Attached files

| file | filename |

|---|---|

| 8-K/A - AMENDMENT NO. 1 TO FORM 8-K - ENDURANCE SPECIALTY HOLDINGS LTD | d400422d8ka.htm |

Endurance

Specialty Holdings Investor Presentation

Exhibit 99.1 |

Safe Harbor for

Forward Looking Statements Some of the statements in this presentation may

include forward-looking statements which reflect our current views with respect to future events and financial performance.

Such statements include forward-looking statements both with respect to us in general and the

insurance and reinsurance sectors specifically, both as to underwriting and investment matters.

Statements which include the words “should”,"expect," "intend," "plan," "believe," "project," "anticipate," "seek," "will," and similar statements of a future

or forward-looking nature identify forward-looking statements in this presentation for

purposes of the U.S. federal securities laws or otherwise. We intend these forward- looking

statements to be covered by the safe harbor provisions for forward-looking statements in the Private Securities Litigation Reform Act of 1995.

All forward-looking statements address matters that involve risks and uncertainties.

Accordingly, there are or may be important factors that could cause actual results to differ

from those indicated in the forward-looking statements. These factors include, but are not limited to, the effects of competitors’ pricing policies, greater frequency or

severity of claims and loss activity, changes in market conditions in the agriculture insurance

industry, termination of or changes in the terms of the U.S. multiple peril crop insurance

program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance or retrocessional

coverage, our inability to renew business previously underwritten or acquired, our inability to

maintain our applicable financial strength ratings, our inability to effectively integrate

acquired operations, uncertainties in our reserving process, changes to our tax status, changes in insurance regulations, reduced acceptance of our existing or

new products and services, a loss of business from and credit risk related to our broker

counterparties, assessments for high risk or otherwise uninsured individuals, possible

terrorism or the outbreak of war, a loss of key personnel, political conditions, changes in insurance regulation, changes in accounting policies, our investment

performance, the valuation of our invested assets, a breach of our investment guidelines, the

unavailability of capital in the future, developments in the world’s financial and capital

markets and our access to such markets, government intervention in the insurance and reinsurance industry, illiquidity in the credit markets, changes in general

economic conditions and other factors described in our most recently filed Annual Report on Form

10-K . Forward-looking statements speak only as of the date on which they are

made, and we undertake no obligation publicly to update or revise any forward-looking statement,

whether as a result of new information, future developments or otherwise.

Regulation G Disclaimer

In presenting the Company’s results, management has included and discussed certain non-GAAP

measures. Management believes that these non-GAAP measures, which may be defined

differently by other companies, better explain the Company's results of operations in a manner that allows for a more complete understanding of the

underlying trends in the Company's business. However, these measures should not be viewed as a

substitute for those determined in accordance with GAAP. For a complete description of

non-GAAP measures and reconciliations, please review the Investor Financial Supplement on our web site at www.endurance.bm.

The combined ratio is the sum of the loss, acquisition expense and general and administrative expense

ratios. Endurance presents the combined ratio as a measure that is commonly recognized as

a standard of performance by investors, analysts, rating agencies and other users of its financial information. The combined ratio, excluding prior

year net loss reserve development, enables investors, analysts, rating agencies and other users of its

financial information to more easily analyze Endurance’s results of underwriting

activities in a manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss

reserve development, should not be viewed as a substitute for the combined ratio.

Net premiums written is a non-GAAP internal performance measure used by Endurance in the

management of its operations. Net premiums written represents net premiums written and

deposit premiums, which are premiums on contracts that are deemed as either transferring only significant timing risk or transferring only significant

underwriting risk and thus are required to be accounted for under GAAP as deposits. Endurance

believes these amounts are significant to its business and underwriting process and excluding

them distorts the analysis of its premium trends. In addition to presenting gross premiums written determined in accordance with GAAP, Endurance

believes that net premiums written enables investors, analysts, rating agencies and other users of its

financial information to more easily analyze Endurance’s results of underwriting

activities in a manner similar to how management analyzes Endurance’s underlying business performance. Net premiums written should not be viewed as a

substitute for gross premiums written determined in accordance with GAAP.

Return on Average Equity (ROAE) is comprised using the average common equity calculated as the

arithmetic average of the beginning and ending common equity balances for stated periods.

Return on Beginning Equity (ROBE) is comprised using the beginning common equity for stated periods. The Company presents various

measures of Return on Equity that are commonly recognized as a standard of performance by investors,

analysts, rating agencies and other users of its financial information.

Forward looking statements & regulation G disclaimer

2 |

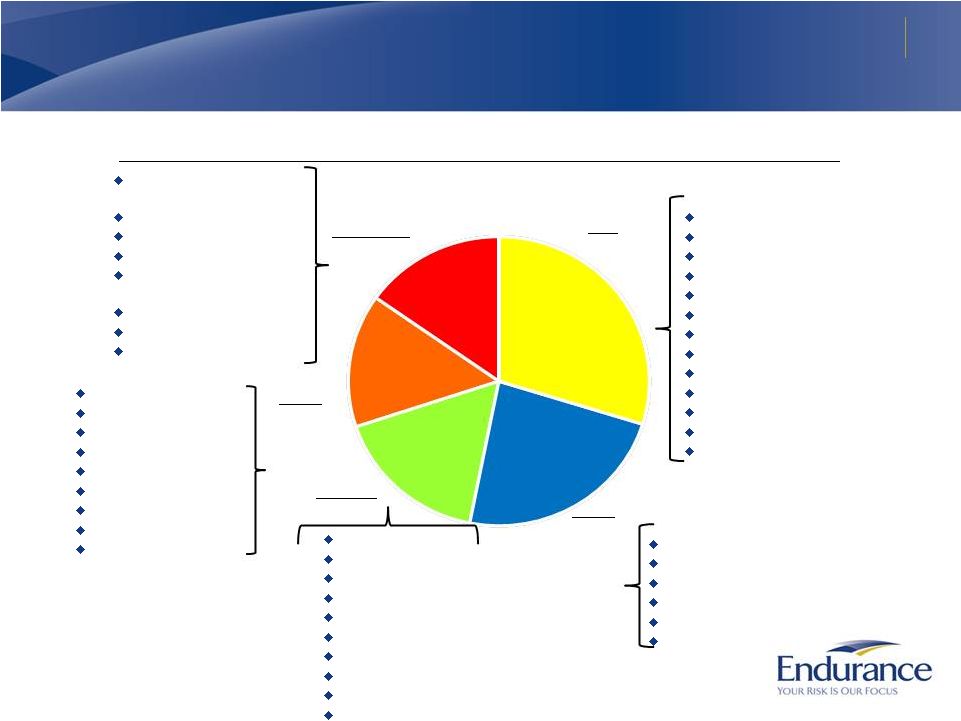

3

Introduction to Endurance Specialty Holdings

(Re)insurance company focused on diversified portfolio of businesses within specialty niches

Diversified Portfolio of Businesses

Evenly split between

insurance and reinsurance

businesses

Maintain strong balance of

specialty, property and

casualty exposures

Track record of

opportunistically entering

and exiting businesses to

achieve strong returns

Strong Balance Sheet

“A”

ratings from AM Best,

S&P and Moody’s

Excellent ERM ranking

from S&P

$3.3 billion of total capital

Conservative, low-

duration, AA rated

investment portfolio

Prudent reserves that

have historically been a

source of value

Active Capital Management

Returned $1.9 billion to

investors through

dividends and share

repurchases

•

Represents 77.2% of

inception to date net

income available to

common shareholders

Maintain a diversified ,

efficient capital structure

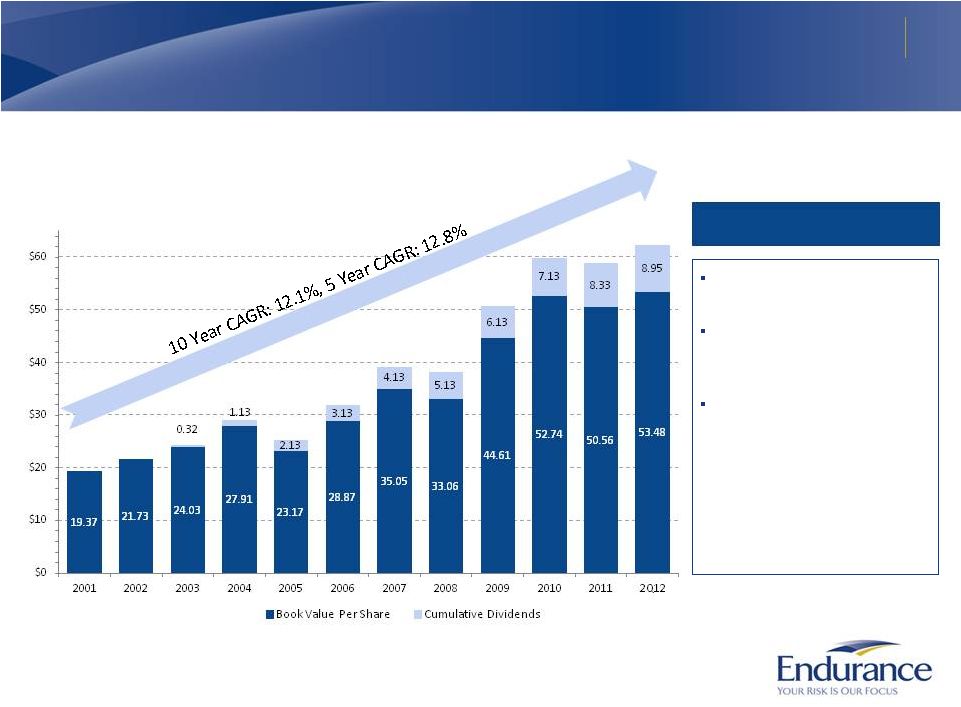

We have built a strong franchise in our first ten years of operation

Inception to date operating ROE of 11.8%

10 year book value per share plus dividends CAGR of 12.1% |

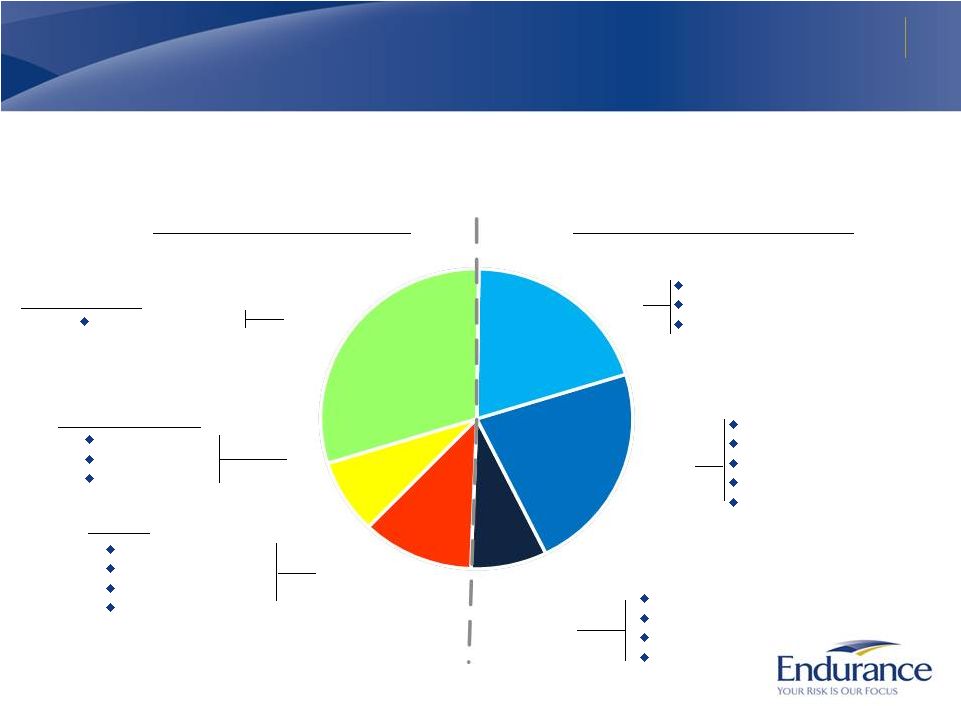

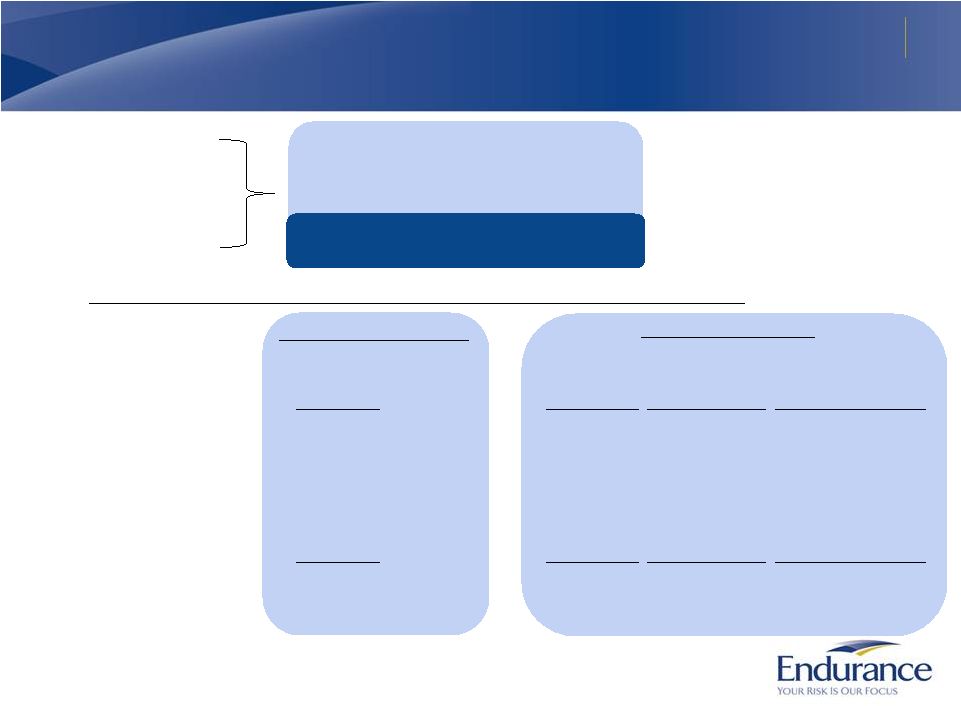

4

Diversified Portfolio of Businesses

Portfolio diversified by product, distribution source and geography

Trailing

Twelve

Months

Net

Premiums

Written

as

of

June

30,

2012:

$2.1

BN

Reinsurance

–

by

Geographic

Market

Insurance -

by Distribution Source

Casualty

Professional Liability

Property Per Risk

Small Business

Surety

International Property Catastrophe

US Property Catastrophe

Other Specialty (Aviation, Clash)

ARMtech Agriculture

US Property

US Casualty

US Miscellaneous E&O

Environmental

Healthcare

Excess Casualty

Professional Lines

International

7%

Global Excess

8%

U.S. Wholesale

11%

Bermuda

21%

Americas

23%

Casualty

Professional Lines

Property

Marine

Small Risk

30%

Independent Agents

Brokers

–

Bermuda/U.S.

Wholesale |

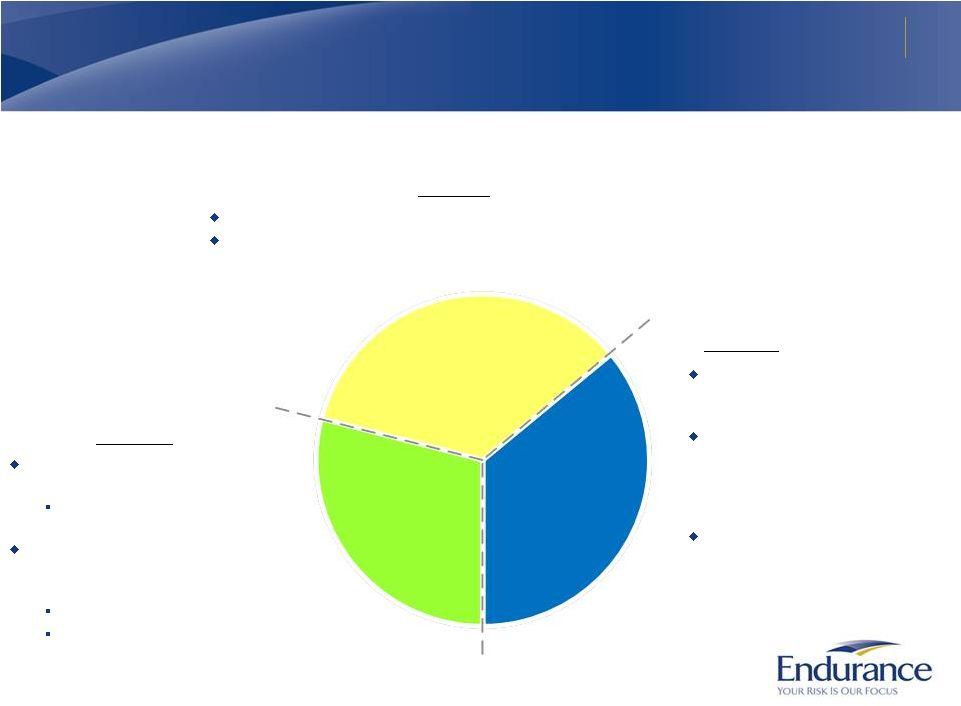

5

Balanced Portfolio of Diversified Risk Types

Adjusted product growth and capital deployment based on market conditions

Trailing Twelve Months Net Premiums Written as of June 30, 2012:

$2.1 BN

Property

(33%)

Casualty

(32%)

Property reinsurance has started

to expand based on improved

pricing and growth in Europe

Catastrophe reinsurance

expanded at mid -year renewals

as pricing improved and capital

was transferred from all risk

insurance business line

Property insurance premiums

reduced due to transfer of

capital away from all risk

insurance business line

Agriculture insurance is not linked to

property-casualty pricing cycle

We have expanded policy count by

40.4% since 2007

Aerospace, marine, surety and other

reinsurance lines of business have declined

significantly from their peaks

Exited offshore energy following KRW

Reduced premiums as competition

has increased

Specialty

(35%)

Casualty reinsurance reduced significantly since its peak in 2004

Casualty insurance lines of business have increased modestly since 2005 as

growth in middle market U.S. based business has been partially offset by declines

in Bermuda based large account business |

6

,

Current market conditions are improving within the catastrophe and property lines of business

where non- impacted areas are seeing modest price improvements while impacted areas

are experiencing significant price increases. Casualty pricing is showing signs

of stabilization as the markets appear to be coming out of the bottom of the

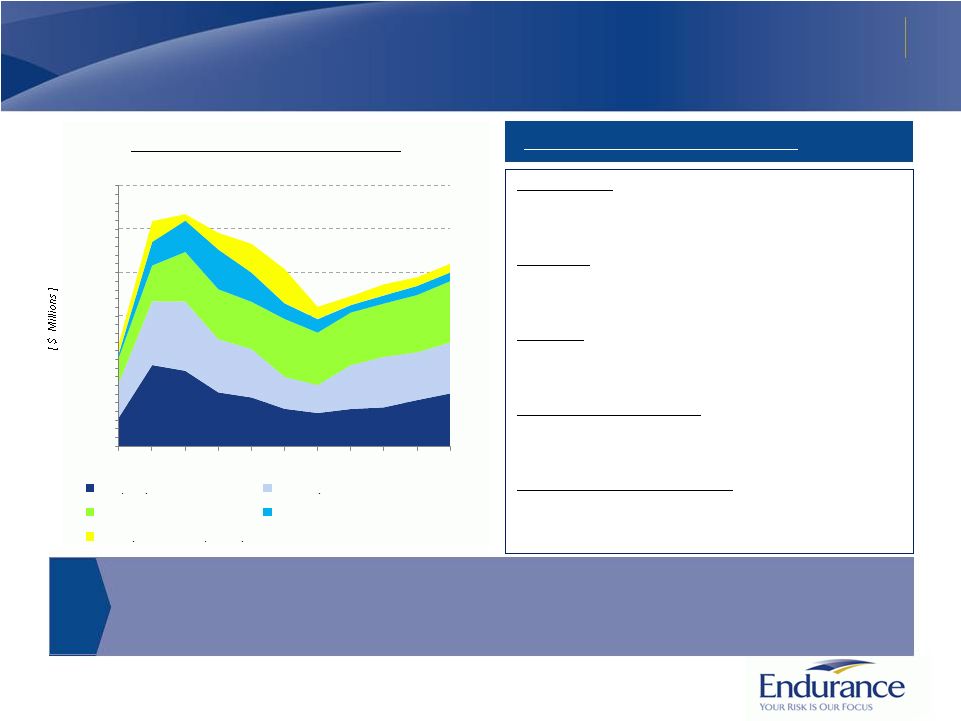

cycle. Opportunistic Reinsurance Portfolio Management

Reinsurance book has been actively managed through market cycles

Managing the Reinsurance Portfolio

* Trailing Twelve Months

Catastrophe

-

Premiums have grown in line with

our capital base and pricing has improved

following global cat losses in 2011

Property -

Premiums have declined 35% since 2003

as prices softened, but have begun to grow in

more recent periods on improved pricing

Casualty

-

Casualty has declined 26% from its peak

in 2004 and recent growth is in shorter tail,

smaller case casualty lines

Aerospace and Marine -

Premiums have declined

78% from 2005 peak as we exited the offshore

energy market and managed exposures

Surety and Other Specialty - Continue to

maintain a core portfolio while remaining disciplined in a

soft market

Reinsurance Net Written Premiums

$0

$250

$500

$750

$1

000

$1

250

$1

500

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

TTM*

Property

Casualty

Catastrophe

Aerospace and Marine

Surety and Other Specialty |

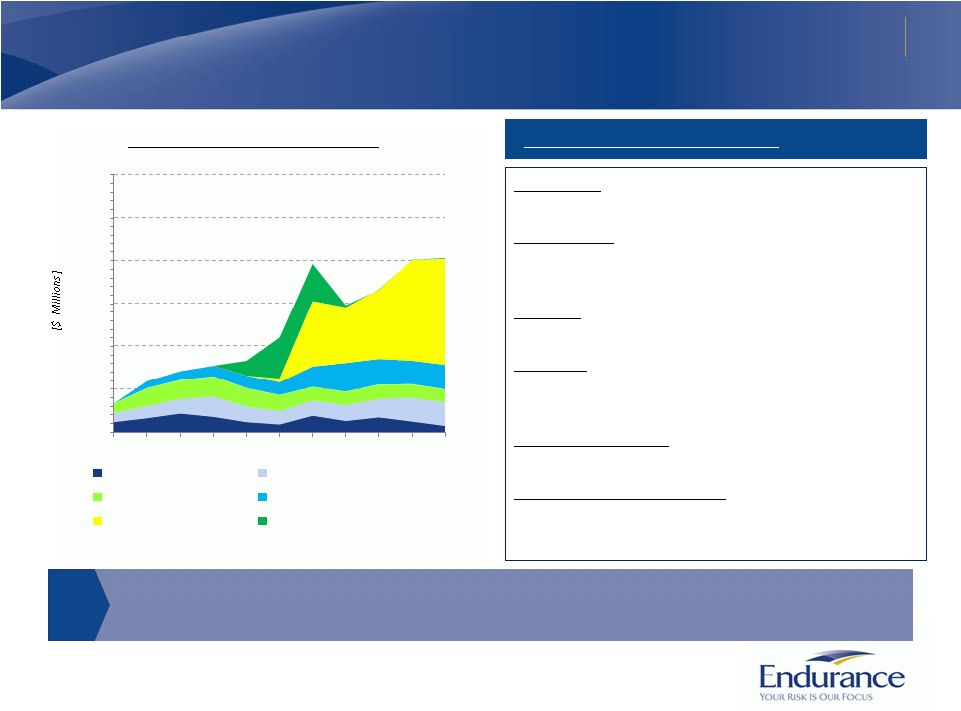

Diversified

Insurance Portfolio Continue to expand insurance capabilities while maintaining

discipline Insurance Net Written Premiums

Managing the Insurance Portfolio

Market conditions are improving as E&S casualty business is experiencing modest rate

improvement, especially for smaller contracts. Larger account professional

lines and excess casualty are experiencing a moderation of price reductions as the

market approaches the bottom of the cycle. * Trailing Twelve Months

$0

$250

$500

$750

$1

000

$1

250

$1,500

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

TTM*

Property

Casualty

Healthcare Liability

Professional

Agriculture

Surety and Other Specialty

Agriculture

–

Strong growth supported by industry

leading technology and customer service.

Professional

–

Recent growth driven by growth in

small case products in the U.S while reducing our

exposures to large case products

Casualty

–

Growth has focused on small case market

where competition has been lower

Property

–

Reducing our exposures within E&S

property lines due to changes in RMS 11.0 and

from reductions in all risk product offer in this line

Healthcare Liability

–

Shrinking historically profitable

line that has attracted aggressive competition

Surety and Other Specialty – Historically

consisted of California’s Workers’

Compensation that we

exited in 2009

7 |

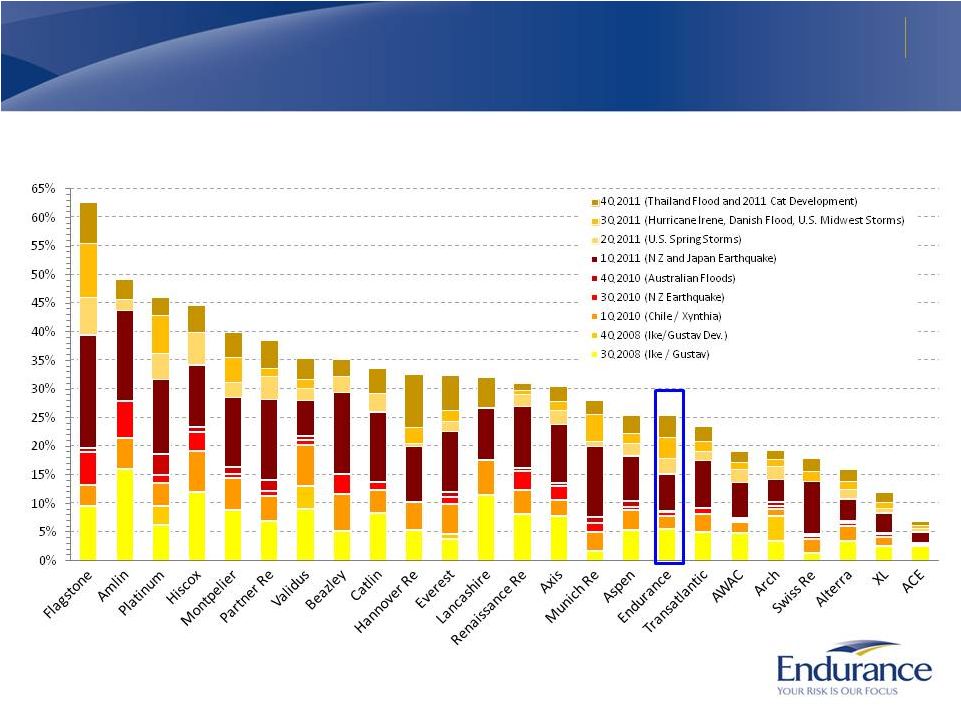

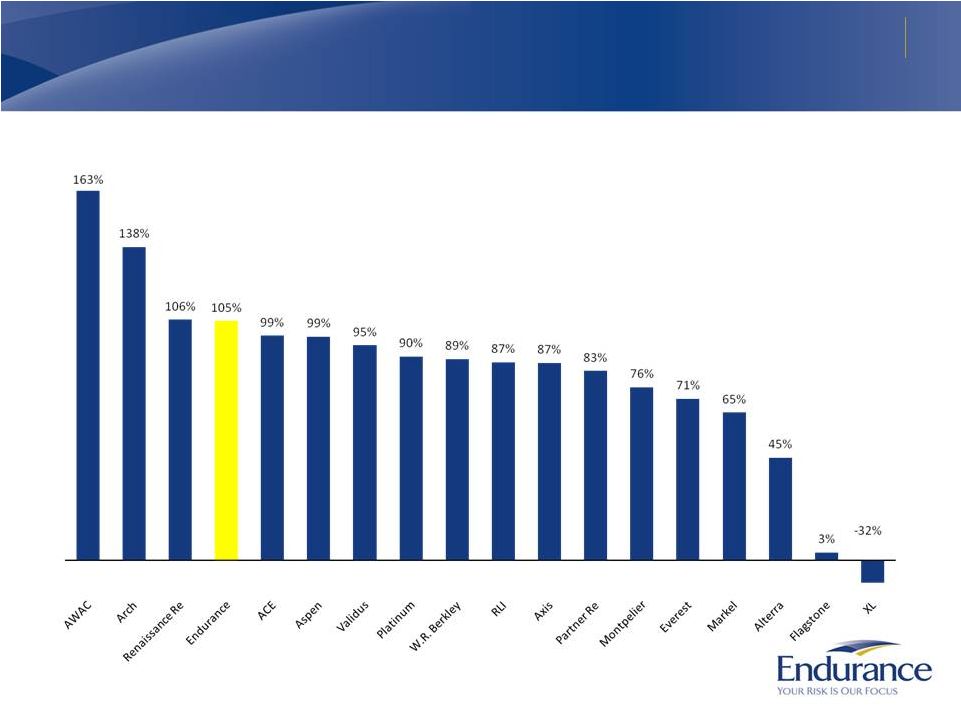

Endurance is

World Class at Risk Management Endurance has performed well versus peers in recent large

catastrophe events 8

Five Year Catastrophe Losses versus Shareholder Equity

From

December

31,

2006

–

December

31,

2011

Note:

Catastrophe loss values were obtained through publicly released information and company

transcripts for each quarter and include current quarter losses as well as announced

loss reserve development associated with prior quarter catastrophe losses.

Catastrophe losses are compared with starting Total Shareholder Equity for each loss

quarter. |

9

Endurance’s Financial Results

Diluted book value per common share has grown tremendously in absolute terms…

Growth in Diluted Book Value Per Common Share ($)

From

December

31,

2001

–

June

30,

2012

Note:

Diluted Book Value Per Share calculated on weighted number of average diluted shares

outstanding. 2005 –

Hurricanes Katrina, Rita

and Wilma

2008 –

Credit crisis and related

impact of marking assets to

market

2011 –

High frequency of

global catastrophes

(Earthquakes impacting New

Zealand and Japan, Hurricane

Irene, Texas wildfires, Thailand

and Australian Floods, Danish

Cloudburst, and a record level

of tornadoes in the United

States)

Significant Impacts to Book Value |

Endurance’s Financial Results

Book value per common share growth compares favorably to peers

10

Diluted Book Value Per Share Plus Dividend Growth

From

December

31,

2006

–

June

30,

2012

Note: Fully Diluted Book value per share and dividend data provided by company press releases

and filings. For those companies that do not disclose fully diluted book value

per share, the dilution was calculated using average diluted shares

outstanding. |

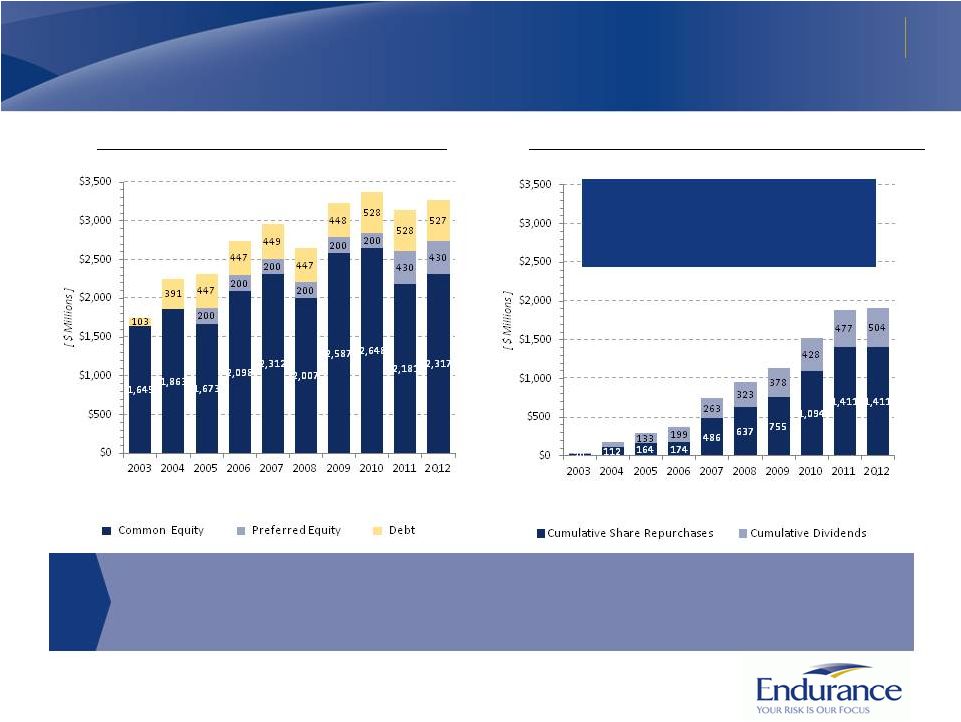

Growing

Capital Base while returning Capital to Investors Diluted shares outstanding have been

reduced by approximately 40% in the last five years Endurance has a Diversified and

Growing Capital Base $1.9 Billion of Capital Cumulatively Returned to

Shareholders 11

Endurance has proven its ability to generate capital which has allowed for the return to its

shareholders of $1.9 billion through share repurchases and dividends while also

supporting organic growth. Current capital

levels

exceed

rating

agency

minimum

levels

allowing

for

the

possibility

of

opportunistic

growth

in the

event that markets harden.

Returned 77.2% of inception to

date net income to common

shareholders |

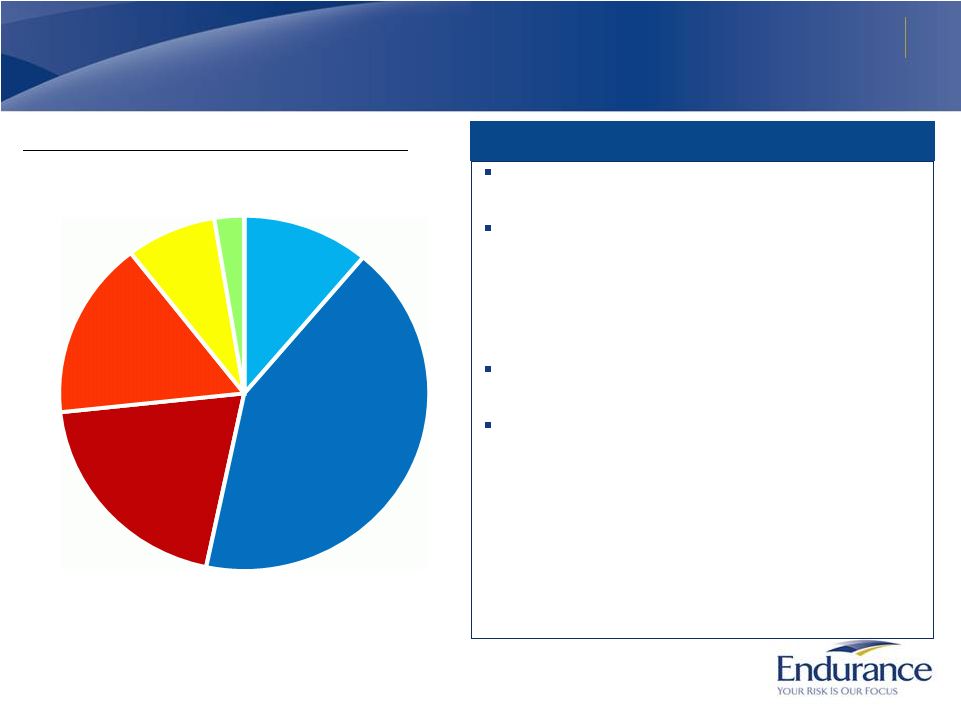

Strong Balance

Sheet Endurance maintains a high quality, short duration investment portfolio

$6.4 B Investment Portfolio at June 30, 2012

Investment Portfolio Highlights

Fixed maturity portfolio duration remains short at

2.60 years

Investment quality (AA average) has remained high as

the portfolio is conservatively managed in challenging

economy

•

52.0% of investments are cash/short term or US backed

•

No direct exposure to sovereign debt or bank debt of

European peripheral countries

Expanded into equities in 2011 to diversify portfolio

and reduce interest rate risk

Other investments of $478.9 million consist of

alternative funds (71.2%) and specialty funds (28.8%)

•

Alternative funds include hedge funds and private equity

funds

•

Specialty funds include high yield loan and convertible debt

funds

•

Other investments returns have significantly outperformed

S&P 500 with half the volatility since programs incepted

12

Cash and

Short Term

11.4%

U.S. Government /

and U.S. Government

Backed –

40.6%

Municipals and Foreign

Government

3.1%

Other Investments

and Equities

8.6%

Asset Backed and

Non Agency Mortgage

Backed –

16.9%

Corporate

Securities

19.4% |

Conclusion

Endurance is a compelling investment opportunity

Strategically manage our businesses

•

Selectively reduced reinsurance premiums, especially in competitive longer tail lines

•

Shifted capital from all risk insurance business line to property catastrophe reinsurance

business line •

Active capital deployment to return excess capital to shareholders

-

Reduced diluted shares outstanding by approximately 40% in the last five years

Maintain excellent balance sheet strength and liquidity

•

High quality, short duration investment portfolio; fixed maturity investments have an average

credit quality of AA •

Prudent reserving philosophy and strong reserve position; strong

history of favorable development

•

Industry leading Enterprise Risk Management

•

Capital levels well in excess of rating agency minimums provide flexibility to grow in

potentially hardening markets The outlook for Endurance’s book of business remains

attractive •

Experiencing improved pricing across most of our lines of business

•

Catastrophe lines have remained disciplined and profitable and market conditions are

improving •

Small account casualty insurance lines are experiencing rate hardening

13 |

Appendix |

Overview of

ARMtech |

Overview of

ARMtech Acquisition of ARMtech has been a great success for Endurance

ARMtech was founded by software developers and has maintained a strong focus on providing

industry leading service through leveraging technology

•

Writes crop insurance through independent agents across 44 states

•

Based in Lubbock, Texas with historic concentration in Texas and

southern states

•

Recent growth has further balanced the portfolio geographically and by crop

ARMtech built a leading specialty crop insurance business from scratch over the last 11

years •

Approximate 7% market share and is 5

th

largest of 15 industry participants

•

Has grown to over 159,000 policies in force

•

2012 crop year* gross written premiums estimated to be $905 million

Endurance

purchased

ARMtech

in

December

2007

at

a

purchase

price

of

approximately

$125

million

•

Since the acquisition, ARMtech has generated in excess of $160 million in operating

profit •

ARMtech has grown MPCI policy count by 40.4% since 2007

Agriculture insurance provides strong return potential, diversification in Endurance’s

portfolio of (re)insurance risks and is an efficient user of capital

16

* 2012 crop year is defined as July 1, 2011 through June 30, 2012 which is the period covered

by crop insurance and reinsurance |

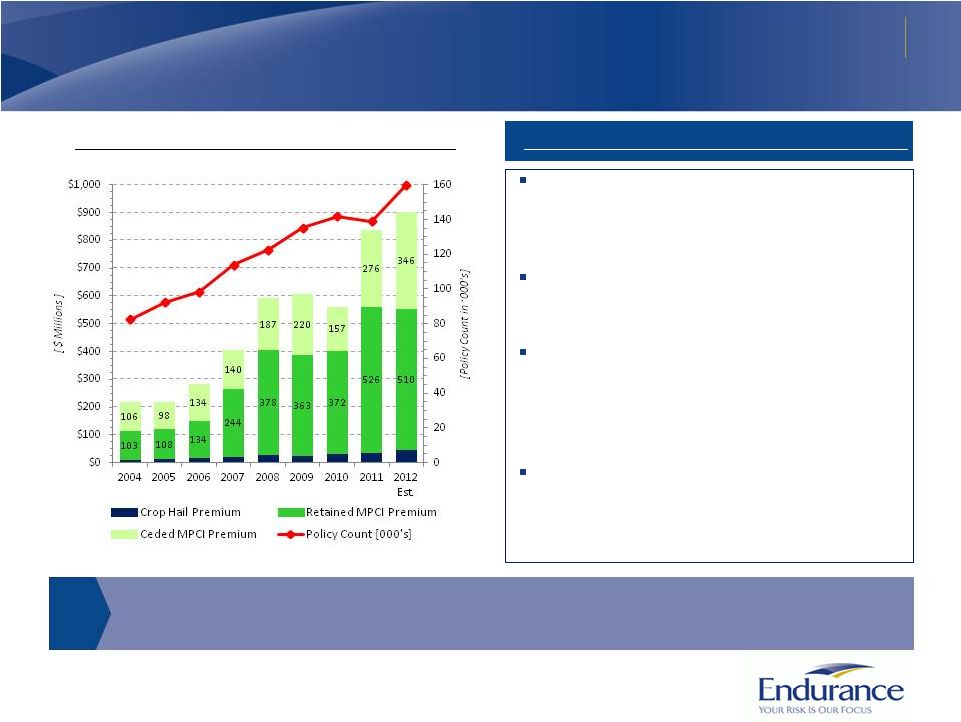

ARMtech is a

Leader in the Crop Insurance Space ARMtech’s focus on technology and service has

allowed it to steadily grow its business Written

Premiums

and

Policy

Counts

by

Crop

Year

Using

technology

and

service

to

expand

premiums

17

ARMtech has demonstrated its ability to grow market share and premiums over time through its

leading edge technology and superior delivery of service and compliance.

ARMtech has built a market leading specialty

crop insurance business through its focus on

offering excellent service supported by industry

leading technology.

Policy count has grown 40.4% over the past five

years in a line of business not subject to the

property/casualty pricing cycle.

ARMtech is a leader in using technology to

deliver high quality service and to satisfy the

very intense compliance and documentation

standards imposed on the industry by the U.S.

Federal Government.

ARMtech has generated an underwriting profit

every year since its formation. |

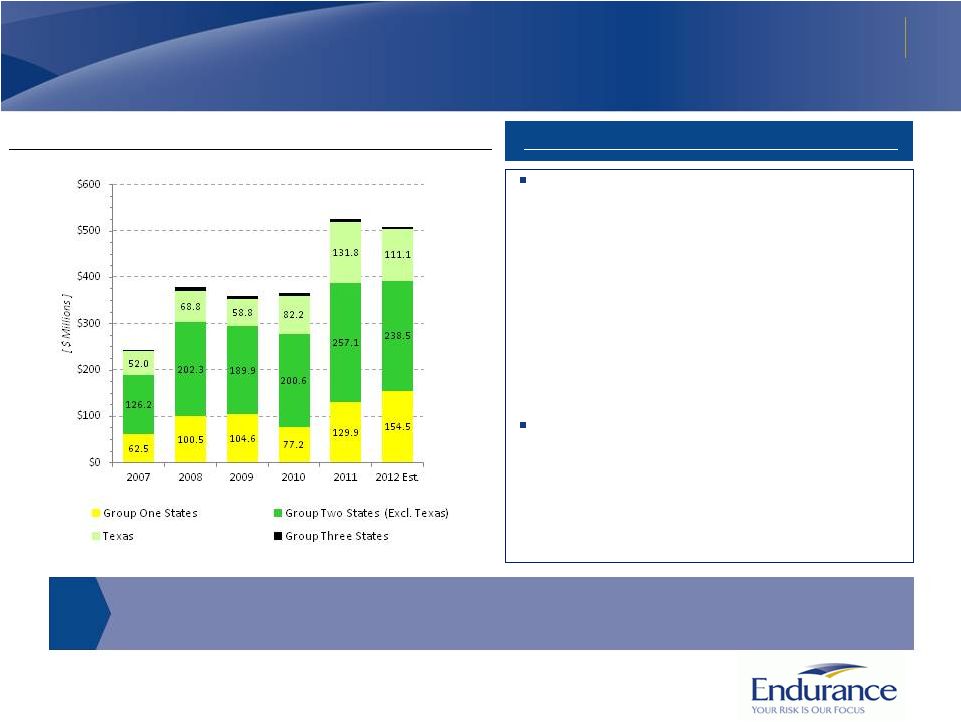

ARMtech is

Gaining Market Share in Broader Geographic Areas 2012 was a very strong marketing

year for ARMtech MPCI Net Written Premiums by Crop Year and State Grouping*

Estimated 2012 Net Written Crop Year Premiums

18

Estimated 2012 crop year MPCI net written

premiums of $509.5 million are 3.1% lower

than crop year 2011

•

Growth from geographically diverse states as

technology focused service offering is attracting

new customers and agents,

•

Partially offset by 15.7% decline in Texas due to

higher cessions, and

•

Partially offset by lower commodity prices on

corn, cotton and soybeans.

The portfolio of crop risk is more balanced in

2012 through greater crop and geographic

diversification and through greater cessions in

Texas (cotton concentration)

* Group One States –

IL, IN, IA, MN, NE

Group Two States –

States other than Group One and Group Three states

Group

Three

States

–

CT,

DE,

MA,

MD,

NV,

NH,

NJ,

NY,

PA,

UT,

WY

ARMtech continues to focus on diversifying its business geographically while managing its

exposure to Texas through active use of available reinsurance protections.

|

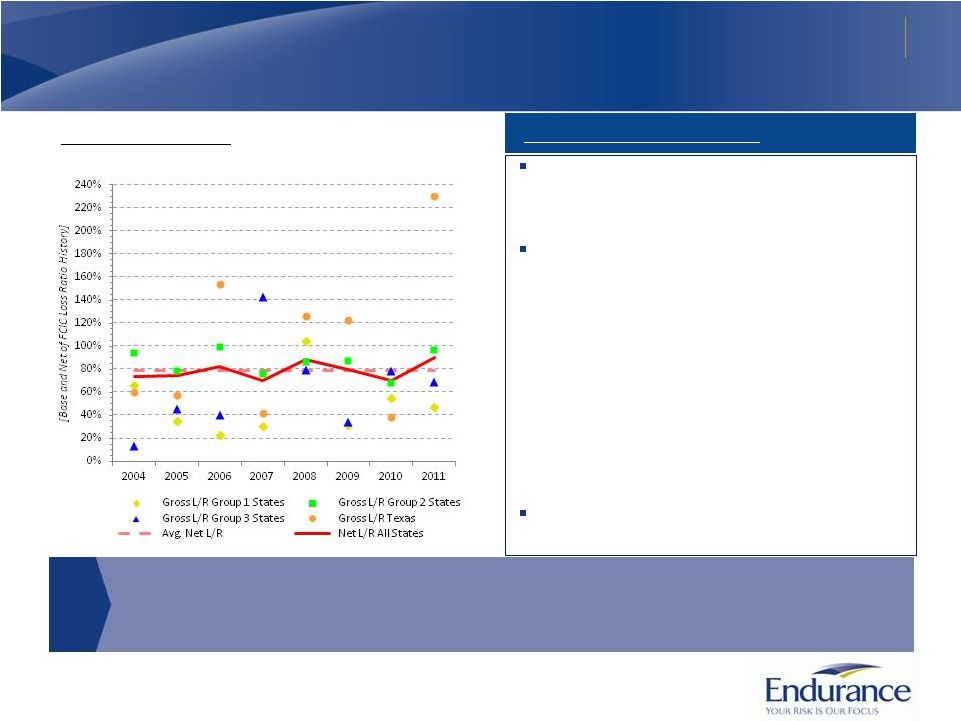

Agriculture

Insurance is Not Correlated with the P&C Business Cycle FCIC reinsurance lowers

volatility Historic

Loss

Ratio

Results

–

Pre

and

Post

Federal

Retrocessions

Stable Results in Volatile Times

19

While individual states can produce large loss

ratios, the U.S. Federal reinsurance program has

historically reduced loss ratio volatility.

ARMtech’s business has historically produced

stable profits over time after reflecting the

reinsurance terms set out in the current

standard crop reinsurance agreement

•

Historic average loss ratio post U.S. Federal

cessions has been 78.7% [adjusted for the 2011

Federal reinsurance terms]

•

The best year was 2007 with a 69.8% net loss ratio

and the worst 2011 with a 90.5% net loss ratio

•

ARMtech’s current expense run rate after the A&O

subsidy is approximately 7%

ARMtech has built a differentiated business

with high risk adjusted return potential

While individual states can produce highly varied gross loss ratios on a year to year basis,

the U.S. Federal reinsurance program has historically mitigated that volatility and

leaves ARMtech with a business which is not correlated to the traditional P&C

pricing cycle and has high risk adjusted return potential.

|

20

Overview of ARMtech

ARMtech’s recognition of premiums and earnings are influenced by growing

seasons

Seasonality of MPCI Business

Recognition of

annual written

premiums

60% -

65%

Spring crops

10% -

15%

Spring crop

adjustments due to

actual cessions

20% -

25%

Spring crop report

adjustments

Winter crops

5% -

10%

Winter crop

adjustments

Recognition of

annual earned

premiums

10%-15%

Largely driven by

winter crops

25% -

30%

Driven by spring

crops and winter

crops

30% -

35%

Largely driven by

spring crops

25% -

30%

Largely driven by

spring crops

Commodity

price setting

Setting of prices for

spring crops (forward

commodity price for

fourth quarter)

Price setting of winter

crops (forward

commodity price for

second quarter)

Harvest

Harvest of winter

crops

Harvest of spring

crops

First Quarter

Second Quarter

Third Quarter

Fourth Quarter |

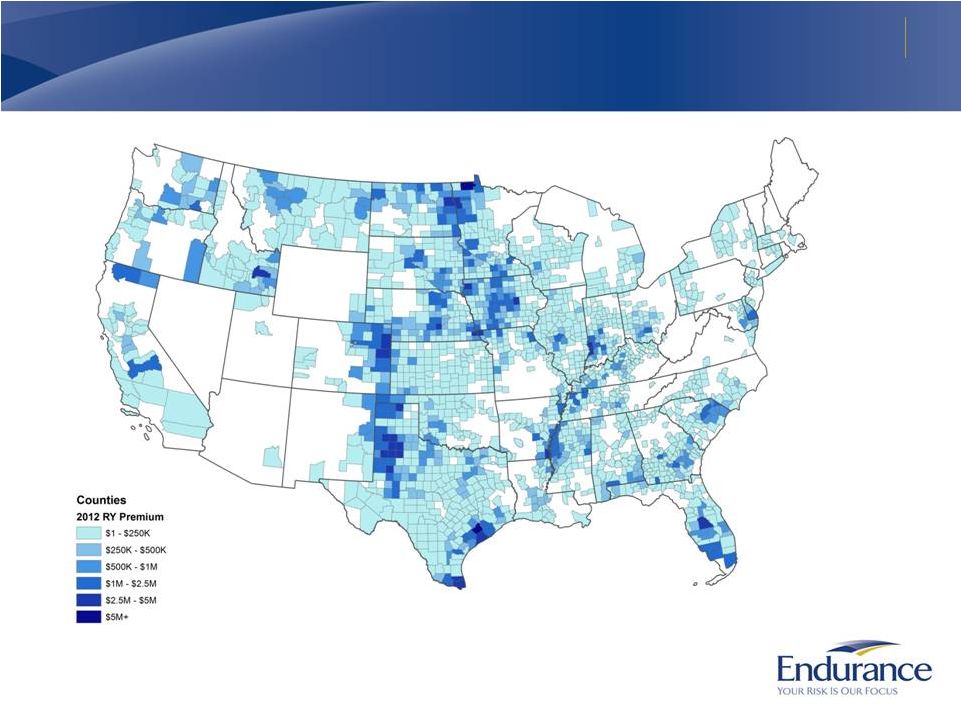

Geographic

Diversification of Crop Insurance Business ARMtech maintains a diversified portfolio of

risk both geographically and by crop 21

1.4%

2.2%

3.7%

3.4%

3.2%

1.6%

2.0%

4.1%

10.3%

1.3%

2.3%

7.6%

3.9%

2.8%

6.4%

4.8%

1.2%

1.9%

2.0%

3.0%

1.8%

21.8%

1.3%

0.9%

0.9%

0.7%

0.9%

0.6%

0.4%

0.4%

2012 Crop Year Estimated 2012 Net Written Premiums |

22

Diversification of Crops Within ARMtech’s Portfolio

Underwritten risks diversified by geography and commodity type

ARMtech’s Estimated 2012 Crop Year MPCI Net Written Premiums

Iowa –

7.1%

Nebraska –

4.6%

Minnesota –

3.4%

Texas –

2.8%

Indiana –

2.5%

Illinois –

1.5%

Colorado –

1.6%

Missouri –

1.5%

South Dakota –

1.5%

North Dakota –

1.2%

Kentucky –

1.0%

Mississippi –

0.8%

All other states –

4.1%

Corn

(33.6%)

Texas –

11.9%

Georgia –

1.7%

Mississippi –

1.1%

Alabama –

0.8%

South Carolina –

0.7%

All other states –

1.3%

Cotton

(17.5%)

Iowa –

3.1%

Minnesota –

2.6%

Nebraska –

1.6%

Mississippi –

1.5%

Indiana –1.5%

Missouri –

1.0%

Arkansas –

1.0%

North Dakota –

0.9%

Kentucky –

0.9%

All other states –

4.5%

Soybeans

(18.6%)

Other Crops

(17.4%)

Wheat

(12.9%)

Texas –

2.4%

Colorado –

1.8%

North Dakota –

1.5%

Minnesota –

1.0%

Idaho –

1.0%

Montana –

0.8%

Oklahoma –

0.7%

South Dakota –

0.7%

All other states –

3.0%

Citrus, Nursery & Orange

Trees -

3.2%

Grain Sorghum –

2.9%

Peanuts –

1.2%

Potatoes –

1.0%

Pasture, Rangeland, Forage –

0.9%

Apples –

0.8%

Rice –

0.7%

All other crops –

6.7% |

23

Agriculture Insurance Contains Three Layers of Risk Mitigation

Farmers retention, ceding premiums to the U.S. Federal Government and limitations on

losses and gains

2012 Crop Year

Gross Liability

Assigned Risk Fund

“Higher Risk Policies”

70.2% of risk retained by

ARMtech

29.8% of first dollar risk retained

by farmers

Commercial Fund

“Lower Risk Policies”

41.2% of MPCI Premiums Ceded to U.S. Federal Government

Loss Sharing

(% of loss retained by

Loss Ratio

Loss Ratio

Group 1 States

Group 2 & 3 States

ARMtech within each

100 - 160

7.5%

100 - 160

65.0%

42.5%

applicable band when

160 - 220

6.0%

160 - 220

45.0%

20.0%

the loss raio is above 100%.)

220 - 500

3.0%

220 - 500

10.0%

5.0%

Gain Sharing

(% of gain retained by

Loss Ratio

Loss Ratio

Group 1 States

Group 2 & 3 States

ARMtech within each

65 - 100

22.5%

65 - 100

75.0%

97.5%

applicable band when

50 - 65

13.5%

50 - 65

40.0%

40.0%

the loss raio is below 100%.)

0 - 50

3.0%

0 - 50

5.0%

5.0%

14.8% of 2012

Crop Year NWP

85.2% of 2012

Crop Year NWP |

Overview of

MPCI Program Multi Peril Crop Insurance provides an essential product to American

farmers Multi Peril Crop Insurance (MPCI) is an insurance product regulated by the USDA

that provides farmers with yield or revenue protection

•

Offered by 16 licensed companies

•

Pricing is set by the government

-

no pricing cycle exists

•

Commissions payable to independent agents are capped

Premiums are directly linked to commodity prices for the underlying crops

•

As

commodity

prices

increase

or

decline

–

margins

stay

flat

but

volume

of

profits

will

increase

or

decrease

•

For crop year 2012, commodity base prices mainly declined after posting strong increases in

2011 -

Cotton declined 24.4%

-

Corn declined 5.5%

-

Wheat (fall) grew by 20.7%

-

Soybeans declined 7.0%

In recent years the MPCI program has undergone several changes:

In 2011 rates for corn and soybeans were reduced approximately 7%

•

Based on actuarial studies to recognize the favorable impact of technology improvements

•

Reductions varied by state with largest reductions being in the mid west

•

All other crops are being reviewed in 2012

24

•

Reinsurance under the standard reinsurance agreement has been simplified into two

categories •

Expense reimbursement has been reduced

•

Allowable agent commissions have been capped

•

Underserved states such as Texas have been granted rate increases

|

Other

Miscellaneous Information |

Estimated Occurrence

Net Loss as of July 1, 2012 July 1, 2011

July 1, 2010

10 Year

25 Year

50 Year

100 Year

250 Year

100 Year

100 Year

Return

Return

Return

Return

Return

Return

Return

Zone

Peril

Period

Period

Period

Period

Period

Period

Period

United States

Hurricane*

$238

$340

$407

$468

$571

$564

$510

Europe

Windstorm

104

187

260

344

456

445

399

California

Earthquake

51

228

350

412

547

442

435

Japan

Windstorm

20

104

173

247

290

268

349

Northwest U.S.

Earthquake

1

9

57

184

356

241

236

Japan

Earthquake

11

66

99

138

201

185

133

United States

Tornado/Hail

40

59

76

96

123

98

72

Australia

Earthquake

-

5

27

83

175

95

52

New Zealand

Earthquake

-

1

6

22

53

34

37

Australia

Windstorm

1

6

18

37

75

39

27

New Madrid

Earthquake

-

-

1

11

100

14

12

26

Probable Maximum Loss by Zone and Peril

Largest 1 in 100 year PML as of July 1, 2012 is equal to 17.0% of Shareholders’

Equity

as of June 30, 2012

(in millions)

Actual realized catastrophic losses could differ materially from

our net loss estimates and our net loss estimates should not be

considered as representative of the

actual losses that we may incur in connection with any particular catastrophic event.

The net loss estimates above rely significantly on computer models created to

simulate the effect of catastrophes on insured properties based upon data emanating from past

catastrophic events. Since comprehensive data collection regarding insured losses

from catastrophe events is a relatively recent development in the insurance industry, the data upon which catastrophe models is based is limited, which

has the potential to introduce inaccuracies into estimates of losses from catastrophic events,

in particular those that occur infrequently. In addition, catastrophe models are

significantly influenced by management's assumptions regarding event characteristics, construction of insured property and the cost and duration of

rebuilding after the catastrophe. Lastly, changes in Endurance's underwriting portfolio

risk control mechanisms and other factors, either before or after the date of the above

net loss estimates, may also cause actual results to vary considerably from the net loss estimates above. For a listing of risks related to Endurance and its future

performance, please see "Risk Factors" in our Annual Report on Form 10-K for the

year ended December 31, 2011. * United States Windstorm estimated net losses as of July

1, 2012 are based on RMS version 11.0 and include reinstatement premiums, if

applicable. The net loss estimates by zone above represent estimated losses related to

our property, catastrophe and aerospace and marine lines of business, based upon our

catastrophe models and assumptions regarding the location, size, magnitude, and frequency of

the catastrophe events utilized to determine the above estimates. The net loss

estimates are presented on an occurrence basis, before income tax and net of reinsurance recoveries and reinstatement premiums, if applicable. Return period

refers to the frequency with which the related size of a catastrophic event is expected to

occur. |

Second Quarter

2012 Highlights Risk management proved effective as catastrophe losses were within

expectations Book value per common share, adjusted for dividends, increased 3.6%

during second quarter 2012 •

Net income available to common shareholders of $64.3 million

-

Includes catastrophe losses of $14.4 million related to U.S. tornadoes and Italian

Earthquake -

Net investment income was $31.8 million, breakeven results on alternatives and lower

book yield on fixed income investments

Net written premiums of $484.4 million increased 9.7% over second quarter 2011

•

Insurance net written premiums of $186.7 million increased 7.6% from second quarter

2011 -

Growth in agriculture premiums driven by policy count growth, partially offset by lower

commodity prices

-

Reductions in property insurance premiums as we reduced our all risk insurance business line

exposures

•

Reinsurance net written premiums of $297.8 million increased 11.0% over second quarter

2011 -

Catastrophe lines grew 14.0% as higher pricing was achieved and capacity was expanded to

partially offset lower capacity deployed in our all risk insurance business line

-

Casualty grew as one contract was expanded at renewal, premium adjustments were larger than a

year ago and one contract had the renewal date shifted to 2Q12

27 |

28

Financial Results for Second Quarter 2012

$MM (except per share data and %)

June 30,

2 0 1 2

June 30,

2 0 1 1

$

Change

%

Change

Net premiums written

484.4

441.8

42.6

9.7%

Net premiums earned

519.3

486.6

32.7

6.7%

Net investment income

31.8

39.8

(8.0)

-20.1%

Net underwriting income (loss)

38.7

(8.1)

46.8

579.4%

Net income

72.5

41.1

31.4

-76.5%

Operating income

59.5

24.5

35.0

-142.9%

Fully diluted net income EPS

1.48

0.87

0.61

-70.1%

Fully diluted operating income EPS

1.18

0.48

0.70

-145.8%

Financial highlights

June 30,

2 0 1 2

June 30,

2 0 1 1

Operating ROE

9.0%

3.7%

Net loss ratio

66.5%

74.4%

Acquisition expense ratio

13.9%

14.0%

General and administrative expense ratio

12.1%

13.5%

Combined ratio

92.5%

101.9%

Diluted book value per share

$53.48

$52.20

Investment leverage

2.72

2.73

Key operating ratios |

29

Second Quarter 2012 Net Written Premiums

In $MM

June 30,

2 0 1 2

June 30,

2 0 1 1

$

Change

%

Change

Property

12.0

26.0

-14.0

-53.8%

Casualty

43.5

43.8

-0.3

-0.7%

Healthcare liability

19.0

20.1

-1.1

-5.5%

Surety and other specialty

2.0

-0.1

2.1

NM

Agriculture

67.3

46.0

21.3

46.3%

Professional lines

42.8

37.7

5.4

13.5%

Total insurance

186.6

173.5

13.1

7.6%

Insurance Segment

In $MM

June 30,

2 0 1 2

June 30,

2 0 1 1

$

Change

%

Change

Casualty

58.9

45.6

13.3

29.2%

Property

54.0

52.2

1.8

3.4%

Catastrophe

158.9

139.4

19.5

14.0%

Aerospace and marine

18.3

24.7

-6.4

-25.9%

Surety and other specialty

7.7

6.4

1.3

20.3%

Total reinsurance

297.8

268.3

29.5

11.0%

Reinsurance Segment |

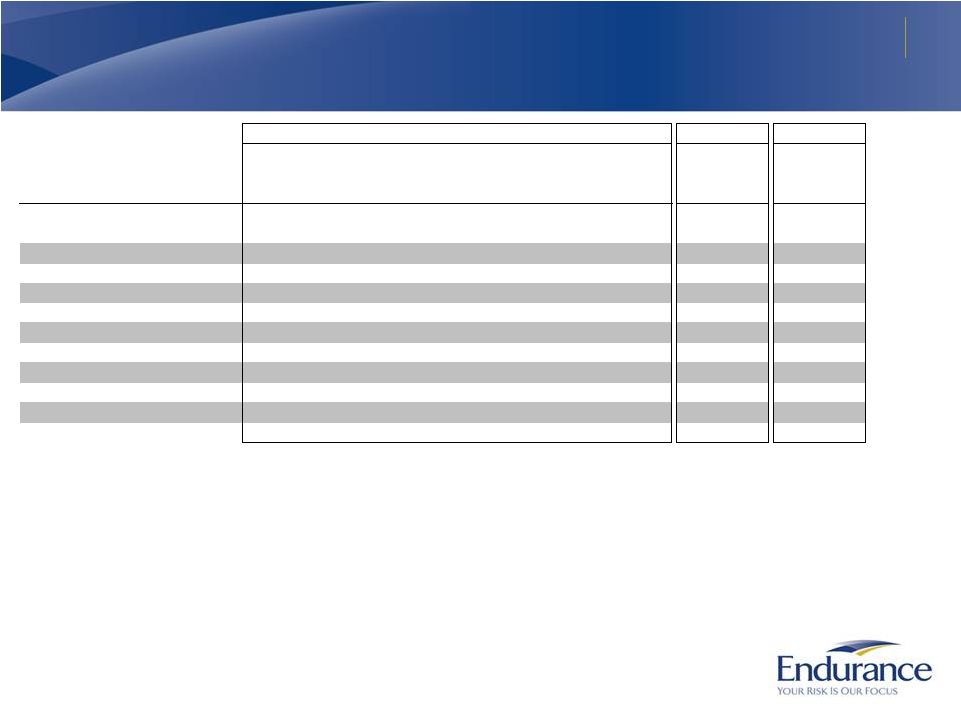

30

Financial Overview: 10 Year Financial Performance

In $MM

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2002

through 2Q

2012

Net premiums written

765

1,598

1,697

1,619

1,586

1,575

1,784

1,606

1,764

1,980

17,301

Net premiums earned

369

1,174

1,633

1,724

1,639

1,595

1,766

1,633

1,741

1,931

16,136

Net underwriting

income (loss)

51

179

232

-410

304

322

111

265

195

-252

1,058

Net investment income

43

71

122

180

257

281

130

284

200

147

1,807

Net income (loss)

before preferred

dividend

102

263

356

-220

498

521

100

555

365

-94

2,600

Net income (loss)

available to common

shareholders

102

263

356

-223

483

506

85

539

349

-118

2,480

Diluted EPS

$1.73

$4.00

$5.28

($3.60)

$6.73

$7.17

$1.33

$9.00

$6.38

($2.95)

$38.27

Financial highlights from 2002 through June 30, 2012

Key Operating Ratios

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Inception-to-

date

Combined ratio

86.2%

84.7%

85.8%

123.5%

81.5%

79.9%

93.5%

84.0%

88.7%

112.9%

93.4%

Operating ROE

7.8%

17.3%

19.9%

(11.9%)

25.7%

23.8%

8.5%

22.0%

12.6%

(6.3%)

11.8%

Book value per share

$21.73

$24.03

$27.91

$23.17

$28.87

$35.05

$33.06

$44.61

$52.74

$50.56 |