Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARO Liquidation, Inc. | aro-20120816x8xk.htm |

| EX-99.1 - EXHIBIT 99.1 - ARO Liquidation, Inc. | q212-exhibit991.htm |

1 Second Quarter 2012 Financial Results

Condensed Consolidated Statements of Income (unaudited) 3 July 28, 2012 % of sales July 30, 2011 % of sales Net sales $ 485,337 100.0% $ 468,191 100.0% Cost of sales (includes certain buying, occupancy and warehousing expenses) [1] 362,567 74.7% 354,156 75.6% Gross profit [1] 122,770 25.3% 114,035 24.4% Selling, general and administrative expenses 122,175 25.2% 108,649 23.2% Income from operations 595 0.1% 5,386 1.2% Interest expense, net 148 0.0% 48 0.0% Income before income taxes 447 0.1% 5,338 1.2% Income taxes 376 0.1% 2,397 0.5% Net income $ 71 0.0% $ 2,941 0.7% Basic earnings per share $ 0.00 $ 0.04 Diluted earnings per share $ 0.00 $ 0.04 Weighted average basic shares 81,266 80,729 Weighted average diluted shares 81,708 81,259 [1] During the second quarter of 2011, the Company recorded a favorable pre-tax benefit of $8.7 million, resulting from the resolution of a previously disclosed dispute with one of its sourcing agents. Of this benefit, $8.0 million related to periods prior to fiscal 2011. 13 Weeks Ended (In thousands, except per share data)

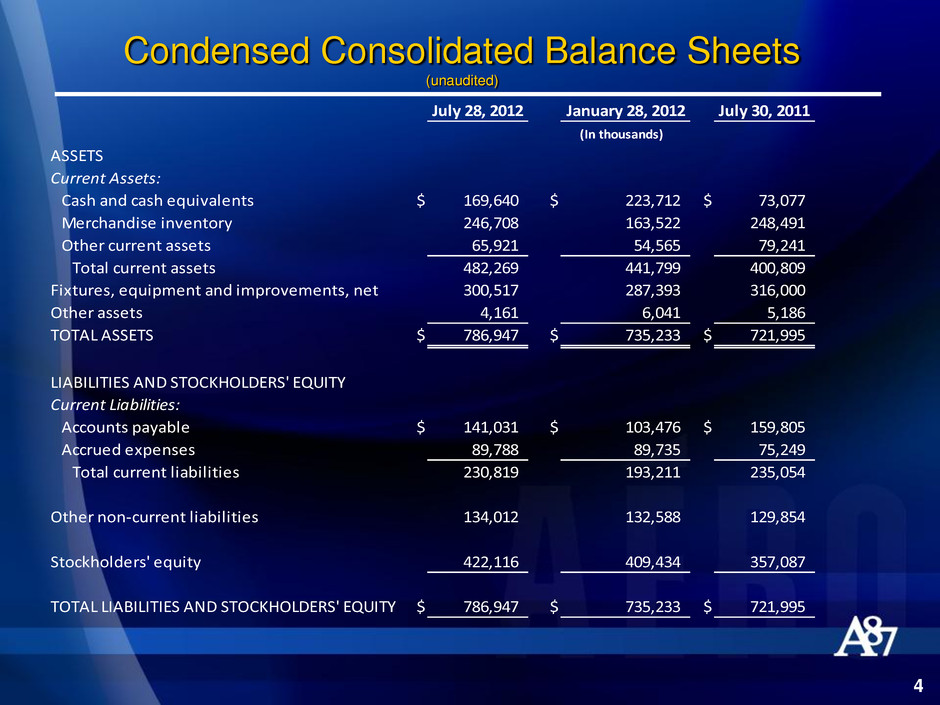

Condensed Consolidated Balance Sheets (unaudited) 4 July 28, 2012 January 28, 2012 July 30, 2011 ASSETS Current Assets: Cash and cash equivalents $ 169,640 $ 223,712 $ 73,077 Merchandise inventory 246,708 163,522 248,491 Other current assets 65,921 54,565 79,241 Total current assets 482,269 441,799 400,809 Fixtures, equipment and improvements, net 300,517 287,393 316,000 Other assets 4,161 6,041 5,186 TOTAL ASSETS $ 786,947 $ 735,233 $ 721,995 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable $ 141,031 $ 103,476 $ 159,805 Accrued expenses 89,788 89,735 75,249 Total current liabilities 230,819 193,211 235,054 Other non-current liabilities 134,012 132,588 129,854 Stockholders' equity 422,116 409,434 357,087 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 786,947 $ 735,233 $ 721,995 (In thousands)

5 Second Quarter 2012 Metrics July 28, 2012 July 30, 2011 Comparable sales change 0% -12% (including e-commerce channel) Comparable sales change -1% -14% (excluding e-commerce channel) Comparable units per transaction change 5% 7% (including e-commerce channel) Comparable sales transactions change -4% -3% (including e-commerce channel) Comparable average unit retail change -1% -15% (including e-commerce channel) 13 Weeks Ended

Second Quarter 2012 Metrics 6 July 28, 2012 July 30, 2011 Average square footage increase 4% 9% Total square footage at end of period 4,010,522 3,836,721 Average square footage during period 3,988,909 3,820,432 Change in total inventory over comparable period -1% 15% Change in inventory per retail square foot -6% 5% over comparable period 13 Weeks Ended

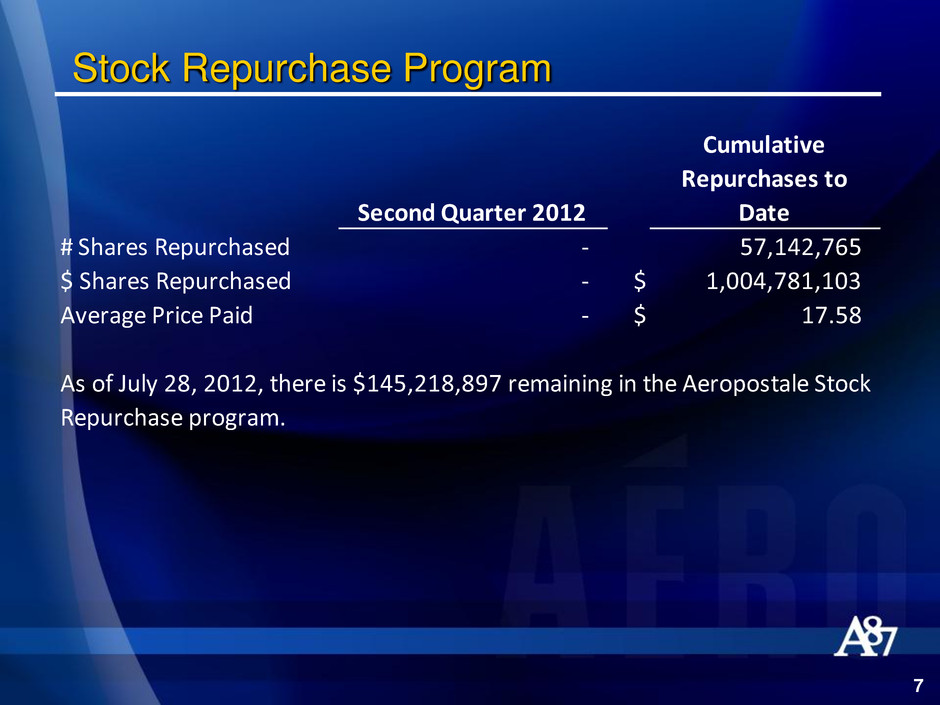

Stock Repurchase Program 7 Second Quarter 2012 Cumulative Repurchases to Date # Shares Repurchased - 57,142,765 $ Shares Repurchased - $ 1,004,781,103 Average Price Paid - $ 17.58 As of July 28, 2012, there is $145,218,897 remaining in the Aeropostale Stock Repurchase program.

8 Second Quarter 2012 Store Count First Quarter 2012 Additions Closures Second Quarter 2012 Aéropostale U.S. 917 1 (4) 914 Aéropostale Canada 69 6 - 75 Total Aéropostale 985 7 (4) 989 P.S. from Aéropostale 81 15 - 96 Total stores 1,067 22 (4) 1,085