Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bristow Group Inc | d400020d8k.htm |

Bristow Group Inc.

Investor Relations Presentation

August 2012

Exhibit 99.1 |

2

Forward-looking statements

This presentation may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements about our future business, operations, capital expenditures, fleet composition,

capabilities and results; modeling information, earnings guidance, expected operating margins

and other financial projections; future dividends, share repurchase and other uses of excess

cash; plans, strategies and objectives of our management, including our plans and strategies to

grow earnings and our business, our general strategy going forward and our business model;

expected actions by us and by third parties, including our customers, competitors and

regulators; the valuation of our company and its valuation relative to relevant financial

indices; assumptions underlying or relating to any of the foregoing, including assumptions regarding

factors impacting our business, financial results and industry; and other matters. Our

forward-looking statements reflect our views and assumptions on the date of this

presentation regarding future events and operating performance. They involve known and unknown

risks, uncertainties and other factors, many of which may be beyond our control, that may cause

actual results to differ materially from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and

other factors include those discussed under the captions “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our

Annual Report on Form 10-K for the fiscal year-ended March 31, 2012 and our Quarterly Report

on Form 10-Q for the quarter ended June 30, 2012. We do not undertake any obligation, other

than as required by law, to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

|

3

Bristow is the leading provider of helicopter services

and is a unique investment in oil field services

•

~20 countries

•

551 aircraft

•

~3,400 employees

•

Ticker: BRS

•

Stock price

*

: $45.77/share

•

Market cap

*

: ~$1.7 billion

•

Quarterly dividend of $0.20/share

$67

Bristow flies crews and light cargo to production platforms, vessels and rigs

* Based on 36.4 million fully diluted weighted average shares outstanding for the

three months ended 06/30/2012 and stock price as of July 31, 2012 |

4

•

Safety is our primary core value

•

Bristow’s ‘Target Zero’

program is now the leading example

emulated industry-wide

•

Safety Performance accounts for 25% of management

incentive compensation

•

2011 National Ocean Industries Association (NOIA) Safety

in Seas Award Winner

our

industry

leading

safety

program,

creates differentiation and client loyalty

,

TARGET

ZERO

|

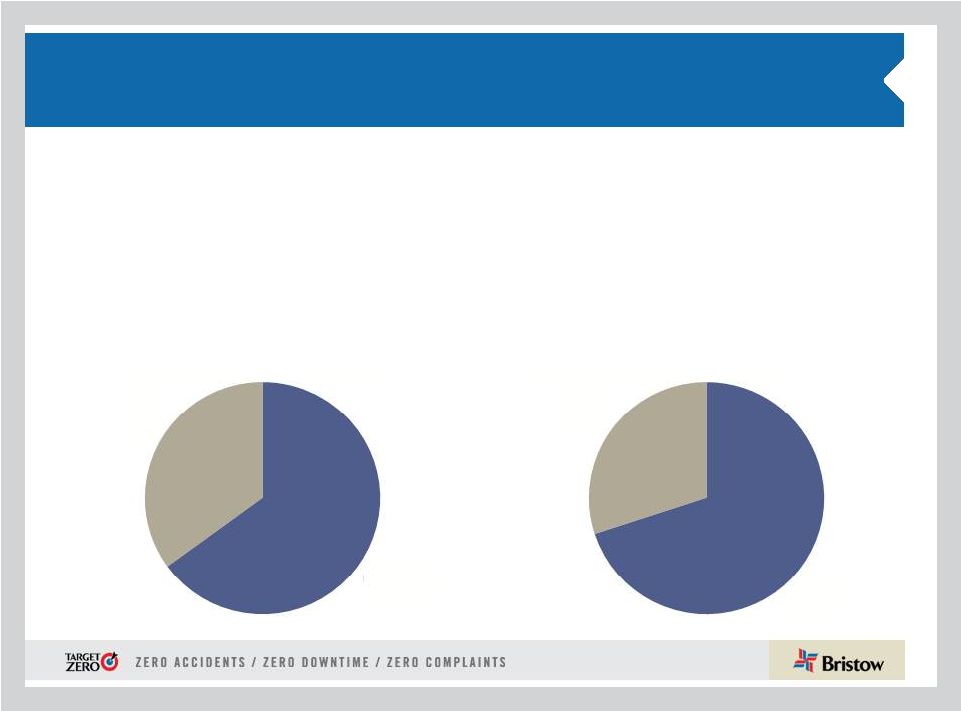

5

Bristow services are utilized in every phase of

offshore oil and gas activity, especially production

•

Largest share of revenues (>60%) relates to

oil and gas production, providing stability and

growth opportunities

•

There are ~ 8,000 offshore production

installations worldwide —

compared with

>600 exploratory drilling rigs

•

~ 1,700 helicopters are servicing the

worldwide oil and gas industry of which

Bristow’s fleet is approximately one-third

•

Bristow revenues are primarily driven by

operating expenditures

Typical revenues by segment

PRODUCTION

Exploration

20%

Development

10%

Production

60%

Other 10%

SEISMIC

EXPLORATION

DEVELOPMENT

ABANDONMENT

H e l i c o p t e r t r a n s p o r t a t i o

n s e r v i c e s |

6

Bristow’s contract and operations structure generates more

predictable income with significant operating leverage

Revenue sources

•

Two tiered contract structure includes both:

–

Fixed or monthly standing charge to reserve helicopter

capacity

–

Variable fees based on hours flown with fuel pass through

•

Bristow contracts earn 65% of revenue without flying

Operating income

Fixed

monthly

70%

Variable

hourly

30%

Fixed

monthly

65%

Variable

hourly

35% |

7

Why Bristow?

$275

•

Bristow has changed

its client and capital allocation approach

(Client Promise/Bristow Value Added) to generate better cash

returns and fund it’s growth

•

Bristow is enjoying improved pricing

for its services with better

utilization especially in North America

•

Bristow is growing

with demand not dependent on economic or

commodity cycles

•

Bristow’s

asset

values

continue

to

be

resilient

even

in

depressed

economic

times

as

there

is

strong

demand

for

helicopters

outside

of

exploration

and

production

(E&P)

•

Bristow cash flow has increased

53% since FY11 and is more

than 2 times higher than our next four competitors* combined

* Four competitors are CHC, ERA, Inaer Aviation, and PHI. Data from latest filings

as of July 29, 2012. ERA based on S-1 pro-forma. |

8

CHANGE:

Bristow’s Client Promise initiative is gaining

traction and is behind our margin improvement

Target Zero accidents, downtime and complaints

programs deliver value to operators.

More zero-accident flight hours than anyone,

more uptime than anyone,

and hassle-free service

creates confidence in flight. Worldwide.

Lowers client’s offshore operating costs

and improves productivity.

Earns us more business

to improve BVA. |

9

CHANGE:

Bristow Value Added (BVA) makes employees

treat the cost of capital like any other expense

•

BVA is the key measure to define Bristow’s financial success

and charges managers for the capital they use every day

•

BVA has changed i) the way working capital is managed, and

ii) has led to our operating lease initiative

* Reconciliation for these items is in the appendix

** Quarterly capital charge of 2.625% is based on annual capital charge

of 10.5% BRISTOW VALUE ADDED CALCULATION SAMPLE

BVA =Gross Cash Flow –

(Gross Operating Assets X Capital Charge)

BVA

=

GCF

-

(

GOA

X

10.5%**

)

Bristow Value Added calculation for Q1 FY12

($15.4)

=

$60*

-

(

$2,874*

X

2.625%**

)

Bristow Value Added calculation for Q1 FY13

$1.9

=

$80*

-

(

$2,976*

X

2.625%**

) |

10

•

Of the 56 aircraft currently leased in our fleet, 30 are training and 26 are

commercial (18 LACE)

•

18 LACE aircraft represent approximately 12% of our commercial fleet

•

Our

goal

is

for

commercial

fleet

operating

leases

to

account

for

20-30%

of

our

LACE

Leased aircraft as of June 30, 2012

Large

Medium

Small

Total

Leased LACE

Total LACE

% Leased

EBU

8

-

-

8

8

47

17%

WASBU

-

1

-

1

1

22

2%

NABU

2

11

1

14

8

30

26%

AUSBU

1

-

2

3

2

18

11%

OIBU

-

-

-

-

-

32

0%

Total

11

12

3

26

18

147

12%

amount of capital needed to grow

Operating

lease

initiative:

lowering

the

cost

and |

11

Net cash provided by operating activities

See June 30, 2012 10-Q for more information on cash flow provided by operating

activities Our focus on BVA has yielded much higher operating

29.6

35.0

25.7

52.9

55.4

127.9

195.4

151.4

231.3

0

40

80

120

160

200

240

280

320

FY09

FY10

FY11

FY12

Q1 FY13

cash flow generation . . . |

12

. . . And when combined with leasing, creates a

significantly higher cash and liquidity position

Total Liquidity

178

261

100

145

140

160

78

116

262

227

0

50

100

150

200

250

300

350

400

450

31-Mar-10

31-Mar-11

31-Mar-12

30-Jun-12

Undrawn borrowing capacity

Cash

402

387 |

13

56

9

5

109

40

8

5

North America

Brazil, Peru,

Trinidad

Gulf of Guinea

Mid East, East Africa,

India, Bangladesh

Malaysia, Thailand

Indonesia

Australia

Small

Medium

Large

Total Opportunities *

. . . Which allows us to pursue the larger scope of growth

opportunities identified between FY13 and FY17

30

40

228

160

11

31

24

27

12

7

Europe

Russia / Caspian

69

20

10

33

3

5 |

14

Overall

activity

above pre-

2008 levels

•

The overall market both in terms of tender activity and pricing is

improving

•

North Sea tender activity remains at historic levels

•

Aircraft supply is tightening with significant search and rescue

(SAR) requirements (both governmental and O&G) and faster

Brazilian expansion

Brazil growth

accelerates

NABU

market

returning

•

Petrobras board approved 52 incremental aircraft through FY15

with a focus on heavy aircraft. First ten were awarded, of which

Lider will provide five, and a new bid is expected later this year

for the next tranche.

•

International demand outside of Brazil expected to be at least

equal to Brazilian demand suggesting further tightening of

supply/demand for large a/c

•

Most clients increasing activity in USGoM as rigs go back to

work

•

Eastern Canada new drilling activity increasing with Statoil,

ExxonMobil and Chevron

. . . With the market outlook even better in FY13 |

15

CONCLUSION:

Bristow enjoys the strongest balance sheet

in our industry with ample liquidity, cash flow and asset value

Ample

Liquidity with

underlying

asset value

Significant

Cash Flow

generation

•

Bristow generated 53% more operating cash flow in

FY12 compared to FY11. Operating cash flow in Q1

FY13 was 5% higher than Q1 FY12 and 48% higher

than the sequential Q4 FY12

•

Bristow closed Q1 FY13 with almost $400 million of

liquidity

•

Fair market value of aircraft is well above share price at

June 30, 2012

Prudent

Balance

Sheet

management

•

Adjusted Debt/Capital Ratio less than 45% with a BBB-

rating from Standard & Poor’s for secured debt

•

Operating lease strategy used to finance growth with a

competitive cost of capital |

16

The

“Growth

Price

Signal”

is

provided

by the commercial markets and outlook

for ANNUAL EPS Growth

Cash

Flow Yield

=

OCF

+

A/C

sales

–

Depreciation

Market Capitalization

We can provide a balanced return, but some years we

will “Go Faster”

depending on price signals

The

“Capital

Return

Price

Signal”

is

provided by the financial markets and

our current free cash flow yield

Today this equals 13.5 %*

FY13

EPS

Guidance:

$3.25

-

$3.55

FY12 –

FY13 EPS

Midpoint

Growth

9.0 %

=

*Trailing twelve months as of June 30, 2012

Conclusion:

Bristow

provides

investors

with

unique

combination of growth and balanced return |

17

Appendix |

18

Bristow’s asset values are resilient as there is strong

demand for helicopters outside of oil field services |

19

•

Europe represented 39% of Bristow operating

revenue and 42% of adjusted EBITDAR* in Q1

FY13

•

Operating revenue increased to $123.2M in Q1

FY13 from $108.3M in Q1 FY12 with the

addition of four large aircraft and increased

activity with new and existing contracts in the

UK and Norway

•

Adjusted EBITDAR increased to $39.7M in Q1

FY13 from $35.7M in Q1 FY12, while adjusted

EBITDAR margin remained relatively flat at

32.2% in Q1 FY13 versus 33.0% in Q1 FY12

•

Outlook:

•

Bristow is shortlisted for UK SAR program

with results to be announced in early 2013

•

High activity continues as demonstrated by

new awards for nine aircraft recently

announced. Additional awards are

anticipated next quarter.

FY13 adjusted EBITDAR margin

expected to be ~ low thirties

Europe (EBU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

20

West Africa (WASBU)

•

Nigeria represented 21% of Bristow operating

revenue and 22% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue of $66.4M in Q1 FY13 increased

27% from $52.3M in Q1 FY12 due to strong activity

and a 12% increase in flight hours compared to Q1

FY12

•

Adjusted EBITDAR increased to $21.2M in Q1 FY13

from $15.4M in Q1 FY12 with adjusted EBITDAR

margin of 32% in Q1 FY13 vs 30% in Q1 FY12

Outlook:

•

Improved service through Client Promise

initiative continues to drive strong results: Two

existing contracts extended with better pricing

and terms

•

Upcoming heavy maintenance on several

aircraft will impact Q2 and Q3 FY13

•

We continue to work on optimizing the

operating model in this business unit as part

of the local content initiative

FY13 adjusted EBITDAR margin expected

to be ~ low thirties

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

21

•

•

North America represented 17% of Bristow operating

revenue and 13% of adjusted EBITDAR* in Q1 FY13

•

Adjusted EBITDAR doubled to $12.2M in Q1 FY13 vs.

$6.3M in Q1 FY12 and adjusted EBITDAR margin was

23.2% in Q1 FY13 versus 14.3% in Q1 FY12

•

Sequential improvement of almost 50% in adjusted

EBITDAR from $8.2M in Q4 FY12 to $12.2M in the

current quarter

•

Business model performed with key parameters

significantly better; several mid-teen price increases;

large aircraft working and costs contained

Outlook:

•

Our business is improving in FY13 similar to other

oil

service

sector

recoveries

-

more

rigs,

more

people, and more investment

•

Client Promise initiative continues to deliver

positive results

FY13 adjusted EBITDAR expected to be ~ low

twenties

North America (NABU)

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. |

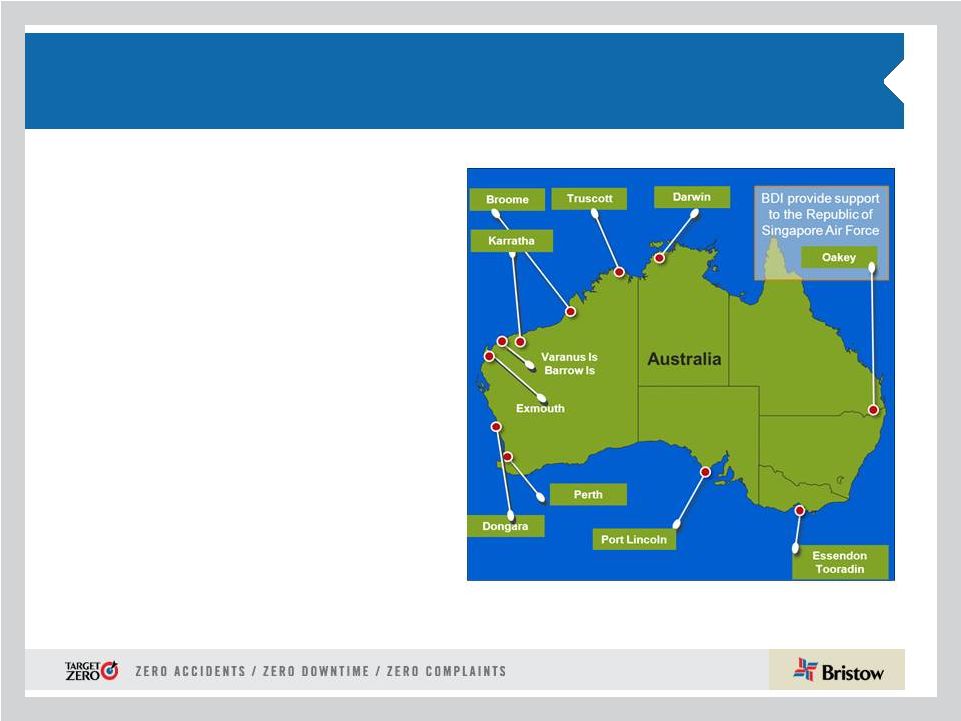

22

Australia (AUSBU)

•

Australia represented 12% of Bristow operating

revenue and 11% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue of $38.2M in Q1 FY13 decreased

from $40.9M in Q1 FY12 due to a decrease in overall

flight activity

•

Adjusted EBITDAR increased to $10.3M in Q1 FY13

from $8.3M in Q1 FY12 and adjusted EBITDAR

margin increased to 27.0% in Q1 FY13 from 20.2% in

Q1 FY12 reflecting better asset utilization along with

lower operating costs

Outlook:

•

INPEX award of a ten-year contract for up to

six large aircraft with an option to add a long

term SAR aircraft with the start date in FY14

•

Aircraft

will

be

redeployed

as

short-

term

contracts roll off; will impact performance in Q2

and Q3 FY13

•

An additional medium aircraft contract award

with improved terms

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. FY13 adjusted EBITDAR margin expected

to be ~ mid to high twenties |

23

Other International (OIBU)

•

Other International represented 11% of Bristow operating revenue

and 12% of adjusted EBITDAR* in Q1 FY13

•

Operating revenue decreased to $33.2M in Q1 FY13 vs. $34.5M

in Q1 FY12 due to decrease in activity in Ghana and the end of a

contract in the Baltic Sea

•

Adjusted EBITDAR margin of 36.2% in Q1 FY13 decreased from

48.1% in Q1 FY12 due primarily to decreased earnings from

unconsolidated affiliates (particularly Lider in Brazil), activity

reduction in Mexico, and increased operating costs in Trinidad

•

Lider equity earnings decreased to $0.0M in Q1 FY13 compared

to $2.7M in Q1 FY12

* Operating revenue and adjusted EBITDAR percentages exclude corporate and

other. Outlook:

•

•

•

FY13 adjusted EBITDAR margin expected to be ~ low

to mid forties

Potential new opportunities in Caspian, East Africa, Southeast Asia

and the Caribbean

Petrobras awarded Lider contracts for five new large aircraft, with

one leased by Bristow to Lider, with operations scheduled to

commence starting in August 2012 through April 2013

Lider’s second half of the year is expected to be better than the

first half as operations under new contracts begin. Currency

fluctuations

make

it

difficult

to

predict

if

this

will

translate

into

higher

equity earnings |

24

Organizational

chart

-

as

of

June

30,

2012

Business Unit

(% of FY13 Operating Revenue)

Corporate

Region

( # of Aircraft / # of Locations)

Joint Venture

(# of aircraft)

Key

Operated Aircraft

Bristow owned and/or operated

357 aircraft as of June 30, 2012

Affiliated Aircraft

Bristow affiliates and joint

ventures operated 194 aircraft

as of June 30, 2012

Bristow

NABU

16%

U.S. GoM

–

79/7

Trinidad

–

10

/1

Alaska

–

12/3

Mexico

–

12/5

Brazil –10/9

Lider

-

85

UK –32/4

Norway

–

26/3

FBH -

64

Nigeria

–

45/7

Australia

–28/10

Other

–

12/1

Russia

–

7/3

Egypt

–

–/–

Turkmenistan

–

2/1

PAS

-

45

AUSBU

12%

EBU

39%

Florida

–

58/1

Louisiana

–

14/1

U.K. –

5/1

Malaysia

–

5/2

WASBU

21%

OIBU

10%

BRS Academy

2% |

25

Aircraft fleet –

medium and large

as of June 30, 2012

Next Generation Aircraft

Medium capacity 12-16 passengers

Large capacity 18-25 passengers

Mature Aircraft Models

Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Large Helicopters

AS332L Super Puma

18

Twin Turbine

23

-

23

-

AW189

16

Twin Turbine

-

-

-

6

EC225

25

Twin Turbine

18

-

18

-

Mil MI 8

20

Twin Turbine

7

-

7

-

Sikorsky S-61

18

Twin Turbine

2

-

2

-

Sikorsky S-92

19

Twin Turbine

32

4

36

11

82

4

86

17

LACE

76

Medium Helicopters

AW139

12

Twin Turbine

7

2

9

-

Bell 212

12

Twin Turbine

1

14

15

-

Bell 412

13

Twin Turbine

34

20

54

-

EC155

13

Twin Turbine

3

-

3

-

Sikorsky S-76A/A++

12

Twin Turbine

15

5

20

-

Sikorsky S-76C/C++

12

Twin Turbine

52

31

83

-

112

72

184

-

LACE

51 |

26

Aircraft fleet –

small, training and fixed

as of June 30, 2012 (continued)

Next Generation Aircraft

Mature Aircraft Models

Small capacity 4-7 passengers

Training capacity 2-6 passengers

•LACE does not include held for sale, training and fixed wing

helicopters Aircraft

Type

No. of PAX

Engine

Consl

Unconsl

Total

Ordered

Small Helicopters

Bell 206B

4

Turbine

1

2

3

-

Bell 206 L-3

6

Turbine

4

6

10

-

Bell 206 L-4

6

Turbine

29

1

30

-

Bell 407

6

Turbine

39

-

39

-

BK 117

7

Twin Turbine

2

-

2

-

BO-105

4

Twin Turbine

2

-

2

-

EC135

7

Twin Turbine

6

3

9

-

83

12

95

-

LACE

21

Training Helicopters

AW139

12

Twin Turbine

-

3

3

-

Bell 412

13

Twin Turbine

-

8

8

-

Bell 212

12

Twin Turbine

-

15

15

-

AS355

4

Twin Turbine

5

-

5

-

AS350BB

4

Turbine

-

36

36

-

Agusta 109

8

Twin Turbine

-

2

2

-

Bell 206B

6

Single Engine

12

-

12

-

Robinson R22

2

Piston

12

-

12

-

Robinson R44

2

Piston

2

-

2

-

Sikorsky 300CB/Cbi

2

Piston

45

-

45

-

Fixed Wing

1

-

1

-

77

64

141

-

Fixed Wing

3

42

45

-

Total

357

194

551

17

TOTAL LACE (Large Aircraft Equivalent)

147 |

27

#

Helicopter

Class

Delivery Date

Location

Contracted

#

Helicopter

Class

Delivery Date

3

Large

December 2012

EBU

3

1

Large

September 2013

2

Large

December 2012

WASBU

0

1

Large

December 2013

2

Large

March 2013

EBU

2

1

Large

March 2014

1

Large

September 2013

EBU

0

1

Large

June 2014

1

Large

September 2013

NABU

0

1

Large

September 2014

2

Large

December 2013

OIBU

0

1

Large

December 2014

1

Large

September 2014

NABU

0

1

Large

March 2015

1

Large

December 2014

OIBU

0

2

Large

June 2015

1

Large

March 2015

OIBU

0

2

Large

September 2015

1

Large

June 2015

EBU

0

2

Large

December 2015

1

Large

March 2016

EBU

0

1

Large

March 2016

1

Large

June 2016

AUSBU

0

2

Large

June2016

17

5

2

Large

September 2016

2

Large

December 2016

* Six large ordered aircraft expected to enter service beginning

1

Large

March 2017

in calendar year 2014 are subject to the successful development

1

Large

June 2017

and certification of the aircraft.

1

Large

September 2017

1

Large

December 2017

1

Medium

June 2013

4

Medium

December 2013

3

Medium

June 2014

2

Medium

September 2014

2

Medium

June 2015

36

ORDER BOOK*

OPTIONS BOOK

Order and options book as of June 30, 2012 |

28

Consolidated fleet changes and aircraft sales for

Q1 FY13

Q 1 FY13

Fleet Count Beginning Period

361

Delivered

S-92

2

Total Delivered

2

Removed

Sales

(4)

Other*

(2)

Total Removed

(6)

357

* Includes destroyed aircraft, lease returns

and commencements

Fleet changes

EBU

WASBU

NABU

AUSBU

OIBU

Total

Large

3

-

-

3

-

6

Medium

2

1

-

1

7

11

Small

-

-

-

-

-

-

Total

5

1

-

4

7

17

Aircraft held for sale by BU

Large

8

-

2

1

-

-

11

Medium

-

1

11

-

-

-

12

Small

-

-

1

2

-

-

3

Fixed

-

-

-

-

-

-

-

Training

-

-

-

-

-

30

30

Total

8

1

14

3

-

30

56

Leased aircraft in consolidated fleet

EBU

WASBU

NABU

AUSBU

OIBU

BA

Total

# of A/C Sold

Received*

Q1 FY13

4

19

$

Totals

4

19

$

* $ in millions |

29

Operating revenue

LACE

LACE Rate

2, 3

EBU

$123.2

47

$10.60

WASBU

66.4

22

12.35

NABU

52.6

30

7.05

AUSBU

38.2

18

8.48

OIBU

4

33.2

32

4.22

Total

$313.6

147

$8.55

Operating Revenue, LACE, and LACE Rate by BU

as of June 30, 2012

Operating Revenue, LACE and LACE Rate by BU

1) $ in millions

2) LACE Rate is annualized

3) $ in millions per LACE

4) OIBU LACE rate is lower than other business units’ LACE rate due to a large proportion of

revenue being from dry leases 1 |

30

Adjusted EBITDAR margin* trend

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

EBU

31.2%

31.7%

31.9%

28.0%

30.8%

29.8%

31.5%

34.6%

34.4%

32.7%

WASBU

31.7%

36.8%

33.7%

39.1%

36.0%

33.7%

36.9%

35.8%

34.3%

35.2%

NABU

18.3%

20.0%

14.9%

17.7%

17.8%

20.8%

25.8%

15.9%

8.5%

18.5%

AUSBU

26.5%

36.7%

34.4%

31.3%

32.4%

33.2%

26.1%

27.0%

31.1%

29.3%

OIBU

34.4%

37.6%

25.9%

25.1%

31.0%

18.3%

40.2%

37.4%

59.4%

39.3%

Consolidated

24.7%

27.8%

24.7%

23.9%

25.3%

23.8%

27.5%

25.9%

29.6%

26.7%

2013

Q1

Q2

Q3

Q4

Full Year

Q1

EBU

33.0%

31.4%

30.7%

36.1%

32.9%

32.2%

WASBU

29.5%

35.5%

37.2%

36.6%

35.0%

31.9%

NABU

14.3%

20.6%

14.8%

19.4%

17.3%

23.2%

AUSBU

20.2%

14.4%

23.5%

35.6%

24.3%

27.0%

OIBU

48.1%

19.1%

47.8%

42.9%

39.5%

36.2%

Consolidated

23.4%

24.0%

27.6%

31.2%

26.6%

26.3%

2010

2011

2012

* Adjusted EBITDAR excludes special items and asset dispositions and calculated by taking adjusted

EBITDAR divided by operating revenue |

31

Adjusted EBITDAR* reconciliation

* Adjusted EBITDAR excludes special items and asset dispositions

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Q2

Q3

Q4

Full Year

Net income

$24.0

$33.7

$27.1

$28.7

$113.5

$20.9

$38.8

$42.3

$31.2

$133.3

Income tax expense

9.5

11.2

5.7

2.6

29.0

8.5

3.3

-11.8

7.1

7.1

Interest expense

10.0

10.6

11.0

10.8

42.4

11.0

11.5

13.8

9.9

46.2

Gain on disposal of assets

-6.0

-4.9

-2.4

-5.3

-18.7

-1.7

-1.9

0.0

-5.1

-8.7

Depreciation and amortization

18.2

18.5

20.7

17.4

74.7

19.3

21.0

21.3

27.7

89.4

Special items

2.6

-2.5

-1.1

1.0

0.0

0.0

0.0

-1.2

2.4

1.2

EBITDA Subtotal

58.2

66.7

60.9

55.1

240.9

58.1

72.7

64.4

73.3

268.5

Rental expense

7.0

7.0

7.2

6.3

27.3

6.6

6.1

8.7

7.7

29.2

Adjusted EBITDAR

$65.2

$73.6

$68.1

$61.3

$268.2

$64.7

$78.8

$73.1

$81.1

$297.7

3/31/2013

($ in millions)

Q1

Q2

Q3

Q4

Full Year

Q1

Net income

$21.2

$3.0

$26.5

$14.6

$65.2

$24.2

Income tax expense

6.6

-1.9

7.1

2.4

14.2

6.2

Interest expense

9.0

9.5

9.8

10.0

38.1

8.8

Gain on disposal of assets

-1.4

1.6

2.9

28.6

31.7

5.3

Depreciation and amortization

22.7

25.4

22.7

25.3

96.1

21.4

Special items

0.0

24.6

0.0

3.4

28.1

2.2

EBITDA Subtotal

58.1

62.1

68.9

84.3

273.4

68.0

Rental expense

9.0

9.1

12.8

15.1

46.0

16.3

Adjusted EBITDAR

$67.0

$71.2

$81.8

$99.5

$319.5

$84.3

3/31/2010

3/31/2011

3/31/2012

Fiscal year ended

Fiscal year ended |

32

Bristow Value Added (BVA)

Sample calculation

* Reconciliation for these items on following two

pages ** Quarterly capital charge of 2.625% is based on annual

capital charge of 10.5% Bristow Value Added = Gross Cash Flow –

(Gross Operating Assets X Capital Charge)

BVA

=

GCF

-

(

GOA

X

10.5%**

)

Bristow Value Added calculation for Q1 FY12

($15.4)

=

$60*

-

(

$2,874*

X

2.625%**

)

Bristow Value Added calculation for Q1 FY13

$1.9

=

$80*

-

(

$2,976*

X

2.625%**

) |

33

Gross cash flow presentation

($ in millions)

Gross Cash Flow Reconciliation

Q1 FY12

Q1 FY13

Net Income

$21

$24

Depreciation and Amortization

23

21

Interest Expense

9

9

Interest Income

(0)

(0)

Rent

9

16

Other Income/expense-net

(0)

1

Gain/loss on Asset Sale

(1)

5

Special Items

0

2

Tax Effect from Special Items

0

(2)

Earnings (losses) from Unconsolidated Affiliates, Net

(6)

(2)

Non-controlling Interests

0

1

Gross Cash Flow before Lider

$54

$75

Gross Cash Flow -

Lider proportional

6

5

Gross Cash Flow after Lider

$60

$80

Special items:

FY13 includes: $2.2m special charge for severance costs related to the termination of a contract

in the Southern North Sea |

34

Gross operating asset presentation

($ in millions)

Adjusted Gross Operating Assets Reconciliation

Q1 FY12

Q1 FY13

Total Assets

$2,701

$2,740

Accumulated Depreciation

463

468

Capitalized Operating Leases

136

194

Cash and Cash Equivalents

(117)

(227)

Investment in Unconsolidated Entities

(210)

(201)

Goodwill

(30)

(29)

Intangibles

(7)

(4)

Assets Held for Sale: Net

(34)

(18)

Assets Held for Sale: Gross

77

86

Adj. for gains & losses on assets sales

(0)

116

Accounts Payable

(51)

(58)

Accrued Maintenance and Repairs

(11)

(16)

Other Accrued Taxes

(4)

(7)

Accrued Wages, Benefits and Related Taxes

(33)

(43)

Other Accrued Liabilities

(18)

(27)

Income Taxes Payable

(16)

(10)

Deferred Revenue

(9)

(13)

ST Deferred Taxes

(10)

(15)

LT Deferred Taxes

(155)

(142)

Adjusted Gross Operating Assets before Lider

$2,672

$2,794

Adjusted Gross Operating Assets -

Lider proportional

202

182

Adjusted Gross Operating Assets after Lider

$2,874

$2,976 |

35

GAAP reconciliation

(i)

These amounts are presented after applying the appropriate tax effect to each item

and dividing by the weighted average shares outstanding during the related

period to calculate the earnings per share impact. Three Months Ended

June 30,

2012

2011

(In thousands, except per

share amounts)

Adjusted operating income

Gain (loss) on disposal of assets

Severance costs for termination of a contract

Operating income

Adjusted EBITDAR

Gain (loss) on disposal of assets

Severance costs for termination of a contract

Depreciation and amortization

Rent expense

Interest expense

Provision for income taxes

Net income

Adjusted net income

$

Gain (loss) on disposal of assets

(i)

Severance costs for termination of a contract

(i)

Net income attributable to Bristow Group

$

Adjusted diluted earnings per share

Gain (loss) on disposal of assets

(i)

Severance costs for termination of a contract

(i)

Diluted earnings per share

$

47,470

$

34,989

(5,315)

1,416

(2,162)

$

84,273

$

67,025

(5,315)

1,416

(2,162)

(21,372)

(22,708)

(16,274)

(8,953)

(8,774)

(8,955)

(6,180)

(6,606)

$

$

$

39,993

$

36,405

24,196

21,219

29,618

$

19,878

(4,234)

1,167

(1,722)

$

23,662

21,045

$

0.81

(0.12)

(0.05)

0.65

$

0.54

0.03

—

0.57

—

—

— |

36

Leverage reconciliation

*Adjusted EBITDAR exclude gains and losses on dispositions of assets

Debt

Investment

Capital

Leverage

(a)

(b)

(c) = (a) + (b)

(a) / (c)

(in millions)

As of June 30, 2012

736.3

$

1,540.7

$

2,277.0

$

32.3%

Adjust for:

Unfunded pension liability

109.8

109.8

NPV of all lease obligations

217.0

217.0

Letters of credit

1.5

1.5

Adjusted

1,064.6

$

(d)

1,540.7

$

2,605.3

$

40.9%

Calculation of debt to adjusted EBITDAR multiple

Adjusted EBITDAR*:

FY 2012

336.8

$

(e)

Annualized

449.1

$

= (d) / (e)

3.16:1 |

37

Bristow Group Inc. (NYSE: BRS)

2103

City

West

Blvd.,

4

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact us

th |