Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Strategic Realty Trust, Inc. | d395309d8k.htm |

| EX-99.1 - LETTER TO STOCKHOLDERS - Strategic Realty Trust, Inc. | d395309dex991.htm |

SRT Property Portfolio

1

July 18, 2012

Exhibit 99.2 |

SRT Portfolio

2

SRT PORTFOLIO ASSETS (As of June 30, 2012)

TOTAL

Purchase Price

$258,686,000

Current Cap Rate

8.31%

Total Rentable Square Feet

2,074,980

Occupancy (% of SF)

87.1%

Current Vacancy (SF)

274,631

Portfolio Debt

$184,427,000

Total Properties

20

Additional Acreage

49.8 Acres*

Anchor Tenants

Publix, Tom Thumb (Safeway), Stater Bros., Longs Drugs,

Wal-Mart, Ralphs, Fresh & Easy

* Approximate rentable square footage that may be built is 476,000 sq. ft. depending

upon use. CURRENT PORTFOLIO

Percent of Revenues from Anchor Tenants

41.73%

Percent of Square Feet Occupied by Anchor Tenants

48.87%

Average Remaining Lease Term of Anchor Tenants

11 Years, 1 Month (2023) |

SRT PORTFOLIO

METRICS TOTAL

Estimated Annual Revenue

$35,159,510

Estimated Annual Net Operating Income*

$21,141,367

Estimated Annual Interest Expense

($10,938,641)

Estimated Annual General Administration Expenses

($2,170,850)

Net Operating Income* after Interest Expense +

General Administration Expenses

$8,304,181

SRT Portfolio

3

*

Estimated

Annual

Net

Operating

Income

(NOI)

figures

are

based

on

2012

Budgets

and

are annualized for full

year operation.

EXPIRING

LEASES

FOR

SRT

PORTFOLIO

(Including

Visalia

Marketplace)

2012

2013

2014

2015

2016+

Number of Expiring Leases

56

48

54

42

124

Expiring Lease Square Footage

110,399

110,353

111,702

150,339

1,597,629

% of Expiring Leases

6.10%

6.10%

6.20%

8.40%

73.2% |

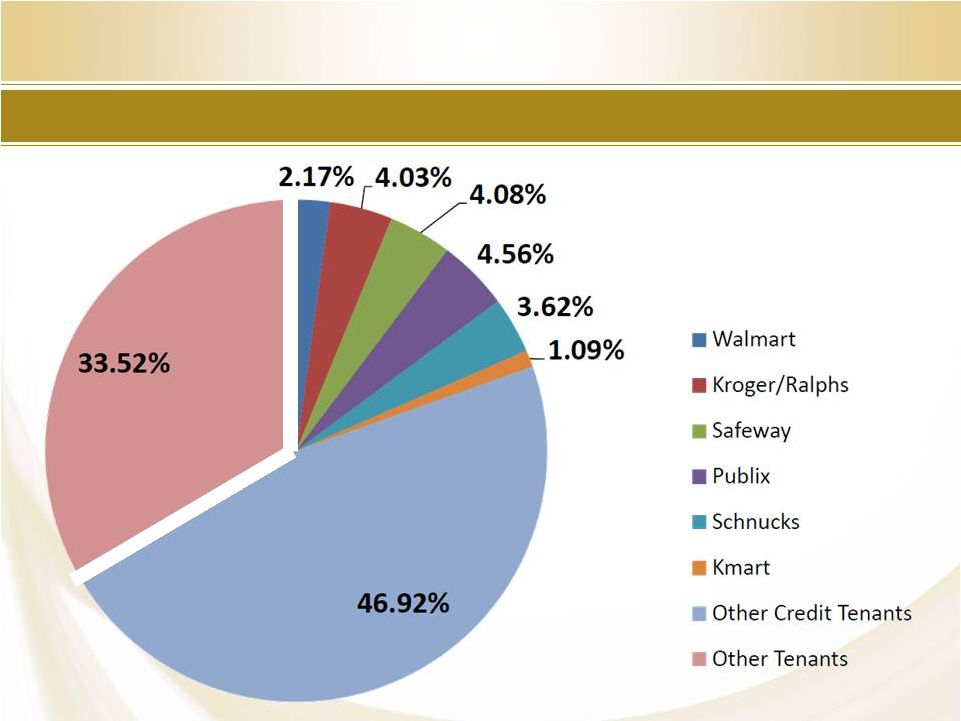

Credit Tenants as a Percentage Revenue

4

66% of Revenue is from Credit Tenants

OTHER

TENANTS |

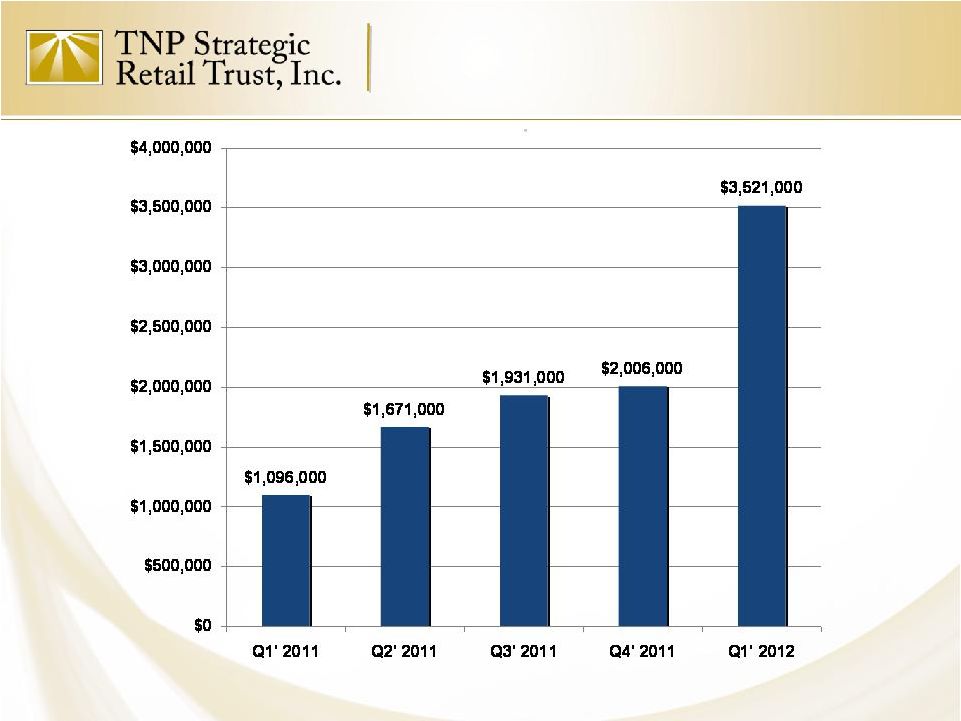

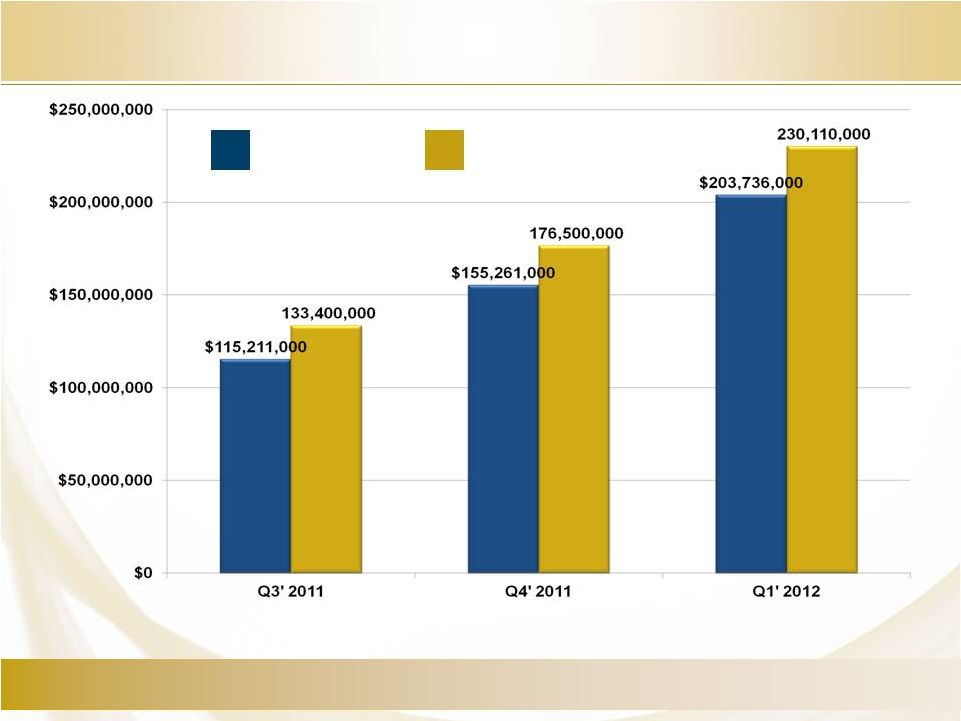

Property NOI*

5

*

Reconciliation of net income to net operating income can be found on the

Appendix to this presentation. |

SRT PAD Sale Review |

Craig Promenade

(North Las Vegas, Nevada) |

Morningside Marketplace

(Fontana, California) |

SRT Completed PAD Sales

PROPERTY

CAP RATE

SALE PRICE

NET PROCEEDS

REINVESTED

CAP RATE

San Jacinto

JACK IN THE BOX

6.12%

$1,225,000

Reinvested in Summit

Point

7.56%

Craig Promenade

POPEYES

6.81%

$1,187,000

Reinvested in Topaz

Marketplace

8.27%

Craig Promenade

CARL’S JR.

7.30%

$2,015,000

Reinvested in Osceola

Village

6.18%

Morningside Marketplace

CHASE/CHEVRON

6.10%

$4,098,000

$1,864,000 Proceeds

Reinvested in

Florissant Marketplace

8.38%

Morningside Marketplace

KFC

5.55%

$1,200,000

$624,000 Proceeds

Reinvested in

Ensenada Square

8.92%

TOTAL

$9,725,000 |

SRT Portfolio Value Summary

Property Value

Cost

$10.08

NAV Per Share

$10.14

$10.18

10

9 SRT PROPERTIES

11 SRT PROPERTIES

16 SRT PROPERTIES |

Portfolio Management

SRT Value Added Advantages

•

Ability To Acquire Assets At Below Replacement

Cost

•

Acquisition Price Based On Existing NOI Allows

For Significant Upside Through Lease Up Of

Vacancies

From

87.1%

To

Stabilization

•

Sale

Or

Lease

Of

476,000

SF

Of

Undeveloped

Pad

Buildings

On

49.8

Acres

11 |

Note: As of June 30, 2012

12

SRT Portfolio Summary

Property Name

Rentable Sq. Ft.

Occupancy

Acq. Cost

(in thousands)

CAP Rate

Excess Land

Moreno Marketplace

78,321

79.4%

$ 12,500

9.68%

1.74

Waianae Mall

170,275

78.2%

$25,688

8.89%

--

Northgate Plaza

103,492

92.0%

$8,050

10.04%

--

San Jacinto

53,777

71.6%

$ 7,088

5.01%

3.62

Craig Promenade

86,395

77.2%

$12,800

6.28%

4.15

Pinehurst Square East

114,292

91.6%

$ 15,000

9.61%

--

Constitution Trail

199,139

73.0%

$18,000

10.46%

--

BI-LO

45,817

100.0%

$2,585

9.13%

28.5

Topaz Marketplace

50,319

100.0%

$13,500

7.41%

0.82

Osceola Village

116,645

77.8%

$21,800

5.41%

8.1

Summit Point

111,970

86.5%

$18,250

6.78%

--

Morningside Marketplace

78,693

90.9%

$18,050

5.57%

--

Woodland West

176,414

86.2%

$13,950

9.03%

--

Ensenada Square

62,612

93.3%

$5,175

8.08%

--

Shops @ Turkey Creek

16,324

100.0%

$4,300

8.49%

--

Aurora Commons

89,211

92.6%

$7,000

10.11%

--

Florissant Marketplace

146,257

100.0%

$15,250

8.31%

--

Willow Run

95,791

87.9%

$11,550

7.51%

--

Bloomingdale Hills

78,442

100.0%

$9,300

6.75%

2.83

Visalia Marketplace

200,794

93.3%

$19,000

9.28%

--

Portfolio Total

2,074,980

87.1%

$258,686

8.31%

49.8 |

Upside Portfolio Opportunity

49.8

acres of Developable Land at No Cost

Potential

to

Construct

476,000

SF

of

New

Buildings

Potential Annual Ground Lease Revenue of up to

$1,634,000

or…

Potential Annual Building Rental Revenue of up to

$7,300,000

13 |

Leasing Summary

14

2011

SQUARE FOOTAGE LEASED

NEW

8,420

RENEWAL

62,952

TOTAL

71,372

2012

SQUARE FOOTAGE LEASED

NEW

27,594

RENEWAL

84,512

VACATE

1,712

TOTAL

110,394

TOTAL

181,766 |

New Leasing –

2011 YTD

PROPERTY NAME

NEW SQUARE

FOOTAGE LEASED

CURRENT

OCCUPANCY*

Moreno Marketplace

3,060

79.4%

Pinehurst Square East

1,885

91.6%

Waianae Mall

3,475

78.2%

Total

8,420

15

* As of June 30, 2012 |

Renewal Leasing -

2011 YTD

PROPERTY NAME

SQUARE FOOTAGE

RENEWED

CURRENT

OCCUPANCY*

Waianae Mall

10,704

78.2%

Northgate Plaza

13,657

92.0%

San Jacinto

4,130

71.6%

Craig Promenade

9,000

77.2%

Pinehurst Square East

2,935

91.6%

Extensions, Options & Other

22,526

Total

62,952

16

* As of June 30, 2012 |

New Leasing –

2012 YTD

PROPERTY NAME

NEW SQUARE

FOOTAGE LEASED

CURRENT OCCUPANCY*

Moreno Marketplace

4,559

79.4%

San Jacinto Esplanade

1,184

71.6%

Craig Promenade

4,474

77.2%

Constitution Trail

14,506

73.0%

Morningside Marketplace

972

90.9%

Aurora Commons

566

92.6%

Pinehurst Square East

1,333

91.6%

Total

27,594

17

* As of June 30, 2012 |

Renewal Leasing -

2012 YTD

PROPERTY NAME

SQUARE FOOTAGE RENEWED

CURRENT OCCUPANCY*

Waianae Mall

23,635

78.2%

Northgate Plaza (Tucson)

11,964

92.0%

Craig Promenade

13,616

77.2%

Pinehurst Square East

16,364

91.6%

Topaz Marketplace

3,943

100%

Woodland West

8,950

86.2%

Ensenada Square

3,500

93.3%

San Jacinto Esplanade

2,540

71.6%

Total

84,512

18

* As of June 30, 2012 |

www.tnpsrt.com

SRT PROPERTY PORTFOLIO JULY 18,

2012 SUMMARY OF RISK FACTORS

AN INVESTMENT WITH TNP STRATEGIC RETAIL TRUST, INC. INVOLVES A HIGH

DEGREE OF RISK AND THERE CAN BE NO ASSURANCE THAT THE INVESTMENT

OBJECTIVES OF THIS PROGRAM WILL BE OBTAINED. AN INVESTOR SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW AND

IN CONJUNCTION WITH THE PROSPECTUS BEFORE PURCHASING OUR COMMON

STOCK. -

Viability of the sponsor.

-

We commenced operations on November 19, 2009, and therefore have a

limited operating history. There is no assurance that we will be able to successfully achieve our investment

objectives.

-

No public trading market exists for our shares and we are not required

to effectuate a liquidity event by a certain date. As a result, it will be difficult for you to sell your shares. If you

are able to sell your shares, you will likely sell them at a

substantial discount. -

The amount of any distributions we may make is uncertain.

Our distributions may exceed our earnings, particularly during the period before we have substantially invested the net

proceeds from this offering. Generally, distributions paid using

offering proceeds will constitute a return of capital, meaning a return of all or a portion of your original investment. To

the extent our distributions are funded from offering proceeds, we will

have less funds to use for investments which may lower your overall return. All distributions paid to date have

been paid with offering proceeds.

-

This is a “best effort” offering and if we are unable to

raise substantial funds then we will be limited in the number and type of investments we may make.

-

We currently have a limited number of properties in our real estate

portfolio. As a result, this is considered a “blind pool” offering and you will not have the opportunity to evaluate

our future investments prior to purchasing shares of our common stock.

-

This is the first non-listed REIT offering sold by our

dealer-manager. Our ability to raise money and achieve our investment objectives depends on the ability of our dealer manager to

successfully market our offering.

-

We rely on our advisor and its affiliates for our day-to-day

operations and the selection of our investments. We will pay substantial fees to our advisor, which were not determined on

an arm’s-length basis.

-

Our advisor and other affiliates will face conflicts of interest as a

result of compensation arrangements, time constraints and competition for investments.

-

We are the first publicly-offered investment program sponsored by

our sponsor. You should not assume that the prior performance of programs managed or sponsored by our sponsor

or its affiliates will be indicative of our future performance.

-

Our use of leverage increases the risk of loss on our investments.

-

We are subject to risks generally incident to the ownership of real

property. -

Economic downturns and disruptions in financial markets could have an

adverse impact on our tenants’ ability to make rental payments and the demand in retail space, result in

disruptions in the commercial mortgage market and adversely effect our

ability to obtain financing on favorable terms, if at all. - We have elected to be taxed as a

REIT for federal income tax purposes. However, if we lose our tax status as a REIT, we will be subject to increased taxes which will reduce the

amount of cash we have available to make distributions to our

stockholders. -

We have operated at a net loss for the last two years.

-

The methodologies used to determine the estimated value per share as of

September 30, 2011, December 31, 2011 and March 31, 2012 were based upon a number of assumptions,

estimates and judgments that may not be accurate or complete. The

estimated value per share does not represent the fair value of our assets less liabilities in accordance with U.S.

GAAP and is not a representation or indication that: a stockholder

would be able to realize the estimated share value if he or she attempts to sell shares; a stockholder would ultimately

realize distributions per share equal to the estimated value per share

upon liquidation of assets and settlement of our liabilities or upon a sale of our company; shares of our common

stock would trade at the estimated value per share on a national

securities exchange; or a third party would offer the estimated value per share in an armslength transaction to purchase

all or substantially all of our shares of common stock.

|

www.tnpsrt.com

SRT PROPERTY PORTFOLIO JULY 18,

2012 APPENDIX

TNP Strategic Retail Trust, Inc.

Net Income to NOI –

reconciliation (in thousands)

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Net Income/(Loss)

$ (1,217)

$ (1,804)

$ (1,378)

$ 6,709

$ (4,365)

General and administrative

418

566

799

389

631

Depreciation and amortization

725

913

1,259

1,487

2,100

Interest Income

(1)

(133)

(407)

(57)

-

Interest expense

680

828

1,677

2,215

3,099

Income (Loss) attributable to non-controlling interests

1

136

23

(348)

212

Gain on sale of real estate

-

-

(310)

(653)

-

Net income from discontinued operations

-

-

(125)

-

(56)

Other extraordinary item – bargain purchase gain

-

-

-

(9,617)

-

Asset management fee

80

123

(415)

(1)

-

Acquisition expense

410

1,042

808

1,887

1,900

NOI

$1,096

$1,671

$1,931

$2,006

$3,521

Net Operating Income (NOI):

Reported net income (or loss) is computed in accordance with GAAP. In contrast,

net operating income (NOI) is a non-GAAP measure consisting of the

revenue and expense attributable to the real estate properties that we own and operate.

Although

NOI

is

considered

a

non-GAAP

measure,

we

present

NOI

on

a

“GAAP

basis”

by

using

property

revenues

and

expenses

calculated

in

accordance

with

GAAP.

The

most

directly

comparable

GAAP

measure

to

NOI

is

net

income

(or

loss),

adjusted

to

exclude

general and administrative expense, depreciation and amortization expense, interest

income, interest expense, income (and certain fees paid to affiliates loss)

attributable to noncontrolling interests, gains on sale of real estate, net income from discontinued operations, other

extraordinary items and certain fees paid to affiliates. We use NOI as a

supplemental performance measure because, in excluding real estate

depreciation

and

amortization

expense

and

gains

(or

losses)

from

property

dispositions,

it

provides

a

performance

measure

that,

when compared year over year, captures trends in occupancy rates, rental rates and

operating costs. We also believe that NOI will be useful to investors as a

basis to compare our operating performance with that of other REITs. However, because NOI excludes

depreciation and amortization expense and captures neither the changes in the value

of our properties that result from use or market conditions, nor the level

of capital expenditures and leasing commissions necessary to maintain the operating performance of our

properties (all of which have real economic effect and could materially impact our

results from operations), the utility of NOI as a measure of our performance

is limited. Other equity REITs may not calculate NOI in a similar manner and, accordingly, our NOI may not be

comparable

to

such

other

REITs’

NOI.

Accordingly,

NOI

should

be

considered

only

as

a

supplement

to

net

income

as

a

measure

of

our

performance. NOI should not be used as a measure of our liquidity, nor is it

indicative of funds available to fund our cash needs, including our ability

to pay distributions. NOI should not be used as a substitute for cash flow from operating activities computed in accordance with

GAAP. |