Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LIBERATOR MEDICAL HOLDINGS, INC. | v321397_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - LIBERATOR MEDICAL HOLDINGS, INC. | v321397_ex99-1.htm |

Company Overview LBMH (OTC)

Safe Harbor This presentation contains certain forward - looking statements. These forward - looking statements may be identified by words such as “believes,” “expects,” “anticipates,” “projects,” “intends,” “should,” “seeks,” “estimates,” “future,” or similar expressions or by discussion of strategy, goals, plans or intentions. Various factors may cause actual results to differ materially in the future from those reflected in forward - looking statements contained in this presentation. Such factors may include, but are not limited to: • Regulatory limitations on the medical industry in general • Changes in Medicare, including reimbursement programs and procedures • Working capital constraints • Fluctuations in customer demand and commitments • Fluctuation in quarterly results • Pricing and competition 2

• Founded in 1999; headquartered in Stuart, Florida • Leading national direct to consumer provider of Urological, Ostomy, Mastectomy, Diabetes and other medical supplies • Markets its products through television, online and print advertising campaigns, which direct the consumer to order by phone or on the internet • Has grown from $9.6 million to $52.7 million in revenue since 2008 representing a 76% CAGR on a total of $13.8 million invested in the business • Proven, highly scalable business model, aggressively expanding into product - line segments targeting chronic conditions resulting in predictable recurring revenue stream with significant customer lifetime values • Ranked #1 in Medicare Payments for Urological and Mastectomy Products according to HME Databank • Direct and payor billing model • Platform with infrastructure built to support growth • An Exemplary Provider™ accredited by The Compliance Team • Experienced Management team with over 30+ years of relevant experience Company Overview 3

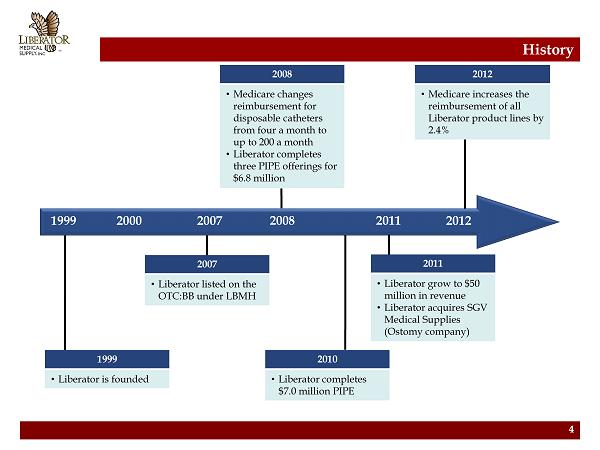

History 1999 2007 2000 2011 2008 2012 4 • Liberator is founded 1999 • Liberator listed on the OTC:BB under LBMH 2007 • Medicare changes reimbursement for disposable catheters from four a month to up to 200 a month • Liberator completes three PIPE offerings for $6.8 million 2008 • Liberator grow to $50 million in revenue • Liberator acquires SGV Medical Supplies ( Ostomy company) 2011 • Medicare increases the reimbursement of all Liberator product lines by 2.4% 2012 • Liberator completes $7.0 million PIPE 2010

Financial Highlights (1) Leading Direct Marketer of Medical Supplies (US$ in millions) 5 (1) CAGR calculated from 2008 to 2011A. Financials are for fiscal year ending September 30. Revenue represents “Net Sales”. 2008 – 2011 Revenue CAGR: 76.4% 2008 – 2011 Gross Profit CAGR: 73.9%

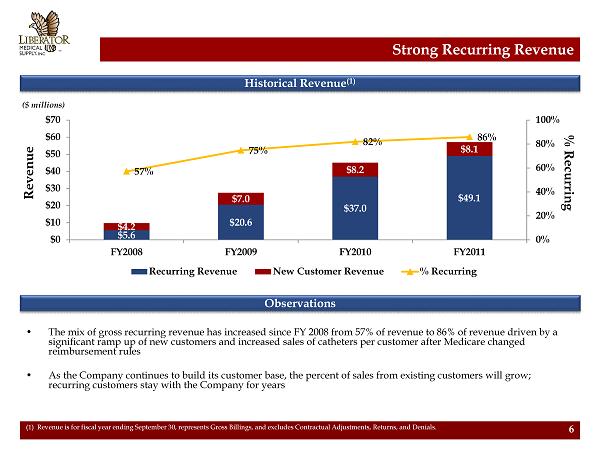

Strong Recurring Revenue Historical Revenue (1) • The mix of gross recurring revenue has increased since FY 2008 from 57% of revenue to 86% of revenue driven by a significant ramp up of new customers and increased sales of catheters per customer after Medicare changed reimbursement rules • As the Company continues to build its customer base, the percent of sales from existing customers will grow; recurring customers stay with the Company for years ($ millions) Observations $5.6 $20.6 $37.0 $49.1 $4.2 $7.0 $8.2 $8.1 57% 75% 82% 86% 0% 20% 40% 60% 80% 100% $0 $10 $20 $30 $40 $50 $60 $70 FY2008 FY2009 FY2010 FY2011 Recurring Revenue New Customer Revenue % Recurring 6 (1) Revenue is for fiscal year ending September 30, represents Gross Billings, and excludes Contractual Adjustments, Returns , a nd Denials. Revenue % Recurring

• Disposable collection devices (bags) • Negotiated significant price reductions – competitive advantage in market with high product costs • Steady growth from pull - through co - morbidity from ads Product Segments Urological (78% of FY11 Revenue) Ostomy (14% of FY11 Revenue) Mastectomy (6% of FY11 Revenue) Other (2% of FY11 Revenue) • Prosthetic and special bras, sleep and swimwear • High gross margins and re - occurring up to twice a year • Customer database includes over 30,000 patients • Disposable catheters, external catheters, specialty foley catheters, etc. • Highest gross margins • Highest percentage of projected revenue • Diabetes • Wound Care • Incontinence Other Potential New Markets: • Diagnostic • DME • Vitamins • Orthopedic • Pain Management • Respiratory 7

4.1% 2.8% 1.3% 1.1% 0.8% 0.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% LIBERATOR HANGER PROSTHETICS & ORTHOTICS* WRIGHT & FILIPPIS LADY GRACE STORES MEDICAL WEST PHARMACY A FITTING EXPERIENCE MASTECTOMY SHOPPE OTHER (1,173 COMPANIES) 18.6% 8.8% 5.7% 4.1% 3.9% 3.1% 55.9% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% LIBERATOR 180 MEDICAL MP TOTALCARE UROMED A - MED HEALTH BYRAM HEALTHCARE OTHER (1,637 COMPANIES) #1 Supplier of Urological and Mastectomy Products 8 Urology Products – 2010 Medicare Payments Mastectomy Products – 2010 Medicare Payments 89.1% Highly Fragmented Highly Fragmented Source: HME Databank. Note: HME obtained this data under the freedom of information act and is based on 2010 data. 2011 data will not be availab le until the 2 nd half of 2012. * represents combined companies as per SNW analysis.

Customer Profile 9 Medicare or Insurance Patient Primary Need Reoccurring Needs Brand Recognition Resulting in Referrals Evergreen Reorders Upselling Products • Advertising provides access to customers with disease specific lifetime medical supply needs • Intake process defines customer needs by product segment • We contact patients on a recurring basis to replenish supplies • Physician and patient referrals • Our technology systems promote “evergreen” concept of aging orders and prompt call - backs

Growth Strategy: Continue to Focus on the Core • Continue direct - response advertising model • Explore additional product lines – New Diabetic Technology – Specialty Foley Catheter • Launch new vendor product offerings through our marketing and distribution channels • Pursue managed care and expand insurance relationships and contracts • Explore potential acquisition opportunities where the cost to acquire customers via acquisition is less than our advertising costs • Strategic acquisitions are a significant source for additional customer base • Continue to invest in infrastructure, systems, and employees to improve productivity, expand capacity, and increase profitability 10

• The U . S . national healthcare spending is expected to increase by approximately $ 2 trillion from $ 2 . 6 trillion in 2010 to $ 4 . 6 trillion in 2020 , according to the Centers for Medicare and Medicaid Services (“CMS”) • CMS estimates that the number of Americans over the age of 65 will increase from an estimated 41 . 1 million in 2011 to 54 . 2 million in 2020 • The research firm Rand estimates the number of Americans with two or more chronic conditions will increase from 60 to 81 million between the years 2000 and 2020 . Currently more than 90 million Americans live with at least one chronic disease • CMS estimates that the national expenditures within the DME market will increase by over $ 20 billion from $ 35 . 7 billion in 2010 to $ 56 . 8 billion in 2020 • The number of DME companies with Medicare billings less than $ 300 , 000 has been declining, or consolidating, over the last few years according to HME News, primarily as a result of increased Medicare accreditation and bonding requirements implemented in 2009 • As the baby boomer population ages, the already flourishing medical supply industry will experience a 20 - year explosion in growth American Medical Supplies Market 11

Substantial Market Opportunity Products Major Manufacturers Est. Market Diagnosed Urology Supplies include both female and male catheters, urine collection devices and various related accessories Bard, Mentor, Coloplast , Cure, Hollister, Astra Tech, Rochester Medical, Rusch , Kendall and Cure $4.4 bn ($0.6+ bn market for disposable catheters) N/A Ostomy Includes ostomy, ileostomy and urostomy supplies Coloplast , Genairex , Hollister and Convatec $400 mm ~0.6 mm Mastectomy Mastectomy bra & post mastectomy fashions N/A $1.1 bn ~3.2 mm Diabetes All diabetes testing supplies including glucose meters, glucose test strips, control solution and lancets Abbot, Bayer, Roche, Accu - check, Simple Diagnostics, LifeScan , Home Aide, J&J and Freestyle Freedom Lite $17 bn (Each patient generates ~$660 in annual revenue) ~25.8mm ( 7 mm undiagnosed) 12 Source: “National Health Expenditure Projections 2010 - 2020”; Centers for Medicare & Medicaid Services.

13 Sample Advertisements

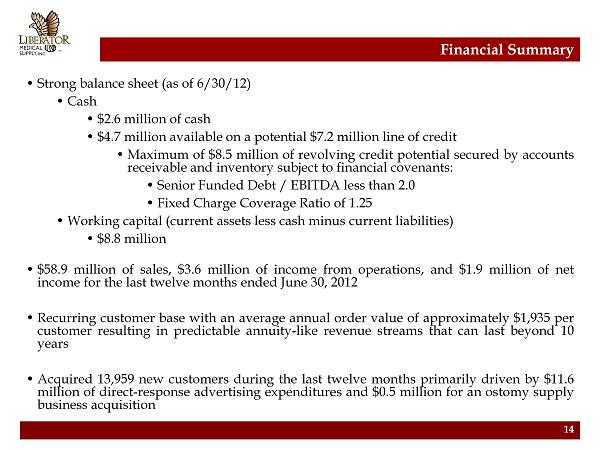

14 Financial Summary • Strong balance sheet (as of 6 / 30 / 12 ) • Cash • $ 2 . 6 million of cash • $ 4 . 7 million available on a potential $ 7 . 2 million line of credit • Maximum of $ 8 . 5 million of revolving credit potential secured by accounts receivable and inventory subject to financial covenants : • Senior Funded Debt / EBITDA less than 2 . 0 • Fixed Charge Coverage Ratio of 1 . 25 • Working capital (current assets less cash minus current liabilities) • $ 8 . 8 million • $ 58 . 9 million of sales, $ 3 . 6 million of income from operations, and $ 1 . 9 million of net income for the last twelve months ended June 30 , 2012 • Recurring customer base with an average annual order value of approximately $ 1 , 935 per customer resulting in predictable annuity - like revenue streams that can last beyond 10 years • Acquired 13 , 959 new customers during the last twelve months primarily driven by $ 11 . 6 million of direct - response advertising expenditures and $ 0 . 5 million for an ostomy supply business acquisition

Highly Experienced Management Team Name & Position Years of Relevant Experience Experience Mark Libratore Chief Executive Officer 41 • Founder of Liberator in 1999; created and executed direct - to - consumer sales model targeting seniors with chronic illnesses in need of medical supplies • Founder of Liberty Medical Supply in 1989 and served as President. Liberty Medical Supply is now a subsidiary of Medco • Responsible for growing Liberty’s annual sales from $0 to over $100 million Robert Davis Chief Financial Officer 40 • Liberator’s Chief Financial Officer since founding • Previously served as CFO at Liberty Medical Supply from 1995 to 1999 • Previous work experience includes working at TurboCombustor Corporation, Data Development Inc., and Caribbean Computer Corproation • Received a Masters degree in Accounting from the University of Houston and holds a CPA from the State of Texas John Leger Chief Operating Officer 38 • Responsible for overall operations at Liberator; has served in role since 2007 • Senior VP of Operations at Liberty from 1991 to 2004 • Responsible for Liberty’s diabetic call center, customer services, repeat customers sales, claims processing to Medicare and document acquisition • Played a vital role in growing Liberty’s customer base to over 650,000 patients • Worked at Closer Healthcare, mail order provider of diabetes testing supplies, as Vice President of Operations from 2005 to 2006 Paul Levett Chief Marketing Officer 35 • Founder of Leiber, Levett, Koenig, Farese and Babcock, a New York advertising agency • Previously President of Lowe Direct, a direct marketing and advertising agency 15

Highly Experienced Management Team Cont. Name & Position Years of Relevant Experience Experience George Narr Chief Information Officer 16 • Responsible for all information systems at Liberator; joined in April 2010 • Previously CIO of Liberty Medical Supply until 2006; Managed a team of 100 staffed developers and I.T. professionals. George was the chief architect of Liberty's proprietary software systems and paperless workflow Travis Brooks Vice President of Finance 20 • Joined Liberator as Controller in August 2008 and was promoted to Vice President of Finance in January 2012 • Responsible for managing the accounting department, the SEC reporting, and acting as the primary liaison with external auditors • Previously served as Controller and/or Financial Consultant for various small to mid - size companies across multiple industries • Graduate of Florida State University with a Bachelor of Science in Accounting Tera Somogyi Vice President of Sales 8 • Joined Liberator as Vice President in January 2010 • Served as a Sales Representative at Eli Lilly USA from 2006 to 2010 • Graduate of Cleveland State University with a Masters in Experimental Psychology • Her education, field and industry experience have led to a fast - track career in sales management and marketing, specializing in product marketing, sales training, research, compliance, and recruiting in the medical industry Jennifer Libratore Vice President of Operations 12 • Joined Liberator in November 2000 • Currently overseas billing, claims entry, quality assurance, sales support, scanning and documentation, insurance verification, and special projects • Previously was an instructor with Medvance Institute of Technology • Graduate of Indian River State College with Bachelor of Applied Science in Organizational Management 16