Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - China Hefeng Rescue Equipment, Inc. | f10q0612ex32i_chinahefeng.htm |

| EX-31.1 - CERTIFICATION - China Hefeng Rescue Equipment, Inc. | f10q0612ex31i_chinahefeng.htm |

| EX-32.2 - CERTIFICATION - China Hefeng Rescue Equipment, Inc. | f10q0612ex32ii_chinahefeng.htm |

| EX-31.2 - CERTIFICATION - China Hefeng Rescue Equipment, Inc. | f10q0612ex31ii_chinahefeng.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2012

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission file number: 000-54224

CHINA HEFENG RESCUE EQUIPMENT, INC.

(Exact name of Registrant as Specified in its Charter)

|

Delaware

|

80-0654192

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification Number)

|

No. 88, Taishan Street

Beigang Industrial Zone

Longgang District, Huludao

Liaoning Province, China

(Address of Principal Executive Offices)

(86) 0429-3181998

(Registrant's Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

As of June 28, 2012, the registrant had 33,600,000 shares of common stock outstanding.

CHINA HEFENG RESCUE EQUIPMENT, INC.

INDEX

|

Page

|

||

|

PART I – FINANCIAL INFORMATION

|

||

|

Item 1.

|

Financial Statements.

|

i

|

|

Consolidated Balance Sheets as of June 30, 2012 and December 31, 2011

|

F-1, F-2

|

|

|

Consolidated Statements of Income and Comprehensive Income for the Three and Six Months Ended June 30, 2012 and 2011 (Unaudited)

|

F-3, F-4

|

|

|

Consolidated Statement of Changes in Stockholders’ Equity for the Six Months Ended June 30, 2012 (Unaudited)

|

F-5

|

|

|

Consolidated Statements of Cash Flows for the Six Months Ended June 30, 2012 and 2011 (Unaudited)

|

F-6, F-7

|

|

|

Notes to Consolidated Financial Statements

|

F-8 - F-27

|

|

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

2

|

|

Item 3.

|

Quantitative And Qualitative Disclosures About Market Risk.

|

15

|

|

Item 4.

|

Controls and Procedures.

|

15

|

|

PART II – OTHER INFORMATION

|

||

|

Item 1.

|

Legal Proceedings.

|

16

|

|

Item 1A.

|

Risk Factors.

|

16

|

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds.

|

16

|

|

Item 3.

|

Defaults Upon Senior Securities.

|

16

|

|

Item 4.

|

Mine Safe Disclosures.

|

16

|

|

Item 5.

|

Other Information.

|

16

|

|

Item 6.

|

Exhibits.

|

16

|

|

SIGNATURES

|

17

|

|

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

In the opinion of management, the accompanying unaudited financial statements included in this Form 10-Q reflect all adjustments (consisting only of normal recurring accruals) necessary for a fair presentation of the results of operations for the periods presented. The results of operations for the periods presented are not necessarily indicative of the results to be expected for the full year.

CHINA HEFENG RESCUE

EQUIPMENT, INC. AND SUBSIDIARIES

Consolidated Financial Statements for the

Three and Six Months ended June 30, 2012 and 2011

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED FINANCIAL STATEMENTS

|

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011

|

|

CONTENTS

|

PAGE

|

|

CONSOLIDATED FINANCIAL STATEMENTS:

|

|

|

Consolidated Balance Sheets

|

F-1

|

|

Consolidated Statements of Income and Other Comprehensive Income

|

F-3

|

|

Consolidated Statement of Changes in Stockholders’ Equity

|

F-5

|

|

Consolidated Statements of Cash Flows

|

F-6

|

|

Notes to the Consolidated Financial Statements

|

F-8

|

i

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

JUNE 30, 2012 AND DECEMBER 31, 2011 (IN U.S.$)

|

|

ASSETS

|

June 30,

2012

|

December 31,

2011

|

||||||

|

(Unaudited)

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 4,968,409 | $ | 3,130,799 | ||||

|

Accounts receivable

|

190,473 | 366,671 | ||||||

|

Deferred income taxes

|

43,642 | 34,809 | ||||||

|

Prepaid expenses and other current assets

|

68,659 | 49,926 | ||||||

|

Total current assets

|

5,271,183 | 3,582,205 | ||||||

|

Fixed Assets

|

73,412 | 71,301 | ||||||

|

Less: accumulated depreciation

|

(41,849 | ) | (29,943 | ) | ||||

|

Fixed Assets, net

|

31,563 | 41,358 | ||||||

|

TOTAL ASSETS

|

$ | 5,302,746 | $ | 3,623,563 | ||||

See accompanying notes to the consolidated financial statements.

F-1

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

|

JUNE 30, 2012 AND DECEMBER 31, 2011 (IN U.S.$)

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

June 30,

2012

|

December 31,

2011

|

||||||

|

(Unaudited)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 393,420 | $ | 708,742 | ||||

|

Advances from customers

|

162,788 | 3,535 | ||||||

|

Deferred revenue

|

174,567 | 139,236 | ||||||

|

Loan from stockholders

|

39,533 | 161,765 | ||||||

|

Payroll payable

|

95,754 | 93,679 | ||||||

|

Tax payables

|

400,950 | 296,131 | ||||||

|

Accrued expenses

|

17,665 | 34,953 | ||||||

|

Total current liabilities

|

1,284,677 | 1,438,041 | ||||||

|

Stockholders’ equity:

|

||||||||

|

Common stock, $.0001 Par; 300,000,000 shares authorized;

|

||||||||

|

33,600,000 and 31,920,000 shares issued and outstanding as of

June 30, 2012 and December 31, 2011 respectively

|

3,360 | 3,192 | ||||||

|

Additional paid-in capital

|

96,175 | 96,343 | ||||||

|

Retained earnings

|

3,613,492 | 1,900,480 | ||||||

|

Statutory reserve fund

|

35,031 | 35,031 | ||||||

|

Other comprehensive income

|

74,785 | 41,397 | ||||||

|

Stockholders’ equity before noncontrolling interests

|

3,822,843 | 2,076,443 | ||||||

|

Noncontrolling interests

|

195,226 | 109,079 | ||||||

|

Total Stockholders’ equity

|

4,018,069 | 2,185,522 | ||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$ | 5,302,746 | $ | 3,623,563 | ||||

See accompanying notes to the consolidated financial statements.

F-2

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

|

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED) (IN U.S.$)

|

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

2012

|

2011

|

||||||||||||

|

Service revenue

|

$ |

776,241

|

$ |

976,108

|

$ |

1,448,090

|

$ |

2,049,870

|

||||||||

|

Cost of service

|

(500,760

|

)

|

(623,565

|

)

|

(978,333

|

)

|

(1,219,256

|

)

|

||||||||

|

Gross profit

|

275,481

|

352,543

|

469,757

|

830,614

|

||||||||||||

|

Commission - manufactures

|

1,881,701

|

574,646

|

3,495,022

|

774,609

|

||||||||||||

|

Rental commissions – related party

|

40,488

|

-

|

64,031

|

-

|

||||||||||||

|

Cost of commissions

|

(687,569

|

)

|

(234,969

|

)

|

(1,335,948

|

)

|

(380,705

|

)

|

||||||||

|

Commission income-net

|

1,234,620

|

339,677

|

2,223,105

|

393,904

|

||||||||||||

|

Gross profit and commission income-net

|

1,510,101

|

692,220

|

2,692,862

|

1,224,518

|

||||||||||||

|

Operating expenses

|

||||||||||||||||

|

Selling and marketing

|

(31,742

|

)

|

(13,361

|

)

|

(75,930

|

)

|

(25,740

|

)

|

||||||||

|

General and administrative

|

(148,892

|

)

|

(31,116

|

)

|

(226,789

|

)

|

(58,284

|

)

|

||||||||

|

Total operating expenses

|

(180,634

|

)

|

(44,477

|

)

|

(302,719

|

)

|

(84,024

|

)

|

||||||||

See accompanying notes to the consolidated financial statements.

F-3

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME AND OTHER COMPREHENSIVE INCOME

|

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED) (IN U.S.$)

|

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

|

2012

|

2011

|

2012

|

2011

|

||||||||||||

|

Income before income taxes

|

1,329,467 | 647,743 | 2,390,143 | 1,140,494 | ||||||||||||

|

Provision for income taxes

|

325,229 | 162,514 | 590,984 | 286,382 | ||||||||||||

|

Net income before noncontrolling interests

|

1,004,238 | 485,229 | 1,799,159 | 854,112 | ||||||||||||

|

Noncontrolling interests

|

(48,654 | ) | (24,377 | ) | (86,147 | ) | (42,957 | ) | ||||||||

|

Net income attributable to common stockholders

|

955,584 | 460,852 | 1,713,012 | 811,155 | ||||||||||||

|

Other comprehensive income:

|

||||||||||||||||

|

Foreign currency translation adjustment

|

4,561 | 18,558 | 33,388 | 31,342 | ||||||||||||

|

Total comprehensive income

|

$ | 960,145 | $ | 479,410 | $ | 1,746,400 | $ | 842,497 | ||||||||

|

Earnings per common share, basic and diluted

|

$ | 0.03 | $ | 0.01 | $ | 0.05 | $ | 0.03 | ||||||||

|

Weighted average shares outstanding, basic and diluted

|

32,218,667 | 31,920,000 | 32,069,333 | 31,920,000 | ||||||||||||

See accompanying notes to the consolidated financial statements.

F-4

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

|

FOR THE SIX MONTHS ENDED JUNE 30, 2012 (UNAUDITED) (IN U.S.$)

|

|

Common

Stock

|

Additional Paid in Capital

|

Retained Earnings

|

Noncontrolling Interests

|

Statutory

Reserve Fund

|

Other Comprehensive Income

|

Total

|

||||||||||||||||||||||

|

Balance, December 31, 2011

|

$ | 3,192 | $ | 96,343 | $ | 1,900,480 | $ | 109,079 | $ | 35,031 | $ | 41,397 | $ | 2,185,522 | ||||||||||||||

|

Reverse merger adjustment

|

168 | (168 | ) | - | - | - | - | - | ||||||||||||||||||||

|

Net Income

|

- | - | 1,713,012 | 86,147 | - | 1,799,159 | ||||||||||||||||||||||

|

Other Comprehensive Income

|

- | - | - | - | - | 33,388 | 33,388 | |||||||||||||||||||||

|

Balance, June 30, 2012

|

$ | 3,360 | $ | 96,175 | $ | 3,613,492 | $ | 195,226 | $ | 35,031 | $ | 74,785 | $ | 4,018,069 | ||||||||||||||

See accompanying notes to the consolidated financial statements.

F-5

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

FOR THE SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED) (IN U.S.$)

|

|

2012

|

2011

|

|||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$ | 1,799,159 | $ | 854,112 | ||||

|

Adjustment to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation

|

11,689 | 10,830 | ||||||

|

Deferred income taxes

|

(8,833

|

) |

(13,350

|

) | ||||

|

Change in operating assets and liabilities:

|

||||||||

|

Decrease (increase) in accounts receivable

|

176,198 | (70,622 | ) | |||||

|

(Increase) in prepaid expenses and other current assets

|

(18,733 | ) | (19,688 | ) | ||||

|

(Decrease) increase in accounts payable

|

(315,322 | ) | 84,845 | |||||

|

Increase (decrease) in advance from customer

|

159,253 | (92,200 | ) | |||||

|

Increase in deferred revenue

|

35,331 | 53,397 | ||||||

|

Increase in tax payables

|

104,819

|

36,143

|

||||||

|

Increase in payroll payables

|

2,075 | 29,836 | ||||||

|

(Decrease) increase in accrued expenses

|

(17,288 | ) | 711 | |||||

|

Net cash provided by operating activities

|

1,928,348 | 874,014 | ||||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from stockholder loans

|

16,372 | 4,581 | ||||||

|

Repayment of stockholder loans

|

(138,688 | ) | (55,762 | ) | ||||

|

Net cash (used in) financing activities

|

(122,316 | ) | (51,181 | ) | ||||

|

Cash flows from investing activities:

|

||||||||

|

Purchase of fixed assets

|

(1,611 | ) | (5,497 | ) | ||||

|

Effect of exchange rate changes on cash

|

33,189 | 21,808 | ||||||

|

Net increase in cash

|

1,837,610 | 839,144 | ||||||

|

Cash, beginning

|

3,130,799 | 1,519,088 | ||||||

|

Cash, end

|

$ | 4,968,409 | $ | 2,358,232 | ||||

See accompanying notes to the consolidated financial statements.

F-6

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

|

FOR THE SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED) (IN U.S.$)

|

|

2012

|

2011

|

|||||||

|

Supplemental disclosure of cash flow information:

|

||||||||

|

Cash paid for income taxes

|

$ | 497,564 | $ | 268,605 | ||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

See accompanying notes to the consolidated financial statements.

F-7

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

1. ORGANIZATION

On August 1, 2012, China Hefeng Rescue Equipment, Inc. (formally known as Bridgeway Acquisition Corp., the “Company”) filed an amendment to change its name from “Bridgeway Acquisition Corp.” to “China Hefeng Rescue Equipment, Inc.” Bridgeway was incorporated in the State of Delaware on October 22, 2010. Since inception until the closing of the Exchange Agreement, the Company has been a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business.

Dragons Soaring Limited (“Dragons”), incorporated in the Territory of the British Virgin Islands (“BVI”) on December 2, 2011, was formed for the purposes of effecting a merger, capital stock exchange, stock purchase, reorganization or similar business combination with one or more businesses.

On January 5, 2012, Dragons acquired 10,000 shares, 100% of the issued and outstanding shares at $1.00 per share of Huashi International Holding Group Limited (“Huashi International”), a company incorporated in Hong Kong on August 10, 2010. Huashi International became a wholly-owned subsidiary of Dragons.

On June 15, 2012, we completed a reverse acquisition transaction through a share exchange with Dragons Soaring and its shareholders, or the “Shareholders,” whereby we acquired 100% of the issued and outstanding capital stock of Dragons Soaring in exchange for 31,920,000 shares of our Common Stock which constituted 95% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Dragons Soaring became our wholly-owned subsidiary and the former Stockholders of Dragons Soaring became our controlling stockholders. The amount of consideration received by the shareholders of Dragons Soaring was determined on the basis of arm’s-length negotiations between Dragons Soaring and Bridgeway. The share exchange transaction with Dragons Soaring and the Stockholders was treated as a reverse acquisition, with Dragons Soaring as the acquirer and Bridgeway as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Dragons Soaring and its consolidated subsidiaries and variable interest entities (“VIE’s”).

F-8

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

1. ORGANIZATION (continued)

Immediately prior to the Share Exchange, the common stock of Dragons Soaring was owned by the following persons in the indicated percentages: Baoyuan Zhu (24.8%); Jianjun Gao (4.8%); Xiaoran Zhang (4.9%); Zhenxing Liu (4.5%); Kun Liu (4.5%); Weiwei Wang (4.00%), Jiujie Xu (4.6%), Ming Cheng (4.0%), Shuangsheng Li (3.8%), Jianfeng Zhang (4.2%), Jing Wang (4.3%), Ping Li (4.1%), Yan Zhang (4.9%), Shuangfei Zhai (4.3%), Wenqin Duan (4.8%), Qiaoli Zhang (4.9%), Xiaoqin Zheng (3.8%) and Li Yi (4.8%).

On June 15, 2012, Keri B. Bosch, our former President, Treasurer, Secretary and sole director, submitted a resignation letter pursuant to which she resigned from all offices that she held and as a director, effective upon the closing of the Exchange Agreement. In addition, on June 15, 2012 our board of directors made the following actions: (a) Baoyuan Zhu was appointed as Chairman of our board of directors; (b) Zhengyuan Yan and JianjunGao were appointed as members of our board of directors; (c) Zhengyuan Yan was appointed to serve as Chief Executive Officer; and (d) Wenqi Yao was appointed to serve as Chief Financial Officer of the Company.

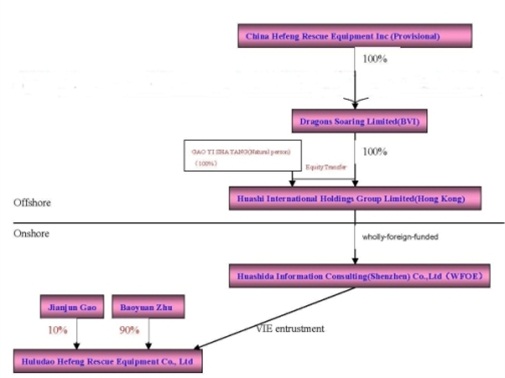

As a result of the acquisition of Dragons Soaring, the Company now owns all of the issued and outstanding capital stock of Dragons Soaring, which in turn owns all of the issued and outstanding capital stock of Huashi International, which in turn owns all of the issued and outstanding capital stock of Huashida Consulting. In addition, we effectively and substantially control Huludao Rescue through a series of captive agreements with Huashida Consulting.

Huludao Hefeng Rescue Equipment Co., Ltd. (“Huludao Rescue”) is an entity in the Peoples’ Republic of China (“PRC”) formed on May 11, 2010 with registered capital of $73,200. Huludao Rescue specializes in designing rescue equipment and security monitoring systems, provides product maintenance, and personnel training for product users. Huludao Rescue also introduces customers to rescue equipment manufacturers for rescue equipment purchases and rentals. Huludao Rescue’s main products are the design of rescue equipment and security monitoring systems, which are used for workers in underground mines until rescued when there is a mining accident.

On January 3, 2012, Huashida Information Consulting (Shenzhen) Co. Ltd. (“Huashida Consulting” or “WFOE”), a wholly-owned subsidiary of Huashi International entered into a series of contractual arrangements (“VIE agreements”). The VIE agreements include (i) an Exclusive Technical Service and Business Consulting Agreement; (ii) a Proxy Agreement, (iii) Share Pledge Agreement and, (iv) Call Option Agreement with shareholders of Huludao Rescue.

F-9

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

1. ORGANIZATION (continued)

Exclusive Technical Service and Business Consulting Agreement: Pursuant to the Exclusive Technical Service and Business Consulting Agreement, the WFOE will provide technical support, consulting, training, marketing and operation consulting services to Huludao Rescue. In consideration for such services, Huludao Rescue has agreed to pay an annual service fee to the WFOE in an amount equal 95% of Huludao Rescue’s annual net income with an additional payment of approximately US$15,800 (RMB 100,000) each month. The Agreement has an unlimited term and only can be terminated upon the written notices agreed to by both parties.

Proxy Agreement: Pursuant to the Proxy Agreement, the shareholders of Huludao Rescue agree to irrevocably entrust the WFOE to designate a qualified person acceptable under PRC law and foreign investment policies, part or all of the equity interests in Huludao Rescue held by the stockholders of Huludao Rescue. The Agreement has an unlimited term and only can be terminated upon the written notices agreed to by both parties.

Share Pledge Agreement: Pursuant to the Share Pledge agreement, each of the stockholders of Huludao Rescue pledged their shares in Huludao Rescue, respectively, to the WFOE, to secure their obligations under the Exclusive Technical Service and Business Consulting Agreement. In addition, the stockholders of Huludao Rescue agreed not to transfer, sell, pledge, dispose of or create any encumbrance on their interests in Huludao Rescue that would affect the WFOE’s interests. This Agreement remains effective until the obligations under the Exclusive Technical Service and Business Consulting Agreement, Call Option Agreement and Proxy Agreement have been fulfilled.

Call Option Agreement: Pursuant to the Call Option agreement, the WFOE has an exclusive option to purchase, or to designate a purchaser, to the extent permitted by PRC law and foreign investment policies, part or all of the equity interests in Huludao Rescue held by each of the stockholders. To the extent permitted by PRC laws, the purchase price for the entire equity interest is approximately US$0.16 (RMB1.00) or the minimum amount required by PRC law or government practice. This Agreement remains effective until all the call options under the Agreement have been transferred to Huashida Consulting or its designated entities or natural persons.

As a result of the entry into the foregoing agreements, the Company has a corporate structure which is set forth below:

F-10

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

1. ORGANIZATION (continued)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting and Presentation

Pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810, “Consolidation” (“ASC 810”), the Company is required to include in its consolidated financial statements the financial statements of its variable interest entities (“VIEs”). ASC 810 requires a VIE to be consolidated by a company if that company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual returns. VIEs are those entities in which a company, through contractual arrangements, bears the risk of, and enjoys the rewards normally associated with ownership of the entity, and therefore the company is the primary beneficiary of the entity.

Through the VIE agreements as disclosed in Note 1, the Company is deemed the primary beneficiary of Huludao Rescue. Accordingly, the results of Huludao Rescue have been included in the accompanying consolidated financial statements. The following financial statement amounts and balances of Huludao Rescue have been included in the accompanying consolidated financial statements. Huludao Rescue has no assets that are collateral for or restricted solely to settle their obligations. The creditors of Huludao Rescue do not have recourse to the Company’s general credit.

|

ASSETS

|

June 30,

2012

|

December 31,

2011

|

||||||

|

(Unaudited)

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 4,937,154 | $ | 2,960,284 | ||||

|

Accounts receivable

|

190,473 | 366,671 | ||||||

|

Deferred income taxes

|

43,642 | 34,809 | ||||||

|

Prepaid expenses and other current assets

|

68,659 | 49,926 | ||||||

|

Total current assets

|

5,239,928 | 3,411,690 | ||||||

|

Fixed Assets

|

73,412 | 71,301 | ||||||

|

Less: accumulated depreciation

|

(41,849 | ) | (29,943 | ) | ||||

|

Fixed Assets, net

|

31,563 | 41,358 | ||||||

|

TOTAL ASSETS

|

$ | 5,271,491 | $ | 3,453,048 | ||||

F-11

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basis of Accounting and Presentation (continued)

|

LIABILITIES

|

June 30,

2012

|

December 31

2011

|

||||||

|

(Unaudited)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 488,310 | $ | 707,563 | ||||

|

Advances from customers

|

162,788 | 3,535 | ||||||

|

Payroll Payable

|

95,121 | 93,051 | ||||||

|

Deferred revenue

|

174,567 | 139,236 | ||||||

|

Tax payable

|

400,950 | 296,131 | ||||||

|

Accrued expenses

|

12,015 | 31,952 | ||||||

|

Total current liabilities

|

1,333,751 | 1,271,468 | ||||||

|

TOTAL LIABILITIES

|

$ | 1,333,751 | $ | 1,271,468 | ||||

|

For the three months ended

June 30, (Unaudited)

|

For the six months ended

June 30, (Unaudited)

|

|||||||||||||||

|

2012

|

2011 |

2012

|

2011

|

|||||||||||||

|

|

||||||||||||||||

|

Total revenue

|

$ | 1,510,309 | $ | 690,880 | $ | 2,692,862 | $ | 1,224,518 | ||||||||

|

Net income

|

973,225 | 492,206 | 1,722,947 | 859,147 | ||||||||||||

|

For the six months ended

June 30,

(Unaudited)

|

||||||||

|

2012

|

2011

|

|||||||

|

Net cash provided by operating activities

|

$ | 1,945,551 | $ | 879,034 | ||||

|

Net cash used in investing activities

|

(1,611 | ) | (5,497 | ) | ||||

|

Effect of exchange rate changes on cash

|

32,930 | 21,118 | ||||||

|

Net increase in cash

|

$ | 1,976,870 | $ | 894,655 | ||||

F-12

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basis of Accounting and Presentation (continued)

The accompanying consolidated financial statements have been prepared on the accrual basis in accordance with accounting principles generally accepted in the United States of America. The unaudited financial statements for the three and six months ended June 30, 2012, include Bridgeway, Dragons, Huashi International and its wholly owned subsidiary, Huashida Consulting and its VIE, Huludao Rescue. The unaudited financial statements for the three and six months ended June 30, 2011, include Huashi International and its wholly owned subsidiary, Huashida Consulting and its VIE, Huludao Rescue for comparative purpose only, as Dragons was not in existence at that time. All significant intercompany accounts and transaction has been eliminated in consolidation when applicable.

The Company believes that Huashida Consulting’s contractual agreements with Huludao Rescue are in compliance with PRC law and are legally enforceable. The shareholders of Huludao Rescue are also the senior management of the Company and therefore the Company believes that they have no current interest in seeking to act contrary to the contractual arrangements. However, Huludao Rescue and its shareholders may fail to take certain actions required for the Company’s business or to follow the Company’s instructions despite their contractual obligations to do so. Furthermore, if Huludao Rescue or its shareholders do not act in the best interests of the Company under the contractual arrangements and any dispute relating to these contractual arrangements remains unresolved, the Company will have to enforce its rights under these contractual arraignments through the operations of PRC law and courts and therefore will be subject to uncertainties in the PRC legal system. All of these contractual arrangements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. As a result, uncertainties in the PRC legal system could limit the Company’s ability to enforce these contractual arrangements, which may make it difficult to exert effective control over Huludao Rescue, and its ability to conduct the Company’s business may be adversely affected.

Under ASC 810, an enterprise has a controlling financial interest in a VIE, and must consolidate that VIE, if the enterprise has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s economic performance; and (b) The obligation to absorb losses, or the right to receive benefits, that could potentially be significant to the VIE. The enterprise’s determination of whether it has this power is not affected by the existence of kick-out rights or participating rights, unless a single enterprise, including its related parties and de facto agents, has the unilateral ability to exercise those rights.

F-13

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Basis of Accounting and Presentation (continued)

Huludao Rescue’s actual shareholders do not hold any kick-out rights that will affect the consolidation determination.

The unaudited interim financial statements of the Company as of June 30, 2012 and for the three and six month periods ended June 30, 2012 and 2011, have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules and regulations of the SEC which apply to interim financial statements. Accordingly, they do not include all of the information and footnotes normally required by accounting principles generally accepted in the United States of America for annual financial statements. The interim consolidated financial information should be read in conjunction with the consolidated financial statements and the notes thereto, included in the Company’s Form 8-K for the year ended December 31, 2011, previously filed with the SEC. In the opinion of management, such information contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The results of operations for the three and six months ended June 30, 2012 are not necessarily indicative of the results to be expected for future quarters or for the year ending December 31, 2012.

All consolidated financial statements and notes to the consolidated financial statements are presented in United States dollars (“US Dollar” or “US$” or “$”).

Change of Fiscal Year End Date

On June 15, 2012, in connection with the Share Exchange, the Company changed its fiscal year end date from October 31 to December 31. The operating expenses for Bridgeway from January 31, 2012 to June 15, 2012 (date of reverse acquisition), which were immaterial have been included in the consolidated statements of income and other comprehensive income for the three and six months ended June 30, 2012.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results could differ from those estimates.

F-14

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currency Translations

Almost all of the Company’s assets are located in the PRC. The functional currency for the majority of the operations is the Renminbi (“RMB”). For Huashi International, the functional currency for its majority of the operations is the Hong Kong Dollar (“HKD”) and US Dollar. The Company uses the US Dollar for financial reporting purposes. The consolidated financial statements of the Company have been translated into US dollars in accordance with FASB ASC 830, “Foreign Currency Matters.” All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date.

All asset and liability accounts have been translated using the exchange rate in effect at the balance sheet date. Equity accounts have been translated at their historical exchange rates when the capital transactions occurred. The consolidated statements of income and other comprehensive income amounts have been translated using the average exchange rate for the period presented. Adjustments resulting from the translation of the Company’s consolidated financial statements are recorded as other comprehensive income.

The exchange rates used to translate amounts in RMB and HKD into US dollars for the purposes of preparing the consolidated financial statements are as follows:

|

June 30, 2012

|

December 31, 2011

|

June 30, 2011

|

||||||||||||||||||||||

|

RMB

|

HKD

|

RMB

|

HKD

|

RMB

|

HKD

|

|||||||||||||||||||

|

Balance sheet items, except for stockholders’ equity, as of period end

|

0.1582 | 0.1289 | 0.1571 | 0.1287 |

N/A

|

N/A

|

||||||||||||||||||

|

Amounts included in the statement of income and statement of cash flows for the period

|

0.1581 | 0.1288 | N/A | N/A | 0.1527 | 0.1285 | ||||||||||||||||||

Foreign currency translation adjustments of $4,561 and $18,558 for the three months ended June 30, 2012 and 2011, respectively, and $33,388 and $31,342 for the six months then ended, respectively, have been reported as other comprehensive income in the consolidated statements of income and other comprehensive income.

F-15

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Foreign Currency Translations (continued)

Although government regulations now allow convertibility of the RMB for current account transactions, significant restrictions still remain. Hence, such translations should not be construed as representations that the RMB could be converted into US dollars at that rate or any other rate.

The value of the RMB against the US dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the RMB may materially affect the Company’s financial condition in terms of US dollar reporting.

Service Revenues and Cost Recognition

The Company’s primary sources of revenues are derived from (a) design of security monitoring systems and rescue equipment, including rescue capsules for coal mine companies, (b) commissions from introducing customers to manufacturers for the purchase of rescue equipment that will be used in the mining industry, (c) rental commissions from introducing customers to companies for the rental of rescue capsules, which provide a temperate space for workers in an underground mine until rescued when there is a mining accident, and (d) revenues from providing maintenance and personnel training services to product users. The Company’s revenue recognition policies comply with FASB ASC 605-35, “Construction-Type and Production-Type Contracts” (“ASC 605-35”). In general, the Company recognizes revenue when there is persuasive evidence of an arrangement, the fee is fixed or determinable, the products or service have been delivered and collectability of the resulting receivable is reasonably assured.

Revenues from design of security monitoring systems and rescue equipment with major customization, modification and development are recorded primarily under the percentage-of-completion method, in accordance with ASC 605-35, when the contracts fulfill the following criteria:

|

1.

|

Contract performance extends over long periods of time;

|

|

2.

|

The design involves significant customization, modification or development;

|

|

3.

|

Reasonably dependable estimates can be made on the progress towards completion, contract revenues and contract costs; and

|

F-16

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Revenue and Cost Recognition (continued)

|

4.

|

Each element is essential to the functionality of the other elements of the contracts.

|

Profits recognized on contracts in process are based upon estimated contract revenue and related total cost of the project at completion. The extent of progress toward completion is generally measured based on the ratio of actual cost incurred to total estimated cost at completion. Contract costs include all direct material, direct labor, subcontractor costs and those indirect costs related to contract performance. If the contract provides services that are considered essential to the functionality of the rescue equipment and the security monitoring system, both the rescue product revenue and services are recognized under contract accounting in accordance with the provisions of ASC 605-35. Losses on contracts are immediately recognized when they come known.

“Costs and estimated earnings in excess of billings on uncompleted contracts” are recorded as an asset when revenues are recognized in excess of amounts billed. “Billings in excess of costs and estimated earnings on uncompleted contracts” are recorded as a liability when billings are in excess of revenues recognized. At June 30, 2012 and December 31, 2011, amounts over billed or under billed on uncompleted contracts were not material.

The Company makes recommendations to its customers for rescue equipment purchases from third party suppliers and for rental of rescue capsules from a related party (see note 6), within the cost range specified by its customers, or the Company can determine the rescue equipment to be used for specific projects based on the contract terms. For rescue equipment used in projects that is purchased and leased from third parties, the Company generally earns a pre-negotiated commission from the third party manufacturers once the contract for the rescue equipment is signed by the customers and the manufacturer receives the initial deposit. The pre-negotiated commissions from purchases and leases are calculated (a) for purchased equipment, the commission ranges from 10% to 20% of the purchase price; and (b) for leased equipment, the Company receives 20% of the total annual rent amount. Rental commissions are received annually in advance and recognized monthly over the term of the lease agreements between third party manufacturers and customers. The related cost of commissions, which is primarily the costs of safety inspection and training, are reflected as the reduction to commission revenue in the accompanying consolidated statements of income and other comprehensive income.

F-17

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Revenue and Cost Recognition (continued)

The Company also enters into maintenance service contracts with its customers. Maintenance service fees, included in sales in the accompanying consolidated statements of income and other comprehensive income, are received in advance and recognized monthly over the term of the maintenance service contracts between the Company and its customers.

Vulnerability Due to Operations in PRC

The Company’s operations may be adversely affected by significant political, economic and social uncertainties in the PRC. Although the PRC government has been pursuing economic reform policies for more than twenty years, no assurance can be given that the PRC government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption or unforeseen circumstances affecting the PRC’s political, economic and social conditions. There is also no guarantee that the PRC government’s pursuit of economic reforms will be consistent or effective.

Advertising Cost

Advertising costs are charged to operations when incurred. Advertising cost was $6,794 and $1,537 for the three months ended June 30, 2012 and 2011, respectively, and $24,585 and $3,054 for the six months ended June 30, 2012 and 2011, respectively.

Fair Value of Financial Instruments

Financial instruments include accounts receivable, accounts payable and accrued expenses and other payables. As of June 30, 2012 and December 31, 2011, the carrying values of these financial instruments approximated their fair values due to the short term nature of these financial instruments.

Cash and Cash Equivalents

The Company considers all demand and time deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents.

F-18

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Accounts Receivable

Accounts receivable is stated at cost, net of an allowance for doubtful accounts. Receivables outstanding longer than the payment terms are considered past due. The Company maintains an allowance for doubtful accounts for estimated losses resulting from the failure of customers to make required payments. The Company reviews the accounts receivable on a periodic basis and makes allowances where there is doubt as to the collectability of the outstanding balance. In evaluating the collectability of an individual receivable balance, the Company considers many factors, including the age of the balance, the customer’s payment history, its current credit-worthiness and current economic trends. The Company considers all accounts receivable at June 30, 2012 and December 31, 2011 to be fully collectible and, therefore, did not provide for an allowance for doubtful accounts. For the periods presented, the Company did not write off any accounts receivable as bad debts.

Fixed Assets

Fixed assets are recorded at cost, less accumulated depreciation. Cost includes the prices paid to acquire the assets, and any expenditure that substantially increase the assets value or extends the useful life of an existing asset. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Major repairs and betterments that significantly extend original useful lives or improve productivity are capitalized and depreciated over the periods benefited. Maintenance and repairs are generally expensed as incurred.

The estimated useful lives for fixed assets categories are as follows:

|

Machinery and equipment

|

3 years

|

|

Fixtures and furniture

|

5 years

|

Advances from Customers

Advances from customers primarily consist of payments received from customers by the Company for the design of the rescue equipment and monitoring systems.

F-19

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Deferred Revenue

Deferred revenue includes a) rental commissions received from a related party for introducing customers who rent mining rescue capsules; b) maintenance service fees received in advance from customers for maintenance services of rescue equipment and security monitoring systems. These payments received but not yet earned are recognized as deferred revenue on the balance sheets.

Loans from Stockholders

Loans from stockholders, representing advances from stockholders, are non-interest bearing and are due on demand.

Impairment of Long-lived Assets

The Company applies FASB ASC 360, “Property, Plant and Equipment,” which addresses the financial accounting and reporting for the recognition and measurement of impairment losses for long-lived assets. In accordance with ASC 360, long-lived assets are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The Company may recognize the impairment of long-lived assets in the event the net book value of such assets exceeds the future undiscounted cash flows attributable to these assets. No impairment of long-lived assets was recognized for the periods presented.

Income Taxes

The Company accounts for income taxes in accordance with FASB ASC 740, “Income Taxes” (“ASC 740”), which requires the recognition of deferred income taxes for differences between the basis of assets and liabilities for financial statement and income tax purposes. The difference relates primarily to deferred revenue. Deferred tax assets and liabilities represent the future tax consequence for those differences, which will either be taxable or deductible when the assets and liabilities are recovered or settled. Deferred taxes are also recognized for operating losses that are available to offset future taxable income. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be realized. As of June 30, 2012 and December 31, 2011, the Company had deferred income tax assets of $43,642 and $34,809, respectively.

F-20

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Income Taxes (continued)

ASC 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Under ASC 740, the Company may recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position would be measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement. ASC 740 also provides guidance on de-recognition of income tax assets and liabilities, classification of current and deferred income tax assets and liabilities, and accounting for interest and penalties associated with tax positions. As of June 30, 2012 and December 31, 2011, the Company does not have a liability for any unrecognized tax benefits.

Statutory Reserve Fund

Pursuant to corporate law of the PRC, the Company is required to transfer 10% of its net income, as determined under PRC accounting rules and regulations, to a statutory reserve fund until such reserve balance reaches 50% of the Company’s registered capital. The statutory reserve fund is non-distributable other than during liquidation and can be used to fund previous years’ losses, if any, and may be utilized for business expansion or used to increase registered capital, provided that the remaining reserve balance after such issue is not less than 25% of the registered capital. The Company has fully funded the statutory reserve fund.

Reclassification

Certain amounts in the prior year’s financial statements have been reclassified for comparative purposes to conform to the presentation in the current period’s financial statements. These reclassifications have no effect on previously reported earnings.

F-21

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

3. RECENTLY ISSUED ACCOUNTING STANDARDS

In December 2011, the FASB issued Accounting Standards Update (“ASU”) No. 2011-11, “Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). The amendments in this ASU require an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. An entity is required to apply the amendments for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. An entity should provide the disclosures required by those amendments retrospectively for all comparative periods presented. The Company does not expect that the adoption of ASU 2011-11 will have a significant, if any, impact on the Company’s financial statements.

In September 2011, the FASB issued Accounting Standards Update No. 2011-08, “Testing Goodwill for Impairment” (“ASU No. 2011-08”), which allows entities to use a qualitative approach to test goodwill for impairment. ASU No. 2011-08 permits an entity to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying value. If it is concluded that this is the case, it is necessary to perform the currently prescribed two-step goodwill impairment test. Otherwise, the two-step goodwill impairment test is not required. ASU No. 2011-08 is effective for annual and interim goodwill impairment tests performed for fiscal years beginning after December 15, 2011. The adoption of the provisions of ASU No. 2011-08 did not have a material impact on the Company’s consolidated financial statements.

In June 2011, the FASB issued Accounting Standards Update No. 2011-05, “Presentation of Comprehensive Income” (“ASU No. 2011-05”), which improves the comparability, consistency, and transparency of financial reporting and increases the prominence of items reported in other comprehensive income (“OCI”) by eliminating the option to present components of OCI as part of the statement of changes in stockholders’ equity. The amendments in this standard require that all nonowner changes in stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements.

F-22

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

3. RECENTLY ISSUED ACCOUNTING STANDARDS (continued)

In December 2011, the FASB issued Accounting Standards Update No. 2011-12, “Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income” (“ASU No. 2011-12”), which indefinitely defers the requirement in ASU No. 2011-05 to present on the face of the financial statements reclassification adjustments for items that are reclassified from OCI to net income in the statement(s) where the components of net income and the components of OCI are presented. The amendments in these standards do not change the items that must be reported in OCI, when an item of OCI must be reclassified to net income, or change the option for an entity to present components of OCI gross or net of the effect of income taxes. The amendments in ASU No. 2011-05 and ASU No. 2011-12 are effective for interim and annual periods beginning after December 15, 2011 and are to be applied retrospectively. The adoption of the provisions of ASU No. 2011-05 and ASU No. 2011-12 did not have a material impact on the Company’s consolidated financial statements.

In May 2011, the FASB issued Accounting Standards Update No. 2011-04, "Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs" ("ASU No. 2011-04"), which amends current guidance to result in common fair value measurements and disclosures between accounting principles generally accepted in the United States and International Financial Reporting Standards. The amendments explain how to measure fair value. They do not require additional fair value measurements and are not intended to establish valuation standards or affect valuation practices outside of financial reporting. ASU No. 2011-04 clarifies the application of certain existing fair value measurement guidance and expands the disclosures for fair value measurements that are estimated using significant unobservable inputs (Level 3 inputs, as defined in Note 7). The amendments in ASU No. 2011-04 are effective for interim and annual periods beginning after December 15, 2011. The adoption of the provisions of ASU No. 2011-04 did not have a material impact on the Company's financial statements.

F-23

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

4. FIXED ASSETS

Fixed assets at June 30, 2012 and December 31, 2011 are summarized as follows:

|

June 30,

2012

|

December 31,

2011

|

|||||||

|

Machinery and equipment

|

$ | 66,958 | $ | 64,891 | ||||

|

Fixtures and furniture

|

6,454 | 6,410 | ||||||

| 73,412 | 71,301 | |||||||

|

Less: Accumulated depreciation

|

(41,849 | ) | (29,943 | ) | ||||

|

Fixed assets, net

|

$ | 31,563 | $ | 41,358 | ||||

Depreciation expense charged to operations for the three months ended June 30, 2012 and 2011 was $5,895 and $5,604, respectively, and $11,689 and $10,830 for the six months ended June 30, 2012 and 2011, respectively.

5. LEASE OBLIGATIONS

The Company leases one of its offices at a monthly rental of approximately $2,100 under an operating lease which expired on April 30, 2012 and was renewed to April 30, 2014 at a monthly rental of approximately $2,200. The Company leases another office at a monthly rental of approximately $1,100, under an operating lease expiring on December 31, 2014. The minimum future rentals under these leases as of June 30, 2012 are as follows:

|

Year Ending

|

||||

|

December 31,

|

Amount

|

|||

|

2012

|

$ | 19,921 | ||

|

2013

|

39,841 | |||

|

2014

|

22,134 | |||

| $ | 81,896 | |||

Rent expense charged to operations for the three months ended June 30, 2012 and 2011 was $10,321 and $9,640, respectively and $19,921 and $19,240 for the six months ended June 30, 2012 and 2011, respectively.

F-24

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

6. RELATED PARTY TRANSACTION

Leasing commissions are generated from Heilongjiang Hefeng Rescue Equipment Co., Ltd (Heilongjiang Hefeng), for introducing customers who rent mining rescue capsules. The Company’s majority shareholder, Mr. Baoyuan Zhu is also the owner of Heilongjiang Hefeng. The Company recognizes lease commission revenue monthly when earned, which is based on a percentage of annual prepaid rent over the lease period. For the three months ended June 30, 2012 and 2011, lease commission generated from Heilongjiang Hefeng was $40,488 and $0, respectively. For the six months ended June 30, 2012 and 2011, lease commission generated from Heilongjiang Hefeng was $64,031 and $0, respectively.

Future rental lease commissions to be earned as of June 30, 2012 are as follows:

|

Year Ending December 31,

|

Amount

|

|||

|

2012

|

$ | 107,113 | ||

|

2013

|

214,226 | |||

|

2014

|

214,226 | |||

|

2015

|

214,226 | |||

|

2016

|

214,226 | |||

|

Thereafter

|

767,969 | |||

| $ | 1,731,986 | |||

7. FAIR VALUE MEASUREMENTS

FASB ASC 820, “Fair Value Measurements and Disclosures,” specifies a hierarchy of valuation techniques based upon whether the inputs to those valuation techniques reflect assumptions other market participants would use based upon market data obtained from independent sources (observable inputs). In accordance with ASC 820, the following summarizes the fair value hierarchy:

|

|

Level 1 Inputs – Unadjusted quoted market prices for identical assets and liabilities in an active market that the Company has the ability to access.

|

F-25

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

7. FAIR VALUE MEASUREMENTS (continued)

|

|

Level 2 Inputs – Inputs other than the quoted prices in active markets that are observable either directly or indirectly.

|

|

|

Level 3 Inputs – Inputs based on prices or valuation techniques that are both unobservable and significant to the overall fair value measurements.

|

ASC 820 requires the use of observable market data, when available, in making fair value measurements. When inputs used to measure fair value fall within different levels of the hierarchy, the level within which the fair value measurement is categorized is based on the lowest level input that is significant to the fair value measurements. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. The Company did not identify any assets or liabilities that are required to be presented on the balance sheets at fair value.

8. INCOME TAXES

The provision for income taxes consisted of the following for the three and six months ended June 30, 2012 and 2011:

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|||||||||||||||

|

2012

|

2011

|

2012

|

2011

|

|||||||||||||

|

Current

|

$ | 335,804 | $ | 176,235 | $ | 599,817 | $ | 299,732 | ||||||||

|

Deferred

|

10,575 | 13,721 | 8,833 | 13,350 | ||||||||||||

| $ | 325,229 | $ | 162,514 | $ | 590,984 | $ | 286,382 | |||||||||

The Company’s effective tax rate was the same as the statutory rate of 25% for the three and six months ended June 30, 2012 and 2011. The Company’s tax filings for the years ended December 31, 2011 and 2010 were examined by the tax authorities in April 2012 and 2011. The tax filings were accepted and no adjustments were proposed by the tax authorities.

F-26

CHINA HEFENG RESCUE EQUIPMENT, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2012 AND 2011 (UNAUDITED)

9. CONCENTRATION OF CREDIT RISK

Substantially all of the Company’s bank accounts are in banks located in The People’s Republic of China and are not covered by protection similar to that provided by the FDIC on funds held in United States banks.

10. SIGNIFICANT CUSTOMERS

The Company had two customers which accounted for 60% and 34% of sales for the three months ended June 30, 2012 and 2011, respectively, and the same two customers accounted for 62% and 18% of sales for the six months ended June 30, 2012 and 2011, respectively. The same two customers accounted for 75% and 66% of accounts receivable as of June 30, 2012 and Decemeber 31, 2011, respectively.

F-27

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with our unaudited financial statements and notes thereto included in this Quarterly Report on Form 10-Q and our audited financial statements and notes thereto included in our Current Report on Form 8-K/A filed with the SEC on August 1, 2012.

Forward Looking Statement Notice

This quarterly report on Form 10-Q contains forward-looking statements within the meaning of the U.S. federal securities laws. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “likely,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are subject to a number of risks that could cause them to differ from our expectations. These include, but are not limited to, risks relating to:

|

▪

|

the impact of a downturn or negative changes in the market for mining safety and equipment.

|

|

▪

|

our ability to obtain additional capital in future years to fund our planned expansion.

|

|

▪

|

economic, political, regulatory, legal and foreign exchange risks associated with our operations.

|

|

▪

|

the loss of key members of our senior management and our qualified sales personnel.

|

You should not place undue reliance on these forward-looking statements, which are based on our current views and assumptions. In evaluating these statements, you should specifically consider various factors, including the foregoing risks and those outlined under “Risk Factors” in our Current Reports on Form 8-K/A as filed with the SEC on August 1, 2012. Many of these factors are beyond our control. Our forward-looking statements represent estimates and assumptions only as of the date of this quarterly report on Form 10-Q. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date of this quarterly report on Form 10-Q.

Overview

China Hefeng Rescue Equipment, Inc. (“the Company,” formerly known as Bridgeway Acquisition Corp.) was incorporated in the State of Delaware on October 22, 2010. Since inception until the closing of the Exchange Agreement, the Company has been a vehicle to pursue a business combination through the acquisition of, or merger with, an operating business. The Company changed its name from Bridgeway Acquisition Corp. to China Hefeng Rescue Equipment, Inc. on August 1, 2012.

We conduct our operations through our consolidated affiliated Huludao Hefeng Rescue Equipment Co., Ltd. (hereinafter referred to as “Huludao Rescue”). Huludao Rescue, founded in May, 2010, is a company specializing in mining equipment design, mine safety system research, sales agent of mining equipment and leasing agent of rescue capsules. The Huludao Rescue is located in integrated industrial park of Beigang Industrial Park of Huludao City, People’s Republic of China.

Recent Developments

Debt Cancellation

On June 14, 2012, we entered into a Debt Cancellation Agreement with Bosch Equities, L.P., Keri Bosch and Devin Bosch (the “Boschs”), pursuant to which all outstanding debt owed to the Boschs was cancelled in exchange for 880,000 shares of common stock of Bridgeway. At the time of the debt cancellation, the amount of outstanding debt owed to the Boschs was estimated to be $8,088. Keri Bosch, the Company’s former sole director and officer is the sole shareholder of KBB Financial, Inc., Bosch Equities, L.P.’s General Partner. At the time of the transaction Bosch Equities, L.P. was the Company’s sole shareholder.

2

Acquisition of Dragons Soaring

On June 15, 2012, we completed a reverse acquisition transaction through a share exchange with Dragons Soaring and its shareholders (the “Stockholders”), whereby we acquired 100% of the issued and outstanding capital stock of Dragons Soaring in exchange for 31,920,000 shares of our Common Stock which constituted 95% of our issued and outstanding capital stock as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Dragons Soaring became our wholly-owned subsidiary and the former Stockholders of Dragons Soaring became our controlling stockholders. The amount of consideration received by the shareholders of Dragons Soaring was determined on the basis of arm’s-length negotiations between Dragons Soaring and the Company. The share exchange transaction with Dragons Soaring and the Stockholders was treated as a reverse acquisition, with Dragons Soaring as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Dragons Soaring and its consolidated subsidiaries and variable interest entities (“VIE’s”).

Immediately prior to the Share Exchange, the common stock of Dragons Soaring was owned by the following persons in the indicated percentages: Baoyuan Zhu (24.8%); Jianjun Gao (4.8%); Xiaoran Zhang (4.9%); Zhenxing Liu (4.5%); Kun Liu (4.5%); Weiwei Wang (4.00%), Jiujie Xu (4.6%), Ming Cheng (4.0%), Shuangsheng Li (3.8%), Jianfeng Zhang (4.2%), Jing Wang (4.3%), Ping Li (4.1%), Yan Zhang (4.9%), Shuangfei Zhai (4.3%), Wenqin Duan (4.8%), Qiaoli Zhang (4.9%), Xiaoqin Zheng (3.8%) and Li Yi (4.8%).

On June 15, 2012, Keri B. Bosch, our former President, Treasurer, Secretary and sole director, submitted a resignation letter pursuant to which she resigned from all offices that she held and as a director, effective upon the closing of the Exchange Agreement. In addition, on June 15, 2012 our board of directors made the following actions: (a) Baoyuan Zhu was appointed as Chairman of our board of directors; (b) Zhengyuan Yan and JianjunGao were appointed as members of our board of directors; (c) Zhengyuan Yan was appointed to serve as Chief Executive Officer; and (d) Wenqi Yao was appointed to serve as Chief Financial Officer of the Company.

As a result of our acquisition of Dragons Soaring, we now own all of the issued and outstanding capital stock of Dragons Soaring, which in turn owns all of the issued and outstanding capital stock of Huashi International, which in turn owns all of the issued and outstanding capital stock of Huashida Consulting. In addition, we effectively and substantially control Huludao Rescue through a series of captive agreements with Huashida Consulting.

Dragons Soaring was established in the British Virgin Islands on December 2, 2011. Huashi International was established in Hong Kong on August 10, 2010 to serve as an intermediate holding company. Huashida Consulting was established in the PRC on October 19, 2010. Huludao Rescue, our operating consolidated affiliate, was established in the PRC on May 11, 2010. On October 11, 2010, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Huashida Consulting by Huashi International, a Hong Kong entity.

The “certificate of approval” is necessary for a Hong Kong foreign-owned enterprise to register a wholly foreign owned entity (“WFOE”) in China, and to get approval from both the State Administration of Foreign Exchange (SAFE) and the Trade and Industrial Bureau for the initial investment of funds by the HK company into the WFOE. Only with their approvals, along with the ‘certificate of approval for establishment of enterprises with investment of Taiwan, Hong Kong, Macao and overseas Chinese in the people’s republic of China’ can a WFOE be established in China.

Subsequent to the closing of the Exchange Agreement, we conduct our operations through our controlled consolidated affiliate Huludao Rescue.

3

Contractual Arrangements with our Controlled Consolidated Affiliate and its Shareholders

On January 3, 2012, prior to the reverse acquisition transaction, Huashida Consulting and Huludao Rescue and its shareholders, Baoyuan Zhu and JianjunGao, entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Huludao Rescue became Huashida Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. Although Huludao Rescue falls under an industry that is not a restricted or forbidden to foreign investment, PRC regulations do require only certain methods of foreign ownership are permissible. Stock exchanges are not a permissible method of gaining foreign ownership of a PRC operating company under current PRC regulations. As a result, the Company utilized the VIE Agreements in order to properly gain control and the economic benefits of Huludao Rescue. The VIE Agreements included:

|

(1)

|

an Exclusive Technical Service and Business Consulting Agreement between Huashida Consulting and Huludao Rescue pursuant to which Huashida Consulting is to provide technical support and consulting services to Huludao Rescue in exchange for (i) 95% the total annual net profit of Huludao Rescue and (ii) RMB100,000 per month (approximately $15,000 US).

|

|

|

(2)

|

a Call Option Agreement among Baoyuan Zhu, Jianjun Gao, and Huashida Consulting under which the shareholders of Huludao Rescue have granted to Huashida Consulting the irrevocable right and option to acquire all of the equity interests in Huludao Rescue to the extent permitted by PRC law. If PRC law limits the percentage of Huludao Rescue that Huashida Consulting may purchase at any time, then Huashida Consulting may repeatedly exercise its option in such increments as may be allowed by PRC law. The exercise price of the option is RMB1.00($0.16 US) or any higher price required by PRC law. Huludao Rescue shareholders agreed to refrain from taking certain actions which might harm the value of Huludao Rescue or Huashida Consulting’s option;

|

|

(3)

|

a Proxy Agreement by Baoyuan Zhu and Jianjun Gao pursuant to which they each authorize Huashida Consulting to designate someone to exercise all of their shareholder decision rights with respect to Huludao Rescue; and

|

|

|

(4)

|

A Share Pledge Agreement between Baoyuan Zhu, Jianjun Gao, Huludao Rescue,and Huashida Consulting under which the shareholders of Huludao Rescue have pledged all of their equity in Huludao Rescue to Huashida Consulting to guarantee Huludao Rescue’s and Huludao Rescue’s shareholders’ performance of their obligations under the Exclusive Technical Service and Business Consulting Agreement, the Call Option Agreement and the Proxy Agreement. As discussed above, share exchanges are not permitted methods to transfer ownership of PRC operating companies to foreign investors. As a result, the VIE agreements through the Call Option and Share Pledge Agreement, attempt to give Huashida Consulting the option to gain actual ownership of the shares of Huludao Rescue in the event it is can be achieved in accordance with PRC laws. The transfer of ownership interests in Huludao Rescue to Huashida Consulting would be beneficial to U.S. investors because having ownership control, in contrast to contractual rights over Huludao Rescue, strengthens the control the US parent company has over the operating company Huludao Rescue.

|

The VIE Agreements with our Chinese affiliate and its shareholders, which relate to critical aspects of our operations, may not be as effective in providing operational control as direct ownership. In addition, these arrangements may be difficult and costly to enforce under PRC law. See “Risk Factors - Risks Relating to the VIE Agreements” included in our Current Report on Form 8-K/A filed with the SEC on August 1, 2012.