Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - NTS, INC. | nts_8k.htm |

Exhibit 99.1

NTS, Inc.

(Formerly Xfone, Inc.)

Monitoring Report | August 2012

Author:

Tal Tutnauer, Analyst

talt@midroog.co.il

Contact:

Sigal Issachar, Head of Corporate

i.sigal@midroog.co.il

1

NTS, Inc.

|

Series Rating

|

Ba1

|

Outlook: Stable

|

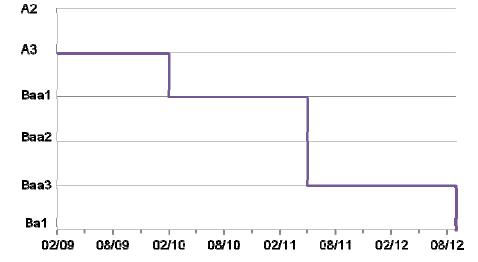

Midroog announces the downgrading of NTS Inc. ("NTS" or the "Company") Series A Bonds from Baa3 to Ba1 and the stabilization of outlook from negative to stable.

Bond series rated by Midroog:

|

Series

|

Stock No.

|

Issue Date

|

Coupon

|

Linkage

|

Value in Books of Bond

Balance as of March 31, 2012 (NIS M)* |

Bond Repayment Years

|

|

A

|

1112721

|

12/2007

|

8.00%

|

CPI

|

56.7

|

2008-2015

|

|

*

|

The bond balance in US dollars in the Company's books was translated into New Israeli Shekels at the exchange rate of March 31, 2012.

|

Summary of Main Rating Rationale

The rating was lowered primarily due to the ongoing negligible free cash flow (FCF) which the Company generates, making it difficult to fulfill its obligations from operating sources, and compelling it to largely rely on external sources for paying back the debt. The Company posted a drop in revenues in the last two years. Despite the improvement in the EBITDA operating cash flow and the FFO operating cash flow in 2011 and in the first quarter of 2012, its cash flow after changes in working capital and capital investment remains low. In Midroog's assessment, at least in the next two years, the free cash flow will remain insignificant.

The Company's rating is negatively impacted by a weak financial profile, slow coverage ratios and a lack of financial flexibility, coupled with ongoing investments in expanding operations in fiber optic telecommunications. The rating is supported by a slight improvement in the Company's profitability, an improvement in liquidity owing to rights offering conducted in the second half of 2011 and an improvement in amortization scheduling.

2

NTS (Consolidated): Key Financial Data (NIS K):

|

Q1/2012

|

Q1/2011

|

FY 2011

|

FY 2010

|

FY 2009

|

|

|

Total revenues

|

14,924

|

14,257

|

57,658

|

58,944

|

61,410

|

|

Operating profit (EBIT)

|

1,130

|

759

|

3,241

|

2,128

|

2,069

|

|

EBIT (%)

|

7.6%

|

5.3%

|

5.6%

|

3.6%

|

3.4%

|

|

Net Profit (Loss)

|

(339)

|

(634)

|

(1,167)

|

(4,473)

|

(22,159)1

|

|

EBITDA

|

2,664

|

1,928

|

8,592

|

6,582

|

5,864

|

|

EBITDA (%)

|

17.9%

|

13.5%

|

14.9%

|

11.2%

|

9.5%

|

|

FFO

|

1,892

|

1,633

|

4,751

|

3,394

|

4,053

|

|

CAPEX

|

623

|

899

|

2,472

|

2,378

|

3,342

|

|

RUS2 CAPEX

|

2,687

|

1,831

|

13,822

|

6,724

|

,2074

|

|

FCF

|

746

|

75

|

(59)

|

927

|

1,898

|

|

Balance sheet total

|

96,439

|

74,058

|

91,528

|

73,644

|

78,475

|

|

Equity

|

27,369

|

21,955

|

27,667

|

22,506

|

21,683

|

|

Cash and cash equivalents

|

7,672

|

314

|

6,564

|

1,217

|

1,533

|

|

RUS debt

|

24,885

|

10,675

|

21,380

|

9,492

|

5,311

|

|

NTS debt (without RUS)

|

28,331

|

26,678

|

27,700

|

25,933

|

28,221

|

|

Debt-to-EBITDA

|

4.99

|

4.84

|

5.71

|

5.38

|

5.74

|

|

Debt-to-FFO

|

14.1

|

9.8

|

10.3

|

10.4

|

8.3

|

|

Equity-to-balance sheet assets

|

28.4%

|

29.6%

|

30.2%

|

30.6%

|

27.6%

|

Breakdown of Key Rating Factors

High business risk due to transition to new technology

The majority of the Company's activity (about 70%) comes from landline communication services on copper fibers owned by a third party, and the remaining revenues come from Fiber-to-the Premise (FTTP) services which it owns. The Company has a multi-annual plan to change the mix of operations, and is investing resources in developing its FTTP network to offset the declining landline operations. Consequently, the Company's revenues from landline activity fell back by 8.6% in 2011, whereas revenues from FTTP activity (including government-funded projects) rose

by 29%. Therefore, the Company's total revenue has been on a downtrend in recent years. In 2010 and 2011 the Company posted a drop in revenues of 4% and 2.2%, respectively. The first quarter of 2012 shows a 4.7% rise in the revenue item compared to the first quarter of 2011.

________________

2 Rural Utilities Service – RUS. The U.S. Department of Agriculture, through which the Company receives funding for government projects. The investments in these projects are made concurrent with the receipt of loans and grants. In the Company's books, the investments in the projects are posted net, in deducting the grants.

3

Midroog expects revenues to stabilize at around $60 million by 2014, while the fall in revenues from non-fiber landline communication operations will be compensated by a rise in revenues from fiber network operations. We also anticipate that the Company will have difficulty raising revenues substantially until the FTTP network activity accounts for over 50% of the Company's operations.

The Company's fiber operations currently focus on three projects awarded by the U.S. Department of Agriculture in 2010 worth about $100 million, which are in various stages of performance. About 45% of the amount the Company receives as grants, and the rest in government loans (long-term payment schedule at government bond interest rates for matching periods). These are non-recourse loans for closed projects, and were put up against a lien on the projects' assets.

The first government project is Levelland worth about $12 million. The Company has finished deploying the infrastructure and is continuing to expand its customer base for broadband telecommunication services. The progress on this project may indicate the Company's likelihood of success in other projects, under the U.S. Government's plan to connect rural areas of the country to fiber optic network, which it was selected to set up. However, in Midroog's assessment, there still remains a significant level of uncertainty.

Low operating profitability and negative net profit

Despite high gross profitability (50.2% on average in the last three years), the Company is showing low operating profit (EBIT) owing to its high marketing and administrative costs averaging at 38.3% of its revenue. There has been a trend of improvement in the last few quarters. The Company's operating strategy has led it to rechannel marketing and selling resources from traditional landline telecommunications to fiber communications.

The Company still has not managed to post a positive net profit in the fiscal year, although its situation did improve in 2011, and it ended the year with a net loss of $1.2 million compared to $4.5 million in 2010. The net loss is attributed, among other things, to the Company being at a stage of operations shortly after making substantial investments and having to bear high depreciation and financing expenses, without sufficient growth to compensate for these costs. The ongoing loss poses a threat to the Company as it weakens its financial flexibility and handicaps its ability to deal with crisis situations.

4

Weak cash flows, slow coverage ratios and low financial flexibility

The Company's debt stands at about $54 million, up from about $38 million a year ago. The higher debt is largely due an increase in loans which it received from the U.S. Government for projects involving the deployment of optic fiber infrastructure that it is financing. The U.S. Government loans comprise about half of the Company's debt, about a quarter of which are bank loans backed by the Company's assets, except for projects, and about a quarter of the debt is in bonds.

The Company partially hedges currency exposure to the shekel bonds by hedging the annual payment (principal and interest) several months ahead. It should be noted that the Company did not issue the bonds which was scheduled for 2011.

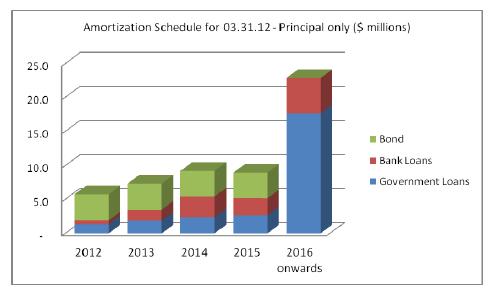

Amortization Schedule as of March 31, 2012 – Debt Principal Only ($M)

The Company's coverage ratios are slow, since funds from operations (FFO) account for only 8% of the total revenue and 9% of the debt (including RUS loans). Free cash flow (FCF) was low and even negative in recent years, and we do not anticipate a major improvement in the intermediate term. Up to now, the Company mainly fulfilled its obligations by raising external capital and debt refinancing. Thus, the rights offering, which was conducted in 2011 injected about $6 million into the Company's coffers and improves the liquidity-to-debt payment ratio until 2013. We believe that more funds will be needed in the intermediate term.

The Company has kept the equity-to-balance sheet ratio stable around 30% in the last three years. As of March 31, 2012, the Company has cash of $7.7 million which accounts for about 14% of its debt. The Company has weak financial flexibility, it does not have available credit facilities, and most of its assets are encumbered. It should be noted that the Company spread its amortization schedule last year by refinancing a bullet loan and scheduling long-term payments.

5

The Company is expected to continue to develop the government projects with the help of government debt and grants. The Company will have to finance Capex for non-government operations by itself using its free cash flows which, as stated, were very weak in recent years.

Rating Outlook

Factors likely to improve the rating:

|

●

|

Significant improvement in cash flow from operating resources, which will be reflected, among other things, in a surplus cash flow after debt payment.

|

Factors that could lower the rating:

|

●

|

Significant weakening in the amount of free cash flow.

|

|

●

|

Failure to maintain adequate liquidity for debt servicing needs, and at least sources to pay a year ahead.

|

|

●

|

Deterioration in the Company's business environment that could threaten the volume of activity and long-term profitability.

|

About the Company

NTS is a U.S. telecommunications services provider, offering a wide array of services which include local, long distance and international telephony, broadband Internet and broadband IPTV video in the U.S. In 2010, the Company sold its operations in Israel and in the UK. Today, the Company is focusing its operations in the U.S. on two core fields of business through its subsidiaries (NTS Communications, Xfone USA): (1) provides telecommunication services (telephony, Internet and television) on existing infrastructure in several states in the U.S. Up until 2010, these operations were the source of most of the Company's business results. (2) projects for deploying telecommunication infrastructure in areas with poor infrastructure in the U.S. with the backing of the U.S. Government and the provision of telecommunication services through them.

The Company's headquarters are based in Lubbock, Texas. The Company's ordinary shares are traded on the NYSE Mkt exchange in the U.S. as well as on the Tel-Aviv Stock Exchange (in a "dual listing"). The bond is traded on the Tel-Aviv Stock Exchange only. The major shareholders are Gagnon Securities LLC (Neil Gagnon), Richard L. Scott, LLC, Burlingame (Blair E. Sanford), Windcrest Partners (James H. Gellert), Leslie J. Schreyer, Manchester Management Company and Mr. Guy Nissenson.

6

Rating History

Related Reports

Previous monitoring report – Monitoring Report, May 2011

Reports published on Midroog's website at www.midroog.co.il.

Date of the report: August 6, 2012

7

Key Financial Terms

|

Interest expenses

|

Net financing expenses from Income Statement

|

|

Cash flow interest expenses

|

Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows.

|

|

Operating profit (EBIT)

|

Pre-tax profit + financing + non-recurring expenses/profits.

|

|

Operating profit before amortizations EBITA)

|

EBIT + amortization of intangible assets.

|

|

Operating profit before depreciation and amortizations (EBITDA)

|

EBIT + depreciation + amortization of intangible assets.

|

|

Operating profit before depreciation, amortization and rent/leasing (EBITDAR)

|

EBIT + depreciation + amortization of intangible assets + rent + operational leasing.

|

|

Assets

|

Company's total balance sheet assets.

|

|

Debt

|

Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing

|

|

Net debt

|

Debt - cash and cash equivalent – long-term investments

|

|

Capitalization (CAP)

|

Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet

|

|

Capital Expenditures (Capex)

|

Gross investments in equipment, machinery and intangible assets

|

|

Funds from Operations (FFO)*

|

Cash flow from operations before changes in working capital and before changes in other asset and liabilities items

|

|

Cash flow from operating activity*

(CFO)

|

Cash flow from operating activity according to consolidated cash flow statements

|

|

Retained Cash Flow (RCF)

|

Funds from operations (FFO) less dividend paid to shareholders

|

|

Free Cash Flow (FCF)*

|

Cash flow from operating activity (CFO) - CAPEX - dividends

|

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

8

Obligations Rating Scale

|

Investment grade

|

Aaa

|

Obligations rated Aaa are those, which in Midroog's judgment, are of the highest quality and involve minimal credit risk.

|

|

Aa

|

Obligations rated Aa are those, which in Midroog's judgment, are of high quality and involve very low credit risk.

|

|

|

A

|

Obligations rated A are considered by Midroog to be in the upper-end of the middle rating, and involve low credit risk.

|

|

|

Baa

|

Obligations rated Baa are those, which in Midroog's judgment, involve moderate credit risk. They are considered medium grade obligations and could have certain speculative characteristics.

|

|

|

Speculative Investment

|

Ba

|

Obligations rated Ba are those, which in Midroog's judgment, are speculative and involve a high degree of credit risk.

|

|

B

|

Obligations rated B are those which, in Midroog's judgment, are speculative and involve a high credit risk.

|

|

|

Caa

|

Obligations rated Caa are those, which in Midroog's judgment, have weak standing and involve very high credit risk.

|

|

|

Ca

|

Obligations rated Ca are very speculative investments and are likely in, or very near, default, with some prospect of recovery of principal and interest.

|

|

|

C

|

Obligations rated C are assigned the lowest rating and are generally in a situation of insolvency with remote prospects of repayment of principal and interest.

|

Midroog applies numerical modifiers 1, 2 and 3 in each of the rating categories from Aa to Caa. Modifier 1 indicates that the bond ranks in the higher end of the letter-rating category. Modifier 2 indicates that the bonds are at the higher end of the letter-rating category; and modifier 3 indicates that the bonds are in the lower end of the letter-rating category.

9

Report No: CCNO3071200M

Midroog Ltd., Millennium 17 Ha’Arba'a Street, Tel-Aviv 64739

Tel: 03-6844700, Fax: 03-6855002, www.midroog.co.il

© Copyright 2012, Midroog Ltd. (“Midroog”). All rights reserved.

This document (including the contents thereof) is the property of Midroog and is protected by copyright and other intellectual property laws. There is to be no copying, photocopying, reproduction, modification, distribution, or display of this document for any commercial purpose without the express written consent of Midroog.

All the information contained herein on which Midroog relied was submitted to it by sources it believes to be reliable and accurate. Midroog does not independently check the correctness, completeness, compliance, accuracy or reliability of the information (hereinafter: the "information") submitted to it, and it relies on the information submitted to it by the rated Company for assigning the rating.

The rating is subject to change as a result of changes in the information obtained or for any other reason, and therefore it is recommended to monitor its revision or modification on Midroog's website www.midroog.co.il. The ratings assigned by Midroog express a subjective opinion, and they do not constitute a recommendation to buy or not to buy bonds or other rated instruments. The ratings should not be referred as endorsements of the accuracy of any of the data or opinions, or attempts to independently assess or vouch for the financial condition of any company. The ratings should not be construed as an opinion on the attractiveness of their price or the return of bonds or other rated instruments. Midroog's ratings relate directly only to credit risks and not to any other risk, such as the risk that the market value of the rated debt will drop due to changes in interest rates or due to other factors impacting the capital market. Any other rating or opinion given by Midroog must be considered as an individual element in any investment decision made by the user of the Information contained in this document or by someone on his behalf. Accordingly, any user of the information contained in this document must conduct his own investment feasibility study on the Issuer, guarantor, debenture or other rated document that he intends to hold, buy or sell. Midroog's ratings are not designed to meet the investment needs of any particular investor. The investor should always seek the assistance of a professional for advice on investments, the law, or other professional matters. Midroog hereby declares that the Issuers of bonds or of other rated instruments or in connection with the issue thereof the rating is being assigned, have undertaken, even prior to performing the rating, to render Midroog a payment for valuation and rating services provided by Midroog.

Midroog is a 51% subsidiary of Moody’s. Midroog's rating process is entirely independent of Moody's and Midroog has its own policies, procedures and independent rating committee; however, its methodologies are based on those of Moody’s. For more information on Midroog's rating process, please see the relevant pages of this website.

For further information on the rating procedures of Midroog or of its rating committee, please refer to the relevant pages on Midroog's website.

10