451,602)

($34,451,602)

($2.62)

($2.62)

Total (pre ASD warrants)

$230,443,746

$984,031,481

$16.70

$72.37

Total (post ASD warrants)

$190,644,296

$797,282,422

$13.44

$58.26

Shares outstanding

(4)

13,158,578

13,158,578

Notes

(1)

Figures below only the assets in Trans Energy's 100% wholly-owned subsidiary,

ASD; Figures do not reflect shallow well assets. (2)

Assumes

an

average

EUR

of

7.8

Bcfe

per

well

and

an

average

NRI

of

40%.

(3)

Current drilling locations defined as wells where:

(a)

ASD

currently

controls

100%

of

the

acreage

required

to

drill

each

well

(b) The average lateral length on each pad site is at least 3,000 feet,

(c) Each well is on a pad site from which ASD can currently drill at least two such

wells, and (d) Each pad site has been fully surveyed in the field, and a

judgment has been made that the topography will support the pad site (4)

Does not reflect potenital dilution due to outstanding options.

Value Per Share

Total Value

Unit Value

Category

High

Low

Low

High

Low

High |

Why

Invest in Trans Energy? 23

Marcellus Shale Pure Play

62,688 gross acres in core of the Marcellus Shale

Utica Shale potential

Upper Devonian upside potential

High-BTU, liquid-rich focus

$1.50 per MMBtu breakeven natural gas price

Extensive Organic Drilling

Inventory

w/ Large Acreage

Position

400 + potential drilling locations

3+ Tcfe upside potential

Significant portion of acreage HBP (over 2/3)

Off-take agreements totaling up to 45,000 MMBtu per day

Improved Financials

$50 million credit facility funding near term drilling program

Experienced Management w/

Technical Expertise

More than 200 years combined management experience

Well-funded joint development partner has geologic / engineering team

|

APPENDIX

APPENDIX |

Overview of Recent Corporate Reorganization

The new credit facility involves a reorganization of the operating

subsidiaries and assets of Trans Energy

Below summarizes the movement of significant assets in the corporate

reorganization:

25

Trans Energy will continue to perform all accounting

and processing of mineral owner royalty payments

for Prima / shallow wells

Notes

Trans Energy, Inc. and Subsidiaries

21,739 net Marcellus acres

112 active shallow wells

Interest in 14 Marcellus wells

Office equipment and Corporate Functions

Trans Energy, Inc. and Wholly Owned Subsidiaries:

Office equipment and Corporate Functions

Wells

112 active shallow wells

Acreage rights to drill shallow (not leases)

25,683 net acres

American Shale Development, Inc. (“ASD”):

Acreage Leases (All zones below the top of the

Rhinestreet Formation)

21,739 net acres

Interest in 14 producing Marcellus wells

Before Reorganization

After Reorganization |

Marcellus BTU Content By County

Marshall, Wetzel, and Tyler counties have high BTU content with significant

liquids potential

Marion County is dry gas

26

Well

Well Type

BTU/SCF (Dry)

BTU/SCF (Saturated)

Marshall County

Lucey #2H

Horizontal

1,228

1,208

Lucey #1H

Horizontal

1,246

1,225

Keaton #1H

Horizontal

1,238

1,216

Groves #1H

Horizontal

1,218

1,198

Stout #2H

Horizontal

1,186

1,165

Whipkey #2H

Horizontal

1,219

1,198

Whipkey #1H

Horizontal

1,225

1,204

Goshorn #1H

Horizontal

1,211

1,191

Goshorn #2H

Horizontal

1,204

1,184

Whipkey #3H

Horizontal

1,196

1,176

Wetzel County

Hart #28H

Horizontal

1,197

1,177

Dewhurst #50

Vertical

1,119

1,100

Hart #20

Vertical

1,115

1,072

Dewhurst #73

Vertical

1,090

Marion

County Blackshere #101

Vertical

1,073

1,020

@14.73 (PSIA) |

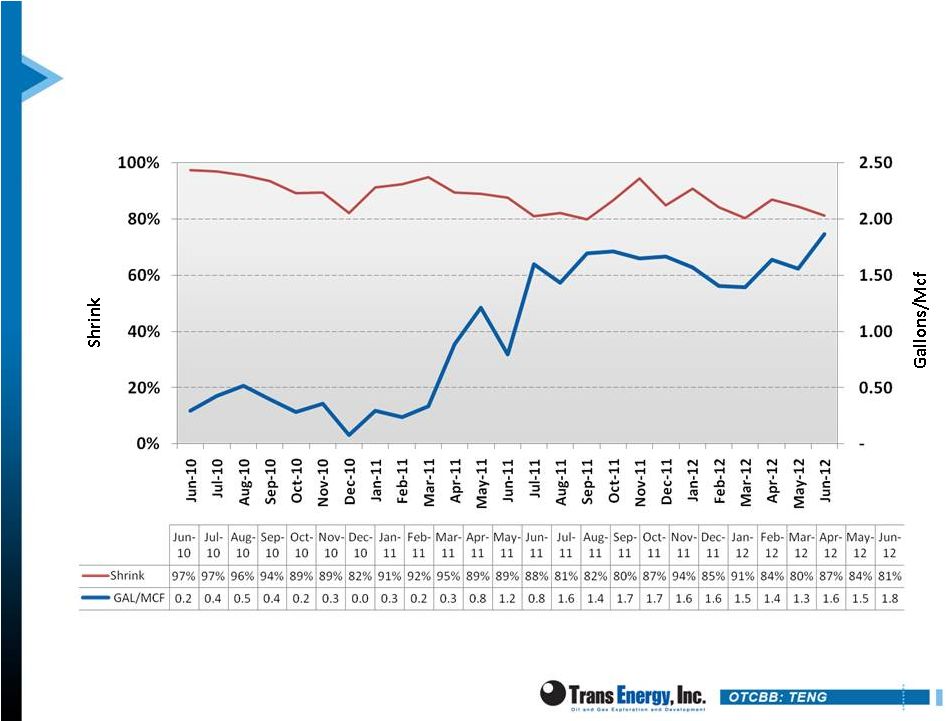

Shrink and Gallons/MCF Correlation |

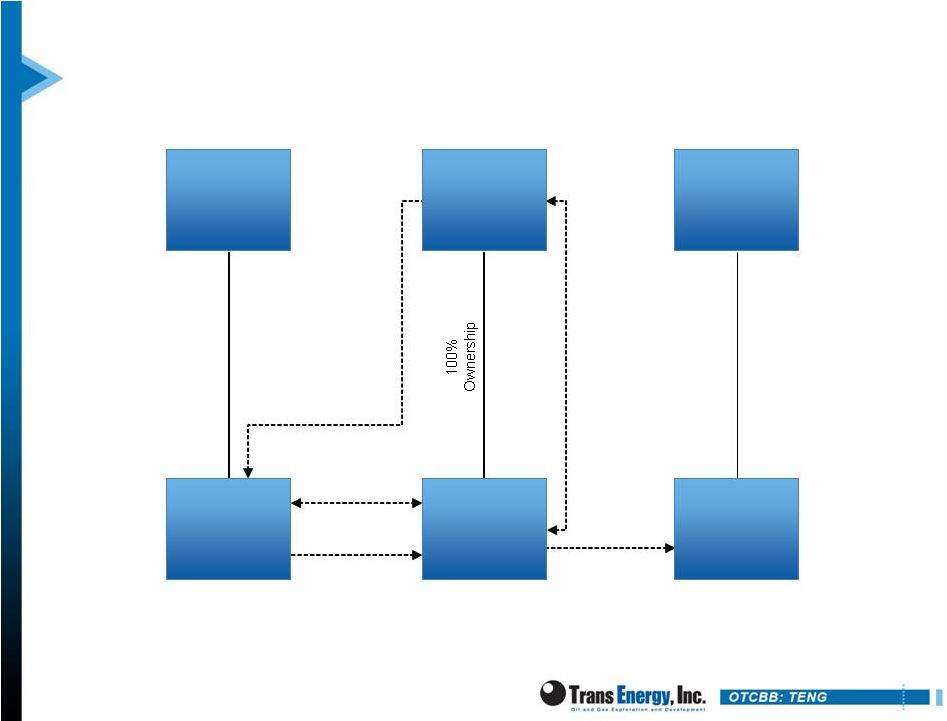

Overview of ASD Entity

28

(1) Upon execution of its warrants, Lender will own 19.5% of ASD

3.AJDA

4.JOA

5.

Contract

Operator

Agreement

7.Overhead

Support

1.Credit

Agreement

2.Warrant

(1)

6.Administrative

Services

Republic

Energy

Ventures,

LLC

Trans

Energy,

Inc.

(OTCBB:

TENG)

Lender

Parent

Lender

Subsidiary

American

Shale

Development,

Inc.

(ASD)

Republic

Energy

Operating,

LLC

(REO) |

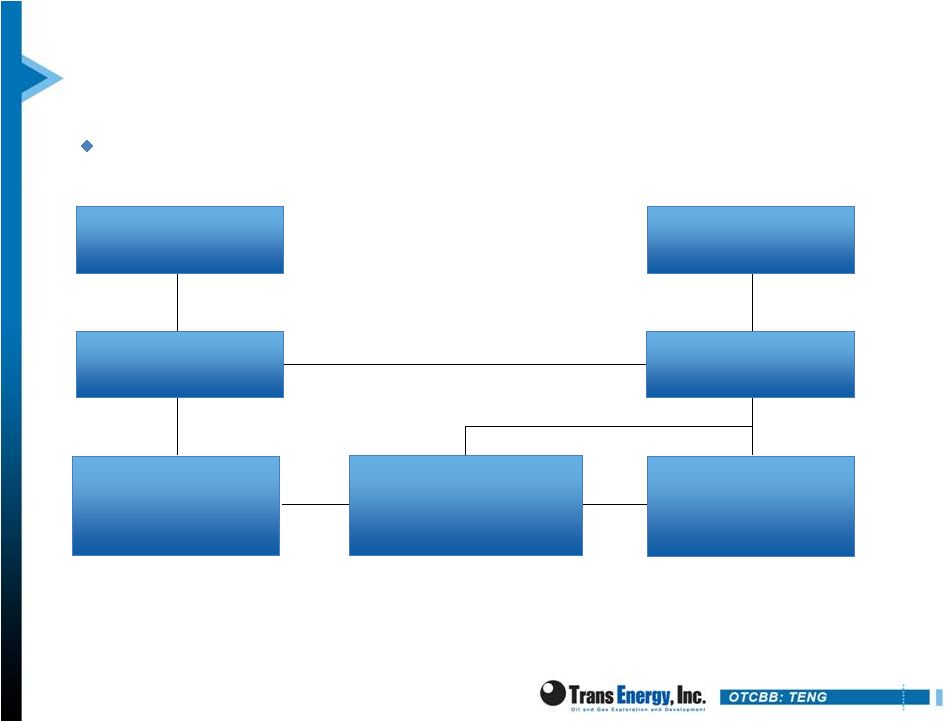

AJDA Summary

Trans Energy entered into an AJDA with Republic Energy during 2007 to

develop its Marcellus acreage

29

36-50%

(3)

Contract Operator to REO

50-64%

100%

(1)

Technical Expertise & Admin

Services

Public & Management

Shareholders

Trans

Energy,

Inc.

Shallow

Conventional

Acreage

Rights

American

Shale

Development

Utica

(~26,000

net

acres)

Marcellus

&

Other

Upper

Devonian

(2)

(4,897

acres

not

in

AJDA)

AJDA Marcellus & Other Upper

Devonian Assets

43,342 Gross Acres in AMI

4 Vertical Marcellus Wells

10 Hz Marcellus Wells

4 Hz Marcellus Wells (awaiting completion)

Republic Energy Ventures &

Affiliates

Republic Energy Operating

Republic

Management

&

Energy

Trust

Partners

(1)

Reflects Trans Energy’s ownership of American Shale Development (“ASD”) prior

to potential dilution that could occur upon the exercise of the lenders’ option for 19.5% of the stock of ASD.

(2)

Includes acreage in Doddridge County that is outside of the AMI, plus approximately 4,500

acres in Wetzel County for which Republic has an option to obtain a 50% WI.

(3)

Reflects Trans Energy’s ownership of all assets within the AJDA, except for four

horizontal Marcellus wellbores in which Trans Energy owns 5% WI prior to payout, and 10% WI after payout,

per the terms of a farm out agreement with an unaffiliated third party. Trans Energy owns

between a 36% WI and a 50% WI in AJDA gross acres.

|